Real Estate Roundup

Kindly sponsored by abrdn

Performance data

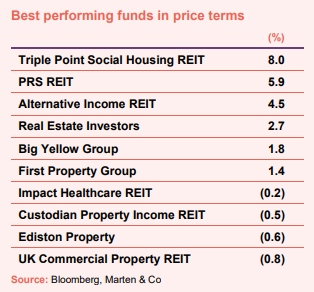

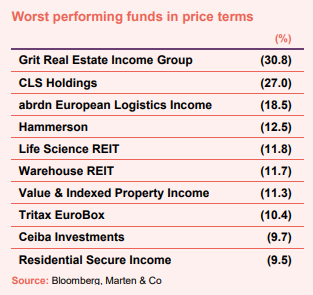

October’s biggest movers in price terms are shown in the charts below.

October was another difficult month for property companies, with only a handful of positive moves and the median share price across the sector down 4.7%. Although not reflected in the data here, the Bank of England’s announcement at the beginning of November that it had held the base rate at 5.25% for a second consecutive month and that it expects inflation to have dropped below 5% in October (figures released later this month) was a boost for the sector and saw the share price of a number of REITs and property companies bounce as hopes that interest rates have peaked grew. Triple Point Social Housing REIT topped the list of positive share price movers in October, bouncing slightly having seen its discount to NAV creep up to almost 60%. Build-to-rent specialist PRS REIT reported impressive annual results (see page 2) with both NAV and rental growth reflecting the favourable dynamics at play in the residential rental sector (see page 7). Investors reacted positively to self-storage provider Big Yellow Group’s £110m capital raise (more details on page 3) that will fund the construction of new sites across the UK. Custodian Property Income REIT made the top 10 list for the second month in a row.

Grit Real Estate Income Group suffered a heavy sell-off of its shares after it announced that it would not pay a dividend for the second half of its financial year as part of its annual results. It intends to pay a special dividend or an increased dividend for the first half of the current financial year once new developments come on board.

CLS Holdings continues to suffer from negative investor sentiment towards the office sub-sector and its share price has plunged 45.4% over 2023. Both European logistics investors abrdn European Logistics Income and

Tritax EuroBox experienced double-digit falls in October and now trail on identical discounts to NAV of around 43%. The topsy-turvy nature of Life Science REIT’s share price continued, having been a positive mover in September. The company, which transforms office space into laboratories for burgeoning life science companies at hefty rental premiums, has now lost 15.1% in value in the year to date. Warehouse REIT was among the worst performing REITs during October despite announcing the sale of two assets at a hefty premium to book value (see page 4 for more detail). Its share price is down 30.7% in 2023 and it trades on a discount of around 34%.

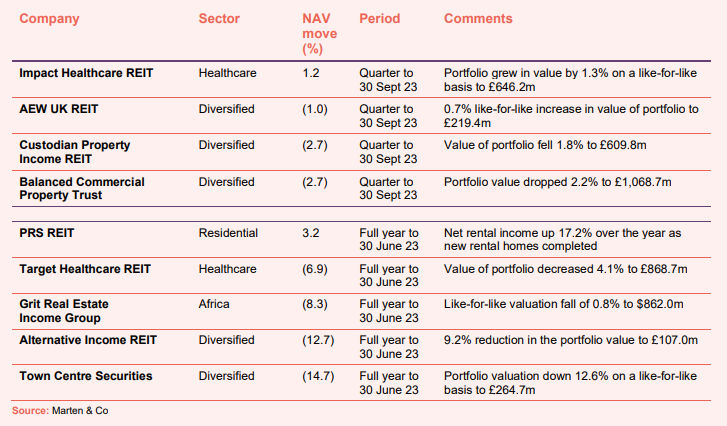

Valuation moves

Corporate activity

Big Yellow Group raised £110m in a placing. A total of 11,470,212 new ordinary shares were placed at a price of 945 pence. Concurrent with the placing, retail investors raised £1.6m. The placing price represented a discount of 2.9% to the closing share price on 10 October 2023. The proceeds will be used to fund the construction of six sites, all of which have planning consent at a cost of £90m.

