In the United States, May 2025 saw a robust rebound in equities, with the S&P 500 surging 6.2%, its best May performance since 1990. However, it was another month of rising Treasury yields and a falling dollar. The two generally move in the same direction, so this could be construed as a sign that investors are withdrawing capital from the US.

A downgrade of the USA’s credit rating may have played a small part in the government bond selling but more impactful was growing concern over Trump’s “One Big Beautiful Bill”, which is widely tipped to worsen the deficit. JPMorgan’s Jamie Dimon warned that the bond market will crack. Ultimately, this was also a contributing factor in the fallout between Trump and Musk that surfaced in June. Another problem highlighted in the Bill was section 899, which would allow Trump to impose extra taxes for foreign investors in US assets.

Yields on Japanese government bonds are reaching levels where domestic investors may favour them over US bonds. That puts further pressure on the US and the dollar.

Economic indicators painted a mixed picture, as private-sector job growth slowed to a two-year low, and services sector activity declined, raising concerns about the labour market.

‘If it is believed that tariff action is needed to create the shock and awe to get these issues on to the table and dealt with, then something has gone wrong with the multilateral system’

Andrew Bailey, Governor of the Bank of England

On the tariff front, “Trump always chickens out (TACO)” began to trend as he announced a dramatic climb down on tariffs on China. These are now 30%, down from 145%.

Closer to home, the EU and the UK announced a welcome reset of Brexit terms of trade. The UK economy displayed signs of resilience. The FTSE 100 reached record highs in May, buoyed by improved service sector confidence and a 0.7% GDP growth in Q1 2025. Positive corporate earnings and a temporary exemption from US steel and aluminium tariffs further supported market sentiment.

In the Eurozone, economic growth remained subdued amid trade tensions and the European Commission revised its 2025 GDP growth forecast downward to 0.9%, citing uncertainty and higher US tariffs on European goods. Inflation slowed to 1.9%, prompting expectations of further interest rate cuts by the ECB.

BlackRock Frontiers

‘Whilst the developed markets are concerned with the impact of the trade tensions and protectionist policy, the emerging markets have recently seen an increase in intra-country trade’

CT UK Capital and Income Investment Trust

‘In recent decades it is difficult to think of a parallel for the current economic and geo-political situation’

JPMorgan Japanese Trust

‘International interest in Japan remains elevated, shareholder activism is gaining traction, and M&A activity is on the rise‘

At a glance

| Exchange rate | 31 May 2025 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.3459 | 1.0 |

| Pound to euros | GBP / EUR | 1.1860 | 0.8 |

| US dollars to Japanese yen | USD / JPY | 144.02 | 0.7 |

| US dollars to Swiss francs | USD / CHF | 0.8224 | (0.4) |

| US dollars to Chinese renminbi | USD / CNY | 7.1990 | (1.0) |

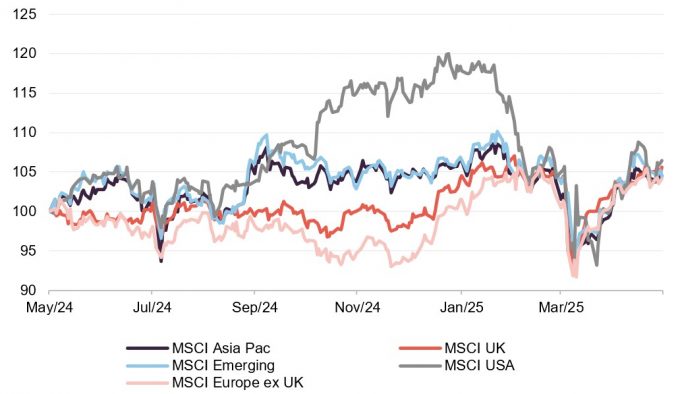

MSCI Indices (rebased to 100)

The dollar initially strengthened but weakened later in the month. The pound surged to a multi-year high, helped by stronger domestic data, while the euro gained as investors explored it as a reserve currency alternative.

Oil prices recovered a little from April’s lows, while the gold price ended up flat over the month. The big move was in bond yields as investors looked nervously at government deficits.

Time period 31 May 2024 to 31 May 2025

Source: Bloomberg, QuotedData. Converted to pounds to give returns for a UK-based investor.

| Indicator | 31 May 2025 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 63.90 | 1.2 |

| Gold (US$ per Troy ounce) | 3289.25 | 0.0 |

| US Treasuries 10-year yield | 4.40 | 5.7 |

| UK Gilts 10-year yield | 4.65 | 4.6 |

| German government bonds (Bunds) 10-year yield | 2.50 | 2.3 |

Global

Peter Spiller, Alastair Laing, and Chris Clothier, managers, Capital Gearing Trust, 28 May 2025

On the 2 April, US President Donald Trump announced sweeping trade tariffs on friend and foe alike. The breadth and arbitrary nature of these actions added to a sense of revolutionary change as the institutions that have underpinned Western development and security since the second world war are systematically dismantled. There remains considerable uncertainty over how long lasting and significant these changes will prove but even if these policies are reversed during, or after, a Trump presidency, the role of America as a benevolent hegemon may never return. The world feels that bit more dangerous and divided.

There are early signs that trust in the exceptionalism of American assets is being called into question. The December 2024 Bank of America Global Fund Manager Survey recorded the largest ever overweight allocation to US equities, the culmination of 15 years of staggering outperformance versus other markets. At that point the Trump bump turned to slump as a slew of weaker than expected economic data combined with policy uncertainty and elevated valuations caused a correction in US equities, particularly the Magnificent Seven. To date there is limited evidence of the impact of recent events on corporate earnings but there is a considerable risk that margins will suffer given the extremely elevated levels of profitability achieved by US corporates. An ominous precedent is the dot com bust which also occurred after 15 years of outperformance of US equities and resulted in a decade of relative underperformance as write-offs and bankruptcies from excessive capital expenditure weighed on profits.

Bond markets are also beginning to show strain in the face of excessive government deficits. While it was central to US Treasury Secretary Scott Bessent’s economic strategy that the fiscal deficit be reduced to 3% of GDP, neither the current fiscal plans nor the growth prospects for the US economy suggest that this is likely to be achievable. Closer to home, the UK faces similar issues: a combination of weaker-than-expected growth, higher-than-expected interest rates, and the Government’s wafer-thin fiscal headroom have created a vicious cycle that will likely require some combination of tax increases and spending cuts later in the year. Even Germany has dropped its debt brake amendment to allow significant increases to spending on infrastructure and defence. Despite governments’ commitments to fiscal consolidation, it appears bond markets will have to prepare to digest a wave of issuance over the coming years.

The sheer weight of this issuance will create additional upward pressure on long bond yields even as many central banks reduce short-term interest rates to counter the economic slowdown. Whilst tariffs are likely to have a deflationary impact on the overall global economy, they will create pockets of inflation, not least in the US where retailers are likely to pass through a majority of price rises to consumers. These new relatively steep yield curves are a welcome opportunity. Whilst there is still scope for further curve steepening, historically purchasing long UK index-linked bonds above a 2% real yield has been a rewarding investment and we are watching developments in this market with interest.

It is true that markets will always face a degree of uncertainty. However, the present level of uncertainty faced by the global economy in the face of constant change to trade policy makes the possible outcomes for corporate profits, inflation, interest rates and global growth staggeringly wide. We expect that these conditions will continue for some time.

. . . . . . . . . . .

