Ecofin Global Utilities and Infrastructure Trust

Investment companies | Update | 22 August 2023

Utilities and infrastructure at low tide

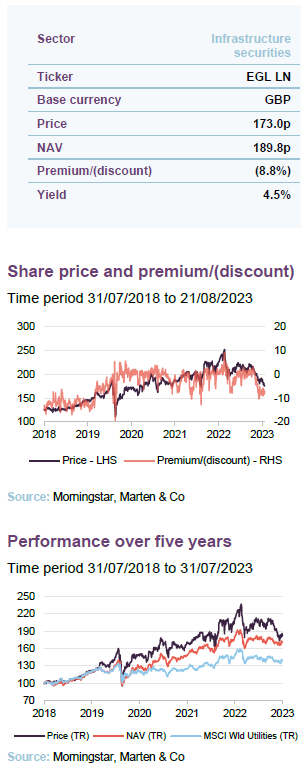

In recent months, macroeconomic conditions have weighed on the utilities and infrastructure sectors and on the returns generated by Ecofin Global Utilities and Infrastructure (EGL). Now, as the peak of interest rates draws nearer and economic growth stutters, the tide may be about to turn in EGL’s favour. EGL’s manager, Jean-Hugues de Lamaze highlights the strong earnings of the companies in its portfolio, which have exacerbated the undervaluation of some of these.

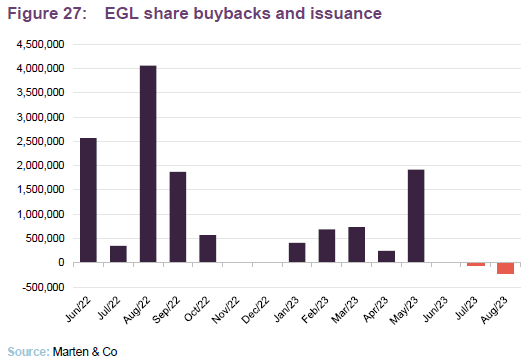

In common with most London-listed investment companies, EGL has experienced some modest discount widening recently. The board is tackling this with share buy backs, but this does provide an opportunity for investors to get exposure to the trust at attractive levels.

Developed markets utilities and other economic infrastructure exposure

EGL seeks to provide a high, secure dividend yield and to realise long‐term growth, while taking care to preserve shareholders’ capital. It invests principally in the equity of utility and infrastructure companies which are listed on recognised stock exchanges in Europe, North America and other developed OECD countries. It targets a dividend yield of 4% a year on its net assets, paid quarterly, and can use gearing (borrowing) and distributable reserves to achieve this.

Background

Readers may wish to refer to our earlier notes, a list of which is provided on page 18.

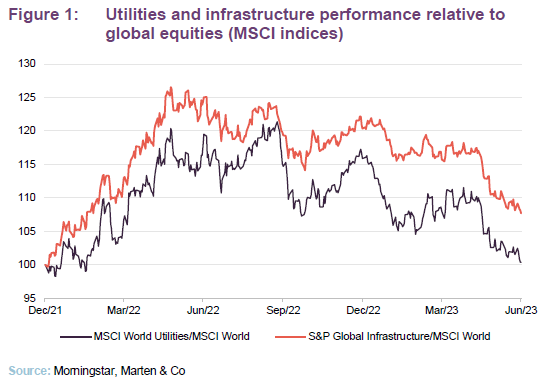

As Figure 1 shows, globally utilities and infrastructure have been underperforming wider market indices for some time now. Jean-Hugues feels that parts of EGL’s investment universe are consequently attractively valued.

US utilities are attractively valued on average.

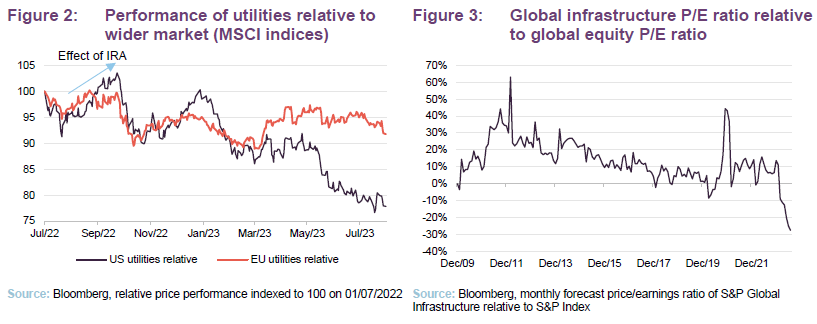

On a relative basis, US utilities have underperformed EU ones, despite an initial boost following the passing of the Inflation Reduction Act. In part, that is likely a reflection of the narrow group of AI-related companies driving US markets higher. However, as we discuss later, Jean-Hugues believes that US utilities are attractively valued on average.

