It’s all about renewables

The energy sector has been particularly buoyant over the past 18 months, and JLEN Environmental Assets (JLEN) is well-positioned to benefit. Initiatives such as COP26, incoming TCFD regulations and the Russo-Ukrainian crisis, combined with rising inflation and power prices, have only heightened the attractions of renewable energy.

The managers have identified an exciting pipeline made up of a number of opportunities from electric vehicle charging infrastructure to biomass, an area which JLEN dipped its toe into last year with its acquisition of the Cramlington facility. A recent fundraise means JLEN’s managers can get to work on this pipeline now, while the trust is also on track to achieve its dividend target for 2021/22 of 6.80p.

Progressive dividend from investment in environmental infrastructure assets

JLEN aims to provide its shareholders with a sustainable, progressive dividend, paid quarterly, and to preserve the capital value of its portfolio. It invests in a diversified portfolio of environmental infrastructure projects generating predictable, wholly or partially index-linked cash flows. Investment in renewable energy projects is supported by a global commitment to support low-carbon electricity targets.

Fund profile

JLEN invests in infrastructure projects that use natural or waste resources or support more environmentally-friendly approaches to economic activity, support the transition to a low carbon economy or which mitigate the effects of climate change. This could involve the generation of renewable energy (including solar, wind, hydropower and biomass technologies), the supply and treatment of water, the treatment and processing of waste, and projects that promote energy efficiency. JLEN aims to build a portfolio that is diversified both geographically and by type of environmental asset. This emphasis on diversification helps differentiate JLEN from the majority of its peers, which tend to specialise in solar or wind.

Reflecting its objective of delivering sustainable, progressive dividends and preserving its capital, JLEN does not invest in new or experimental technology.

A substantial proportion of its revenues is derived from long-term government subsidies.

Appointment of Foresight as AIFM

In January 2022, JLEN appointed Foresight Group LLP (Foresight) as its external alternative investment fund manager (AIFM) with discretionary investment management authority for the company. This arrangement replaces the investment advisory agreement between the company and Foresight, which has now been terminated.

Until now, the company had been a self-managed alternative investment fund which took its own investment management decisions based on advice from Foresight. As discretionary investment manager, Foresight will take investment management decisions on behalf of JLEN, subject to the terms of the investment management agreement. The fees payable to Foresight under the new agreement remain unchanged.

As AIFM, Foresight remains subject to the investment policy and the supervision of JLEN’s board. The board also retains overall responsibility for JLEN’s activities, including reviewing its investment activity, performance, business conduct and policy. In addition, certain investment decisions are reserved to the board, including in respect of very large investments, those which would involve taking the company near to the limits of its available borrowing facilities, those involving the company investing in new geographies or technologies and those which may cause reputational risk to the company.

Foresight is one of the best-resourced investors in renewable infrastructure assets, with £8.4bn of AUM as at 31 December 2021. This includes Foresight Solar Fund, which sits in JLEN’s listed peer group. Foresight has a highly-experienced and well-resourced global infrastructure team. The co-lead managers to JLEN are Chris Tanner and Chris Holmes (see page 25).

In connection with Foresight Group’s appointment as AIFM, JLEN appointed NatWest Trustee and Depositary Services Limited as its depositary.

New impetus towards adoption of renewable energy

The environmental infrastructure markets in which JLEN operates have experienced a continuous period of growth, supported by worldwide commitments to decarbonise, increasing focus on the protection of the natural environment and the treatment and processing of waste, and decreasing capital costs. These trends are expected to create an attractive environment for further investment into these markets, in the UK and Europe.

Global investment in the energy infrastructure market has been significant, with Bloomberg calculating investment into renewable energy in 2020 totalling $303.5bn (up 2% on the prior year). Zero emission or low carbon energy generation continues to be central to European carbon targets and of the global decarbonisation agenda, an objective that has only gotten stronger with the current Russo-Ukrainian crisis.

Renewable energy continues to be supported by the UK government, which has published the budget for its fourth Contracts for Difference (CfD) auction, to allocate around £265m to renewables development. This will also allow for onshore wind and solar to access some of the CfD funding (previously they could not). The UK has also confirmed its commitment to close coal‑fired plants by 1 October 2024 (brought forward from 2025).

Meanwhile, the UK’s national target under the Renewable Energy Directive was, by 2020, for 15% of gross final energy consumption to come from renewable sources. The final outturn was 13.6%, which consisted of 38.7% for electricity, 10.3% for transport and 6.6% for heat. This implies that both the transport and heat sectors need to make further progress in order to hit the 2030 target of 32%, with electricity already meeting this target.

Low carbon investment opportunities could encompass combined heat and power systems, battery storage and flexible generation, low carbon agriculture, co-location of battery storage with existing assets, electric vehicle and low carbon transport infrastructure such as biofuels.

Open to new opportunities

JLEN’s board continues to view the wider market environment as favourable for its investment policy. It says that the resilience shown during the COVID-19 pandemic has reinforced the value of established environmental infrastructure assets and now that economies have fully embarked on their fiscal and regulatory stimulus programmes, the outlook continues to appear promising.

Prompted by COP26, market discussions have been dominated by how pledges can be translated into physical infrastructure while the focus has fallen on the finance sector to facilitate a greener economy. The sector is being asked to direct its capital to help solve environmental issues and it is also being asked to “future-proof” those investments to plan for climate change scenarios. The latest study by Climate Action Tracker (CAT), suggests that global greenhouse gas emissions in 2030 will be double the level needed to meet the Paris agreement target of limiting heating to 1.5C. This stresses the need for firm, irrevocable legislation and sets the tone for the renewable infrastructure market.

The Climate Change Committee 2021 Progress Report to Parliament (CCC) notes that lockdown measures led to a decrease in UK emissions in 2020 of 13% from the previous year, although driving reductions in emissions requires sustained government leadership, underpinned by a strong net zero strategy.

Areas the CCC highlights that require particular attention include:

- a heat and building strategy;

- transport, hydrogen, biomass and food; and

- plans to decarbonise energy from waste.

These are all areas that JLEN has either invested into or has the potential for future investment. While power price forecasts have rebounded strongly over the short term, it remains to be seen how this will feed into market competition for core renewables. It is anticipated that acquisitions of operational wind and solar projects will continue to remain challenging from a yield and return perspective. Bioenergy assets remain attractive, as shown by the recent acquisitions of energy from waste project, ETA Manfredonia, and biomass project, Cramlington.

Beyond these sectors, JLEN’s broad investment mandate provides investors with access to a wider range of environmental infrastructure opportunities that conform to the company’s investment targets.

