Long COVID effect requires a focus on corporate health

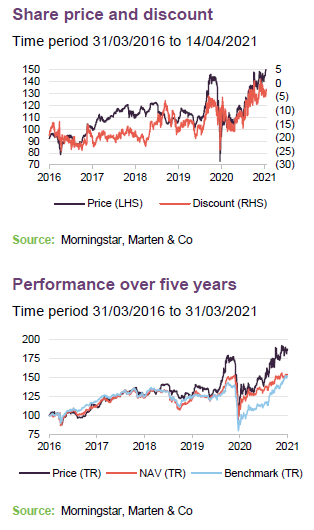

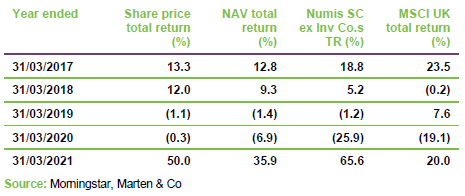

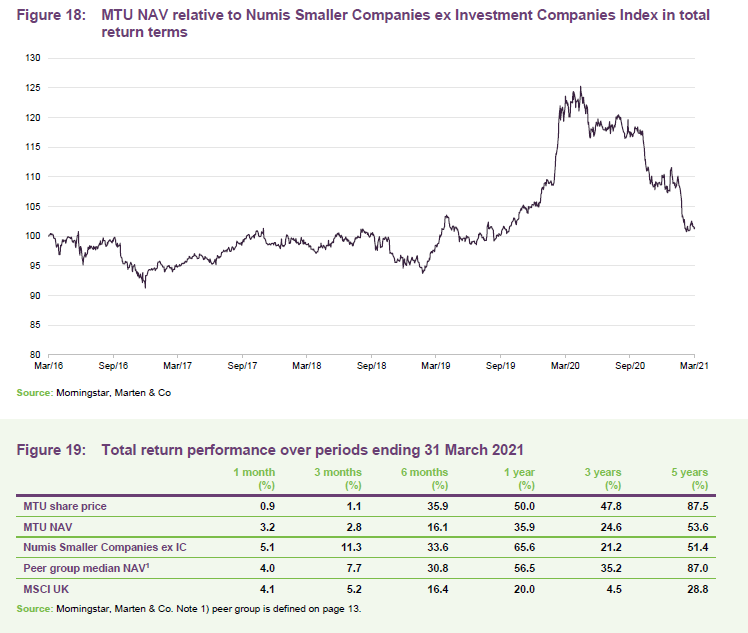

In absolute terms, Montanaro UK Smaller Companies Trust (MTU) has been generating healthy returns for its shareholders; both the share price and the NAV are close to all-time highs. However, recently MTU has given up some of its earlier outperformance.

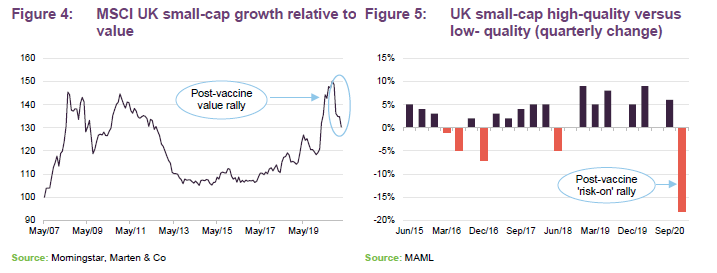

As vaccines are rolled out, the end of lockdowns may be finally in sight and most people will be eager to get back to ‘normal’. Last November, the news that a number of vaccines were effective triggered a surge in stock markets and a sharp rotation from high quality and growth stocks into riskier and/or value stocks. This did not suit MTU’s style.

MTU’s manager, Charles Montanaro, is convinced that this is likely to be a short-term setback. He thinks that the long-term economic effects of COVID will put a severe strain on companies with unsustainable business models and some may fail. MTU will stick with its quality and growth focus.

UK small cap with a bias to quality

MTU aims to achieve capital appreciation through investing in small quoted companies listed on the London Stock Exchange or traded on AIM and to outperform its benchmark, the Numis Smaller Companies Index (excluding investment companies).

