Negotiating choppy waters

It appears that high interest rates have hit the share price of real estate companies, with those in sectors with low investment yields, such as logistics, particularly impacted. abrdn European Logistics Income (ASLI) is no different and the market turmoil has seen its discount widen to 34.0% – in line with its UK peers despite the spread between yields and cost of debt being far wider in Europe (which the manager suggests will mean values in Europe will be less impacted).

The fundamentals of the European logistics sector remain strong, the manager says. A chronic shortage of supply (below 3% across Europe and as low as 2% in prime markets) and robust demand could see strong rental growth remain. ASLI’s income is linked to inflation, with 66% of it uncapped, which could feed through to stronger rental growth this year and next. This should off-set inevitable valuation declines as investment yields soften, the manager adds. Meanwhile, ASLI’s debt is fixed for an average of four years at around 2%.

Mid box and urban logistics across Europe

ASLI invests in – and actively asset-manages – a diversified portfolio of logistics real estate assets in Europe with the aim of providing its shareholders with a regular and attractive level of income return, together with the potential for long-term income and capital growth (target total return of 7.5% a year in euros).

Fund profile

ASLI invests in a portfolio of European urban mid-box logistics assets, diversified by both geography and tenant, with a focus on what the manager believes are well-located assets at established distribution hubs and within population centres. ASLI’s aim is to provide its shareholders with a regular and attractive level of stable income return, together with the potential for long-term income and capital growth (it has targeted a total return of 7.5% a year in euros). ASLI benefits from inflation-linked leases across its portfolio.

ASLI has an annual dividend yield target of 5% for an investor in the company at launch. Quarterly dividends are expected to be consistent with the annual underlying levered portfolio return. Dividends have historically been paid in sterling, with the assets and the income derived from them predominantly in euros. The manager may use currency hedging to help reduce the volatility of the income, but there is no current intention to hedge the capital value of the portfolio. Shareholders are also able to elect to receive distributions in euros.

ASLI’s portfolio management services are undertaken by abrdn, led by fund manager Troels Andersen, who replaced Evert Castelein in October 2022. The core fund management team also includes of deputy fund managers Geoff Hepburn and Attila Molnar. abrdn Real Estate is the second-largest European real estate investment manager, managing €45bn of real estate, and has an extensive regional presence, with over 225 real estate investment professionals and offices in eight countries across Europe. More information on the investment team is on page 25.

Market overview

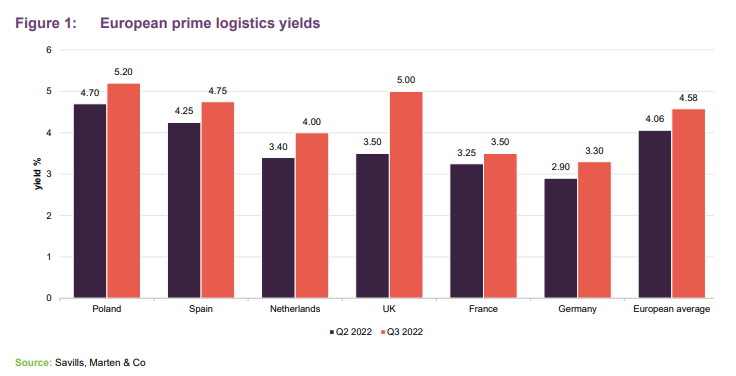

The higher interest rate environment across the Eurozone has negatively impacted valuations of commercial real estate. The European Central Bank announced in December a rise in eurozone interest rates to 2.5% to help fight inflation. More rate rises are expected, putting pressure on investment yields across the commercial real estate sector. The five-year Euribor swap rate (the typical floating rate on which banks add their margin for lending to real estate) has increased from 0.086% to 2.899% in the 12 months to 10 January 2023. This reduced the spread between total cost of debt and real estate yields, including prime logistics where yields had compressed to around 3%.

Without the availability of low-cost finance, which had pushed yields to new record low levels, many leveraged investors have been taken out of the market and the pressures that underpinned pricing have been taken away, the manager says. Lower-yielding commercial real estate sectors find themselves one of the most susceptible among the real estate sectors to softening investment yields and falling capital values. This is likely to have a greater impact on the UK logistics sector where the yield spread (prime logistics yields minus total financing cost) was demonstrably narrower than in Europe– with historically higher finance costs and lower property yields, the manager adds.

By how much values fall, it is too early to say and depends on a number of factors including how long it takes to bring inflation under control – something inherently linked with the war in Ukraine and energy prices. abrdn says that a re-rating of real estate yields is underway and will continue throughout 2023, before stabilising.

Another important driver of real estate valuations over the past decade has been the spread between real estate yields and bond yields. The surge in bond yields in 2022 has squeezed that spread abruptly. In many countries, prime all-property yields fell below bond yields through the second half of 2022. According to abrdn, rising rates and stubborn inflation is likely to sustain high bond rates in the first half of 2023, but the spread is likely to stabilise and then widen in the second half, based on current interest rate forecasts.

Investment hiatus

Understandably, there has been a hiatus in European logistics investment over the past few months as investors assess the market. This followed record breaking investment volumes in the first half of 2022 of almost €30bn – 9% above last year and 59% above the five-year average, according to Savills. Third-quarter investment statistics showed a fall of 13% on second-quarter numbers, according to JLL, and the lowest transaction activity since the first quarter of 2020. The strong start to 2022 means that investment volumes through to the end of September was still on par with 2021, but JLL predicts that the investment hiatus in the second half of 2022 will result in a fall of between 15% and 20% on the record level set in 2021.

Prime yields continued to drift out in the third quarter of 2022, with the average prime logistics yield across Europe moving to 4.58%, as shown in Figure 1. The manager expects further softening of yields over the next six months before the investment markets pick up again.

Correction should have less impact on mid-box, urban assets

Logistics assets in the mid-box size range – 10,000 sqm to 40,000 sqm size – are more liquid in terms of both investment and leasing deals, the manager states. The pool of investors looking to buy assets in that size bracket, which usually trade for around €30m, is deep, the manager says, adding that tenant demand in that size bracket is also highest, due to the fact that they are often located closer to urban areas. Typically, around 70% to 80% of all leasing and investment deals across European logistics occur in that size bracket, according to abrdn.

Conversely, logistics assets in the big-box higher size range are less liquid on an occupier and investment front, the manager adds. There are not many occupiers that can take such a big unit, which is often very bespoke and equipped with multi-level mezzanine floors. There is also a limited pool of investors for these facilities, which can often be priced at €100m-plus, making it more difficult to dispose of such an asset. The manager adds that in the current high cost of debt environment, there are even fewer potential investors and this problem is exacerbated.

