Real Estate Roundup

Kindly sponsored by abrdn

Performance data

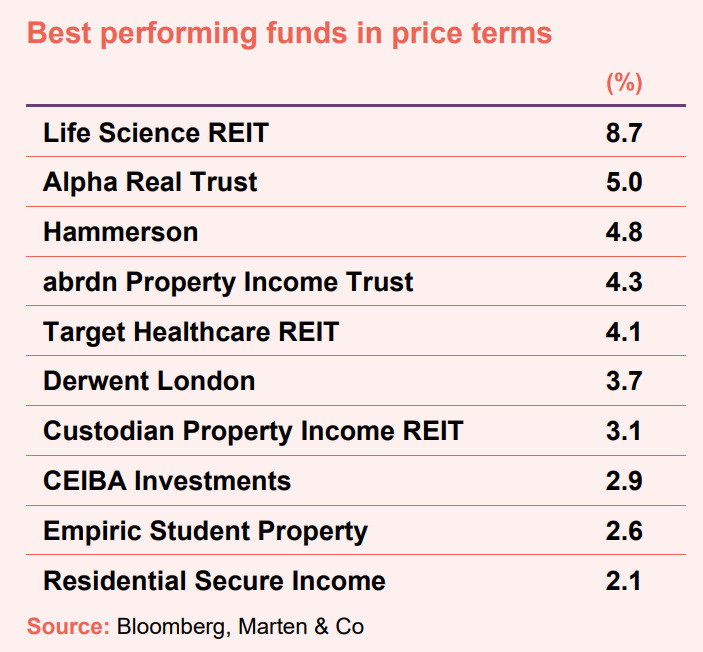

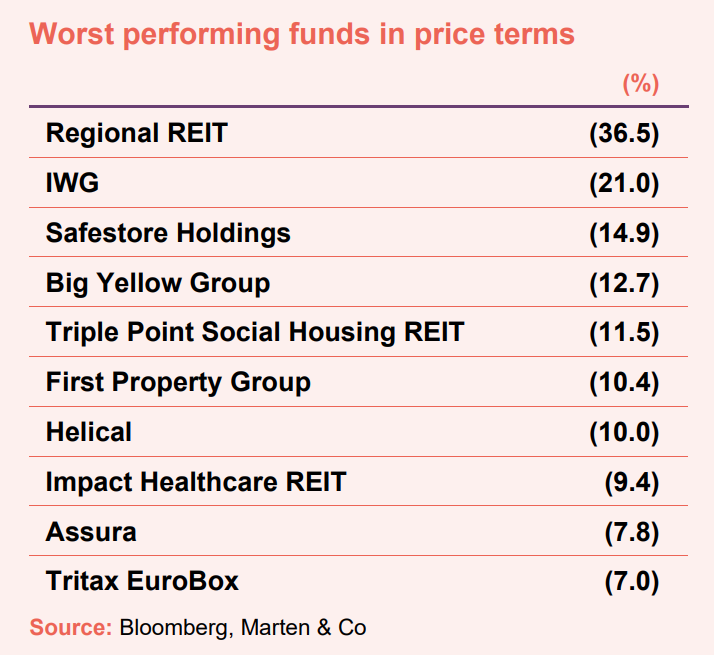

September’s biggest movers in price terms are shown in the charts below.