Global infrastructure trading at a material valuation discount to global equities.

As Figure 3 shows, based on relative forecast price/earnings ratios, infrastructure is looking cheap too. A lot of the reason for that has been rising interest rates.

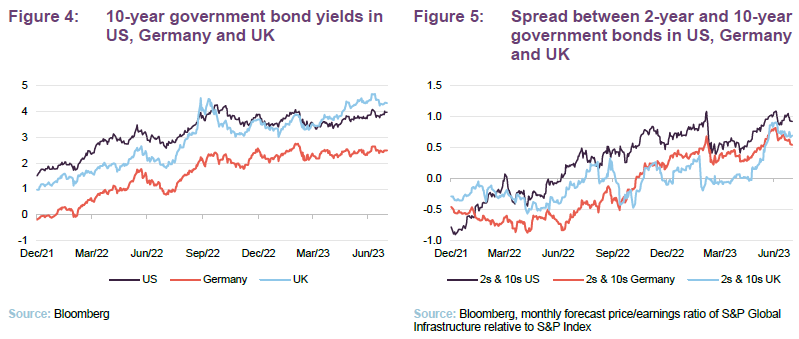

Figure 4 illustrates the shift in 10-year government bond yields in EGL’s major markets. However, short-term rates have been rising faster than long-term ones and the result is an inversion of yield curves – historically a strong indicator of a recession.

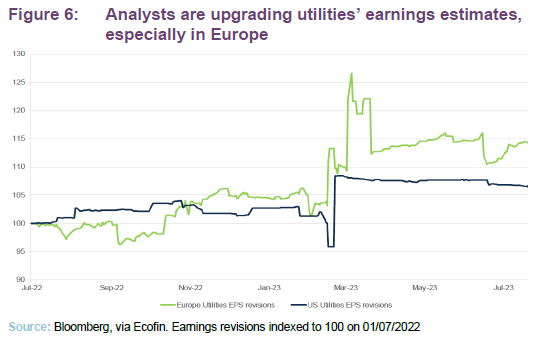

Nevertheless, on the whole utilities are doing well, as Figure 6 illustrates. During this unusually-long period of underperformance for utilities, analysts have actually been raising their earnings estimates, especially in Europe.

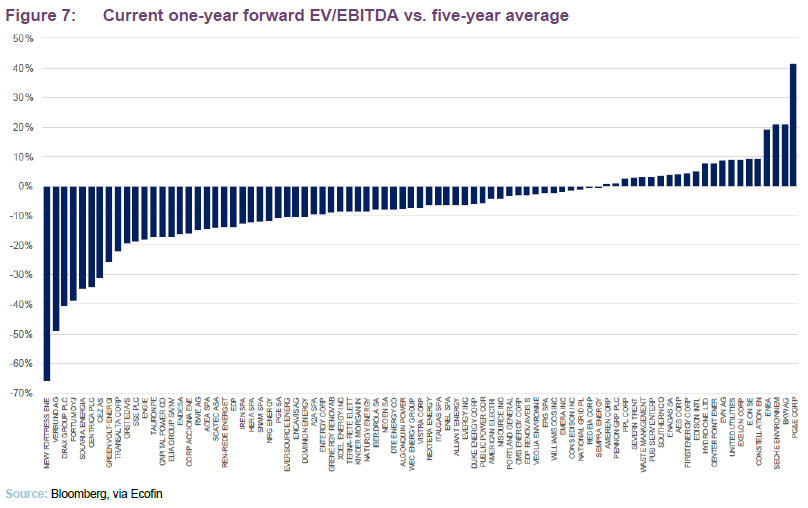

Most of the companies that the Ecofin team follow closely are looking cheap relative to history.

With relatively strong fundamentals coupled with share price weakness, most of the companies that the Ecofin team follow closely are looking cheap relative to history. Figure 7 shows how current valuations for these companies compare to five-year averages. Around three quarters of this universe is trading below its long-term average.

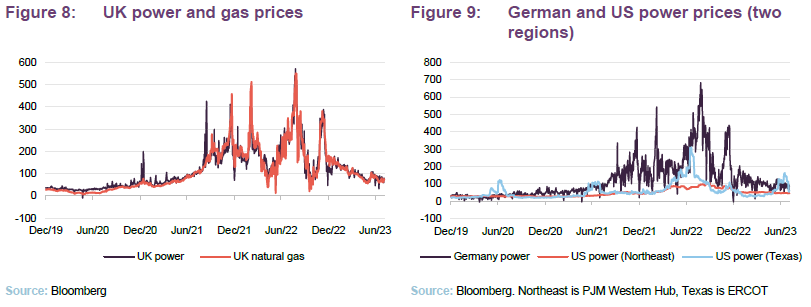

Power prices remain elevated relative to history.