Urban logistics assets (typically between 5,000 sqm and 20,000 sqm in size and located close to towns and cities) are considered very liquid by the manager. ASLI’s manager has upped the fund’s exposure to this sub-sector over the past few years and it now makes up 51% of the portfolio – with the rest made up of mid-box assets (more detail on the portfolio make-up is on page 10).

The manager says that the growth in e-commerce has resulted in a strong increase in demand for urban logistics space, where tenants (often third-party logistics operators) can be as close to consumers as possible. Supply of urban logistics properties is even more acute than the wider logistics sector, the manager states.

A correction in valuations could be less keenly felt in the mid-box and urban part of the market, where ASLI invests, the manager says. Supply of space is also at its lowest here and, with robust demand, should result in rental growth that would off-set some of the yield softening in the market, the manager adds.

Occupier market still strong

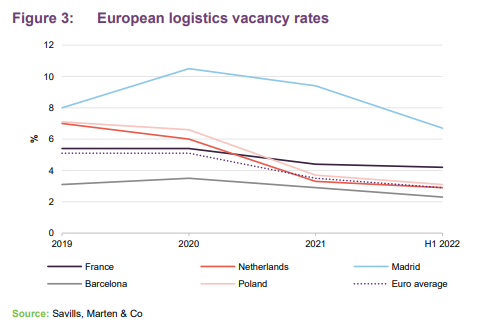

The manager states that the market fundamentals remain very supportive in Europe, driven by low vacancy rates of less than 2% in many prime locations and increasing demand driven by e-commerce, the strengthening and diversification of supply chains and higher inventories.

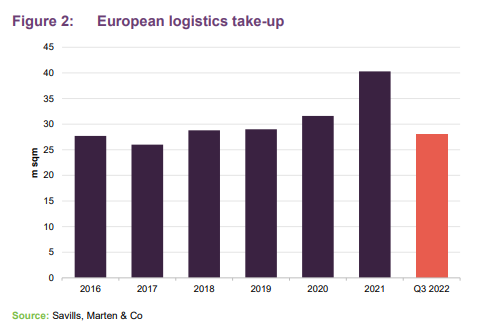

The uncertainty in Europe’s economy did not have an impact on demand for logistics space during the first half of 2022, with take-up across Europe reaching around 20m sqm, up by 12% compared to the same period last year, according to Savills. Third-quarter take-up was around 7.6m sqm, 24% lower than the second quarter and 16% lower than the same period in 2021. This was partly due to the severe shortage of space in the market rather than a lack of demand. Occupier markets remain very active with strong leasing momentum, the manager adds.

If take-up in the fourth quarter hits the long-term average of 8.6m sqm, full year take-up would be 37m sqm, which would be a 7% decline on 2021 but 18% higher than the five-year average. However, Savills expects take-up to fall short of this figure. However, activity from third-party logistics operators (3PLs) picked up in 2022, accounting for 47% of total take up, while supply chain realignment through reshoring and higher inventories increased space requirements for both manufacturers and 3PLs. Demand from both occupier segments increased during the first three quarters of 2022, up 42% and 32% respectively, according to JLL.

As a result of the high take-up, vacancy rates across Europe dropped a further 60 bps to set another record low to an average of 2.9%, as shown in Figure 3.

The most notable drop in vacancy was in Spain, with the vacancy rates in Madrid dropping 300 bps to 6.4% and in Barcelona by 60 bps to 2.3%. Meanwhile, vacancy rates in France and the Netherlands dropped slightly or remained stable at all-time lows.

This supply-demand dynamic resulted in substantial rental growth across Europe. abrdn says that logistics rents increased by 3.2% year-on-year in the second quarter of 2022, but in the most supply constrained parts of the market higher rental growth was recorded. It expects rents to grow at a faster rate over the next five years given low supply and rising development costs. According to Savills, prime rents across Europe grew by 10.7% over the year to 30 September 2022.

Inflation to be captured

Annual inflation in the European Union was 10.1% in November, down marginally from 10.6% in October. All of ASLI’s leases are index-linked to the equivalent of CPI, with 66% uncapped. A further 28% has a cap in place of between 2% and 3%. The manager says that it plans to pass on inflation uplifts in annual rent reviews and estimates that rental growth from indexation in 2022 will be 4% and 5% in 2023. The manager says that affordability of rents for tenants is an important consideration when increasing rents but adds that the logistics properties are critical to the success of its tenants and that rent is often a smaller portion of overall operating expenses for companies, between 3% and 6%, limiting the impact especially for companies with pricing power in their particular market. The biggest cost is transportation and energy, which accounts for between 40% and 70% of overall costs. Location over rent, therefore, is mission-critical for e-commerce companies, the manager adds.

Investment process

ASLI focuses on mid-sized assets in the 10,000 sqm to 40,000 sqm range that the manager says is the most liquid part of the market in both investment and letting terms. The properties will predominantly be located at established distribution hubs and within population centres. Typically, these will come with long-term, index-linked leases. The manager may also target properties that could benefit from structural change. When selecting investments, the manager will look at aspects such as:

- the property characteristics and whether they are appropriate for the location (such as technical quality, strong ESG credentials, scale, configuration, layout, transportation links, power supply, data connectivity, manoeuvrability, layout flexibility, and overall operational efficiencies);

- the location and its role within European logistics (city, regional, national or international distribution), key fundamentals supporting logistics activity within the micro location such as proximity to airport, port, transport nodes, multimodal transport infrastructure, established warehousing hubs, transport corridors, population centres, labour availability and market dynamics such as supply (of both land and existing stock), vacancy rate and planned infrastructure upgrades;

- the terms of the lease(s) (focusing on duration, inflation-linked terms, ESG criteria, level of passing rent relative to market rent, the basis for rent reviews, and the potential for capturing growth in market rental income);

- the strength of the tenant’s financial covenant;

- the business model of the tenant and their commitment to the asset both in terms of capital expenditure and the role it plays in their operations; and

- the potential to implement active asset management initiatives to add value over the holding period.

The team looks at potential acquisitions on a bottom-up basis, ensuring that the locations are suited to the lessor’s target markets. Local market dynamics are always very important in combination with analysing macroeconomic considerations.

In addition to buying operational assets, the company may forward fund new developments or commit to buying an asset once building is complete. The manager will do this when it thinks this would lead to better returns for shareholders. It may also be a good way of securing an asset at an attractive yield. These assets will be predominantly pre-let when ASLI commits to the investment or come with a rental guarantee.

