A remarkable success story

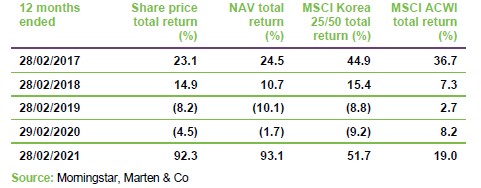

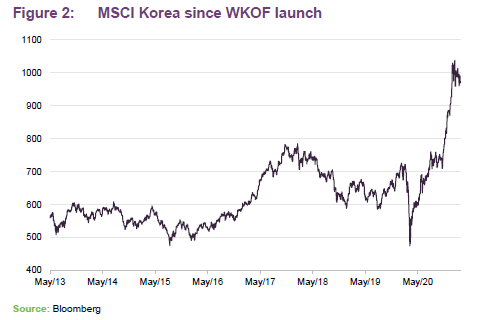

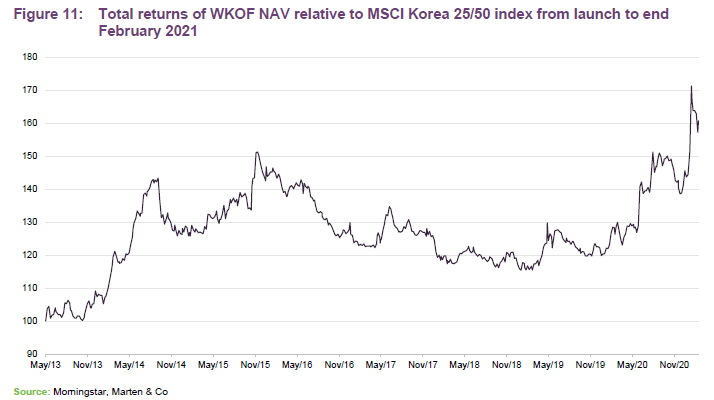

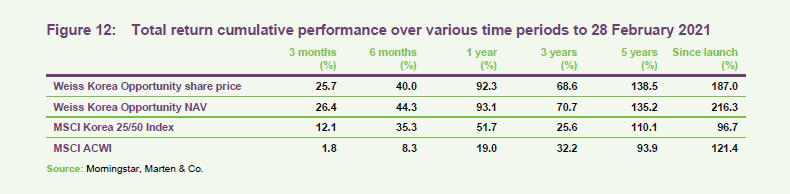

Weiss Korea Opportunity Fund (WKOF) was one of the best-performing of all London-listed investment companies last year, and since its 2013 launch it has delivered more than twice the return of its benchmark.

WKOF has a unique investment approach within the investment company sector. Not only is it the only UK-listed fund offering investors dedicated access to South Korean stocks, it has also adopted a differentiated investment approach that seeks to profit from the valuation gap between the non-voting Korean preference shares that make up substantially all of its portfolio and their equivalent common shares.

South Korean preference shares

WKOF aims to earn an attractive return through long-term capital appreciation by investing primarily in South Korean preference shares. Most Korean preference shares are effectively non-voting common shares and are generally entitled to the common per share dividend plus an additional fixed amount. Relative to their corresponding common shares, many Korean preference shares trade at a discount resulting in higher dividend yields and lower price-to-earnings ratios.

Fund profile

Weiss Korea Opportunity Fund (WKOF) is the only UK-listed fund offering investors dedicated access to the South Korean stock market. It seeks to add value relative to that market by exploiting the valuation gap between the preference shares that make up substantially all of its portfolio and the common shares issued by the same companies.

Preference shares form part of the equity capital of many South Korean companies. They are generally entitled to receive the same dividends as the common shares but tend to have no voting rights. Generally, they rank alongside common equity in seniority (as opposed to a UK preference stock, which usually rank ahead of ordinary/common shares in their claim to dividends and capital). Korean preference shares often trade at a substantial discount to equivalent common shares. Consequently, an investment in WKOF offers access to South Korean companies at price-to-earnings ratios that are typically lower and dividend yields that are typically higher than an investment in their common shares.

