Real Estate Roundup

Kindly sponsored by abrdn

Performance data

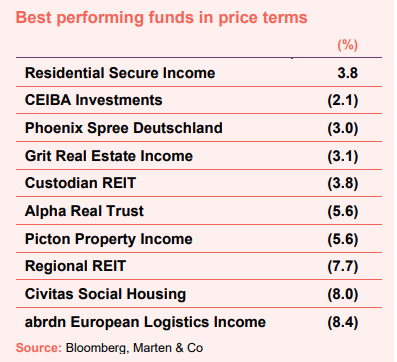

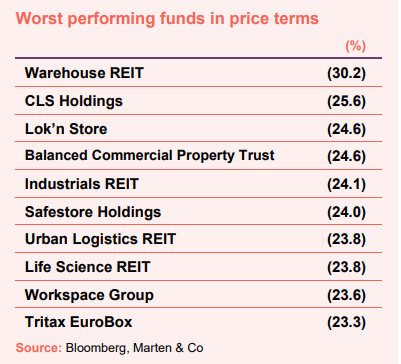

September’s biggest movers in price terms are shown in the charts below.

The real estate sector is facing the perfect storm. Fears that interest rate rises will be higher and faster as the Bank of England looks to quell inflation, exacerbated by the chancellor’s disastrous ‘mini budget’ at the end of September, hit the share prices of listed real estate companies during the month. The market is pricing in large valuation declines as investment into real estate is choked off by rising debt costs. Meanwhile, the cost-of-living crisis threatens the discretionary retail sector, and a recession would have a negative impact on demand for office space. There was one positive mover during the month, however. Residential Secure Income saw its share price rise 3.8% after it announced extended debt facilities (see page 3 for more details) and a £50m acquisition partnership (see page 4). Those to have limited the damage include Berlin residential landlord Phoenix Spree Deutschland, which announced solid interim results during the month (see page 2 and 6 for details). Others, such as office specialist Regional REIT and Civitas Social Housing, were already trading on significant discounts to NAV with both their share prices down more than 30% in the year to date.

A softening of investment yields and capital values are inevitable and lower yielding real estate sub-sectors such as industrial and logistics are most susceptible. Both Warehouse REIT and Industrials REIT own portfolios of multi-let industrial properties, which are more exposed to small and medium-sized enterprise (SME) businesses that could be hit hardest in a recession. Urban Logistics REIT, which is focused on single-let warehouses located close to city centres, also saw its share price plummet during the month, as too did European logistics specialist Tritax EuroBox. Concerns over the impact of a recession on leasing demand in the office sector, on top of uncertainty over future demand in a hybrid working environment, may have been behind the large share price declines of CLS Holdings and Workspace Group. A large increase in interest rates and the affordability of mortgages, coupled with a recession, may also impact on demand for self-storage space, with less people moving home and requiring storage space. Two of the biggest operators in this sector – Lok’n Store and Safestore Holdings – saw their share price fall 24.6% and 24% respectively.

