Primed for long-term growth

Primed for long-term growth

CEIBA Investments (CBA), the foremost foreign investor in Cuban real estate, has reason to be optimistic for its long-term growth despite the present covid-19 pandemic. Not only does CBA stand to benefit from the development of the Caribbean island as a leading holiday destination, but with the US Presidential election taking place this year and Raul Castro stepping down from politics in 2021, it may benefit further from positive changes in Cuba’s economic landscape.

During a tough 2019 in which US sanctions on Cuba were escalated, the company saw income grow 28% to US$20.7m. CBA’s investment portfolio includes the premier office complex in the country, which had its best ever year in 2019, and quality hotels located in Havana and Varadero. Its experienced on-the-ground management team has a strong track record of investing in Cuba, built up over 20 years.

As a result of the ongoing cost of construction of a hotel in Trinidad and the temporary drop in income resulting from the closure of all its hotels due to covid-19, CBA will not pay a dividend for 2019. Nevertheless, it is relatively well-placed to see out the global crisis given healthy cash balances, the absence of leverage and the performance of the office complex, the Miramar Trade Centre. CBA’s stock is very thinly traded and has a small number of long-term shareholders with large positions, which may account for the discount.

Tourism and commercial property in Cuba

Tourism and commercial property in Cuba

CBA invests in and manages a portfolio of Cuban real estate assets, focused on commercial and hotel properties, with the aim of providing a regular level of income and substantial capital growth.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Earnings per share (pence) | Dividend per share (pence) |

|---|---|---|---|---|---|

| 1 | 30 Apr 2020 | -30.50 | 1.80 | 4.20 | 0 |

Fund profile

Fund profile

CEIBA Investments (CBA) is a country fund with a primary focus on Cuban real estate assets. It invests in and manages a portfolio of Cuban real estate assets, with a focus on commercial and hotel properties. It was incorporated in October 1995 and started making investments in Cuba in 1996. It was listed on the Irish Stock Exchange between 1996 and 2002 and what was then called the Channel Islands Stock Exchange, between 2004 and 2011. In 2002, a new management team was appointed, headed by current lead manager Sebastiaan Berger.

On 22 October 2018, the company completed an IPO raising a further £30m and listed all of its ordinary shares (total market cap of close to £137m) on the Specialist Fund Segment of the London Stock Exchange.

CBA’s objective is to provide a regular level of income (a target yield of 4% on the IPO price) and substantial capital growth from a portfolio with a primary focus on Cuban real estate assets. The existing portfolio is made up of five operating assets: four hotels and an office complex.

The manager

The manager

Since 1 November 2018, CBA has been managed by Aberdeen Standard Investments, which hired Sebastiaan Berger as lead manager. An internal management team, based in Cuba, is employed by a subsidiary of CBA, CEIBA Property Corporation (CPC), whose costs are deducted from the management fee payable to Aberdeen Fund Managers. More information on the investment team and on the internal management team is provided later.

Investment process

Investment process

Whilst the present focus of CBA is on commercial and hotel properties in Cuba, it may also invest in other Cuban real estate assets such as infrastructure, industrial, retail, logistics, residential and mixed-use assets (including development projects).

CBA may also invest in any type of financial instrument or credit facility secured by Cuba-related cash flows. In addition, subject to the investment restrictions set out below, CBA may invest in other Cuba-related businesses that are considered by the company to be complementary to its core portfolio. Other Cuban assets may include, but are not limited to, Cuba-related businesses in the construction or construction supply, logistics, energy, technology and light or heavy industrial sectors. Investments may be made through equity, debt or a combination of both.

Foreign companies investing in Cuba usually do so through joint ventures with local investors. CBA will invest either directly or through holdings in special purpose vehicles, joint venture companies, partnerships, trusts or other structures. The Cuban Foreign Investment Act guarantees that the holders of interests in Cuban joint venture companies may transfer their interests, subject always to agreement between the parties and the approval of the Cuban government.

CBA’s present portfolio has been established over a period of more than 15 years. The investment team on the ground in Cuba has, amongst other things, performed extensive due diligence on potential acquisitions; established a working relationship with the appropriate authorities; negotiated the acquisition (and, later, extension) of surface rights over land; secured planning approvals and labour supply agreements; and worked closely with partners to optimise the performance of its portfolio.

Investment restrictions

Investment restrictions

On a look-through basis and at the time of acquisition:

• CBA will not knowingly or intentionally use or benefit from confiscated property to which a claim is held by a person subject to US jurisdiction;

• CBA may invest up to 10% of its gross assets in Cuban and non-Cuban companies, joint ventures and other entities that earn all or a substantial part of their revenues from activities outside Cuba;

• with the exception of Monte Barreto, the maximum exposure to any one asset will not exceed 30% of gross assets;

• no more than 20% of gross assets will be invested in non-real estate Cuban assets; and

• no more than 20% of gross assets will be exposed to real estate development projects, being new-build construction projects carried out on undeveloped land.

Results for 2019

Results for 2019

CBA published results for 2019 in April 2020. Its net asset value (NAV) is calculated and published on a quarterly basis. Whilst its shares are quoted in pounds sterling, an investment in CBA should be considered a US dollar investment. CBA’s functional currency is the US dollar and therefore its accounts and its NAV are published in US dollars. CBA also publishes a NAV in sterling based on the prevailing exchange rate. As part of the NAV calculation, the underlying properties are valued by an independent third-party valuation adviser, Abacus Consulting. Abacus is a registered member of the Royal Institution of Chartered Surveyors (RICS) and is a certified valuer with broad experience and expertise in the property market of Cuba.

