For the US, the defining event of November was Donald Trump’s win in the presidential election, indicated by record highs for major US indices such as the Dow Jones and S&P500. The largely positive market response is thought to be driven by expectations of corporate tax cuts and waves of deregulation. US government bond yields jumped initially on fears that the new government’s policies might be inflationary but fell back again to end the month lower.

Despite unemployment rising to 4.2%, the labour market exceeded expectations by adding over 227,000 jobs over the month. At the same time, The Conference Board Consumer Confidence Index increased by 2.1 points from October. This is thought to reflect the US’s falling inflation, although 53% of respondents to a survey conducted by McKinsey still expressed concerns over a ‘inflation overhang’ that would affect prices.

“We cannot take the UK’s status as a global

financial centre for granted’” – Rachel Reeves, Chancellor of the Exchequer

In terms of the UK market’s reaction to the Republican win, the FTSE 100’s initial surges were dampened by the likelihood of upcoming tariffs and concerns that deregulation in the US could see a further outflow of UK investors’ capital across the Atlantic. In the wake of the budget, UK consumer confidence posted its largest drop in over three years. Jumps in national insurance will lead to higher costs for employers, which likely contributed to a decline in job vacancies, with a 13th consecutive month of falling demand for employees. On a more positive note, the Bank of England reduced its main rate by 0.25% to 4.75%, yet even it acknowledged that domestic inflationary pressures are lessening at a slower speed.

Similarly in Europe, investors have exhibited worries over the knock-on effect of potential high tariffs on the region’s goods and a lack of Chinese demand. However, while the European benchmark STOXX600 made some initial losses, it ended the month with a turnaround, encouraged by predictions that the ECB will make further rate cuts, with Finnish central bank chief Olli Rehn stating that current data would support leaving ‘restrictive territory’ in 2025.

SVM UK Emerging Fund

‘Positive real wage growth has supported a recovery in consumer confidence, with the potential for further improvement from release of excess savings’

abrdn New India Investment Trust

India remains more insulated from global macroeconomic concerns due to its growing domestic economy

Barings Emerging EMEA Opportunities

The recently announced Chinese stimulus to boost domestic consumption may help economies globally

At a glance

| Exchange rate | 30 November 2024 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.2735 | (1.3) |

| Pound to euros | GBP / EUR | 1.2038 | 1.6 |

| US dollars to Japanese yen | USD / JPY | 149.77 | (1.5) |

| US dollars to Swiss francs | USD / CHF | 0.8810 | 2.0 |

| US dollars to Chinese renminbi | USD / CNY | 7.2460 | 1.8 |

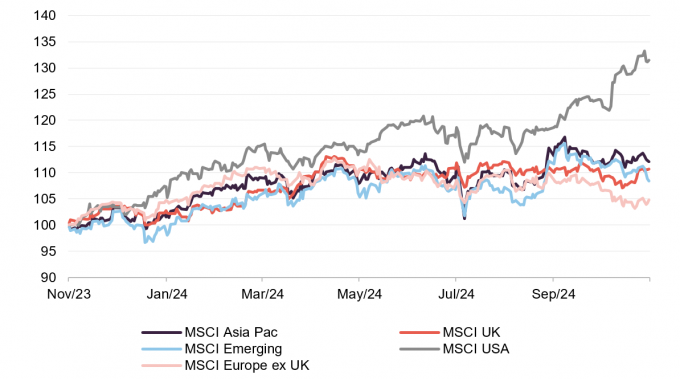

MSCI Indices (rebased to 100)

Major indices saw substantial gains over the month, with the S&P500 reaching a record high of 6,025.42 on 26th November.

Despite gains at the end of the month, gold prices fell to their worst monthly drop since September 2023, largely caused by a selloff following the US election result.

Expectations of rate hikes by the Bank of Japan led to a stronger yen against the dollar, reaching a six-week high by the end of November.

Time period 31 October 2023 to 31 October 2024

Source: Bloomberg, QuotedData. Converted to pounds to give returns for a UK-based investor.

| Indicator | 30 November 2024 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 72.94 | (0.3) |

| Gold (US$ per Troy ounce) | 2643.15 | (3.7) |

| US Treasuries 10-year yield | 4.17 | (2.7) |

| UK Gilts 10-year yield | 4.24 | (4.6) |

| German government bonds (Bunds) 10-year yield | 2.09 | (12.6) |

Global

JPMorgan Global Core Real Assets, 26 November 2024

The six months to 31st August 2024 have seen continued economic growth and a moderation in of inflation. Over the second quarter of 2024, real GDP growth increased to 3.0% in the U.S. following a 1.6% rise in the first quarter, driven by increases in consumer spending, inventory investment and business investment. The U.K.’s real GDP grew by 0.5% in the second quarter of 2024, caused primarily by increases in services output, despite declines in production and construction sectors. While labour markets remain strong, they are showing signs of slowdown, with the pace of job creation decelerating (including downward revisions to previous figures) and growth becoming more uneven across sectors.

During this period, monetary policy in both the U.S. and the U.K. took a dovish turn. The Federal Reserve maintained rates at 5.50% until the end of the period but later reduced the rate at its September and November meetings. Meanwhile, the Bank of England has now lowered rates by 0.5%, following cuts at both its August and November meetings. It is expected that both central banks will likely lower interest rates further in 2025. Inflation continued to decline, with U.S. headline inflation falling to 2.6% year-on-year as of the end of October, with recent prints showing the lowest inflation since 2021. In contrast, U.K. headline inflation remained steady at 2.3% year-on-year. In the U.S., inflation was primarily affected by housing costs, which rose by c.5% over the year. In the U.K., services inflation has been the main factor driving costs, although slowing wage growth and a modest rise in unemployment may indicate a further slowdown. While inflation has generally eased, central banks are expected to remain cautious for the remainder of the year, carefully balancing economic growth, employment, and consumer prices.

During the period U.S. real estate continued its adjustment to the interest rate environment, with easier times ahead. Transaction activity is increasing, downward price adjustments are smaller, and credit activity is recovering. Office space remains an outlier, but data shows that most vacancies are in lower-quality assets, while newer buildings have experienced rent growth and stable leasing activity. In the Asia-Pacific region, diverging monetary policies, foreign exchange fluctuations, and consumer demand may cause variance in near-term real estate performance. However, growth expectations remain healthy, and fundamentals across most sectors are strong, highlighting the need for diversification.

Global infrastructure assets remain resilient due to non-cyclical returns from utilities and other long-term contracted assets. The increasing demand for computing in an increasingly “intelligent” world is boosting demand for utility assets, and valuations for publicly traded utility companies have begun to reflect this. Geopolitical tensions, particularly ongoing conflicts in the Middle East and Europe, continue to benefit transportation assets. Whilst a slowdown in GDP growth and an expected increase in supply of LNG carriers may put downward pressure on lease rates, yields are expected to remain high over the next 1-2 years.

. . . . . . . . . . .

Peter Spiller, Alastair Laing & Christopher Clothier, Capital Gearing Trust, 12 November 2024

It is widely known that every US recession since the second world war was preceded by an inverted Treasury yield curve. Less discussed is the most proximate warning signal of a recession, the point at which the yield curve normalises, known as a dis-inversion. The US yield curve has been inverted for two years and on 5 September 2024 the two-year Treasury yield fell below the ten-year Treasury yield, by this measure it dis-inverted. The reason the curve dis-inverted is because the bond market is implicitly assuming six further interest rate cuts over the next 18 months, which will only occur if the economy slows down significantly.

