abrdn European Logistics Income

Real estate | Update | 23 June 2023

Riding out the storm

abrdn European Logistics Income (ASLI) is riding out the storm of market valuation declines, with a focus on managing its portfolio and securing income. It has recently completed a number of letting renewals across its portfolio (see page 9) and uncapped, annual inflation-linked rental uplifts on two-thirds of its leases offer further promise. Evidence that valuations in the European logistics real estate sector are stabilising is growing, not least through the sale of an asset from ASLI’s portfolio at a small premium to book value, which should serve to support its net asset value (NAV).

The sale of the mid-box property in Leon, northern Spain, formed part of the group’s strategic pivot to urban logistics properties, where the supply-demand dynamic is favourable and rental growth prospects are strong. The transaction improves the company’s cash position (thereby lowering its loan-to-value ratio – LTV) and reduces the company’s all-in interest rate to 1.97% – one of the lowest in the real estate sector (with its first refinancing event not until mid-2025).

Mid box and urban logistics across Europe

ASLI invests in – and actively asset-manages – a diversified portfolio of logistics real estate assets in Europe, with the aim of providing its shareholders with a regular and attractive level of income return, together with the potential for long-term income and capital growth (target total return of 7.5% a year in euros).

Market overview

Valuations in the European logistics property sector have tumbled over the past two quarters as investment yields moved outwards in response to higher interest rates (property yields are intrinsically linked to the interest rate and should offer a greater return due to the risk involved – therefore if interest rates go up, so too will property valuation yields). This was reflected in ASLI’s portfolio value which fell 10.5% in the six months to 31 March 2023. European logistics valuation movements seem to be trending one quarter behind the UK, which has seen a larger and swifter correction than on the continent at around 26% in the final six months of 2022. This was due to a demonstrably wider yield spread (prime logistics yields minus total financing cost) in the UK compared to Europe in the lead-up to rising interest rates.

Values seem to have started to stabilise in the UK at the end of the first quarter of 2023, and the manager believes that the European logistics sector has now taken the brunt of valuation declines and a stabilisation in values is close. This was evidenced by the sale of one of ASLI’s assets in Spain, which sold at a 3% premium to the 31 December 2022 valuation and a slight premium to the March 2023 book value (see page 9 for more details). Further deals are occurring in the wider market, suggesting that fair value is approaching.

Higher interest rates are starting to have the desired impact on inflation in the eurozone, which fell to 6.1% in May, from 7% in April. Inflation expectations are trending downward and the recent fall in energy prices is positive news. Both food and energy prices, which were major contributors to last year’s inflation, now account for a considerably smaller share of the overall inflation rate.

The correction in values within the logistics sector will be polarised, the manager says. Newer assets in good locations, with strong supply-demand fundamentals, are still sought after by investors and have been less affected by yield expansion than assets that do not display these characteristics – where yield expansion has been greater. The manager says that ultimately this is a good thing, as before the valuation correction, investors were not pricing in risk in their clamour to invest in the logistics sector.

Occupier markets

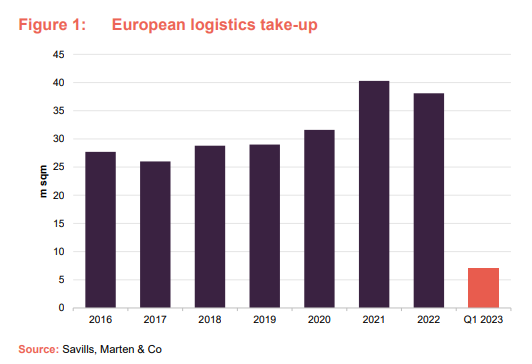

Economic uncertainty has started to permeate into European logistics take-up figures. In the first quarter of 2023, take-up amounted to 7.0m sqm, reflecting a 16% decline compared to the five-year first quarter average, according to research by Savills. This was a year-on-year decline of 37% (against the strongest first quarter on record). The take-up figure is back to pre-COVID norms, however, with figures in line with the three years prior to the pandemic.

