Fast-tracked

Tritax EuroBox (EBOX) is continuing on its rapid growth path, having raised €250m of fresh equity in September 2021 and secured a private placement for €200m more in December. It has already acquired four assets with the proceeds and has a further pipeline worth €300m. Once the proceeds of the September capital raise has been fully deployed, the group’s assets will be worth around €1.9bn – remarkable growth from a portfolio value of just over €800m a year ago.

Furthermore, EBOX’s manager expects to consistently beat its medium-term total return target of 9% per annum through asset management initiatives. These include both new lettings to capture the benefits of rising market rents and development/extension opportunities within the portfolio. The group continues to move up the investment risk curve, taking advantage of the favourable dynamics in the European logistics market and pressing ahead with new developments with its exclusive developer partners.

Reflecting its recent growth, the group was added to the FTSE 250 index in October 2021.

Big box logistics in Europe

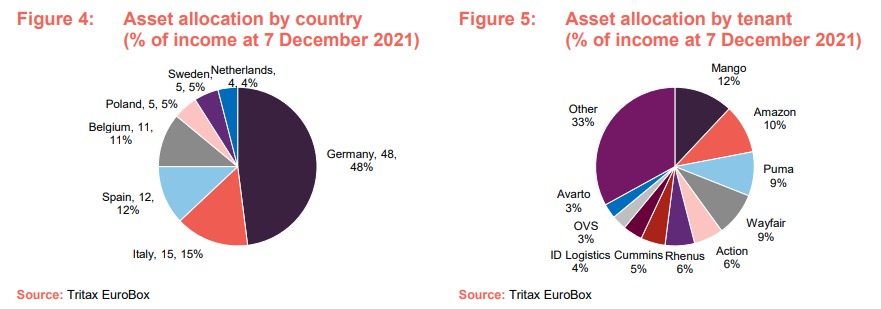

EBOX invests in a portfolio of logistics assets in continental Europe, diversified by geography and tenant, targeting well-located assets, within or close to densely populated areas. The strategy aims to capture market rental value growth and deliver an attractive capital return and secure income. EBOX is targeting a total return of 9% per annum over the medium term.

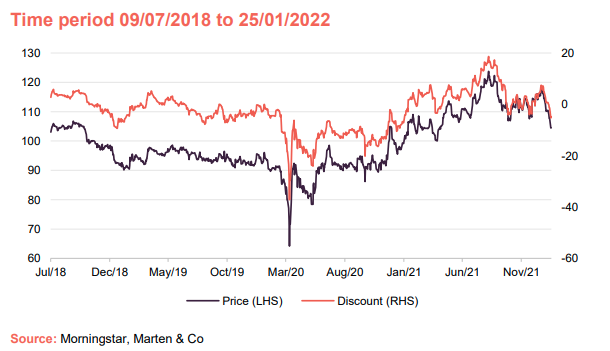

Share price and discount

EBOX’s share price has performed well since the onset of the pandemic, as the market recognised the structural tailwinds at play in the continental logistics sector. It had been trading at a premium to net asset value (NAV) for much of 2021 but the recent equity raise and growth in NAV has seen its rating swing to a discount.

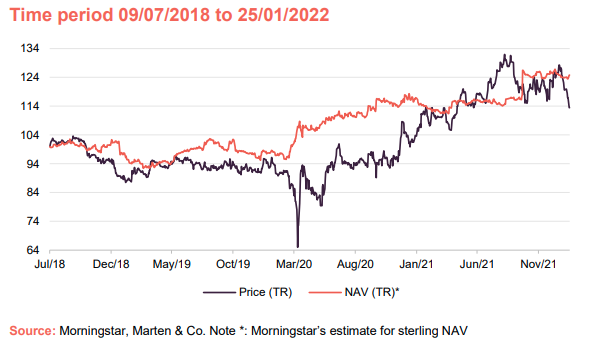

Performance since launch

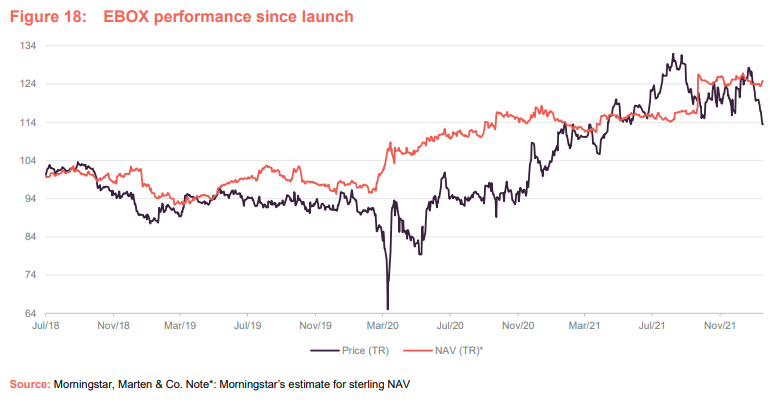

EBOX’s NAV made steady progress from launch as it pieced its portfolio together. The NAV grew significantly with the deployment of the proceeds of the equity raise in March 2021, and we expect it to grow substantially further with the deployment of the September 2021 proceeds and the private placement.

Fund profile

Tritax EuroBox (EBOX) invests in and manages a portfolio of logistics assets in continental Europe, diversified by geography and tenant, targeting well-located assets in established distribution hubs close to densely populated areas. The strategy aims to capture market rental value growth, which is becoming evident in the key distribution markets of continental Europe.

EBOX was launched on 9 July 2018 after raising gross proceeds of €339.3m (£300m) at initial public offering (IPO). Following full deployment of the capital from the IPO into a portfolio of nine continental European logistics real estate assets, the company successfully raised additional gross proceeds of €135m (£119.1m) in a placing on 21 May 2019. In 2021 the group made two substantial capital raises, in March raising gross proceeds of €230m and in September €250m. At 30 September 2021, it had a portfolio of 15 assets in seven countries, with 27 tenants, worth €1,281.4m.

EBOX’s shares are traded on the premium segment of the London Stock Exchange, with both a sterling and euro quotation. These are the same class of shares and trading line, are fully fungible, and have no impact on overall liquidity of the stock. On 1 October 2021, the group was added as a constituent of the FTSE 250 index. To enhance equity returns, the company borrows money, with a medium-term target loan to value (LTV) ratio of 45% of gross assets and a maximum limit of 50%.

