Real Estate Roundup

Performance data

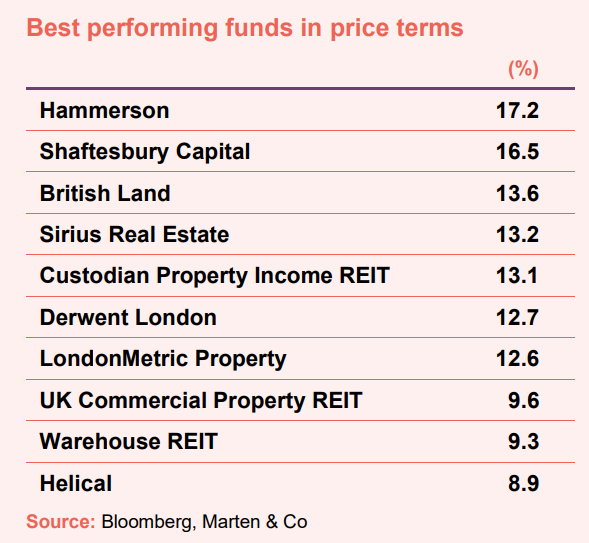

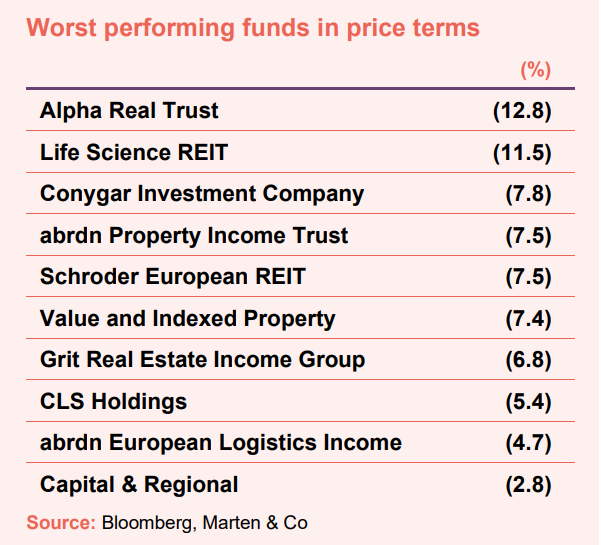

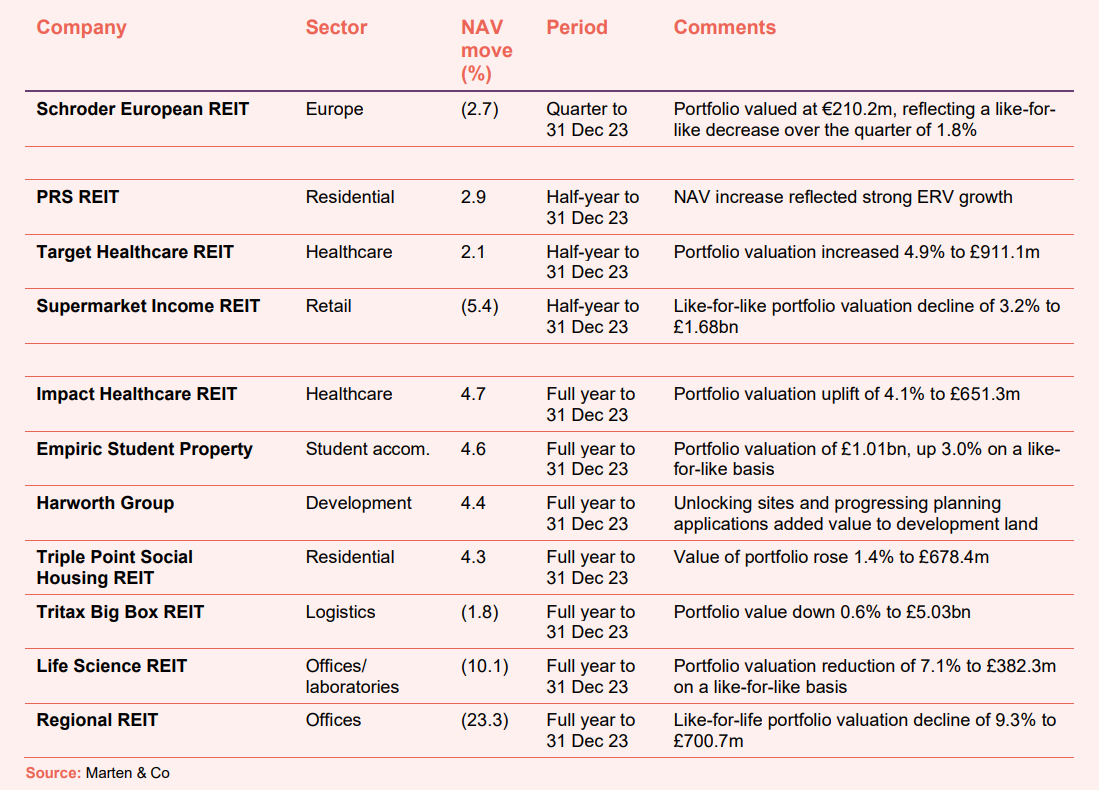

March’s biggest movers in price terms are shown in the charts below.

The release of positive inflation data during the month – which showed CPI was back trending down towards the 2% target – was a much-needed tonic for the real estate sector. The median average share price rose 3.5% across the listed sector in March – the first monthly average uplift this year. Retail giant Hammerson led the way, continuing its mini revival. Its share price was up 17.2% in the month and is up 14.1% over 12 months. Another retail heavyweight Shaftesbury Capital also witnessed substantial gains and is now up 25.8% over 12 months. Anglo-German business park owner Sirius Real Estate is making good progress in deploying the proceeds of its £147m capital raise at the end of 2023, which is reflected in its share price. Custodian Property Income REIT’s share price bounced after the proposed deal to merge with abrdn Property Income Trust fell through, but it is still down 7.1% from pre-deal announcement. LondonMetric saw its share price leap after completing the acquisition of LXi REIT during the month. Meanwhile, terms on the merger of UK Commercial Property REIT with Tritax Big Box REIT have been agreed, boosting the former’s share price.

Having reported the sale of its largest property asset at a substantial discount to book value (see page 4), Alpha Real Trust, which focuses on asset-backed lending, debt investments and high return property investments, saw its share price fall in kind. Life Science REIT has come under intense share price pressure in recent months and again shed double-digits in March, again despite completing an encouraging office-to-laboratory letting at a substantial