Don’t stop me now

Don’t stop me now

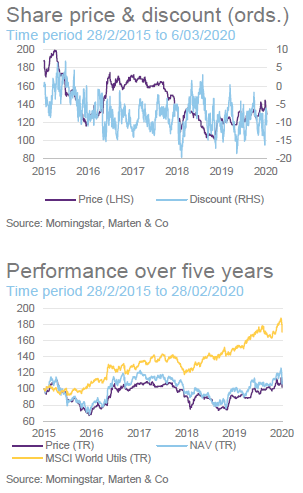

A much-improved 2019, helped by falling interest rate expectations, translated into 38.3% gains for Premier Global Infrastructure Trust (PGIT) ordinary shareholders. Before the viral panic engulfed markets, PGIT was having a strong start to 2020 as well, with the shares hitting 147p on 21 February.

In unsettled markets, the predictable and reliable cash flows generated by utilities and infrastructure make them an attractive safe haven for investors. The predictable response from the Fed to the selloff is another rate cut. Relatively speaking, PGIT could be in a good place. The manager remains enthused about the earnings and dividend growth prospects of the portfolio.

This is important, as 2020 is going to be a big year for PGIT. It faces its five-yearly continuation vote in May, and its zero dividend preference shares (ZDPs) mature at the end of November. Shareholders will ultimately have the final say but, for our two penn’orth, we’d like to see it continue.

Geared global utilities and infrastructure exposure

Geared global utilities and infrastructure exposure

PGIT invests in equity and equity-related securities of companies operating in the utilities and infrastructure sectors, with the twin objectives of achieving high income and long-term capital growth from its portfolio. Its ZDPs provide a high level of gearing to its ordinary shares.

PGIT: Income from utilities and infrastructure exposure

PGIT: Income from utilities and infrastructure exposure

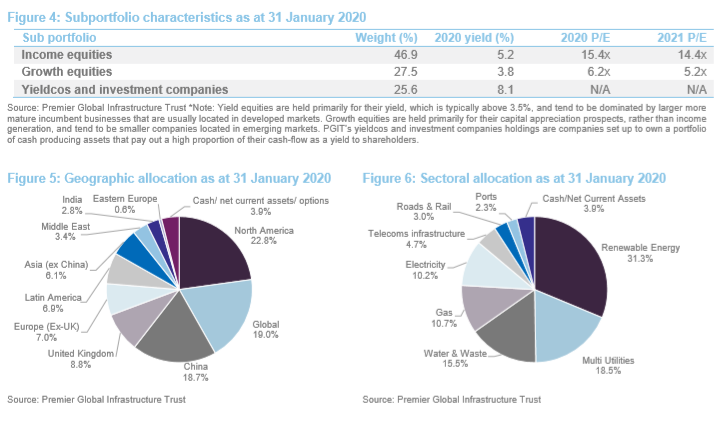

Premier Global Infrastructure Trust Plc (PGIT) is a UK-listed investment trust that invests globally in the equity and equity-related securities of companies operating in the utility and infrastructure sectors. The relatively concentrated portfolio has a strong emphasis on emerging markets, smaller companies, special situations and lower weightings to traditional, developed-market utility companies. It is split into three distinct areas: income equities; growth equities; and yieldcos and investment companies.

PGIT aims to pay a high level of income on its ordinary shares (a yield of 7.9% as at 6 March 2020) and provide long-term capital growth. PGIT’s income generation is enhanced by the significant gearing provided to the ordinary shares by its ZDPs (net gearing of 92.4% of the ordinary shares’ NAV, as at 6 March 2020, on our estimates), but this structure significantly increases the volatility of NAV returns.

Premier Miton Investors

Premier Miton Investors

PGIT’s portfolio has been managed by Premier Fund Managers, part of Premier Miton Group Plc, since its launch in 2003. Premier Miton was formed in November 2019 with the merger of Premier Asset Management Group Plc and Miton Group Plc. The combined group had some £11.1bn of assets under management as at 31 October 2019.

James Smith and Claire Long are responsible for the management of PGIT’s portfolio. They follow a bottom-up investment process based on fundamental research and are able to draw on the wider resources of Premier Miton Investors. See our initiation note for more details of the managers’ investment process.

2020 sees continuation vote and PGIT’s ZDPs mature

2020 sees continuation vote and PGIT’s ZDPs mature

2020 is a significant year for PGIT. Ordinary shareholders are given five-yearly continuation votes and the next one is due at PGIT’s AGM on 5 May. Furthermore, PGIT’s zero dividend preference shares mature on 30 November.