The manager

Weiss Asset Management LP (Weiss), a Delaware limited partnership formed on 10 June 2003, is the company’s investment manager. Weiss is registered as an investment adviser with the SEC.

At the end of February 2021, Weiss had combined assets under management of approximately $2.7bn, including private investment funds with diversified strategies. Dr. Andrew Weiss, who founded the investment manager, has been managing private investment funds for over 29 years and the senior management team has been with the firm for an average of 15 years. The investment manager has over 70 employees, working from offices in the US and Asia.

Weiss invests using proprietary value-based strategies, identifying opportunities from deep fundamental research and statistical analysis. The investment team works collaboratively and rigorous debate of investment decisions is encouraged.

Weiss has been successfully investing in emerging markets for more than 28 years, with 20 years of experience investing in Korea. Weiss has accumulated substantial expertise in Korea over that period, in regards to registration in Korea, relationships with local brokers, in depth trading and research analysis, and understanding of regulatory requirements. The investment team includes two Korean speakers.

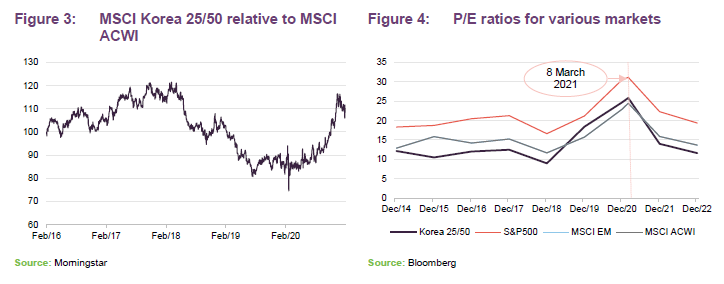

The performance benchmark

WKOF compares its performance to the MSCI Korea 25/50 net total return index and iShares MSCI Korea UCITS ETF (both in sterling terms). The two comparators tend to move in tandem and therefore we have just used the MSCI index in this note. We have also added a comparison to the MSCI All Countries World net total return index (abbreviated throughout to MSCI ACWI). All returns are in sterling unless otherwise indicated.

At the end of February 2021, the MSCI Korea 25/50 Index had 106 constituents and covered approximately 85% of the free float-adjusted market capitalisation in Korea. It caps the exposure to the largest single issuer at 25% and the sum of the exposure to issuers accounting for more than 5% of total unadjusted market capitalisation of the index is capped at 50%.

A realisation opportunity

In its admission documents, WKOF committed to allowing investors to redeem all or some of their investment in the company at biannual intervals. Shareholders may elect to take advantage of the realisation opportunity. The portfolio is then split into continuation and realisation pools and the realisation pool is liquidated with the net proceeds returned to exiting investors.

The opportunity is presented every two years, with the last being 15 May 2019 and the next scheduled for May 2021. In May 2019, holders of 3.3% of WKOF’s issued share capital elected to realise their shares.

