First quarter of 2023

Investment Companies | Quarterly roundup | April 2023

Kindly sponsored by abrdn

Into the unknown

The first quarter of 2023 serves as a good reminder that things are never quite as predictable or certain as the consensus may lead you to believe. Having seemingly come around to the prospect of ‘higher for longer’ rates that had been repeated ad nauseum by central bankers, markets came full circle as yields collapsed following March’s regional banking turmoil. After all that, we are now back to where we started the year. But therein lies the point; that market conviction should never become too extreme given we’re always just one step away from something breaking, economic, geopolitical, or otherwise (just look back a few months ago to the LDI debacle).

This becomes even more relevant towards the end of business cycles. Uncertainty abounds and central bankers have acknowledged as much, indicating they are not even sure how drastic the impacts of quantitative tightening will be on the economy. LDI, SVB, and Credit Suisse may be the first of what will likely be a growing list of victims.

Unfortunately, it now seems like we have reached the point where policy makers are damned if they do and damned if they don’t. A dovish tilt further increases the possibility of inflation becoming unanchored, while maintaining course risks exacerbating financial instability within the banking sector (and who knows where else).

Markets have so far responded positively as they price in an increased likelihood of a pivot, which has historically resulted in outsized returns for equities. We will likely find out if that optimism is justified over the next few months as policy makers attempt to run the tightrope.

New research

So far this year, we have published notes on: Herald Investment, Bluefield Solar Income Fund, abrdn European Logistics Income, Ecofin US Renewables Infrastructure Trust, GCP Infrastructure, North American Income Trust, abrdn New Dawn, Civitas Social Housing, AVI Global Trust, Lar España Real Estate, India Capital Growth, Pantheon Infrastructure, JPMorgan Japanese Investment Trust, JLEN Environmental Assets, Oakley Capital Investments, RIT Capital Partners, Gulf Investment Fund, and Rights and Issues Investment Trust. You can read all of these notes by clicking on the links above or by visiting our website.