No formal benchmark

No formal benchmark

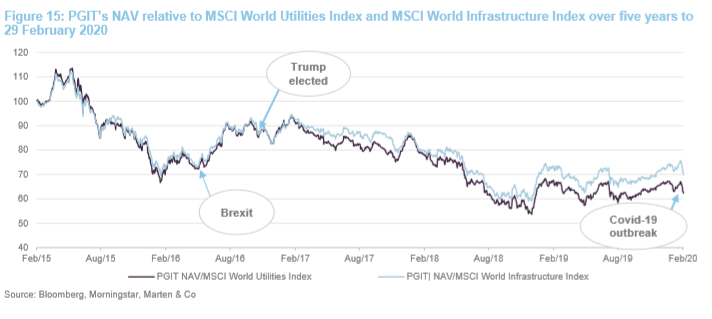

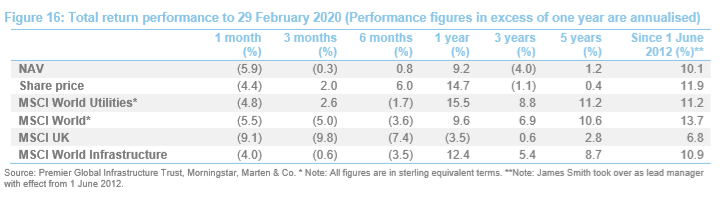

PGIT does not have a formal benchmark and its portfolio is not managed with respect to one. Instead, the managers’ performance is assessed against a set of reference points that are more general in nature and intended to be representative of the broad spread of assets in which the portfolio invests. These references include the FTSE Global Core Infrastructure 50/50 Total Return Index, FTSE All-World Total Return Index and FTSE All-Share Total Return Index. As with previous notes, we are using the MSCI World Utilities Index, the MSCI World Infrastructure Index, the MSCI World Index and MSCI UK Index for performance comparison purposes.

Market outlook and valuations update

Market outlook and valuations update

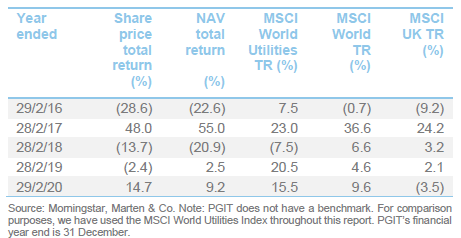

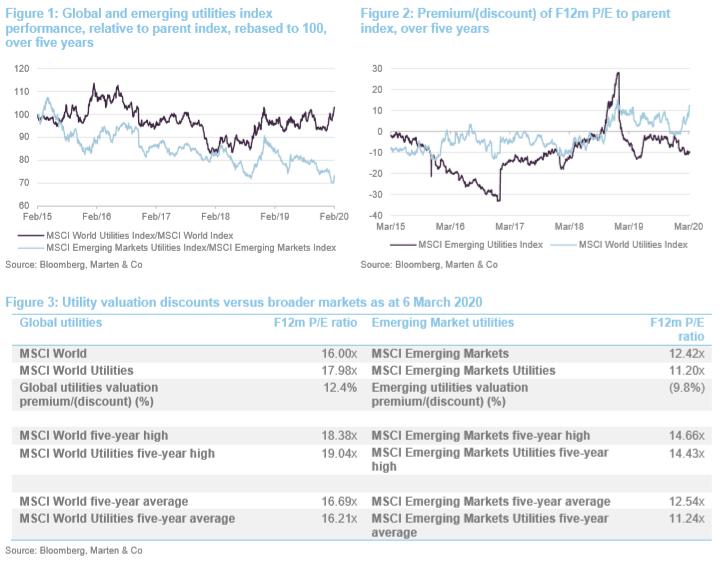

Following a testing 2017 and a mixed 2018, 2019 was a good year for utilities and infrastructure. Overall, these sectors generated strong positive performance (the MSCI World Utilities index gained 17.8% in 2019, versus 8.3% in 2018 and 3.8% in 2017, while the MSCI World Infrastructure gained 18.0% in 2019, versus 1.6% in 2018 and 1.1% in 2017 ) although they underperformed broader global markets (the MSCI World returned 23.4% in 2019 – all in sterling total return terms). However, these gains have primarily been made in developed markets where, in a reversal of the trend for 2018, interests rates fell, while emerging markets have been hurt both by the US/China trade war and a strong US dollar. Developed market utilities have been outperforming since markets began to take the covid-19 outbreak seriously. Emerging market utilities are yet to respond but it seems reasonable that they will in due course.

The emerging markets discount (and developed market premium) continues to be expressed by having a higher exposure to emerging markets. The managers continue to focus on the Asia Pacific ex Japan region (with an emphasis on China) and Latin America as they favour the long-term growth outlooks in these regions. They say that whilst there has been considerable noise within emerging markets (global economic weakness and the US-China trade war, for example), emerging markets’ earnings growth continues to be strong. The managers see the potential for capital improvements once markets are less macro- and more fundamental-driven.

The UK market has faced a number of headwinds during the last couple of years (threats of nationalisation, price caps and the prospect of rising interest rates), some of which have receded with the strong conservative majority in the election in December.

Managers’ view

Managers’ view

The managers’ long-term arguments for investing in the utilities and infrastructure sectors, and their preference for higher-growth emerging markets, remain broadly unchanged, and we recommend readers see our previous notes for more discussion, while noting the following key points:

• Over the last five years, global utilities have modestly underperformed global equities (see Figure 1), albeit with marked periods of under- and outperformance.

• A similar pattern has been seen with emerging market utilities also underperforming emerging market equities.

• During the last couple of years, markets have been very macro-driven, with less attention placed on company fundamentals. This appears to be a particular issue in emerging markets, especially in China, where the managers see a lot of deep value (see below).

• There is considerable variation between markets, with North America, for example, looking particularly expensive.

• The global economy is increasingly late cycle and utilities’ defensive exposure may become increasingly sought-after, particularly given a trend of improving earnings, should the global economic outlook soften.

• The UK market, which has been under a cloud for the last three years (concerns regarding nationalisation, price caps on electricity and gas and concerns over interest rate rises) has benefitted from the election result as the threat of nationalisation, under a Corbyn-led labour government, has dissipated.

• The signing of the phase one trade agreement between the US and China has provided some clarity and avoided another round of tariffs in the near term. However, the truce is likely to be temporary and there may be further shifts in sentiment during the year as negotiations proceed.

