Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

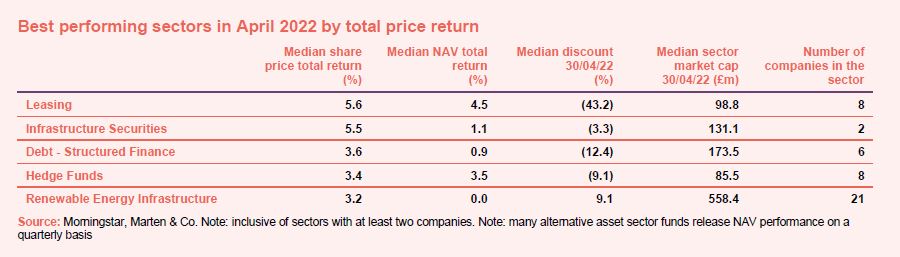

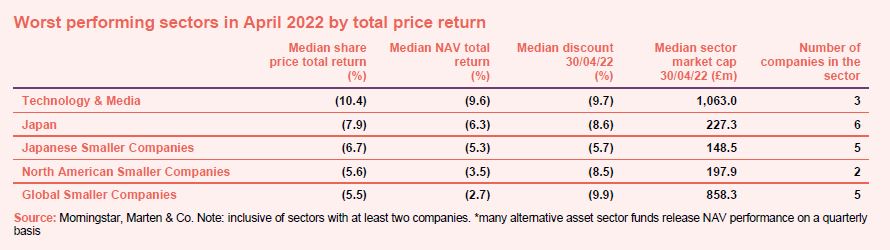

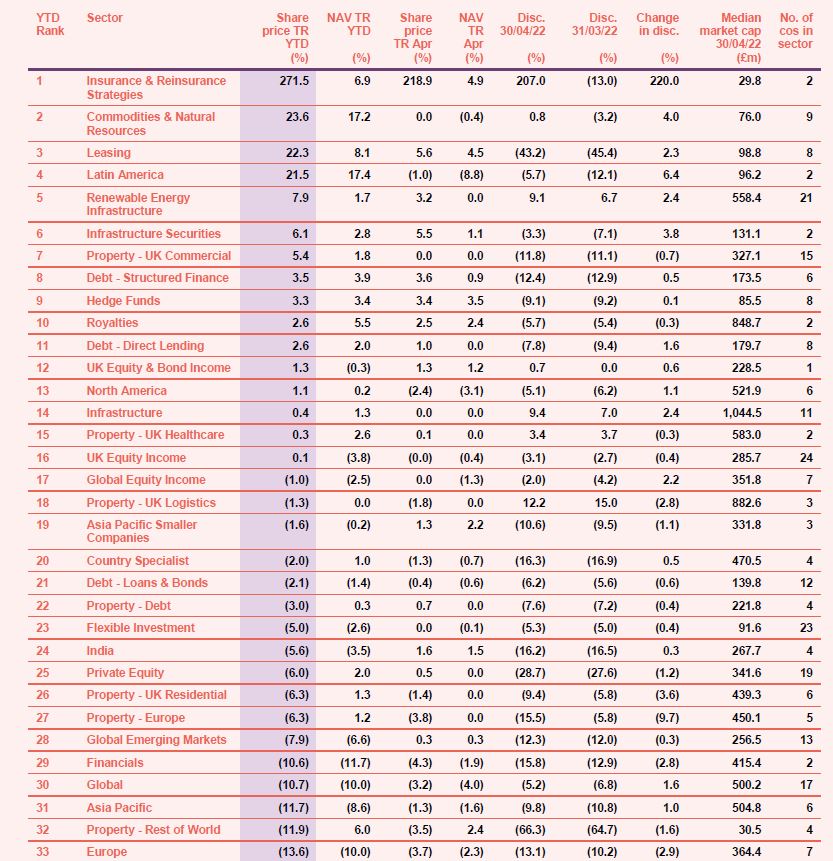

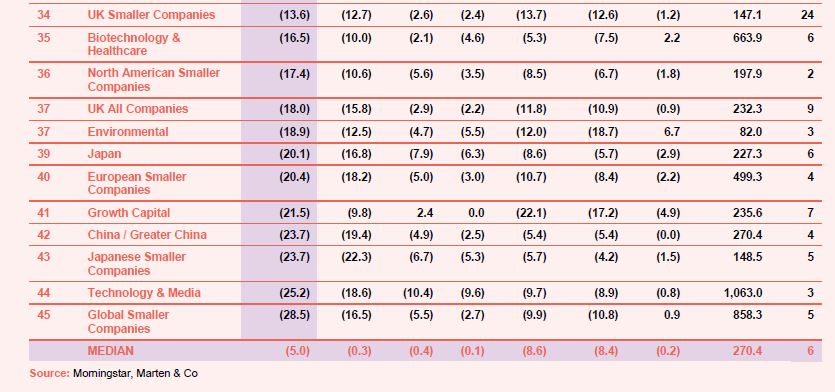

After an already difficult first quarter to the year, April proved no different as the war in Ukraine, Covid-induced lockdowns in China and the prospect of a tighter monetary policy in the US all weighed on sentiment. In terms of performance within the investment companies’ universe, leasing trusts took the top spot with all members delivering positive returns as Emirates made positive noises about extending its use of A380 aircraft. Meanwhile, the infrastructure securities and renewable energy infrastructure sectors also did well helped by high energy prices, while countries continue to show their commitment towards better use of energy, transport and the like. On the negative side, technology & media trusts were the biggest losers as growth stocks continue to be out of favour. The month saw tech giant Netflix’s shares plummet as it reported a surprise loss of 200,000 subscribers. Meanwhile, Japanese funds also suffered with the yen down -11.1% versus the dollar year-to-date. No changes were made at the BoJ’s April meeting, but commentators say its actions will be important to monitor in the coming months given the potential impact on global bond yields if Japanese yields move higher (see Appendix 1 for a breakdown of how all the sectors have performed this year).

April’s median total share price return was -0.4% (the average was 3.7%) which compares with a median of 1.9% in March. Readers interested in recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over April

Worst performing sectors over April