premium (see page 4). The company has lost 37.8% in value so far in 2024. The aborted merger of abrdn Property Income Trust and Custodian Property Income REIT (see page 3) had a contrasting impact on their individual share prices, this likely reflects unwinding of merger arbitrage activity in these companies’ shares. A quarterly NAV update that revealed a further hit on the value of Schroder European REIT’s portfolio (see page 2) saw its share price drop 7.5% in the month. Continental logistics landlord abrdn European Logistics Income, which effectively put itself up for sale last year, saw its share price fall on news that it had sold a vacant French asset at a discount (see page 4).

Valuation moves

Corporate activity

The proposed and recommended merger of abrdn Property Income Trust (API) and Custodian Property Income REIT (CREI) failed after not receiving enough support from API shareholders. Just over 60% of votes cast were in favour of the merger, below the 75% threshold to sanction the deal. The API board will now take steps to implement a managed wind-down of the company subject to the approval of API shareholders at another general meeting.

The boards of Tritax Big Box REIT and UK Commercial Property REIT (UKCM) reached agreement on the terms of a £3.9bn merger of the two company. Both boards, excluding UKCM chairman Peter Pereira Gray, have recommended an all-share offer at an exchange ratio of 0.444 new ordinary Tritax Big Box shares per UKCM share. The possible offer implied a value of 71.1p per UKCM share and around £924m for the company (at the time of the announcement). This represented a premium of 10.8% to UKCM’s share price, but a discount of 9.7% to its NAV at 31 December 2023. The deal has the support of UKCM’s two largest shareholders – Phoenix Life and Investec – who combined own 56.5% of the company.