Forward funding new developments

ASLI does not undertake speculative development, but has forward funded a selection of developments on the basis that these were 50% pre-let. There are good reasons for this: these deals tend to be agreed off-market and so are not as exposed to competitive pressures; new developments do not attract stamp duty; you can be sure that the tenant is committed to the location; and the buildings are high-quality and, because they are new, have low maintenance costs.

Deals are usually structured so that ASLI makes an upfront payment for the purchase of the land (typically 20%) and then makes monthly instalments dependent on progress. The developer normally pays a coupon to ASLI during the development. abrdn has a strong reputation and track record within the European property market and is therefore a favoured partner for developers and lenders.

Risk limits and controls

The following limits apply at the time ASLI makes an investment:

- ASLI will only invest in assets located in Europe;

- Maximum of 50% of gross assets in any one country;

- Maximum of 20% of gross assets in any one investment;

- Forward-funded commitments will be wholly or predominantly pre-let;

- Maximum 20% of gross assets in forward funded commitments;

- Maximum 20% of gross assets exposed to any single developer;

- No investment in other closed-ended investment companies;

- Tenants must have strong financial covenants (in the manager’s view); and

- No single tenant to provide more than 20% of ASLI’s annual gross income.

abrdn’s resources

When it comes to sourcing deals, abrdn has local offices across Europe, seven of which host local abrdn real estate professionals. The manager says that it is very important that it has access to local knowledge and a local network, which makes it easier to source off-market deals. Ideas are shared across abrdn’s property teams through weekly deal allocation calls. All prospective investments are listed and reviewed on an internal portal, and first right to deals cycles between the teams to ensure that all clients have fair access to prospective investments.

For the most part, the manager finds itself competing against local investors. However, there are quite a few pan-European investors looking at the largest investment grade properties. The manager will check the strength of tenant covenants with external sources such as Dun & Bradstreet, but it also cross-correlates this with information drawn from abrdn’s equity, fixed income and credit teams.

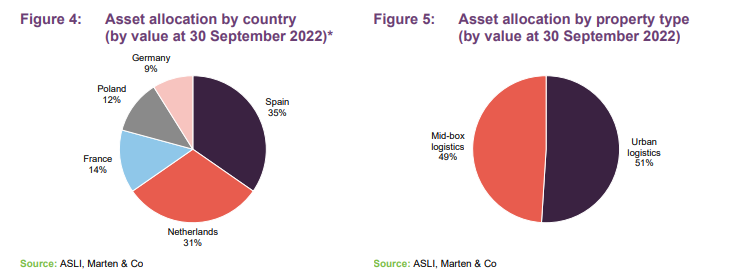

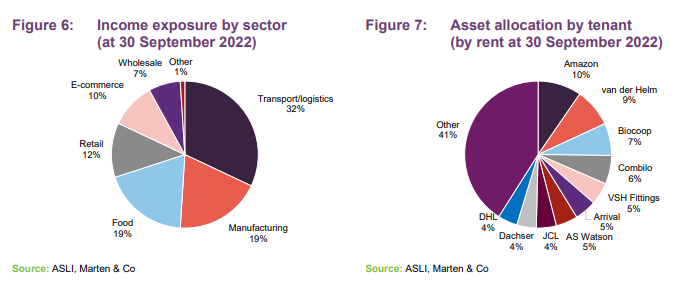

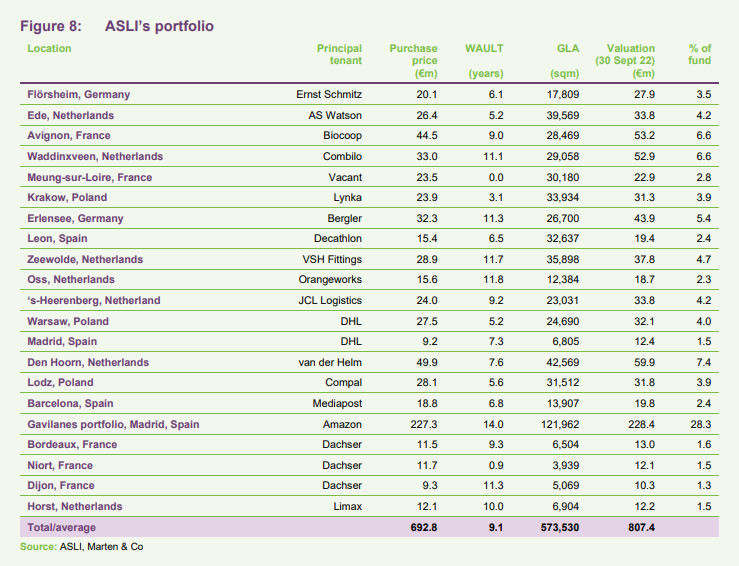

Asset allocation

ASLI’s portfolio consists of 27 assets valued at around €807.4m and located across five European countries. ASLI’s portfolio has 60 tenancies across 50 tenants, with Amazon being its largest tenant by income, and has a WAULT of just over nine years to lease expiry. Urban logistics assets make up 51% of the portfolio where the manager believes greater growth potential exists, as mentioned earlier.

All of ASLI’s income is linked to inflation, with 66% uncapped – meaning it will rise in line with the relevant inflation index in place in that country. A further 28% of the income is inflation-linked with a cap in place – between 2% and 3% per annum.

Horst

ASLI’s most recent acquisition was the €12.1m purchase of this 6,900 sqm property in Horst, the Netherlands. It was acquired as part of a sale and leaseback deal with Limax (a producer, packager and distributor of soft fruits and mushrooms). Limax signed a 10-year lease term subject to annual CPI capped indexation, with the rent reflecting a net initial yield of 3.8%. Serving as its headquarters, the tenant-critical asset with cold storage lies between Venlo and Venray, an area which is well known for its agrifood and agricultural businesses. It is considered the gateway to the European hinterland, close to barge and rail terminals.

The property, which covers a total land plot of 40,500 sqm, provides the company with the opportunity for future extensions. It features rooftop solar panels, enhancing ASLI’s portfolio sustainability credentials.

Dijon

In October 2022, ASLI also completed the purchase of this 5,069 sqm Dijon property for €9.3m, reflecting a net initial yield of 4.2%. Constructed in 2004 and subsequently refurbished in 2021, the property sits on a total plot size of 27,000 sqm and is located 10 kilometres from Dijon on the main logistics route to Lyon and the wider Alpine road network.

