Powering on

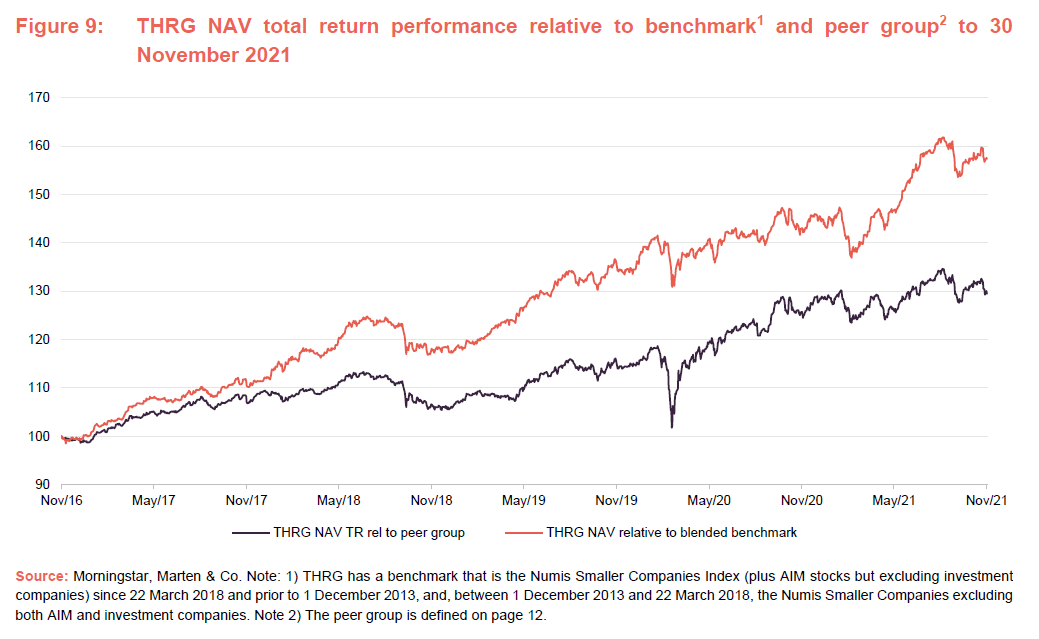

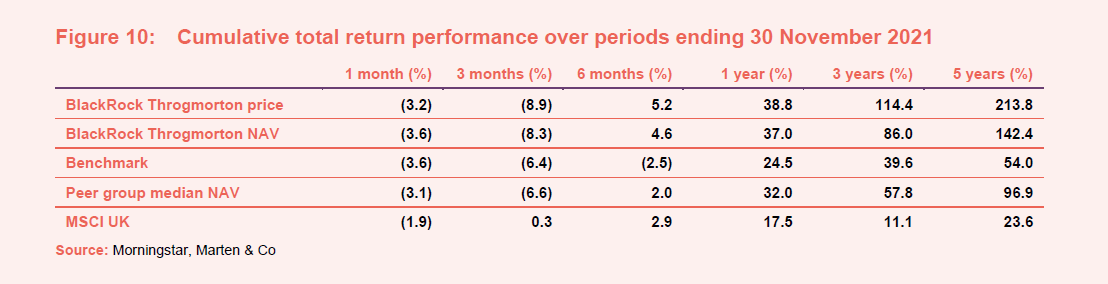

BlackRock Throgmorton Trust (THRG)’s results for the accounting year ended 30 November 2021 will not be published for a while yet, but it looks as though THRG has had another great year, with its net asset value (NAV) and share price returns well above peer group averages and its benchmark (see pages 8 to 12).

It might have been reasonable to think that the resurgence in sectors hit badly by COVID (retail, leisure, banks, energy and mining, for example) – areas that THRG tends to have little or no exposure to – would have provided a significant headwind. However, this has not been the case and THRG manager Dan Whitestone says that the trust’s good performance reflects the success of the companies in the portfolio. He remains enthused about their prospects.

Both long and short positions in UK small- and mid-cap companies

THRG aims to provide shareholders with capital growth and an attractive total return by investing primarily in UK smaller companies and mid-capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction. Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks.

