Economic and Political Roundup

Investment companies | Monthly | December 2023

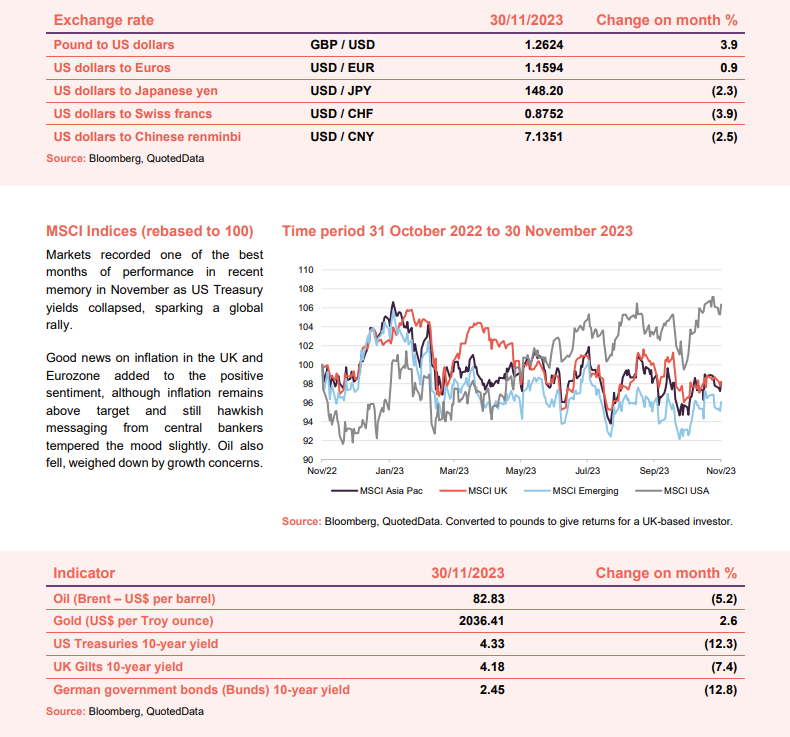

November saw a deepening of the world’s geopolitical woes, with intensifying conflict in the Middle East and continued belligerence in Ukraine. Despite the hostilities, the market mood was optimistic thanks to collapsing US Treasury yields, driving government bonds to their best monthly return since May 1985. Having briefly breached the 5% threshold at the end of October (for the first time in almost two decades) US 10-year yields have now fallen to 4.2%, sparking a global rally as markets adjusted to the possibility that interest rates may now have finally peaked.

Across the pond, inflation in the UK fell sharply, although it remains elevated at 4.6%, and markets, while positive, lagged global returns as the BOE remained hawkish, pouring cold water on the idea of pre-emptive rate cuts. In similar fashion, European inflation fell to 2.4%, reaching its lowest level in two years, thanks in part to stabilising energy prices. While the positive news also raised hopes of an interest rate cut, the ECB remained cautious despite weakness across the economy.

“I remember the $0.05 hamburger and a $0.40-per-hour minimum wage, so I’ve seen a tremendous amount of inflation in my lifetime. Did it ruin the investment climate? I think not.” — Charlie Munger

Despite the broadly positive news on inflation, central bankers clearly remain cautious as they look to ensure inflation does not reignite, particularly in the US where recent labour market data showed annualised wage growth of 4%.

Still, the outlook is much improved, particularly considering where we were only a few months ago.

At a glance

Global

(compare global investment funds here, here, here, and here)

John Scott, chair, JP Morgan Global Core Real Assets – 27 November 2023

Despite the acute geopolitical tensions arising from Russia’s war in Ukraine and Israel’s military operation in Gaza, the global economy and financial markets have to date been relatively muted in their response to these threats. Whilst we all fervently hope that both conflicts will be resolved as rapidly as possible, it is now apparent that in both theatres of war we may be facing the prospect of engagements which endure much longer than was initially thought possible, with the consequent effects on macro-economic conditions of inflation, higher interest rates, and equity market uncertainty.

Nonetheless, I see grounds for optimism: inflation’s dragon appears to have been tamed, if not yet slain, and there are indications that central banks may start to cut interest rates.

. . . . . . . . . . .

Kate Fox & Lee Qian, managers, Keystone Positive Change – 27 November 2023

In a world where ageing populations, increasing geopolitical tensions and rising protectionism present challenges to economic growth, seeking out industries that are vital for the transition to a sustainable and inclusive future should be a fruitful way to search for growth. For example, to combat climate change, we need to rapidly build out renewable energy capacity, invest in the grid and commercialise a range of technologies that can help to decarbonise industries. According to Bloomberg New Energy Finance, investments in renewable energy reached US$358 billion in the first half of 2023, a 22% increase from the same period last year and yet to keep global warming well below 2°C, the world needs to invest more than US$8 trillion in renewable energy between 2023 and 2030, or US$1 trillion per year. Decarbonising industries also present significant opportunities. Wood Mackenzie estimates that decarbonising iron and steel production alone will require US$1.4 trillion of investment.

Education is another good example. With technologies such as AI and automation impacting the economy, the need for training and upskilling is increasing. According to Morgan Stanley, the global higher education and lifelong learning market is expected to exceed US$3 trillion by 20303. In healthcare, innovations are improving treatments for noncommunicable diseases, which are increasing in prevalence owing to an ageing population and better diagnosis. The global oncology market is expected to reach US$250 billion by 20244. Not all industries are conducive to profitable growth, given that the level of entry barriers and technology differentiation will vary. However, we are confident that valuable companies will emerge from some of these areas.

. . . . . . . . . . .

Jonathan Davie, chair, Hansa Investment Company – 16 November 2023

As in my past recent reports, I continue to be cautious about the future direction of both equity and bond markets. I have been surprised by the strength of the US equity markets and the continuing divergence of the bond and equity markets.

My own view is that there are some hard yards ahead in the drive to get back to the 2% inflation era. In no particular order, I think service industry inflation is going to remain sticky, El Niño will be a threat to food prices next year and the present problems in the Middle East probably mean oil prices are unlikely to fall very far.

Rising interest rates, creating a lowering of demand, will help to reduce inflationary pressures, although the ever-increasing debt levels in most parts of the world, particularly those of many governments, will tend to keep longer-term interest rates higher than they otherwise would be, causing a certain degree of crowding out, thereby creating challenges for the private sector.

It will be interesting to see if Chairman Powell starts to make any comments about the substantial increases in US government debt at a time of full employment. Apart from wartime, the combination of accelerating government borrowing at a time of very low unemployment has never been seen before. None of the large problems facing governments have gone away, whether it is conflicts, higher interest rates to combat inflation, the reduction in globalisation or trade spats.

Let us hope Europe can get through the coming winter without too many difficulties with gas supplies. The positives are that the storage tanks are full and the price much lower than last year. However, problems in the Straits of Hormuz or with Israeli gas supply could cause difficulties.

. . . . . . . . . . .

The key feature of the last six months has been the surprising resilience of the US economy (and, to a lesser extent, Europe and the UK). This has resulted in the market coming to believe the Federal Reserve when they said that rates needed to be “higher for longer”. Accompanying this realisation is a growing chorus of voices calling for a “soft landing”. We remain sceptical of this outcome: the effects of the rate hiking cycle have not fully flowed into the economy, credit availability is falling rapidly, and the money supply is shrinking. As Niall Ferguson recently put it “The US economy’s not a plane and it won’t land gently”. Nor is history on the side of the optimists, indeed the swelling chorus may itself be a siren song. There was a huge spike in the number of articles containing the phrase “soft landing” in both 1999/2000 and 2007/08. We worry that history will repeat itself.

