Discounted value

Discounted value

India Capital Growth (IGC)’s portfolio was trading at just 12x FY21 earnings at the end of August. The manager says that when it last hit that level, in August 2013, IGC delivered a 197% return in sterling over the following three years. Stocks have begun to rebound but there could be much more to go for and there is scope for IGC’s discount to narrow further.

Over the past year India’s stock market has de-rated and the small and medium sized stocks that IGC favours have suffered disproportionately. After a couple of missteps, the Indian government has now taken decisive action to rejuvenate the economy in the form of a cut to corporation tax.

A significant contributor to weakness in India’s economy and its stock market has been a liquidity crisis, born out of ill-disciplined lending practices. The manager is optimistic that this will be the catalyst for further reform of the financial sector.

Mid-and-small-cap listed investments in India

Mid-and-small-cap listed investments in India

IGC’s investment objective is to provide long-term capital appreciation by investing (directly or indirectly) in companies based in India. The investment policy permits the company to make investments in a range of Indian equity securities and Indian equity-linked securities. The company’s investments are predominantly in listed mid-and-small-cap Indian companies.

Fund profile

Fund profile

IGC is an investment company listed on the Main Market of the London Stock Exchange. It invests in India, predominantly in listed mid-and-small-cap Indian companies. The trust is aiming to generate capital growth for shareholders. IGC has not paid dividends in the past and the manager says it is unlikely to do so in the near future.

Management arrangements

Management arrangements

IGC has been managed since 2010 by David Cornell of Ocean Dial, a company owned by Avendus Capital Private Limited, which in turn is backed by KKR. He has been assisted in this, since November 2011, by Gaurav Narain (Gaurav or the adviser) of Ocean Dial Asset Management India Private Limited, which is based in Mumbai. Gaurav has over 25 years of experience in Indian capital markets, having started his career as vice president of research for SG Asia. The six-strong investment team is split between London and Mumbai. Each of the analysts is assigned responsibility for a number of industry sectors. The manager is responsible for monitoring portfolio risk and all dealing is done from London.

In addition to IGC, Ocean Dial manages three open-ended funds, the largest of which is the Gateway to India fund. Ocean Dial had AUM of US$318m as at the end of August 2019.

Employees of Ocean Dial collectively hold 403,822 shares in IGC, while members of IGC’s board collectively own 92,500 shares between them. Combined Ocean Dial employees and the three directors hold 0.4% of IGC’s issued share capital.

Taxation

Taxation

IGC invests through a Mauritian subsidiary (ICG Q Limited) in a portfolio of Indian securities. Changes to the Indian tax regime in 2018 mean that ICG Q Limited is now liable to pay capital gains tax at 15% on short-term gains and 10% on its long-term (over 12 months) gains. IGC will accrue any potential CGT liability in its NAV. Given the manager and adviser’s focus on holding companies for the long-term, it might be reasonable to expect that the bias will be to the realisation of long-term gains. No CGT was accrued at 30 June 2019.

Index comparators

Index comparators

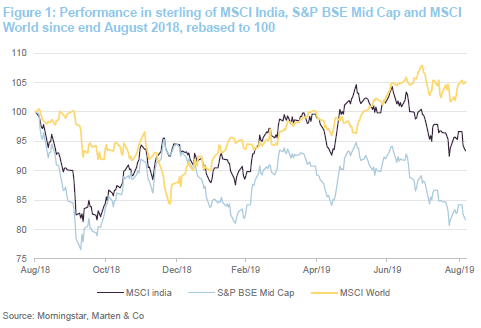

IGC’s main focus is on Indian mid-and-small-cap companies, but the fund can and does hold large-cap stocks as well. The board and the manager use the S&P BSE Mid Cap Index (total return) for performance evaluation purposes, although the portfolio is not constructed with reference to this index. The other funds in IGC’s peer group (see page 12) benchmark themselves against the MSCI Index and therefore we have included this index within the report as well.