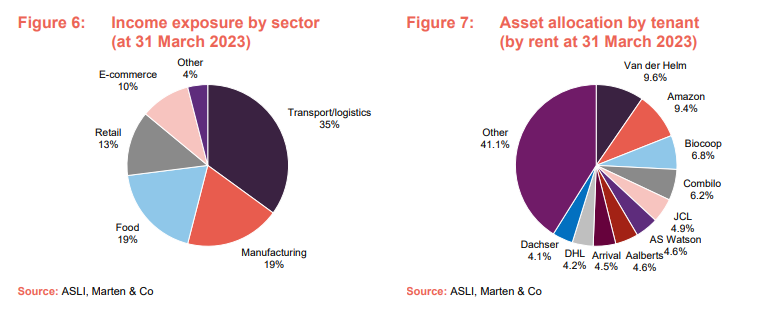

Savills says that cost-consciousness has returned to the occupier mindset, which mainly impacted demand for big-box units in the first quarter, which typically require significant capital expenditure for fit-out costs, Savills adds. ASLI’s portfolio is exclusively focused on mid-box (between 10,000 sqm and 40,000 sqm) and urban (typically between 5,000 sqm and 20,000 sqm) assets, where the manager says the occupier market is more liquid (more detail on the portfolio make-up is on page 8).

The macroeconomic outlook is expected to improve later this year, which the manager expects to be a catalyst for more leasing activity.

Two of the main drivers of demand for logistics space have still some way to play out, the manager says. The growth in e-commerce has fuelled take-up and growth of the sector over the last few years, but the demographics point to continued growth in online sales over the long-term. A simplified way of looking at it is that a 40-year-old today will spend more online in 10 years’ time than a 50-year-old does today.

The second driver of demand for logistics space is a ‘re-shoring’ of manufacturing from Asia. This trend has been commented on for a number of years, since the COVID pandemic exposed the weakness in supply chains. There are factors other than supply chain resilience that point to an uplift in manufacturing demand in Europe. Firstly, labour costs in Asia have increased exponentially in recent years (for example, Chinese labour costs have risen 250% in 20 years) meaning it is less attractive to base manufacturing in the Far East. Secondly, it is carbon-intensive to move containers around the world (international trade accounts for 20% to 30% of global carbon emissions) and as carbon emissions ratchet up the agenda of manufacturers, shipping cargo around the world has become less acceptable.

Vacancy trending slightly upwards

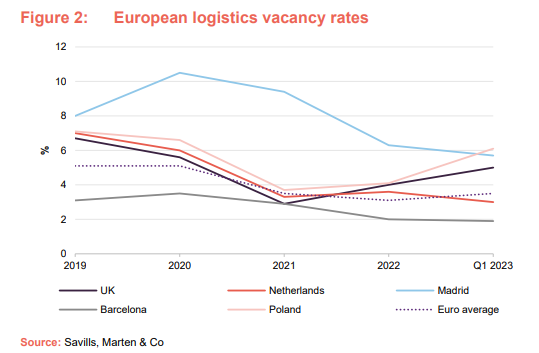

Slower leasing levels has seen vacancy of European logistics space move up slightly, from record lows. The average vacancy rate across Europe increased from 3.1% to 3.5% in the first quarter of 2023, reflecting the impact of slower leasing activity. Also impacting vacancy was the completion of developments that started over the last year. However, the vacancy rate is still at historic lows and critically low in some markets, according to Savills. Vacancy rates are likely to rise slightly in the second quarter of 2023 until a slowdown in construction starts translates into reduced completions later in the year.

Figure 2 shows that the Netherlands (where around 30% of ASLI’s portfolio is located) and Madrid (where around 30% is located) are continuing to see vacancy rates fall – both by 60 basis points (bps – the equivalent of 0.6%) in the first quarter. While vacancy rates are rising in most other markets, Savills states that constrained development over the past decade and strong take-up in recent years allow for further rate increases without triggering a fall in rents. In fact, economic uncertainty has halted speculative development across the continent, which will mean that the impact of new vacant space will be negligible next year.

