Economic and Political Monthly Roundup

Investment companies | Monthly | June 2023

By now, it’s probably a pretty safe bet that people are sick of talking about inflation. With the midpoint of the year fast approaching, it feels like we have spent the best part of the last six months attempting to forecast the direction of the CPI with about as much accuracy as the government’s immigration targets. Thankfully, the month of May gave us something much more interesting to prognosticate about with the market falling over itself to throw money at what looks suspiciously like the dot com bubble reincarnate. Artificial Intelligence has been the talk of the town since Nvidia upgraded its revenue guidance by 50% on the back of expected growth in AI revenue, resulting in an overnight market cap gain of more than $150bn, one of the largest one day moves in history. The rally sent the stock careering towards a much vaunted trillion-dollar market cap which it reached a few days later; becoming only the seventh company in history to do so.

“It is hard to see how you can prevent the bad actors from using it for bad things.” Geoffrey Hinton, AI pioneer

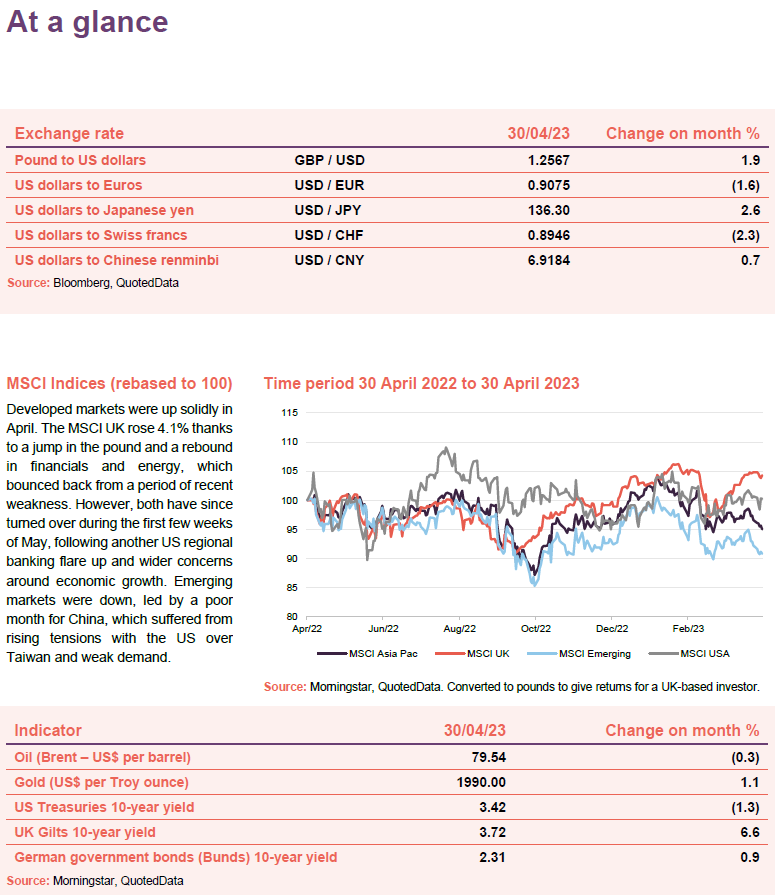

While mega cap tech drove US markets higher thanks to the AI explosion, the move masked a smorgasbord of recessionary indicators which have dragged broader market indices (and the oil price) lower, highlighted by the weakness in the cyclically dominated UK market.

Still, like inflation, it feels like we have spent the last six months being bearish only for index returns to make fools of us all, particularly in the US, but even markets outside the AI boom, in the UK and Europe, remain in positive territory for the year.

Suddenly, it seems like the talk of goldilocks, or the ‘immaculate disinflation’ is back on the table. Labour markets have remained resilient, as have earnings, although both have softened, while inflation has begun to at least show signs of peaking, so we are left with a scenario that perhaps looks slightly more stable than many expected.

Consensus forecasts are for things to deteriorate further in the second half of the year, and it would be brave to bet against the house given the raft of macro issues present. Although that was the same argument given to start the year and look where we are.

Global

(compare global and flexible investment funds here, here, here and here)

Jean Matterson, chairman, Capital Gearing Trust – 24 May 2023

There is a sense that the interest rate cycle is returning to normal, after more than a decade of virtually zero rates. The recent rise in rates has failed to quell inflation, which has led to large wage rise demands as people struggle to offset the increase in the cost of living. Our Investment Manager believes that the headline inflation rate will subside in the near term, assisted by anniversary effects. They believe however, that inflation will remain persistent as wage demands continue to build until the unemployment level rises materially.

The policy response from governments and central banks has been somewhat confused, with tighter policy affecting real incomes, but fiscal policy remaining stimulative. This makes economic growth difficult to predict and it is considered likely that there will be a recession at some point. As the stock of government debt continues to grow, public debt to GDP has fallen slightly, aided by the elevated levels of inflation that the economy has experienced over the past year.

Markets remain fragile and unpredictable. History suggests that, in times of low interest rates, the misallocation of capital becomes prevalent. It may take a while before this becomes apparent, but we welcome the return to a more rational interest rate environment. The recent demise of Silicon Valley Bank (SVB) has exposed bank’s tier one capital as being less robust after their assets are marked to market on the back of higher interest rates.

There is some value emerging in markets, but it is someway off a really attractive entry level. This being so, our Investment Manager remains cautious and is keen to steward shareholders’ funds wisely by retaining a defensive stance until the outlook becomes clearer, and value is noticeably more attractive.

. . . . . . . . . . .

Peter Spiller, Alastair Laing, Christopher Clothier, managers, Capital Gearing Trust – 24 May 2023

The last 15 years have been characterised by low inflation and weak aggregate demand. This environment favoured speculation over investment and financial engineering over productivity improvements. The result has been depressingly familiar: a gross misallocation of capital, economic sclerosis, rising inequality and rising economic fragility. The central bank response – ever more extreme monetary policy – was iatrogenic. It didn’t fix the demand problem and contributed to the speculation and misallocation of capital.

