Hot stuff

Hot stuff

The covid-19 pandemic has heavily impacted global uranium production, taking around 20% of global capacity offline. This has exacerbated the supply deficit, leading to users running down inventories at an even faster rate. The net effect has been a rising uranium price (up 32% so far in 2020), but the managers of Geiger Counter (GCL) believe that there is still much more to go for.

With a number of major mines currently mothballed, primarily due to the low uranium price, the managers believe that little production capacity will be brought back online until the uranium price reaches US$45 per pound. With this currently in the region of US$32-33 per pound, there is considerable scope for earnings increases, and improvements in equity prices, before this happens. In the longer term, emerging markets continue to be the main source of demand growth, as China and India bring more nuclear reactors online. Nuclear also looks set to be part of the power mix in the developed world for decades to come.

Capital growth from a diversified global portfolio of uranium stocks

Capital growth from a diversified global portfolio of uranium stocks

GCL aims to provide investors with capital growth by investing in a portfolio of securities of companies involved in the exploration, development and production of energy, as well as related service companies. Its main focus is the uranium sector, but up to 30% of assets can be invested in other resource-related companies. These include, but are not limited to, shares, convertibles, fixed-income securities and warrants.

Fund profile

Fund profile

Diversified global uranium exposure

Diversified global uranium exposure

GCL aims to provide investors with attractive returns, primarily in the form of capital growth, by investing in a portfolio of securities of companies involved in the exploration, development and production of energy and related service companies in the energy sector. Its main focus is uranium, but to allow for some diversification beyond this highly concentrated sector, up to 30% of assets can be invested in other resource-related companies.

As discussed below, GCL does not have a formal benchmark and is not managed with the aim of providing outperformance relative to an index. Instead, the portfolio is managed to make money for investors, with the managers selecting the securities that they believe will provide the best returns, relative to their risk, over the longer term. Although the managers consider uranium to benefit from long-term structural growth drivers, the portfolio is focused on securities that the manager has identified as being undervalued by the market. The expectation is that such securities will benefit from a re-rating over time, and therefore provide the scope for a capital appreciation beyond what the market expects.

GCL has a global remit, but its portfolio tends to be biased towards North American- and Australian-listed equities. The portfolio is predominantly invested in equities, but it is not restricted to these and can also invest in convertible securities, fixed-income securities and warrants.

Further information on GCL can be found at the manager’s website: ncim.co.uk

CQS Group and New City Investment Managers

CQS Group and New City Investment Managers

New City Investment Managers (NCIM) has been GCL’s investment manager since its launch in July 2006. On 1 October 2007, NCIM joined the CQS Group, a global diversified asset manager running multiple strategies with AUM of US$16.9bn as at 29 May 2020. Keith Watson and Rob Crayfourd are responsible for the day-to-day management of GCL’s portfolio.

No formal benchmark index

No formal benchmark index

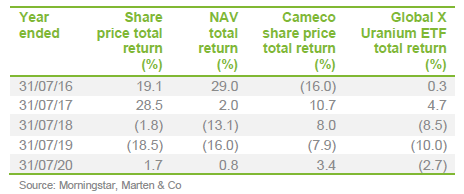

Reflecting both its specialist investment proposition and a relatively small universe, GCL does not have a formal benchmark. However, for the purpose of performance evaluation, the manager has traditionally made comparisons against the price of Cameco (a significant uranium miner) and the spot price of triuranium octoxide (U3O8 – the most stable uranium compound and consequently one of the more popular forms of the product).

Cameco is the largest listed uranium producer in the world and the second-largest uranium producer globally. It also provides the processing services needed to produce fuel for nuclear power plants. Cameco has a Canadian listing and its share price and the associated total return series are readily available, so this has been included in this note.

Comparisons against the spot price of U3O8 have not been included in this note. Whilst a potentially useful comparator, it became much harder to access U3O8 spot price reduced dramatically from June 2017 onwards. An additional concern regarding the validity of the U3O8 spot price, for the purposes of performance comparison, is that the majority of market practitioners cannot invest directly in this commodity.

Finally, the Global X Uranium exchange-traded fund (ETF) – URA – has also been used as a comparator in this note. This is a reasonably large (net assets of around US$262m) and liquid ETF that provides investors with access to a broad range of companies involved in uranium mining and the production of nuclear components (this includes companies involved in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries). Its objective is to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium & Nuclear Components Total Return Index.

Market outlook

Market outlook

Uranium demand driven by power production

Uranium demand driven by power production

According to Natural Resources Canada, more than of 99% of uranium produced is used to produce fuel for nuclear power plants (other uses include the production of medical isotopes and fuel for research reactors). Power production is therefore the key driver of the long-term uranium price on the demand side. (Note: a medical isotope or radioisotope is a radioactive isotope that is used in medicine. Isotopes are variants of a particular chemical element which differ in terms of the number of neutrons that are contained in the nucleus. In simple terms, the greater the number of neutrons makes such atoms heavier and it is more likely that the additional neurons will be released as radiation.)

Nuclear power plants are high capital expenditure, long-term investments, with uranium supply typically tied to long-term contracts. Given this, and the fact that nuclear power stations are expensive to ramp up and down (switch on and off), demand for uranium tends to be price-inelastic, at least in the short to medium term.

Concentrated production leaves market open to supply side shocks

Concentrated production leaves market open to supply side shocks

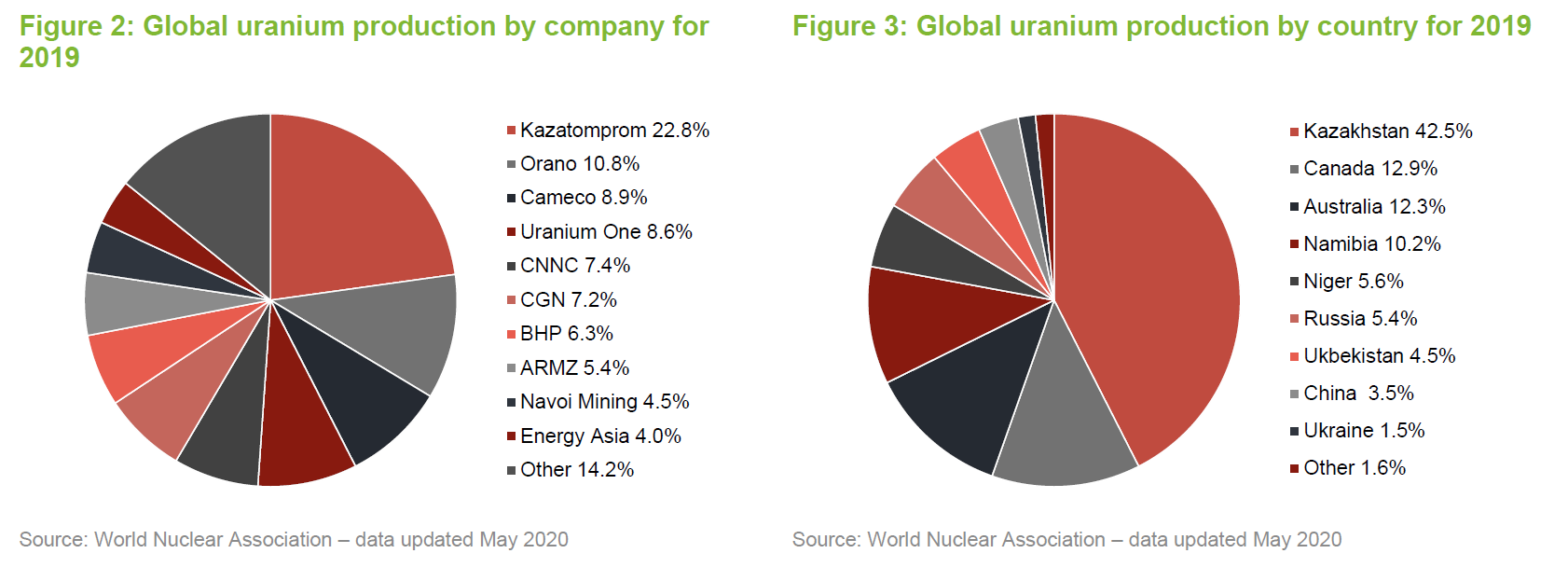

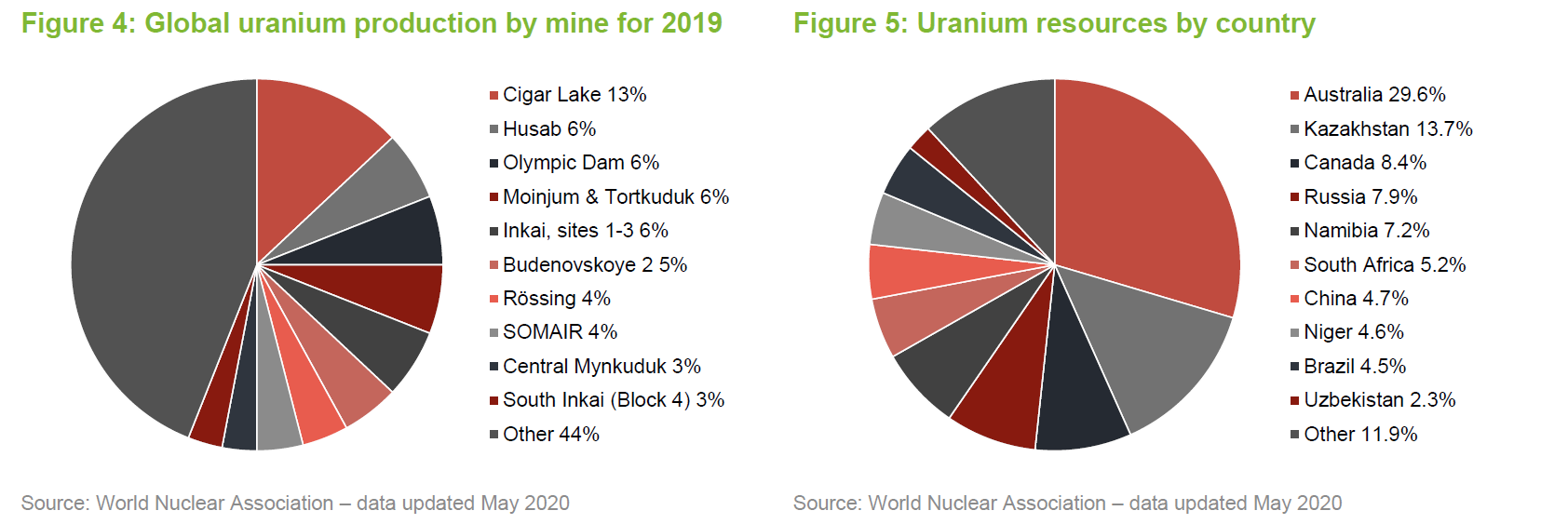

Uranium is reasonably abundant within the earth’s crust and, whilst it may require additional permits and be subject to additional regulation when compared to other commodities, it is not technically difficult to mine. Uranium processing is heavily regulated, but obtaining the necessary permits is not unduly onerous. However, as illustrated in Figures 2, 3 and 4, uranium production is highly concentrated. The top five producers collectively control around 60% of production, while the top 10 account for around 85%. Furthermore, around 48% of production is located in regions of geopolitical risk (primarily Kazakhstan and Russia), while the US accounted for 0.1% of production during 2019, but accounted for around 31% of consumption.

