More than a port in a storm

More than a port in a storm

It is often said that markets climb a wall of worry, but there are times when investors panic and run for the exits. In such an environment, the attractions of funds which are defensively positioned and managed by an experienced team, with an investment ethos based on an assessment of long-term fundamental value, come to the fore.

CG Asset Management (CGAM)’s defensive stance is based on its belief that almost all asset classes offer the prospect of low or negative returns at current valuations. The two funds that we cover in more depth in this report, Capital Gearing Trust and CG Absolute Return Fund, have relatively low exposure to equities and have high levels of liquidity. These funds are not just hiding places in times of market turmoil, however. The managers stand ready to increase the weighting to risk assets when they feel that valuations reach attractive levels.

Impressive long-term track record

Impressive long-term track record

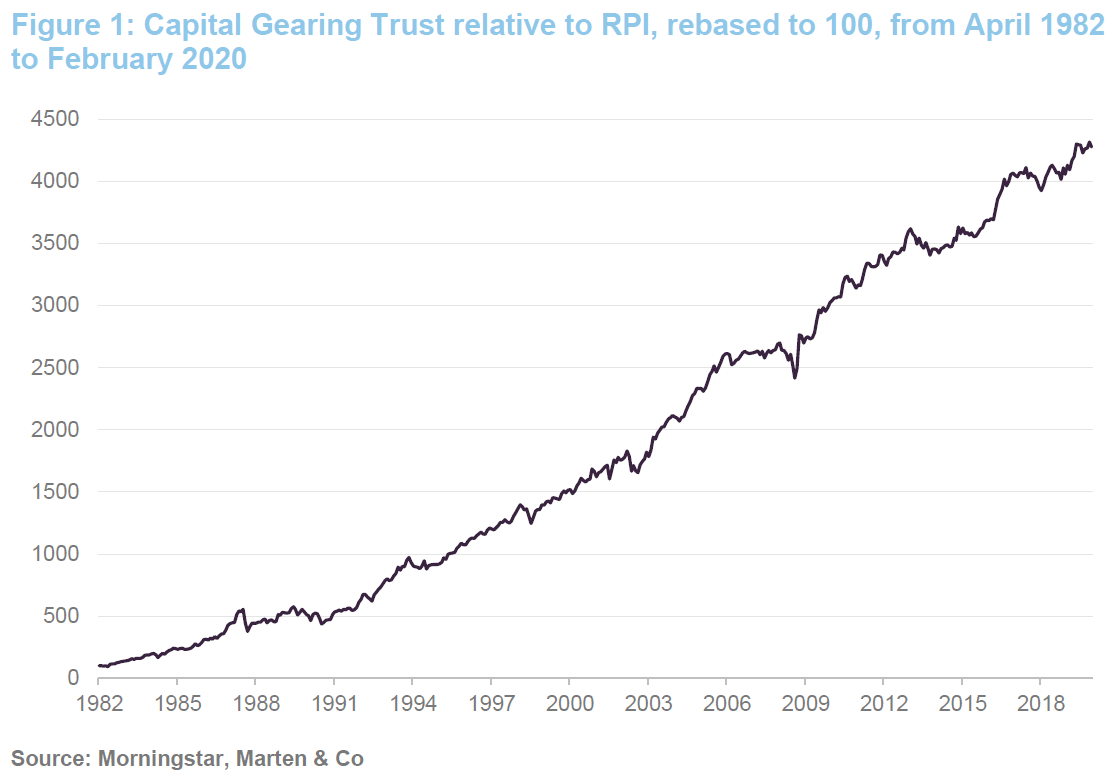

Peter Spiller, CGAM’s chief investment officer, assumed responsibility for Capital Gearing Trust in 1982 and since then it has been the best-performing of all conventional investment companies. An investment of £100 in April 1982 would have been worth £22,969 by the end of February 2020. That is more than 6x the return from the UK stock market (as measured by the MSCI UK Index) and is equivalent to £6,279 after adjusting for inflation.

CGAM has launched a number of open-ended, UCITS funds over the years. One of these, CG Absolute Return Fund, has many of the same characteristics as Capital Gearing Trust, offers a liquid way of accessing CGAM’s absolute return strategy.

Introducing CG Asset Management

Introducing CG Asset Management

CG Asset Management (CGAM) was founded in 2000 but its roots go back much further than that, to 1982. This was when Peter Spiller took on the management of Capital Gearing Trust and developed the investment approach that CGAM still uses today.

CGAM’s founders set out three key principles:

- the client comes first;

- don’t be greedy; and

- have fun.

CGAM’s initial aim was to design funds that could be used to look after all of a client’s money, particularly where these clients share the same aims as CGAM. The founders of the business and the other employees have substantial personal investments in the funds.

To achieve this aim, CGAM:

- takes a genuinely long-term view;

- has an aversion to losing money;

- has a preference for capital gains over income; and

- aims to benefit from the potential returns offered by equity markets but recognises that its funds would not participate in the latter stages of a bull market.

CGAM’s chief executive is Alastair Laing, who has been an integral part of CGAM’s management team since 2011. Peter Spiller acts as chief investment officer for the company. Chris Clothier is the third co-manager within the team. More detail on CGAM’s team is provided on page 30.

The success of this thinking is evident in the long-term real returns generated by CGAM’s flagship fund, Capital Gearing Trust. The trust was established in 1963 and listed on the London Stock Exchange in 1973, but we have used a start point of 1982 for Figure 1, reflecting Peter Spiller’s first involvement with the fund.

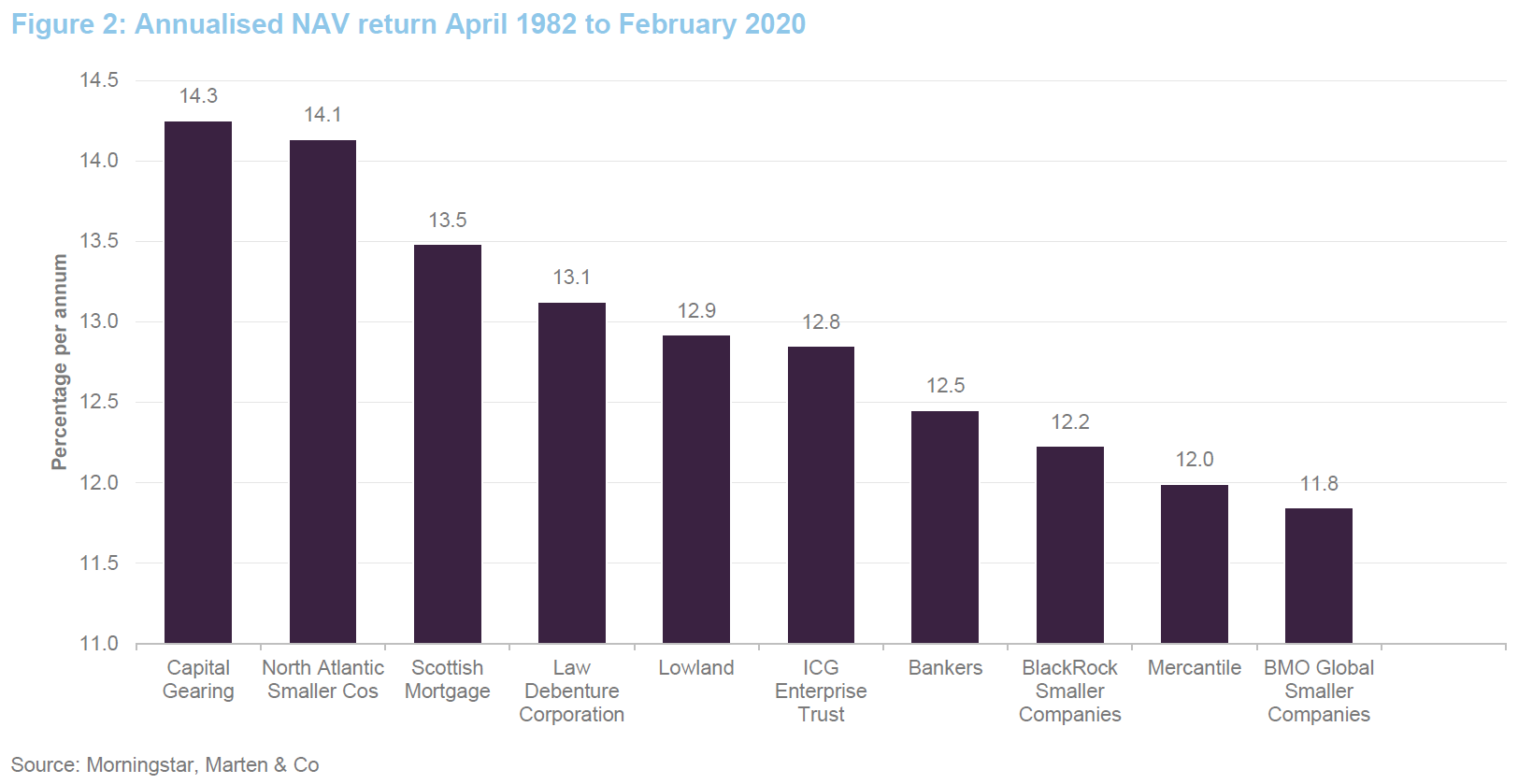

Figure 2 shows the annualised NAV performance of the 10 best-performing conventional investment trusts since April 1982 (when Peter Spiller took on the management of Capital Gearing’s portfolio). The chart excludes Rights & Issues, which beats even Capital Gearing but whose returns were magnified by a split capital structure.

Defensive in falling markets

Defensive in falling markets

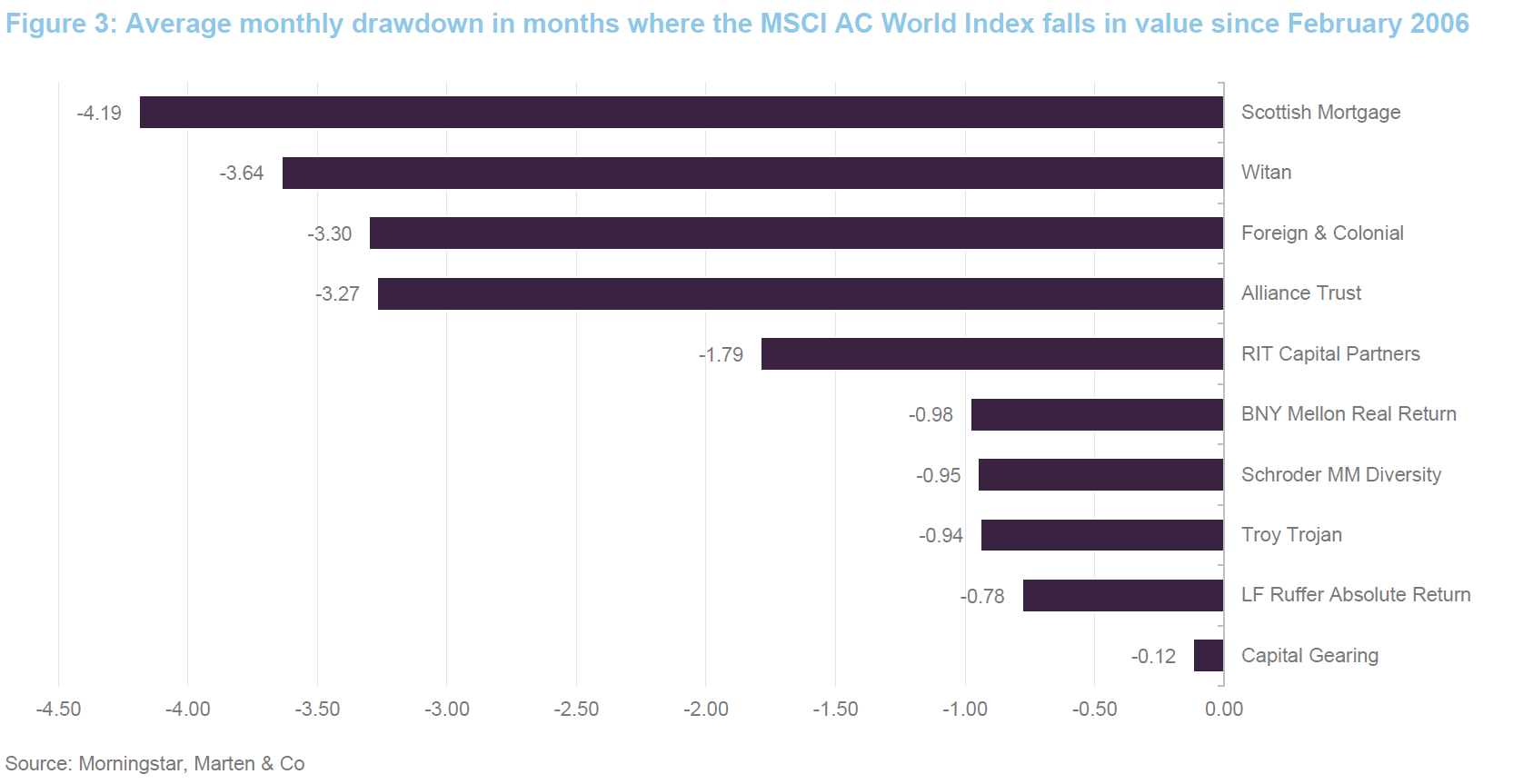

For an absolute return strategy, the real test is whether the manager can preserve capital in falling markets as well as providing real growth of capital over the long term. Capital Gearing Trust has a strong track record in this regard.

Figure 3, which covers the period from February 2006 (the earliest date that data is available for the funds in the chart) to the end of February 2020, shows how various funds performed, on average, in months where world equity markets (as represented by the MSCI All Countries World Index in Sterling) were falling. When compared to a peer group of large global investment trusts and well-known open-ended funds with an absolute return objective, Capital Gearing is by far the most defensive.

Investment thesis

Investment thesis

Putting it simply, CGAM’s investment thesis is that when potential returns are good, try to lock these in for as long as possible; when potential returns are poor, do the opposite.

In 1982, prospective returns across most asset classes were exceptionally good:

- inflation had purged balance sheets of excessive debt;

- real interest rates were high and falling;

- inflation was high and falling; and

- p/e ratios were very low.

The model (described in the next section) suggested that real returns of 16% per annum were available over the next ten years but only if they could be locked in.

Given that equities are in CGAM’s view the longest duration asset class, 1982 was the perfect time to have more than 100% of the portfolio invested in equities. In the case of Capital Gearing Trust, this meant employing gearing and having an allocation to the capital shares of split capital investment companies.