Quality will out

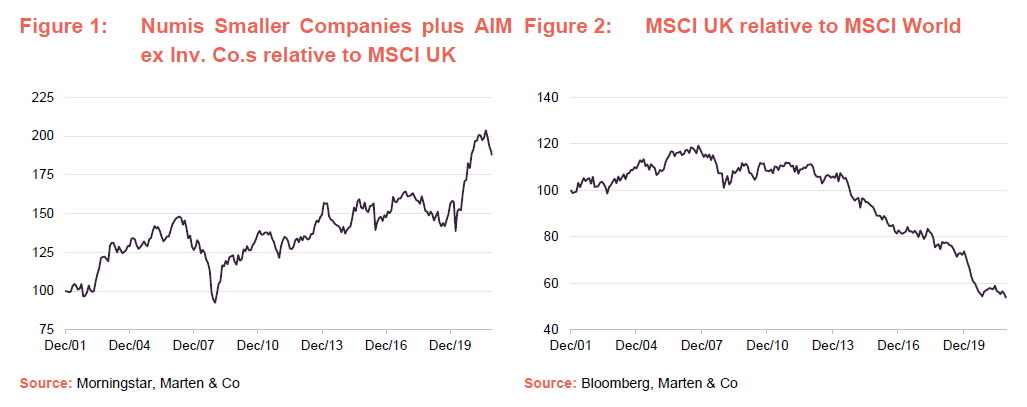

The charts in Figures 1 and 2 illustrate the case for investing in smaller companies and just how poorly the UK market has done relative to developed market peers.

There can be more risk associated with investment in small- and mid-cap companies but there is greater opportunity too. THRG’s portfolio is highly diversified to reflect that stock-specific risk, but it is also very different to the composition of its benchmark index. The stocks are chosen from a pool of around 1,600 companies, many of which are under-researched. This presents opportunities for an active investor, especially one backed by a well-resourced team.

Dan’s investment style – which focuses on identifying high quality companies and companies leading industry change – is described more fully in our last note – a link to this is available on page 16.

Last year’s Brexit agreement removed one cloud hanging over the UK market. However, Dan is keen to emphasise that an investment in the UK small- and mid-cap universe is not an investment in the UK economy. Many of the companies in the portfolio are, or have the potential to be, global leaders in their field. Nevertheless, there is the potential for a re-rating of the UK market relative to peers.

The pandemic worked in THRG’s favour, accelerating the adoption of many of the structural trends that Dan had identified previously. He is not fearful of the impact on the global economy, therefore.

There are winners and losers from these trends, and the ability to short companies facing unsurmountable challenges gives Dan another way to profit from them.

Themes represented within the portfolio include:

- disruption within distribution;

- changing consumer behaviour;

- evolving manufacturing models;

- the increasing relevance of data analytics and insights; and

- compounders

The trust’s NAV return for the 12 months ended 30 November 2021 was 14.3 percentage points ahead of the benchmark. The fact that this was achieved in a period where COVID-afflicted stocks rallied significantly and quality and growth styles faced significant headwinds, is commendable. Dan attributes this to the success of the companies in the portfolio. Many of these are discussed in this note.

Asset allocation

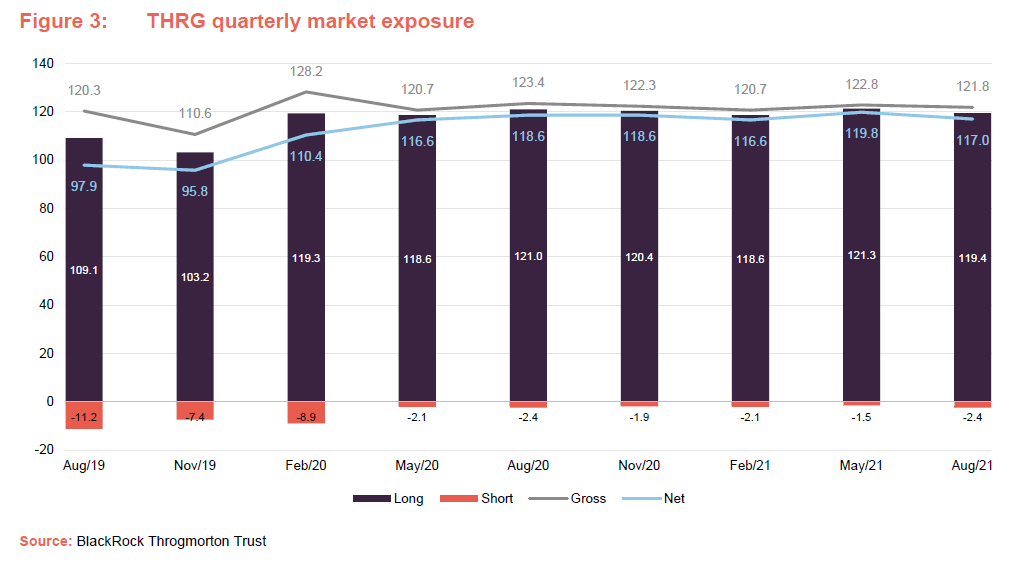

We don’t yet have data for the size of THRG’s short positions at the end of November 2021. However, we do know that at the end of October, the fund’s net market exposure was 119.0% (equivalent to gearing, or borrowings, of 19.0% of total net assets), and anecdotally, Dan has been adding a few more short positions to the portfolio in recent months.