Total net assets at 31 December 2019 amounted to $262.0m (2018: $268.4m), of which around 87% was indirectly invested in income-generating Cuban commercial and tourism related real estate assets and 10% represented finance facilities and cash.

The total dividend income from the Cuban joint venture companies during the year ended 31 December 2019 was $20.7m (2018: $16.2m).

Monte Barreto, the joint venture company that owns the Miramar Trade Centre office complex in Havana, had its best performance ever with a net income of $13.5m. However, the performance of the hotels was below expectation, with net income after tax of $17.9m, compared to $21.7m in 2018. More details on the assets and their performance can be found in the asset allocation section.

The net income attributable to the shareholders was $7.6m and NAV per share at 31 December 2019 was $1.50/£1.14 (2018: $1.49/£1.18).

The fair value of CBA’s equity investments in the year was down $14.2m and was primarily due to the decrease in the fair value of the hotels. The decrease of CBA’s share of the joint venture company that owns the hotels, Miramar, was $17.4m.

Due to the impact covid-19 has had and is expected to have on the Cuban tourism sector and general liquidity this year, the board decided to cancel the dividend that was scheduled to be paid in June 2020.

Market outlook

Market outlook

Coronavirus

Coronavirus

As with all countries around the world, the covid-19 pandemic has had a devastating impact on the Cuban economy and in particular the tourism sector. However, the Cuban government has handled the situation well. It moved quickly to deal with the emerging threat of coronavirus and in January 2020 had already prepared a “prevention and control” plan. This included training medical staff, preparing medical and quarantine facilities, and informing the public (including tourism workers) about symptoms and precautions. When the first three reported cases were confirmed on 11 March 2020, arrangements were in place to trace and isolate contacts, mobilise medical students for nationwide door-to-door surveys to identify vulnerable people and check for symptoms, and roll out a testing programme.

On 20 March 2020, with 21 confirmed cases reported, the government announced a ban on tourist arrivals, lockdown for vulnerable people, provision for home working, reassignment of workers to priority tasks, employment protection and social assistance.

As at 8 May 2020, Cuba had 1,729 confirmed cases of covid-19, with 1,031 recoveries and 73 deaths. Cuba’s reported cases are based on tests using WHO protocols.

Cuba has a number of advantages in the fight against covid-19, according to the Institute of the Americas, University College London. It has free universal healthcare, the world’s highest ratio of doctors to population, and positive health indicators, such as high life expectancy and low infant mortality. In addition, Cuba has an advanced medical research industry, including three laboratories equipped and staffed to run virus tests.

Cuba has implemented a rigorous testing regime. According to available data, Cuba has a test-to-reported-cases ratio of 25:1, compared with 10:1 in Germany, 5:1 in the US and 4:1 in the UK. Around 40% of Cuba’s recent positive results are from asymptomatic cases, further highlighting the importance of testing.

Some areas of Havana, the capital city, have been designated as quarantine zones to combat further spread of covid-19. In these areas, a limited number of people have been given permission to leave and return, such as people in essential jobs. There are designated entry and exit points and everyone leaving is tested for covid-19. No traffic is allowed in other than essential services and supplies organised by the authorities.

On 1 April 2020, all commercial and charter flights were suspended from entering or leaving Cuba until further notice, and since Monday 23 March, only Cuban nationals and foreign residents of Cuba have been allowed to enter the country, adhering to a 14-day period in government-managed self-isolation accommodation. The Cuban government also announced that anyone who arrived in Cuba between 17 and 23 March 2020 would be tested for coronavirus.

However, a lack of resources in Cuba has contributed to a housing shortage that has made physical distancing difficult, and the island’s poor infrastructure has created logistical challenges. US sanctions on Cuba have also hampered trade (including medical equipment imports) and obstructed access to international finance – including emergency funds.

The effect of the measures on CBA’s portfolio is described in the asset allocation section.

The Cuban economy

The Cuban economy

Since 2011, the Cuban government has enacted reforms intended to modernise Cuba’s centrally controlled socialist economy as well as allowing private entrepreneurship in Cuba and encouraging foreign investment. This strategy was endorsed by the 2016 Communist Party Congress and Miguel Diaz-Canel Bermudez, who succeeded Raul Castro as president of Cuba in April 2018, becoming the first president that is not a Castro family member since 1976.

Raul Castro (aged 88) is currently serving as the First Secretary of the Communist Party of Cuba, the most senior position in the country, but is stepping down in 2021 and is likely to be replaced by Diaz-Canel.

In July 2018, Cuba’s National Assembly endorsed a new constitution and in February 2019, Cuban’s voted in favour of the new constitution, replacing the 1976 charter. It protects private property and foreign investment, and for the first time, places two fiveyear terms on the office of the presidency.

Tourism is Cuba’s main source of revenue, after the export of professional services, with emigrés’ remittances also a large source of revenue for the economy.

In January 2020, before the covid-19 pandemic, Cuban deputy prime minister and minister of economy and planning Alejandro Gil Fernández stated that over the last 12 months, Cuba’s economy saw growth of around 0.5%, and Cuba’s economy was on course to show 1% growth in 2020.

The Economic Commission for Latin America and the Caribbean (CEPAL) had estimated average 2019 economic growth for the region of 0.1% and projected growth for 2020 of around 0.3%. However, in a special covid-19 report published by CEPAL on 3 April 2020, it stated that as a result of the pandemic, its original projections should be adjusted downwards by some three, four or even more percentage points. So far, no estimates have been given on the effect covid-19 will have on Cuba’s original growth projections for the economy.

US sanctions on Cuba

US sanctions on Cuba

Cuba’s relationship with the US has been poor since the Cuban revolution and the failed US invasion in 1961. The Helms-Burton (Cuban Liberty and Democratic Solidarity (Libertad)) Act of 1996 strengthened and extended US sanctions against Cuba and has also created uncertainty on the part of non-US investors in Cuba.

