Throgmorton – get it while the price is good

Dan Whitestone, BlackRock Throgmorton’s (THRG’s) manager, believes that the historic selloff of UK equities, with investors taking their money out of UK equities in record numbers, is a behaviour that represents both a disconnect to the strong earnings reported by UK companies, and an attractive valuation opportunity based on the current price of UK equities relative to said earnings. UK companies remain more than competitive compared to international peers based on predicted their predicted earnings growth and valuations, and overseas companies are taking advantage of the situation to snap up UK peers at rock-bottom prices. Investors also seem to overlook the UK economy’s improving fundamentals, with business confidence turning positive, the UK consumer remaining robust, and inflation falling to low single digits.

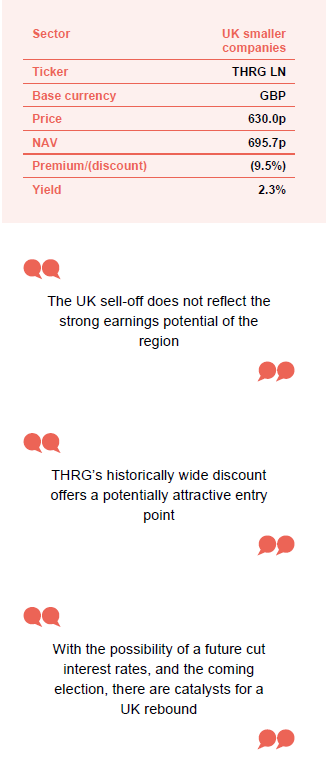

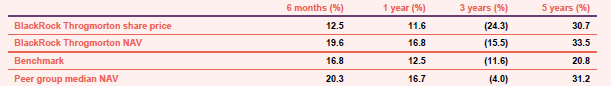

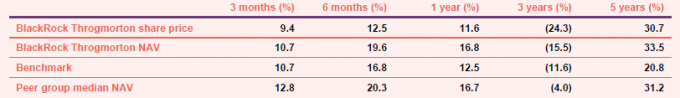

Whilst the total returns of THRG’s Net Asset Value (NAV) have exceed both its peers and benchmark over the last year, its discount to NAV has still widened to a historically wide 9.5%.

Both long and short positions in UK small-and-mid-cap companies

THRG aims to provide shareholders with capital growth and an attractive total return by investing primarily in UK smaller and mid-capitalisation companies traded on the London Stock Exchange. Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long position in stocks.

At a glance

Share price and discount

We believe that there are now signs that THRG’s recent discount to NAV widening reflects investors’ general aversion to UK companies, rather than the region’s actual performance. Although a potentially irrational sell-off is painful, it does reflect a detachment from the fundamentals of THRG’s holdings, as Dan has argued, and may in fact represent an attractive buying opportunity for those able to wait for the possible rebound.

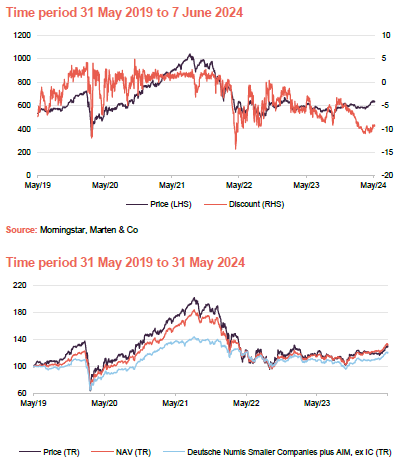

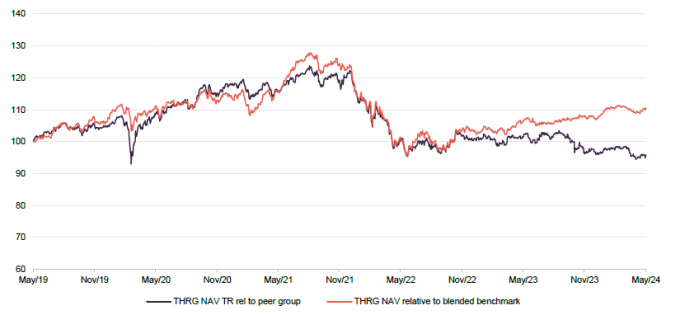

Performance over five years

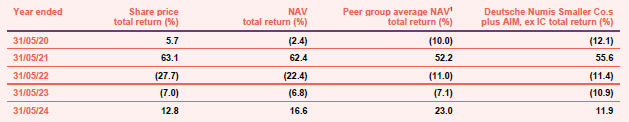

THRG has continued to extend the positive reversal in its performance, increasing its outperformance since November. It has beaten its benchmark’s returns over the last six and 12 months and has also edged out the median returns of its peers over the last 12 months.

Source: Morningstar, Marten & Co. Note 1) see page 20

Investment summary

As the years and months have gone on, investors have increasingly discounted the UK equity market, withdrawing their capital from the region to invest elsewhere. However, for BlackRock Throgmorton’s (THRG) manager, Dan Whitestone, this is an increasingly attractive opportunity, as many of his companies continue to hit new earnings and profit highs. Given their repressed share prices, the opportunity presented by these companies has become ever more tantalising for Dan.

Dan’s focus on fundamental business strength, low leverage (debt levels), and experienced management teams has meant that in his view, almost all of his investments are likely to emerge from this sell-off unscathed if not stronger and, while it would be fair to say that THRG’s growth biased investment style does come with greater risk than many of its peers and benchmark (due to the relatively higher price paid for such high-growth companies), its long-term returns have been strong enough to more than compensate investors for the additional risk.

Performance

Although THRG has made decent progress in its NAV growth during the last 12 months, recovering some of the ground that was lost during the previous couple of years, there is still a long way to go and, as noted above, the progress made does not properly reflect the performance of the underlying holdings.

Despite this, THRG has outperformed its benchmark, the Deutsche Numis Smaller companies plus AIM ex Investment trusts, over the last year (THRG provides an NAV total return of 16.8%, versus the benchmark’s 12.5%) and has generated a return that is far in excess of its benchmark during the last five years (33.5% versus 20.8%). Furthermore, the progress made in the NAV has not been fully reflected in THRG’s share price, which has seen the discount to NAV widen, as discussed below.

