BlackRock Throgmorton Trust

Investment companies | Update | 22 November 2023

Growth in all things

BlackRock Throgmorton Trust (THRG) remains committed to the UK quality-growth small-and-mid-caps that has long characterised the trust. While the UK small-and-mid-cap sector has appeared to have been out of favour recently, THRG’s holdings seem to have stock specific strengths that have allowed its returns to pull away from the wider UK small-and-mid-cap market, once again. The trust is outperforming its benchmark over both the near and long term.

The manager says that, irrespective of their share price movements, many of THRG’s holdings have also continued to demonstrate robust/improving fundamentals over the last 12 months. Consequently, it feels that many valuations look more attractive today than they did in the post-pandemic-era.

Both long and short positions in UK small-and-mid-cap companies

THRG aims to provide shareholders with capital growth and an attractive total return by investing primarily in UK smaller companies and mid-capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction. Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks.

Market update

The UK seems to be over the worst of its inflationary pressures

The UK, like other parts of the developed world, may finally be able to look forward to an end to interest rate rises as the rate of inflation is slowing. Uncertainties around the future of the UK economy may remain. The National Institute of Economic and Social Research (NIESR) said recently that it would take until the third quarter of 2024 for UK output to return to its pre-pandemic peak and that there was a 60% risk of recession in 2024. Generally, one could view the headline issues as remaining the same as they were in our last note, which we published in November 2022.

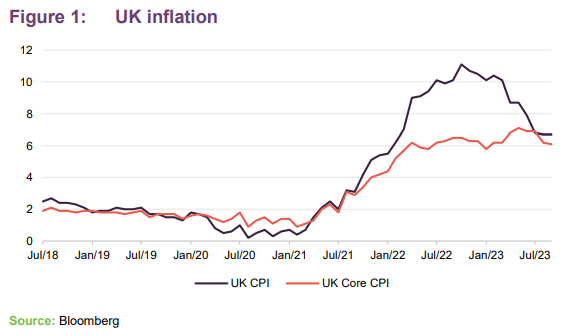

Over the peak, finally

One of the most important changes since our last note, written in November 2022, could be the dampening of the UK’s inflation outlook. As can be seen in Figure 1, both core and CPI inflation (core inflation excludes the more volatile fuel and food costs) have finally begun to fall. Rampant inflation has been a potentially thorny issue for the UK, as many pundits believed that the UK’s inflation could be far stickier than that of North America’s or Europe’s, citing its tighter labour market and Brexit-related issues as factors driving up costs.

While this could be a possible watershed moment for the UK market’s near-term outlook, the current level of inflation is still above the Bank of England’s (BoE) 2% target. The BoE has recently put a pause to its rate rising policy, having kept its key rate at 5.25% after its most recent monetary policy meeting. However, what could matter most are expectations of the persistence of inflation and hence the prospect of higher for longer interest rates. The BoE has pushed back against speculation over possible interest rate cuts.

The rises in interest rates have arguably had greater impact on growth stocks like those which make up THRG’s portfolio, and which may have to adjust to a higher cost of capital (via higher discount rates and debt interest).

At the same time, there seems to have been a longstanding aversion to UK equities amongst both international and domestic investors. Brexit could have been the main trigger for this, but political infighting and the effects of last year’s ‘mini budget’ have also weighed on valuations.

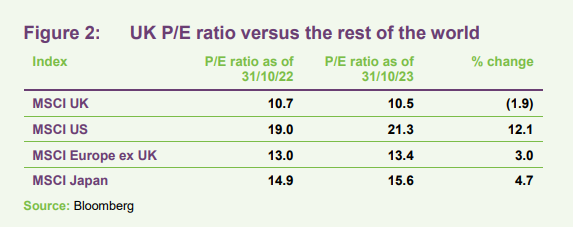

UK equity markets have become cheaper, whereas other developed markets have become more expensive

Some may take the view that UK valuations remain repressed relative to their peers. As can be seen in Figure 2, the UK’s price-to-earnings ratio has declined over the last 12 months, whereas the other major developed markets, US, Europe, and Japan, have all seen theirs creep up. This does not seem to be due to a weakening of corporate fundamentals, as corporate earnings have largely remained robust, but rather it could be due to market dynamics and the fact that investors have yet to return to the UK market as they have for other equity regions. It may be that the hangover from previous risk factors still drags on investor sentiment for the UK.