Winners and losers

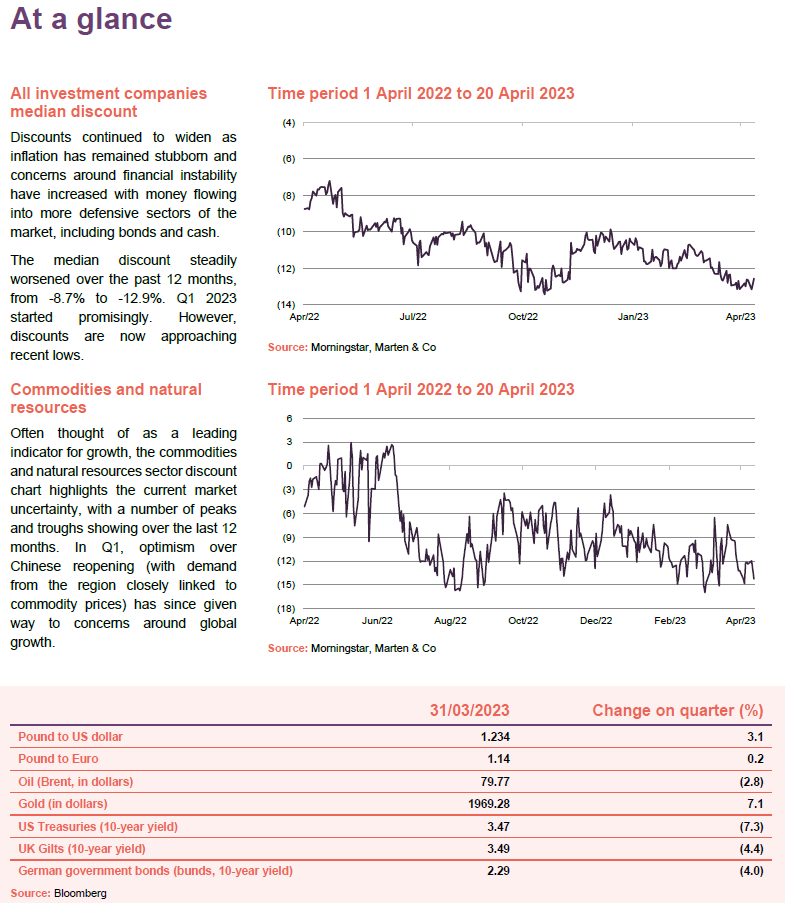

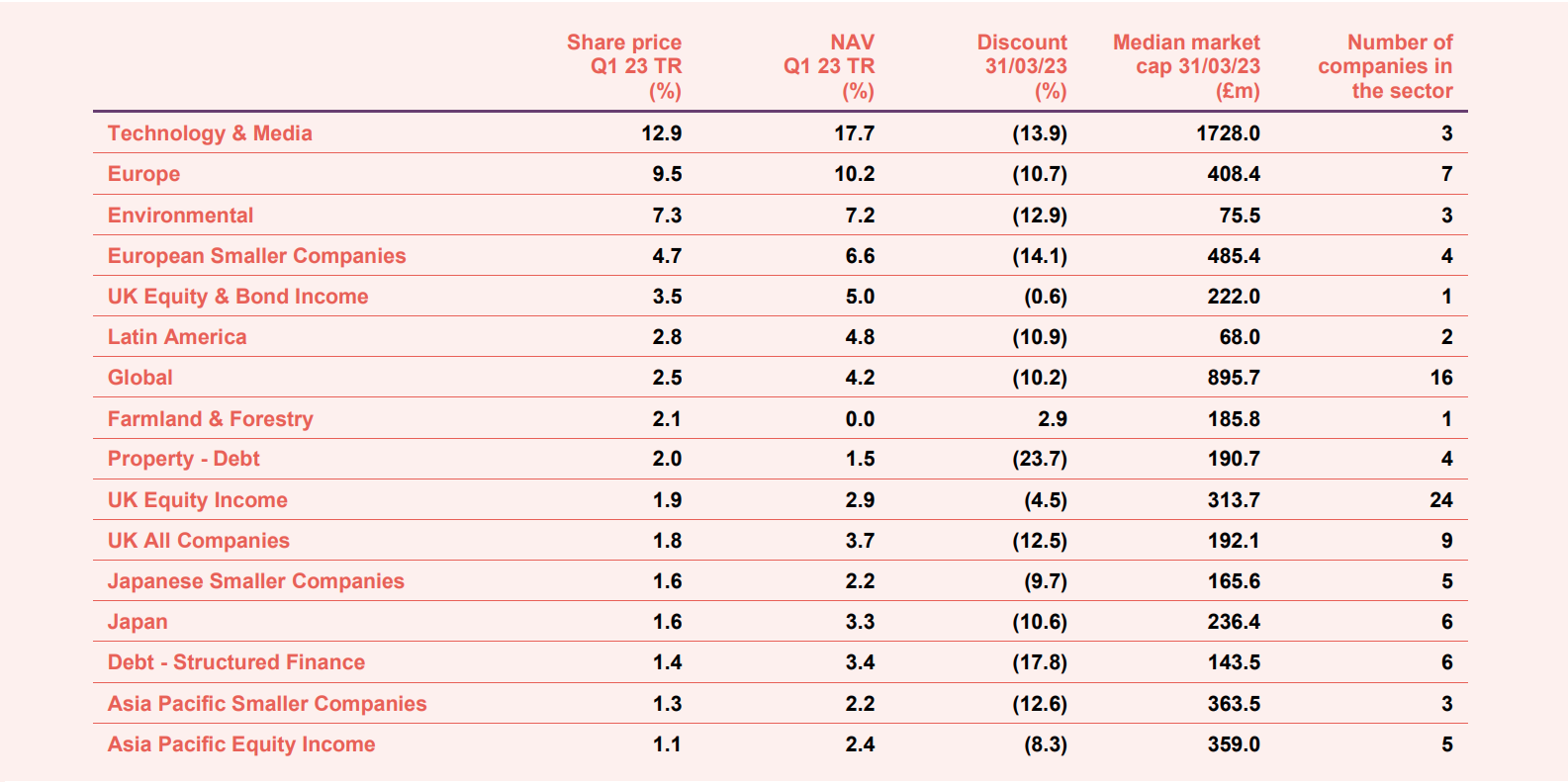

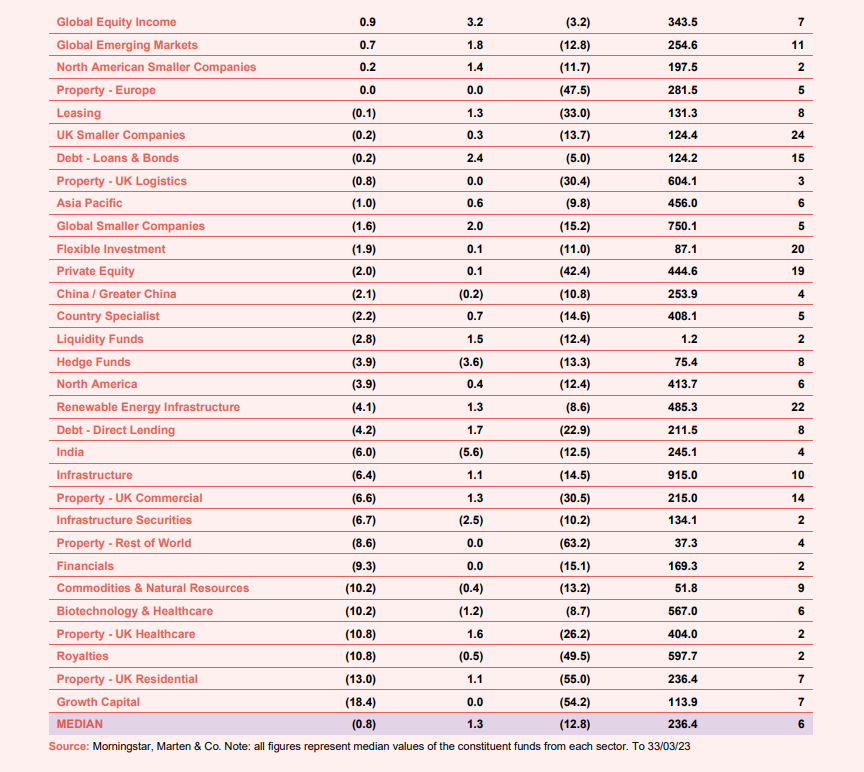

Despite median NAV growth of 1.3% for the quarter, discounts continued to widen, falling from -10.8% at the start of the year to 12.9% as the median share price fell -0.8%.

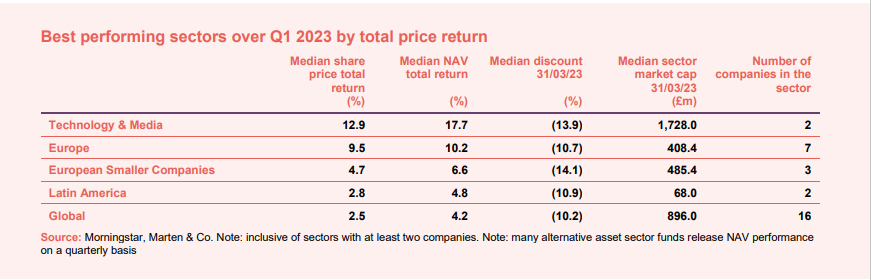

By sector

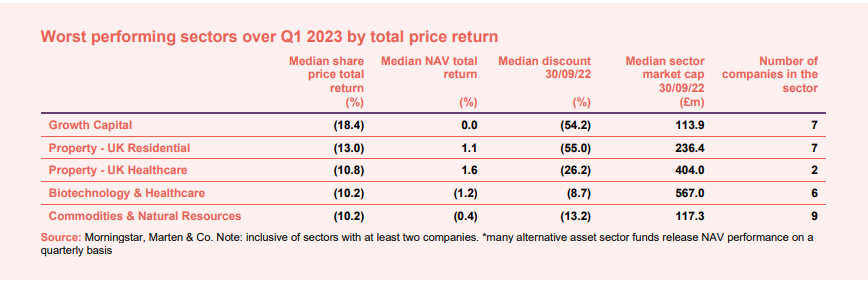

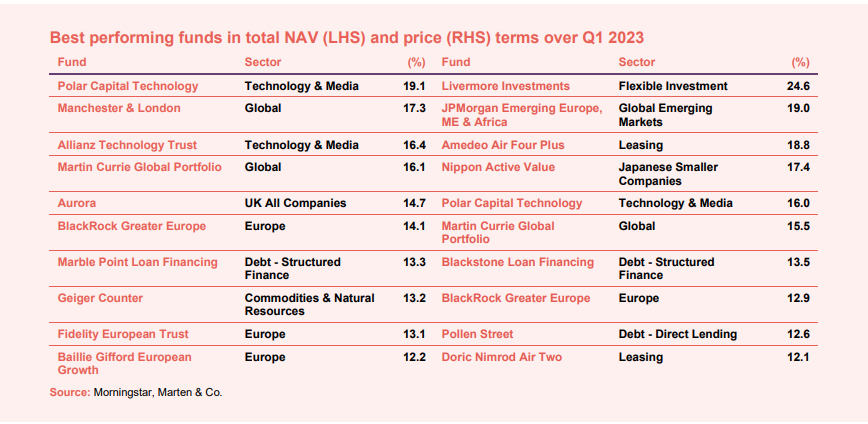

Technology & technology innovation (renamed in March from technology & media) had an impressive run through Q1 helped by a considerable overweight to mega cap tech. The outperformance was accelerated in the latter half of the quarter thanks to a dramatic fall in global bond yields precipitated by the collapse of SBV which drove investors back into longer duration stocks. However, even as yields have since recovered, flows out of cyclicals and more risky areas of the market suggest that investors are also seeking the relative safety of highly liquid, cash printing companies like Apple, Microsoft, and Google.

Europe was another sector with strong returns for the quarter. The sector was led by Fidelity European Trust which was a beneficiary of defensive positioning across staples and luxury assets as well as a falling USD which also contributed to the returns of the other ex-US sectors. Global funds rounded out the best performers list, benefiting from similar tailwinds as the Technology and technology innovation sector.