The team has been assessing opportunities in sectors such as controlled environment agriculture and aquaculture, which are good examples of new and potentially attractive sectors for JLEN. We talk more about these in the pipeline section of this note. These investments can be particularly effective when co-located with renewable energy generators such as AD plants, where renewable heat, power and CO2 are readily available.

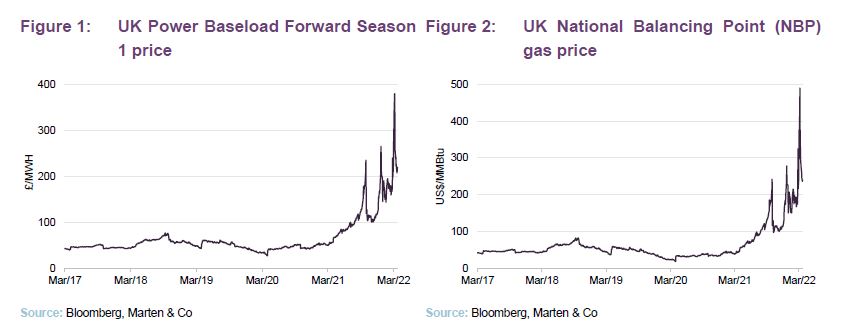

Impact of Ukraine crisis on power prices

As we highlighted in our previous update note, having fallen sharply in the early period of the pandemic in 2020, power and gas prices rebounded last year and have since soared to record levels on a global basis. This has been further accelerated by Russia’s invasion of Ukraine. Russian oil and gas is being increasingly shunned as the United States, the European Union, and other countries, including China, introduce sanctions and try to undermine the regime’s ability to fund its war. Some countries, such as Germany have realised the need to wean themselves off fossil fuels more aggressively, but may have to, in the short-term, look to quick-fix solutions like burning more coal.

The US is banning all Russian oil and gas imports and the UK will phase out Russian oil by the end of 2022, while the EU, which gets a quarter of its oil and 40% of its gas from Russia, says it will switch to alternative supplies and make Europe independent from Russian energy ‘well before 2030’. Germany has put on hold permission for the Nord Stream 2 gas pipeline from Russia to open.

JLEN’s co-lead manager Chris Tanner says the key thing the crisis highlights is the problem with energy dependency. He says more investment is needed to help with transition into renewable energy sources and that the major energy firms need to work harder and faster to transition to renewable provisions so as not to rely on countries such as Russia.

JLEN had been able to lock in prices across its core wind, solar and AD projects last year and continues to see strength in the market, which it has been fixing into for future periods.

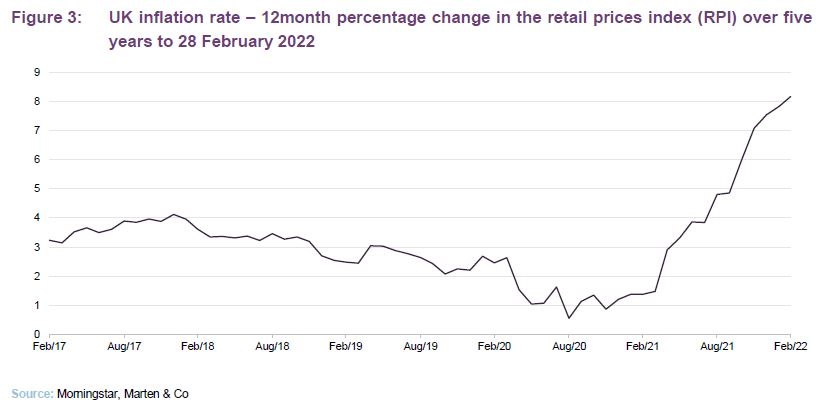

Inflation concerns

Since the beginning of the year, central bankers in major developed markets have, in the face of rapidly rising inflation, been reversing their positions on the outlook for raising interest rates. Following a significant increase in energy costs and household expenses more generally, The Bank of England’s MPC has now raised its key rate to 0.75% with 0.25% jumps in February and March. The February move was shortly followed by an announcement from the European Central Bank (ECB) of a sharp turnaround in its policy that would see its deposit rate raised to -0.25%, from -0.5% (a record low) by the end of 2022 (the ECB having previously said there would not be a rate rise until at least 2023). The US Fed has also just weighed in, increasing the funds rate by a quarter point to a range of between 0.25% and 0.5% – the first such increase since 2018. The Fed has also indicated that it has earmarked a further six increases by the end of the year which, if it comes to pass, will be the fastest pace of tightening for more than 15 years.

JLEN’s most direct risk is of rising running costs. However, a large part of its revenue (71% at end December 2021) is linked to inflation. This will more than exceed any negative cash flow impacts from inflation linked costs. If higher than trend inflation is expected, then the earnings from the company will increase, everything else being equal.

If higher inflation assumptions become embedded for the longer term, such that it becomes appropriate for JLEN to revisit its long-term inflation assumption of 3% until 2030, then this will also benefit the NAV, as future cash flows from the portfolio will be assumed to be higher. However, higher long-term inflation expectations may also have impacts on other risks. If central banks believe that they need to combat high inflation, we might expect to see interest rates rise. The large majority of JLEN’s debt is project finance at the project level, fully hedged against interest rate rises and so this risk is mitigated. However, JLEN’s revolving credit facility (RCF) is not hedged and so an increase in interest rates indirectly brought about by inflation concerns would have a small negative impact on RCF interest costs depending on the level of borrowing.

Higher inflation expectations may also change investors’ views on what constitutes a reasonable return from assets, including environmental infrastructure assets. This would typically manifest in an increase in the discount rates used to value such assets, causing the value of such assets to decrease, everything else being equal. The market for infrastructure assets remains very competitive, and the return differential to gilts (generally used as a proxy for a ‘risk free’ return on capital) remains high, so JLEN does not expect any material negative movement in discount rates for the foreseeable future.

Investment process

Foresight selects projects for the portfolio based on its assessment of each project’s risk and reward profile that fit within its defined investment policy. The group operates within a limited set of investment restrictions. New assets predominantly come from investments in the secondary market acquired from third parties.