Fund profile

MTU is a UK smaller companies trust with a focus on capital growth. Montanaro Asset Management Limited (MAML) is the trust’s AIFM. Charles Montanaro established MAML in 1991, and MTU was launched in March 1995 with Charles as its lead manager. He has been the trust’s named manager for about 70% of its life, most recently returning in 2016. The trust raised £25m at launch and topped that up with a £30m C share issue the following year. Today the trust has a market cap of £259m.

More of the history of the trust was set out in our initiation note – see page 3 of that note.

MAML has one of the largest teams in Europe focused on researching and investing in quoted small- and mid-cap companies. In spite of the pandemic, MAML has been growing its team since we last published and it is now 35-strong altogether, including an investment team of 13. The team is experienced, multi-lingual and multi-national (10 different nationalities). All but two of the fund managers also have research responsibilities. At the end of December 2020, MAML had AUM of almost £4.0bn. Charles Montanaro and his family together own 95% of the business, but staff have options over about half of that.

The trust is benchmarked against the Numis Smaller Companies Index (excluding investment companies) and we have also used the MSCI UK Index as a performance comparator in this report. The benchmark plays no part in determining which stocks are selected for the portfolio, or how large positions are as a percentage of net assets.

MAML’s interests have some alignment with those of MTU’s shareholders in that MAML owns around 5% of the trust. Charles added to his own holding by buying 850,000 shares in December 2020.

Shareholders are offered regular continuation votes. The next of these is scheduled for this year’s AGM.

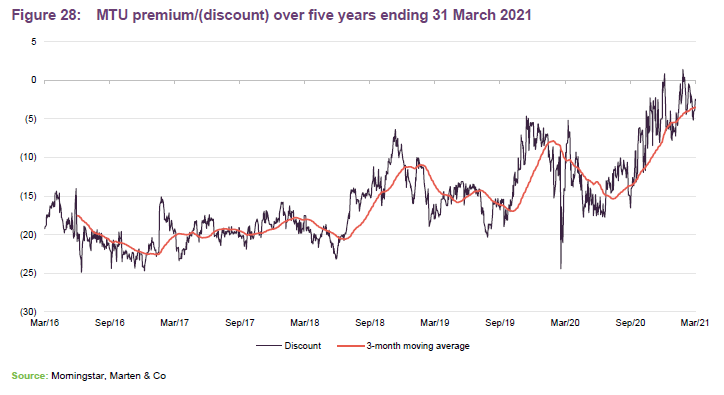

As we discuss on page 16, MTU’s discount has narrowed over the past year and, at times, the shares have traded at a premium to asset value. A better appreciation of the quality of the portfolio, and the trust’s strong ESG credentials (see page 6) may have played a part in that, but the enhanced yield offered by the trust (see page 15) could have been another important factor.

Navigating 2020

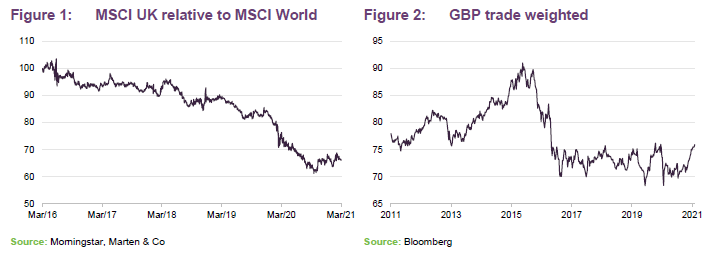

Globally, the UK market was one of the worst-performing over 2020 – the total return on the MSCI UK Index lagged the MSCI World Index by 22.7% over the year.

This was not a one-off, however. Until relatively recently, the UK market had been underperforming other major markets since the Brexit referendum was announced. As Figure 2 illustrates, a significant component of that initial underperformance can be attributed to weak sterling.

Q4 2020 was marked by good news on the vaccine front and a last-minute agreement on the terms of trading with the EU post-Brexit. The UK may have had a poor record of controlling the coronavirus, and has suffered a significant economic hit, but the pace of the vaccination programme appears to have injected a note of optimism. There are tentative signs that both domestic and overseas investors may be looking at the UK once again.