Tom Slater, investment manager, Scottish Mortgage Investment Trust, 22 May 2025

The Rise of AI and the Shifting Shape of Value

Few developments this year were more consequential than the rise of generative AI. The conversation has moved quickly from theory to practice. We see its impact most clearly in software engineering, where productivity is already rising dramatically. This matters because software sits at the core of the modern economy, and many of our companies are already putting these gains to work. Several have increased output without increasing engineering headcount. Others have launched new products with surprisingly lean teams. AI is not a distant promise. It is driving real operational leverage today.

How should we, as investors, respond to such a powerful, yet hard-to-quantify force? Our largest holding at the start of the year, NVIDIA, sits at the heart of the current AI boom. Its dominance in training large AI models is unmatched. However, to be truly transformational, we believe AI must become ubiquitous-and that implies commoditisation. A world built on $70,000 chips and 60% margins may not be sustainable. As a result, we chose to reduce our position significantly over the year. This does not reflect diminished respect for the company. It reflects our long-held discipline: we seek asymmetric outcomes. And at the prevailing valuations, the risk/reward looked more balanced than we prefer.

Resilience as a Strategic Advantage

In an environment defined by unpredictability, resilience is not a secondary virtue; it is central to long-term success. We are increasingly convinced that the companies most likely to endure and thrive are those capable of adapting. This means not just those with strong balance sheets, but with leadership teams willing to evolve, reallocate capital, and make difficult decisions without losing sight of their long-term mission.

This year brought a fresh reminder of how interconnected, and vulnerable, the global system has become. Just after our financial year end, the United States announced sweeping new tariffs on several of its key trading partners. The reaction from markets was immediate and severe. We are cautious about leaping to conclusions, but we do not view these developments as transitory. The underlying imbalances in the US and global economy whether in trade, debt accumulation, inequality or political cohesion are increasingly unsustainable. As Herbert Stein’s Law famously states, “If something cannot go on forever, it will stop.” It appears the current administration is accelerating that moment of reckoning.

Equity markets offer no hiding places in such a landscape. Few companies will be unaffected by a reordering of the global trading regime. What matters is how they respond. Our task as investors is to seek out businesses with the adaptability to recalibrate and the cultural foundations to withstand disruption. In this context, resilience becomes not just about enduring shocks but learning from them and emerging stronger.

. . . . . . . . . . .

James Harries, STS Global Income and Growth Trust, 21 May 2025

The re-election of Donald Trump to the US presidency has set off a chain of events that few could have predicted and whose long-term effects may be profound. Global capital markets are now reacting to communications from the president, or his acolytes, on a seemingly hour-by-hour basis. While our capital is allocated across the globe, all eyes are currently on the US following the announcement of the so-called reciprocal tariffs on the world. Given that the president appears to change his mind at will, it is somewhat thankless to make too many predictions about what may or may not happen. However, to maintain some perspective it may be worth putting the current market backdrop in some context.

The inclusion of China into the global trading system in 2001 and the development of an integrated globalised economy under the auspices of the Pax Americana, led to a shift in manufacturing to lower cost areas, a restructuring towards services in the developed world and the relative rise of China. While this may have been desirable from an economic point of view, by optimising the ability of economies to pursue their comparative advantage and companies their cost base, it has created imbalances and societal pressures. This dynamic was worsened by policymakers reducing interest rates to 0% and deploying Quantitative Easing (‘QE’)[2] which pushed up asset prices (for those with assets). The effect has been to denude the relative living standards of the least well off. It is into this despondency that President Trump is tapping.

The new US administration campaigned on a mandate of disrupting the status quo: geopolitically (via the threatened breakdown of the rules-based system of post-war international relations including the fraying of NATO), economically (through challenging the desirability of globalisation with the resurrection of protectionism via tariffs), and in currencies (where having the dollar as the world’s reserve currency is no longer seen as an exorbitant privilege but rather as a burden to the US). Each marks a seismic shift of direction if seen through to conclusion.

The valuation in the US market has been stretched in absolute terms and relative to government bond markets. This is at a time of economic and now political uncertainty. The US equity market represents about 70% of the global index and the Magnificent 7 around 35% of that. The pain of a reversal of these trends could be material to both investors who are over-exposed to this dynamic, as well as the economy, as declining wealth saps confidence and discourages spending.

. . . . . . . . . . .

Dan Higgins, manager, Majedie Investments, 21 May 2025

The second Trump administration believes that America’s medium-term prosperity depends on reducing the federal deficit and lowering the national debt as a share of GDP. Alongside efforts to slash government spending, a cornerstone of its economic policy is the imposition of tariffs on trading partners whom the President and his advisors believe have treated the U.S. unfairly.

Back to the Great Depression era

As tends to be the case with Trump, there is a kernel of intuitive logic to his actions. The instinct that persistent fiscal imbalances pose a long-term threat to prosperity is not unfounded. However, by upending the global trading system and traumatising the domestic economy, the manner of his actions is potentially damaging and counterproductive.

Even before ‘Liberation Day’ the new administration’s policies were hurting business sentiment and making long term planning challenging for companies. M&A activity stalled, and capital expenditure decisions were put on hold. US consumer confidence wobbled, with expectations dropping well below the threshold that usually signals a recession ahead.

What is most unsettling for markets is that a self-inflicted slowdown may be accompanied by resurgence of inflation. JP Morgan economists had projected that tariffs will result in a full-year GDP decline of -0.3%, down from an earlier estimate of +1.3%, and they put the odds of a recession at 60%. Following Trump’s announcement of a 90-day pause for ‘non-retaliatory countries’, those projections will presumably have to be revisited.

Aside from the daily tariff circus, trouble is brewing between Trump and Fed Chair Jerome Powell, who will demur from easing when inflation is on the rise. We also expect Congress to enact fiscal measures in due course, to mitigate the impact of tariffs on voters’ pockets before the midterm elections at the end of 2026.

Over the medium term, the Trump presidency may (ironically) have galvanised the other G7 countries into focusing on their shared priorities such as security, industry and trade. Europe, especially Germany, is meanwhile considering stimulus actions of its own. The ECB and Bank of England have more scope to ease monetary policy because the strength in their currencies is disinflationary at the margin.

Recent developments are, on balance, negative for risk assets.

While Trump sees the long-standing trade deficits as symptomatic of an abusive relationship, the global flow of capital has been hugely beneficial to the United States over many years. Since the Global Financial Crisis. Investors in Europe, the U.K., Japan and Canada have bought substantially more U.S. assets than Americans have invested abroad. Consequently, the U.S. Net International Investment Position (NIIP) has widened from -$2.6 trillion to -$23.6 trillion since 2009, while the Dollar index has risen from 93 to 121.

Previously, we highlighted the stretched valuations of many U.S. financial assets, a result of America’s prolonged economic and market outperformance, as well as the dominance of a handful of expensive mega-cap growth stocks within the market-cap-weighted indices. Even after the recent rout, U.S. stocks appear relatively expensive because the outlook for their earnings has deteriorated alongside falling share prices. Regardless of whether the Trump administration is following the usual tactic of taking an aggressive opening posture to negotiate from a position of strength, lasting damage has been done.

China has some room to manoeuvre. Roughly 20% of its GDP comes from exports, so tariffs will undoubtedly hurt. However, the US takes only 15% of China’s exports. Importantly, we expect stimulus to ramp-up following last month’s Twin Sessions, at which a package was announced that included a higher budget deficit (4% of GDP), 1.3 trillion Yuan in special treasury bonds, 4.4 trillion in local government bonds, and 500 billion for bank recapitalisation to support infrastructure, public services, and economic stability. For now, fiscal stimulus is preferred to a destabilising outright currency depreciation, especially as China seeks to build new regional trading alliances.