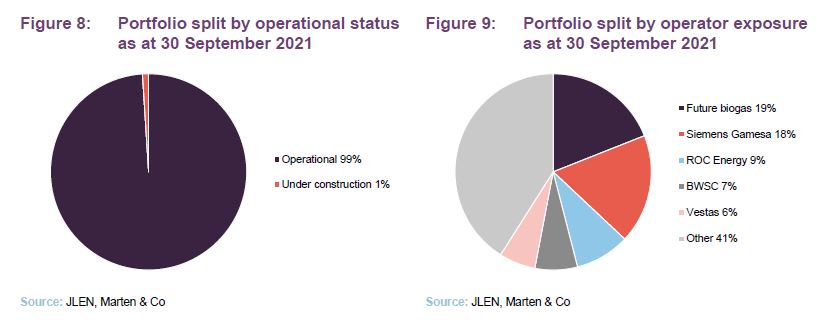

The AIFM aims to maintain the balanced and diverse nature of the portfolio. Its approach is a cautious one. Although JLEN can invest across all OECD countries, to date investments have predominantly focused on the UK, with a small but growing exposure to European renewables. Through its investment in FEIP, it has also invested in single assets in Spain, Finland and Sweden. The managers say that they prefer to concentrate on countries and regulatory/subsidy regimes that they know well or where they have relationships with established partners.

Investment restrictions

- No more than 25% of the portfolio is to be invested in assets under construction or that are not yet operational. The board does expect to see an increase in the allocation to construction-ready assets, within the 25% limit, following the commitment to Foresight Energy Infrastructure Partners (FEIP).

- At least 50% invested in the UK and the balance invested in other OECD countries.

- No new investment to exceed 30% of NAV (or 25% of NAV based on the acquisition price, taking the value of existing assets into consideration).

Purchases from third parties in the secondary market

The managers have built up good working relationships with project developers. Some opportunities are brought to the managers for appraisal by specialist consultancy firms operating in the area. Deals may also be introduced by the wider Foresight team.

Prices are negotiated at arms-length and reflect the managers’ assessment of the potential risks and rewards from each project. This includes a review of the project’s capital structure.

ESG assessment

Environmental criteria are embedded in the structure of JLEN’s investment and portfolio management activities.

With Foresight, JLEN considers the following key environmental criteria during due diligence of a potential acquisition and thereafter the ongoing monitoring of its assets:

- Resource management

- Life on land/below wate

- Climate change and resilience

In order to inform its environmental objective, JLEN intends to consider the following environmental KPIs and associated measurements.

- Renewable energy generated (MWh renewable electricity, MWh renewable heat)

- GHG emissions avoided (tCO2e avoided for each investment)

- Waste treatment (waste recycled, waste diverted from landfill, in tonnes)

- Water treatment (wastewater treated in litres)

- Environmental incidents (reportable environmental incidents)

- Purchased energy originating from renewable sources (% of total purchased energy in the portfolio originating from renewable sources)

- Management of biodiversity (% of assets with biodiversity plans, number of assets engaged with on biodiversity issues)

- Assessment of major contractors against ESG criteria (% of major new and existing suppliers assessed against environmental criteria)

Ongoing management

The day-to-day facilities management, operations and maintenance of the projects is contracted to third parties and part of the managers’ role is overseeing these arrangements, including approving payments.

The managers seek to identify opportunities for efficiency enhancements and capacity increases.

The managers also aim to optimise the company’s financial structure.

Disposals

JLEN will usually hold its assets for the long term, and only one disposal has been made to date. The company will sell assets when the managers feel the sale price justifies it or when there are other valid reasons for doing so.

Hedging

When they invest in assets in currencies other than sterling, the managers may choose to hedge the currency exposure back to sterling. The managers may also hedge interest rate risk, inflation risk, power, and commodity prices. All hedging is at the board’s discretion. The proportion of the portfolio assets with cash flows denominated in euros accounted for 5% of the portfolio value at

30 September 2021. The directors consider the sensitivity to changes in the euro/sterling exchange rate to be insignificant due to this low amount.

Regulation and directives

Taskforce on Climate-related Financial Disclosures

In December 2020, the FCA published a policy statement confirming a new rule for companies with a UK premium listing requiring them to make disclosures consistent with the recommendations of the Taskforce on Climate‑related Financial Disclosures (TCFD) in their annual reports or to explain why they have not done so.

From 6 April 2022, TCFD reporting will be mandated for more than 1,300 of the largest UK-registered companies and financial institutions pending parliamentary approval. These include many of the UK’s largest traded companies, banks and insurers, as well as private companies with more than 500 employees and £500m in turnover.

The rule also comes into force for those with accounting periods starting after 1 January 2021. While JLEN is a closed-ended investment company and therefore not in the scope of this regulation, it intends to provide full climate-related disclosures in its annual report, due to be published in June 2022.

Increasing environmental disclosures

In October 2021, the UK government published a new policy document to serve as a roadmap to green the UK’s finance activities. The document includes new policy measures and clarity on several areas of green finance and sets the tone for the role that the finance sector will play in addressing issues of climate risk and transparency to maintain momentum in the shift to a net-zero future.

Key takeaways relevant to JLEN involve:

- Development of the UK’s Sustainability Disclosure Requirements (SDR) to build on the UK’s TCFD implementation. The SDR will integrate new and existing sustainability and climate risk reporting requirements into one comprehensive framework and aims to clarify the extent to which economic activities are sustainable. The timeframe for the SDR is relatively open-ended but the government intends to legislate the framework and regulators will set out sector-specific requirements with these coming into force starting in 2022; and

- Clarity around the UK’s green taxonomy, that will be based on the EU taxonomy, and is expected to be legislated by the end of 2022. The taxonomy will focus on the outcomes of economic activities through the lens of a contribution to environmental objectives.

EU taxonomy for sustainable activities

The EU taxonomy is a classification system, establishing a list of environmentally sustainable economic activities. It could play an important role in helping the EU scale up sustainable investment and implementing the European green deal. The EU taxonomy would provide companies, investors and policymakers with appropriate definitions for which economic activities can be considered environmentally sustainable. In this way, it should create security for investors, protect private investors from greenwashing, help companies to become more climate-friendly, mitigate market fragmentation and help shift investments where they are most needed.

In order to meet the EU’s climate and energy targets for 2030 and reach the objectives of the European green deal, it is vital to direct investments towards sustainable projects and activities. The current COVID-19 pandemic has reinforced the need to redirect money towards sustainable projects in order to make economies, businesses and societies – in particular health systems, more resilient against climate and environmental shocks.

To achieve this, a common language and a clear definition of what is ‘sustainable’ is needed. This is why the action plan on financing sustainable growth called for the creation of a common classification system for sustainable economic activities, or an ‘EU taxonomy’. Controversially, the EU included gas and nuclear as environmentally sustainable. It is possible that they will be removed from the definition as EU member states and the EU parliament review the proposal.

Sustainability

Climate change and issues of sustainability are pressing long-term challenges. The UK government’s commitment to net-zero emissions by 2050 will require considerable investment in renewable energy and energy storage, as it seeks to cut CO2 output associated with power generation.

