November 2023

Monthly| Investment companies | October 2023

Kindly sponsored by abrdn

Winners and losers in October 2023

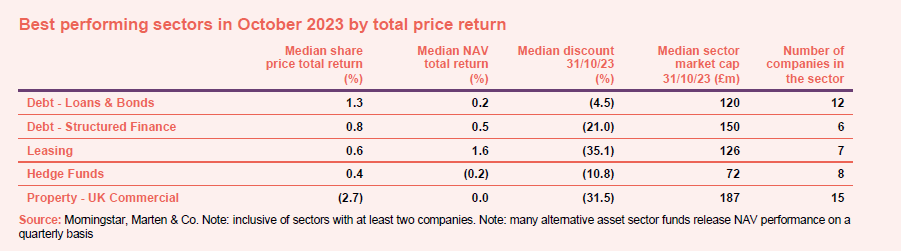

October marked the third consecutive aggregate monthly fall for investment companies, with only four of 48 sectors recording a positive return. All major markets were down as the narrative continued to be driven by the US bond sell off; 10-year treasury yields briefly breached the 5% threshold for the first time since before the collapse of Lehman Brothers in 2007. UK markets led the slide, falling 3.7%, weighed down by tepid economic growth and stubborn inflation. It was a similar story in the Eurozone, while emerging markets including China, also suffered from rising yields, geopolitical concerns, and China’s ongoing economic slowdown.

The broad-based nature of the sell-off over the course of the month is clear when considering the best performing sector, Debt – Loans & Bonds, had a share price total return of just 1.3%. Led by CVC Income and Growth, which was up 5%, the sector has been one of the few beneficiaries of rising rates, with companies able to roll loans at higher coupon rates, boosting earnings and insulating returns. The Structured Finance sector has benefited from similar tailwinds, although it tends to focus on the more complex end of the bond market, utilising financial engineering to provide more bespoke debt solutions, and this has led to a wider dispersion of returns within the peer group (for example Marble Point Loan Financing was up 5.1%, while Blackstone Loan Financing was down 3%). It was a similar story for the Hedge Fund sector with a broad spread of returns for the month.

The Leasing sector was driven by a 15.5% bounce in the share price of Doric Nimrod Air Two following the sale of two aircraft, which have recently come off 12-year leases, to Emirates for a total of US$70m.

The Property – UK Commercial sector rounds out the best performers list although the median share price total return was down 2.7% for the month. Given the negative return, there wasn’t anything particularly notable from the sector, and while relative performance was positive, this appears to be more a function of how far UK commercial property has already sold-off, with average discounts over 30%.

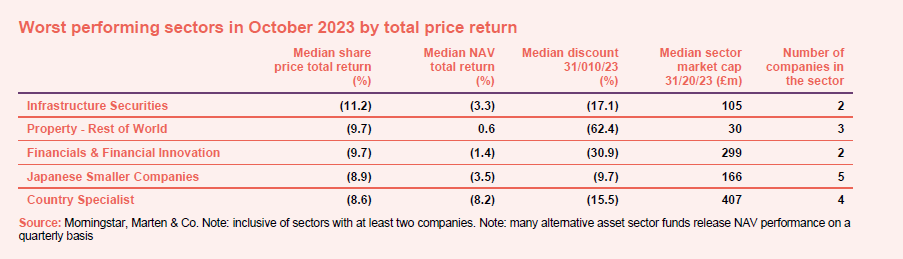

There was plenty of competition in the worst performers list with Infrastructure Securities recording the steepest drop, falling 11.2%. The sector is made up of only two companies, Ecofin Global Utilities & Infrastructure which fell 5.5% (despite making it into the highest NAV risers list – see below), and Premier Miton Global Renewables Trust which fell 16.9%. Both funds may have been hit hard by increased concerns around the availability and cost of financing, in addition to the added competition from money markets which are now providing steady returns without the associated credit and duration risks. The sell-off in the Premier Milton fund, amplified by the structural gearing provided by its zero dividend preference shares, has been particularly galling for investors. Rising bond yields have weighed heavily on its yieldco holdings, which, along with related funds, make up almost 40% of the portfolio. One silver lining is that over the first weeks of November, yields fell considerably, and the market has begun to price an end to the global tightening cycle which should help this and other affected funds recover some of this lost ground.