Meanwhile, last year’s measures are gaining some traction. Funds raised by real estate developers have turned positive, and new home sales in Tier-1 cities rose by +20% year-over-year. The latest PMI showed that factory orders expanded, suggesting exports were resilient in the face of initial tariffs. If only a portion of China’s vast domestic savings is channelled into consumption and equities, it would have major positive effects on a market where valuations are depressed, and allocators are underweight. There is no change to our (selectively) constructive stance on Chinese equities.

. . . . . . . . . . .

UK

Andrew Watkins, chair, CT UK High Income Trust, 29 May 2025

Global tensions have continued and there’s no doubt that more recent concerns over the tariff wars disrupting trade have contributed to the tricky economic situation in which the new Labour Government now finds itself. One must concede that the Government has a lot on its plate at the moment but some of the domestic issues it now faces are partly due to the Chancellor’s decisions in the autumn budget and the largesse she immediately bestowed upon the striking train drivers and doctors. Don’t for one minute think this has settled the problem permanently as this is likely to have merely strengthened their resolve to come back for more this year, and for other unions to follow suit. Additionally, there is already evidence that increasing the National Insurance contribution paid by employers is likely to dampen hiring over the medium term, reduce profits and stunt economic growth.

Similarly, I think the Bank of England has been extremely slow in recognising the cost difficulties faced in the “real world” by businesses and households, focusing almost solely on the 2% inflation target rather than easing the burden with lower interest rates. The Bank of England did reduce the key interest rate by 0.25% at its May meeting but, barring an annus horribilis, rates must come down further and faster this year, regardless of the predictable and almost inevitable variations in the monthly inflation numbers.

. . . . . . . . . . .

Ian Pyle, manager, Shires Income, 28 May 2025

The 2025/2026 financial year has certainly started with a high degree of volatility. A very active new US administration has turned global trade relations upside down in recent weeks, causing markets to swing one way or the other depending on the latest statements. As such, by the time we reach our AGM in July any outlook statement may be more redundant than usual!

Despite the short term unpredictability of markets, we are seeing some events happen that have been well flagged. After an almost unprecedented period of market leadership, US equities are struggling this year as concerns build around the strength of the domestic economy and the consumer in particular. While the potential for inflationary tariffs have acted as a catalyst for this, it would be no surprise if we saw a US downturn after such a strong period of growth. At the same time, international markets have held up well, helped by government stimulus in Europe and by much lower starting valuations. Given the extent of US outperformance in the last decade and the still extreme weighting of global equity funds to the US, we consider there is significant runway for this trend to continue. Diversification for all investors should be at the top of the agenda. Any holder of a global index tracker has around 70% of their assets in US large cap companies and April’s changes should be a trigger to look closely at that allocation.

Any change in equity allocation should favour UK markets – a small outflow from the US becomes a big inflow if it crosses the Atlantic. UK companies remain cheap on any objective measure and the high level of distributions should prove very attractive to investors at a time when market directions are uncertain. The opportunities in value stocks remain compelling in our view and we continue to steer in this direction. Low starting values protect the downside in the event of a recession while providing the potential for higher returns in the eventual cyclical upturn – even if great care is needed to avoid the value traps.

An important part of the portfolio positioning remains having an overweight exposure to UK small and mid-cap companies. This has not worked so far in 2025, with rising bond yields at the start of the year acting as a headwind to this part of the market. However, we remain convinced this is the place to be. The fundamentals for UK mid-caps have been robust and there are bargains to be found, with quality companies at very reasonable prices. The expectation is that we will see a faster pace of interest rate cuts from the Bank of England this year, and that will help government finances, allow bond yields to move lower and act as a tailwind.

A return to international and mid-cap outperformance would also likely benefit active management. While benchmarks and passive index trackers think in terms of market capitalisation, active managers tend to think about the opportunity set as more equally weighted. This matters – in the UK, the large cap FTSE 100 Index makes up over 85% of the FTSE All-Share Index by market-cap, but only 20% of the constituents. There are plenty of opportunities out there for the year ahead.

. . . . . . . . . . .

Linda Wilding, chairman, Odyssean Investment Trust, 28 May 2025

Although the uncertainties driven by the tariff announcements have created market volatility, at the time of writing, it feels like markets are past the point of peak panic.

Many of the share price moves of portfolio companies appear to have been driven on very low volumes, with the extent of price moves being amplified by low liquidity. After the initial “sell everything” knee jerk reaction, the market is beginning to realise that the impact on tariffs, particularly given the roll-backs announced, may not be as negative as originally anticipated. That said, uncertainty remains and until there is clarity on the direct and indirect impacts on companies, share prices of companies with international exposure are likely to remain depressed.

Notwithstanding these dynamics, sentiment towards UK equities appears to be improving. The strong performance of the FTSE 100 has been delivered despite outflows from UK-focused open ended funds, implying buying has been driven by international investors and global funds. It is unusual for UK large caps to outperform small and mid caps, and it bodes well for future absolute and relative performance of UK smaller companies, whose performance quite often lags rallies in their larger peers.

. . . . . . . . . . .

Nicky McCabe, CT UK Capital and Income Investment Trust, 28 May 2025

Without risking hyperbole, in recent decades it is difficult to think of a parallel for the current economic and geo-political situation and there is very considerable uncertainty as to how this will evolve. It is a truism to state that markets dislike uncertainty and this is causing a higher level of volatility in markets than during our first six months. However, it is a fair observation to note that the epicentre of the uncertainty is in the United States, and that is where the most negative impact on markets is currently being felt. In the UK, the Government’s large working majority signals to international investors that we are a relative haven of stability, so whilst the UK as a considerable trading and strategic partner of the US is not immune to events there and internationally, neither are we completely swept up in them.

It is certainly important for investors to focus on the long-term, to try to ignore the noise of current events and not to act hastily; historically, it has been the case that trying to get the timing of investments in and out of markets has been a less profitable activity than remaining invested in profitable businesses.

. . . . . . . . . . .

Imran Sattar and Emily Barnard, The Edinburgh Investment Trust, 20 May 2025

At the time of writing, equity markets have recovered much of the ground that was lost in early April after President Trump’s tariff plans were announced. The scale of any tariffs is yet to be confirmed and therefore the actual economic impact hard to predict. Nonetheless, the volatility in markets that followed the tariff announcements is another reminder of the short‑term challenges that investors face as the global economic order evolves. We feel more strongly than ever that a stock‑driven and flexible investment process, focusing on delivering attractive long-term total returns, is the best way of navigating the geopolitical and macroeconomic challenges to the advantage of shareholders.

. . . . . . . . . . .

James Henderson and Laura Foll, fund managers, Lowland Investment Company, 14 May 2025

Tariffs are the current concern for investors and if imposed as currently suggested will lead to downgrades in economic activity and higher inflation. The biggest losers could ironically be the American consumer so there is a chance the tariffs will be reduced in the coming months. The UK escapes relatively unscathed. The cheapest stocks in the UK are usually domestic earners and these are well represented in the portfolio. They are also the companies least affected by Trump’s tariffs. They might even be indirect beneficiaries as reduced global economic activity will bring forward interest rate cuts. These cuts will be useful to UK businesses and should divert cash from bank deposits into the stock market. The dividend yield from equities coupled with low valuations may attract investment support.

. . . . . . . . . . .

Sarika Patel, chair, abrdn Equity Income, 14 May 2025

The reporting period ended two days before President Trump declared 2 April 2025 as “Liberation Day” and initiated a week of some of the most volatile markets we have seen in the last 15 years – the 5.0% fall in the FTSE 100 Index on Friday 4 April 2025 was the fourth largest daily drop in the market since the global financial crisis in 2008. Investors were clearly unnerved by the idea that “tariffs” might be anyone’s favourite word. As is often the case the initial knee-jerk reaction to an exogenous event caused a sharp drop and then a time of reflection.

