Retail ready for a renaissance?

Retail ready for a renaissance?

There have been few structural shifts in the property sector as profound as the one currently taking place in retail. Consumer spending patterns have drastically changed over the past five years, with online sales now accounting for 19.7% of all retail spend in the UK (August 2019, source: ONS), compared to 11.5% in August 2014. When you look at fashion retailing specifically, online sales accounted for 26.8% of consumer spend on clothing in 2018 (source: Mintel).

It is little wonder, then, that ‘bricks-and-mortar’ retailers are suffering. Those that haven’t invested in a strong online service are being left behind. Retail empires, once kings of the high street, are crumbling – the latest two being the Arcadia Group and Debenhams.

A growing number of retailers, even those that are still profitable, have resorted to the use of the controversial company voluntary arrangements (CVAs) – a form of insolvency – to shut unwanted stores or slash rents across their estate. Retailers are increasingly exploiting the CVA to duck their financial commitments. Healthy retailers are now at a disadvantage and have started to push for rent cuts of their own to level the playing field. Until legislative change comes from central government, retailers will continue to exploit this loophole, at a significant cost to retail landlords.

The double whammy of an erosion of income and a drop-off in the value of retail assets have hit retail-focused property companies hard. They are all trading at significant discounts to net asset value (NAV), to such an extent that some have become takeover targets. Intu Properties, which has been the subject of two failed takeover attempts recently, is trading at around an 80% discount to NAV and is now reportedly the subject of a buyout led by Orion Capital Managers. Capital & Regional is in talks with South African REIT, Growthpoint, about the sale of a majority stake. However, other retail-focused property companies are actually performing well but have become victims of the negative sentiment around retail.

Amid all the doom and gloom, there are underlying trends emerging in the sector that suggest it could be due for an uplift in fortunes. Here we explore more…

| wdt_ID | Companies covered | Ticker | Market cap |

|---|---|---|---|

| 1 | Capital & Counties | CAPC LN | 1,931.6m |

| 2 | Shaftesbury | SHB LN | 2,653.0m |

| 3 | NewRiver REIT | NRR LN | 583.4m |

| 4 | Intu | INTU LN | 489.4m |

| 5 | Hammerson | HMSO LN | 2,069.0m |

| 6 | Capital & Regional | CAL LN | 135.8m |

Mixing it up

Mixing it up

With estimates by some property consultants stating that there is as much as 30% excess retail space in the UK, all retail landlords are looking at mixed-use development to take the redundant space out of their portfolios. Many of the big shopping centre landlords are looking closely at incorporating residential development, and other property use classes such as hotels and offices in and around their existing schemes in a bid to support their underperforming assets.

The move, if executed well, has the potential for both an increase in land values and customer numbers. Last year, Intu revealed plans to develop around 5,000 private rented sector (PRS) homes and almost 600 hotel rooms and office developments on 470 acres of land surrounding six of its out-of-town centres, most notably at Intu Lakeside in Essex. It is reportedly close to pressing the button on the development of 1,700 rented homes with a targeted yield of around 5% on total development costs of around £240m.

Rival shopping centre landlord Hammerson is pressing ahead with its own mixed-use development plans. Its ‘City Quarters’ strategy has been devised to “create vibrant mixed-use neighbourhoods beyond pure retail to deliver homes, workspace, leisure, cultural and educational space around Hammerson’s existing flagship retail destinations”.

It has set out its plans for its first City Quarters at the Martineau Galleries shopping centre site in Birmingham city centre. Its proposals for the 7.5-acre site include up to 1,300 homes and 1.4m sq ft of workspace, as well as a new city centre hotel, restaurants, a new public square and boulevard. The retail element of the scheme is set to take up around 100,000 sq ft of space – far less than the 900,000 sq ft that was included in a previous planning application for the site back in 2006. Hammerson has also unveiled plans to build a 205-room, 14-storey hotel adjacent to its Victoria Gate shopping centre in Leeds.

Shopping centre specialist Capital & Regional is also working up plans to incorporate housing on top of its centres. It already has planning consent for circa 450 units at The Mall Walthamstow and is in the final stages of selecting a development partner to fully fund and build out the scheme. It has said it expects to realise a capital receipt of around £20m during 2020. The company has planning consent for 214 units at The Exchange in Ilford and is exploring adding more housing to other centres in and around London that could increase the size of its residential portfolio by up to 40%. Subject to planning permission, Capital & Regional could develop an additional 150 apartments at the centre in Ilford, as well as 100 at The Mall in Wood Green and between 20 and 40 at The Marlowes in Hemel Hempstead.

NewRiver REIT is getting in on the act too, and has identified sites in its portfolio that could potentially deliver up to 2,400 residential units over the next five to 10 years, which it estimates would result in up to £140m of development profit.