All the investment decisions that CGAM makes are driven by value. As the investment thesis played out in the early 1980s, the prospective returns on equities started to decline but returns on bonds still looked attractive. It therefore made sense to switch portfolios gradually into long-duration (30-year) bonds.

More recently, in CGAM’s view, prospective returns have looked exceptionally poor; zero to negative on most asset classes. The implication of this is that it makes sense to lock those returns in for as short a period as possible. Therefore, portfolios should have low exposure to equities, and where bonds are held, they should be short duration.

CGAM says that it is important that investors accept that returns will be unexciting when valuations are high. Many investors have a tendency to take on additional risk in an attempt to maintain returns in these environments. CGAM believes that is a recipe for disaster down the line. Some alternative asset classes do offer attractive returns, however, and the portfolios have some exposure to these areas.

Investment process

Investment process

CGAM seeks to add value both through stock selection and asset allocation. Equity exposure is achieved through investment in listed closed-ended funds and other collective investment vehicles including ETFs. Closed-ended funds are preferred to ETFs where the managers believe that excess returns can be achieved by purchasing funds at discounts to NAV and benefitting as those discounts narrow. In current market conditions, a discount narrowing opportunity of 5% or more is considered attractive.

The managers also note that the opportunity set in listed closed-ended funds is limited. ETFs and other collective investment vehicles may offer asset allocation opportunities not available to a portfolio comprised entirely of closed-ended funds.

CGAM’s asset allocation model assumes that rates of return on individual asset classes mean revert over time. Short-term market timing is not possible (i.e. markets are fairly efficient) but longer-term market timing can add value.

The model assumes that, over 10 years, rational investors should expect:

- real equity returns equal to the dividend yield plus real earnings growth plus or minus any valuation change; and

- real bond returns equal to the 10-year inflation-linked bond yield (held to maturity)

It also assumes that reversion to the mean takes place very slowly (over 20 years).

Positions sizes reflect the managers’ conviction on an investment idea but are heavily influenced by their analysis of the riskiness of the position.

CGAM’s approach and the asset allocation decisions it makes may lead to sub-par returns for periods of time, especially at the tail end of a bull market. This would be an uncomfortable position for most managers, given the short-termism prevalent across much of the investment industry, but CGAM’s managers can point to their long-term success and ride these out.

CGAM tends not to use derivatives, complex strategies or short positions in the management of its portfolios. The managers are concerned about counterparty risk in the derivatives market. They feel that short positions are more suited to short-term tactical investment decisions.

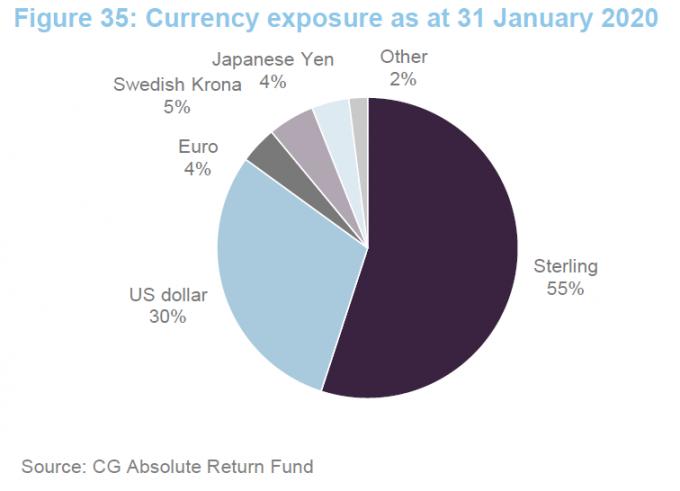

Currency exposures are considered within the context of asset allocation.

Valuations not yet attractive

Valuations not yet attractive

The managers note that history shows that all major equity markets are correlated when markets correct. Geographic diversification does not provide a place to hide.

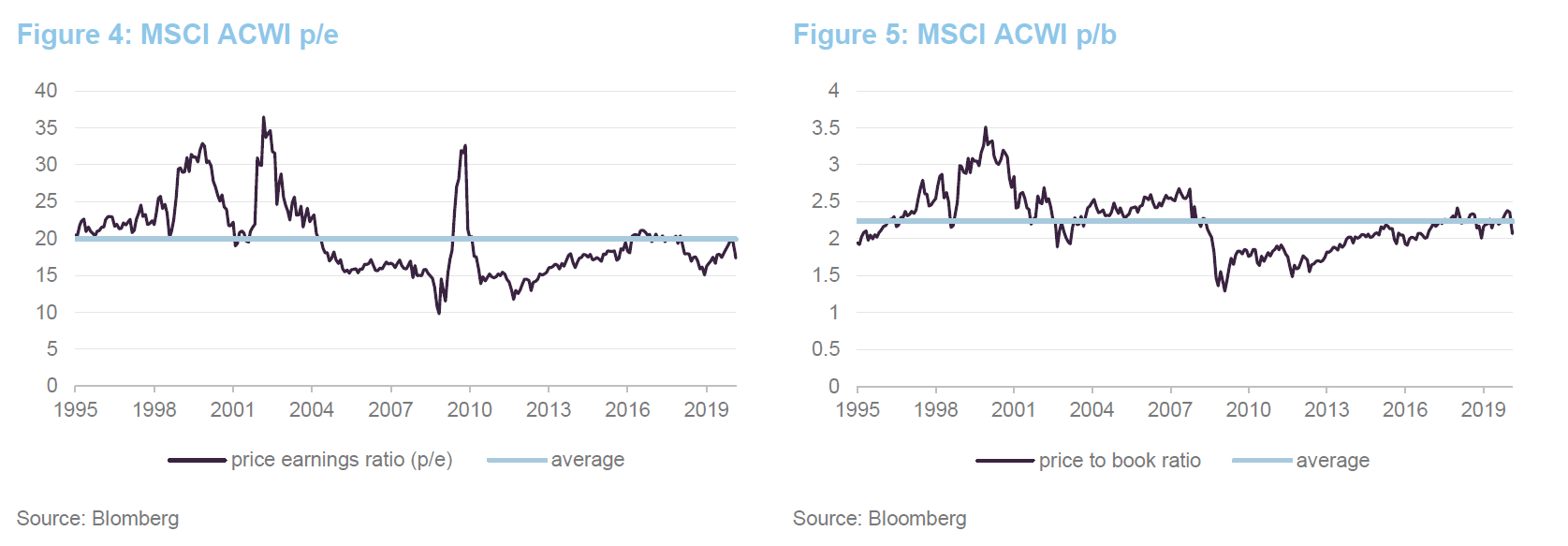

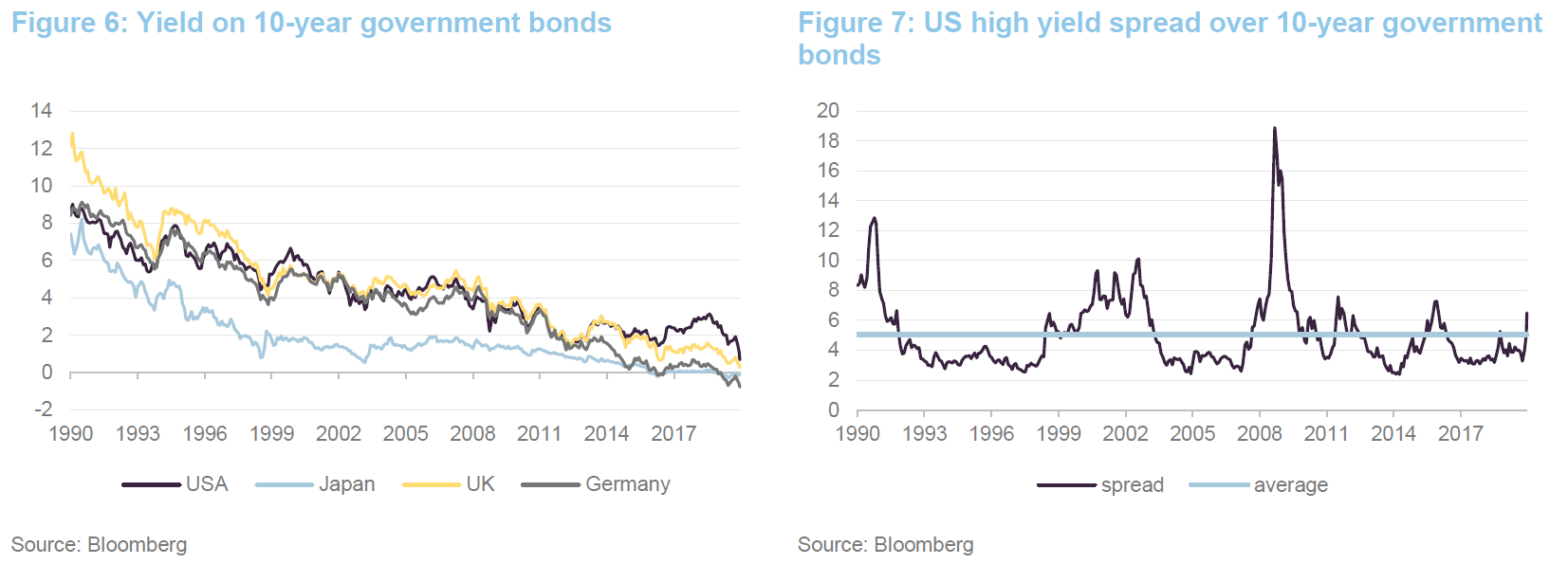

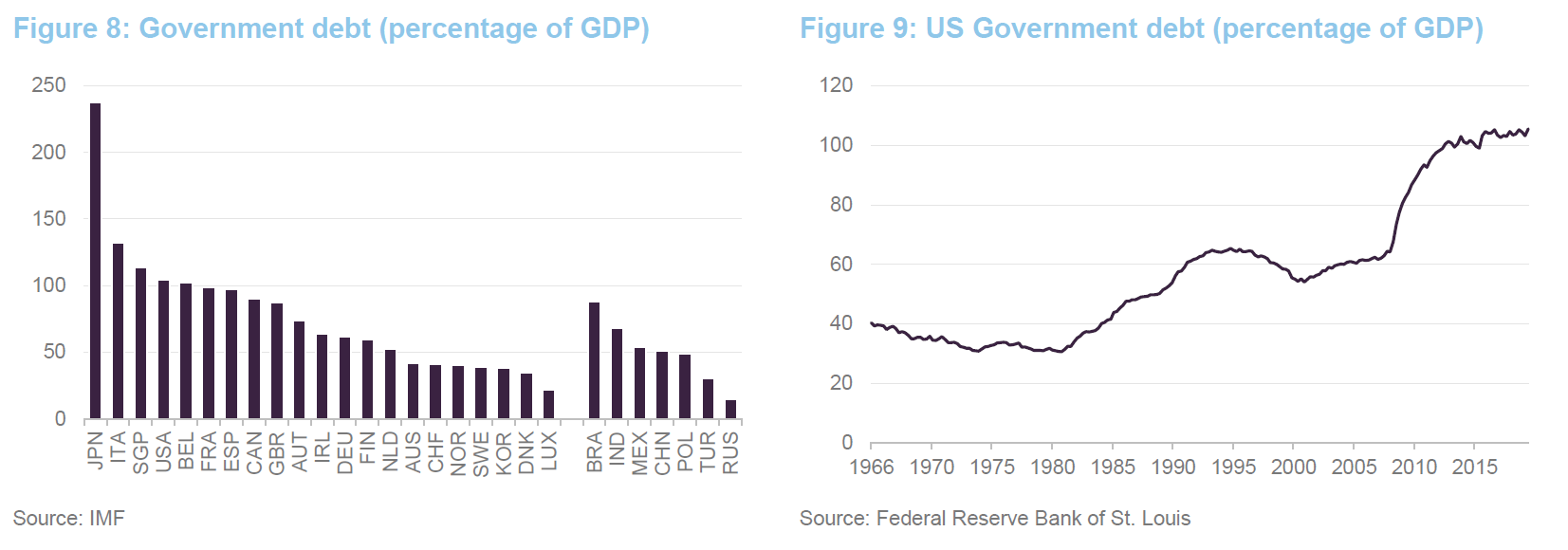

Even after the recent covid-19 related falls in equity markets, valuations are still expensive relative to history, especially given that a decade after the financial crisis, we are late in the economic cycle. A flight to the perceived safety of government bonds leaves them trading at or close to record low yields. The charts in Figures 3 to 6 underscore CGAM’s belief that prospective returns from these asset classes are poor relative to history.

US Gilts and UK Treasuries are trading at record low yields; yields on German and Japanese government bonds have been negative for some time. Credit spreads have widened a little but remain below average.

The Chinese government’s response to the economic disruption caused by its quarantine measures has been to pump liquidity into the system. Hong Kong has implemented a ‘helicopter money’ cash grant of $10,000 per person for permanent residents. Both China and Japan are thought to be intervening in equity markets as well as bond markets. The Fed and the Bank of England have topped this off with 0.5% rate cuts.

These policy responses to the virus are symptomatic of a global policy of staving off the threat of recession through fiscal largesse. A pattern that has been repeated since the financial crisis and arguably dates back to 2001 and Greenspan’s response to the bursting of the tech bubble and the September 11 attacks. Real interest rates are now zero or negative in many countries and QE has depressed bond yields and inflated the valuation of most asset classes.

At the same time, the proportion of investment grade debt rated BBB (the lowest level) has risen from just 17.4% in 2001 to well over 50% (source: Bloomberg Barclays) and credit ratings agencies are assigning investment grade status to loans with higher levels of leverage. This grade-inflation is worrying as many investors would be forced to sell loans that are downgraded to non-investment grade status.

In such an environment, the managers believe that they should lock in returns for as short a time period as possible and maintain an underweight exposure to long-duration assets such as equities.

CGAM’s absolute return portfolios hold considerable ‘dry powder’ which can be used to buy risk assets when valuations adjust to attractive levels. It is too early to tell whether the current market sell-off will gather pace sufficiently to be the catalyst for this.