The manager – Tritax Management

The company’s manager is Tritax Management, part of the Tritax Group. Since 1995, the Tritax Group has acquired and developed more than £6bn of commercial property assets across multiple sectors including big box logistics assets, industrial properties, office, retail and hotels.

Tritax Group manages just over £6bn of assets (including EBOX), consisting of more than 46.7 million sq ft. Tritax has a particular specialisation in the acquisition and management of logistics portfolios, most notably through Tritax Big Box REIT, a UK FTSE 250 REIT launched in December 2013. Tritax is headquartered in London with over 30 professionals and is authorised and regulated by the FCA.

In December 2020, Aberdeen Standard Investments announced it was to acquire a 60% interest in Tritax Management. As part of the deal, Tritax will lead ASI Real Estate’s global logistics team.

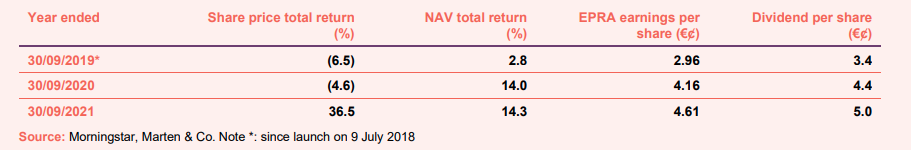

Results to 30 September 2021

In December, EBOX published its annual results for the year to the end of September 2021, during which its NAV increased to €1.31 per share from €1.19. The value of the portfolio grew 11.9% on a like-for-like basis in the period to €1,281.4m.

Adjusted earnings grew 10.8% to 4.61 euro cents per share, while the group declared total dividends of 5 euro cents a share – a 13.6% increase year-on-year. These dividends were not fully covered by earnings due to the dilution of the equity raise in September. The manager said that it expects the dividend next year will be fully covered by earnings as income from new acquisitions and asset management initiatives on the existing portfolio come through.

The group posted a NAV total return for the year of 14.3%, exceeding its medium-term annual total return target of 9%.

Market overview

The structural trends behind the substantial growth witnessed in the logistics property sector has accelerated during the COVID-19 pandemic, most prominently with the surge in online retailing. The accepted consensus among market commentators and research houses is that five or more years of growth has been condensed into 18 months. With the Omicron variant raging through Europe, fresh restrictions and lockdowns seem inevitable. This could result in a further uptick in online retailing in 2022.

Forrester Research has forecast that by 2025, online retail will average 25% of all retail sales across Europe, which will see an estimated extra €342bn spent online. This surge in online retailing will require a significant amount of warehouse space, with US logistics developer Prologis predicting that each additional €1bn spent online requires an extra 77,000 sqm of warehouse space. This will mean that for the online retail sector alone an additional 26.3m sqm of warehouse space needs to be found.

It is not just online retail that is expected to further boost demand for logistics space. Supply chain resilience has become a top priority for businesses since the events at the start of the pandemic and more recently the Suez Canal blockage exposed their reliance on Asia. Manufacturing companies are moving towards a ‘just in case’ supply chain, rather than ‘just in time’ and are considering bringing manufacturing processes closer to home and increasing the amount of inventory held to mitigate for delays.

Europe is also witnessing record low supply of logistics space, with average vacancy rates of 4.6%, as explained on page 6. The manager states that this favourable supply-demand imbalance is already supporting rental growth across Europe and it expects it to become more acute over the next few years.

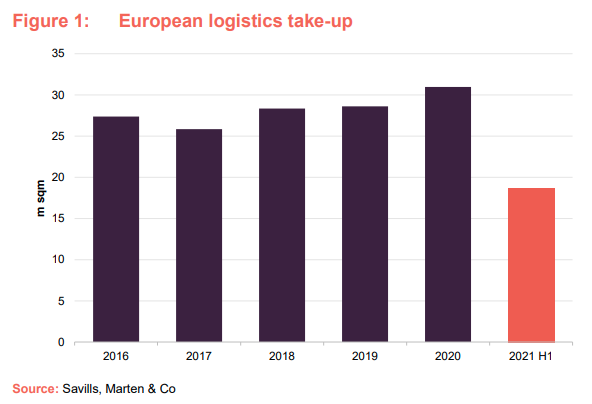

Record take-up levels

As mentioned earlier, extended lockdown periods have continued to support the growth of online retail across Europe. Western Europe’s e-commerce penetration rate jumped from an average of 13% to 16% between 2019 and 2020, according to Forrester. This growth directly correlates with a record uplift in take-up of logistics space in Europe.

European logistics take-up reached 18.7m sqm in the first half of 2021, according to Savills, which is 63% above the half-year average. It is on course to surpass the record take-up levels achieved in 2020. Germany (3.9m sqm, 28%), the Netherlands (3.9m sqm, 64%) and Poland (3.4m sqm, 102%) performed the strongest against their five-year averages.

Dwindling supply

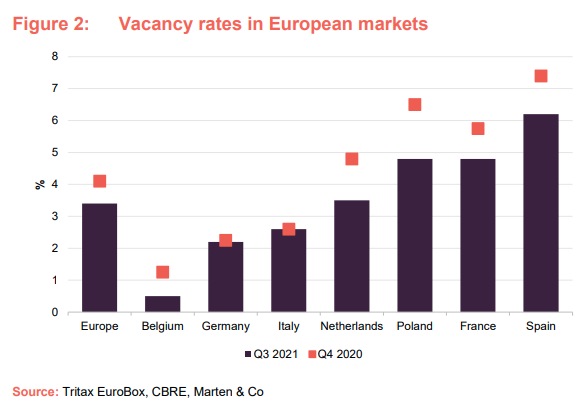

There is a severe shortage in supply of logistics property across Europe, with vacancy rates continuing to fall due to several factors including a limited number of sites available to deliver new logistics schemes and zoning or permit constraints (especially in Germany and the Netherlands). Overall, European logistics vacancy rates have fallen by an average of 80 basis points (0.8%) over the past 12 months to 4.6%, according to Savills. This is even more acute in some markets, with EBOX’s manager estimating that the unweighted average across Belgium, France, Germany, Italy Netherlands, Poland and Spain being 3.4%, as shown in Figure 2.