Whilst a US recession in the next 12 months is not our central expectation it is notable how many US economic indicators are slowing, in some cases markedly. Key amongst these are falling consumer confidence, falling wage growth, rising unemployment and falling future capital expenditure intentions. It is clear that less affluent Americans are feeling stretched as evidenced by the very low savings rate. On balance we think the implied forecast of six interest rate cuts is too pessimistic but a slowdown seems all but assured.

The combination of an economic slowdown (recession or not) and very high US equity valuations could make for a testing time for investors in US equities. Much of the recent equity market performance has been driven by the “magnificent seven” hyperscale technology companies that are central to the development of Generative Artificial Intelligence (‘AI’). Goldman Sachs estimates that the capital expenditure to build AI infrastructure will cost $1tn in the coming years and they are sceptical that there are general applications valuable enough to deliver a good return on this investment. News that the infamous mothballed nuclear plant at Three Mile Island was recently reopened on the back of a 20-year power purchase agreement with Microsoft is the most vivid example of the scale of infrastructure spend. This is a long way from the historically ‘capex-light’ business model of software development.

Much like the internet inspired dot-com boom (and bust) even if AI does prove to be revolutionary technology it seems likely we are at least a decade away from deploying it in a way that meaningfully impacts economy wide productivity. The early 2000’s proved that a slowing economy combined with post-bubble asset write-downs could inflict very serious losses on investors even in the absence of a serious recession. The American economist Robert Shiller famously publicised the cyclically adjusted price earnings ratio (‘CAPE’) in his March 2000 book “Irrational Exuberance”. At that time CAPE hit its all-time high of 42x. Today the CAPE ratio sits at 37x, below that highest ever peak but at the 97th percentile high of its 150-year historic range. Against this backdrop of elevated equity market valuations, there is a growing number of geopolitical developments which have the potential to act as catalysts to a broader market repricing. Among these are implications from the result of the US election, the ongoing war between Russia and Ukraine, the spread of conflict in the Middle East, and increasing trade tensions with China.

. . . . . . . . . . .

Joe Bauenfreund, manager, AVI Global Trust – 12 November 2024

The macroeconomic and geopolitical environment remains confusing, worrying and interesting in equal measure. Equity markets – as they tend to – have continued to climb the wall of worry from the October 2023 lows.

Then, as now, the risks feel real and there are plenty of issues to worry about. Indeed, investors continue to fret over whether we will endure a so-called soft, hard or even no landing. A lot of ink has been spilt by others on which of these might occur; however, history shows that market timing is largely a futile exercise and it must always be remembered that the economy and the market are not the same thing.

The opportunity set across the niche and overlooked parts of the equity market in which we fish is rich. Discounts are wide by historical standards.

. . . . . . . . . . .

UK

CT UK High Income Trust, 28 November 2024

There had been a lot of leaks and even more speculation on its content but we have finally now seen the first budget from Rachel Reeves, the Chancellor of this new Labour government. The initial judgement from investors was positive with bond yields falling and domestic UK shares rising. Unfortunately, this lasted only until we saw the detailed numbers as the Office for Budget Responsibility revised up borrowing numbers and revised down growth. As investors digested this information and the sheer amount of debt the government intends to issue, sentiment turned more negative with bond yields rising sharply and shares falling. Even if this looks like a classic left-wing tactic of tax and spend, investment in UK infrastructure and housing is desperately needed. Businesses at least now know the rules under which they have to operate and the ultimate impact remains to be seen.

We probably all have a view on the pros and cons of borrowing more to invest and raising taxes but I think arguments will persist for some time as to whether pre-election promises have been broken and the right taxes have been raised. Whilst I think this debate will rumble on, the fact that we will have a period of stable government intending to invest more has to be beneficial for the long-term future of the country, helpful for economic growth and positive for those businesses that are exposed to infrastructure and housing in particular.

Without acknowledging it, this new Labour Government has actually inherited one of the fastest growing European economies and with fiscal clarity now here and interest rates still likely to fall further, our portfolio manager remains constructive on the UK and positive on UK domestic companies where dividends and valuations remain very attractive.

The landslide election victory by President-elect Trump in America defied prediction but is being taken particularly well by equity markets. His pre-election rhetoric is yet to be tested but, as the UK’s largest single-country trading partner, we should take the early signs as encouraging. We shall see.

. . . . . . . . . . .

Stuart Widdowson and Ed Wielechowski, Odyssean Investment Trust, 27 November 2024

Since the period end, the long trailed first budget of the new UK government as well as the decisive US election result have removed two key uncertainties for investors.

The long lead up to the UK budget, with many of the tax changes being telegraphed in advance, in our view has led to both UK consumer and business sentiment falling – and marginal decisions on spending investment and hiring being delayed. We share the concerns of some commentators that the increase in public expenditure beyond existing plans is unlikely to stimulate growth, as historically the public sector has generally been a poor allocator of capital and according to the Economist, public sector productivity is unchanged since the mid-1990s despite the advances the private sector has made and the advent of more technology in the workplace.

The largesse being afforded to the public sector in the UK is reminiscent of the 1970s, and we fear that there will be increasing “crowding out” of the private sector by the public sector. The ultimate result of this is likely to be that the UK economy slips back from the growth trajectory experienced in the first half of the year – both in absolute terms and relative to other advanced economies.

In contrast, the clear mandate given to the incoming US government will support de-regulation and lower taxation, providing an even more supportive environment for private sector businesses. There is likely to be much more ambition to curtail public sector waste and inefficiency than in the UK, which we believe should help slow the unsustainable rise in US public debt. In short, we expect the performance gap between the growth in the US and the UK economies to continue to widen, not shrink.

In both the US and the UK, our expectation is for interest rates, whilst on a downward trend, to perhaps decline less fast and to settle at a higher level than previously anticipated.

Given this backdrop, it is likely that US equities will remain in favour, but that performance will be driven much more broadly across all companies, rather than the extreme concentration of recent performance – which had been driven by the large tech stocks. The decisive victory is likely to lead to improved business confidence and a pick-up in economic activity through 2025. This is likely to drive re-ratings of more traditional and small and mid-cap US companies, which we believe will begin to re-consider acquisitions.

With interest rates not set to fall back to the very low levels of the last decade, we believe that growth at a reasonable price (GARP) and value investing will continue to be relatively more attractive than growth investing. At some point as the US equity market re-rates, we believe it is likely that international investors will begin to look to non-US equity markets, initially seeking companies which have significant sales and earnings exposure to the US, but are trading at a material discount to US peers on account of a non-US listing.

. . . . . . . . . . .

Thomas Moore, manager, abrdn Equity Income – 27 November 2024

Looking ahead, the performance of UK equities will be driven by a number of factors, notably the prospects for interest rates and economic growth in the UK and globally. After a brief period of more positive sentiment towards the UK following Labour’s landslide general election victory, the tone is once again more sceptical as investors scrutinise the new Government’s policies, in particular the decision to increase taxes and borrowing in the budget. Investors recognise that there is little room for manoeuvre on fiscal policy given the state of government finances, but they would welcome any signs of policy that would help to reverse the UK’s long history of under-investment and low productivity growth.

Trading at a Price/Earnings ratio of around 11.5x, UK equities are cheap relative to other equity markets and their own history, creating a low bar for share prices on the announcement of any positive news. Among developed markets, Europe trades at a Price/Earnings ratio of 13.5x, Asia and Japan trade at 14x and the US trades at over 20x. We see the valuation opportunity within the UK equity market as two-fold:

- The FTSE 100 Index generates 78% of its revenues outside the UK, meaning that these are internationally focused businesses that should, but often don’t, trade at similar valuations to their global peers. We will continue to seek out these valuation anomalies among large caps, which represent 48.9% of the portfolio.