Power prices have come back sharply – roughly halving over the first half of 2023. Nevertheless, Jean-Hugues points out that even after the falls, power prices remain elevated relative to history. Ukraine may have caused them to spike, but they were already rising in advance of the invasion given very slim reserve margins.

Other factors have been at play, such as the effect of the phasing out of coal plants, generally low rainfall levels in some markets leading to shortfalls in hydro production, and the failure to replace an ageing nuclear fleet, which means that older power stations are being shuttered before new plants come online.

Falling power prices are good news for governments too, which had felt pressured to act by imposing windfall taxes, price caps and the like to cushion consumers.

Generators have been locking in high power prices where possible, and now have good visibility of their earnings for the next couple of years.

Watch out for possible new price spikes this winter.

Nevertheless, we are not out of the woods yet. Some regulators are concerned about possible supply/demand imbalances for this winter, which could lead to new price spikes.

Manager’s views

The traditional perception of utilities as a bond proxy has had a significant influence on returns.

Jean-Hugues says that the utilities and infrastructure sectors have experienced an interesting year. The main driver of share price moves has been the macro environment rather than company fundamentals (a tale that we have heard from a number of managers across different sectors). The one exception to this has been the excitement around progress in AI, an area that EGL has no meaningful exposure to. In the case of the utilities sector, the traditional perception of utilities as a bond proxy, and as long-duration assets with defensive characteristics, has had a significant influence on returns.

Jean-Hugues feels that in equity investors’ minds, at least, the risk of recession has eased over the course of 2023 and the consensus is for a soft landing. However, this is less true of bond investors where, as we illustrated in Figure 5, yield curves remain inverted (usually a good indicator of economic contraction) in key markets such as the US, Germany and the UK.

Jean-Hugues is reasonably optimistic but wary of a UK recession.

Jean-Hugues believes that there is a very broad consensus amongst equity investors that we are close to the peak of interest rates, but expectations are that both rates and inflation will remain well above recent levels. He is reasonably optimistic but thinks it would be risky to be overly confident. Jean-Hugues is wary of a UK recession, for example.

The peak of US interest rates is likely to be a turning point.

The peak of US interest rates is likely to be a turning point for sentiment towards the utilities and infrastructure sectors.

Having said that, Jean-Hugues’s focus is still very much on bottom-up stock selection.

Climate change impacts factored into analysis, and portfolio companies have geographically diverse asset bases

We asked Jean-Hugues about the impact of climate change on hydro and wind (there seems to be a trend towards lower wind speeds as the atmosphere warms). He pointed out that reservoir volumes have largely recovered in countries such as Portugal from 2022’s lows. This is less true in Spain, but reservoirs are close to historical levels across Europe. However, he noted that some companies such as EDP Renovaveis and NextEra Energy had seen their earnings impacted by lower-than-normal wind resource. This is another input that the team is factoring into their analysis.

Inflation Reduction Act should start to impact on earnings.

The Inflation Reduction Act provided a fairly short-term boost to sentiment. However, Jean-Hugues expects this will soon start to feed through into earnings, and will be very beneficial for some companies. The scope and impact of the EU equivalent is harder to ascertain as EU countries are yet to agree its final form. Leading countries therefore have very different energy mixes and different vested interests. Germany has been trying to move ahead unilaterally on some fronts, but Jean-Hugues thinks that the effect of this has been limited so far.

Jean-Hugues does note that whereas permitting for some projects had been proving a bottleneck, this situation seems to be improving.

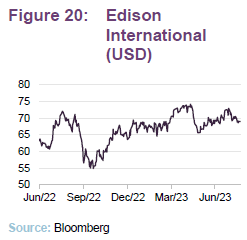

Power grids are key to the energy transition and need significant investment, and this creates opportunities for EGL.

The other significant bottleneck is the problem of securing grid connections. However, this represents a significant opportunity for companies such as SSE and National Grid (discussed on page 9) and is one reason why Jean-Hugues has been adding to those positions. These companies also benefit from inflation pass-throughs and are insulated from power price fluctuations, which adds further to their attractions. Other ways that EGL has exposure to this theme are through integrated utilities in Europe, US companies such as Exelon (which recently spun out its Constellation nuclear business – see page 8) and Edison International, a Californian utility discussed on page 11).

Yieldcos looking more attractive post-share price falls.