Tackling the liquidity crisis

Tackling the liquidity crisis

When we last published on IGC, at the end of November 2018, we highlighted liquidity problems that had emerged following the September 2018 default of Infrastructure Leasing and Finance Services (IL&FS). IL&FS was an AAA-rated, unlisted infrastructure finance company with a $13bn loan book and 349 subsidiaries across India (see pages 3 to 4 of our November 2018 note). The stock market fell sharply and the central bank (the RBI), concerned about the potential danger of contagion, pumped liquidity into the system (it has also cut rates four times this year). Markets recovered and investor attention moved onto the upcoming election. However, the liquidity challenges facing the non-bank financial and housing finance companies continued to overshadow the economy.

Gaurav says that a central problem is that banks have become more risk-averse and have not been lending. The difficulty of obtaining borrowing and general adverse sentiment is creating a cascade effect, causing growth to slow. Over the last few months, this has been showing up in companies’ quarterly results and it seems likely that the FY Q2 and maybe FY Q3 numbers will also disappoint. The economy continues to operate with surplus capacity; some consumers find their finances are stretched, others appear to be sitting on their hands. Rural consumers have been particularly badly affected. Every part of the automotive sector has been reporting slowing sales. Overall passenger car sales in August 2019 were 31.6% lower than the equivalent month in 2018 and sales of two-wheelers were 22% lower. This buyers’ strike by consumers is being accompanied by slower investment by corporates. Gaurav thinks they have one eye on the global macroeconomic problems associated with the US/China trade dispute. Investors expected that the emphatic re-election of Prime Minister Modi’s BJP-led coalition would be swiftly followed by the announcement of measures to stimulate the economy. However, the budget in the first week of June disappointed in this regard. Hopes for more aggressive investment, financed by a small uplift in the deficit, did not materialise. The government said at the time that it would not jeopardise fiscal stability (opting to reduce the deficit from 3.4% to 3.3%) and provided nothing in the short-term to kick-start the economy. A proposed 6% CGT surcharge on wealthy individuals and unincorporated funds (catching many foreign portfolio investors but not IGC) further unsettled the stock market, accelerating outflows by foreign portfolio investors, and this was compounded when plans to transfer $25bn from the central bank’s balance sheet to government coffers were announced.

As sentiment has deteriorated, levered businesses and some wealthy families are facing a credit crunch. Defaults have been picking up and this has been affecting the non-banking finance sector, some private banks and the state banks. There has been a longstanding non-performing loan problem at the state banks related mainly to failed or struggling infrastructure projects. The new problem is expected in the SME and consumer lending that has largely been provided by the non-bank financial sector. The sector’s share prices have been falling. Across the market, falling stock prices have eroded loan collateral in some cases, compounding problems (see our comment on Emami on page 10).

Results for the end June quarter were poor and, unusually, the earnings of a number of stocks in IGC’s portfolio have been downgraded. However, there are some stocks whose earnings are expected to grow substantially from a low base, and these drag up the earnings growth figures for the portfolio as a whole to about 18% for FY20 (see Figure 5 on page 9). Ocean Dial says that if we exclude these stocks, overall earnings growth is running at about 8%.

Belatedly, the government has been taking action. Over the week ending 15 August, the finance minister consulted with industrialists and subsequently announced a mini budget. Measures included a recapitalisation of the banks. All pending payments by the government are to be cleared within 30 days – including GST payments for example. Measures to revive the housing sector have been introduced, including help for housing finance companies. Vehicles can be depreciated faster and a proposed registration tax has been deferred. The CGT surcharge on foreign portfolio investors has been waived.

On 30 August, the minister announced the consolidation of ten state banks into four new companies but that just seemed to exacerbate the share price declines of these banks as investors worried that the weak banks would drag down the stronger ones rather than the reverse. The government also authorised the transfer of $7.6bn of its $10bn planned recapitalisation package.