Markets do not share our concerns: credit spreads and equity risk premia are low. In the full year results we wrote that the most rapid rate hiking cycle, following on from an extended period of ultra-cheap money, might result in the financial system breaking. So far this has not come to pass. That crises at Credit Suisse and Silicon Valley Bank were contained does not mean that future crises will be avoided. To give an example, at the end of Q3 Bank of America’s losses on its hold to maturity portfolio – mostly comprising agency mortgage bonds – were $130 bn, around 58% of its tier 1 capital. Given the subsequent moves in rates we can only assume those losses have grown. This is just one bank and one part of its balance sheet. The scale of losses throughout the financial system must be very large indeed.

Ordinarily a financial crisis or a recession would be bullish for long bonds. While this may yet occur, it is by no means certain. Short dated bonds will rally as markets anticipate rate cuts from the Federal Reserve. What happens to longer dated bonds is less clear. If the Fed is forced to cut rates before inflation has been brought under control, then long term interest rates may rise as investors price higher inflation and demand additional term premium to compensate for volatility.

Such a move might be exacerbated by concerns over debt sustainability. This year the US budget deficit is forecast to be 7.7% of GDP – a truly staggering $2tn. A recession would only make this figure worse. As the Federal Government rolls over its debts (around one third over the next 12 months) it is paying real interest rates of around 2.5%. This is higher than the trend growth rate of the economy. The formula r – g neatly encapsulates the problem. It shows that the debt to GDP ratio would rise even if it were to run a balanced primary budget. For the past two decades the increasing debt stock of the US has been financed by relatively price insensitive buyers. The appetite of these buyers is waning and new buyers will need to be found. The price of money may rise to enable the market to clear. The knock-on impact to other asset classes is unknown but fiscal dominance and crowding out must be a risk.

Eventually, these high yields are the source of their own destruction. There are only two ways in which government borrowings can be made sustainable. Either countries must run balanced budgets or, through financial repression, reduce the interest rate they pay on their debts. With no political constituency for fiscal prudence the latter becomes the only viable route.

The destination is clear, but the timing and the path taken are not. There are only three things of which we can be reasonably certain. First, the attempt by markets to price a bi-stable regime (comprising the present regime of rising real yields and a future regime of financial repression) will bring volatility to bond markets. Second, long duration nominal bonds are likely to be a poor investment across both regimes. Third, index-linked bonds will fair much better than their nominal cousins and thrive when the financial repression eventually comes. For the time being, we accept our inability to forecast the future and therefore adopt a cautious stance.

. . . . . . . . . . .

Graham Kitchen, chair, AVI Global Trust – 9 November 2023

The geopolitical and economic environment are undoubtedly challenging and the world is likely to be unstable for some time. This provides excellent investment opportunities and in their report AVI speak of valuations last seen at the time of the global financial crisis. While progress is unlikely to be straightforward, given the resources at our Investment Manager’s disposal and the opportunities that they perceive, we look forward to the future with optimism and continue to believe that, over the long term, AVI will deliver attractive returns to AGT’s shareholders.

Having emerged from restrictions intended to minimise the effects of the Covid-19 pandemic in 2022, the world entered a period of heightened geopolitical tensions. The two combined led to higher levels of inflation and, as a result, interest rates not seen for over a decade, albeit arguably more “normal”. Central bankers continue to try to walk a fine line in attempts to control inflation while not raising interest rates to a level which stifles economic growth. As our Investment Manager mentions in their report, the developed world in particular has been forced to move on from a period when the cost of capital was kept artificially low.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

Stuart Widdowson & Ed Wielechowski, managers, Odyssean Investment Trust – 30 November 2023

At the time of preparation, there continues to be both geopolitical unrest in the Middle East as well as uncertainties on future interest rates and inflation. Market “fear” levels are elevated as investors worry about the prospect of geopolitical and monetary shocks. The concept of transitory inflation is long gone and whilst inflation is likely to continue to fall, our working expectation is that interest rates will remain higher for longer.

Sentiment has been poor in our sector for almost two years. This period of negative market sentiment in UK Smaller Companies exceeds the length of the downturn during the Great Financial Crisis, where the UK Smaller Companies sector peaked in early Q3 2007 and bottomed in Q1 2009.

UK quoted equities continue to be cheaply valued against history and international peers across a number of metrics, on both an absolute and relative basis. Our own analysis based on the Quest® cashflow modelling tool, suggests UK Smaller Companies in aggregate are trading on a wide 28% discount to their intrinsic Quest® Fair Value, compared with a 20-year average premium of 41%. This top-down analysis suggests substantial re-rating potential for UK Smaller Companies. In stark comparison, US equities remain expensive trading at more than a 50% premium to Quest® Fair Value – expensive in absolute terms but also compared with their long-term premium over time, and also against all other equity markets, most of which are trading on discounts to Fair Value. Over the past 15 years or so we have found that Quest® valuations have proven to be excellent indicators of long-term intrinsic value.

Such potential upside in UK Smaller Companies is similar to see from a bottom-up perspective in our portfolio. In early October, shares in the top 10 portfolio companies were trading at around a 50% discount to their average 10-year EV/Sales and price to book ratios. This is indicative of the level of distress in our markets, and the lack of investor interest.

Unlike large cap US equities, UK Small and Mid Cap stocks did not re-rate to very high multiples during the period of zero interest rates. Therefore, we see the implied potential 100% rating upside as markets normalise as a credible possibility.

Not surprisingly in this environment we are not short of new investment ideas. Given the uncertain demand environment, we continue to have a strong preference for investing in companies with multiple opportunities for “self help”, particularly gross and operating margin improvement. As well as making these businesses stronger and more sustainable, such actions help mitigate the risks of a softening in demand. If the environment remains more benign than feared, then there is the potential for these self-help actions to amplify companies’ organic progression.

Managing assets in a closed ended fund through this market environment is, in our view, a major competitive advantage. Firstly, we are focused on seeking an optimal long-term capital return from a fixed capital base, rather than worrying about the risk of potentially quite significant redemptions and forced selling to meet the redemption calls. Secondly, this enables us to consider investing in less liquid companies which open ended fund managers are either not willing, or not permitted to invest in. This has led swathes of the market in our view to be materially underpriced. Ironically as markets improve and companies re-rate to become larger, leading to better liquidity, we would not be surprised to see today’s selling institutions buying back in.

At some point we see sentiment towards the UK turning, the buyers’ strike ending and valuations normalising. This should provide a material tailwind to our absolute performance, which overall has been absent since we launched. Once the market can get confidence in the level of trough earnings, it can price them, moving from trough rating on trough earnings, to a normalised rating, and finally to a potential recovery rating. Any improvement in sentiment or liquidity can drive sudden and sharp movements in UK Smaller Companies. It is impossible to time such a turn in the “animal spirits” or even the specific event or events which will catalyst it. But we are strongly of the view it will come.

Even if this does not happen in 2024, we believe that corporate acquirers from overseas will take a more active interest in acquiring global companies listed in the UK given current ratings, particularly those in the industrials sector where they have material US earnings and significant synergies are on offer.

We do not anticipate a swathe of companies being taken private by Private Equity (“PE”), unless a bidding PE house has an asset in its portfolio which can offer significant cost savings on acquisition of a target. We understand that lending margins are around 700 basis points for senior debt, leading to total cost of debt being just below the low teens. This fundamentally changes the multiples that PE funds can afford to pay to generate their required returns. As a result, interest rates normalising appears to have levelled the playing field somewhat between private and public equities. It is possible that at some point the private market “premium” which emerged in the last decade may reduce or even disappear as the investment community accepts that zero interest rates will not be back for some time.

Private equity allocations are still high amongst institutional investors due to the delay in marking to market, allied with realisations slowing. We do wonder whether, for family offices and long-term endowments, the pendulum is starting to swing back to quoted equities ex US, which appear to offer material absolute and relative long-term value. Given the niche size of our market, we do not believe it would take much in the way of new allocations to change the balance of buying and selling.