During the Presidency of Barrack Obama, diplomatic relations were restored, prohibitions on banking transactions were relaxed and US travel to Cuba was made easier (including the reintroduction of direct flights and cruise ship travel), resulting in an increase of US visitors. Following his election, President Donald Trump re-imposed most of the travel restrictions and prohibited individual licensed travel.

Against the backdrop of the upcoming US Presidential election and the ongoing efforts made by the US administration to force Cuba to withdraw its support for Venezuela, US-Cuban relations have deteriorated. In 2019, the US adopted harsher measures, including enacting Title III of the Helms-Burton Act.

Title III of the Act allows US citizens that had ownership claims with respect to properties confiscated by the Cuban State – including Cuban Americans who were not US citizens at the time of confiscation – the right to file claims in US courts against enterprises and individuals (both Cuban and of other nationalities) doing business in Cuba, accusing them of “trafficking in confiscated property”. Effectively, the Helms-Burton Act seeks to compensate persons that lost properties and businesses during Cuba’s revolution. Thousands of claims worth billions of dollars have been certified.

The Helms-Burton law has been strongly condemned by the European Union, Canada, Mexico and other allies of the United States who trade with and invest in Cuba. The application of Title III is likely to discourage potential foreign investment into Cuba, which needs about $2bn per year of foreign direct investment to sustain its economy, as well as the willingness of international banks and other financial institutions to deal with Cuba.

Title III lawsuits have been filed against cruise liners (which are accused of using terminals that were confiscated illegally during the Cuban revolution), major airlines and other tourism-related companies such as Expedia and Booking.com. CBA’s manager says that whilst it will take some time for the lawsuits to work their way through the US court process, several had been withdrawn and all were unlikely to succeed. Although the language and terminology of Title III is vague and so far few courts have interpreted the law, the manager does not expect that any of the properties in which CBA has an investment will be subject to a successful Title III action.

Other economically driven sanctions adopted by the Trump administration during 2019 included increased restrictions on US citizens travelling to Cuba, prohibiting all US flights to Cuba except to Havana, banning US cruise ships from stopping in the country, and limiting family remittances to $1,000 per quarter.

Tourism

Tourism

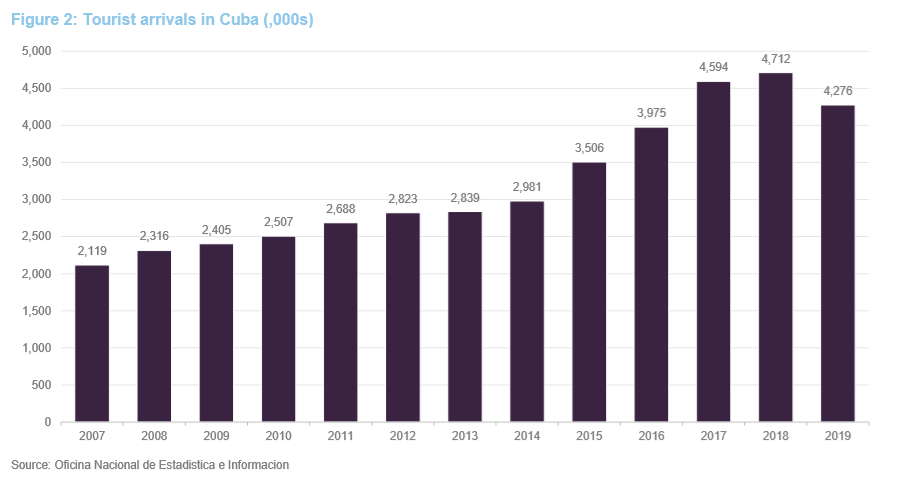

With seven UNESCO World Heritage sites and some of the best beaches in the world, Cuba has long been a tourist hotspot. Prior to the US ramping up its measures against Cuba, the number of visitors to the island had increased each year since 2008. In 2010, 2.5 million tourists visited Cuba. Growth in tourism was particularly evident in the threeyear period between 2016 and 2018, when numbers increased by 1 million to 4.7 million.

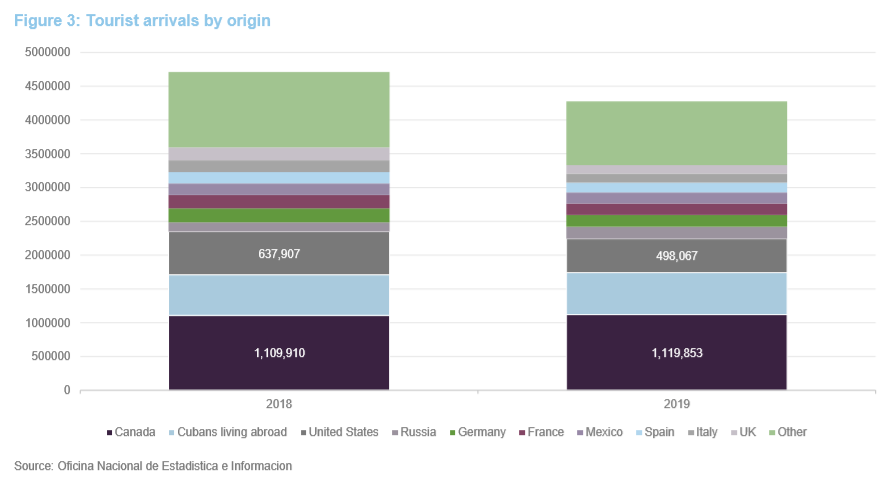

In 2019, however, Cuba drew 4.3 million tourists, massively down on the 5.1 million forecasted at the start of the year and the first fall in more than a decade. The restrictions on US citizens travelling to the island had a huge bearing on this. Official figures show that 498,000 Americans visited Cuba in 2019, the large bulk coming in the first four months, a 22% fall on 2018 figures.