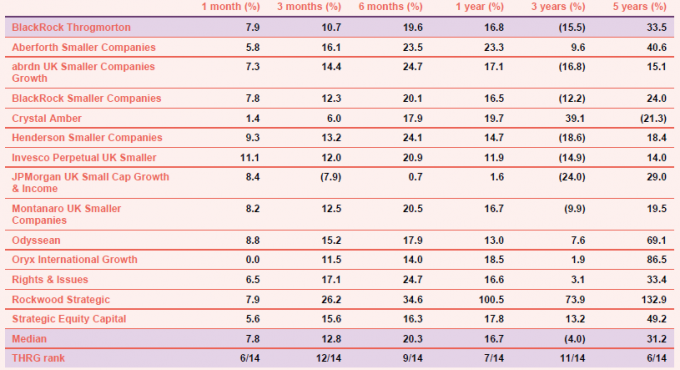

Figure 1: Cumulative total return performance over periods ending 31 May 2024

Source: Morningstar, Marten & Co

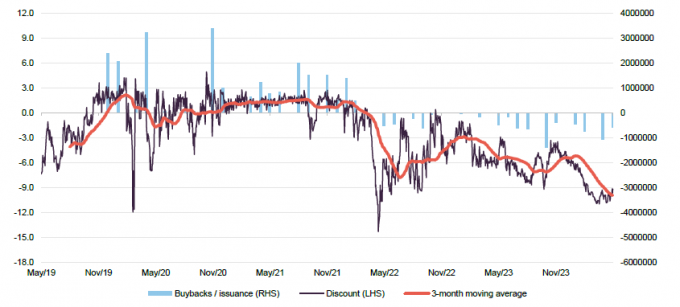

Discount to NAV

This negative sentiment towards UK stocks, particularly growth stocks in an environment of heightened – albeit gradually retrenching – interest rates (growth stocks tend to suffer in an environment of higher interest rates as they tend to have a greater proportion of their value discounted from the future), has also impacted THRG’s discount to NAV, which has widened so that it is now close to longer-term highs. As at 31 May 2024, THRG was trading at a discount to NAV of 9.5%, which is at the wider end of its one-year trading range (2.9% to 11.0%) and also above its longer one-, three- and five-year averages of 7.1%, 4.1% and 2.6%, respectively. With both the economic and political outlooks in the UK improving, there is little logic behind the cheap valuations of THRG’s holdings, or its historically wide discount to NAV. There is the opportunity for significant mean reversion in THRG’s discount as economic certainty improves and a period of difficult politics comes to a close. THRG’s board has been taking advantage of this by continuing to repurchase its shares.

Fund intro

Further information about THRG is available at the investment manager’s website. Please click here

BlackRock Throgmorton Trust (THRG) aims to generate capital growth and an attractive total return by investing primarily in UK smaller companies and mid-capitalisation companies traded on the London Stock Exchange. It uses the Deutsche Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction.

UK smaller and mid-capitalisation companies tend to outperform large companies over longer timeframes. In addition, the focus on smaller and mid-capitalisation companies offers exposure to a less-efficient and less-well-researched area of the market, which creates opportunities for an actively-managed fund to add value. Dan also has permission to invest up to 15% of the portfolio in stocks listed on exchanges outside the UK.

Both long and short positions

THRG’s unique approach includes taking both long and short positions within the portfolio

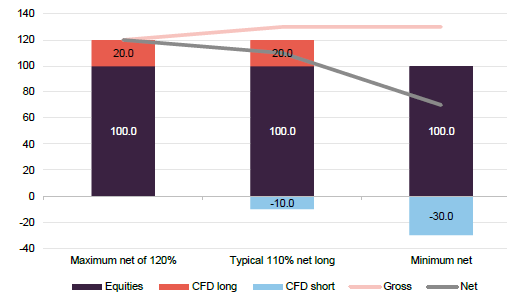

Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks. Up to 30% of the portfolio may be invested in CFDs, both long and short. Under normal market conditions, the net market exposure will account for 110–115% of net assets.

The manager

Dan Whitestone has been sole manager of the trust since 12 February 2018

BlackRock Investment Management (UK) Limited was appointed manager of the trust in July 2008. Dan Whitestone, head of the Emerging Companies team at BlackRock, has been sole manager of the trust since 12 February 2018 (he had been co-manager, alongside Mike Prentis, since March 2015). Dan heads a team of four. All members of the team manage portfolios, and between them they manage or advise on a variety of different funds. The team share research responsibilities between them.

Market backdrop

It has been a tough year for UK smaller companies, which have underperformed large cap UK companies as well as small cap equities in other developed markets more generally . The sector rather trod water over 2023, and into 2024, eking out just 1.6% in returns over the first three months of this year. However, as Dan outlined when we caught up with him recently, his outlook on the sector remains bullish. He is particularly positive about the earnings potential of UK companies, and what he believes is fundamentally resilient economy.

UK earnings – keep calm and carry on

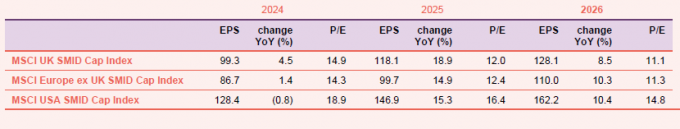

Dan’s comments on UK earnings are echoed by the wider market, as can be seen in Figure 2, which shows the estimated future valuation ratios and earnings growth of UK small-and-mid-sized (SMID) companies versus their global peers over the next two years. The valuation ratios utilised are earnings per share (EPS) and the price to earnings ratio (P/E) that the market is forecasting for the total of 2024, 2025 and 2026.

Figure 2: Market earnings expectations for UK, Europe, and US SMID-cap companies

Source: Blomberg estimates as of 12/04/2024, all figures in GBP

As can be seen above, the UK SMID market is expected to largely trade at a lower price-to-earnings ratio than the rest of the western world, with Europe trading at a marginally cheaper valuation over 2024 (P/E ratio). This could be explained if the UK was projected to see a sustained weakening in its earnings projections; however, this is not the case.

As can be seen in Figure 2, the market expects the earnings growth of UK small and mid-sized companies to exceed both the US and Europe over 2024 and 2025, with its lower 2025 growth figures likely the result of coming off the back of two years of superior growth. These earnings are also produced by, on average, higher quality companies (which are defined by superior balance sheet metrics and business practices), as the UK SMID sector reports lower debt-to-earnings ratios, and higher dividend and cashflow yields. We note that the data presented in Figure 2 excludes companies that have negative earnings, as well as extraordinary earnings (which are one-off events which can have strong skewing effects), as it is a better reflection of the opportunity presented to Dan, given that he filters out unprofitable companies during his stock selection process.