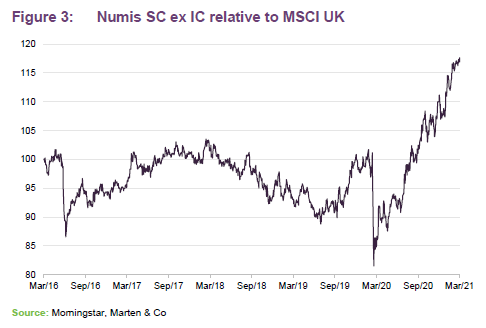

Over 2020, smaller UK stocks outperformed larger ones on average, with a pretty strong inverse correlation between market cap and returns. The pandemic panic of March 2020 saw the usual flight to the perceived safety of large cap stocks. However, smaller stocks quickly regained their footing, probably helped by the substantial financial support package provided by the government.

This trend seemed to be accentuated by good news on vaccines and the promise of an end to lockdowns. However, that was accompanied by a rotation into ‘value’ and lower-quality stocks. This appears to have triggered a short-term setback in the relative performance of MTU’s quality and growth-focused portfolio.

The manager’s outlook is positive overall but Charles cautions investors that the economic effects of the virus will be long-lasting. Government finances have been stretched by fiscal stimulus. Measures are already being taken to recoup some of this, with corporation tax rises planned and tax allowances frozen (which will restrict consumer spending).

Charles notes that COVID-related lockdowns accelerated many trends that were already underway, such as the shift to online retail, education and healthcare, and increased working from home. A reopening of shops and offices may provide some relief, but many companies have borrowed significant sums to tide them over and will be struggling with this debt burden for years to come. MAML is also concerned that consumers may have been unnerved by recent events and may fear for their job security. Any initial consumer boom that occurs after the lifting of lockdowns may prove short-lived.

We must also acknowledge that the virus has not yet been defeated and new variants may complicate the situation. Even in the UK, where the vaccination programme has been a notable success story, obstacles are emerging to delay its completion.

Long-term quality growth focus

QuotedData’s initiation note set out MAML’s approach to managing MTU in some detail. However, it might be worth a reminder that MAML invests in:

- simple businesses that it can understand;

- profitable companies trading at sensible valuations;

- niche businesses in growth markets (non-cyclical companies, growing organically);

- market leaders (strong, defensible market positions and pricing power);

- companies with high operating margins and high returns on capital (barriers to entry/a sustainable competitive advantage);

- good management that it trusts (aligned to shareholders and demonstrating sound ESG practices); and

- companies that can deliver self-funded organic growth and remain focused on their core areas of expertise, rather than businesses that spend a lot of time on acquisitions.

This could be summed up as investing in high quality businesses at sensible prices.

MAML places great emphasis on conducting its own research on potential investments rather than relying on third parties such as brokers. Meeting companies is an important part of this. The team conducted almost 500 meetings over 2020, albeit mostly virtually, and will return to making site visits when this is permitted. An evaluation of ESG aspects is integral to the analytical process. High quality companies have sustainable businesses in their view.

Sustainability

ESG analysis has been part of MAML’s investment process for 20 years and sustainability is embedded within the culture of the firm. MAML has been a B Corporation since June 2019. Certified B Corporations are legally required to consider the impact of their decisions on their workers, customers, suppliers, community, and the environment. MAML has committed to achieving net zero emissions by 2030, offsets its business travel in conjunction with ClimateCare, supports a number of charities and promotes diversity, equality and wellness within the team.

Within its portfolios, including MTU’s, MAML will not invest in tobacco companies; companies manufacturing weapons, those facilitating gambling or manufacturing alcohol; companies engaged in oil and coal-related E&P; companies involved with pornography; and those making high-interest-rate loans. MAML’s corporate governance checks include an assessment of a company’s remuneration policy.

MAML has an internal sustainability committee that meets quarterly and oversees MAML’s efforts in this area. MAML also has its own handbook, policies and checklists. It votes the shares it controls, and engages with companies. MAML expects the companies that it invests in to improve their ESG awareness and it monitors their progress.

Asset allocation

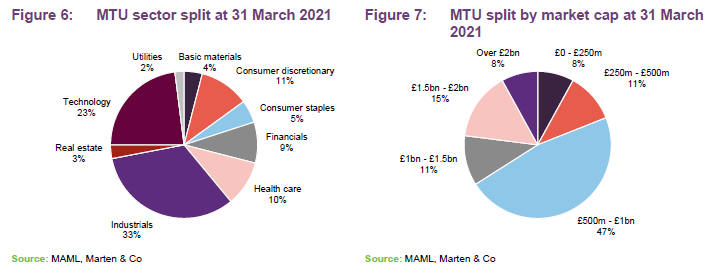

At the end of February 2021, MTU had 53 holdings and the median market cap of the companies it was invested in was £702m. The sector split is driven by MAML’s stock selection decisions.