Investors adjusted to the new landscape and the UK’s success in maintaining a favourable trading relationship with the US may have contributed to the outperformance of UK indices relative to international counterparts as investors looked to stocks with less exposure to the US. As a consequence, at the time of writing, we have seen the FTSE 250 Index deliver a total return of almost 17% since the markets bottomed on 9 April 2025, outperforming the FTSE 100 and FTSE All-Share indices. It is early days, but the announcement of a US/UK trade deal on 8 May 2025 and a US/China trade agreement on 12 May 2025 suggests that tariffs will have a less pronounced barrier to international trade than had been forecast only one month ago.

President Trump’s tariff policies continue to evolve, raising the risk of further equity market volatility throughout the next four years. Having said that, these are precisely the conditions in which active management can have a positive impact, cutting out the macro noise and instead focussing on the corporate fundamentals. Valuations can become temporarily depressed and this can provide a wide range of attractive stock-level investment opportunities.

. . . . . . . . . . .

Managers, Schroder Income Growth, 13 May 2025

US exceptionalism, riding high at the turn of the calendar year, has been replaced by policy uncertainty of unprecedented levels. President Trump 2.0 has sought to change the world order on both trade, and security and defence. There are truths at the heart of both these issues – that the US has borne more than its fair share of costs but also benefitted from buying goods cheaply from the rest of world, whilst the rest of the world funded the US government through purchases of US Treasury bonds and US dollars. President Trump’s so called “reciprocal tariffs” were larger and more wide ranging than had been anticipated. This resulted in significant volatility in global equity markets and the US bond market during April, together with weakness in the US dollar.

The impact of President Trump’s approach to defence spending, and attempts to resolve the ongoing conflict between Russia and Ukraine, has succeeded in spurring European countries to commit to future increased spend on defence, in absolute terms and as a proportion of their GDP. The newly elected German government has released its fiscal debt brake and looks set to spend significant sums on defence and infrastructure projects which could, all other things being equal, provide a boost to the German and European economy.

Bond markets tested the US administration’s resolve. Sharply rising yields provoked a U-turn from Trump when on 9 April he announced a 90 day pause on tariffs for all but China. This, together with moves to carve out specific sectors with targeted tariffs, such as consumer electronics and autos, may be sufficient to have cut the tail risks of a major recession, however many possible outcomes, and risks remain. At the time of writing, there are signs of a thaw in US – China relations, as well a proposed deal between the US and Ukraine on minerals.

President Trump’s “Liberation Day” was followed by a blizzard of announcements, U-turns, 90 day reprieves, and escalation of tariffs against China. The situation is fluid and ongoing, we anticipate there could be several more twists and turns and that de-escalation is likely. There will likely be much debate over the path of the US and thus global economy. In the shorter-term, inflation expectations have increased, consumer and business sentiment has declined and slower growth is expected. The rest of world could see a slowdown in the rate of inflation – from falling energy costs, exchange rate movements, and as goods previously destined for the US get redirected to other countries. Interest rates outside of the US could fall further and faster than previously anticipated. Your Investment Managers anticipate that central banks around the world stand ready to respond with accelerated rate cuts, as necessary. The markets are currently pricing between three and four cuts, of one quarter of a percent, in Europe, the UK, and the USA. The US Federal Reserve will likely tread more carefully until the US economic situation becomes clearer.

It is too early to know whether the events of the past few weeks of President Trump’s presidency will lead to a reassessment of asset allocation on the part of investment managers seeking to diversify from their portfolio concentration in US assets.

Meanwhile flows out of UK equities have continued at pace over the first quarter of 2025. These outflows have continued to weigh on valuations, particularly at the small and mid-cap end of the market spectrum. This has spurred a wide range of companies to use their surplus cash to commence or extend buying their own shares for cancellation. Your Investment Managers view UK equity market valuations as having more cushion to absorb disappointment than the more highly valued US equity market – where downside risk is neither priced into market earnings expectations nor valuation multiples. By contrast, the UK equity market has been long unloved. At current prices it trades at valuations which are a 20% discount to both its own long run history and other international equity markets. It would not take much, for even a small move out of US equities were it to be redirected towards the UK market, to move the dial on valuations.

The UK economic backdrop has remained one of sluggish growth and moderating inflation. Increased employment costs, including the National Minimum Wage and National Insurance costs from April 2025, are an inflationary pressure. However, sterling’s strength against the US dollar, together with falls in oil prices and energy costs, and an element of redirected goods no longer destined for the large US consumer market, if sustained, could provide an offset. Corporate and consumer balance sheets are in good health with household savings rates of 12% at 25-year highs, except for the Covid period. According to Computershare, UK dividend prospects for 2025 are “relatively muted” with lower special dividends but median growth at the company per share level expected to continue around 4%. Exchange rate movements, if sustained, would moderate that growth from the market. Your Investment Managers continue to see attractive long-term opportunities in under owned and under researched areas of the UK equity market – particularly in domestic and smaller sized companies where share price performance has lagged that of larger sized companies and other equity markets.

. . . . . . . . . . .

Ronald Arnold, chair, BlackRock Smaller Companies, 7 May 2025

It is my belief the UK small and mid-cap market is at a critical juncture. Outflows persist, placing continued pressure on share prices and by definition on the valuation of those companies that remain listed. Government policy, particularly with regards to AIM and Inheritance Tax, places further distortions. In light of these pressures, management teams are voting with their feet, either choosing to list somewhere else or delay any capital market activity, whilst would be acquirers are taking advantage of the valuation anomalies the listed market is unable to seize, and purchase companies at very attractive prices. The UK needs a period of stability, enough to make long term investors once again consider the opportunity the UK market offers, and for companies to have confidence that London is a suitable listing venue. The current global political climate may just be the catalyst that starts this process of reassessment.

. . . . . . . . . . .

Asia ex Japan

Sir Richard Stagg, chair, JPMorgan Asia Growth and Income, 29 May 2025

Effective levels of tariffs may prove to be lower than initially threatened but it is likely that economic growth will be slower than previously expected. Uncertainties around the broader geopolitical landscape are unlikely to dissipate. None of this is good news for investors.

That said, there are ample reasons to be optimistic about the opportunities offered by Asian equities in relative and absolute terms. Asian economies will continue to grow more rapidly than their Western counterparts, where lacklustre growth is likely to be further diminished by the threat of a trade war. Most important, the Chinese authorities are trying to stimulate their economy which is showing some signs of recovery. This should be good for regional growth, as will interest rate cuts by Asian central banks. In addition, the launch of DeepSeek serves as a reminder of how rapidly artificial intelligence is evolving. This, combined with the more general trend towards digitalisation should provide further impetus to regional growth and improved productivity. At the corporate level, an increasing focus on improving governance is lifting shareholder returns in Korea and China via increased dividends and share buybacks. We hope that this is an example which other Asian markets will follow.

It is important to bear in mind that market volatility, whether generated by near-term geopolitical disturbances or longer-term structural change, almost always creates opportunities for watchful, nimble and well-informed investors.

. . . . . . . . . . .

Abbas Barkhordar and Richard Sennitt, Schroder AsiaPacific Fund, managers, 27 May 2025

Perhaps of greatest concern for investors in Asia at the time of writing is the uncertainty around the impact on countries in the region – and China in particular – from the punitive tariffs announced by the Trump administration on ‘Liberation Day’, 2 April 2025. While the absolute level of tariffs is clearly important, the lack of clarity over policy objectives and the scope for negotiation have caused a significant amount of investor uncertainty. Previous experience suggests that White House announcements can quickly be reversed, changed or abandoned, creating a very difficult environment for both market participants and companies making long-term investment decisions.