The case for TIPS

The case for TIPS

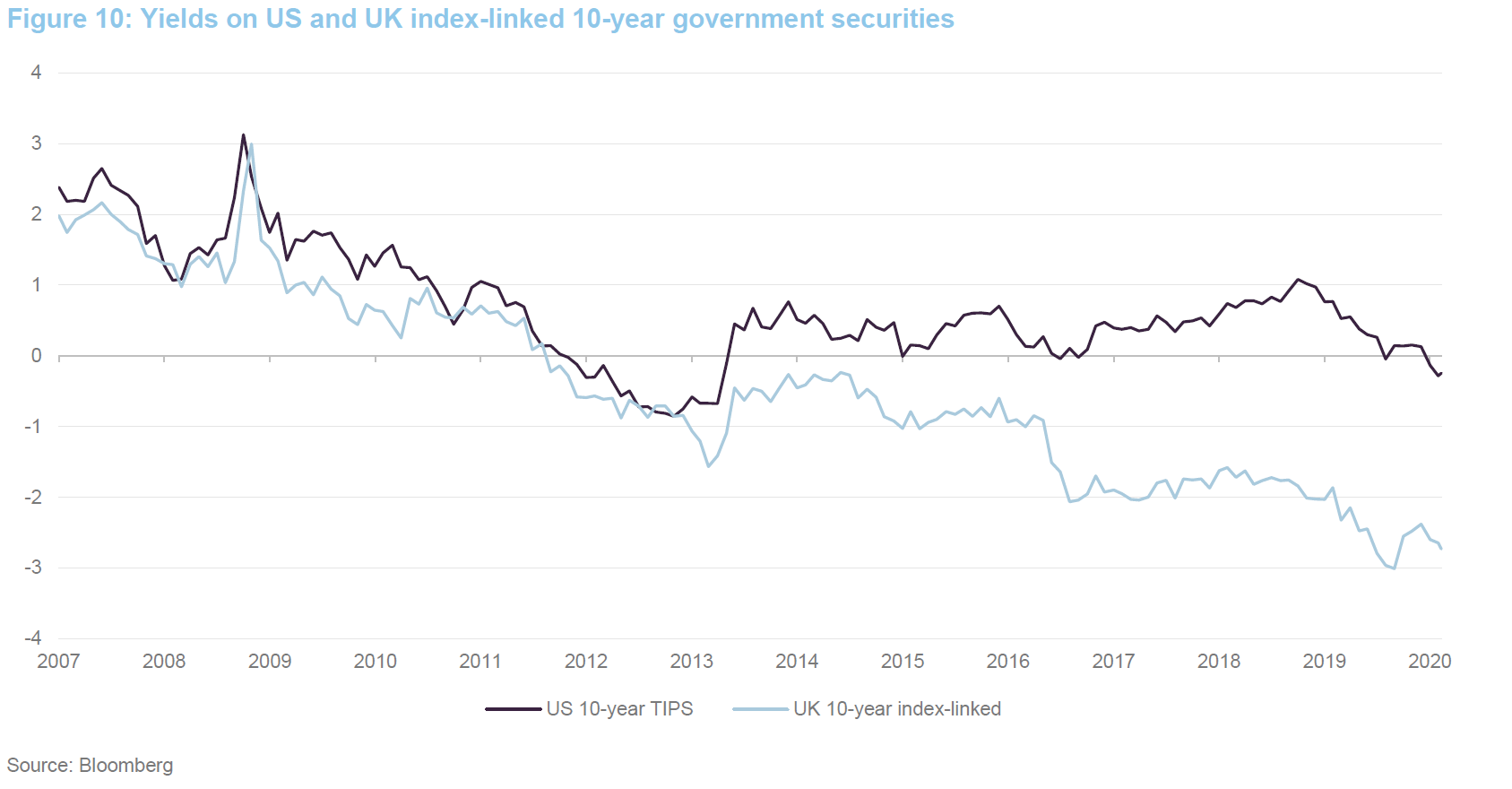

A substantial proportion of the portfolios of CGAM’s absolute return funds are exposed to inflation-protected securities, notably TIPS. Part of the attraction of these is that they have a negative correlation to UK equities but the managers are also convinced that inflation is dormant not dead. The managers believe that governments and central banks have or will come to realise that inflation offers the only realistic route towards reducing the global debt burden.

Consider the dilemma facing the UK Government. A decade of austerity in the UK still leaves it with a debt to GDP ratio more than double the level ahead of the financial crisis. For the time being, it has no trouble issuing gilts on record low yields. Corporates have reduced their debt burden and banks are rebuilding their balance sheets but many companies are still quite highly leveraged. A return to ‘normal’ rates would cripple the current economy and would make it much harder for the UK to service its debt. If inflation creeps into the system, therefore, the Bank of England has only limited room to choke this off by raising rates. This is a scenario that applies to many other developed economies.

Across traditional asset classes, there is nothing that benefits from high inflation except, perhaps, gold – and it is unpredictable. The portfolios have only limited exposure to gold and this reflects the difficulty that the managers have in determining what the ‘right’ price for gold should be. They note that, on an inflation-adjusted, long-term basis gold looks expensive relative to history.

It is clear from Figure 10 that US TIPS offer much better value than equivalent UK securities. Year to date, yields on TIPS have moved negative, however. This reflects that flight to perceived safety that investors have executed since covid-19 emerged. CGAM’s funds have benefitted as a result (see page 17).

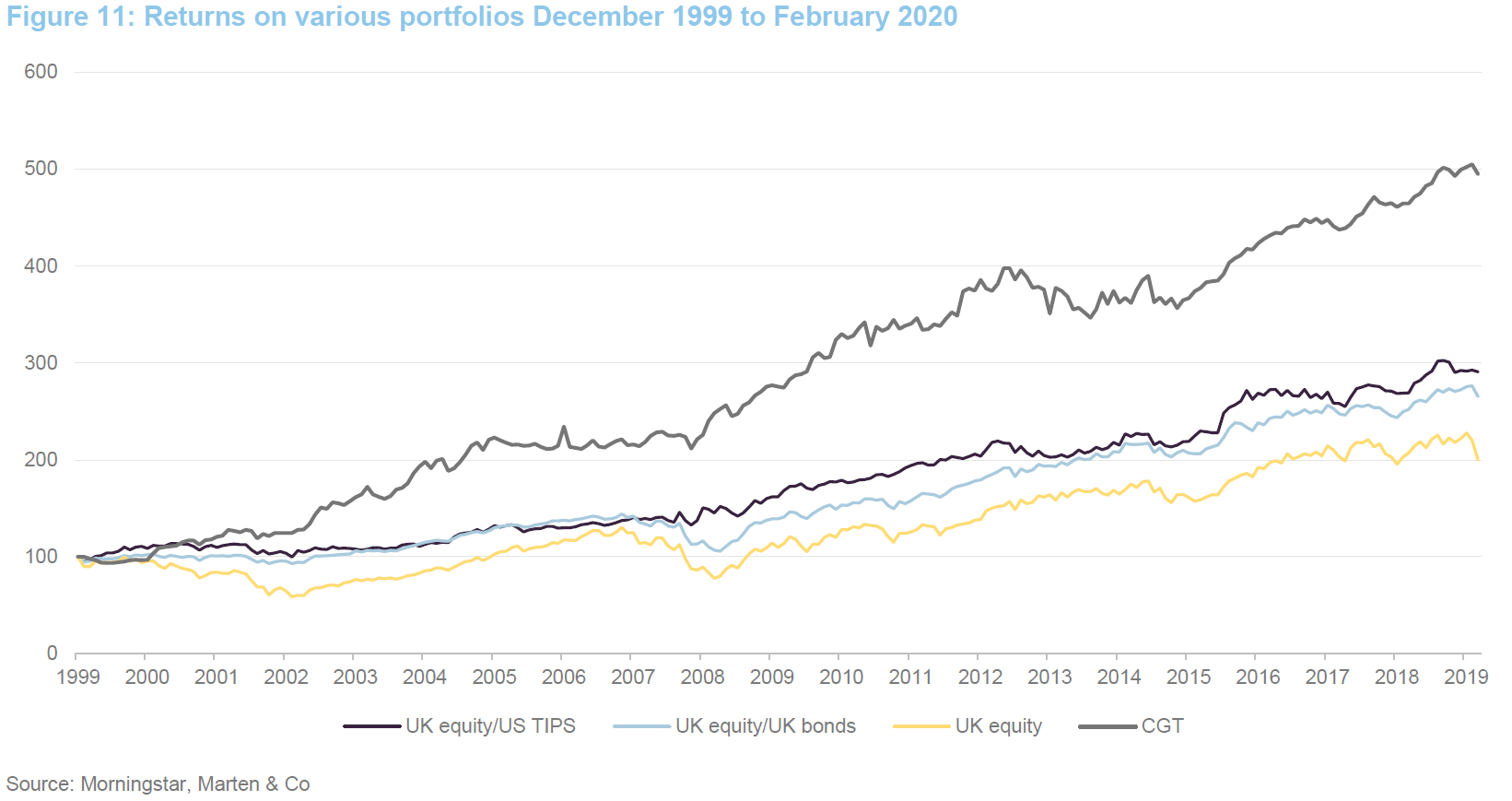

Figure 11 compares the returns that could have been achieved by an investment in Capital Gearing Trust against portfolios comprising 50/50 UK equities (as represented by the MSCI UK Index) and US TIPS, 50/50 UK equities and UK bonds (as represented by the Bloomberg Barclays Sterling Aggregate Corporate Bond Index), and 100% UK equities. It underlines the added value of including TIPS within the mix and the alpha that CGAM has achieved through its asset allocation and stock selection decisions.

Tackling discounts

Tackling discounts

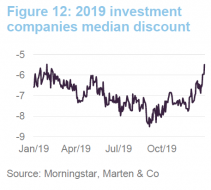

Ahead of the recent market falls, discounts on UK listed investment companies were narrow relative to history. However, CGAM feels that this was masking a number of issues facing the industry. Regulations aimed at shoring up banks in the wake of the financial crisis have had the effect of reducing capital available to market makers and this has reduced liquidity. At the same time, MiFID rules now require that wealth managers and IFAs ensure that clients with similar objectives have identical portfolios. A lack of liquidity makes that much harder to achieve with investment companies than with open-ended funds and ETFs.

CGAM’s managers observe that mergers of funds with similar objectives – to create larger and more liquid vehicles – seem to be hard to achieve, although it is not clear why. They suggest that, where possible, investment companies adopt zero discount control mechanisms with the aim of facilitating liquidity. This is not an option for investment companies holding illiquid assets, however. In such cases, the managers suggest that funds provided periodic liquidity (regular offers of stock accompanied by tender offers), an approach that has been adopted by BlackRock Frontiers, for example.

The managers are not convinced that investment companies that have been issuing stock to meet demand will be as ready to buy back stock when sentiment turns. The current market environment may test this. It may also provide opportunities to buy some investment companies cheaply.

Ranger zeros

Ranger zeros

CGAM’s absolute return funds had a large position in Ranger Direct Lending’s zero dividend preference shares. This alternative finance company was making loans to and through a range of direct lending platforms. In December 2016, the fund highlighted issues with one of its lending partners, Princeton. The GRY on the zeros rose as investors became more nervous about being repaid (although the zeros were always well-covered by assets). CGAM built up the position over the first half of 2017.

Issues elsewhere in Ranger’s portfolio and deepening problems with Princeton prompted shareholders to shake up the board. The decision was taken to liquidate the portfolio and return the net proceeds to shareholders; the company was renamed RDL Realisation.

The zeros had a maturity date of 30 July 2021 and covenants were in place that prevented RDL Realisation from making distributions that would compromise the level of asset cover on the zeros. The new board repurchased some zeros but felt that it had to repay the zeros early.

CGAM were unhappy with the first offer made by the board and led a consortium of zero holders, engaging legal counsel, with the aim of securing a higher exit price. This succeeded and the funds were able to book a substantial profit on the position.

Investment company bonds – Burford and Pershing

Investment company bonds – Burford and Pershing

In response to the shrinking of the zero market, CGAM evaluated a range of bonds issued by investment companies as alternative investments. It knew the underlying companies well, having analysed them from an equity standpoint. The team alighted on Burford Capital’s bonds, which have a range of maturities between 2022 and 2026. This litigation finance company’s NAV can easily be questioned, since it relies on the manager’s estimation of the likely proceeds and timing of litigation claims. CGAM acknowledges this but felt comfortable that the company was capable of generating sufficient cash to service its debt.

Burford Capital was attacked by short-seller Muddy Waters. This drove down Burford’s ordinary share price and raised the yield on its debt. CGAM took advantage of the situation to add to its Burford bond exposure. Prices have recovered somewhat since.

In Pershing Square’s case, in 2015 CGAM identified Pershing Square’s 5.5% bond due 15 July 2022 as a potential investment. Poor performance within the hedge fund had affected the rating of the bond but CGAM was comforted by the high level of asset cover (6.2x at the time) and was able to buy the bond as low as $85.2. Ahead of the sell-off it was trading around $105.

Hard currency property – Germany/Sweden

Hard currency property – Germany/Sweden

Although it was reduced in H1 2019, CGAM’s absolute return funds retain an exposure to German and Swedish property, through a spread of companies. The managers believe that property in these countries still offers attractive levels of yield relative to government bonds, and are happy to have exposure to Swedish krona and euros backed by German assets. German wages are rising, which should make rents more affordable, and finance is cheap. In Sweden, one of the companies that CGAM has invested in – Castellum – was able to make use of some short-term finance at negative rates.

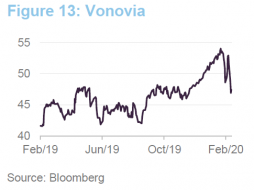

Vonovia, which owns close to 400,000 residential units across Germany, Austria and Sweden, was at one time of the largest positions in the portfolio. Its focus is on properties outside Berlin and investors appear to be factoring this into its share price now. However, in June 2019 it was affected, alongside other German residential property companies, by the prospect of the imposition of a five-year rent-freeze in Berlin. The Berliner Mietendeckel law implementing this was approved on 30 January 2020. It mandates that rents cannot be increased between now and mid-June 2024 and by no more than 1.3% a year thereafter.

The Mietendeckel law was preceded by a petition to nationalise Deutsche Wohnen, and demonstrations against rent levels. This was a trigger for the managers to reduce exposure to this area from 6.5% to 5%. Following the Mietendeckel announcement, the position was reduced again to around 2.5%. More recently, the managers have been rebuilding positions on weakness, however.

It seems unlikely that Berlin’s rent control policy will be repeated in many other cities in Germany (Bremerhaven is mentioned as a possibility). The managers feel that rents are likely to rise more slowly, but dramatic rent rises are not a prerequisite to producing decent returns from this asset class.

Phoenix Spree Deutschland was one stock that the managers bought after the Mietendeckel-related price weakness. This investment company had been issuing shares at a premium but it moved to a discount. The managers applauded the way that it sold assets to buy back 10% of its issued share capital. Debt considerations limit its ability to do more, but CGAM commends the company’s actions.