On the positive side

Both top and bottom performers in April included a mix of mandates showing no strong trends but rather individual circumstances contributing to performance. In NAV terms, Africa Opportunity was the best performer (the trust remains in winding down mode) and Symphony International took the top spot in share price terms, having done well from an improving outlook for the hospitality, healthcare and lifestyle sectors. BH Macro had a good month after reporting strong results while Gulf Investment Fund has continued to benefit from rising oil prices. After being one of the worst performers in recent months, JPMorgan Russian Securities made it into the top NAV performers list as the price of one of its Kazakh investments soared. US dollar denominated assets benefited from dollar strength, helping funds such as US Solar and Doric Nimrod Air Three. An investment in Grindrod, a listed shipping company, helped Taylor Maritime make the top ten list.

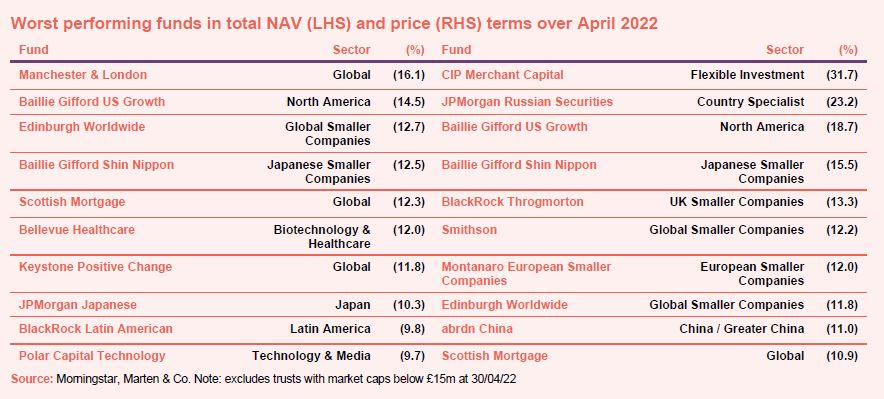

On the negative side

Growth-focused global (and global smaller) funds suffered with Manchester & London, Edinburgh Worldwide, Scottish Mortgage and Keystone Positive Change down in NAV terms while Smithson was down in share price terms. Three of the names listed are Baillie Gifford mandates which is famously a growth house, an area which has struggled since the start of the year. abrdn China’s share price continued to fall as parts of the country went back into lockdown while Japanese funds Baillie Gifford Shin Nippon and JPMorgan Japanese also took a beating for reasons already discussed. The worst performer in share price terms was CIP Merchant Capital after it became obvious that the bidder for the company had won the day.