- The FTSE 250 and Small Cap indices are far more domestically focused, generating over 50% of their revenues in the UK, making them more dependent on the UK economy. Recent Goldman Sachs research observes a tight inverse correlation between the performance of the FTSE 250 Index (relative to the FTSE 100 Index) and UK 10-year Gilt yields, as well as a strong positive correlation between the FTSE 250’s Price/Earnings ratio and current economic activity levels. It is therefore understandable that investors will be scrutinising government policies in the months ahead, seeking to establish whether they will help to deliver higher levels of investment and productivity growth, which could create the conditions for more sustainable economic growth.

. . . . . . . . . . .

Robert Talbut, chair, Schroders UK Mid Cap, 27 November 2024

The Bank of England’s Monetary Policy Committee has recently made its second rate cut in four years, reducing the bank rate by 25 basis points to 4.75% and there should be further cuts over the next 12 months. In addition, inflation, which has been a concern over recent years, should remain at a moderate level going forward boosting disposable incomes and generally helping improve sentiment towards the UK. It is encouraging to see that this supportive environment is now starting to be reflected in growing interest and future expectations for the UK equity market, as investors start to recognise the value on offer both relative to other regional equity markets but also compared to historical valuations. Within the wider UK market, the mid-cap sector is looking particularly attractive given earnings growth expectations and healthy dividend prospects. These factors help explain the increased merger and acquisition activity within the mid-cap sector from both domestic and international corporate buyers as well as private equity investors.

. . . . . . . . . . .

Iain Pyle and Charles Luke, Shires Income, 20 November 2024

Starting the second half of our financial year, the direction, if not the pace, of change seems well set. Interest rates are falling, inflation is under control and global economies are predicted to have a period of consistent, if unspectacular, growth. That should be a good set up for investors – but we should not be complacent. As mentioned above, there is a large amount of risk in the market at the current time. The conflict in the Middle East is an obvious source of risk, given its potential to impact global energy prices and return inflation to the top of the agenda. The US election in November has also introduced increased uncertainty. We would expect Republican policies to increase tariffs and lower taxes – both of which are inflationary changes. The current concentration of markets into US technology stocks also creates a risk if they fail to deliver on expectations for high growth. Any recent shortfall to high expectations in this sector has led to quite significant share price reactions and, given the high weighting, this has created market volatility. It is also worth noting that valuation at purchase can be a strong driver of future returns – cheap entry points can lead to higher forward returns and vice versa. Historically, when the US market has traded at this level, ten year forward returns have been close to zero.

That last point in particular is important for our approach. Equity income has been out of favour for some time. There are some good reasons for this – market growth has been driven by technology stocks with low dividend payments and investors have been able to take advantage of attractive yields on cash and bonds to generate income. However, in a world where market levels are flatter (which seems likely after a period of rapid growth) income naturally makes up a greater proportion of investors’ total return and again returns to prominence. With the yield on cash investments also falling the value of a resilient income strategy becomes much clearer.

After a period of market concentration, we may also see some dispersion, and allocators should look to diversify. The UK, in particular, screens as undervalued, with discounts to US or global equities still close to record levels. The income outlook for the market remains positive. UK companies have healthy balance sheets, with the net debt / EBITDA ratio, a standard measure of balance sheet risk, at less than 1x, which compares to an average over the last twenty years of nearer 2x. Payout ratios, at just under 0.5x, are also lower than average. And while an increasing amount of excess cashflow is directed to share buybacks, that shouldn’t be seen as a negative factor given it will spread future cashflows over fewer shares and allow for dividends to increase on a per share basis over time.

In summary, while the outlook is benign, we should not be complacent. But we see plenty of opportunities in an inexpensive UK equity market to invest in great companies at reasonable prices.

. . . . . . . . . . .

Richard Staveley, Rockwood Strategic, 18 November 2024

Post period end the new government’s budget measures included higher capital gains tax on profitable share investments, reduced inheritance tax reliefs designed to incentivise risk capital into the AIM market and no new specific measures to encourage further investment into the British stock market. Furthermore, the raising of National Insurance costs for employers, above inflation minimum wages increases and tougher employment laws are unlikely to make life easier for small British businesses. The importance of a healthy listed market for small businesses is critical to allowing our best British businesses to scale up and we hope that the new government is not reverting back to the long period of neglect and indifference that had been occurring.

. . . . . . . . . . .

Imran Sattar & Emily Barnard, Edinburgh Investment Trust, 18 November 2024

Across global markets, risks remain high. Multiple volatile geopolitical situations exist, with one of the biggest uncertainties being whether the recently announced stimulus measures in China will be sufficient to reignite growth. The re-election of Donald Trump also increases the risk of global trade wars. Closer to home things appear more sanguine. With Chancellor Reeves’ inaugural budget now in the past, UK consumers can plan their finances with greater certainty and, in any event, they are in better shape compared with a few years ago. We are also considering the increase in employer National Insurance rates, which are a modest headwind for the more domestically orientated holdings in the portfolio. That said, political stability combined with lower levels of inflation should promote higher levels of corporate investment. We are finding many opportunities to invest in high quality businesses in the UK market at attractive valuations.

. . . . . . . . . . .

Peter Dicks, chair, SVM UK Emerging Fund, 8 November 2024

This year, investors have favoured businesses seen as ‘quality’, with strong balance sheets and less debt risk. Before this rally began, smaller and medium sized London-listed companies had fallen to long term low valuations relative to the largest global businesses. The period under review has seen a broadening of stock market performance, with investors looking for growing businesses in out-of-favour areas. Despite the challenges for the global economy there appears potential for more catch up from small and medium-sized businesses.

Positive real wage growth has supported a recovery in consumer confidence, with the potential for further improvement from release of excess savings. UK smaller companies are more exposed to the domestic economy and typically more cyclical. They are also more geared to central bank base rates and should benefit from easing of inflation and interest rates. UK inflation has reduced and forecasts for growth of the UK economy for 2025 exceed both the US and the Eurozone.

. . . . . . . . . . .

Alex Wright, manager, Fidelity Special Values – 6 November 2024

While UK equities have generated good returns since the pandemic, fund flows have remained negative, which is puzzling. Many domestic investors seem to have had their heads turned by the strong historic returns generated by US and technology stocks. However, the latter’s lofty valuations make them vulnerable to disappointments, as we have seen in recent months and any sustained underperformance may well cause investors to reassess their allocation.

Labour’s landslide victory is expected to result in improved political stability in the UK. This should prove attractive to investors against a backdrop of increased uncertainty in Europe and the US, where the future course of domestic and foreign policies looks more unpredictable. The new UK government, with its large majority, has sought to foster more favourable business and market sentiment by stressing the importance of fiscal discipline and boosting economic growth, as well as its desire to work towards improved relations with the European Union. This, combined with a domestic economy that has performed better than anticipated, and corporate earnings that have proved particularly resilient in a global context, may help draw more attention to the UK.

We have recently seen a pick-up in M&A activity, as corporates grow in confidence amid improving economic and business conditions. This trend should continue given how attractive large parts of the UK market are. Other supportive dynamics include attractive dividends in a global context and the fact that a record number of UK companies are buying back their own shares.

Conditions surrounding the UK equity market are beginning to improve and this should hopefully help turn the tide. However, as the past year has shown, inflows into UK equities are not necessary to be able to generate attractive returns, although they would clearly have helped.

We continue to believe that the combination of attractive valuations and the large divergence in performance between different parts of the market creates good opportunities for attractive returns from UK stocks on a three-to-five-year view.

Given the relatively robust performance of UK companies, it has been a surprise that we have not started to see the valuation gap between the UK and other global markets narrow. For us, this demonstrates the strong opportunity for savvy investors willing to buy into the UK market today. Compared with their own historic averages, as well as stock markets across the globe, UK shares remain cheap and we are seeing value across the market cap spectrum.

