Real Estate Roundup

Kindly sponsored by abrdn

Performance data

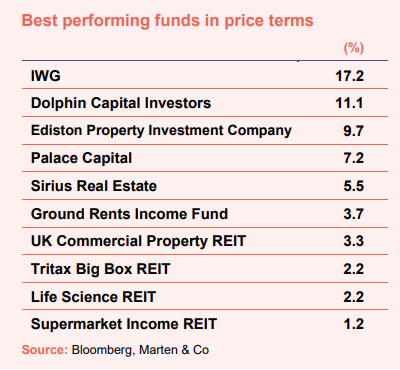

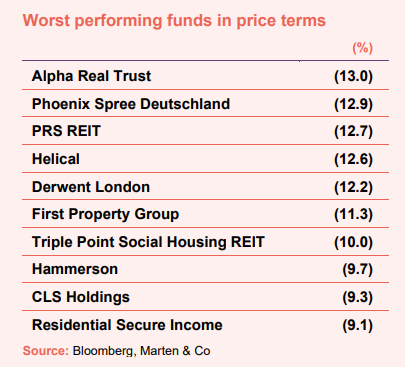

August’s biggest movers in price terms are shown in the charts below.

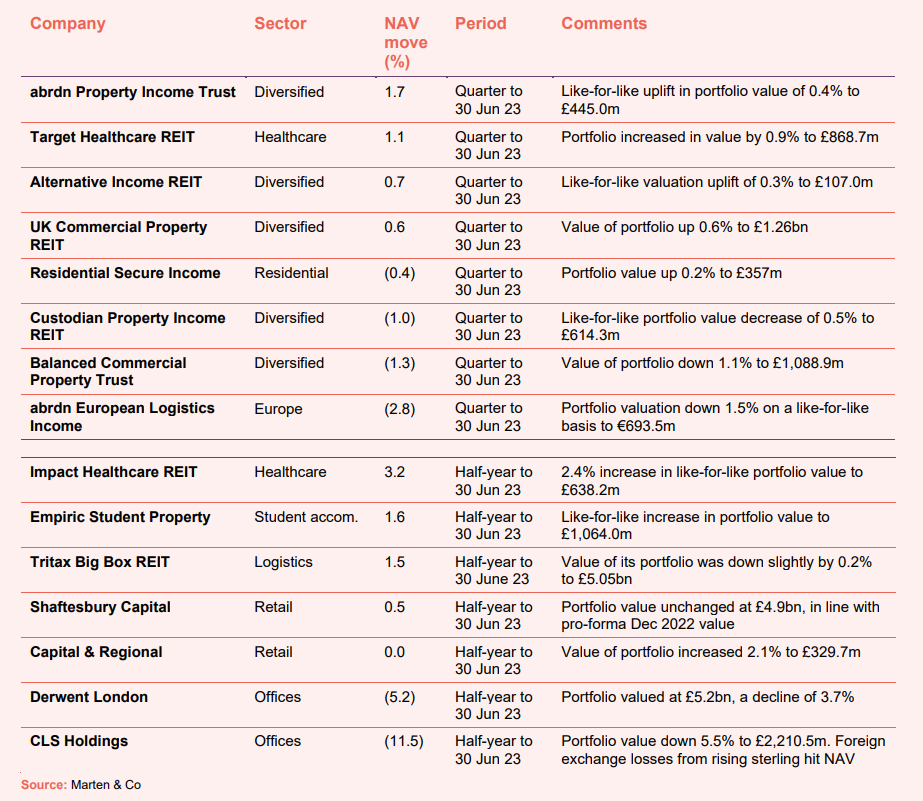

The property sector remains in a state of limbo as investors await signs that interest rates have peaked. The median share price of REITs and listed property companies was down 2.4% over the month of August. There was a number of positive movers, however, led by hybrid workspace provider IWG. The company reported strong half year results, in which group revenue was up 14% and adjusted EBITDA by 48%. Ediston Property Investment Company saw its share price jump almost 10% on news that it was in advanced discussions with US REIT giant Realty Income over a sale of the portfolio (see page 3). Palace Capital continues an orderly sell-down of its assets and return of capital to shareholders (see page 4). UK Commercial Property REIT posted a positive NAV uplift for the quarter to the end of June (see page 2), further evidence of values stabilising in commercial real estate. Logistics specialist Tritax Big Box REIT also reported an uplift in NAV, while also continuing to execute its disposal programme to recycle proceeds into its higher yielding development pipeline (see page 4). Life Science REIT’s share price has bounced around in recent months. It is down 11.5% in the year to date.

Shareholder malaise towards the sector continues to see the majority of companies trade on wide discounts to NAV. Alpha Real Trust, which focuses on asset-backed lending, debt investments and high return property investments, is languishing on a 40%-plus discount following a double-digit fall in its share price in August. Berlin residential landlord Phoenix Spree Deutschland’s portfolio value fell another 7% in the first half of the year due to the impact of high interest rates. Office focused companies continue to be in the doldrums as several elements stack up against the sub-sector. While we await to see the long-term implications of hybrid working on office demand and valuations, the consequences of any future energy regulations and the current economic uncertainty companies like Helical, Derwent London and CLS Holdings continue to suffer from negative investor sentiment. The latter two endured large valuation declines in the first half of this year (see page 2). Triple Point Social Housing REIT, which had seen an upturn in its share price in recent months following the bid for its peer Civitas Social Housing, lost 10.0% of its value during August and is now down 32.0% over 12 months.

Valuation moves

