abrdn Property Income Trust

REITs | Update | 16 August 2023

Ready and waiting

Negative investor sentiment towards the commercial real estate sector appears to be behind the discounts to NAV among REITs and listed property companies remaining excessively wide, including abrdn Property Income Trust (API). This is despite a large valuation correction at the end of 2022 and transactional evidence of value stabilisation. API’s manager says that a re-rating of the sector and API’s shares should be triggered by market indications that interest rates have peaked, so promising inflation data for June was encouraging, it adds.

For API’s manager, the focus continues to be on growing income, and on that front it has carried out several asset management initiatives within the portfolio, especially within its office portfolio, that has seen its vacancy rate drop to below 5%. Additional rental reversion potential across the wider portfolio may encourage further positivity.

UK commercial property exposure

API aims to generate an attractive level of income, along with the prospect of both income and capital growth, by investing in a diversified portfolio of UK commercial property assets, in the industrial, office, retail and alternative sectors. API uses gearing with the aim of enhancing returns, with the current loan-to-value (LTV) ratio at 28.1%.

Market outlook

The UK property sector went through a swift valuation correction at the end of 2022. The manager says that high interest rates and the gloomy outlook for further rate hikes to bring inflation under control has driven investor sentiment towards the commercial real estate sector to levels not seen since the global financial crisis.

However, the latest UK inflation numbers were cause for optimism in the commercial real estate sector, it adds. CPI for June was 7.9%, down from 8.7% in May, which the manager says may be the first real positive indication that stubbornly high inflation in the UK could be on a meaningful downward trajectory.

SONIA five-year swaps rates have fallen back to around 4.7% – from a peak of more than 6% – as it appears that optimism is growing that further Bank of England rate rises may be off the table.

Investor sentiment toward property still weak despite values stabilising.

REITs and listed property companies have been trading on substantially wide discounts to NAV. This is despite the rapid valuation fall at the end of 2022 (of around 26% between July and December according to MSCI) and a number of REIT assets sales that have completed in recent months at or above book value (which should validate valuations, according to the manager). API’s manager, Jason Baggaley, says that the pace of the value correction should have given the market confidence that proper mark to market valuation was being applied (which has taken longer in the past) and in the NAVs themselves.

There have been numerous sales across all sectors in recent months, which have been transacted at or above the independent asset valuation at 31 March 2023. These include:

- UK Commercial Property REIT’s £74m sale of a logistics asset in Wembley at a 3.5% net initial yield in May – in line with the March valuation;

- LondonMetric’s sale of a number of assets (mainly industrial) for a total of £64m and 1% ahead of March book value;

- Warehouse REIT’s sales of £29.9m of property at a 17% premium to March valuations;

- LXI REIT’s sale of a retail park for £31m, at a 4.7% net initial yield, inline with the March book value; and

- NewRiver REIT’s sale of two retail parks for £62.6m, just 2.8% below the March valuations.

The manager says that despite the swift valuation correction at the end of 2022 and the stabilisation experienced since, it seems investor sentiment towards the sector has yet to pick up. It believes that significant movements in SONIA, which will indicate when the market has confidence that rates have peaked, could be the trigger for an improvement in investor sentiment and a re-rating.

Investment volumes down but values stabilising

Investment down 40% in first half of the year.

At between £14bn and £15bn, investment in UK commercial real estate in the first half of 2023 is expected to be 40% lower than the five-year average, according to Savills. Both volumes and deal count are down, suggesting that investors generally adopting a ‘wait and see’ approach. The UK average prime yield edged out slightly in June and is now 5.8%, almost 100bps higher than 12 months ago.