While there continues to be a degree of uncertainty both in the UK as well as globally, overall the UK economic outlook has improved. Companies have proved surprisingly resilient.

. . . . . . . . . . .

Asia

Pruksa Iamthongthong and James Thom, managers, Asia Dragon – 22 November 2024

The US has elected Donald Trump as its next president, and he has also secured control of both Houses of Congress. Asset prices have moved along with a focus on the reflationary aspects of Trump’s pre-election pledges and promises. We expect tax cuts and deregulation, but also higher tariffs. This could mean higher nominal GDP, mainly via inflation, and potentially higher for longer interest rates. We continue to monitor Trump developments closely, and higher nominal GDP growth and higher-than-otherwise interest rates are the macro implications that we are most confident about for now.

As for the implications for Asia, it is a complex picture. Trump is likely to drive uncertainty and volatility, but this could also create opportunities for long-term investors. Higher tariffs and barriers to trade are bad news, and this seems likely under Trump. China could be affected, and this might prompt the Chinese government to ramp up domestic economic growth efforts with aggressive stimulus measures. It is also possible that with a more transactional US President, the US and China could arrive at some mutually beneficiary agreement; we should remember the first Trump presidency did see the Chinese equity market outperform. We should not ignore the risks though as unmitigated; the imposition of huge tariff hikes would have a significant impact on China’s economy. Similarly, export markets, too, with trade-oriented countries potentially facing pressure from higher tariffs and limited rate cuts in the US.

Geopolitical tensions remain difficult to navigate and whilst the world’s focus is on Ukraine and the Middle East, Asia could also see shifts if Trump follows a similar playbook to his first term. So, we are likely to be in for a period of change, uncertainty, and volatility across multiple fronts.

Asia, however, is a diverse region and it is wrong to paint it with the same broad brush. Largely domestic driven economies like India will be insulated and may even benefit from continued supply diversification away from China. Intra-regional trade continues unhindered. Asia also does not have the macro imbalances that the West is saddled with, so economies should be resilient. And there is still growth. All of which means quality companies should remain structurally well positioned.

Finally, Asia remains home to some of the highest quality and most dynamic companies in the world. The region continues to offer rich pickings, underpinned by long-term structural growth trends such as the rising middle classes, rapid adoption of emerging technologies and continued urbanisation.

. . . . . . . . . . .

FSSA Investment Managers, managers, Scottish Oriental Smaller Companies – 13 November 2024

India, Indonesia and Philippines have steadily recovered since the disruption of the pandemic. The business outlook here remains positive. In some instances, this is also reflected in the valuations of some companies in India being re-rated to expensive levels.

In China, companies have been weighed down by numerous challenges, including the impact of the pandemic on consumer sentiment, the decline in the large property sector, and regulatory interventions across industries ranging from e-commerce to healthcare. However, these challenges have also provided opportunities for well-run companies to gain market share.

Taiwan and Korea have witnessed increased investor enthusiasm about the opportunity provided by artificial intelligence, reflected in the increase in valuations across several parts of the investment universe. These opportunities are yet to be seen in the performance of businesses. Our experience suggests that periods of technological disruption such as this usually come with low levels of predictability about the eventual winners.

. . . . . . . . . . .

Sat Duhra, manager, Henderson Far East Income – 6 November 2024

Asia is well placed to take advantage of a number of unique exposures for global investors. It remains a hub for technology supply chains and is crucial to the development of AI given the strength in hardware and semi-conductor manufacturing for example. There is an incredible opportunity for financial companies in markets such as Indonesia and India where hundreds of millions of bank accounts have been opened in recent years. Infrastructure continues to forge ahead with record levels of spend in India, in addition to a strong commitment to renewable energy. The emergence of strong domestic brands and widespread corporate reform in South Korea and to a degree China are other bright spots. There is much to be excited about and your Company is positioned to take advantage of growth in these themes alongside strong dividend growth.

The outlook for dividends has been strengthened by a very positive payout during our financial year, the long term trend of strong dividend growth is certainly intact and provides a very supportive backdrop for our strategy. Our investment region has progressively improved its commitment to dividends but remains one of the lowest payout ratios globally, it is our belief that this can only improve in future years.

Asia has seen the transfer of power in several markets as Taiwan, India and Indonesia held elections that passed by without incident and continue to support our recent shift towards these markets. However, China remains a concern and its economic challenges have been well documented but there are numerous signals that the government is taking a more proactive stance towards stimulus though it is piecemeal. The underlying economic model focused on high investment rates as a percentage of GDP is failing to create jobs whilst weak consumption trends are being neglected creating structural imbalances.

There are of course many potential pitfalls for global markets. China’s economy may continue to falter although recent stimulus initiatives are clearly having a positive impact short-term. The Middle East remains a tragic area of instability, war continues in Ukraine and the policies of a new US administration are hard to predict. Notwithstanding all this, Asia remains attractive on valuation metrics versus developed markets and with strong balance sheets and positive free cash flow we remain optimistic about the outlook for our region as rate cuts provide more accommodative policy. The recent weakness of the US dollar has been an additional boost for our markets given the historical headwinds that a stronger dollar creates for emerging markets. Many of our markets have strong macro-economic positions, valuations are generally attractive and the potential for capital and income growth at high quality companies representing some of the most attractive investment themes globally is an exciting prospect for the years to come.

. . . . . . . . . . .

Europe

Rita Dhut, chair, JPMorgan European Growth & Income, 27 November 2024

The devastating conflicts in Ukraine and Gaza continue with the latter escalating into Lebanon and Iran and threatening to engulf the wider region. At this time, there seems to be no end in sight to either tragedy. Global stock markets have shrugged off any material effects from these events, but geopolitical tensions, declining confidence levels and subdued domestic demand have taken their toll on the growth of the European economies. Throw into this mix the collapse of the German Government and a hung parliament in France and it seems from a top down perspective, the Eurozone has a lot to power through. However, there are factors that shine through the gloom. The European Central Bank (ECB) has remained proactive with three 0.25% interest rate reductions in June, September and October 2024 and headline inflation reduced to 1.8% in September supporting higher economic growth expectations in the years to come.

We cannot be complacent as to the fragility of the geopolitical outlook. There is a distinct possibility a widening escalation of conflict in the Middle East means further uncertainty as to the direction of economic growth and inflation if energy prices rise as a consequence. We must also acknowledge the US Presidential elections, where the arrival of President Trump in the New Year could bring significant change both to the world stage and to US economic policy including a faster resolution to the conflicts pre-occupying us all.

. . . . . . . . . . .

Stephen Paice, Chris Davies, managers, Baillie Gifford European

In terms of cyclical tailwinds, broader macroeconomic conditions are more supportive than they have been for many years. Interest rates and inflation are either falling or stabilising, normal ordering patterns are resuming in many industries we are exposed to, M&A activity is picking up, as are the number of IPOs, and the outlook for demand seems to be improving from a low base.

We believe valuations do not reflect this upside. We also see record levels of discounts right across Europe, across the small and mid-cap sector, and on Investment Trusts and other listed holding companies.

. . . . . . . . . . .

Stefan Gries and Alexandra Dangoor, managers, BlackRock Greater European – 5 November 2024

Following the “AI Boom” at the beginning of 2024, at the time of writing the global investment community had begun a more critical assessment of the return on investment on the large amounts of money pouring into the build-out of AI infrastructure. Market concerns have centred around the sustainability of this AI capital expenditure cycle. While some of the initial excitement was clearly overdone, we remain of the view that new technological breakthroughs often follow a familiar pattern – investors overestimate their potential in the near term while underestimating what is possible in the medium to longer term. We suspect the adoption of AI and its different use cases are no different in that regard. The race to build leading AI infrastructure is still in its infancy, with significant competitive momentum pushing cash rich companies to continue to innovate and invest to stay ahead. It is clear hardware infrastructure roadmaps are not keeping up with the pace of development in AI, leading to a widening gap between model training computational needs and the key infrastructure that is available in compute, rack design, network, cooling systems and power. None of today’s technology leaders can afford to be left behind in delivering breakthrough technologies in what could be the defining technological development of this generation.