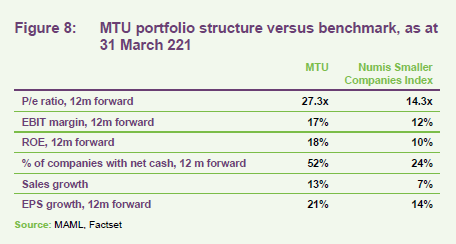

MTU’s bias to quality is evidenced in Figure 8. That quality seems to come at a price, but it is clear that on this analysis MTU’s companies have, on average, stronger balance sheets, faster sales and earnings growth and higher returns on equity than the average stock in the benchmark index.

At the end of 2020, MAML estimated that around half the portfolio’s sales were to the UK domestic market.

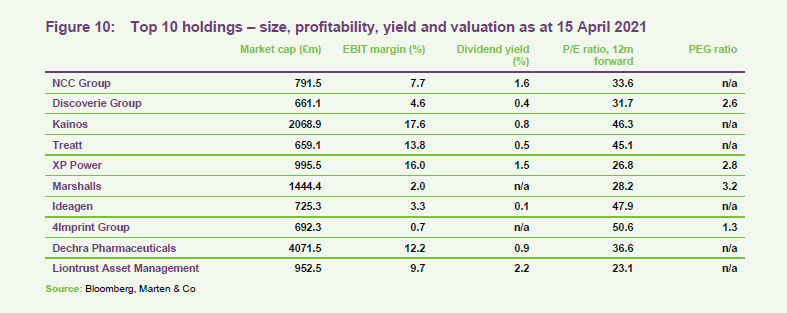

Top 10 holdings

The underlying turnover within the portfolio has remained relatively low (21% in 2020 as compared to 29% in 2019, and an average of 24.4% over the past seven years).

Since QuotedData published its initiation note (using data as at 31 January 2020), new entrants into the list of the 10-largest holdings are NCC Group, Kainos, Treatt, Dechra Pharmaceuticals and Liontrust Asset Management. Most of those were pre-existing holdings that performed well.

Kainos was discussed in the last note as MTU had been building a position in this software company. Kainos’s share price has more or less doubled since that note was published. A trading update, released on 22 January 2021, revealed that the company expected that its results for the year ending 31 March 2021 would be ahead of market consensus expectations. Amongst other things, it has been working with the NHS as part of the UK Government’s digital transformation programme.

Looking at some of the others:

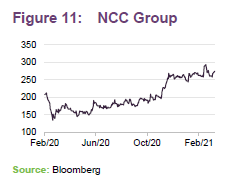

NCC Group

NCC Group (nccgroup.com) is a global cybersecurity and risk mitigation specialist. Despite some deferral of projects by firms as a result of COVID-19, NCC’s revenue grew over 2020 and the company continued to generate strong cash flows from its operations. In its interim results presentation, it drew investors’ attention to the Solarwinds hack and the impetus that this might bring to its business. The shift to the cloud is requiring customers to rethink their approach to cybersecurity. NCC’s escrow-as-a-service (EaaS) business – which allows customers to access or replicate their cloud environment in the event of a service disruption – is proving increasingly popular. Market consensus is for a near doubling of EPS in FY21 and 20% growth in FY22.

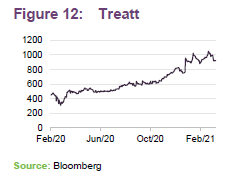

Treatt

Treatt (treatt.com) has made it into the list of largest holdings by virtue of its strong price performance. The company is a market leader in flavourings for non-alcoholic drinks. It has a strong history of margin and profits growth. In a trading update released in January 2021, the company said that it was performing particularly well in its citrus, health & wellness, fruit & vegetables and tea categories, had achieved some material new business wins, and was cautiously optimistic that its profit before tax and exceptional items for FY21 would materially exceed the then-market consensus.