The measure that appears to have done most to restore confidence is a cut in corporation tax from 30% to 22%, meaning that the effective rate will fall from around 35% to around 25%. This is equivalent to an injection of $20bn into the economy. This will fall through to the bottom line for most profitable companies, but the hope is that it will stimulate investment too. New manufacturing companies will pay even lower rates of corporation tax – headline rate of 15% and about 17% all in. This should help level the playing field relative to other Asian economies and could encourage inward investment. The tax cut should provide a boost to growth but, given the government’s earlier commitment to fiscal prudence, there is an expectation that the pace of privatisations will pick up.

Commentators stress that the corporation tax cuts are not a panacea, more reforms are needed, nevertheless they are a step in the right direction.

Not all doom and gloom

Not all doom and gloom

The July 2019 budget reconfirmed the government’s commitment to invest in infrastructure, with targets such as 125,000km of new roads, electricity and cooking gas for all by 2022 and clean water for rural households by 2024. It is far too early to tell whether the government’s actions will turn the economy around but Gaurav highlights that, outside of the liquidity problem, many of the other factors that traditionally affect sentiment toward India are working in its favour. The oil price has bounced after the attacks on Saudi oil installations but is still lower than it was a year ago, inflation is benign (3.15% in July 2019), interest rates are well below long-term averages and the monsoon season seems to be going well. The implication might be that, if the credit market can be unlocked, economic growth could reaccelerate.

Investment process

Investment process

Companies exposed to the Indian growth story

Companies exposed to the Indian growth story

The basis of Ocean Dial’s investment philosophy is that investors will benefit most, over the long-term, by being invested in those companies best-placed to benefit from the Indian growth story. You also need good, credible management in these companies if they are to make the most of this opportunity.

Bottom-up stock selection

Bottom-up stock selection

Gaurav is a bottom-up stock-picker. When he is searching for investments to recommend to the manager, he is looking primarily for stocks that can grow and generate high cash returns on capital employed. Ideally, he wants to find companies that have been generating cash for at least six years, and are exhibiting ROE of 15% to 20%. These companies must also pay dividends and taxes; this demonstrates that they are honest and willing to put shareholders first. Cash generation alone is not enough; the company has to have a USP. Gaurav wants to avoid commoditised businesses as he is looking for ‘pricing power’. Crucially, the company must also have credible management that he can trust and that is shareholder friendly.

Gaurav aims to identify and invest in these opportunities ahead of the competition. Sometimes, when the fund first buys into a stock, IGC is the only institutional investor. Such stocks may have relatively lower levels of liquidity but, as a closed-end fund, IGC’s structure allows it to take a long-term view and get into stocks ahead of a rerating.

Large pool of potential investments

Large pool of potential investments

There are well over 5,000 listed companies in India but Gaurav believes only about 400 of these would be suitable for inclusion within IGC’s portfolio. From these he is looking to assemble a portfolio of 30-35 stocks. Low liquidity is one of the main criteria that disqualifies stocks as potential investments. The manager monitors how many days it would take to turn the whole portfolio into cash and the proportion of the portfolio that could be sold in a day. Generally, the manager wants to be able to liquidate a position within five dealing days, assuming dealing by IGC accounts for a third or less of average daily volume. Gaurav told us that, were he advising on a $1bn fund, there would still be 100 or so companies that would fit the bill. When he is weighing up the relative merits of stocks, he says he needs to have much stronger conviction on any stock with lower relative liquidity.

Despite the size of the Indian stock market, there is no shortage of research available, with around 70 foreign and domestic brokers analysing companies. To make the process more manageable, the adviser first sifts through the market using a series of quantitative based screens.

The data to support this analysis is readily available as all listed stocks are required to submit accounts and these have been compiled into various databases – Ocean Dial use Capitaline. Data is imported into Ocean Dial’s own templates. Gaurav says it is straightforward to download a detailed financial history of any stock. The team runs screens to highlight stocks that might be interesting and makes a point of visiting as many of the companies as possible. Gaurav reckons he meets in excess of 300 companies a year and says he is travelling outside Mumbai about once a month. There are some sectors that he tends to avoid because he believes there is a greater risk of corruption. He cites infrastructure companies as an example of this as they have to interact substantially with the government, there is less transparency than he would like and he does not trust the balance sheets.