Rental growth still being achieved

Despite rising vacancy rates, prime rents in Europe increased by 10.4% over the 12 months to 31 March 2023, according to Savills. This, it says, suggests that even with declining take-up, landlords can still demand higher headline rents due to vacancy rates being below their ‘natural’ level and low in a historical context. In this regard, rents continued to grow in the first quarter of 2023, rising by 4.7%.

All of ASLI’s leases are index-linked to the equivalent of CPI, with 65% uncapped. A further 27% has a cap in place of between 2% and 3%. The manager says that it plans to pass on inflation uplifts in annual rent reviews and estimates that rental growth from indexation in 2023 will be 5%. The manager says that affordability of rents for tenants is an important consideration when increasing rents, but adds that the logistics properties are critical to the success of its tenants and that rent is often a smaller portion of overall operating expenses for companies, between 3% and 6%, limiting the impact especially for companies with pricing power in their particular market. The biggest cost is transportation and energy, which accounts for between 40% and 70% of overall costs. Location over rent, therefore, is mission-critical for e-commerce companies, the manager adds.

Investment stalls but signs of activity returning

Investment volumes in the first three months of 2023 came to a virtual standstill, with just €5.1bn transacted in the quarter. This followed a marked slowdown in the fourth quarter of 2022 (€10bn) as the impact of higher interest rates took effect and a period of price discovery ensued. As mentioned earlier, there have been positive signs that prices have reached fair value, with deals starting to happen again – not least with ASLI’s recent asset sale (more details on page 9). The €5.1bn transacted in the first quarter was a 49% decline quarter-on-quarter and a 73% fall compared to the same period in 2022 (which was a record high).

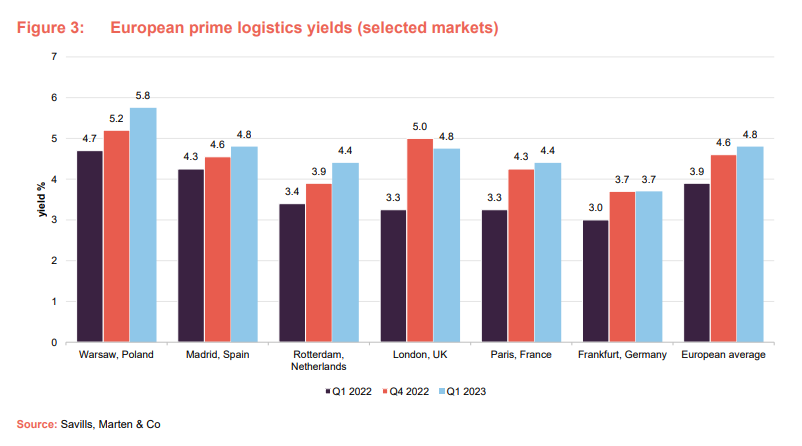

Figure 3 shows that prime yields were flat in most markets in the first quarter, with the average prime yield for European logistics assets rising to 4.8%. This translates to an increase of 21bps over the quarter and 93bps in the last year. Despite this, average European prime yields remain more than 60bps below the pre-COVID average of 5.38% between 2017 and 2019.