Despite several harrowing geopolitical events over the course of the month, the rise in US bond yields remained the only game in town for markets, and the list of worst performers reflects the sensitivity of some sectors to these events. Commensurate with rising yields was the rally in the USD, with the dollar index coming within touching distance of its three years high. This has triggered significant capital outflows from emerging economies (who traditionally have high levels of dollar denominated debt) including Vietnam which makes up the bulk of the Country Specialist sector. Similar headwinds weighed on the global property sector, particularly Aseana Properties, which also invests in Vietnam as well as Malaysia, with the trust down 22% in October.

There are a number of factors driving returns in Japan, including corporate governance reforms and divergent monetary policy, and weakness over the course of the month is more a function of timing, with the country’s benchmark indices still up around 25% year to date offset by a weak yen. Despite this, the Japanese Smaller Companies sector has continued to be an area of weakness, reflecting broader market trends as investors seek the safety of larger caps which are traditionally more stable during periods of volatility.

The bulk of the negative returns in the Financials & Financial Innovation sector were driven by Augmentum Fintech which fell 12.9% over the course of the month, reflecting the ongoing negative perception of fast-growing companies that need cash to fuel growth.

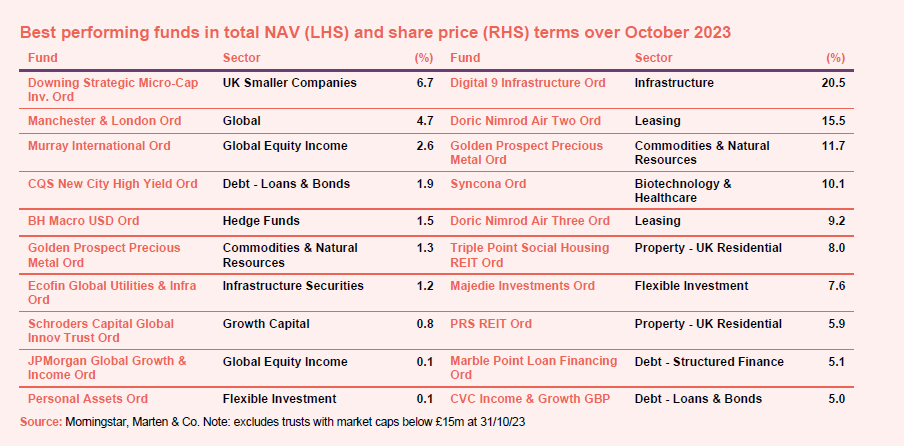

Looking at the list of best performing funds, Downing Strategic Micro-Cap led the way in terms of NAV return after its holding in Fire Angel was bid for.

The bulk of the outperformance from the collection of Global funds was thanks to contributions from stock selection. For example, Manchester & London’s returns were due to a 7% move in Microsoft which makes up 30% of its portfolio, while Murray International benefited from two of its largest holdings, RELX and Diageo both returning around 4%.

As noted above, Debt – Loans & Bonds has been one of the few sectors seeing sustained benefits from higher rates, with CQS New City High Yield a feature of this performance. The fund has been able to rollover loans at a higher coupon.

While gold has generally struggled with rising real rates over the last few months, escalating geopolitical concerns saw the commodity catch a bid, driving up Golden Prospect Precious Metal. Although we note that over the past few years, Golden Prospect’s small cap bias seems to have worked against it.

The Schroders Capital Global Innovation trust has seen its NAV fall dramatically over the past 12 months, so the slight bounce is welcome but not much to write home about. We would say the same about the modest returns from BH Macro and Personal Assets.

In terms of share price performance, Digital 9 Infrastructure led the way following an announcement that the company is assessing the possibility of divesting its entire stake in the Verne Global group of companies which make up almost 40% of the fund. As noted above, the Doric Nimrod Trust bounced on the announcement of the sale of two aircraft, while shares of Syncona responded positively to the announcement of a share buyback programme of up to £40m.

Shares in PRS REIT rallied following the release of its annual report which highlighted that demand and supply dynamics are currently in a ‘sweet spot’ driving strong performance across the board, although it is worth noting that the fund still trades on a 32% discount. Triple Point Social Housing REIT also bounced off its lows. It is not immediately clear what drove the move, although with the discount at over 50% and shares trading towards the bottom of their range, the path of least resistance now appears to be up.

Majedie Investments has experienced a dramatic turn of fortunes over the course of the year, falling around 20% from its peak, before recovering almost all this lost ground over the last couple of months. It is not immediately clear what is driving recent returns, although the fund targets idiosyncratic bottom-up opportunities, to provide high active share and no inherent style or sectoral bias, which goes some way to explain the recent volatility.