In the wake of the collapse in the UK equity market last March, Dan was wary of taking on too much short exposure in what he felt was likely to be a rising market. The good news on vaccines in November triggered a sharp recovery in the companies that had been hit hardest by COVID restrictions, validating Dan’s theory. However, many of these companies are the ones that he feels face long-term structural challenges. The short positions that he has taken in these since the summer are likely proving profitable as the new Omicron variant weighs on markets. Indeed, one short position (unnamed as is BlackRock practice) was the sixth-largest contributor to THRG’s relative outperformance of its benchmark over the 11 months ended 31 October 2021.

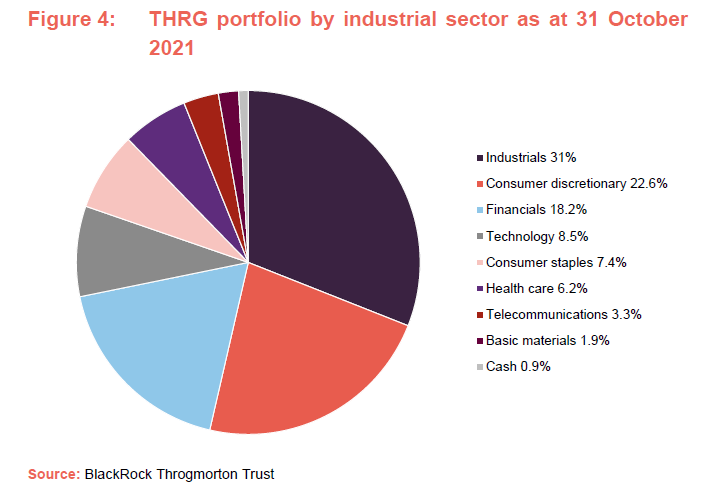

THRG’s sector exposures are driven by the manager’s stock selection decisions and the sector split is not much changed from when we last published.

Top 10 holdings

The list of THRG’s 10-largest stock positions is not much changed from when we last published. Most of these stocks have been discussed in previous notes. YouGov and Pets at Home have dropped out of the list to be replaced by Dechra Pharmaceutical and CVS Group, both of which are longstanding holdings and represent the greater pet ownership and higher spend per pet theme that we have discussed in previous notes. YouGov’s share price dipped slightly between 31 August and 31 October, but since then has continued to climb. Pets at Home’s stock has gone sideways over the last six months.

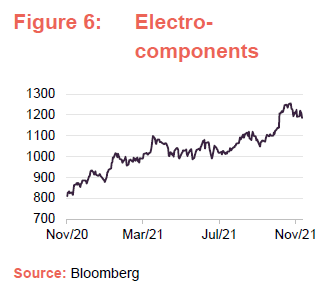

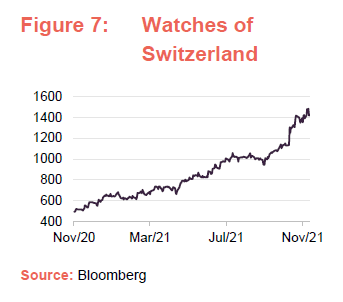

At the top of the list, Electrocomponents and Watches of Switzerland continue to perform well.

Electrocomponents

Electrocomponents (electrocomponents.com) provides access to over 650,000 products, including electrical components. Its recent half-year results, covering the six months ended 30 September 2021, showed revenue up 22% compared with the equivalent period in 2019 (undisturbed by the impact of COVID). On the same basis, operating profit was up 37% and earnings per share (EPS) up 41%.

Electrocomponents is serving more customers with more products (higher average order value). Brexit, COVID, supply shortages and inflation (in wages and overheads) were constraints on profit growth. However, much improved online and higher own-brand sales more than offset those effects.

The balance sheet is strong (net debt/adjusted EBITDA of 0.3x) and the company is looking at acquisition opportunities, but stresses that any deal must be a good fit with the existing business.

Watches of Switzerland

Watches of Switzerland (thewosgroupplc.com) recently published results for the half-year ended 31 October 2021. Revenue was up 44.6% year-on-year and up 40.8% versus the equivalent period in the prior year. Even though the company’s physical stores have reopened, the ecommerce business continued to grow (up 28.7% on the prior year). It is the company’s success in swiftly repositioning its business to incorporate an online presence that has most impressed Dan.

The US business is growing faster than the UK one (from a lower base). Agreements are in place to purchase five stores in four US states as yet untapped by the company, including Vail and Aspen in Colorado, and Greenwich, Connecticut.

The company has been rebuilding its stock of Rolex watches, yet still managed to shift from a net debt to a net cash position.

The statement included guidance for higher revenue and margins.

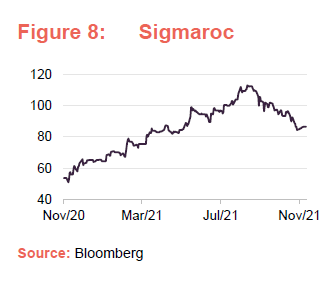

Sigmaroc

Sigmaroc (sigmaroc.com) was a new entrant into the top 10 earlier this year. It is a building materials company which has been expanding through acquisitions as well as organically. In July it made a significant acquisition, buying European limestone products business Nordkalk for €470m. This was financed in part with a placing of shares at 85p, which was supported by THRG. The plan is to use this as the base for a new Northern Europe business platform.