Rental growth forecasts driving record investment volume

On the back of the supply-demand imbalance, EBOX’s manager states that rents are stepping up materially, as evidenced by a 2.4% increase in like-for-like rental income in its portfolio in the year to 30 September 2021. Savills believes that many rental growth forecasts are underestimating the localised market conditions which ultimately drive rental growth and leads them to state that current forecasts from Capital Economics of 1.8% rental growth per year, as a European average, should be easily exceeded.

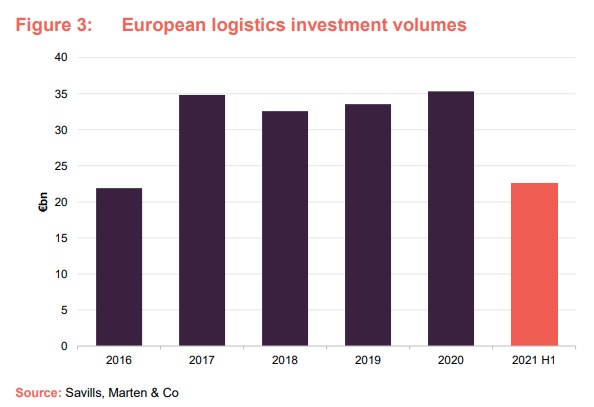

The long-term structural characteristics that make up the European logistics market has allowed investors to underwrite their acquisitions with increasing rental growth assumptions. This led to a record level of investment in European logistics in 2020, with 2021 on course to better this. According to Savills, European logistics investment reached a record €22.5bn during the first half of 2021, a 60% increase on the five-year half year average.

Record investment levels has led to yield compression across the continent, with most core European markets sub-4%. Prime European logistics yields compressed by an average of 40 basis points (0.4%) to 4.40% over the past 12 months, according to Savills.

Europe vs UK

There are many significant differences between the UK and European logistics markets that the manager believes points to potential favourable returns from European assets. Many European markets are not as mature as the UK, with the exponential growth in online retail sales yet to fully take place in most regions. Savills estimates that the western European average penetration rate remains around five years behind the growth trajectory observed within the UK. Even the mature markets like Germany, France and the Netherlands are some way behind what has been witnessed in the UK. This growth in e-commerce penetration rates is expected to come through over the next few years.

Unlike in the UK, leases on commercial real estate in Europe include annual indexation rent rises as standard. This gives property owners protection against inflation. The indexation is sometimes agreed with a cap and collar in place – an upper and lower limit on the rental uplift. This is reflected in EBOX’s portfolio, where 78% of leases are linked to inflation (more detail on EBOX’s portfolio is on page 12).

Financing costs in Europe are significantly cheaper than in the UK, meaning the yield spread (the difference between income returns and finance costs) can be much more favourable in Europe.

Developments

EBOX’s manager states that an important driver of future returns for the company is through increased exposure to developments. EBOX has exclusive partnerships with two specialist logistics developers and asset managers – Dietz AG and Logistics Capital Partners (LCP) – that offer it asset management expertise on its current portfolio and access to their respective development pipelines. EBOX has first right of refusal over the two developers’ pipelines, providing it with acquisition opportunities in some of the best logistics locations across continental Europe.

Not only do these partnerships provide EBOX with access to a significant quantum of the best quality assets in Europe, but they can also purchase them at competitive prices. The manager states that acquisition yields can be between 25-50 basis points (0.25%-0.5%) higher on income producing assets, and 100 basis points (1.0%) on forward funding developments. This is because developers like to sell assets before construction has started, rather than taking them to market, to provide them with certainty of transaction and allow them to recycle capital into other projects.

EBOX has recently partnered with a third logistics developer, Verdion, in both Sweden and Germany, although this is not an exclusive partnership as is the case with Dietz and LCP. The companies have substantial teams in all of the countries that EBOX operates, with a fundamental understanding of the local markets, knowledge of occupier requirements and relationships with local municipalities. The scale and quality of EBOX’s exclusive development partners are explained below.

Dietz AG

Dietz is focused on the German logistics market and is one of the biggest developers in Germany. It has more than 40 years of experience covering a wide range of services including development and asset management.

Germany has historically been the most difficult market for overseas investors to get access to. Partnering with Dietz allows EBOX to grow in the highly sought-after and competitive German logistics market.

Dietz has assets under management of around €1.3bn, comprising 81 properties across Germany totalling a rental area of 1.9m sqm. Tenant relationships include Daimler AG, Deutsche Post Immobilien, Hermes, FedEx, DHL, VolkswagenLogistics, BMW, Kuehne & Nagel, Siemens and REWE.

Under the terms of the agreement, Dietz retains a 10% non-controlling, dormant investment in the assets that it sells to EBOX, which helps to align both parties’ interests.

Logistics Capital Partners

LCP is an established pan-European provider of project development and asset management services for logistics real estate, with offices in the UK, the Netherlands, France, Belgium, Italy, Spain and Luxembourg, employing 18 staff.

LCP’s partnership team has extensive experience in the investment, development and occupier sectors of the logistics market. LCP exclusively controls around 60 hectares of land in Europe with 55,000 sqm currently under construction and an active pipeline of standing investment opportunities totalling several hundred million euros in asset value.

Investment process

EBOX focuses on investment in properties fulfilling a key part of the logistics and distribution supply chain for occupiers including retailers, manufacturers and third-party logistics operators (3PLs). Its portfolio is predominantly made up of large, modern distribution warehouses, with some exposure to urban distribution hubs, which help occupiers fulfil the ‘last mile’ part of the distribution chain.

EBOX has a ‘bottom-up’ approach to investment, focusing on good real estate in good locations with limited supply and strong occupational demand. The company targets and maintains a weighted average unexpired lease term (WAULT) of more than five years across the portfolio.

The majority of the company’s portfolio is currently invested in completed, let investments and pre-let income-producing forward funded developments; however, a proportion of the portfolio may be invested in land zoned for logistics use (and options over such land). These types of acquisition allow the group to source higher-quality, lower-priced assets than could be found in the investment market. It allows the company to enter into earlier stage discussions with developers and prospective occupiers, thereby minimising competition with other investment buyers.

EBOX categorises its investments into four investment pillars:

- Foundation Assets are core low-risk income assets. They typically benefit from long leases to institutional grade tenants in prime locations with index-linked rents, providing the foundation to the portfolio.

- Value Add Assets provide asset management opportunities. These assets are fundamentally strong assets let on shorter leases to financially strong tenants allowing implementation of asset management initiatives to drive value, for example by lease renegotiation or building extension.