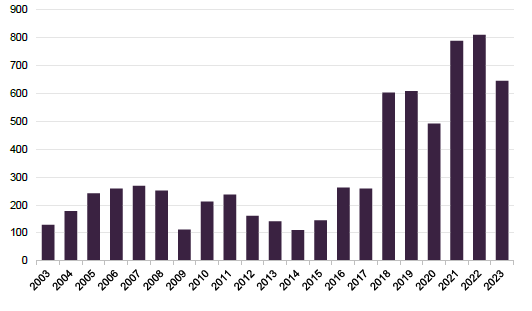

Whilst listed market participants as a whole have yet to come to the same conclusions as Dan, given the lack of UK share price appreciation, there are other industry participants and private equity firms that appear to have done so. For example, foreign companies’ mergers and takeovers of UK companies remain at an elevated level relative to their history, as demonstrated in Figure 3. We think that this is a clear reflection of the value that these investors see in UK companies. We note that the fall in activity over 2023 is not a UK-specific issue, but rather a reflection of the global slowdown in merger and acquisition (M&A) activity over the year, due to the increased cost of debt from higher interest rates. The heightened M&A activity has also been reflected in the UK’s private equity market, as although total dealmaking did fall over 2023, both the number and total value of private equity deals in the UK remain above their pre-COVID levels.

Figure 3: Takeovers of UK companies by foreign buyers

Source: ONS

Waiting for the starter pistol

Whilst the current cheapness of UK valuations is compelling (at least in the eyes of Dan) some form of catalyst will likely be needed to see the valuation gap narrow. Thankfully, there may be a few forthcoming possibilities that might provide the necessary spark.

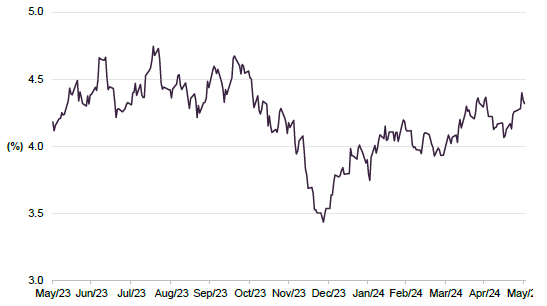

Inflation and interest rate policy remain the major concerns for investors

Interest rates have been the perennial millstone around many investors’ necks and doubly so for growth stock investors given the style’s heightened sensitivity. Many pundits have been expecting a gradual decline in inflation and interest rate expectations, including ourselves, as per our comments in our previous THRG note.

However, recent inflation data coming out of the US has put a damper on the market’s hopes for a near-term interest rate cut as it has not been falling as fast as was expected (a 3.4% year-on-year (YoY) increase in consumer prices (CPI) was reported in April, down only 0.1% from its March figure). This has led the Federal Reserve to suggest it will now ‘wait and see’ with regards to further interest rate cuts and will be looking for further evidence that inflation is retrenching before monetary policy becomes more accommodative.

The market has also adjusted its expectations for interest rate cuts across the developed world as a result, pricing in a mere 0.5% cut in UK interest rates at the time of writing, having priced in a c.1.5% cut in rates at the start of the year. The effects of this can be clearly seen in Figure 4, with UK gilt yields (the return one gets from bonds, with higher returns indicating a falling price and negatively related to interest rates) increasing quickly over the start of 2024. This increase came off a 10-month low yield, reflecting the shift in investor sentiment from one that had expected more accommodative monetary policy from the Bank of England to one that reflected a more uncertain future.

Figure 4: UK 10-year gilt yield

Source: Bloomberg

However, the UK is nonetheless still seeing falling inflation, with its February figure of 3.4% down from January. Certain key components of inflation are falling even faster, with food inflation – a major drag on the consumer’s pocket and one of the stickiest parts of UK’s inflation calculation – coming in at 5%, down 1.1% from its January figure.

With respect to the UK, its most recent inflation print for April showed a marked fall in inflation, down from 3.2% in March to 2.3%. However, it was still slightly above the market’s expectation of 2.1%, a fact which may take some of the wind out of the tailwinds that falling inflation had previously provided, vindicating the market’s reduction in expected rate cuts. The market is now pricing a rate cut towards the end for the third quarter or during the fourth quarter of this year. Like earlier in the year, April’s fall in inflation numbers were driven by falling food and energy prices.

Ultimately, though, March was the first month in which UK inflation was below that of America’s, which may mean that the UK’s monetary policy could decouple from that of the US, as US inflation and rate expectations are the largest driver in setting global expectations given its role as the world’s largest economy. The key issue, besides the lower inflation rates, is that UK GDP growth figures are far lower than those of the US, which may prompt the Bank of England to cut rates earlier, lest they run the risk of engineering a prolonged recession. We note that the UK’s current rate of 5.25% implies that we have real interest rates, i.e. above current annual inflation, which is a headwind against economic growth as the higher cost of financing can weigh on investment. However, in setting monetary policy, the Bank of England has a sole mandate to target inflation, while the US had a dual mandate of targeting inflation and promoting GDP growth. This could lead the Bank to be more aggressive in its approach to taming inflation.

Another consideration is that the UK may be approaching a political turning point, with the upcoming general election presenting a real possibility of the first Labour government in 14 years. If the polls are to be believed, the election is Labour’s to lose. Keir Starmer, the UK’s arguably soon-to-be prime minster, has taken a more centrist view to politics than past Labour leadership, and this may mean that his tenure will take a degree of political risk off the table when compared to his less-business-friendly predecessors. His election may also bring greater stability by bringing to an end to the revolving door of Prime Ministers that the UK has seen under the Conservatives in recent years.

UK consumers and business remain robust

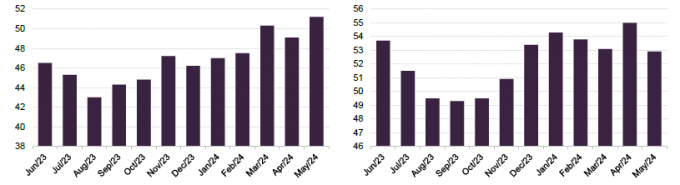

Regardless, Dan has increasing confidence in the fundamentals of the UK economy, with business confidence improving and the UK consumer remaining robust. March saw a notable milestone for the UK businesses, as the Manufacturing PMI (a barometer of overall monthly orders and output) went above 50, indicating expanding manufacturing activity, and the second time it’s been above 50 since July 2022. This comes in tandem with another above-50 figure from the UK services PMI, as seen in Figures 5 and 6.