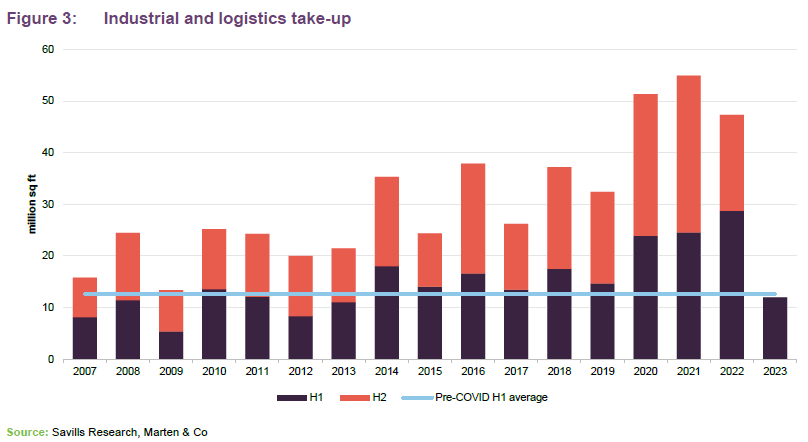

As mentioned above, there are deals taking place, with the industrial and logistics sector the most liquid sub-sector – which the manager puts down to the continued positive occupier fundamentals making the corrected valuations appealing to investors. Investment volumes in the sub-sector are down on recent record-breaking years, but have returned to pre-COVID levels. The retail park sector is also fairly liquid (relatively speaking) but does not have the same rental growth prospects of the industrial and logistics sector, the manager adds.

API’s manager says that investor appetite for offices is extremely low due to uncertainty around demand (impacted by the developing hybrid working trends, sustainability of buildings and a potential economic downturn). It comments that there are very few buyers for office assets, and those that are in the market are looking for bargains, while those that are selling are forced sellers.

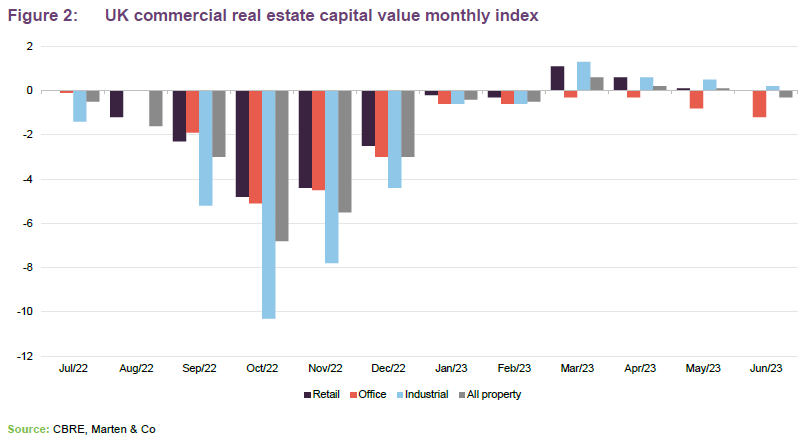

Figure 2 shows monthly capital value moves over the past year, according to CBRE. Values have stabilised in recent months, having fallen dramatically over the four months between September 2022 and December 2022. Values in the industrial sector – and, to a lesser degree, retail – have picked up, while offices have continued to decline.

The manager believes that value recovery will continue to be asymmetric, with those sectors which benefit from positive underlying fundamentals and experienced the largest correction in capital values in late 2022 likely to see a more pronounced recovery – specifically industrial and logistics, supermarket, and retail parks. The manager anticipates that further capital value declines will continue for secondary offices, which remain under structural pressure.

Occupier markets diverge

Industrial market continues to display strong occupier fundamentals.

Like the divergence across sectors in the investment market, a similar pattern exits in the occupier markets, according to the manager. It observes that the industrial and logistics sector continues to display strong occupier fundamentals. Demand has remained robust, with take up over the first half of the year just shy of the pre-COVID average (although down on recent years), according to Savills. Meanwhile, supply has moved up to 6.75%, which Savills expects to start trending downwards again due to healthy occupier requirement levels and very limited new developments scheduled (exacerbated by increased cost of development). This makes the sector well-placed for further rental growth, the manager says. API, whose portfolio is 54.1% weighted to industrial assets, has recently concluded rent reviews within its industrial portfolio at a 40% and 20% uplift in rent.

While demand for office space is struggling.

