Economic and Political Monthly Roundup

Investment companies | Monthly | October 2022

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

“We have got to get inflation behind us. I wish there were a painless way to do that, there isn’t” Jerome Powell, chair of the Federal Reserve, 21 September 2022

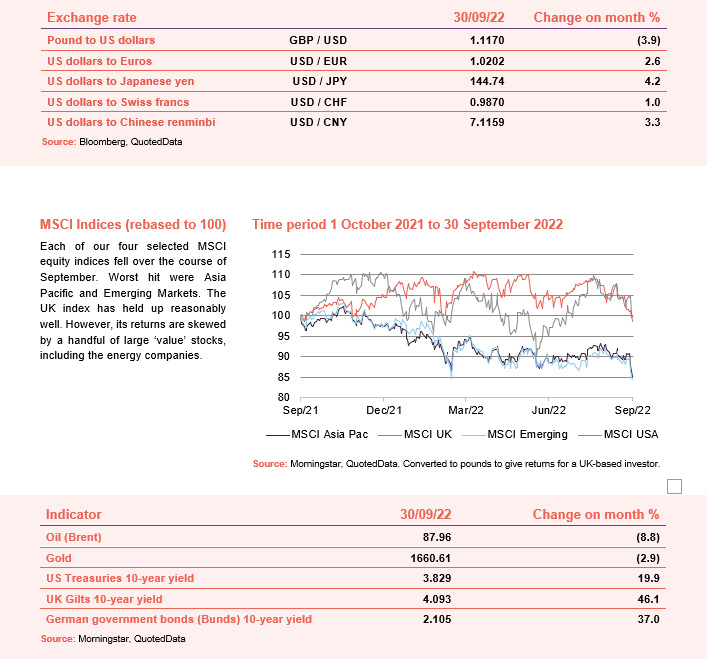

September was a month of quite savage moves in markets. The wider context remains the same: central banks in most major markets are raising interest rates in an effort to choke off inflation. In the US, the Federal Reserve increased its policy rate by 0.75%, the third time it has done so. Its chair left investors in no doubt that a US recession was possible, but the bank would hold its nerve in the face of market weakness and keep tightening until it judged that inflation was under control. Yields on US government bonds rose, the dollar continued to strengthen, and the threat of recession weighed on the oil price.

Against that unnerving backdrop, the new UK government’s ‘mini’ budget promised huge unfunded tax cuts. The political implications of that are being worked through as we write this. However, the financial implications were an immediate collapse in the pound and a spike in the government’s borrowing costs as gilt yields soared. We found out that a large number of pension funds were caught out by the move, but fortunately the Bank of England stepped in with emergency purchases of gilts to prevent some from becoming insolvent. We are not sure what happens when the 13-day intervention period ends. The Bank of England was supposed to be shrinking its balance sheet rather than growing it.

At a glance

Global

(compare global funds here)

Tristan Hillgarth, chairman, JPMorgan Global Growth and Income – 28 September, 2022

After a strong 2021, 2022 has been a difficult year to date for equity markets with rising concerns about elevated inflation, central bank tightening and the terrible devastation of Russia’s invasion of Ukraine, causing significant volatility.

Concerns over rising inflation have led to increased bond yields and a severe de-rating in the valuation of growth companies, despite often strong underlying operational and financial performance. The direction of monetary policy is invariably a key determinant of the outlook for markets.

Central banks continue to deliver further interest rate rises, as anticipated given inflationary pressures. Global equity and fixed income markets rebounded in July as weaker activity data tempered expectations for further central bank tightening and Q2 earnings releases were better than feared. This said, the going is likely to get tougher for companies, faced with rising costs on the one hand and the removal of government support measures on the other, and hence we expect profit warnings and corporate failures to increase in the next 12 months.

In the shorter term we could well see increasing market volatility in a deteriorating global growth backdrop, with elevated inflation and risks to energy supply in Europe. However, we are inclined to view this prospect as a period of turbulence likely to provide attractive opportunities.

. . . . . . . . . . .

At present, economic and political uncertainty is probably greater than at any other time during our careers. Persistent, historically high inflation is being compounded by the war in Ukraine. Central banks are responding with unusually aggressive interest rate increases, which risk driving major economies into recession. Investors are also increasingly nervous about escalating tensions between China and the west, over China’s ambitions to reclaim Taiwan.

At times like these, it is important to remember lessons from previous crises, while at the same time understanding the limitations of historical comparisons. As Mark Twain said, “History never repeats itself, but it does often rhyme”. The similarities thus far between the current situation and previous episodes of extreme economic and financial market uncertainty appear to include the elevated valuations of ‘defensive’ companies, that can maintain earnings and dividends in challenging times, combined with a pullback in more economically sensitive cyclical companies. However, unlike in previous periods, we have not yet seen any easing in current, historically tight labour markets. Nor have we seen the negative earnings revisions we would typically expect given the current climate.

One example of our efforts to balance the portfolio is the recent change to our positioning in Japan. In the past few years we have struggled to find many compelling Japanese investments. More recently though, we have moved to a neutral weighting. This decision was motivated in part by the fact that the valuations of high-quality Japanese cyclicals reached attractive levels, compared to their global peers. Historically, higher quality Japanese stocks have tended to trade at a significant premium to their foreign counterparts and competitors, but this premium almost completely eroded in the first months of 2022. The yen’s recent weakness has also increased the appeal of Japanese equities. The yen has depreciated by around 30% from its pre-pandemic levels, but we expect this weakness to be a short-term phenomenon. If we are correct, the yen’s revaluation will generate a sizeable tailwind for UK investors in coming years.

. . . . . . . . . . .

Zehrid Osmani, manager, Martin Currie Global Portfolio Trust – 26 September, 2022

As we look forward, we believe that there are risks that inflation stays at elevated levels for a prolonged period, with the potential risk of accelerating wage inflation that could turn the frictional inflation that we have been seeing into a more structural inflation issue. As a result, we believe that central banks might have to continue to be aggressive and faster at hiking interest rates, which could continue to fuel the elevated volatility in equity markets.

Central banks being significantly more hawkish comes at a time of rapidly decelerating leading indicators globally, which creates an unhelpful cocktail of interest rate hikes whilst economies are rapidly losing momentum. This has brought to the forefront of the market an additional risk – global recession.

We continue to believe that we have entered into a sharp slowdown phase of the economic cycle for 2022, but the risk of a bleaker scenario for 2023 has risen. With ongoing deterioration in leading indicators and a further upward shift in interest rate expectations since our last report, we have amended our outlook downwards. For the remainder of 2022, our assessment of the probability of a sharp slowdown is 70-75%, whilst we recently increased the probability of stagflation to 25-30%. For 2023, we estimate the probability of stagflation at the global level to be 25-30%, whilst the probability of stagflation for Europe is closer to 60-70%. This is because of the energy supply shortage risks, leading to potential rationing which would impact European economic activity negatively, whilst maintaining upward pressure on inflation. The probability of an ongoing sharp slowdown in 2023 remains our core scenario at the global level, with a probability of this at 65-70%.

As the probability of a recession has grown bond yields have been volatile, with the US 10 year yield hitting c.3.5% in June, before dropping to below 2.7% by the end of July. As a result of these bond yield gyrations, style leadership in equity markets has recently shifted away from value towards quality growth.

As a result of the rapidly deteriorating leading indicators in the world’s major economies and given our view of a sharp slowdown phase in the economic cycle, we believe that earnings growth expectations are likely to continue to be revised down. Current market expectations remain too high in our view. Our top down expectation is for no growth both at the global level and – most specifically – in Europe.

Because of this view, we expect ongoing disappointments during the next few quarters of earnings reports. Investors will however need to be highly selective and discerning, as there will be contrasting fortunes in momentum across different industries.