This is relevant to us because the European market is home to an ecosystem of companies which possess the enabling technologies required in these transformational changes – not just AI adoption, but also the energy transition and global efforts to reorganise supply chains. Many of these businesses sell to global customer bases and are the world leaders in their fields. These competitively advantaged and secular growth businesses have become an increasingly important component of the overall market whilst undifferentiated ‘older economy sectors’ like telcos, auto and energy producers have shrunk in size over the last decade.

Alongside the investment opportunities afforded by these structural forces, we detect a cyclical upturn in a variety of industries like construction, life-sciences and chemicals which have suffered from pronounced volume declines for the best part of two years. Global manufacturing Purchasing Managers Indices have stayed below 50 for the last 23 months, signalling the longest period of contraction since 1951; importantly, in many end markets management teams are now talking about stabilisation of demand with painful inventory adjustments having come to an end. European construction is a good example, where easing financial conditions are helping activity levels to recover following the 40-45% collapse in new built residential volumes over the past couple of years.

Against the backdrop of a structurally improved market composition and a cyclical recovery, we see valuations in the European market at a record wide discount relative to the US. This dichotomy does not make sense to us. A healthy market operates as a discounting mechanism and the investment community’s myopic focus on near term problems should soon make way for the medium- to long-term opportunities. We see 2025 as a recovery year for earnings and beyond that we envisage a multi-year period of healthy profit growth, alongside the potential for this historic valuation gap to the US to narrow. Those prepared to take the optimistic view should be rewarded over time.

. . . . . . . . . . .

Global emerging markets

John Rennocks, chair, Utilico Emerging Markets Trust, 25 November 2024

EM stock markets were up for the half year, with the Asian markets leading the way. The Hang Seng Index was up 27.8%, the Indian Sensex Index up 14.5% and the Shanghai SE Composite Index was up 9.7%.

All portfolio currencies trended down against Sterling. The Brazilian Real was down 13.4%, the Indian Rupee down 6.3% and the Philippine Peso down 5.5%, mostly reflecting the continued improved outlook for Sterling.

Over the half year, copper moved sharply higher, up 13.6% as the equity markets gained greater confidence in China’s policies to strengthen its economy and thereby supporting demand for copper. Contrary to this, Brent crude oil decreased by 18.0% driven partly by concerns around global demand especially in China and oil supply remaining strong.

The strong win by Donald Trump in the US elections and his MAGA agenda will mean rising economic tensions globally. It is difficult to have strong conviction on the impact of his policies and approach, but we expect volatility to remain elevated and the outcomes for different emerging markets may well be uneven in nature.

. . . . . . . . . . .

Frances Daley, chair, Barings Emerging EMEA Opportunities, 6 December 2024

The global backdrop for the Company’s investment activity looks set to be one of unsynchronized economic activity and persistent geopolitical uncertainty. While a soft-landing scenario looks increasingly likely in the US, investors and company managements are weighing expectations for China’s economic growth, European stagnation, and the continuing wars in Ukraine and the Middle East, where developments could hinge on the position of the incoming administration in the US. The resulting market focus on top-down and geopolitical developments should enhance opportunities for bottom-up stock selection.

The economic impact of these conflicts is felt mainly through their effect on energy prices – a key driver for investment returns in the Middle East. Over the past year, lower oil prices have led some countries in the region to recalibrate ambitious projects, such as Saudi Arabia’s Vision 2030, and prioritize domestic projects in sovereign resource allocation. This is a welcome trend for investors in the region’s markets – not least for showing the seriousness of these Gulf nations’ long-term strategies for diversifying their economies away from hydrocarbons. The benefits of this shift are already starting to take form on the region’s stock exchanges, where a growing number of companies are coming to market through initial public offerings each year.

Amid all the uncertainty, the economic environment should be supportive. In the US and most other developed markets, inflation has been brought under control without causing a recession, allowing central banks to stimulate activity by reducing interest rates. Lower rates will squeeze the profitability of the region’s financial services companies that form the portfolio’s single largest sector weighting. This negative effect will be partially offset, however, by rising consumption and a reduction in credit risks for most banks. The recently announced Chinese stimulus to boost domestic consumption may help economies globally, with EM EMEA being no exception as the region is an important supplier of natural resources imported by China.

. . . . . . . . . . .

Omar Negyal and Isaac Thong, managers, JPMorgan Global Emerging markets income – 1 November 2024

Emerging Markets are subject to multiple influences, both positive and negative. Export-oriented economies such as South Korea and Taiwan will continue to benefit from the surge in global demand for AI-driven tools. However, the risk of a US economic slowdown is increasing, as shown by the US Federal Reserve cutting interest rates. Yet with US interest rates set to decline, individual Emerging Markets such as Indonesia, South Africa and Mexico may have more scope to follow their own monetary easing cycles, which could be supportive for domestic demand in these economies. Meanwhile, the Indian economy continues to forge ahead, but as value investors, we still view valuations as relatively unattractive.

In contrast to India and several other emerging economies, China’s economy is sluggish, but we are seeing increasing evidence that policymakers are acting with a higher sense of urgency to improve economic conditions and, crucially, to help consumer confidence to improve. Easing measures announced so far are mainly monetary policy focused and we suspect we need to see more fiscal tools being used for there to be more traction in terms of stimulus – but the higher degree of policy coordination is a positive and is being taken well by markets. Our constructive case for China is more based on the micro than the macro, i.e., we see attractive opportunities at the stock level driven by increasing focus on cash returns to shareholders via both dividends and buybacks. We continue to see improvement here, however, the desire to return cash to shareholders should always be balanced against the need to invest for future growth.

. . . . . . . . . . .

China

Dale Nicholls, Fidelity China Special Situations, 6 December 2024

The current year began as a continuation of the challenges seen in the Chinese equity market last year, with ongoing uncertainty over the macroeconomic outlook, negative headlines in the property sector and consumer confidence remaining fragile. This was the picture for much of the six month period under review. However, a raft of stimulus measures announced by the Chinese authorities in late September saw the stock market surge in the last few days of the half-year.

In brief, the announcement from the People’s Bank of China on 24 September 2024 included rate cuts and other monetary policy measures to support capital markets. This was followed two days later by positive rhetoric from the Politburo meeting signalling policymakers’ willingness to accelerate necessary fiscal spending to achieve the aims of revitalising the economy, stabilising the property market and boosting consumption and employment.

Key among the factors underlying these announcements is an increasing focus on the risk of deflation. Consumer price inflation in China has been muted, while producer prices have been falling for some time. Importantly, further progress has been made on easing purchasing restrictions and having programmes to address housing inventories. While lacking specific numbers, the Ministry of Finance briefing on 12 October 2024 confirmed a commitment to incremental fiscal stimulus, with expanded government debt limits and local government debt resolutions. In my mind, broadening the scope of local government special bond proceeds to help address the problem of excess housing inventories is probably the most positive outcome, given the property sector’s importance in the economy and funding challenges faced at the local level.

Weak consumer confidence has been a feature of the Chinese economy since the pandemic, partly driven by the troubled property market, but also by employment and wage concerns. Our sense from discussions with many companies on the ground is that we have now most likely seen the worst of the job cuts, particularly in areas like the big technology companies. Coupled with the policy support for the real estate sector, there is meaningful scope for confidence to gradually improve.