Lettings in the office sector have been few and far between, the manager says. This has been more evident in the secondary end of the market, it adds, with demand for ‘best-in-class’ assets proving more resilient. Tight supply of best-in-class accommodation should insulate Grade A rental values, the manager predicts, but a decline in secondary office rents is expected. It says that the sector is still in a state of flux following the pandemic and the growth in hybrid working. The manager believes that some downsizing may take place and that buildings with large floorplates are most at risk. Demand for offices with smaller floorplates and fitted solutions should hold up, the manager adds. This is evidenced in API’s office portfolio, where several offices lettings have completed in recent months (more details can be found on page 9).

An ongoing occupier trend across all sectors will continue to be the sustainability of buildings, the manager believes. Both occupiers and investors are putting a greater emphasis on the green credentials of the buildings they occupy or own and assets that do not display good sustainability attributes will be left stranded without significant capital expenditure, the manager adds. It states that future rental growth will come from better-quality assets. Details of the ESG credentials of API’s portfolio are on page 11.

Portfolio

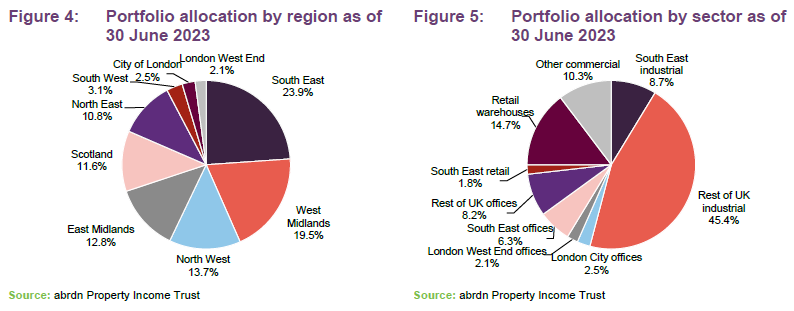

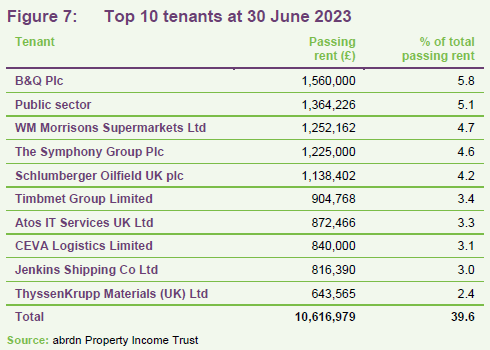

API’s portfolio was valued at £445.0m on 30 June 2023 (March 2023: £437.0m) and consists of 47 assets, primarily allocated across three sectors: industrials 54.1%, offices 19.1% and retail 16.5%. The ‘other commercial’ sectors make up 10.3% of the portfolio and consist of a data centre and a leisure complex in north London with redevelopment potential. The three largest properties are covered in more detail below.

The portfolio had a net initial yield at 30 June 2023 of 5.4% and an equivalent yield of 7.0%. The portfolio had a WAULT of 6.3 years (March 2023: 6.5 years) and an occupancy rate of 91.8% (however, several recent leasing transactions have pushed the occupancy rate up to 95.4% – more detail on page 9).

Top 10 holdings

Acquired Morrisons-let supermarket at 6.35% yield.

The biggest change to API’s top 10 assets was the acquisition of a Morrisons supermarket in Welwyn Garden City, Hertfordshire. The company bought the asset, which also includes a petrol filling station, in March 2023 for £18.29m (at a net initial yield of 6.35%) in a sale and leaseback deal with the grocer. A new 25-year lease was signed, with annual CPI inflation-linked rent reviews for the first five years (with a cap and collar of 0% and 4%), then every five years thereafter. The purchase was funded from the company’s RCF, which has a floating interest cost based on SONIA after it was refinanced in October 2022 (more detail on the terms of the refinance can be found in our annual overview note, links to which can be found on page 15). The income yield from the asset is greater than the RCF debt cost, and the differential will increase if interest rates decline and the rent grows in line with inflation. The manager says that some concerns exist around the Morrisons covenant, but the location of the asset gives it confidence of re-letting the asset in the event of a tenant failure.