In addition to the fall in American visitors, tourists from Europe also decreased. The collapse of Thomas Cook in late 2019 affected many hotels and air travel to Cuba, significantly reducing visitor numbers from the UK and Germany, in particular.

However, the 2019 figures must be put in the context of continued growth for the past decade. Cuba remains a popular holiday destination for many Europeans, South Americans and Canadians – indeed, 1.1 million Canadians visited Cuba in 2019, representing over 26% of all visitors.

US elections

US elections

The US presidential election is scheduled for November 2020 and the manager believes the result could have a material impact on the future US-Cuban relations and an easing of the economic measures in place.

Joe Biden was fully supportive of the easing of embargoes on Cuba when he was vice president in Obama’s administration and recently stated: “As President, I will promptly reverse the failed Trump policies that have inflicted harm on the Cuban people and done nothing to advance democracy and human rights.” (Newsweek, 16 April 2020). The manager believes that if Biden was to be elected, there would be a change in US policy towards Cuba and an easing of restrictions similar to those seen under Obama’s administration.

The manager believes that there is also a possibility that a re-elected president Trump will change his tune. The increased US sanctions against Cuba have a primary purpose of punishing Cuba for its ongoing support for Venezuela’s president Maduro. The manager coincides with various journalists, however, that it also serves Trump’s 2020 re-election strategy, which is based on the assumption that, in order to win the State of Florida, he needs the support of hard-line Cuban American and Venezuelan voters.

The historic performance of CBA’s hotels, when relations with the US were favourable during the later years of Obama’s presidency, provides the manager with an encouraging measure of the potential upside for the Cuban economy if relations with the US improve and the number of US visitors increases again.

Asset allocation

Asset allocation

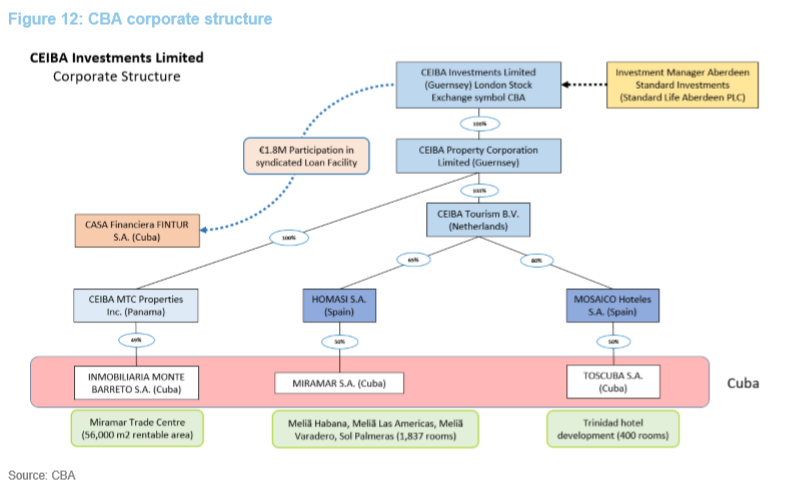

As explained, CBA does not have any direct interests in Cuban properties, but has indirect interests in Cuban joint venture companies that in turn have ownership interests in Cuban properties.

As at 31 December 2019, CBA’s portfolio was valued at $227.3m. It comprises the office complex of the Miramar Trade Centre, the adjacent Meliã Habana Hotel, three hotels in Varadero (next to Cuba’s only 18-hole golf course), a new hotel construction at the beach next to Trinidad (Cuba) and various financial assets and liabilities.

Miramar Trade Centre (Monte Barreto)

Miramar Trade Centre (Monte Barreto)

CBA owns a 49% interest in Monte Barreto, the Cuban joint venture company that owns the Miramar Trade Centre. The 55,530 sqm office complex is made up of six mixeduse office buildings at the core of the Miramar business district in Havana. CBA’s interest was valued at $86.7m at 31 December 2019. The dividend income for the year was $9.1m.

Monte Barreto, which was incorporated in 1996 for an initial term of 50 years, was granted surface rights to the land on which Phase I and Phase II of the trade centre were constructed and these surface rights end in 2046. The surface rights may be extended if an agreement can be reached with the Cuban partner and the Cuban government approves the extension.

With an 80% market share of the modern office space segment (or a 50% market share when including modern government offices), the complex has limited competition and in 2019 maintained full occupancy for the second year in a row. It is the premier commercial office complex in Cuba and is the largest in terms of net rentable area. Space is let on short lease terms (typically one to two years) in order to facilitate the repositioning of tenants and the rapid resetting of rent levels. The average monthly rent per square metre rose 4% from $25.22 in 2018 to $26.28 in 2019.

The existing phases were constructed between 1996 and 2006, although the original master plan contemplated 18 buildings having a total net rentable area of 150,000 sqm. The construction of additional phases of the project is subject to obtaining required government approvals, including those relating to the acquisition of additional land rights and construction permits.

Performance

Monte Barreto had its best ever year in 2019. Increased rental rates during 2019 saw EBITDA increase to $18.1m, from $17.3m in 2018. Net income after tax was up 5.9% to $13.5m for the year.

Impact of covid-19

The operations of Monte Barreto do not appear to be materially impacted by the coronavirus pandemic, the manager says. A limited number of tenants are in industries that have suffered an instant loss of income, such as airline operators, travel agencies and other tourism-related companies. The manager says the outlook for 2020 remains encouraging and expects occupancy levels to remain in the high 90s and the loss of rental income as a result of concessions to travel and tourism companies to be modest.