Meanwhile, savings rates remain elevated and consumer balance sheets are relatively healthy, suggesting that there is buying power to support any recovery in consumer sentiment.

. . . . . . . . . . .

India/Indian subcontinent

Michael Hughes, chair, abrdn New India Investment Trust

27 November 2024

India presents numerous compelling attractions for investors. The country boasts favourable demographics, including a large, relatively young population and a growing middle class. Rising disposable incomes are driving consumption to become increasingly aspirational. Indian corporations are becoming more sophisticated, expanding their presence beyond its borders, and starting to compete on an international level.

However, investing in India requires accepting market volatility and a degree of risk. Some of the potential near-term challenges include a spike in global energy prices, due to heightened tensions in the Middle East and a slowdown in the global economy, where India is affected as a net oil importer. There also remains concern, from certain quarters, that valuations of Indian companies are high and this has been reflected to a degree in recent falls in the market.

President-elect Donald Trump’s return to the White House in January 2025 increases uncertainty. While geopolitics remains a concern, India’s international standing is comparatively robust, supported by strong ties with the US, Europe, and ASEAN. Moreover, India remains more insulated from global macroeconomic concerns due to its growing domestic economy.

. . . . . . . . . . .

Biotechnology & Healthcare

Geoff Hsu and Josh Golomb, Biotech Growth Trust, 26 November 2024

Former president Donald Trump won the U.S. Presidential election on 5 November. He will take office in January 2025 with the Republicans having majority control of both the House of Representatives and the Senate, giving Trump some latitude in pushing his policies through Congress along partisan lines. Republicans have historically been more friendly towards the biopharmaceutical industry than Democrats, so it is possible that legislation like the Inflation Reduction Act’s Medicare price negotiation could be amended to be more industry friendly. At the time of writing, the president-elect has proposed Robert F. Kennedy, Jr., a noted vaccine sceptic, as his nominee to head up the Department of Health and Human Services (“HHS”). Kennedy has previously stated that the U.S. health system relies too heavily on medicines to treat disease rather than focusing on the root causes of chronic disease. This has raised concerns among investors that the HHS, which oversees the FDA, may not be as science-based or industry-friendly as Trump’s previous administration. Our view is that Kennedy is unlikely to materially change the way the FDA reviews drugs, though his comments questioning vaccine safety may reduce utilisation of certain vaccines. We note that Vivek Ramaswamy, a former biotech entrepreneur, also appears to be part of Trump’s inner circle of advisors and has publicly stated that FDA regulatory requirements are actually too onerous for the industry and unnecessarily delay the delivery of new medicines to patients. He has advocated for less stringent approval requirements for new drugs. It is still unclear whether Kennedy will be confirmed by the Senate, as his views on certain health topics are not regarded as mainstream. Even if he is confirmed, we anticipate that his focus will be on nutrition and food safety rather than pharmaceuticals. At the time of writing, an FDA Commissioner has not yet been nominated by president-elect Trump. As long as the FDA Commissioner remains science-based, we think the constructive regulatory environment at the FDA will continue.

One of the impediments to larger-scale mergers recently has been the aggressive attempts to block M&A transactions on antitrust grounds by the FTC during the Biden administration. While the FTC has ultimately failed in many instances to block many of the proposed transactions, the threat of a prolonged FTC fight to consummate larger scale M&A (with targets >$10 billion market cap) has dampened such activity in the biotech space. We expect that aggressive FTC antitrust enforcement will cease during the Trump administration, paving the way for larger scale mergers in the biotech space.

. . . . . . . . . . .

Sven H. Borho & Trevor M. Polischuk, Worldwide Healthcare Trust, 14 November 2024

The malaise that hung over the Biotechnology industry post-COVID has now evaporated, and investors are re-focused on the fundamentals. The healthcare industry continues to benefit from significant technological advancements and accelerating innovation in drug discovery and development. Across therapeutics, continuous advancements in genetic engineering, personalised medicine, and synthetic biology are fostering a robust pipeline of new therapies and treatments. Increased investment in early-stage science feeds long-term opportunities. Artificial intelligence and machine learning are already impacting all facets of the industry despite still being in its infancy. New product approvals are delivering a quantity and quality of medicines never seen before. The growing elderly demographic worldwide is driving demand for new healthcare solutions, particularly in areas such as cancer treatment, chronic disease management, and age-related health issues. Overall, the future of healthcare will remain robust and dynamic, driven by data, shaped by innovation, improving access and quality for patients on a global basis.

. . . . . . . . . . .

Ailsa Craig and Marek Poszepczynski, managers, International Biotechnology Trust – 4 November 2024

The biotechnology sector looks poised to make further progress as we look towards 2025 and beyond. Despite the recent rally, the Reference Index remains well below its peak of 2021 and valuations are generally reasonable, suggesting significant future upside potential, given the sector’s accelerating pace of innovation.

In large part, we believe this innovation is driven by necessity. The increasingly complex demands of a global population that is growing older, richer and sicker, are driving rising demand for healthcare services in general and placing public healthcare systems under ever increasing strain. These fundamental demographic tailwinds look capable of driving structural growth and continued biotechnology innovation for many years, if not decades, into the future.

In the meantime, with inflation seemingly under control and interest rates expected to decline, the investment environment is again becoming increasingly favourable for long-duration assets such as biotechnology. There are signs that the IPO window is beginning to open and secondary offerings remain strong, indicating renewed appetite for biotechnology from a broader range of investors. This is all typical of what we would expect to see in the more positive stages of the biotechnology investment cycle.

The potential for further M&A activity is another positive feature of the outlook, as large, cash-rich pharmaceutical companies seek to fill gaps in their pipelines and replace expiring patents by buying smaller biotechnology businesses. The implementation of the US Inflation Reduction Act, which may negatively impact the pricing of key established drugs sold by large pharmaceutical companies, could increase the demand for innovative biotechnology still further.

As has been the case in prior years, the US Presidential election could result in near-term volatility in the biotechnology sector, and for healthcare more broadly. However, we do not expect any election outcome to materially change the positive long-term biotechnology investment case.

. . . . . . . . . . .

Financials & financial innovation

Augmentum Fintech, 26 November 2024

Despite ongoing inertia in public markets, listed fintechs have navigated valuation recovery and stabilisation in 2024, although these are yet to be fully reflected across the sector. In response to market conditions, listed firms have prioritised profitability over growth, and a flight to quality dynamic has rewarded exceptional companies whose capital efficiency has seen them continue to deliver both. Listed fintech approaches 2025 on a surer footing than it did in 2024, with positive spillover effects in private markets, where investment activity has returned to the long-term trend. Across Europe, healthy levels of dry powder and strong local ecosystems continue to support high-potential fintechs from idea through growth stages.

Many exceptional European fintechs have completed long journeys to scale and profitability, but still today remain private, including a growing number of the Company’s portfolio companies. These firms collectively form a mature cohort with exciting exit prospects in the near to mid-term. Such cases have required patience from early investors but hold the promise of ample reward upon realisation. The focus now is on ensuring that exits are delivered at deserved market premiums. Many of these firms have taken 2024 as an opportunity to prepare for listing in 2025 and beyond. However, M&A remains the dominant exit route for fintech firms with 98% of all fintech exits since 2020 completed through this approach, of which 85% during 2023 and Q1 2024 were strategic acquisitions from incumbent financial services firms (source: FT Partners). With access to the right portfolio and an experienced manager, a private market strategy will reward investors for progress made while private, and ensure value is maximised in exit scenarios. While companies continue to perform, and market conditions are improving, continued patience in these late stage positions is the rational approach.