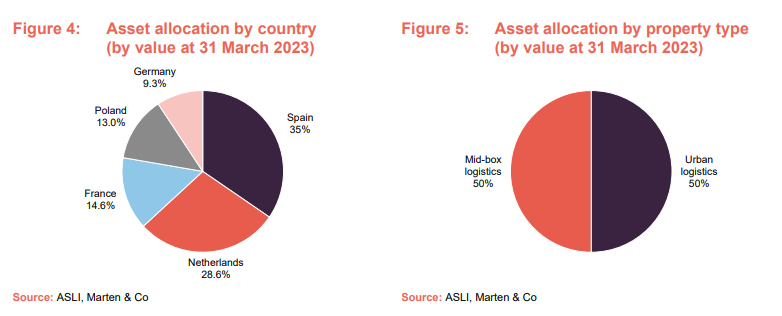

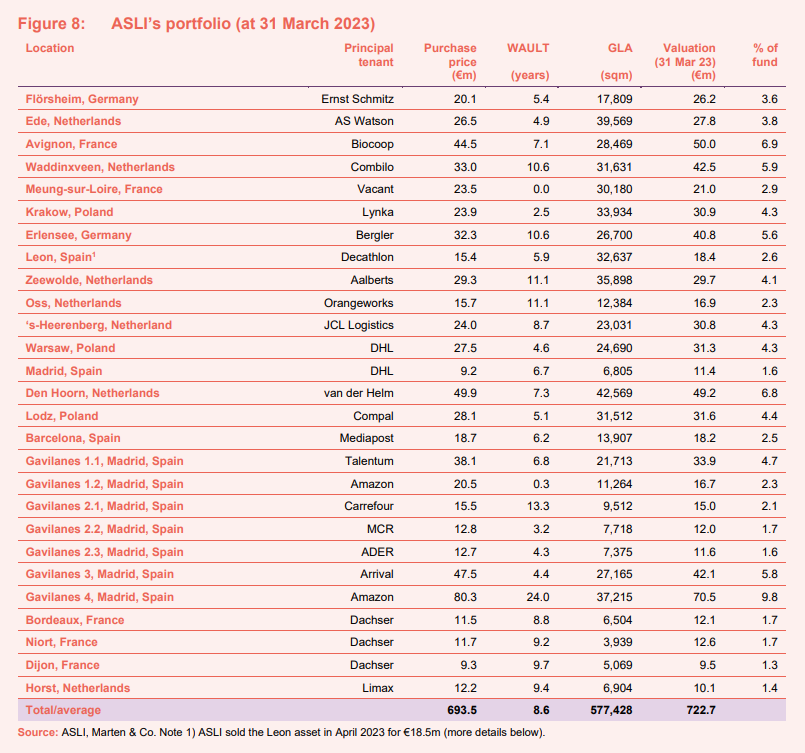

Asset allocation

ASLI’s portfolio consisted of 27 assets valued at €722.7m (at 31 March 2023) and located across five European countries. ASLI’s portfolio has 60 tenancies across 50 tenants, with Amazon being one of its largest tenants by income, and has a WAULT of just under nine years to lease expiry. Urban logistics assets make up 50% of the portfolio where the manager believes greater growth potential exists, as mentioned above.

All of ASLI’s income is linked to inflation, with 65% uncapped – meaning it will rise in line with the relevant inflation index in place in that country. A further 27% of the income is inflation-linked with a cap in place – between 2% and 3% per annum.

Details on each individual asset can be found in our last annual overview note, published in January 2023 (a link to which can be found on page 14).

The value of ASLI’s portfolio fell by 4.7% to €722.7m in the first quarter of 2023, following a 6.0% drop in the fourth quarter of 2022, reflecting the continued outward yield movements due to higher interest rates. The manager believes that values are stabilising (as demonstrated by the sale of its Leon asset for a small premium to book value – more details below) and that the worst of value declines are over.

The most significant change in the composition of the portfolio since our last note was the sale of the asset in Leon, northern Spain. The company completed the deal in April for €18.5m (a small premium to the most recent valuation). This represented the company’s first disposal from its portfolio and crystalised a 20% gross profit on the acquisition price of €15.4m.

The manager made the decision to sell the asset as it was one of the more mature in the portfolio (having been acquired in 2018) and the sale formed part of the group’s more recent strategic pivot to smaller, urban logistics properties. The sale, slightly above the book value at 31 March 2023, also validates the portfolio values. The transaction improves the company’s cash position (thereby lowering its LTV to 34.7%), and an adjustment to the fixed term debt arrangement over the asset reduces the company’s all-in interest rate to 1.97% – one of the lowest in the real estate sector (with its first refinancing event not until mid-2025).