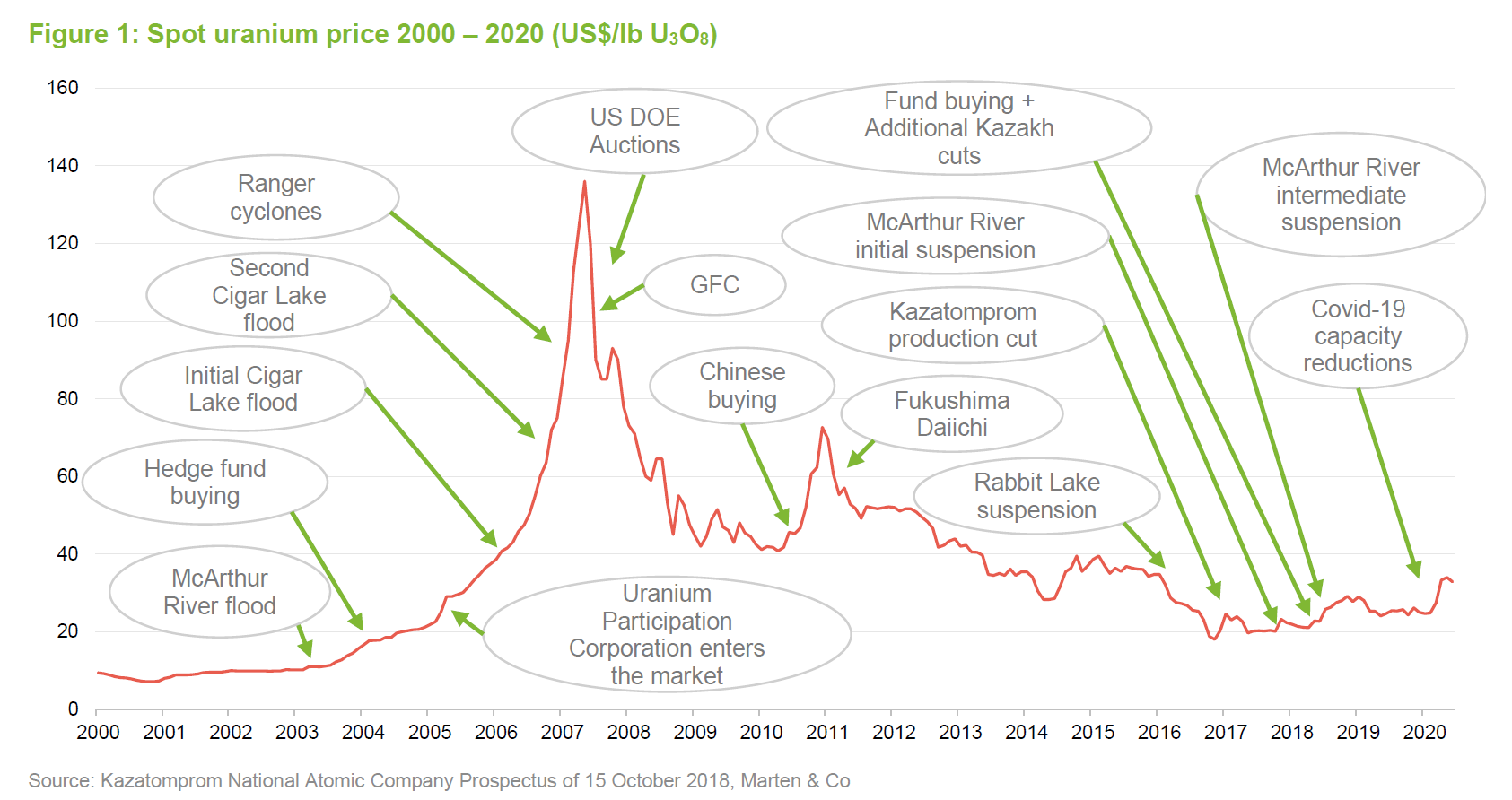

The concentration of production in specific regions, companies and mines leaves the uranium market vulnerable to supply-side shocks (that is, disruptions in supply could, faced with stable demand, lead to sharp price increases). This is particularly apparent when supply-demand imbalances are taken into account. For example, the US accounted for less than 1% of primary uranium supply in 2019, but represents around 30% of global demand. The 2007 flooding of Cameco’s Cigar Lake mine illustrates the potential impact from supply disruption, as illustrated in Figure 1, in the price rise experienced at the time. Figure 5 also illustrates that uranium resources are unevenly distributed.

Covid-19 has heavily impacted uranium supply

Covid-19 has heavily impacted uranium supply

The covid-19 pandemic has had a very heavy impact on the supply side of the uranium market. Around 20% of global production has been taken offline as companies have sought to implement distancing measures designed to both limit the spread of the virus and minimise the potential damage to their businesses. For example, Cameco shut its Cigar Lake mine (as illustrated in Figure 4, this accounted for around 13% of global production in 2019) and has been making purchases in the spot market to fulfil its long-term contracts, while Kazatomprom’s production is reportedly down by around 10%. Cameco has since announced it would look to restart the Cigar Lake mine from September, although it would likely take a while to ramp back up to normalised production.

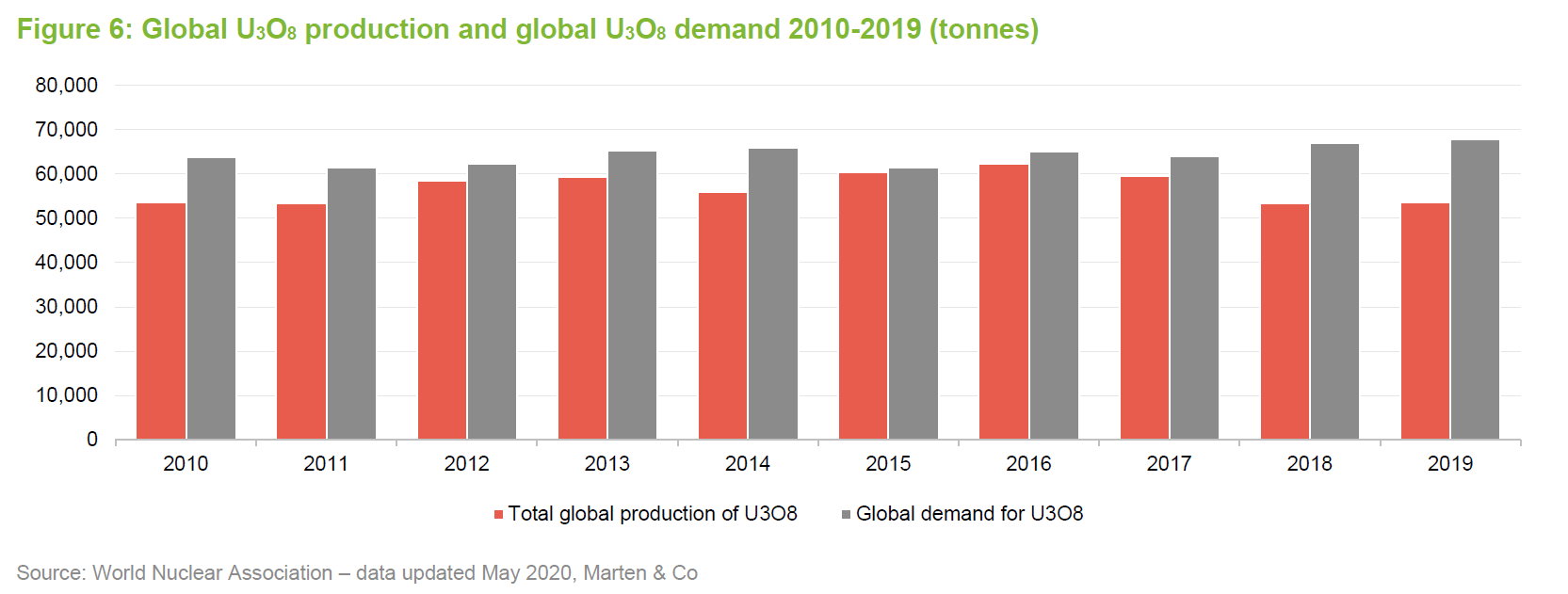

As illustrated in Figure 6 below, the uranium market was already in supply deficit prior to the outbreak of the pandemic, with users running down global inventory. The pandemic has had little impact on the demand for uranium, so the rate of stock depletion has accelerated. The net effect has been to tighten the uranium market and drive up the spot price.

There are also potential demand risks, but nuclear remains a carbon-friendly and consistent technology

There are also potential demand risks, but nuclear remains a carbon-friendly and consistent technology

The March 2011 Fukushima incident (when a tidal wave overwhelmed the sea defences of a nuclear power station in Japan) illustrates that there are also potential demand risks. Occurring just as Kazakhstan was nearing the end of a five-year industry development programme that nearly quadrupled the nation’s uranium output, demand disruption from Fukushima, as Japan shut all its reactors prompting an industry wide safety review, created a significant supply imbalance.

Environmentalists are increasingly looking at nuclear in a positive light, after years of opposition. Nuclear power has a key advantage in an increasingly carbon-conscious world in that it is a clean technology that does not emit carbon dioxide into the atmosphere. Moreover, it is an established technology that can provide a consistent supply 24 hours a day, whatever the weather (in contrast, generation from renewables such as solar and wind can be impacted by climatic conditions). This makes it suitable for baseload power in a way that other low-carbon technologies, such as solar, wind or tidal generation, are perhaps not. (Note: baseload is the minimum level of demand on a electrical grid over a given period of time. The grid needs to be able meet this demand and respond to demand increases as they occur. Nuclear is well suited to meeting the demand floor).

From this point of view, new nuclear displaces coal power generation rather than other lower carbon sources. It is clear that the world will need significantly more battery storage if it is to increasingly draw on renewables for power generation. Whilst this has begun, it is still in the early stages of development and policy makers have yet to develop clear programmes of support to enable its roll-out in any meaningful way. It seems reasonable that nuclear will remain an essential part of the power generation mix for decades to come.

Prior to the Fukushima Daiichi disaster in March 2011, there was an emerging consensus that traditional nuclear power would need to take a greater role in meeting the world’s energy requirements, if carbon levels were to be reined in. This is particularly the case in emerging and frontier markets whose energy needs multiply as they develop (developed markets’ energy requirements tend to be more stable). The Fukushima Daiichi disaster in March 2011 disrupted this consensus, particularly in the developed world. Germany, for example, shut down eight of its 17 reactors and committed to closing the rest by 2022. In the US, a nuclear energy renaissance was taking place, but this gave way to a climate of net closures. Japan, traditionally a major user of nuclear power due to its limited supply of oil and similar alternatives, took all of its nuclear power stations offline by May 2012. France also announced plans to scale back its nuclear power production.

These moves dented demand from the developed world, leading to over-supply and a marked fall in the uranium price. This has had a knock-on effect on uranium equities, although the prices of these have shown signs of improvement as the uranium price has strengthened recently.

Poor pricing environment has curtailed capital investment and led to production cuts

Poor pricing environment has curtailed capital investment and led to production cuts

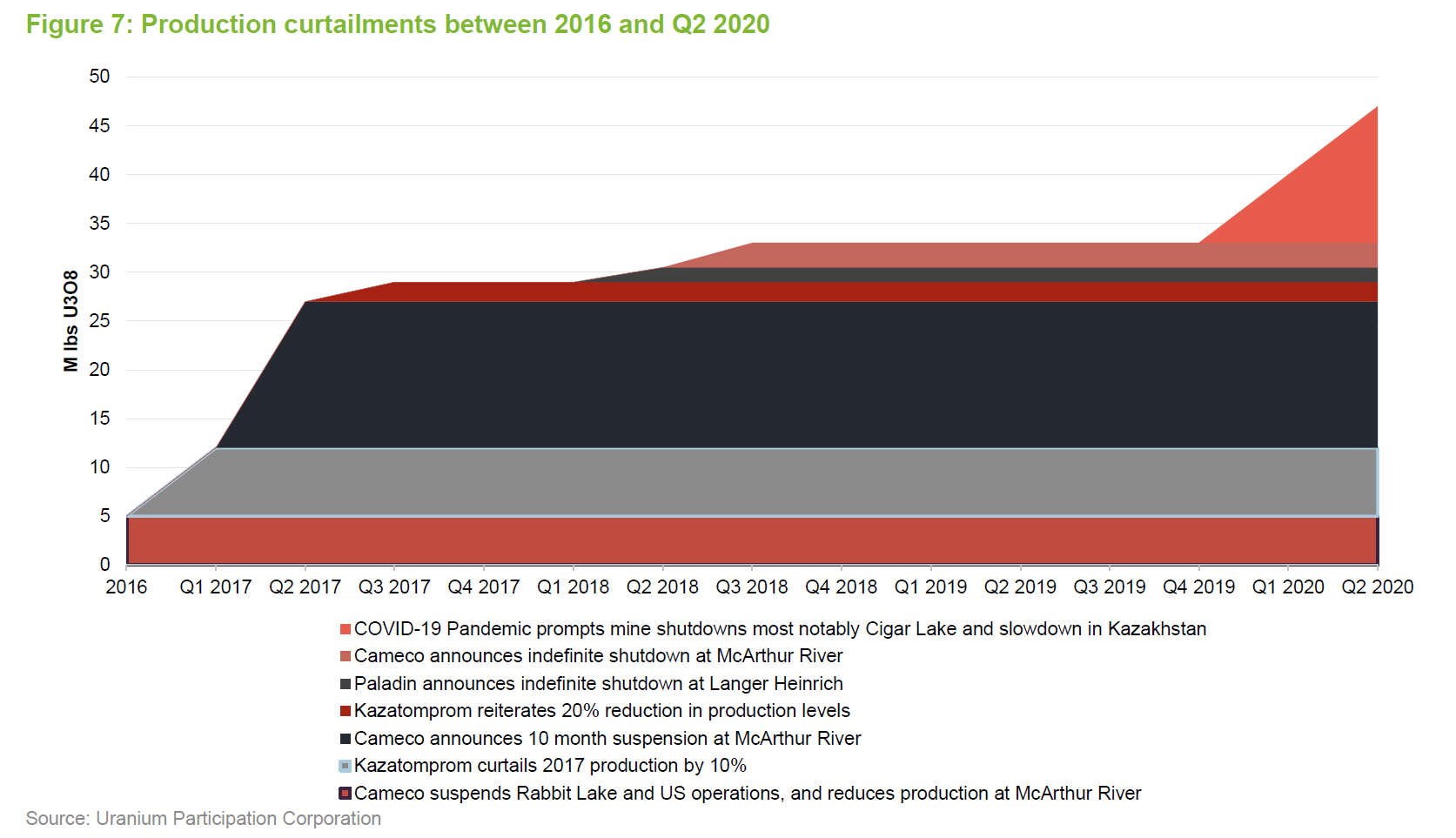

Over time, a lower uranium price has choked off supply from uranium producers as more expensive projects have been taken out of production. Data from Uranium Participation Corporation suggests that supply close to 35m lbs per annum has been removed from the uranium market since 2016. This progression is illustrated graphically in Figure 7.