Discounts and premiums

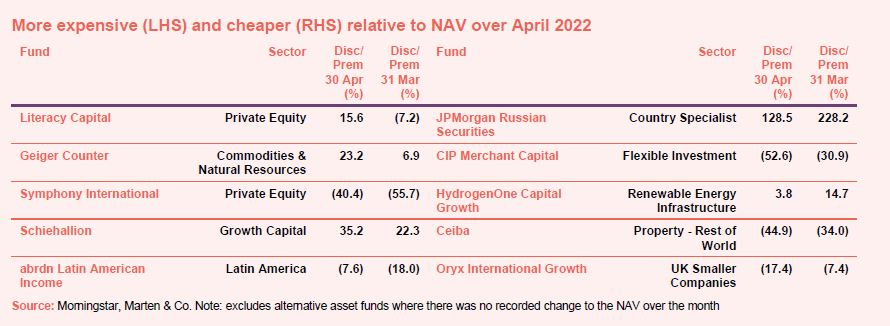

More expensive and cheaper relative to NAV

Literacy Capital enjoyed a significant turnaround in April, with its 7% discount swinging to a 15% premium. This comes after the trust reported strong figures in its maiden results for 2021. Meanwhile, Geiger Counter’s NAV and share price have both been quite volatile recently, a double-digit premium at the end of April has since evaporated, while Symphony International’s 55% discount narrowed slightly to 40%. As already mentioned, the latter has been benefiting from an improving outlook for the hospitality, healthcare and lifestyle sectors.

After coming back down to reality last month (it was trading on a 59.3% premium at the end of 2021) Schiehallion’s premium increased yet again in April. It also reported strong results for the 12 months to 31 January 2022, achieving a 17.8% share price return despite the turmoil faced by growth stocks at the start of the year. abrdn Latin American Income has had an excellent start to the year as the region has fared well from higher commodity prices. However, the NAV slipped in April and the share price fall did not reflect all of this.

Having increased to ludicrous levels over the past two months, JPMorgan Russian Securities’ premium fell sharply in April, helped by the NAV uplift referred to above but remains at an absurd 128%. Meanwhile, HydrogenOne Capital Growth’s premium narrowed during the month. The company bought a minority stake in an aerospace business at the end of March which investors may be cautious about as travel hasn’t fully returned to pre-pandemic levels, but the general growth sell-off may also be a factor. After seeing its discount swing out in February and narrow in March, Oryx International Growth’s discount widened to double digits once more in April.

Money in and out

Money coming in and going out

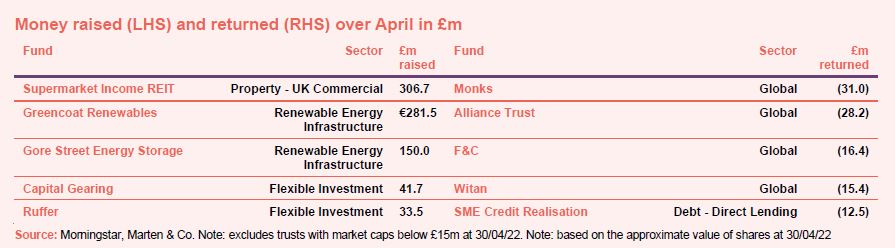

Just over £470m of net new money was raised in April, led by a £307m fundraise from Supermarket Income REIT. Having initially targeted £175m, the board agreed to raise more due to its confidence in acquiring assets in the pipeline, the increase in the availability of attractive investment opportunities since the marketing roadshow began and the extremely strong level of support and quality of demand from investors in the issue. Greencoat Renewables also saw its placing oversubscribed and raised a commendable €281m (£250m) while Gore Street Energy Storage raised £150m (up from the £75m target) with net proceeds planned to be deployed towards the company’s significant pipeline.

Ruffer and Capital Gearing also issued new shares while share buybacks were led by Monks, Alliance Trust, F&C, Witan and SME Credit Realisation.

Major news stories over April

Portfolio developments

- Triple Point Energy Efficiency Infrastructure buys BESS assets

- TRIG acquires 49% interest in Spanish solar park, Project Valdesolar

- International Public Partnerships buys Gold Coast Light Rail Stage 3

- Schroder Asian Total Return outperforms during tough 2021

- BB Biotech remains resilient in another difficult quarter

- Baillie Gifford China Growth discusses ‘biggest regulatory reset in a decade’ in dismal year

- Merchants ekes out 40th year of dividend growth after good year

- Lindsell Train changes the way it values its asset management business

- North American Income ups dividend despite lower option income

- NextEnergy Solar starts construction of its 36MW Whitecross project in Lincolnshire