Corporate activity

LondonMetric completed the acquisition of CT Property Trust. As part of the acquisition 105.6 million new LondonMetric shares were issued to CT Property shareholders. LondonMetric’s portfolio is now valued at £3.2bn and generates £160m of rental income per annum.

Capital & Regional raised £25m in an open offer, the proceeds of which was used to part-fund the acquisition of the Gyle Shopping Centre in Edinburgh. Growthpoint, the company’s largest shareholder, subscribed for over 80% of the money raised and as a result now owns 67.64% of the company.

Ediston Property Investment Company confirmed it was in advanced discussions with RI UK 1 Limited, a wholly owned indirect subsidiary of US REIT Realty Income Corporation, regarding a possible sale of its property portfolio.

Shareholders of Home REIT voted overwhelmingly in favour of its new investment policy and the appointment of AEW as investment manager.

Shaftesbury Capital agreed a new £200m loan with Aviva Investors for a 10-year term secured against a portfolio of assets within the Carnaby estate in London’s West End. The facility will sit alongside existing debt with Aviva Investors of £130m and £120m, which mature in 2030 and 2035 respectively and share in the asset security of the Carnaby estate. The additional financing has been priced with reference to 10-year UK gilt yields and when blended with the existing Carnaby term loans, the annual cash interest rate in respect of the overall amount of £450m will be 4.7%. The proceeds of the facility will be used to repay in part the £576m unsecured loan which was drawn in April 2023 to fund the repayment of the Shaftesbury PLC secured bonds.

Impact Healthcare REIT purchased a new £50m interest rate cap at a cost of £1.76m, which caps SONIA at 4.0% for two years. The group has now hedged or fixed the interest rates on 92% (£175m) of its current drawn debt.

Major news stories

- Tritax Big Box REIT sells Howdens warehouse for £84.3m

Tritax Big Box REIT sold an asset let to Howdens in Raunds for £84.3m, in line with its June 2023 valuations, and reflecting a net initial yield of 4.0%. The company has now sold £235m of assets in 2023 and is targeting a further £100-£200m of sales in the second half of this year. Proceeds will be put into its development pipeline.

- Empiric seeks JV partner to expand student digs portfolio

Empiric Student Property is exploring bringing on board a joint venture partner to grow its portfolio of student accommodation properties. The company has engaged PwC to find a suitable partner that would put up the capital to buy properties that would be operated under Empiric’s student brand.