Mixed-use development will also be key in the ever-increasing likelihood of department store failures. Both Debenhams and House of Fraser – the latter being the subject of a scathing assessment by its owner, Mike Ashley, during the Sports Direct results in July 2019 – have announced intentions to vacate stores across the country, and John Lewis has stated it will withhold 20% of its service charge bill for the fourth quarter of 2019 at some of its stores located in shopping centres. Landlords will have to get creative to fill the potential huge voids. At its Lakeside scheme, Intu has lodged plans to replace a branch of House of Fraser with homes, and many other landlords are drawing up mixed-use plans in the event of department store closures.

Those companies that are pro-active and can implement their mixed-use strategies quickly and decisively will be able to navigate their way to calmer waters, bringing in much needed additional income that will complement their remaining retail offering.

Bagging a bargain

Bagging a bargain

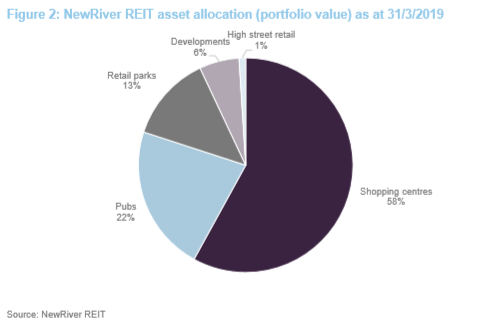

Retail values have fallen to such an extent that investment activity has started to pick up across the sector. Contrarian, opportunistic investors have been taking advantage of market dislocation, as well as a lack of buyers in the market, to pick up some bargain deals for fundamentally good real estate. There are certainly hidden gems to be found if investors know where to look. NewRiver REIT, which has a diversified portfolio including community-focused shopping centres, retail parks and pubs, strongly believes the gems are in the retail park sector. It formed a 50:50 joint venture with Pimco’s opportunistic fund BRAVO in June 2019, with the aim of building a £500m portfolio over the next two years. It seeded the joint venture with the acquisition of four retail parks – in Aberdeen, Dundee, Inverness and the Isle of Wight – for £60.5m and has since grown the portfolio to over £100m.

The strategy appears to make sense. The portfolio has been bought at an average yield of 9% and the properties have particularly low capital values. Well-located retail parks are becoming important assets for retailers with a strong online presence to carry out click and collect operations. All retailers with an online presence, including the behemoth of Amazon, are handicapped by failed deliveries and returns. Returns – often free of charge – are becoming a real concern for online retailers.

One way around this, and one advantage that retailers with physical stores are starting to exercise, is through click and collect. For this to work, the ideal location would be a retail park on the edge of town, with free parking. It is the reason Next is shutting stores on the high street and opening in retail parks. Retail parks also often provide more efficient space with lower rent and service charges.

Well-located retail parks have high alternative use values too. They can be repurposed or sold off with development potential into residential schemes, hotels or even light industrial units.

NewRiver REIT may well be on to a winner if it gets its asset selection right. When the dust settles on retail revaluations, it will be real estate fundamentals that underpin valuations – namely cash flow, affordable rents and alternative use values. Retail parks, in the right locations, have all these attributes.

Flight to prime

Flight to prime

Not all retail is dead, despite the overwhelming number of negative headlines. Recent retail news stories, especially regarding CVAs, don’t make for easy reading, but the knock-on effect has meant the whole sector has been tarred with the same brush. Poor retail, in poor locations, is certainly dead. But well-run retailers that know their brand and their customers, located in prime destinations, are very much alive and kicking.

With an estimated 600 malls fighting against obsolescence, a ‘de-malling’ has started to take place in the UK market. It will see some of the less attractive, failing schemes demolished – taking capacity out of the market. What is left will be the prime, well-located shopping centres, with a concentrated amount of retail coupled with a strong leisure and food & beverage offering.

These types of centres are predominantly owned by listed property companies. Intu owns nine of the top 20 malls in the UK (based on key metrics including annual turnover, size, footfall and shopper ratings. Source: GlobalData) and Hammerson’s shopping centres include the flagship malls Cabot Circus in Bristol, the Bullring in Birmingham and Brent Cross in North London.

British Land, owner of the mammoth Meadowhall shopping centre in Sheffield, has found that location in retail is everything. While it has been hit hard by retailer failings across its retail portfolio, those have disproportionately impacted its smaller centres, especially those in weaker demographic locations. Meadowhall, one of the UK’s biggest regional shopping centres, on the other hand, has continued to outperform. It is 98% let and footfall has grown for eight consecutive months – outperforming all national benchmarks.

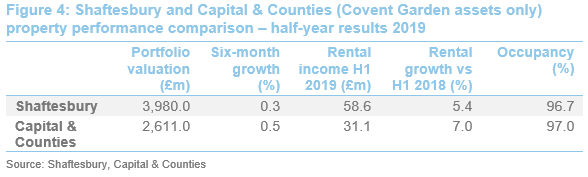

Central London continues to prove that retail is still alive. The West End offers greater insulation from the wider retail challenges and, whilst not immune, curated spaces such as Covent Garden, Carnaby Street and Seven Dials are continuing to see store openings, high footfall and, importantly, rental growth. Capital & Counties, which announced in July 2019 its intention to demerge its £2.6bn Covent Garden business from its Earls Court estate, creating a new London-focused REIT called Covent Garden London, reported significant rental growth in Covent Garden in the first half of this year – 2% above 31 December 2018 estimated rental value (ERV). Net rental income for the first half of the year was up 7% compared to June 2018.