Asset allocation

Asset allocation

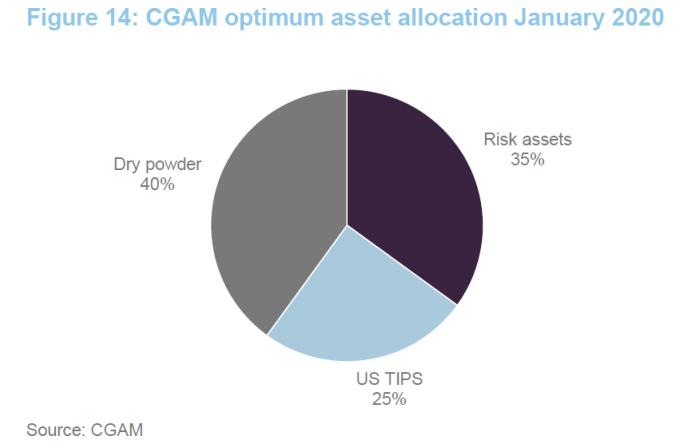

The managers believe an optimum asset allocation should include elements of short-duration fixed-interest securities, longer-duration inflation-linked bonds and a selection of risk assets with defensive qualities.

CGAM has taken the decision not to hedge the US dollar exposure associated with the TIPS portfolios in its absolute return funds. It believes that the world is still addicted to the dollar. The Fed actions to shore up other central banks in the financial crisis reinforced this view.

Capital Gearing Trust – Substantial dry powder

Substantial dry powder

Substantial dry powder

The easy-money policies adopted in the wake of the financial crisis left valuations stretched for almost all asset classes. CGT’s asset allocation reflects this, with high levels of liquidity and low exposure to equities. It is testament to CGAM’s stock selection that, despite this defensive stance, over the decade ended 31 December 2019, CGT generated real NAV returns of 3.7% a year, only narrowly failing to match the 4.1% per annum return on the MSCI UK Index.

Covid-19 may prove to be the catalyst for a decisive market correction, but it is too early to say this definitively. Policymakers are attempting to stabilise the situation by injecting additional liquidity into the system, and they may succeed. However, this would just kick the can down the road. Over 2020 year to date, CGT has held up well, helped by tightening yields in its conventional and index-linked bond portfolios. However, when CGAM decides valuations are attractive, it will redeploy CGT’s substantial dry powder into risk assets and reap the rewards as markets recover.

Medium to longer-term absolute total returns

Medium to longer-term absolute total returns

CGT’s dual objectives are to preserve shareholders’ real wealth and to achieve an absolute total return over the medium to longer term.

It aims to achieve its investment objectives through long-only investment in quoted closed-ended funds and other collective investment vehicles, bonds, commodities and cash, as considered appropriate.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | RPI | MSCI UK total return (%) |

|---|---|---|---|---|---|

| 1 | 29 Feb 2016 | 4.20 | 4.20 | 1.30 | -7.80 |

| 2 | 28 Feb 2017 | 14.40 | 13.80 | 3.20 | 23.20 |

| 3 | 28 Feb 2018 | 1.40 | 1.40 | 3.60 | 4.40 |

| 4 | 28 Feb 2019 | 6.10 | 5.20 | 2.50 | 1.40 |

| 5 | 29 Feb 2020 | 6.50 | 8.60 | 2.00 | -2.30 |

Fund profile

Fund profile

Capital Gearing Trust (CGT) was incorporated in May 1963 and listed on the London Stock Exchange on 14 February 1973. Peter Spiller has been managing the trust since 1982 and has therefore been responsible for CGT’s excellent long-term performance record, described on page 2. CGAM’s founders and its other employees have substantial personal investments in the funds that it manages, and Peter Spiller is one of the largest shareholders in CGT. Since 2011, he has been assisted by Alastair Laing. Chris Clothier joined the team in 2015.

CGT’s dual objectives are to preserve shareholders’ real wealth and to achieve an absolute total return over the medium to longer term. It aims to achieve its investment objectives through a long-only, multi-asset portfolio of quoted closed-ended funds and other collective investment vehicles, bonds, commodities and cash. The generation of capital gains is prioritised over income.

Portfolio positioning

Portfolio positioning

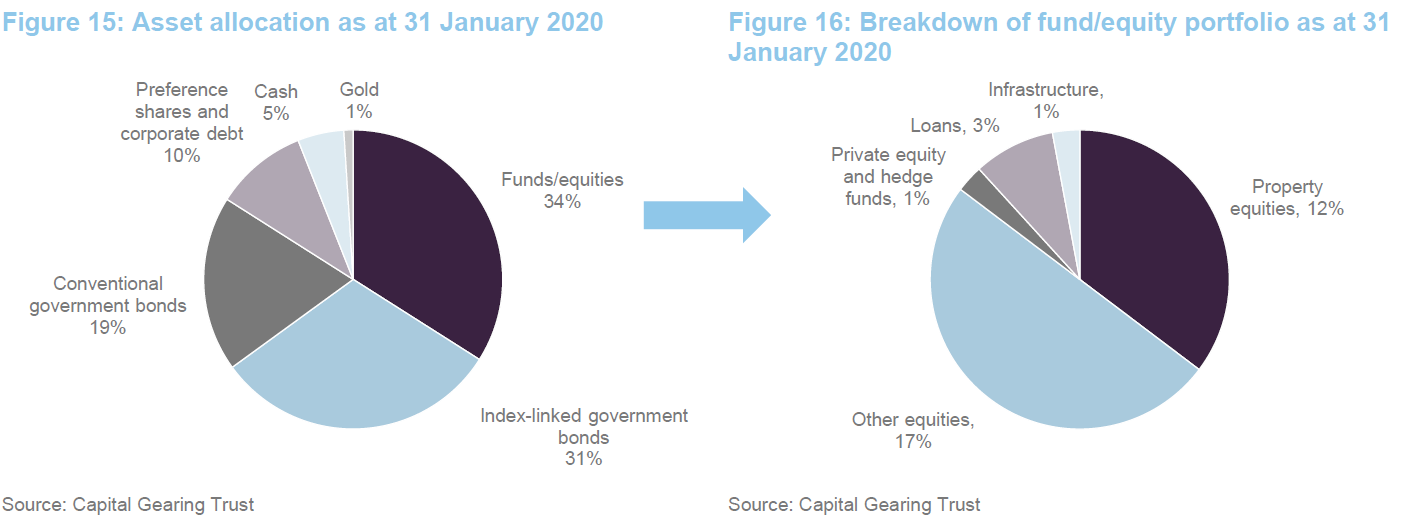

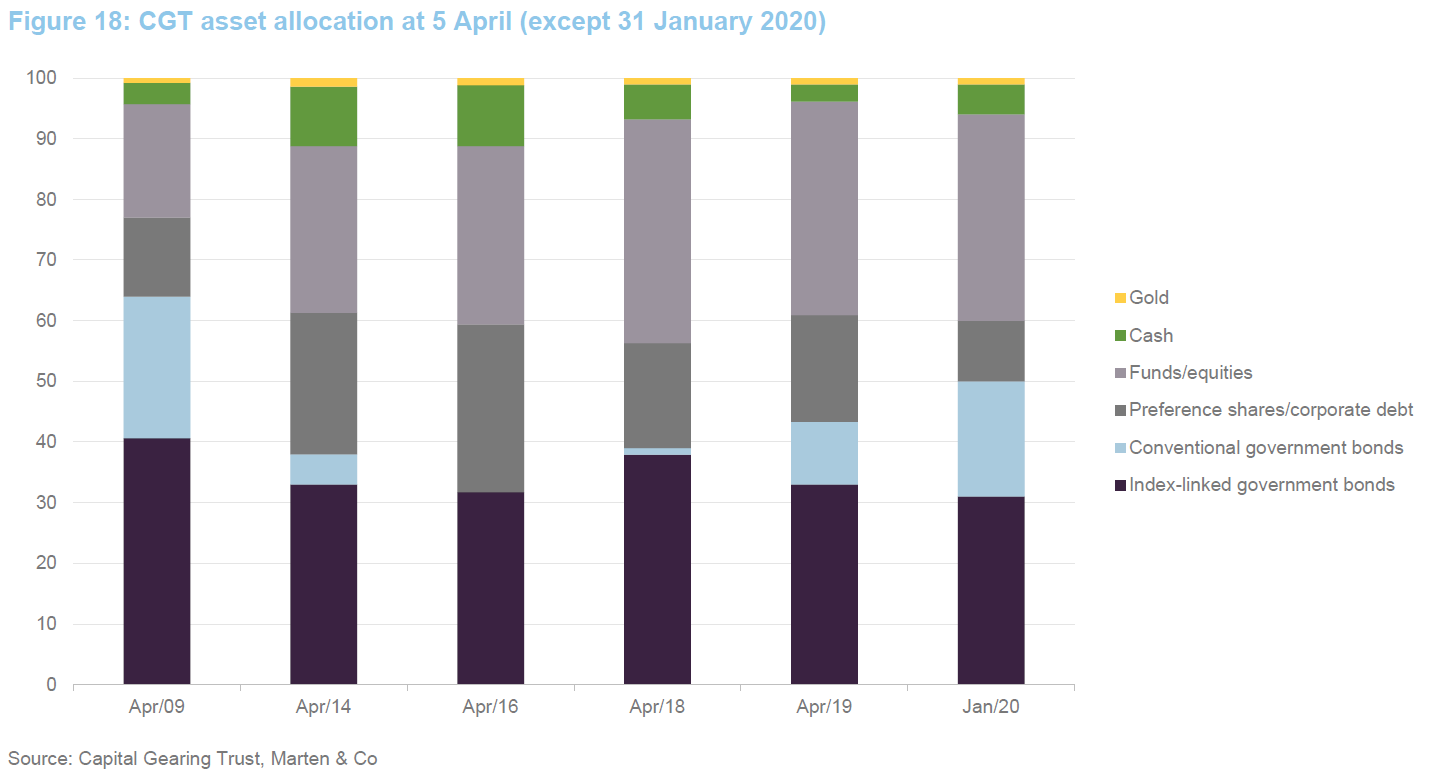

The most significant change in CGT’s asset allocation since we last published (using data as at the end of June 2019) is an increase in exposure to conventional government bonds at the expense of preference shares/corporate debt. This is largely the consequence of the early repayment of RDL’s zero dividend preference shares, discussed on page 9.

Within the allocation to index-linked bonds, the trust retains a bias to US TIPS.

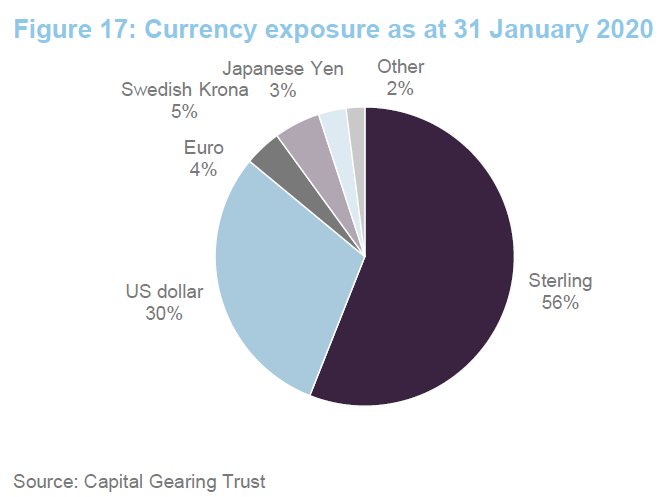

CGT retains its bias to sterling and this will have been beneficial following the strengthening of the currency following the UK election.

CGT’s exposure to funds/equities was increased in the wake of the financial crisis, but the allocation to conventional bonds was eliminated for a time as real yields fell to unattractive levels. The zero dividend preference share market has been shrinking and short-dated conventional bonds have been used as a home for some of CGT’s ‘dry powder’.

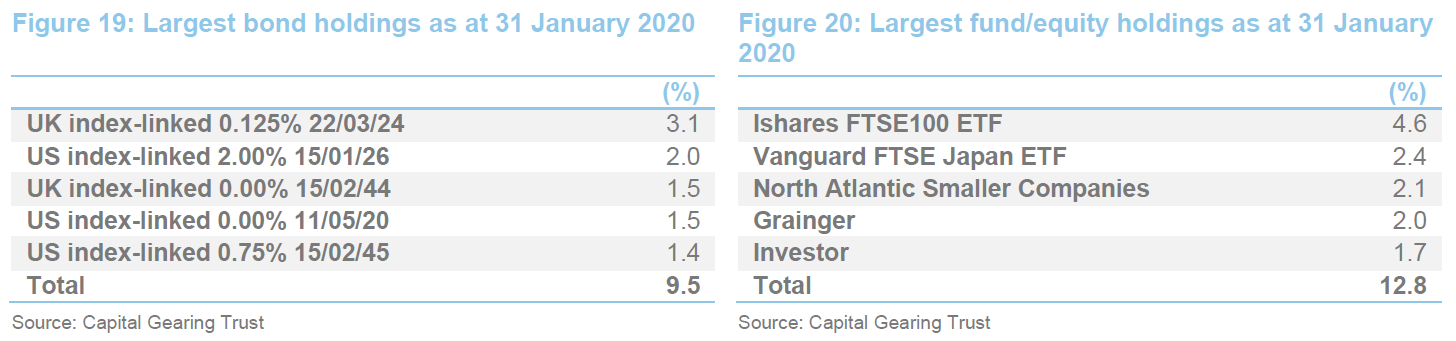

Largest holdings

Largest holdings

Unsurprisingly, given CGAM’s investment approach, CGT’s biggest fund/equity positions at 31 January 2020 were largely unchanged from when we last published using data at the end of June 2019. The ETF positions have been used to gain additional access to markets that the managers believe are attractively valued but where they were wary of having too much discount risk.

Swedish conglomerate Investor performed well in 2019, delivering net asset growth of 33% and a total shareholder return of 40%. The position has been trimmed.

North Atlantic Smaller Companies (NAS) was one of a number of UK smaller companies trusts that benefitted from the UK election result in December. Its share price rose by 13.5% in the week following the Conservative victory and held up fairly well until markets were hit by covid-19. It is investing in listed and unlisted companies that it considers to be undervalued. The manager works to unlock that value, sometimes taking an activist approach.

Despite the strong share price, NAS still trades on one of the widest discounts of any global trust, 27.7% at 10 March 2020, according to Morningstar. CGT also holds Oryx, a trust managed by the same manager with a similar investment approach.

Other trusts that they have positions in include Ground Rents Income, where question marks over the future of the leasehold market and specific problems with one asset have weighed on the share price; and Empiric Student Property, which had excessive overheads and has been working to reduce these.

The problems that certain well-known UK asset managers experienced last year led to sales of some investment companies at fire sale prices. CGAM has been taking advantage of this to gain exposure to attractively valued positions.