• The UK is now in the Brexit transition period and the direction of negotiations is far from certain. However, the managers have conducted an assessment of the likely impact of Brexit on portfolio companies, and have concluded that, aside from the currency effects, the impact is unlikely to be material.

Net zero carbon emissions by 2050 requires a focus on renewables

Net zero carbon emissions by 2050 requires a focus on renewables

PGIT’s managers say that, if the aim of achieving net zero carbon emissions by 2050 is to become a reality, we will need to substantially eliminate all fossil fuels. This is likely to be good for and have implications for generators of renewables and grid operators, as electricity production from green sources will need to increase significantly. In contrast, gas distributors are expected to see progressively lower returns. The shift will be seen first in more-developed western markets, but will follow in developing markets over time. PGIT’s managers are giving increased consideration to the longer-term implications of this trend in managing PGIT’s portfolio, as it will create winners and losers.

For example, there will be opportunities for local balancing of power supply with batteries. They expect regulators will incentivise producers to develop the infrastructure the world needs for the future. The managers say that this is a seismic shift for the sector. For many years, electricity consumption in the western world has been gradually declining as a result of energy efficiency improvements. This has been a relentless headwind for firms operating in this area. However, as transport, heating and the like shift to electric power, it seems that this has to reverse. PGIT’s managers envisage that, for the first time in a long time, investors in the space will benefit from growth assets rather than facing a managed decline in consumption.

Chinese value stocks are significantly out of favour

Chinese value stocks are significantly out of favour

Chinese value stocks, listed in Hong Kong, continue to be out of favour. As we have previously discussed, PGIT’s Chinese utility and infrastructure investments fall in this camp and, whilst underlying growth in earnings has been strong, this has not been reflected in share prices. The managers say that, while this is frustrating, they will not be changing their style. In the meantime, dividends from these stocks are seeing good growth, and so investors are being paid to be patient. The coronavirus outbreak has clearly had a suppressing effect on world markets and China in particular, but the managers say that their holdings were already trading on low valuations, with a lot of negative sentiment already priced in, and so the share prices have been relatively resilient. There have also been rumours that the Chinese government has been quietly purchasing stock to support the market. If true, this may also account for some of this resilience.

The managers acknowledge that there are numerous reasons to be negative on the outlook on China. For example, the economy is slowing; it is at the sharp end of trade tensions and the politics are strained. However, PGIT’s managers believe that their investments will come good over the longer term. They say that if investors are prepared to look through the noise, they can buy good regulated stocks at 5-6x earnings and will be rewarded over the longer term.

Asset allocation

Asset allocation

PGIT maintains a portfolio of relatively high-conviction positions that fall into one of three sub-portfolios: growth equity, yield equity and yieldco. The top seven or eight largest holdings tend to be core positions that the managers are happy to hold for the medium to longer term.

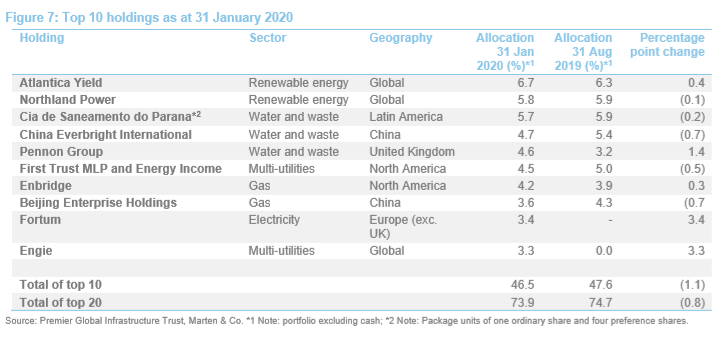

Comparing PGIT’s portfolio as at 31 January 2020 and 31 August 2019 (the most recently available data when we last published) there has been a mild reduction in portfolio concentration (the number of portfolio holdings has increased from 38 to 39, while the proportion of the portfolio accounted for by the top 10 holdings has reduced from 47.6% to 46.5%). PGIT’s portfolio has an active share of 87%.

Portfolio activity continues to be modest. The managers have largely focused their efforts on trimming positions that have performed well, rotating the proceeds into holdings that offer better value. The managers initiated a position in Fortum in 2019. They also chose to participate in the IPO of Helios Towers in November.

The managers reduced the portfolio’s exposure to the UK in advance of the general election in December 2019, but strong post-election performance has more than compensated for that. North America has been a strongly performing market; this has been trimmed at the margin. Valuations in this market, which the managers already considered to be full, have risen further. The managers have also been increasing PGIT’s allocation to stocks they classify as global.

Otherwise, there has been limited movement in the balance of asset type (growth equity, yield equity and yieldco), and there have been limited changes in the geographical allocation.

Top 10 holdings

Top 10 holdings

Figure 7 shows PGIT’s top 10 holdings as at 31 January 2020 and how these have changed since 31 August 2019 (the most recently available data when we last published). Reflecting the manager’s long-term, low-turnover approach, most of the top 10 portfolio holdings will be familiar to regular followers of PGIT’s portfolio announcements and our notes on the company.

New entrants to the top 10 are Fortum and Engie. Names that have slipped out of the top 10 are Metro Pacific Investments and Centre Coast MLP & Infrastructure Fund (although both of these stocks were within PGIT’s top 15 holdings as at 31 January 2020). We will discuss some of the more interesting developments and have provided a brief update on most of the top 10 holdings. However, readers interested in more detail on these top 10 holdings, or other names in PGIT’s portfolio, should see our earlier notes, where many of these have been discussed previously.