Exploiting a double discount

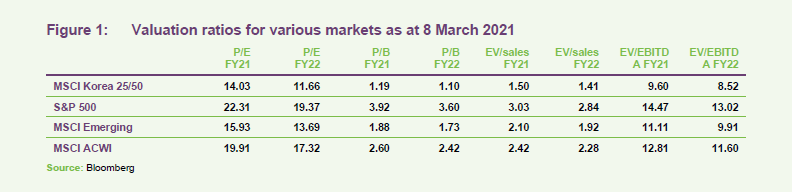

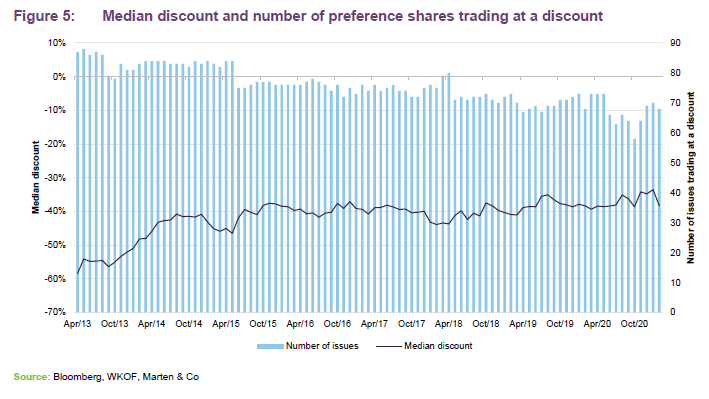

Investors in WKOF can benefit from a double discount. Whilst the manager feels that some of the extreme cheapness of the Korean market has gone, Korean shares are, on average, less expensive than those in comparable markets. In addition, Korea preference shares tend to trade at a discount to equivalent common shares. By trading discounts on preference shares, Weiss is able to add value over an investment in common stock, and benefit from higher dividend yields.

The effect of changes of the discount on the price of the preference shares is nonlinear. A given percentage change in the discount will have a disproportionate effect on the price. For example, assume the price of the relevant common share is unchanged, a preference share discount closing from 50% to 0% translates into a return of 100%.

The Korean market has clawed back some ground relative to global markets over the past year, but it remains cheap, on average, relative to many markets.

South Korea is regarded as one of the world’s most innovative countries and is well-known for its technological expertise. It is embracing the need to invest to combat climate change and has ambitious plans to ramp up production of renewable energy. In the current market, where these attributes are prized by investors, the Korean market could be well positioned to benefit.

Nevertheless, Weiss notes that there are good reasons why Korean companies may be significantly undervalued. These include inefficient, over-capitalised balance sheets, low dividend pay-out ratios and cross-shareholdings (which tend to be valued at book rather than market value). Improved corporate governance should, all things being equal, help to positively re-rate the Korean market.

In 2015/16 and later in 2017, heightened tension in US/North Korean relations, largely triggered by North Korea missile tests, weighed on markets. Around this time, WKOF introduced its risk-mitigation strategy (see page 8). Korea suffered along with other markets when COVID-19 unnerved investors in March 2020. The strong performance of the market over the past couple of quarters may reflect the importance of technology stocks within the index.

The Korean government appears to have learned from the lessons of the MERS coronavirus outbreak in 2015. It had an efficient track and trace system in place, the means to produce testing kits, and ample supplies of PPE. Some social distancing measures were implemented but there was no need for lockdowns. Although its second wave of infections was worse than the first wave, case numbers were not that problematic (hitting a peak of 1,237 cases on 24 December). Without that many cases, the urge to vaccinate the population has not been as acute as elsewhere. A vaccination programme is beginning now.

Weiss notes that a Stewardship Code, introduced at the end of 2016, has gathered support from Korean companies and has positive effects in terms of improved shareholder engagement. The National Pension Service, a significant domestic investor, has engaged with companies on corporate governance matters, for example. The Korean Financial Services Commission (FSC) announced on 14 January 2021 that it would upgrade its mandatory corporate disclosure system (which includes elements such as sustainability reporting). The rules would apply to progressively smaller firms (from KRW2trn now, to KRW1trn in 2022 and KRW500bn from 2024). Policymakers are considering relaxing specific disclosure and holding requirements for private equity funds to engage with companies and management.

The investment manager believes that improved corporate governance could encourage companies to raise pay-out ratios. It thinks that the knock-on effect of this would be to narrow preference share discounts as higher yields attract investors.