Performance

Performance

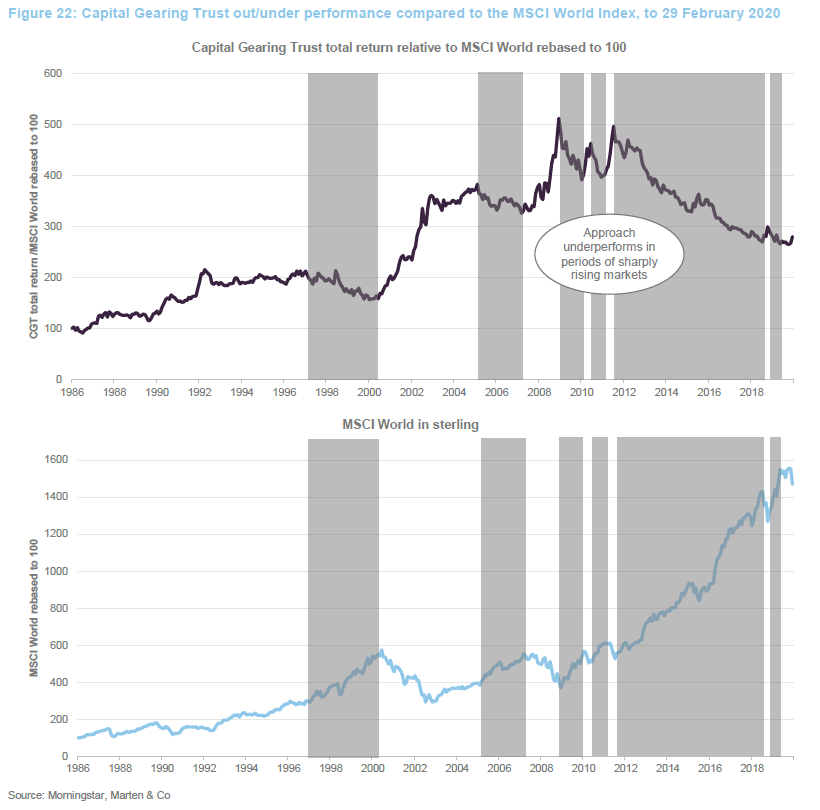

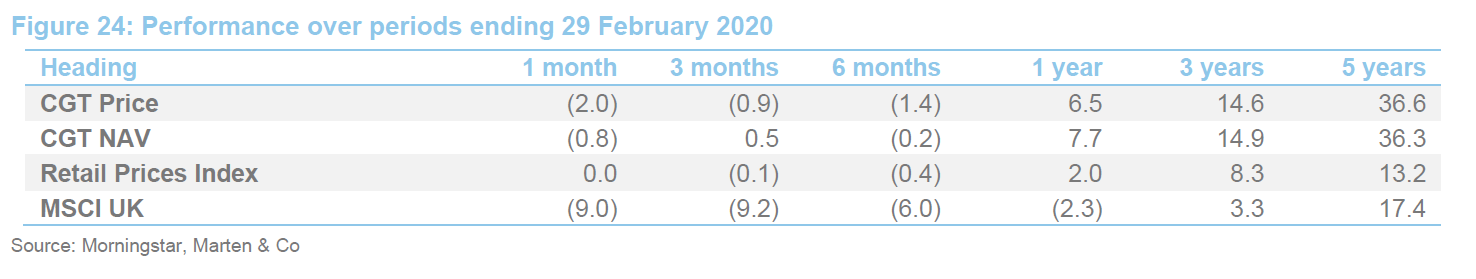

CGT has a tendency to underperform strong markets but holds up well in downturns (as was also shown in Figure 3 on page 3). The decade-long bull run in equities may be faltering, which should benefit CGT’s relative performance. Since 1986 – the earliest data we have for the MSCI World Index – CGT has generated 2.8x the return from this index.

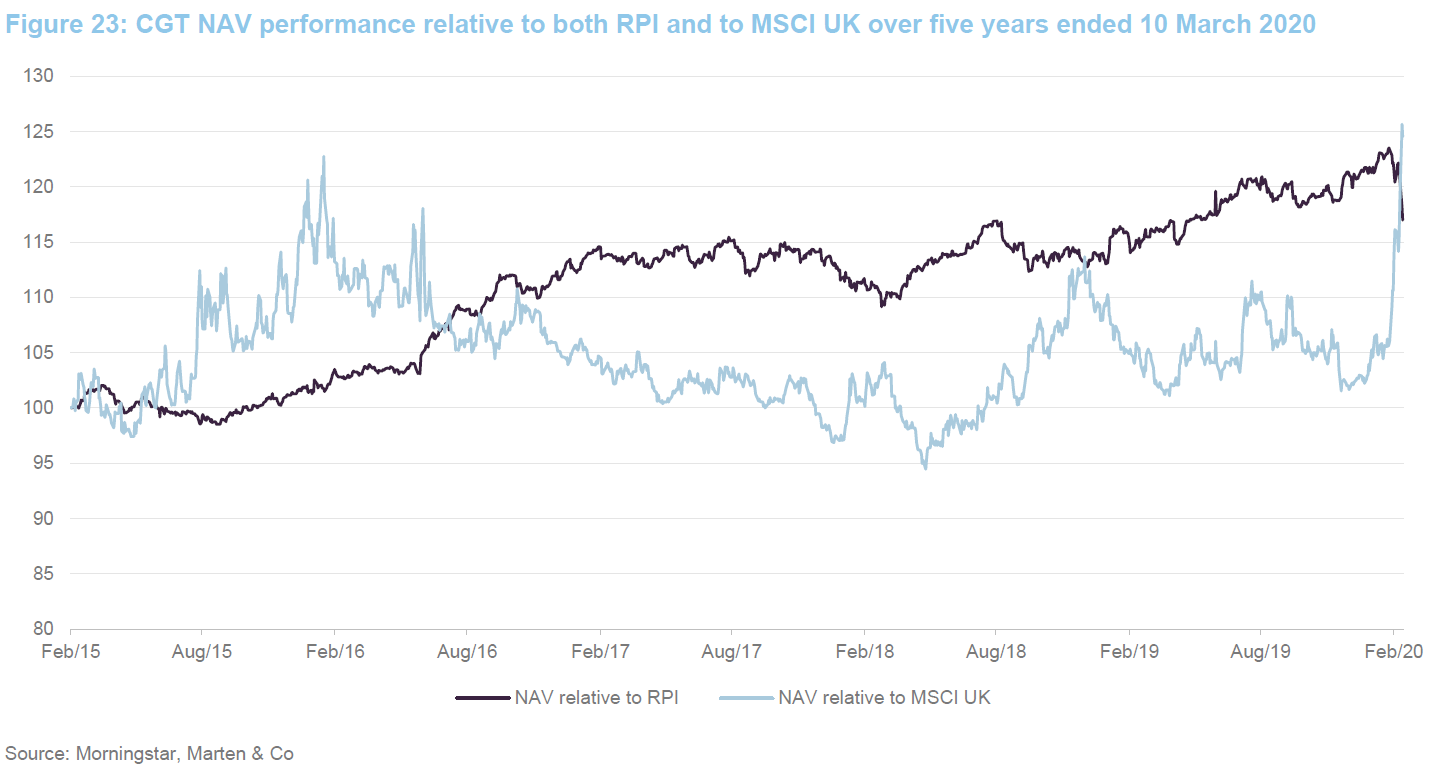

Over the short term (five years), as Figure 23 shows, CGT’s NAV has exceeded both UK inflation, as measured by RPI, and UK equity returns, as measured by the MSCI UK Index.

The relative resilience of CGT’s portfolio in the face of recent market falls has amplified CGT’s outperformance of the MSCI UK Index over the past five years.

Drivers of recent performance

Drivers of recent performance

On the positive side, the value of CGT’s conventional bonds and TIPS has been rising as yields fall. The uplift in the value of UK smaller companies funds post-election helped, as did positions in Investor and Ranger zeros (page 9).

Exposure to German property (discussed on page 10) did take a little off returns, although the managers say that Vonovia still made a meaningful contribution over 2019. The trust’s Japanese exposure was a drag on returns as Japan was impacted by the US/China trade war.

The trust’s exposure to renewable energy and infrastructure funds proved especially beneficial after the UK election, once the threat of a Labour government was removed. The managers have started taking profits on some of these positions.

Peer group

Peer group

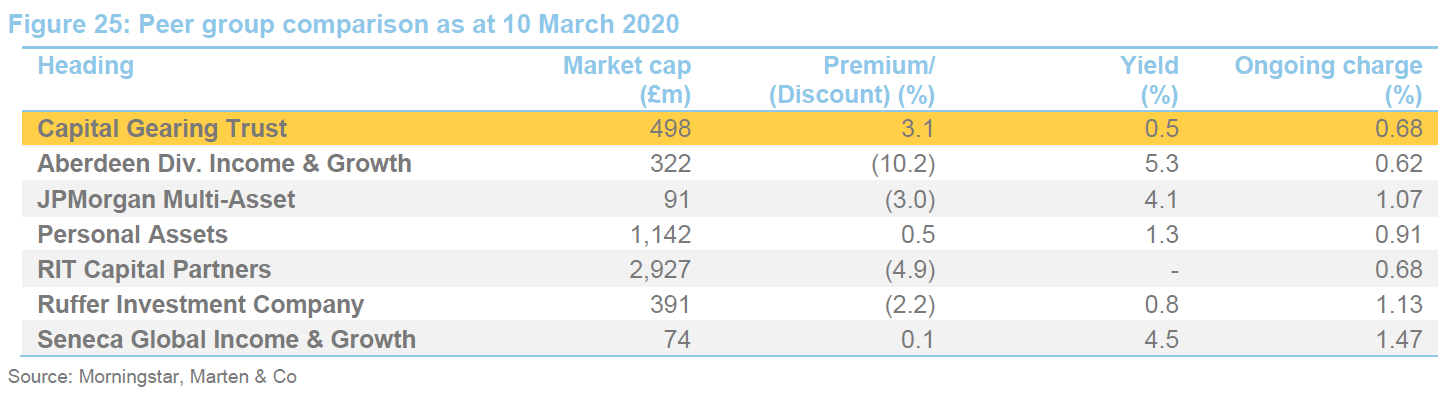

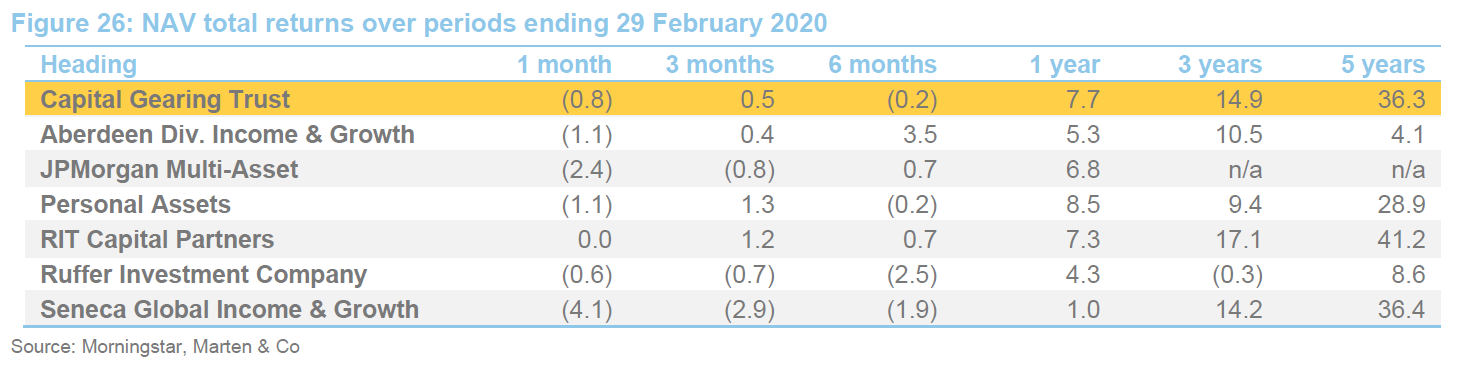

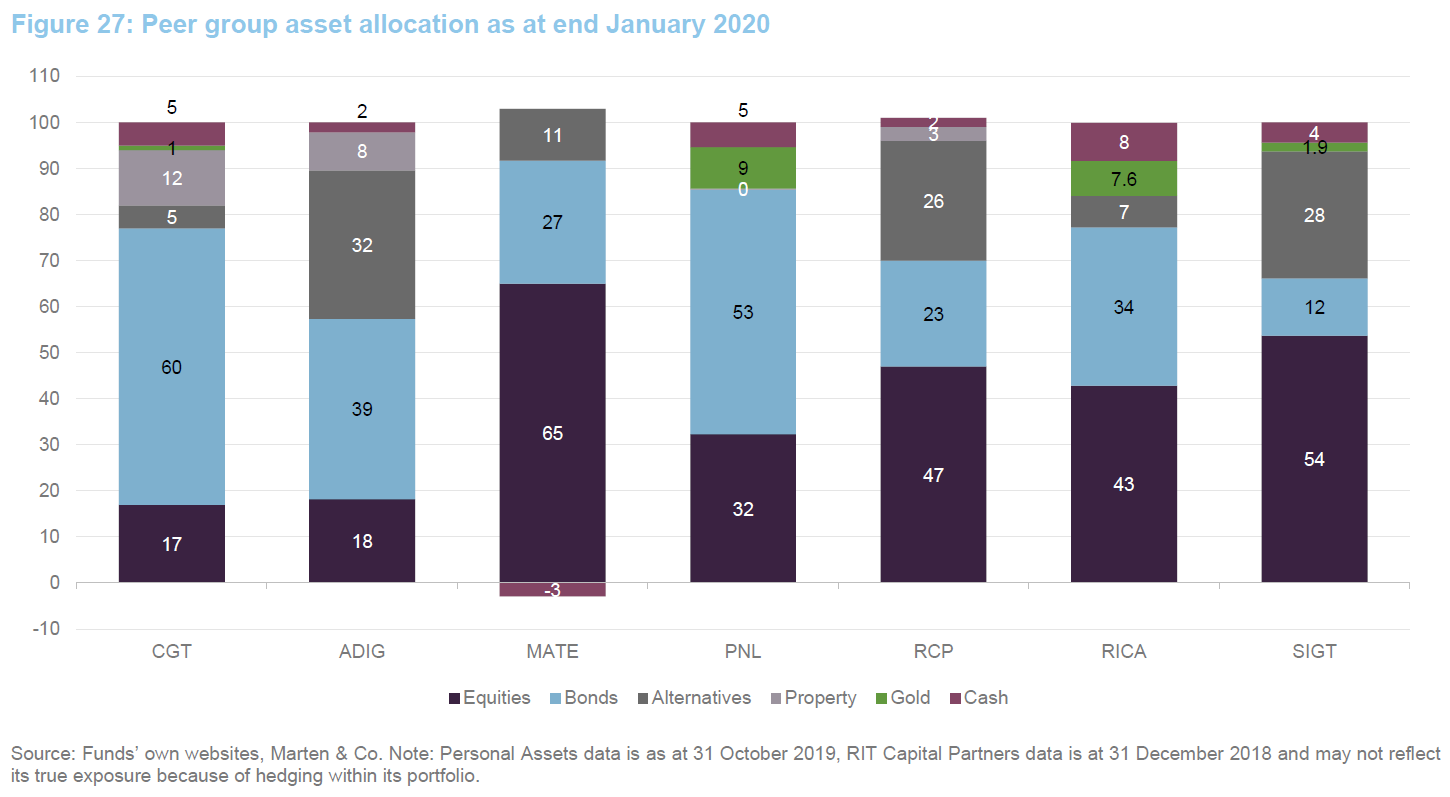

The AIC’s flexible investment sector continues to expand. These encompass a wide range of objectives and investment styles. CGT believes its closest listed peers are probably Personal Assets (PNL) and Ruffer Investment Company (RICA), but in Figures 25 and 26 below, we have also included RIT Capital Partners (RCP), which aims to deliver long-term capital growth while preserving shareholders’ capital, and Aberdeen Diversified Income & Growth (ADIG), JP Morgan Multi-Asset Trust (MATE) and Seneca Global Income & Growth (SIGT), all of which have objectives of delivering absolute returns with low volatility, but which place greater emphasis on the provision of income, impacting their asset allocation decisions.