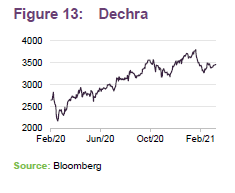

Dechra Pharmaceuticals

Global veterinary healthcare business Dechra Pharmaceuticals (dechra.com) is upbeat, helped by the trend towards greater pet ownership. In its half-year presentation, covering the six months ended 31 December 2020, it said that each of its product categories was delivering double-digit growth. Revenue growth for the business as a whole was 22% higher year-on-year and undiluted EPS 24.7% higher.

The company is growing both organically and by acquisition. In 2020 it bought dermatology products business Osurnia from Elanco Animal Health for $135m and global rights to Mirataz for $43m. Mirataz products are aimed at tackling weight loss in cats. Chiming with MTU’s strong focus on ESG, Dechra recently appointed a global sustainability director.

Other recent portfolio changes

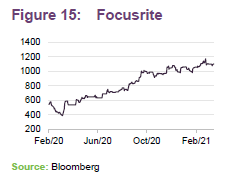

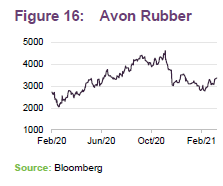

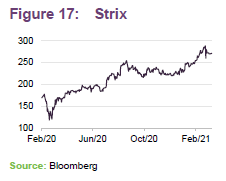

The manager reports that it has been buying AB Dynamics, Focusrite, Avon Rubber and Strix, while reducing Brewin Dolphin, IntegraFin and Gooch & Housego.

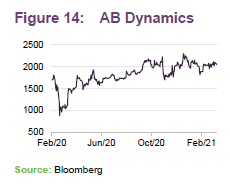

AB Dynamics

AB Dynamics (abdplc.com) is a global automotive testing business, working with automotive manufacturers on both real-world and virtual testing. COVID-19 impacted revenue in 2020, particularly in areas such as track testing and motorsport. Advanced driver assistance systems are a growth area for the business as is autonomous driving. The company has been making bolt-on acquisitions to broaden its product range and strengthen its market position. The most recent of these was the €26m purchase of Vadotech, a supplier of testing services in the Asia Pacific region.

Focusrite

Focusrite (focusriteplc.com) is a global music and audio products group making a range of products from speakers to synthesisers. Despite the effect of lockdowns on its Martin Audio division (which makes loudspeakers and associated equipment), Focusrite’s sales have been very strong recently. A trading update released in February suggested that sales for the six months to the end of February 2021 might be more than 80% ahead of the equivalent period in 2020. There is a potential constraint on growth in the form of a global shortage of semiconductors.

Avon Rubber

Avon Rubber (avon-rubber.com) sold its milking machine operations in September 2020 to focus on its defence business (making helmets and ballistic protection equipment). In December 2020, the company announced that there were problems with the approval process for certain US defence business and a protest had been lodged against its U.S. Army Next Generation Integrated Head Protection System sole source contract announced on 24 September 2020. The protest was upheld and the contract is to be re-tendered. This has knocked Avon Rubber’s share price, but the company believes that it can continue to meet financial estimates for 2021 and 2022.

Strix

Strix (strix.com) makes controls for kettles and water filters. A new production facility in China should come onstream in August 2021 and is designed to support the company’s ambition of doubling its revenue over the next five years. COVID-19 had a temporary adverse effect on kettle manufacturing in H1 2020 but Strix offset that by growing its market share to 55% from 54% and aims to take this to around 57% over the medium term. The purchase of Laica in 2020 boosted Strix’s water filtration and small domestic appliance business and this could be the major growth driver in coming years.

Performance

Charles Montanaro’s return as MTU’s lead manager in the summer of 2016 appears to have been the catalyst for improved returns for the trust. Its outperformance of the Numis Smaller Companies Index accelerated in the spring of 2020, perhaps as investors became more unnerved about the likely effects of COVID and sought safety in the high-quality and growth stocks that are the focus of MTU’s portfolio. However, the good news on vaccines last November seemed to trigger a sharp rotation into riskier, value stocks and, against that backdrop, MTU lagged the benchmark index.

The short-term reversal in MTU’s fortunes has clouded its record versus its benchmark and its peer group (see page 14). However, the manager is convinced that the realities of life post-COVID will soon reassert themselves in investors’ thinking and quality and growth will be back in demand, to MTU’s benefit.