Shaftesbury, owner of Carnaby Street and Seven Dials, has performed well for a sustained period of time off the back of the prime locations of its holdings. It has reported robust demand for its space from domestic and international retailers, reflected in its half-year figures to 31 March 2019 that saw EPRA vacancy across its retail portfolio drop from 10.9% to 6.4% in the period. Retail tenant failures so far in 2019 has represented less than 1% of its portfolio ERV.

Another segment of the retail market that is sheltered from the fundamental shift in consumer spending is grocery. Online grocery shopping accounts for around 6% of the market. The major reason for this low percentage is that it is not profitable. Supermarket Income REIT, which has a growing portfolio of Sainsbury’s, Tesco and Morrisons let supermarkets, reported a total shareholder return of 8% in the year to 30 June 2019 against the UK REIT sector of -6%.

The rise of online retail and the evolving omni-channel sales strategies of retailers has brought into sharp focus the importance of choosing the best locations and destinations. Those property companies with assets in prime locations will be best placed to ride out the storm.

Rates relief coming?

Rates relief coming?

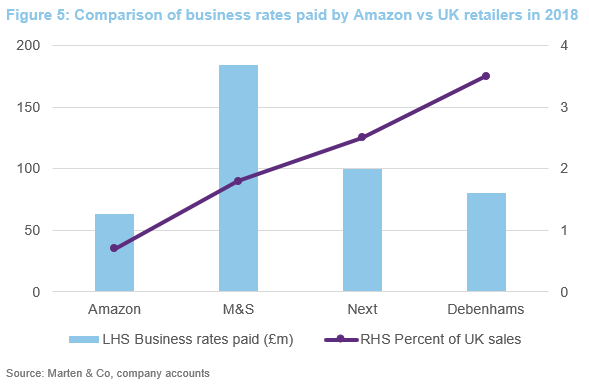

Aside from increased competition from pure-play online retailers, one of the biggest killers for bricks-and-mortar retailers is business rates. Business rates are based on ‘rateable values’, calculated every five years by reference to property rental values and a multiplier that rises annually in line with inflation. Retailers and the property industry have been campaigning for years about the unfair and archaic nature of the system and have lobbied government for an overhaul. It appeared that government had started to get the message, to some degree anyway, when in the Autumn Budget 2018 it announced retailers with a rateable property value of less than £51,000 would receive a one-third discount on their business rates bills for two years.

However, it was little help for bigger retailers, and in fact stymied growth of smaller retailers that had no incentive to grow to above the discount threshold. In August 2019, more than 50 retailers, including some of the biggest names in the sector such as Marks & Spencer, J Sainsbury’s, Asda and Harrods, wrote to chancellor Sajid Javid to call on him to freeze increases in business rates.

The prospect of an online sales tax is also gaining traction. Led by Tesco, a group of retailers have called on the government to cut business rates by 20% and make up the shortfall with a 2% levy on all online retail sales. In February 2019, a parliamentary inquiry issued a proposal for an online sales tax to help “level the playing field” and provide “meaningful relief” for bricks-and-mortar retailers that have been hit with higher taxes due to business rates. By way of comparison, Amazon’s business rates bill last year amounted to around 0.7% of its UK turnover, while bricks-and-mortar stores were paying between 1.5% and 6.5%.

A change in policy would have a material effect on the performance of retail stores and go some way to countering a drop off in store sales. It is clear the government is starting to listen. How quickly reform can be implemented is another question, though, given the political uncertainty created by Brexit.

Move to turnover rents

Move to turnover rents

Something that has become abundantly clear during the heightened CVA activity over the last 18 months is that the traditional landlord-tenant relationship is not working. The walls that have been built up between landlords and retailers are slowly starting to come down, however, as the two parties work together to combat the high-street woes.

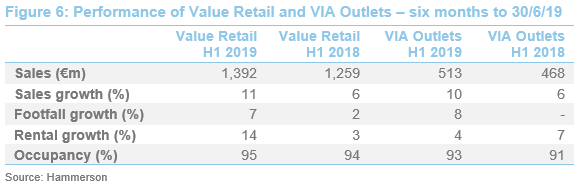

The reign of the archaic institutional model of long-term leases is over. Retailers are demanding increasingly shorter and more flexible leases. One way that landlords, especially shopping centre owners, can thrive in this new world is through a restructuring of the leases to a turnover rent model. It has been highly successful in the outlet centre segment of retail, which has consistently been the star performer in the retail sector and is forecast to grow by 6% a year to 2025. Hammerson has a huge holding in outlet centres via a 50% stake in VIA Outlets and a 39% stake in Value Retail, which owns Bicester Village – although it is reportedly looking to sell some or all of its £1.9bn stake in Value Retail as it bids to cut debt.