- Great Portland Estates buys West End office development

Great Portland Estates acquired 16/19 Soho Square, 29/43 Oxford Street and 7 Falconberg Mews, W1, from Belgravia & Chelsea Property Services Limited, for around £70m. Vacant possession of the buildings is expected by March 2024, at which point the company plans to demolish the buildings and develop a new office and retail scheme.

- Tritax EuroBox sells German asset in line with book value

Tritax EuroBox sold an asset in Hammersbach, Germany for €64.6m to a pan-European real estate investment manager. The sale, which was broadly in line with the valuation as at 31 March 2023, was the first in its €150m sales program.

- Tritax EuroBox also secures duo of lettings

Tritax EuroBox secured two new leases across its continental European logistics portfolio, adding €1.3m of rental income. The first is the 14,150 sqm letting of Unit 1 of the speculatively developed Settimo asset in Italy to a leading Italian logistics specialist on a six-year lease. The second letting is a new seven-year lease for Unit 3 (8,300 sqm) at the group’s Bochum asset in Germany to a specialist catering equipment company, at a rental uplift of 32% on the current passing rent.

- Balanced Commercial Property Trust in industrial letting success

Balanced Commercial Property Trust secured two lettings in its industrial portfolio. At Hams Hall Distribution Park, Birmingham, pet food company Nestle Purina took a 10-year lease extension commencing March 2025. At Hurricane 52 on the Estuary Business Park, Liverpool, Montirex Ltd, a sportswear clothing brand, signed a 10-year lease at a rent that was more than 7% over estimated rental value (ERV).

- Home REIT sells portfolio for huge loss as stabilisation period under new manager begins

Home REIT sold a portfolio of 40 properties for £4.848m at auction as new manager AEW tries to stabilise the portfolio. The sales price represented an average 39.4% of the price it paid for them due to the condition of the properties.

- Palace Capital continues sell off with Maidenhead disposal

Palace Capital sold 22 Market Street, an office property in Maidenhead, to a client of Soor Capital for £9.6m. The sale price reflects a net initial yield of 7.3% and was 9.7% ahead of the 31 March 2023 book value. The company will use some of the proceeds to pay off bank debt and return cash to shareholders through a share buyback programme.

- Life Science REIT leases up more space at Oxford Technology Park

Life Science REIT leased 10,765 sq ft of space at the Innovation Quarter at Oxford Technology Park to Oxford Gene Technology IP Limited. It agreed annual rent of £220,000, equating to £20.40 per sq ft, for a 10 year term.

- Alternative Income REIT books out of hotel

Alternative Income REIT sold the Mercure City Hotel, in Glasgow, for £7.5m to the current tenant S Hotels & Resorts. The disposal represented a 7.9% premium to the book value at 30 June 2023 and a net exit yield of 8.9%.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Retail

Ian Hawksworth, chief executive:

There has been continued improvement in trading over the period, with certain categories such as performance wear, premium and luxury outperforming significantly. We closely monitor trends in consumer demand to target brands and concepts relevant to our consumers with a strong omni channel presence, across a broad mix of categories.

There is strong demand from British, independent and global brands ranging from start-ups to established retailers seeking global flagships, which are attracted by the seven-days-a-week footfall and trading environment. With a broad range of unit sizes and rental tones on offer we can cater for a variety of retailers and provide flexibility for expansion within our portfolio.

Retailers are increasingly focusing on fewer stores, placing greater emphasis on global location, consumer experience, service and flagship retailing with better digital engagement. The West End, and particularly our portfolio, continues to be a destination of choice for both market entry and retail expansion.