CGT has risen through the ranks to become the third largest of these trusts. This expansion is helping to reduce its ongoing charges ratio, which we expect to fall year-on-year for the current financial year ending 5 April 2020.

The disparity between the performances of the various funds in the peer group shown in Figure 26 can be attributed largely to their asset allocation. We have attempted to compare this in Figure 27. This is an inexact comparison, however, as there are substantial differences in the way that the various funds classify the exposures within their portfolios.

CGT still has the lowest allocation to equities of any fund in this peer group and the highest allocation to index-linked bonds. CGT’s allocation to property looks high relative to this peer group but this may be overstated as some part of the other trusts’ allocation to equities may relate to property stocks.

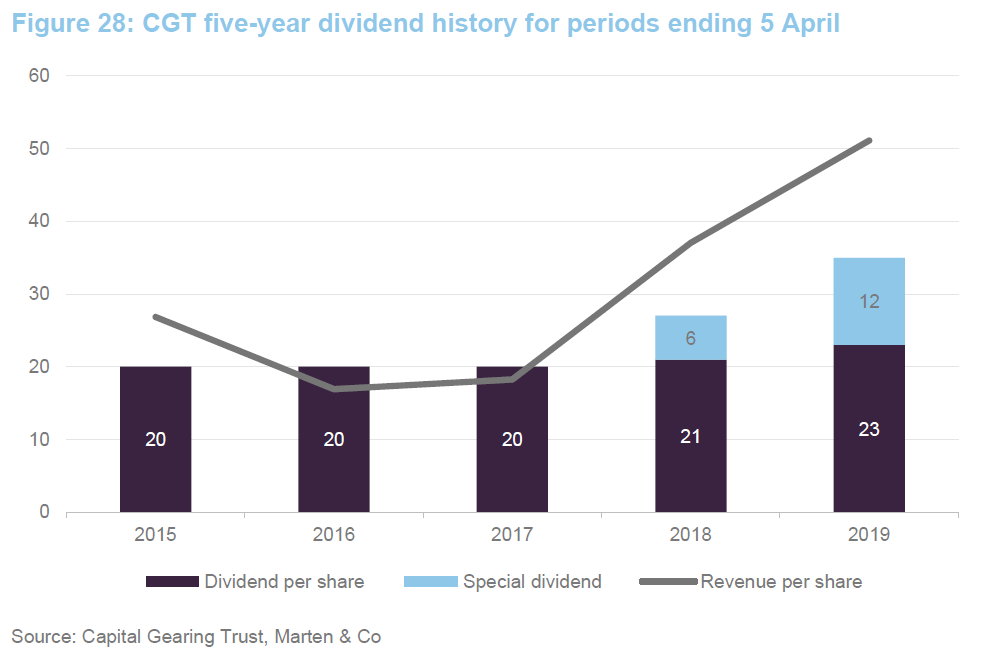

Dividend

Dividend

CGT is not managed to produce an income return for its shareholders. One dividend per annum is declared in order to maintain the company’s investment trust status. The dividend has not been covered by earnings in recent years, but the board has elected to make a small transfer from capital reserves rather than cut the dividend.

At 5 April 2018, CGT had revenue reserves of £2.7m, or 44 pence per share.

Premium

Premium

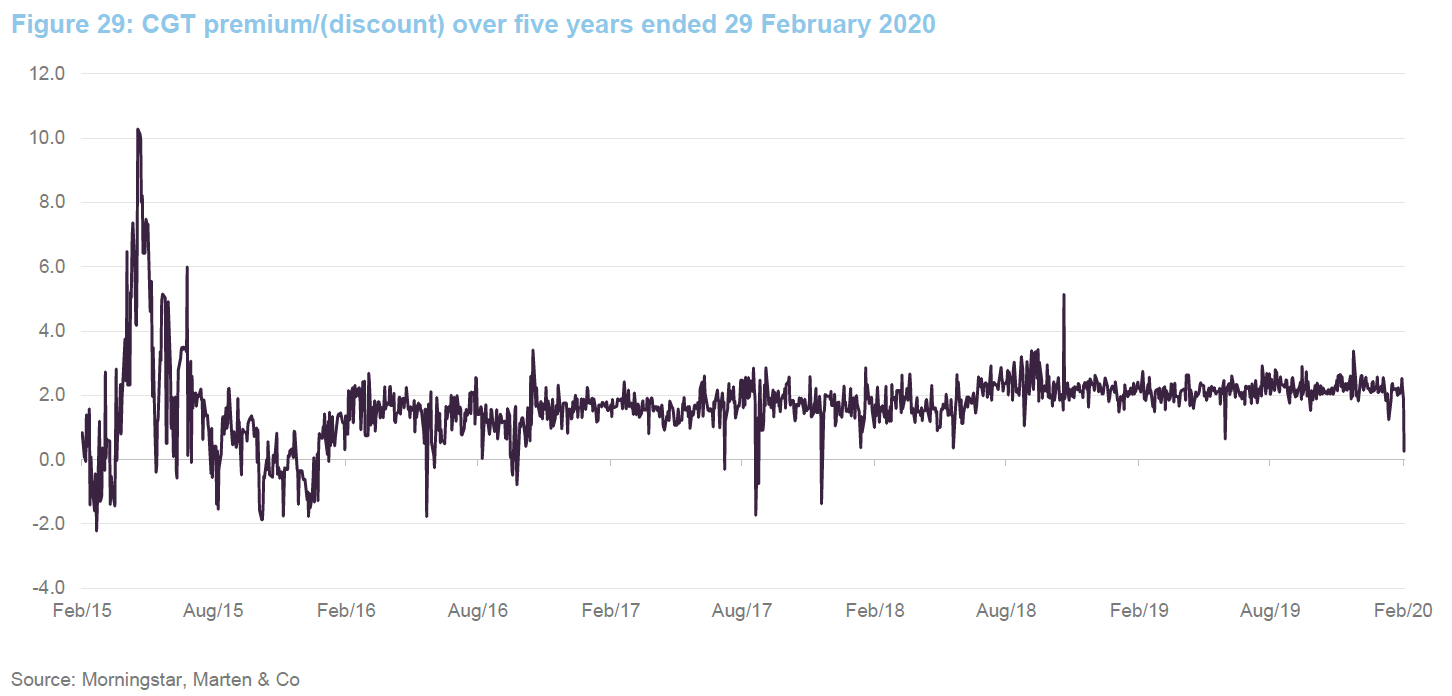

CGT implemented a zero discount mechanism (ZDM) at the end of July 2015. Figure 29 shows that this is working well, and it has contributed towards the substantial growth of the trust in recent years. Personal Assets Trust Administration Company Limited manages the ZDM on behalf of the company.

CGT’s policy is to issue shares at a small premium to NAV and redeem them at a small discount, thereby ensuring that ongoing shareholders are not disadvantaged by the costs of implementing the ZDM.

Over the year ended 29 February 2020, CGT’s shares have traded within a range of a 0.3% premium to a 3.4% premium and an average premium of 2.2%. As at 10 March 2020, the shares were trading at a premium of 3.1%.

Fees and costs

Fees and costs

CGAM is entitled to receive an annual management fee of 0.6% on the first £120m of CGT’s net assets, 0.45% on the next £380m of assets and 0.3% on the balance. There is no performance fee. The management fee is calculated quarterly and paid in arrears. For accounting purposes, 40% of the management fee is allocated against revenue and 60% against capital. The management agreement is terminable on six months’ notice.

Northern Trust Company acts as the company’s custodian. Corporate secretarial, administrative, accounting services and the management of CGT’s ZDM are provided by PATAC Limited. PATAC’s fee amounted to £142,000 for the year to 5 April 2019.

CGT’s ongoing charges ratio for the year ended 5 April 2019 was 0.70%, down from 0.77% for the prior year and less than half the ratio for the year ended 5 April 2009.

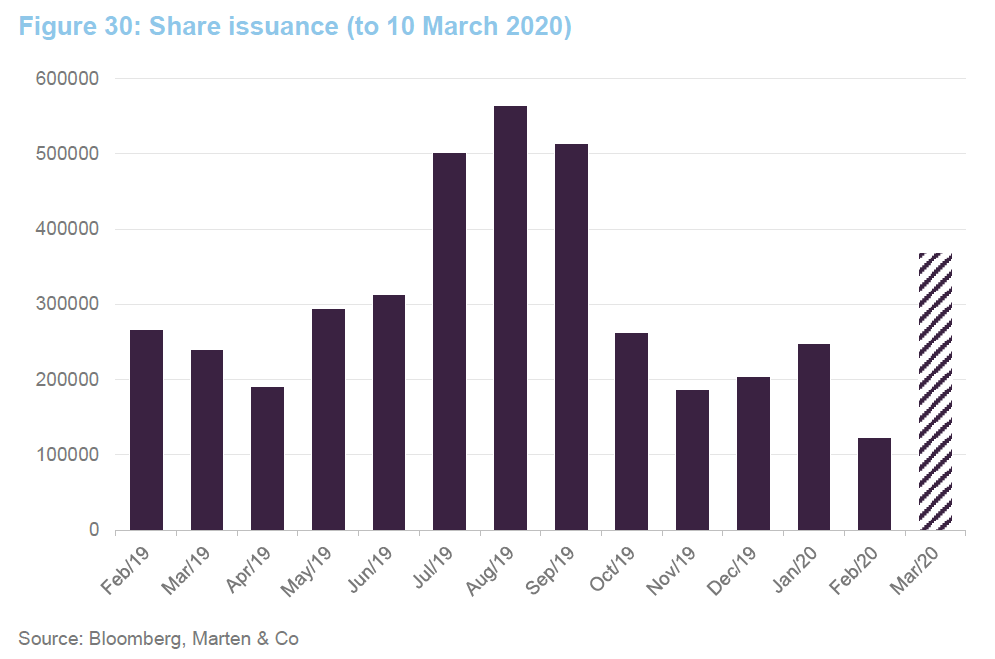

Capital structure

Capital structure

At 10 March 2020, CGT had 11,608,563 ordinary shares in issue and no other classes of share capital. There were no shares held in treasury. At the AGM in July 2019, shareholders voted to allow the directors to issue up to one third of its issued share capital, between that AGM and the next, and up to 10% of its issued share capital without pre-emption. In August 2019, after that 10% had been exhausted, shareholders renewed the one-third limit and gave the board permission to issue all of these (2,861,678 shares) without pre-emption.

At the AGM in July 2019, the board was also given power to buy back up to 14.99% of its then-issued share capital. If it does repurchase shares, these will be held in treasury for potential reissue at NAV or a premium.

The company’s year end is 5 April (coincident with the end of the fiscal year in the UK) and AGMs are typically held in July. CGT has an unlimited life. There is no regular continuation vote but the ZDM allows shareholders to exit the fund at prices close to NAV and the board says that it considers the continuation of the trust at each board meeting.

CGT has the power to borrow up to a limit of 20% of net assets, subject to the approval of the board. At present, given the managers’ concern over asset valuations, the company has no borrowings and net cash of 5%.

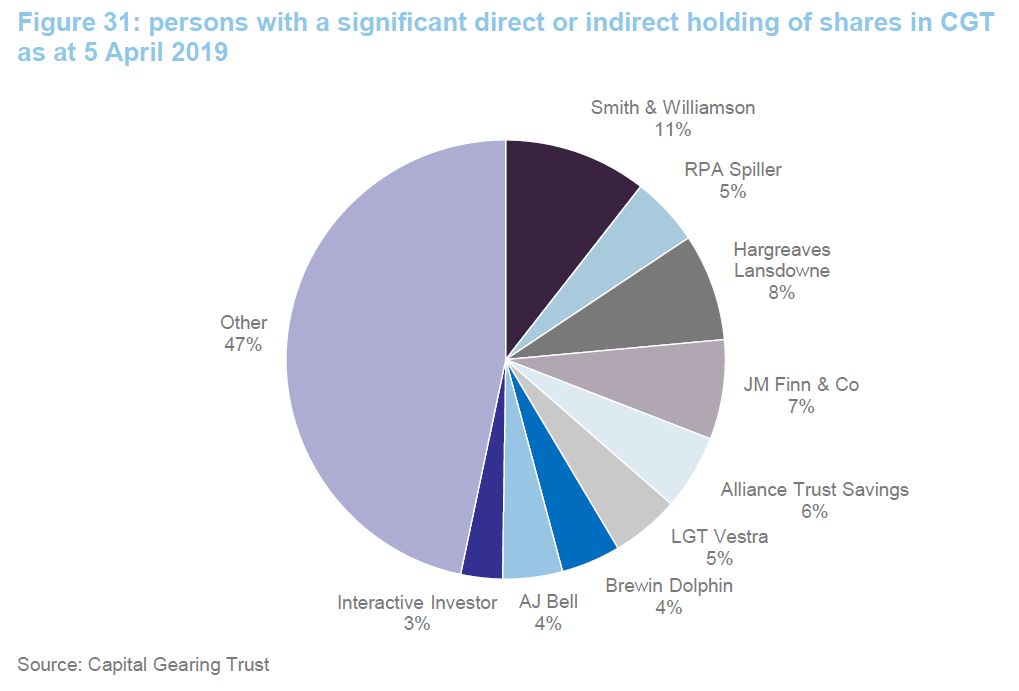

Major shareholders

Major shareholders

Board

Board

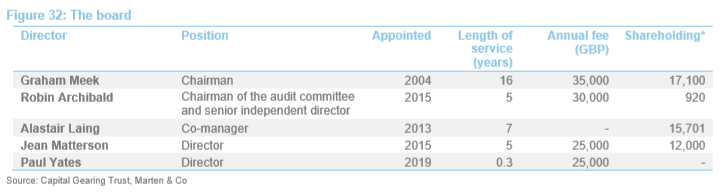

The board is comprised of five directors, who do not sit together on any other boards, and four of whom are independent of the manager. The company’s articles of association currently limit the aggregate fees payable to the board to a total of £150,000 per annum.