Figure 5: UK manufacturing PMI and Figure 6: UK services PMI

Source: S&P Global

The UK consumer, by certain metrics, remains robust in the face of rising living costs. The biggest tailwind is likely to be the ongoing real wage growth that UK workers are experiencing, a result of the country’s tight labour market. While year-on-year wage growth (excluding bonuses) has declined from its 2023 peak of 7.9%, April’s figure of 6.0% remains comfortably above inflation and well above its historic levels.

Household debt to GDP (an indicator of how indebted the average consumer is) has also fallen continuously since the start of 2021, with the most recent figure (for the third quarter of 2023) indicating a ratio of 80.6%, a level not seen since 2004. Consumer confidence figures have remained negative for the last three years, but this does not seem to have hampered consumption, as year-on-year consumer card spending grew 1.0% in April, according to Barclays. Barclays also commented that “As consumers gear up to spend more with better weather, and with the Euros, Wimbledon, and Taylor Swift’s ‘Eras Tour’ on the horizon, there’s a brighter outlook for the coming months.” echoing Dan’s views.

Process

When selecting long investments for THRG, Dan focuses on two types of opportunity: high-quality differentiated companies and companies leading industry change. This is a process which places THRG within the universe of ‘quality-growth’ strategies; those defined by above-market earnings expectations and stronger balance sheet, but also priced at a premium as a result.

High-quality differentiated companies

Dan believes that high-quality companies have certain characteristics for long-term success, based on:

- management team;

- product;

- industry; and

- balance sheet/cash flow.

The most important factor in driving value creation or destruction is the quality of the management team

In Dan’s view, the most important factor in driving value creation or destruction is the quality of the management team. Its ability to have a vision, execute on strategy and adapt to a changing environment is crucial. The BlackRock team makes a point of meeting not only the top layer of management, but also other key people within a business. Dan believes that a common reason for growing companies experiencing ‘growing pains’ is if they fail to build the infrastructure and depth of team beneath the top management layer.

Meeting management is a core part of the approach

Meeting management is a core part of the BlackRock team’s approach, and between them they probably have around 750 meetings a year. Usually, they try to have as many of the team in a meeting as possible, in order to get a spectrum of views.

Dan looks for companies whose products are not purely competing on price, but instead offer solutions to customers’ problems – this gives the company pricing power and persistent demand for its products. It is also important that a company maintains its product’s relevance through research and development (R&D).

The industry that a desirable company operates in should have structural growth drivers. It should not be capital-intensive, nor cyclical. It should be free from regulatory interference and should not be facing competitors with strong financial support.

Dan avoids heavily indebted companies, believing that the chief financial officer (CFO) often ends up managing the company for the benefit of the lending bank rather than the company’s shareholders in these situations. He focuses on cash flow measures of value, as these are less easy to manipulate than profits. Dan looks for indicators of quality such as the conversion of sales into cash – such companies can establish a virtuous circle whereby excess cash can be recycled into sales efforts. A company trading on 25x cash earnings is preferable in his eyes to one on 10x earnings but with no cash flow. The latter are the types of companies that tend to be shorted.

On average, THRG’s long investments trade on higher multiples than the short investments. This reflects a focus on quality and a desire to avoid value traps (stocks that look cheap but are in inevitable decline).

Industry change

Industry change can provide both long and short ideas

Industry change can provide both long and short ideas. Previously in his career, Dan was a strategy consultant. The experience highlighted the impact of disruptive change on industries and has influenced his thinking since. Small and medium-sized companies can be a good source of industry disruptors, as they need to do something special, or otherwise innovate, if they are to compete effectively.

There are many ways that disruptive change can manifest itself. These include new products, changes to manufacturing that allow products to be sourced more cheaply, vertical integration to improve and extract cost from supply chains, and changes in distribution.

Environmental, social and governance (ESG)

THRG’s board acknowledges that ESG issues can present both opportunities and threats to long-term investment performance. THRG does not have an ESG mandate (and accordingly does not have an ESG- or impact-focused investment strategy and has not adopted any exclusionary screens), but the manager does take ESG factors into account as part of the investment process.

The manager believes that ESG factors can be useful and provide relevant indicators for investment purposes and can help its decision-making through identifying potentially negative events or corporate behaviour. The manager works closely with BlackRock Investment Stewardship to assess the governance quality of companies and investigate any potential issues, risks or opportunities.

ESG factor risk is assessed as part of regular portfolio reviews undertaken in conjunction with BlackRock’s Risk and Quantitative Analysis (RQA) group.

In conjunction with BlackRock Investment Stewardship, the manager and analysts may engage with portfolio companies on any ESG issues that have been identified.

Portfolio construction

The portfolio will tend to have a high active share

Dan does not consider the benchmark when constructing the portfolio; consequently, the portfolio will tend to have a high active share.

Position sizes are driven by liquidity (how easy it is to buy and sell a company’s shares), risk considerations and conviction. Liquidity is important: Dan wants to be able to trade out of a position in the event that something is going against it. He says that he is ruthless about selling positions when the investment thesis is not working. As an aside, Dan says that historical average daily volume is a misleading indicator of future liquidity for small-cap stocks.

120 positions – about 80 long positions and 40 shorts

The target is to create a portfolio with 120 positions – about 80 long positions and 40 shorts. The number of shorts may seem large, but it is important that the short book is diversified. Dan points out that it is perfectly possible to accurately predict that an industry will suffer long-term decline, then select a stock to represent this, which is then subject to a bid, quite possibly from a competitor. This is because companies in declining industries frequently see consolidation as a remedy, although this may not work as a strategy in the long term. Nevertheless, being short a stock that becomes subject to a bid can be costly. It is therefore better to own a spread of stocks to represent a theme.

The largest position size that Dan would be comfortable with is 5% – there is nothing in the portfolio that is as big as that now. At the low end, he wants to avoid having a long tail of small positions in the portfolio. Individual short positions (see below) are typically sized at about 0.5%–1.0% of net assets.