Monte Barreto has no debt financing, and a cash balance in excess of $10m. However, the general liquidity situation in Cuba may have a negative effect on the ability of Monte Barreto to distribute dividends to its shareholders, including CBA.

Hotels in Havana and Varadero (HOMASI/Miramar)

Hotels in Havana and Varadero (HOMASI/Miramar)

CBA has interests in four hotels in Cuba: a five-star hotel in Havana and three hotels (four- and five-star) in Varadero. The hotels have a total of 1,834 rooms and are all managed and operated by Meliã Hotels International (MHI).

CBA owns a 65% interest in HOMASI, with MHI owning the other 35%. HOMASI owns a 50% interest in Miramar, the Cuban joint venture company that owns the four hotels. Via this structure, CBA has an ultimate economic interest of 32.5% in the hotel assets.

CBA’s stake in the four hotels was valued at $83.1m at 31 December 2019 and dividend income for the year was $7.5m.

Meliã Habana Hotel

A 397-room (including 16 suites) five-star business hotel located on prime ocean-front property directly facing the Miramar Trade Centre, 10 minutes from the city centre and 15 minutes from the airport. The hotel offers conference facilities, numerous meeting rooms, a business centre and three executive floors.

Miramar has agreed a four-year refurbishment and development plan for the hotel, which involves improvements to existing rooms, public areas and restaurants, the construction of an additional 163 new rooms and the construction of a large modern ballroom and conference centre.

The 2020 investment programme would have seen the construction of 24 new rooms (bringing the hotel up to 421 rooms) and the refurbishment of 68 rooms. However, these plans have been put on hold due to covid-19.

Meliã Las Americas Hotel

The Meliã Las Americas Hotel is a five-star luxury beach resort hotel located next to the Varadero Golf Course. It has 340 rooms, including 90 bungalows and 14 suites. It is located on 400 metres of beachfront and operates as an all-inclusive beach resort. The hotel has been managed by MHI since commencing operations in 1994.

Miramar had planned to modernise and upgrade the common areas of the hotel as well as 144 rooms and seven bungalows during 2020. These plans have been put on hold.

Meliã Varadero Hotel

The five-star Meliã Varadero Hotel is located adjacent to the Meliã Las Americas Hotel and the golf course. It has 490 rooms, including seven suites and is located on 300 metres of beachfront. It operates as an all-inclusive beach resort. The hotel has been managed by MHI since commencing operations in 1992.

Miramar had planned to upgrade 238 rooms at the hotel during 2020, but has put this work on hold.

Sol Palmeras Hotel

The four-star Sol Palmeras Hotel is located next to the Meliã Varadero Hotel and also borders on the golf course. It has 607 rooms, including 200 bungalows, of which 90 are of suite or deluxe standard. It is located on 500 metres of beachfront and operates as an all-inclusive beach resort. The hotel has been managed by MHI since commencing operations in 1990.

Miramar’s plans to refurbish 63 rooms and 50 bungalows at the hotel in 2020 have also been put on hold.

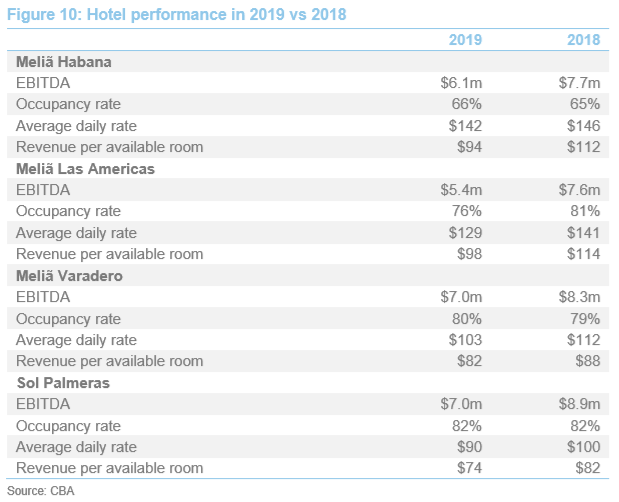

Performance

During 2019, the hotels suffered from various negative external factors, including the strengthening of the US embargo and the bankruptcy of travel company Thomas Cook.

During the year, the Meliã Habana, Sol Palmeras and Meliã Varadero hotels maintained or slightly increased their average occupancy rates compared to the prior year. However, the Meliã Las Americas saw a 5% decline in average occupancy. Each of the hotels suffered a significant decrease in average room rates, resulting in lower income and EBITDA compared to the prior year.

The decrease in the 2019 operational results of Miramar were partially compensated by a $2.5m tax credit it received from the Cuban government relating to the reinvestment of profits by Miramar at the time of completion of the 2018 merger between Miramar and Cubacan (at the time the joint venture company that owned the Varadero hotels).

Taking into account the receipt of the tax credit, the net income after tax of Miramar was $17.9m, down from $21.7m in 2018.

Impact of covid-19

As a direct result of the measures announced by the Cuban government on 20 March 2020, Miramar closed all four hotels. The manager says that it is inevitable that the income levels for 2020 and possibly beyond will fall below the projections that were used by its valuers at the time of calculating the fair values of the assets as at 31 December 2019. It is therefore likely that the fair values of the hotels will be adjusted downwards as at 30 June 2020 to reflect the temporary loss of income and the present uncertainty surrounding the effects of the covid-19 pandemic.

Although Miramar has no debt financing, and a healthy cash balance in excess of $40m, the closing of the hotels will have a negative effect on the results of Miramar and its ability to distribute dividends to its shareholders, including CBA.