The future is unknowable and any forecast we make can only be one of a wide possibility of outcomes. But, it seems that this era is ending and a new era is upon us. Of course, it is possible that – after a recession – inflation and growth will fall back to their post-GFC trends and central banks revert to their recent playbooks. The balance of probability suggests otherwise. The economic forces that defined the last 15 years are waning and new forces are rising.

The deflationary impulse from China is receding as wages begin to approach Western levels and, for the first time, Chinese consumption growth exceeds fixed capital formation. Globalisation is in retreat and protectionism on the rise.

War is the ultimate inflationary force. Defence spending is an economic potlatch. In peace it is merely economically unproductive, in war it brings about destruction of capital, to say nothing of death and human misery. Further resources must be diverted to replace the capital that war destroys. Trade is disrupted, sanctions imposed and, when trade resumes, it flows along political not economic lines – by definition at greater cost.

Tackling climate change is inflationary. The explicit aim of divestment is to drive up the cost of fossil fuels by increasing the cost of capital of producers and reducing exploration expenditure. Carbon taxes will add further to their cost. The switch from an energy system based predominantly on hydrocarbons to electricity will be hugely expensive requiring investment not just in renewable energy sources, but upgrades to grid infrastructure and technologies to mitigate intermittency.

Finally it appears that the relationship between capital and labour, and governments and labour, is shifting. In recent years it was commonly held that wage spirals could not occur because of the lack of unionisation. The relationship is probably the other way round: unionisation is a response to inflation, not its primary cause.

Monetary policy is grappling with these macrotrends as well as central banks’ own mis-steps during the pandemic: money creation on a truly unprecedented scale. In addition, rising rates have led to, or brought into focus, financial fragility: mark to market losses on bank balance sheets; consumers refinancing large mortgages and highly leveraged businesses rolling their debts at much higher rates.

What makes central banks’ jobs even harder is the largess of fiscal authorities even as monetary authorities attempt austerity. The US is the most extreme example: unemployment is at generational lows, inflation is proving persistent and yet the forecast budget deficit this year is 5.3% of GDP. Monetary policy works best when fiscal policy is working with, not against, it. To compensate, monetary policy has to work harder than would otherwise be the case. This increases the likelihood that it will be the financial system that breaks before the economy does. We have already seen several examples in the financial sphere: LDI Pensions, FTX, Silicon Valley Bank and Credit Suisse. It seems unlikely that these will be the last shoes to drop.

Even if we are wrong, and a financial crisis is averted, it seems likely that a recession is on the horizon. One consequence of ructions in the banking market is that credit standards have tightened dramatically, consistent with levels that historically have presaged recession and, with inflation remaining sticky, inflation hawks in central banks on both sides of the Atlantic are in the ascendancy. Global equity markets do not share our analysis and have rallied 8.5% year to date. We are taking the opportunity to reduce our exposure to risk assets and take shelter in treasury bills. Our exposure to index-linked bonds is at record levels. While we sit on the side-lines of equity markets, we take great comfort from the fact that, for the first time in 15 years, we are being paid to wait.

. . . . . . . . . . .

Sir William Barlow, chief executive, managers, Majedie Investment – 23 May 2023

The consequences of Central Bank tightening in 2022 are becoming apparent especially in the US Regional Bank sector evidenced by the collapse of Silicon Valley Bank and the subsequent failure of Signature and First Republic. The ensuing crisis of confidence across the sector led to the acquisition of Credit Suisse by UBS. Whilst prices have largely recovered after the initial shock as the largest banks are well capitalised, markets remain nervous. One of the consequences could be Central Banks adopting a less hawkish stance on further tightening as the availability of credit has become scarcer. Inflation remains stubborn, but adjustment to commodity price increases and fuel prices caused by the invasion of Ukraine by Russia over a year ago, tight money supply and improvements in the global supply chain as China opens up should lead to lower inflation in the second half of the year. Geo-political risks remain at heightened levels and increase uncertainty.

. . . . . . . . . . .

Sarah MacAulay, chairman, JPMorgan Multi-Asset Growth & Income – 18 May 2023

In recent months, at the start of the current calendar year, global markets had found renewed optimism on the back of China’s successful emergence from its zero-Covid policy and the prospect of peaking inflation and interest rates. However, post the Company’s financial year end this enthusiasm has been swiftly dampened by the challenges to the financial system caused by the failure of Silicon Valley Bank and Credit Suisse in March, and the subsequent turmoil in the US regional banking sector. Furthermore, geopolitical tensions continue to unsettle equity markets with Russia’s aggression against Ukraine, China’s lack of condemnation of Russia’s invasion tactics, and difficult US/China relations over Taiwan, US sanctions and US technology transfer to Chinese companies.

. . . . . . . . . . .

Tom Slater, manager, Scottish Mortgage Investment Trust – 16 May 2023

Geopolitical tensions have escalated this year, most notably with Russia’s invasion of Ukraine, which marked the return of major war to Europe and had significant global repercussions. The invasion exposed the fault lines between nations and created economic challenges such as price shocks, supply disruptions and food shortages. Inflation emerged as a global concern, affecting both developed and developing nations alike. Meanwhile, the great power competition between the United States and China intensified, with both countries adopting increasingly adversarial stances and actions, further straining their relationship. On a more positive note, many countries abandoned lockdowns, travel restrictions, and other pandemic-related measures due to the success of vaccines and therapeutic treatments. Having initially been slow to respond to rising inflation, central banks raised interest rates aggressively.