Essentially, Dan is a growth investor. He therefore believes that the portfolio may underperform in an environment where investors are favouring value stocks. Valuation is secondary to the investment thesis, in Dan’s opinion, but part of the assessment of the merits of a stock is an attempt to identify whether the market appreciates, and is therefore pricing in, the story.

Dan does not believe that mean reversion applies to the types of stocks that he is focused on; winners win big and losers go bust. Therefore, he does not trade stocks based on valuation differentials.

Shorting

Short positions can represent certain themes – for example, industries under pressure. These themes are expressed through several stocks in accordance with the approach outlined above. It is not as simple as shorting a basket of stocks in any given industry, however. Even within a struggling sector, there may be companies whose strategy allows them to survive or even thrive.

The rest of the book represents idiosyncratic shorts selected for stock-specific reasons. Companies with questionable accounting are a fertile hunting ground for shorts, although Dan says that sometimes these can take a while to come to fruition.

The gearing is provided by the contract for differences (CFD) portfolio. The fund operates with an upper limit of 130% gross exposure to equities. Typically, this might comprise 100% in physical equities, 20% in long CFD’s and 10% in short CFD’s, i.e. a net exposure of 110%.

Figure 7: Portfolio construction in different scenarios

Source: Marten & Co

Cash balances are generally kept low and gearing is flexed by adjusting the size of the CFD book. Dan expects to operate within a range of 110% to 115% net long.

Portfolio

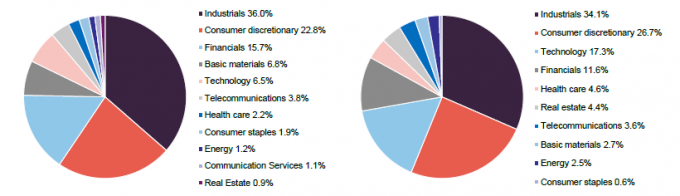

Dan’s approach is one of high-conviction, bottom-up stock selection rather than a judgment of the current macro-economic environment. Figures 8 and 9 reflect the shift in THRG’s portfolio since its last financial year end. There have been three notable shifts in THRG’s allocation since our last note: the reduction in consumer discretionary and technology exposure and the increase in exposure to financials. Though this trading activity does reflect the shifting valuation opportunities presented to Dan, all movements are a reflection of stock-specific decisions he has made rather than a call on the direction of the economy, with the new holdings detailed in the next section.

Figure 8: Sector allocation as at 31 March 2024 and Figure 9: Sector allocation as 30 September 2023

Source: BlackRock

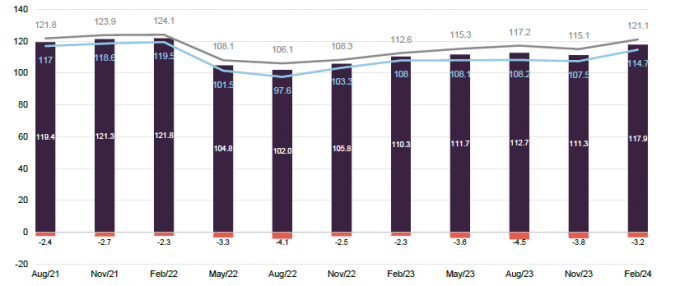

Figure 10: THRG quarterly market exposure

Source: BlackRock

When assessing THRG’s total market exposure, investors should be aware of both its long and short positions. As can be seen in Figure 10, THRG has increased both its net and gross market exposure over 2024. This aligns with Dan’s bullishness as well as the volume of opportunities presented by an increasingly cheap UK market. Whilst Dan’s short position has declined slightly from its 2023 level, it remains commensurate with its long-term average.

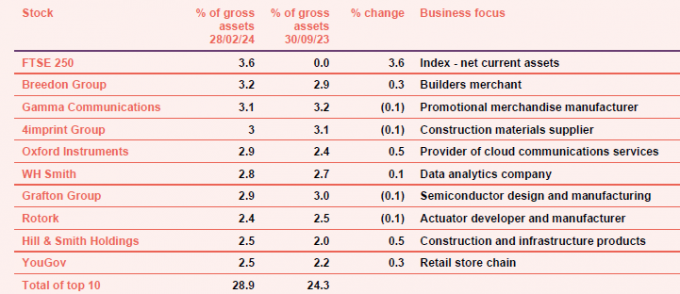

Top 10 holdings

There have been no new holdings in THRG’s top 10 since our last note, apart from an investment into a FTSE 250 index fund. However, this is not a long-term holding for Dan, but rather a highly liquid vehicle for holding cash in order to reduce the ‘cash drag’ on the trust (i.e. the lost returns from not participating in a strategy’s respective markets) and ensure that THRG remains exposed to the wider market.

Dan has been trimming some of his top performing holdings, such as Games Workshop and Watches of Switzerland (both in the consumer discretionary sector), bringing their weightings down to roughly benchmark level.

Figure 11: THRG’s 10-largest holdings as at 31 March 2024

Source: BlackRock Throgmorton Trust

Rather than comment on the companies in THRG’s top 10, most of which we have covered in our previous two notes (which are outlined on page 26), we have focused on companies that illustrate Dan’s more recent trading activity and market outlook; specifically, house builders and semiconductors. Given THRG’s long-held bias towards companies that are both high-quality and high-growth, the inclusion of house builders seems contradictory as these are often more mature, cash-generative businesses (i.e. less growth potential) that tend to attract value investors. Dan’s interest in both house builders and semiconductors is evidence that, rather than simply being wedded to the growth ‘style’ of investing, he is more interested in the most attractive return opportunities within the UK small-and-mid space, whatever style that may take. In the case of the house builders (and the servicing companies that support them), Dan believes that intense pessimism in the market for the sector (a result of higher mortgage costs weighting on housing demand) has led to certain higher-quality companies being aggressively oversold, leading to an attractive recovery opportunity.

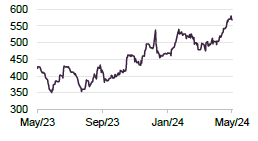

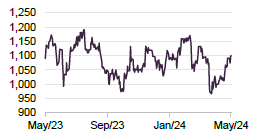

Figure 12: MJ Gleeson

Source: Bloomberg

MJ Gleeson and Crest Nicholson are two house builders recently purchased by Dan. The sector has suffered from the impact of rising mortgage costs on housing demand. Looking more closely at MJ Gleeson (www.mjgleesonplc.com), it reported a halving of profits in the first half of its financial year (with its results released in February 2024) as well as a 10% drop in revenue. However, the losses originated from its housebuilder arm, and increased costs of sales, rather than from its land segment (which originates new developments). The drop in profits reflected the broader market environment rather than the company’s business practices, as the costs associated with several new sites created a temporary drag on profits for the period. In response, MJ Gleeson has brought in new management teams, tightened its operating procedures, and improved its cost discipline. Whilst the company cut its interim dividend by 20%, its management team believes that with its improved operating standards, and strong order book for the second half of its financial year, it is in a strong position to rebound. It is already up 17% year to date.