Atlantica Yield (6.7%) – renewable energy generation in North and South America

Atlantica Yield (6.7%) – renewable energy generation in North and South America

As readers of our March 2019 and October 2019 notes will know, PGIT’s managers increased the holding in Atlantica Yield (www.atlanticayield.com) following a period of share price weakness in the wake of the PG&E bankruptcy in January 2019. Investors became concerned that PG&E would be able to break or renegotiate PPAs with the company. However, this has not happened.

PGIT benefitted from the company’s strong share price recovery in 2019 and the managers say that it continues to perform well. Atlantica Yield owns a portfolio of renewable energy assets located in North and South America, and certain markets in EMEA, along with electricity transmission, gas generation and water production assets. This fits with PGIT’s focus both on higher-growth emerging markets and companies that will benefit from the move to a lower-carbon world.

Northland Power (5.8%) – 2020 results to see full benefit of third North Sea wind farm

Northland Power (5.8%) – 2020 results to see full benefit of third North Sea wind farm

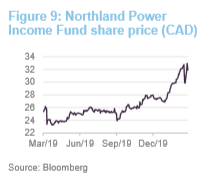

PGIT acquired its initial stake in Northland Power (www.northlandpower.com) in January 2018 and, through a combination of positive share price performance and further purchases made as the managers gained confidence, Northland quickly moved up PGIT’s rankings.

Northland describes itself as a power producer dedicated to developing, building, owning and operating clean and green power infrastructure assets in Canada, Europe and other selected global jurisdictions. The bulk of its facilities are in Canada, but it also has sites in Germany, The Netherlands and Taiwan. The company is expanding its footprint in Europe.

When we last wrote, Northland owned two operational wind farms in the North Sea and had a third under construction, which PGIT’s managers believe will drive future earnings growth. Construction of the third plant is complete, the plant has been commissioned and 2020 will be the first year where Northland sees the benefit of this in its earnings. Now, Northland will be shifting its focus to offshore Taiwan, where it is developing three large offshore wind farms over the next few years. Northland is also taking over a number of functions for its European operations, which had previously been outsourced. PGIT’s managers expect that this will improve the company’s margins.

PGIT’s managers say that the obvious comparator to benchmark Northland against is Denmark’s Ørsted A/S. They acknowledge that Ørsted is much bigger but say that otherwise the two companies have similar operations. Northland is significantly cheaper.

As at 31 December 2018 (this being the most recently published data), Northland had a total gross generating capacity of 2,429MW. This comprised 973 MW of thermal generation (primarily natural gas with a small component of biomass), 1,326MW wind and 130MW solar. The company also had an additional 399 MW of wind projects under construction and 1,044 MW in advanced development.

Cia de Saneamento do Parana (Sanepar) (5.7%) – strong results

Cia de Saneamento do Parana (Sanepar) (5.7%) – strong results

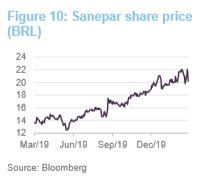

Brazilian water and waste management company Sanepar (www.sanepar.com.br) is a core PGIT holding. PGIT’s managers comment that Sanepar’s recent results were very strong and exceeded their own expectations. Net revenue growth for Q4 2019 was 22.0% year on year, and 13.5% for 2019 as a whole. EBITDA margin for Q4 2019 was 47.1% (41.5 for 2019 as a whole) and net profit increased by 20.7% year-on-year, for Q4 2019, and 21.0% for 2019 as a whole.

PGIT’s managers say that previous regulatory concerns have now been addressed (its shares were weighed down by uncertainty regarding the implementation of a portion of its annual tariff increase) and with 2–3% growth per annum in clean water and 5– 6% per annum growth in sewerage, they are happy to hold Sanepar for the longerterm. Anecdotally, the managers say that, as a large proportion of water and waste assets are privately owned, they are scarce within public markets. The same applies to Pennon Group.

China Everbright International (4.7%) – hurt by negative sentiment

China Everbright International (4.7%) – hurt by negative sentiment

As discussed in our October 2019 note, waste to energy company, China Everbright International (www.ebchinaintl.com), saw its shares fall sharply in August 2018 following a dilutive rights issue undertaken to fund growth development. The company reported strong 2018 results, with a 55.3% increase in waste volumes treated and earnings per share up 12.6% (despite the dilution from the rights issue).

The first half of 2019 saw a steady flow of new contracts to build and operate waste to energy facilities, but the company’s share price failed to respond. In 2020, there might be some concern that the company would be affected by the coronavirus. However, PGIT’s managers say that, with the company already trading at low valuations, considerable negative sentiment was already priced in and the stock, in common with PGIT’s other Chinese holdings, has been resilient. The managers are expecting the company to announce a good set of results in March (for the year ended 31 December 2019) and are happy to continue to hold the position.

Pennon Group (4.6%) – double bubble

Pennon Group (4.6%) – double bubble

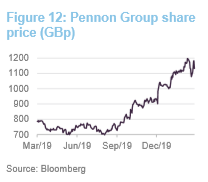

In our March 2019 note, we noted PGIT’s manager had topped up its holding in water and waste management company, Pennon Group (www.pennon-group.co.uk), along with a number of UK utilities and infrastructure holdings. In the case of Pennon, the managers highlighted their view that the market was undervaluing Pennon’s waste business, Viridor, which burns rubbish to generate energy.

More recently, Pennon has benefitted both from the strong Conservative election victory in December, which has removed the potential threat of nationalisation under a Corbyn-led Labour government.