Against this background, continued volatility in share prices is perhaps inevitable. It is important to look beyond this noise.

Based on cyclically adjusted PE ratios, we remain of the view that European and Asian equities are attractively valued versus history, and versus US equities. US equities, despite the pullback seen this year, are generally relatively less attractive.

. . . . . . . . . . .

Peter Burrows AO, chairman, UIL – 21 September, 2022

Three themes continue to dominate global events: Covid-19, heightened geopolitical tensions and the outlook for inflation and interest rates.

While Covid-19 continues to disrupt, the impact on most economies is very reduced. We now expect it to recede and not be an issue going forward. But the exception is China. As we noted before, their zero policy to Covid-19 sets them apart from every other significant economy, and nearly every country in the world. The economic damage being inflicted on the Chinese economy as a result of this approach is very significant and sad to see. The Chinese consumer confidence has deteriorated to the point where housing is facing very severe challenges. Given that China is the world’s second biggest economy, and that housing is some 35% of economic activity this is a significant headwind and of deep concern. It is hard to judge when this dogmatic policy changes.

In the half-yearly report, we referred to heightened geopolitical events and risk of war with devastating consequences for its global economy. Clearly Russia going to war reflects the worst outcome and the question now is what is next. Our view is that it will take time for both sides to exhaust their ambitions, but once they reach a neutral position a negotiated outcome would be expected. Russia’s maximum leverage is likely to be early next year, at which point Europe will be facing the worst of the energy crisis they now certainly face.

We also noted at the interim stage the ongoing friction between China and the USA is again a clash of ideologies and will likely lead to ongoing resistance between the two nations and their allies. The tensions over Taiwan are symptomatic of two ideologies facing each other across the economic, political and social divide. This is concerning over the longer term.

Inflation moved markedly higher follow the Russian invasion of the Ukraine. Coupled with surprising low unemployment globally this has driven inflation markedly higher. Central Banks have had to respond much more firmly in combating the very high inflation expectations. This in turn is slowing economic growth. We see this headwind continuing for the rest of the year. However, once the Russian/Ukraine conflict is resolved we expect inflation to subside.

The one unknown in our view is the response of the labour force. The labour market remains tight and the number of unemployed are at record lows in many economies. If this continues, then the shortage of the work force will drive up wages and in turn feed inflation.

The outlook for global economies is inextricably linked to Covid-19 in China, to resolving geopolitical differences and to central banks navigating inflation and interest rate responses. We remain optimistic that solutions can be found and that policy makers can navigate through the challenges. We expect inflation to be elevated for much of 2022, assets valuations to increase, technology to continue to gain market share and commodities to rise in value.

. . . . . . . . . . .

Russell Napier, chairman, Mid Wynd – 9 September, 2022

‘There are decades when nothing happens; and there are weeks where decades happen’. This quotation, attributed to a range of authors, seems to summarise the way we live now. The price of financial securities reflect the future and therefore they are likely to be particularly volatile when decades are happening in weeks. The return of inflation, higher interest rates, a hot and bloody war in Europe and a cold war with China are just some of the major changes that the price of financial securities are currently trying to digest. It would be peculiar if investors accurately discounted such profound shifts in how the world works at their first attempt. I was a young fund manager in 1989 and remember the initial reaction to the fall of The Berlin Wall in which investors proclaimed that the demand for capital to ‘rebuild the east’ would result in higher inflation and higher interest rates. The profound structural change that followed, in Europe and in China, unleashed disinflationary forces and, as a result, falling interest rates. Back then decades also happened in weeks, but markets took years to discount the consequences.

In such periods investors are even more interested than usual in what these rapid changes mean for the two powerful currents; being the future path of corporate profits and also the likely future level of interest rates, which are both key in determining equity prices. Rising interest rates tend to be negative for equity prices but rising corporate profits tend to be good for equity prices. Forecasting the net impact on share prices from these competing forces is particularly difficult in a period of structural change. It is the gap between the interest rate/discount rate and the growth rate of earnings that is particularly important in establishing the correct valuation for equities. When both variables are subject to considerable volatility the gap between them is even more volatile. This greater uncertainty brings greater volatility in share prices and greater opportunities for those focusing on longer-term trends during this choppy period.

The aim of the investor, seeking to preserve and grow the purchasing power of capital through such turbulence, should be to focus on the long-term prospects and attempt to create an equity portfolio suited to the dominant current when it finally prevails. The cross-currents that prevail until that new current dominates create opportunities for investors.

Can an investment in equities alone defend investors from the ravages of inflation? As ever in the investment field there is no clear-cut answer to that question but there is evidence that a well-selected portfolio of equities can provide such protection. An era of higher inflation has had a dramatic impact on equity markets before. The valuation of the S&P 500, a broad index of US equities, declined, not of course in a straight line, from January 1966 to July 1982. However, with dividends re-invested the total return from large capitalisation US equities was still positive. The problem was that the total return of 126%, from 1966 to 1982, was significantly less than the rise in the inflation index of 206% over the same period. For those who invested in small capitalisation stocks there was much better news as they produced a total return of 643% far outstripping the rise in inflation. There were sectors of the US equity market that also produced positive real returns at a time when investors who had bought the stock market index witnessed a major decline in the purchasing power of their savings.

The point of these reflections is not that the inflationary winners of that era will be the inflationary winners of our new era. The point is that it has been possible to find a portfolio of equities that can produce positive real returns in a prolonged period of high inflation. That portfolio is unlikely to be biased towards the stocks in the S&P 500 or other key global equity indices. The companies now included in these indices, due entirely to their large market capitalisations, represent the companies that have prospered and have been awarded higher valuations in the old regime. To preserve and grow the purchasing power of savings via equity investment, it is now important to find the winners of a new and very different regime.

Our Managers have the flexibility to invest our capital in tens of thousands of different companies that are listed on the global exchanges. The management of each company has significant flexibility to adapt their business to change. The world is changing but so is our portfolio as are the companies that we invest in. Having started with a somewhat alarming quotation, let us end with something more upbeat from Socrates – ‘The secret of change is to focus all of your energy not on fighting the old, but on building the new.’

. . . . . . . . . . .

Richard Horlick, chair, BH Macro

Unfortunately, when looking at the outlook for markets from here, I find that there is little that I can say to shareholders on a positive note. Geopolitical tensions remain at a very high level. The outcome of the invasion of Ukraine remains uncertain. The zero-COVID policy in China appears to be continuing to create severe supply chain disruption. Inflationary pressures remain strong across the globe though certain component data will start to decline on a year-on-year basis. Interest rates seem set to rise even further with significant consequences for the UK and European economies and will only exacerbate the tensions within the EU. There has been very significant tightening of money supply as Central Banks move from Quantitative Easing (“QE”) to Quantitative Tightening (“QT”) and a huge wealth effect from the evaporation of over $2 trillion of cryptocurrency in a very short space of time. Energy prices have risen sharply in the past 12 months, caused by increased demand as countries eased COVID lockdown restrictions; international travel returning to levels similar to 2019; supply chain slowdowns; and the supply of oil and natural gas tightening due to sanctions imposed on Russia over the invasion of Ukraine.

. . . . . . . . . . .

UK

(compare UK funds here)

Colin Clark, chairman, The Merchants Trust – 29 September, 2022

Regretfully the terrible conflict stemming from Russia’s invasion of Ukraine is still raging. The conflict passed a six-month landmark at the time of writing this report. Some days there may be less in the news, but that does not diminish the scale of what is occurring and our thoughts remain with those affected. We can only hope that peace may return to the region in the coming months.

As I have written in previous reports the Russian invasion of Ukraine was a shock to the global economic system. It exacerbated inflationary pressures across the world, primarily of energy supply constraints, economic sanctions against Russia and the disruption of certain crop supplies from Ukraine.