The US Federal Reserve was holding the federal funds rate at around zero as recently as the first quarter of 2022 and buying billions of dollars of bonds every month to stimulate the economy. This started to change in March 2022 with the first of a series of rate increases that summed close to five percentage points over the company’s financial year, one of the steepest increases on record. This has led to strain in the banking sector and the collapse of several US regional banks. The impact of tighter financial conditions on consumers, inflation and the broader economy will be felt over the coming year, given the delays in the system. In this environment, investors have flocked to assets that are already proven and profitable. Predictability can have a deep allure as uncertainty grows and people are fearful. Investing in such assets may be appropriate for others, but we are sceptical that our shareholders will benefit in the long run if we too resort to following the crowd. Buying predictability may provide temporary comfort, but it is by embracing discomfort that we can entertain the possibility of outsized returns from exceptional companies.

The universe of businesses with bounded opportunities and well-analysed competitive positions is unlikely to yield extraordinary outcomes. The sharp increase in interest rates and associated collapse in the supply of capital has led to a fearful mood in financial markets. This negative disposition ignores the exciting progress in several key technologies and companies. The deterioration in markets has a greater impact in the near term, both through the immediate prospects for corporate profitability and the decline in our stock price relative to the value of our assets. However, over the longer term, the more profound consequences will come from developments in areas such as mRNA-based medicines or artificial intelligence. Progress Growth and innovation are not dependent on the direction of macro-economic developments. Instead, we pay close attention to exponential trends such as Moore’s Law in semiconductors, Carlson’s curve in genomic sequencing or Wright’s Law in manufacturing. These predictable trajectories of progress are a valuable way to understand what is happening in the world. A feature of these laws is that progress each year can underwhelm but cumulative progress over a decade or more is remarkable. The past year was an exception because there were breakthroughs across various industries and technologies.

While the focus of energy markets was on the immediate impact of the crisis in Ukraine, the long-term trajectory away from carbon remains. The Inflation Reduction Act in the United States has created a framework for significant investment in electrification, aiming to prevent Chinese companies from dominating the supply chain. Europe must respond with an equivalent strategy to avoid all the industrial capacity being built elsewhere. Solar generating capacity doubled in the three years to 2022 although it remains less than 5% of the global energy mix. In December, there was the first confirmed example of net power production from a nuclear fusion reaction. This result has proven elusive for several decades and is an important milestone on the path to harnessing the technology.

The price deflation that will eventually flow from renewable generation makes identifying direct investments challenging, but it is crucial to consider how abundant clean energy will impact society’s ability to innovate. The Henry Adams curve describes the 7% annual growth in energy available to civilisation since the invention of the steam engine 300 years ago. However, since the 1970s oil price shocks, we have fallen off the curve and energy consumption in Western economies has stagnated. As a result, we have seen significant innovation in areas where we can do more with less. Semiconductors have turned some science fiction predictions into reality, but advances in other areas have lagged. We have few space stations, no lunar landings or bases, no interplanetary travel or colonies and no supersonic aircraft or flying cars. Amidst the many challenges, a missing ingredient for all these endeavours has been abundant, low-cost, clean energy.

The commercial space market has finally become a reality thanks to SpaceX’s reusable rockets, which have reduced launch costs by 95% from those of the space shuttle. This is even more striking when you consider that Moore’s law and associated software have made each kilogram of payload much more productive. The first iterations of extra-terrestrial services have been focused on sectors such as agriculture and mining. Consumer applications are now appearing. Over time, R&D, manufacturing, tourism, and other space-based applications will become more common.

We have been commenting on progress in Artificial Intelligence (AI) for some time, and we saw some meaningful breakthroughs this year. At the risk of hyperbole, this could be the start of another computing paradigm akin to the personal computer or smartphone. Most noteworthy was the success of OpenAI in making AI technology available to non-technical users with the release of ChatGPT. The service signed up a hundred million users in just two months as engineers and entrepreneurs recognised the potential offered by this approach to computation. AI can already augment human software programmers and enhance productivity, and AI services will likely write most computer code in the future. The implications of AI-generated student essays are less encouraging and only a minor example of the governance challenges these systems will create. AI will likely transform many parts of the economy, but it would be foolhardy to make specific predictions. We can, however, say with some certainty that AI systems will require a lot of silicon. OpenAI has suggested that the computing power needed to run the latest models doubles every 14 weeks.

. . . . . . . . . . .

Ben Lofthouse, fund manager, Henderson International Income – 2 May 2023

Over the last few years companies, and obviously all the people that make them what they are, have coped better than investors could have hoped with the unexpected events that have occurred.

In 2021 we were concerned about the impact of rising interest rates as the need for stimulus abated. Central bank rate increases around the world last year mean that interest rates have generally normalised, and whilst they may not have peaked it is likely that most of the increases are behind us. The impact of higher interest rates on asset values is already being felt in lower bond, property and equity values, but the impact on inflation is not yet clear. There is often a lag between higher interest rates and lower inflation, but higher rates plus improved supply chains should result in inflation abating in due course. We do not, however, expect an instant return to the very low level of inflation and interest rates that the world has become used to over the last decade.

Whilst the outlook for inflation and interest rates remains unclear, market valuations have fallen over the last year and provide us with an opportunity to invest in well-managed, resilient businesses at more attractive valuation levels. We continue to focus on identifying companies with robust free cash flow characteristics and strong balance sheets that we believe are well positioned to navigate the challenging global economic environment. Robust dividend growth from companies supports our confidence in the long-term outlook for the businesses in which we invest your money.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

James De Uphaugh, portfolio manager, Edinburgh Investment Trust – 25 May 2023

While we are cautious about the outlook for equity markets in general, the better recent returns from UK equities strike us as being the early stages of a recovery in the market. This recovery is rooted in the undervaluation of UK equities that has built up over time for a variety of well-rehearsed reasons such as Brexit and final-salary pension funds reducing equity exposures.

We are cautious about markets because inflation remains a challenge. It will naturally come down to a degree, helped by some inputs such as gas prices being markedly lower than a year ago. But consumer expectations have ratcheted up. Economic history tells us that it is much harder to squeeze inflation back into the bottle, once the inflation genie is out.