While the barriers to trade and investment have already risen, the ultimate extent and specific targets of these restrictions remain hard to predict. One silver lining here could be that higher tariffs on China make other Asian exporters more competitive, but President Trump’s approach to trade has so far shown little distinction between allies and adversaries. Any country with a bilateral trade surplus with the US may still be at risk of further measures. With exports a key driver for regional earnings, the path of US trade policy – and its implications for the strength of the US economy – will remain a central focus for Asian markets, especially given that the size and scope of tariffs announced to date have materially exceeded expectations.

Another key driver for Asian markets will be the path of US interest rates and the strength of the US dollar in coming years. Global bond and currency markets have already started to price in a ‘higher for longer’ rate outlook, driven by the US administration’s protectionist and expansionary fiscal policies, which are expected to lead to stickier inflation. This reassessment, together with an improved outlook elsewhere, had seen the dollar actually weaken earlier in the year – a move that had supported Asian markets in line with historic precedent, at least until the disruption caused by Liberation Day tariff announcements. Higher US interest rates would likely prove a headwind for countries with weaker external balances, including some ASEAN markets, but they could be a tailwind for other areas, including many Asian financial stocks.

Within the region, the Chinese economy remains weak, with consumer confidence still extremely low and the property market weak. Although the government has announced further support measures – including expanding subsidies for home appliances, electric vehicles and other consumer products – these remain modest in scale and are unlikely to drive a meaningful recovery, given the broader backdrop of weak private credit growth and other persistent structural challenges.

More recently, the excitement around the launch of DeepSeek’s new AI model and what appears to be a more constructive approach towards the private sector, have raised hopes that we could see an improvement in ‘animal spirits’ across the broader economy. Some investors also anticipate a more aggressive fiscal response from the government once there is greater clarity on the tariffs facing Chinese exporters under the Trump administration. However, there is scope for disappointment if this stimulus fails to materialise.

Meanwhile, the surprise addition of internet platform Tencent and battery maker Contemporary Amperex Technology (CATL) to a US Department of Defence list of Chinese military-linked companies has further highlighted the ongoing geopolitical risks facing Chinese companies, underlining the fragile and uncertain external environment.

. . . . . . . . . . .

Eruope

Stefan Gries and Alexandra Dangoor, BlackRock Greater Europe, 6 May 2025

We remain optimistic on European equities as we move forward. We see several building blocks that could lay the foundation for the recently seen outperformance of the asset class to extend. To start with China, at least temporarily, should turn from a headwind into a tailwind for European companies as the Chinese economy gradually stabilises, benefiting global demand for European goods and services. In Northern Europe, construction activity is picking up after three years of weak construction volumes and activity finally reaching a trough. Increased spending on renovation projects and the potential for lower interest rates should lend further support.

Additionally, we see the manufacturing sector beginning to bottom out, with end markets showing signs of recovery, which should drive growth across key industrial sectors. Stronger domestic earnings from European companies further bolster this optimistic outlook, as many firms continue to report solid results.

On the political front, the new US administration appears to have created a greater sense of urgency among European policymakers, leading to an understanding that now is the time to act to address some of Europe’s structural issues. Germany’s plan for increased infrastructure spending and the growing commitment from European countries to boost defence budgets highlight a more proactive approach, which bodes well for long-term growth. With the ongoing rate-cutting cycle providing additional support, these factors collectively point to a more favourable environment for European equities moving forward.

Finally, at the time of writing, uncertainty around the US tariffs remains high and we are likely to see soft-data, such as US consumer sentiment, continue to deteriorate while corporate reporting and outlook statements will likely point to a wider range of possible outcomes. All of which brings expectations for heightened volatility.

. . . . . . . . . . .

Japan

Nicholas Weindling, Miyako Urabe and Xuming Tao, investment managers, JPMorgan Japanese Trust, 28 May 2025

While the market has performed strongly over the past two years, we believe the transformation underway in Japan is still in its early stages. The full impact of corporate governance reforms and other structural changes, such as increased focus on capital efficiency and shareholder returns, has yet to be realised, and these shifts should continue to support investor interest well into 2025 and beyond.

International interest in Japan remains elevated, shareholder activism is gaining traction, and M&A activity, particularly unsolicited bids, is on the rise, all of which reflect growing confidence in the market’s evolving landscape.

That said, risks remain. Chief among them are uncertainties related to U.S. trade policy. Japanese automakers are especially vulnerable to potential tariff increases; accordingly, we currently have no exposure to companies with significant U.S. auto sales. We also manage currency risk carefully, maintaining a well-balanced portfolio that can adapt to external shocks.

It is important, however, not to overstate these risks. Trade negotiations are ongoing, and any eventual tariffs may be less severe than initially feared. Moreover, Japanese corporates benefit from strong balance sheets and operational resilience, positioning them to withstand short-term disruptions. Market volatility, when it arises, provides opportunities to acquire exceptional businesses at more attractive valuations.

. . . . . . . . . . .

Global emerging markets

Katrina Hart, chair, BlackRock Frontiers, 28 May 2025

Markets are currently grappling with heightened geopolitical volatility and unprecedented macroeconomic shifts that have global ramifications. The impact of yoyo-ing US tariffs on global trading relationships is a key concern for markets, with economists downgrading growth forecasts and interest rate expectations turning more dovish. The outcome of the tariff negotiations is still unknown. Since ‘Liberation Day’ on 2 April, the US dollar has been notably weak, but this could reverse if the Trump administration’s policies exert upward pressure on US inflation, which may have a knock-on negative impact on emerging markets. The outcome of Trump’s unpredictable foreign policy is highly uncertain and our portfolio managers expect to see continued volatility as we move through the second half of the financial year. Although not immune to the geopolitical turmoil created by Trump’s desire to reshape global trade relationships, our portfolio managers believe the markets in which they invest will continue to be driven to a significant extent by local factors and by domestic investor flows, thereby potentially offering investors diversification benefits. In addition, several of our markets may become beneficiaries of the rewiring of global supply chains, in particular the shifting of manufacturing away from China as existing US/China tensions are exacerbated by the imposition of trade tariffs and inevitable retaliation by trade partners. Indeed, our unique mandate should become increasingly attractive to investors seeking diversified ex-China exposure as they finally pivot away from the US.

Another positive trend within our investment universe is the marked increase in intra-emerging markets trade. Whilst the developed markets are concerned with the impact of the trade tensions and protectionist policy, the emerging markets have recently seen an increase in intra-country trade, in Asia in particular. For example, countries such as Vietnam and Indonesia, to which our portfolio is well exposed, have benefited from their ability to act as regional trade hubs. This trend is set to continue, driven by increasing domestic demand, regional free trade agreements, and robust economic growth.

The frontier markets comprise a large and diverse range of countries which are under-researched, generally have relatively low levels of foreign debt, higher yields and superior demographics compared with more developed economies. In many cases they trade at significant valuation discounts relative to both developed markets and their own history.

. . . . . . . . . . .

South Korea

Weiss Korea Opportunity Fund, 15 May 2025

In our 2024 Half Yearly Report, we mentioned that investors might gain more clarity on South Korea’s Corporate Value-Up Programme (CVUP) by the end of the year. However, despite some periods of optimism, the CVUP still lacks clarity and effectiveness. A large part of this was due to increased political turmoil in South Korea towards the end of 2024.