There is evidence to suggest that the current situation is not sustainable over the longer term. Specifically:

- In Japan, the re-election of Abe’s pro-nuclear government has seen it slowly switching its reactors back on.

- The US government is now offering nuclear plants a zero-emission credit in recognition of their zero carbon emissions. This helps to level the playing field against renewables and fossil-fuelled generation.

- Whilst the US government’s section 232 investigation into the security of uranium supply concluded that uranium imports do not threaten US national security, and no import quota is required, it did call for a fuller analysis of the entire nuclear fuel supply chain. Furthermore, the fact that the investigation took place suggests that the US government continues to see nuclear generation as part of the long-term power mix, despite the availability of cheap shale gas. (The US section 232 investigation looked at the effects of imports on national security.) (Note: nuclear works well for baseload capacity; gas turbines are well suited to meeting short term fluctuations in demand as they can be quickly turned on and off.)

- Having had government proposals to close them, South Korea and Taiwan have now voted to retain their nuclear power stations.

- France has extended its timeframe for de-emphasising nuclear within its power mix (it was targeting a reduction to 50% by 2025, but this has been extended by 10 years to 2035).

- Higher-priced, long-term supply contracts to utilities have been running off recently. This is has led to a rebalancing in the market as mine supply has been curtailed and in some cases utility supply contracts (for example Cameco) have been fulfilled by U3O8 purchased in the market.

The manager’s thoughts on some of these issues are explored in more detail below.

Managers’ view

Managers’ view

Prior to the outbreak of covid-19, GCL’s managers had observed that the fundamentals of the uranium industry were showing a marked shift in fortunes following a 10-year bear market. 2018 marked a crucial point, with the uranium market moving from a supply surplus to a supply deficit. The global pandemic has served to exacerbate this deficit by taking further production capacity out of the market, at a time where demand for uranium has seen little change. This has accelerated the rate of drawdown from global inventories and has driven up the price of uranium in the spot market.

Whilst this has had some impact on the value of uranium equities, GCL’s managers believe that there is still room for considerable price appreciation from here. They believe that the uranium price needs to reach around US$45 per pound for mines to restart. With a uranium price currently in the region of US$32-33 per pound, they are not expecting any genuinely new supply to come back into the market for now, noting that even the Cigar Lake mine, that was suspended in response to COVID-19, will be barely profitable at current spot prices, when it is set to restart in September.

There is considerable scope for prices and profits to increase before new supply comes onstream. GCL’s managers say that they are, however, seeing a significant pick up in investor interest. They believe that the market as a whole is expecting the supply deficit to persist for some time. Current uranium prices are up 32% over 2020 to date, but are still considerably below the levels required to incentivise new supply.

Covid-19 does not affect the long-term demand outlook for uranium

Covid-19 does not affect the long-term demand outlook for uranium

GCL’s managers believe that while the outbreak of covid-19 has reduced energy demand, as industrial activity has been curtailed, and has also disrupted supply by taking further capacity offline, the long-term outlook for uranium is unchanged. They still expect that demand growth will be driven by a build out of new reactors led by emerging regions of China and India, which are focussing on improving air quality. The primary driver behind the market’s rapid shift to deficit production in 2018 was production cuts by major producers such as Kazakhstan and Cameco, both have stated the need for materially higher pricing before increasing output.

Nuclear power generation requires a lot of fixed capital investment, with uranium feedstock only constituting a small proportion of the cost per KWh of electricity generated. This results in a very low elasticity of demand to pricing (that is, the level of demand changes very little in respond to changes in price) with a greater strategic emphasis being placed on certainty of supply.

Nuclear is entering a period of renaissance in the east, where its credentials as a zero-carbon source of base load power are appreciated, primarily for its benefits of displacing polluting coal-fired power generation. The managers acknowledge that renewables will be an increasing part of the mix, but say that this will displace fossil fuelled generation rather than nuclear, which is still the greenest solution for baseload. Renewables, with their higher output volatility, are unable to displace this portion of the global power supply. Utility scale batteries will help reduce this volatility over time, but this technology is still young and way below the necessary scale to provide a solution. Governments are yet to develop a framework to incentivise the build out of the necessary battery infrastructure, which appears to be some way off.

Emerging markets are driving demand growth, particularly in China

Emerging markets are driving demand growth, particularly in China

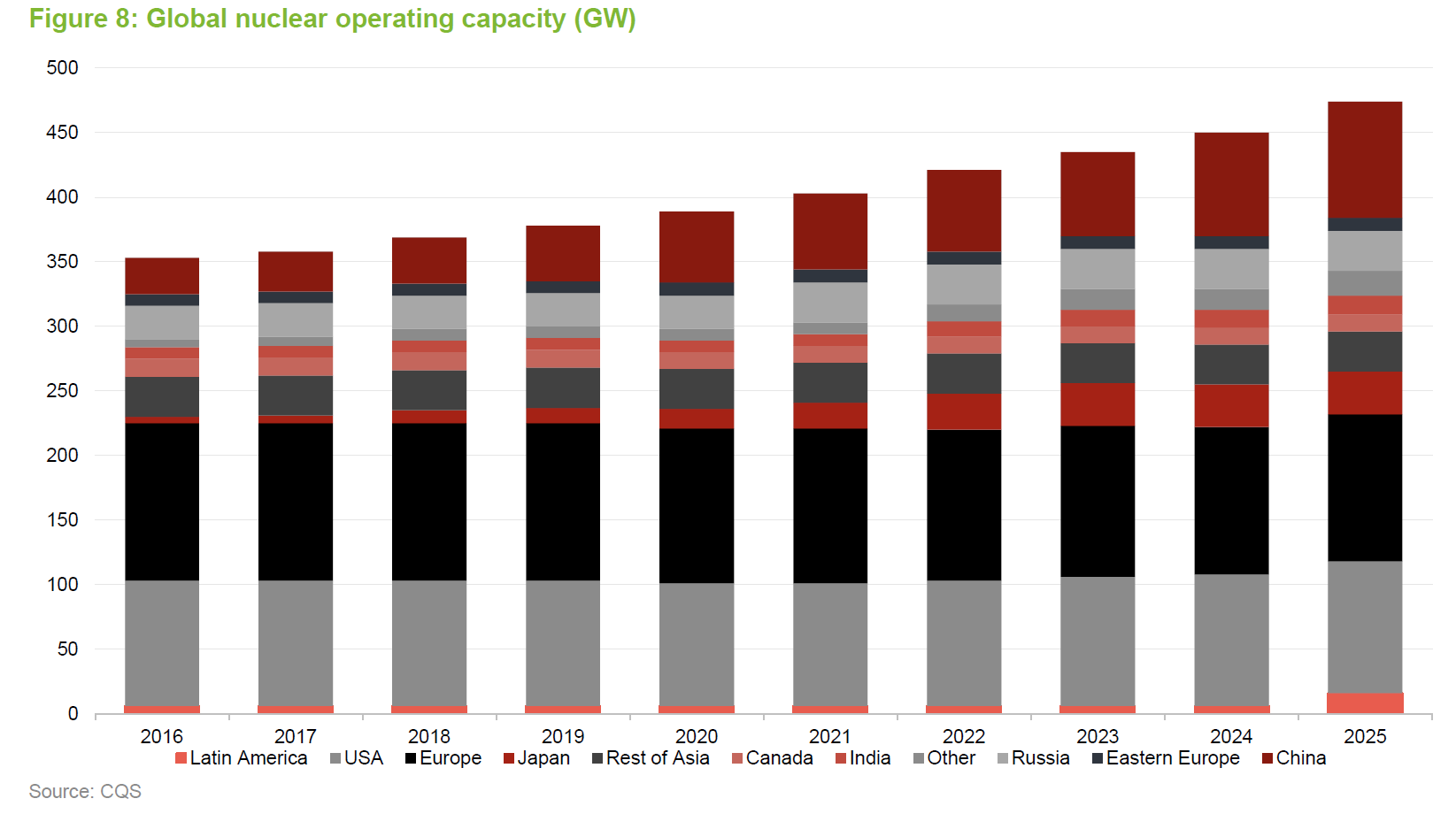

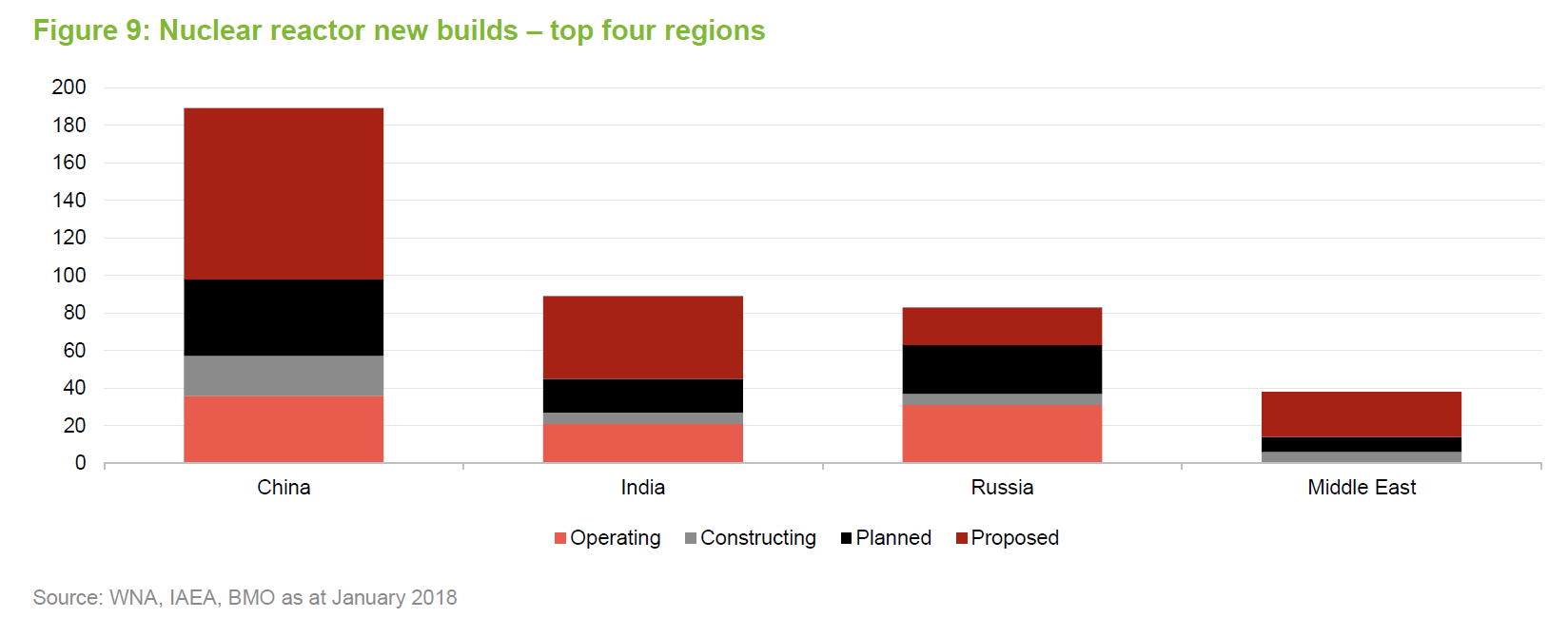

There is demand growth; as illustrated in Figure 8, global nuclear operating capacity is expected to expand from around 350 gigawatts (GW) in 2016 to around 465GW by 2025 (an increase of 33%). As also illustrated in Figure 8, emerging markets are driving this expansion (developed markets are generally flat or down) with China, India and Russia at the forefront (See Figure 9).