The worst performing list presents a clear picture of capital exiting more risky areas of the market, highlighted by growth capital’s median discount stretching over the 50% mark. Healthcare is generally considered more defensive, however biotech is lumped together with other growth-focused sectors, as companies often require significant amounts of cash to maintain their R&D pipelines.

Funds exposed to property have also struggled. The sector is highly leveraged while valuations look stretched at the same time as demand for rent falters. These funds also suffered from the SVB incident, as investors took a more critical eye to the sector on fears that debt refinancing might be harder to achieve. The ongoing debacle at Home REIT, which is currently under investigation for bribery, among other things, may also be impacting sentiment towards the wider residential sector (although the business models are different – see Richard Williams’ take on the story in our most recent weekly show). It was somewhat of a surprise to see UK healthcare (property) feature considering it is made up of two aged care REITs which are generally less correlated to broader market fluctuations.

Outside of property, several cyclically exposed companies – such as those in the commodities and natural resources sector – also underperformed as markets began to price an increasing risk of recession following the banking crisis earlier in the month. SVB’s collapse and rising interest rates have also affected the ability for more risky sectors of the market to access capital.

Top 10 performers by fund

In terms of NAV growth, there’s a strong representation of funds benefiting from exposure to US large caps as discussed above, despite the weakness in the USD, including Polar Capital, Manchester & London, Martin Currie Global Portfolio, and Allianz Technology. A number of other funds have benefited from a combination of solid stock selection and exposure to rebounding sectors such as Aurora, whose impressive performance can be attributed to considerable holdings in EasyJet and Ryanair which are up 55% and 29% respectively. Geiger meanwhile is up thanks to a bounce in the price of uranium while the European funds have seen gains thanks to continued weakness in the USD as well as exposure to large, stable cash generators like Nestle, and LVMH.

Livermore Investments headlined share price movement for the quarter, however its performance was more a function of thin trading and market timing as it recovers from a steep sell off in 2022. Amedeo’s performance was driven by an announcement to return a large amount of capital to shareholders, while Nippon Active Value benefited from a strong start to the year for Japanese stocks. Flows into fixed income have been steady throughout Q1 helping drive the two debt funds. Elsewhere, there was plenty of overlap from the NAV, list.

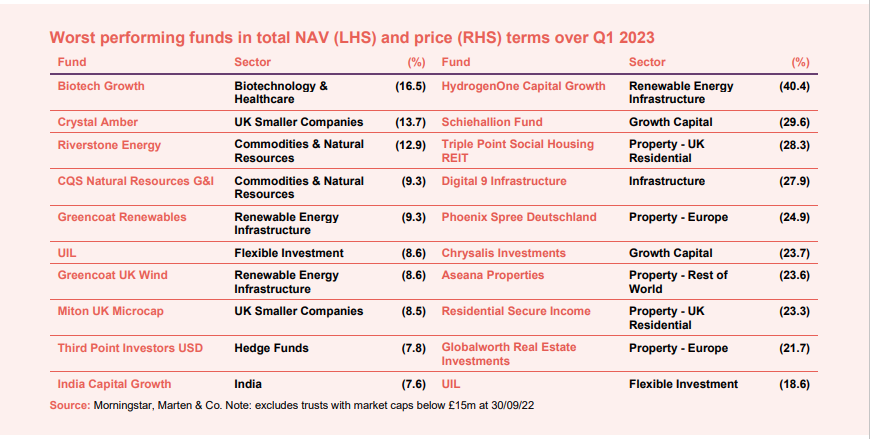

Bottom 10 performers by fund

The overwhelming theme of the worst performers is the rotation away from risk: small caps, growth capital, biotech, nascent renewable infrastructure. Companies perceived as having large capital requirements and relatively weak balance sheets reliant on external funding for growth were hit particularly badly. That being said, much of this seems overdone to us. For example, the fall in the share price of HydrogenOne when government money is pouring into the hydrogen sector, globally. DGI9 also appears to have been relatively hard done by considering the strength of its underlying fundamentals, however it’s also not a surprise to see the fund struggling due to the relatively indiscriminate selling from the market.

Real estate and property dominated the list of worst performing funds as you might expect considering the range of headwinds affecting the industry. TriplePoint Social Housing appears to have been dragged down (wrongly in our view) by the capitulation at Home REIT which has currently been suspended from trading and would otherwise likely be at the top of this list. Phoenix Spree, meanwhile, failed to pay its dividend due to weak sales of condominiums in Berlin.

Crystal Amber continues to trade down following its continuation vote failure last year while UIL’s poor quarter was down to a lack of diversity within the fund. Its main holding, Somers, which contributes 37.5% of gross assets, fell 11.1% in March alone. Chrysalis suffered from a poor reaction to its £20m equity purchase of Starling Bank which was compounded further by the possibility of higher discount rates due to stubborn US inflation.