President Yoon declared martial law, which was later revoked, leading to two impeachment proceedings. After President Yoon was impeached, the National Assembly also sought to impeach acting President and former Prime Minister Duck-soo Han for his role in the martial law order and his lack of cooperation during the impeachment process; however, he has since been reinstated.

This political instability has temporarily hindered the government’s ability to function effectively and damaged the nation’s international reputation. The economic impact is already being felt in South Korea’s heavily export-oriented economy. Most notably, the South Korean won has depreciated significantly against the U.S. dollar, prompting the National Pension Service to implement a “strategic currency hedging” practice using up to 48.2 billion U.S. dollars in foreign currency reserves. Additionally, there were net foreign outflows of 9.7 billion USD from the South Korean stock market in the fourth quarter. In December alone, during the brief declaration of martial law and the ensuing impeachment process, foreign investors sold 3.86 billion USD worth of South Korean securities, marking the largest monthly foreign outflow since March 2020. Furthermore, although acting President Choi has publicly supported the Corporate Value-Up Programme, it remains unclear how committed the post-Yoon South Korean government is to corporate governance reforms.

The “Korea Value-Up Index” is considered one of the three main components of the Corporate Value-Up Programme (CVUP). According to the Korea Exchange (KRX), this index is designed to highlight local companies that follow best practices in corporate governance and take steps to enhance shareholder value. Some investors consider the development of this index encouraging, especially if the National Pension Service (NPS), South Korea’s largest pension fund, decide to use it as a long-term benchmark.

However, when the KRX launched the Value-Up Index on September 25, which included 100 listed companies from the KOSPI and KOSDAQ, it was criticised for being an underwhelming selection with inconsistent standards. In response, the KRX announced plans to actively reconsider the standards used for selecting companies in the index.

One potentially positive development in corporate governance this year is that lawmakers have voted to expand the fiduciary duties of corporate boards to include responsibilities to shareholders, not just the company. The National Assembly, controlled by the opposition, passed a bill to amend the commercial code, but it faces possible veto by Acting President Choi Sang-mok. Proponents argue that the reform will restore market confidence and align corporate actions with shareholder interests. Opponents, including the ruling party and business groups, believe the change will lead to an increase in shareholder lawsuits and negatively impact the national economy.

Finally, protectionist trade policies under the Trump administration pose significant risks to the profitability of South Korea’s leading companies. The U.S. government raised concerns about trade imbalances with countries including South Korea and announced its intention to use tariffs to address them. Duties were imposed on steel and aluminium—directly affecting manufacturers such as POSCO (currently not a WKOF holding). Separately, broader “reciprocal” tariffs of 25% on South Korea were announced in April before being reduced to 10% temporarily. Given South Korea’s economic reliance on large conglomerates (“chaebols”), these trade actions could have ripple effects across the broader economy. The complex network of subsidiaries and supply chains within chaebols means that tariffs on one part of the group can indirectly impact the entire organisation.

. . . . . . . . . . .

Biotechnology and healthcare

James Douglas and Gareth Powell, co-managers, Polar Capital Global Healthcare, 22 May 2025

Near-term considerations: Slowing economic growth?

Wherever you look, the economic outlook is clouded with uncertainty driven by potential global trade frictions, geopolitical tension, a depressed consumer and rising unemployment. This is an uneasy backdrop made even more challenging by confusing messaging from the Trump administration, not just on tariffs but on cost savings being driven by DOGE (Department of Government Efficiency) that could adversely impact several government agencies, including those directly involved in healthcare policy. The uncertain macroeconomic backdrop has benefitted the healthcare sector, as witnessed by the outperformance versus the broader market during the first three months of 2025. That outperformance could continue if the macroeconomic uncertainty lingers on given the healthcare sector is defensive and composed of a broad and diversified universe of businesses with many different end markets and operating models. Importantly, if the concerns of a stagflationary environment persist, the more mature mega-cap companies, with high gross and operating margins, will become more attractive on a relative basis.

Key themes: Access and affordability, China and artificial intelligence

In last year’s annual report, we outlined three key investment themes which offered the potential for significant returns. As a reminder, those themes were access and affordability, reimbursement of Artificial Intelligence / Machine Learning-enabled technologies and China. Broad access and affordable treatments are essential for not only the sustainability of healthcare systems globally but also societal wellbeing. There are many levers that can be used to widen access and control healthcare budgets, but we focus on two key areas: the widespread utilisation of low-cost medicines and the adoption of AI and ML technologies to generate efficiencies and to also complement existing technologies to drive superior results. We also believe that China has the potential to be an interesting recovery story driven by, amongst other things, government stimuli.

Access and affordability: Promoting healthcare equity and driving better outcomes

Broad access and affordability are critical for both medical and financial health, with a key driver being the availability of low-cost, high-quality medicines. For context, generic drugs and biosimilars account for c90% of all US prescriptions but represent only 13% of spending, offering clear evidence of the value that low-cost, high-quality medicines bring to patients, healthcare systems and government budgets alike. As such, it is imperative that regulators and manufacturers continue to work together to ensure long-term sustainability for the generics and biosimilars industries. In terms of investment opportunities, the primary beneficiaries are the companies involved in the manufacture and distribution of biosimilars, with the second derivative beneficiaries being the life sciences tools and services companies that provide the equipment and reagents used during the quality control and manufacturing processes.

. . . . . . . . . . .

Alisa Craig and Marek Poszepczynski, portfolio managers, International Biotechnology Trust, 12 May 2025

The structural growth drivers underpinning biotechnology remain firmly intact. As populations become older, richer and sicker, demand for healthcare innovation continues to rise. Against this backdrop, it is clear that biotechnology must continue to play a central role in delivering both significant societal benefits and attractive investment opportunities.

Despite these long-term tailwinds, biotechnology valuations remain at compellingly low levels, particularly among small and mid capitalisation companies where we believe the opportunity for future growth looks significant. We believe 2025 is shaping up to be a major year for product launches, with several portfolio companies bringing their therapies to market independently without additional marketing and distribution muscle from a pharmaceutical partner. This is perhaps a reflection of the recent M&A lull, but these businesses are obvious bid targets for large pharmaceutical companies looking to replace revenues that are under threat from patent expiries, should the industry’s appetite for deals return.

Biotechnology remains the engine of healthcare innovation, with 70% of new drug approvals now originating from the sector. Ten years ago, the inverse was true, with 70% of new drug approvals emanating from big pharmaceutical R&D. One of the few missing ingredients in an otherwise attractive backdrop has been IPO activity, which has remained subdued since the speculative wave of 2021. The return of IPO activity would be a welcome development, but we do not view it as essential for the sector to perform well.

Ironically, the paucity of IPOs has contributed to a steady decline in the number of constituents in the Reference Index. This should not be mistaken for a lack of opportunity – on the contrary, it reflects a ‘survival of the fittest’ dynamic which results in a stronger set of businesses that are better positioned for long-term success.

Although healthcare did not feature prominently in the US election campaign last year, President Trump’s victory has introduced elements of uncertainty for the biotechnology sector. This has been exacerabated by the new tariff framework, where the pharmaceutical sector was not included in the first wave of announced tariffs. The sector’s complexity means that more analysis is required and the expectation is that it will be a few months before any clarity on pharmaceutical tariffs emerges.

As mentioned previously, the appointment of Robert F Kennedy Jr unsettled the market due to his history of vaccine scepticism. More broadly, other key appointments for the sector, such as Dr Martin Makary for Commissioner of the FDA and Dr Jayanta Bhattacharya for Director of the NIH, initially appeared relatively benign. However, recent changes to senior management at the FDA alongside widespread staffing cuts, have caused some market turbulence and, in combination with the prospect of tariff impositions, may continue to do so. In addition, NIH funding cuts are already being implemented, with grant terminations and budget reductions affecting some early-stage research and academic institutions. While this could create near-term challenges for companies reliant on early-stage funding, we believe the strongest and most innovative biotechnology businesses will continue to attract capital and advance new treatments.