Focus on income

Asset management initiatives that have recently been executed include:

- a new 9.5-year lease with Dachser at the Niort asset, in France. The rent is 3% ahead of previous annual rent and significantly ahead of estimated rental value (ERV), which the manager says reflects the tenant critical nature of the asset, the strategic significance of the location and the continued upward pressure on real rents. Uncapped annual ILAT indexation has been agreed, with the next uplift effective 2025 (which will be backdated to January 2023 when calculated);

- a new 12-year lease with Biocoop at the Avignon property, in France, generating annual contracted rent of €2.5m, equating to €86 per sqm with full annual French ILAT indexation and no cap. The climate-controlled facility serves a network of over 570 organic food stores. The property also generates €165,000 per annum of additional income from rooftop solar panels; and

- a five-year lease extension with AS Watson at the Ede asset, in the Netherlands. The new deal extends the lease expiry from 2028 to July 2033 and will generate additional income 4% above the previous passing rent. It provides for future upward-only indexation capped at 4% per annum.

The manager is in advanced discussions with a party to lease the group’s Meung-sur-Loire property in France, which has been vacant since Office Depot France fell into administration in February 2021 (although ASLI collected rent from the administrator up to the end of the first quarter of 2022). The manager says that it is confident in re-letting the building, due to the location of the property close to Orleans, which can serve Paris as well as central and southern France, making it suitable as a national distribution centre. A sale of the asset is not off the table, if the right offer came in, the manager adds.

Two buildings in the Gavilanes portfolio, in Madrid, Spain – measuring 27,165 sqm – are let to Nasdaq-listed Arrival, which makes electric delivery vans. The company has stated that it will draw back from its European operations. Both properties are let to Arrival until 2031. The manager expects that the two parties will negotiate a lease surrender (whereby ASLI will receive a premium from Arrival to exit the lease contract). The manager says that Madrid is one of the most supply-constrained markets in Europe, with good demand levels.

Environmental, social and governance (ESG)

ASLI has made strong progress on the sustainability of its portfolio and improved its Global Real Estate Sustainability Benchmark (GRESB – a leading indicator for measuring green performance) score to 86 out of 100 in 2022 (up from 84 in 2021). This placed it second in its peer group of six listed logistics strategies in Europe. It was also eighth out of 57 European industrial companies and sixth out of 94 in the listed European sector.

As a next step, the manager is working on defining a Net Zero Carbon strategy with reduction targets for the future. It is undertaking a portfolio analysis with a third-party specialist to collect data, analyse energy and water consumption and identify areas for improvement. Other sustainability initiatives include a significant roll-out of solar panel installations, which now exist on 11 properties within its portfolio, generating €260,000 of income annually and green energy for tenants, and LED lighting in all buildings.