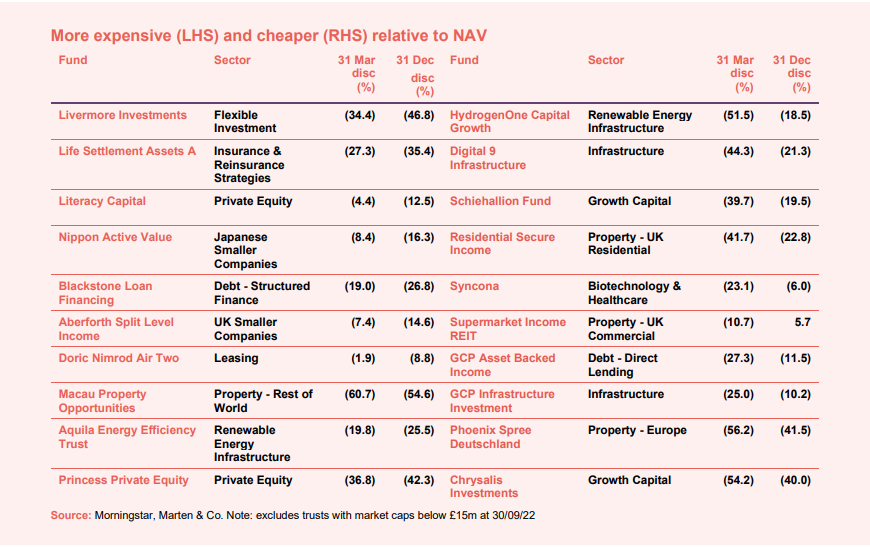

Getting more expensive

Getting more expensive

Of the funds not mentioned above, Literacy Capital benefited from the sale of its fourth largest asset for a 48.9% premium to carrying value while Life Settlement Assets saw several positive portfolio developments over the course of the quarter, including the resolution of a long running legal dispute. Aberforth Split Level Income’s positive NAV growth appears to be a reflection of its strong finish to 2022, although the company has also benefited from the helpful timing. Doric Nimrod Air One’s success in selling its main asset encouraged a re-rating of other Doric Nimrod funds. Macau Property Opportunities Fund continues to be incredibly volatile, and its recovery should be put in context of the company’s recent performance. Aquila Energy failed its continuation vote earlier in the quarter while Princess Private Equity staged a slight recovery after a very challenging year where shares fell 40% over the course of 2022.

Getting cheaper

For those funds whose discounts continued to widen, growth and property were again the dominant themes. Schiehallion suffered from a business model that targets private investments in high growth businesses. Its shares dropped 57% in 2022. Syncona held up reasonably well during initial market volatility, perhaps benefiting from a bias towards unlisted investments, however it has since traded down as private markets have begun to derate. While rising UK inflation and power prices have driven a substantial, positive uplift for GCP’s NAV, higher interest rates and perhaps the UK government’s new levy (windfall tax) on energy producers seem to have offset that in investors’ minds. GCP Asset Backed Income has been struggling with the availability of a broader range of income producing investments arising from increased interest rates.

The discount on Chrysalis continues to widen. The managers have ceased making new investments and are instead focused on preserving value within the existing portfolio. It is possible that not everything will survive, but the managers would argue that the market is being too pessimistic about the prospects of the portfolio as a whole.

Money raised and returned

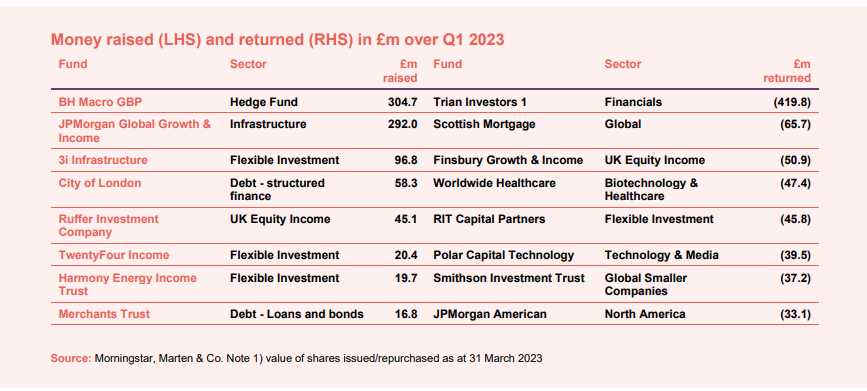

Money coming in

For the most part, capital has dried up in Q1, although BH Macro bucked the trend, taking advantage of its impressive performance over the last three years to raise £315m. The raise was particularly notable considering the wider economic circumstances and management suggested they could have taken in more but decided to scale back investors’ applications, favouring existing shareholders in the allocation process. 3i Infrastructure managed to raise £100m. The company’s share price has been flirting with both sides of its NAV over the past six months, and the issue came at a slight discount of 3.4% in the end (that is dilutive for shareholders, and we think that there would have been an outcry had investors thought it was deliberate). JPMorgan Global Growth & Income was the other big mover, although this was via converted C shares, which saw a total of 58,605,746 ordinary shares enter circulation.