Meliã Trinidad Playa Hotel project (TosCuba)

Meliã Trinidad Playa Hotel project (TosCuba)

CBA has a 40% economic interest in the TosCuba joint venture company that owns a hotel development project on a four-hectare beachfront site just outside the town of Trinidad on Cuba’s southern coast. Trinidad and the nearby Valle de los Ingenios (the site of many historic sugar mills) are UNESCO world heritage sites. The hotel will, once completed, be a 400-room, four-star resort hotel, inspired by the Paradisus (Meliã) Playa del Carmen La Perla hotel in Mexico.

Structural works are around 90% complete and significant internal works including electrical, plumbing, doors and windows, flooring, internal structures and drywall installation were under way.

TosCuba received a $10m non-repayable grant under the Spanish Cuban Debt Conversion Programme and in accordance with the terms of the grant, the funds were used to purchase goods and services delivered under the construction contract by Cuban suppliers.

Impact of covid-19

Construction of the project, which was expected to complete in December 2020 at a budget of $60m, has been delayed due to covid-19. CBA is in discussion with TosCuba to substantially lower the capital expenditure on the construction until there is greater certainty around the repatriation of dividends from Miramar and Monte Barreto that allow for the future financing and construction of the new hotel. The timeline and disbursement schedule of the construction will be extended.

TosCuba construction facility

TosCuba construction facility

In April 2018, CBA arranged and executed a secured construction finance facility to provide funding for the construction of the Meliã Trinidad Playa Hotel. The facility is worth up to $45m, to be disbursed in two tranches, with an 8% interest rate. The first disbursement under the facility was made in November 2018 in the lead-up period to the formal construction start of the project in December 2018, and as at 31 December 2019 just over $9.9m had been disbursed. The remainder of the facility will be disbursed over the remaining construction period, followed by a nine-year repayment period.

The facility is secured by future income of the Meliã Trinidad Playa Hotel and 50% of the principal amount is further secured by a guarantee given by Cubanacán, the Cuban shareholder of TosCuba, backed by income from another hotel in Cuba.

Impact of covid-19

Due to the delay in construction, disbursements to be made under the facility are being discussed between the constructor, TosCuba and its shareholders. The manager says it is likely that the company may be forced to attract funding from its shareholders or third parties in order to continue providing the amounts committed under the facility. The manager says it envisages debt rather than equity funding for this purpose.

FINTUR finance facility

FINTUR finance facility

CBA invested $6m in an 8% interest-bearing structured finance transaction with Casa Financiera FINTUR S.A. (FINTUR), the financial house of Cuba’s tourism sector, in March 2016. The facility acts as a medium-term investment and treasury management tool for CBA and is fully secured by offshore tourism proceeds from numerous internationally managed hotels.

As at 1 April 2020, CBA is owed €1,716,667. Payment of the outstanding amount is scheduled to take place in three monthly instalments ending on 30 June 2021, but this schedule will now likely be re-negotiated due to covid-19, and the final payment date extended.

Corporate structure

Corporate structure

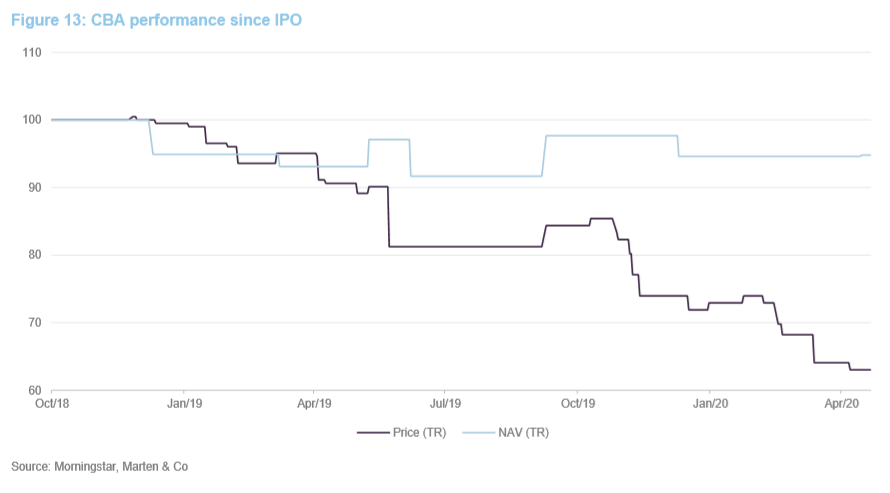

Performance

Performance

CBA’s NAV has fluctuated since launch as the US sanctions on Cuba escalated and impacted on the valuation of CBA’s portfolio, especially the hotel assets. The NAV is reported in both US dollar and sterling. The NAV here is in sterling and has been influenced by the prevailing dollar/sterling exchange rate. In dollar terms, the NAV has been less volatile.

Dividend

Dividend

The board decided that, in light of the covid-19 pandemic, it would not declare a yearend dividend in respect of the 2019 financial year. The board said it would re-consider CBA’s dividend policy for the year ending 31 December 2020, dependant on the length and severity of business disruption and the outlook for the remainder of 2020.

CBA paid an annual dividend of 4.9p per share for the year to 31 December 2018, a 4.9% yield based on the IPO subscription price.