Currently, the retail leasing market is strong, with various units attracting interest from multiple occupiers. Recent signings across the retail portfolio include luxury watch brand Tissot on James Street and the re-location and upsizing of the Arc’teryx store from Long Acre to King Street creating a new London flagship in Covent Garden, whilst in Carnaby, Hollister and OG Kicks have opened on Foubert’s Place. There has been a number of openings including the new flagship Uniqlo store, Sessun, Mejuri and Gramicci in Covent Garden and Farah in Soho.

The portfolio offers a diverse range of food concepts, from accessible casual to premium dining. In our experience, an innovative hospitality and leisure offering provides a halo effect on footfall, increasing dwell time, and drives improved trading in our areas. Competition for available hospitality accommodation has been strong throughout the period. With availability of restaurant and leisure space being constrained by strong trading prospects together with local planning and licensing policies, and we are seeing a high rate of renewals from existing customers.

Logistics

Colin Godfrey, chief executive:

Occupier leasing has moderated after the exceptional pandemic-driven activity of recent years, with underlying demand remaining healthy. Leasing volumes for the period totalled 10.0 million sq ft, in line with the pre-pandemic average of 12.8 m sq ft. This reflects current economic conditions, with occupiers taking a slower and more cautious approach to capital expenditure. Demand across the market remains diverse, with third-party logistics providers (44% of leasing activity in the last 12-months) and manufacturers (16%) being prominent.

Underlying demand for space remains strong with 10.4 million sq ft under offer at the period end, while Savills reported a 64% rise in occupier enquiries since Q4 2022. This is consistent with enquiries to our occupier hub, which are the highest in the last two years.

Companies continue to evolve their supply chains with greater resilience, selective reshoring, and decarbonisation amongst their ongoing priorities. Additional catalysts for network evolution exist in the UK such as further growth of the already large e-commerce sector, challenges posed by high inflation, and the country’s revised global trading position. Companies continue to adjust their supply chains accordingly and in doing so, generate new and additional demand for logistics buildings.

The amount of ready to occupy space rose in the period and market vacancy stood at 3.4% at the end of the period (Q4 2022: 2.0%). New speculative announcements have declined through the first half of 2023, with Savills reporting 5.2 million sq ft of announcements in H1 2023 (H1 2022: 7.9 million sq ft).

Barriers to new supply remain significant, in particular the need to control suitable sites and the time to secure planning consents. Capital market conditions mean financing costs have increased markedly on a year ago, while construction costs have levelled off but not fallen. Importantly, well capitalised investor-developers control significant land portfolios and remain incentivised to obtain the best possible terms for new leases to protect the value of their existing investments.

Vacancy remains low by historic standards and continues to support rental growth. Prime headline rent index (regional headline rents weighted by stock) increased by 4.9% in the period with all UK regions experiencing growth.

H1 2023 transaction volumes totalled £1.6bn (H1 2022: £4.1bn) with buyers from a variety of capital sources completing deals. After the very rapid pricing adjustment in H2 2022, yields stabilised during the period. CBRE and MSCI monthly indices both reported modest positive capital growth of 1.4% and 0.3% respectively in H1 2023.

While wider capital market conditions are likely to weigh on investment volumes in the near term, we believe high quality logistics real estate remains a compelling investment in the medium term. The long-term structural drivers that underpin occupier demand remain in place and investment capital is committed to the sector.

Offices

Fredrik Widlund, chief executive:

As expected, the economic backdrop for the property market has been challenging and we expect it to remain so until interest rates have definitively peaked. There are tentative signs that the labour market is becoming less tight which is encouraging more employers to demand employees back in the office more often particularly as reports, such as “The working-from-home illusion fades” from the Economist in June 2023, demonstrate that productivity is enhanced in the office.

To encourage workers back to the office and in response to market trends, CLS is continuing to invest in its portfolio to provide high quality and affordable offices that are sustainable with good amenities and well-being facilities whilst providing flexible and digitally connected space. This, together with the majority of our leases being index-linked, is contributing to rental growth in excess of ERV growth.