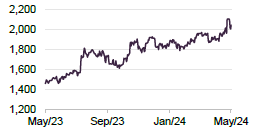

Figure 13: Oxford Instruments

Source: Bloomberg

Whilst not a new entrant, Oxford Instruments (oxinst.com) has been a long-held position within THRG, and a champion of the UK’s semiconductor industry, with the company also being a designer and manufacturer of advanced industrial components. Oxford Instruments entered a new chapter of its life in 2023, with its previous CEO stepping down after 25 years in the role. Its current CEO, Richard Tyson, has begun his tenure on the back of positive results (released seven months after his appointment). Oxford Instruments’ preliminary full-year results continue its story of persistent earnings growth, with its revenues expected to be up 9% year-on-year, and the company is likely to maintain its long-held (approximately 50%) gross profit margin.

Its management has attributed its ongoing success to the company’s focus on “key sustainability-driven and structurally growing end markets, including advanced materials, life science and semiconductors”. In more concrete terms, these tailwinds have resulted in company reporting a book-to-bill ratio greater than 1 (the ratio of orders received to units shipped and billed, with a value greater than 1 being a positive as it is an indication there is excess demand that a company can grow into) and a strong order book pipeline. Oxford Instruments has made c. £90m in investment in new life science and semiconductor sites to support its growth. Its shares are nonetheless down on the year, with the market likely not realising the growth opportunities presented to the company or taking a wait-and-see approach to the new CEO, given his short tenure.

Performance

In our previous note, published in November 2023, we highlighted the recovery in THRG’s NAV, with THRG having been previously caught up in the growth-stock selloff of 2022. As can be seen in Figures 14 and 15, THRG has continued to extend the positive reversal in its performance, increasing its outperformance since November. It has beaten its benchmark’s returns over the last six and 12 months and has also edged out the median returns of its peers over the last 12 months. Note that the peer group performance in Figure 14 uses the average performance, which has outperformed THRG due to the outsized returns of two trusts, Oryx International Growth and Odyssean Investment Trust, whose approaches differ substantially from more conventional small- and mid-cap strategies that make up the majority of the peer group.

Figure 14: THRG NAV total return performance relative to benchmark and peer group to 31 May 2024

Source: Morningstar, Marten & Co. Note: 1) THRG has a benchmark that is the Deutsche Numis Smaller Companies Index (plus AIM stocks but excluding investment companies). 2) The peer group is defined on page 12.

Figure 15: Cumulative total return performance over periods ending 31 May 2024

Source: Morningstar, Marten & Co

Whilst THRG’s performance has been caught up in macroeconomic headwinds, such has rising global interest rates and heightened political risks (both at home and overseas), it has always been Dan’s intention for it to reflect the structural trends that ultimately drive long-term outperformance (the long-term drivers of growth that are not economically sensitive, such as the advancements in artificial intelligence). This can be seen clearly by THRG’s five-year performance, where it has outperformed its benchmark and peers by a significant margin, largely driven by Dan’s stock selection.

However, given the correlation between growth stocks and interest rates, it may remain difficult for THRG to avoid the fallout of central bank decision-making in the near-term, as we pointed out on page 5. Even so, Dan’s ability to balance growth potential with quality business models and management should work in his favour even during an economic downturn.

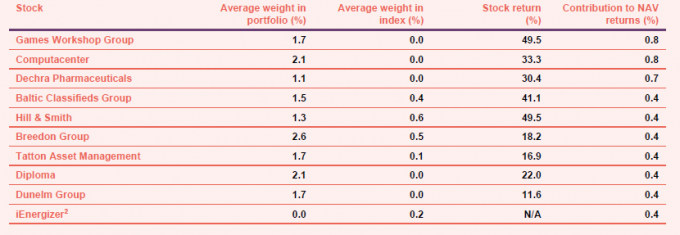

Drivers of returns

We have been provided with a breakdown of THRG’s return drivers for its 2023 financial year, which ended on 30 November 2023. We will highlight performance of those not covered in previous notes.

THRG had a number of companies within the portfolio that were taken over in the year, including Dechra Pharmaceuticals, which was one of THRG’s largest contributors. These takeovers are symptomatic of the heightened M&A and private equity activity over the period we mention on page 6. Whilst they do offer one-off boosts to the NAV, these corporate actions can also be frustrating for Dan if the price does not adequately reflect their future growth potential. Nonetheless, at the same time, these buyouts do serve to validate Dan’s investment philosophy.

Figure 16: Largest positive contributions to relative returns, twelve months ended 30 November 2023 (long only)

Source: BlackRock, Morningstar *iEnergizer delisted over the period

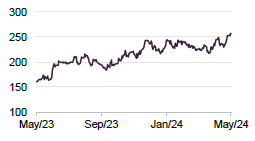

Baltic Classifieds Group

Figure 17: Baltic Classified Group

Source: Bloomberg

Baltic Classifieds Group (https://balticclassifieds.com) is a holding company which operates 14 online classified ads platforms, servicing automobiles, real estate, recruitment, and generalist advertising. It primarily services the Baltic regions, focusing mainly on Lithuania, Estonia and Latvia.

Baltic Classifieds’s share price performance has likely been a reflection of its strong earnings and recent share buybacks. In its most recent half-year results, it reported c.20% growth in revenue, profits, and earnings-per-share. The largest contributor to its revenue growth came from its automobile sites, with its revenues increasing by 28% over the six months to end October 2023. Baltic Classifieds is benefitting from an increasing volume of users as well as the increased value of transactions made on its sites (reflecting the increased wealth of emerging Europe), which allows Baltic Classifieds to take home larger nominal amounts per transaction. Recent actions by its management seem to support Dan’s confidence in the company’s ‘quality’, whereby it has returned1/3 of adjusted net income as a dividend each year, while also proactively repaying its debt to keep its leverage ratio manageable (currently sub 1x) and returning cash to shareholders via buybacks, when appropriate. The combination of growth and shareholder alignment has seen Baltic Classifieds’ share price grow by 49% over the last 12 months.