The investment universe

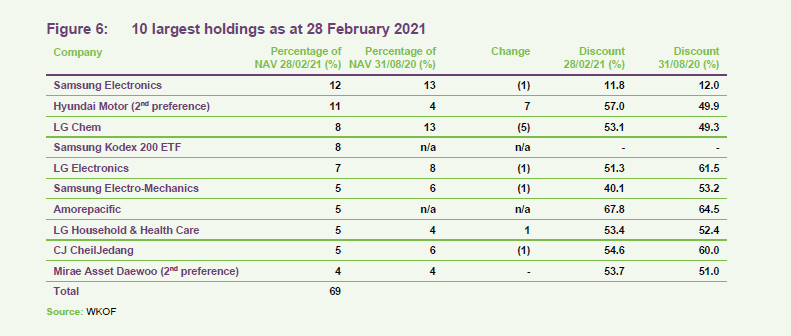

At the end of February 2021, Weiss was monitoring 121 preference share issues. Of these, 68 were trading on discounts and hence were potential investments for WKOF. The median discount of this potential pool of investments was 38.3%. A 38.3% discount implies potential upside of more than 62% if the discount closes.

At the end of February 2021, the market cap of the wider list of 121 preference shares was KRW95,521bn (£62.2bn). The market cap of the potential pool of investments trading on discounts was KRW80,570bn (£52.4bn). The investment manager notes that some issues that trade $50m a day are still on discounts of around 50%.

The larger issues are often held by foreign pension funds, which are attracted by the superior yield relative to the common equity. Smaller issues are often owned by company management and are sometimes used to pay bonuses. Some issues are dominated by retail investors. Weiss believes that local expertise is important. The documents that support many issues are only available in Korean, which presents a non-trivial language barrier for most foreign investors.

Investment process

Weiss maintains a model for every preference share on the Korean stock exchange. The model incorporates elements such as the discount, the convergence target (where it estimates the discount might narrow to) and the timing of this, and relevant cash flows.

The analysis will include any catalyst that might bring about that discount narrowing. There are activist investors at work within the Korean market, but Weiss says that these investors tend to target the whole corporate structure rather than just the preference share element.

Dividends enhance WKOF’s returns (a preference share trading at a discount will offer a higher yield than an investment in the equivalent common stock). However, the investment manager does not manage the portfolio with a yield target in mind.

Weiss also factors in its expectation of the potential performance of the common stock. However, Weiss emphasises that it is more focused on the discount opportunity than the fundamentals of the underlying issuer. Thus, its analysis differs from that of a dedicated long-short equity manager. It believes that there is a margin of safety in the discount.

Weiss calculates an annualised gross return potential for each preference share. This and an analysis of elements such as liquidity inform which issues are selected for the portfolio.

The investment manager is not bound by any benchmark. On a market cap basis, the Korean stock exchange is heavily weighted to technology hardware (memory) stocks (notably Samsung and Hynix), financials and healthcare. By contrast, WKOF’s portfolio has more of a bias to the consumer, electronics and materials sectors.

The investment manager has a top-down view of potential concentrations of risks within the portfolio and aims to manage this accordingly.

Portfolio turnover is driven by the availability of trading opportunities. The market volatility in 2020 did help boost turnover last year. However, it is notable that discounts did not seem to spike out in the panicky markets of March 2020 to the same extent as they did in other asset classes such as UK-listed investment companies.

WKOF will invest in new issues of preference shares, which often come at a discounted price to the common stock. When assessing a potential new issue, the investment manager uses existing preference share prices as a guide to where the new issue might trade.

New issues of stocks that the market is unfamiliar with, for example where a company spins off a division into a separate company, may be attractively priced. Some new issues are convertible into common stock.

Hedging

Given the political situation in Northeast Asia – most acutely the relationship between North and South Korea and its allies – the board has approved a hedging strategy that has been in place since September 2017. The strategy is designed to cushion the exposure to extreme moves in markets, providing investors insurance with downside limited to the premium paid upfront. The investment manager has used a combination of put options and credit default swaps in an attempt to achieve this. The company does not hedge its exposure to foreign currency.

Asset allocation

At 28 February 2021 there were 45 positions in the portfolio. The portfolio discount of the preference shares was 46.2%.