. . . . . . . . . . .

Jane Lewis, chair, CT UK Capital and Income Trust – 30 November 2023

The immediate economic background is far from promising with growth expected to be at only very pedestrian levels in the UK and many other developed economies, but as we have seen over the last year and many years in the past, it would be wrong to believe that stock market performance is linked too closely to domestic economic growth. On a more positive front, inflation and interest rates are widely expected to fall and this should be supportive of markets.

Over the next twelve months, the UK is likely to have another General Election and most probably, on present polling, to face a change in government. It seems though, whichever political party is in power, that the government of the day will be fairly heavily constrained in the actions it can take by a range of factors. Moreover, it is far from just the UK that is facing elections as it is estimated that 2024 will be the biggest election year in history with more than 40% of the world’s population having the chance to cast a ballot.

There have been a number of substantial challenges for the UK and international economies and stock markets to face in recent years, most obviously the impact of COVID-19, Russia’s invasion of Ukraine, rising inflation and interest rates. Since our financial year end, Hamas’s attack on Israel has increased the chance of war in the Middle East, while China, experiencing rapid economic deterioration of its own, has ongoing aspirations with regard to Taiwan.

. . . . . . . . . . .

Sarika Patel, chair, abrdn Equity Income Trust – 30 November 2023

I described last year as “challenging” at the start of this report. I suspect this situation will persist well into 2024. Economically, the Office for Budget Responsibility (“OBR”) has downgraded forecast growth of the UK economy to 0.7% in the coming year which does not suggest much prospect of robust earnings growth. The fact that UK equities are already undervalued relative to other markets might provide some downside protection. This filters through to the sector, where investment trusts are trading at discounts not widely seen for over ten years. The announced reduction in employee National Insurance contributions is welcome, but unlikely to be the catalyst to kick start the recovery the economy needs. On top of that, politically we must expect that by the time we report on the 2024 earnings we will either have had or be about to have a General Election. A change of government seems almost inevitable but, whatever its hue, how it will address the fiscal issues is far from clear.

Against that gloomy background, one can see some glimmers of hope. The latest inflation numbers for the UK, announced on 15 November show, as expected, a marked downward trend to 4.6% and there is a possibility that this will continue over the next few months as the impact of the energy prices increases last winter, cease to have a bearing on the calculations. That, in turn, could mean that the next move in interest rates, when it happens (and we are not expecting it to be soon), might be downwards. Both these changes should boost confidence, particularly if they are sustained.

. . . . . . . . . . .

Andrew Watkins, chair, CT UK High Income Trust – 30 November 2023

It’s unlikely that at this time last year I would have expected the world’s geopolitical situation to get any worse. In fact, I was hoping for significant improvement, particularly with regard to Ukraine’s war with Russia. How wrong could I be? Tensions on several fronts have not been as high for several decades and it’s a wonder the investment environment has stayed relatively benign.

It is clear that the higher interest rate environment in the UK is having an impact, particularly for those struggling with the cost of living and higher monthly mortgage repayments. Whilst a good number have been protected by fixed-rate deals, these will unwind over the coming months and years, so the full impact of higher rates is likely to not yet have been felt by many. From an industry perspective, businesses have also been affected by higher costs of borrowing and sluggish productivity so, among other things, will be looking to the Government to find a way to encourage greater business investment, well before the expected date of the next General Election, in line with its pledge to make “long-term decisions for a brighter future” narrative.

The good news is that there finally seems to be some signs that inflation is easing with positive surprises in the UK and Europe of late. As a result, it is increasingly likely that interest rates have peaked (or be very close to peaking) and commentary from central banks appears to support this. This will, I believe, be particularly important for the UK partly due to the importance of housing on consumer sentiment and partly as stubbornly high UK inflation has been a real negative for investors. UK equities, whether small, medium or large-cap are very attractively valued on any metric, especially, relative to overseas developed markets and our portfolio manager believes that there is a large number of very attractive opportunities in the UK market where it is possible to buy high quality companies at attractive valuations with high dividend yields.

. . . . . . . . . . .

Managers, Chelverton UK Dividend Trust – 27 November 2023

The stock market for the last six months, and in fact the last two years, has been very difficult for small and mid cap companies. It is well-documented that UK shares have been lowly rated over several years and this is particularly so in the area of the market in which the Company invests.

There is no need to recount here the extraordinary events and circumstances that the United Kingdom and indeed the world have experienced over the recent past. Gradually, however, the macro environment is improving. The rate of inflation is now reducing across Europe and, in the UK, has fallen to 4.6% and is on course to trend down to target levels during the next year. There is no expectation of a return to the extraordinarily low interest rates that have prevailed over the past decade, but latest developments suggest that we may be at or near the peak in interest rates. That will take the pressure off central banks to increase rates further and should lead to a gradual reduction from current levels.

Logically this will lead to a reduction in mortgage rates and combined with an expectation that energy prices will decline further in the near future should result in an improvement in household spending power and confidence.

Our portfolio has and is experiencing an unprecedented level of share buy-backs by portfolio companies. This de-equitisation process, whilst rewarding for shareholders, will ultimately be damaging for the London Stock Market. The headlong rush by wealth managers to switch from UK equities to Global equities has been part of the problem leading to the general decline in UK share values. When this trend reverses there will be a sharp upward correction in share prices.

. . . . . . . . . . .

Charles Montanaro, manager, Montanaro UK Smaller Companies Investment Trust – 23 November 2023

The optimism of the summer months was dashed towards the end of the half-year period. Rising bond yields were accompanied by similar style headwinds to those of 2022. UK SmallCap underperformed LargeCap by c.2% in the six-month period to 30 September 2023, while SmallCap Growth extended its underperformance vs Value by another 3% (taking the underperformance to a whopping 57% over three years). AIM, which had performed so poorly in 2022, lost another 9% and has now underperformed Main List SmallCap for 12 consecutive quarters.

It is difficult to overemphasise how challenging the past few years have been for our asset class. The Numis Smaller Companies (excluding investment companies) Index has lagged the broad UK market over the past 1, 3, 5 and 10 years. In other words, the “SmallCap Effect”, which has been a major tailwind to investors’ returns for the past 70 years, has been working in reverse for the past decade. This is a rare event: the last time this happened was in the late 1990s.

More recently, this underperformance has coincided with outflows from the asset class reaching parity with that witnessed after the Global Financial Crisis. According to the Investment Association, cumulative outflows from UK SmallCap Funds amounted to £2.1 billion since January 2022, almost in line with the £2.3 billion experienced in 2007-09. Several open-ended UK SmallCap Funds decided to wind up this year while some industry veterans have retired. In the investment trust space, wider discounts have prompted some consolidation.

Valuations for the asset class have returned to levels last seen during the Global Financial Crisis, which marked the start of the recent Great Bull Market. At 13.9x, the 8-year Shiller P/E for UK SmallCap is rapidly heading towards the all-time lows of August 1992 (10.9x), March 2003 (11.6x), February 2009 (11.8x) – which would suggest 15% to 20% maximum downside from current levels. While the past is of course not guaranteed to repeat, history tells us that when valuations have previously reached current levels, returns over the subsequent 5 years for SmallCap were between 100% and 150%. Investors should perhaps take note.

Ironically, amidst all the doom and gloom, Smaller Companies – quality ones in particular – have resurfaced on the radar of trade buyers and private equity fund managers. M&A activity is quietly making a comeback. MUSCIT lost Dechra Pharmaceuticals (at a premium of 47%) to a bid by a consortium of investors before the Summer and Ergomed received a bid (at a 30% premium) in September 2023. Although we never invest in a business in the hope that it will be taken over, we would not be surprised to see more bids in the portfolio over the coming months.

. . . . . . . . . . .