As we get closer to the peak of interest rates, Jean-Hugues has been adding to positions in yieldcos. In that area, TransAlta recently bid C$1.38bn for the balance of TransAlta Renewables that it did not already own. The price offered was a 20% premium to the undisturbed price. Nevertheless, the offer was well below the price in December 2022 and well down on its January 2021 peak – these yieldcos seem undervalued.

Given the inflation issue, regulated utilities in jurisdictions that have adopted models that allow inflation pass-through – such as the UK and Italy – look more attractive. By contrast, regulated utilities operating in a regime such as that of Spain, which does not allow for any inflation adjustment, are more challenged. Jean-Hugues also notes that infrastructure assets such as toll roads and, to a lesser extent, airports have reasonably strong pricing power.

Asset allocation

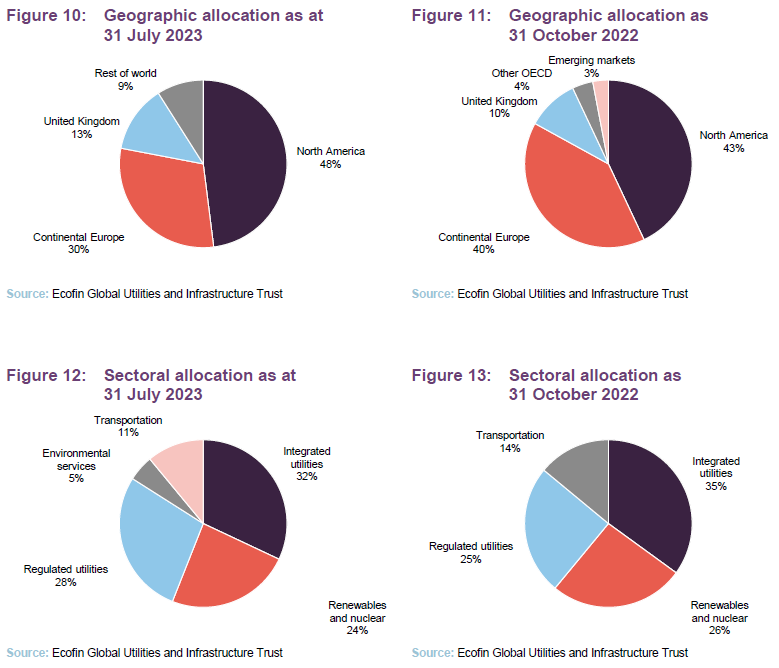

Comparing EGL’s exposures at the end of October 2022 (the data available when we last published) and the end of July 2023, EGL has more exposure to North America and the UK which has come at the expense of a lower exposure to continental Europe.

There is a new allocation to environmental services at the end of July 2023 that was not present at the end of October 2022. In reality, this represents a redesignation of some names that were previously ascribed to other sectors such as Veolia and American Water Works, plus a new position in China Water Affairs (discussed on page 11).

The number of holdings as at the end of July 2023 was 43, unchanged from October 2022.

Jean-Hugues has been taking profits and trimming positions on some stocks to fund a reduction in EGL’s gearing. At the end of July 2023, this stood at 9.7%. Higher interest rates have increased EGL’s cost of debt (it pays a margin over SONIA) and this has raised the hurdle to justify using gearing.

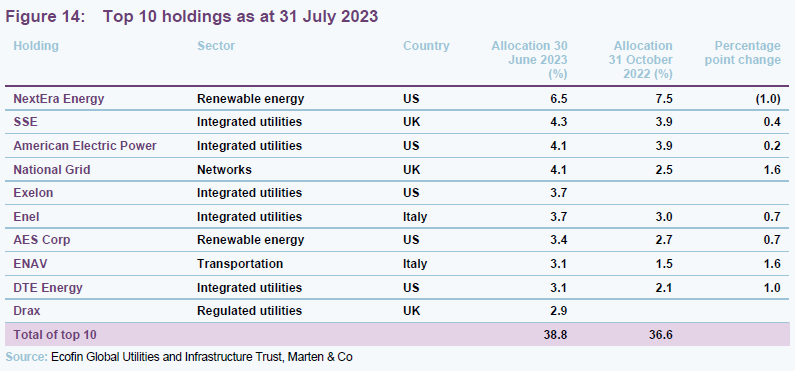

Top 10 holdings

Since we last published, National Grid, ENAV, Exelon, DTE and Drax have moved into the list of EGL’s 10 largest holdings, and RWE, Constellation Energy, Endesa, Engie and EDF have dropped out. RWE was a position reduction, Jean-Hugues felt that the stock could continue to suffer from its large exposure to power generation. The next three of those that dropped out were trimmed as they performed well. In the case of Endesa, Jean-Hugues was also concerned about political uncertainty in Spain and a difficult pricing environment. Jean-Hugues still likes Engie but took advantage of a strong rally in its share price. EDF was nationalised (as discussed in our last note – see page 7 of that note).