NewRiver REIT appointed Lynn Fordham as chair designate. She will succeed Baroness Ford OBE as non-executive chair of the board on 30 May 2024. Fordham has extensive board level experience gained as an executive director and non-executive director of listed companies. She is currently non-executive director and of NCC Group plc, Caledonia Investments plc, Domino’s Pizza Group plc and Enfinium Group Ltd.

Regional REIT announced that it was exploring a possible equity capital raise of around £75m through a rights issue that would be at a material discount to the current share price. The rights issue was one of a range of refinancing options it was exploring, including the issuance of new debt, the proceeds of which would be used to service an existing £50m retail bond that matures in August 2024.

Land Securities launched and priced a £300m bond with a maturity of 7.5 years and a coupon of 4.75%, representing a spread of 103 basis points over the reference gilt rate. This followed the maturity of two bonds in February 2024, totalling £417m. The bond will extend the group’s weighted average debt maturity to 9.4 years.

Major news stories

- British Land sells stake in 1 Triton Square for £192.5m

British Land sold a 50% stake in its 1 Triton Square office, in London’s Regent’s Place, to Royal London Asset Management Property for £192.5m. This was the building that Meta (Facebook) surrendered its lease on last year, paying British Land £142m in order to walk away from its lease agreement. The combined impact of the surrender premium and JV formation is expected to deliver a 30%-plus IRR.

- Shaftesbury Capital grows Covent Garden footprint with £75m buy

Shaftesbury Capital bought 25-31 James Street, Covent Garden, London for £75.1m. The properties have a contracted rent of £3.9m and comprise 21,000 sq ft of lettable area, including 12,000 sq ft of retail and 9,000 sq ft of residential/office.

- Sirius Real Estate expands UK portfolio with £48.25m acquisition

Sirius Real Estate acquired Vantage Point Business Village, a business park in Gloucestershire, for £48.25m, representing a net initial yield of 10.2%. The purchase was made using proceeds from the company’s £147m capital raise in November 2023.

- Life Science REIT lets lab space at substantial premium

Life Science REIT leased 7,497 sq ft of space at the Innovation Quarter at Oxford Technology Park to ColdQuanta UK Limited, which is part of global quantum technology company Infleqtion, at a substantial premium to the rent level of the park. ColdQuanta will pay an annual rent of £337,365, equating to £45.00 per sq ft for 10 years, with a break clause and rent review at the end of the fifth year.

- Helical sells London office for £43.5m

Helical sold the 45,000 sq ft, six-storey office building 25 Charterhouse Square, in London, to Ares Management for £43.5m. The disposal price represented a 6.5% discount to the 30 September 2023 book value.

- Supermarket Income REIT buys £34.7m Tesco store

Supermarket Income REIT acquired a Tesco omnichannel supermarket in Stoke-on-Trent, Staffordshire, for £34.7m, reflecting a net initial yield of 7.5%. The asset comprises 54,451 sq ft net sales area and a petrol filling station, and was acquired with an unexpired lease term of 11 years and annual RPI-linked rent reviews (capped at 4%).

- abrdn European Logistics Income sells vacant French asset for €17.5m

abrdn European Logistics Income completed the sale of a 30,180 sqm warehouse in Meung sur Loire, France, to Castignac for €17.5m. The disposal price of the vacant asset was in line with the 31 December 2023 valuation but a 7% discount to the 30 September 2023 valuation.

- abrdn Property Income sells duo of assets at book value

abrdn Property Income Trust sold two assets for a combined £16.55m, reflecting a very slight discount of 0.3% to their 31 December 2023 valuations. The sales comprised the London office building 15 Basinghall Street for £9.8m and the industrial assets Opus 9 for £6.75m.