At the half-year stage (30 June), revenue, EBITDA and underlying EPS growth were all strong. The business is also expected to be significantly cash generative.

Following the placing, the shares did well initially, but they have come back since the middle of September. A trading update released in mid-October said trading had been strong over the third quarter (Q3) and the near-term outlook was good. However, rising energy costs and the shortage of truck drivers were expected to have an impact. Nevertheless, the statement said that supply chain and inflationary pressures were being managed effectively.

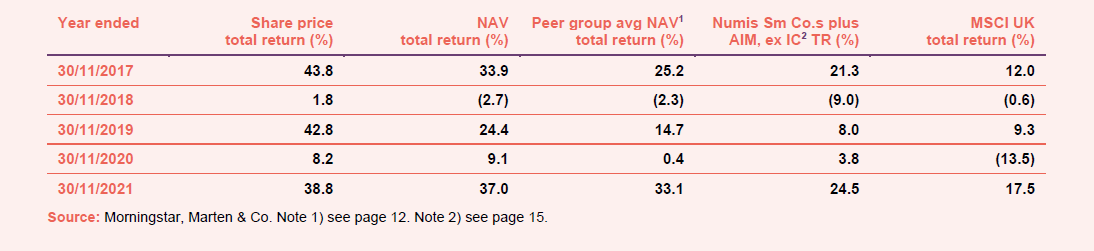

Performance

Whilst there has been some modest pull-back in THRG’s relative performance in recent months, the longer-term picture remains very good with significant outperformance of the benchmark, the peer group and the wider UK market.

Drivers of returns

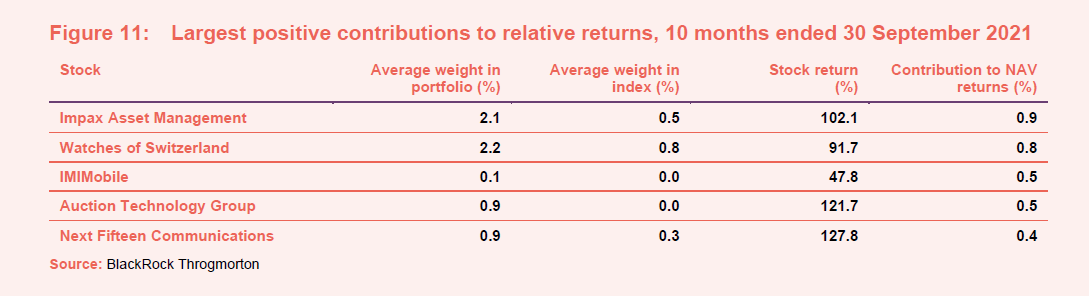

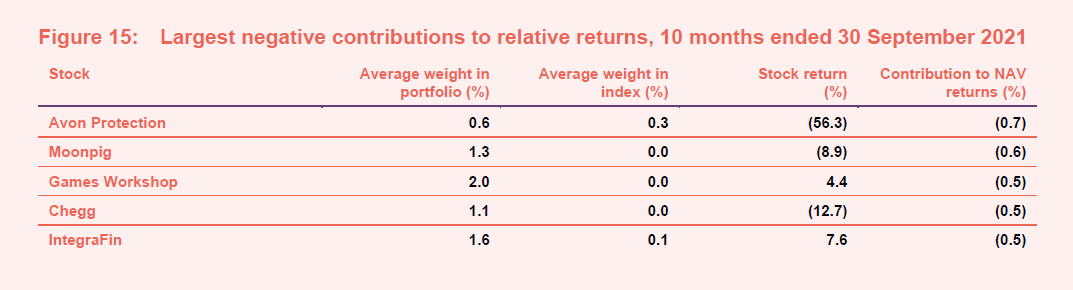

BlackRock kindly supplied us with some relative performance attribution data covering the 10 months ended 30 September 2021 (the trust’s financial year runs to 30 November).

We discussed Watches of Switzerland above and IMIMobile’s takeover in our last note.

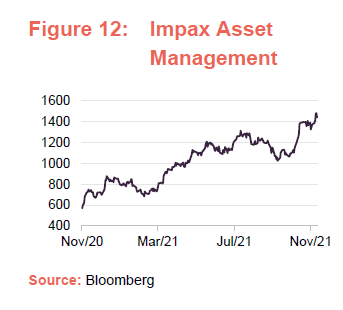

Impax Asset Management

Impax Asset Management (impaxam.com) recorded an 84% increase in its assets under management over the year ended 30 September 2021, driven by good performance as well as the demand for funds focused on sustainability. At that stage, eight out of 10 of its largest strategies were ahead of their benchmarks over three years. The increase in assets under management helped power a 64% increase in revenue and more than 170% increase in pre-tax profits.