Readers interested in other names in the top 10 should see our previous notes (see page 18 for a list of these).

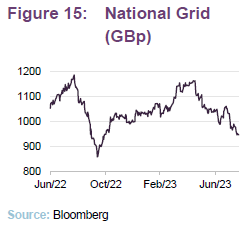

National Grid

National Grid (nationalgrid.com) is a longstanding position within EGL’s portfolio which we have discussed in earlier notes (see page 14 of our October 2021 note, for example). However, the manager added to it in March 2023 as he became more optimistic about the positive drivers of investment in networks. The growth in renewables requires considerable investment in power grids and hence an expansion of the company’s regulated asset base. Jean-Hugues also felt that the company was attractively valued and offered a combination of defensiveness and inflation protection.

Growth for the company’s US and UK businesses is underpinned by the Inflation Reduction Act and the UK’s Net Zero Strategy. The bulk of the company’s cash flows now come from the US and Jean-Hugues suggests that on some measures National Grid looks like a cheap US utility.

Other investors must also see National Grid’s virtues, as its share price has bucked the trend year-to-date.

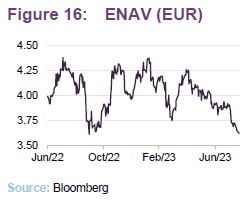

ENAV

ENAV (enav.it) has a natural monopoly of air navigation services in Italian airspace. It is a regulated business (c. 96% of income) and one that benefits from the ability to pass the effects of inflation through to its customers.

ENAV gets paid for every plane that takes off or lands in Italy (over 2m flights each year) regardless of aircraft occupancy. It is a beneficiary of the easing of COVID restrictions as volumes have returned to normal levels. It is also due to be compensated for its loss of business during the COVID period. The company is estimating 3.9% CAGR in air traffic over the period from 2019 to 2040.

Jean-Hugues added to the position following a price setback in March 2023. As a relatively small company and one which has no listed competitors globally, he feels that it is being overlooked by other investors. However, this should rectify itself in time. In the meantime, it offers an attractive dividend yield (currently around 5.4%).

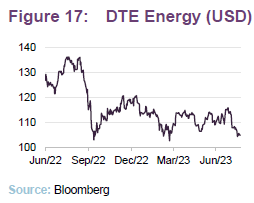

DTE Energy

Jean-Hugues describes Michigan-based DTE Energy (dteenergy.com) as a traditional US utility and one which offers a relatively ‘safe’ way (in terms of regulatory and interest rate risk)to gain exposure to US utilities. The attraction is DTE’s relatively low valuation, modest (6%) EPS and 8% EBITDA growth, coupled with a yield of about 3.6%.

DTE is transitioning its portfolio of generation assets from coal to gas and renewables. It is also developing energy storage projects. In renewables, it has a decade-long $11bn project that is intended to deliver over 15GW of renewable energy.

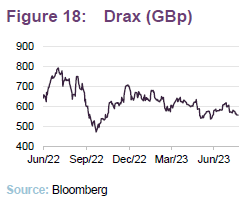

Drax

Drax (drax.com) produces power from biomass, hydro-electric and pumped hydro storage assets across four sites in England and Scotland. It also operates a global bioenergy supply business with manufacturing facilities at 13 sites in the United States and Canada, producing compressed wood pellets for its own use and for customers in Europe and Asia. However, it has been criticised for logging primary forest in Canada.

To improve its green credentials, Drax is exploring options to develop carbon capture and storage (CCS), which it aims to integrate into its biomass plant at the Drax Power Station by 2030. Drax plans to build two biomass-fuelled plants with associated CCS in the US. It has also secured planning permission for a 600MW expansion of its Cruachan Pumped Storage Power Station.

Half-year figures covering the first six months of 2023 showed a more than doubling of EPS from 20p to 46p and a hike in its dividend from 8.4p to 9.2p (it is targeting 23.1p for the full year, up 10% on the previous year). This was despite wildfires impacting on wood pellet production. Strong cash flow is being used to reduce leverage in the short-term, as well as to complete a share buyback programme, which Jean-Hugues sees as justified by Drax’s current undervaluation.

Other new holdings

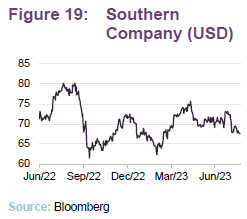

Southern Company

Like DTE, Southern (southerncompany.com) offered a way to increase EGL’s exposure to relatively cheap US utilities. It is one of the largest constituents of the sector by market cap and is one of the US’s largest clean energy producers (although renewables makes up 16% of its portfolio – about the same proportion as coal or nuclear, and much less than gas, which is just over 50%). Jean-Hugues says that it offers the prospect of about 7% EPS growth, and a good yield. It should also be a beneficiary of the investment that is going into the sector on the back of the Inflation Reduction Act.