Poor air quality in China (and elsewhere) is driving this increase. According to the manager, China, India and Russia combined represent over 60% of the 566 reactors that are currently under construction globally. In the case of China, the manager says that its new designs are safer, larger and have a longer, 60-year life and are also cost-effective.

China has developed a ‘cookie-cutter’ approach that is allowing it to ramp up capacity – the managers say that it is targeting capacity increases from 15GW in 2013 to 200GW by 2030 and 400–500GW by 2050. This aligns with narrative from Uranium Participation. It says that Asia & Oceania remain the key driver of growing demand and are expected to represent over half the global market by 2040. It also says that declines in North America and Western Europe are expected to be more than offset by the Asian build-out.

Another consideration is the programme of nuclear reactor restarts in Japan. While this was slow to get going, this gathered some pace in 2018 with five that brought to total to nine. A further 18 reactors are currently in the process of restart approval, although Japan has some 54 reactors in total, so there is considerable scope for more of these to come back online.

Supply cuts have put the market into deficit

Supply cuts have put the market into deficit

The manager says that, with rising demand and curtailed supply, the uranium market has moved into production deficit (more uranium is being consumed than is being produced by running down inventories). Reflecting this, and other market uncertainties, an increasing volume of demand is not covered by long-term contracts. Data from Uranium Participation Corporation suggests that by 2021, approximately 20% of demand will be uncovered, increasing to approximately 50% in 2025 and 65% by 2030 and beyond. The managers think that this is unsustainable and will drive a continued recovery in the uranium price, particularly as current market uncertainties are making it difficult for new projects to advance.

Bottom-up investment process coupled with a top-down macro-overlay

Bottom-up investment process coupled with a top-down macro-overlay

The team at CQS New City manage their portfolios using a mixture of top-down and bottom-up investment strategies, although, reflecting the concentrated nature of its universe, the bulk of the managers’ efforts are focused on fundamental analysis of the risk and return prospects for potential and existing investments. The portfolio is primarily invested in equity securities, but the managers will consider other instruments where they feel these are appropriate.

GCL has a significant exposure to physically backed uranium entities through its holdings in Uranium Participation Corporation and Yellow Cake Plc. However, the fund’s primary focus is on companies that the managers believe will offer strong returns at a U3O8 price in the range of US$45/lb to US$50/lb. The managers feel that prices above this will incentivise some mines to restart leading to a step increase in supply. However, there is also a tail of higher cost projects that will offer operational leverage as the uranium price increases.

Comprehensive programme of resource company meetings coupled with extensive fundamental analysis

Comprehensive programme of resource company meetings coupled with extensive fundamental analysis

As a recognised investor in the natural resources space, the CQS New City team meets an average of 20 resource-related companies a week. The team employs a range of metrics to try and identify undervalued assets, which vary depending on the type of investment (for example, fixed income versus equities) but the team seeks to identify assets that offer superior returns relative to their risk. These will frequently have the potential for capital growth through a rerating of a security. The managers’ analysis, which is conducted in-house, includes assessments of the following:

- The quality of a company’s projects;. are the projects in mining-friendly jurisdictions? Do the projects have high-quality deposits? Are there appropriate transport links as well as access to the necessary processing facilities?

- The quality of a company’s management; does the management team have a good track record in developing or managing similar projects? Do they have experience of operating in the relevant mining jurisdiction? Does management have a good track record in managing its obligations? Does management have a strong corporate governance record as well as a record of treating shareholders fairly?

- The free cashflow available from projects and how this flows to the various security holders within a corporate’s capital structure (for example, equity holders, debt holders, preferred stock holders and convertible security holders); and

- The prospect of changes to cashflows (for example, from changes in interest rates or the competitive landscape).

Macroeconomic analysis guides managers research efforts

Macroeconomic analysis guides managers research efforts

The macroeconomic element of the investment process begins with an assessment of the factors driving global demand and supply for uranium. This considers supply-side factors such as exploration success, capacity developments, potential for supply disruptions and technological developments. It also considers demand-side factors such as new applications, the potential for substitution, and technological developments.

The managers look at demand from developed markets, but particular emphasis is placed on developments in the large industrialising emerging markets, as these (China being an example) have significant programmes to develop nuclear power stations and are expected to be the major source of new demand for uranium in coming years (emerging and frontier markets energy demands tend to increase dramatically as they develop). The analysis also takes into consideration inventory levels and how these might develop. This analysis identifies areas (for example, sub-sectors and geographies) for the managers to focus their attention on when conducting their bottom-up analysis of potential investments.

Portfolio construction – unconstrained by benchmark

Portfolio construction – unconstrained by benchmark

It should be noted that GCL’s portfolio is not managed with reference to any benchmark and, whilst the macroeconomic assessment acts as a guide by directing the managers’ research efforts, it does not provide specific targets for the geographic and sectoral allocations. Instead, these are a result of the managers’ stock selection decisions, which reflect the managers’ assessment of the relative strength of individual investment ideas.

The managers, Keith Watson and Robert Crayfourd, make the final decision on what enters GCL’s portfolio, but they are able to draw on the expertise of the wider CQS New City team. Once included in the portfolio, the managers continue to assess stocks to ascertain whether the level remains appropriate.

Investment restrictions

Investment restrictions

- GCL’s main focus is on companies involved in the uranium industry, but up to 30% of gross assets may be invested in other resource-related companies.

- GCL’s articles of association do not include a specific gearing limit. Instead, the board sets borrowing limits, which it reviews regularly to ensure that gearing levels are appropriate to market conditions.

Asset allocation

Asset allocation

As at 30 June 2020, GCL’s portfolio had exposure to 37 issues, down from 46 issues as at 30 September 2019. GCL’s portfolio is highly concentrated (the top five holdings have tended to account for around 55% of the fund in recent years – see Figure Z) and to protect the company from being unduly exposed to arbitrageurs (seeking to exploit GCL’s discount), details of its holdings are limited to the top five largest positions in its monthly factsheets. Greater detail is provided in its annual and interim reports, but this data is inevitably more dated by the time these reports are released.

Concentrated and low turnover portfolio of uranium stocks

Concentrated and low turnover portfolio of uranium stocks

As illustrated in Figure 12, the top five issues accounted for 57.6% of the portfolio as at 31 May 2020, which, perhaps reflecting the decrease in the number of issues, has increased from 54.9% as at the end of September 2019. In part reflecting the managers’ investment style, but also the concentrated nature of the industry (nine producers control around 90% of supply between them), GCL’s portfolio is inherently low-turnover.

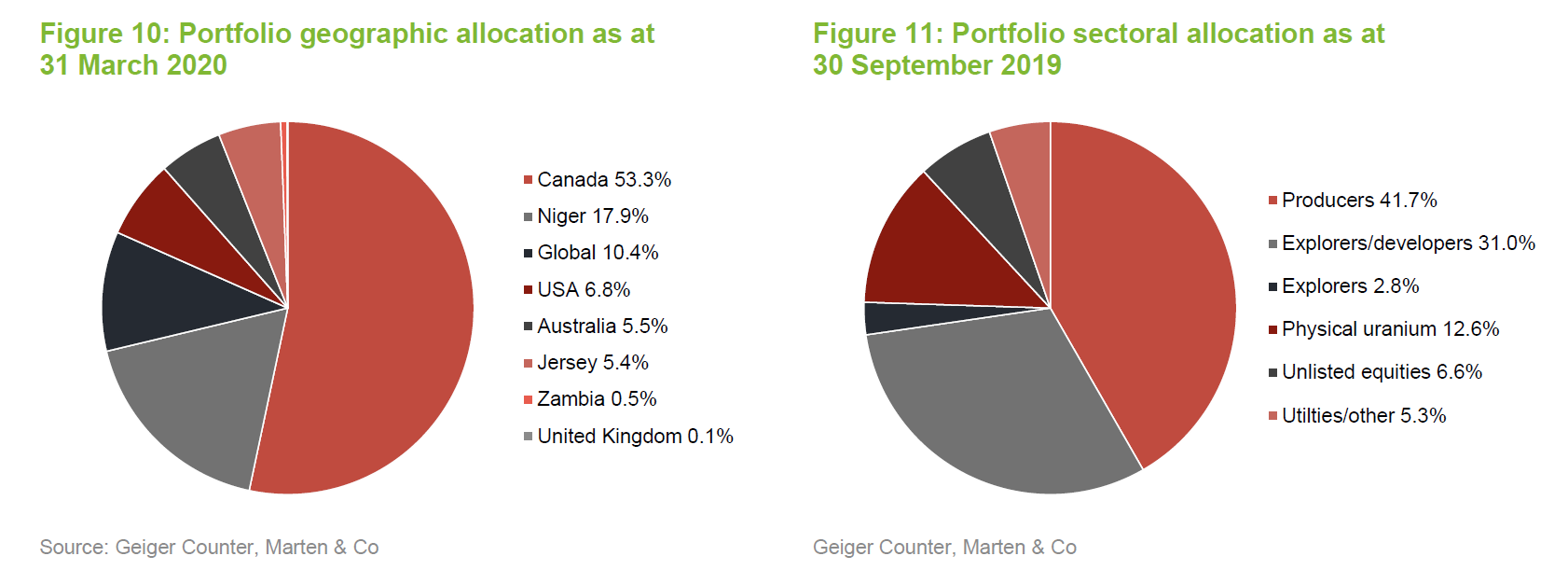

Figures 10 and 11 show the portfolio’s geographical allocation and sectoral allocations as at 31 March 2020 and 30 September 2019 respectively (this being the most recent publicly available data). These highlight a number of themes:

- While GCL has a global mandate, North America (particularly Canada) and Australia dominate the portfolio. These are viewed as politically safer regions that have “extractable pounds”; that is, they have good geology and mining-friendly environments.

- Over half of GCL’s portfolio is invested in safer assets; that is, producers or companies backed by physical uranium.

- Companies that are purely focused on exploration are a limited component of the portfolio.

Although not illustrated in Figures 10, 11 and 12, GCL’s portfolio has a strong bias towards small and mid-cap uranium mining companies. For example, GCL does have an investment in Cameco but this accounted for some 2.7% of net assets as at the end of September 2019 (down from 4.7% as at the end of September 2018). The bias towards small and mid-cap companies reflects the managers’ view that these generally have superior growth prospects (for example, production improvements or improvements in reserves) and, generally being less well-researched, it is also where the manager is more likely to find a mispriced security.

As at 31 March 2020, GCL had four unlisted investments, which were valued in total at £2.0m and accounted for 23.2% of its net assets – the largest of which is High Power Exploration (discussed below). It also held three warrants, which were value at £25,000 in total and accounted for 0.3% of GCL’s net assets.

As discussed above, GCL has a significant exposure to physically-backed uranium entities through its holdings in Uranium Participation Corporation and Yellow Cake Plc. However, in comparison to alternatives such as the URA ETF, GCL is relatively underweight Cameco.

Top five holdings

Top five holdings

Figure 12 shows GCL’s top five holdings as at 30 June 2020 and how these have changed since 30 September 2019 (the most recently available data when QuotedData last published in November 2019). Reflecting both the concentrated nature of the uranium sector and manager’s long-term, low-turnover approach, the names in the top five portfolio holdings will be familiar to regular followers of GCL’s portfolio announcements and QuotedData’s notes on the company.