The performance of the two outlet centre operators is detailed below in figure 6.

The fundamental advantage with turnover rents, which typically range between 8% and 12% of store sales, is that they capture income growth annually. The typically short lease lengths give landlords the ability to swap out tired or failing retailers and introduce new brands to their shopping centres that reflect changing consumer preferences. It also means that the landlord has as much of an interest in the retailers’ success as the retailer itself.

This also gives the landlord real-time sales data from every retailer in its portfolio. This data is gold dust to landlords, and provides them with a dynamic management tool that can drive income. Intu hinted at a move to turnover rents in its half-year results. Its chief executive Matthew Roberts said: “As data becomes increasingly important, it is key that we and our customers can join forces and share data to ensure we both benefit and potentially share the risk and reward.”

A sticking point to turnover rents is that it is asset management-intensive, which means capital expense for the landlord in growing its in-house asset management team. It is also difficult to differentiate and securely monitor data on sales that have been made in-store but bought online. For example, if a customer tries out a new gadget in the store and then buys it online, where is that included in the retailer’s sales figures?

Landlords fighting back in CVA battle

Landlords fighting back in CVA battle

An interesting dynamic has developed in the CVA story. Landlords, no longer willing to just accept the demands of retailers, have started to dig their heels in. In two of the most recent CVAs, of Arcadia and Monsoon Accessorize, the property companies have come away with equity stakes or profit-sharing schemes in the retailers.

In June 2019, Sir Philip Green was forced into conceding a 20% stake in Arcadia in return for landlords’ support – having realised he was unlikely to garner the required number of votes to pass the CVA. Landlords including Intu, Hammerson, British Land and Landsec will now all own a slice of the retailer.

These same landlords again bared their teeth in the Monsoon Accessorize CVA in July 2019, negotiating a profit-sharing scheme that would see them receive up to £10m if the retailer trades profitably and above-forecast in the future.

It is widely predicted that these kinds of deals will become commonplace in future CVAs. In the US, fashion retailer Forever 21 is reportedly in discussions to give up a stake in the company to its two biggest landlords in a bid to get restructuring plans passed. Apart from the obvious aim of trying to offset the losses from lower rents, these deals give landlords direct sight of the performance of the retailer and invaluable data.

This data, as mentioned above, is highly valuable to landlords and is something that they would otherwise rarely get their hands on. If they have real-time data on enough retailers in their portfolio, they will be able to react more quickly to – or even pre-empt – poor-performing retailers and, for that matter, strongly-performing ones. It also makes for a far more level playing field in lease negotiations if they know the ins and outs of the retailer’s performance.

It is a development that we are monitoring closely. Will the big property companies end up becoming retailer-landlord hybrids with a small stake in several high street brands and what will that mean for the companies going forward? Retailing is not the property company’s area of expertise and there is also the fact that the equity stake and profit-sharing concessions are being made by failing businesses. 20% of not a lot is not a great deal. Nor is sharing the profits of a company only if it trades above forecast in the future. A big if, in many cases.

Gen Z – the saviour?

Gen Z – the saviour?

As unlikely as it may sound, the saviour of physical retail could come in the form of Gen Z: the generation below millennials and Gen X, made up of children, teens and young adults roughly between the ages of seven and 22. Having been brought up on the iPhone and instant gratification of social media, logic would have it that Gen Z would continue the trend of shunning physical retail stores in favour of online shopping. But if research from the US is correct, and consumer behaviour is replicated in the UK, there could be a material change in shopping habits. The study found that Gen Z values experiences over anything else.

The research by the International Council of Shopping Centres, the global trade association of the shopping centre industry, found that around 95% of Gen Z respondents visited a physical shopping centre in a three-month period in 2018. This compared with 75% of millennials and 58% of Gen X. Three-quarters of them said that going to a bricks-and-mortar store was a better experience than online.

A host of retailers have opened experiential stores in the UK, including Vans, Farfetch and John Lewis, and online retailers are even getting in on the act, opening ‘showcase’ stores, including the likes of Amazon. These stores tend to be bigger than traditional retail outlets and offer a wide variety of activities far beyond just shopping.

HMV, which was bought out of administration in February 2019, has signed a deal with Hammerson to open a 40,600 sq ft experiential store in Birmingham city centre. It will offer customers the opportunity to see and test products in an interactive space and will also include space for bands to perform live.

Hammerson has made enhancing the experience at its venues a key element to its strategy. It launched a ‘super events’ programme in 2019 across its flagship destinations in the UK, France and Ireland that has had immediate impact. A ‘Festival of Light’ experience was held at two of its UK venues: Westquay, in Southampton, and the Bullring and Grand Central, in Birmingham. It said over 125,000 people attended the event and footfall was 9.8% higher at Bullring during the festival.