To some degree the world has also been caught somewhat off guard with the foundations for a higher inflationary environment quietly cementing in the background over many years.

Central banks are now acting more decisively and consistently in their efforts to control inflation, pushing interest rates higher. This is creating an environment in contrast to that of recent decades, where quantitative easing by central banks around the world led to a loose money environment where growth stocks flourished. We now have a very different new world, where both equity and bond markets have been weak and investors are showing nervousness. However, indiscriminate pressure on all stock prices resulting from macroeconomic concerns, largely irrespective of company fundamentals, can provide an environment where active management should prevail and for skilled stock pickers numerous opportunities can arise. Many stock prices have become depressed below the fundamental worth of a company.

The UK market – value investing in vogue

The UK market has been a relative bright spot amongst global peers. The market includes a greater proportion of value stocks compared to growth stocks when viewed in a global context. The general move by investors spurred by rising inflation and interest rates, has impacted many of the largest global markets such as the US where high growth stocks predominate and in return favoured the UK market. In sector terms the UK market also has a relatively high exposure to energy firms that also benefited from the energy crisis unfolding across Europe.

It hasn’t been a totally easy ride for the whole UK market though. Returns have seen a wide dispersion by sector and market capitalisation. Whilst the largest (mainly multinational) companies in the index provided good returns, the picture was worse for smaller capitalisation companies with greater exposure to the UK economy. Defensive companies perhaps unsurprisingly were better performers than more cyclical stocks which were shunned by investors concerned about the economic backdrop.

The UK as an investment

Whilst the UK has become more attractive over recent months and, indeed, we have seen overseas investor interest including takeover offers, in terms of an asset class the UK remained on a somewhat shaky footing with money flowing out of many subsectors, most notably from domestically focused small cap funds. UK equity income was more neutral and broadly flat as investors continued to find an income stream attractive amid the uncertain environment. It has been pleasing therefore to see Merchants continue to perform well with steady, positive investor demand.

Outlook

What the near future will bring is extremely hard to predict. We can only hope that it is a world with less conflict and geopolitical tension. From an economic perspective there are many factors at play and the possible outcomes range anywhere from a moderation of inflation and return to more ‘normal’ scenario, to a full-blown recession and spiralling inflation. The UK market seems at the moment to be concerned with something akin to the latter scenario.

. . . . . . . . . . .

David Barron, chairman, Dunedin Income Growth – 28 September 2022

As I write this interim report, we move into unchartered waters in the United Kingdom. A new King, a new Prime Minister and a new government. Globally too, the challenges are mounting from ongoing events in Ukraine, a slowing Chinese economy, recessionary conditions in Europe and an aggressive monetary tightening in the United States. It is likely to be a tough and challenging period. Yet, building our strategy around a single outcome, given such a wide variance of potential future developments, seems an unwise course of action. The very unpredictability of world and economic events instead makes us concentrate on the companies within the portfolio and their ability to navigate the environment ahead of them.

Whilst the global outlook is uncertain and likely to be volatile, building an actively managed portfolio of UK and European companies, that are leading on sustainability today or taking steps to lead the way in the future, is, we believe, a sound strategy, and particularly so when the outlook is more difficult to foresee.

. . . . . . . . . . .

Neil Rogan, chairman, Murray Income – 21 September, 2022

We find ourselves in a scarcely credible era of uncertainty and without strong political, economic or social leadership. Domestic politics, geopolitical tensions and war, inflation, labour shortages, recession, strikes, energy shortages; all these factors have the capacity to heavily affect the outlook for the companies in which we invest. Every one of them is impossible to predict with confidence at the moment. So what is the outlook? In truth, we can’t be sure.

All the issues are fixable but not without strong leadership. That’s the most concerning thing this time around. After similar issues in the 1970s, the 1980s saw Margaret Thatcher, Ronald Reagan, Mikhail Gorbachev and, perhaps most importantly, Paul Volcker (chairman of the US Federal Reserve from 1979 to 1987) provide very strong leadership and guide their countries to recovery. I’m a naturally optimistic person so I scour the TV news and politics programmes for the world’s new generation of strong leaders which will take us towards recovery. I’m still looking. Full recovery may take a long time.

What will happen to the companies in our portfolio while we wait? Based on trailing earnings, the PER (price to earnings ratio, the most popular stock valuation measure) of our current portfolio is 13x. That is down from 16x six months ago and is the lowest I have seen it in the eight years I have been a Director. It has been as high as 20x. To me that means that a lot of the bad news is priced in. If you think about the headlines we’ve been reading these past six months, it is possible to make a case that much of the bad news is behind us. But note that this is a valuation measure based on the previous 12 months of earnings. If corporate earnings are about to tumble, then stock markets could move down in parallel and still give the same valuation. That’s the real danger, so not surprisingly our Investment Manager is analysing our holdings’ earnings prospects with extra vigilance. One of the main reasons behind our Investment Manager’s quality philosophy is that the companies selected should be sufficiently robust and well managed to withstand turbulent times like these.

In theory, it should be a good moment for quality. In reality, we will have to wait and see.

. . . . . . . . . . .

Charles Luke, Iain Pyle, managers Murray Income – 21 September, 2022

Looking forward, the outlook is becoming more difficult with a tightening policy backdrop and inflationary challenges coupled with the implications of the Russian invasion of Ukraine, all leading to slower global growth. Despite that there are reasons to be confident in the outlook for the Company. Our focus on quality companies provides protection through a downturn: those companies with pricing power, high margins and strong balance sheets are better placed to navigate a more challenging economic environment and emerge in a strong position. Furthermore, these quality characteristics are helpful in underpinning the portfolio’s income generation.

The valuations of UK-listed companies remain attractive on a relative and absolute basis. Moreover, the dividend yield of the UK market remains at an appealing premium both to other regional equity markets and to other asset classes. Indeed, we believe that in many cases the attractiveness of our holdings is not reflected in their share prices, particularly given the underlying strengths of the businesses. This view is reflected in the bids for holdings. We think a fair proportion of the portfolio may be vulnerable to corporate activity and it is noteworthy that private equity purchasers often look for attractive quality characteristics in potential acquisitions that dovetail with our investment criteria. Furthermore, international investors remain underweight the UK; this provides an additional underpin.

. . . . . . . . . . .

John Evans, chairman, JPMorgan Mid Cap – 20 September, 2022

The Russian invasion of Ukraine occurred at a time when financial markets across the globe were anticipating tighter monetary conditions, as the financial support provided by governments and Central Banks to deal with the economic dislocation caused by COVID-19 was being withdrawn. Higher interest rates were anticipated to deal with already rising rates of inflation caused by, among other factors, supply and labour shortages.

The surge in energy, food and many commodity prices has raised the (current) forecast peak in the CPI in the UK to 13%, which may yet prove to be optimistic. The Bank of England has raised base lending rates to 1.75%, not a high rate by long term standards, but a very significant increase by recent comparators. The triumvirate of substantial and unforeseen rises in energy costs, rising interest rates and a widespread rise in consumer prices in general, has created an extremely challenging backdrop for the UK Consumer.

Stock markets adjusted rapidly to the deterioration in the economic background that emerged in the first half of this year. As always, the key to future returns will be whether current expectations are subject to revision (in either direction). However, value is now evident in many sectors and constituents of the FTSE 250.

While economic conditions are very difficult for consumers and companies alike, good companies with strong market positions have the attributes to deal with tougher trading conditions and crucially protect themselves and their shareholders from the effects of rising prices.

. . . . . . . . . . .