Worst Performing

As noted on page one, the worst performing list reflects a continuation of the year’s dominant themes, as emerging markets, smaller companies, and growth orientated funds in particular continue to struggle with increasing financing costs and competition from rising cash yields and government debt. USD strength has compounded these issues further, as has general defensive positioning within the market.

Vietnam Enterprise, as discussed above, has been heavily impacted by foreign exchange headwinds, broader macroeconomic stress and a country-specific issue with its real estate sector, with the company’s two month decline of 17.5% wiping out what was up until now, a very productive year. The performance of Chelverton UK Dividend Trust, which invests predominantly in small and midcap companies, highlights the current issues facing the sector as the market favours the perceived more defensive qualities of larger caps.

Of the funds or sectors not already discussed, Bellevue Healthcare features due to exposure to subsectors like med tech and diagnostics which exist more towards the growth-orientated end of the healthcare spectrum. Stock selection has also weighed on returns for the trust, for example, its largest holding, Exact Sciences, fell 10% in October. Henderson Opportunities has fallen steadily over the course of the year, also suffering from its growth bias, while the two environmental funds have been impacted by weakness in the demand for sustainable agriculture and exposure to renewables, including sectors like offshore wind which have been hit hard by rising costs and supply chain constraints.

In terms of share price returns, the Seraphim Space Investment Trust has continued its volatile run over the last few months. The stock rallied almost 90% from its lows following a positive trading update, although it has since given up all of those gains with shares continuing their downward trend after the company’s annual report which showed a 7% reduction in NAV.

The broader renewable energy sector troubles are compounded for Gresham House Energy Storage and HydrogenOne which both invest in fast growing but relative nascent technologies that are still ramping up profitability, with these sorts of companies heavily out of favour in the current market. It is a similar case for the Schiehallion Fund which is down over 35% year to date.

Moves in discounts and premiums

The bulk of the moves in discounts have been discussed above, with the companies becoming more expensive benefiting from a range of positive updates over the course of the month. In term of those funds getting cheaper, Gulf Investments fell 16% following its latest quarterly update, although the NAV was only down 1% over that period. This seems illogical to us, especially given the great track record that fund has of beating local indices. JPMorgan Global Core Real Assets has seen considerable weakness across several of its main asset classes, including global transportation, global infrastructure, and Asia Pacific real estate. Shares in abrdn European Logistics Income have trended down steadily over the course of the year, dropping further following its half year report which showed a fall in NAV of 9%.

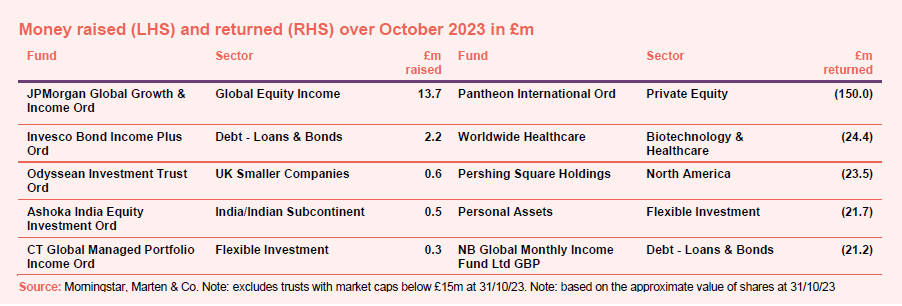

Money raised and returned

October was another month of modest fundraising, which is understandable given broader macro headwinds. JPMorgan Global Growth & Income has been a constant in this space, benefiting from its impressive stability over the past few years.

The Invesco fund was the only other company to raise over £1m, reflecting the broader challenges of fundraising Iin the current environment.

In terms of money being returned to shareholders, the list was dominated by the usual suspects, outside of Pantheon International which completed a previously announced tender offer, buying back £150m of shares at a 34% discount to its net asset value.