Hill & Smith

Figure 18: Hill & Smith

Source: Bloomberg

Hill & Smith (hsgroup.com) is a designer, manufacturer and supplier of products for the construction and infrastructure industries across the globe. Hill & Smith recently reported higher revenue and profits than analysts expected over 2023, with pre-tax profits up 34% and revenues up 13%. One explanation for this growth has been its ability to successfully expand in the US market, capturing the structural drivers behind the region’s growing infrastructure investment (a result of President Biden’s increased fiscal spending). Given the company’s resilient balance sheet, its managers will likely have sufficient leeway to continue this trend of M&A activity and further accelerate its growth. Thanks to its increased cash flow, Hill & Smith increased the 2023 dividend by 23%. The company’s share price is up 40% over the past year.

Tatton Asset Management

Figure 19: Tatton Asset Management

Source: Bloomberg

Tatton Asset Management (www.tattonassetmanagement.com) is a financial services firm focused on providing investment and operational services to financial advisers, predominantly in the UK. Despite its small market cap (compared to larger wealth managers), Tatton has demonstrated its leadership within the UK’s model portfolio services industry over 2023 and 2024, having reported the largest assets-under-mangment growth of any provider over 2023, and its portfolios’ returns repeatedly ranking in the top quartile for performance versus its peers. Tatton’s strong performance has led it to report £910m in new inflows over the first half of its 2024 financial year, with its total assets now reaching £13.7bn.

While its share price has performed well on the back of its positive results, it is still below its post-COVID peak. Given the quality of Tatton’s offering, and asset management groups’ natural correlation to global equity markets (with global equities markets having reached new highs in 2024), there is the possibility of a further runway for Tatton’s growth.

Dunelm Group

Figure 20: Dunelm Group

Source: Bloomberg

Dunelm Group (dunelm.com) is a home furnishing retailer, with c.180 stores across the UK, largely selling products from external suppliers under its own Dunelm brand. Dunelm has reported revenue growth in both its 2022 and 2023 financial years, and 2023 bringing in its highest-ever total sales at £1.6bn. Although its profits did fall over 2023, thanks to a fall in demand due to a weakened UK consumer, it has already begun to bounce back over 2024.

In its half-year update, Dunelm reported positive revenue and profit growth, driven by increases in sales values and a small reduction in the cost of goods sold. As a key indicator of its competitiveness, Dunelm has been able to grow revenues by increasing its sales rather than its prices (the latter often being the case with other retailers during the past years of rising inflation).

Another testament to the quality of Dunelm’s management has been its disciplined approach to returning capital to shareholders, with the company having announced a special dividend of 35p for 2024, as its managers saw fit to return its surplus cash to shareholders.

Peer group

Up-to-date information on THRG and its peer group is available on the QuotedData website

For comparison purposes, we have used a subset of funds in the AIC’s UK smaller companies sector. We have excluded split-capital companies, trusts with a small market capitalisation (below £50m), Marwyn Value Investors (which has a very different investment approach), and those that focus exclusively on micro-cap companies.

Figure 21: Cumulative NAV total return performance over periods ending 31 May 2024

Source: Morningstar, Marten & Co

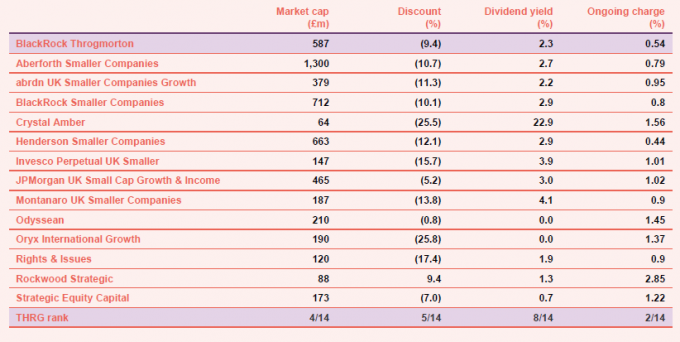

THRG is set apart from its peers by three distinct qualities: its above-average long-term track record, its ability to short stocks, and its bias to high-growth equities. Whilst there are other strategies which follow a growth-focused approach to stock selection, such as Montanaro UK Smaller Companies and abrdn UK Smaller Companies, THRG is the only trust in the UK smaller companies sector that is able to capitalise on the fall in share prices.

THRG’s discount may offer a more attractive opportunity than its peers based on its z-score

THRG has historically traded on a narrower discount than many of its peers, a reflection of the strength of its historic performance plus its differentiated approach to UK equity investing. THRG was even able to issue shares between 2020 and 2022. However, its current 12-month z-score (a measure of deviation from the average) of -1.1 is among the largest of the UK small cap trusts, which makes it one of the more attractive opportunities for investors looking to capitalise on a potential market rebound (improved performance could lead to a narrowing of the discount as well).

THRG’s market cap of £587m places it above the average of its peers, and its ongoing charges ratio is highly competitive, being one of the lowest amongst its peers. THRG’s ongoing charges would also be competitive compared to the open-ended sector (based on the average IA UK smaller companies sector member).

Figure 22: Listed UK smaller companies funds, comparison as 3 June 2024

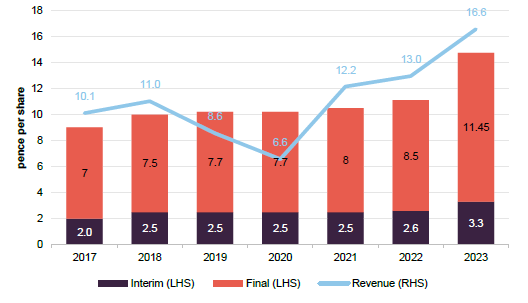

Dividend

Figure 24: THRG dividends and revenue per share

Source: BlackRock Throgmorton Trust

Dividends are a by-product of the investment process and THRG’s portfolio is not managed with any income generation objective in mind. Nevertheless, the portfolio may generate reasonable levels of income. The base management fee is charged 25% and 75% to the revenue and capital accounts respectively, while 100% of any performance fee is charged to capital.

Thanks to a substantial increase in revenues generated by THRG over 2023, a reflection of the recovery in UK companies, and Dan’s preference for high-quality companies (which are typically more disciplined when it comes to returning capital to shareholders when appropriate), THRG was able to pay a 14.75p per share dividend in 2023, a 34.7% increase on the previous year.