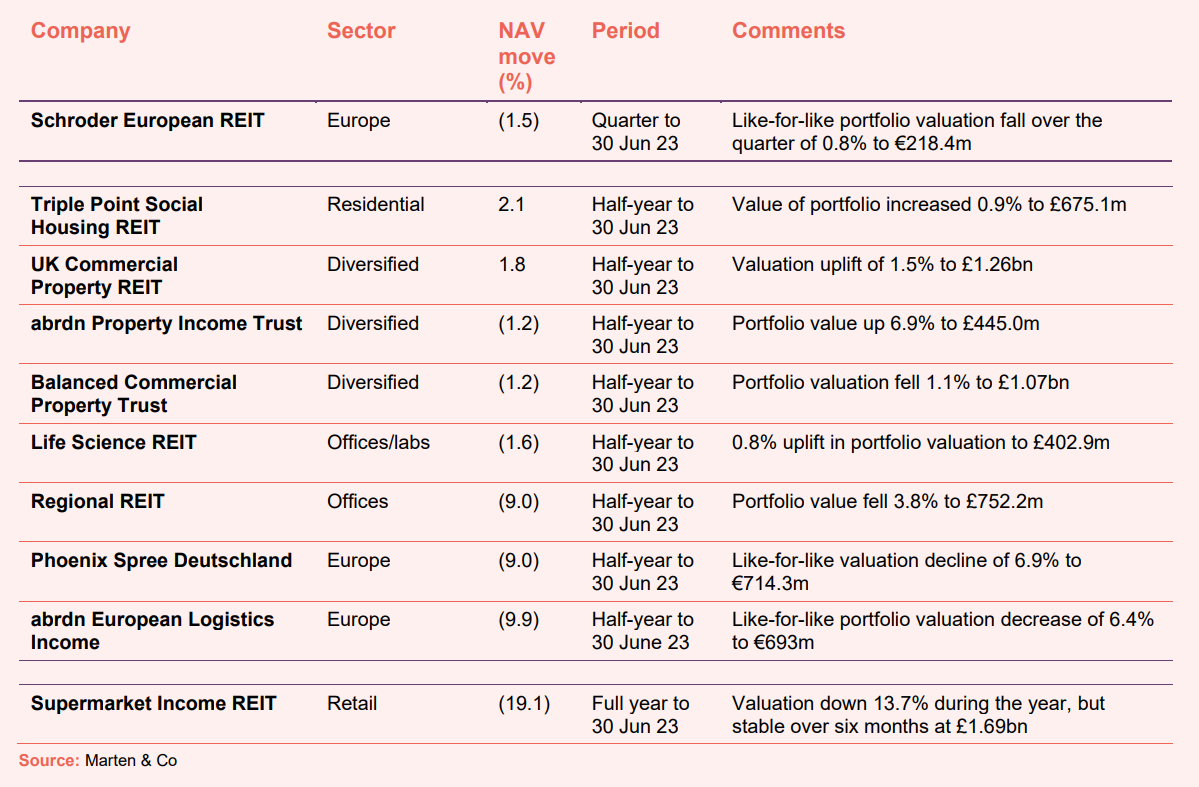

Investor sentiment towards property stocks continues to wane, with the median share price of REITs and listed property companies down another 2.4% over the month of September – and 14.8% in the year to date. On the positive side, leading the way was Life Science REIT, which seems to finally be getting some recognition for its investment case – essentially to transform offices into lab space for burgeoning life science companies at hefty rental premiums. The value of its portfolio increased slightly in the first six months of 2023 (see page 2), while its share price is down 3.7% in the year to date. Diversified REITs abrdn Property Income Trust and Custodian Property Income REIT both saw an uplift in their share prices, with the former reporting healthy valuation growth as the market appears to be stabilising (see page 2). Empiric Student Property continues its solid share price performance this year – gaining 2.6% in September and 6.3% in the year to date. This is recognition of the highly favourable supply-demand dynamic and rental growth prospects in the student accommodation sub-sector. It was still trading on a 24% discount to NAV, despite its new strategy seemingly paying off.

Regional REIT suffered a heavy sell-off of its shares after the surprise announcement that it would cut its dividend 14% to be in line with earnings (which in turn have been hit by higher costs associated with the maintenance of vacant space). The company reported a 9.0% drop in NAV in half-year results, with the sub-sector most out of favour with investors amid a myriad of potential demand-side issues. Self-storage providers Safestore Holdings and Big Yellow Group both took a double-digit hit to their share prices following a trading update from Safestore that revealed some softness in business demand was creeping in related to macroeconomic uncertainty. Triple Point Social Housing REIT saw its share price fall by double-digits for the second month in a row, despite reporting an uptick in values. The company, which sold a portfolio of social homes at a 3.6% discount to book value (see page 4), is now down 31.2% over 12 months. The share price performance of Impact Healthcare REIT and its peer Target Healthcare REIT (in the top 10 best performers in September) could not have been more contrasting, but the NAV performance over 12 months and their discount to NAV (around 30%) are identical.