Southern has been developing two additional reactors at its existing Vogtle plant in Georgia; on completion this will be the largest nuclear plant in the US. Unit 3 became operational at the end of July 2023 and Unit 4 is scheduled to come on stream around the end of the year. Overruns on the build costs for Vogtle have been weighing on Southern’s earnings.

A mild winter impacted on Southern’s earnings for the first six months of 2023 – the largest negative EPS impact from weather in the company’s history.

Edison International

Edison International (edison.com) is a specific play on the investment required to upgrade California’s power grid. It is a holding company for Southern California Edison (SCE), one of the largest electric utilities in the US, and energy consultants Edison Energy.

The core of the utility is its wires business, which has over 125,000 miles of transmission and distribution lines. The utility’s regulated asset base is forecast to grow at 6–8% per annum over the next five years. Driving that, the California Independent System Operator (CAISO) estimates that $30bn needs to be invested in the State’s transmission system up to 2040 and $54bn in the CAISO area’s energy storage capacity.

In light of the wildfire-related bankruptcy of Pacific Gas and Electric, SCE is devoting considerable effort to mitigating the risk of wildfires, coating/burying cables, for example. In March this year, SCE said that the probability of wildfires associated with its utility equipment had been cut by 75%–80% since 2018.

China Water Affairs Group

Jean-Hugues was keen to increase EGL’s exposure to China ahead of an economic recovery associated with the lifting of COVID restrictions in the country. Although he acknowledges that the recovery has been disappointing so far, recent economic stimulus announcements are moving in the right direction to support a recovery. China Water Affairs (chinawatergroup.com) is one of China’s largest integrated water operators, providing raw water, tap water, sewage treatment and related services.

Jean-Hugues sees the possibility of the company spinning off its Silver Dragon water supply business via an IPO. He feels that this would help highlight the hidden value within that business.

The stock looks to be very cheap, trading on about 5.7x historic P/E and a 5.2% yield even after a recent rally in its share price.

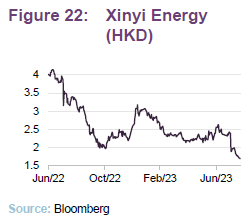

Xinyi Energy

Jean-Hugues bought a position in Xinyi Energy (xinyienergy.com) in May 2023 to replace apposition in wind developer China Longyuan Power Group, which was fully exited at the same time. The company is an operator of 36 solar farms with a total capacity of 3.3GW in Central, Eastern and Southern China. He feels that there is plenty of potential for it to expand its portfolio as China continues to transform its generation mix. 1.7GW of Xinyi’s existing solar farms are supported by feed-in-tariffs with the balance, including any new projects, subsidy-free.

Supply chain bottlenecks had been putting pressure on capex costs, but these are easing. In its interim results to end June 2023, the company said that PV module prices and installation costs were both falling once again and that it intended to speed up construction of new farms over the second half of the year.

Recent interim results, covering the first six months of 2023, were held back by the weakness of the Renminbi relative to the Hong Kong Dollar. The dividend was cut to increase cash available to fund its pipeline, but this was not taken well by investors.

Performance

Up-to-date information on EGL is available on the QuotedData website.