At the market level, this economic slowdown is likely to be different from those we have experienced since the turn of the millennium. They may be more reminiscent of those of the 1980s and 1990s: more typical slowdowns when inflation has been too high and interest rates have been raised to choke it off. At the same time, bank lending criteria are likely to tighten in the US because of the recent set of banking failures and near failures in the US and Switzerland, which could present downside risk to economic growth.

On a more positive note, at the corporate level, the current elevated rate of inflation means nominal revenue growth should be tolerable even if real GDP falters. Another help is that China has ‘reopened’. Overall, 2023 could see lower inflation, peaking interest rates and perhaps a slightly better tenor from the consumer.

Therefore, a balanced, diversified portfolio is as important as ever. In market terms, we may have entered a new and different investing environment from that which has prevailed since the financial crisis of 2008. For much of the period since then, it often seemed that an investment style that focused on buying and holding growth stocks – sometimes with little regard to valuation or how durable the growth would be – was all that was required. Now, we have a return to an investment environment in which an understanding of company fundamentals matters, as does an appreciation of how the valuation paid for a stock ultimately determines investment returns.

. . . . . . . . . . .

Iain Pyle, Charles Luke, managers, Shires Income – 25 May 2023

After the first quarter of 2023, anyone hoping for calmer markets after a turbulent 2022 would have been disappointed, with a sharp equity rally to start the year followed by a banking “crisis” which has hopefully largely passed by already. It has been a surprising start to the year in two ways. Firstly, fundamentals have so far been better than expected, with economic data proving resilient, A recession has so far been avoided and consensus forecasts have been upgraded from outright bearish to just slightly gloomy. Company results have proved to be better than expected, particularly in more cyclical areas of the market, with retailers and industrial companies rallying in recent months.

That should all support higher equity markets, but the second surprise in our view is that equities have risen as strongly as they have done. While the fundamentals have been less bad than feared, valuations already looked generous and it is notable that the market now prices in the lowest equity risk premium for many years once we account for impact of higher interest rates and slower profit growth based on consensus forecasts.

Interest rate expectations continue to drive the market direction, and we should not expect a pivot from central banks soon – falling energy costs have helped confidence rebound, but core inflation remains stubbornly high globally. Wage growth continues to surprise to the upside and, until this adjusts, central banks are unlikely to risk the rate cuts the market seems to be expecting. A correction in market levels is therefore likely in our view, especially as Q1 earnings could be a source of downgrades given that aggregate company margins remain close to all-time highs, something that should simply not persist with higher interest charges and wage inflation.

How do we reflect this outlook in the portfolio? The focus on quality companies and the generation of resilient income remains to the fore and becomes more important than ever. In a period where equity market returns could pause after an unprecedented run since the global financial crisis, income is likely to be a more important part of total return.

It is also worth noting that not all parts of the equity market are equally valued: the UK market remains at a record discount to other developed markets. In the last month we have started to see this reflected in a notable increase in acquisitions of UK listed companies. Unless the valuation gap closes, this is likely to continue and could be an additional tailwind, especially for UK companies with genuine barriers to entry and scarcity value which is underappreciated in public markets. For overseas investors, the need to deliver growth and margin improvement as organic opportunities reduce will likely compel further deals. So overall, a focus on income and stock selection is more important than ever as we look to generate returns.

. . . . . . . . . . .

James Henderson, Laura Foll, fund managers, Lowland Investment Company – 19 May 2023

GDP forecasts are being upgraded for 2023 by economic forecasters, and the inflation rate is falling, but slowly. The stickiness in inflation partially reflects many companies preserving operating margins. This suggests that, to protect the real value of capital in an inflationary period, a good hedge is a well-diversified portfolio of excellent companies which have pricing power through operational strengths and product excellence. If inflation falls faster than expected, interest rates may peak sooner and should fall faster, benefitting company valuations. In the meantime, we anticipate that dividend growth from the underlying portfolio should improve, backed by the predicted progression in earnings.

. . . . . . . . . . .

Sarika Patel, chair, abrdn Equity Income Trust – 16 May 2023

There seem to have been storm clouds on the economic horizon for some time now and we do not see much sign of them dissipating in the near future. Having said that, we are of the view that despite them looking ominous, there remain opportunities in the market that can be pursued. The macro environment is going to remain challenging with respect to inflation, the cost-of-living crisis, and the war in Ukraine. However, the indications are that they are not going to be quite as damaging, economically, as was being predicted six months ago; the UK was expected to have gone into recession but that has not yet happened.

The Bank of England raised interest rates to 4.5 per cent on 11 May 2023, and warned it would not hit its inflation target until 2025. Investing against such a backdrop remains challenging.

. . . . . . . . . . .

Thomas Moore, portfolio manager, abrdn Equity Income Trust – 15 May 2023

The fluctuating macro landscape has created some sharp swings in performance within the UK equity market during the period. Although markets went up during the six months, there was an underlying tone of caution, as reflected in the continued out-performance of large cap stocks. This was largely driven by the ever-present fear that recession could be imminent. Many commentators pointed to the inversion in the yield curve (where long-dated bond yields fall below short-dated bond yields) as a forward-looking indicator that recession is likely at some point in the next two years.

Against this uncertain backdrop, our approach remains to stay focused on companies that have the ability to generate strong cash flows and pay these cash flows out in the form of dividends. We believe that many companies with these characteristics have been overlooked by the wider market in recent years, resulting in valuation opportunities. Historically dividends have tended to represent a relatively high proportion of total return, especially when investors shift their focus from growth stocks to value and income stocks. We have consciously tilted the portfolio towards stocks that offer a high free cash flow yield, underpinning an attractive dividend yield.