- Growth Covenant Assets are fundamentally strong assets in good locations but let to tenants with improving financial covenants. These assets offer the opportunity to add value as the tenant’s financial standing improves and hence improving income security.

- Strategic Land assets are investments in land zoned for logistics use in strong locations and include options over land. These assets offer the opportunity to add value as they are positioned at an earlier stage of the development cycle and so have the potential to become Foundation Assets for the future.

On a long-term fully-invested and geared basis, the company expects that its portfolio would have an equal split between investments in Foundation Assets and value-add investments (incorporating Value-Add Assets, Growth Covenant Assets and Strategic Land).

Sustainability

EBOX’s environmental, social and governance (ESG) policy sets out the group’s approach to managing sustainability covering acquisitions, developments and asset management. The group has recruited a sustainability lead to develop a long-term strategy and improve sustainability performance.

The large, modern warehouses that EBOX invests in are designed to mitigate their impact on the environment, and, unlike other property classes, such as offices, have lower obsolescence and running costs. EBOX works closely with its tenants to undertake environmental initiatives that improve the efficiency of the buildings. The group has obtained operational performance data from the vast majority of its tenants to help measure and manage their environmental impact. Examples of sustainability initiatives within the portfolio include the generation of renewable energy through photovoltaic panels at many of the group’s assets; LED lighting; electric car charging stations; solar carport for power generation, and energy controlling. The improvements across its portfolio saw EBOX awarded four green stars out of five in the 2021 survey by GRESB (Global Real Estate Sustainability Benchmark) with a score of 82/100. This is a significant improvement on its 2020 GRESB survey score of 64/100 and compares favourably not only against its peer group average score of 64/100 in 2021 but also against the 73/100 GRESB 2021 average score.

Acquisition due diligence explicitly integrates ESG considerations, including assessing risks such as changes to legislation, contaminated land or flooding, as well as opportunities to improve environmental performance or wellbeing for tenants’ employees. The area surrounding the asset is also considered, including how well it is served by public transport, a ‘walkability’ score and the distance to green space or amenities. Other considerations include internal and external air quality, electric vehicle charging and cycle facilities. Opportunities for improvement are included in the asset management plans and sustainability action plans.

It is EBOX’s long term ambition to have all assets let on green leases, as it works towards achieving net zero carbon across the portfolio by 2030. It has recently signed four green leases that incentivise the tenant to invest in green initiatives. More detail on the sustainability credentials of some on EBOX’s assets can be found in the asset allocation section from page 12.

The manager says that all new developments will obtain Green Building Certifications and have strong sustainability credentials. EBOX sets ESG standards with its development partners, including a sustainable construction brief and a supplier code of conduct.

EBOX’s social approach focuses on positive relationships with occupiers and providing an environment that encourages employee wellbeing, including introducing nature and wellbeing measures. The group’s local community investment fund supports its tenants’ community engagement initiatives.

Internally, the manager has policies covering equal opportunities, disability discrimination, health and safety, data-protection and whistle-blowing.

The strength of the group’s ESG credentials enabled it to issue a €500m ‘green’ bond in May 2021 (details of which are on page 22) that comes with far more attractive interest rates.

Asset allocation

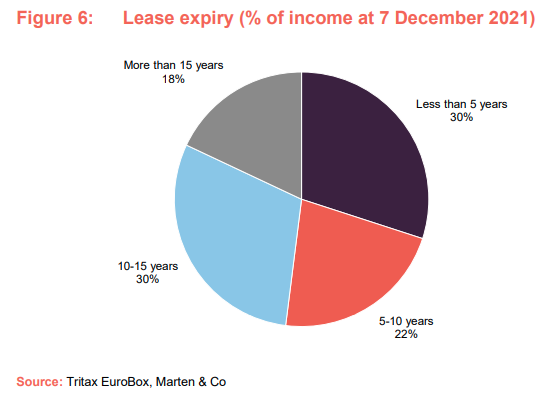

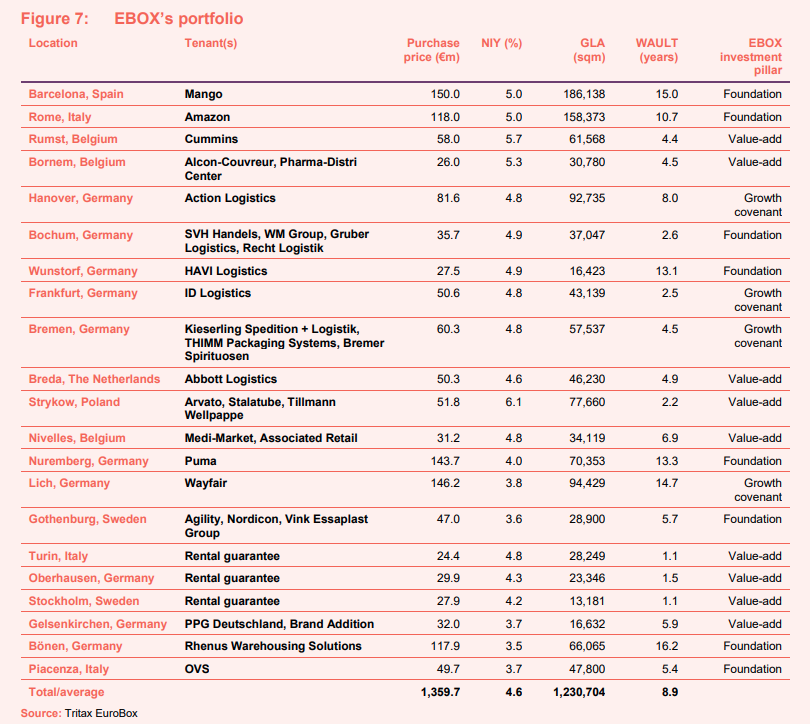

EBOX has a portfolio of 21 assets worth around €1,564m located across seven European countries. The portfolio has a WAULT of 8.9 years, with a spread of short- and long-term leases, let to 33 tenants. The majority of leases are inflation-linked (78%), with a further 17% with fixed annual uplifts and just 5% with no uplifts. As well as capturing the vast majority of inflation growth through index-linked leases, the group hopes to capture market rental growth through a balanced lease expiry profile on the portfolio, as shown in Figure 6. The shorter leases and rental guarantees it has within its portfolio gives EBOX the opportunity to capture the higher market rents.