Richard Staveley, manager, Rockwood Strategic – 21 November 2023

The last six months have surprised most market commentators. Economies have proved reasonably resilient, at stagnant levels of growth, whilst monetary policy has continued to tighten. The FTSE Aim All Share Index fell 10.3% and is now down 44.7 % from its peak in September 2021. OPEC co- ordination alongside resilient US growth and regional geo-political tensions have caused the oil price to rise 18% from $77.9 to $92.2. UK interest rates rose from 4.25% to 5.25%. There are some signs that inflation has peaked but a material reduction has not occurred yet (Core inflation September 2023 6.3%) and Central Banks remain committed to this goal in their public statements. The share-price rises of mega-US technology stocks appears the only consensual positive trend and feels as if its sucking in all spare capital, herd-like, whilst UK equity valuations are at their lowest for a generation. The IPO market is moribund. However, merger and acquisition activity is clearly increasing as savvy trade buyers and private equity firms exploit the liquidity hungry, redemption heavy UK equity market. The ‘transmission mechanism’ of higher interest rates has clearly had slower effects than in previous rate cycles, albeit insolvencies are picking up, as is unemployment off a very low base and house prices are falling. We believe the lag is due to a hangover from the COVID related government largesse to both consumers and corporates, which we perceive has nearly fully unwound and the move in recent years by large parts of both groups to extend their interest rate protection on debt at the previously very low levels. This is gradually unwinding.

The ‘Mansion House’ reforms hopefully represent the ‘starting-gun’ for more initiatives to improve the attractiveness of small UK businesses, but it will take time. As we move into an election year competing policy announcements will emerge, so we urge all parties to take seriously the health of the UK stock market. Its primary purpose is to raise capital and support UK businesses when they reach a certain maturity and whilst many schemes exist for very small private businesses, more is needed to encourage investors to deploy capital to our public market. It is a key source of employment, tax receipts and UK investment. The alternative is everyone buys Nvidia, now valued at c.$1 trillion.

We stated in previous reports that we would anticipate limited sustained market recovery until ‘core’ inflation is demonstrably falling and the market can have real confidence to anticipate the commencement of monetary easing. We believe the portfolio holdings are deeply undervalued, almost all are very well financed, all have the potential for operational improvements and strategic improvements too which can drive shareholder value irrespective of the doom and gloom. Takeover interest continues to emerge for a number of our holdings due to their attractive cash flow generation and market positions and we expect realisations to produce material NAV uplifts and cash for re-investment. We do see a high probability of a recession and expect market profit expectations to fall further and have built this backdrop into the margin of safety we expect in our holding valuations and the extent of profit recovery we are expecting from the businesses and their management teams many of which evolved positively during the period.

. . . . . . . . . . .

James De Uphaugh, manager, Edinburgh Investment Trust – 20 November 2023

In our opinion, UK equities are undervalued in absolute terms and against peers. For example, the market’s free cash flow yield is the highest of major markets. Even if you adjust for the cyclical element of the market (i.e. allowing for the higher exposure of the market to e.g. banks and oil stocks), it still appears very attractively valued.

While it is hard to identify in advance a specific catalyst that will ignite a rerating of UK equities, we do note that the market has absorbed a lot of selling since 2016, particularly by pension and retail investors. At the same time, we observe a pick-up in interest in UK companies by overseas corporates. Taking all this together, we believe there is potential for a pleasant surprise from UK equities on a three year view.

. . . . . . . . . . .

Judith MacKenzie, manager, Downing Strategic Micro-Cap Investment Trust – 9 November 2023

Small companies are the seedbed of growth for the UK. Our institutions and our future well-being need that growth; desperately. The UK can punch way above its weight in a range of knowledge intensive, highly skilled industry and research. That is underrated in the application of national and institutional resources. Centrally the country has become so bound by departmental defensive statements that cold feet too often respond to opportunity and a confused ‘establishment’ fails to foster a culture of personal and local determination that drives growth. Was it Hayek who said all information is on the edges (meaning locally, where enterprise and people meet); the centre knows nothing? We are still a nation too much centrally governed.

Nationally we drift through central caution, isolation and missed opportunity. Success demands determination (vide the USA over the last 150 years) not a country that is in a state something akin to administration (for those who recognise the Insolvency Acts) with decisions ruled centrally by the bank manager – HM Treasury struggling in a furrow largely of their own making over many years. I would suggest that over the last 75 years centrally bungled direction has now run its course. The ‘private’ governance of public money has not helped national wealth. Once that wealth was fired by drive and innovation well outside London – Birmingham, Manchester, Leeds, Newcastle, all long ago. Recently some future wealth creation has been born in places like Cambridge and a bit elsewhere round the UK. If the inward restriction of central thinking has truly run its course, as I believe it has, the time has come for the devolution of drive, energy, determination, funding, and the needs of national future growth to be allowed to be taken up by local enterprise and management and to be given much more equity funding by a greater risk-taking nation and its institutions. Some of the West Midlands, maybe Manchester, are seeking to do that.

. . . . . . . . . . .

Dean Buckley & Alex Wright, portfolio manager, Fidelity Special Values – 6 November 2023

The UK equity market has remained distinctly out of favour in a global context, particularly when compared with the US. The macro headwinds are undeniable: inflation has been stubbornly higher than in other developed economies, interest rates have risen further and faster, and there is the added uncertainty of a General Election at some point in the next 15 months. However, there are also reasons for optimism: both core and headline inflation have begun to trend downwards, there is an increasing expectation that the Bank of England base rate is at or close to a cyclical peak and upward revisions to UK GDP numbers suggest a greater likelihood of avoiding recession. Added to this, the UK stock market remains at low valuation levels compared to other developed markets, reducing downside risk and providing the potential for significant upside when sentiment becomes more positive.

UK equities are pricing in extreme pessimism and, as a result, trade at a significant discount to other markets. While the near-term outlook is uncertain and corporate earnings could still disappoint in the UK, this is also true of other markets such as the US, where valuations are meaningfully more expensive.

To provide some context, at the time of writing (September 2023), our analysts estimate that the UK equity market (FTSE All-Share Index) trades on 10.9x 2024 earnings; continental European equities (MSCI Europe ex UK Index) trades on 13.4x earnings and the US (S&P 500 Index) trades on 18.6x earnings. Our portfolio, which trades on only 7.7x earnings, is at the very bottom of the valuation range seen over my ten year tenure, despite offering better sales and profit growth prospects, and carrying significantly less debt.

. . . . . . . . . . .

Asia Pacific

(compare emerging market funds here, here, and here)

Mike Kerley & Sat Duhra, fund managers, Henderson Far East Income Limited – 30 November 2023

Whilst the headlines around China, some fair and some unfair, have dominated news flows, this has masked the strong performance in several of our other markets. The strength of a number of themes which are unique to our region and are yet to fully play out, creates an exciting time for investors. We are witnessing the build-out of green infrastructure, strong consumption trends, technology supply chains supporting global innovation and financial inclusion as household wealth increases, amongst others.

Asian markets have, however, struggled over the last five years and are now at attractive valuations relative to other regions. Record low interest rates and supportive fiscal policies have encouraged money flows into alternative risk assets such as housing, private equity, special purpose acquisition companies and crypto currency, to name a few, at the expense of Asia and Emerging Markets. The return of inflation and higher interest rates has called into question some of these investment destinations and should lead to a focus on fundamentals now that the cost of capital is well above zero.

There are, though, some headwinds. Higher for longer interest rates in the US will most likely lead to a stronger US dollar, which historically has been a challenge for Asia, and the relationship between the US and China around Taiwan and access to technology continues to have the potential to escalate. There is also considerable risk in China with local governments facing significant bond maturities this year and property volumes still weak. We believe that the Chinese government still has the monetary and fiscal tools to address these issues, but it is sure to be a bumpy ride.