COP26 and the associated pledges to tackle greenhouse gas emissions drove interest in Impax’s investment approach. It anticipates rapid market growth in renewable power generation and energy efficiency, but also expects to back innovative companies in sectors such as new materials and agriculture.

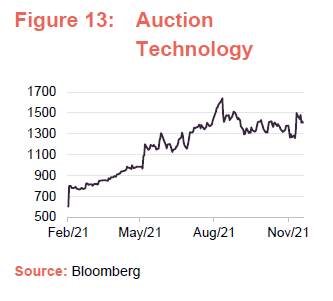

Auction Technology Group

We discussed Auction Technology Group (auctiontechnologygroup.com) in our last note. The company recently published results covering the 12-month period ended 30 September 2021. The company has expanded since its IPO in February, notably with the acquisition of LiveAuctioneers.

£2.2bn of merchandise was traded through its online marketplaces over its accounting year (47% more than the comparable period a year earlier) and a further £4.1bn was transacted through physical auctions (37% higher). This drove a 34% increase in aggregate revenue (29% organic).

The expansion of the company drives a virtuous circle of more bidders and more auctions to its marketplaces. Auction Technology’s industry-leading position reinforces this.

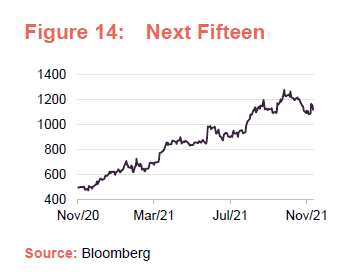

Next Fifteen Communications

Next Fifteen Communications (www.next15.com) is a data analytics, branding consultancy and advertising agency operating globally but with a bias to US and UK. The last trading news we have from the company relates to the six months ended 31 July 2021. Over that period, it delivered 32% revenue growth (23% organic) and a 51% increase in adjusted diluted earnings per share, beating analyst expectations.

Some of the growth is coming from bolt-on acquisitions, and more are planned, but new client wins included Boots, Citibank, Diageo and Disney+. The company has forecast double-digit growth over the remainder of 2021.

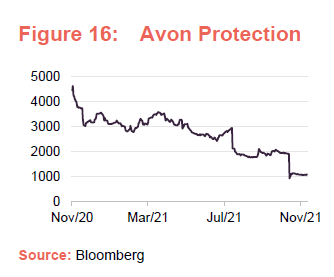

Avon Protection

We discussed Avon Protection (avon-protection-plc.com) in our last note. Problems within the company’s body armour division have resulted in the company initiating a strategic review of the business. US Army contract awards have been delayed again following a failure in the testing process. Notwithstanding this, the company’s order book is strong (up 39% year-on-year as at 30 September 2021).

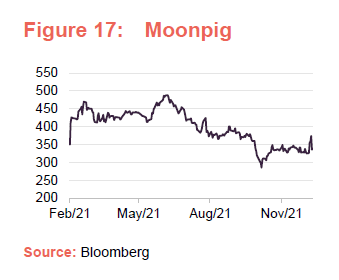

Moonpig

Moonpig (moonpig.group) has been benefitting from a shift towards online purchases of greetings cards, a trend that was accelerated by COVID. As lockdowns eased, some business shifted back to physical stores. Results for the six months to the end of October 2021 show an 8.5% fall in revenue and 30.6% fall in adjusted pre-tax profits relative to the same period in 2020. However, sales, margins and profits remain considerably higher than two years ago.

Management have guided towards revenue for the full year at the upper end of previous estimates. They believe UK customer purchase frequency will be about 15% up on pre-COVID-19 levels.

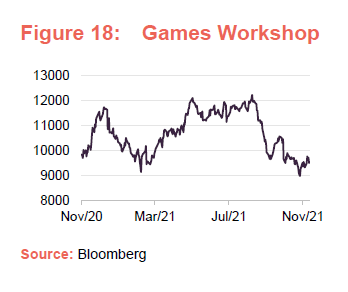

Games Workshop

Dan has both trimmed and added to THRG’s holding of Games Workshop (investor.games-workshop.com) over 2021. After an extended period of very strong share price performance, the stock has fallen back a little since early September. In part, this may reflect profit-taking. However, there have also been some negative comments and calls for a boycott of the company from some customers after the company clamped down on fan films and animations based on its intellectual property.

That does not appear to have had much of an impact on sales. Games Workshop recently said that it expected revenue for the six months to end November to be not less than £190m (£197m in constant currency terms), above 2020’s £186.8m. However, it does expect that operating profits will fall year-on-year, impacted by foreign exchange movements, and higher delivery and staff costs.