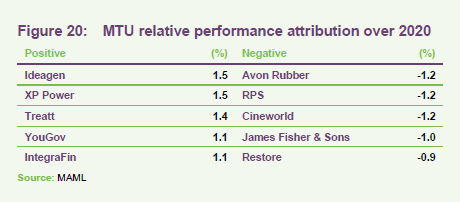

Attribution

Figure 20 shows the stocks that had the greatest impact on MTU’s returns over 2020.

Looking at some of these in more detail:

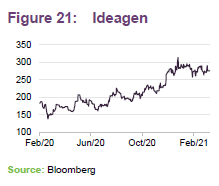

Ideagen

Ideagen (www.ideagen.com) is a regulatory and compliance software business. It has been delivering organic growth and expanding through acquisition – most recently with the purchase of Qualtrax (a Blacksburg, Virginia-based business with around 340 clients and about $5m of revenue). That acquisition and the earlier £28m purchase of Huddle (a SaaS-based secure content collaboration and workflow solution with customers across highly-regulated sectors such as accountancy and government) were funded from a £48.7m fundraise that Ideagen carried out last December. Its half-year results, announced in January, came with an upbeat trading statement.

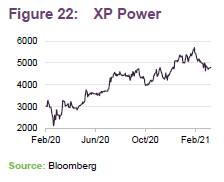

XP Power

XP Power (xppower.com) provides a comprehensive range of power supply and power converters to a wide range of industries. Results for 2020 were released in March 2021. These showed revenue growth of 17%, which when coupled with margin growth translated into a 40% increase in adjusted EPS. Strong cash flow helped slash net debt by 57%. A new facility in Vietnam helped offset the temporary COVID-19-related shutdown of the group’s Chinese manufacturing facility. The restoration of dividends (which were suspended on COVID uncertainty) and a strong order book for 2021 have helped improve investors’ confidence in the company.

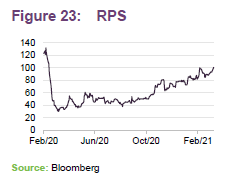

RPS

Professional services firm RPS (rpsgroup.com), a global engineering consultancy, saw its share price fall sharply as concerns built about the potential effects of COVID-19 on its business, particularly with respect to its exposure to the energy sector. Its balance sheet looked stretched in this context. The manager sold the position.

Results for 2020, published on 9 March 2021, showed that fee revenue for each quarter of 2020 was impacted by COVID-19 but was on an improving trend. Strong cash conversion and a small placing of stock dramatically reduced the group’s outstanding debt, which fell from £103m to £17m over the year.

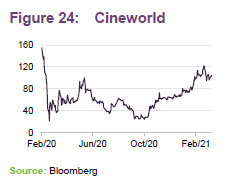

Cineworld

Cineworld (cineworldplc.com) is the second-largest cinema chain in the world by number of screens (9,311 screens across 767 sites at 31 December 2020). COVID-19 has hit the business hard, with all sites closed since March 2020 (barring a brief re-opening in the summer). The effect was an 80% fall in revenue for 2020, net cash outflow of $691m and significant losses – 66.5 cents adjusted earnings per share loss versus EPS of 21.3c for 2019.

The company raised $811m of debt over 2020 and deferred $350m of rental payments. A US tax credit of $200m should be received shortly and a $213m convertible bond issue increases liquidity further. Nevertheless, the business may be operating with capacity restrictions for some time yet. MTU’s position was sold in 2020.

Peer group

The peer group that we have used in this note is a subset of funds within the AIC’s UK smaller companies sector. We have omitted split-capital companies, trusts with a small market capitalisation, and those with an exclusive focus on micro-cap companies.

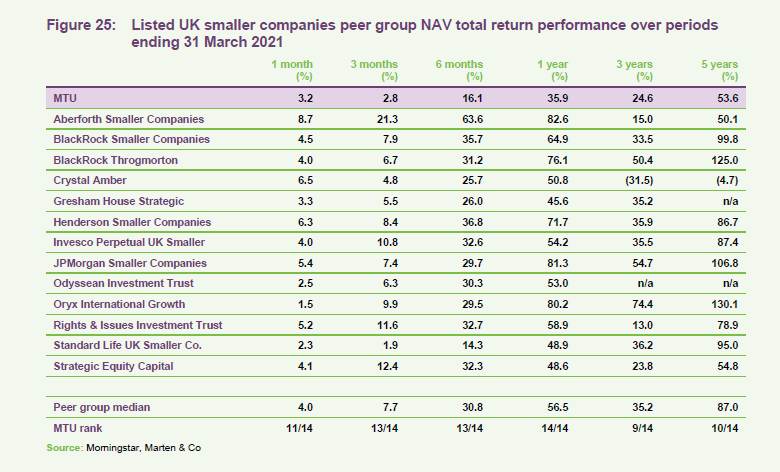

MTU’s portfolio held up well in the falling markets of a year ago, but the gyrations in markets around that time may mean that the one-year figures in Figure 25 provide little useful information.