The building is leased to Dachser Intelligent Logistics, the German-owned global third-party logistics provider founded in 1930, operating as Dachser France, on a 10-year term. The lease benefits from annual French ILAT indexation (the French measure of inflation). The manager says that the low site coverage provides excellent opportunities for future expansion.

Bordeaux and Niort

In August 2022, ASLI purchased two logistics properties, in Bordeaux and Niort, in France for an aggregate purchase price of €23m, reflecting a net initial yield of 4.0%.

Both properties are also leased to Dachser France on leases which provide annual indexation. Both assets have medium-term asset management opportunities in the form of building extensions or development due to their low site coverage.

Built in 2005, the Bordeaux urban logistics asset totals 6,504 sqm and sits on a total plot size of 29,000 sqm (22% site cover). It is located 8km from the centre of Bordeaux, one of France’s most populated cities, and offers fast access to the area’s major arterial routes to Paris, Lyon and the Spanish border. The property has a WAULT of 9.5 years, and annual ILAT indexation.

Built in 2014, the Niort property totals 3,939 sqm, on 44,000 sqm of land (9% site cover) and is located 10km from the centre of Niort and benefits from its proximity to the A10 motorway connecting to Paris and Bordeaux. The lease is also subject to annual indexation.

The Gavilanes portfolio

After raising £125m in September 2021, ASLI acquired a portfolio of urban logistics assets located just outside Madrid for €227.3m, reflecting a net initial yield of 3.4%. The portfolio was developed in four phases and consists of eight newly-built warehouses completed between 2019 and 2022. The rental income of €7.7m is subject to annual uplifts linked to inflation, with the leases having a WAULT of 14.3 years (8.2 years to first break). E-commerce and logistics giant Amazon makes up 43% of the income across two assets, while other tenants include Carrefour, MCR, Talentum and ADER. Gavilanes is one of the leading last-mile logistics areas in both Madrid and the wider Spanish market, with a population of almost six million people accessible within a 30-minute drive time.

Phase one

Phase one comprises two warehouses that were built in 2019. The first building extends to 21,713 sqm and is let to Talentum, an online marketing company, until September 2029 with annual uplifts linked to IPC (Spanish Consumer Price Index) capped at 3%. The second building, measuring 11,264 sqm, is let to Amazon for a further eight years, with a break option in August 2023. The rent is also linked to IPC with a cap of 3% per annum.

Phase two

The three warehouses that make up phase two include Carrefour’s first Spanish e-commerce facility. The French supermarket giant has 13.7 years left on its lease at the 8,241 sqm warehouse. MCR, a Spanish electronics and IT hardware distributor (which lists Amazon as its main client) occupies the second building, which extends to 6,660 sqm. Its lease expires in June 2026. Both leases are linked to IPC with a 2% cap. ASLI’s manager recently completed the letting of the third building, which extends to 7,375 sqm, to ADER (which provides distribution services to companies in the freight and logistics sector) on a five-year lease. The letting is fully CPI indexed.

Phase three

Phase three is made up of two newly-developed warehouses, measuring 16,500 sqm and 10,665 sqm, both let to Arrival until 2031, linked to IPC. Nasdaq-listed Arrival makes electric delivery vans and counts global logistics specialist UPS as one of its clients.

Phase four

Phase four comprises the recently completed development of a 16,467 sqm parcel delivery hub and an adjacent multi-storey van parking station fully equipped for electric vehicles. It is let to Amazon on a 25-year lease, with upward only annual rent reviews linked to IPC (capped at 3%).

Barcelona

ASLI acquired this 13,907 sqm urban logistics warehouse in Barcelona for €18.8m, in July 2021. The purchase price reflected a net initial yield of 3.7% and a reversionary yield of 4.7%, due to the rental growth prospects of the asset.

Built in 2019, the building is fully let to Mediapost, a subsidiary of LA POSTE Group, the French state-owned company, serving as its Spanish headquarters. The lease expires in 2029, with a mutual break option in 2026, while rental income will be indexed from 2023.

The warehouse is located in the first ring of Barcelona, within a 25-minute drive (27km) of the city centre. The local market is characterised by a low vacancy rate of 3%, which falls to 1% for the first ring. The property offers a high-grade specification of 11.5 metres clear height in the warehouse area, 10 loading docks, LED lighting and a small number of solar panels, which the company will seek to enhance.

It is well positioned to benefit from the growth of e-commerce and the scarcity of development opportunities in and around Barcelona, which provides strong rental growth potential, the manager states.

Lodz

Acquired in April 2021 for €28.0m from logistics developer Panattoni, the 31,500 sqm Panattoni Lodz City VIII Logistics Centre is 100% leased to tenants generating a net annual income €1.59m and has a WAULT of 5.8 years.

The tenants are:

- Bilplast (a manufacturer of thermoplastic elements);

- Tabiplast (a manufacturer of plastic components for household goods and car parts);

- Mecalit Polska (a manufacturer of plastic components);

- Alfa Laval (a Swedish company that produces specialised products and solutions for heavy industry);

- EGT Express Polska (a logistics operator);

- KAN (a Polish retailer that owns the fashion brand Tatuum); and

- Compal (one of the world’s largest computer component manufacturers, which signed a new seven-year lease in February 2021 and supplies the DELL factory located less than one kilometre from the site).

The property is located adjacent to a Bosch-Siemens production and distribution campus and benefits from access to the Intermodal Container Terminal, created to support the international white-goods manufacturer, offering direct rail connections with China.

It is located at the heart of one of the Central and Eastern Europe (CEE) region’s most strategically important manufacturing and logistics hubs. The asset’s proximity to the nearby Bosch-Siemens Campus provides strong long-term attraction to occupiers in this supply chain, while the new international railway station and its direct links to China and other European markets provide unrivalled international connections. The Lodz region is in high demand from occupiers and the vacancy rate is one of the lowest in Poland.

Den Hoorn

Acquired in January 2020 for €49.9m, the 43,316 sqm logistics facility is the fund’s largest purchase to date. The newly built warehouse was bought on a perpetual leasehold basis with the option to purchase the freehold from the local municipality. It is fully let to logistics operator A.G. Van der Helm Vastgoed Moerdijk B.V. on a 10-year CPI indexed lease.

The warehouse is located within the Randstad region, the most densely populated area in Europe, close to both the Hague and Rotterdam and with access to the A4 connecting Den Hoorn with the port of Rotterdam and Schiphol airport.

In the first quarter of 2021, ASLI signed a 20-year lease with the tenant for the installation of solar panels, which will generate an additional annual income of €80,000 per year and increase the value of the property by almost €800,000. Panels were installed in the third quarter of 2021.