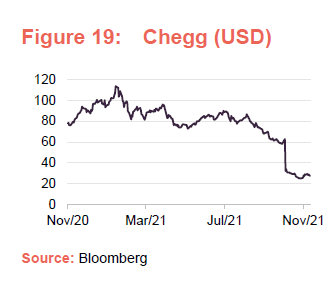

Chegg

Online education business Chegg (investor.chegg.com) saw a sharp drop in its share price following the announcement of third quarter figures. Q3 numbers were not bad – 12% year-on-year revenue growth on 17% year-on-year growth in subscribers. However, the company said that in the US and Canada, learning sites and apps – both free and paid for – experienced significantly reduced traffic from the start of the ‘fall semester’. Subscriber numbers fell by about 9.5% over Q3. The company’s projections for the fourth quarter were well below analysts’ expectations. The company attributes this in part to the end of the pandemic and a shift from study to employment as the US labour market tightened.

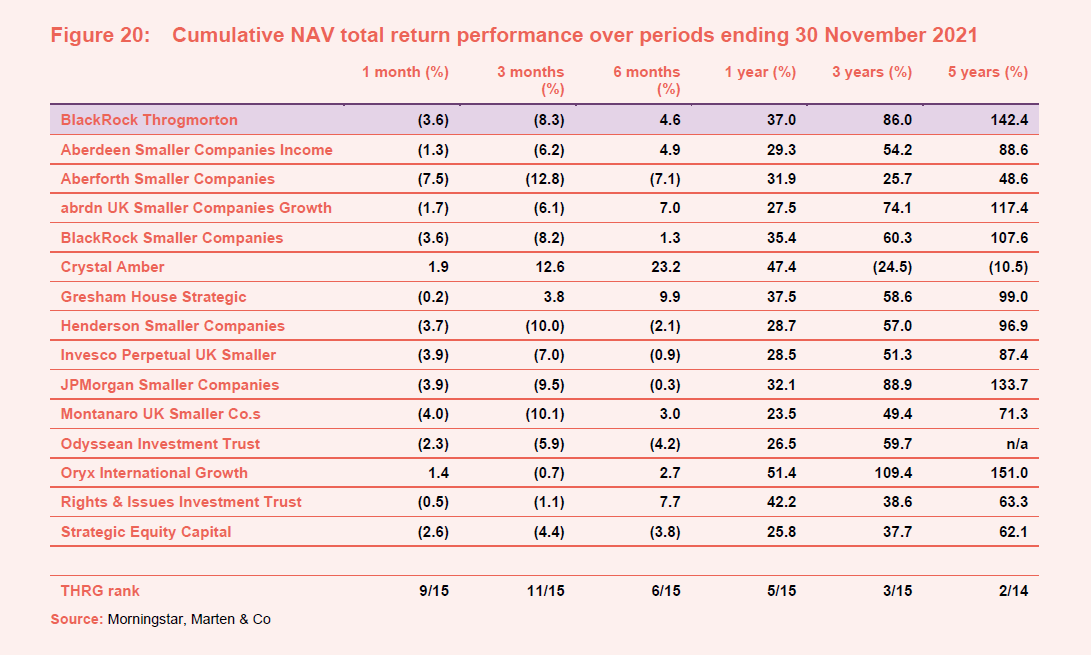

Peer group

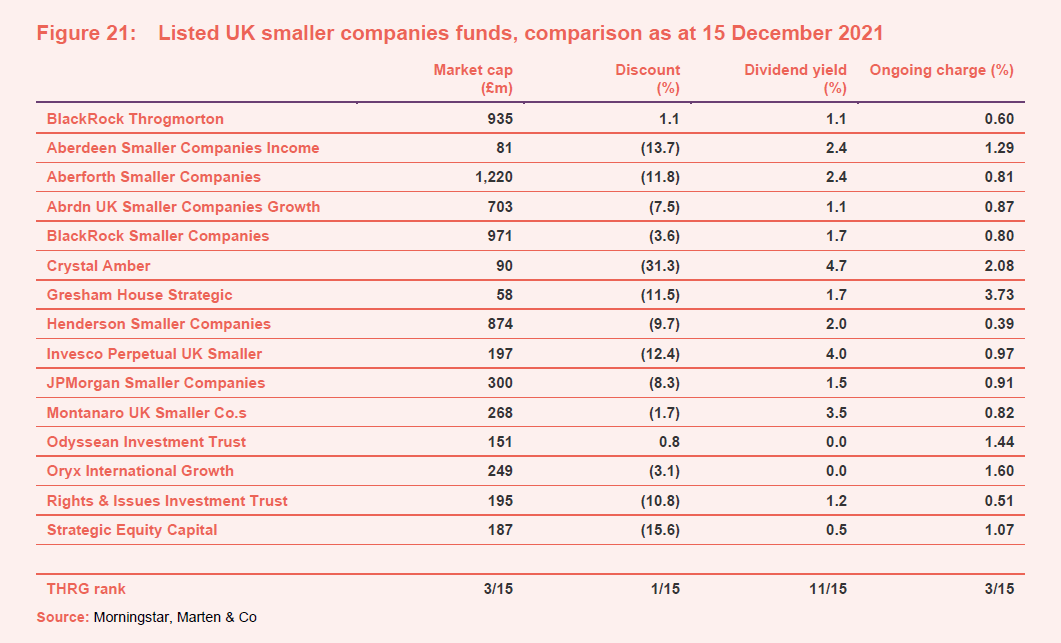