Since QuotedData last published, private company High Power Exploration has moved up into the top five, and NAC Kazatomprom has moved back up into the top. They have displaced Fission Uranium and UR-Energy, which have moved out of the top five altogether. Otherwise, NexGen Energy still occupies the top spot, while the other names are unchanged, albeit their relative positions have changed. We discuss the changes at High Power Exploration that led to its promotion below, but the managers say that, otherwise, GCL’s holdings have continued to tick over, with nothing significant to report.

Readers interested in more detail on these top five holdings, or other names in GCL’s portfolio, should see QuotedData’s previous notes (see page 28 of this note), where many of these have been discussed. For example, NexGen Energy, UR-Energy, Denison Mines, Uranium Participation and Fission Uranium were discussed in QuotedData’s March 2019 initiation note, while Greenland Resources (sold), Alkane Resources (sold), NAC Kazatomprom and NexGen Energy were discussed in QuotedData’s November 2019 update note.

High Power Exploration (13.5%) – a non-uranium holding

High Power Exploration (13.5%) – a non-uranium holding

Although its name might lead you to believe otherwise, High Power Exploration (hpxploration.com) is an unlisted holding within GCL’s portfolio, backed by mining developer Robert Friedland, that has no exposure to uranium. GCL has held a small position in the company for some time, but this rose up GCL’s ranks in November 2019, pushing it into the top five holdings, when High Power Exploration (HPX) announced that it had completed an equity raise of some US$88m.

The equity raise was conducted to fund the development of the Nimba iron ore project in Guinea. Nimba is a high-grade project that HPX acquired from BHP Newmont and Orano, in the second half of 2019, which is now HPX’s largest asset. The fundraise was undertaken at a price that was at a substantial premium to the valuation it was being held at in GCL’s portfolio. This required a revaluation of the holding, which led to a marked uplift in GCL’s NAV.

The fundraising, which saw a number of large investors join the register, included a condition whereby the cost of the fundraise becomes more expensive if HPX does not list by the end of 2020. These new investors wanted clarity and the fundraise effectively set HPX on a planned IPO timeline, which could provide greater liquidity by the end of this year. Of course, the listing provision was agreed before the outbreak of covid-19 and inevitably this puts the listing at risk. However, GCL’s managers say that, as the last capital raise will become notably more expensive if the listing does not take place by the end of this year, HPX’s management are well incentivised to bring the company to market in time.

GCL’s managers also acknowledge that the holding in HPX is now a large position within GCL’s portfolio, but they say that this is purely due to strong performance and have reiterated that it does not mark any intentional deviation from the uranium focus of the fund. It should also be noted that, in addition to the mining assets the company holds, HPX has expertise in deploying advanced geophysical technologies that allows it to look deeper into the earth to explore areas where other systems are ineffective. This allows it to revisit areas that have previously been explored, uncovering hidden targets, and breathing new life into exploration permits. In return, it often receives a stake in these projects.

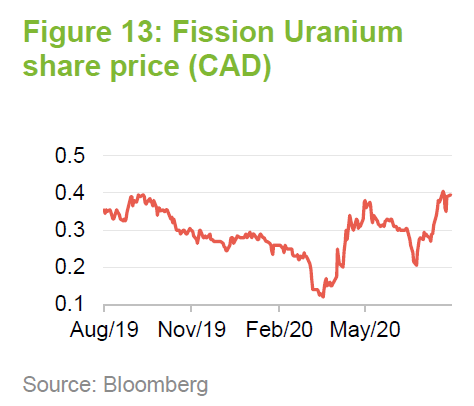

Fission Uranium – US$10m of new debt finance

Fission Uranium – US$10m of new debt finance

Fission Uranium (www.fissionuranium.com) describes itself as “one of the most successful exploration companies in the uranium sector”. Like NexGen Energy and Denison Mines (both top five GCL holdings), Fission Uranium is a uranium exploration and development company that is focused on the Athabasca Basin in Canada. Its primary asset is its wholly-owned Patterson Lake South project (PLS project), which is home to the Triple R deposit. Fission Uranium has described the Triple R deposit as the most significant high-grade, near-surface project in the region. The Patterson Lake South Project comprises 17 mineral claims totalling 31,039 hectares that are located on the southwest margin of the Athabasca Basin. The property is accessible by all-weather Highway 955.

In May 2020, Fission announced that it had closed a US$10m senior secured facility with Sprott Resource Lending. It says that this new facility, in combination with the cost-cutting programme it has had in place since 2018, has “significantly strengthened the company’s treasury”. It also says that while it has minimised onsite activity at its PLS project, in line with covid-19 precautions, it is moving forward with environmental and feasibility study activity.

Updates on other major holdings

Updates on other major holdings

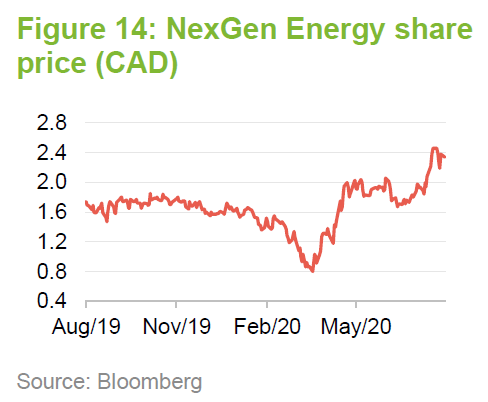

NexGen Energy (19.7%) – secures £30m of financing

NexGen Energy (19.7%) – secures £30m of financing

NexGen Energy (www.nexgenenergy.ca) is a uranium exploration and development company with a portfolio of projects that are centred on the Athabasca Basin in Canada, where it holds over 259k hectares of land. NexGen’s southwestern Athabasca Rook 1 property hosts the Arrow Deposit, the South Arrow discovery, the Harpoon discovery, the Bow discovery and the Cannon area. All of these are 100% owned by NexGen. On 28 May 2020, NexGen announced that it had completed a US$30m financing with Queen’s Road Capital Investment Ltd. This comprises US$15m of NexGen ordinary shares (11,611,667 placement shares at a price of CAD$1.80 per share) and US$15m of unsecured convertible debentures.

The debentures carry a 7.5% coupon over a five-year term to 27 May 2025 and can be converted into common shares at a conversion price of CAD$2.34 (this being a 30% premium to the issue price of the placement shares). Interestingly, two-thirds of the coupon (equal to 5% per annum) is payable in cash, while one-third of the interest (equal to 2.5% per annum) is payable in common shares. These are issued at a price equal to the 20-day volume weighted average trading price (on the exchange that has the greatest trading volume). NexGen is entitled to redeem the debentures at par plus accrued and unpaid interest, on or after the third anniversary of the date of the issuance of the debentures, provided that the 20-day volume-weighted average price (VWAP) on the Toronto Stock Exchange exceeds 130% of the conversion price.

Following the financing, NexGen said that it has cash reserves of approximately CAD$78m, which will be used to fund the permitting and development of the company’s Rook I Project, which hosts the 100%-owned Arrow Deposit, and for general corporate purposes. We have previously said that GCL’s managers like NexGen’s assets, its management team and its financial strength. They consider that NexGen is well positioned to bring the Arrow Deposit into production.

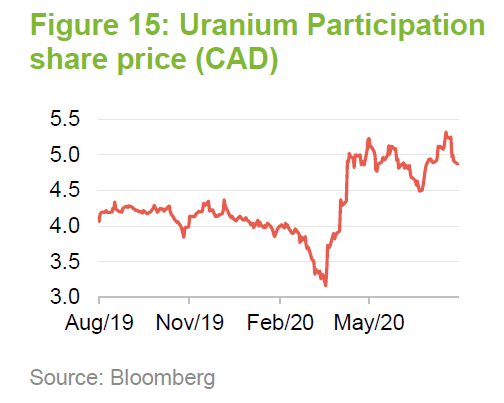

Uranium Participation (9.1%)

Uranium Participation (9.1%)

Uranium Participation (www.uraniumparticipation.com) is a fund that invests in uranium oxide and uranium hexafluoride. It aims to achieve appreciation in the value of its uranium holdings through increases in the uranium price. The fund, which is managed by Denison Mines Inc, a wholly-owned subsidiary of Denison Mines (see below), also lends its uranium to third parties from time to time.

All uranium owned by Uranium Participation is stored at licensed uranium conversion, enrichment, or fuel fabrication facilities that are owned by different organisations in Canada, France, England, Germany, the Netherlands and the United States. The terms of storage are negotiated by the fund’s manager. Uranium Participation’s manager says that these facilities represent the only viable source of storage, at present, and are also used by global nuclear energy utilities, and commodity traders for their storage needs. Accordingly, it says that its risks, in respect of ownership and storage, are similar to those of any participant in the nuclear energy industry.

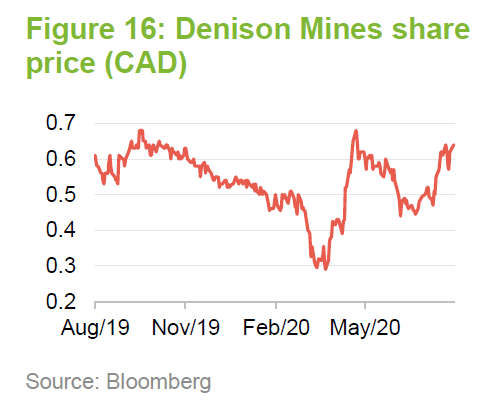

Denison Mines (8.2%) – Phoenix ISR field test demonstrates proof of concept

Denison Mines (8.2%) – Phoenix ISR field test demonstrates proof of concept

Like NexGen Energy, Denison Mines (www.denisonmines.com) is a uranium exploration and development company that has a portfolio of projects that are centred on the Athabasca Basin in Canada. Its projects cover some 320,000 hectares and include its 90% owned Wheeler River project, which the company says is “the largest undeveloped high-grade uranium project in the infrastructure rich eastern portion of the Athabasca Basin region”.

Denison’s also has a 22.5% interest in the McClean Lake joint venture, a 25.17% interest in the Midwest and Midwest A deposits, and a 65.45% interest in the J Zone deposit and Huskie discovery on the Waterbury Lake property. In addition to these interests, Denison also engages in mine decommissioning and environmental services through its Denison Environmental Services division, and it is also the manager of Uranium Participation Corporation (see below).

Denison’s operations have not been immune to the pandemic (for example in March, it announced the temporary suspension of its Wheeler River environmental assessment), but amidst the disruptions the company has continued to make progress. On 26 March 2020, it announced that it had raised US$5.75m through a public offering and, on 4 June 2020, it announced that the hydrogeologic model developed by Petrotek Corporation, Denison’s Phoenix deposit (part of the Wheeler River Uranium Project) had demonstrated proof of concept for the application of in-situ recovery. The hydrogeologic model was developed based on the data collected from the ISR field test completed in 2019, and Denison plans to continue with ISR field testing this year.

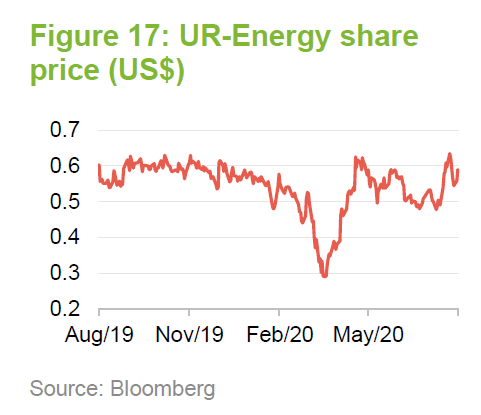

UR-Energy – scaled down operations continue

UR-Energy – scaled down operations continue

UR-Energy (www.ur-energy.com) is a junior uranium mining company that operates an in-situ uranium recovery facility at its Lost Creek property in south-central Wyoming. It also owns the Shirley Basin and Lucky Mc mine sites in the Shirley Basin and Gas Hills mining districts of Wyoming. These were acquired in 2013 along with all of the historic geological and engineering data for the project (it has nearly 3,200 historic drill holes). The tailings facility at the Shirley Basin site is also one of the few remaining facilities in the United States that is licensed by the US Nuclear Regulatory Commission (NRC) to receive and dispose of by-product waste material from other in-situ uranium mines. GCL’s manager says that UR-Energy has decent quality assets and a proven operational record.