The manager says that its urban location is highly sought-after by tenants, giving the asset upside potential on rent. It is a new building with low maintenance costs and strong ESG credentials, such as LED lighting and solar panels.

Madrid

This 6,785 sqm logistics facility, which was acquired in December 2019 for €9.2m, is the first ‘last-mile’ asset in ASLI’s portfolio. It is located in Coslada – a 16-minute drive to Madrid city centre and 1km away from Madrid Barajas International Airport, making it the ideal location for last-mile deliveries.

It is a cross-docked facility, making it ideal for city distribution with lorries bringing in goods at the front end of the building and smaller delivery vans on the opposite side being loaded for onward transmission. It is let to DHL, one of the largest logistics operators in the world, on a 10-year lease linked to CPI.

The manager says that its location in the highly supply-constrained Coslada submarket, which connects Madrid with the airport and city centre makes this is an ideal location for city distribution providing upside potential on the rent.

Warsaw

ASLI acquired the new logistics scheme, which was built in 2019, for €27.5m. It comprises two warehouses totalling 24,626 sqm with one of the buildings containing cross-docking facilities.

The scheme’s main tenant is one of the world’s largest logistics companies, DHL. Other tenants include ICS Polska, which specialises in industrial cleaning products, and Spedimex, a logistics company.

The warehouse is located in an established logistics location in Poland, on the A2 motorway, and benefits from close proximity to the city of Warsaw. It is also close to two international airports, which the manager says makes it the ideal location for urban logistics and ecommerce related delivery.

‘s-Heerenberg

The property, which was acquired in July 2019 for €24.0m, is fully let on a CPI index-linked lease to logistics operator JCL Logistics Benelux. Like the Madrid property, it is cross-docked and located in a strong logistics area – on the border between the Netherlands and Germany. The 23,031 sqm building has a low site coverage, providing expansion/development opportunity.

The manager says that the tenant has a strong covenant, generating a durable income stream. The expansion potential, of around 4,500 sqm, is another positive and there is also the option to add solar panels to the roof.

Oss

ASLI bought the 12,534 sqm asset, which was completed in July 2019, while the building was in construction, paying €15.7m. The asset is located between the port of Rotterdam and the industrial region of the Ruhr – a logistics hotspot with vacancy rates around 2%.

The tenant, Orangeworks (a Dutch food-processing and handling machinery business), signed a new 15-year triple net lease with no break and rents 100% linked to CPI when the building was completed in July 2019. The building spec includes a five tonne/sqm floor loading capacity and five loading doors. There is an option to extend the building by an additional 3,000 sqm.

The manager likes the location’s strong fundamentals, the triple net lease (in a market where landlords are typically responsible for repairs and maintenance), the length of the lease and the 100% inflation-linkage.

Zeewolde

ASLI paid €30.0m for this asset during its construction and was paid a coupon until it was completed in July 2019. It comprises 36,250 sqm of space located in the heart of the Netherlands, near the fast-growing town of Almere. Inditex/Zara has recently built a 100,000 sqm facility here, underlining the area’s desirability as a logistics hotspot. In addition, nearby Lelystad airport is being expanded.

The building is let to VSH Fittings (a Dutch pipes and fittings business, and a subsidiary of Aalberts Industries) on a triple net lease with 12 years to expiry, 100% linked to CPI (but capped at 2.4%).

The manager says that the €41/sqm rent is low, given the building’s central location and ample labour supply. The triple net lease is welcome in a market where landlords are usually responsible for repairs and maintenance. The inflation-linkage is also good news.

Leon

Located in the north-west of Spain, ASLI paid €15.3m for this asset, which was completed in Q1 2019 and fully let to sportswear retailer Decathlon. It comprises three buildings with a total floor area of 32,637 sqm (which could suit a multi-let format in the future, if necessary).

Decathlon, which services 40 shops from the facility as part of its ecommerce business, has an unexpired lease term of 6.7 years, with no breaks, with rent 100% linked to CPI. It also has an option to extend the building by 10,000 sqm.

The manager says that the low rent (€32/sqm) is very competitive and index-linked and that the extension option creates an opportunity to add value.

Erlensee

ASLI bought the asset, which comprises two multi-let buildings of 10,919 sqm and 15,431 sqm, for €32.3m. Built in 2018 to modern specifications, including a five tonne/sqm floor loading capacity and 50 loading doors, the asset is 26km north-east of Frankfurt.

The buildings have a WAULT of 7.6 years, with between 80% and 100% of rents linked to CPI. The tenants are:

- Bergler (a third-party logistics operator);

- DS Smith (a packaging company and FTSE100 Index constituent);

- Fenthol & Sandtman (a third-party logistics operator);

- Linde (a chemicals company); and

- MSG Frucht (a German fruit and vegetable supplier, and a subsidiary of Compass Group).

The manager says that the property is in a prime logistics location in an area with a strong economy. The tenant base is diversified (the largest accounts for no more than 30% of the rent). Rents are rising in the area and the rents for this asset are largely linked to inflation.

Krakow

Built in 2018, ASLI paid €24.5m for this asset, equivalent to a net initial yield of 6.8% (the highest in the portfolio). The 34,932 sqm building is located in an established logistics area alongside the A4 motorway, giving access to Germany, Wroclaw and Silesia and also benefits from proximity to Krakow and Katowice international airports.

It is a true multi-let asset, with nine tenants, including DS Smith (a tenant at Erlensee), which recently extended its lease by four years, and Lynka (a provider of textile printing services). The manager also recently let a vacant unit to Gebrüder Weiss on a new three-year lease ahead of previous rent and ERV. The asset has a WAULT of 3.1 years and all leases are 100% linked to CPI.

The flexible structure allows for future reconfiguration if required, the manager says. In addition, growing demand for logistics space in one of the most affluent urbanised areas of Poland, together with the diversified income stream make this a very attractive asset, the manager adds.

Meung-sur-Loire

The 30,180 sqm building, which was acquired by ASLI for €23.5m, is currently vacant after Office Depot France fell into administration in February 2021. Stationery and office supplies retailer Nouvelle Victoire acquired the majority of the Office Depot France business in March 2022 but terminated its tenancy of the warehouse. ASLI collected rent from the administrator up to the end of the first quarter of 2022.

The manager says that it is extensively marketing the property and has prepared the building for a new tenant, with works including removing the mezzanine level, installing LED lighting and repairing the floor. It adds that it is confident in re-letting the building. The location of the property close to Orleans, which can serve Paris as well as central and southern France, makes the site suitable as a national distribution centre, the manager adds.