The diversification benefits of the portfolio have again been demonstrated with Germany and France balancing the weaker UK market. Whilst markets remain challenging, we are prioritising maintaining a strong balance sheet and will continue to be a net seller of selected assets at appropriate prices. Our long-term approach and active asset management should keep the Group in good stead, and we have significant opportunities to increase rental income through reducing vacancy, to more than compensate for higher interest costs, over the next couple of years.

Paul Williams, chief executive:

London is recognised as a world-leading city with broad appeal. For occupiers, it has a deep talent pool and sophisticated business ecosystem. This makes it a particularly appealing destination for a wide range of occupiers, including both UK and European Head Quarters. For investors, the restrictive planning environment and strong long-term performance provide a robust investment case.

One of the key drivers of the London office market is job creation. In 2021 and 2022, c.335,000 net new office-based jobs were added (CBRE). A further c.235,000 jobs are forecast between 2023 and 2028. In addition, the population of London continues to grow and is forecast to reach 10.6m by 2035, an 11% increase compared to 2022. This is significantly higher than the general rate of growth forecast in most other major European cities.

London attracts a broad range of occupiers while many other global cities are more reliant on specific sectors. The three largest sectors currently looking for space in the capital are banking & finance, business services and creative industries. There is also good demand from high growth areas such as AI and life sciences.

Businesses are more discerning around their occupational requirements as the flight to quality gathers pace. Encompassing many factors including amenity, location and sustainability credentials, the definition of prime is becoming more nuanced. Set against this, a large part of the current available supply does not meet these more stringent needs.

London has recently seen a trend of companies committing to return to more central, well-located and amenity-rich locations, notwithstanding the higher occupational costs. The opening of the Elizabeth line last year has emphasised the importance of location and connectivity and c.80% of our portfolio is within a 10-minute walk of an Elizabeth line station.

In a recent Knight Frank report, 77% of businesses surveyed expect their total floorspace to increase or remain the same over the next three years. In addition, 87% of businesses believe the office will play a central role in their future occupational models. The return to the office is continuing and a rising number of corporates have issued more prescriptive guidelines to their employees. The majority of those reported now require a minimum of three days in the office as businesses plan for peak occupation.

Vacancy is not evenly spread across central London. While overall office availability remains elevated at 8.5%, the West End is very tight at 3.8% compared to the City at 11.7% and Docklands at 14.3%. New supply, however, is constrained. Only 3.4m sq ft of projects are due to complete in the West End by the end of 2026, of which 28% is pre-let. Against long-term average annual take-up of 4.1m sq ft, the West End faces an emerging supply shortage.

Central London office take-up in H1 of 4.2m sq ft was down 36% compared to H1 2022, but space under offer increased 51% to 4.1m sq ft through H1. Pre-letting levels across central London are high at 45% as companies with larger requirements increasingly recognise the forthcoming lack of prime supply, particularly in central locations. Active demand increased 35% in H1 to 7.7m sq ft, a positive indicator for future take-up.

Investment volumes of £2.9bn in H1 were low against long-term trends. Market interest rates have increased with the 10-year gilt yield rising from 3.0% in February to 4.4% at 30 June 2023. Lender risk appetite has reduced leading to an increase in margins and contraction in lending volumes. City prime yields increased by 75bp to 5.25% in the first half. However, reflecting the level of equity targeting the West End, prime investment yields were unchanged in H1 2023 at 3.75%, per CBRE.

Diversified

Will Fulton, investment manager:

Having just agreed its latest base rate increase to 5.25%, we believe the Bank of England will have to push rates to at least 5.5% to tackle underlying inflation pressures. Looking forward, given the risks of significantly overtightening policy, we remain sceptical rates will follow the market curve which currently sees rates climbing close to 6%. With the interest rate regime likely to tip the UK economy into recession, our base case forecast sees an easing of monetary policy to begin during 2024, reducing rates. Risks to this base case exist around both a surprise burst of stronger inflation than expected, forcing the Bank into a more aggressive rates stance, and mounting pressure on the government to ease fiscal policy, particularly around introducing substantial mortgage relief. This would make the Bank’s monetary policy less effective, exacerbating the UK’s inflation problems, resulting in interest rates needing to stay higher for longer. This weaker macroeconomic backdrop continues to weigh on UK real estate performance with any improvement in the economic environment likely to support a recovery.