Three-year time horizon

Three-year time horizon

When recommending an investment, Gaurav thinks about what is the fair value for the business and sets a price target based on an absolute assessment of value rather than a comparison to similar listed stocks. Gaurav always focuses on the long term. He wants any investment to at least double over three years. He is willing to accept lower returns initially, if a stock is investing for the future or restructuring for example, and it will take a while for the benefits to emerge. Gaurav believes that such stocks are often more attractively priced as short-term investors do not appreciate their long-term potential.

In India, a majority of companies are still controlled by their founding families. Gaurav believes the best of these bring in outside management. He says it is a good sign when the second or third generation within a family is willing to hire outside professionals to run its businesses.

IGC does not tend to own the listed subsidiaries of multinational companies. Gaurav appreciates that they often have good management but thinks they are often stifled by slow decision making and bureaucracy. Instead, he prefers businesses in the same fields that are run by people that used to work for multinational companies. He says that they tend to be nimbler and can have greater potential to add value by improving systems and processes.

Gaurav will recommend the sale of a stock if he loses faith in management or the business case for a company. Otherwise, he advises the trimming of holdings when they become significant weights in the portfolio or as they hit his price targets. Price targets are reviewed on an ongoing basis – always in the context of what Gaurav feels the stock can achieve over the coming three years, both on a fundamental basis and a valuation basis. Given the long-term time horizon, portfolio turnover is low.

The role of the board

The role of the board

The board has an oversight role. Its permission must be sought before IGC can take on any permanent borrowings, invest in any unlisted investment or buy back shares. It is worth bearing in mind that the manager says it is highly unlikely that it will invest in unlisted investments. The board also sets the company’s policy on currency hedging.

Asset allocation

Asset allocation

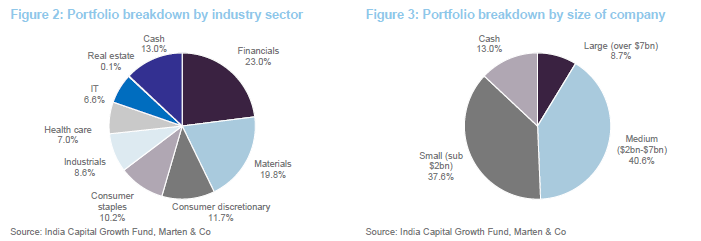

At the end of August 2019, there were 34 holdings in IGC’s portfolio. Gaurav has been advising that the manager consolidates the number of positions, focusing on those in which he has the highest conviction.

Within the portfolio cash levels have risen. This was not a policy decision but rather it reflects two sizeable takeovers of stocks within the portfolio. Five percentage points of the 13% cash weighting at the end of August came from the sale of NIIT Technologies and 2.5% from Essel Propack.

A controlling stake in NIIT Technologies, which was IGC’s fifth-largest position at the time that our November 2018 note was published, has been acquired by Baring Private Equity (Asia). The private equity firm made an open offer at R1394 per share; more than three times the level NIIT was trading at three years ago.

Blackstone Group made an open offer for packaging firm, Essel Propack, at R134 per share, around a 50% premium to the level that the stock was trading at when we published our last note. IGC retains a 0.5% position in the stock, which is still a listed company.

Gaurav expects that the cash will be deployed selectively and slowly, seeking to take advantage of price weakness in favoured positions.