As the developed world slows over the next couple years, the growth differentials between Asia Pacific and the US, EU and UK will look increasingly attractive, which we believe will prompt positive flows to the region and be supportive of equity market returns.

. . . . . . . . . . .

FSSA Investment Managers, Scottish Oriental Smaller Companies Trust – 6 November 2023

We noted varying economic outlooks during our recent visits to companies across Asian countries. The operating environment for businesses in China is difficult, with regulatory disruptions in industries such as healthcare and e-commerce, as well as the challenges emerging in the real estate industry. Large economies which are driven by exports to Western markets, including South Korea and Taiwan, are also facing cyclical challenges as demand across the global technology supply chain is weak. In contrast, businesses in countries such as India and Indonesia, whose revenues are largely driven by domestic demand trends, are witnessing stronger prospects as their economies have recovered from the pandemic. These countries saw a period of relatively weak economic growth during the previous decade. In this period, businesses de-leveraged their balance sheets and the governments of these countries introduced various reforms. Their stronger financial position and the formalisation of the economy has helped the market-leading organised sector companies to gain market share from their competitors in the informal sector.

. . . . . . . . . . .

Europe

(compare European funds here and here)

Howard Zenah & Shuhaiber Tim Lewis, JPMorgan European Growth and Income – 29 November 2023

The already fragile geopolitical outlook was further weakened in October 2023 by the vicious escalation of hostilities between Israel and Palestine. The economic impact that this latest tragedy will have on European equity markets is uncertain but has the potential to develop into a wider regional conflict which could further exacerbate already elevated energy prices. The recent run of increases in interest rates by the major economies central banks, including the ECB, seems to have ended as the desired reduction in inflation rates has so far been achieved. Whether the current rates of interest will precipitate a global recession remains to be seen.

By the end of the half year under review the European Central Bank (ECB) had hiked interest rates for the tenth consecutive time in its efforts to control inflation. While it has now indicated that it may pause it also reiterated that it expects to keep rates high for some time. Bank lending to households in the eurozone rose by 1.3% year-on-year, the lowest growth rate since November 2015, as the deceleration in credit demand persisted due to the unprecedented policy tightening enforced by the ECB over the past months.

Despite a growing belief that a recession in Europe had been avoided, or at least pushed out into 2024 economic growth has started to weaken. For example, the Eurozone Composite Purchasing Managers’ Index (PMI) fell to 47.2 in September, suggesting economic contraction across the bloc’s private sector economy. While manufacturing has been weak for some time the decline in the services side of the economy is a newer problem. Although the employment backdrop remains robust consumer confidence has started to decline again.

Our optimism for European equities over the long term remains undimmed.

. . . . . . . . . . .

Michael MacPhee, chair, Baillie Gifford European Growth Trust – 16 November 2023

Fund managers are nearly always prone to regard the current environment as difficult. It is no exaggeration, however, to describe the present geopolitical turmoil and deterioration in the fabric and harmony of both democratic and autocratic societies as troubling and unusual. 25 years of unprecedented and arguably reckless money printing has come home to roost. Adding value in anticipating big picture change either good or bad is difficult, even accepting an element of reflexivity: one thing leads to another. Inflation leads to falling living standards and, historically, wars.

The good news, as ever, is in the degree of innovation, disruption and commercial success that can flow from human ingenuity. Stock-picking in the form of focussing on what might go right is the best way to explore and mine this seam. Growing, high quality companies delivering goods and services that enhance their customers’ lives are worthy of attention and investment.

. . . . . . . . . . .

The noise around market moves seems to increase with every passing year. More recently, the war in the Middle East has further complicated matters and has, for now, put a risk premium on equities. As with all geographical risks, we monitor the situation very carefully.

We make no attempt to predict to the basis point the next quarters’ gross domestic product (GDP), growth inflation or unemployment rate. Nor do we pay much heed to top-down indicators or what they may reveal about the health of the global economy. As described earlier in this report, the world is clearly in the midst of several transitions: COVID-19 to post COVID-19, inflation to disinflation, low interest rates to high interest rates. These dynamics must be considered when assessing the health of the global economy and the prospects for equity markets. Various end markets may continue to imply weak demand as inventories are run down, while others – perhaps those associated with Chinese real estate – may have more prolonged problems.

However, assessing the economy from the bottom-up, company by company, we see no reason for investors with a reasonable time horizon to be alarmed. Household debt relative to assets is low in large economies, interest rate sensitivity is lower than in previous cycles and real wages are growing. Similarly, corporate balance sheets are strong after 15 years of deleveraging, margins remain at healthy levels and we may be at the foothills of an increase in capital expenditure spending resulting in a ‘modern era industrial revolution’. Long-term structural trends and large amounts of stimulus in both Europe and the US can drive demand for years to come, for example in areas such as infrastructure, automation, innovation in medicines, the shift to electric vehicles, digitisation or decarbonisation.

. . . . . . . . . . .

Emerging Markets

(compare emerging market funds here)

Audley Twiston-Davies, chair, BlackRock Frontiers Investment Trust – 29 November 2023

While developed market economies have been experiencing heightened inflation, slowing growth and the spectre of recession, by contrast, many of the countries in our frontier market universe are in the growth phase of their economies. Moreover, a significant proportion of frontier markets are further along the curve in their monetary tightening cycle, having raised interest rates earlier, and in many cases have now already cut interest rates. Our portfolio managers believe that this represents a more stable and benign environment for growth.

Our managers also note that the rise in geo-political tensions globally is leading major developed economies to diversify their food, energy and technology supply chains, to the benefit of many of the countries in which they invest. This, combined with an investment universe of countries with favourable demographics, a growing and more affluent middle-class, relatively low debt and low stock market valuations, both versus developed markets and their own history, presents an ever more compelling investment case for exposure to frontier markets.

. . . . . . . . . . .

John Rennocks, chair, Utilico Emerging Markets Trust – 21 November 2023

As referred to above, there are numerous headwinds currently faced by the markets, each of which is challenging in its own right. We have historically discussed a number of these and they largely remain unresolved. We continue to witness a significant rise in nationalism, wealth inequality and global migration. All of these issues and challenges no doubt continue to tear at the fabric of our societies and institutions.

While Covid-19 is behind us, the legacy of Covid-19 and the West’s response to it has undoubtedly led to higher debt and higher inflation in the developed western economies. Furthermore, the war in Ukraine has seen sharply higher commodity prices and accelerating inflation especially in Latin America. The response by the central banks to higher inflation has been to rapidly raise interest rates to bring inflation under control.

The markets are rightly concentrating on the US and the Federal Reserve in particular, given the size of the US market and global dominance of the US Dollar. The Federal Reserve is laser-focused on reducing inflationary pressures by raising interest rates and has encouraged the market to adopt a “higher for longer” outlook. The resilience of the US markets has been unexpected. With GDP growth in the last quarter of over 4.0% and unemployment remaining low, it is unsurprising the Federal Reserve has raised rates to 5.25%. The higher for longer expectation is starting to be seen in longer duration treasuries. They started the half year at 3.5% and stood at 4.6% as at 30 September 2023. This has had two outcomes: first, many central banks reference the Federal Reserve and cannot risk currency weakness by cutting rates in their local currency; and second, investors have been reducing investments in equities and moving into bonds.

Again, as we have noted before, the need to have resilient and diversified supply chains, energy security, green energy and increased defence capabilities will see resources diverted and reinvested with an urgency and scale not previously witnessed in our lifetime. This shift will give rise to new opportunities for investors, including UEM. There are a number of megatrends that should provide many of UEM’s investment strong tailwinds.