- Digital 9 buys data centre in London

- Octopus Renewables backs Finnish renewables developer

- RTW backing Lenz Therapeutics

- Ecofin US Renewables well placed for expansion

- Pershing Square dumps Netflix stake

- Aquila European results overshadowed by discount problem

Corporate news

- Final update on offer for CIP Merchant Capital

- Greencoat Renewables raises €281.5 million in oversubscribed placing

- HydrogenOne Capital Growth announces placing to fund immediate £45m pipeline

- Mercantile dips into revenue reserves to increase dividend

- Gresham House Energy Storage mulls international opportunities as it seeks approval to change investment policy

- Rockwood comes full circle

- Aquila Energy Efficiency wants to push on

- NB Global Monthly Income exit opportunity looms

- Schroder UK Public Private considers going global

- Polar Cap Financials benefits as Schroders sorts out capital structure

- Round Hill Music ready to expand again

Managers and fees

Property news

- Palace Capital to boost dividend following strong year

- UK Commercial Property hit by wider discount

- BMO Commercial Property Trust to change name

- Warehouse REIT buys £62m estate in Milton Keynes

- abrdn European Logistics Income posts 12.4% NAV total return

- British Land sells chunk of Paddington Central for £694m

- Urban Logistics REIT deploys further £45m

- Tritax EuroBox to acquire Swedish development land for €21.4m

- Supermarket Income REIT raises £300m in oversubscribed issue

- Standard Life Investments Property Income delivered benchmark beating returns

QuotedData views

- Circling the Pershing Square – 1 April

- To B or not to B – 8 April

- Are you still watching? – 22 April

- What’s going on? – 29 April

Recently published research notes

Henderson High Income – Last man standing

Henderson High Income (HHI) has enjoyed something of a UK revival for a year now, boosted by a recovery from the pandemic and a game of catch-up among dividend-paying companies, which manager David Smith says still have further to go. Concerns around inflation, and now the Russo-Ukrainian conflict, linger – but the trust’s focus on high quality companies and its ability to invest across both equities and bonds means that it has more scope to prepare for any uncertainty on the horizon. Following the liquidation of Acorn Income in Q4 2021, HHI is now the only trust in the UK equity and bond income sector.

Polar Capital Global Financials Trust – Riding out the storm

Polar Capital Global Financials Trust (PCFT) has been a beneficiary of renewed interest in the financials sector, as economies reopen from the effects of lockdowns and interest rates begin to edge up (as we explain in this note, higher rates should feed into higher margins for banks). Incredibly, the sector is yet to make up the ground it lost relative to the wider market in early 2020, as COVID-19. Many of the companies in PCFT’s portfolio are reporting strong earnings growth already. However, the sector’s rerating has stalled on fears of a recession. PCFT’s managers point to the strength of banks’ balance sheets and their conservative lending policies. They also cite the evidence of 1970s UK – when barring brief periods of very high inflation – banks did relatively well.

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- AVI Japan Opportunity AGM 2022, 3 May

- Smithson AGM 2022, 3 May

- RIT Capital AGM 2022, 4 May

- Apax Global Alpha AGM 2022, 5 May

- Pershing Square Holdings AGM 2022, 5 May

- abrdn Smaller Companies Income AGM 2022, 5 May

- Witan AGM 2022, 5 May

- BlackRock World Mining AGM 2022, 6 May

- Temple Bar AGM 2022, 10 May

- abrdn Asian Income AGM 2022, 11 May

- Schroder Asian Total Return AGM 2022, 11 May

- Baillie Gifford Shin Nippon AGM 2022, 12 May

- Schiehallion AGM 2022, 12 May

- Dunedin Income Growth online presentation, 16 May

- European Assets AGM 2022, 17 May

- Fidelity Japan AGM 2022, 17 May

- Mercantile AGM 2022, 17 May

- Merchants Trust AGM 2022, 18 May

- JPMorgan American AGM 2022, 18 May

- Impax Environmental Markets AGM 2022, 18 May

- Schroder UK Public Private AGM 2022, 18 May

- abrdn UK Smaller Companies Growth Trust, 20 May

- North American Income Trust online presentation, 23 May

- Digital 9 Infrastructure AGM 2022, 23 May

- Dunedin Income Growth AGM 2022, 24 May

- International Public Partnerships AGM 2022, 25 May

- Fundsmith Emerging Equities AGM 2022, 25 May

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – April 2022 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.