Asset allocation

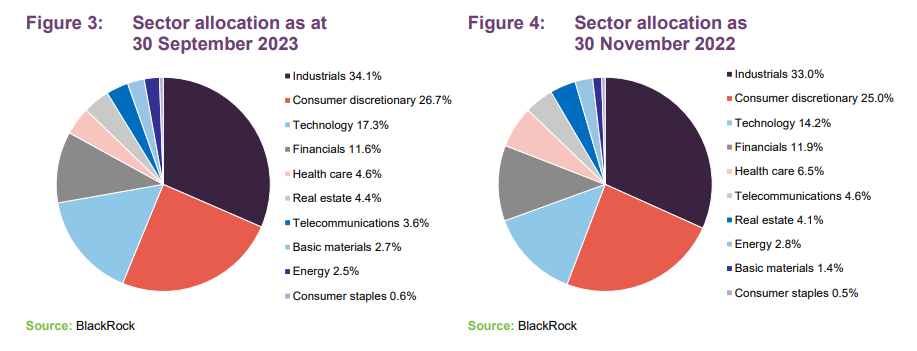

Dan says that his approach is one of high conviction, bottom-up stock selection rather than a judgment of the current macro-economic environment. Figures 3 and 4 reflect the shift in THRG’s portfolio since its last financial year end.

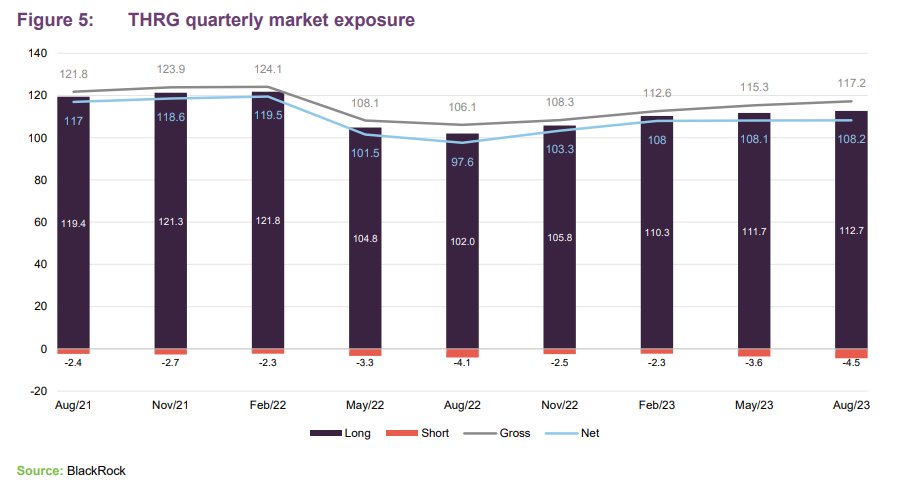

When assessing THRG’s total market exposure, investors may wish to be aware of both its long and short positions. As can be seen in Figure 5, THRG has a level of gross market exposure commensurate with its previous level, however the total long and short positions have increased in 2023. While THRG’s net long position has begun to increase, it still remains below its level prior to the rotation out of growth in response to rising interest rates.

Like THRG’s long positions, its short positions are a reflection of companies the manager believes have a negative outlook, such as what he believes are weak competitors to his investments, or companies that Blackrock’s analysts have highlighted as structurally impaired.

Top 10 stocks

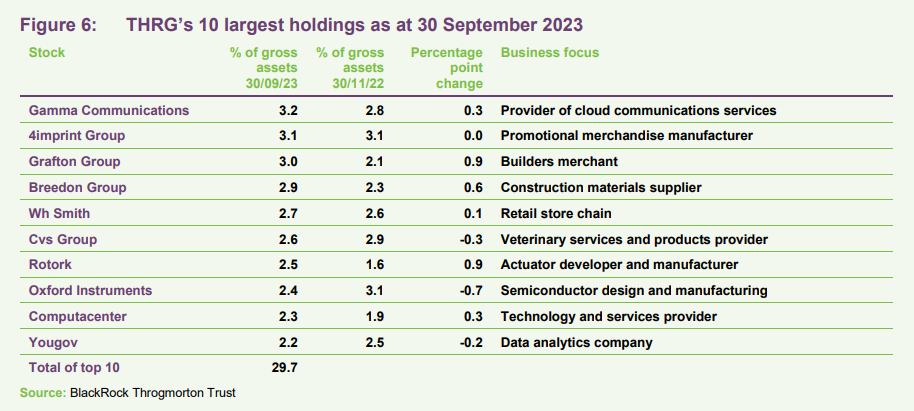

Figure 6 shows the top 10 holdings for THRG, compared to their weightings in our previous note. While we outline the major changes in stocks in the subsequent paragraphs, the general trend of THRG’s shifts have been a combination of trading activity but also a rebound of the share prices of some of THRG’s more highly-valued investments.