In the company’s September 2019 trading statement, Pennon said that following continued strong performances from its Viridor and South West Water businesses it would conduct a full review of its strategic focus, growth options and capital allocation policy. It has since been reported that, as part of this process, investment bankers from Morgan Stanley and Barclays have been appointed to sell Viridor, reflecting strong interest from a number of potential buyers. KKR’s bid, which was made in early 2019 but came to light early this year, appears to have been an attempt to kickstart this sales process.

There have been reports that the price tag for Viridor is in the region of £4bn. If true, this could unlock significant value for Pennon shareholders (as at 28 February 2020, Pennon Group’s market cap was £4.54bn). PGIT’s managers think that now is a good time for Pennon to be spinning off Viridor. There is clearly demand for green investments; the company has been investing to expand its operations but capex is expected to peak in the current financial year (ending 31 March 2020); three of its energy recovery facilities are currently in operational ramp up, but these should be strong contributors to earnings growth during the next two years; and the business model has been significantly de-risked (all of its revenues are covered by long-term contracts with around 80% of this being index-linked).

Fortum (3.4%) – new entrant in 2019

Fortum (3.4%) – new entrant in 2019

Fortum (www.fortum.com) is a new entrant to PGIT’s portfolio. It is a Finnish heat and power company focusing on providing clean energy in the Nordic and Baltic countries, Poland, Russia and India. It also provides a range of waste services. Fortum has core operations in 10 countries globally; it employs over 8,000 people; its generation portfolio comprises 128 hydro power plants as well as 26 CHP, condensing and nuclear power plants globally; and it is also growing its solar and wind generation capabilities. Fortum supplies heat to some 22 cities and towns and has five main waste treatment facilities.

In June 2018, Fortum took control of Uniper, a company that was spun out of the German energy giant E.ON when it split to focus on renewables and energy (Uniper assumed control of E.ON’s fossil fuel assets (primarily gas and coal, with a small amount of oil) as well as some nuclear and hydro assets, leaving E.ON with a more focused proposition). Uniper had 34GW of generating capacity as at 31 December 2019. 51% of this is gas, 27% is coal, 11% is hydro, 8% is oil and 4% is nuclear.

PGIT’s managers were somewhat indifferent to the Fortum-Uniper tie up. They felt that while the asset mix was complimentary and the management team has a decent record of execution, the fossil fuel assets were potentially a divergence from Fortum’s green focus. However, they felt that, in a world that is striving for net zero carbon emissions by 2050, the strategic value of Fortum’s Hydro assets was being overlooked.

As we have discussed in previous notes, in an effort to reduce reliance on dirtier fossil fuels, such as coal, in favour of greener alternatives such as natural gas, the EU has reformed its Emissions Trading Scheme (ETS). The result is a reduction in the number of carbon permits available (the managers say that the market is now structurally short), which has driven up the carbon price, which in turn has driven up the power price. Higher power prices benefit all power producers, but it is highly beneficial to the fixedcost producers (for example, renewables, hydro and nuclear generators) who see the full benefit drop through to their bottom lines.

PGIT’s managers say large scale hydro and nuclear are the only carbon-friendly generation sources that are suitable for baseload. Of the two, hydro has the potential to be especially valuable as it can be used to balance grid demand (nuclear takes more time to ramp up and down production). The managers say that Fortum’s portfolio is benefitting from higher power prices and growing electricity demand. However, it also provides a free option, through its hydro assets, if reform of Europe’s ETS has tightened its carbon market too quickly.

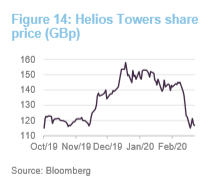

Helios Towers – PGIT participated in November 2019 IPO

Helios Towers – PGIT participated in November 2019 IPO

PGIT participated in the initial public offering of Helios Towers (www.heliostowers.com) in October 2019. Helios is a sub-Saharan telecoms towers business that builds, owns and operates towers in five high-growth African countries (most notably Tanzania, but also Ghana, Congo Brazzaville, the DRC and South Africa). Its markets are experiencing rapid growth in demand for mobile data, which is driving demand for telecommunications infrastructure. Its towers are capable of accommodating and powering the needs of multiple tenants (typically large mobile network operators and other telecommunications providers) and it also offers a range of tower-related operational services (site selection and preparation, maintenance, security and power management).

Performance

Performance

Results for the year ended 31 December 2019

Results for the year ended 31 December 2019

Following a difficult 2018, 2019 was a stellar year of performance for shareholders in PGIT. The total return on its gross assets was 19.0% (2018: -11.0%) but the significant level of gearing provided by PGIT’s ZDPs amplified this gain so that the NAV total return was 38.9% (2018: -25.4%). PGIT’s share price captured almost all of this, returning 38.3% in total return terms. In comparison, the MSCI World Utilities, with its higher weighting to developed markets, gained 17.8%. The first half of 2019 was stronger in absolute return terms (a total return of 21.4%) although, compared to its reference index, PGIT displayed stronger outperformance in the second half of the year.

During 2019, many of PGIT’s larger positions performed very well. On average, PGIT’s investments in yield equities and yieldcos and investment companies substantially outperformed. These were aided by improving sentiment at the beginning of the year and falling interest rates (lower interest rates pushed down bond yields, which provided a valuation tailwind to yieldcos). However, PGIT’s investments in emerging markets, which mainly fall into its growth equities segment, were the main source of underperformance. These were hampered both by the trade dispute between China and the US and a strong US dollar. In a continuation of the trend from 2018, PGIT’s investments in Asia and China continued to perform well operationally, with growing earnings and dividends, but this was not fully reflected in their share prices and so their valuations improved.