Experiential retail is certainly the future, and shopping centre landlords and retailers that get it right could be in line to capture some of Gen Z’s expected multi-billion-pound spending power.

Conclusion

Conclusion

Structural changes in retail still have some way to play out, but there are green shoots of optimism beginning to appear. With their backs against the wall, property companies are having to use all their nous and knowhow to fight their way out of trouble. The physical store still plays a key role in retail sales. Research by CACI found that 90% of all retail spend in the UK was influenced by having a store nearby to the consumer. It also found that retailers’ online sales were 50% lower in areas where they did not have a physical store. Owning a portfolio of well-located assets, and having the means and wherewithal to repurpose secondary retail, will hold the key.

With many retail-focused property companies trading at significant discounts to NAV, now could be an opportune time to bet on those with sound strategies for future growth.

Peer group analysis

Peer group analysis

The six retail-focused companies covered in this note all have different operational strengths and weaknesses. Some have been impacted by retailer CVAs and administrations more than others, while some are hamstrung by debt. The company profiles on the following pages offer a look into each company’s share price and NAV total return performance, as well as dividends paid.

Here we take a closer look at the impact of retailer failures to each company and their individual debt profiles.

Impact of CVAs and administrations

Impact of CVAs and administrations

As has been widely reported, retailer CVAs and administrations have had an impact to some degree on every high street and shopping centre landlord.

Intu has been one of the worst-affected. In the first half of 2019, 71 of its stores were impacted by a CVA or administration, accounting for around 7% of passing rent. Of the retailer failings, 52% resulted in discounted rent being paid, 45% had no impact on rent and 3% resulted in store closures. It accounted for a 4.3% drop in net rental income (NRI), mainly driven by the 2018 administrations and CVAs, including House of Fraser, HMV and New Look.

Intu said it expected a similar impact on NRI for the remainder of 2019. For 2020, it said it expected like-for-like NRI to be moderately down due to the full-year impact of the 2019 CVAs, with the overall run rate improving against 2019.

Capital & Regional’s 2019 first-half results saw NRI, which totalled £25.2m, impacted to the tune of £1.1m by CVAs and retailer restructurings. A total of 13 stores in its portfolio were affected by four CVAs in the period – Debenhams, Arcadia, Monsoon/Accessorize and Select. The largest of which was Debenhams which is expected to result in a reduction of approximately £0.7m to NRI in the second half of the year and £1.3m on an annualised basis. The total expected impact on full-year NRI is £1.3m, or £2.3m on an annualised basis.

Hammerson’s NRI in the first half of 2019 fell by 6.8% due to a large extent to tenant restructurings. 10 retailers in Hammerson’s portfolio undertook a CVA or went into administration in the period, affecting 45 stores and resulting in a £1.1m reduction in passing rent.

In full-year results to end of March 2019, NewRiver reported a £1.4m reduction in net property income due to CVAs and administrations. Since then, CVAs have had a limited impact on its portfolio, with 0.5% of its gross income affected during its first quarter. Arcadia’s CVA will have no impact on rental income and NewRiver said it expects the impact on full-year 2020 net property income to be £1.2m.

The two West End landlords, Shaftesbury and Capital & Counties, had very limited impact of retailer failures and, in fact, both reported increases in rental income.

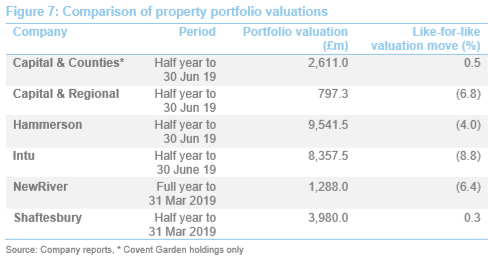

Property valuations

Property valuations

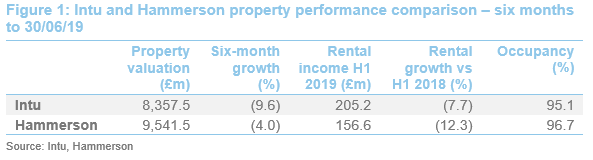

The upshot of the retailer failings and falling rents has been a drop-off in the value of retail property. Valuations, which are conducted quarterly by property consultancies hired by the landlord, have come under scrutiny, with some market commentators suggesting that they have not been reduced enough. In fairness to the valuers, there has been little to no activity in the investment markets for them to go off. Values across the four companies that have significant exposure to shopping centres – Intu, Hammerson, Capital & Regional and NewRiver – have unsurprisingly fallen dramatically. Capital & Counties and Shaftesbury on the other hand, have seen the value of their property portfolios increase.