Despite the loss of income at Meung sur Loire, the company passed the recent interest cover ratio (ICR) test on the debt facility (which is held against the property and ASLI’s Avignon asset). Income from the Avignon asset enabled the ICR covenant test to be met. The next ICR test is scheduled for September 2023.

Waddinxveen

Acquired for €33.0m, this asset, which was constructed in 1983 and part refurbished to modern specifications in 2018. In August 2022 ASLI completed a 2,557 sqm extension to the building, bringing the asset to a total size of 30,688 sqm, for €4.9m. The tenant, Combilo International (a fruit and vegetable import/export business), has signed a lease to run concurrently with its existing lease for an additional rent of €250,000 a year. The lease has 11.4 years left to run and is linked to CPI.

The asset, which has 51 loading doors in a cross-dock formation, is located within the Randstad conurbation of the Netherlands (8m consumers live within one hour’s driving distance). The extension complies with the latest energy neutrality standards in the Netherlands and includes 16 rooftop solar panels, which contributes to its A+++ energy rating.

The manager says that the low vacancy rate of around 2% in the Randstad area supports future rental growth, but in the meantime, the long index-linked lease with a strong covenant provides an attractive income stream.

Avignon

ASLI paid €44.5m for this asset, which comprises 28,571 sqm arranged as four cells, two of which (2/3 of floor space) are cold storage. It is located in the Noves suburb of Avignon with good road links to Marseille, Lyon and Montpellier.

The buildings have a WAULT of 9.3 years and rents are 100% linked to ILAT. The property is the headquarters of Biocoop, the leading organic supermarket in France with over 500 stores located across the country. It migrated its south-east distribution centre (one of four centres) to Noves from Sorgues, where it had an 18,000 sqm facility constructed in 1984.

The impact of cold storage usage on energy usage and carbon emission is offset by solar panels on the roof. The panels generate an additional annual income of €160,000.

The manager says that the building is of very high quality, being Biocoop’s HQ. Land supply in the area is constrained and the building comes with a tenant with a strong covenant and index-linked rent. The sustainability credentials of the building increase the stickiness of the tenant to the building.

Ede

The 39,840 sqm building, which ASLI paid €26.5m for, was originally constructed in 1999 but half of the building was fully refurbished in 2018.

The asset, which is centrally located within the Netherlands in an area of just 3.9% vacancy for logistics assets, has a WAULT of 5.5 years with no break and the rental income is 100% linked to CPI. The tenant is Kruidvat, a leading drugstore in the Netherlands and part of the AS Watson Group, which is using the facility for ecommerce related activities due to its central location in the Netherlands.

The manager likes the location, close to the main transport corridors towards Germany, the strong tenant covenant and the attractive yield (especially given the inflation-linkage and WAULT).

Flörsheim

Flörsheim was ASLI’s first acquisition, in February 2018. It paid €20.1m for the asset, which comprises two multi-let buildings of 10,762 sqm and 7,047 sqm and is located 15km from Frankfurt Airport.

The buildings have a WAULT of 6.3 years and rents are 100% linked to CPI. The tenants are: Maintrans (a third-party logistics firm); DuHome (an ecommerce retailer); Ernst Schmitz (a third-party logistics firm); Horiba (a global coatings and materials business); and Hangcha Europe (a forklift and material handling business).

The manager says that there is limited logistics capacity in the Rhine-Main region, with less than a 5% vacancy rate. The local economy is strong and the building is of good quality. The diversified tenant base and the CPI-linked rents are a further source of comfort, with market evidence showing growing rents in the area.

ESG

ASLI has made progress on the sustainability of its portfolio and once again improved its Global Real Estate Sustainability Benchmark (GRESB – a leading indicator for measuring green performance) score to 86 out of 100 (up from 84 in 2021). This placed it second in its peer group of six listed logistics strategies in Europe. It was also eighth out of 57 European industrial companies and sixth out of 94 in the listed European sector.

As a next step, the manager is working on defining a Net Zero Carbon strategy with reduction targets for the future. It is undertaking a portfolio analysis with a third-party specialist to collect data, analyse energy and water consumption and identify areas for improvement. Other sustainability initiatives include a significant roll-out of solar panel installations, which now exist on 11 properties within its portfolio, generating €260,000 of income annually and green energy for tenants, and LED lighting in all buildings.

Performance

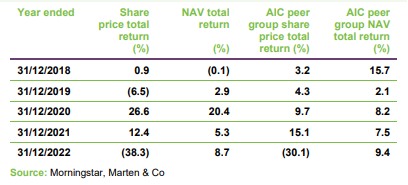

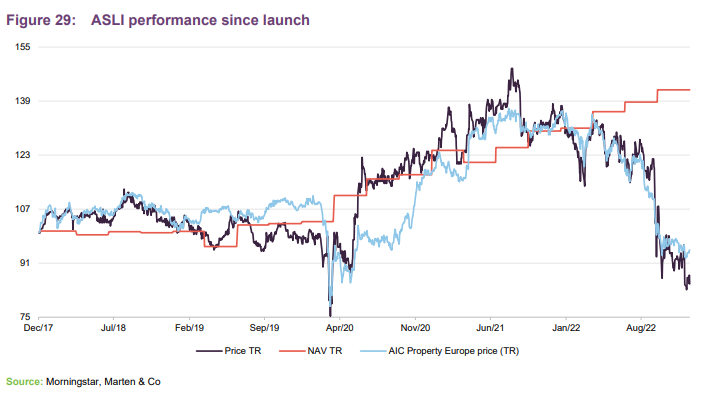

ASLI’s NAV initially made modest progress from launch, with rising property values offset by expenses incurred in establishing the portfolio. As the portfolio has expanded and valuations increased, the NAV total return has increased sharply and has continued its steady rise. The NAV is reported in both euro and sterling. The NAV in Figure 29 is in sterling and can be sensitive to the euro-sterling exchange rate. We have also compared ASLI’s share price total return with that of its AIC Property – Europe peer group. It had been outperforming the peer group for much of its life, but in recent weeks has fallen below the index.

Logistics peer group

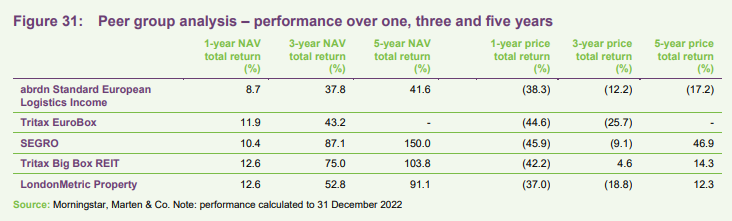

We have assembled a more comparable peer group of UK-listed, logistics-focused companies. Most of those investing in European logistics are unlisted funds or subsidiaries of larger groups. The listed peer group we have assembled consists of: Tritax EuroBox, ASLI’s closest peer; SEGRO, which owns a mixture of ‘big box’, urban and industrial space (about a third of which is located in continental Europe); Tritax Big Box; and LondonMetric Property. The latter two are UK-focused.

