Real Estate Roundup

Kindly sponsored by abrdn

Performance data

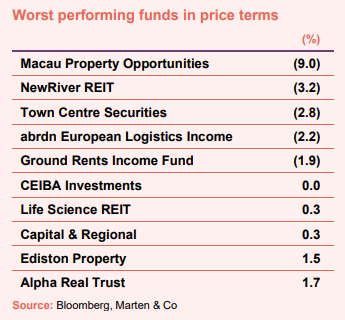

December’s biggest movers in price terms are shown in the charts below.

A challenging 2023 for the real estate sector was rounded off on a positive footing, with a median average share price increase of 7.1% across the listed sector in December (down 6.3% in the year). Improving market conditions, with inflation trending downwards and interest rate cuts anticipated by some economists, saw investor sentiment towards the sector turn positive. Heading the list was Grit Real Estate Income Group, whose share price was coming off all-time lows having plummeted following an announcement that it would not pay a second-half dividend. Flexible office provider IWG, which is behind brands including Regus, saw its share price jump after it announced it would resume regular dividends and committed to additional capital returns to shareholders. The big named property companies rallied for a second consecutive month on the improving macroeconomic outlook, with Shaftesbury Capital, British Land, and Land Securities all beneficiaries. The worst share price performer in 2023, Regional REIT, bounced back at the end of the year as the economic fog lifted. In the last quarter of the year the office landlord’s share price was up 23.5%, but was down 40.3% over the year.

There were a handful of fallers in December, led by the niche fund Macau Property Opportunities, which invests in residential properties in the Chinese gambling city of Macau. Retail specialist NewRiver REIT also saw its share price down in the month despite reporting encouraging half-year figures at the end of November that indicated good growth prospects. Town Centre Securities completed a tender offer at the start of December (see page 3), following which its share price dropped back below the tender price. abrdn European Logistics Income (ASLI) saw its share price fall following a mini-rally in November on the news that its board was conducting a strategic review into its future. Ground Rents Income Fund was the final company to suffer a share price fall in December. It is on the wrong end of proposed government legislation, which would restrict ground rents for existing leases. The company lost 35.1% in value in 2023. Life Science REIT saw just a very slight uplift in its share price, despite announcing a significant portfolio letting (see page 4). Meanwhile, Ediston Property’s share price moved to 69p, the price shareholders will receive when its portfolio is sold and the company liquidated.

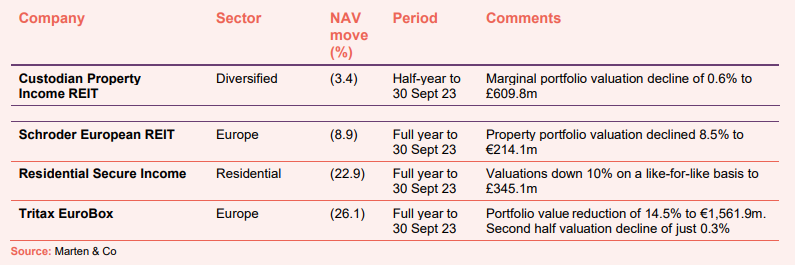

Valuation moves

Corporate activity in December

LondonMetric Property is in talks with LXi REIT over the possible merger of the two companies, that would see LondonMetric acquire the entire share capital of LXi. A merger would create a combined company with assets worth £6.4bn and a market capitalisation of around £3.9bn. LondonMetric’s portfolio is weighted towards logistics, with a sizable portfolio of long-leased properties, while LXi’s portfolio is focused on long-leased income.

Shaftesbury Capital signed a £300m unsecured loan agreement with Santander, HSBC and BNP Paribas. The facility has an initial maturity of three years, with the option to extend the tenor by a further two periods of one year each. The new loan, combined with the existing cash resources of the company, will be used to repay the remaining balance (£376m) of an unsecured loan, which was arranged at the time of the merger between Capital & Counties and Shaftesbury and drawn in April 2023. This loan was put in place to fund the repayment of the Shaftesbury secured bonds, that were due to mature in 2024. As a result of the refinancing, the weighted average maturity of the company’s drawn debt will be extended to over 5 years. The current weighted average cost of debt is unchanged at 4.2%.