On 8 May 2020, the company announced its Q1 results in which it commented that its workforce is healthy and that scaled down operations at Lost Creek have allowed its reduced staff to remain physically distanced. During 2020 Q1, the company captured 4,113 pounds of U3O8, within the Lost Creek plant, and 1,433 pounds were packaged in drums. Drumming activities during the quarter were limited, as packaging only occurs on an as-needed basis to minimise costs, and no shipments were made to the conversion facility during the quarter. At 31 March 2020, the company’s inventory at the conversion facility was approximately 268,552 pounds of U3O8.

Performance

Performance

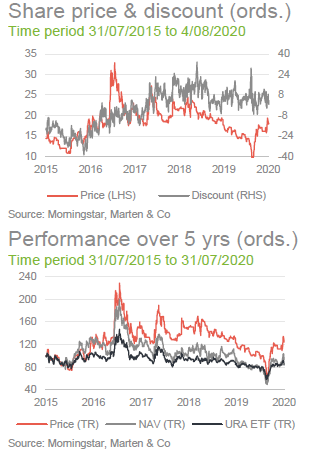

As QuotedData has discussed in its previous notes, GCL and the broader uranium market suffered heavily in the aftermath of the Fukushima Daiichi disaster, as the world’s focus shifted away from nuclear power as a low-carbon solution (see pages 7 and 8 for more discussion) leaving an excess of supply capacity in the market. However, as capacity has been taken out of the market and the spot price has recovered, the fortunes of the sector have improved, albeit with periods of marked volatility.

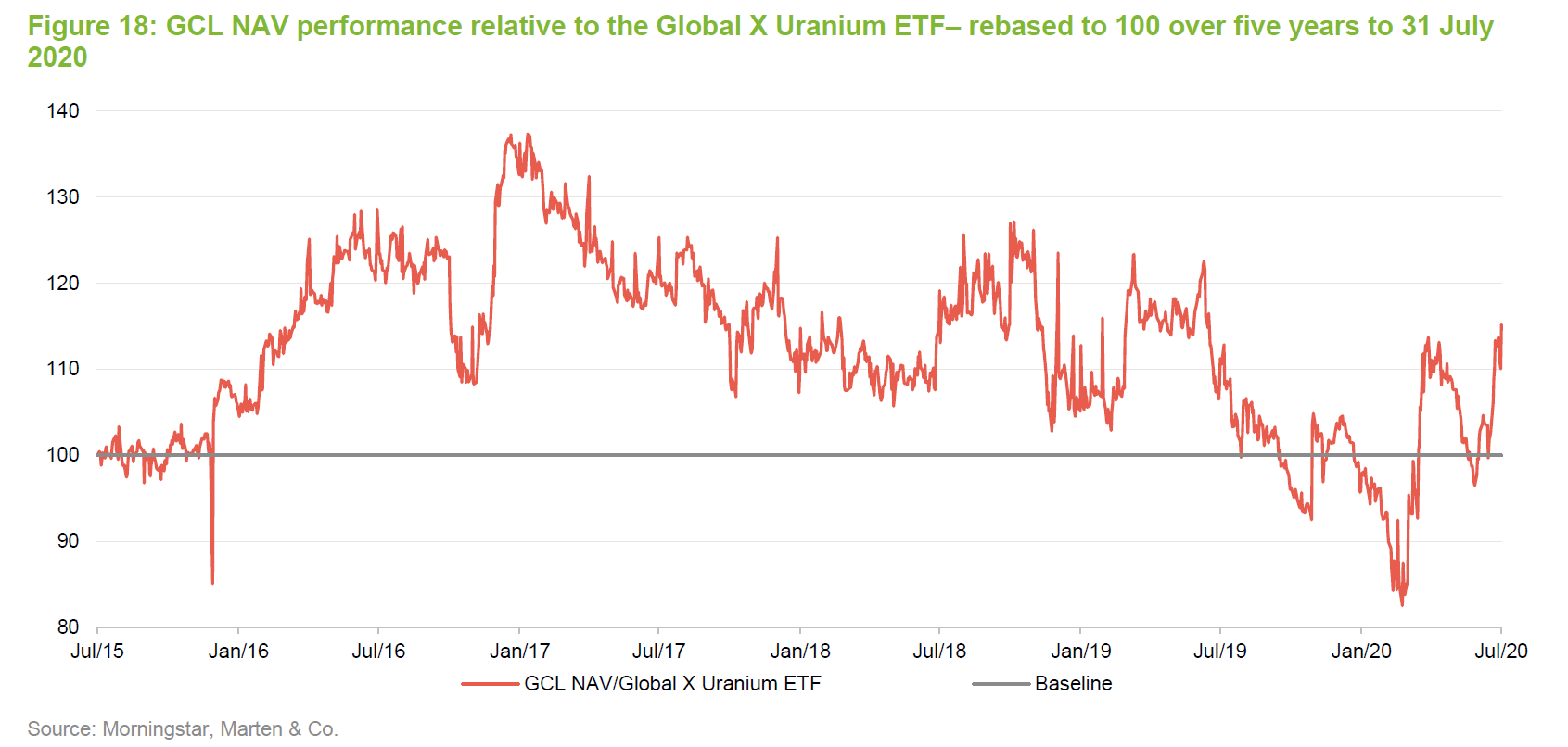

As illustrated in Figure 18, GCL’s NAV broadly outperformed the Global X Uranium ETF up until the end of 2016, when the uranium market started to turn, but has failed to keep pace since. This may be due to its bias away from the majors, which would appear to respond more quickly in a recovery. However, it should also be noted that around 50% of the URA ETF is in non-uranium stocks, which have generally outperformed uranium. This is a driver of GCL’s relative underperformance. (Note: the major uranium companies are a much larger part of the ETF’s portfolio than they are GCL’s. The price of the majors tend to respond more quickly to a recovery and so the ETF’s own pricing responds more quickly. However, while the smaller and mid-cap companies tend to respond with a lag, they may, for a variety of reasons show stronger appreciation than the majors if the recovery is sustained).

A key consideration is that, from 2018, the market has moved into supply deficit and, with major players having mothballed mines and reduced their output, no significant production capacity is expected to enter the market until the uranium price has increased substantially from here. It seems reasonable that we may have moved closer to the point where smaller players may benefit, particularly if other demand drivers, such as build outs in emerging markets and restarts in Japan gather pace.

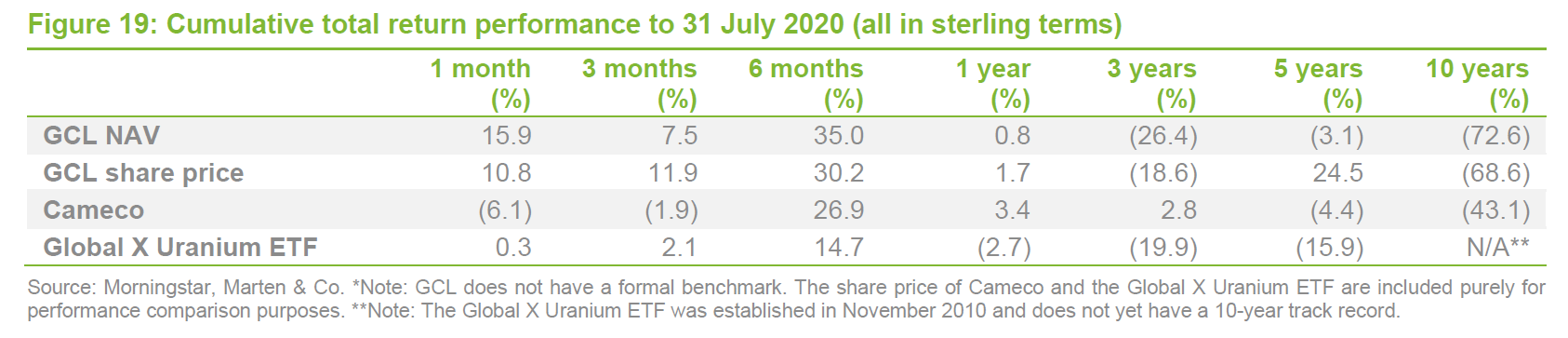

Looking at the cumulative performance table in Figure 19, it is clear that uranium has suffered from an extended bear market, but there has also been a marked uplift during the last six months. GCL appears to have responded well to this adjustment, with both its share price and NAV total returns outperforming all of the other comparables provided over the six-month and one-month periods. We have previously observed that, whilst GCL’s performance has lagged the other comparables in recent years, its managers argue that over the medium to long term, its holdings have superior growth potential and should be more leveraged to the upside. Recent performance illustrates that there is the possibility of strong performance if the uranium market continues to make positive progress and the junior players are able to catch up.

Peer group

Peer group

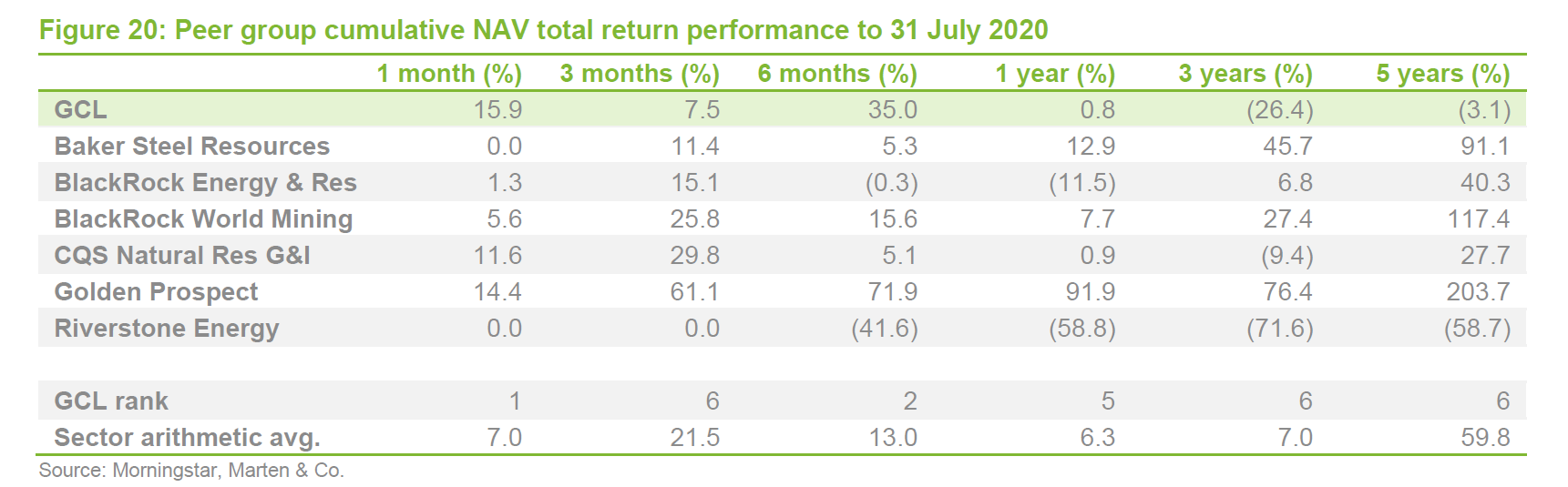

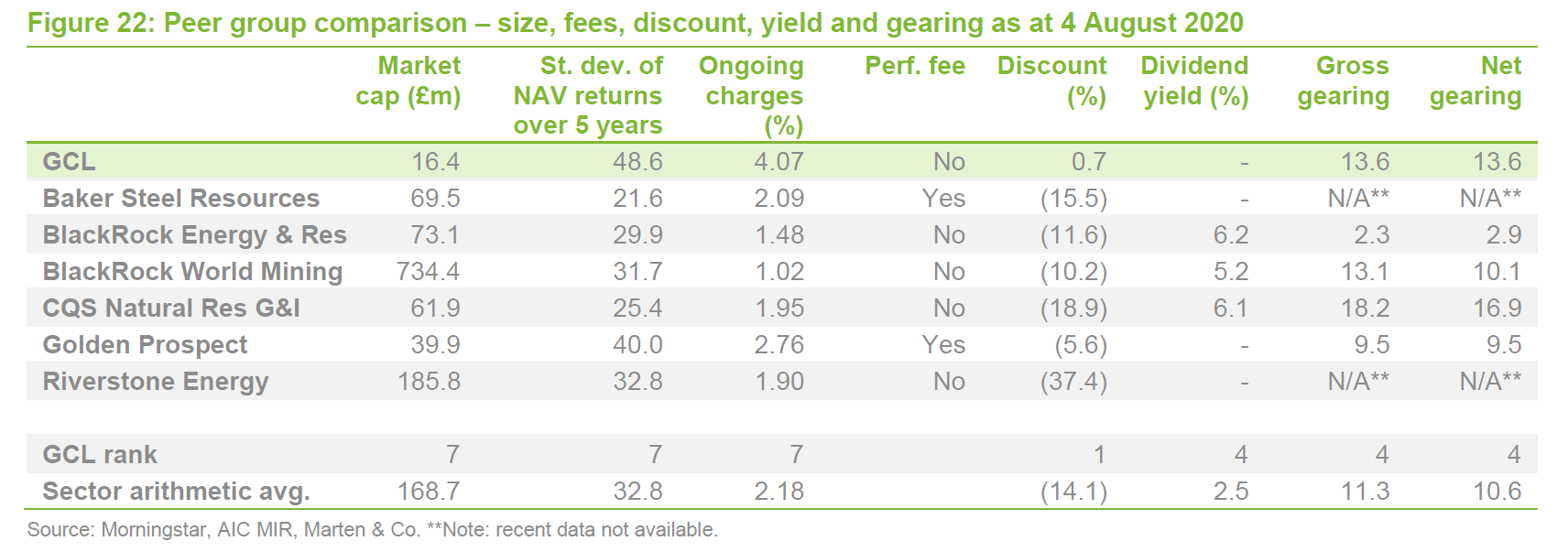

GCL is a member of the Association of Investment Companies (AIC)’s specialist commodities and natural resources sector, which comprises 10 members. Seven of these are illustrated in Figures 20 through 22. For the purposes of this peer group analysis, Global Resources Investment Trust (GRIT), Tiger Resource Finance (TIR) and Polo Resources (POL) have been excluded, on the grounds that their reduced scale and liquidity make them less relevant as comparators for GCL.