The chairman has served on the company’s board for 16 years and offers himself for re-election at each AGM. The other directors stand for re-election, by rotation, on a triennial basis. There is no standing nomination committee; the full board is responsible for succession planning. The board has used a combination of both an internal process and external consultants when selecting new board members in the past.

Graham Meek MSc has been chairman of CGT since 8 July 2015. He is also a member of the audit committee. Graham is a former investment banker and stockbroker and was previously an executive director of Smith New Court Plc and chairman of SPI Lasers Plc. He was previously a non-executive director of Filtronic Plc, and of King’s College Hospital NHS Foundation Trust. He currently serves as a trustee of the Royal College of Physicians.

Robin Archibald BCom CA became chairman of the audit committee and the company’s senior independent director in January 2020 when George Prescott retired from the board. Robin was formerly head of corporate finance and broking of Winterflood Investment Trusts. He qualified as a chartered accountant in 1983 and subsequently worked with Samuel Montagu, SG Warburg Securities, NatWest Wood Mackenzie and as partner and corporate financier with the corporate finance division of a Scottish accountancy firm. Since the early nineties, Robin has concentrated on advising and managing transactions in the UK closed-ended funds sector. He is a non-executive director and audit chairman of Albion Technology and General VCT Plc, and a non-executive director of Ediston Property Investment Company Plc (where he is also the senior independent director), Henderson European Focus Trust Plc and Shires Income Plc.

Alastair Laing CA MBA joined CGAM in 2011 and has been co-manager of the company since that time. He joined CGAM from Hg Capital LLP (a pan-European private equity fund) and previously worked with the mergers and acquisitions team at Deloitte LLP. Alastair was educated at Edinburgh University and was an MBA Scholar at London Business School. He is a member of the Institute of Chartered Accountants of Scotland.

Jean Matterson MCSI is a partner of Rossie House Investment Management in Edinburgh, which specialises in private client portfolio management with particular emphasis on investment trusts. She was previously with Stewart Ivory & Co Ltd for 20 years, as an investment manager and director. She is the chairman of Pacific Horizon Investment Trust Plc and a non-executive director of BlackRock Throgmorton Trust Plc. Jean is also a director of Herald Investment Management Limited and HIML Holdings Limited.

Paul Yates BCom is chairman of the Advisory Board of 33 St James’s Limited and is a non-executive director of Fidelity European Values Plc, The Merchants Trust Plc and Witan Investment Trust Plc. His extensive career in investment management began at Samuel Montagu & Co in 1980. He joined Phillips and Drew in 1985, being the year that it was acquired by UBS. During his time at UBS he held a number of positions covering management, portfolio management, pensions, strategy and client service. Paul was CEO of UBS Global Asset Management (UK) Limited between 2001 and 2005 and, after undertaking a number of global roles at UBS, he retired in 2007.

Previous publications

Previous publications

Readers may be interested in our initiation note, Focus on absolute returns, published in September 2018 and our update note, The rewards of long-term thinking, published in July 2019. Please click the links above or visit our website.

CG Absolute Return Fund – Well-deserved expansion

Well-deserved expansion

Well-deserved expansion

CG Absolute Return has preserved its record of strong performance since we last wrote, and is attracting impressive inflows, almost tripling in size since our first note was published in September 2018. The strategy is designed to be liquid and the portfolio can absorb this influx without compromising on potential returns.

The recent market correction has demonstrated the resilience of the portfolio and now provides CG Absolute Return with a three-year track record ahead of the UK equity market, which could be sustained if the virus nudges the world into recession.

Long-term capital growth in absolute terms

Long-term capital growth in absolute terms

CG Absolute Return Fund’s investment objective is to achieve long-term capital growth in absolute terms.

It attempts to achieve this by investing in a spread of direct equities, exchange-traded funds (ETFs), open-ended funds, closed-ended funds, and government and corporate bonds, including index-linked bonds – all listed on a recognised exchange.

Investment trusts and investment companies are used to obtain exposure to global and domestic equity markets, real estate, infrastructure, commodities and precious metals.

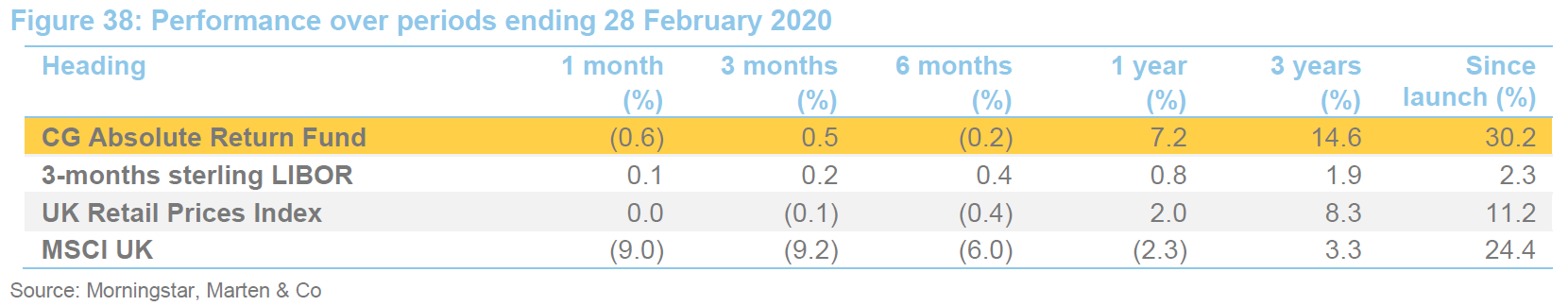

| wdt_ID | Year ended | Price total return (%) | 3-month Libor (%) | RPI (%) | MSCI UK total return (%) |

|---|---|---|---|---|---|

| 1 | 28 Feb 2018 | 2.10 | 0.30 | 3.60 | 4.40 |

| 2 | 28 Feb 2019 | 4.80 | 0.70 | 2.50 | 1.40 |

| 3 | 29 Feb 2020 | 7.20 | 0.80 | 2.00 | -2.30 |

Fund profile

Fund profile

CG Absolute Return Fund aims to achieve long-term capital growth in absolute terms by investing in a spread of direct equities, ETFs, open-ended funds, closed-ended funds, and government and corporate bonds, including index-linked bonds – all listed on a recognised exchange.

CG Absolute Return Fund is a UCITS fund domiciled in Ireland. CGAM acts as investment manager to the fund with the same team that manages CGAM’s other absolute return funds.

The fund was established in May 2016 as the fourth fund managed by CGAM with an absolute return objective.

A liquid alternative to Capital Gearing Trust

A liquid alternative to Capital Gearing Trust

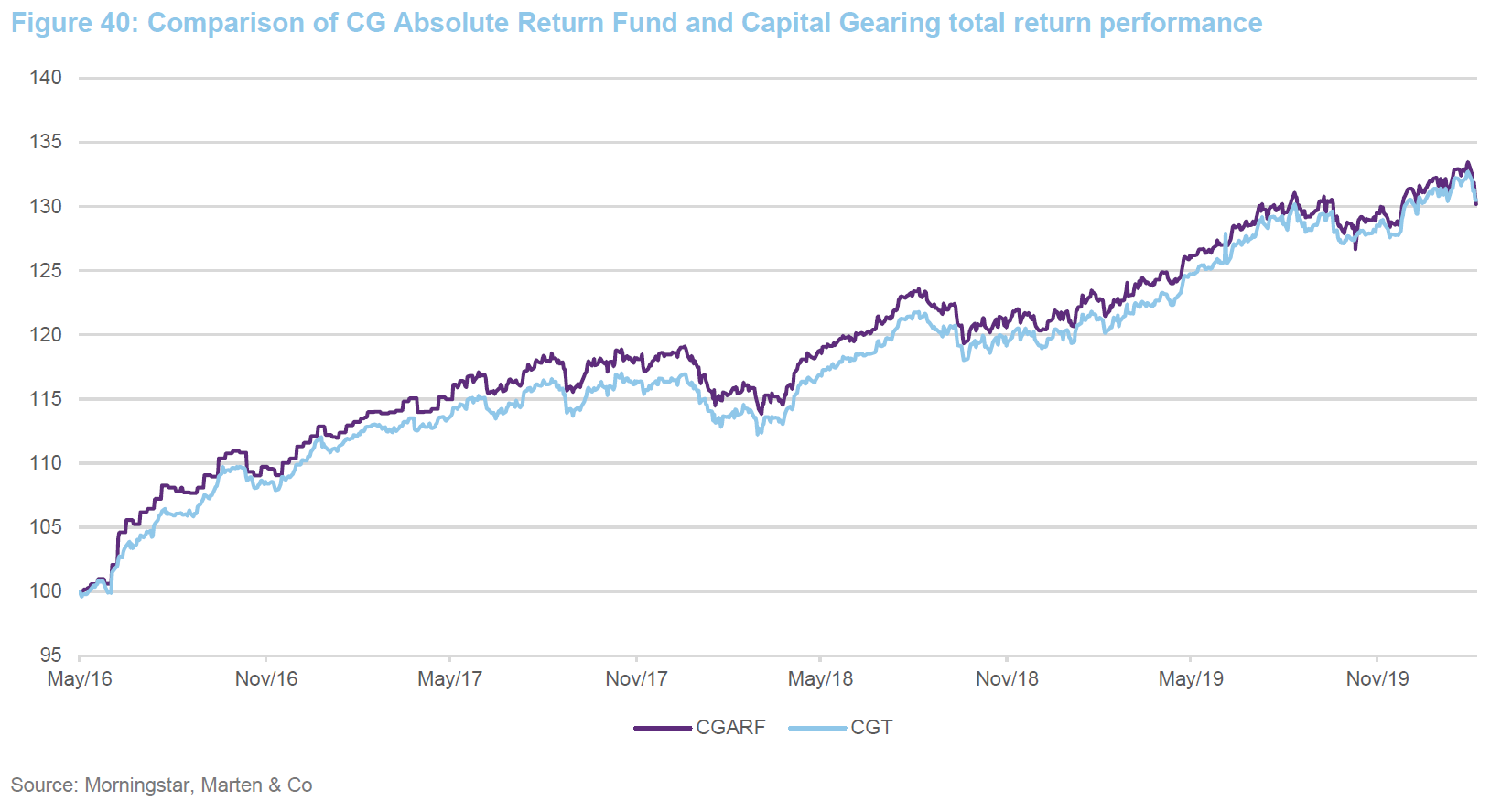

CG Absolute Return’s portfolio closely resembles that of CGAM’s flagship investment trust, Capital Gearing Trust. As we explain on pages 26 and 27, over the fund’s relatively short life, it has delivered on its objectives, beaten competing funds by some margin and has outperformed Capital Gearing Trust modestly, aided by its lower fee structure.

CGAM has made modest adjustments to CG Absolute Return’s portfolio relative to Capital Gearing Trust, which it believes will allow CG Absolute Return to expand to a multiple of its current size, without an adverse effect on its performance. The UCITS structure offers daily dealing. CG Absolute Return is, therefore, a liquid alternative to Capital Gearing Trust and, in CGAM’s opinion, an ideal core investment for most investors’ portfolios.

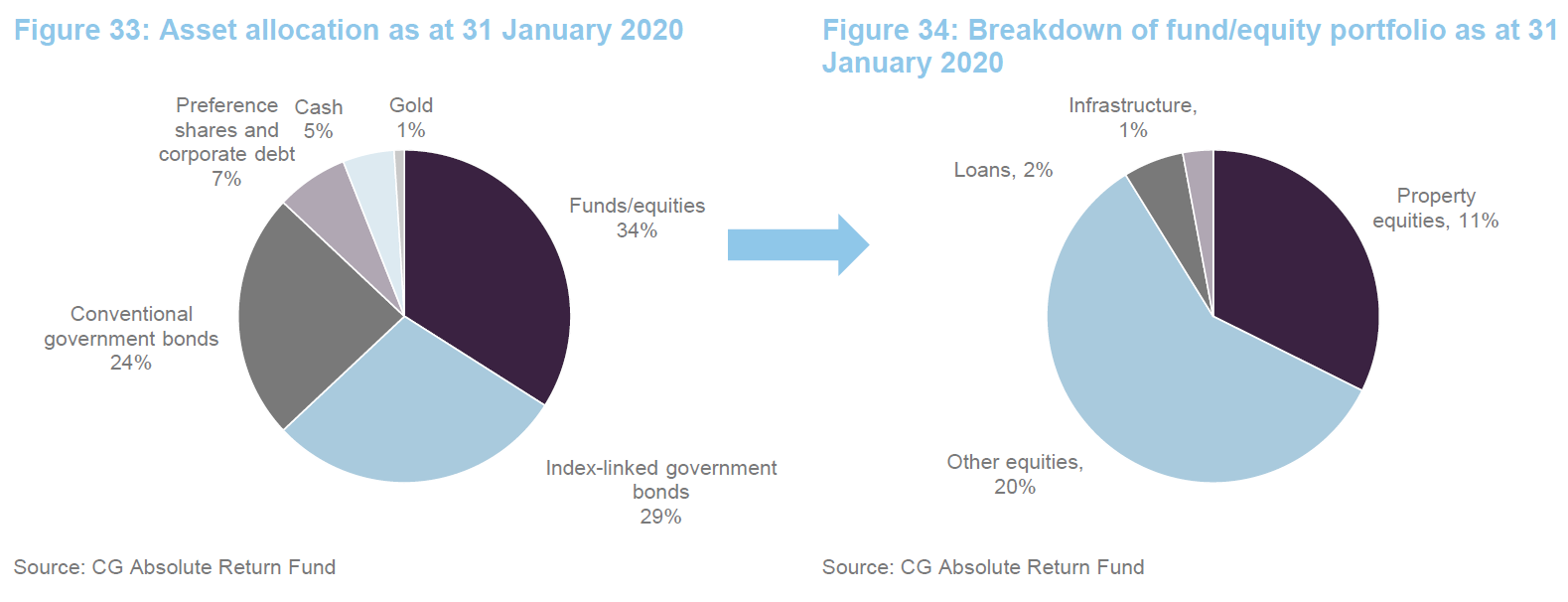

Portfolio positioning

Portfolio positioning

The most significant change in CG Absolute Return’s asset allocation since we last published (using data as at the end of June 2019) is an increase in exposure to conventional government bonds at the expense of preference shares/corporate debt. This is largely the consequence of the early repayment of RDL’s zero dividend preference shares, discussed on page 9.