Georgina Brittain, Katen Patel, managers, JPMorgan Mid Cap – 20 September, 2022

Some things we know. Inflation is going to worsen in the UK, and remain high, for some time to come, driven in significant part by energy costs. Wage inflation will not keep up. The cost of living pressures will get worse before they get better. Some things we do not know. How long will energy costs remain elevated? When will the Russian war with Ukraine end? Will there be gas shortages in Europe and the UK this winter? Will UK taxes continue to rise, or will they be cut as our new Prime Minister Liz Truss has strongly suggested? The answer to this last question will have a direct impact on the looming recession in the UK – small and short, or long and severe, as suggested by the recent BoE forecast.

Shortly before writing this report, the BoE raised interest rates for the sixth consecutive time to 1.75% and forecast a recession commencing in Q4 2022 and lasting for five quarters, with inflation now being forecast to peak only in Q4 at 13% and remain elevated through 2023. The UK stock market did not react to these shocking forecasts. This is for two reasons. First, stock markets are forward-looking and were already pricing in much of the poor news. And secondly, the BoE uses the current status quo in making its forecasts, so it assumes taxes continue to rise, as per the last Budget, and that both gas and oil prices will remain at their current elevated levels. In one of her very first actions, our new Prime Minister has already announced a two year energy price cap for consumers, which of itself will lower inflation somewhat, and we await news on fiscal policy.

Our current view is that there is likely to be a recession in the UK, but it will be of a short and shallow duration. Currently, key metrics in the UK such as employment levels, PMIs (purchasing manager indices), the housing market and retail sales are all holding up – and indeed that is the message we are receiving when talking to the companies that we hold. We are obviously monitoring the potential recessionary impact on Europe, and then the UK, if gas shortages emerge in the coming winter. But the key metric we are focusing on is inflation, and in particular a fall in core inflation. If this starts to emerge, then we believe stock markets will start to rally. If history provides a reliable guide, markets will rally prior to the GDP data turning more positive.

The long-term drivers that have driven the outperformance of the FTSE 250 arena over the last 50 plus years have not changed. Periods of extreme volatility, and drawdowns (such as we experienced during the Brexit referendum and the initial onset of COVID-19, and now again in 2022 when the domestic UK market has fallen dramatically out of favour) have historically proven to be very advantageous buying opportunities in this area of the market, and we do not believe this is different in this economically challenging time.

. . . . . . . . . . .

Jeremy Rigg, Chairman, Henderson High Income – 20 September, 2022

The near-term outlook for markets is dictated by the likely path of inflation and therefore global interest rates (as policy makers attempt to bear down on inflation) and the impact on economic activity. The Bank of England is currently forecast to increase the UK base rate to around 4% in 2023, a sharp increase from 0.25% where it started 2022. Undoubtedly the next several months will prove a very challenging time for both consumers and companies. However, UK companies are generally in good financial health having repaired balance sheets during the pandemic and the valuation of the UK market continues to look relatively attractive in a global context.

. . . . . . . . . . .

Sir Laurie Magnus CBE, chairman, The City of London Trust – 16 September, 2022

The macro economic outlook has darkened since the year end, with inflation expectations increasing to levels last seen in the 1980s. The Bank of England which, this time last year, predicted that elevated inflation would be “transitory”, is now forecasting that it could reach 13.3%. It has reacted by increasing its base rate to 1.75%, whilst simultaneously warning of an impending recession. These forecasts are inevitably damaging for consumer and business confidence, with a growing risk that inflationary expectations become embedded as pay settlements “catch up.”

The outlook for the UK is particularly unclear as the new Prime Minister steers a course towards increased public borrowing and tax cuts. This uncertainty, which appears already to be unsettling confidence about sterling in the currency markets, is compounded by the prospect of higher interest rates across all major economies as central banks respond to inflation and start to reverse their programmes of quantitative easing. Most worrying, however, are the rising geopolitical risks stemming from Russia’s invasion of Ukraine and the tensions with China over Taiwan, with consequences which are already apparent for the sourcing of energy supplies and important manufacturing components.

It remains the case, despite these concerns, that UK equities still offer a better dividend yield than can be obtained from bank deposits or ten-year gilts. Many of our shareholdings are in high quality businesses, with significant foreign revenues, which are well placed to withstand economic turbulence. Furthermore, UK-listed companies continue to attract takeover bids in recognition of their relative value compared with peers traded in other stock markets.

. . . . . . . . . . .

Liz Airey, chairman, abrdn UK Smaller Companies – 7 September, 2022

Anticipating the future is never easy, but given the severity of the economic and political turmoil that exists, giving guidance to shareholders right now is particularly complex.

The challenges facing Liz Truss as the UK’s new Prime Minister are multi-fold and daunting, with inflation running into double digits for the first time in almost 40 years, expectation of a recession and interest rates on a rising trajectory. Action will need to be taken urgently on the cost-of-living crisis, most notably the rapidly rising cost of energy, but at the time of writing the policy decisions, which will impact the whole of the UK economy, are unclear.

The problem for UK policy is that the root causes of these issues are primarily driven by external events; the energy crisis caused by the Russian invasion of Ukraine in February coming on top of existing climate change challenges and the effects of global policy responses to the Covid pandemic. The aftermath of Covid has seen significant global economic disruption and social change which is still unfolding.

Against this backdrop, markets as a whole are likely to remain volatile, responding to economic and geo-political developments as they unfold.

. . . . . . . . . . .

Asia Pacific

(compare Asia Pacific funds here)

Stewart Investors, manager, Pacific Assets – 28 September, 2022

News headlines tend to provide low value, short shelf-life information. The current headlines are worrisome and must not be trivialised but they are not, as is often claimed, detailing unprecedented events. In the short history of the Trust alone, Asian companies have overcome: war, natural disasters, epidemics, economic crisis and inflation. One of the many attractions of investing in Asia is a large number of high-quality stewards operating excellent franchises with experience of overcoming adverse events. Inflation, or as the UK media calls it, ‘the cost of living crisis’, is a good example.

Prices in Asia are rising at half the pace of prices in developed markets, broadly speaking1. These headline figures alone are comforting. But more importantly, from our perspective, is the observation that all our stewards in India, and beyond, can easily recall prices rising at double the rate they are today. Only a decade ago, Indian companies experienced inflation at 12%2. In contrast, many western peers are facing the challenge of inflation for the first time in the last 25 years. It is for this reason that we spend more time studying people, franchises and financials rather than speculating on the range of possible outcomes from ‘short-term events’. Quality tends to be enduring and provides some insight into how a company will survive and prosper though unknowable short-term economic environments.

. . . . . . . . . . .

Manager, Pacific Horizon – 15 September, 2022

We remain extremely positive on the long-term outlook for the region. The rise of the Asian middle class, accelerated by technology and innovation, continues to be one of the most powerful investment opportunities of the coming decade. We are enthused by the number of exciting growth companies we can buy that are exposed to these themes, many of which are now trading on historically low valuations.

Against this long-term positive backdrop for Asia, we would however note that shorter term there are many challenges facing global markets and rarely has it been harder to predict outcomes.

We also see reasons for optimism. Many of the inflationary causes effecting the world are likely to subside with the ending of lockdowns and related monetary stimulus. Such a scenario would be extremely beneficial to the global economy and very supportive to growth companies more generally. Asia itself looks well placed, having run far more prudent fiscal and monetary policies over the Covid crisis compared to the profligacy of many developed countries. Over the coming years, the decent growth rates, sensible interest rates and limited balance sheet expansion across much of Asia, is likely to compare very favourably to other markets. The future is to the east.

. . . . . . . . . . .

Robin Parbrook, Lee King Fuei, managers, Schroder Asia Total Return – 15 September, 2022

It was the technology and export heavy Taiwanese and Korean markets that performed worst, dropping 16% and 20% respectively over the first half (in sterling terms). The falls were led by technology stocks where worries over falling consumer demand and rising inventories caused a large pull back.