Following the value correction of late 2022, UK real estate pricing has experienced a period of stabilisation through 2023 particularly in those areas of the market that saw the greatest capital declines. Those declines were, by and large, a yield correction driven by rising interest rates rather than a reflection of underlying occupational strength. Indeed, modest capital value growth has been recorded in sectors that benefit from structural tailwinds, such as industrial/logistics.

According to the MSCI Monthly Index, all property capital values fell by 0.4% in Q2 2023, though this hides sector variance. Industrial recorded growth of 1.2% over the quarter followed by Retail growing by 0.3%; Office values remain under pressure and saw capital value declines of 4.1%.

Transaction activity remained muted in the second quarter of 2023, as investors continued to take a more cautious approach to UK real estate. Transaction volumes were £5.6bn in the second quarter, down 64% on the same period a year earlier and 63% below the 10-year quarterly average. Limited good-quality investment stock has come to market so far in 2023, which has suppressed transaction volumes. Given lower conviction in the market, on the back of a weaker macroeconomic environment, we are likely to see a further slowdown in activity during the summer months.

Investment into the industrial sector accounted for the largest proportion of total investment volume over the quarter at approximately 32%. Total volumes were dominated by overseas investors accounting for approximately 52% with private capital trending upwards.

The office sector remains under structural pressure as evolving working habits and economic uncertainty weigh on the sector. In London, supply levels are rising and over 10 million sq ft of new accommodation is expected to be completed this year according to Deloitte – the highest level in over 20 years. Rising supply and weakening demand are forcing the vacancy rate higher, with the Central London vacancy rate now more than 9% according to CoStar data, the bulk of which relates to old stock as occupiers increasingly seek prime modern space with strong environmental credentials. We expect this to dampen rental growth prospects and expediate the bifurcation in performance between new and old. Investor demand for UK offices remains weak amid a poor outlook for the sector. Further capital value declines, particularly for secondary office assets, are expected across the sector.

Improved sentiment returned to the industrial and logistics sector during the second quarter of 2023 with pricing and performance demonstrating tentative signs of stabilisation. Whilst short-term pressure as a result of the weaker macroeconomic environment and rising debt costs are expected to dent investor confidence, the sector continues to benefit from structural and thematic tailwinds. We expect continued longer term positive performance, principally driven by robust rental growth. Supporting this, and despite an increase since the start of the year, UK industrial vacancy remains near historic lows, with any new supply unlikely to satisfy current occupational demand.

The retail sector has proven to be more resilient than many had expected over the first half of 2023. According to the Office for National Statistics (ONS), retail sales in the UK unexpectedly expanded in May, boosted by spending on summer clothing and outdoor goods. While the presence of discount retailers in the UK is not new, changes in consumer shopping behaviour have propelled them to the top of the wish list for many UK retail schemes. Discounter retailers have been a key beneficiary of a more cost-conscious UK consumer illustrated by B&M’s recent results, reporting like-for-like sales growth of 9.2% in its UK business over the first quarter of 2023. As a result, retail parks with a strong discount-orientated line-up remain in high demand for UK institutional investors.

Investor sentiment towards the purpose-built student accommodation (PBSA) sector remains positive and underlying occupational demand for the sector is robust, as illustrated by strong booking momentum for the 2023/2024 academic year. Like build-to-rent residential, there is an acute shortage of supply, particularly for the strongest university towns, which supports rental value growth for the sector. Investment volumes are down over 80% year-on-year for the sector. However, this is primarily due to a limited amount of investment stock being brought to the market, as opposed to any softening in investor sentiment towards the sector.