A pre-let industrial development in St Helens completed in March, with the new 15-year lease to the local authority commencing in early April at a rent of £657,040 a year.

B&Q retail warehouse, Halesowen

API’s largest asset is a B&Q retail warehouse located in Halesowen, West Midlands, which it purchased for £19.5m in September 2020. The purchase price reflected a net initial yield of 7.5%.

The property is let to B&Q for a further eight years and is a top-quartile trader for B&Q. The manager says that it is let on a reasonably low rent in the mid-teens per square foot, equating to £1.56m per annum, making B&Q the fund’s largest tenant.

Although the DIY sector may suffer during a recession, the manager says it is not worried about B&Q, which has survived many recessions in the past. It has very little competition in the retail DIY sector, the manager adds, with Homebase reducing its presence and smaller operators (such as ScrewFix and Wickes) more focused on the trade sector and operating from smaller units on industrial estates.

Why does the manager like it? The manager says the asset fits its strategy exceptionally well, providing secure long-term income on an asset that not only works for the existing tenant, but also has future potential for urban logistics.

54 Hagley Road

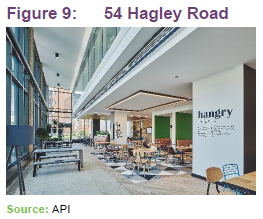

API acquired 54 Hagley Road, Birmingham, in late 2018 for £23.75m, the fund’s largest acquisition to date. The multi-let office complex comprises 141,436 sq ft and is located in an area where the manager says rents are generally cheaper than in other parts of Birmingham, at around £20 per sq ft compared with prime rents in excess of £40 per sq ft. The building is equipped with shared amenities that include conferencing facilities, a yoga studio and parking docks for cyclists.

Five floors in the building, including the reception area, underwent a £2m refurbishment following the administration of a tenant. The ground floor refurbishment included new conference facilities (which double up as a fitness studio), bike storage, lockers and changing facilities. API has completed several lettings in the refurbished space – including some of its flexible fitted office suites – bringing the building to more than 90% let (more details on API’s vacant space and lettings can be found below).

A new tram stop right outside the building opened in December 2021, increasing connectivity. Meanwhile, 54 Hagley Road is located just outside of Birmingham’s new Clean Air Zone congestion charge, which launched in June 2021.

Why does the manager like it? The manager believes the building to be well-situated and to offer good prospects for rental growth. The location on the edge of the congestion charge zone, a new tram stop outside, ample car parking, and shared services have resulted in strong demand for space at the building.

Symphony

The Symphony acquisition in October 2014, for £14.6m, included three storage units in Rotherham, covering 360,000 sq ft. The units were acquired with a 20-year letting agreement in place with Symphony Group, a kitchenware and bathroom furniture manufacturer. The passing rent is £1.225m per annum, making Symphony the fourth-largest tenant behind B&Q, the public sector and Morrisons.

Symphony Group is the UK’s largest privately-owned manufacturer in the kitchenware and bathroom sector, turning over more than £350m per annum, with a headcount of over 2,000 staff. It supplies private developers, social housing providers, retailers and hotel operators across the UK and internationally. The 20-year lease includes a tenant break clause after 15 years, as well as a provision for fixed uplifts every five years.

Why does the manager like it? The three units are located in an established manufacturing region and were acquired with a long-term lease in place with a leading firm in its sector. The lease contract also includes an inflation adjustment.