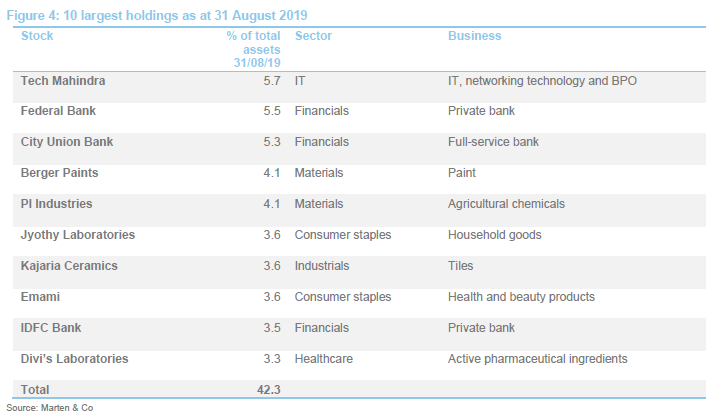

10 largest holdings

10 largest holdings

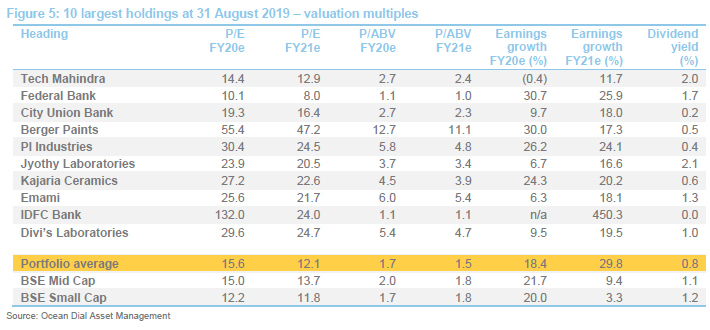

At the end of August 2019, the 10 largest holdings in IGC’s portfolio accounted for 42.3% of the fund.

Gaurav has observed that the derating suffered by the portfolio has left many positions trading on multiples far lower than he has seen in many years. Figure 5 shows various multiples for stocks within the portfolio as at the end of August 2019. Note, In accordance with Indian convention, FY (which is an abbreviation for fiscal year) refers to the 12-months to the end of March in the year indicated.

A few things stand out:

- Even in FY21, the top 10 positions are on average more highly valued than the average of the portfolio. This reflects the market’s perception of the quality of these businesses, which in turn helps justify the confidence that Gaurav has in them.

- Overall, IGC’s portfolio is not valued expensively; 12.1x FY21 estimated earnings is as cheap as the portfolio got in August 2013, when stocks were similarly out of favour. The portfolio returned 197% in sterling over the next three years, equivalent to 44% per annum. The 10-year average portfolio P/E ratio has been 16.3x.

- While sector-specific problems continue to weigh on FY20 estimated earnings, FY21 earnings growth for the portfolio is forecast to be well-ahead of the market.

Many of the stocks in the list of the top 10 holdings have been discussed in earlier notes (see page 16 for a list of these), having been longstanding positions within IGC. Gaurav highlights a few stocks.

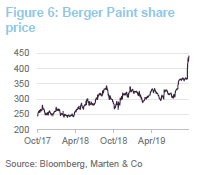

Berger Paint

Berger Paint

Berger Paint (www.bergerpaints.com) has been a holding in IGC’s portfolio for some time but paint companies have been performing relatively well during this period of market weakness and this helped propel it into the list of the 10 largest holdings. Essentially, the four main paint manufacturers form an oligopoly and have been disciplined in their pricing. All four have been announcing good results. Berger Paint delivered year-on-year revenue growth of over 15% and higher margins for the April-June quarter and was rerated as a result.

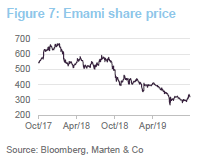

Emami

Emami

Healthcare and beauty products company, Emami (www.emamiltd.in) has been a holding in IGC’s portfolio for five or six years. Its share price has been falling, on concerns about the pace of consumer spending (particularly in rural areas). However, more recently, it has been a casualty of the liquidity crisis. The founding family owns a cement company that it planned to list (plus a hospitality business and real estate) but stock market weakness prevented the listing. Emami shares were posted as collateral against a loan. As stock prices fell, the amount pledged as collateral rose. In June, the family was forced to sell a 10% stake in the company. Gaurav believes that the business is fundamentally sound and advised IGC to increase its stake.