There were no investment trust IPOs during the quarter, and there have not been for the past 18 months although WhiteOak Capital Management is hoping to bring the Ashoka WhiteOak Emerging Markets Trust to market, with an announcement of the intent to raise £100m.

Usual suspects City of London, Ruffer, and Merchants took advantage of respective premiums to raise capital while Harmony Energy Income merged its C shares into its ordinary shares during the quarter. TwentyFour Income benefited from the structural rise in rates as capital flows into the fixed income sector.

Money going out

Buybacks continued aplenty for the larger trusts, led by Scottish Mortgage, although Pershing Square is a notable absence from this list as its buyback activity was placed on hold.

Trian Investors distributed its Unilever shares as it goes through the process of winding up and we said goodbye to JPMorgan Elect, Blue Planet and Doric Nimrod Air One during the quarter. Perhaps a surprise entry is Finsbury Growth and Income. We have long argued that the trust does not offer a sufficiently attractive yield to be considered an income fund, were it to relocate to the UK all companies sector, its performance would not look too bad relative to its new peer group.

Major news stories over Q1 2023

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled.

| · RIT Capital Partners AGM – 26 April

· Mobius Investment Trust AGM 2023 – 26 April · Smithson Investment Trust AGM – 27 April · AVI Japan Opportunity Trust AGM – 2 May · Dunedin Income Growth manager presentation – 3 May · Apax Global Alpha AGM – 3 May · Temple Bar AGM – 9 May |

· The Renewables Infrastructure Group AGM – 10 May

· Dunedin Income Growth AGM – 16 May · Nippon Active Value AGM – 8 June |

Interviews

Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest discussing a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 13 January | DGI9, AT85 | Thao Ngo | Vietnam Enterprise |

| 20 January | RICA, ORIT | Stephanie Sirota | RTW Venture Fund |

| 27 January | JLEN, HGEN, USF, HNE | Eileen Fargis | Ecofin US Renewables |

| 3 February | SOHO, AERI | Will Fulton | UK Commercial Property REIT |

| 10 February | 3IN, CCJI, CHRI | Colm Walsh | ICG Enterprise |

| 17 February | IBT, ASCI | James Dow | The Scottish American Investment Company |

| 24 February | HEIT, NESF | Jean Hugues de Lamaze | Ecofin Global Utilities and Infrastructure |

| 03 March | AEET/AEEE, PEY/PEYS, SOHO | David Bird | Octopus Renewables Infrastructure Trust |

| 10 March | ATST, FCIT, HOT, OCI | Anthony Catachanas | VH Global Sustainable Energy Opportunities |

| 17 March | BGLF / BGLP, EPIC, SMT, ALAI | James Hart | Witan Investment Trust |

| 24 March | SMT | Richard Staveley | Rockwood Strategic |

| 31 March | GOT, PSDL, TFG, MNTN | Alex O’Cinneide | Gore Street Energy Storage Fund |

Research notes published over Q1 2023

While Herald Investment Trust (HRI), like many other technology and growth-focused strategies, has been caught up in the grips of 2022’s market selloff, the fundamentals of many of the companies in its portfolio have remained largely unscathed. In fact, HRI’s management team believes that today’s market represents an opportunity, as falling prices and earnings strength push valuations to attractive levels.

As we describe in this note, there are a lot of moving parts that go into making Bluefield Solar Income Fund (BSIF) run smoothly. However, the net result should be a fund that offers investors attractive, relatively predictable and largely inflation-linked levels of income, plus the prospect of capital growth.

In recent months, the actions of successive UK governments and sharp increases in bond yields have unnerved investors in the sector. This has created some discount volatility for BSIF and its peers. However, we think that this is a short-term problem.

High interest rates have hit the share prices of real estate companies, with those in sectors with low investment yields, such as logistics, particularly impacted. abrdn European Logistics Income (ASLI) is no different and the market turmoil has seen its share price discount to net asset value (NAV) widen to 34.0% – in line with its UK peers. This is despite the fact that the spread between property yields and the cost of debt is far wider in Europe (property yields were higher in Europe than the UK and cost of debt lower meaning rising interest rates would put less pressure on property yields in Europe in comparison to the UK and suggesting values will be less impacted).