EM were mixed over the half year reflecting local headwinds, higher interest rates and lower valuations. Bucharest’s BET Index was up 18.4%, Brazil’s Bovespa Index was up 14.4%, the Indian Sensex was up 11.6%, Chile’s IPSA Index was up 9.6% and Vietnam’s Ho Chi Minh Index was up 8.4%. Meanwhile the Hong Kong Hang Seng Index was down 12.7%, the Mexican Bolsa was down 5.6% and the Philippine PSEI Index was down 2.7%. A common theme has been rising inflation in Latin America and Eastern Europe and weakening consumer confidence in Asia.

Most currencies continued to be weak against UK Sterling, although the exceptions included the Mexican Peso, up 5.3%, the Brazilian Real, up 2.6%, and the Hong Kong Dollar, up 1.5%. Oil rose 19.5% over the six months to 30 September 2023, in response to rising uncertainties and supply constraints.

. . . . . . . . . . .

China

(compare China funds here)

Dale Nicholls, portfolio manager, Fidelity China Special Situations – 28 November 2023

After a spell of increased uncertainty over China’s growth trajectory as it emerged from Covid lockdowns, the mood music has moved to a slightly more positive tone in recent weeks. Regulatory concerns are now less relevant, and the narrative again focuses more on growth. While a 5% annual GDP growth target seems largely on track, we believe the current backdrop reflects a more measured growth outlook going into 2024.

In the face of a problematic property market in China, the refinancing conditions for property developers will likely remain challenging in the near-term despite more supportive policies. However, this is not detrimental to all property developers. While we do not expect a significant property rebound given the structural challenges, home prices are showing signs of resilience, especially in top tier cities. Ultimately, the existing divergence between various developers could be magnified further. The indiscriminate sell-off so far this year has caused some mispricing and this provides an opportunity for active investors who can successfully identify the leading players who are most likely to benefit from lower funding costs and can gain market share, while cash-strapped developers struggle.

While economic challenges and geopolitical risks remain, policy direction towards regulatory loosening is clear. We have already seen action taken to boost consumer confidence, such as tax breaks on the purchase of electric vehicles and lower mortgage requirements for home buyers. Although job and wage cuts have clearly hurt consumer confidence, we have the sense that the worst is behind us from our discussions with companies. Over the longer-term, improved corporate earnings could be a key driver for investor confidence to return.

China is at a different point in the economic cycle to many Western countries. Rising interest rates and inflation in the West have meant tightening central bank policies aimed at slowing economies down, whereas the opposite is the case in China. Inflation has not been a problem, and the authorities are taking a more stimulative approach to boost growth.

At the same time, valuations in the Chinese equity market – barring some post-Covid reopening beneficiaries in the consumer discretionary space – remain very compelling both in historic and absolute terms and compared to some other major markets. The low level of valuations is despite a corporate earnings outlook that compares well to most other large markets. Clearly, a lot of pessimism over the economy appears priced in.

It is widely recognised that the long-term plan of the Chinese government is to seek to reduce the economy’s reliance on investment and property and pivot away from some of the country’s traditional growth drivers towards high-end manufacturing and domestic consumption. The pace of innovation in China remains strong, primarily led by private enterprises in sectors such as industrials and health care. Globally, leading companies have emerged in areas such as electric vehicles and renewable energy. These are factors contributing to consolidation trends across a range of sectors, many of which remain very fragmented. While overseas investors may focus on the impact on China of de- globalisation and ‘near-shoring’ of industry, the corollary to this is an increasing preference among Chinese consumers for Chinese brands, resulting in domestic companies taking ever greater market share in what remains one of the world’s largest markets.

. . . . . . . . . . .

India

(Compare India funds here)

Andrew Watkins, chairman, Ashoka India Equity Investment Trust – 9 October 2023

India has come a long way since Narendra Modi took over as Prime Minister in 2014, initiating a plan for India to become a developed nation within 25 years. It is certain that, come next year’s election, he will make much of the progress over that 10-year period and he would be right to do so. India’s population, at 1.4 billion, overtook China’s this year and the differences between the world’s largest autocracy and the world’s largest democracy in the race for economic growth remain stark; China’s leader favours a retention of power over a well-functioning economy thus reducing the potential for entrepreneurial flair that is so evident in India. It seems very likely that growth will expand for the foreseeable future with material investments in renewable energy, high-speed railways and new roads in a generational boost to India’s economy. Of this expanding population, a significant number will grow up as well-educated, tech-savvy individuals who speak fluent English and, therefore, be well equipped to converse in the business markets of the world. Hosting the G20 conference in September added further to both India’s and Modi’s personal status.

The “global south”, as this part of the world is now being referred to, is growing in importance, both geographically, politically and economically. It is not at all unreasonable to assume that India is the unelected leader of such a bloc and its relevance and importance is only likely to grow in direct proportion to its economic growth and continuing status as a democracy, perhaps eventually leading to a permanent seat on the UN Security Council, further burnishing Modi’s personal credentials and India’s world status.

Global inflation is easing and, war to one side, India is coping well with supply lines both in and out of the country. Growth is forecast to reach 6% this year, materially in excess of any other major economy, and is likely to continue apace into 2024-5.

. . . . . . . . . . .

Michael Hughes, chair, abrdn New India Investment Trust – 23 October 2023

There are certainly plenty of positives attracting investors to India. It is one of the world’s fastest-growing major economies, benefiting from its resilient domestic macro environment. Supportive government policy has helped this and is likely to remain this way for the foreseeable future, with sufficient fiscal discipline to not worry investors. Continuing expansion of public capital expenditure will support growth momentum, creating more jobs and potentially reviving private capex as well. Even with elections to be held next year, India has less perceived geopolitical risk compared with other emerging market nations, and its companies are benefiting from the “China plus One” strategy as global businesses seek to diversify their supply chains.

The most recent strong rally aside, India has a lot to offer investors looking to the longer term. With its large population, favourable demographics and evolving middle class, India is a formidable investment opportunity. The structural growth stories we have referenced in previous reports: domestic consumption, urbanisation and infrastructure, together with increasing digitalisation, are as compelling as ever.

. . . . . . . . . . .

Biotech and Healthcare

(compare Biotech and Healthcare funds here)

Doug McCutcheon, chair, Worldwide Healthcare Trust – November 2023

Macroeconomic conditions continue to be difficult. Against a backdrop of high interest rates and volatile markets, equity investment remains challenging. This includes investing in the healthcare sector. However, the fundamentals of the healthcare sector remain strong.

As our Portfolio Manager sets out in their report, they are positive about the outlook for the healthcare sector. At some point, investment fundamentals will again reassert themselves over the macro environment. Our Portfolio Manager expects the currently elevated level of merger and acquisition activity to continue, supported by attractive valuations, healthy balance sheets and, within the larger pharmaceutical and biotechnology sub-sectors, a need to address future patent expirations. In addition, the pace of scientific and technological development within the healthcare sector more broadly will remain unchecked, with clinical and technological catalysts providing a regular flow of significant share price moving events.

. . . . . . . . . . .

The future of the biotech sector is complex. On the one hand, current macroeconomic conditions remain extremely challenging. Volatile equity markets, rising interest rates and investor risk aversion all increase the cost of the capital the sector relies on to fund investment. However, confidence can be found in the exciting range and pace of innovation in the biotech sector. The pace of innovation is accelerating and there is a robust pipeline of therapies based on a wide variety of scientific and technological developments. The challenge of the forthcoming ‘patent cliff’ faced by larger biopharmaceutical companies is an opportunity for emerging biotech companies and we expect to see a further increase in merger and acquisition (“M&A”) activity.

Ultimately, the successful development of novel medicines is the principal driver of value creation in the biotech sector, and innovation remains as strong as ever. We firmly believe that the valuation decline we’ve observed in the sector over the past two years is not reflective of the strong fundamentals of the industry. Innovation remains robust across a wide range of therapeutic areas and technologies, and it is the strength of this innovation that ultimately underpins our confidence that the biotech sector will recover from its current depressed levels.

. . . . . . . . . . .