10 largest holdings

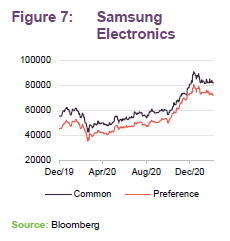

The Samsung Kodex 200 ETF tracks the performance of the KOSPI200 Index. It is used as a home for short-term liquidity as the manager rotates out of narrow discount preference shares and into wider discount preference shares. Looking at a selection of some of the other large positions:

Samsung Electronics

Samsung Electronics (samsung.com) is the largest constituent of the MSCI Korea 25/50 Index and the largest listed company in Korea (accounting for more than 32% of the uncapped MSCI Korea Index at the end of February 2021). The Samsung preference share is also the largest issue in the Korean preference share market.

Samsung Electronics is the largest component of the Samsung chaebol. It is the world’s largest mobile phone company, a leading manufacturer of semiconductors and makes a wide range of consumer electronics products, with a particular strength in visual displays.

At the end of February 2021, the preference share was trading at an 11.8% discount to the common share, having narrowed from a 35.6% discount at the end of May 2013 (around the time of WKOF’s launch). Weiss has been gradually reducing the position, booking profits and redeploying the proceeds into other preference shares trading on wider discounts.

A number of factors may have contributed to the narrowing of the discount on Samsung Electronic’s preference shares. The investment manager notes that Samsung enacted general policies that improved its corporate governance, including a restructuring in 2018 that tackled its circular holding structure. However, Samsung also publicly stated what it viewed as an appropriate level of discount (around 10%). From October 2015, the company overweighted the repurchase of preference shares in its share buyback programme with the stated intention of narrowing the preference share discount.

In 2018, Samsung also announced a three-year shareholder return policy, targeting a 50% pay-out ratio of FCF and renewed this for a further three years in January 2021.

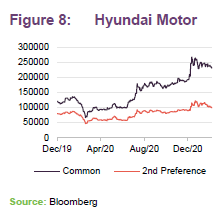

Hyundai Motor

Hyundai Motor (hyundaimotorgroup.com) is a leading global automotive manufacturer. It also owns around a third of Kia Motors. Hyundai sells electric vehicles under its Ioniq brand and it also has a hydrogen fuel cell vehicle – the Nexo – in production. In 2020, in common with other automakers, Hyundai Motor’s business was impacted by COVID-19.

At the end of February 2021, Hyundai Motor’s three preference share issues were trading on discounts between 56.1% and 58.0%. In Figure 6 we compare the top 10 holdings from the end of February and from six months prior. In August 2020, Hyundai’s first preference share was a top 10 holding. The shift into the second preference share reflects the manager trading to take advantage of discount moves. This is helped by the relative liquidity of these two issues.

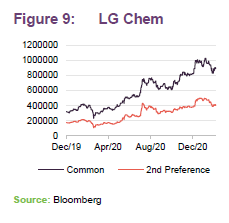

LG Chem

LG Chem (lgchem.com) is one of the world’s largest chemical companies, manufacturing a wide range of products across three divisions: petrochemicals, advanced materials and life sciences. Many of its products are used in the automotive industry. LG Chem has a sizeable battery materials business (excitement around which has been the driving force behind its soaring share price) and is the leading domestic producer of agrichemicals (under a business branded Farm Hannong).

In December 2020, the company spun out its fast-growing battery business into a separate company, LG Energy Solution, which is for the moment a 100% subsidiary but may IPO as a way of securing the funding it needs to finance its expansion. LG Energy Solution supplies batteries to Tesla.

LG Electronics

LG Electronics (lg.com) produces a wide range of domestic appliances, home entertainment equipment, mobile communications, automotive components and business solutions (which includes displays and solar power modules). In 2020, it achieved revenue growth across each of its five divisions.

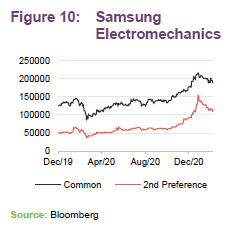

Samsung Electro-Mechanics

Samsung Electro-mechanics (samsungsem.com) is an electronic components manufacturer with particular expertise in materials, multilayer thin-film moulding, and high-frequency circuit design. Applications include chip parts, camera modules, communication modules and boards. Whilst sales in its module business fell in 2020, overall, it achieved revenue and profit growth.