Low probability of reverting to era of zero rates:

Inflation is set to fall back through the course of 2023 thanks to base effects one year after the start of the Ukraine war, particularly in relation to energy prices. This is raising hopes that interest rates are approaching their peak level, but tight labour markets are likely to cause monetary policy setting to remain tight in order to bring down core inflation. Just as loose monetary policy was a boon for highly-valued growth stocks, we expect an era of elevated interest rates to favour the more traditional cash-generative stocks that our investment process favours. One clear example is the transformation in interest income prospects for many of our Financials holdings. This will not be a linear path, as interest rate expectations wax and wane from quarter to quarter, but overall we expect this to be a favourable environment for the portfolio, helping to support both income and capital growth.

The UK stands out within global stock markets as offering a rich seam of dividend payouts. We see this as a mark of strength as it reflects rigorous corporate governance standards, disciplined capital allocation and robust cash generation. Having come through recent crises, we believe that our portfolio holdings have demonstrated a level of resilience that is not reflected in their valuations. We see potential for share prices to respond to further evidence of resilience in cash flows and dividends in the months ahead.

. . . . . . . . . . .

Roland Arnold, Manager, BlackRock Smaller Companies – 5 May 2023

Equity volatility has remained extremely high as we have entered 2023. However, this was seen in by an unexpected splurge from consumers, a re-awakening of demand in some of the more cyclical industrial sectors, a fall in bond yields, a rise in bond yields, oil falling in anticipation of economic weakness, oil rising in response to OPEC cuts, China reopening, a belief inflation may have peaked, and stubbornly high inflation prints. In short we believe 2023 will see a continuation of recent themes of uncertainty; the Russian invasion of Ukraine, China, supply chains and inflation. However, currently we do expect 2023 to see an end to rising interest rates and the start of disinflation. Generally speaking, financial conditions are not too stretched; corporates and consumers are reasonably well capitalised, and banks have plenty of capital. As such the path of employment will dictate the consumer outlook but we continue to expect the trough to be shallower than in previous recessions.

Industrial activity is likely to decline as excess inventory works through the system, but given major markets such as automotive and aerospace were already seeing choked demand through supply chain issues, again we expect a shallower trough. Housebuilding and Renovation, Maintenance and Improvement will have a tough first half of 2023, but given the rapid repricing of mortgages post the brief Truss premiership, the outlook isn’t as bad as it was in September 2022. Valuations have corrected quickly and looking back it appears all consumer orientated stocks overshot to the downside during the chaotic period around the Truss budget.

Whilst there is much that can be discussed with regards to the economic outlook, one thing is irrefutable; the valuation of UK small and mid sized companies is more attractive than it has been for some time, and if that valuation is not recognized by the stock market, it will be recognized by others. We expect to see M&A picking up through the course of the year and indeed in the last few days we have seen approaches for several companies in the UK as Private Equity players have decided to start deploying their substantial cash piles.

We are not out of the woods yet, but the recent round of trading updates from our investments have generally been in line or better than expectations. However, with oil and gas prices lower year-on-year, China re-opening, US$ weakening, shipping/logistics/factory gate prices dropping, much of the inflation pressure of last year could become deflationary during the course of this year, and we have tentatively started to utilise more of our gearing facilities.

Against this difficult backdrop, we remind ourselves that many equity markets (Europe, UK) are structurally under owned and could benefit as sentiment turns and investors begin to reduce these underweights. We remain focused on bottom-up company specific analysis to identify high quality, nimble businesses, operated by entrepreneurial management teams, with strong market positions and resilient cash-flows. These are the types of businesses that we believe will be best placed to manage and thrive in the current environment. Historically these periods have been followed by strong returns for the strategy and presented excellent investment opportunities.

. . . . . . . . . . .

Asia

(compare Asian funds here)

Rebecca Jiang, Howard Wang, Li Tan, Investment Team, JP Morgan China Growth & Income – 26 May 2023

The global economy is facing ongoing challenges – record inflation, high, and possibly still rising, interest rates, and a resultant slowdown in growth, which may drift into recession in some countries. This is in sharp contrast to China’s economic outlook, where inflation measured by CPI is 1.3% for 1Q 2023, the five year loan primary rate is down 4.3% from 4.6% a year ago, and the government is targeting GDP growth of around 5% during 2023. This is considered conservative by some market observers, but in our view, it is a reasonable goal given the headwinds faced by developed economies and the impact this will have on demand for Chinese exports. We expect consumption to be the main driver of Chinese GDP growth. Service sector activity is already rebounding strongly and certain industry data, such as trips made by high-speed rail, have surpassed their pre-pandemic levels.

However, the recovery in demand for big-ticket household items and cars is likely to be more gradual, as the property market remains lukewarm, the labour market is still slack and the demand for vehicles was front-loaded into 2022 thanks to government subsidies. The contribution from investment is also likely to be modest, as it is coming off a high base following last year’s surge in public infrastructure investment, which was intended to support growth. In addition, new home starts will be slow to increase as developers are still repairing their balance sheets. The official GDP growth target may also assume a decline in net exports, as growth slows in many developed markets, but the severity and duration of this adverse influence is difficult to forecast.

On the global stage, fundamental disagreements between China and the US persist and there seems little prospect of near-term reproachment. For instance, the US continues its efforts to limit China’s access to cutting-edge technologies. However, it is extremely difficult for the world’s two largest economies to decouple, and it is in neither’s economic interests to do so. This mutual self-interest should serve to encourage ongoing dialogue and co-operation in some spheres. Since the country exited its zero-Covid policy, government and business leaders have been keen to rebuild international relationships, which, if successful, should help the economy regain momentum.

In this persistently uncertain climate, it may take time for business and consumer confidence to recover from the past three, very difficult years, but the recent, much more pro-growth, pro-business tone of government policy announcements should lay the base for a multi-year recovery.