Major news stories and QuotedData views over October 2023

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 28 July | RNEW, HDIV, ASCI | Uzo Ekwue & Pav Sriharan | Schroders British Opportunity Trust |

| 4 August | BPCR, TLEI | Fotis Chatzimichalakis | Impax Asset Management |

| 11 August | GCP/GABI/RMII, HGEN, NAVF/AJG | Helen Steers | Pantheon International |

| 18 August | TLEI, RSE, BSIF, NESF, EPIC, ESP | Richard Moffit | Urban Logistics |

| 25 August | USF, RICA, TLEI, EPIC, HOME | Iain Pyle | Shires Income |

| 1 September | HEIT, SOHO | Ed Simpson | GCP Infrastructure |

| 8 September | RNEW, RHM, RMII | Prashant Khemka | Ashoka WhiteOak |

| 15 September | EPIC, SONG, SUPR, TLEI | Dean Orrico | Middlefield Canadian Income |

| 22 September | AIG, GABI, GCP, HICL | Andrew Jones | LondonMetric Property |

| 29 September | DGI9, GIF, HICL, SONG | Carlos Hardenberg | Mobius Investment Trust |

| 6 October | ORIT, PSH, RGL | Alan Gauld | abrdn Private Equity |

| 13 October | EOT, GSF, CHRY | James de Uphaugh | Edinburgh Investment Trust |

| 20 October | SONG, SYNC | Tom Williams | Downing Renewables |

| 27 October | UKW, SONG, ADIG | Richard Sem | Pantheon Infrastructure |

| 3 November | ARIX, RWT | Minesh Shah | Renewables Infrastructure Group |

| 10 November | PCTN, DSM | Craig Martin | Vietnam Holding |

| Coming up | |||

| 17 November | Joe Bauernfreund | AVI Global Trust | |

| 24 November | Ben Green | Supermarket Income REIT | |

| 1 December | Charles Luke | Murray Income |

Research

Downing Renewables and Infrastructure Trust – Powering ahead

Downing Renewables and Infrastructure (DORE) set out to build an attractive portfolio of renewable energy assets diversified by geography and asset type, and has succeeded in that. In doing so, it identified an opportunity to build a portfolio of hydropower assets in Sweden. As we describe in this note, the management team has identified a number of ways in which it feels that it can significantly enhance the returns of these assets.

Herald Investment Trust (HRI) demonstrates why patience can be key when it comes to investing. The managers highlight the drought of funding available to small cap technology stocks. The team has ensured that HRI has sufficient liquidity to take advantage of opportunities as these arise. HRI is operating in a buyers’ market, and this often gives it the power to dictate terms.

Figure 12

With its strong focus on growth, European Opportunities Trust (EOT) has faced significant headwinds during the last couple of years as, in the face of higher inflation and interest rates, investors have favoured more value and defensive exposures over growth stocks. Inflation now seems to be coming under control, but with growing signs of a recession in Europe, sentiment in financial markets is poor. Consequently, valuations of European equities are cheap relative to their history and global markets.

Lar España Real Estate continues to defy the doom and gloom surrounding the retail sector, posting strong financial and operational numbers. The value of its Spanish shopping centre and retail park portfolio has been stable despite higher interest rates (investment yields that are used to value property tend to move with interest rates – and rising yields equal falling capital values). This was in large part thanks to extraordinary rental growth within its portfolio (gross rental income was up 16.4% over the first half of 2023).

The disconnect between HydrogenOne Capital Growth (HGEN)’s net asset value (NAV), current and prospective track record, and its share price is hard to rationalise.The recent bond market rout (yields have spiked higher, driving down bond valuations) has added insult to injury for renewable energy investors. Higher interest rates have increased concerns around the availability and cost of financing, in addition to the added competition from money market funds, which are now providing steady returns with lower risks than other investment types.

Henderson High Income / Henderson Diversified Income – Merger terms agreed

Henderson Diversified Income (HDIV) has agreed heads of terms for a combination with Henderson High Income (HHI). As part of the deal, shareholders in HDIV will have the option to take cash for all or part of their holding if they choose. In July 2023, HDIV’s chairman noted (see our news story here) that the trust had shrunk through share buybacks, and that this was inflating its average running costs and affecting liquidity in its shares. More importantly, he also made some observations about the fund’s investment approach (devised at launch in 2007) and the impact that this might be having on the sustainability of HDIV’s income and shareholders’ total returns (see page 4).

Bluefield Solar Income Fund – Record year supports growth strategy

While shares across the whole of the renewable energy infrastructure sector have been under pressure over the past 12–18 months, the execution by Bluefield Solar Income Fund (BSIF) has remained impressive, helping it to maintain its record of sector-leading distributions. The company’s record performance has been driven by its locking in of higher power prices through power purchase agreements. Thanks to the execution of these contracts, the board has good visibility over the bulk of company earnings for the next few years.