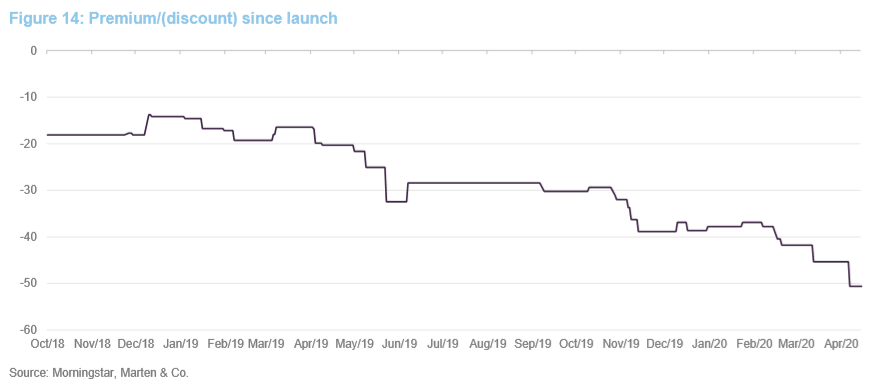

Premium/(discount)

Premium/(discount)

CBA’s discount widened during the course of 2019 as tougher economic sanctions were imposed on Cuba by the US. When CBA’s hotels closed in March 2020 due to the covid-19 pandemic, CBA’s discount widened further and as at 12 May 2020 stood at 50.6% (using a forex exchange rate of 1.2243 and CBA’s NAV at 31 December 2019 of $1.50).

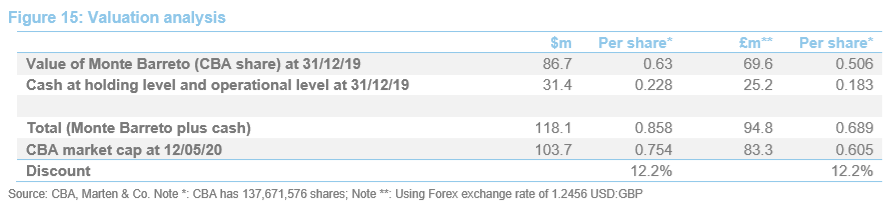

CBA’s present market capitalisation of £83.3m is still at a discount to the value of its holding in Monte Barreto (as at 31 December 2019) plus cash, as set out in Figure 15.

With the severity and longevity of the impact of covid-19 on CBA’s hotels unknown, Figure 15 shows that if the four hotels and the Trinidad development were stripped out, CBA’s share price would trade at a 12.2% discount to the value of CBA’s holding in Monte Barreto plus cash (at holding level and in the hotel joint venture).

This model assumes that Monte Barreto is worth the same now as it was valued at the end of December 2019 and the cash levels remain unchanged.

CBA has the authority to buy back shares if it is trading at a discount if they believe it to be in shareholders’ interests and as a means of correcting any imbalance between the supply of and demand for the ordinary shares. The company can repurchase up to 14.99% of its issued share capital. Similarly, if CBA’s shares are trading at a premium, it has the authority to issue new shares in order to satisfy any excess demand.

Ordinary shares repurchased may be held in treasury and reissued at a later date (but only at NAV or at a premium).

Fees and costs

Fees and costs

CBA pays the Alternative Investment Fund Manager (AIFM) an annual management fee of 1.5% of NAV. This fee is payable quarterly in arrears. There are no performance fees, transaction fees or property management fees. The fee is reduced by the running costs of CPC’s operations in Havana. The cost of the Cuban operations is borne by the AIFM. The manager has agreed to defer the management fee payable in respect of the second and third quarters of 2020 until 31 December 2022 (or sooner if the operational results of the company permit) in order to alleviate the working capital requirements of the company during the present difficult trading environment.

MHI is entitled to 12% of the first $8.5m of net income from the hotels, 18% on the next $6.5m and 24% of amounts above $24m. The contract with respect to each of the hotels runs until 2022 and can be terminated early if minimum net income thresholds are not met. As a result of the impact of covid-19, MHI will not meet the minimum thresholds stipulated in the management agreements, but the Cuban joint venture that owns the hotels has no intention to terminate any of the hotel agreements.

The administrator and company secretary is JTC Fund Solutions (Guernsey) Limited. It is entitled to an annual fee of £120,000, plus £10,000 per subsidiary, plus some other fees for ad hoc services. The depositary is JTC Global AIFM Solutions Limited; it is entitled to a £30,000 annual fee. The auditor is Grant Thornton Limited; its fee is agreed by the board each year in advance. The directors estimate that total annual expenses will be below 2%.

Capital structure and life

Capital structure and life

CBA has 137,671,576 ordinary shares in issue and no other classes of share capital.

The fund’s year end is 31 December. It published its annual report in April 2020 and will hold its AGM on 19 June 2020.

CBA has powers to issue additional ordinary shares, up to a total of 300m, and 200m C shares in the future. Any C shares will be issued at 100 pence per C share and will convert subsequently into ordinary shares using a conversion ratio calculated on the basis of their respective NAVs.

The shares listed on the Specialist Fund Segment (SFM) of the London Stock Exchange (LSE). The LSE advises, but does not mandate, that funds listed on the SFM are not considered suitable for distribution to retail investors. The shares are not subject to the FCA’s restriction on the promotion of non-mainstream pooled investments. The board has also concluded that the shares constitute a non-complex product for the purposes of MiFID II. US persons are prohibited from owning shares in CBA and the company’s articles give it power to disenfranchise and forcibly transfer any shares acquired by a US person.

Gearing

Gearing

CBA does not have any external finance at the holding company level or at the level of each underlying investment. In the event that gearing becomes available in the future on attractive terms, the board would establish gearing guidelines for the AIFM in order to maintain an appropriate level and structure of gearing.

The cash position of the company at holding level, as at 31 March 2020, was in excess of $9m. The board said it had entered into discussions with third parties and shareholders with a view to obtaining a credit facility of up to €15m.