JLEN’s investments sit at the heart of the solution to these problems. This has been recognised by the London Stock Exchange (LSE), which awarded JLEN its Green Economy Mark (recognising companies that derive more than half of their revenues from products and services that contribute to the green economy).

In its most recent report, JLEN said the resilience shown during the Covid-19 pandemic has reinforced the value of established environmental infrastructure assets and now that economies have fully embarked on their fiscal and regulatory stimulus programmes, the outlook continues to appear promising.

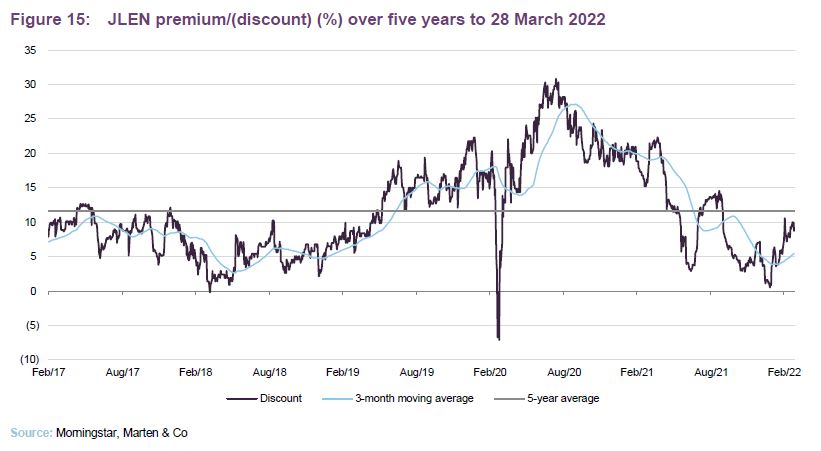

In our view, JLEN’s clear appeal to ESG investors is amongst the key factors behind the degree to which its shares trade at a premium to NAV (see the premium/(discount) section).

JLEN’s AIFM, Foresight, is a signatory of the United Nations’ Principles for Responsible Investment (UNPRI) and ESG analysis is built into JLEN’s investment process. It is also incorporated into the ongoing monitoring programme for JLEN’s portfolio.

Environmental performance 2020/2021

JLEN publishes ESG reports regularly, with the most recent findings available in its half-year report published in November 2021 for the six months ended 30 September 2021.

Over the six months to the end of September 2021, JLEN’s portfolio generated more than 560,000MWh of clean energy and among other achievements.

Highlights from the six-month period to 30 September 2021 include:

- 564,000 MWh energy generated;

- >330,000 tonnes of waste diverted from landfill;

- >78,000 tonnes of waste recycled; and

- >16.5bn litres of wastewater treated.

Meanwhile, the company made three new investments, which are forecast to avoid around 41,500 tCO2e emissions per year. This is equivalent to 17,975 cars off the road per year.

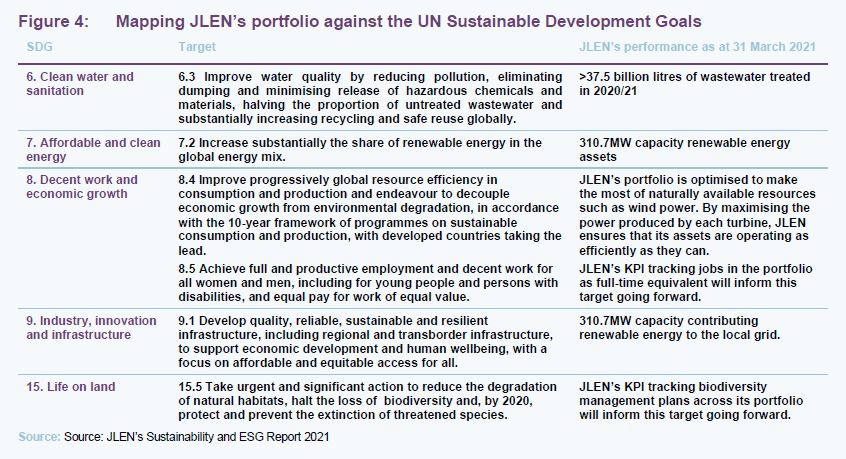

United Nations SDGs

The United Nations Sustainable Development Goals (SDGs) are a set of 17 goals for sustainable development. To be achieved by 2030, they recognise that ending poverty must go hand-in-hand with strategies that build economic growth and address a range of social needs including education, health, social protection and job opportunities, while tackling climate change and environmental protection. JLEN has mapped its portfolio against the SDGs and the results of this analysis are set out in Figure 4 below.

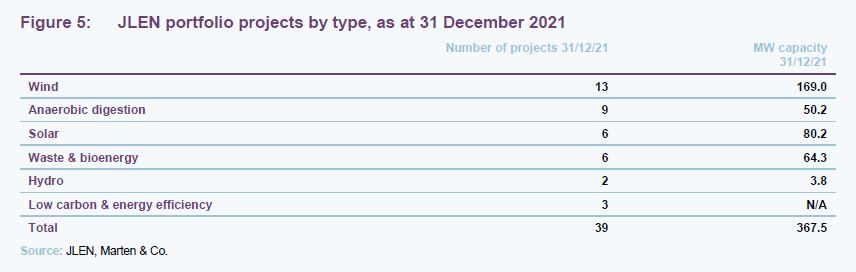

Asset allocation

Figure 5 displays JLEN’s portfolio by project type, as at 31 December 2021 (this being the most recently available data). In aggregate, at that date there were 39 projects spread across the wind, AD, solar, waste & wastewater, hydro, and low carbon & energy efficiency technologies.

Between 31 March 2021 (the end of JLEN’s last financial year) and 31 December 2021, the company bought a 100% stake in Cramlington Renewable Energy Developments Limited, a biomass combined heat and power plant located in Cramlington, UK. For more information on this purchase, which was made in June 2021, readers can look at our last update note: On the front foot.

Since the publication of this data, there have been two disposals in the wind segment of the portfolio, which we explain in more detail on page 15. As a result, JLEN now has 37 assets, though this is not presented in the table below.