The dividend is expected to increase from KRW1,100 to KRW1,400, but this represents only a modest uplift in its pay-out ratio from 16% to 18%. The discount on its preference shares narrowed significantly over 2020.

Performance

Since launch, WKOF has delivered material outperformance of the Korean market and both its relative and absolute performance has been particularly strong over the past year.

In fact, in NAV total return terms, WKOF was the eighth-best performing of all London-listed investment companies over 2020, delivering a return in sterling of 66.9%. Given WKOF’s unique approach, we have not included a peer group comparison within this note.

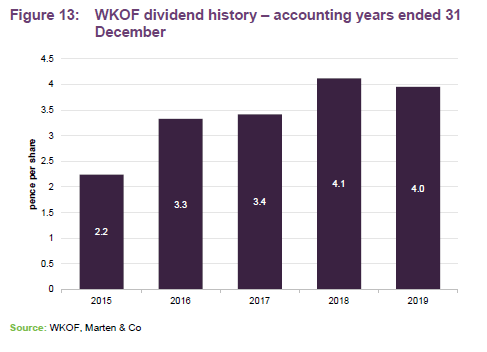

Dividend

WKOF aims to return to shareholders all dividends received (net of withholding tax), on an annual basis, and no reduction is made in relation to expenses incurred by the company. As a Guernsey company, WKOF does not prepare accounts that separate income and capital items within its income statement.

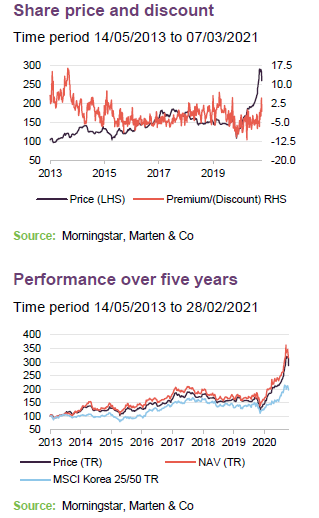

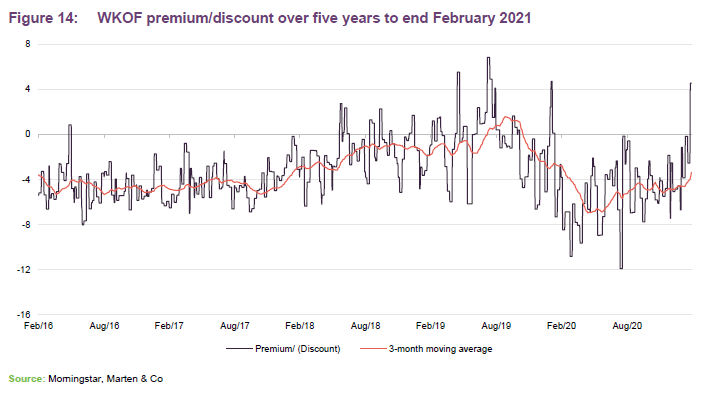

Discount

Over the 12 months ended 28 February 2021, WKOF’s discount moved within a range of 11.9% to a premium of 4.6% and averaged a discount of 4.8%. At 7 March 2021, based on Marten & Co’s estimate of WKOF’s NAV, WKOF’s discount was 1.6%.

Shareholders have granted the directors the authority to purchase in the market up to 40% of WKOF’s ordinary shares in issue from time to time following admission. The directors seek annual renewal of this authority from shareholders at each AGM.

In addition, as described on pages 4 and 14, WKOF offers its shareholders a realisation opportunity on a biennial basis.

2,747,153 shares were bought back in connection with the realisation opportunity provided in May 2019; no shares were bought back over 2020; and 600,000 shares were bought back at 286p on 27 January 2021.