Financials and Financial Innovation

Tim Levene, CFO, Augmentum Fintech Management 27 November 2023

As I write, markets are exhibiting the early signs of a shift in sentiment. The Bank of England’s decision to hold rates steady since September, followed by the Federal Reserve’s similar stance in early November, signals a cautious yet hopeful economic outlook. While the months ahead present likely challenges with persistently high rates, the encouraging performance of growth stocks in response to these developments suggests a return to more positive equity market performance. Patience is required, as confidence and capital gradually reinvigorate the markets. However, reaching the apex of this rate tightening cycle marks a significant turning point, steering us towards a more optimistic future.

Despite these positive shifts, the UK equity market continues to grapple with deep-rooted demand issues, even amidst numerous strategic efforts to enhance its competitiveness. The overwhelming preference for passive investment strategies, coupled with the US market’s dominance, remains a formidable challenge for trading volumes. This trend has led to reduced liquidity in domestic European exchanges, with our pension funds and wealth managers disproportionately investing in US markets.

Each new advance in technology, such as those seen this year with AI, adds momentum to the structural trends driving digitalisation across the economy. Momentum meets opportunity in financial services, penetration of fintech market share remains well below 2% and global fintech revenue is forecast to reach US$1.5 trillion in 2030 (BCG, 2023).

Combined with clear strategy and a disciplined approach, market conditions are such that returns from 2024-25 private investment vintages have the potential to be exceptional.

. . . . . . . . . . .

Debt

Bronwyn Curtis, chair TwentyFour Income Fund, 23 November 2023

The start of the reporting period saw wider financial markets sailing into calmer waters, following the regional US regional banking turmoil, which gave the market the necessary stability and favourable backdrop to support primary issuance in a meaningful way.

Fundamentals have played their part in the overall performance of the sector. While traditional fixed income markets have been dominated by discussions around central bank policy and peak rates, with multiple increases in key rates by the Bank of England and the European Central Bank, the floating rate Asset Backed Securities (“ABS”) and Collateralised Loan Obligations (“CLOs”) markets have benefitted from the anticipated higher for longer rate environment.

In the UK, headline inflation is moderating – although core inflation remains challenging. House prices have been steadily falling over the reporting period and the Nationwide House Price Index fell 5.3% year on year to September 2023. Housing market activity remains weak with just 45,400 mortgage approvals in August, which is around 30% below the monthly average prevailing in 2019 prior to the pandemic. This subdued picture is not surprising given rising mortgage rates and the challenging picture for housing affordability, however, swap rates stabilised over the reporting period and some lenders started to reduce mortgage lending rates.

The unemployment rate over the reporting period continued to be very low. As job losses are generally the biggest driver of mortgage arrears, the actual losses remain minimal. However, the job market is weakening and while wage growth continues to be strong; cracks are starting to appear and mortgage arrears have increased this year. TwentyFour Asset Management LLP (the “Portfolio Manager”) highlighted this development in previous reports to you, so it isn’t a surprise and they have positioned the portfolio for this. The levels of arrears are low, and the portfolio has seen no defaults. Most of the asset class’s underperformance has been seen in legacy (pre-Global Financial Crisis) non-conforming mortgage portfolios. None of these are held by the Company.

The debate around rates has shifted from how high rates might go, to how long rates might remain elevated. Deutsche Bank analysis recently noted that from a UK RMBS perspective one thing is clear: that the vast majority of borrowers who reverted from a fixed rate to a floating mortgage in 2023 (the cohort that in theory, should be most exposed to affordability stress), have so far, weathered the shock. Actual losses remain almost non-existent within UK and European RMBS and ABS securitisation pools and the 12-month trailing leveraged loan default rate remains low at 1.5%, which is well below the levels that had been forecast.

. . . . . . . . . . .

Infrastructure

Robert Jennings, chair, Sequoia Economic Infrastructure Income – 23 November 2023

The economic outlook in the US, UK and other developed economies where the portfolio is invested remains challenging, but there are reasons to be cautiously optimistic. Inflation is now falling quite rapidly in the US, UK and Europe. Interest rates set by Central Banks may have peaked in most of the jurisdictions where the Company invests. In the US, consumer spending is driving strong economic growth. Without wanting to sound falsely optimistic, these trends give hope that we may be close to entering a less challenging economic environment.

However, we have not invested on the basis of such optimism. In fact, our strategy has been to find investments which will be resilient even if things do not improve. For a significant period now the Investment Adviser has focused on making senior secured – rather than subordinated – loans, and has favoured sectors of the infrastructure market with defensive characteristics rather than cyclical sectors.

We are of the view that the time is now right to lock in some of the high rates currently being earned on our floating rate loan portfolio.

. . . . . . . . . . .

Mike Bane, chair, HICL Infrastructure – 21 November 2023

The volatile macroeconomic environment continues to be the primary driver of public market valuations across the real assets sector, with this trend set to continue until markets establish greater certainty over the rate cycle. However, resilient valuations evidenced in the period continue to demonstrate a disconnect between private and public market valuations for attractive core infrastructure.

As long-term investors through multiple cycles, it is the Investment Manager’s experience that such an environment can present attractive investment opportunities via special situations, including with reduced competition.

. . . . . . . . . . .

Renewable Energy Infrastructure

While the listed renewable infrastructure sector as a whole is facing headwinds and equity markets are likely to remain closed to JLEN and its peers for some time, the fundamental growth story for the sector and for JLEN remains as strong as ever. In the current environment we are focusing our efforts on laying the foundations for future NAV growth through the Company’s construction-stage assets, currently 9% of the portfolio.

These assets provide potential for capital growth as they pass through the construction stage and become operational. We are particularly optimistic about the outlook for green hydrogen and its potential to decarbonise many carbon-intensive sectors of the economy, with some analysts predicting that the green hydrogen market will grow exponentially (by 500 times) by 2050(1) to meet net zero targets. We also remain focused on effective allocation of capital and so have paused on starting construction of the two remaining battery energy storage projects given the volatility seen in that market.

The outlook for sustainable infrastructure investment remains positive as the UK and European economies decarbonise to meet net zero emissions targets and find ways to live more sustainably. We will be suitably cautious in our approach given the prevailing uncertainties, but considering this is a long-term asset class, we view the future with confidence.”

. . . . . . . . . . .

Property

(compare UK property funds here, here, here, here, here, here and here)

Andrew Jones, CEO, LondonMetric

Global economic and geopolitical uncertainty continues to dominate the investment backdrop. The conflict in the Middle East, together with the ongoing war in Ukraine and tensions with China, has added further volatility into the financial markets which continue to navigate uncertainty over interest rates, persistent inflationary pressures and worries about future growth.

The UK economy has been highly resilient with strong wage growth and near to full employment. 14 consecutive increases in interest rates are, however, now having the desired impact of dampening the economy and inflation, which has more than halved from c.11% at its peak to c.5% today. Whilst inflation has remained more persistent than most expected, there are suggestions that the economy is in fact weaker than the data is currently showing. Peering through the fog of data, there is evidence of a weakening labour market with gently rising unemployment. This indicates that the full impact of higher interest rates will take time, with economists suggesting that less than half of the BoE’s tightening has actually passed through into the real economy.

We believe that the UK consumer is well positioned to navigate these challenges, helped by healthy saving ratios, falling energy costs and good wage growth. Furthermore, more than half of all homeowners do not have a mortgage.

Whilst liquidity for real estate has improved from the days of the mini budget last year, the property market is still a long way from functioning normally. We remain of the view that we won’t start to see normal liquidity for real estate until five year swap rates fall materially towards 300bps. The five year swap rate is currently 415bps which, whilst down from its peak of 540bps, is still up from 400bps at the time we last reported. However, we expect liquidity to benefit from a growing assumption that base rates have peaked at 5.25% and will start to fall during 2024.