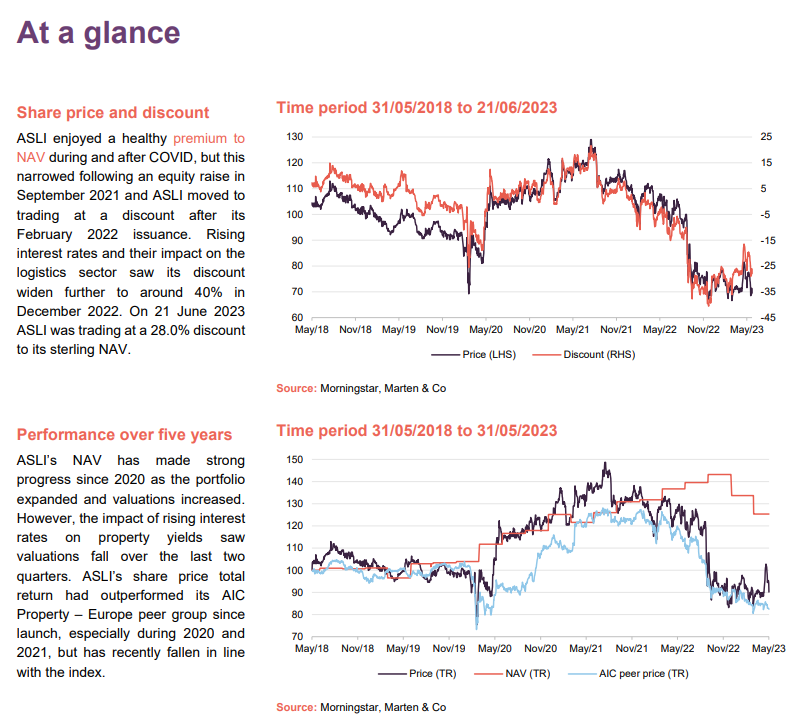

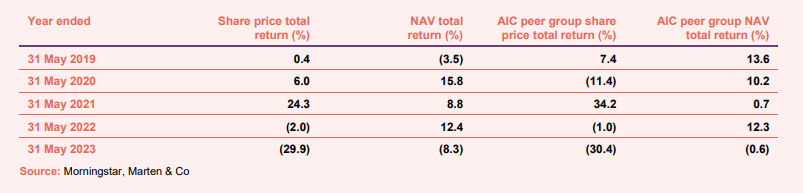

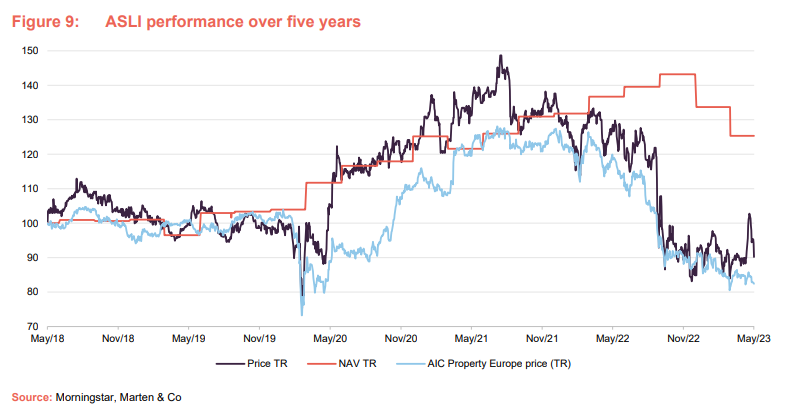

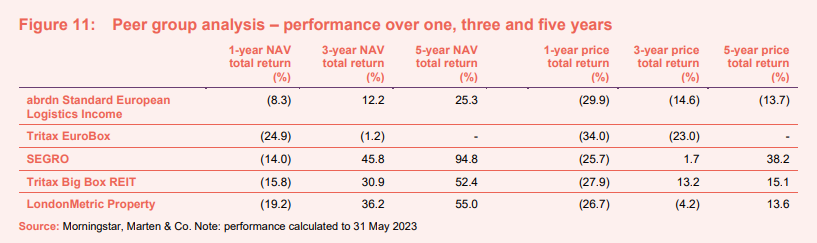

Performance

ASLI’s NAV has made strong progress since 2020 as the portfolio expanded and valuations increased. However, the impact of rising interest rates on property yields saw valuations fall over the last two quarters. The NAV is reported in both euro and sterling. The NAV in Figure 9 is in sterling and can be sensitive to the euro-sterling exchange rate. We have also compared ASLI’s share price total return with that of its AIC Property – Europe peer group. It had been outperforming the peer group since launch, especially during 2020 and 2021, but has recently fallen in line with the index.

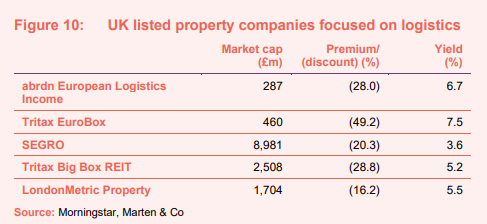

Logistics peer group

We have assembled a more comparable peer group of UK-listed, logistics-focused companies. Most of those investing in European logistics are unlisted funds or subsidiaries of larger groups. The listed peer group we have assembled consists of: Tritax EuroBox, ASLI’s closest peer; SEGRO, which owns a mixture of ‘big box’, urban and industrial space (about a third of which is located in continental Europe); Tritax Big Box; and LondonMetric Property. The latter two are UK-focused.