We remain equally optimistic about the longer-term prospects for Chinese equities. Despite the market rally triggered by China’s re-opening, valuation signals remain attractive compared to historical averages. Our proprietary, five-year expected return model, as well as familiar measures such as price-to-book (P/B) and Price Earnings (P/E) ratios, remain near long-term lows, suggesting a sustained recovery in Chinese equity prices is in prospect. The main driver of future stock performance is likely to be renewed earnings growth. While some industries operating at the cutting-edge of technology will remain susceptible to geopolitical risks, elsewhere we see ample opportunities to invest in companies benefiting from structural trends such as the growth in China’s middle class, import substitution, digitalisation and the transition to carbon neutrality.

All this, combined with the size of the Chinese economy, suggests to us that Chinese equities demand a meaningful allocation within any fully diversified global portfolio. Historically low valuations suggest now may be a particularly good time to invest.

. . . . . . . . . . .

Sir Richard Stagg, chairman, JP Morgan Asia Growth & Income – 24 May 2023

The international investment climate remains particularly uncertain. The war in Ukraine, combined with China’s territorial ambitions in relation to Taiwan, mean global geo-political tensions are at their highest for many decades. On the economic front, the good news is that last year’s aggressive monetary tightening by the US Federal Reserve and other central banks appears to be having its desired effect – inflation pressures are slowly subsiding across the major western economies. The likely pace of interest rate reductions is unclear. However, it remains to be seen whether high interest rates will result in at least a mild recession in the US and elsewhere. Recent instability in some smaller US financial institutions has given investors a fresh source of concern.

Asian economies are currently faring much better. China, India and other regional economies are all expected to achieve annual GDP growth of 5% or more this year, and next, while inflation, although elevated, is less of a concern than in western countries. The Asian region’s longer-term growth prospects are also positive. Very favourable structural trends such as digitalisation, urbanisation and the expansion of the middle class should continue to support rapid productivity increases and economic growth. This vibrant environment is likely to generate many attractive investment opportunities. In addition, Asian equity market valuations look appealing compared with both the US and Europe.

. . . . . . . . . . .

Ayaz Ebrahim, Robert Lloyd, chairman, JP Morgan Asia Growth & Income – 24 May 2023

There is increasing evidence that last year’s aggressive monetary tightening by the US Federal Reserve, the Bank of England and the European Central Bank is slowing the pace of inflation in these major economies. While this is certainly welcome news, it has come at the cost of weaker growth, lower corporate earnings growth and financial instability in parts of the banking sector, notably in the US, where the emergency buy-out of Californian bank First Republic is the latest unsettling event.

However, while western economies struggle to contain inflation, avoid recession and shore-up shaky financial institutions, the picture in Asia is much brighter. From a top-down perspective, the region boasts large, vibrant, expanding economies that together account for roughly 40% of the world’s GDP, while from the bottom up, Asian businesses are global leaders in a wide range of sectors including banking, semiconductor manufacturing, insurance, healthcare, renewable energy and next generation automotive production.

Asian markets are also benefiting from improving structural trends. As just one of many examples, in Indonesia, improvements in transport infrastructure and a visible reduction in traffic congestion in the country’s largest cities have resulted in efficiency gains in transportation, logistics and employment. Previous estimates valued total costs in these areas at 25-30% of GDP, but this figure has now dropped to 20%. The Indonesian economy has also benefited from efforts to add value to its exports. In the past, the country was prone to the typical boom and bust cycles of commodity-based economies – high economic growth was driven by exports of unprocessed commodities, which increased domestic consumption, but higher imports of consumer goods pushed up the current account deficit and destabilised the currency. However, since 2015, Indonesia has focused on developing more downstream industries which add value to its raw materials, and create a virtuous cycle that raises selling prices, profits, wages, living standards and export values, thereby reducing the current account deficit. Prior to 2020, Indonesia frequently ran a current account deficit of 2-3% of GDP, but the current account has now shifted into positive territory.

The long-term growth prospects of Asian economies are clearly very positive and valuations in many markets across the region are presently attractive. The MSCI AC Asia ex Japan Index is trading at 1.5x price to book, which is approximately 5% lower than its average over the last 20 years. Following the sharp recovery in Chinese and Hong Kong equities, valuations in these markets are less attractive, and Indian company valuations remain elevated, but South Korea continues to trade at a substantial discount to its market average.

Despite persistent uncertainties related to the war in Ukraine and regional geo-political tensions, Asia’s powerful combination of strong growth, innovation, favourable structural trends, and attractive valuations – at least in some key markets – underpins our belief that Asian equity markets continue to provide many attractive investment opportunities.

. . . . . . . . . . .

Managers, Scottish Oriental Smaller Companies Trust – 15 May 2023

After a prolonged period of disruption, Asian economies have finally emerged from the impact of the Covid-19 pandemic. A strong recovery is evident in countries such as India and Indonesia, to which Scottish Oriental has significant exposure. Consumer demand is also expected to gradually improve in Greater China and South Korea as movement restrictions have been removed. Historically, periods of disruption such as that witnessed over the last three years, has led to consolidation of industries in favour of market leaders which use their strong balance sheets, pricing power and technology resources to gain market share from their weaker competitors. We have seen this across various Asian economies recently as well.

. . . . . . . . . . .

James Williams, chairman, Pacific Assets Trust – 9 May 2023

Our investment universe covers an area that contains over 60% of the world’s population, and an ever growing proportion of global GDP. Generalising about such varied countries is always hazardous, which makes predicting the short-term future hard. However, we note that the anxieties about interest rates, inflation, and financial accidents seem to diminish the further you move away from the developed world. There can be no isolation from difficult global trends, but there is a feeling of greater self-sufficiency in Asia than there was a few years ago. Our goal is to invest for the long term alongside successful and experienced local business leaders. The rewards that will accrue come from satisfying the needs of a huge and growing middle class, from exploitation of technological inventiveness, and from skilful management.

. . . . . . . . . . .