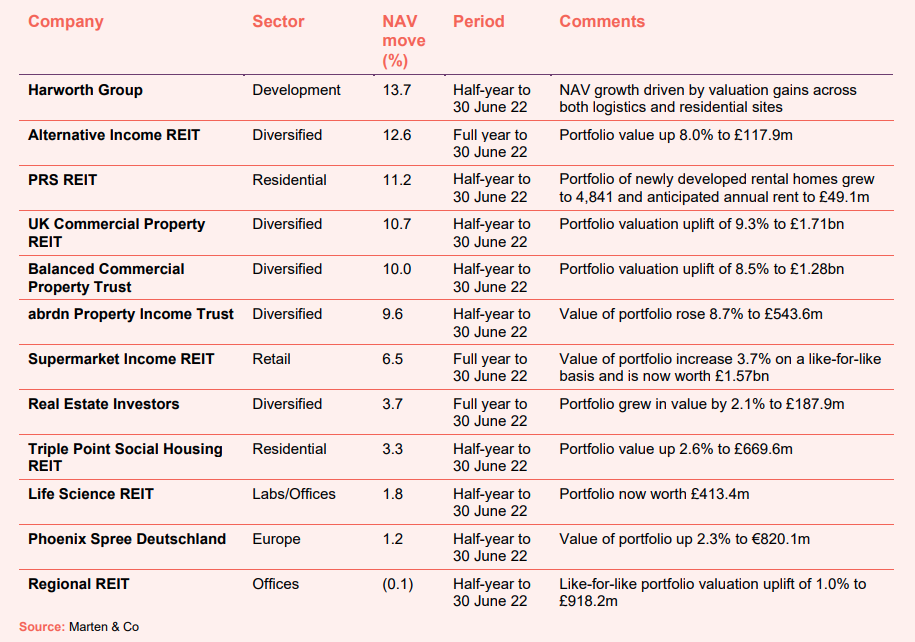

Valuation moves

Corporate activity

The planned initial public offering (IPO) of a new supported living real estate investment trust (REIT) was shelved due to market turmoil. Independent Living REIT had sought to raise £150m, which it would have used to acquire social housing properties.

CLS Holdings announced the results of the tender offer for one in every 40 shares in the company. A total of 10,184,894 shares were tendered, scaled back from 154,132,053 shares that were validly offered, at an aggregate price of £25.5m. This represented around 2.5% of the share capital of the company.

Tritax EuroBox appointed Phil Redding as its new fund manager replacing Nick Preston. Redding joined Tritax in November 2020 as director of investment strategy, from SEGRO plc, where he held the position of chief investment officer and was a member of the board.

Alternative Income REIT announced that chairman Alan Sippetts intends to step down from the role. A formal recruitment process for a replacement will be carried out, and Sippetts will remain as chairman until this process has been completed.

Residential Secure Income agreed a £15m expansion of its £10m revolving credit facility with Santander. The expansion comes with an interest rate margin reduction of 55 basis points, from 2.80% to 2.25%, as well as a one-year extension to March 2025.

Warehouse REIT was added as a constituent of the FTSE 250 and All Share Indices, on 19 September 2022.

Major news stories

- Land Securities sells Moorgate station office for £809m

Land Securities sold its 21 Moorfields office development in the City of London, which is pre-let to Deutsche Bank, for £809m and a 4.7% net initial yield. The price represents a 9% discount to the March 2022 value, but crystallises a development profit of £145m, representing 25% profit on cost.

- LXI REIT pulls out of £500m Sainsbury’s portfolio buy due to market conditions

LXI REIT pulled out of its planned £500m acquisition of a portfolio of Sainsbury’s supermarkets. The deal was conditional on LXI raising equity from investors, which it wasn’t able to do following the market crash at the end of September.

- LXI REIT sells income strip on Thorpe Park and Alton Towers for £257m

LXI REIT sold a 65-year “income strip” on its Thorpe Park and Alton Towers assets to an institutional investor for £257m. As part of the deal, the company sold the freehold in the properties, with 999-year leases granted back to the company, with LXI paying the buyer an annual aggregate rent of £8.2m. The company can acquire the freehold back from the buyer for a nominal price of £1 in year 65. The deal reflects a net initial yield of 2.96%.

- Helical sells TikTok office for £158.5m

Helical exchanged contracts to sell its TikTok-let Farringdon office building Kaleidoscope to Chinachem Group for £158.5m, at a 4.8% yield. It let the 88,580 sq ft office to TikTok in March last year on a 15-year lease at £7.6m a year.

- Supermarket Income REIT checks-out £84m Tesco buy

Supermarket Income REIT bought a Tesco supermarket, an Iceland Food Warehouse and complementary non-grocery units in Bradley Stoke, Bristol, for £84.0m, reflecting a net initial yield of 5.6%.

- Home REIT continues expansion drive

Home REIT continued its acquisition drive with the purchase of 158 additional properties for £57.4m. The acquisitions were funded by the proceeds of its £263m equity issue in May 2022 (of which it has now deployed 88%).

- Unite sells Aberdeen student digs for £33m

Unite Students sold a portfolio of six properties in Aberdeen, comprising 1,050 beds, for £33m (Unite share: £20m) to Clearbell Property Partners III LP. The disposal was priced in line with prevailing book value, which reflects a yield of 6.0%.

- Residential Secure Income agrees £50m tie-up for shared-ownership homes

Residential Secure Income agreed a £50m partnership with social impact real estate firm HSPG, giving it the exclusive option to acquire HSPG’s entire pipeline of shared ownership properties on a tranched basis. The company expects to acquire at least £50m of properties as part of the deal over the next three years.

- Custodian REIT buys distribution centre

Custodian REIT acquired a 91,955 sq ft distribution facility between Glasgow and Edinburgh for £11.125m, reflecting a net initial yield of 5.25%. The property is fully let to Gist, a national distribution business, for a further five years.