For comparison purposes, we have used a subset of funds in the AIC’s UK smaller companies sector. We have excluded split-capital companies, trusts with a small market capitalisation (below £50m), and those with a very different investment focus, such as Marwyn Value Investors and those that focus exclusively on micro-cap companies. A complete list is provided in Figure 20.

THRG is one of the leading trusts in its peer group. Whilst its short-term performance figures are towards the middle of the pack, its long-term performance continues to be amongst the best of its peer group. THRG is the only fund in this group that seeks to add value through the use of short positions.

The expansion of the trust in recent years has increased the liquidity in its shares and helped to lower its ongoing charges ratio.

THRG is not managed to produce an income, and this is reflected in its relatively-low dividend yield.

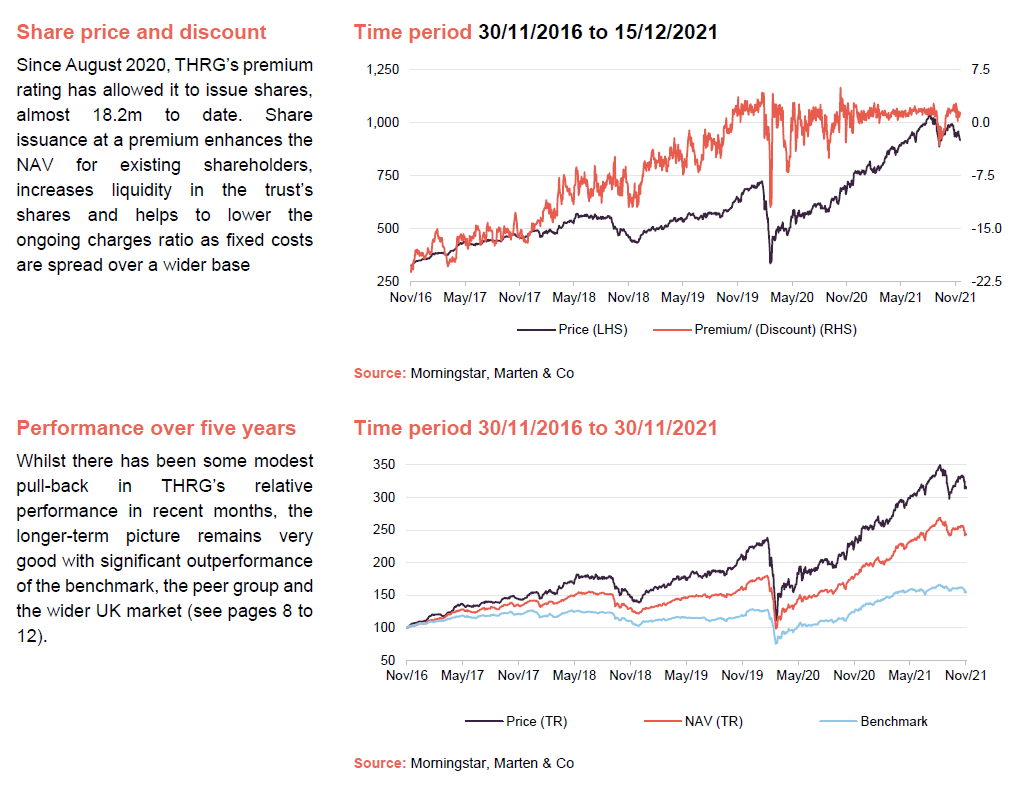

Premium/(discount)