The situation that the family controlling Emami found itself in is not uncommon in India and this has been one factor weighing on the stock market.

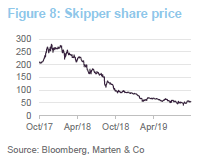

Skipper

Skipper

One other position that IGC has been increasing is Skipper (www.skipperlimited.com). In our November 2018 note (see page 8 of that note), we noted that the manufacturer of pylons for electricity transmission and distribution, railways and telecom towers had been performing badly, making it one of the largest detractors to IGC’s performance in 2018. Skipper had been experiencing a slowdown in top line growth and narrowing margins as raw material prices rose. However, Gaurav notes that the company now has a strong order book and believes margins will recover. After the falls, it trades on just 5.3x FY21 earnings and only 60% of its book value. The founding family has also been buying shares.

Performance

Performance

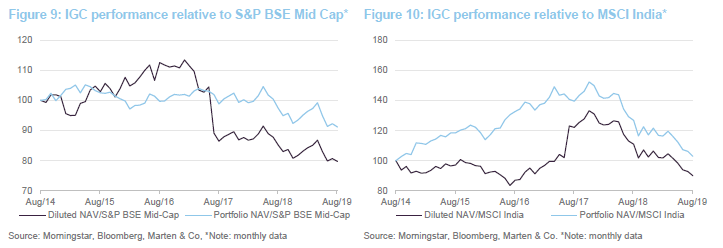

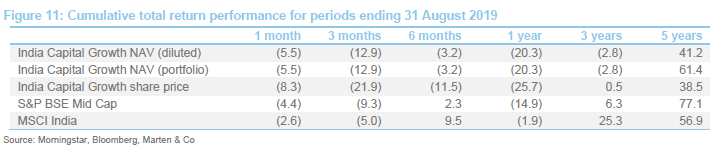

The data in Figures 9, 10 and 11 show returns for both IGC’s published NAV and for an adjusted, ‘portfolio’ NAV. The portfolio NAV removes the dilutive effects of IGC’s subscription shares (which were exercised in full in August 2016) and represents the performance generated by the manager and adviser.

As we noted on page 5, small and medium sized Indian companies have been underperforming larger ones and this impacts on IGC’s performance relative to the MSCI India Index. IGC has underperformed the S&P BSE Mid Cap index too.#

Performance attribution

Performance attribution

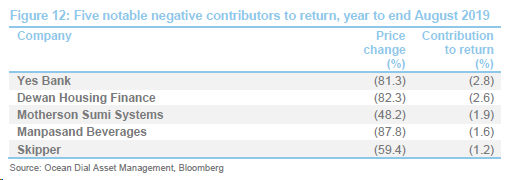

Ocean Dial kindly supplied us with performance attribution information covering the year to 31 August 2019.

Yes Bank and Dewan Housing Finance found themselves at the centre of the liquidity crisis. Both struggled to finance new business. Yes Bank was hit hard both when the RBI ousted its chief exec, Rana Kapoor, on governance grounds and following allegations of Yes Bank underreporting bad loans. In this case, Gaurav thinks the new management has ‘kitchen sinked’ the numbers, he likes the bank’s SME lending business and sees the chance of growth in its retail operations. On his advice, IGC has added to the position.

The holding in Dewan has been sold completely. As we noted last November, IGC managed to book considerable profits on this position over the years but this bank is now seeking emergency funding.

As an automotive components business, Motherson Sumi has been hit hard by the dramatic drop in vehicle sales. Gaurav believes that the share price has overreacted and IGC has increased its position.

Manpasand Beverages was discussed in our June 2018 note (see page 10 of that note). Gaurav acknowledges that in this case he misjudged the quality of the company’s management. He remains convinced of the quality of the company’s franchise but Manpasand became a test case for non-compliance with GST, lost two auditors in quick succession and now faces rumours of accounting fraud.