Valuation moves

Corporate activity

Ediston Property Investment Company completed the sale of its entire portfolio to RI UK 1 Limited (a subsidiary of Realty Income) for a total of £196.8m. Shareholders will vote on the voluntary liquidation of the company and the return of cash to shareholders at the end of the year (expected to be 72.0p per share).

Supermarket Income REIT refinanced a large portion of its debt. It cancelled two shorter-dated debt facilities – a £77.5m secured revolving credit facility (RCF) with Barclays and Royal Bank of Canada, and a £62.1m unsecured debt facility provided by a syndicate of banks. It reduced and extended an existing £150m RCF with HSBC to a new £50m, secured, three-year RCF with a £75m uncommitted accordion option at a margin of 170 basis points (bps) over SONIA. It also completed a new unsecured £67m debt facility with Sumitomo Mitsui Banking Corporation, for a three-year term. The debt facility has two one-year extension options and a margin of 140 bps over SONIA. As a result of the refinancing loan-to-value (LTV) has reduced to 34% (from 40%) and the weighted average term of debt is now in excess of four years and the weighted average all-in cost of debt is 3.1%.

AEW UK REIT appointed a new chairman designate. Robin Archibald, formerly head of corporate finance and broking at Winterflood Investment Trusts, has taken a non-executive director role and will be appointed chairman of the company at the 2024 AGM when current chairman Mark Burton will retire. The company also appointed Liz Peace as a non-executive director, who will replace Bim Sandhu on the board, who will retire on 30 September 2023 having reached the end of his nine-year tenure as director.

Primary Health Properties appointed former NewRiver REIT director Mark Davies as chief executive. He will take over from Harry Hyman at the conclusion of the company’s Annual General Meeting on 24 April 2024.

LXi REIT’s investment advisor has appointed Alex MacEachin as chief financial officer, replacing Freddie Brooks, whose resignation became effective on 3 September 2023.

Major news stories

- IPSX to wind down

The dedicated real estate stock exchange – IPSX (International Property Securities Exchange) – is winding down having struggled to find new investment. Launched in 2019, the exchange, which allows investors to invest in real estate investment trusts made up of a single asset or a group of assets with commonality, has just three companies listed.

- Meta surrenders lease at British Land office

Meta (Facebook) surrendered its lease with British Land at 1 Triton Square – one of the two buildings it has leased at Regent’s Place in London – paying the landlord £149m. The decision reflects the shift in office occupation with firms scaling back space as more employees work from home.

- Home REIT board to be replaced

The majority of Home REIT’s board will be replaced over the next 12 months, the company said in the first of its monthly updates since its stabilisation period commenced. The board – made up of Lynne Fennah, chairman, Simon Moore, Peter Cardwell and Marlene Wood – oversaw the tumultuous period of wrongdoing at the REIT’s former investment manager from inception in 2020.

- Home REIT sells portfolio at heavy discount

Home REIT sold another batch of properties at auction at a huge discount to the price it paid for them. It has sold 137 properties for £22.845m. The sales price represented an average of 32% of their purchase price. Sales proceeds will be used to reduce borrowings and provide working capital as part of the manager’s strategy to stabilise the property portfolio.

- Phoenix Spree Deutschland to accelerate condominium sales

Phoenix Spree Deutschland has accelerated plans for condominium sales, reflecting the wide discrepancy between values and its share price. With the proceeds, the company will look to reduce overall debt levels and return capital to shareholders.

- LondonMetric sells industrial portfolio for £40.5m

LondonMetric Property sold four multi-let industrial estates to Hines for £40.5m, in line with March 2023 valuations and reflecting a net initial yield of 6.2%. The sale was in line with its focus on aligning its portfolio to triple net leases.

- Primary Health Properties buys €30m Irish care facility

Primary Health Properties acquired Ireland’s first Enhanced Community Care (ECC) facility at Ballincollig, near Cork, for €29.64m. The property is fully let to the Health Service Executive on a 25-year lease and benefits from five yearly, compounded annually, Irish CPI indexed rent reviews.