Furthermore, following material repricing of lower yielding and high growth real estate, some sub sectors have been experiencing much improved liquidity for a while now, and we have also seen good volumes for smaller lot sizes where debt is less of an issue. The logistics sector has been one of the few sectors transacting and this has helped price discovery and supported evidence for our valuations.

In our last set of results, I wrote that the more challenged sub-sectors of retail and offices had escaped the dramatic revaluation relatively unscathed. This seemed rather irrational and, not surprisingly, we are now seeing appraisers reassess the values within these sectors, even when there are few transactions.

We are now operating in a new paradigm where, if the property market won’t offer price discovery, then the debt market inevitably will. There is a significant amount of debt expiring and loans to be refinanced over the coming years. The overall property market remains over leveraged or under equitized and the banks are becoming increasingly active in forcing assets to the market.

This is creating some very interesting debt propositions and distressed sales, especially outside of our core sectors. Refinancings are exposing proper price transparency and highlighting to owners and debt providers that assets that once yielded a positive carry and attractive cash on cash metrics are now seeing equity holders being wiped out and lenders taking a loss. This is particularly acute in the office sector where new working patterns combined with ageing stock and growing ESG requirements is having a dramatic impact on valuations. Assets that made sense when in a QE World of free money are no longer viable when borrowing costs are at 7+%.

The good news is that the UK listed sector is in a much better position than the private sector or indeed many of the European REITs, where leverage is materially higher. Many of the lessons learned from the Global Financial Crisis were forgotten, but, in the UK, lower leverage was not one of them and so we are a long way away from a repeat of 2008/09.

. . . . . . . . . . .

Richard Moffitt, CEO, Urban Logistics REIT

Of all areas in commercial real estate, the logistics market retains some of the strongest fundamentals. Our belief is that the urban logistics sub-sector, comprising well located, single let logistics warehousing serving the UK’s urban areas, remains the most exciting part of this market.

The macro-economic uncertainty that has plagued markets throughout 2023 has manifested itself in the wide discounts which the majority of listed REITs are currently traded at when compared to their underlying NAVs. These discounts reflect the uncertain outlook on where the interest rate cycle will settle and the inherent impact that will have on asset pricing.

Given the interest rate environment, capital market transactions have been subdued, and corporate decision making around leasing activity has slowed. It is only now as we move towards the end of the year, with the Bank of England pausing monetary tightening, that commentators anticipate a period of stability and correspondingly the market’s ability to price assets or benchmark risk free rates with any degree of certainty.

. . . . . . . . . . .

During the six months to 30 September 2023, there has been a painful readjustment in the investment market as valuation yields have increased to reflect movements in ten year gilts and five year swap rates, the pricing of which is correlated to real estate property yields.

There are signs, however, with inflation falling and predictions that CPI will be in low single figures by the end of 2024, that base rates have peaked and may start to fall sooner than the “higher for longer” commentators suggest, allowing yields to stabilise.

Occupational demands are evolving in the office sector, with tenants using their premises to optimise the work experience for their employees. Amenity, connectivity, service and sustainability are encouraging businesses towards new buildings. At the same time, buildings that provide a poorer working environment are driving occupiers away. This bifurcation of the market between the “best-in-class” and the rest is accelerating with rental growth continuing for the “best” and values falling for the rest. This will provide opportunities to acquire potential developments and major refurbishments at levels that allow for strong capital returns.

We have experienced a further significant outward yield movement in the period, and while interest from potential occupiers has been encouraging, lease negotiations are taking longer to conclude. However, having taken the pain of reductions in value, Helical is now well positioned to drive growth through the letting of the vacant space in its investment portfolio.

. . . . . . . . . . .

Mark Allan, CEO, Land Securities

Since the start of the year, the reduction in inflation, return to real wage growth for consumers and better than expected resilience in UK GDP have been encouraging. Still, we remain mindful that the ongoing transition from a decade of free money and excess liquidity to a higher interest rate world could continue to create its dislocations and that higher-for-even-longer rates could eventually start to impact consumer and customer demand, even though we are not seeing any signs of this yet.

Investment activity remains subdued for now but the combination of recent relative stability in long-term rates and greater economic resilience so far means that we expect activity levels to pick up in 2024. The refinancing of cheap debt issued before 2022 across the sector remains a challenge, but the apparent availability of new equity and mezzanine finance to plug gaps in the capital stack means that we see the risk of disorderly sales putting significant pressure on the value of high-quality assets as lower than six months ago. As a result, for the best assets we expect values will start to stabilise during 2024, although secondary assets where the sustainability of cashflow is questionable will likely continue to fall.

Whilst macroeconomic signals remain mixed, with long-term rates seemingly beginning to stabilise and occupier demand for the best assets remaining robust, the outlook for values for best-in-class assets should start to improve.

. . . . . . . . . . .

Simon Carter, CEO, British Land

Despite the uncertain UK macroeconomic outlook, we are seeing an improvement in some leading indicators. While GDP forecasts continue to adjust from quarter to quarter, the UK has thus far avoided a recession, consumer confidence has been resilient and labour markets have remained robust with unemployment at 4%.

In the wake of the mini budget, searches for London office space paused, impacting take up in the first three quarters of 2023 (calendar year), which was 25% below the ten-year average. However, the forward-looking indicators in Q3 are very encouraging with the volume of space under offer 8% above the 10-year average and active demand 27% higher. Demand remains focused on core markets, with location a critical criteria for occupiers.

The City is performing particularly well with take up in Q3 exceeding the long-term average by 5%. The banking and financial sectors continue to drive activity in both the City and West End, with most larger deals and under offers, originating from these sectors. We are also seeing increased demand for larger requirements. There are now 24 active requirements over 100,000 sq ft, compared with 11 at the start of the year. Furthermore, most of this demand is for best in class space, which is shown in the high proportion of take up for new buildings, reaching 71% in September. Supply is also constrained, with very low levels of best-in-class space being delivered beyond 2025. The result is that we are seeing strong rental growth for best-in-class space, particularly new space in the development pipeline.

Investment markets were subdued in the first half of the year with investors continuing to exercise caution in a high interest rate environment with ongoing macroeconomic and geopolitical uncertainty. Total volumes were £2.9bn across the City and West End compared to £6.6bn in the same period last year.

. . . . . . . . . . .

Laura Elkin, fund manager, AEW UK REIT

Despite uncertainty remaining in the wider economy, values in UK commercial property largely stabilised during the six months to 30 September 2023. UK property is expected to offer healthy return prospects over the coming periods, with consensus foreca222sts showing an expected return to positive rental growth across all major market sectors by 2025, and all UK property total returns to average 5.6% per annum over the next five years (2023-2027).

During the period, the industrials sector remained robust having been the sector which saw the steepest value declines at the end of 2023. Supported by resilient levels of occupational demand, the sector has continued to see the highest levels of rental growth and although this is expected to slow in coming years, it is expected to remain in positive territory, showing expected average annual growth of 3.3% between 2023 and 2027. We believe that the Company’s industrial portfolio, with a low average passing rent of £3.60 per sq ft, will be well placed to benefit. The Company has completed several sales from the sector during the period, where sales yields have compressed significantly compared to pipeline assets, due to vendors’ positive expectations on rental growth.

Values in the retail sector also faired robustly during the period, buoyed by positive sector indicators. Retail sales volumes increased 0.3% over the three months to August 2023 and the proportion of online retail sales fell marginally in the month to August. These figures, however, mask a divergence in performance of the underlying retail sectors, with retail warehousing remaining more robust on a total return basis than its high street equivalent. Vacancy levels across retail warehousing have fallen to 4.7%, the lowest level seen since 2018. Performance on the high street remains significantly polarised from town to town, with the top tiers remaining robust and those now deemed to be lower quality struggling, both for occupational and investor demand.