WH Smith

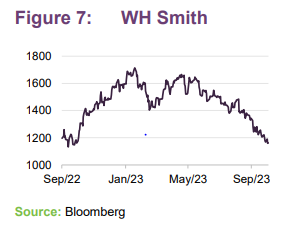

WH Smith (whsmith.co.uk) is a UK retailer. Although most may know it as a high street news agent, its retail footprint has a much wider reach due to its major presence in the global airport retail business. Dan says that this exposure to general UK consumer spending as well as global travel meant WH Smith was able to announce a 23% year-on-year (YoY) increase in revenues over Q1 2023 in a recent earnings call (in May 2023), with WH Smith’s management confident that the company is “very well positioned for further growth” and that ” expectations for the full financial year have modestly improved”.

WH Smith is a direct beneficiary of increased travel numbers. However, despite its improving fundamentals, WH Smith’s share price has fallen over the last year, as investors may still be mulling the potential uncertainty around future economic performance, as it is sensitive to discretionary consumer spending.

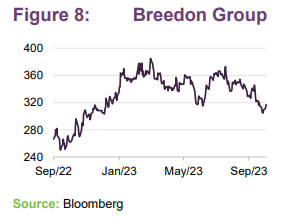

Breedon Group

Headquartered in Leicestershire, Breedon Group (breedongroup.com) is the UK’s largest independent construction materials company; it produces cement, construction aggregates, asphalt, ready-mixed concrete, bitumen and other construction materials, with it also having a major role in highway surfacing.

In its interim results, Breedon announced an 11% growth in its YoY revenues, and 7% growth in its pre-tax profits (excluding the impact of acquisitions). Its management team highlighted the resilience of its end markets and structural drivers (such as the increasing infrastructure spending and housing supply shortage) as major factors in its performance, with the company able to more than increase prices to offset lower volumes.

Since May 2023, Breedon trades on the main market of the London Stock Exchange (LSE), having previously traded on AIM. While Breedon is a new entrant in the top 10, it is a longstanding position within the portfolio.

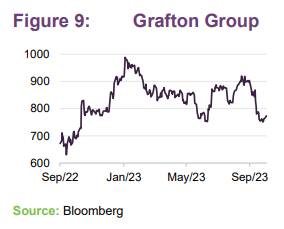

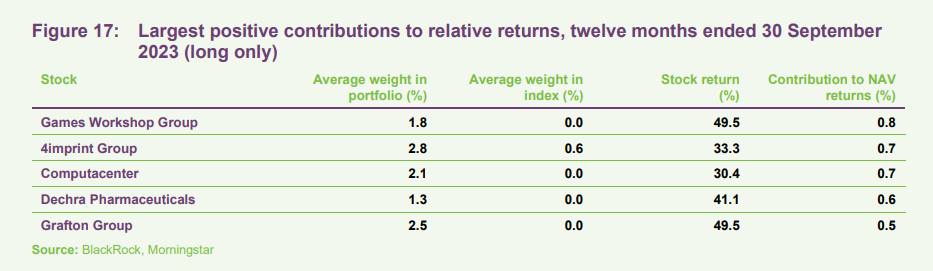

Grafton Group

Grafton Group (graftonplc.com) is a builders’ merchants business based in the UK and Ireland, and is Ireland’s largest DIY retailer (trading under the Woodie’s brand). Despite apparent fears around a possible slowdown in demand, Grafton’s earnings in Q1 were robust and in line with management expectations, up 2.8% YoY. Grafton maintains its market guidance, and also announced a share buyback programme worth £50m.

Dan has taken advantage of periods of weakness to top up his holding in the company. Grafton remains hugely depressed from its COVID-19 highs, which Dan believes is simply a reflection of market sentiment rather than a judgment on Grafton’s outlook.

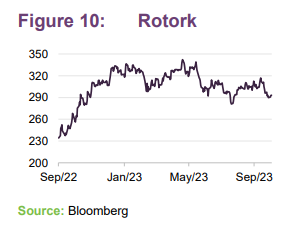

Rotork

Rotork (rotork.com) is a world leading developer and manufacturer of actuators (a device that produces motion by converting energy and signals going into a system), and related products and services. Its devices are utilised in the oil and gas, water, chemical, and a wide array of industrial industries.

In its most recent half year results, released in August, Rotork announced that its revenues were up 20% year on year, and ahead of analyst estimates, while its profits were up 23% year on year, helped by higher margins. These revenue beats were across multiple business lines. The company also announced an interim dividend of 2.55p, well ahead of the 2.4p expected by the market, as well as maintaining its full year guidance.