The impact of MTU’s focus on quality and growth on its returns might be best illustrated by comparing its recent returns with those of Aberforth Smaller Companies, a value-focused trust.

The sharp deterioration of MTU’s relative returns since the vaccine announcements of early November 2020 has pushed it towards the bottom-end of the peer group performance tables over most short/medium-term time periods. If Charles is right, and quality starts to reassert itself, MTU could move swiftly back up the rankings.

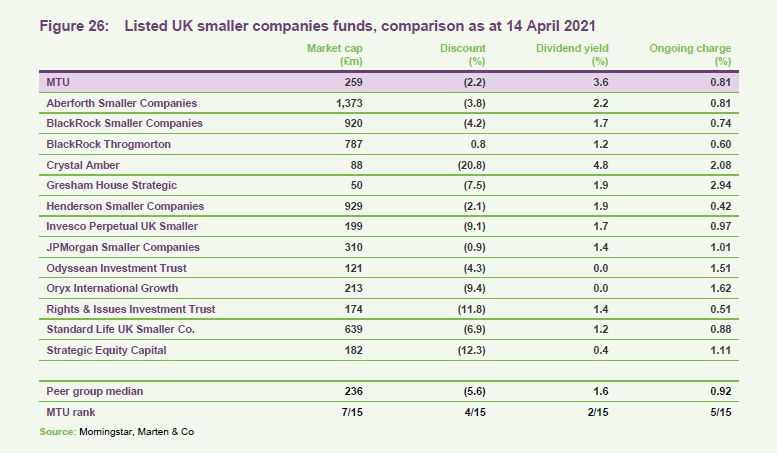

Comparing MTU on other measures, it is a reasonable size – about middle of the pack for this peer group. Demand for MTU’s shares has helped keep its discount under control, perhaps suggesting that investors agree with Charles that the relative underperformance will prove temporary.

MTU’s dividend, which is discussed overleaf, may be another source of comfort for investors. It is one of the highest in the peer group and it is growing.

Lastly, MTU’s ongoing charges ratio is towards the lower end of those in the peer group, especially given its size.

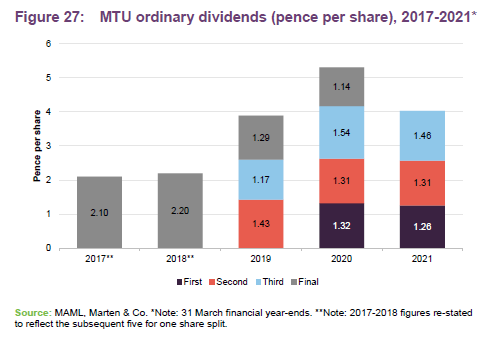

Dividend

In accordance with a policy introduced in July 2018, MTU pays out 1% of its NAV each quarter as a dividend – a level it considers to be meaningful for investors. Dividends are now paid quarterly; they are declared in July, October, January and April and paid in August, November, February and May. At 31 March 2020, MTU had distributable reserves of £114m equivalent to about 13 years of dividends.

The enhanced dividend policy has had no impact on the way in which the fund is managed or the yield on the underlying portfolio. MTU’s primary objective is to generate capital growth with the income generation of the underlying portfolio considered to be a by-product of the stock selection process.

Premium/(discount)

Over the year ended 31 March 2021, MTU’s shares traded in a range from a discount of 17.7% (when markets were panicky back in April 2020) to a premium of 1.4% and an average of a 9.4% discount. At 14 April 2021, MTU’s shares were trading at a discount of 2.2%.

Previous publications

Our initiation note – Reputation restored – was published on 5 March 2020 and is available on the QuotedData website or by clicking the link above.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Montanaro UK Smaller Companies Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.