Ecofin US Renewables Infrastructure Trust’s (RNEW’s) share price moved from a premium to net asset value (NAV) to a discount in July 2022 as the original fund management team resigned. The portfolio assembled is solid, performing well and delivering on expectations. A new fund management team, led by Eileen Fargis, is now in place and the opportunity available to RNEW is considerable.

GCP Infrastructure (GCP) has seen a dramatic improvement in the tailwinds supporting its investment approach. The rise in UK inflation and power prices has driven a substantial, positive uplift in its net asset value (NAV). This uplift has more than made up for the negative impact of the government’s new levy (windfall tax) on energy procedures. GCP has also made major strides in the quality of its ESG disclosure.

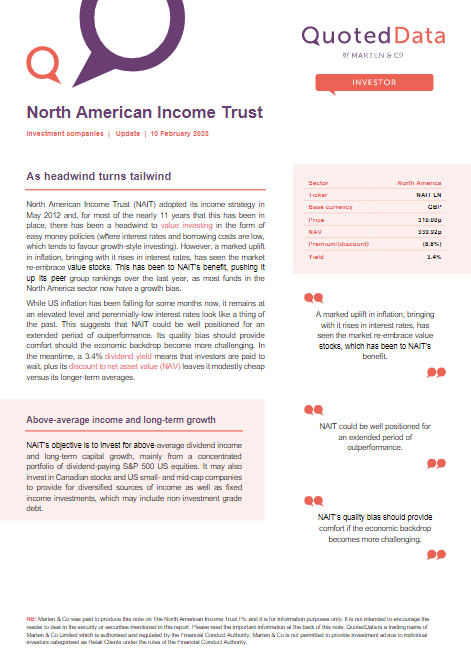

North American Income Trust (NAIT) adopted its income strategy in May 2012 and, for most of the nearly 11 years that this has been in place, there has been a headwind to value investing in the form of easy money policies (where interest rates and borrowing costs are low, which tends to favour growth-style investing). However, a marked uplift in inflation, bringing with it rises in interest rates, has seen the market re-embrace value stocks. This has been to NAIT’s benefit, pushing it up its peer group rankings over the last year, as most funds in the North America sector now have a growth bias crisis, for example), they say, it pays to take on more risk.

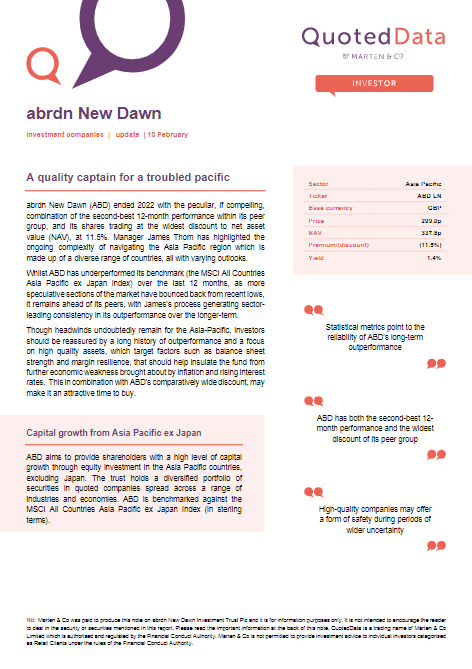

New Dawn (ABD) ended 2022 with the peculiar, if compelling, combination of the second-best 12-month performance within its peer group, and its shares trading at the widest discount to net asset value (NAV), at 11.5%. Manager James Thom has highlighted the ongoing complexity of navigating the Asia Pacific region which is made up of a diverse range of countries, all with varying outlooks.

Whilst ABD has underperformed its benchmark (the MSCI All Countries Asia Pacific ex Japan index) over the last 12 months, as more speculative sections of the market have bounced back from recent lows, it remains ahead of its peers, with James’s process generating sector-leading consistency in its outperformance over the longer-term.

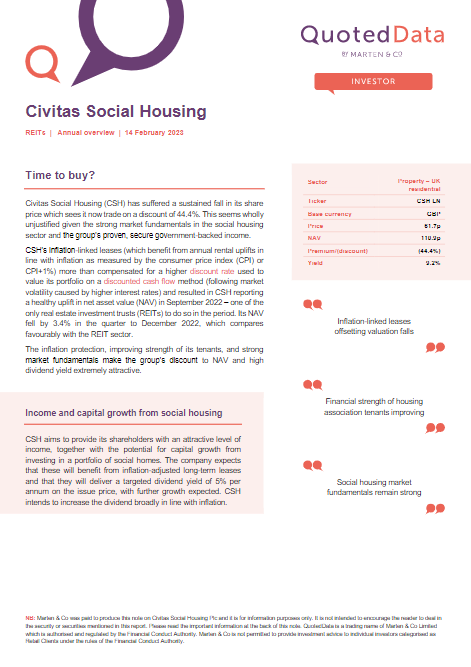

Civitas Social Housing (CSH) has suffered a sustained fall in its share price which sees it now trade on a discount of 44.4%. This seems wholly unjustified given the strong market fundamentals in the social housing sector and the group’s proven, secure government-backed income.