Of the other major markets Australia and China fell around 10% in local currency terms in the first half, which meant in GBP terms they were only down slightly given how weak sterling was over the period. Within China we saw quite volatile performances. Technology and internet stocks in particular were initially very weak but then rebounded strongly in May and June on hopes that regulatory pressures were easing and the Chinese economy was set to improve on back of economic stimulus and falling Covid-19 case numbers. We are cautious on the Chinese outlook both for the economy and stockmarket.

The best performing stockmarket over the first half was Indonesia where market sentiment was helped by rising commodity prices given the Indonesian economy remains quite commodity dependant. The Thai and Hong Kong stockmarket indices also performed relatively well as both indices have large weightings in banks and defensive utility stocks which helped their performance.

As we write at mid-year 2022 it is clear macro events are likely to have a big bearing on Asian stockmarkets and most of these events are ones we have no real insight on. Will the “zero-Covid” policy in China lead to new and extensive lockdowns and will the Ukraine-Russia war escalate or remain prolonged? Will the consumer in Europe and USA remain resilient (given tight labour markets), despite high oil prices and rising food costs and will China- US tensions over Taiwan and more generally escalate leading to a full-blown trade/cold war?

We really don’t know answers to any of these questions. Predicting “black swan” events and endlessly discussing tail risks is, we believe, pretty futile.

MSCI AC Asia ex Japan index is now back to pre-Covid-19 levels and to similar index levels to five years ago. With broad based foreign investor selling pressure hitting nearly all Asian stockmarkets, a general sense of investor gloom and continuous broker downgrades of many stocks it does feel like we are at a capitulation level in the region. Whether we face a final leg down to the despair level probably depends on the maelstrom of unpredictable events mentioned above. What we can say however is there is a lot of fear in markets so whilst we might not want to be greedy, our appetites are rising – and in particular using another Buffet maxim, we are now seeing opportunities to “buy a wonderful company at a fair price”. This was opposed to 18 months ago when we were often looking at buying “a fair company at a wonderful price”.

What is interesting is most sectors are now cheap/fair vs history. This contrasts with 18 months ago when nearly all sectors other than the out of favour “value” areas (banks, insurance, property etc…) were expensive. Stocks classified as “growth” and “value” by MSCI have now fully mean reverted back to their pre-Covid levels. At the current time, given the size of the correction, we see the best opportunities in stocks typically classified as more “growth” businesses.

Given the weakness in Chinese stockmarkets over the last 12 months many shareholders have asked why we have not added to our exposure to China. Whilst we would fully accept there is scope for a short-term rebound in Chinese markets given the extent of the sell-off and negative sentiment, we remain structurally cautious on Chinese equities. This is due to multiple factors. These include more short-term cyclical ones like the weak housing market, continued adherence to “zero Covid” policies, slowdown in exports as global demand for manufactured goods slows or more serious structural factors. The latter include the increasing role of the state in the economy, challenging demographics, elevated debt levels and macroeconomic risks, or geopolitical tensions and commercial cold wars.

Interestingly the country models we use in the Company’s process for hedging have also turned more cautious on China despite the market falls. This is because of the deterioration in both the earnings outlook and the cyclical business factors the model picks up. A continued adherence to a “zero-Covid” policy will be likely to make any consumer recovery muted and, if we have further lockdowns, very stop-start. We expect significant earnings downgrades to come – Chinese equities are almost certainly not as cheap as they optically appear.

But surely China can just pump things up and get the economy moving again? We would caution on this thesis. Chinese property may be slowing but it is from a very elevated level (property sales and starts are double pre-GFC levels). This is happening at a time when Chinese demographics have turned much less favourable with the workforce now shrinking. Indeed, Goldman Sachs’ Jon Ennis is now forecasting a 15% decline in births in China in 2021, which follows an 18% decline in 2020 overall, he expects new births in China in 2023 will be 40% below the level of 2016. A recent study published by the Lancet predicts that China’s population could half by 2100. None of this looks structurally good for a sector that comprises c.20-25% of Chinese GDP.

Given the weak domestic picture we want to buy stocks when they are genuinely cheap and once the more difficult earnings outlook is fully discounted. In light of the current backdrop we are still not convinced we are there. The better managed consumer, industrial and domestic stocks in China have actually held up reasonably well as fund managers hide in the increasingly small pockets of the market that aren’t officially state-owned enterprises (SOEs). The same applies to those companies being regulated such that they become quasi SOEs, which is what we worry is happening in the technology and internet space in China as founders get replaced and Chinese Communist Party Committees play a more prominent role in decision making at companies.

The Company does not invest in official SOEs or quasi SOEs (stocks heavily state “influenced”) given our views on state owned capitalism. We also don’t invest in stocks in sectors facing structural challenges (disruption, regulation, demographics) or ESG headwinds – this removes a significant part of the MSCI China index (by market cap) from our investment universe. Instead, we have a relatively short list of Chinese stocks which we believe still have good long term growth options – some of which we currently own, and others which we have on a watchlist to add to if they fall to levels which offer enough upside to our fair values.

In general, we would like to add more to India whether that be consumer stocks, Indian private sector banks or potentially some of the internet names. Whilst we have qualms about Mr Modi, some of his policies and reforms should raise the potential growth rate of the country. India is also likely to benefit both at a foreign direct investment level (FDI) as capacity moves out of China and potentially at a portfolio level as Asian and emerging market funds look to reduce China exposure. Our caution to add to date to Indian exposure has primarily been based on high valuations combined with unrealistic earnings expectations – if we do however see corrections we would expect to add to our Indian weightings.

The other market where we have added to in the current weakness is Australia. Whilst the overall market has held up reasonably well this has masked some very divergent performances. Resources and financials which comprise around 60% of the MSCI Australian index have done relatively well – whilst some of the internet, healthcare and overseas (mostly US) exposed names have come off sharply.

And what of the ASEAN 4? Thailand, Malaysia, Indonesia and the Philippines have been markets that have serially disappointed for 25 years. Why have the ‘ASEAN 4’ disappointed? This is mostly due to institutional failure – or the fact they are perhaps suffering from the middle-income trap. All are now struggling to grow faster per capita than the USA. Building roads and basic infrastructure only gets you so far. The ASEAN countries suffer from poor educational attainment, low levels of corporate investment due perhaps to corruption and crony capitalism – meaning we tend to have neither a vibrant economy or stockmarket.

Having provided all this negative commentary, we should highlight all is not bad in ASEAN stockmarkets. The ASEAN countries look much less vulnerable to macroeconomic headwinds than they have historically, with relatively low debt levels (especially short-term US$ debt) and they run current account surpluses. There are also some good, well-run business in ASEAN. Our problem has always been valuations as investors have tended to view the region as high growth when it clearly is not (also scarcity value in ASEAN has meant good business are often pricey). We have several ASEAN consumer names we would like to add to the portfolio, and we will monitor for opportunities to pick up the best names in ASEAN if falls continue.

Overall, we now see some good opportunities in Asian stockmarkets and we are optimistic the Company should make money over the next 12 months – assuming we avoid black swan events and global recession. Valuations are increasingly attractive and reflect in many cases a fairly pessimistic outlook for earnings. China, whilst we are structurally cautious, clearly has the possibility for a short term rebound if Covid policies are relaxed, reformed or successful. However, we believe the best opportunities in Asia in the current sell-off are to pick up best in class businesses/global leaders in Taiwan, Korea and Australia. We also hope further corrections will provide an opportunity to add to Indian and perhaps ASEAN consumer stocks where valuations have, we believe, historically been set too high on unrealistic earnings expectations.

. . . . . . . . . . .