The Inflation Reduction Act (IRA), introduced by the Biden administration, is expected to remain in place, though discussions about possible modifications are ongoing. These could ease pressure on the healthcare sector, but legislative changes would take time and remain uncertain. It is worth noting that during President Trump’s previous term, the biotechnology sector experienced a 40% increase, suggesting that political uncertainty does not necessarily prevent the sector from outperforming.

. . . . . . . . . . .

Infrastructure

Manager, Ecofin Global Utilities and Infrastructure, 23 May 2025

The valuation of some parts of the stock market may be high but listed infrastructure is still undervalued by historical standards, relative to broad market averages and compared with valuations of private infrastructure assets. We saw a partial rerating in March as the market took a more defensive stance, but the sector continues to trade well below relative historical averages. We believe the valuation gap will narrow further as infrastructure company fundamentals remain positive against market uncertainty.

Our strategy’s investment universe comprises businesses providing infrastructure and services essential for economic activity and progress. Serious weather events make modern, durable infrastructure all the more important, and climate risk mitigation is fundamentally reliant on infrastructure companies investing to facilitate the transition to a cleaner world. The world now invests almost twice as much annually in clean energy as it does in fossil fuels. This growth is underpinned by strong demand, continued cost reductions, emissions reduction goals and considerations of energy security. Companies developing, owning and operating the infrastructure behind the energy transition will, we expect, continue to be areas of profitable opportunity.

Transportation infrastructure and environmental services (water and waste management) businesses have limited competition and good pricing power, operational performance is strong, and they contribute to portfolio diversification. Stock valuations in these infrastructure segments are still low.

. . . . . . . . . . .

Private equity

Richard Hickman, managing director, HarbourVest Global Private Equity, 29 May 2025

The US administration’s evolving tariff policy has temporarily dampened private market deal activity as buyers and sellers pause to assess the full impact. Both the heightened economic uncertainty and trading disruption faced by companies could lead potential buyers to pull back from the market or apply higher risk premiums when pricing assets. This may result in a widening of the bid-ask spread and a reduction in private market exit activity.

While we wait for this uncertainty to abate, we remain optimistic that the resilience and long-term horizon of private capital will continue to deliver more advantageous returns than public markets. In fact, the current market dislocation presents buying opportunities for secondary managers, such as HarbourVest, when private market investors seek to free up capital or rebalance their portfolio exposures.

Market indicators show there is some cause for cautious optimism. Venture capital rounds in the US and Europe appear to have bottomed out1 and there has been a healthy flow of new venture deals, particularly in the AI space, indicating there is still a selective demand for high-quality assets in specific attractive sub-sectors. Falling interest rates and the recovery of broadly syndicated loans as a viable source of debt have resulted in credit spreads tightening for senior private credit, which should help facilitate a broader range of new buyout deals.

Additionally, there is evidence that the prolonged period of reduced transaction volume in the buyout market has helped converge buyers’ and sellers’ pricing expectations. GPs also have access to a significant amount of uninvested capital, which they are under increasing pressure to deploy. Prior commitments from LPs are continuing to age, with approximately 26% of buyout funds’ available invested capital now being four or more years old2. These dynamics could drive a renewed upturn in deal activity, which would bode well for liquidity in HVPE’s portfolio if the uncertainty around tariffs were to subside.

Turning to the listed private equity market, a resumption of the upward trajectory for exit activity seen in Q1 would provide increased liquidity for share buybacks while enabling a greater level of new investment in attractive opportunities. This process of reinvestment while maintaining a balanced vintage exposure is vital to the sector being able to create long-term value for investors. Furthermore, given the healthy uplifts to GP valuation marks at which private market exits are typically completed, this activity will likely help allay the valuation scepticism which has been a key factor in the persistently wide discounts observed in the listed PE sector in recent years.

. . . . . . . . . . .

Property

Helen Gordon, chief executive, Grainger

The UK Labour government is proving its commitment to supporting economic growth and investment, specifically by stimulating new housing delivery. We are heavily engaged in positive dialogue with policy makers and there is clear, strong support for build-to-rent (BTR), recognising the important contribution businesses like Grainger can make to the UK housing market. Proposals to improve and speed up the planning process are welcome, as are proposals to strengthen recognition for BTR within the planning system.

The Renters’ Rights Bill, entering its final stages of debate and scrutiny in the House of Lords, will professionalise the rental market and raise standards, something that Grainger has been forging the way forward for many years. Grainger, in the main, is already aligned to the new legislative landscape with our focus on high management standards, good quality customer service and high-quality, energy efficient properties. We are very well positioned to continue to perform strongly. That said, it is likely that many smaller, private individual landlords will find the new regime challenging and will therefore accelerate their exit from the market, further constraining supply.

Clarity on the Renters’ Rights Bill, a resolute commitment from government opposing rent controls, and support from government for growing the BTR sector means Grainger is in a strong position to continue to grow.

. . . . . . . . . . .

Mark Allan, chief executive, Land Securities

In major retail, the top 1% of all shopping destinations in the UK provide brands with access to 30% of all in-store retail spend. As close to 90% of our retail assets are in this top 1%, brands continue to invest in space with us, focussing on ‘fewer, bigger, better’ stores in the best locations. Any pressure on brands’ margins from increased NI costs or wider economic uncertainty will likely sharpen this focus further and put more pressure on the tail-end of brands’ store portfolios. As our occupancy is now higher than it was before Covid, we expect rental value growth this year to be around similar levels as last year.

In London, office utilisation across our portfolio continues to grow and customers are now planning for c. 25% more space per person than five years ago, with c. 80% of our lettings over the past year having seen customers grow or keep the same space. In the near future, new supply across London is modest, so we expect our rental values this year to continue to grow at a broadly similar rate as they did last year. This also bodes well for our two committed developments, Thirty High and Timber Square, where we expect to see first pre-let activity in the second half of this year, in line with our underwrite assumptions.

Meanwhile, in residential, we have created a £3bn development opportunity to build scale in a sector with strong structural growth characteristics, attractive real returns and much lower volatility. The attractive long-term prospects in this space should enhance our sustainable income and EPS growth over time.

The trends that have supported our strong operational performance over the past few years remain intact, even though the global economic outlook has become more uncertain in recent months as a result of shifting US trade policy. We are mindful of the disruption this can cause but, as a purely UK focused business with an existing customer base that is primarily focused on successful omnichannel retail brands, professional services and financial services and a development pipeline which is increasingly focused on residential, we are not seeing any impact on customer demand or financial performance.

In investment markets, we continue to see a steady pick-up in activity across the UK and increasingly in London offices, albeit from a low base. The outlook for long-term interest rates is more relevant than the outlook for base rates, but for assets where there is an opportunity to drive income growth in the coming years, such as our best-in-class portfolio, there appears to be a growing understanding amongst investors that real returns look attractive relative to real interest rates. Absent any major economic shocks, we expect this will continue to underpin valuations for such assets as investment activity recovers further.

. . . . . . . . . . .

Michael Morris, chief executive, Picton Property

Political decisions are influencing the economic backdrop. The US government’s tariff announcement in April caused significant disruption in financial markets and downgrades to economic growth forecasts globally. The situation remains fluid, with the 90-day implementation delay and the more recent announcement of a temporary tariff reduction between the US and China resulting in an equity market recovery.