EBOX’s most recent acquisitions are detailed below. See our initiation note for details on the assets in the wider portfolio.

Nivelles

EBOX acquired the newly built 34,125 sqm logistics facility in Nivelles in January 2021 for €31.2m, reflecting a net initial yield of 4.8%. The asset comprises two units, one of which is let to MediMarket Group on a nine-year lease without a break at a rent, subject to annual indexation, of €803,000 per annum reflecting €44.3 per sqm. The second, slightly smaller unit was vacant on acquisition and had a 12-month rental guarantee. The company signed a new lease in November 2021 to Associated Retail (trading as Match Supermarkets), a leading Belgian supermarket, for nine years, with a break option at six years, at €793,553 rent per annum, reflecting €44.8 per sqm. The rent will be subject to annual uplifts in line with the Belgian Healthcare Index. This rental level is around 8% above the rental guarantee.

The Nivelles property includes a range of sustainability measures such as LED lighting with motion sensors, insulated exterior walls to achieve good energy performance, cycle storage and a cycle path, along with installation of solar panels to provide tenants with a renewable power source. EBOX negotiated a ‘green lease’ with Match Supermarkets to include specific clauses to ensure the commitment of the tenant to use the building in a sustainable way, sharing data on energy, water consumption, waste management and recycling.

Nuremberg and Lich

EBOX acquired the Nuremburg and Lich properties in the same transaction with its development partner Dietz for a combined price of €290.9m, reflecting a combined net initial yield of 3.9%.

The 70,353 sqm property in Nuremberg is let to global sportswear manufacturer and retailer Puma. It serves as the European distribution headquarters for Puma, which signed a 15-year lease on the property in April 2020. The property produces an annual rental income of €5.78m, with the lease subject to annual indexation of 100% of German CPI, following a four-year indexation holiday from the start of the lease.

The property is carbon neutral, built to LEED Gold standard, benefits from certified green energy procurement, and has a roof mounted photovoltaic system generating up to 1.5 megawatts of electricity. The 20-hectare site comes with extension potential for an additional 42,000 sqm of floorspace. The asset is categorised as a foundation asset by EBOX, due to the low-risk nature of the income.

The 94,429 sqm distribution unit in Lich, near Giessen, is let to online furniture retailer Wayfair. It is Wayfair’s first distribution centre in Germany as the US-based company continues its expansion in Europe. It signed a 15-year lease on the property that commenced in May 2021 at an annual rent of €5.6m, linked to German CPI, following a three-year indexation holiday at the commencement of the lease. The property is certified to DGNB Gold standard, and it benefits from a range of operational energy reduction measures. The roof has the capacity to support the installation of solar PV panels. The asset is categorised as a growth covenant asset by EBOX due to Wayfair’s growth potential.

Gothenburg

In June 2021, EBOX acquired its first investment in the Nordic region with the €47m purchase of this asset in the Port of Gothenburg. The asset comprises two purpose-built logistics facilities totalling 28,900 sqm that are fully let to Agility AB, Nordicon AB and Vink Essåplast Group AB, generating a total annual rent of €1.79m (equating to €62.50 per sqm) on leases with a WAULT of six years. All leases are annually indexed to 100% of Swedish CPI. The manager says that the Port of Gothenburg is one of the most attractive logistics locations in the Nordics and currently has no vacant logistics buildings in the port area. The port is home to Scandinavia’s largest container terminal, which is forecast to grow over the coming years.

Turin

EBOX completed the forward funding acquisition of the 28,249 sqm asset in Settimo Torinese near Turin in November 2021, for a total consideration of €24.4m. The property is being developed by LCP under a fixed-price development contract and is expected to complete in 2022. LCP will provide a rental guarantee of €1.277m from completion, based on 12 months estimated rental value.

The cross-docked logistics facility will be arranged as two equal sized units in one single building, capable of being leased either as a single building or two separate buildings. The facility is expected to achieve a BREEAM Very Good rating and to benefit from roof mounted photovoltaic panels, which are expected to provide income of €45,000 per annum. The manager states that the Italian logistics market is currently characterised by record levels of occupational take up, particularly in the northern part of the country, as well as vacancy rates at a low level of around 2%.

Oberhausen

In September 2021, EBOX signed a deal to forward fund the acquisition of a 23,346 sqm logistics asset, at a fixed purchase price of €29.9m. The development will be undertaken by Verdion, which specialises in European industrial and logistics real estate. The land purchase is conditional on receiving the building permit and access rights which are both expected in the near-term. From completion of the land purchase and during the construction phase, EBOX will receive from the developer an income return equivalent to the agreed net initial yield. On completion of construction, which is expected by the end of 2022, the group will benefit from a 12-month rental guarantee from Verdion of €1.313m (equating to €56 per sqm).

Oberhausen, located between Duisburg and Essen, is one of the cities forming the Rhine-Ruhr area, the largest urban area in Germany with a population of over 10 million. The manager says that the Rhine-Ruhr area currently has high levels of occupier demand and very low levels of vacancy for prime logistics real estate and expects the asset to lease before the end of the rental guarantee period. Verdion will assist EBOX with the letting based on pre-agreed leasing criteria with an incentive mechanism.

The developer is targeting a minimum BREEAM Very Good and DGNB Gold certification, and the construction will include a range of energy saving initiatives and staff wellbeing measures.

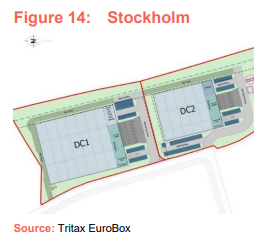

Stockholm

The €27.9m forward funding acquisition of EBOX’s second asset in Sweden completed in November 2021. The site, which will host a 13,181 sqm facility, is located in Rosersberg just north of Stockholm and is being developed by Verdion. EBOX will receive an income return equivalent to the net initial yield from completion of the land purchase (which is conditional on receiving the building permit), as well as a 12-month rental guarantee of €1.18m from completion of construction, which is expect by the end of 2022.

Rosersberg, which is located close to Stockholm Arlanda Airport, has one of the highest logistics market rents in Sweden. Due to the strength of the local leasing market, the manager says that it is confident that it will be able to lease the units quickly and benefit from any increased value that a new lease may create. Verdion will assist with the letting based on pre-agreed leasing criteria with an incentive mechanism and will be retained as asset manager. The developer is targeting a minimum BREEAM Very Good certification.