Whilst they are all members of the commodities and natural resources sector, the funds used in this peer group comparison are quite diverse, and GCL is somewhat unique as it is the only fund that is uranium-focused. GCL is not the only fund with a narrow focus, however. For example, Golden Prospect Precious Metals is focused on gold; Riverstone Energy has a concentrated portfolio of energy companies that are primarily engaged in oil exploration and production; and the BlackRock funds are both primarily invested in larger cap stocks. However, none of the funds used are perfect comparators for GCL.

The closest peer to GCL is Yellow Cake Plc (YCA). This company has just had its second birthday (it listed on the AIM segment of the London Stock Exchange in July 2018) and was established to purchase and hold triuranium octoxide (this is held in a storage account at Cameco’s Port Hope/Blind River facility in Ontario, Canada). It aims to provide investors with exposure to the uranium price and to exploit a range of opportunities offered by holding physical uranium. YCA has been excluded from the comparison, in Figures 20 to 22, due to its very short track record and the limited data currently available (YCA publishes quarterly rather than daily Net Asset Values (NAVs), for example).

As illustrated in Figure 20, GCL’s NAV has provided a stellar performance over the last six months as conditions in the uranium market have tightened as well as a general resurgence in commodities (notably during the last three months). However, the longer-term numbers reflect the 10 year bear market in uranium that was accelerated by the Fukushima Daiichi disaster. A similar pattern is witnessed in share price total return, albeit the returns are lower reflecting the recent narrowing of GCL’s premium (GCL was the only fund trading at a premium as at 4 August 2020 – See Figure 22).

The volatility of GCL’s NAV returns is the highest of the peer group, perhaps reflecting the fact that it has a more concentrated portfolio than a number of the funds in the peer group, as well as having a narrow focus.

GCL has the highest ongoing charges ratio in its peer group. This does in part reflect its relatively small size. GCL does not pay a performance fee. GCL does not pay a dividend (see above and below). In compiling the above analysis, QuotedData was not able to find complete information in terms of gearing levels across the peers. However, of those that is was able to find reasonably recent data, GCL’s were above the sector averages. This suggests that, all things being equal, it should benefit if uranium continues to perform well, but will suffer disproportionately if it does not.

No dividend – capital growth focused

No dividend – capital growth focused

GCL’s investment objective is to achieve returns primarily through capital growth. GCL does not have a formal dividend policy and has not paid a dividend since its launch. The investment objective and dividend policy are both a reflection of GCL’s underlying investments. Traditionally, commodities and natural resources have been among the lower-yielding sectors. These industries are capital-intensive, and companies have frequently retained a high proportion of earnings for reinvestment in the business, rather than returning cash to shareholders. In addition, where GCL holds physical commodities, these do not pay dividends. The combined effect is that GCL’s dividend income tends to be a relatively small component of its total return. GCL’s accumulated revenue reserve has been on a declining trend in recent years. As at 31 March 2020, GCL had accumulated revenue reserves equal of £12k, equivalent to 0.014p per share.

Premium/(discount)

Premium/(discount)

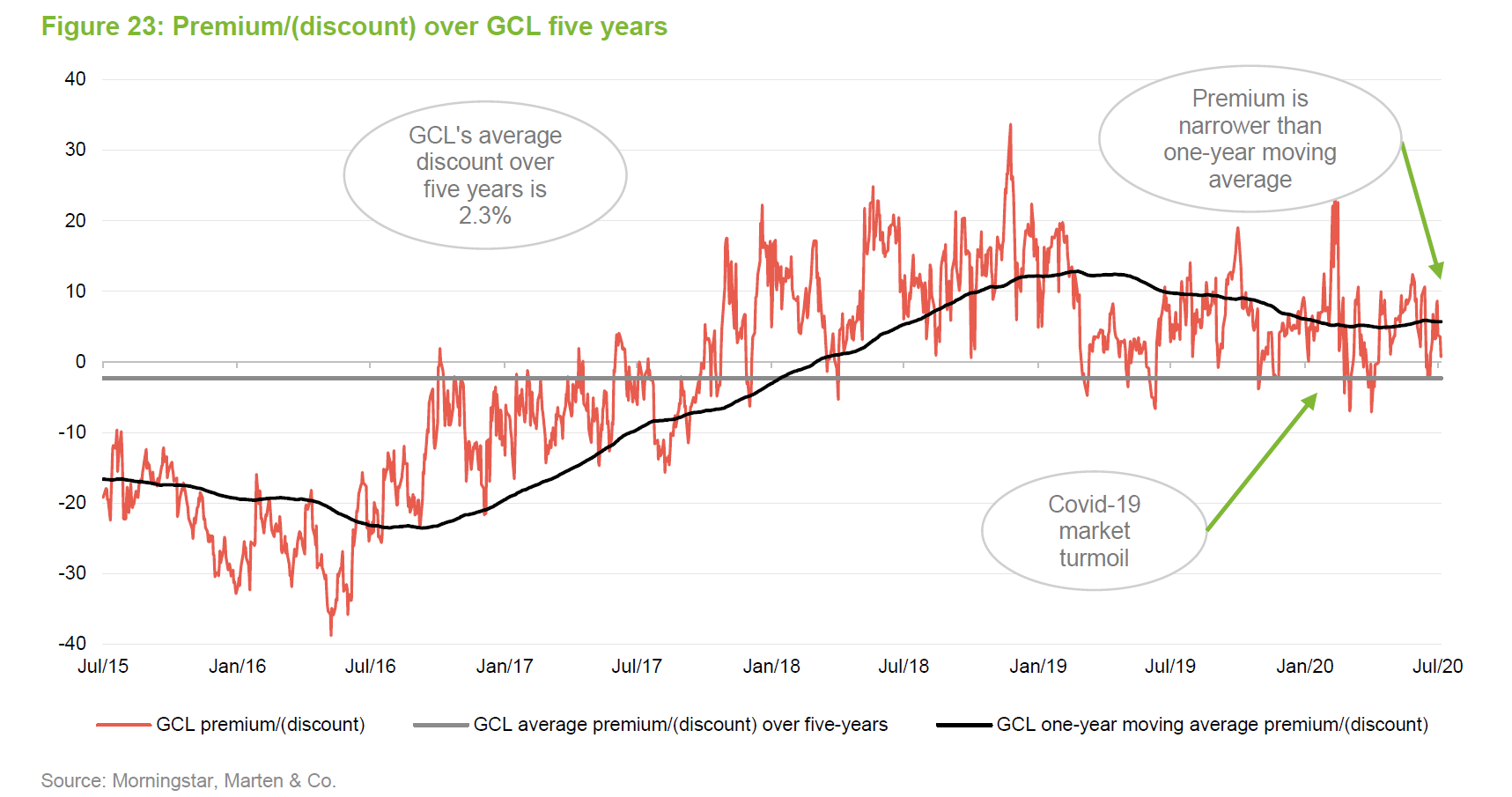

As illustrated in Figure 23, GCL has during the last three and a half years moved from trading at a marked discount to a significant premium, albeit with marked volatility in the premium/discount. This tightening coincides with a recovery in the broader uranium market as supply conditions have tightened, the uranium price has recovered, and sentiment has improved. GCL was not immune to the market turmoil that emerged in March as the virus infection rate accelerated, but the impact has been limited and GCL is now trading around a 2% premium, which is towards the middle of its typical trading range during the last 18 months.

While there was a brief pause in March, GCL has once again been issuing stock while it has been trading at a premium to satisfy investor demand (stock was most recently issued on 12 May 2020 – 5.25m shares were issued at 17.4p per share – a premium of 4.1% to the prevailing NAV of 16.71p per share). This is beneficial to existing shareholders, as it should, all things being equal, support liquidity and lower GCL’s ongoing charges by spreading its fixed costs over a larger asset base.

GCL’s premium is in marked contrast to the broader natural resources sector, was trading at an average discount of 14.1% as at 14 August 2020 (see Figure 22. As we have previously noted, this in part reflects GCL’s narrow focus and the resurgence of interest in the uranium market, however, it also reflects the fact that with the exception of gold and precious metals, natural resources suffered heavily as aggregate demand slumped. Many stocks have since rebounded, but are still weighed down by the effects of the pandemic (GCL’s managers believe that commodities and mining companies could see their prices move up quickly – click here to read QuotedData’s most recent note on GCL’s sister fund, CQS Natural Resources Growth and Income). During the last 12 months, GCL has traded between a discount of 7.1% (on 1 May 2020) and a premium of 29.0%, with an average premium of 5.7%.

GCL does not have an explicit discount management policy but it is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, which gives the board a mechanism with which it can influence the premium/discount. However, whilst it has used its authorities to moderate the premium, GCL has not made any repurchases to date. It is possible that share repurchases would have a limited impact on the discount as they would also serve to reduce the liquidity of its shares and put upward pressure on GCL’s ongoing charges ratio (i.e. reversing the benefits of growing GCL’s size, as discussed above). Instead, GCL may be better served by working to increase its size, with its efforts on increasing awareness of GCL among investors.

Fees and costs

Fees and costs

Under the terms of the investment management agreement, CQS is entitled to receive a basic management fee of 1.375% per annum of net assets (after adding back any bank borrowings). The management fee is calculated and paid monthly in arrears and the company valued monthly, with assets valued using mid-market prices.

Previously, CQS was entitled to a performance fee of 20% of any of the outperformance of GCL’s net assets, in total return terms, above an 8% per year hurdle rate. However, GCL has not paid a performance fee since the year ended 30 September 2008 and, on 28 November 2019, the managers agreed to remove this element of their remuneration.

GCL’s management agreement can be terminated on 12 months’ notice by either side.

Fund administration services

Fund administration services

GCL has an agreement with R&H Fund Services (Jersey) Limited for R&H to provide administrative, compliance oversight and company secretarial services to GCL.

Under the administration agreement, R&H is entitled to an administration fee calculated as 0.1% of GCL’s gross assets up to £50m and 0.075% of gross assets in excess of £50m. The administration fee is subject to an overall minimum fee of £75,000 per annum and an overall maximum fee of £115,000 per annum. R&H’s total fees for the year ended 30 September 2019 were £75,000 (2018: £75,000).

Allocation of fees and costs

Allocation of fees and costs

The investment management fee, finance costs and costs incurred in relation to the disposal of investments are charged wholly to capital. All other expenses are charged wholly to revenue. Using information from GCL’s accounts, QuotedData has estimated the ongoing charges ratio for the year ended 30 September 2019 at 2.50% (2018: 2.48%).