Big Yellow Group completed the refinancing of its revolving credit facility (RCF), putting in place a new £300m ESG-linked facility for an initial term of three years, with the option to extend the facility by two additional one-year terms through to December 2028. The facility has been provided by Lloyds Bank, HSBC, Bank of Ireland and Barclays Bank. The margin of 1.25% is unchanged from the existing facility. The facility’s ESG-linked KPIs include targets to reduce Scope 1 and 2 emissions, increase solar generation capacity, increase total annual grants to Big Yellow Foundation charity partners, and to increase the value of storage space provided free of charge to local charities. These will be measured annually, and a margin decrease or increase will be applied to the headline margin on the basis of performance.

Town Centre Securities purchased £9.125m of shares in the company through a tender offer. In total, 6,292,920 ordinary shares were purchased at a price of 145.0p. This represented around 13.0% of the issued share capital of the company.

Major news stories

- Home REIT’s portfolio value downgraded by almost 60%

A new valuation report on Home REIT’s portfolio revealed a 57.7% reduction to the price it paid for them. The report valued the company’s residential portfolio at £412.9m at 31 August 2023, versus £977.0m it spent on purchasing them from inception in 2020. Many of the homes are in a state of disrepair. Investigations into the conduct of the former investment manager – Alvarium – are ongoing.

- Helical lets office for Sainsbury’s HQ

Helical let the first, second and third floors (totalling 68,002 sq ft) at the JJ Mack Building, 33 Charterhouse Street, EC1, to J. Sainsbury plc. The retailer is expected to relocate its existing London office from 33 Holborn to the new building in the next two years. The JJ Mack Building is now 58% occupied.

- Letting success for Life Science REIT at Oxford Technology Park

Life Science REIT completed a major letting at its Oxford Technology Park asset to Oxford Ionics, a pioneer in quantum computing. The letting of the entire Building 6A, comprising 29,661 sq ft, sees Oxford Ionics increase its footprint at the campus by more than six times. Oxford Ionics will pay an annual rent of £593,220 for a 10-year term.

- Workspace to power up buildings with green energy

Workspace Group entered into a Corporate Power Purchase Agreement (CPPA) with Statkraft, Europe’s largest generator of renewable energy, to supply around two-thirds of the group’s expected electricity demand for the next 10 years. Workspace will take all the electricity generated by a newly constructed solar plant in Devon.

- abrdn Property Income Trust captures rental growth with trio of deals

abrdn Property Income Trust captured strong rental growth with three rent reviews in its industrial portfolio. In Bristol, a rent review at Kings Business Park was agreed at a 38.6% uplift to the previously rent. At Opus 9 in Warrington, a rent review was settled at a 57.6% premium to the previous level. And lastly, a rent review at Elliot Way in Birmingham was agreed 52.4% above the previous rent.

- Alternative Income REIT buys Virgin Active gym in London

Alternative Income REIT completed the acquisition of a Virgin Active leisure club in Streatham, in South-West London, for £5.1m, reflecting a net initial yield of 9.8%. The asset has been acquired with an unexpired lease term of over 10 years, which is subject to five-yearly upward only uncapped rent reviews linked to RPI.

- abrdn Property Income Trust sells Scottish industrial asset

abrdn Property Income Trust completed the sale of an industrial asset in Livingston for £6.25m, reflecting a net initial yield of 6.37%. Acquired in 2014, the investment has contributed a 13.1% annualised return over the hold period. The sales proceeds will be used to reduce the company’s revolving credit facility, which is subject to a floating rate of interest.

- Life Science REIT offloads Oxford office

Life Science REIT sold Lumen House in Oxford for £7.65m to Harwell Science and Innovation Campus, representing a 5.6% net initial yield and a 2% uplift on the June 2023 book value.

- Tritax EuroBox sells Swedish development site

Tritax EuroBox sold its redevelopment site in Malmö, Sweden to a data centre owner-occupier for a headline price of SEK320 million (€28m). The net sale price is 39% above the valuation as at 31 March 2023.

- LXi REIT expands portfolio’s solar roll-out at Bombardier factory

LXi REIT announced that a 1.2MWp solar PV array will be added to its Bombardier facility at Biggin Hill Airport. The array will be funded by Octopus Energy Group’s generation arm at no cost to LXI.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Europe

Robert Orr, chairman:

Inflation in Continental Europe is now on a downward trajectory and interest rates are forecast to have peaked. This increased visibility is leading to signs of stabilisation in asset values, as demonstrated by the marginal fall in our portfolio valuation over the second half of the financial year and recently completed disposals broadly in line with book values.