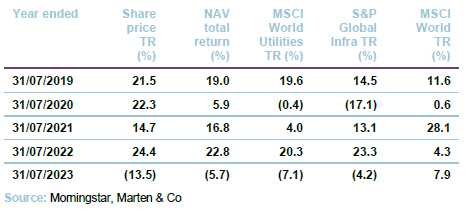

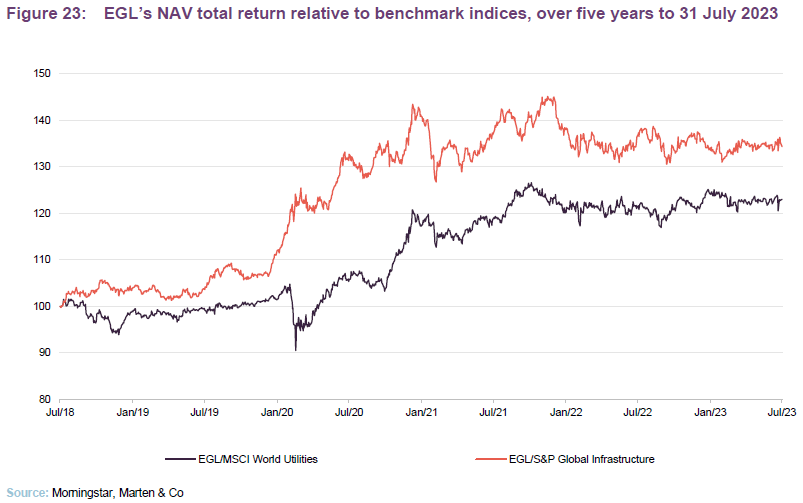

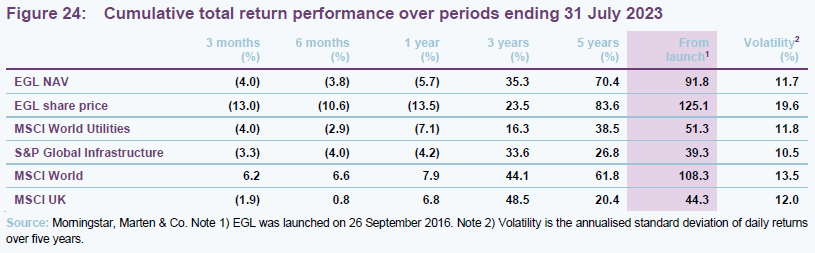

After the significant relative outperformance of both the MSCI World Utilities and S&P Global Infrastructure indices in 2020/2021, EGL’s NAV has held its own against these performance benchmarks subsequently.

Figure 24 highlights the underperformance of Utilities and Infrastructure relative to wider benchmark indices that we discussed earlier in the note. However, the key takeaway from the table is the impressive outperformance of EGL over the medium-to-long term, both in NAV and share price terms.

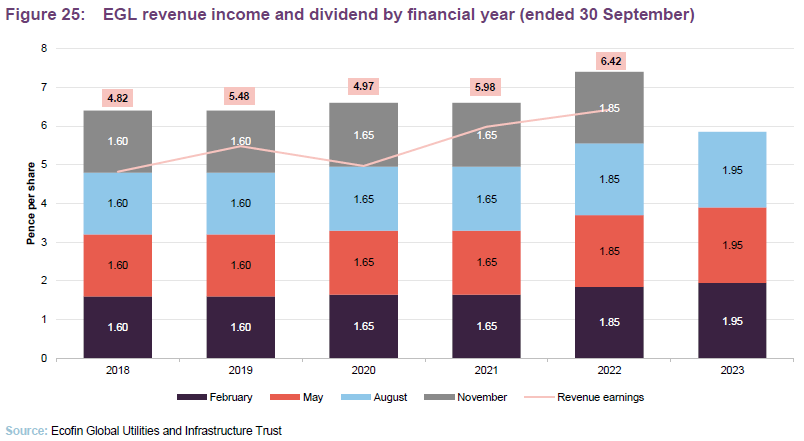

Dividend

As Figure 25 shows, EGL has tended to pay an uncovered dividend in recent years, supplementing its revenue income with modest amounts from its distributable reserves. These reserves are substantial, amounting to £117.0m at the end of September 2022, and therefore there is little likelihood in our view that the board would feel it was unable to pay its target dividend, as is evidenced by its actions in 2020 when COVID knocked companies’ distributions.

Premium/(discount)

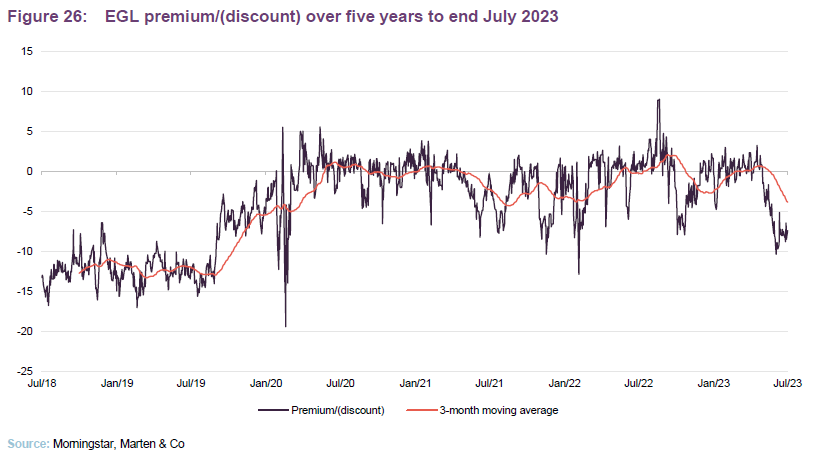

Over the 12 months ended 31 July 2023, EGL’s shares have traded between an 10.4% discount to NAV and a 9.0% premium. The average over that period was a 1.1% discount. As at 21 August 2023, EGL was trading at an 8.8% discount.