For policy makers across our key markets of focus, growth agendas are the order of the day. This bodes well for the fintech sector as a leading recipient of investment capital, and a driver of productivity growth and job creation. In the UK, fintech continues to be regarded as a jewel in the crown and recently surpassed a valuation of US$1 trillion, to join only the US and China at this scale (source: Dealroom). Productive engagement, and the supportive policy and regulatory environments in the UK have continued under a new Labour government. Despite the additional costs for businesses introduced in the budget, the UK remains a highly attractive location for starting and scaling fintech firms.

. . . . . . . . . . .

Debt

TwentyFour Income Fund, 19 November 2024

European credit markets have enjoyed a relatively smooth period, notwithstanding an acute episode of volatility in early August, which followed a weaker than expected employment report in the US. Geopolitical uncertainty has continued to be a concern, albeit market reaction to events was relatively muted over the period.

The housing market has moved in tandem with other assets over the period, with the latest House Price Index data for the UK and Eurozone showing growth of 2.7% and 2.9% respectively in the 12 months to 30 June 2024 (non-seasonally-adjusted). Mortgage rates fell across the period, with demand increasing to reflect growing consumer confidence, such that mortgage borrowing in the UK sits at a two-year high. Mortgage affordability remains more in focus in the UK due to the prevalence of shorter term fixed contracts in contrast to the rest of Europe.

The period has been characterised by the data dependency of central banks and the subsequent repricing of market interest rate expectations. In the US, a pivotal moment came in early August with the publication of the labour market report for July, which indicated a slowdown and sparked an acute sell-off across global markets. Subsequent data from the US was in line with expectations, although we subsequently saw the US Federal Reserve (“Fed”) cut interest rates by 50 basis points (“bps”) at its September meeting. The Fed also indicated it would remain agile on the pace of future rate cuts to ensure the path to sustainable inflation is maintained.

From the European Central Bank (“ECB”) and BoE, we saw 50bps and 25bps cuts respectively over the period. The ECB has acted in line with expectations, though persistently weak economic data in core economies such as Germany and France, particularly concerning manufacturing, led markets to price in a further 25bps cut in October. The BoE has been the most cautious of the trio on rate cuts, supported by a resilient labour market and stronger economic activity data and, with core inflation failing to return to target until after the period end, we may expect higher for longer rates in the UK.

Collateral performance across European markets has remained strong as consumers continue to display resilience. This is largely thanks to the strength of labour markets, which have seen only mild increases in unemployment from post-Covid lows. Additionally, we have seen strong wage growth and continue to see positive wage negotiations across Europe. These two factors have supported healthy savings rates; saving rates in the UK and Europe remain above pre-Covid averages, supporting consumer balance sheets.

. . . . . . . . . . .

Growth capital

Schroder British Opportunities Trust, 29 November 2024

The UK small-cap sector is displaying signs of recovery, bolstered by a more favourable macroeconomic climate. A significant milestone was reached when the Consumer Price Index hit its 2% target, preceding similar achievements by Europe and the US. This feat is particularly remarkable given that the UK’s inflation had previously risen to a 40-year peak of over 11% in 2022. The reduction in inflation has created room for the Bank of England to cut base rates, with additional cuts potentially on the horizon. This monetary policy adjustment aligns with the broader economic recovery, where the UK has returned to growth following a historically modest recession, and unemployment has hit its lowest point in 50 years.

Private equity markets have not been immune to the economic headwinds over the past years. However, the Company’s private equity portfolio has proven resilient and continues to perform well. As a reminder, our principal focus is on the small and mid-market area of the UK private equity landscape, and we hope the following provides useful insight into recent activity to contextualise the period under review.

According to KPMG’s UK mid-market private equity analysis, deal volumes in this area declined by 11% in H1 2024 when compared with H1 2023. However, against a pre-pandemic M&A activity (H1 2019), 2024’s figure reflects an increase in activity of 25%, suggesting the market is beginning to normalise. Similarly, the UK private equity market as a whole saw a greater decline of 20% H1 2023 to H1 2024.

Despite this decline, 2024 has brought some optimism, with stabilised interest rates and tamed inflation bringing increased certainty, the attractiveness of UK businesses is increasing and the UK remains a key target for international investors seeking opportunities.

. . . . . . . . . . .

Infrastructure

James Stewart, chair, Sequoia Economic Infrastructure Income Fund, 4 December 2024

The economic outlook for the Company’s main markets is varied but overall better than we have seen over recent years:

- The UK economy has shown resilience, with GDP in Q3 2024 being 3.0% above pre-pandemic levels. However, growth is expected to moderate due to persistent inflation and the ongoing effect of high interest rates.

- The US economy continues to grow, with GDP increasing by 0.7% in Q2 2024 and the advance estimate of Q3 2024 suggesting an additional increase of 0.7%, while CPI inflation finally fell below 3% in July.

- The Eurozone’s economic outlook is more varied. While overall GDP grew by 0.2% and 0.4% in Q2 and Q3 2024 respectively, Germany’s economy contracted slightly in Q2 2024, with a slight recovery in Q3 2024cfd. The region faces challenges such as high energy prices and geopolitical uncertainties, which affect consumer and business confidence.

- With Donald Trump’s election as President and a substantial portion of the Company’s portfolio concentrated in the US, it is essential to assess potential impacts on infrastructure credit markets. Proposed tariffs on imports from countries like China, Canada, and Mexico could increase inflation, leading to higher borrowing costs and expenses for infrastructure projects. While some businesses may offset these costs through higher prices, sectors like construction with fixed budgets could face significant challenges. In the energy sector, the planned deregulation and reduced renewables subsidies might pose risks, but could be offset by the growing energy demand and streamlined permission processes for infrastructure projects.

. . . . . . . . . . .

Property

Jonathan Murphy, chief executive, Assura Group

The changes currently being seen in the UK healthcare market mean there are substantial and varied opportunities for Assura to explore.

The NHS is in crisis. An ageing population, increasingly complex long-term medical conditions and cost inflation, all of which can be seen in the well-documented increase in waiting lists, mean the pressure and challenges faced by the NHS today are greater than ever. This has been highlighted extensively by senior politicians in the new Labour Government.

The recently published report by Lord Darzi painted a bleak picture of the NHS, and highlighted how the material underinvestment in NHS buildings and primary care in general had contributed to the problem. We look forward to the release of the NHS 10-year plan which is due to be published next Spring.

New investment in modern primary care capacity can provide many answers that are more convenient for patients and cheaper for the healthcare system. NHS data shows that primary care treatment can be up to ten times less expensive than hospital treatment. Assura has the skills and track record to deliver primary care buildings that meet these needs.

Meanwhile, the private sector has continued to experience a surge in demand. The private market in the UK has grown substantially to £6.8 billion per annum in revenue, following a 6.3% compound annual growth rate over the past 20 years. Growth prospects are particularly favourable at this time. The UK private sector remains very small in proportion to the NHS budget, and in comparison to other European countries.

The sector creates additional capacity for the health system, with a payor mix split across three main strands: NHS referrals, private medical insurance (“PMI”) and self-pay. Patients are increasingly turning to private providers given the delays to treatment resulting from NHS waiting lists. Each individual asset is bespoke to the local healthcare needs with some focusing on NHS-referred work, while others have a higher proportion of PMI or self-pay.

These private providers generally offer specialisms that are well suited to specialist day-case and outpatient facilities. In particular ophthalmology and orthopaedics are well established, with a focus on efficient treatment for patients as well as high levels of customer service. It also means they are willing to invest in technology to improve operating metrics and seek a specialist healthcare landlord alongside whom they can develop their long-term plans.

Given the strong underlying growth in demand for health services, both the NHS and private healthcare markets offer exciting long-term growth potential.

. . . . . . . . . . .