While more positivity returned to the market in the first half of 2023, the shorter-term outlook for the direct UK real estate market remains clouded on the back of a weaker macroeconomic climate. Gilt yields are anticipated to remain volatile in the third quarter of 2023 and any further rise in gilt yields will result in a tightening margin between UK real estate and gilts, though softened by the previous repricing of UK real estate. Heightened interest rates will also maintain pressure on real estate pricing. On a positive note, debt financing remains available and lender appetite remains for good-quality accommodation. Investors are likely to remain risk-off with good-quality accommodation providing more resilience in the face of weaker economic conditions and benefiting from more robust supply/demand dynamics. Polarisation within sectors is expected to intensify, with secondary rental and capital values under more pressure than prime. Occupational performance is expected to be the predominant driver of real estate returns in the near term and so the resilience of income will be paramount.

An improvement in real estate performance is anticipated in 2024, subject to the path of UK monetary policy which we expect at that time will be designed to stimulate economic growth.

Custodian Property Income REIT

Richard Shepherd-Cross, investment manager:

The listed property market is acutely sensitive to broader economic news with inflation, interest rates and potential recession all impacting investors’ confidence. Interest rate outlook bites the hardest and at the start of the previous quarter there was a belief that interest rates might have been close to topping out. This optimism saw yields harden in some sectors following a market rerating in the second half of 2022, but by the end of the quarter that confidence had been eroded with the 50bps rise in the base rate to 5% and the expectation of more to come. On the back of the rate rise listed real estate prices fell sharply, but there has been some recovery since then on the back of the most recent inflation numbers.

This volatility suggests that investors are keen to upweight to real estate but are waiting for a more certain economic future to be revealed before we see share prices really rally. There is a strong logic for investing in real estate in the current market as real assets should be a good store of value in an inflationary environment as rents grow over time. In the current market, occupational demand is continuing to drive rental growth which is positive for interest cover and dividends.

Healthcare

Simon Laffin, chairman:

The UK has a growing, ageing population. The demand for care home beds is therefore rising. There is also a growing realisation that a key way to take the strain off hospital beds would be to provide more care home facilities and step down care. However, the supply of care homes is fairly static. New build care homes are expensive, usually in excess of £200,000 per bed, compared to about £70,000 for older, early generation homes. Residents’ fees therefore have to be much higher for new build homes than for existing homes. The number of residents prepared and able to pay those higher fees is limited and so this puts a severe constraint on new care homes being built. The state-funded sector, in particular, is reluctant to raise fees to these levels.

The second constraint on the sector is the current high interest rates. With 20-year gilt rates now around 4.5%, the gap has fallen significantly against typical sector rental yields of 6%. This is a key reason why healthcare REIT share prices have fallen below net asset value, although healthcare has suffered less than other REIT sector

There should be more recognition of the importance of the care home sector to the health and well-being of this country. There are nearly 0.5 million vulnerable people in care homes in the UK today. The government needs to review how elderly peoples’ residential care is funded and how it can contribute to meet rising demand from an aging population, release hospital beds and provide post-operative care. This however will need also to address local authority fee rates, which are too low to provide incentives for the sector to build new homes and increase capacity. The private sector wants to play its role in providing more elderly care, both in making available buildings and capital (through REITs and other property investment company structures) and offering quality care and accommodation (through care home operators). We would like to work with government to deliver and expand this promise.

Student accommodation

Duncan Garrood, chief executive:

As other UK real estate sectors have faced a more challenging macro-economic environment, purpose-built student accommodation (PBSA) has continued to defy market trends, with £7.8bn of assets traded during 2022. This figure reflected an increase of 89% on 2021, as real estate investment volumes in the UK as a whole fell by 14.2%. Global appetite for the sector has continued to increase with US and Singaporean investors accounting for 47% and 24% of investment in the past three years, respectively (source: Savills UK PBSA Spotlight May 2023).