The share prices of all of the peer group have suffered in recent months, with discounts widening. ASLI’s discount is one of the narrowest of the peer group, but it has one of the largest dividend yields. Over the last three and five years it has produced solid NAV total returns, while its share price has been less affected than others in the peer group over the shorter term.

Dividend

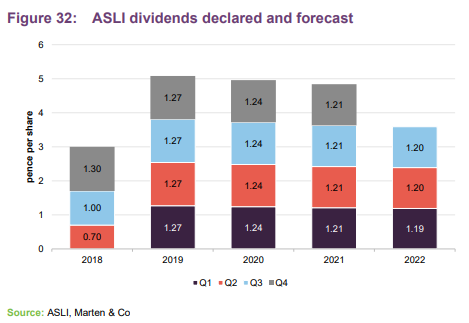

ASLI declared a quarterly dividend of 1.41 euro cents (1.20p) per share for the third quarter of 2022 and is targeting an annual dividend of 5.64 euro cents per share – the same as in the past three financial years. The company paid 3p per share in the period from launch to 31 December 2018, 5.64 euro cents (5.08p) per share in distributions in respect of the year to 31 December 2019 (achieving its target of 5% of the IPO price), 5.64 euro cents (4.96p) per share in respect of 2020 and 5.64 euro cents (4.84p) for 2021.

References to ‘dividends’ in this note cover both dividend income and income which is designated as an interest distribution for UK tax purposes, and therefore subject to the interest-streaming regime applicable to investment trusts.

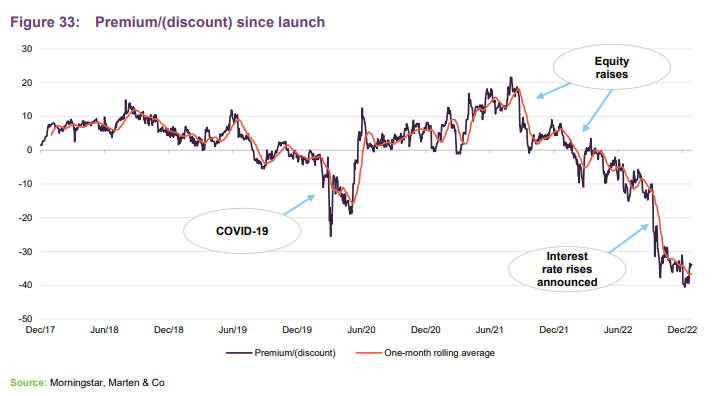

Premium/(discount)

ASLI almost exclusively traded at a premium following its launch. Following the blip at the start of the COVID-19 pandemic, its rating moved to a premium, which it enjoyed for around 18 months. Its premium narrowed following its equity raise in September 2021 and moved into a discount after its February 2022 issuance. Rising interest rates and its impact on the real estate sector may have hit investor sentiment to the logistics sector and the discount has widened further. On 11 January 2023 it was trading at a 34.0% discount to sterling NAV.

In the event that the ordinary shares trade at a premium, ASLI has the authority from shareholders to issue new shares that could be used to satisfy any excess market demand.

Similarly, should the shares trade at a discount, ASLI has authority to repurchase up to 14.99% of its issued share capital. ASLI says that the directors will consider repurchasing ordinary shares in the market if they believe it to be in shareholders’ interests and as a means of correcting any imbalance between the supply of and demand for the ordinary shares.

Fees and costs

The AIFM is a subsidiary of abrdn, sub-delegating investment management to a subsidiary based in Dublin. Under the terms of the management agreement, as amended in December 2018, the AIFM is entitled to receive a tiered annual management fee as follows:

- 0.75% of net assets up to €1.25bn

- 0.60% of any net assets in excess of €1.25bn.

The annual management fee is calculated and paid quarterly in arrears and there is no performance fee. The management agreement can be terminated on 12 months’ notice, by either side. The AIFM provides services in respect of company secretarial services, day-to-day administration, accounts preparation and NAV publication. The accounting and administrative functions are delegated to Brown Brothers Harriman.

Capital structure and life

ASLI has 412,174,356 ordinary shares in issue and no other classes of share capital. The fund’s year end is 31 December. It published its annual report in May 2022 and held its AGM in June 2022.

Borrowing

ASLI uses gearing with the aim of enhancing shareholder returns. All financing decisions are organised by the manager’s in-house treasury team (located in Frankfurt, London and Edinburgh) and must be approved by the investment committee.

ASLI has total fixed-term debt arrangements of €261.6m and a loan to value (LTV – debt relative to gross assets) of 35% at 30 September 2022, which is within its long-term target of 35%. The debt is typically held at the asset level, rather than the company level. Borrowings are secured against individual assets or groups of assets with cross-collateralisation. The loans are fixed with an average all-in cost of 2.0% and a remaining maturity of 3.5 years.

The company also has a €70m revolving credit facility (RCF) with Investec Bank held at the parent company level. Under the facility, the company can make requests for drawdowns at selected short-duration tenors, as and when required, to fund acquisitions or for other liquidity requirements. Drawings of €50m, now repaid, financed the development of phase four of the Madrid portfolio let to Amazon.

Aggregate borrowings will always be subject to an absolute maximum, calculated at the time of drawdown, of 50% of gross assets. Furthermore, where borrowings are secured against a group of assets, any such group of assets shall not exceed 25% of ASLI’s gross assets so as to ensure that investment risk remains suitably spread.

Continuation vote at sixth AGM

ASLI has an unlimited life, but shareholders will be offered a continuation vote at the company’s sixth AGM following admission (in 2023). Thereafter, shareholders are to be offered continuation votes at three-yearly intervals. In the event that a continuation resolution fails to pass, the directors will cease further investment, the properties in the portfolio will be sold in an orderly fashion and the net funds available for distribution will be returned to shareholders.