Simon Carter, chief executive, British Land

Companies want best-in-class space to attract and retain talent, a trend we’ve seen grow in importance post Covid. Although hybrid working seems here to stay, businesses are increasingly mandating their employees to spend more time in the office. As such peak office utilisation (Tuesday-Thursday) on our campuses is back to pre-Covid levels.

The bifurcation in the market between best-in-class space and the rest continues. Very tight supply of the best space in core locations combined with an increasing propensity for customers to favour new and newly refurbished space is driving strong rental growth, a trend that British Land is benefiting from. Vacancy for new or refurbished space in core Central London is at 1.7%, while vacancy for the rest of space in Central London is 10.9%. This is especially stark in the City, where forecast supply is c.3.7m sq ft over the next four years, made up of 0.8m sq ft of vacant new space today, 2.3m sq ft of speculative space under construction to 2028 and 0.6m sq ft of forecast new starts. Over the same period, we would anticipate 8.9m sq ft of demand for new and refurbished space based on historic take-up, meaning a shortfall of 5.2m sq ft of space.

The result is that we are seeing strong rental growth for super prime (top 10% of space) in the City. Over the last six months we have seen asking rents for pre-lets of super prime buildings like 2 Finsbury Avenue and 1 Broadgate increase by more than 10% with Cushman & Wakefield forecasting rents for this type of space to grow by c.8% per annum over the next four years.

Historically, the tight supply demand dynamics in core locations have had a ripple effect in adjacent markets in London, as occupiers explore new locations which can meet their demand for high quality workspace, with good amenities, and transport connectivity, but at a lower price point. In recent years, activity in these markets has been subdued but take up of new space increased by 67% this year and there is a growing pipeline of deals under offer.

. . . . . . . . . . .

Robin Archibald, chairman, AEW UK REIT

With the UK and US elections behind us, and the Bank of England implementing two rate cuts, there are plenty of political and economic events to digest, some of which will have a direct, or at least indirect, impact on UK commercial property in the short to medium term. There are always events to respond to, which is why good investment management anticipates and responds to these in an effective way.

The six-month period to September 2024 saw the economic and political pressures that have constrained the UK commercial real estate market begin to subside. The period commenced with April 2024 marking the end of an 11-month run of consecutive valuation declines at the property level. The MSCI/AREF UK PFI All Balanced Open-Ended Funds Quarterly Property Index delivered a modest total return of 2.7% for the period, driven almost entirely by an income return of 2.4%, which has been most evident in the retail warehousing and industrial sectors. This same theme has been amplified in the company’s portfolio, which delivered a strong income return of 4.5%. Despite the relatively muted economic backdrop, the company’s portfolio has delivered good capital growth of 4.4% during the same period, well exceeding the Index’s average of 0.4%. Overall, the company has delivered a total return of 9.1% for the period, significantly outperforming the benchmark.

. . . . . . . . . . .

Matthew Bonning-Snook, chief executive, Helical

As we approach 2025, the central London office market is showing encouraging signs of life, despite the ongoing economic and geopolitical challenges. The broader economy is also beginning to stabilise, with falling interest rates creating a more favourable environment for the investment market.

Leasing activity has continued to strengthen quarter-on-quarter, outpacing the five-year average. Demand is heavily concentrated at the top end of the market, driven by a “flight to quality” as occupiers seek premium office spaces that align with evolving workplace strategies and stringent ESG criteria. This trend is bolstering demand and rental growth for “best-in-class” assets, while posing challenges for older, less well-specified buildings. Among the larger occupier requirements, a first-mover advantage will likely emerge as the pipeline of new office deliveries slows from 2026.

Over the last year, the Bank of England has cut policy rates twice to 4.75% and further reductions are expected, albeit more slowly than previously anticipated. The combination of economic uncertainty, geopolitical events, and changes in global governance means investors have continued to adopt a “wait-and-see approach”.

Encouragingly, we have seen the arrival of several large lot size sales onto the commercial property market which are expected to serve as key indicators as we enter the new year, guiding the ongoing phase of price discovery and bringing confidence back into the market.

. . . . . . . . . . .

Andrew Jones, chief executive, LondonMetric Property

The global economic outlook continues to dominate the investment market backdrop with the market eagerly anticipating each economic data release to determine the likely path of interest rates.

Interest rates have hit the inflexion point with central banks cutting interest rates on the back of falling inflation and this has supported global equity markets and interest rate sensitive real assets. However, whilst the market has largely looked beyond geopolitical uncertainty, ongoing conflicts in the Middle East and Ukraine as well as the US election result and the UK budget have caused uncertainty and still pose ongoing risks.

Economic data has shown that the global economy, particularly the US, has been resilient to a higher interest rate environment. There are still elevated inflationary pressures which are impacting bond rates, making it likely that we will see more gradual interest rate cuts than previously expected.

The UK economy has proven to be resilient but it is clear that consumer and business confidence has been weaker of late and there are headwinds which could impact future growth, principally rising inactivity rates, ongoing uncertainty over the health of the labour market, the impact of the budget and rising UK debt levels. However, the UK economy remains in reasonable shape with an unemployment rate that remains steady at just over 4% and real wage growth.

Interest rates remain the yardstick against which most investments are measured. Consequently, sentiment in the real estate sector continues to be largely driven by the outlook for five-year swap rates and ten-year gilts. Unsurprisingly, after a recalibration of valuations over the last few years and with five-year swap rates now at c.400bps, sentiment has improved and valuations have stabilised across most real estate sectors.

After a c.30% decline in UK real estate transactions in 2023, total UK investment year to date of £34 billion is 7% higher than the same period last year according to CBRE. We have seen healthy activity across the ‘winning’ sectors, as well as growing popularity for retail warehouse assets amongst UK institutions. There are also some signs of activity in the London office and shopping centre markets, with a handful of transactions, albeit at prices materially below previous valuations which reflects motivated vendors, falling rental values, growing capex requirements and expanded yields.

However, with current swap rates continuing to rule out many debt buyers, we are seeing the greatest liquidity for smaller lots sizes. Our view remains that normal liquidity won’t return until five-year swap rates fall closer to 300bps to derive an all in cost of debt of c.5%, a level that allows most debt led real estate transactions to work.

We have also seen further sector consolidation and managed wind-downs of externally managed REITs where poor structures, lack of scale, limited alignment of interest and legacy investment strategies have manifested in material discount ratings. The days of easy money for externally managed small cap REITs with little in the way of shareholder alignment seems a very distant memory.

As a result, we continue to believe that there are further opportunities for consolidation, with investors increasingly focused on larger, scalable and more efficient propositions. After all, boards have a duty of care to their shareholders.

. . . . . . . . . . .

Richard Moffitt, chief executive, Urban Logistics REIT

Real estate pricing across the UK and the Company’s sector has remained steady in the period, tracking the 10-year gilt which showed little movement in the period. The budget in October removed a level of uncertainty, but has resulted in the 10 year gilt rising from 4.1% at period end to 4.5%, reflecting the expectation of higher inflation and a slower reduction in interest rates.

Against this backdrop, the transactional market was muted, with trading volumes across real estate their quietest since 2012. Even within this context however, the Industrial and Logistics segment increased its share of the real estate market to 27%, the highest proportion ever recorded. This is driven by a continued investor commitment to the wider structural thesis that has driven the sector’s performance over the last decade. Data for the first half of 2024 from Savills shows that within UK distribution, investment volumes reached £1.4bn, 41% up on the same period in 2023, and a 47% increase on the pre-covid H1 average.

This further supports our conviction that the growth case for this sector remains one of the strongest in the real estate market. This investment case is built on the rising rental rates driven by underlying demand for this asset class from occupiers, which is forecast to continue to outstrip supply, leading to rental rates growing faster than inflation.