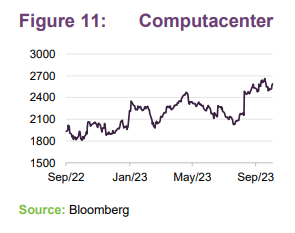

Computacenter

Computacenter (computacenter.com) is one the UK’s largest technology product distributors, providing both software and hardware from leading brands such as Microsoft, Cisco, and Samsung. It operates globally and services both private companies and government organisations.

In its recent Q3 trading update, Computacenter’s management indicated that its performance was in line with their expectations. Computacenter continues to see what it believes are strong results from its US and German business, though the UK continues to remain challenging.

Computacenter’s fundamental growth has been more than matched by the growth in its share price, which is up c.34% over 2023. The steep rise in early September, followed the release of its 2023 interim results, which came in ahead of consensus. Computacenter reported a considerable 23% YoY revenue growth, more than double the market’s expectations, as well as generating more the twice the cashflow the market had forecasted. The success of Computacenter has come in the face of the underperformance of its peers and what some view as a generally challenging backdrop to the IT servicing industry over 2023. We note that Computacenter is one of the largest contributors to THRG’s 12 month returns, as we describe on page 12.

Other noteworthy purchases

While Dan’s top-ups of Breedon and Grafton are noticeable, given their entrance into THRG’s top 10, he also highlights his recent purchases of Gamma Communications, Ergomed, and Morgan Sindall.

Many of his recent purchases have not been new entrants to the portfolio, but rather top-ups of existing holdings, as he capitalised on the broad-based selloff of certain highly-valued companies.

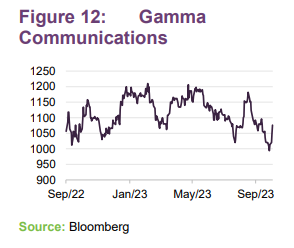

Gamma Communications

Gamma Communications (gammacommunicationsplc.com) is a provider of technology-based communications and software services to businesses in western Europe. Its products range from strategic services like inbound call controls and cloud-based telephone networks to more conventional services like ethernet broadband and phone lines.

Like many of the other companies listed in this note, Gamma posted another year of growth in its 2022 results, with revenues and gross profits both up 8% on the year prior.

While Gamma, through its own software services as well as by simply being a provider of core internet infrastructure, is a possible benefit of companies’ greater integration of digital operations, it may have also benefited from good management practices.

Gamma continues to acquire new corporate clients and is able to achieve very sticky revenue streams, with 89% of its revenue being recurring, and with high gross profit margins of c.50%. Gamma has, like many of the world’s software focused tech stocks, sold off from its peak in the COVID-19 period, and now trades at a share price that is commensurate with its pre-pandemic level, despite its continued earnings growth.

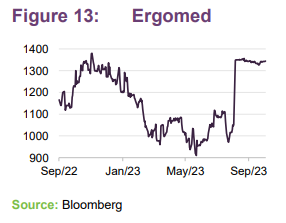

Ergomed

Ergomed (ergomedplc.com) is a specialist clinical services firm, facilitating a full range of clinical research and trials for the biotech and biopharma industry. This allows Ergomed to capitalise on the huge tailwinds behind medical research, such as the increasing need for treatments for an ageing global population.

Rather than exposing THRG to the perils of the possible binary outcomes of medical trials, Dan says that Ergomed is a ‘picks and shovels’ opportunity meaning that it is a service provider to the companies developing therapies, allowing it to potentially benefit from the proliferation of medical research without taking on the same binary risks.

We assessed the historic performance of Ergomed, and how it demonstrates Dan’s process, in a prior note. In its most recent trading update, for Q1 2023, Ergomed reported another period of growth, with 10% revenue growth and a c.10% growth in its orderbook, giving its management team confidence that the 2023 results will be in line with market expectations.

Ergomed’s share price rose on 4 September following the announcement of a possible buyout by private equity group Permira, which offered £13.50 per share, a 30% premium to the prevailing price, valuing the company a £700m. Ergomed’s management team backed the takeover, shareholders approved it on 13 October 2023, and the company delisted on 14 November 2023.

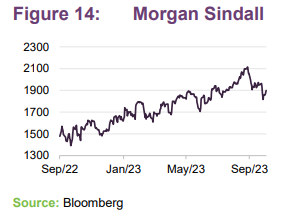

Morgan Sindall

Morgan Sindall (morgansindall.com) is a leading construction and regeneration group, servicing public, private, and regulated sectors. The group encompasses eight different companies, each focusing on a different niche of construction or renovation, be it infrastructure or building construction, office design and refurbishment, or mixed-use urban regeneration.