Europe

(compare Europe funds here)

Alexander Darwall, manager, European Opportunities – 21 September, 2022

The index’s modest advance belies a turbulent period. Cheap money and undue optimism carried the index 10% higher until inflation and the prospect of higher interest rates caused a 15% drop, peak to trough. The war in Ukraine has led to food and fuel shortages, cementing inflation into the mid-term outlook. The US Federal Reserve is showing the way in raising interest rates to tackle inflation. The European Central Bank (ECB), however, is a reluctant, ‘slow follower’. As at 31 May 2022 the ECB’s main refinancing rate remained at 0%, as it had been for the last six years; the 3-month Euribor interest rate had risen slightly to -0.34% at the end of May 2022. In June 2022 the Governing Council decided to discontinue net asset purchases under the Asset Purchase Programme as of 1 July 2022, thereby signalling its intention to raise interest rates. The ECB, apparently, still does not accept the need for aggressive tightening as it thinks that inflation is a transitory phenomenon. Its own projections foresee annual inflation at 6.8% in 2022, before it is projected to decline to 3.5% in 2023 and 2.1% in 2024. I believe this is likely to be optimistic.

For once, the different regional indices tell a clear story about economic performance. The MSCI World index advanced 7.7% in sterling. The S&P 500 was up 12.1% in sterling. Compared with Europe, the US is much better placed in terms of fuel and food supplies. The Nasdaq Composite index was down 0.4% as highly rated technology stock prices started to slide. On the back of much higher soft commodity prices (grain and soy), the Brazilian economy grew, driving a 17.0% increase in the MSCI Latin America index. Lockdowns in China partly explain the 11.5% fall in the MSCI AC Asia ex-Japan.

The macroeconomic outlook is deteriorating. In June 2022, the World Bank reduced its forecasts for world economic growth to 2.9%. It projects 2.5% European growth in 2022. For 2023, it projects 1.9% growth in Europe compared with global growth of 3%. I believe these forecasts are likely to prove overly optimistic. Inflation is likely to remain persistent and there is a likelihood of a long upcycle in interest rates. Forward interest rates point to 3.5% in the US and 1.3% in Europe by the year end. The World Bank’s forecasts suggest that China and other Asian economies will, again, be the growing economies in 2023 with China forecast to grow at 5.2% and India 7.1%. I believe current analysts’ corporate earnings expectations are unrealistic. We expect aggregate European corporate earnings to fall in 2023 as cost inflation and higher interest rates impact corporates and consumers.

Our past reports have warned that the ultra-benign conditions associated with the COVID-19 era could not last, that at some point reality would bite, and businesses would be challenged by the enormity of inflation, debt repayments and weaker demand. Indeed, the market environment has dramatically changed: the COVID-19 era, characterised by free money (that is to say, low or negative interest rates) is over. This has given way to a much harsher environment. The change is extraordinary and sudden. Inflation and higher interest rates are back. Although these are global phenomena, Europe is especially vulnerable. The invasion of Ukraine in February 2022 has exacerbated the ‘food and fuel’ challenges in Europe. Europe’s dependence on Russian oil and gas sets it apart from other regions of the world. Moreover, Europe’s commitment to the ‘Green Economy’, not matched elsewhere, puts further pressure on the energy crisis. These are all the ingredients for a severe and prolonged recession.

Our investments, overall, have strong cashflows and relatively low debt. This is important not just for companies to survive the rigours of a recession but because it will be easier with a strong balance sheet to take advantage of acquisition opportunities; notwithstanding this severe and deteriorating economic backdrop. A solely defensive mindset will not capitalise on the great opportunities which undoubtedly exist.

. . . . . . . . . . .

Japan

(compare Japan funds here)

Joe Bauernfreund, manager, AVI Japan Opportunity Trust – 27 September, 2022

With core inflation holding steady at 2% in both April and May 2022, the Bank of Japan (“BOJ”) stuck with its expansionary monetary policy. In contrast with the direction of rising global rates, the BOJ is defending a 10-year Japanese Government Bond (“JGB”) yield below 25bps and repurchased a record amount of JGBs in May 2022. It is this diverging policy that has been weighing on the Yen, which on an effective real exchange rate basis is at the cheapest since 1971. If a Big Mac in the UK costs £3.50, it only costs £2.32 in Japan.

Although Japan isn’t suffering from the same surging inflation as other countries, rising raw material costs, amplified by the weak Yen, are weighing on corporate margins. While we remain sanguine about our companies’ ability to pass on cost increases, this won’t happen overnight.

After the end of the period, it was with great sadness that the world learned that former Prime Minister Shinzo Abe passed away. His death was a shocking tragedy. While it has taken several years for companies/management to buy into corporate governance reforms, there is now clear evidence of a shift in attitudes amongst corporate Japan, and that is just one of the many important legacies of Shinzo Abe.

. . . . . . . . . . .

North America

(compare north American funds here)

Dame Susan Rice, chair, The North American Income Trust – 26 September, 2022

Major North American equity market indices experienced significant volatility and lost ground during the six-month period ended 31 July 2022. For most of the period, investors grew concerned over the pace of the US Federal Reserve’s monetary tightening. Economists warned that hiking interest rates too much, too quickly could push the US economy into recession. These worries were exacerbated by increasing lockdowns in China due to COVID-19, which further stressed an already challenged global supply chain. However, major US equity market indices rallied sharply in July 2022, buoyed in part by a positive start to the second-quarter corporate earnings season. The Russell 1000 Value Index, the Company’s reference index, returned 4.9% over the review period. The energy, utilities and healthcare sectors garnered positive returns and were the top performers for the period. Conversely, the communication services, financials and technology sectors posted losses and were the primary market laggards.

Inflation in the US remained elevated during the reporting period. The US Consumer Price Index (CPI) rose by an annual rate of 8.5% in July. The year-over-year increases in the CPI ranged from 7.9% in February to 9.1% rate in June. The continued upturn in inflation during the review period was attributable mainly to sharp increases in energy costs, particularly fuel oil and gasoline, which rose at annual rates of 44% and 76%, respectively, in July. Additionally, food prices saw double-digit, year-over-year increases for five consecutive months between March and July. Rising inflation led the US Federal Reserve (Fed) to raise the federal funds rate by 25 basis points (bps) to a range of 0.25%-0.50% following its meeting in mid-March – the central bank’s first rate hike since 2018. The Fed subsequently implemented additional rate hikes totalling 200 bps, lifting its benchmark interest rate to a range of 2.25% to 2.50%.

The US economy contracted by 0.6% in the second quarter of 2022. This marked the second consecutive quarterly decline in GDP – which fell 1.6% in the first quarter – meeting the definition of a ‘technical recession’. The decrease in GDP resulted mainly from reductions in inventory investment (a measurement of the change in inventory levels in the economy) and residential fixed investment, which more than offset increases in exports and consumer spending.

The investment environment has become more challenging given the recession “warning signs” that are flashing, as well as the fact that a period of aggressive interest-rate tightening is well underway. However, periods of positive returns are possible during recessions particularly when companies become undervalued. Although July was overall a very positive month for the US equity market, there are still several headwinds, including the ongoing Russia-Ukraine conflict and questions over the ability of central banks globally to strike the right balance between bringing inflation under control and stymying economic growth.

The value of the portfolio and the strength of the revenue account were enhanced by the continuing strength of the US dollar relative to sterling, which approached parity in late September. The factors that drive relative exchange rate movements, including the ongoing structural impact of Brexit and the recent budget changes announced by the Chancellor of the Exchequer, could lead to an environment where the US dollar will maintain its relative strength against sterling in the near term.

For now, we have been comforted by the strength of the second-quarter earnings season in the US and the fact that the management teams with whom the Manager has recently spoken remain reasonably confident in their forecasts for the current year.