Tritax Big Box REIT signed a £500m sustainability-linked unsecured revolving credit facility (RCF) with a syndicate of existing banks and new lenders. The new RCF has an initial five-year term, which may be extended to a maximum of seven years, and contains an uncommitted £200m accordion option. The new RCF is being used to refinance the company’s existing £450m RCF, which was due to mature in December 2024, and retains the same pricing with an opening margin of 120 basis points (bps) over SONIA. The new RCF will be used to support future investment and development activities. Following the refinancing, the average debt maturity across the company’s loan arrangements extends to 5.4 years, with 95% of drawn debt either fixed or hedged. The company has more than £450m of available liquidity.

Great Portland Estates signed a new £250m unsecured term loan at a headline margin of 175 bps over SONIA with three existing banks – NatWest, Lloyds Bank and Bank of China. The loan has an initial three-year term that can be extended to a maximum of five years. GPE has put in place an interest rate cap to protect against any further increases in rates whilst preserving the benefit of any reductions. The loan will fund the group’s near-term development programme and repay the group’s £175m private placement debt maturing in May 2024.

Assura Group refinanced and increased its RCF. The new facility – provided by Barclays, HSBC, NatWest and Santander – increased from £125m to £200m and now matures in October 2026 (with an option for two one-year extensions). The margin is 135 bps and the company can draw the facility in both GBP and EUR. The RCF includes sustainability-linked KPIs, achievement of which will result in the margin being reduced by 5 basis points.

Schroder European REIT completed a five-year debt refinancing secured against the company’s five-asset Dutch industrial portfolio. The €13.8m refinancing is based on a margin of 2.0%, which is 0.15% below the existing margin. Following this transaction, the company’s debt totals €85.5m across seven loan facilities, with a loan to value of 31% (23% net of cash).

Major news stories

- Regional REIT appoints new investment adviser

Regional REIT appointed ARA Europe Private Markets Limited as its investment adviser, taking over from Toscafund Asset Management. The appointment follows the announcement in April that ARA Europe REIT Manager had acquired a majority shareholding in London & Scottish Property Investment Management, the asset manager of Regional REIT.

- abrdn Property Income Trust vacancy rate falls to 4.4% after series of lettings

abrdn Property Income Trust secured over £1.3m in annual rent through new lettings and lease renewals across its office and industrial portfolios. As a result, the portfolio vacancy rate has fallen to 4.4%.

- Picton Property makes head way on office conversion strategy

Picton Property has sold an office in Cardiff to a student accommodation developer, as it continues to convert failing office space in its portfolio to alternative uses. It has also secured planning consent to turn its Angel Gate office, in the City of London, into residential and let vacant office space at Colchester Business Park to a healthcare provider.

- Home REIT rent collection deteriorates

Rent collection at Home REIT deteriorated to 3% for the month of September from 7% for the three-month period ending 31 August 2023 as its tenant base continues to struggle financially.

- Warehouse REIT sells two industrial units

Warehouse REIT sold two assets for £9.5m, together 30% ahead of the 31 March 2023 book value, reflecting an average net initial yield of 6%. These transactions bring total sales to £94.3m over the last 12 months. Proceeds from the sales will be used to pay down debt. The disposals comprise warehouses in Carisbrooke on the Isle of Wight, for £3.1m, and on Newport Road, Cardiff for £6.4m.

- Sirius Real Estate disposes of German business park

Sirius Real Estate completed the disposal of a business park in Kassel, in Germany’s southwest Hesse region, for €7.3m, representing a net initial yield of 6.0%. The sale was at a 5% premium to book value at March 2023.

- Regional REIT lets Brum office

Regional REIT leased 29,383 sq ft of space at Norfolk House, Birmingham, bringing the office to fully let. Existing tenant, Global Banking School, increased its occupancy to 73,628 sq ft and will pay a rental income of £558,277 per annum (£19/sq ft) for the new space (£1.4m overall). The lease is coterminous with the existing lease, which runs to December 2037.

- AEW UK REIT sells retail unit in Portsmouth ahead of book value

AEW UK REIT sold a high-street retail holding at 208-220 Commercial Road and 7-13 Crasswell Street, Portsmouth, for £3.9m, reflecting a net initial yield of 9.9% and a 22% premium to the 30 June 2023 valuation. Following the completion of two new lettings to Kokoro and Specsavers earlier this year, the property is now fully let.

- abrdn European Logistics Income gains top ESG award

abrdn European Logistics Income was awarded a maximum five stars in the 2023 Global Real Estate Sustainability Benchmark (GRESB – the largest global ESG benchmark for real estate and infrastructure investments) awards, achieving first place in its peer group of funds investing in European warehouses. The company scored 89 points out of 100, up from 86 points in 2022. This compares to the peer group average score of 81 points and an overall GRESB average of 75 points.