The share prices of all of the peer group have suffered in recent months, with discounts widening. ASLI is on the smaller end of the peer group, but has an attractive dividend yield and strong longer-term growth potential.

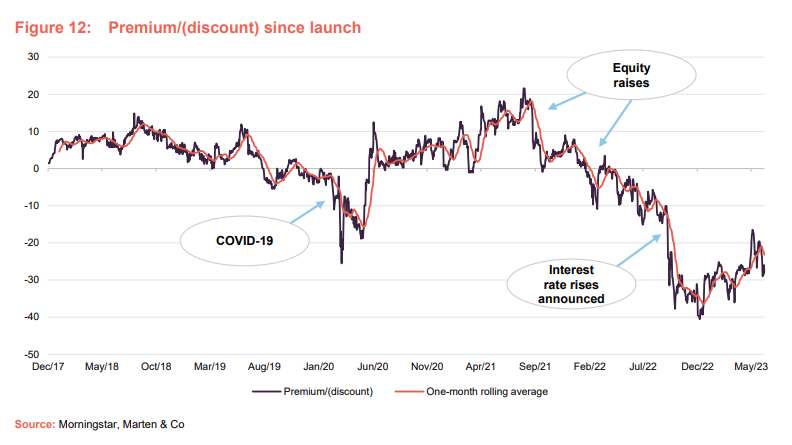

Premium/(discount)

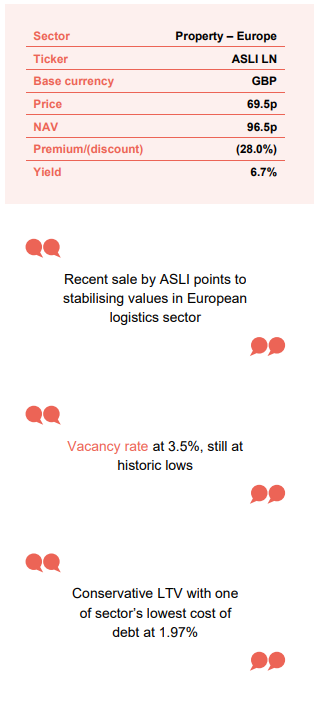

ASLI almost exclusively traded at a premium to NAV following its launch. Following the blip at the start of the COVID-19 pandemic, its rating moved to a premium, which it enjoyed for around 18 months. Its premium narrowed following its equity raise in September 2021 and moved into a discount after its February 2022 issuance. Rising interest rates and its impact on the logistics sector saw its discount widen further to around 40% in December 2022. On 21 June 2023 ASLI was trading at a 28.0% discount to sterling NAV, following a fall in NAV and a rise in share price in recent weeks.

Fund profile

ASLI invests in a portfolio of European urban mid-box logistics assets, diversified by both geography and tenant, with a focus on well-located assets at established distribution hubs and within population centres. ASLI’s aim is to provide its shareholders with a regular and attractive level of stable income return, together with the potential for long-term income and capital growth (it has targeted a total return of 7.5% a year in euros). ASLI benefits from inflation-linked leases across its portfolio.

ASLI has an annual dividend yield target of 5% for an investor in the company at launch. Quarterly dividends are expected to be consistent with the annual underlying levered portfolio return. Dividends have historically been paid in sterling, with the assets and the income derived from them predominantly in euros. The manager may use currency hedging to help reduce the volatility of the income, but there is no current intention to hedge the capital value of the portfolio. Shareholders are also able to elect to receive distributions in euros.

ASLI’s portfolio management services are undertaken by abrdn, led by fund manager Troels Andersen, who replaced Evert Castelein in October 2022. The core fund management team also includes deputy fund managers Geoff Hepburn and Attila Molnar. abrdn Real Estate is the second-largest European real estate investment manager, managing €45bn of real estate, and has an extensive regional presence, with over 225 real estate investment professionals and offices in eight countries across Europe.

Previous publications

QuotedData has published seven previous notes on ASLI. You can read them by clicking the links below.

Figure 13: QuotedData’s previously published notes on ASLI

Source: Marten & Co |

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on abrdn European Logistics Income.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.