Fees and costs

BlackRock Investment Management (UK) Limited provides THRG with portfolio and risk management services under a contract that THRG has with BlackRock Fund Managers Limited. That contract is terminable on six months’ notice by either side. BlackRock Fund Managers’ base fee is calculated as 0.35% of gross assets (calculated monthly and paid in arrears). In addition, it can earn a performance fee of 15% of the outperformance of the benchmark index over a two-year rolling period with an effective cap of 0.9% of average gross assets, resulting in a cap on total management fees of 1.25% over a two-year period.

The ongoing charges ratio (which does not include performance fees) for the year ended 30 November 2023 was 0.54%, equal to the prior year. Had performance fees been included in the calculation, the ongoing charges ratio would have been 0.87% (2022: 0.54%).

Structure

As at 10 April 2024, THRG had 103,370,957 ordinary shares in issue, 92,966,912 of which are in circulation and the rest held in treasury. There is no other class of share capital. THRG’s board takes powers each year to repurchase up to 14.99% of the trust’s issued share capital (excluding treasury shares) and to issue up to 10%. Shares repurchased may be held in treasury or cancelled, at the discretion of the board. No treasury shares will be reissued other than at prices that represent a premium to the prevailing NAV, thereby ensuring that this action does not have any diluting effect on ongoing shareholders.

The board has set a maximum limit of net gearing of 20%. In practice, gearing is provided by the CFD portfolio. The mechanics of this are described on page 11.

The company’s year-end is 30 November and AGMs are normally held in March.

Board

Currently, THRG has six non-executive directors, all of whom are independent of the manager and none of whom sit together on other boards. The size of the board has fluctuated in recent years, but the board felt it important to recruit a sixth director in anticipation of an increased workload as the trust expands.

Since our last annual overview note was published in November 2022, Loudon Greenless has retired from the board (in March 2023), and was replaced by Glen Suarez, who joined in January 2023. Angela Lane was promoted to chairman of the audit committee, replacing Loudon, while Nigel Burton replaced Angela as chair of the remuneration committee.

Figure 25: The board

Source: BlackRock Throgmorton Trust, Marten & Co

Chris Samuel (chairman)

Chris was chief executive of Ignis Asset Management from 2009 until its sale to Standard Life Investments in 2014. He was previously chief operating officer at Gartmore and Hill Samuel Asset Management and was a partner at Cambridge Place Investment Management. Chris is a non-executive director of UIL Limited, its subsidiary UIL Finance Limited and Quilter Plc. He is also non-executive chairman of JP Morgan Japanese Investment Trust Plc and Quilter Financial Planning. Chris graduated from Oxford with an MA in Philosophy, Politics and Economics, and qualified as a chartered accountant with KPMG.

Louise Nash (chairman of the audit committee)

Louise was a UK small- and mid-cap fund manager, firstly at Cazenove Capital and latterly at M&G Investments, which she left in 2015. She now works for family wine business Höpler. She also acts as a consultant to JLC Investor Relations. Louise holds an MA in German and Politics from the University of Edinburgh and the IMRO Investment Management Certificate.

Angela Lane (chairman of the remuneration committee)

Angela spent 18 years working in private equity at 3i, becoming a partner in 3i’s growth capital business managing the UK portfolio. Since 2007, she has held several non-executive and advisory roles for small and medium-sized capitalised companies across a range of industries including business services, healthcare, travel, media, consumer goods and infrastructure. Angela is currently a non-executive director of Pacific Horizon Investment Trust Plc and Dunedin Enterprise Investment Trust Plc, where she is also chairman of the audit committee.

Nigel Burton (director)

Nigel spent over 14 years as an investment banker at leading City institutions including UBS Warburg and Deutsche Bank, including as the managing director responsible for the energy and utilities industries. He has also spent 15 years as chief financial officer or chief executive officer of a number of private and public companies. Nigel is currently a non-executive director of AIM listed companies DeepVerge Plc, Microsaic Systems Plc, eEnergy Group Plc and Location Sciences Group Plc. He was formerly a non-executive director of Digitalbox Plc, Corcel Plc, Modern Water Plc, Alexander Mining Plc, Mobile Streams Plc and chairman of Remote Monitored Systems Plc.

Merryn Somerset Webb (director)

Merryn has significant experience of financial matters through her role as a senior columnist for Bloomberg Opinion. She writes extensively on personal finance and features regularly on both radio and television. She brings valuable investment trust-specific experience and is currently a non-executive director of Murray Income Investment Trust Plc, and Netwealth Investments Limited.

Glen Suarez (director)

Glen Suarez is currently chairman of Impax Environmental Markets and Knight Vinke Asset Management. He is a senior adviser to FMAP Limited, a consultancy founded by Lord Maude, which advises governments on the implementation of public sector reform. Glen was chairman of The Edinburgh Investment Trust Plc until July 2022 and was a committee member and co-chair of the Capital Markets Advisory Committee, an independent body advising the IASB on accounting issues and standards between 2014 and 2020. He is a Fellow of the Institute of Chartered Accountants in England and Wales and a member of the Royal Society of Arts.

Previous publications

Readers may be interested in our previous publications on THRG, which are listed in Figure 26 below. These are available to read on our website or by clicking the links in the table.

| Title | Note type | Publication date |

|---|---|---|

| Vision, execution and adaptability | Initiation | 11 September 2018 |

| Throg’s shorts shine | Update | 16 January 2019 |

| Impressive run continues | Annual overview | 18 July 2019 |

| Look past the short-term noise | Update | 17 December 2019 |

| Separating the wheat from the chaff | Annual overview | 10 June 2020 |

| Infectious enthusiasm | Update | 14 December 2020 |

| Confidence rewarded | Annual overview | 29 September 2021 |

| Powering on | Update | 17 December 2021 |

| The strong have only gotten cheaper | Annual overview | 29 November 2022 |

| Growth in all things | Update | 22 November 2023 |

| Throgmorton’s fuse is lit | Flash update | 20 March 2024 |

| IMPORTANT INFORMATION | ||

|---|---|---|

| Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on BlackRock Throgmorton Trust Plc.This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.Marten & Co is not authorised to give advice to retail clients. The research does not have | regard to the specific investment objectives financial situation and needs of any specific person who may receive it.The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note | until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.