- Irish Residential Properties REIT offloads portfolio

Irish Residential Properties REIT completed the sale of 194 residential units in West Dublin to Tuath Housing for €72.06m. The sales price was in line with book value at 30 June 2023, and the proceeds will be used to strengthen the company’s balance sheet, lowering loan to value to 42.1%.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Custodian Property Income REIT

Richard Shepherd-Cross, investment manager:

The disconnect between the occupational and investment markets in UK real estate continues to persist. While the impacts of high inflation and interest rates appear to weigh heavily on investor sentiment, perhaps the greater influence has been the marked re-rating of valuations in the final quarter of 2022, which still seems to colour investors’ attitude to real estate investment. However, since the start of 2023 valuations have been reasonably stable across the market, with some sub-sectors showing signs of recovery while others continue to drift. The outcome for the NAV of Custodian Property Income REIT has been a marginal decrease of 3.9% over the past three quarters.

By contrast, occupational demand has been consistently strong which has led to a reduced vacancy rate and increase in the portfolio rent roll. It is the strength of the occupational market driving rental growth and low vacancy that will ultimately support fully covered dividends and earnings growth. Income/earnings remain a central focus for Custodian Property Income REIT, and it is income that will deliver positive total returns for shareholders. On this basis we remain cautiously optimistic.

Balanced Commercial Property Trust

Richard Kirby, fund manager:

Real estate continues to be impacted by the macro-economic challenges of elevated rates of inflation and high interest rates which continue to weigh on investor sentiment. However, the Bank of England broke its cycle of 14 consecutive increases to the base rate, holding the benchmark interest rate at 5.25 per cent in September. While the rate of inflation has proven stubborn since, it may be that the worst of the inflation-driven market uncertainty and interest rate hikes are now behind us.

At the market level, total returns as measured by the MSCI Monthly UK Property Index turned negative in the third quarter. This was largely driven by yields continuing to drift out in the retail and office sectors, reflecting perceived risk and an absence of capital as quarterly investment volumes remain subdued. The headline figures are nuanced both between prime and secondary stock and, at the sector level, as investors increasingly favour the resilience offered by the sectors with the strongest occupational markets.

Occupational markets continue to show resilience, with all sectors seeing annualised rental value growth at the headline level. This is an encouraging sign in the prevailing environment of limited capital growth and where income will drive real estate returns.

M7 Real Estate, investment adviser:

After rising substantially over the last two quarters of 2022, commercial property yields effectively plateaued in early 2023. At that time, core inflation data, on the upside of expectations, caused the market to think again. Some were expecting that the previous ‘yield peak’ may be an inflection point with some yield softening in the latter half of 2023, others suspected an extended period of relative stability.

Forecasters’ predictions for a peak in base rates went through a volatile period in the first half of 2023, ranging from 6.0% to 6.5% This rate shift from 5.0% is relatively small compared with the near doubling of the cost of debt last year. Investors in a position to take a medium to long-term view, with long-term drawn down facilities at below current debt pricing, may well start taking key assets from leveraged investors. There is still a weight of global capital seeking a home in UK real estate.

The gap between stronger and weaker assets with more vulnerable occupiers is widening. Investment volumes are down, sellers are reluctant to dispose of assets, and new development supply is slowing. Another summer of low activity was expected.

It is income returns, rather than capital growth, which are expected to continue to drive performance in 2023. Business insolvencies, property defaults and consequently void rates are marginally increasing. However, where businesses have requirements there is a focus on quality and sustainability, reducing their occupational overheads and retaining staff. Moreover, the ongoing lack of suitable development supply continues to underpin prime markets particularly in comparison with secondary space.

The MSCI Capital Value Growth Index (June 2023) demonstrates the historical movement in the investment market, showing the rerating in the second half of 2022 and the recent stability. The industrial sector, being the lowest yielding, fell back more dramatically than the other main sectors, when rising inflation and interest rates hit. This sector sits relatively favourably at present, with a significant global weight of capital targeting the sector, despite headwinds for occupiers. Void rates may rise somewhat over the short term, but rental growth is expected to remain positive.