Morgan Sindall reported record H1 results for 2023, with a revenue increase of 14%, and a 10% increase in pre-tax profit, all while retaining a very strong net cash position of £263m (versus a £910m market cap). Its strongest returns came from the office fit-out, infrastructure, and construction divisions which all saw profit growth of 43%, 24% and 6% respectively. Its management seem particularly pleased by its high quality and substantial order book, with £9.1bn in orders logged, up 7% YoY.

Performance

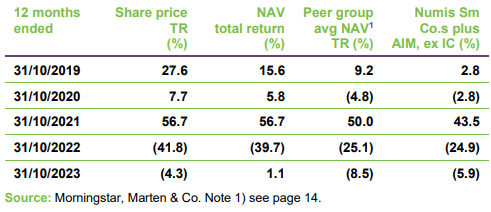

In absolute terms, the impediments that the UK equity market has faced over the last five years may have weighed on returns from UK equities relative to other regions.

THRG is a focused small-and-mid-cap quality-growth strategy, and over the long term the underlying success of its portfolio should reflect structural growth trends rather than the prevailing economic climate. This could also make it resilient if the UK economy continues to be weak.

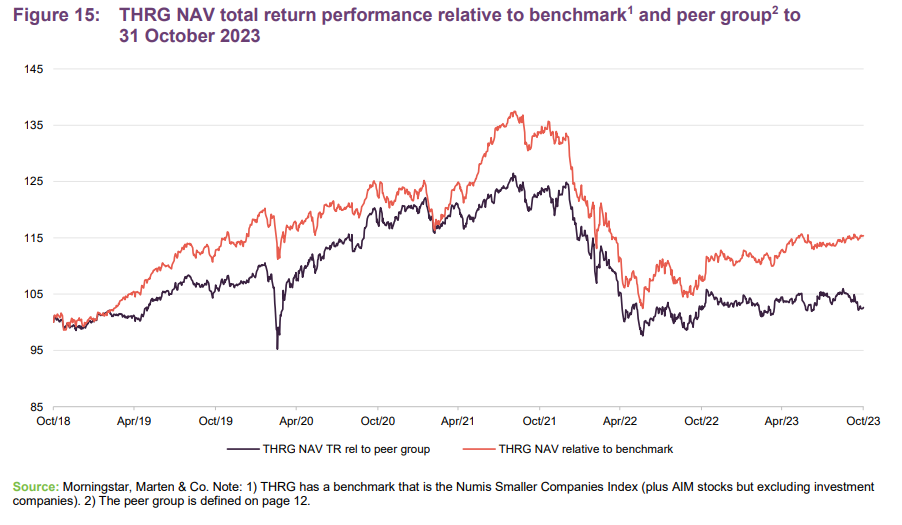

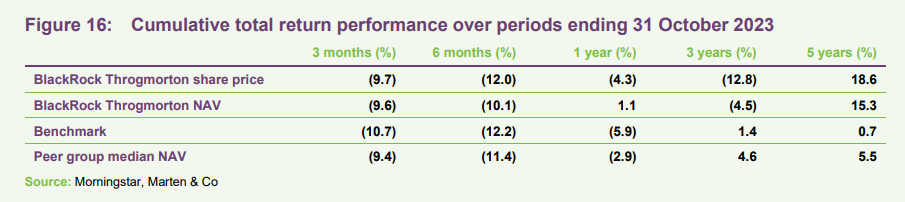

THRG has demonstrated both near- and long-term outperformance

Over five years, THRG’s NAV has outperformed its Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) benchmark, and the peer group. Successful stock selection has played a large part in that.

The rise in growth stocks that followed the initial COVID-related market panic in 2020 was reversed over the early part of 2022, seemingly as rising interest rates drove a rotation away from growth stocks.

Now, hopes that monetary policy may take a more dovish tone look to be benefitting growth companies.

Drivers of returns

BlackRock kindly supplied us with some attribution data which we reproduce in Figures 17.

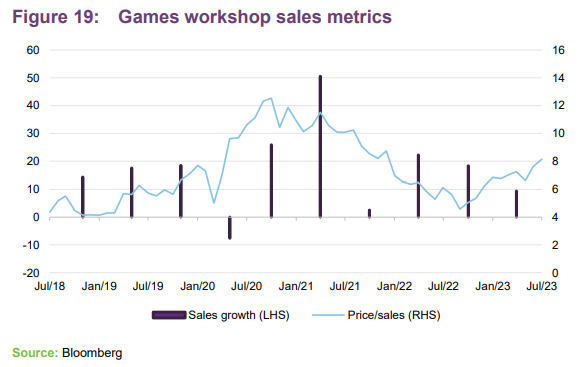

Games Workshop

Games Workshop (games-workshop.com) is based in Nottingham and is the world’s leading maker of tabletop war games and miniatures, with its intellectual property having a presence within computer gaming.