- Great Portland Estates signs up TK Maxx to Oxford Street scheme

Great Portland Estates let 22,500 sq ft of retail space at its Oxford Street asset Mount Royal (508/540 Oxford Street) to TK Maxx. The new space comprises 22,500 sq ft across the ground and first floor, with 70 ft of Oxford Street frontage.

- Alpha Real Trust sells Madrid mall

Alpha Real Trust sold its 30% interest in Madrid shopping centre H2O for net proceeds (after payment of debt) of €14.5m. This was below the €18.9m book value at 31 December 2023, and will reduce the company’s NAV by 1.8%.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Logistics

Aubrey Adams, chair:

Our sector is a key part of the UK’s economic infrastructure and the long-term drivers of e-commerce, supply chain resilience and ESG continue to sustain strong demand for modern buildings. Occupiers continue to consolidate older logistics facilities into larger modern ones that can provide economies of scale, accommodate automation for e-commerce sales, add resilience to their supply chains and meet ESG objectives as well as improved working environments for staff.

Following a period of exceptional demand, 2023 has seen market fundamentals normalise, with UK-wide market vacancy rates increasing from the very low levels reported in 2022. In response to this, and heightened levels of economic uncertainty, construction starts of speculatively developed buildings have fallen back sharply through the year.

Overall, while the occupational market has softened compared to its all-time highs in 2021/22, it remains at levels which would historically be considered strong. Macro-economic improvement is likely to increase occupier demand, which could outstrip decreased levels of supply, causing reduced vacancy levels and maintaining rental growth at attractive rates.

Residential

Steve Smith, chair:

There are long-term drivers supporting the private rented housing sector, most fundamentally lack of supply and burgeoning demand, which is driven by many factors, especially the affordability challenges of buying a home and population growth.

These factors support the long-term prospects for the PRS REIT, and we believe our homes will continue to rent very well over the long-term. This reflects not only macroeconomic factors, but also the attractions of our high-quality, well-located, and professionally-managed homes, which have been designed to be affordable for the typical family. The portfolio’s average rent as a proportion of household income is about 23%.

Triple Point Social Housing REIT

Max Shenkman, fund manager:

Whilst operating conditions have been volatile during this recent period of high inflation, as they were throughout the COVID pandemic, one constant of the sector is the structural excess demand for more Specialised Supported Housing. We see this on a daily basis through a requirement for funding for new developments brought to us by Local Authorities, and our Registered Provider and Care Provider partners. Similarly, the Government estimates that demand for more Specialised Supported Housing homes is set to increase by over 100,000 by 2030, or almost double relative to the number of Specialised Supported Homes occupied today1. A growing prevalence of disability, combined with the requirement to move people out of institutional care settings and provide independent community homes, is driving this increase in demand.

Demand for more Specialised Supported Housing properties underpins the performance of our Registered Provider and Care Provider partners and, in turn, the performance of the Group. Demand drives high levels of occupancy at the Registered Providers the Group works with and has helped ensure that the occupancy of the Group’s portfolio has continued to increase as it matures. In addition, it supports our ability to address any issues within the Group’s portfolio, such as if a new care provider needs to be brought into a property or an alternative Specialised Supported Housing use needs to be sought, thereby adding resilience to the portfolio’s performance.

Looking forward to a year in which there will likely be a General Election, we are reassured that our business model is unlikely to be impacted by the result. Specialised Supported Housing continues to enjoy cross-party support due to its ability to provide independent homes to individuals with care needs whilst ensuring they can remain within their local community receiving the care and support on which they rely. Whatever form the next Government takes, we expect them to preserve the level of benefits available to some of the most vulnerable members of society. Similarly, due to a cross-party focus on fiscal responsibility, we expect any new Government to continue to rely on private funding to help build the new homes required to make meaningful inroads into the UK’s housing crisis. All of this reaffirms the strong fundamentals on which the Group’s strategy is predicated.

Healthcare

Simon Laffin, chair:

There are 6.5 million people aged over 75 living in the United Kingdom in 2024. That number is forecast to increase by 55%, to 10.1 million over the next 25 years. The over 75’s are the fastest growing part of the UK population. These increases will happen during the lives of our long leases.