Although there has been less PBSA transaction activity to date in 2023 as investors take stock of the changing macroeconomic environment, the overall attractiveness of the sector remains strong. A resurgence in activity in the second half of 2023 is anticipated, as the market continues to demonstrate robust year-on-year rental growth for academic year 2023/24, reinforcing the supply/demand imbalance.

According to Higher Education Statistics Agency’s (HESA) latest student population data for the 2021/22 academic year, the number of full-time students increased by 4% to over 2.25 million. This data also showed a rise in total postgraduate students by 77,000 to 820,000, the highest total ever recorded in the UK. The growth trajectory is anticipated to continue as the university-aged population in the UK expands, with the number of individuals aged 18 expected to reach 890,000 by 2030, compared to 717,000 in 2020. The supply of new beds, including its forward pipeline, has decreased and is not anticipated to keep pace with the forecast growth in demand.

The UK’s attractiveness as a destination for international students continues to drive growth in student numbers. HESA report that the number of full-time international students studying in the UK has risen from 432,000 in 2017/18 to 636,000 in 2021/22. This growth has been largely driven by a surge in Indian students, rising from 15,000 in 2016/17 to 112,000 in 2021/22. Chinese student numbers had also experienced sustained growth, surpassing 147,000 in total.

Strengthening international student application statistics continue to be reported. The University and Colleges Admissions Service’s January 2023 statistical release shows a 4% year-on-year rise in non-EU international applications. This was driven by Indian applicants which grew by 5% and Nigerian applicants which rose 26% to 9,130 and 2,930 respectively. Applications from the US rose 10% and UAE applicants rose 21% to 5,800 and 3,570, respectively. The international market accounts for 24% of total UK student numbers, but closer to half the total tuition fees paid to UK universities.

The UK remains within the top four favoured international destinations for students originating from the United States, China and India, attracting almost ten per cent of the total international student market, behind only the United States. The UK continues to perform well on relative affordability, when compared with many other sought after international destinations.

Our marketing and sales strategy has continued to target domestic students as well as international markets where our brand is underweight, for example in the strengthening Indian and Nigerian markets. Demographically, for the forthcoming academic year to date, 49% of rooms have been sold to UK nationals, 32% to Chinese students and 19% to other international students.

Recent UCAS applications data suggests a decline in overall student applications of 2.3%, which includes a fall in applications from Chinese students of 2.2%. This decline in applications can be attributed to the UK domestic market, as the overall number of applications from international students has continued to rise, with strong growth experienced from Indian students. The reduction in Chinese applications is largely due to the reopening of the Australian market, post pandemic. A period during which the UK was a net beneficiary of Chinese applicants.

A key driver behind the reduction in UK domestic applications was a material reduction in applications for Teaching and Nursing qualifications. Both these professions experienced strong growth during the pandemic years of 2020 & 2021. Post pandemic normalisation, together with recent negative sentiment has impacted the number of students applying for these qualifications.

Historically, only 15% of Teaching and Nursing applicants apply to study at higher tariff universities. Removing Teaching and Nursing applications from the data reduces the decline in applications to a more modest 0.8%.

Real estate research notes

An update note on abrdn Property Income Trust (API). The manager’s focus focus continues to be on growing income, and asset management initiatives within the portfolio have seen its vacancy rate drop to below 5%.

An annual overview note on Tritax EuroBox (EBOX). After rapid value declines due to higher interest rates, optimism has grown that prices are stabilising. The company’s is in a good place to increase annual rent through its quality portfolio.

An update note on abrdn European Logistics Income (ASLI). The company is riding out the storm of market valuation declines, with a focus on managing its portfolio and securing income.

An update note on Urban Logistics REIT (SHED). The company’s wide share price discount to NAV, following a re-rating as values in the sector suffered as interest rates rose, is attractive especially given the operational strength of the company.

Urban Logistics REIT – Fundamentals strong as market stabilises

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.