Games Workshop may have become oversold. As a possible lockdown beneficiary, potential fears that it would not be able to sustain its pandemic-level demand, combined with the increased scrutiny around highly valued companies, sent its share price lower over 2021. However, robust earnings figures (the company reported its highest levels of sales and profits for the most recent financial year), Games Workshop has seen its share price recover.

Dan feels that the market may still be under-appreciating its potential. Games Workshop has been able to post double digit revenue growth in a post pandemic world, with earnings only plateauing in the six months immediately post pandemic. Despite this, the market still values its earnings potential at the same level it did pre the pandemic.

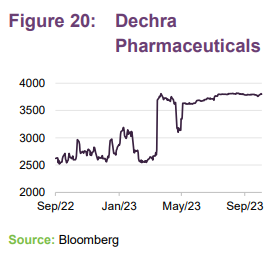

Dechra Pharmaceuticals

Dechra Pharmaceuticals (dechra.com) is a developer of veterinary drugs, based in Northwich. As is illustrated in Figure 20, Dechra’s share price suffered a noticeable retraction, which Dan suggests was caused by rising interest rates but also from stocking issues by its US operation. However, the opportunity that the selloff presented was spotted by EQT, a Swedish private equity firm, which made a successful bid for the company at £38.75 per share (a 44% premium to its undisturbed share price).

EQT believes it can unlock value using its previous experience in the veterinary pharmaceutical industry.

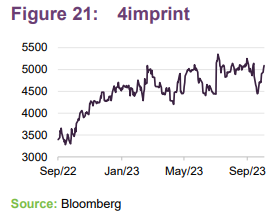

4imprint Group

4imprint Group (4imprint.co.uk) is a producer of promotional merchandise, with a strong global footprint. It is also a rare example of a quality growth stock that did not see a material selloff during 2022.

Rather than a rebound story, 4imprint is a prime example of the importance of disciplined, yet forward thinking management. Instead of scaling back expenditure during COVID-19, the company actually increased its marketing budget and shifted to TV and radio advertising, eschewing the old-fashioned techniques of print advertising that was the norm for the industry.

Over the 26 weeks ended 1 July 2023, 4imprint generated a 23% increase in revenue and 48% uplift in earnings per share. In addition, a pension buy-in transaction in June 2023 allowed it to insure substantially all of its remaining pension benefits.

Dan says that there has been a change in the efficiency of its marketing operations and, having become the largest player in a highly fragmented market, it can achieve economies of scale that its competitors cannot. The company is in a potentially strong position to grab market share, both through organic growth and by absorbing smaller operators.

Peer group

Up to date information on THRG and its peer group is available on the QuotedData website

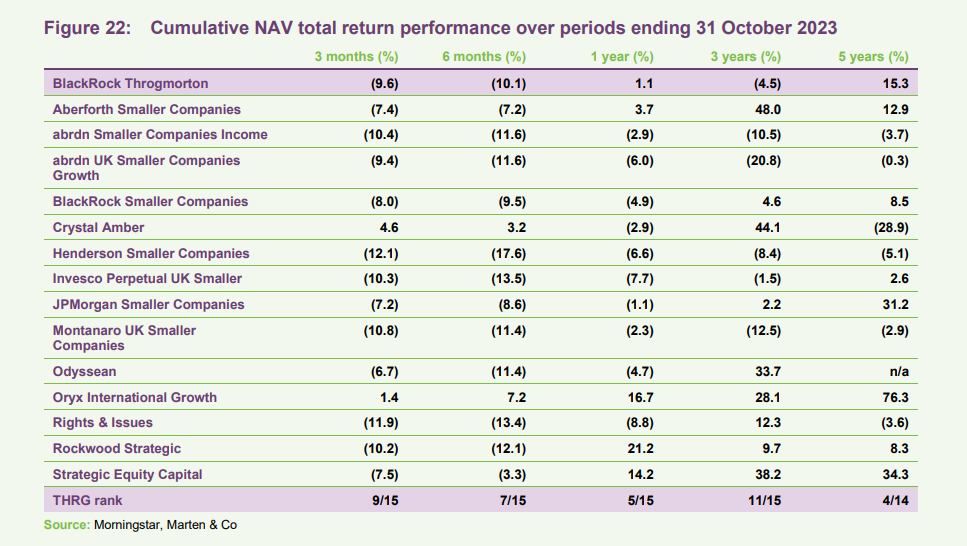

For comparison purposes, we have used a subset of funds in the AIC’s UK Smaller Companies Sector. We have excluded split-capital companies, trusts with a small market capitalisation (below £50m), Marwyn Value Investors (which has a very different investment approach) and those that focus exclusively on micro-cap companies. A complete list is provided in Figure 22.