Fees and costs

The investment manager is entitled to an annual management fee of 1.5% of the company’s NAV. This is accrued daily and is payable within 14 days after each month end. The investment manager is also entitled to reimbursement of certain expenses incurred by it in connection with its duties.

The investment management agreement will continue in force until terminated by either party, giving not less than 12 months’ notice in writing to the other.

Administration and company secretarial services are provided by Northern Trust International Fund Administration Services (Guernsey) Limited. The auditor is KPMG Channel Islands Limited and the Registrar is Link Market Services (Guernsey) Limited.

The annualised ongoing charges ratio for the six months ended 30 June 2020 was 1.87%, marginally higher than the ratio for the year ended 31 December 2019, which was 1.85%.

Capital structure and life

At 7 March 2021, WKOF had 81,017,828 ordinary shares in issue. There are no shares held in treasury. The number of total voting rights on that date was 81,017,828. There are no other classes of share capital.

WKOF does not have a fixed life. Its financial year end is 31 December and its AGM is usually held in July.

Realisation Opportunity

Every two years, WKOF offers all shareholders the right to elect to realise some or all of the value of their shares (less applicable costs and expenses). The next such opportunity will take place in May 2021.

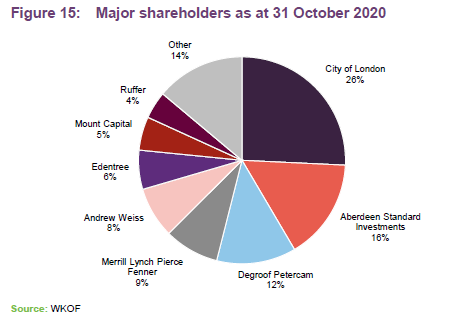

Major shareholders

WKOF’s share register is quite concentrated.

Gearing and hedging

Whilst it is permitted to use borrowing for short-term liquidity purposes, the company does not intend borrow to fund investments or for working capital purposes. The company’s use of hedges is described on page 8.

Board

WKOF has three directors, all of whom were appointed as directors at launch, who are non-executive, are independent of the manager and who do not sit together on other boards. The total fees payable to the directors are capped at £150,000. Actual fees payable are well below this at £81,500.

Norman Crighton

Norman was, until May 2011, an investment manager at Metage Capital Limited where he was responsible for the management of a portfolio of closed-ended funds. He has more than 25 years’ experience in closed-ended funds having worked at Olliff and Partners, LCF Edmond de Rothschild, Merrill Lynch, Jefferies International Limited and latterly Metage Capital Limited. Norman’s experience covers analysis and research as well as sales and corporate finance. He is also non-executive chairman of RM Secured Direct Lending Plc and AVI Japan Opportunity Trust.

Stephen Coe

Stephen qualified as a Chartered Accountant with PriceWaterhouseCoopers in 1990. From 1997 to 2006 he was a director of the Bachmann Trust Company Limited and managing director of Bachmann Fund Administration Limited. Between 2003 and 2006, Stephen was managing director of Investec Administration Services Limited and of Investec Trust (Guernsey) Limited prior to becoming self-employed in 2006 providing director services to financial services clients. Currently, Stephen sits on the board of a number of listed companies including as a director (and chairman of the audit committee) of Leaf Clean Energy Company and Merian Chrysalis Investment Company, and as a director of River & Mercantile Micro Cap Investment Company Limited.

Robert King

Robert is a non-executive director for a number of open and closed ended investment funds including Tufton Oceanic Assets Limited, Chenavari Capital Solutions Limited and CIP Merchant Capital Limited. Before becoming an independent non-executive director in 2011, he was a director of Cannon Asset Management Limited and their associated companies. Prior to this he was a director of Northern Trust International Fund Administration Services (Guernsey) Limited (formerly Guernsey International Fund Managers Limited), where he had worked from 1990 to 2007. Robert has been in the offshore finance industry since 1986, specialising in administration and structuring of offshore open and closed-ended investment funds.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Weiss Korea Opportunity Fund.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.