CSH’s inflation-linked leases (which benefit from annual rental uplifts in line with inflation as measured by the consumer price index (CPI) or CPI+1%) more than compensated for a higher discount rate used to value its portfolio on a discounted cash flow method (following market volatility caused by higher interest rates) and resulted in CSH reporting a healthy uplift in net asset value (NAV) in September 2022 – one of the only real estate investment trusts (REITs) to do so in the period. Its NAV fell by 3.4% in the quarter to December 2022, which compares favourably with the REIT sector.

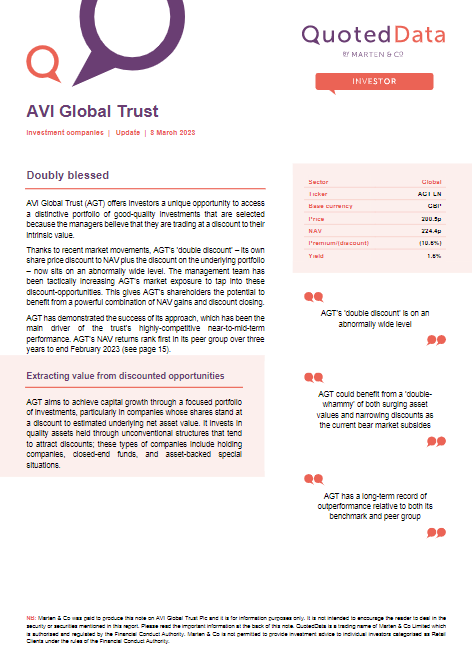

AVI Global Trust (AGT) offers investors a unique opportunity to access a distinctive portfolio of good-quality investments that are selected because the managers believe that they are trading at a discount to their intrinsic value.

Thanks to recent market movements, AGT’s ‘double discount’ – its own share price discount to NAV plus the discount on the underlying portfolio – now sits on an abnormally wide level. The management team has been tactically increasing AGT’s market exposure to tap into these discount-opportunities. This gives AGT’s shareholders the potential to benefit from a powerful combination of NAV gains and discount closing.

JLEN Environmental Assets (JLEN) experienced an eventful but fruitful 2022. Volatile power prices, rampant inflation, rising interest rates and new taxes buffeted the renewables sector but generally acted as a tailwind for net asset value (NAV) growth. Some of these issues will continue to affect the sector in 2023. We explore all of these from page 4 onwards. JLEN’s managers can have little influence on these big macroeconomic factors but they can, through their investment activity, lay the foundations for future NAV uplifts.

Pantheon Infrastructure (PINT) has been busy assembling a diverse portfolio of 11 investments in infrastructure projects, located in developed markets. The majority of these have explicit inflation-linkage built into their structure or implicit protection through regulation or market position.

Oakley Capital Investments (OCI) invests in private equity funds managed by Oakley Capital Limited (Oakley). OCI is, as we show on page 22, the best-performing fund in its peer group over five years. As evidenced by its latest full-year results, this has been achieved in spite of a difficult macroeconomic backdrop. OCI believes that this can be attributed to three core factors:•the expertise that its adviser has built in a focused group of sectors (technology, consumer, education) over 20 years of private equity investing;•a unique investment origination strategy, which continues to unearth opportunities that others cannot access (seven new investments were made last year); •and a set of proven value-creation strategies that help accelerate the earnings growth of the companies that OCI backs.

India Capital Growth’s (IGC’s) adviser, Gaurav Narain, says that at a time when many economies and equity markets are struggling, there are many reasons to be optimistic about the outlook for the Indian economy. Although down in sterling absolute terms during the last 12 months, the Indian market made progress in local currency terms and has performed well relative to its emerging market peers, benefitting from a good run in the second half of 2022 from which IGC also benefitted. Despite the recent market setback so far this year, Gaurav thinks there is more upside to come, noting that business confidence is high.

JPMorgan Japanese Investment Trust (JFJ) has a large exposure to good quality companies that are at the forefront of the modernisation of the Japanese economy. The portfolio embraces businesses in robotics, ecommerce, digitalisation, healthcare, and renewables. It also backs some great Japanese brands and businesses that are helping the economy adapt to an ageing population. These are ‘growth’ stocks and, as we discussed in our last note, even though Japan has not, as yet, experienced the interest rate rises that triggered the selloff in growth stocks in other markets, their share prices have plunged, and this has impacted on JFJ’s performance.

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

Appendix 1 – median performance by share price return over Q1 2023

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.