Against a diverse peer group, consisting of many different styles of investing, THRG has outperformed its average peer over one and five years, though it has fallen into the bottom third over three years.

THRG ranks as one of the most growth-focused strategies within the peer group, likely giving it greater exposure to rising interest rates and the market’s reaction to it, as well as the market trends during COVID-19.

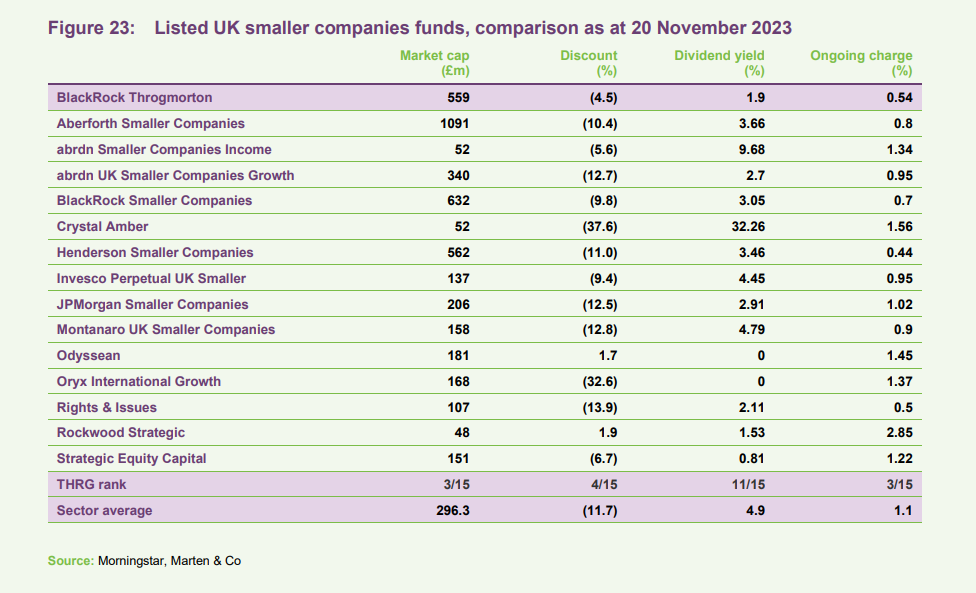

THRG continues to trade on a narrower discount than its average peer, as it has done for many years. This may be the result of the combination of THRG’s past performance, its ability to short stocks (which is a clear differentiator from its peers), and perhaps the possible resurgence in growth stock investing.

THRG’s market cap of £527m places it above the average of its peers and its ongoing charges ratio is one of the lowest amongst its peers. THRG’s ongoing charges could also be seen as being competitive when compared to the open-ended sector (based on the average IA UK smaller company sector member).