- Harworth sells development site for £54m

Harworth Group completed the sale of its Kellingley development site in Selby, North Yorkshire, for £54.0m.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Jason Baggaley, manager:

2022 will likely be categorised as a year of change as the strong performance in the first half of the year is unwound. Real estate has benefited from low gilt yields in recent years, with an attractive yield margin attracting investors. With the rapid rise in gilt yields the attractive income margin that real estate offered has been eroded, and it is reasonable to expect a repricing in real estate as yields move out to re-establish an acceptable margin over the risk free rate.

Pricing in the lower yielding areas of the market, including the industrial and logistics sector, is expected to move first but, as the relative pricing between prime and secondary assets tightens, greater capital value declines are to be expected in the secondary end of the market. As a result, investors are anticipated to take a more risk off approach towards UK real estate in the second half of this year and polarisation of investor focus will deepen as investors target best in class assets which should provide more resilient returns in a weakening environment.

ESG considerations are expected to become even more integral to investor decision making and asset underwriting. This trend was expedited as a result of the Covid-19 pandemic, but with the current energy crisis and pathway to net-zero, the case for integrating ESG considerations across all UK real estate sectors has never been greater. A greater focus on ESG requirements for both acquisitions and developments is expected to gain further momentum. Initially this will lead to greater pricing impact on secondary offices.

Overall, we expect volumes to decline in the second half of 2022 and in 2023, before stabilising in 2024. The recovery in pricing will come as inflation, then interest rates fall and the yield on real estate again looks attractive.

Ken McCullagh, chairman:

The underlying pace of the UK economy is clearly slowing whilst inflation is running at multi-year highs. Despite the government’s announcement that energy prices will be frozen to help UK households and businesses, short-term inflation is still set to rise above 10% in October. The government’s huge fiscal stimulus was always going to cause interest rates to rise further, but the large market moves since the government’s economic agenda was announced suggest even higher rates will be necessary to restore confidence in UK assets. We are sceptical on what is currently priced by markets, but a period of high and sustained rates is likely increasing our conviction that the economy will soon be in a recession.

For UK real estate, the environment of rising rates has resulted in a repricing of debt and other asset classes, which has been a catalyst for a change in sentiment towards UK real estate more generally, with prices having started to adjust. Weaker returns are expected for UK real estate over the next 12-18 months, led by the lower yielding industrial and logistics sector although almost all sectors are expected to follow suit. On a positive note the occupational market for the industrial sector remains well balanced, with healthy levels of take-up and a national vacancy at a low 3%. Despite increased development for this sector, build cost inflation and development delays are expected to act as a natural cap on future supply.

Meanwhile, the office market is becoming increasingly polarised between truly best in class space and the rest. ESG is playing an increasingly critical role in this regard, as are changing tenant requirements due to hybrid working arrangements, necessitating greater flexibility of space. With the cost of living crisis likely to weigh on consumer spending, the retail sector is more exposed, but this will be felt most acutely for discretionary led retailers, with high street shops and shopping centres more vulnerable.

Balanced Commercial Property Trust

Richard Kirby, manager:

The economic context is increasingly challenging as geopolitical tension, continued supply chain disruption and significant inflationary pressures weigh on the UK economy and its consumers. Interest rate increases and the outlook for further increases is impacting the cost of finance and many debt backed purchasers have stepped back from the market. This is having an impact on asset pricing in the sectors where these purchases were motivated and active over the first half of the year. The second half of the year will naturally see investors exercising caution.

While economic pressures may yet precipitate a UK recession, a lower-growth environment is inevitable. The likelihood is that investment yields will see a softening, rather than slowdown in the occupational markets, although rental levels are likely to remain benign. The coming months will be focused on price discovery amid a pause in investment activity.

Through periods of uncertainty investors will look to drive income. However, the rising cost of capital and increasing gilt yields mean that yields in some sectors of the market are increasingly hard to justify at their current levels. Industrial – where yields reached historic lows over the period – has already been subject to a marginal adjustment with more expected to follow. The wider market will likely come under the same pressures, albeit relative yield premiums in the other sectors will offer some protection.

In challenging market conditions, asset fundamentals come to the fore. The company’s conviction to high quality real estate in enduring prime locations positions the portfolio to perform through the market cycles as robust capital values alongside a yield premium will protect long-term returns. Alongside asset management to extract value from the standing portfolio, there is significant opportunity to further boost returns through the delivery of capital expenditure initiatives.