Paul Meader, chairman, Schroder Oriental Income Fund – 3 May 2023

The ongoing acrimony between the US and China with regard to Taiwan and China’s political stance on the Russian Ukraine conflict continues to cast a geopolitical shadow over the region. Nevertheless, economic recovery in China and initiatives by both Chinese and Western businesses to diversify production across the Asia Pacific region could have significant positive implications for Asian equities. Over the coming months it seems likely that we will approach the peak of this global interest rate cycle. Equity valuations in Asia are now looking more attractive. With this combination of factors, it seems plausible that Asian equity markets may make headway over the next year. Events closer to home over the last few years, such as sharp dividend cuts by UK companies during COVID or the turbulence in UK markets last autumn, show how important international diversification remains.

. . . . . . . . . . .

Managers, Schroder Oriental Income Fund – 03 May 2023

We entered the Year of the Rabbit with the hope that China’s re-opening and the potential for a softer US dollar and peaking US rate hike cycle should provide a more supportive backdrop for Asian markets, although slowing global growth would inevitably be a headwind given Asia’s position as manufacturer to the world. More recently the collapse of Silicon Valley Bank (SVB) in the US and the proposed takeover of Credit Suisse have added to concerns over financial sector risk globally, as well as the potential knock-on impact on growth. Geopolitics remains a risk with US-China relations, Taiwan and the Ukraine all areas of tension. The U-turn in China’s Zero COVID policy unsurprisingly saw the Chinese market rally hard off its lows, rising some 50% before pulling back. Clearly the move away from zero COVID is a positive from an economic perspective and, when combined with the stimulus measures that have been announced, particularly towards the property sector, this should help remove the tail risk of a hard landing in China centred on the property market. We remain very underweight China and, from a reopening standpoint, it feels as though much of the upside has already been priced in. Notwithstanding the recent pullback, valuations of many of the ‘reopening plays’ pre the U-turn on COVID were not particularly attractive, as there was already an expectation that 2023 would see a move away from Zero COVID – albeit very few, including ourselves, expected it to happen as rapidly as it has. Following the rally, valuations in a lot of these names are now well above historic levels despite factoring in a large recovery in profits.

Other areas have in part also benefitted from this change in policy, together with a perceived lowering of risk from a regulatory perspective. Statements at the CEWC (Central Economic Work Conference) in December around equal support for state owned and private owned enterprises, as well as support for the internet platform companies, helped here. This, along with a diminished ADR-delisting risk, saw the likes of Alibaba rally strongly from their lows. Whilst things have improved from a regulatory perspective, we remain sceptical that risks around ‘national service’ have entirely gone away, as highlighted by the recent use of ‘golden shares’, and thus think that long term returns in a number of areas in the market have likely come down.

Lastly, although the domestic demand outlook has improved in China, the external side is moving in the opposite direction, with net exports likely to continue to be under pressure through 2023. Given its importance in employment (approximately 24% of the workforce), this slowdown will have obvious ramifications for growth. All this means we remain meaningfully underweight China.

We are, however, more positive on Hong Kong, where valuations are lower and the SAR will see a recovery as the border with the mainland opens and tourists come back. If we look further afield, we think the stabilisation of China’s economy and rebound in consumption, albeit most evident in services rather than goods, will also help a number of regional names including some of the IT companies in Korea and Taiwan, resource names in Australia and other companies that will benefit from an increased level of travel by Chinese visitors.

Markets globally have been more recently impacted by the collapse of SVB and Credit Suisse and their wider impacts on the financial system. The Asian financial sector has few direct parallels for the problems faced in these cases. In particular, the Asian banks tend to have strong deposit franchises, smaller investment portfolios and mark to market their fixed income positions. They have been seeing improved profitability and are generally well capitalised. Most banks we own are more domestically focussed retail names and in general trade at attractive valuations and decent dividend yields. Still, we are mindful of the global tightening in liquidity that we are seeing and the potential contagion risks, and will continue to monitor our positions carefully.

Elsewhere, our preference for IT continues. The IT names remain sensitive to the global slowdown and the Korean names, despite a recent rally are still trading at relatively attractive levels from a valuation perspective. Although the demand slowdown has been worse than we expected, there are signs that an adjustment on the supply side is starting to take place as announcements on production and capital expenditure cuts have started to be seen. Underweights remain in the more defensive areas of the market, including consumer staples and utilities, where valuations in our view still remain relatively full. Near term, it is likely that we will see further downward revisions to earnings as global growth slows and an ongoing period of inventory adjustment amongst companies to reflect this slower growth, which will hopefully put them in a position to start to grow earnings once more. Given overall aggregate valuations for the region are now trading at or below long-term averages, this does set up a more constructive backdrop for Asian markets in the coming year, barring a global hard landing or a more extreme geopolitical risk event.

As we have discussed previously, it is our belief that Asia remains an attractive source of equity income, potentially providing diversification for some UK investors seeking income, as we saw through the initial wave of COVID. In the medium to long term, dividends tend to follow earnings and earnings have recovered materially from the COVID lows. However, earnings growth this year will likely face some downward pressures as has been seen in earnings revisions trends which may impact dividends, particularly in some of the more cyclical areas, including resources and information technology. It should not be forgotten that overall payout ratios in Asia do not look extended versus some other markets and that corporates in Asia remain relatively lowly geared. From an overall fund distribution perspective, the other dynamic to be cognisant of is Sterling, whose direction will obviously impact the size of translated dividends, with a stronger Sterling acting as a headwind.

. . . . . . . . . . .

Europe

(compare European funds here and here)

Vicky Hastings, chair of the board, Henderson European Focus Trust – 22 May 2023

The swift recovery has not been without its nuances. At the time of writing, the market is in the throes of a ‘defensives vs cyclicals’ tug of war, as markets struggle to contend with a potential recession. We are cognisant of the near-term risks to our ‘quality cyclicals’, but we must not take our eye off the long-term opportunities for those with the luxury of long-term capital to deploy — ‘global champions’ that live in Europe. This includes companies which are highly competent in providing tangible goods and services which have taken on renewed strategic importance in an increasingly multi-polar world: clean-energy generation, onshore digital automated factories, smart infrastructure, and their myriad components and raw materials. These are companies and investment opportunities which come at reasonable valuations. If the last decade was about owning ‘asset-light’, the next will be ‘asset-heavy’. Mean reversion is alive and well.