- Unite Group buys in Glasgow for student development

Unite Students acquired a new 800-bed development scheme in central Glasgow, subject to planning. The scheme has a total development cost of £95m and is expected to deliver a yield on cost of around 7.5%.

- AEW UK REIT buys Bath office

AEW UK REIT acquired an office in Bath city centre for £11.5m, reflecting a net initial yield of 8.0%. The 51,632 sq ft asset is multi-let to five tenants across office and retail accommodation.

- Triple Point Social Housing REIT sells portfolio

Triple Point Social Housing REIT sold four specialised supported housing properties for just under £7.6m, reflecting a 3.6% discount to book value at 30 June 2023. The company will use the proceeds to repay debt or fund further share buybacks.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Balanced Commercial Property Trust

Richard Kirby, fund manager:

Interest rates and the high cost of debt have remained at the forefront of investment considerations as the rate of inflation peaked over the period at 10.4% in February 2023. While the rate of inflation has moderated since, the headline level remains high, and the Bank of England’s monetary response has proven slow to cool pricing pressures. Consequent increases in the cost of debt have added a further layer of caution to investment underwriting given uncertainty around interest rates. This economic environment has resulted in muted activity in the real estate investment markets. Whilst there is no shortage of capital available for deployment into key sectors such as industrial, retail warehousing and alternatives, investment markets have been impacted by a lack of available stock, with investment volumes in the first half of 2023 down 53% year on year, and down 27% on the second half of 2022.

Against this backdrop, the MSCI UK Quarterly Property Index generated a subdued total return of 0.3% over the six months, constrained by a capital return of -2.0%. However, the headline position belies a significant divergence at the sector and sub-sector level.

This has been most notable in the office sector, where the popularity of hybrid working strategies has brought about a structural reduction in occupier demand. However, corporates are increasingly seeking to tempt employees back to the office and consequently occupier demand has been strongly focussed on high-quality accommodation in locations offering attractive amenity. This has served to reinforce the now-established bifurcation between prime and secondary accommodation. Retail warehousing remains the favoured sub-sector, delivering the highest total return over the six-month period. With large, flexible units, the sector forms a key part of an omni-channel retailing platform and we have consequently seen demand from an increasingly wide variety of well-capitalised retailers. Offering a yield advantage over other sectors, investor appetite for retail warehousing has remained robust but constrained by a lack of available supply.

The wider retail sector has seen a more benign period with both rents and yields having been substantially rebased across the sector in prior years. Central London in particular has seen renewed levels of occupier demand as rents have been reset to more viable levels and accompanied by significant reductions in business rates, combining to materially decrease occupational costs and boost retailer profitability.

Whilst demand for logistics space has fallen from the highs seen during the pandemic, the sector’s fundamentals remain robust with demand stemming from a diverse range of occupiers within a well-balanced market. Supply has been constrained by a lack of speculative development due to tighter lending conditions and inflated construction costs. However, there is also evidence of occupiers trading down the quality spectrum in order to benefit from lesser rents and a slightly more muted rental growth outlook. We are yet to see a full recovery in pricing following outward prime yield movement of 150 basis point in the second half of 2022, with yields softening by 25 basis points over the first half of 2023, reflecting hesitancy within an uncertain economic environment.

Will Fulton, fund manager:

UK real estate recorded a period of greater stability in the first half of 2023 following the significant repricing the sector experienced in late 2022. That repricing was principally driven by increased interest rates raising the cost of debt in what was a largely a debt-driven property market, while rising gilt yields reduced the yield margin available from property versus the risk-free rate. These sudden movements also dented investor conviction on asset pricing. Although this has served to help insulate UK real estate from economic volatility during the first six months of 2023, market volatility and macro headwinds continue to impact investor sentiment, which has remained weak. Underneath the bonnet of real estate, occupational strength endures in many sectors and, indeed, modest capital value growth has been recorded in those sectors that benefit from structural tailwinds, such as industrial and logistics.

According to the MSCI Balanced Portfolios Quarterly Property Index, all property recorded a total return of 0.0% over the first half of the year with capital values falling by 2.3%. However, this hides sector variance with the industrial sector recording capital growth of 0.3%. Office values remain under pressure and saw capital value declines of 6.7%.