Major shareholders

Major shareholders

Investment team

Investment team

Sebastiaan Berger is the lead manager. He is a Dutch trained lawyer who has been advising foreign investors in Cuba since 1996, first as founder of the Havana office of an international law firm, then as a founding partner of Berger, Young and Associates (1998). He has been the lead investment manager since 2002 and was appointed as chief executive in 2010, when the management of the company was internalised. As at 31 March 2020, Sebastiaan held 3,273,081 shares in the company.

Stephen Coltman is a senior investment manager within the Alternative Investment Strategies division at ASI. He has extensive experience investing across both public and private markets and spent many years in Latin America, including a three-year period in Cuba during the 1990s. Stephen holds an MSc in Chemistry from Imperial College, London and is a CFA charterholder.

Christian Pittard is group head of product opportunities. He was previously a director of the company from 2001 to 2005. Christian is qualified as a chartered accountant and a fellow of The Securities Institute by Diploma. He has experience in launching and servicing both closed- and open-ended funds. Christian graduated with a BSc (Hons) Degree in Economics from Southampton University.

Internal management team

Internal management team

In addition to the external management provided by the AIFM and the investment manager, CBA benefits from the services of its extensive and experienced on-theground team, through its operating subsidiary CPC.

Cameron Young is a Canadian who has lived and worked in Havana since 1998. Following a number of years as a lawyer with Baker McKenzie in Hungary, he cofounded Berger, Young and Associates, a leading international consulting firm focused on Cuba, in 1998. He originally joined the management team as a principal investment manager in 2002 and became chief operating officer when CBA’s management became internalised in 2010. He held 4,129,672 shares in CBA as at 31 March 2020.

Paul S. Austin is a Canadian chartered professional accountant (CPA, CA) who has lived in Havana since 2001. He started his career with Pricewaterhousecoopers where he worked in Toronto, San Jose, California and Cuba. He originally joined the management of the company in 2005 as financial controller and became chief financial officer in May 2013. He held 144,000 shares in CBA as at 31 March 2020.

Gilberto Perez is a Cuban lawyer who heads the day-to-day operations and management of the Madrid offices of HOMASI S.A. and Mosaico Hoteles S.A. and oversees the investments in Miramar S.A. and TosCuba S.A. Gilberto previously headed the on-the-ground management of the Havana office of CPC and prior to joining CPC he worked for Corporacion Financiera Habana S.A., the first joint venture in Cuba’s financial sector, and Grupo B.M., an Israeli company that previously held the 49% interest in the capital of Monte Barreto that was acquired by CBA.

Enrique Rottenberg is a real estate developer who has successfully developed residential and commercial real estate projects in Israel, Spain and Cuba. He was the promoter and driving force behind the development of the Miramar Trade Centre and originally joined the management of the company in 2006, when it acquired its interest in Monte Barreto. He continues to act as general manager of the Miramar Trade Centre.

Board

Board

CBA has five directors, all of whom are non-executive and independent of the manager. Two of the directors, John Herring and Colin Kingsnorth, have close connections with two of the largest investors in CBA. None of the directors sit together on other boards. The board considers that John Herring, in his role as chairman, is independent in character and judgement and brings a wealth of experience, particularly in relation to the company and its investments. Due to his historical connection with Northview Investment Fund Limited (the largest shareholder), John is not considered fully independent for the purposes of the UK Corporate Governance Code.

John Herring qualified as a chartered accountant in 1982. In 1986, he joined the corporate finance department of Kleinwort Benson, where he was involved in the IPOs on the LSE for several companies. In 1996, he established his own private equity advisory business and joined the boards of a number of public and private companies including JD Wetherspoon Plc, where he became deputy chairman and served as a non-executive director for 14 years. He is currently the non-executive chairman of the Edinburgh Woollen Mill Group Limited. John acts as a consultant to Northview Investment Fund Limited (a substantial investor in CBA).

Keith Corbin is a principal and executive chairman of Nerine International Holdings Limited, a network of trust and fiduciary services companies with operations in Guernsey, British Virgin Islands, Hong Kong, India and Switzerland. He serves as a director of a number of regulated financial services companies and is also the senior independent non-executive director of HarbourVest Global Private Equity Limited, a FTSE 250 company. Keith is an Associate of the Chartered Institute of Bankers (ACIB) and a Member of the Society of Trust and Estate Practitioners (STEP).

Peter Cornell is a founding partner of Metric Capital, a pan-European special situations fund. He is a non-executive director of F&C Commercial Property Trust Limited and a member of the International Advisory Board of the Madrid Business School. Previously he was global managing partner of Clifford Chance until 2006. During his 36-year tenure with Clifford Chance, his roles included managing partner for Spain and continental Europe. He then became managing director of Terra Firma, a European private equity firm, until 2011. Peter holds a BA (Hons) in Economics and History.

Trevor Bowen has over 30 years’ experience spanning across a variety of industries. Trevor spent 11 years as a partner of KPMG and 17 years managing U2 and other artists. Trevor has acted as a non-executive director on a number of boards, most notably as a director on the board of Ulster Bank for nine years, which included six years as the chairman of the bank’s audit committee. He is an Irish national and a chartered accountant.

Colin Kingsnorth is a partner and director of Laxey Partners, a UK-based active value investment firm focusing on closed-end funds and property investments. Colin previously worked for Robert Fleming Asset Management, headed the investment trust research at Olliff & Partners, and managed the emerging markets fund of Buchanan Partners Limited. In 1995, Colin co-founded Regent Kingpin Capital Management. Then, in 1997, he founded Laxey Partners with Andrew Pegge. Since then Laxey Partners has become a prominent active value investor focusing on closed-end funds and property investments. Colin holds a BSc in Economics and is a CFA charterholder. Laxey Partners and Value Catalyst Fund are substantial investors in CBA.

The legal bit

The legal bit

This marketing communication has been prepared for CEIBA Investments by by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.