Gelsenkirchen

EBOX agreed the acquisition of a €32m asset in the Rhine-Ruhr region in Germany in October 2021. The asset has a total gross internal area of 16,632 sqm and comprises three purpose-built logistics facilities. Unit one completed in December 2021 while units two and three are expected to be delivered by February 2022.

Units one and two are let to strong tenants with robust covenants, while the third unit is currently vacant. EBOX will benefit from a rental guarantee on the third unit but expects to let it in the near term. The asset will generate a total annual rent of €1.21m on leases with a weighted average unexpired lease term of six years.

The acquisition price of €32m reflects a net initial yield of 3.7% based on the income from the existing leases and rental guarantee. Completion of the acquisition is subject to practical completion of the construction of unit one.

Bönen

In November 2021, EBOX agreed to acquire land and fund the development of an €117.9m asset in the Rhine-Ruhr region in Germany, which is pre-let to the Rhenus Warehousing Solutions SE & Co KG, a leading global logistics service provider. The property will comprise a single building of 66,065 sqm split into six units and is expected to be completed in February 2023.

EBOX will buy the land initially and then fund the construction of the building under a fixed price contract with Dietz. From receipt of the building permit (expected by February 2022) and during the 12-month construction phase, EBOX will receive from the developer an income return equivalent to the agreed net initial yield of 3.5%. The entire building is pre-let on a 15-year lease to Rhenus, commencing on practical completion of the building. The lease will generate a total annual rent of around €4.1m.

Piacenza

The €49.65m acquisition of the 47,800 sqm asset in Piacenza, Northern Italy, completed in November 2021. The property comprises two units (DC4 and DC5) constructed in 2016 and 2020 and let to Italian fashion brand OVS, which uses the property as its European distribution hub. The lease on DC4 is for a further eight years and on unit DC5 for nine years. Both leases are subject to annual indexation. The gross annual rent of €2.01m reflects an average of €44 per sqm, which the manager says is below the prevailing headline rents in the area of €47 per sqm.

The asset, which fronts the A1 motorway that connects Milan and Rome and is close to the A21 east to west route linking Turin and Brescia, has obtained BREEAM Very Good and BREEAM Excellent certification and has roof mounted photovoltaic systems installed.

Pipeline

After raising €250m of capital in September 2021 and securing €200m through a private placement (more details on page 22), EBOX has substantial firepower for investments. The group has an identified near-term investment pipeline worth more than €500m of prime ‘big box’ logistics assets in key locations in Continental Europe. It has already deployed around €240m through the acquisition of three assets mentioned above – Gelsenkirchen, Bönen and Piacenza – and the recently announced purchase of land for the development of a 17,832 sqm logistics asset in Rosersberg, near Stockholm, Sweden, for €39.4m. The site is adjacent to the group’s ongoing development mentioned on page 16. The investment reflects a net initial yield of 4.0%, based on the income from a 12-month rental guarantee from the developer Verdion.

It has further assets in its acquisition pipeline worth around €300m, which includes development land and forward funding development opportunities. The manager expects to fully deploy the proceeds from the equity raise and private placement in early 2022. When fully deployed, the portfolio value should increase to around €1.9bn.

Asset management initiatives

Many of the assets in EBOX’s portfolio have expansion and development opportunities, as well as leasing potential. The group is currently undertaking two expansion developments that will result in significant valuation uplifts. At its largest asset, in Barcelona, EBOX is funding a 93,931 sqm extension on an adjacent plot of land for the tenant, Mango, at a cost of €31.5m and a yield on cost of 8.8%. Construction started in June 2021 and practical completion is targeted for September 2022. The extension will be incorporated into the existing lease, which runs until December 2046. EBOX has also funded the construction of 15,000 sqm of warehouse space at its Bornem asset in Belgium, which completed in September 2021. EBOX has actively marketed the property and the manager says that it has received a good level of interest. The yield on cost is expected to be around 9%.

Expansion or development opportunities also exist on plots of land at the Rome, Rumst, Strykow, Wunstorf and Nuremberg assets.

Performance

EBOX’s NAV made steady progress from launch as it pieced its portfolio together. The NAV grew significantly with the deployment of the proceeds of the equity raise in March 2021, and we expect it to grow substantially further with the deployment of the September 2021 proceeds and the private placement as detailed earlier. EBOX’s NAV is quoted in euro, and the NAV in Figure 18 is Morningstar’s estimate for sterling NAV based on the daily exchange rate.

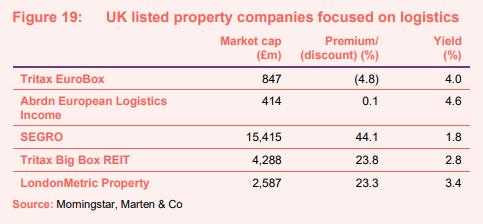

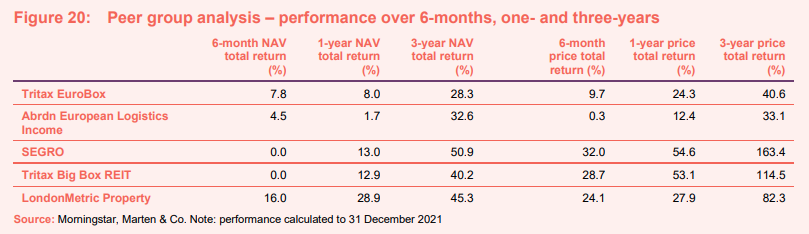

Peer group comparison

Most property companies investing in European logistics are unlisted funds or subsidiaries of larger groups. The listed peer group we have assembled consists of EBOX’s closest peer abrdn European Logistics Income (ASLI); SEGRO, which owns a mixture of ‘big box’, urban and industrial space, about a third of which is located in continental Europe; Tritax Big Box; and LondonMetric Property. The latter two are UK-focused.

NAV and portfolio valuation

EBOX publishes its NAV twice a year, based on portfolio valuations, which are approved by the board prior to publication.

Independent international real estate consulting firm JLL performs the valuation, in accordance with the Royal Institution of Chartered Surveyors (RICS) guidance. Each property is unique, and the fair value includes subjective selection of assumptions, most significantly the estimated rental value and the yield. These key assumptions are impacted by a number of factors including location, quality and condition of the building, tenant credit rating and lease length. Whilst comparable market transactions can provide valuation evidence, the unique nature of each property means that a key factor in the property valuations are the assumptions made by the valuer.