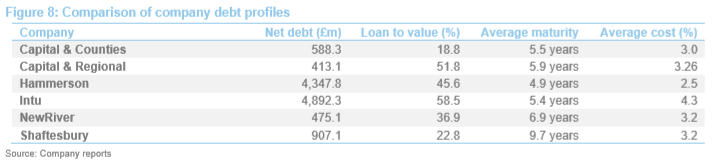

Debt profiles

Debt profiles

Each company has vastly different debt profiles. Intu has significant debt of almost £5bn, of which large chunks come to maturity in 2021 (£926m), 2022 (£778m) and 2023 (£1.033bn). It is also sailing close to the wind on a number of its loan covenants, details of which can be found by clicking on this link. It has a number of ‘loan to value’ and ‘interest cover’ covenants for which a 15% fall in capital values, as of 30 June 2019, would create a covenant shortfall of £83m. A 10% fall in income would create a covenant shortfall of £26m. Intu has made it its priority to reduce debt ahead of the upcoming financing events through the sales and part-sales of its assets. It also didn’t pay a 2018 final dividend or a 2019 interim dividend.

Hammerson has also made reducing its debt its main priority. It had targeted making sales of more than £500m in 2019 and by the end of September had made disposals, or had exchanged contracts to make disposals, of £523m. At its half-year results, the company said its property portfolio would have to fall by 26%, or more than 50% for the UK portfolio only, to breach the tightest of the group’s gearing covenants. The disposals made since have increased this headroom. Details of Hammerson’s covenants can be viewed by clicking this link.

Capital & Regional’s debt is almost 52% of the value of its properties, with it being close to breaching one covenant – the £26.9m secured against its shopping centre in Hemel Hempstead. The covenant states that debt to net rent on the mall should not exceed a ratio of 9:1. As at 30 June 2019 it was 8.97:1. A summary of Capital & Regional’s debt covenants can be found here.

NewRiver’s loan to value increased from 28% in 31 March 2018 to just under 37% on 31 March 2019. However, this is comfortably below its policy of less than 50% and within its guidance of less than 40%. The group is currently well within the prescribed financial covenants on its borrowing facilities, details of which can be found here.

Capital & Counties’ net debt increased by £16m to £588m in the six months to 30 June 2019. This meant its loan to value increased slightly to 18.8% but it was still well within the group’s limit of no more than 40%. The company has substantial levels of headroom against its covenants across all its debt facilities – a summary can be found here.

Shaftesbury’s net debt also increased marginally in the six-month period to 31 March 2019, from £900m to £907.1m but its loan to value ratio remained the same at 22.8%. It has a spread of loan maturities, with its weighted average maturity of debt 9.7 years, comfortably the highest in the peer group. Details on its debt facilities can be found here.

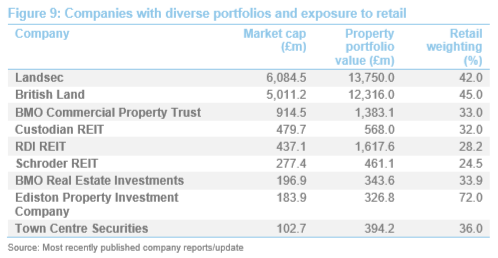

Other companies with retail exposure

Other companies with retail exposure

Many of the listed property companies have a mixed-use portfolio with differing weightings to retail. Here we round up those companies that have an exposure to retail properties of more than 20% and compare their performance and strategies.

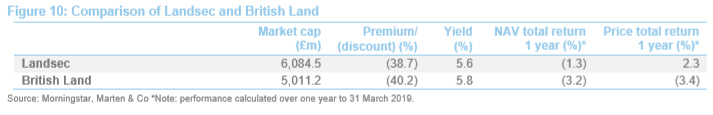

For ease of comparison, the companies can be split by market cap, with Landsec and British Land by far the biggest. Each has an extensive portfolio, in which retail plays a significant part.

Both companies are looking to reduce their exposure to the sector in the long-term, having seen the value of their retail assets fall dramatically (Landsec by 8.4% and British Land by 11.1% in full-year results to 31 March 2019). They both say that they will hold assets in prime locations that support the changing role of physical retail. British Land said its smaller multi-let schemes were disproportionately affected by CVAs and administrations and that these would be the target of disposals. However, unlike some companies, it is in a strong financial position to continue with its London office and mixed-use development plans, and can avoid a fire sale. Just a fifth (18%) of Landsec’s retail assets are located in London, which is less affected by retailer woes, and provides it with good development opportunities in densely populated areas, and regional assets will be the focus of its disposals.

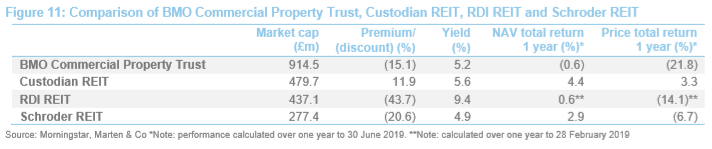

The next band of companies by market cap are all comparable in their exposure to retail, which range between 24.5% and 33% in portfolio value.