Europe

Stuart Young, manager:

During recent months there has been a significant change in investor and consumer confidence in reaction to inflationary pressures, consequential interest rate rises, expectations for future global central bank monetary policy and economic growth. This has further been impacted by the ongoing conflict in Ukraine. Although PSD’s share price has significantly outperformed its listed German residential peers during the first half of the financial year, these circumstances have created a degree of uncertainty across global equity markets from which PSD has not been immune.

Whilst rental values should continue to be supported by industry fundamentals, there has been a material deterioration in buyer sentiment since the beginning of the year. For PSD, this has been evident in condominium sales and, to the extent that the key drivers of weaker buyer sentiment (higher mortgage rates, and a higher cost of living) are unlikely to reverse during the second half of the year, it is anticipated that condominium sales for the full year 2022 will be materially lower than 2021.

Whilst there is now evidence of yields rising in certain segments of the German residential market, supply-demand imbalances within the Berlin PRS market should continue to support rental values. An increase in the cost of home ownership is likely to place further pressure on the significant shortage of housing that already exists in Berlin, as potential buyers remain within the rental system for longer. This shortage has been further exacerbated by the migration of almost one million refugees into Germany from Ukraine.

Additionally, higher funding, labour and construction costs present significant headwinds to large-scale new-build construction, a trend which is likely to further limit the future supply of rental accommodation. Future rent growth should therefore continue to be underpinned, and there remains significant future reversionary rental potential across PSD’s portfolio of buildings.

The Company recognises the challenges that its customers are facing as a direct consequence of inflation. Notwithstanding current cost-of-living pressures, year-to-date rent collection levels have remained stable. The Company has always managed rent-to-income multiples for new tenants conservatively and this customer demographic, combined with recent Federal support initiatives to help mitigate the financial impact of rising fuel costs, should ensure rent collection levels remain resilient.

Laboratories

Claire Boyle, chairman:

There are powerful long-term drivers of demand for life science real estate in the UK. Life science organisations are investing heavily in research and development, to bring forward new technologies and meet challenges such as ageing populations, the associated growth in healthcare costs and the demand for digital health solutions. The Covid-19 pandemic has also been a catalyst for new research. The UK’s strong position in life science continues to attract global companies to invest here, while the Government is also increasing investment in the sector.

All of this activity is creating significant demand for suitable real estate, ranging from labs and offices to production facilities. The Golden Triangle (“Golden Triangle”) of Oxford, Cambridge and London’s Knowledge Quarter is particularly in demand, reflecting the benefits of being part of a cluster of like-minded organisations, which creates opportunities for knowledge sharing and collaboration, and helps to attract the best talent.

This demand has led to very low vacancy rates, particularly for lab space, contributing to rising rents and asset valuations. As many companies look to shorten their supply chains in the wake of Covid-19 and Brexit, they are increasingly looking for flexible space where they can have all their operations in one building, ranging from office space, research and development, to production. In response, we are looking at how we can create flexible space that occupiers can adapt to their needs.

Development

Lynda Shillaw, chief executive:

Over the past six months, the near-term outlook for the UK economy has weakened considerably. The war in Ukraine has had a dramatic impact on energy prices and food supply chains across Europe and beyond. Globally, inflation and interest rates have been rising and UK inflation stands at a 40-year high with interest rates rising sharply. This is placing huge pressure on household budgets and consumer confidence. We are beginning to see signs that both the residential and industrial & logistics markets are coming off record highs as a number of these factors begin to take hold. Debt markets are tightening as interest rates rise, and supply chains and labour markets remain restricted. Investors still have a substantial amount of capital to deploy into the right product in the right sectors, and Harworth’s products are in two of the most resilient real estate asset classes and, fundamentally, both sectors are still undersupplied.

These economic stresses are impacting everyone, and whilst there is little we at Harworth can do to change these factors, we can ensure that we monitor and respond to them. We are confident that Harworth is well-placed to do this, and that we are adapting to the changing risk environment. However, it is our expectation at this stage that, as a result of this market backdrop, valuation gains during 2022 will be first half-weighted.

Real estate research notes

Urban Logistics REIT – Long-term dynamics remain strong

Grit Real Estate Income Group – Transition underway

Civitas Social Housing – Fundamentals remain strong

Standard Life Investments Property Income Trust – Resilient income in uncertain times

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.