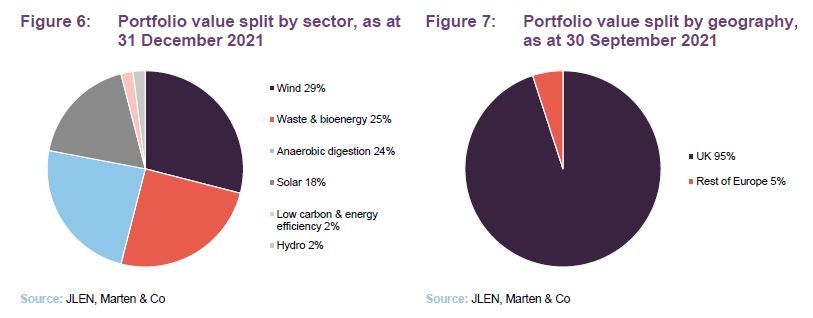

The shape of JLEN’s portfolio as at 31 December 2021, by sector and geography, is shown in Figures 6 and 7. Note, this does not include the recent French disposals.

As at 31 December 2021, the weighted average remaining asset life of the portfolio was 17.4 years, with 89% of the portfolio having an asset life above 10 years. We also note that 71% of portfolio distributions were inflation-linked.

Disposal of French wind assets

In January, JLEN reached an agreement for the sale of its two French onshore wind farms – Parc Éolien Le Placis Vert and Energie Eolienne de Plouguernevel – to Volta Developpement, for a total consideration of €5.9m. This was in line with the valuation as at 30 September 2021 and represented a 25% uplift to the value of the assets at 30 June 2021, the last valuation prior to receipt of firm bids.

The wind farms have been operational since 2016 and are located in the Côtes-d’Armor region of Brittany in north-western France. They were acquired by JLEN in 2016 from Energiequelle in an operational state, and have a combined generating capacity of 8MW. Both projects benefit from a 15-year Feed-in-Tariff.

Investment returns on French wind farms are now quite constrained at current valuations. The team did not anticipate adding to that part of the portfolio to try and bring down the overall cost.

This is JLEN’s first divestment since inception and while the trust’s strategy is to hold its assets over the long-term, it will consider opportunities to generate value for shareholders through the divestment of certain assets as they arise. These opportunities will be evaluated against its strategy of diversification and the ability of the asset to generate stable financial returns.

When the agreement was made, JLEN’s chair, Richard Morse, said: “While the scale of the valuation uplift on disposal cannot necessarily be assumed to apply across the entire portfolio, we believe that it demonstrates our conservative approach to valuations.”

JLEN will continue to consider selective divestment opportunities to recycle capital into pipeline assets leveraging the broad expertise of Foresight.

Other portfolio developments

A trial technical enhancement project at the Amber solar project has had positive results and so is now planned to be rolled out across both of the Amber sites. Work is due to be completed in early 2022 and is expected to result in a significant uplift in generation performance.

Within the wind portfolio, various value enhancements have taken place during the period; hardware designed to improve blade aerodynamics has been attached to all turbines at the Burton Wold site and Foresight is in the process of looking at further software upgrades that can be made.

Following the Environment Agency’s release of the regulatory position statement on the Farming Rules for Water, the AD sites are investing in additional storage capacity, to be in full compliance with these rules. New digestate storage tanks and lagoons are due to be installed in 2022 that will provide greater resilience to risks associated with digestate storage and removal.

At ELWA, Foresight and the operator of the plant have been working on enhanced fire protection measures to satisfy the requirements of insurers.

Investment opportunities

In January 2022, JLEN raised £60.7m from an oversubscribed issue of shares. The money was used to reduce the amount outstanding on the RCF – providing further headroom to fund a pipeline of environmental infrastructure projects.

JLEN says that it is excited by the breadth of opportunities within the wider environmental infrastructure sector with a pipeline of opportunities across anaerobic digestion, controlled environment, low carbon & energy efficiency and biomass. It identified a number of opportunities within these areas as described below.

Anaerobic digestion

Anaerobic digestion (AD) is now JLEN’s second largest sector exposure, and the AD portfolio has consistently outperformed, driving strong returns for shareholders. The company first entered the sector in 2017 and has built the AD portfolio to nine agricultural-fed assets and two food waste-fed assets and is seeking to expand this exposure, while being mindful of the overall balance of its portfolio.

The managers are aware of several opportunities in the AD sector in the UK and in continental Europe and are monitoring them for possible investment. The managers believe production of biomethane for either heat or transport can play an important role in transitioning economies to a low carbon environment with further value enhancement possible from capturing carbon from the process.

Controlled environment

JLEN believes there is a potentially significant opportunity within the controlled environment agriculture (CEAg) and aquaculture (CEAq) sectors. The growing global population will increase food demand and using the current agricultural practices is a challenge.

Controlled environment sectors provide a greater level of efficiency with CEAg using up to 95% less water per kilo of crop and onshore CEAq being able to recycle 99% of water. It also avoids erratic weather conditions, pollution, pests and use of antibiotics. The reduction in transportation distance decreases the loss of produce and carbon dioxide emissions, and increases the quality in transit.

The operations of CEAg/CAEq facilities can be highly automated and benefit from the reducing cost of and/or co-location with renewable energy. In that regard, one of the two near-term controlled environment opportunities is the construction of a 3-hectare glasshouse on land adjacent to the Codford AD plant held by JLEN. The company is exploring the possibility of providing energy to the glasshouse, by diverting to the glasshouse electricity normally destined for direct export to the grid to be sold at a premium price. Waste heat from the existing CHP engines will be captured and delivered by pipe and a heat exchanger to the glasshouse. Wastage from the glasshouse produce may also be returned to the digester providing a truly circular ecosystem.

Low carbon and energy efficiency

The performance of the compressed natural gas (CNG) refuelling assets in JLEN’s portfolio has been encouraging, with 31% more biomethane dispensed to customers than budgeted. The project company is regularly setting new weekly dispensing records and the take-up of vehicles by fleet operators has significantly exceeded the first-year investment case. Funding the roll-out of further refuelling stations is expected during the next 12 months.

JLEN has investments in two grid-scale battery projects that are progressing through the construction stage. The managers are closely involved in the battery sector and have an active pipeline of possible investment opportunities that they are assessing.

JLEN is reviewing opportunities in the electric vehicle (EV) charging infrastructure sector for those that offer good growth potential for its targeted market segment.

Biomass

JLEN recently acquired its first biomass asset in the Cramlington facility. As a base load generator of sustainably sourced renewable energy that also provides low carbon heat and power to nearby industrial customers, it is regarded as an attractive asset with strong credentials. Within the investment case for the first 18 months of ownership it is the intention to enhance key operational aspects of the plant to increase resilience and maintain consistency of production. These are all progressing well to date and once achieved the asset will be in a strong position to pursue value enhancing heat and power offtake arrangements with additional nearby industrial customers.

The manager is pursuing acquisition opportunities in a number of other operational biomass plants across the UK and Europe, as it sees this source of renewable energy production, with subsidy-backed revenue streams, as very attractive.