BMO Commercial Property Trust’s property portfolio fell in value by 3.3% in the six months to the end of June 2019, led primarily by sharp falls in the value of two of its retail parks – in Newbury and Solihull. The Newbury asset was hit by a series of CVAs and administrations – to Homebase, Poundworld and Mothercare. The group has made progress in re-letting those stores, signing up Lidl to occupy the majority of the Homebase store, Hobbycraft to replace Poundworld and Deichmann to take half of the former Mothercare store. As in Newbury, the Solihull asset was hit by the Homebase CVA, but the company said that it was close to re-letting the store. The group’s retail holdings also include the St Christopher’s Place estate in the heart of London’s West End.

Custodian REIT was hit by a valuation decrease in its high street retail assets (which accounts for 11% of its total portfolio by value), primarily due to the CVAs of Paperchase and Cotswold Outdoors. Its retail warehouse portfolio (21%) also lost value, but the company believes that the low rents, large store format and free parking provision of the assets stand them in good stead to capitalise on growth in demand from retailers looking for locations to serve click and collect functions.

RDI REIT has been dogged by the performance of four UK shopping centres in its portfolio, located in Wigan, Northampton, Warrington and Seaham. It has put the portfolio on the market after breaching the debt covenant held against it, following a sustained drop off in values. A disposal would result in the group’s UK retail weighting falling from 28.2% to 19.3% and its overall loan to value reducing from 48.5% to 45.4%. It brings into sharp focus the importance of well-located prime assets.

Schroder REIT’s biggest retail asset, St John’s Retail Park in Bedford, was hit by the closure of a Homebase store as part of their CVA in December 2018. Since then, the company has agreed deals with Lidl and Home Bargains to occupy the vacated store at a combined rental uplift of almost 50%.

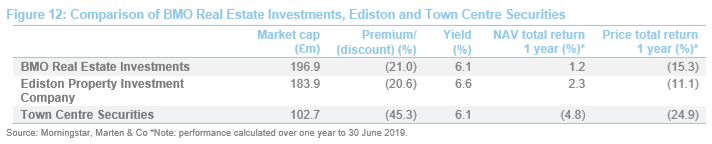

The final group of property companies in this comparison have market caps of less than £200m and similar sized portfolios in terms of value, ranging between £325m and £395m.

The value of BMO Real Estate Investments’s retail assets fell by 11.4% in the year to 30 June 2019. Almost a fifth (19%) of the group’s overall property portfolio is made up of retail parks and the company believes that these assets will perform well going forward, as retailers increasingly look to use them to complement its online sales. The group has conducted a number of sales of its retail assets over the last couple of years, but it has said it has no intention of making a wholesale exit from the sector.

Ediston Property Investment Company has by far the biggest exposure to retail among this group, with 72% of its assets being retail parks. Against some pretty big drop-offs in values across the sector, Ediston’s portfolio has fallen by just 1.4% over the year to 30 June 2019. It successfully and quickly re-let stores affected by CVAs, in some instances increasing the rent, and has kept its vacancy rates low at 3.1%.

Town Centre Securities has focused on mixed-use development over the last few years, reducing its exposure to retail in the process. In 2016, retail and leisure accounted for 70% of its portfolio but today it stands at 50% (36% retail and 14% leisure).

Company profiles: Capital & Counties

Company profiles: Capital & Counties

Capital & Counties announced in July 2019 its intention to launch its £2.6bn Covent Garden holdings as a new London-focused REIT through a demerger from the company. It is also in talks with a number of parties about the sale of the rest of its portfolio – the Earls Court development estate. The plan makes complete sense – the performance of the company has been held back by the Earls Court business and the stalling high-end residential market in London for far too long. Its Covent Garden holdings, on the other hand, have been going great guns. Capital & Counties is currently trading at a 28.2% discount to NAV.

Covent Garden is an established tourist destination in the heart of London’s West End, attracting 40 million visitors a year, and Capital & Counties’ holdings is made up of approximately 1.2m sq ft of lettable space, across 79 buildings and 526 units. Despite the challenging national economic and retail backdrop, Covent Garden continues to deliver rental growth and capture income. During the first half of 2019, Capital & Counties conducted 40 leasing transactions at 2% above 31 December 2018 estimated rental value (ERV). Net rental income for the period was up 7% (like-for-like) or 9.8% in absolute terms. Occupancy on the estate is 97% while both tenant sales and footfall are growing.

Company profiles: Capital & Regional

Company profiles: Capital & Regional

The company, which owns seven shopping centres in the UK, is in discussions with South African REIT Growthpoint Properties regarding the sale of a majority stake in the business. Growthpoint chief executive Norbert Sasse said it had “taken a view that there are opportunities in a section of the market around community-focused retail centres targeting nondiscretionary spend” and that Capital & Regional had many of these elements. The company is also trading at a significant discount to NAV of 64% and in its half-year results to the end of June 2019 made a loss of £55.4m primarily due to a decline in property values.