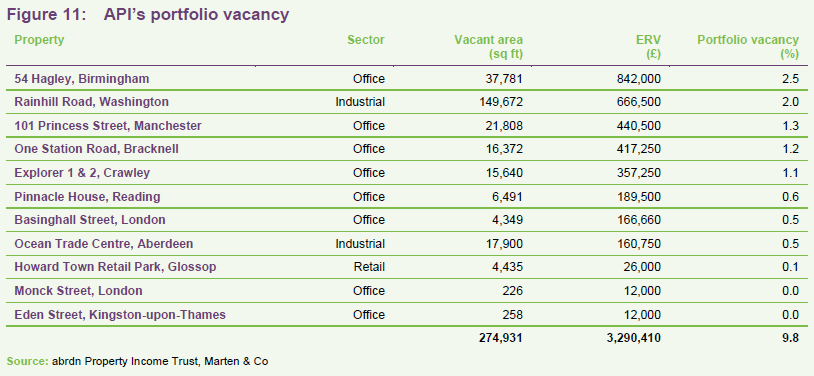

Capturing rental reversion through asset management

API’s manager says that it has made great leasing progress across the portfolio in recent months, especially in the company’s office portfolio (against a backdrop of a tough leasing market due to the structural dynamics at play in the office sub-sector). Figure 11 shows the vacant space within the portfolio at the end of March 2023.

Asset management initiatives since March include:

- three lettings at 54 Hagley totalling 29,700 sq ft accounting for £586,886 in annual rent (bringing the building to over 90% let);

- two lettings at Explorer in Crawley, completed in April, for £296,730 per year; and

- a lease at Basinghall Street in London for 2,892 sq ft for £142,817 in annual rent (bringing the building to 100% let).

The company has also exchanged contracts for the leasing of the industrial asset in Rainhill Road, Washington at £591,500 a year. When all of these are considered, the portfolio vacancy rate falls to 4.6%.

The portfolio has further rental reversion to be captured, the manager adds. There is currently a difference of just over £2.5m between the current rent and the ERV that could be realised (with around 33% of income subject to inflation linked and fixed rate annual uplifts and 67% open market reviews). Recent rent reviews at the company’s industrial assets showed strong rental performance, with a settlement in Birmingham at a 40% increase in rent and a regear and rent review in Scotland providing a 20% uplift in rent.

Pre-let industrial developments – which comprises the St Helens asset (which, as mentioned earlier, completed in March) and the Rainhill Road, Washington asset – will provide annual rent of £1.25m (linked to CPI uplifts). The company has also received planning consent for the speculative development of a 110,000 sq ft logistics unit in Knowsley, with construction commencing in April and completion expected in December 2023. The ERV of the development is £830,000 a year and the manager says that it is confident of letting the asset before completion due to the favourable demand and supply balance in the area.

Future investments

The company has financial resources of £28.1m through its undrawn RCF, giving the manager the opportunity to take advantage of what it calls price dislocation in the sector – where some assets with strong long-term property fundamentals can be acquired at attractive yields. That was part of the manager’s rationale for acquiring the Morrisons supermarket in March. The manager says that any further acquisitions would have to come at a yield greater than the 150bps margin over SONIA it would cost to draw from the RCF.

The manager says that potential sales would need to be assessed with a view to taking some short-term pain for long-term gain. For example, an industrial asset currently yielding less than the cost of debt has the potential to provide greater returns over the medium and longer term due to the rental growth prospects.

ESG initiatives

The manager states that ESG and sustainability are at the heart of all of its investment decisions. API made a significant purchase in September 2021 in its aim to be carbon net zero, acquiring 1,471 hectares of upland rough grazing and open moorland in the Cairngorm National Park, in Scotland, for £7.5m that is expected to offset a large proportion of carbon emissions from the portfolio.

Around 195,630 tonnes of carbon is expected to be offset from portfolio.

Around 1.5m trees will be planted and the site is expected to offset around 150,000 tonnes of carbon up until 2060, representing 73% of the company’s residual embedded and operational carbon. It is anticipated that the costs of planting the 1.5m trees will be met through grant funding. All approvals are now in place and a contract has been agreed with Scottish Forestry to enable planting to commence in September 2023.

API has locked in a cost of £22 per tonne, with offsets on the Voluntary Carbon Market expected to cost between $30 and $100 per tonne by 2030. Through this investment, API is taking the issue of carbon offsetting into its own hands, and avoiding any potential future increases in carbon credits by paying a fixed price today, the manager says.

The fund’s net carbon zero strategy is primarily based on reducing operational carbon at the individual property level, with offsets for residual carbon that cannot be eliminated, the manager adds.