Despite reducing the portfolio’s exposure to the UK in the run-up to December’s general election in the UK, PGIT remained substantially overweight UK stocks and benefitted from the substantial Conservative majority win as worries over nationalisation swiftly receded.

PGIT also made a good start to 2020, with both its share price and NAV total returns exceeding that of the MSCI World Utilities Index at the of January. However, while February’s market turmoil has eaten into PGIT’s NAV and share price total returns (falls of 3.5% and 3.4% YTD to 9 March 2020) its defensive qualities have come to the fore. In comparison, the MSCI World has fallen 14.1%, the MSCI UK has fallen 20.3%, the MSCI World Infrastructure has fallen 6.2%, while the MSCI World Utilities Index has fallen just 1.0%.

Yield equities – all major holdings performed well

Yield equities – all major holdings performed well

Sanepar was a standout contributor during the year. It is a core holding and has been trimmed reflecting its strong performance. Its shares had been weighed down by short term uncertainty regarding the implementation of a portion of its annual tariff increase. However, once this was resolved, the share price rebounded strongly (an increase over 2019 of 64.9% in local currency terms).

Northland Power was another strong contributor. Its share price increased by 25.3% during 2019 but it continues to trade at a substantial discount to its peers.

Pennon Group, which owns and operates South West Water and Viridor waste subsidiary, was held back by political uncertainty for a considerable part of 2019.

It received a strong boost following the conservative election win in December and its shares ended the year up 48.0%. The story for SSE was similar. It suffered political uncertainty during the first half of the year, improved in the second half and rallied in December following the conservative election victory.

North American pipeline operator Enbridge saw its shares gain 21.7%, while Acea (Italian multi-utility) saw its shares increase by 53.5%.

Yieldcos and investment companies – generally performed well

Yieldcos and investment companies – generally performed well

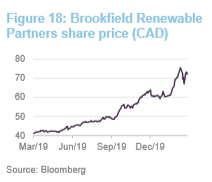

Atlantica Yield, which was PGIT’s largest investment at the year-end, posted a solid operational performance. It increased its dividend steadily and its share price increased by 34.6% over the course of the year. Brookfield Renewable Partners (global renewables with an emphasis on North American hydro assets) was another strong contributor. Its shares gained 70.6% over the course of 2019 (see figure 18).

Transalta Renewables (primarily Canadian renewables, but it also owns some gas-fired generation in Australia) saw its shares increase by 49.7% during 2019. Pattern Energy, a North American renewables business that is now developing new assets in South America and Japan, saw its shares gain 43.7%.

Clearway Energy returned 13.0% over the year and while this is a decent absolute return it markedly underperformed its peer group. The primary cause is the PG&E bankruptcy. Several of Clearway’s subsidiaries have long-term power sales agreements with PG&E and there has been concern that these agreements could be renegotiated. This has not been an issue to date, but while the bankruptcy proceedings are ongoing, Clearway has not been able to access cash flows from its affected subsidiaries due to banking covenants. This forced it to cut its dividend, although PGIT’s managers hope that this is a temporary problem.

Growth equities – main source of underperformance

Growth equities – main source of underperformance

As noted above, PGIT’s investments in emerging markets, which mainly fall into its growth equities segment, were the main source of underperformance. The main culprit was China, where performance was lacklustre, despite PGIT’s Chinese investments’ providing encouraging operational performances. For example, China Everbright International saw its share price fall by 11.0% (see Figure 19), despite reporting half year attributable earnings growth of 19.5%, together with a steady stream of new contracts. Similarly, Beijing Enterprises Holdings increased its first half 2019 earnings by 11.2%, with an accompanying dividend increase of 25.0%, but its share price fell by 13.9% over 2019.

China Longyuan Power’s interim 2019 earnings were flat, but its shares fell by 7.5% during the year. Anecdotally, PGIT’s managers say that the company is expected to exhibit strong growth in 2020, prior to the phasing out of subsidies for new wind farms in 2021 as costs have now fallen to the level of thermal generation, reaching “grid parity”.

Metro Pacific’s share price was flat for most of 2019 but fell sharply in December on the news that the government in the Philippines was seeking to renegotiate its water concession which serves the western half of Manila, such that the company ended the year with its share price 25.0% down. PGIT’s managers think that the market has overreacted. They believe that the water business comprises only 13% of the total value of the group and that the electricity and toll roads businesses are set to grow earnings at a far faster pace than the more mature water business.

OPG Power Ventures reported strong half-year results (earnings up 26.2% on higher electricity tariffs, flat coal costs and lower debt costs) but, despite the market’s positive reaction to the results, OPG’s shares ended the year 25.0% down. Global port operator DP World saw its shares decline by 23.4% despite steady volumes, and solid earnings performance in the year. Happily, DP World has just announced that it is to delist and its parent company will buy out minority investors such as PGIT at $16.75, a 29% premium to the $13 level it was trading at ahead of the announcement.

Premium/(discount)

Premium/(discount)

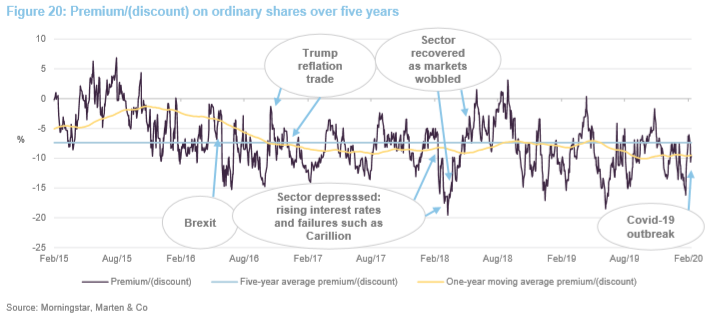

As we have discussed in our previous notes, the volatility present in PGIT’s ordinary share discount is in part a feature of the high level of gearing that is provided by its ZDPs and the volatility that this leads to within PGIT’s ordinary share NAV. As illustrated in Figure 20, PGIT’s ordinary share discount has recently been widening so that the discount is now noticeably wider than both its five-year average and one-year moving average.