Performance

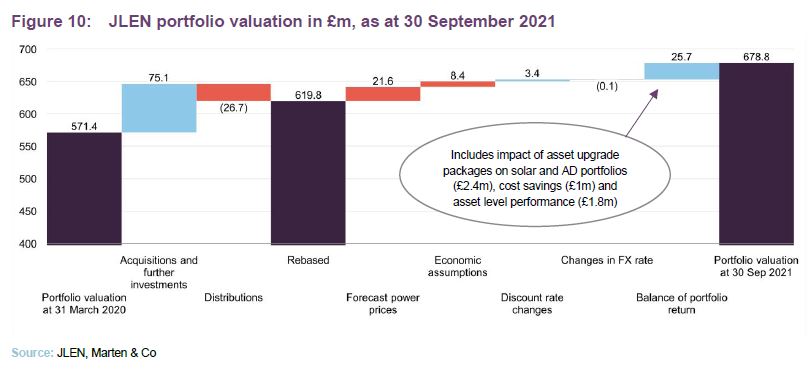

JLEN published results for the six months ended 30 September 2021 on 25 November 2021. JLEN’s portfolio increased in value from £571.4m as at 31 March 2021, to £678.8m. Figure 10, below, seeks to break down the major influences on JLEN’s portfolio over the six-month period.

Operational performance

Over JLEN’s half-year results period to 30 September 2021, the greatest outperformance against budget came from agricultural AD, solar, hydro and CNG refuelling portfolios.

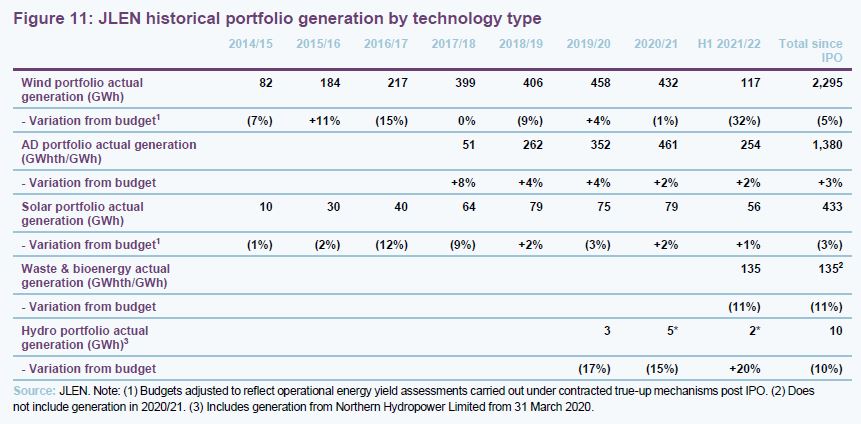

Looking first at generation, where total generation for the period from the portfolio was 564GWh, 10% below budget:

- The AD portfolio generation for the half year was 254GWh (45% of JLEN’s total power production), 2.5% above budget in energy generation terms. This continued a trend of outperformance that has been seen since JLEN began to buy AD assets in 2017. Notably strong performers were Peacehill Gas, Icknield and Egmere.

- At 56GWh, generation from the solar assets (which represents 10% of the JLEN portfolio energy generation for the period) was 0.9% above budget. Irradiation levels were above forecast levels and overall the portfolio performed satisfactorily. Notably strong performances were seen at the Branden sites and at Pylle and Crug Mawr. Monksham experienced a partial outage, due to delays in repairing a defect on one of its transformers. Associated lost revenue was compensated by the engineering, procurement and construction contractor.

- The main detractor was the wind portfolio, which generated 117GWh, 32% below budget due to low wind resource. Notwithstanding the lack of wind, the portfolio performed generally well, with contractual availability 2% above warranted levels and overall availability in line with expectations.

The environment for gas and power prices was strongly positive, as already highlighted. Foresight hedged gas prices with 75% fixed until March 2022, tapering to 28% fixed by September 2023.

Power prices across the wind portfolio were broadly fixed so revenues were not impacted by this volatility, and Foresight capitalised on opportunities to fix future seasons at prices above previous assumptions. Price fixing arrangements are in place for 100% of the wind portfolio by generation through March 2022 which then taper down to 40% by March 2024.

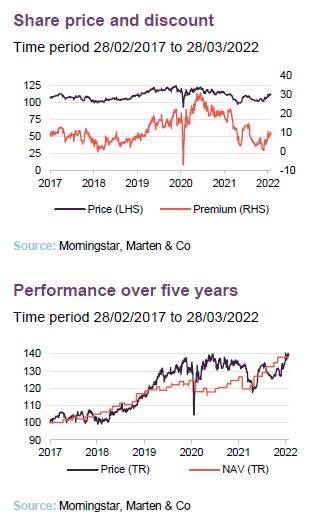

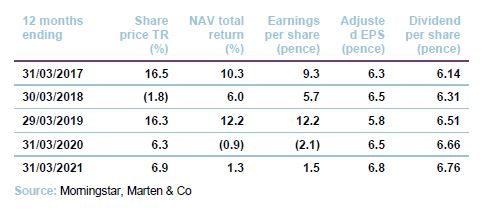

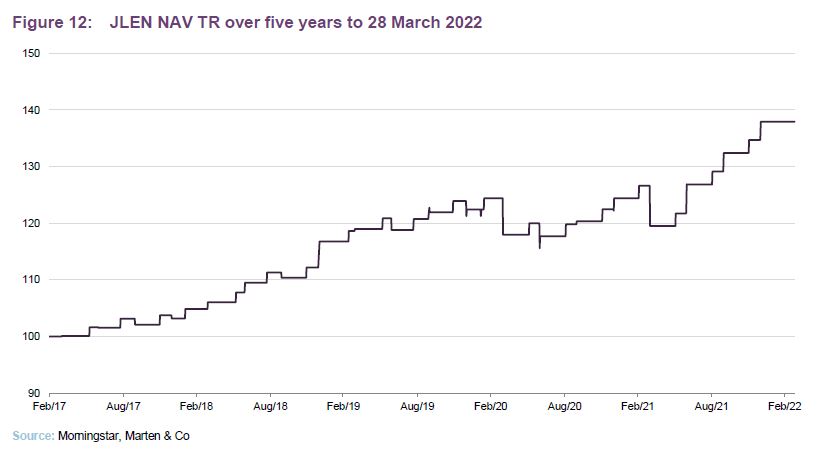

Financial performance

Over the six months year to 28 February 2022, Morningstar’s estimate of JLEN’s NAV has risen by 8.8% while its share price has increased by 2.1%. This compares with a 5.8% sector average NAV increase and a 1.2% sector average share price increase.