Discounts have been widening across the investment companies sector and – especially relative to funds focused on renewable energy and infrastructure – EGL has held up relatively well. That is likely a reflection of EGL’s twin appeal both as a source of income and in terms of the capital growth that the trust has been able to deliver since launch.

The step change in EGL’s discount that occurs from September 2019 is a subject that we first discussed in our October 2019 note (see previous publications on

page 18).

EGL has powers to issue and repurchase shares and the board has been using these to help moderate volatility of both EGL’s premium and the discount. We have been pleased to see the trust grow over the past few years and encouraged by the board’s willingness to repurchase shares since the discount has reappeared in recent months.

Fund profile

Developed markets utilities and infrastructure exposure with an income and capital preservation focus

Further information regarding EGL can be found on the manager’s website: uk.ecofininvest.com/funds/ecofin-global-utilities-and-infrastructure-trust-plc.

Ecofin Global Utilities and Infrastructure Trust Plc is a UK investment trust listed on the main market of the London Stock Exchange (LSE). The trust invests globally in the equity and equity-related securities of companies operating in the utility and other economic infrastructure sectors. EGL is designed for investors who are looking for a high level of income, would like to see that income grow, and wish to preserve their capital and have the prospect of some capital growth as well.

Reflecting its capital preservation objective, EGL does not invest in start-ups, small businesses or illiquid securities, as these may involve significant technological or business risk. Instead, it invests primarily in businesses in developed markets, which have ‘defensive growth’ characteristics: a beta less than the market average; dividend yield greater than the market average; forward-looking EPS growth; and strong cash-flow generation.

It also operates with a strict definition of utilities and infrastructure as follows:

- electric and gas utilities and renewable operators and developers – companies engaged in the generation, transmission and distribution of electricity, gas, liquid fuels and renewable energy;

- transportation – companies that own and/or operate roads, railways, ports and airports; and

- water and environment – companies operating in the water supply, wastewater, water treatment and environmental services industries.

EGL does not invest in telecommunications companies or companies that own or operate social infrastructure assets funded by the public sector (for example, schools, hospitals or prisons).

No formal benchmark

EGL does not have a formal benchmark and is not constructed with reference to any index.

EGL does not have a formal benchmark and its portfolio is not constructed with reference to an index. However, for the purposes of comparison, EGL compares itself to the MSCI World Utilities Index, the S&P Global Infrastructure Index, the MSCI World Index and the All-Share Index in its own literature. We are using a similar approach here, but are using the MSCI UK Index to represent the UK market. Of the three indices, we consider the MSCI World Utilities to be the most relevant – although it should be noted that this index has a strong bias towards US companies.

Manager

Ecofin is a sustainable investment firm founded in 1991 with $2.3b of AUM at 30 June 2023. Its objective is to deliver strong risk-adjusted returns as a specialist in global infrastructure and energy transition thematics. Ecofin combines expertise across public and private equities, and private debt, as well as social impact investing.

Ecofin Advisors Limited is EGL’s investment manager and AIFM. Ecofin Advisors is a subsidiary of TortoiseEcofin Investments, LLC, a privately-owned US-based firm which owns a family of investment management companies. At the end of June 2023, TortoiseEcofin had approximately $9.1bn of client funds under management.

EGL’s senior portfolio manager is Jean-Hugues de Lamaze. He has worked for Ecofin since 2008 and has managed both EGL and its predecessor, Ecofin Water & Power Opportunities (EWPO), since March 2016. Prior to joining Ecofin, Jean-Hugues co-founded UV Capital LLP and served as its chief investment officer. Previously, he oversaw the Goldman Sachs European Utilities research team and prior to that he was a senior European analyst and head of French Research & Strategy at Credit Suisse First Boston.

Jean-Hugues’s professional career began at Enskilda Securities. He is a CFAF-certified analyst and a member of the French Financial Analysts Society, SFAF. Jean-Hugues completed the INSEAD International Executive Programme, graduated from Paris-based business school Institut Supérieur de Gestion and earned a LLB in Business Law from Paris II-Assas University. He was voted Top 10 Buy-Side Individual – All Sectors and Top 3 in the Utilities category in the 2018 Extel survey.

Well-resourced team.

Jean-Hugues leads a team of seven investment professionals. This team has worked together for an average of 10 years. Jean-Hugues is also able to draw on extensive resources in Kansas City.

Previous publications

Figure 28: QuotedData’s previously published notes on EGL

Source: Marten & Co

Readers interested in further information about EGL may wish to read some of the earlier notes that we have published, a list of which is provided above.

Legal

This marketing communication has been prepared for Ecofin Global Utilities and Infrastructure Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.