Peer group

Peer group

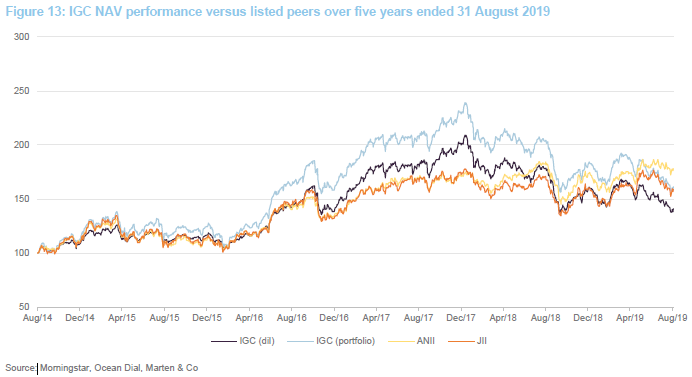

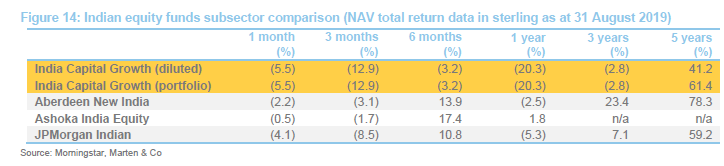

IGC’s listed peer group includes three funds with more of a large cap bias than IGC, Aberdeen New India, JPMorgan Indian and Ashoka India Equity (a relatively recent – July 2018 – launch and therefore excluded from Figure 11). Of the three, Ashoka is perhaps the closest competitor. However, there is little commonality in the stocks held by IGC and the other funds.

As Figures 13 and 14 show, IGC’s medium and longer-term performance was, until last year, well ahead of both Aberdeen New India and JPMorgan Indian. Over the past year, as small and mid-cap stocks have lagged larger ones, IGC has lost its edge.

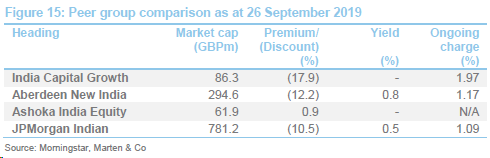

Figure 15 shows that IGC is third-largest of the four UK-listed India-focused funds. It trades on the widest discount, reflecting to some extent perhaps its recent relative performance but this is at odds with the valuations of the stocks in its portfolio. None of the funds pays much, if anything, by way of a dividend. IGC’s relatively high ongoing charges ratio will fall (as we discuss on page 14). Ashoka India Equity pays no base management fee but is subject to a performance fee equivalent to 30% of its outperformance of its benchmark over three-year periods. This will flatter its ongoing charges ratio.

Discount

Discount

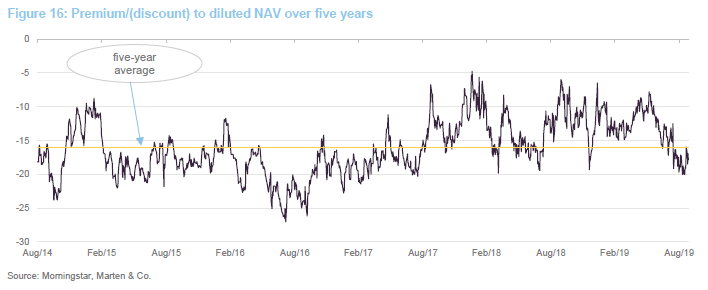

As Figure 16 shows, IGC’s discount has widened in recent months and now sits towards the bottom-end of its trading range over the past couple of years. Over the year to the end of August 2019 it traded within a range of 19.3% to 6.0% and, at 26 September 2019 the discount was 17.9%.

The most likely catalyst for a narrowing of IGC’s discount would be an improvement in its relative performance. The adviser’s comments, that the companies in the portfolio are, on average, as cheap as he has seen them for many years, might suggest that the trust would respond well to any improvement in India’s economy. For IGC’s shareholders, that might be compounded by a narrowing of the discount.