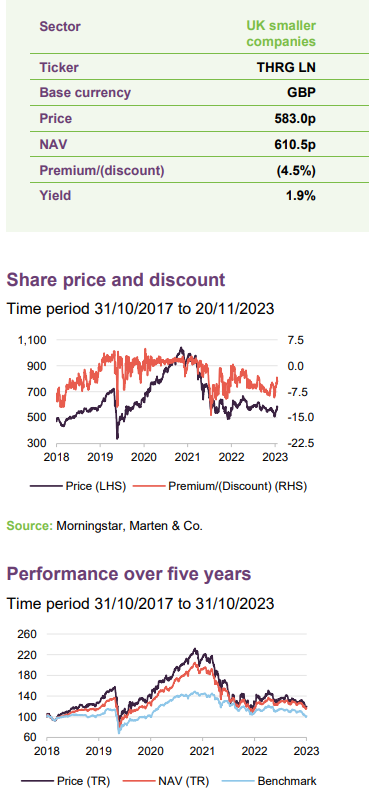

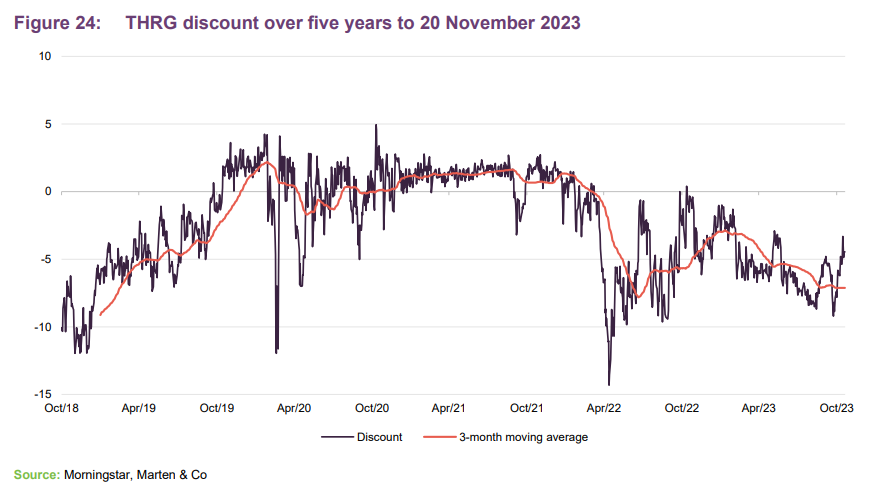

Premium/(discount)

As at 20 November 2023, THRG was trading on a 4.5% discount. Over the 12 months to 31 October 2023, THRG’s shares have fluctuated between trading on a premium of 0.4% on 11 November 2022, to a 9.2% discount on 31 October 2023, and on average have traded on a 5.0% discount.

THRG’s discount, like its performance, may be a reflection of the wider market sentiment. Having previously traded at a sustained premium between 2020 and 2022, THRG moved to a discount in early 2022, which matched the wider sell off in global growth stocks; though, like its performance, its discount has begun to narrow from the initial sell off, reflecting the recovery in growth stock performance.

THRG’s discount has been resilient when compared to its peers

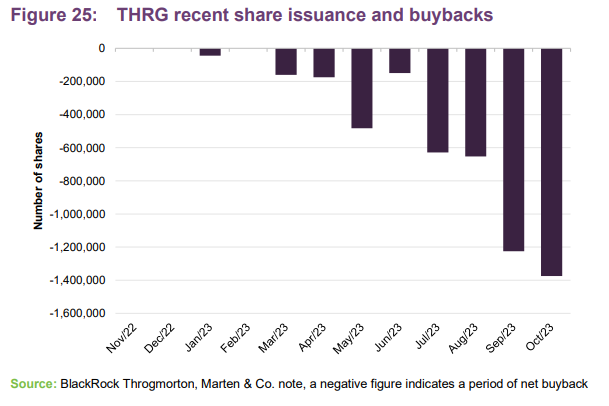

The board has said that it believes it is in shareholders’ interests that the share price does not trade at an excessive premium or discount to NAV. Therefore, it may exercise its powers to issue or buy back shares with the objective of ensuring that an excessive premium or discount does not arise. Consequently, the board asks shareholders at each AGM for approval to issue up to 10%, and to buy back up to 14.99%, of THRG’s issued share capital.

THRG been buying back shares with 4,894,267 repurchased and held in treasury over the 12 months ended 31 October 2023, which is equal to 4.8% of the issued share capital at the end of October 2022.

Issuing shares at a premium enhances the NAV for existing shareholders, increases liquidity in the trust’s shares and helps to lower the ongoing charges ratio as fixed costs are spread over a wider base; while buybacks at a discount enhance the NAV, provide liquidity and improve the supply/demand imbalance.

Fund profile

Further information about THRG is available at the investment manager’s website. Please click here

BlackRock Throgmorton Trust (THRG) aims to generate capital growth and an attractive total return by investing primarily in UK smaller companies and mid capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction. Up to 15% of the portfolio can be invested in stocks listed on exchanges outside the UK.

Dan Whitestone, head of the emerging companies team at BlackRock, has been sole manager of the trust since 12 February 2018 (he had been co-manager alongside Mike Prentis since March 2015). Dan heads a team of three. All members of the team manage portfolios, and between them they manage or advise on a variety of different funds. The team shares research responsibilities between them.

UK smaller and mid-capitalisation have the potential to outperform large companies over longer timeframes. In addition, the focus on smaller and mid-capitalisation companies offers exposure to what some believe is a less efficient and less well-researched area of the market, which may create opportunities for an actively-managed fund to add value. When selecting long investments for THRG, Dan focuses on two types of opportunity: high-quality differentiated companies and companies leading industry change.

Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks. Up to 30% of the portfolio may be invested in CFDs, both long and short. Under normal market conditions, the net market exposure will account for 100–110% of net assets.

Previous publications

Readers may be interested in our previous publications on THRG, which are listed in Figure 26 below. These are available to read on our website or by clicking the links in the table.

Figure 26: Previous publications

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on BlackRock Throgmorton Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.