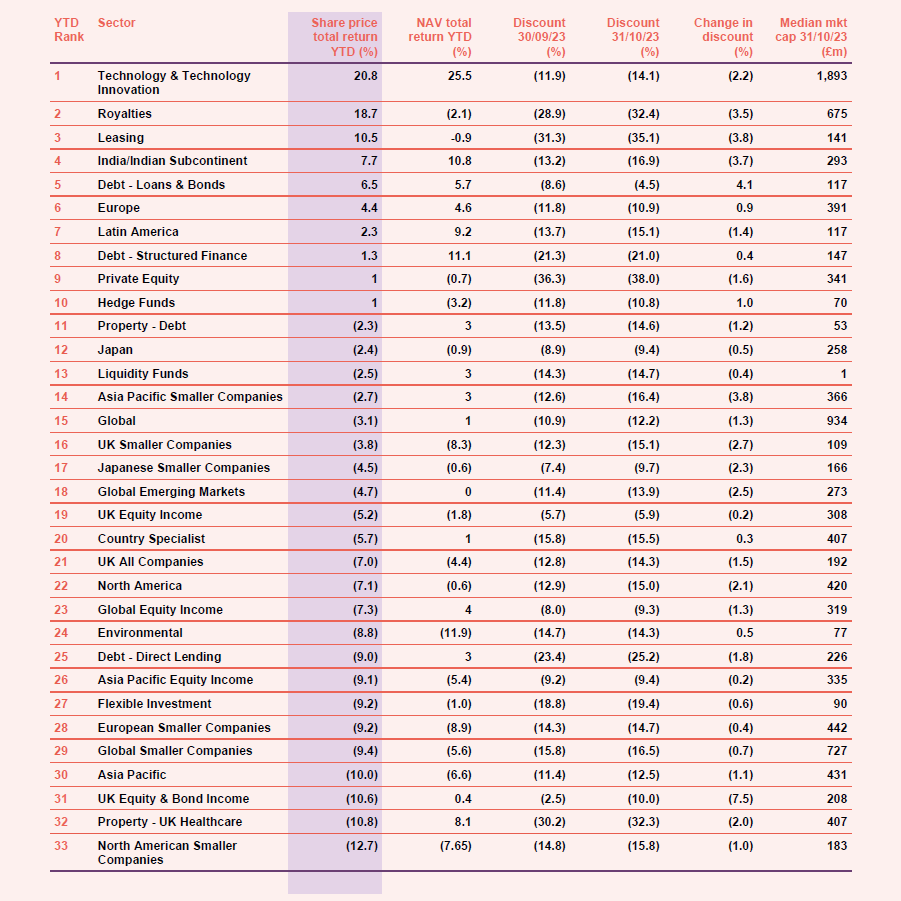

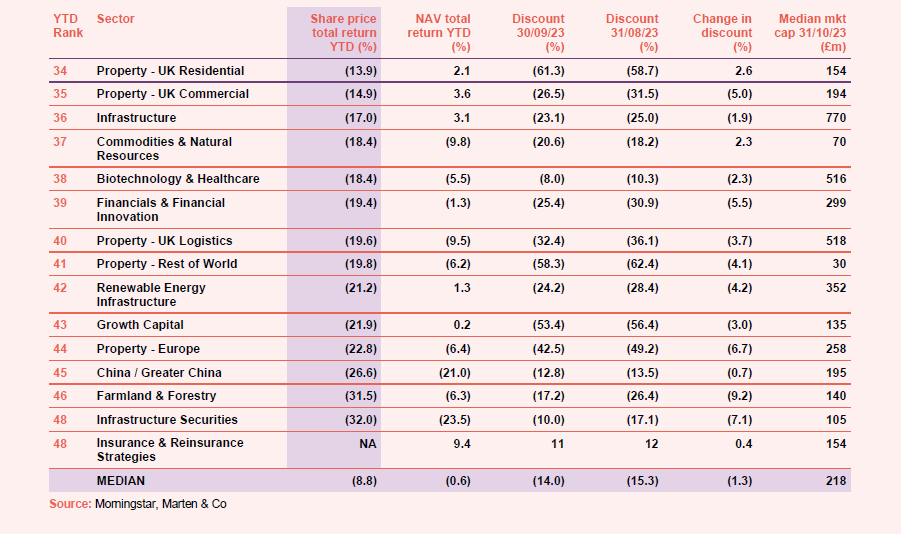

Appendix 1 – median performance by sector, ranked by 2023 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.