. . . . . . . . . . .

Stephen White, chairman, Brown Advisory US Smaller Companies – 20 September, 2022

Equity markets are likely to remain unsettled for the time being, and US smaller companies are no exception. How long the war in Ukraine will last and what direction it will take, how far the Federal Reserve will raise interest rates in an effort to rein in inflation without causing a recession, how resilient the consumer will remain as purchasing power declines and how corporate profits will hold up given the rise in input costs including labour are all questions weighing on markets and which will take time to resolve. However, once the fundamentals do start to improve, we see the US again at the forefront of any recovery.

. . . . . . . . . . .

Michael Phair, chairman, Middlefield Canadian income – 13 September, 2022

The Investment Manager remains optimistic that North American inflation will trend lower in the coming months and market conditions will improve. The global and Canadian economies are evolving broadly in line with the Bank of Canada’s recent predictions. Canadian inflation decreased in July 2022 to 7.6% from 8.1% because of moderating commodity prices. This development supports the Investment Manager’s view that the pace of interest rate hikes will soon begin to slow and market volatility will subside. The Canadian economy continues to operate in excess demand and labour markets remain tight. Canada’s GDP grew by 3.3% in Q2 2022 bolstered by both consumption and business investment. Due to the strength in household and corporate balance sheets, the Investment Manager does not anticipate a material economic slowdown in either Canada or the U.S. in the latter half of the year . Their investment conviction remains in cyclical sectors such as real estate, financials and energy.

Canada is a secure net exporter of oil and natural gas and should benefit from Europe’s growing focus on energy independence over the coming years. Its rate of inflation remains below that of the United States and Europe, supporting the purchasing power of Canadian consumers. Cyclical sectors such as energy, financials and real estate also serve as effective hedges against inflation for U.K. investors.

. . . . . . . . . . .

South Korea

(compare country specialist funds here)

Weiss Asset Management, manager, Weiss Korea Opportunity – 9 September, 2022

Challenging global macroeconomic conditions have led to weaker South Korean market performance over the last two quarters. According to figures released by Bank of Korea (“BoK”), South Korea experienced a 3.1% drop in exports between the first and second quarter of 2022. Data published for June 2022 indicate a 5.4% year-over-year increase in exports, led by demand for semiconductors and petrochemicals; however, this figure also represents the slowest monthly growth in exports since November 2020. 20 The decrease in export activity comes as a result of lower global demand while the economies of South Korea’s largest export partners continue to be impacted by the economic toll stemming from the Russia-Ukraine war, uncertainty in the Chinese economy, and recovery from COVID-19. In contrast to the single digit increase in exports, South Korea experienced a year-over-year increase of 19% in imports at the end of Q2 2022 as energy and commodity prices increased, resulting in a growing trade deficit that had begun to take effect in early 2022.

Despite the slowdown in exports between the first and second quarter, the South Korean economy continued to grow between April and June 2022, outpacing inflation for a 0.7% increase in real GDP. An increase in household spending was the main contributor to this growth, spurred by the loosening of COVID-19 restrictions. This increase in consumption, however, contributed further to inflationary pressure experienced by both consumers and producers with South Korea’s consumer price index (“CPI”) up 6.0% year-over-year and producer price index (“PPI”) up 9.9% over the same period.

With the growth in CPI reaching its fastest pace since the Asian Financial Crisis of 1997, the South Korean government implemented a number of initiatives to control this rising inflation. Elected in March 2022, new BoK governor Rhee Chang-yong has taken a stance to focus on combating inflation. BoK delivered four rate hikes throughout the first half of the year, raising the country’s policy rate from 1.00% at the beginning of 2022 to 2.50% as of the date of this report. In addition, South Korea’s newly elected president Yoon Suk-yeol has attempted to enact his own set of economic policies to combat inflation and shift the government to a more pro-business and market-friendly stance. After assuming office in May, President Yoon’s conservative government expanded its list of tariff-free import items to include more than 25 major imported products and floated the idea of a corporate-friendly tax reform to encourage private sector investments. The new administration’s attempts to usher in more shareholder-friendly practices in South Korea while fostering a deregulated business environment for private-led growth, have received mixed levels of responses. For instance, the four largest conglomerates in South Korea have pledged capital investments of more than 860 trillion KRW (550 billion GBP) in the next five years following the entrance of the new administration. Nevertheless, President Yoon’s approval ratings have deteriorated from 52% when he was sworn in to 28% as of the last week of July.26 It is likely too early to predict whether the new administration will successfully achieve its stated goals to stimulate the economy while improving corporate governance.

. . . . . . . . . . .

Global emerging markets

(compare global emerging markets funds here)

Sarah Arkle, chair, JPMorgan Emerging – 29 September, 2022

A global environment of higher inflation and interest rates together with geopolitical concerns will continue to pose challenges for world stockmarkets. However, it is encouraging that inflationary pressures are less extreme in many emerging economies than in a number of Western countries and preemptive interest rate rises have meant that further rises are likely to be more subdued than in the developed world. Economic activity in many of the emerging market economies where your Company invests remains stronger than in the developed world and their debt to GDP levels are less stretched. Lower debt levels will also make emerging market economies more resilient to the impact of a stronger US dollar than in past cycles. Over the longer term, emerging economies should continue to show superior growth underpinned by several positive structural trends such as generally favourable demographics which support growing working-age populations and rising incomes.

Valuations have now returned to more reasonable levels following the recent falls in stock markets and a period of underperformance for the Manager’s investment strategy, which focuses on high-quality companies that can sustain earnings growth over the longer term. Strong franchises and healthy balance sheets should support the earnings of these companies in a period of rising interest rates and slower global growth. Any further stockmarket volatility will create a number of interesting investment opportunities for stock pickers.

. . . . . . . . . . .

Austin Forey, John Citron, managers, JPMorgan Emerging Markets – 29 September, 2022

This has been a very political year for investors, and geopolitical events and decisions have had a large effect on markets. The clearest example of this is Russia’s invasion of the Ukraine, a military intervention which has produced many negative consequences. We could not understand, before it happened, how it could possibly work out positively from any perspective, including Russia’s. Yet not for the first time, political actions were taken whose logic and purpose escaped us. International isolation, sanctions, and the acceleration of a strategic shift in European energy policy which ultimately will threaten Russia’s only strategic export; that does not seem like a set of choices which will look good when seen through the lens of history. But we are, as they say, where we are, …and Russia is no longer an investable market for us.

If Russia and the Ukraine came as a sudden shock to markets, political risk in China is something we have worked with for years. Political risks in China are endemic; far more than in most countries, the government and the economy cannot be separated. Last year this risk found its clearest expression in regulatory interventions in various industries; this year, it has been the government’s “zero Covid” policy which has had the biggest effect on the economy and on the corporate sector. Some aspects of this policy, especially the desire to protect the healthcare system, seem familiar from other countries’ experience of the pandemic; what is different is the lack of public policy debate, and the consequent difficulty of judging how policy may evolve. The probability that China will change its approach must be high; eventually the economic costs of maintaining it will prove too burdensome, and the need to do so will fade too. But how long that change takes seems hard to judge.

One could say much the same of the other big political issues that involve China – its relations with the USA, and its actions regarding Taiwan. Nobody should expect a return to the previous norms here: for the USA in particular, China is a strategic rival that will be treated as such. Given the economic interdependency that exists, including China’s importance for major American companies, this is not a simple thing to do. We should expect tensions to continue, and we need to factor that into our assessment of every stock we own in China. The companies that are probably least affected are those which operate domestically within China, and are listed, regulated and owned in China. It is not a coincidence that our recent new investments in China, in companies in the consumer and software industries, conform to this pattern.

Markets are forward-looking, and are anticipating a cycle in corporate profits; if western economies slide into recession, which appears possible, then companies exposed to global demand will not be immune.