Transaction volumes have also remained constrained during the first half of 2023 as investors have taken a risk off approach. According to Real Capital Analytics data, approximately £18.3bn transacted across the UK to June 2023. To put these number volumes in perspective, this is lower than the same period in 2020 during the onset of the COVID-19 pandemic and 37% below the 10-year H1 average. Proportionately, each of the three principal sectors – industrial, office and retail – accounted for broadly similar volumes representing between 20-26% each.

Interestingly, transactions in residential assets continue to rise, with the sector accounting for 19% of total half year volume. Transaction volumes are anticipated to remain subdued over the remainder of the year against a weak macroeconomic backdrop and volatile interest rates, with owners of good quality real estate likely to remain unwilling sellers. Improved investment activity is likely to be prompted by greater confidence around the path of the Bank of England’s monetary policy, with an end to base rate rises likely to improve investor sentiment.

James Clifton-Brown, chairman:

With a marginally positive total return during the six-months to 30 June 2023 we have seen the beginnings of a stabilisation in the UK property market. This remains a relatively fragile position, with inflation still running well ahead of UK Government targets, and therefore the threat of further interest rate increases continues to linger.

Whilst we have seen a recovery in some sectors of the UK real estate market during the first half of 2023, there has been a significant divergence in returns between the sectors. We expect this to widen and continue for at least the next 12 months, with the office sector in particular faring the worst.

Overall office demand is anticipated to continue to decrease, leading to a further weakening of investor sentiment towards the sector. The impact is likely to be most acutely felt on secondary assets as occupiers and investors alike favour “best in class” buildings. Ensuring that assets offer good levels of amenity that appeal to occupiers will be key, and the Company’s strong letting activity in 2023 to date is a positive indicator that its portfolio is well positioned.

The industrial sector is forecast to continue its recovery after the turbulence of 2022. Whilst supply levels have started to increase, with Savills reporting a June 2023 vacancy rate only marginally below the pre-COVID average, they remain at manageable levels given robust demand levels. The expectation is that this dynamic will result in more muted rental growth than has been seen over recent years.

With expectations that the squeeze on household incomes will continue, this will result in further pressure on the retail sector. Discretionary spending is anticipated to be most impacted, with food and discount retailers proving more resilient.

Retail

Nick Hewson, chairman:

Despite the economic volatility, the UK grocery market has grown by 11% during the year and 30% since our IPO to a £242bn market today. This highlights the strength and resilience of grocery spending through the peaks and troughs of the economic cycle.

The robust performance of the supermarket operators is in stark contrast to the valuation declines experienced by the broader property investment market. The scale and pace of interest rate hikes since September 2022 has triggered a rapid decline in property values, with the MSCI UK All Property Capital Values Index declining by over 19% for the year to 30 June 2023. Supermarket property has been less volatile, but not immune, with a 14% like-for-like decline in our portfolio value resulting in a net initial yield of 5.6% as at 30 June 2023 (30 June 2022: 4.6%, 31 December 2022: 5.5%).

The property market experienced an initial rapid repricing to December 2022. We have since observed a stabilisation of pricing in recent transactions and our 30 June 2023 valuations are essentially flat to our last reported valuation as at 31 December 2022. It is also noteworthy that we have seen significant investment volumes in UK supermarket property which have exceeded £1.7bn. This total includes £483m of leasehold store buybacks by operators; a unique feature of the grocery real estate market. This elevated interest in grocery property highlights the positive long-term outlook for the sector. We are cautiously optimistic on the outlook for supermarket property valuations, though we recognise the general correlation of these values to Bank of England policy and interest rate movements.

While economic conditions look set to remain challenging in the near term, our unique high-quality portfolio of omnichannel supermarkets, let on long-term, predominantly inflation-linked leases, with strong tenant covenants, in the non-discretionary spend sector of grocery, continues to offer a compelling investment case.

The stabilisation of valuations in the short term and strong sector dynamics in the medium to long-term mean that the board is confident of the growth prospects for the company.