The statement accompanying the announcement of JLEN’s end December NAV said that the 2.3p increase in the NAV over the final quarter of 2021 reflected a further upward revision of power price assumptions, including actual fixed price arrangements.

Over the five years to 28 February 2022, JLEN delivered total NAV and share price returns of 38.0% and 36.2% respectively, equivalent to annualised total returns of

6.6% and 6.4%.

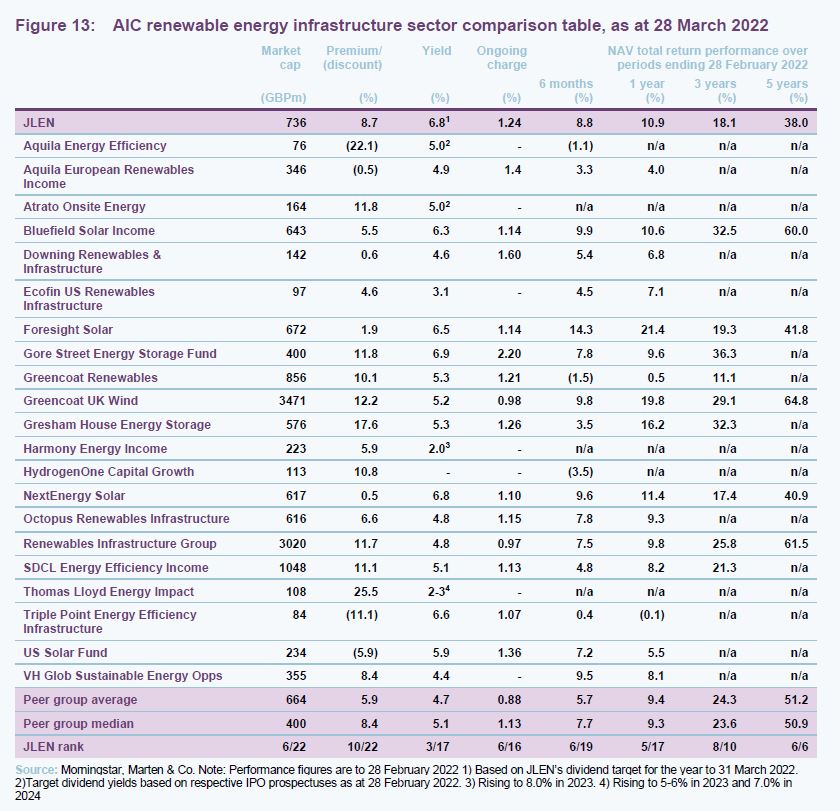

Peer group comparison

JLEN has one of the broadest remits of the 22 companies that comprise the members of the AIC’s renewable energy sector. Most of these funds are focused on solar or wind or some combination of the two. Three of these funds are focused solely on energy storage. HydrogenOne is very different in that it is focused on capital growth and less-mature technologies.

There is an increasing variation of geographic exposure within the peer group too, with a number of funds that are heavily exposed to the North American market (which has a different risk/reward structure) and one focused on Asia.

JLEN is unique in that it is the only fund, at present, in the peer group to incorporate environmental infrastructure assets such as AD and water and waste projects within its portfolio. JLEN has been differentiating itself further from the majority of the peer group by adding assets such as the Cramlington biomass-fuelled (CHP) plant, the CNG biomethane refuelling stations and the stake in the Italian energy-from-waste plant.

Figure 11 compares the performance of the funds and illustrates some of the structural differences between them. JLEN is one of only six funds that were in existence five years ago. The performance numbers suggest that its relative performance is on an improving trend.

Variations in performance across the peer group tend to reflect differences in asset composition. Wind-focused funds performed well over the longer term, though conditions for generation were not as good over the past year. Solar has benefited from a significant uptick in irradiation over the peak months since 2018.

JLEN’s unique incorporation of environmental infrastructure assets means it is less vulnerable to a poor year of irradiation or weak wind generation than most of its peers. Technologies in which JLEN is actively expanding, such as AD and hydro, continue to benefit from a high proportion of inflation-linked cash flows that are backed by subsidies. JLEN is also pushing into non-mainstream technologies, which are also set to play an important role through in decarbonisation, while also arguably providing more compelling valuation dynamics.

JLEN’s ongoing charges ratio and yield appears competitive in absolute terms compared to similarly sized funds, especially when taking into account the extra diversification provided by its wider remit.

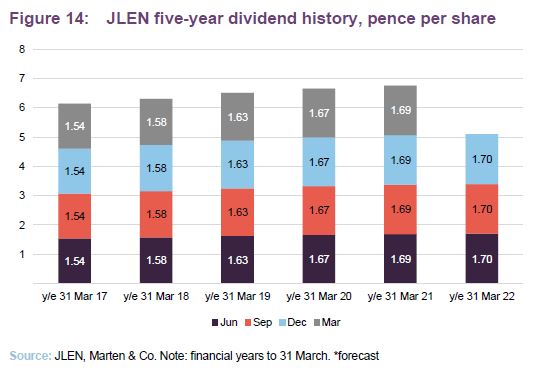

Dividend

As highlighted in our last note, in June 2020, JLEN amended its dividend policy by breaking the explicit link with inflation, which came into effect following the conclusion of the 31 March 2021 financial year. JLEN will aim to increase the dividend each year, without being tied to a formal inflation link.

The company is targeting a total dividend of 6.80p for the year ended 31 March 2022. The first three quarterly dividends were declared at 1.70p per share, in line with this target.

The team is confident it will achieve the dividend target.

Premium/(discount)

JLEN’s attractive yield, supported by a high proportion of protected revenues and the broadest remit of any fund within its peer group, continues to appeal to investors. Most (but not all) listed renewable energy funds trade at premiums. Investors are likely attracted by returns uncorrelated with equity markets and the high proportion of government-backed income (particularly true of JLEN’s portfolio). Renewable energy funds provide a compelling alternative to traditional equity income investments that proved vulnerable to the effects of COVID and now perhaps to a looming recession.

Over the year to 28 March 2022, JLEN’s shares traded at a premium to NAV within a range of 0.5% to 22.3%. The average premium over the year was 9.7%. By way of comparison, we note that over the same period, the funds that comprise the AIC renewable energy infrastructure sector traded at an average premium of 5.9%.

As at 28 March 2022, JLEN was trading on a premium of 8.7%.

As we highlighted in our previous note, continued growth of ESG investing, and a view that the government will likely look to renewables to play a key role in a post-COVID economic recovery, have also shaped market sentiment.