Capital & Regional has been pushing its ‘community centres’ strategy focusing on tenants that provide non-discretionary and needs-based products and services, which it thinks are best placed to counter the effects of structural changes in the retail sector and slowing consumer spending. Its London weighting, where it owns three malls, together with affordable rents across the portfolio, averaging £15/sq ft, are key advantages. It is pressing ahead with plans to develop residential units above its London and South East malls, where prices and demand for housing is high.

Company profiles: Hammerson

Company profiles: Hammerson

Hammerson owns a £9.5bn portfolio of flagship shopping centres, retail parks and premium outlets in the UK, France and Ireland. It has taken a hit on rental income due to the high number of CVAs and its UK shopping centres lost 9.1% in value in the first half of this year. Its saving grace has been its exposure to the booming outlets sector, where it has a 27% exposure through investments in Value Retail and VIA Outlets. The value of outlet centres in its portfolio grew by 4.5% in the first half of 2019.

Hammerson says its strategy is hinged on three pillars: reducing debt; optimising its portfolio; and managing the structural shift in retail. It is on the right path for achieving the first. It has disposed of £523m of assets as of the end of September 2019 (exceeding its £500m target for the whole of 2019). It is continuing to pursue an exit from its retail park portfolio and further portfolio-wide disposals. On point two, it has started to establish its City Quarters initiative of developing major mixed-use schemes in city centre locations, drawing up plans for its first in Birmingham. On the third point, it has shifted its retail line-up towards categories with greater customer appeal and rental growth potential, including non-fashion and food & beverage brands.

Company profiles: Intu Properties

Company profiles: Intu Properties

Of all the retail-focused property companies, Intu has suffered the most and is now trading at more than 80% discount to NAV. Its shopping centre portfolio has been hit hard by the spate of company voluntary arrangements (CVAs) and administrations from retailers, and the company is laden with debt. Erosion of income, caused by tenant failures, and an almost endless fall in the value of its shopping centres means it is now operating at a loan to value ratio of 58.5%, markedly above its 50% target.

Intu has long been a takeover candidate and with it now trading at a massive discount to NAV rumours have resurfaced. It is reportedly the target of Orion Capital Managers, which is said to be weighing up an offer to take the company private. For now, chief executive Matthew Roberts has outlined a five-year strategy with four priorities: shoring up its balance sheet; driving efficiencies; sharpening its focus on customers; and transforming its malls. It has put its three Spanish shopping centres up for sale and is pressing ahead with plans to make part-disposals of some UK malls. Intu has identified eight sites across its portfolio that could accommodate around 6,000 residential units, seven potential hotel sites that could offer around 800 rooms and six flexible office sites.

Company profiles: NewRiver REIT

Company profiles: NewRiver REIT

NewRiver REIT has a £1.3bn portfolio comprised of 34 shopping centres, 23 retail parks and 650 pubs. It primarily focuses on convenience and community-led retail, with the core of its tenants made up of grocery and value retailers. It is no stranger to being a contrarian investor, having been a first mover on shopping centres after the great financial crisis. It is taking a similar approach now, targeting retail parks.

Values have fallen in the retail sector to such a degree that chief executive Allan Lockhart believes buying opportunities now exist. The company has formed a 50:50 joint venture with Pimco’s opportunistic fund, BRAVO, to build a £500m portfolio of retail parks. The rationale reflects forecasts of significant retailer demand for stores that can service click and collect functions. Click and collect has become increasingly important for omni-channel retailers to fulfil online orders, with the primary advantage of driving footfall to these stores and encouraging additional spend. Retail parks come with several plus points for retailers including free car parking, lower rents and service charges than high street/shopping centre locations, and are often more efficient spaces. For NewRiver, the retail parks also come with high alternative use values, such as residential, hotel and industrial.

Company profiles: Shaftesbury

Company profiles: Shaftesbury

Shaftesbury is a REIT that owns a 15.1-acre portfolio in the heart of London’s West End with a focus on retail, leisure and restaurants. Its portfolio is concentrated around Carnaby Street, Seven Dials and Chinatown, together with substantial holdings in Covent Garden, Soho and Fitzrovia. This comprises 599 shops, restaurants, cafes and pubs extending to 1.1m sq ft; offices; and 599 residential apartments. London’s continued attractiveness as a tourist hotspot means that Shaftesbury has been somewhat sheltered from the trials and tribulations of the wider retail market. However, it is trading at an attractive discount to NAV of 13.3%.

Shaftesbury has performed well for a sustained period of time due to the location and curated nature of its holdings. The rise of online retail and the evolving omni-channel sales strategies of retailers has brought into sharp focus the importance of choosing the best locations. Destinations like those that Shaftesbury can offer are becoming increasingly popular. Net property income was up 5.2% to £48.6m in the six months to the end of March 2019, following a 6.4% like-for-like increase in rent. EPRA vacancy across its retail portfolio dropped from 10.9% to 6.4% in the period, and retail tenant failures represented less than 1% of its portfolio ERV.

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.