Both investors and occupiers have a renewed focus on the physical climate risk after record temperatures which may be the new norm. Each are developing a better understanding of the value of sustainability features, accurate measurement of ‘green’ features and the impact of improved energy efficiency on the corporate bottom line. More mandatory disclosure requirements are expected, including net zero transition plans.

Healthcare

Alison Fyfe, chair:

Our share price has declined alongside the UK REIT sector, reflecting the expected impact of higher interest rates and concerns for the UK economy on earnings and valuation outlooks. We believe our own outlook is more positive, given the high levels of investment demand for our assets, the underlying demographics of an ageing population, and the dearth of quality care home real estate across the UK. Our portfolio is performing strongly, benefitting from our initiatives to dispose of non-core assets, from further capex to refresh or enhance our real estate, from our active engagement with tenants, and from the more favourable trading environment.

The downward pressure on real estate valuations was muted in our portfolio, underpinned by the strength of investment demand for our type of modern, purpose-built assets and from the improved trading conditions our tenants are encountering. The net result has been a valuation move of c.40 basis points on yield, significantly lower than UK real estate has experienced more widely.

Despite the more challenging macroeconomic environment, strong sector tailwinds continue to support investment in modern care home real estate. Underlying demand for residential care places is supported by demographic change, evidenced by projected growth in the number of those aged over 85, and investment demand for modern, ESG-compliant care home real estate remains strong.

On inflation and recessionary concerns, our portfolio bias towards private pay provides comfort that our tenants are more likely to be able to pass on their cost increases through higher resident fees, supporting sustainable tenant trading. We have seen evidence over the year that the quality of our real estate allows tenants to secure commercially appropriate fee levels.

Residential

Steve Smith, chairman:

The total number of rental properties in the UK has not increased significantly since 2016 although demand for rental accommodation continues to rise. According to Zoopla, a leading UK aggregator of property listings, the ongoing chronic imbalance between supply and demand has pushed rents higher across all parts of the UK. It forecasts continued demand and rental inflation into the second half of 2023.

Private landlords have faced greater pressures since 2016, when an extra 3% was added on stamp duty for additional home purchases. This was followed by reform on mortgage interest rate relief. Proposed rental reform measures in the government’s Renters (Reform) Bill have further added to pressures on private landlords. These include the proposed abolition of fixed-term tenancies and reform of the grounds for repossession. Higher interest rates gave further cause for concern for private landlords.

According to the National Landlords Association, even though rental demand is high, the proportion of landlords looking to reduce their portfolio over the next 12 months continues to rise and landlords “planning to sell” are now at record highs, with 30% planning to cut the size of their portfolios. Hamptons, the property consultancy, reports that 140,000 landlords left the sector last year and expects the run-rate of landlords leaving the sector to be 100,000 per year for the next five years.

Challenges to home ownership have not eased, further fuelling rental demand. Increased interest rates have created new pressures for prospective homeowners wishing to purchase their first home and for homeowners with mortgages due for renewal. The median house price to income ratio, according to the Office for National Statistics is currently 8.16, and in August 2023, the average interest rate on a two-year fixed mortgage was 6.85% according to financial data provider, Moneyfacts, with the average rate on a five-year fixed mortgage at 6.35%. By comparison, the PRS REIT’s homes remain very affordable. At 30 September 2023, the average household income of a PRS REIT tenant was £51,000 and the average rent was £934 per calendar month, meaning that rent as a proportion of household income was 22%. We believe that it is reasonable to assume this improvement reflects a combination of wage inflation and the emergence of a wealthier cohort of disenfranchised would-be home buyers.

In summary, it is clear that the market opportunity in the build-to-rent (BTR) sector remains significant and that the sector remains an important means of fulfilling a social need and meeting demand for high-quality, well-managed rental housing in the UK.

Real estate research notes

An update note on Lar España Real Estate (LRE SM). The company continues to defy the doom and gloom surrounding the retail sector, posting strong financial and operational numbers.

An update note on Grit Real Estate Income Group (GR1T). The company has been reborn, with the acquisitions of a developer and asset manager making annual return targets of 12-15% more achievable.

An update note on abrdn Property Income Trust (API). The manager’s focus focus continues to be on growing income, and asset management initiatives within the portfolio have seen its vacancy rate drop to below 5%.

An annual overview note on Tritax EuroBox (EBOX). After rapid value declines due to higher interest rates, optimism has grown that prices are stabilising. The company’s is in a good place to increase annual rent through its quality portfolio.

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.