Historically, PGIT’s discount has tended to narrow with improving performance and yield, while the reverse has also been true (see page 9 of our July 2017 annual overview note for more discussion). It also has a tendency to be influenced by macroeconomic developments (for example, widening with the prospect of interest rate rises and narrowing in times of uncertainty when markets are seeking more defensive allocations). It seems reasonable to us that, if PGIT continues to provide strong performance, this could lead to a sustained narrowing of the discount.

Quarterly dividend payments

Quarterly dividend payments

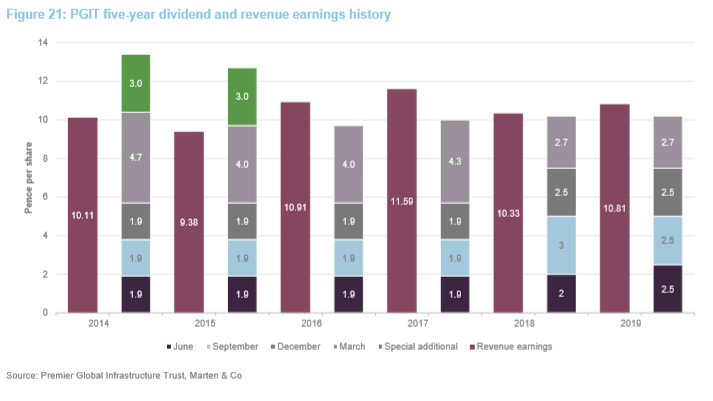

PGIT pays quarterly dividends on its ordinary shares in June, September and December and March. All dividends are paid as interim dividends. Traditionally, the first three interim dividends (June to December) were smaller, with a larger fourth interim in March. However, in 2018, PGIT moved towards more equal dividend payments throughout the year.

For the year ended 31 December 2019, PGIT paid interim dividends its first three dividends at a rate of 2.5p per share. With the announcement of its annual results, has declared a fourth interim dividend of 2.7p per share, which brings the total dividend for the year to 10.2p per share. This is level with the prior year and a yield of 7.9% on PGIT’s ordinary share price of 129.0p per share as at 6 March 2020. In terms of income generation, PGIT’s ordinary shares benefit from the significant finance provided by the ZDP borrowings. The ordinary shares incur the cost of financing the ZDP borrowings, but this is charged to capital, thereby bolstering the revenue account.

2019 revenue generation shows modest improvement over 2018

2019 revenue generation shows modest improvement over 2018

For the year ended 31 December 2019, PGIT generated net revenue income per share of 10.81p per share, a 5.4% increase over the 10.33p per share generated for the 2018 year (see Figure 21 below).

As at 31 December 2019, PGIT had revenue reserves of 7.9p per share (equivalent to 5.2p per share after deducting the final dividend for the year of 2.7p per share). This is a healthy increase over 2018’s 4.6p per share (that is, PGIT’s revenue reserve was 7.3p per share before deducting a 2.7p final dividend). The 5.2p per share for 2019 is equivalent to 51% of the total dividend for the 2019 year, suggesting that PGIT retains some capacity to smooth dividends going forward.

Fees and costs

Fees and costs

Simple fee structure with no performance fee element

Simple fee structure with no performance fee element

PGIT pays a base management fee of 0.75% per annum of its gross assets (i.e. including the assets attributable to the ZDP holders), which is calculated monthly and paid in arrears. The management fee is charged 40% to revenue and 60% to capital.

Premier Asset Management also provides company secretarial and administrative services to the company. Company secretarial fees for the year ended 31 December 2019 were £75k (2018: £75k), while administrative expenses were £274k (2018: £307k).

Reflecting its split capital structure, PGIT’s ordinary shareholders benefit, in full, from the returns made on both their capital and that of the ZDP holders (positive or negative), but are also liable for the management fees on PGIT’s ZDP capital, in addition to their own. As such, the ongoing charges based purely on the ordinary share’s NAV are amplified. We estimate these as being 3.8% for the 2019 year and 3.6% for the 2018 year. PGIT’s ongoing charges, based on PGIT’s total assets (the costs that would be borne by an investor holding a package unit of ordinary shares and ZDPs in their proportions in the capital structure), were 1.66% for 2019, slightly below 2018.

Capital structure and trust life

Capital structure and trust life

Split capital structure – highly geared by ZDPs

Split capital structure – highly geared by ZDPs

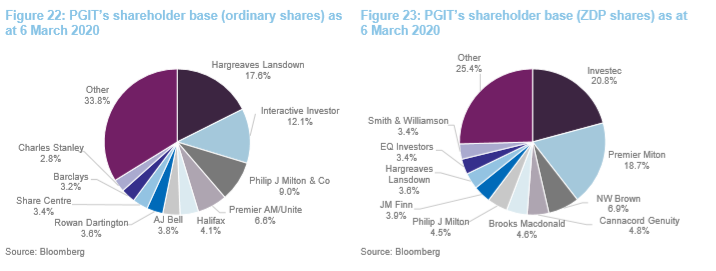

PGIT is a split-capital investment trust. It has two types of security in issue: ordinary shares and ZDPs. PGIT’s ordinary share register has a strong retail presence. The ZDPs, which were issued by PGIT’s wholly-owned subsidiary, PGIT Securities 2020 PLC, provide substantial gearing to PGIT’s ordinary shares (facilitating both income enhancement and amplifying performance). As at 6 March 2020, PGIT had 18,088,480 ordinary shares and 24,073,337 ZDP shares in issue.