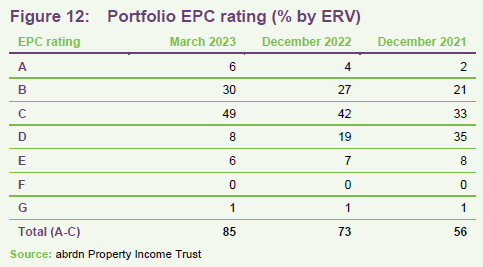

Progress made on improving portfolio EPC rating.

Upgrades have been made on the energy efficiency of API’s portfolio through refurbishments. At 31 March 2023, 85% of API’s portfolio was rated EPC C and above – up from 73% at the end of 2022 and 56% at the end of 2021.

New legislation is expected to come into force requiring that commercial properties have EPC ratings of at least C by 2027 and B by 2030. The manager says that businesses are demanding more greener buildings, and less-sustainable assets will continue to be negatively impacted through valuation. It adds that the company has a clear route to getting the portfolio to a minimum C-rating, and is assessing the route to a B-rating.

API has undertaken a major Photo Voltaic (PV) installation across its industrial portfolio, the largest undertaken by abrdn in the UK. It currently has 10 operational PV schemes, providing almost three million kWh of power. Contractors have been appointed on a further project (which will be the fund’s largest to date), while terms have been signed on three other schemes and five are at advanced stages. In total, 11 other sites are at various stages of due diligence.

Performance

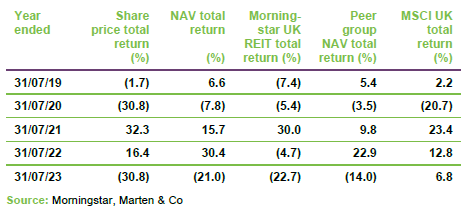

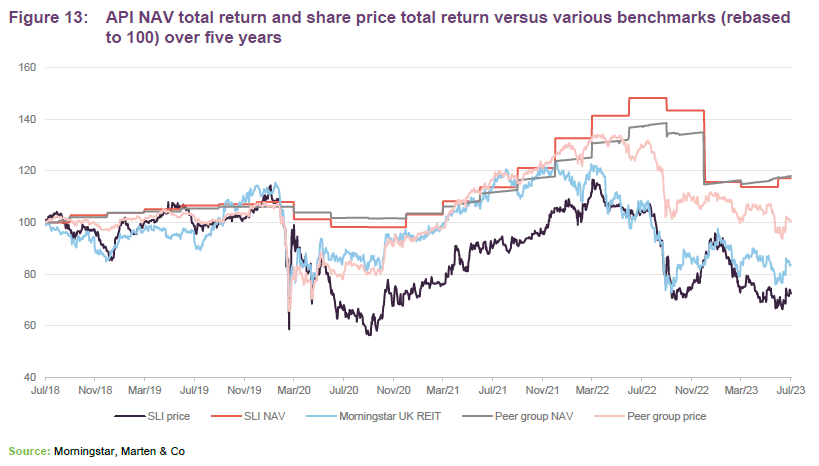

API’s NAV total return fell dramatically at the end of 2022, due to valuation declines in the commercial real estate sector (as mentioned earlier) but has started to stabilise. Prior to this, API’s NAV total return had recovered strongly from its pandemic lows, markedly outperforming that of its Property – UK Commercial peer group (which is made up of 14 REITs – primarily with diversified portfolios) as shown in Figure 13. However, the large decline relative to the peer group at the end of 2022 has seen API give up this outperformance over the five-year period. The group’s share price has lagged that of both the peer group and the Morningstar UK REIT index.

Peer group analysis

Click here for an up-to-date comparison of API and its Property – UK Commercial peer group.

Over the longer term, API’s NAV total return has outperformed that of the Property – UK Commercial peer group average, as illustrated in Figure 14. However, in share price terms over the same longer-term time periods, it has considerably underperformed the peer group. We have used the Morningstar UK REIT Index and the MSCI UK Index as further comparators to API’s short- and long-term performance.