Capital structure and life

Capital structure and life

GCL has a relatively simple capital structure with two classes of share in issue: ordinary and subscription shares (both of nil par value). Both share classes are traded on the London Stock Exchange and, as at 4 August 2020, there were 90,601,611 ordinary shares in issue and 37,420,104 subscription shares in issue. As at the same date, there were no ordinary shares or subscription shares held in treasury.

Subscription shares

Subscription shares

On 13 December 2017, GCL made a bonus issue of subscription shares to existing ordinary shareholders, on the basis of one subscription share for every two ordinary shares held.

Each subscription share confers the right, but not the obligation, to subscribe for one ordinary share on the last business day of November 2020 (the first subscription date was 30 November 2018, which saw 308,388 subscription shares exercised at a price of 24.98p per share, while the second subscription date was 29 November 2019, which saw 63,731 subscription shares exercised at a price of 26.17p per share). The subscription price was set as the unaudited NAV as at 13 December 2017 plus a premium of 5%, 10% and 20% respectively if exercised in November 2018, 2019 or 2020. The November 2020 subscription price is 28.55p per share.

Borrowing facility

Borrowing facility

GCL is permitted to borrow and has a credit facility with Credit Suisse Dublin AG that can be used for this purpose. The credit facility incurs interest at a rate of Libor + 1.75%. GCL’s articles of association do not have any specific borrowing limits, although the board has previously said that GCL’s borrowings are not expected to exceed 35% of its net assets. Borrowings under the credit facility are limited to the collateral held by Credit Suisse, which is effectively GCL’s investment portfolio. GCL does not have any other borrowing facilities in place and, as at 30 June 2020, GCL had gross and net gearing (borrowings and borrowings less cash) of 13.6%.

Unlimited life with an annual continuation vote

Unlimited life with an annual continuation vote

GCL does not have a fixed winding-up date but at each annual general meeting (AGM), shareholders are given the opportunity to vote on the continuation of the company. This is an ordinary resolution. If this resolution is not passed, the board is required to put forward proposals to shareholders within four months, to liquidate or otherwise reconstruct or reorganise the company.

Major shareholders

Major shareholders

As at 30 September 2019, no individual shareholder held more than 10% of GCL’s ordinary shares, although the company was aware of two combined holdings hat represented more than 10%: funds managed by Premier Miton Group (14.71%) and clients of Hargreaves Lansdown Asset Management (14.44%). Richard Lockwood, a director of GCL, held 4.0% of GCL’s issued share capital as at 4 August 2020 (3,584,000 shares – see pages 25 to 27) as well 1,792,000 subscription shares.

Financial calendar

Financial calendar

The trust’s year-end is 30 September. The annual results are usually released in December (interims in June) and its AGMs are usually held in March of each year.

Corporate history

Corporate history

GCL is a Jersey-domiciled closed-ended investment company incorporated on 6 June 2006. It listed on the International Stock Exchange (formerly the Channel Islands Stock Exchange) on 7 July 2006 and trades on the London Stock Exchange SETS QX Electronic Trading Service (GCL was admitted to trading on the LSE on 10 July 2006).

Management team

Management team

GCL is co-managed by Keith Watson and Rob Crayfourd. Keith and Rob are able to draw on the expertise of the wider team at CQS. This includes Ian “Franco” Francis who, with over 35 years’ investment experience, primarily in the fixed interest and convertible spheres, can assist with the small number of fixed income investments that GCL may hold from time to time. (Ian manages the CQS New City High Yield Fund – click here to read QuotedData’s most recent note on this fund.) Ian, Keith and Rob also manage CQS Natural Resources Growth & Income Plc – click here to read QuotedData’s most recent note on this fund.

Keith Watson

Keith Watson

Keith Watson joined the NCIM team in 2013, initially as a dedicated natural resources analyst. Prior to NCIM, Keith worked for Mirabaud Securities, where he was a senior natural resource analyst; Evolution Securities, where he was director of mining research; Dresdner Kleinwort Wasserstein, where he was a top-ranked business services analyst; Commerzbank; and Credit Suisse/BZW. Keith began his career in 1992 as a portfolio manager and research analyst at Scottish Amicable Investment Managers. He has a BSc (Hons) in Applied Physics from Durham University.

Robert (Rob) Crayfourd

Robert (Rob) Crayfourd

Rob Crayfourd joined the NCIM team in 2011. He has 16 years’ experience of investing in resources, having previously worked for the Universities Superannuation Scheme and HSBC Global Asset Management, where he focused on the resources sector. Rob holds a BSc in Geological Sciences from the University of Leeds and is a CFA charterholder.

Board

Board

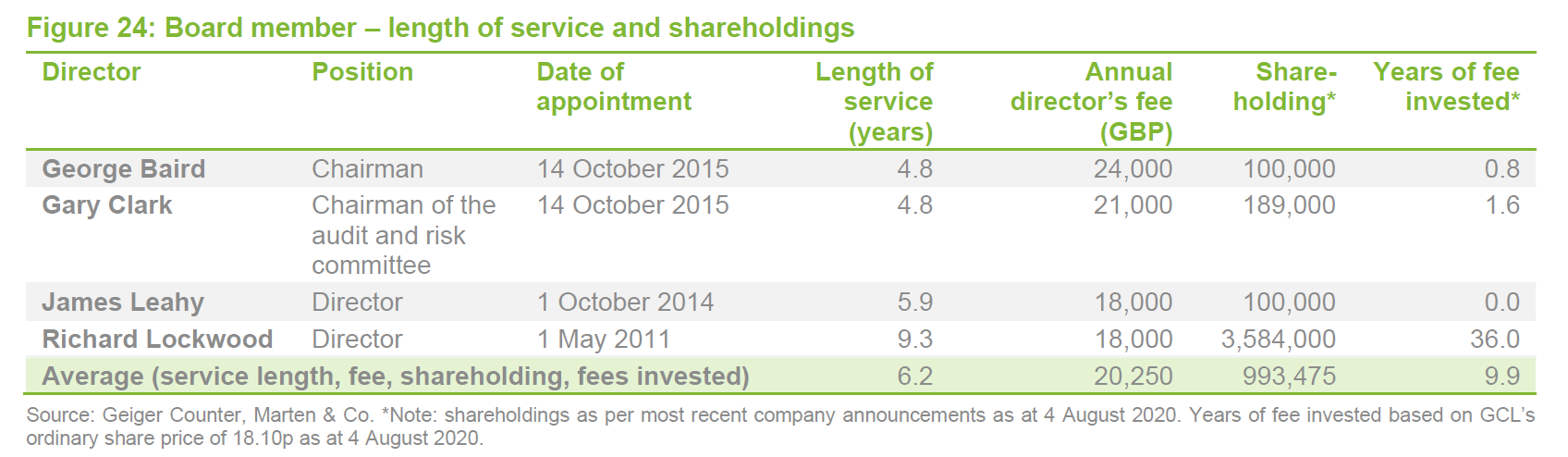

GCL’s board is comprised of four directors, all of whom are non-executive and considered to be independent of the investment manager. Other than GCL’s board, its directors do not have any other shared directorships. As noted on page 27, Richard Lockwood founded GCL’s investment manager, NCIM, in December 2003. NCIM was sold to CQS in 2007, and Richard retired in 2012. Richard has been a strategic consultant to all of the NCIM funds, but is no longer involved with NCIM. It is also noteworthy that Richard has a substantial personal investment in GCL (equivalent to 4.0% of its issued share capital as at 4 August 2020). This should help to align interests with those of shareholders and assist in bolstering his independence.

Board policy is that all of GCL’s board members retire and offer themselves for re-election annually. GCL’s articles of association limit the maximum remuneration for directors to £30,000 per director per annum.

George Baird (chairman)

George Baird (chairman)

George Baird, a Jersey resident since 1980, is a chartered accountant with a variety of experience in Finance, particularly in local government. He is now a non-executive director of several Channel Islands-based companies including Aberdeen Latin American Income Fund limited, LXB Retail Properties Plc and Yatra Capital Limited.

Prior to his retirement in 2002, George was finance director with the Mourant Group and was Treasurer of the States of Jersey (from 1991). In this role, George was one of the most senior civil servants reporting to the Finance and Economics Committee, whose main responsibility was defining and implementing government financial and budget strategy. Prior to this, George worked in local government in Scotland, and for Arthur Young McClelland Moores & Co, where he became a member of the Institute of Chartered Accountants of Scotland in 1975.

George is also a non-executive director and chairman of the audit committee for Thread Green Industrial Limited and until recently held the same roles at Economic Lifestyle Property Investment Co Limited. George graduated from Dundee University, with a degree in Law, in 1971.

Gary Clark (chairman of the audit and risk committee)

Gary Clark (chairman of the audit and risk committee)

Gary Clark is a chartered accountant with considerable experience in the investment fund industry. He is a non-executive director on a number of boards that cover investment funds, fund managers and investment management for a variety of financial services businesses. These include Emirates, Standard Life Aberdeen, Blackstone and ICG.

Gary served as chairman of the Jersey Fund Association from 2004 to 2007 and was managing director at AIB Fund Administrators Limited when it was acquired by Mourant in 2006. This business was sold to State Street in 2010, and until 1 March 2011, Gary was a managing director at State Street and their head of hedge fund services in the Channel Islands. Prior to his time at State Street, Mr Clark was managing director of the futures broker GNI (Channel Islands) Limited in Jersey.

Gary was one of a number of practitioners involved in a number of significant changes to the regulatory regime for funds in Jersey. This included the move to function-based regulation and introduction of both Jersey’s expert funds and unregulated funds regimes. Gary is resident in Jersey. He graduated with a degree in mining engineering from Nottingham University in 1986.

James Leahy (director)

James Leahy (director)

James Leahy has over 30 years’ experience in the mining sector as a senior mining analyst and as a specialist corporate broker with expertise in international institutional and hedge funds, foreign capital and private equity markets. He has previously worked at James Capel, Credit Lyonnais, Nedbank and Canaccord, and he was the founding partner of Mirabaud Securities. During his career, James has raised funds for a wide range of projects worldwide that include industrial minerals, precious metals, copper, diamonds, coal, iron ore, uranium and lithium (he was involved in more than 30 IPOs and a large number of primary and secondary placings).

Since 2010, James has been a director of a number of mining and exploration companies. His former roles include: non-executive director of Continental Coal Limited (between May 2011 and July 2013); a director of African Power Corporation (between May 2011 and May 2014); non-executive director of Bacanora Lithium Plc (between July 2011 and May 2017 – this also included a stint as interim chairman between July and November 2016); non-executive director of Forte Energy NL (between April 2012 and August 2015); non-executive director of BOS GLOBAL Holdings Limited (between April 2012 and August 2015); independent non-executive director of Mineral Commodities Limited (between December 2012 and May 2015); and independent non-executive director of Bellzone Mining Plc (Between November 2014 and May 2015).

James, a UK resident, has been a member of the advisory board at Aton Resources Inc since October 2015 and is a director of a private start-up, Energy Minerals Investments Ltd.

Richard Lockwood (director)

Richard Lockwood (director)

Richard Lockwood has over 50 years’ experience in the mining and natural resources space, primarily with Hoare Govett, where he was a partner. He was a founding director of City Merchants High Yield Trust Plc, which he managed from May 1991 to April 2003. He then joined Midas Capital Partners Limited in June 2003 before founding New City Investment Managers Limited (NCIM) in December 2003. NCIM was sold to CQS in October 2007 and Richard continued to be involved in the management of NCIM funds until his retirement in January 2012 (this included the management of City Natural Resources High Yield Trust). Richard is no longer involved in NCIM or CQS but has previously acted as a strategic consultant to all NCIM funds, including Geiger Counter.

Richard has held a number of resource and investment management related directorships. These former directorships include: Kalahari Minerals (between March 2010 and February 2012); Ambrian Plc (between July 2001 and May 2007); Marechale Capital (between July 2001 and December 2001); VSA Capital (between April 1997 and December 2001); and Citadel Holdings (June 1997 and November 2000).

Richard, a UK resident, founded Praetorian Resources in July 2012 (now Duke Royalty). He is non-executive chairman of ASX-listed Ausgold Limited, has been a director of Arlington Group Asset Management since December 2012, and founded Auctus Growth Plc in 2014.

Previous publications

Previous publications

Readers interested in further information about GCL may wish to read our previous update note and our initiation note (details are provided below).

- Supply deficit unsustainable, update, published in November 2019.

- Nuclear exposure, initiation, published in March 2019.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Geiger Counter Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.