With NAVs of 137.31p and 121.43p for the ordinary shares and ZDP shares respectively as at 6 March 2020, we estimate PGIT had gross gearing of 117.7% and net gearing of 92.4%. The ZDP shares mature on 30 November 2020 with a final entitlement of 125.6519p per 2020 ZDP share. This is equivalent to a GRY of 4.75% per annum over the life of the ZDPs. As at 6 March 2020, the ZDPs had an attributable asset value of 121.43p per share and were trading at 120.00p (a discount of 1.2%). With the final entitlement noted above, the ZDPs offer a yield to maturity of 4.26% per annum. The ZDPs have a coverage ratio of 1.79x.

Major shareholders

Major shareholders

Unlimited life with five-yearly continuation votes

Unlimited life with five-yearly continuation votes

PGIT has an unlimited life, but offers its ordinary shareholders five-yearly continuation votes (the next continuation vote is scheduled for the company’s AGM on 5 May this year). PGIT’s ZDPs mature in November 2020.

Financial calendar

Financial calendar

The trust’s year-end is 31 December. The annual results are usually released in March (interims in July) and its AGMs are usually held in April/May of each year. As discussed, PGIT pays quarterly dividends in June, September and December and March.

Board

Board

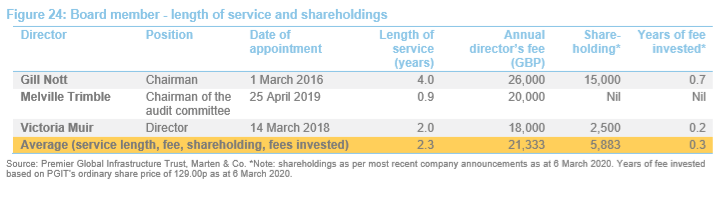

As discussed in our March 2019 annual overview note (see pages 14 and 15 of that note), PGIT’s board has undergone a major refresh in recent years. It now consists of three non-executive members. All considered to be independent of the investment manager, and aggregate directors’ fees are limited to £150k per annum.

Gill Nott became chairman on 27 July 2018 following the retirement of Geoffrey Burns. Kasia Robinski stood down at the company’s AGM in December 2019, with Melville Trimble appointed at the same time to take her place.

All directors stand for re-election at three-yearly intervals, unless they have served for nine or more years, after which they stand for re-election annually (PGIT has a relatively young board and no director has served more than nine years). Gill Nott is now the longest-serving director, with just 4.0 years of service under her belt.

Gillian Nott OBE (chairman)

Gillian Nott OBE (chairman)

Gill spent the majority of the first 27 years of her career working in the energy sector, including positions with BP. In 1994 she became chief executive of ProShare and, due to her work in the retail savings sector, she spent six years on the board of the Financial Services Authority between 1998 and 2004. She was also deputy chairman of the Association of Investment Companies. Gill has held a portfolio of non-executive positions, particularly in the closed-end fund sector, over the last 15 years. She is currently chairman of JPMorgan Russian Securities Plc and Hazel Renewable Energy VCT1 Plc.

Melville Trimble (chairman of the audit committee)

Melville Trimble (chairman of the audit committee)

Melville has many years of experience in the investment trust industry and was, until January 2019, a deputy chair of the Association of Investment Companies and chair of its audit committee. Melville has previously worked for PwC, where he specialised in providing advisory services to London listed funds. He was previously the finance director of Herald Investment Management Limited and, prior to this, was a corporate financier specialising in investment trusts for Cazenove and Merrill Lynch International. Melville has previously held a number of non-executive directorships, including The Black Sea Property Fund, Anson Group and Invesco Income Growth Trust Plc.

Victoria Muir (director)

Victoria Muir (director)

Victoria is a chartered director and a fellow of the Institute of Directors. She is a distribution specialist and has worked in financial services, with a focus on asset management, for 25 years. She was Global Head of Investor Relations at BlueBay Asset Management and Head of Client Account Management at Royal London Asset Management, where she held four executive directorships on various group companies, including the asset management company. Victoria is a non-executive director of Christie Group Plc, Invesco Perpetual Select Trust Plc, Smith & Williamson Fund Administration Limited and State Street Trustees Limited.

Previous publications

Previous publications

Readers interested in further information about PGIT may wish to read our previous notes. You can read the notes by clicking on the links or by visiting our website.

A step change in performance, initiation note, published 18 June 2014

Solid interims and plans for the future, update note, published 7 August 2014

Value in emerging markets, update note, published 2 February 2015

3 years later, in a new league!, annual overview, published 16 July 2015

It’s a £24m rollover!, update note, published 4 February 2016

A BREXIT beneficiary, update note, published 5 September 2016

Pocket rocket, annual overview, published 12 July 2017

Evolution, not revolution, update note, published 28 November 2017

Swings and roundabouts, update note, published 10 May 2018

Quick out of the blocks in 2019, annual overview, published 29 March 2019

Strong income growth, update note, published 30 October 2019

The legal bit

The legal bit

This marketing communication has been prepared for Premier Global Infrastructure Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.