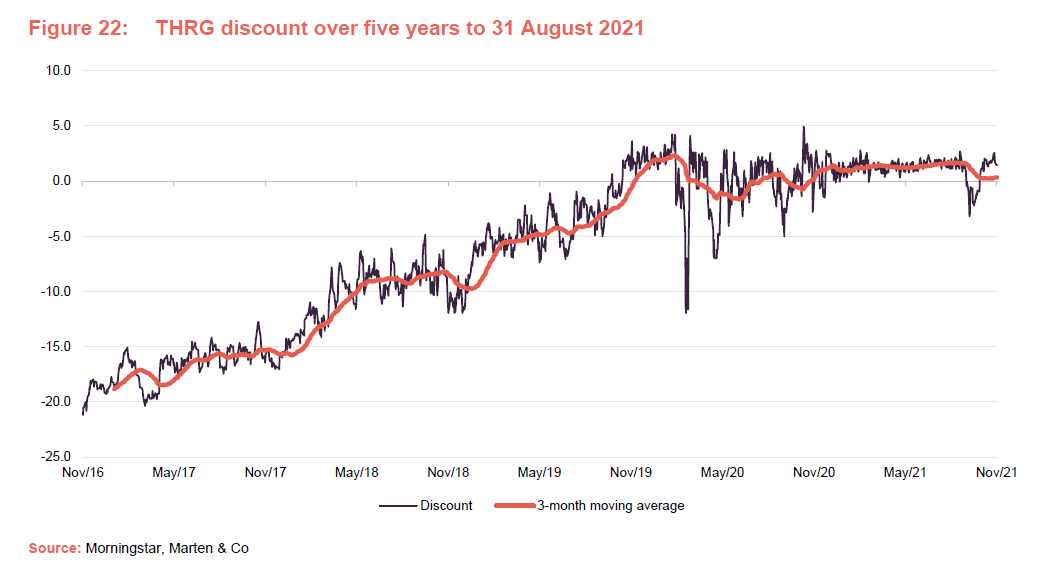

Over the 12 months ended 31 October 2021, THRG’s shares moved between trading at a 3.2% discount and a 2.8% premium to NAV and, on average, traded at a premium of 1.2%. On 15 December 2021, THRG was trading at a premium of 1.1%.

The board has said that it believes that it is in shareholders’ interests that the share price does not trade at an excessive premium or discount to NAV. Therefore, where deemed to be in shareholders’ long-term interests, it may exercise its powers to issue or buy back shares with the objective of ensuring that an excessive premium or discount does not arise. Consequently, the board asks shareholders at each AGM for approval to issue up to 10%, and to buy back up to 14.99% of THRG’s issued share capital.

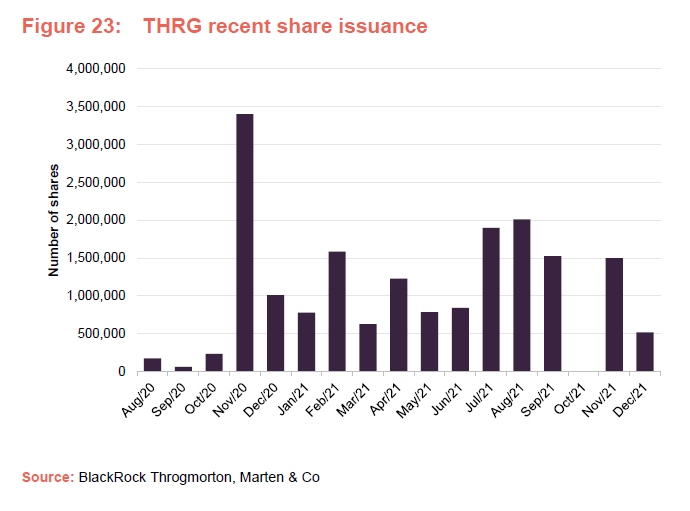

Since August 2020, THRG’s premium rating has allowed it to issue shares, almost 18.2m to date. Share issuance at a premium enhances the NAV for existing shareholders, increases liquidity in the trust’s shares and helps to lower the ongoing charges ratio as fixed costs are spread over a wider base.

Fund profile

BlackRock Throgmorton Trust (THRG) aims to generate capital growth and an attractive total return by investing primarily in UK smaller companies and mid-capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction.

For the period between 1 December 2013 and 22 March 2018, the benchmark was Numis Smaller Companies Index, excluding both AIM stocks and investment companies. There used to be a restriction on the trust’s exposure to AIM companies, but this was removed in March 2018 and, at the same time, the manager was given permission to invest up to 15% of the portfolio in stocks listed on exchanges outside the UK.

UK smaller and mid-capitalisation companies tend to outperform large companies over longer time-frames. In addition, the focus on smaller and mid-capitalisation companies offers exposure to a less-efficient and less-well-researched area of the market, which creates opportunities for an actively-managed fund to add value.

Both long and short positions

Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks. Up to 30% of the portfolio may be invested in CFDs, both long and short. Under normal market conditions, the net market exposure will account for 100–110% of net assets.

The manager

BlackRock Investment Management (UK) Limited was appointed manager of the trust in July 2008. Dan Whitestone, head of the emerging companies team at BlackRock, has been sole manager of the trust since 12 February 2018 (he had been co-manager, alongside Mike Prentis, since March 2015). Dan heads a team of five. All members of the team manage portfolios, and between them they manage or advise on a variety of different funds. The team share research responsibilities between them.

Previous publications

Readers may be interested in our previous publications on THRG, which are listed below.

BlackRock Throgmorton Trust – Vision, execution and adaptability

BlackRock Throgmorton Trust – Look past the short-term noise

BlackRock Throgmorton Trust – Separating the wheat from the chaff

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on BlackRock Throgmorton Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.