Offices/laboratory

Claire Boyle, chair:

The UK life sciences market, which is underpinned by some compelling long-term structural drivers, remains robust despite the ongoing macro uncertainty. In particular, our focus on the Golden Triangle of Oxford, Cambridge and London’s Knowledge Quarter, where demand is strongest and supply is highly constrained, positions us well, and is why we have delivered a valuation uplift over the period, outperforming much of the property sector.

However, with five interest rate rises since the start of the year, the economic environment continues to be challenging. Occupiers are being more thoughtful about taking space, and we have seen the pace of decision-making slowing. Nevertheless, we are encouraged by the level of enquiries and, as a result, we are continuing to let at rents ahead of our own and the valuers’ expectations.

The wider environment continues to be supportive for life science operators, with the funding pool diversifying to include sovereign wealth as well as venture capital funds, in addition to large pharmaceutical companies increasingly looking to invest in smaller businesses to supplement research and development. The UK Government also remains supportive of the sector, and we were delighted to see that the UK will rejoin Europe’s Horizon programme under a bespoke deal. This provides UK scientists with access to the world’s largest research collaboration programme.

Ultimately, having the right space is fundamental to the business model for life sciences companies. To support them, we have developed a deliberately differentiated offer, which even in the current environment appeals to a range of occupiers across the life science spectrum.

While we recognise that the economic environment continues to be challenging, our conviction in the longer-term prospects for our business remains strong. Occupier demand in our key markets is encouraging and is underpinned by powerful long-term trends, while supply is low, supporting rental growth.

Europe

abrdn European Logistics Income

Tony Roper, chairman:

GDP growth in the Eurozone has been muted, with seasonally-adjusted quarter -on-quarter figures of 0.0% and 0.3% in Q1 and Q2 2023 respectively. Both were disproportionately affected by Ireland’s volatile national accounts, creating the impression of a pickup in momentum that is not reflected across other Eurozone members. Indeed, surveys suggest the Eurozone carried poor momentum into Q3, and purchasing manager indices (PMI’s) point to contraction in July.

Additionally, with retail sales falling, the industrial sector shrinking, bank lending conditions becoming more restrictive, and the impact of monetary tightening building, there is every chance that the Euro economy will fall into recession in Q4 of this year.

Encouragingly the ECB is no longer signalling further rate increases. It increased the deposit rate by 25bps to 4.0% from 20 September due to concerns around strong wage growth and sticky inflation. Ultimately a recession would likely mean a rate cutting cycle during 2024.

Prospects for both the sector and the company remain positive. As the uncertainty surrounding the macroeconomic backdrop begins to clear, we believe that the combination of strong underlying market fundamentals and positive structural drivers will continue to attract capital to the European logistics sector, and will support rental growth.

Interest rate rises and tougher economic conditions have undoubtedly left their mark on the real estate sector and have impacted valuations. Investor confidence has also been tested, with the share price falling as risk aversion took hold, as has been the case for many in the real estate sector. Nonetheless, with the Eurozone seeing an end in sight for rate tightening, the signs are promising for the European logistics occupier market. We should benefit in time from strong leasing momentum, with Europe still at a relatively early stage of its supply chain reconfiguration and e-commerce penetration still some way behind the UK. The incontrovertible shift in the way in which consumers shop, and the infrastructure required to service this new form of demand close to population centres, underpins the positive longer-term prospects for the Company’s investment approach.

Real estate research notes

An update note on Grit Real Estate Income Group (GR1T). The company has been reborn, with the acquisitions of a developer and asset manager making annual return targets of 12-15% more achievable.

An update note on abrdn Property Income Trust (API). The manager’s focus focus continues to be on growing income, and asset management initiatives within the portfolio have seen its vacancy rate drop to below 5%.

An annual overview note on Tritax EuroBox (EBOX). After rapid value declines due to higher interest rates, optimism has grown that prices are stabilising. The company’s is in a good place to increase annual rent through its quality portfolio.

An update note on abrdn European Logistics Income (ASLI). The company is riding out the storm of market valuation declines, with a focus on managing its portfolio and securing income.

An update note on Urban Logistics REIT (SHED). The company’s wide share price discount to NAV, following a re-rating as values in the sector suffered as interest rates rose, is attractive especially given the operational strength of the company.

Urban Logistics REIT – Fundamentals strong as market stabilises

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.