Within the allocation to index-linked bonds, the trust retains a bias to US TIPS.

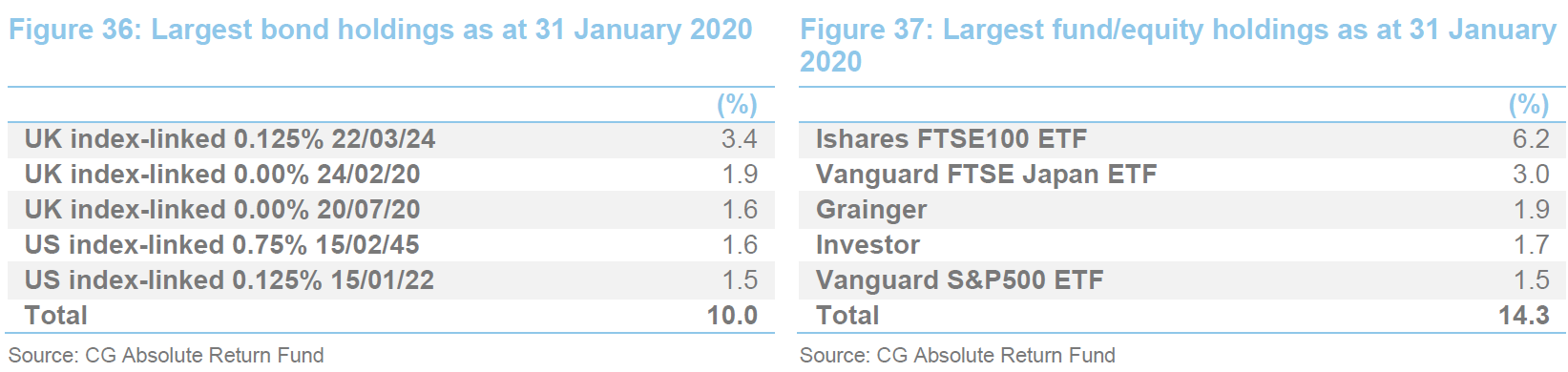

Largest holdings

Largest holdings

CG Absolute Return’s biggest fund/equity positions at 31 January 2020 were largely unchanged from when we last published using data at the end of June 2019. The ETF positions have been used to gain additional access to markets that the managers believe are attractively valued but where they were wary of having too much discount risk.

Swedish conglomerate Investor performed well in 2019, delivering net asset growth of 33% and a total shareholder return of 40%. The position has been trimmed.

Performance

Performance

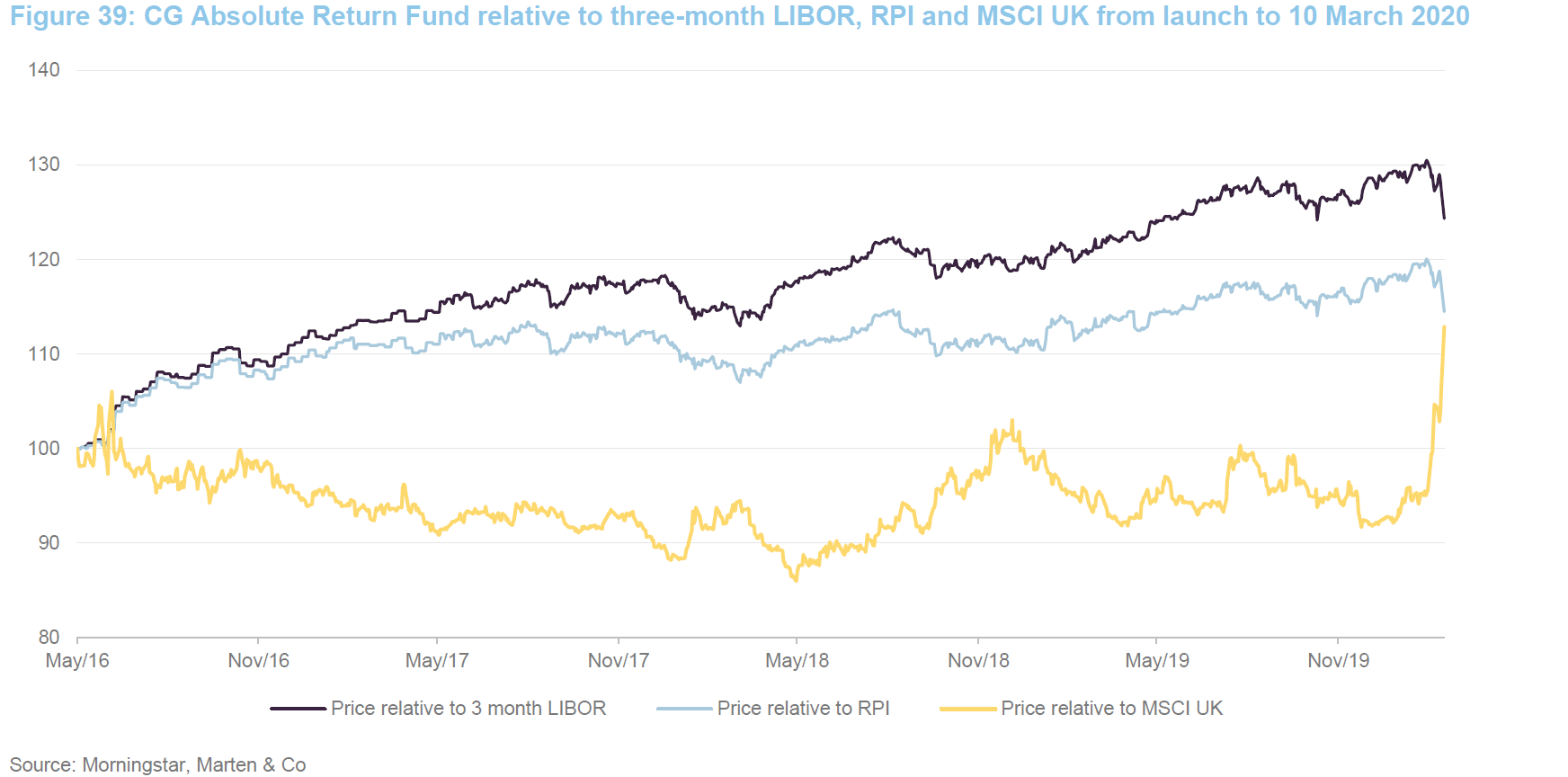

CG Absolute Return Fund has delivered returns well ahead of both its benchmark, inflation and equity markets, here represented by the MSCI UK Index. The three-month returns, which incorporate the effects of the covid-19 outbreak, demonstrate the defensive characteristics of the portfolio.

Figure 40 shows CG Absolute Return’s performance side-by-side with that of Capital Gearing Trust. From the launch of the open-ended fund to the end of February 2020, it outperformed the investment trust by more than 1%, while tracking it fairly closely. CG Absolute Return’s relative performance will have benefitted in recent weeks as discounts have widened across the investment company sector (CGT has more exposure to this than CG Absolute Return Fund).

Drivers of recent performance

Drivers of recent performance

On the positive side, the value of CG Absolute Return’s conventional bonds and TIPS has been rising as yields fall. Positions in Investor and Ranger zeros (page 9) proved beneficial.

Exposure to German property did take a little off returns, although the managers say that Vonovia still made a meaningful contribution over 2019. The fund’s Japanese exposure was a drag on returns as Japan was impacted by the US/China trade war.

Exposure to renewable energy and infrastructure funds added to performance after the UK election, once the threat of a Labour government had dissipated. The managers have started taking profits on some of these positions.

Peer group

Peer group

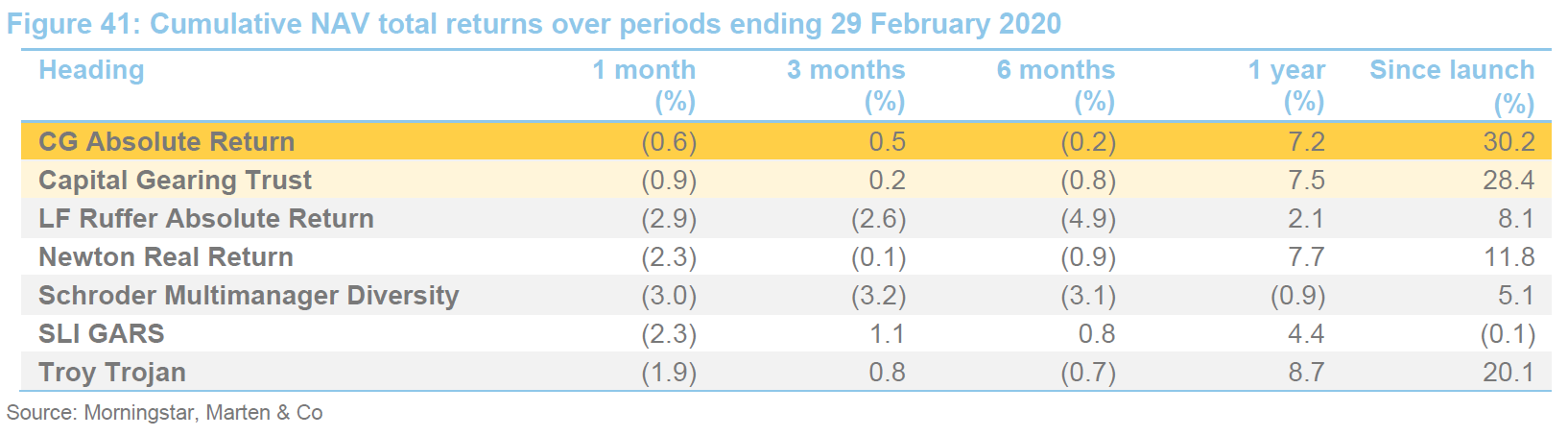

The following peer group contains well-known funds with similar objectives to CG Absolute Return Fund.

CG Absolute Return has outperformed all of these funds since it was launched, in most cases by a considerable margin. At the end of February 2020, it also appeared to have been the most defensive in the current market sell-off.

Previous publications

Previous publications

Readers may be interested in our initiation note, Focus on absolute returns, published in September 2018 and our update note, The rewards of long-term thinking, published in July 2019. Please click the links above or visit our website.

The management team

The management team

Peter Spiller co-manages CGAM’s funds and acts as CGAM’s CIO. He has managed Capital Gearing Trust since 1982. He was a partner and strategy director at Cazenove & Co Capital Management and a US equity investor at Capel Cure & Myers. He was a co-founder of CGAM in 2000.

Alastair Laing is CGAM’s CEO. He joined CGAM in 2011 and has co-managed its funds since that date. He was appointed as a non-executive director of Capital Gearing Trust in 2013. Alastair joined CGAM from Hg Capital LLP (a pan-European private equity fund) and previously worked with the mergers and acquisitions team at Deloitte LLP. Alastair was educated at Edinburgh University and was an MBA Scholar at London Business School. He is a member of the Chartered Institute of Accountants of Scotland.

Chris Clothier is a co-manager of CGAM’s funds. Before he joined CGAM in 2015, he was a director at IPGL Limited, a private investment vehicle with a range of public and private interests predominantly in the financial services industry, where he worked for six years. Before that he worked at MMC Ventures, an early-stage venture capital firm. Chris studied Chemistry at New College, Oxford.

Assets under management

Assets under management

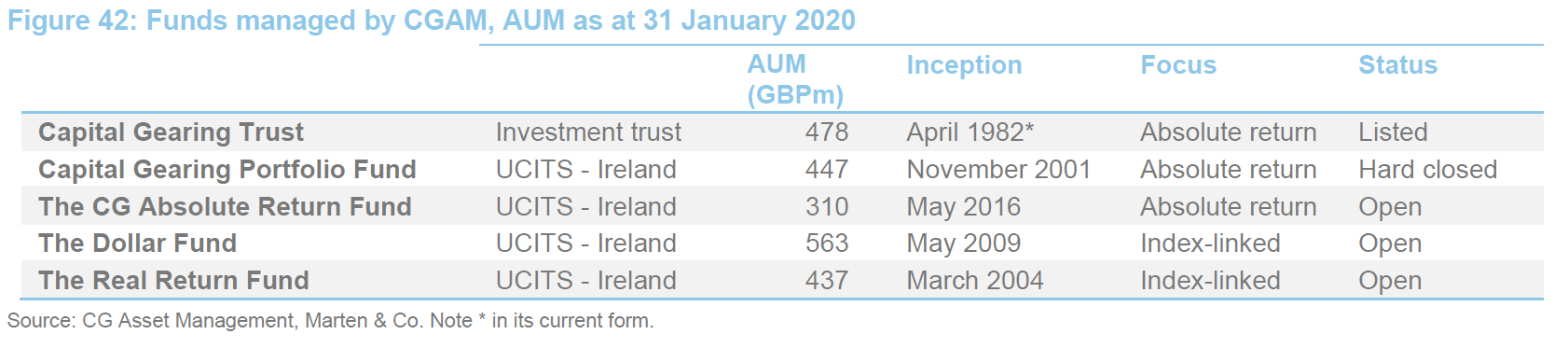

CGAM manages £2.2bn across five funds (it merged its Capital Value and Capital Gearing Portfolio Fund in July 2019); three have an absolute return objective and two invest solely in index-linked securities issued by governments.

CGAM has at times made sizeable allocations to index-linked securities within its absolute return funds. A group of investors asked it to create funds dedicated to this strategy, for lack of suitable alternatives. This led to the creation of The Real Return Fund in 2004 and The Dollar Fund in 2009. An international hedged version of the Dollar Fund was launched in August 2016.

Capital Gearing Trust and CG Absolute Return Fund are the only ways that new investors can gain access to CGAM’s absolute return strategy.

The legal bit

The legal bit

This marketing communication has been prepared for CG Asset Management by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.