For the UK, exports to the US account for a relatively small percentage of overall Gross Domestic Product (GDP). Certain industries are likely to face direct challenges, while indirect effects may arise from weakened global demand and heightened trade uncertainty. On a relatively positive note, if the tariffs are enforced following the 90-day delay, the 10% rate on most UK goods is comparatively lower than what has been suggested for many other nations.

In 2024, UK GDP is estimated to have grown by 1.1%, placing the UK third in the ranking of G7 economies. This compares to the 0.4% recorded for 2023. With mounting concerns over US tariffs, public borrowing and fiscal rules, in the Spring both the Office for Budget Responsibility and the Bank of England halved their GDP growth forecasts for 2025.

Since August 2024, inflation has remained close to the Bank of England’s 2% target, with the annual Consumer Prices Index (CPI) standing at 2.6% in March 2025. The Bank of England began its rate-cutting cycle in August, implementing four 25 basis point reductions, which have brought the base rate down to 4.25%. The five-year SONIA swap rate has decreased to 3.8%, compared to around 4% a year ago. In January, concerns over public finances and the UK’s economic trajectory led to a sharp rise in the ten-year gilt yield, which surged to a post-Global Financial Crisis high of 4.9%. It has since fallen slightly, but remains above the ten-year average.

Businesses are contending with uncertainty as well as escalating costs, as the tax increases announced in the October budget took effect in April, potentially impacting expansion and hiring decisions. Recent data from the Office for National Statistics recorded a further softening in employment; in March payrolled employees decreased by 78,000 (0.3%) on the month to 30.3 million. The number of job vacancies fell for the thirty-third consecutive quarter to 781,000. The unemployment rate is now 4.4%, in line with the ten-year average.

The consistent increases in the household savings ratio since September 2022 reflect the impact of underlying economic uncertainty felt by consumers. Recent retail sales data has been more positive than expected, although thought to be attributable to unseasonably good weather. The April GFK Consumer Confidence Barometer recorded declines across all measures compared to the previous month, indicating that this level of consumer spending growth may not last. However, in real terms, wages continue to show a steady increase; for the three months to February, regular and total pay grew by 1.9%.

Whilst the situation with US tariffs continues to evolve, the outcome could have a disinflationary effect on the UK, potentially prompting a faster reduction in the base rate than anticipated. Furthermore, unlike other recent market shocks, the tariffs are a voluntary measure and could be reversed as quickly as they were announced.

With inflation no longer a pressing concern, the Bank of England’s decision to lower interest rates now depends more on economic growth forecasts and labour market data.

The UK’s high level of market transparency, coupled with comparative stability, low inflation and interest rates, continues to make it an attractive market for global investors, and well placed to capitalise on any positive momentum during a recovery in commercial property pricing.

. . . . . . . . . . .

Andrew Jones, chief executive, LondonMetric

The global economic outlook has changed significantly over recent months and continues to set the scene for the investment market. The US president’s ‘Liberation Day’ tariffs have created significant volatility in the global bond and equity markets as investors have looked to assess the longer-term impact of deglobalisation and increased protectionism. How this plays out is too difficult to predict, particularly with ongoing uncertainty from elevated inflation and geopolitical events, but lower growth is an inevitable outcome and a widespread global economic slowdown is being assumed by the markets.

For the UK, there are material risks to economic growth and a range of potential outcomes for inflation. The impact of recent rises in utility prices, national insurance costs, national living wage and above trend wage growth continues to add to inflation pressures that have persisted for several years. However, there is also potential for a disinflationary impact from tariffs from factors such as weaker commodity prices, lower input costs and a stronger currency.

For the UK consumer, what particularly matters is the impact of all this on future interest and mortgage rates. After hitting an inflexion point during the year and having been cut four times since, a further decline in interest rates is widely expected which could provide some cheer to the UK consumer; the same can’t be said for the US consumer.

Interest rates remain the yardstick against which most investments are measured. Consequently, sentiment in the real estate sector continues to be largely driven by the outlook for five-year swap rates and 10-year gilts. Unsurprisingly, after a recalibration of valuations over the last few years and with five-year swap rates now nearer 375bps compared to over 400bps a year ago, sentiment has improved and valuations have moved upwards across most real estate sectors.

Total UK real estate investment activity was over £50bn in 2024, a 23% increase on 2023. This increased level of activity has continued into the first quarter of 2025 with £15bn of transactions, reflecting a 75% increase year on year. There has been healthy activity across the ‘winning’ sectors, as well as growing popularity for warehouse assets; both distribution and retail. There have also been signs of activity in the London office and shopping centre markets, albeit at prices materially below previous valuations which reflects motivated vendors, falling rental values, growing capex requirements and expanded yields. However, the ‘traditional’ sectors accounted for only 46% of all investment activity in 2024, which is the lowest on record, and a number of high-profile office and shopping centre transactions have been pulled as bids received did not meet sellers’ inflated expectations.

We continue to see significant capital sit patiently on the sidelines awaiting greater macroeconomic and geopolitical clarity. With current swap rates continuing to rule out many debt funded buyers, we are seeing the greatest liquidity for smaller lots sizes. Our view remains that normal liquidity won’t return until five-year swap rates fall closer to 300bps to derive an all in cost of debt of c.5%, a level that allows most debt led real estate transactions to work; we’re a lot closer but still not close enough.

We have also seen further sector consolidation and managed liquidation of externally managed small cap REITs where poor structures, lack of scale, limited alignment of interest and legacy investment strategies have manifested in material discount ratings. The days of easy money for externally managed small cap REITs with little in the way of shareholder alignment have long disappeared and the list of such companies is reducing by the day.

. . . . . . . . . . .

Toby Courtauld, chief executive, Great Portland Estates

Despite ongoing macro-economic volatility, our confidence and belief in London remain strong. As one of the world’s most attractive and diverse mixed-use destinations, London stands unrivalled as a true global city. Its unique ability to attract people and businesses from around the world continues to drive strong demand for commercial space. However, occupiers are increasingly targeting only the highest-quality spaces, and the supply of such premium space in London will substantially lag this demand. As a result, we anticipate that these market conditions will continue to drive rents upwards and we expect further rental growth of 4% to 7% over the next financial year. For prime office space, our guidance is stronger still at 6% to 10%.

. . . . . . . . . . .

Matthew Bonning-Snook, chief executive, Helical

The past year has seen the central London office market continue to be characterised by strong occupational demand, driving sharp rental growth for prime space, alongside more recent encouraging signs of recovery in the investment market.

Leasing activity remains robust, with structural supply imbalances in key sub-markets and high levels of demand, particularly for large, high-quality floorplates. By the end of March 2025, active requirements for space over 100,000 sq ft had reached record highs. With limited availability, occupiers are increasingly looking ahead at lease events and acting early to secure preferred options, leading to a notable rise in pre-letting activity.

Momentum is also returning to the investment market, buoyed by the strength of underlying occupational activity and the stabilisation of the financial markets. There is broad consensus that 2024 marked the cyclical low, with investment volumes in Q1 2025 exceeding those recorded in the same period last year. Investor interest has notably returned recently with global capital exploring investment into the central London market, and reassuringly the increasing number of transactions exceeding £100m point to improving liquidity and renewed confidence.

Although macroeconomic and geopolitical uncertainties persist, the outlook for London commercial real estate has strengthened. London continues to attract investors with its transparent legal framework, market stability and relative resilience. Looking ahead, constrained supply, continued occupier focus on quality and early-cycle investment opportunities are expected to define market dynamics through the remainder of 2025.

. . . . . . . . . . .

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.