While we expect investors to remain cautious and transaction volumes relatively low in the near term, we anticipate the positive structural drivers and strong market fundamentals of the logistics sector will support investor appetite and liquidity as we move through 2024.

In addition, while take-up of warehouse buildings has fallen over the past nine months, the availability of modern, sustainable logistics space remains low and the potential for a material supply increase limited. We expect these dynamics to keep vacancy rates at low levels and support positive rental growth, albeit at more normalised levels versus the very high rates seen recently.

Sir Julian Berney, chairman:

European economies continue to face headwinds and growth is expected to be subdued for the short term, particularly given the expectation for the European Central Bank (ECB) to maintain its restrictive monetary policy stance and adverse credit conditions. Although we are seeing inflationary pressures dampen, and despite strong labour markets, the higher interest rate environment is impacting investor sentiment, disposable incomes and household demand. In terms of real estate values, we are starting to see transaction evidence that supports valuations and provides confidence in the company’s NAV.

Diversified

Custodian Property Income REIT

Richard Shepherd-Cross, investment manager:

The disconnect between the occupational and investment markets in UK real estate continues to persist. While the impacts of high inflation and interest rates appear to weigh heavily on investor sentiment, perhaps the greater influence has been the marked re-rating of valuations in the final quarter of 2022, which still seems to colour investors’ attitude to real estate investment. However, since the start of 2023 valuations have been reasonably stable across the market, with some sub-sectors showing signs of recovery while others continue to drift, albeit at a much-reduced rate.

By contrast, occupational demand has been consistently strong, and our asset management team has been able to capitalise on this to reduce vacancy and increase in the portfolio rent roll. It is the strength of the occupational market driving rental growth and low vacancy that will ultimately support fully covered dividends and earnings growth. Income and earnings remain our central focus, as it is income that will deliver positive total returns for shareholders. On this basis we remain cautiously optimistic.

Residential

Rob Whiteman, chairman:

The market opportunity across both retirement and shared ownership is both enormous and growing. Despite recent operational challenges and macroeconomic headwinds, the fundamentals underpinning the sector and the longer-term outlook have never been stronger. The UK has consistently fallen short of the government’s aspiration for 300,000 new homes per year with an estimated need for £34bn of annual investment over the next decade to begin addressing the shortfall.

The UK population is rapidly ageing, with the demographic over 65 expected to increase by almost 50% by 2060. Social isolation can have a material impact on the health of the elderly, driving demand for independent retirement accommodation where customers can enjoy the benefits of living and socialising with other like-minded individuals. There will be huge growth in this sector of the market, and with that a great opportunity for the company to take advantage of its market leadership position.

For shared ownership, most of the population lives in areas where home purchase is unaffordable for average earners. Continued inflation, rising mortgage rates and the consistent demand for a permanent home have increased demand for shared ownership as the most affordable homeownership option (particularly in light of the end of the Help-to-Buy programme in March 2023). Housing associations, which have historically been the primary investors in affordable housing, are now dealing with rent caps on their social and affordable rental portfolios in addition to allocating c.£10bn for fire safety and c.£25bn to upgrade the energy efficiency of their social rented stock by 2030. These financial pressures impact housing associations’ ability to continue to fund their 43,000 homes per year development programmes, with many now looking to bring in partners to acquire some of their existing 200,000 shared ownership homes. This is continuing to drive demand and opportunity for further long-term investment into the sector – both to fund new homes and acquire existing shared ownership portfolios providing capital to housing associations to invest back into their social rented stock.

Real estate research notes

An annual overview note on Urban Logistics REIT (SHED). The company appears to be a re-rating candidate as values stabilise and management extracts the rental reversion in the portfolio.

An update note on Lar España Real Estate (LRE SM). The company continues to defy the doom and gloom surrounding the retail sector, posting strong financial and operational numbers.

An update note on Grit Real Estate Income Group (GR1T). The company has been reborn, with the acquisitions of a developer and asset manager making annual return targets of 12-15% more achievable.

An update note on abrdn Property Income Trust (API). The manager’s focus focus continues to be on growing income, and asset management initiatives within the portfolio have seen its vacancy rate drop to below 5%.

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.