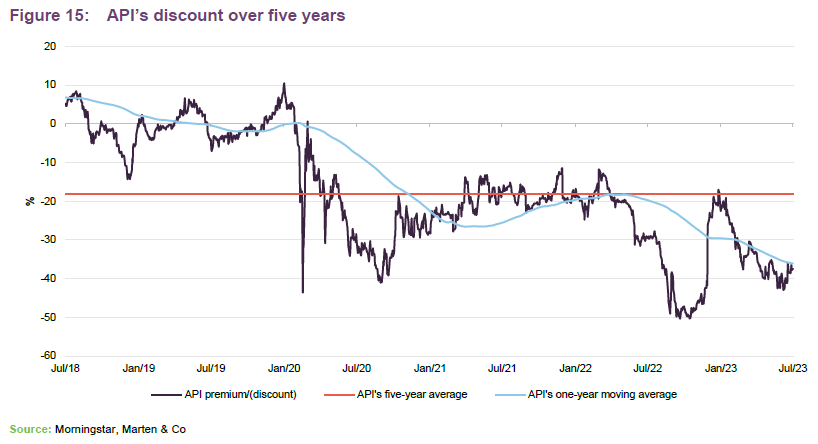

Premium/(discount)

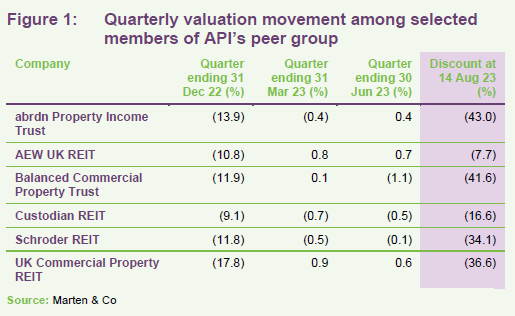

As illustrated in Figure 15, API’s discount narrowed sharply at the start of 2023 due to the large decrease in NAV, but widened as investor sentiment towards the commercial real estate sectors continued to wane in the high interest rate environment. At 14 August 2023, API’s discount was 43.0%, one of the widest among its peer group.

Fund profile

More information on the trust is available at www.abrdnpit.co.uk.

API launched on 19 December 2003. It was previously called Standard Life Investments Property Income Trust and is domiciled in Guernsey. It has a premium main market listing on the London Stock Exchange and, to maintain a tax-efficient structure, migrated its tax residence to the UK on 1 January 2015, when it also became a UK Real Estate Investment Trust (REIT).

API aims to provide investors with an attractive level of income, together with the prospect of income and capital growth. It aims to achieve this by investing in a diversified portfolio of UK commercial property. These are principally direct holdings within the industrial, office, retail and ‘other’ sectors, where ‘other’ includes leisure, data centres, student housing, hotels (and apart-hotels) and healthcare.

The board’s and manager’s preference is towards properties that are in good – but not necessarily prime – locations, where it is perceived that there will be good continuing tenant demand. The manager also looks for properties where it can add value using asset management initiatives. There is a focus on tenant quality, and as part of API’s strategy, tenants are treated as key stakeholders and the manager works closely to understand their needs. The aim is to achieve greater tenant satisfaction and retention, and hence lower voids, higher rental values and stronger returns.

API has full use of the wider abrdn team, which has 270 people globally working on property. This provides access to specialist transactions, ESG, debt and research teams, as well as providing a risk management framework.

Previous publications

QuotedData has published seven previous notes on API. You can read these by clicking the links in the table below or by visiting our website.

Figure 16: QuotedData’s previously published notes on API

| Title | Note type | Date |

| KYT (know your tenant) | Initiation | 8 July 2019 |

| Adding value in cautious times | Update | 13 February 2020 |

| Building for a new normal | Annual overview | 25 September 2020 |

| Focus on tomorrow’s world | Update | 13 April 2021 |

| Post-COVID ready | Annual overview | 13 October 2021 |

| Resilient income in uncertain times | Update | 19 May 2022 |

| Laser focus on the basic | Annual overview | 20 December 2022 |

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on abrdn Property Income Trust.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.