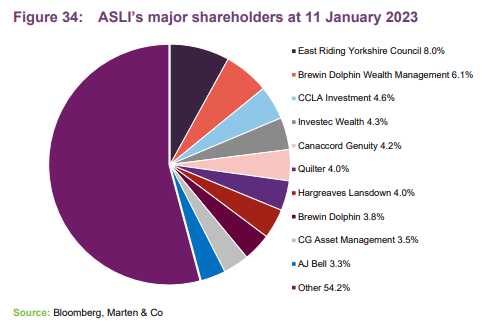

Major shareholders

The investment team

ASLI’s investment team is made up of Troels Andersen (fund manager), Geoff Hepburn (deputy fund manager) and Attila Molnár (deputy fund manager). The team has over 60 years’ combined experience of investing in European logistics and commercial real estate, and abrdn is currently managing €17bn of logistics warehouses in Europe.

Troels Andersen – fund manager (Copenhagen)

Troels is the primary fund manager responsible for the company’s portfolio. He replaced Evert Castelein (who had been fund manager since the fund launched in 2017) earlier this month after Evert’s resignation. Since 2019 Troels had been fund manager of abrdn’s multi-sector European Long Income Real Estate Fund, which has a gross asset value of €150m, having successfully overseen its launch. Prior to this, he was fund manager of abrdn’s €500m gross asset value Aberdeen Property Nordic I Fund, together with a further segregated value-add mandate. He was previously a member of abrdn´s Nordic and European Investment Committees, which approve all major decisions for investments in the region. Troels has 25 years of real estate investment experience, including logistics asset transactions, together with knowledge of debt facility management, having spent the first part of his career working for German banks in both Germany and the UK.

Geoff Hepburn – deputy fund manager (Edinburgh)

Geoff is deputy fund manager of ASLI. His responsibilities include developing and implementing fund strategy, client reporting, managing transactions and ensuring the delivery of the ESG strategy. Since joining abrdn in January 2012 he has been investment manager and deputy fund manager for several balanced UK institutional funds. Prior to joining abrdn, Geoff worked at a London property company as development & investment manager responsible for two large central London office projects as well as a mixed-use regional investment and development portfolio. Previously, Geoff worked for Ediston Properties having begun his client-side career at Standard Life Investments as portfolio manager on the Pooled Pension Fund in 2001. Over his career spanning more than 20 years, he has transacted and developed over £1bn of real estate. He qualified as a chartered surveyor (MRICS) in 2001, and speaks English and French.

Attila Molnár – deputy fund manager (Frankfurt)

Attila is fund manager at Aberdeen Immobilien KAG, based in Frankfurt, Germany. Attila joined Dresdner Bank’s property fund management business (DEGI) in 2006, shortly before the business was acquired by Aberdeen. He has been involved from the beginning in the planning and establishment of new product lines for institutional clients and joined the fund management teams of those funds. Now he is responsible for two institutional funds. Prior to this, Attila worked for PricewaterhouseCoopers where he was responsible for diverse audit and due diligence projects in the property fund business. Attila graduated with an MSc in Accounting and Finance from Budapest University of Economics, and speaks German, Hungarian and English.

abrdn Real Estate

abrdn Real Estate is the second-largest European real estate investment manager, with total direct real estate assets under management of €45bn. It has an extensive regional presence with offices in eight countries across the UK and continental Europe. The pan-European real estate team is comprised of over 225 real estate professionals with expertise in fund management, research, transactions, asset management, financing and other specialist property activities. The manager says that having teams in the key target markets in which the company proposes to invest provides a significant competitive advantage, with improved local market knowledge, better access to potential deals, closer implementation of asset business plans and improved ability to manage and mitigate risk.

Board

The ASLI board has four members. Tony Roper was appointed chairman following the company’s AGM in June 2019. All directors are independent of the manager and do not sit together on other boards.

Tony Roper

Tony started his career as a structural engineer with Ove Arup and Partners in 1983. In 1994 he joined John Laing Plc to review and make equity investments in infrastructure projects both in the UK and abroad. In 2006, Tony joined HSBC Specialist Investments (part of the HSBC Holdings group) to be the fund manager for HICL Infrastructure Company Limited, and continued in this role until May 2017, during which time HICL grew from £250m to circa £2.8bn. In 2011, he was part of the senior management team that bought HSBC Specialist Investments from HSBC, renaming it InfraRed Capital Partners. Tony was a Managing Partner and a senior member of the infrastructure management team at InfraRed Capital Partners until June 2018, and remains a non-executive director for them on Affinity Water Limited. He holds a MA in Engineering from Cambridge University and is an ACMA.

Caroline Gulliver

Caroline is a chartered accountant with over 25 years’ experience at Ernst & Young LLP, latterly as an executive director before leaving in 2012. During that time, she specialised in the asset management sector and developed an extensive experience of investment trusts. She was a member of The Association of Investment Companies’ Technical Committee and also the AIC SORP working party for the revision to the 2009 investment trust SORP. Caroline is also a non-executive director and audit committee chair for JP Morgan Global Emerging Markets Income Trust Plc, International Biotechnology Trust Plc and Civitas Social Housing Plc.

John Heawood

John has 40 years’ experience as a Chartered Surveyor, advising a broad range of investors, developers and occupiers. In 1987 he became a partner, and subsequently a director, of DTZ, responsible for the London-based team dealing with industrial, logistics and business park projects across the UK. John was appointed to the board of SEGRO plc in 1996 and was responsible for its UK business for the next 12 years. From 2009–2013 he was managing director of the Ashtenne Industrial Fund a £500m multi-let industrial and logistics portfolio managed by Aviva on behalf of 13 institutional investors. John is currently a member of council and the finance and general purposes committee of the Royal Veterinary College and a trustee of Marshalls Charity, a Southwark-based charity established in 1631. He holds a BSc in Estate Management and an MSc in Rural Planning Studies from the University of Reading.

Diane Wilde

Diane has over 30 years’ experience of managing equity, balanced and multi-asset funds in both the asset management and wealth management sectors. She was managing director at Gartmore Scotland Ltd, managing investment trust assets on behalf of the company from 1993 to 2000. Following a period of managing similar assets at Aberdeen Asset Managers between 2000 and 2003, she joined Barclays Wealth as Head of Endowment Funds in Scotland. A former member of the Pension Fund Advisory Committee to the Barclays Bank UK Retirement Fund, Diane was a senior adviser at Allenbridge, an investment consulting firm, until May 2018. She is also a board member of the Social Growth Fund, managed by Social Investment Scotland (SIS), a leading social enterprise and impact investor in Scotland and the United Kingdom. Diane holds a BA in Economics and Social Administration from the University of Strathclyde.

Previous publications

QuotedData has published six previous notes on ASLI. You can read them by clicking the links below.

Figure 36: QuotedData’s previously published notes on ASLI

Source: Marten & Co |

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on abrdn European Logistics Income Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.