Fees and costs

Fees and costs

The investment manager is entitled to receive a management fee payable jointly by IGC and ICG Q Limited (see page 3 for an explanation), equivalent to 1.25% per annum (pre 1 July 2019 1.5%) of gross assets less current liabilities. Either side must give 12 months’ notice to end the contract. There is no performance fee.

The administrator is Apex Fund Services (Guernsey) Limited. The custodian of IGC’s assets is Mumbai-based, Kotak Mahindra Bank Limited. Cash is held in both Mauritius and India.

The ongoing charges ratio for the year ended 31 December 2018 was 1.91%, slightly higher than the equivalent figure for 2017 (1.86%). The increase reflects a lower average asset base in 2018, as fixed costs were spread over a smaller base. However, the reduction in the investment manager’s fee with effect from 1 July 2019 will, all things being equal, result in a fall in the ongoing charges ratio in 2019 and again in 2020.

Capital structure and life

Capital structure and life

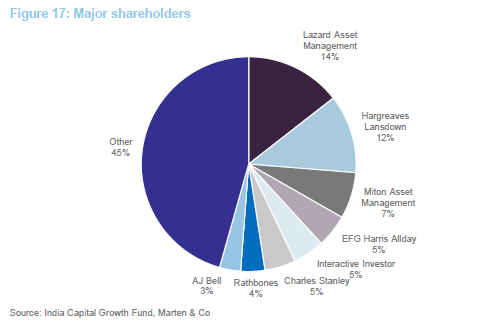

IGC’s capital structure consists of 112,502,173 ordinary shares and no other classes of share capital. IGC has the authority to buy back up to 14.99% of its issued share capital, a power that it renews at each AGM. Figure 17 shows the major shareholders in IGC at the end of June 2019.

IGC has an unlimited life. Its year end is 31 December and it holds its annual general meetings in April.

Although permitted to, the manager does not employ gearing in the management of the fund. This reflects the relative volatility of the Indian stock market. The manager will normally keep cash of 3-4% on hand to take advantage of attractive investment opportunities as they arise, although, as noted on page 8, recently the cash weighting has risen well-above this level, following corporate activity within the portfolio.

Board

Board

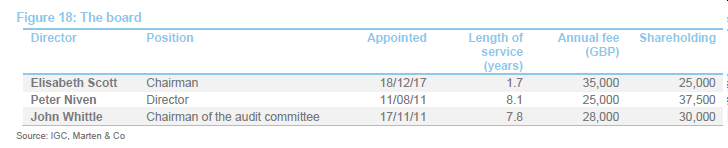

The board consists of three non-executive directors, all of whom are independent of the manager and who do not sit together on other boards. Any director who has served for more than nine years stands for re-election annually, and one third of the remaining directors retire by rotation at each AGM and seek re-election. The maximum total payable to the directors is set in the articles of association as £200,000.

Elisabeth Scott has 34 years’ experience in the asset management industry, having started as a US equity fund manager in Edinburgh in 1985. She went to Hong Kong in 1992, where she remained until 2008, most recently in the role of managing director and country head of Schroder Investment Management (Hong Kong) Limited and chairman of the Hong Kong Investment Funds Association.

Peter Niven has over 40 years’ experience in the financial services industry, both in the UK and offshore. He was a senior executive in the Lloyds TSB Group until his retirement in 2004 and until July 2012 was the chief executive of Guernsey Finance LBG, promoting the island as a financial services destination. He is a Fellow of the Chartered Institute of Bankers and a chartered director.

John Whittle is a chartered accountant and holds the IoD Diploma in Company Direction. He was previously finance director of Close Fund Services, a large independent fund administrator. Prior to moving to Guernsey, he was at PricewaterhouseCoopers in London before embarking on a career in business services, predominantly telecommunications.

Previous research publications

Previous research publications

Readers interested in further information about IGC, may wish to read our earlier notes. All of these are available on our website, www.martenandco.com.

The legal bit

The legal bit

This marketing communication has been prepared for India Capital Growth Fund by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.