While rising life expectancies are good news, the downside is that most people will spend the last 15 years of their life with some ill health. Around 10% of people over 80 have care needs that make it difficult for them to live at home. Many people end up stuck in hospital beds, which means they’re in the wrong setting for the type of care they need, particularly if they have dementia, and this increases costs for the NHS.

Despite the ageing population and rising acuity, the number of available care beds for elderly care has been stagnant. Between 2012 and 2021, the number of beds in nursing and residential care homes fell from 11.3 per 100 people aged over 75 to 9.4 – a 17% decrease. Looking at longer-term trends, an estimated 25% of over 85s lived in care homes for the elderly in 1996. By 2017, this had fallen to 15%. This reflects several factors, including a shift in social care policy towards home care. It might also reflect an element of rationing in the care system, as many older people struggle to access the care they need.

Although the care home market is attractive, for existing care homes the economics make it difficult to create much new supply. Construction costs have risen substantially over the past two years, making it difficult to deliver a high quality new care home for less than £200,000 per bed. In contrast, an older home with an established record for providing good quality care can cost less than £100,000 per bed, which we believe offers a better risk adjusted return. Given the higher capital costs of brand new homes, tenants have to pay higher rents – up to 20% of their revenues as opposed to our average of 12.6% – which means that they in turn have to pass these costs on by charging higher fees to their residents. The higher fees needed by newly built care homes limit the number of residents who can afford this, restricting the size and growth of this segment of the market. Slightly older homes also offer opportunities to add value, by updating them, adding facilities and improving their environmental performance, which is another reason we favour this part of the market over new builds.

Alison Fyfe, chair:

Care homes fill a crucial role in meeting the nation’s health and social care need. A growing and ageing population is placing stress on the system overall, given the increased frailty and dementia naturally associated with an increased elderly population. This is an obvious demand driver for care home places. As our healthcare system struggles to keep up with increasing demand, social care is increasingly being recognised and looked-to as the appropriate setting for many who don’t necessarily require NHS/primary care. Increased investment in the sector can readily help alleviate the pressures on the NHS and primary medical care settings. We see no let-up in the need for substantial investment in modern care home real estate and our mission is to provide and support such investment.

Retail

Nick Hewson, chair:

The UK grocery sector continued to show strong growth in 2023 against a persistently uncertain economic backdrop. During the period, Kantar reported an 8% increase in UK grocery sales building on the strong growth seen in the previous period. Tesco and Sainsbury’s, the UK’s largest grocery operators by revenue, and our two largest tenants, have performed particularly strongly, with both operators growing market share and sales, which is fuelling cash flow growth and profit margins.

In a tight market for new sites due to a lack of prime locations, planning restrictions and elevated construction costs, our large format stores provide the operators with the space to grow sales volumes and thus sales densities, which will further increase rental affordability and should feed through to higher rental income at lease expiry.

The importance of mission-critical supermarkets, the revenue hubs in this growing sector, together with long inflation-linked full repairing and insuring (FRI) leases, has attracted a growing range of investors to this market. In 2023 we saw a record £2.1bn of investment volumes. In addition, we continue to see our two biggest tenants, Tesco and Sainsbury’s buying in their stores with over £2.0bn of supermarkets purchased in the last five years, testament to the value that they see in owning their top trading, omnichannel stores.

Student accommodation

Duncan Garrood, chief executive:

Demand and supply imbalance continues unabated. Participation rates in the UK’s higher education sector remains historically high with over 2.2 million full-time students. China remains the dominant domicile of international students, but shifting demographic trends demonstrate the attractiveness of a relatively affordable UK higher education to a growing number of students from other international markets, particularly India. The UK remains a very attractive high quality, and affordable higher education destination of choice.

A clear flight to quality is continuing, with higher tariff, typically Russell Group, universities experiencing year on year growth in acceptances to the detriment of medium and lower tariff universities. This validates our strategy of focusing our portfolio on these cities, which deliver growth and encourage investment.