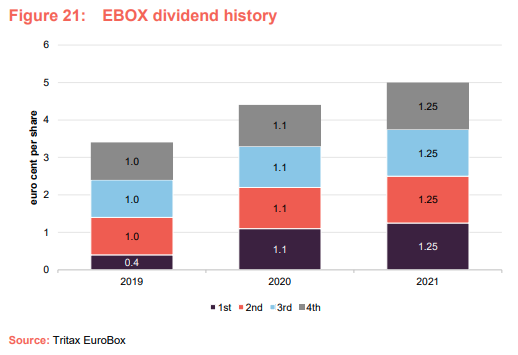

Dividend

EBOX’s quarterly dividend is declared in euros and paid, by default, in sterling (although shareholders can elect to receive dividends in euros). The euro/sterling exchange rate is determined following the dividend declaration. In the 2021 financial year EBOX paid 5 euro cents per share in dividends. This is a 13.6% increase on the 4.4 euro cents paid in 2020. It paid 3.4 euro cents per share in the period from launch to 30 September 2019.

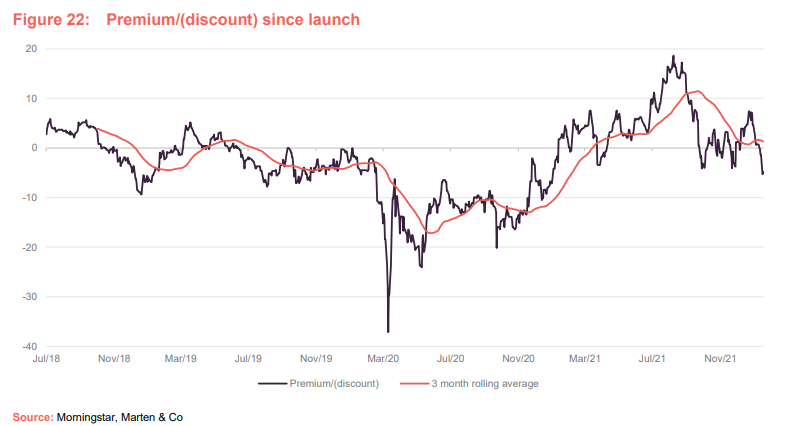

Premium/(discount)

EBOX’s rating had fluctuated between a 5% premium and a 10% discount for the first 18 months from launch, as it grew its portfolio. When the COVID-19 pandemic hit markets in early March 2020, EBOX’s discount widened to as much as 38% before narrowing considerably. As the market recognised the structural tailwinds at play in the continental logistics sector, exacerbated by the pandemic, its discount narrowed and moved to a premium rating from early 2021. The recent equity raise and growth in NAV has seen the premium narrow and on 25 January 2022 EBOX was trading at a 4.8% discount.

EBOX has the authority to buy back or issue ordinary shares to address anomalies in the share price performance, if necessary.

In the event that the ordinary shares trade at a discount, EBOX has authority to repurchase up to 10% of its issued share capital. Similarly, should the shares trade at a premium, EBOX has the authority to issue new shares that could be used to satisfy any excess market demand.

Fees and costs

EBOX’s management fees are charged according to the following structure: 1.3% of basic net asset value up to €1bn; 1.15% of basic net asset value between €1bn and €2bn; and 1% of basic net asset value above €2bn. EBOX does not pay a performance fee. In the year to 30 September 2021, the manager was paid €7.88m (2020: €6.02m).

All costs in relation to core asset management services (which includes fees paid to LCP and Dietz) and property management services are paid by the manager from the management fee.

Administrative, secretarial and registrar services

Administrative and accounting services are provided by CBRE. EBOX consolidated both the administration and property management services to CBRE in 2019 on the premise that one supplier using the same software and systems would deliver better operational efficiencies.

Company secretarial services are provided by the manager. The registrar is Computershare Investor Services.

Portfolio valuation services

The portfolio valuation services provided by JLL incurred a fee of €75,400 in the year to 30 September 2021 (2020: €67,600).

Capital structure and life

EBOX has a simple capital structure with a single class of ordinary shares in issue and trades on the main market of the London Stock Exchange. As at 26 January 2022, there were 806,693,378 ordinary shares in issue and no shares in treasury.

Borrowings

In May 2021, EBOX issued a five-year €500m senior unsecured green bond, with a coupon of 0.95% per annum. The notes are rated BBB- (Stable) by Fitch Ratings. The issue significantly reduced the company’s average cost of debt and represented its first step in diversifying its funding sources. The group has allocated the proceeds to refinancing a number of existing green assets in the portfolio as well as acquiring new green assets. The group has also used the green bond to reduce its revolving credit facility (RCF) from €425m to €250m.

The unsecured RCF is provided by a group of five lenders – HSBC, BNP Paribas, Bank of America Merrill Lynch, Bank of China and Banco de Sabadell – and matures between 2023 and 2025. The loan has a margin of 1.2% to 1.9% above the higher of zero or Euribor. At 30 September 2021, the RCF was not being used.

Combined with the proceeds of the bond, the group’s loan to value (LTV) ratio was 13.3% at September 2021. This compares with the medium-term target of 45% and the maximum permitted by the company’s investment policy of 50%.

On 1 December 2021, EBOX issued its first loan notes in a private placement of €200m, further diversifying its sources of debt funding and extending the weighted average maturity of the debt facilities. The notes have an average maturity term of nine years and an average coupon of 1.37%. The manager says the funds will be drawn in early 2022.

The notes comprise three tranches:

- €100m at a fixed coupon of 1.216%, with seven-year maturity;

- €50m at a fixed coupon of 1.449%, with 10-year maturity; and

- €50m at a fixed coupon of 1.59%, with 12-year maturity.

EBOX’s debt has a weighted average term of maturity of 5.3 years at 1 December 2021 (September 2020: 4.75 years) and a weighted average cost of debt of 1.3% (September 2020: 2.3%).

EBOX’s primary debt covenants relate to LTV (maximum of 65%), interest cover (earnings before income and tax divided by finance costs – minimum of 1.5 times) and gearing ratio (net borrowings divided by shareholder funds – maximum of 150%). Interest cover as at 30 September 2021 was 3.59 times and the gearing ratio was 16%.