Fees and costs

JLEN’s ongoing charges ratio for the year ended 31 March 2021 was 1.24%, fractionally up from 1.22% for the prior year. As highlighted in its interim results, JLEN expects its ongoing charges ratio to decrease for the year to 31 March 2022.

The managers are entitled to a base fee of 1% on the first £500m of adjusted portfolio value and 0.8% on the balance. There is no performance fee and the manager’s contract can be terminated on one year’s notice. For the year ended 30 March 2021, the total investment adviser fee was £5.6m (2020: £5.5m) and for the six months ended 30 September 2021, the total investment adviser fee was £3.2m (prior year: £2.7m). As stated earlier, Foresight’s fee as manager will be the same as it was when it was the adviser.

For the year ended 31 March 2021, directors’ fees and expenses totalled £263,754 (prior year: £244,698) and, for the six months ended 30 September 2021, these totalled £148,420 (prior year: £132,254).

Capital structure

Following the £60.7m oversubscribed issue that we referred to in the fundraise and pipeline section of this note, JLEN has 661,531,229 ordinary shares in issue and no other classes of share capital. No shares are held in treasury.

JLEN is domiciled in Guernsey and is listed on the main market of the London Stock Exchange. Investments are carried out through JLEN Environmental Assets Group (UK) Limited (UK Holdco), a subsidiary in which JLEN may own both equity and loan notes. As at 30 September 2021, JLEN had 586.7m ordinary shares in issue.

JLEN has an indefinite life, but a discontinuation vote may be triggered if its shares trade at a discount for a prolonged period. The company’s financial year-end is 31 March and AGMs are typically held in August or September.

Gearing

The reliable and predictable cash flows associated with most renewable energy generation support the incorporation of gearing within capital structures. Gearing is intrinsic to the investment models applied by JLEN and the majority of its listed peers. Reflecting this, JLEN is permitted to borrow up to 30% of its NAV, at the fund level, and has a £170m committed multi-currency RCF as well as an uncommitted accordion facility of £30m, for borrowing purposes. The facility is provided by National Australia Bank, Royal Bank of Scotland International, ING, HSBC, and NIBC. The RCF matures in May 2024 but has an uncommitted option to allow it to be extended for a further year at JLEN’s discretion.

As discussed in our August 2021 update note, the facility has an innovative feature whereby the interest charged is linked to JLEN’s ESG performance. JLEN’s interest rate will rise or fall based on performance against defined targets. Those targets include:

- Environmental: increase in the volume of clean energy produced;

- Social: the value of contributions to community funds; and

- Governance: maintaining a low number of work-related accidents, as defined under the Reporting of Injuries, Diseases and Dangerous Occurrences (RIDDORS) by the Health and Safety Executive.

As at 30 September 2021, drawings under the RCF were £111.1m, leaving a balance of £58.9m undrawn on the committed facility. However, since this time, JLEN has raised £60.7m from a fundraising in January 2022 and has also disposed of its French wind farm assets in January 2022 for €5.9m (circa £4.9m).

At the project level, JLEN is constrained to a maximum of 65% gearing on gross project value for renewable energy generation projects and a maximum of 85% gearing on gross project value for PFI/PPP type projects. In practice, actual project gearing is much lower than this.

Across the portfolio, project level gearing was 23.6% at the end of September 2021, compared to 28.4% as at 31 March 2021. The 23.6% figure reflected a 21.9% level for the renewable energy assets and 51.36% for the PFI processing plants. Including the £111.1m drawn down on the RCF, total gearing was 32.1% at

30 September 2021. This project-level debt is non-recourse to the fund.

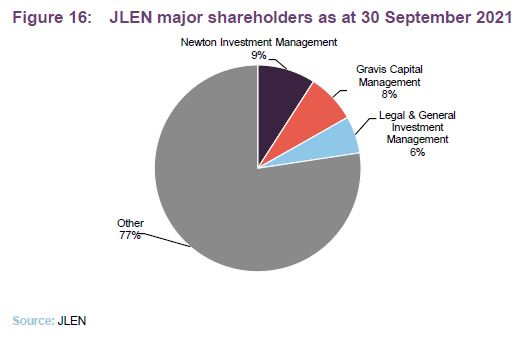

Major shareholders

Lead managers

Chris Tanner

Chris has been the co-lead investment manager to JLEN since IPO. He joined Foresight in 2019 as a partner and currently works in the London office. He has over 20 years’ of industry experience. Chris is a member of the Institute of Chartered Accountants in England and Wales and has an MA in Politics, Philosophy and Economics from Oxford University.

Chris Holmes

Chris has been co-lead investment manager to JLEN since January 2018. He joined Foresight in 2019 as a partner in the London office. He has over 23 years’ experience in infrastructure investment and financing in PFI/PPP and renewable energy projects. Chris has a BA (Hons) in Business Economics from the University of Durham.

Board

JLEN’s board is composed of six directors, all of whom are non-executive and considered to be independent of the investment manager. The board has undergone a modest refresh during the last couple of years and its size has expanded (previously JLEN’s board comprised five directors, which helped to keep a rein on costs, but a trust of this size can comfortably support a larger board with shareholders benefiting from the additional oversight that this greater resource allows).

Peter Neville, formerly JLEN’s audit committee chair, stood down at the conclusion of its AGM in September 2021, as part of the group’s succession planning. In advance of this, Alan Bates and Jo Harrison were appointed to JLEN’s board with effect from 10 June 2021. Similarly, Denise Mileham resigned on 3 September 2020 and Stephanie Coxon was appointed in advance on 11 June 2020. Short biographies of all board members are provided below.

Other than JLEN’s board, its directors do not have any other shared directorships. It seems likely that the remaining original directors that were appointed at the fund’s creation in 2013 will seek to retire as the 10th anniversary of JLEN’s listing approaches in March 2024.

Recent share purchase and disposal activity by directors

As illustrated in Figure 15, with the exception of Alan Bates and Jo Harrison, who are the most recent new additions to JLEN’s board, having both joined in June 2021, all of the directors have made significant personal investments in JLEN’s ordinary shares. This is favourable in our view, as it shows significant commitment and helps to align directors’ interests with those of shareholders.

The last twelve months have seen both Stephanie Coxon and Hans Rieks make their first share purchases since joining the board (15,000 and 95,000 shares respectively on 25 November 2021). Otherwise, all of the remaining directors have held their shareholding levels constant during the last year.

Previous publications

Readers interested in further information about JLEN may wish to read our earlier notes. You can read the notes by clicking on the links below.

The legal bit

This marketing communication has been prepared for JLEN Environmental Assets Group Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.