The take up of postgraduate studies has grown considerably, aided by the student loan system, visa changes and the desire for further qualifications, while meeting the need of UK universities to generate additional revenue. One quarter of all students now study at postgraduate level full time.

The year saw a net increase in Purpose Built Student Accommodation (PBSA) beds of only 8,760, the lowest in a decade. This highlights the challenges faced, including planning, construction costs and increased interest rates. Legislative changes have driven more than 400,000 private rental properties from the market, contributing to a decline in HMOs, our main competitive market. This has driven more students, particularly domestic students, towards PBSA operators like ourselves.

Offices

Kevin McGrath, chair:

In a challenging environment for REITs, the company continued to see a rise in tenants’ return to the office with an average of 4.1 days per week and increased space enquiries across the portfolio. The Asset Manager’s survey showed an increased 71.4% active office occupation across the portfolio (June 2023: 65.4%) and that current active occupation is 102% of the pre-pandemic occupancy levels and is expected to grow further. However, the company was not immune from the wider macro-economic environment with inflation continuing to impact costs and in-turn potential occupiers taking a ‘wait and see’ position on office requirement or downsizing in the near-term,

Investment in commercial property amounted to £36.7bn during 2023, according to research by Lambert Smith Hampton, 34.5% below the volumes recorded in 2022, and 23.5% below the five-year average. However, improving investment volumes in the final quarter suggest the market bottomed out in 2023, signalling the early stages of an upward trend and a reason to be optimistic moving into 2024.

Overall, investment in regional offices, throughout the UK reached £2.4bn in 2023, and although investment in regional offices across 2023 was 40.2% below trend, optimism in the regional markets continues to be supported by strong employment levels and a fall in the number of employees exclusively working from home. As demonstrated with Q4 2023 investment volumes being 62.1% higher than the previous quarter, reaching £0.8bn.

According to monthly data from MSCI, rental value growth held up well for the rest of UK office markets in the 12 months ended December 2023 with growth of 2.3%. Conversely, central London offices experienced modest growth of 1.7% over the same period.

Offices/laboratories

Claire Boyle, chair:

With five interest rate rises over the year, occupiers have been more cautious about taking new space. The life sciences sector, where fit-out is relatively more expensive and businesses move less frequently, has not been immune. As a result, take-up in Oxford was down slightly on last year’s peak, although was stronger in Cambridge where availability is critically low at under 3%.

However, confidence built towards the end of the year, with greater certainty that we are at or close to peak interest rates, even if the consensus is that they will remain higher for longer. Venture capital (VC) funding in the sector looks to be stabilising following the post pandemic peak in 2021 and has proved more resilient than other areas of the market, down 6% year on year, compared with a fall of 43% for total UK VC investment.

The second half of the year also saw a string of key policy announcements in support of our sector, most notably the Government’s decision to rejoin Horizon Europe in September. The £520 million funding package announced in the Autumn Statement and positive response to the review of university spin-outs also supports an ecosystem where young life sciences businesses can be successful. This backdrop is helpful for our occupiers, many of whom are emerging businesses, looking for affordable space close to their roots in the academic institutions of the Golden Triangle.

The fundamentals of our sector are among the strongest in UK real estate, with demand supported by powerful long-term trends and supply constrained by the need to be located in centres of academic excellence, notably the Golden Triangle.

Real estate research notes

An update note on Tritax EuroBox (EBOX). is sailing in calmer waters as demonstrated by a portfolio valuation that has changed little and a 30% uplift in earnings that now fully covers its 8.6%-yielding dividend.

An annual overview note on Urban Logistics REIT (SHED). The company appears to be a re-rating candidate as values stabilise and management extracts the rental reversion in the portfolio.

An update note on Lar España Real Estate (LRE SM). The company continues to defy the doom and gloom surrounding the retail sector, posting strong financial and operational numbers.

An update note on Grit Real Estate Income Group (GR1T). The company has been reborn, with the acquisitions of a developer and asset manager making annual return targets of 12-15% more achievable.

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.