EBOX has a hedging strategy available to it that includes using interest rate caps to benefit from current low interest rates, while minimising the effect of a significant rise in underlying interest rates. It holds interest rate caps of €300m to act as a hedge against the €250m RCF. However, at 30 September 2021, the balance on the RCF was zero, and the interest rate on the green bonds is fixed, and hence no debt was hedged via interest rate derivatives.

Financial calendar

EBOX’s year-end is 30 September. The annual results are usually released in December (interims in May) and its AGMs are usually held in February of each year. EBOX pays quarterly dividends in March, June, September, and January.

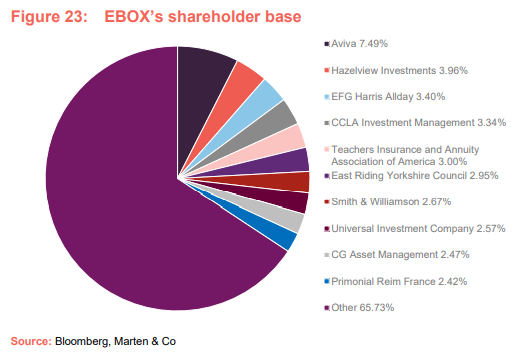

Major shareholders

Management team

The manager has in place an experienced team of investment and asset management specialists. The team has the ability to access off-market transactions in the logistics real estate sector through an extensive and established network across the UK and continental Europe. Key senior personal include:

Nick Preston – fund manager

Nick is the fund manager for the company, with overall responsibility for the provision of investment management and advisory services. He has extensive experience at managing portfolios of commercial real estate across the UK and continental Europe. Before joining Tritax Group in September 2017, Nick worked for Grosvenor Europe in the positions of managing director (Europe) and head of portfolio, responsible for the management of €3.5bn of pan-European assets. Prior to this, he held the position of senior director at CBRE Global Investors, with responsibility for the management of a wide range of portfolios, including separate accounts, pooled funds and fund of funds. Nick also acted on behalf of a major US public pension scheme on a pan-European mandate to invest in logistics assets.

Mehdi Bourassi – finance director

Mehdi joined Tritax Group in May 2019. He is responsible for historical and strategic financial matters in relation to the company, including half-year and year-end reporting, transaction structuring, corporate compliance, budgeting/forecasting, treasury management, monitoring of internal financial controls and the company’s wider capital market activities. Mehdi has 10 years’ experience in pan-European real estate finance roles, most recently at Savills Investment Management as finance manager, focusing on executing real estate transactions across Europe. Previously, he worked as financial controller in real estate at Abu Dhabi Investment Authority (ADIA). He began his career at PricewaterhouseCoopers (PwC) in Luxembourg, conducting audit engagements mainly for real estate and private equity clients. Mehdi holds an MSc in Management from IESEG School of Management and an MBA from London Business School.

James Dunlop

James has overall responsibility for identifying, sourcing and structuring investment assets for the company. He is one of the founding partners of the manager, and became a partner at Tritax Group in 2005. He is responsible for identifying sectors and specific properties, negotiating on approved opportunities and handling the disposal of assets in due course. James read Property Valuation and Finance at City University and qualified as a chartered surveyor in 1991.

Henry Franklin

Henry is responsible for the structuring of the Tritax Group funds, providing general legal counsel and overseeing compliance activities. He is a qualified solicitor who completed his articles with Ashurst in 2001, specialising in taxation and mergers and acquisitions. He also qualified as a chartered tax adviser in 2004 before moving to Fladgate in 2005, where he became a partner in 2007. At Fladgate, Henry specialised in the structuring of commercial property funds. He joined Tritax Group in 2008.

Board

EBOX’s board is comprised of four directors, all of whom are non-executive and considered to be independent of the investment manager. All directors stand for re-election on an annual basis.

Robert Orr (chairman)

Robert is chairman of the group and chairman of the nomination committee. He has extensive board experience at a strategic and operational level in the real estate industry, most significantly as JLL’s European chief executive and currently as a non-executive director of M&G European Property Fund SICAV. He is a qualified chartered surveyor and has an in-depth knowledge of the real estate industry, in particular the European real estate markets. He founded the International Capital Group for JLL in 2005, establishing strong relationships with international investors seeking real estate investment opportunities. Robert is also appointed to the board of APCOA Parking Holdings GmbH, and is a member of the investment advisory committee of EQT Real Estate and a senior adviser to Blue Coast Capital (Lewis Trust Group).

Keith Mansfield

Keith is chairman of the audit committee. He is a chartered accountant with extensive experience of leading significant international transactions. He spent 22 years as partner at PwC, where he developed a specialisation in the real estate industry. He served as regional chairman of PwC in London for seven years. He has previously been a board member of Tarsus Group plc, where he was also chairman of the audit committee, and chairman of Albemarle Fairoaks Airport Limited. Keith is currently a non-executive director at DGI9 following its admission to trading on the London Stock Exchange on 31 March 2021, a director at Real Time Sports Bingo Limited and Motorpoint Group plc.

Taco de Groot

Taco is chairman of the management engagement committee. He is a chartered surveyor with significant experience in the real estate and investment funds markets. He was a founding partner of M7 Real Estate in the UK, as well as at GPT/Halverton, Heston Real Estate B.V. and Rubens Capital Partners. Taco has also been chief executive of Cortona Holdings BV, based in Amsterdam, and Vastned Retail NV, a European retail property company listed on Euronext Amsterdam. He is currently a non-executive director of EPP NV, a real estate investment company that operates throughout Poland.

Eva-Lotta Sjöstedt

Eva-Lotta has extensive experience in global retail, supply chain and digital transformation strategy. She has been chief executive of Georg Jensen, a Scandinavian luxury jewellery and home design brand, and Karstadt, a German premium luxury department store chain. She has also held several senior roles over a 10-year period at IKEA including deputy global retail manager, responsible for the development and implementation of IKEA’s global omnichannel strategy, chief executive of IKEA Holland, and deputy retail manager at IKEA Japan. Eva-Lotta is currently a supervisory board member at METRO AG, a leading international wholesale and food service company, and non-executive director of Elisa Corporation, a telecommunications company registered on the Nasdaq Helsinki.

Previous publications

QuotedData has previously published an initiation note on EBOX – Boxing Clever, on 23 November 2020 and an update note Full throttle on 25 May 2021. You can read them by clicking the links or by visiting our website.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Tritax EuroBox Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.