Given that, what is the outlook for growth now? The major exposures in the portfolio are in three sectors: technology, financial services and consumer. Of these three, technology is the most sensitive to global economic conditions. The technology companies held in the portfolio are export businesses whose primary markets are the USA and Europe. They are bound to reflect cycles in demand to some extent in their revenues in the short term, though there is little sign of this in their latest results. In the past these companies have grown partly because global demand for technology rises over time, but mostly because they have been able to grow their share of that growing pie. If both persist in the future, which we expect they will, we should see good returns in the future as well.

The second category, financial services, is a far more localised industry; macroeconomic conditions at the national level are important, and it’s more difficult to generalise about prospects. Growth rates for our largest financial holdings have slowed in the last year, but also remain positive. Looking ahead, we should expect some cycle in credit quality, but our holdings are in companies with very strong capital ratios and a history of prudent risk management, which should stand them in good stead.

Finally, the consumer sector; companies in this sector cater mostly to everyday demand for everyday products, including staples like food and beverages. They are intrinsically less cyclical than many other industries, and tend to be strongly financed because they generate cash continually. Here too, growth has been solid in the last year.

We should add one last comment about the outlook for growth. It’s much easier to assess a company’s relative strengths than it is to make specific and accurate forecasts about its financial performance in any one period. When times are more challenging, advantage accrues faster to the strongest companies than it does in times when all are prospering. We cannot be certain about the growth that will be achieved as the world goes through an economic cycle, but we can be confident about the competitive position of the companies in the portfolio, and about their ability to come through a cycle in good shape. With the exception of the financial companies, for whom leverage is an inherent part of their business, the companies held in your portfolio have unleveraged balance sheets; which is to say that in aggregate they have a net cash position with no net debt. So in addition to their operational strengths as businesses, they are well-placed to withstand higher interest rates too.

Inflation and then what?

It seems that central banks have awoken from a trance and remembered that their primary function is to prevent inflation. That is not going to be a comfortable experience for economies or for capital markets. In the near term, most risk assets face some headwinds, as interest rises affect bonds, equity, real estate and most other assets as well. We are currently carrying a little more cash in the portfolio than usual. But for those with long memories, current conditions will seem more like a throwback to the eighties and nineties: this looks like an inflationary cycle rather than a systemic financial crisis, and even though cycles are never comfortable times to be investing, they do bring opportunities and they do eventually pass. When markets are most negative, the risk/reward is actually at is most attractive.

In emerging markets, central banks have been tackling inflation with sharper rate rises than we have seen in the developed world, and mostly without the same challenges involved in changing energy supplies. Macroeconomic fundamentals actually look much better in some countries than they have in previous periods of monetary tightening, and the long-term economic growth rate achievable by emerging markets should continue to outpace that of the developed world. The scope for productivity gains remains significant, and other macro-economic factors like demographics are also look relatively favourable. But much more important than that will be economic results achieved by companies, especially the returns they make on the capital they invest in their businesses.

Sources of return again

What do our forecasts tell us about the future now? One of the most striking things is that the dollar looks very expensive, having appreciated strongly against many other currencies. For sterling-based investors, this is less of a factor: developed world currencies like sterling, the euro and the Japanese yen have weakened against the dollar just as much as many emerging market currencies. But historically a strong dollar has not been a good thing for emerging equity markets: if that trend of dollar strength fades or reverses, it could lead to a more propitious environment for the asset class.

It’s also logical to feel more relaxed about valuations now than a year ago; as we wrote above, the portfolio looks reasonably valued to us for the quality of the businesses it owns.

So a lot will come down to growth rates, and here we should reiterate that we try to think about all the factors which determine any business’s ability to generate returns on the capital it invests, and thereby create value over the long term. If we hold a collection of highly competitive, strongly financed companies on reasonable aggregate valuations, which we believe we do, it is not hard to believe that they will in the long run continue to grow their intrinsic value, which will in turn translate into good returns for their shareholders.

Closing thoughts

As Warren Buffett is reputed to have said, investment is simple, but not easy. This past year stands as a good illustration of that maxim. We will keep investing in strong businesses with the ability to compound their intrinsic value, mindful of two other comments attributed to Buffett: “time is the friend of the wonderful business, the enemy of the mediocre”, and “the stock market is a device for transferring money from the active to the patient”.

. . . . . . . . . . .

Manager, Gulf Investment Fund – 13 September, 2022

Saudi Arabia aims to raise US$100 million to establish the Tourism Support Fund in collaboration with the World Bank to further advance the sustainable tourism by increasing job opportunities and preserving natural heritage. The target is to receive as much as 100 million visits per year from both domestic and international tourists by 2030.

The National Development Fund (NDF) will inject US$151.9 billion into the economy by 2030, under the new strategy revealed by the Saudi Crown Prince. Furthermore, as a part of its new strategy NDF aims to triple the kingdom’s non-oil GDP to US$161.25 billion by 2030, while generating new job opportunities in the kingdom. The IMF expects the kingdom’s economy to grow by 7.6 per cent in 2022.

The UAE government announced new initiatives to provide entrepreneurs and Small and Medium Enterprises (SMEs) with several integrated services aimed at enhancing their growth possibilities and market share. These include the Government Procurement Program, the Business Support Program, and the Financing Solutions Program. These new services represent a continuation and expansion of the National SME Program’s efforts. The IMF sees growth accelerating in the Emirate on the back of structural reform efforts, increased foreign investment, and rising oil production

Qatar is partnering with international companies in the first and largest phase of the nearly $30 billion expansion that will boost Qatar’s position as the world’s top LNG exporter. The first phase of the expansion project, called North Field East, is expected to increase Qatar’s LNG production capacity to 110 mtpa from 77 mtpa. The second phase of expansion plan will involve six LNG trains, which are anticipated to boost Qatar’s liquefaction capacity to 126 mtpa by 2027.

The Kuwait government announced a draft budget for FY2022/23 projecting a narrower budget deficit of KWD3.1 billion, down 74.2 per cent amid higher oil prices and reduced spending. Total revenues are projected at KWD18.8 billion, a rise of 72.2 per cent, on the back of higher oil revenues. Total Spending to fall 4.8 per cent to KWD21.9 billion, with capital expenditure accounting for 13.2 per cent of total expenditure. The IMF projects real GDP to accelerate to 8.2 per cent in 2022, on the back of higher oil output and strengthening domestic demand.

Oman’s stock exchange plans to allow full foreign ownership in listed companies to attract more investments to its market. The move is expected to make the bourse more attractive for international investors as it seeks inclusion within global emerging market indices. Furthermore, Oman plans to list 35 state owned companies in the next five years.

Oman has allocated an additional 200 million rials for the 2022 budget to bring total expenditure this year to 1.1 billion rials. Additionally, country has also directed to allocate an additional 650 million rials for development projects for a five-year plan that ends in 2025. Oman posted a budget surplus of US$545m in the first two months of this year, helped by higher oil prices and tax collection. Oman also announced expansion of free zones to boost the economy and attract foreign investments in the country. The free zones in Muscat, Salalah, Sohar and Duqm are expected to bring in economic benefits by diversifying the state income and bringing prospective trading partners. The move is aimed to align Oman with international standards and create a global investment scenario. Growth is projected by the IMF to be 5.6 per cent in 2022.

GCC banks should benefit from higher interest rates. This, coupled with attractive valuations post the recent correction should provide better value to shareholders. Hence, we continue to remain overweight on financials.

Inflation is still running at below 2 per cent so far in 2022. We expect some increase over the second half of this year, but we see inflation remaining well below international levels. HSBC forecasts GCC inflation at around 3.8 per cent for 2022 and 3 per cent for 2023.