. . . . . . . . . . .

Tom O’Hara and John Bennett, fund managers, Henderson European Focus Trust – 22 May 2023

At the time of writing the market is moving to price recession. Stocks with defensive qualities such as food, beverages and healthcare are back in vogue, while those of a more cyclical nature – such as chemicals, materials and certain industrials – are given short shrift.

At the risk of testing our readers’ patience with repetition, it remains our view that we are unlikely to return to the madness of the free-money era, that inflation is likely to linger for longer, and that interest rates are more likely to plateau than to pivot. As a result, we believe that valuation – the price you pay for an asset – will regain its rightful place as the cornerstone of one’s investment framework. It is worth reflecting for a moment on just how financially absurd recent history has been. The total value of negative yielding bonds (yes, you pay the borrower to take your money…) peaked at 18 trillion dollars in 2020. The amount as of today is negligible. The withdrawal of silly money has seismic consequences for the investment regime, but it will take time to fully bear out.

Moreover, given the multi-polar geopolitical shifts now undoubtedly taking place, we believe tangible goods – the energy, infrastructure and supply chains that underpin a society’s security and resilience – are to be desired over the many intangible winners of the last decade – think software, technology and other often over-hyped ‘asset-light’ business models. On this basis Europe, which has now outperformed the US over the last six months by over 20%, screens rather attractively; valuations are reasonable and the region – often dismissed as the ‘museum continent’ – actually excels at ‘making stuff’. It is home to global champions whose competencies include renewable energy infrastructure, semiconductor manufacturing equipment, the provision of digital automated factories, not to mention the vast and varied skills, materials and components which they draw upon. It is no longer novel to suggest that the Western world is urgently moving to rebuild its strategic resilience, but what is still underappreciated by the market, in our opinion, is the speed with which these new long-duration capital investment cycles are emerging. A major takeaway from the full-year 2022 results season was the number of companies: 1) highlighting a tangible benefit to their orderbooks from these trends; and 2) taking action to improve their own supply-chain resilience through the onshoring of manufacturing activities, or the investment into automation.

‘Asset-light’ was a posterchild of the last decade, courtesy of monetary abundance, non-existent inflation and a still largely unipolar world order. ‘Asset-heavy’ will have renewed significance in the next. In this realm, Europe has winners.

. . . . . . . . . . .

Stefan Gries, manager, Blackrock Greater Europe Investment Trust – 10 May 2023

Moving to our macro view, which is largely informed by our micro observations and insights we have on individual companies. We have discussed that we believe the environment for European equities has materially improved due to the better energy situation, falling inflation and China re-opening. However, as is usual in Europe, selectivity is key. We have seen a few sectors that have over-earned since the pandemic. Think autos for example, where we believe margins will come under pressure in the future due to rising rates, falling used car prices and intensifying competition. We also make sure to avoid highly leveraged or unprofitable companies with poor cash flow and near-term debt refinancing demands. Some companies have in the past supported their earnings growth by refinancing at lower levels. These times are clearly over.

Going forward, markets are likely to continue to closely follow inflation numbers. With energy prices coming down, there is reason to be hopeful they move to levels equity markets can deal with. Clarity on the terminal rate of this hiking cycle would likely be enough to bring attention back to company fundamentals – the ultimate driver of long-term equity returns.

Support comes from corporate balance sheets that are in decent shape and in much better positions than in previous downturns. Many companies in Europe have spent the last decade deleveraging balance sheets and interest coverage is significantly higher than during the Global Financial Crisis or other prior periods associated with deep recessions or prolonged bear markets. Corporate spending intentions also remain healthy and this spend is often linked to transformational capital expenditure.

Lastly, long-term structural trends and large amounts of fiscal spending via the Recovery Fund, Green Deal, the REPowerEU plan or the latest Green Deal Industrial Plan in Europe, can drive demand for years to come in areas such as infrastructure, automation, medical innovation, electric vehicles, digitisation and decarbonisation. We believe the portfolio is well aligned to many of these structural spending streams.

. . . . . . . . . . .

Eric Sanderson, Chairman, Blackrock Greater Europe Investment Trust – 10 May 2023

The outlook for Europe has improved considerably with some of the macroeconomic and political shocks caused by Russia’s invasion of Ukraine, which were weighing on global markets, now reversing. The improvements result from a variety of reasons including the success in filling gas storage and diversifying Europe’s sources of energy, as well as the mild weather over the winter which helped to reduce energy demand and kept gas prices lower. As energy prices fell back and the overall inflation rate declined, the annual inflation rate in the Eurozone also finally dropped from double figures, having surged to a 41-year high in October. Europe should also benefit from the lifting of COVID-19 restrictions in China. This has already led to a rebound in the country’s equities and should help broader equity markets, including Europe, one of China’s largest trading partners. However, the consequences of China’s closer association with Russia have yet to be evidenced.

After a year of concerns over a recession hitting Europe and a significant interest rate hiking cycle, we continue to see many companies delivering good results and the consumer being more resilient than expected. However, market volatility is expected to remain in the near term as macro uncertainty continues to be elevated. Going forward it will be important to see whether inflation comes down to levels the market can deal with, and we continue to see evidence that inflation has peaked and is falling. A sharp drop in gas prices, China’s reopening and slowing inflation has also meant that European equities not only rose in absolute terms but also significantly outperformed US equities over the six-month period under review.

. . . . . . . . . . .

Private Equity

(compare private equity funds here)

Richard Hickman, managing director, HarbourVest Global Private Equity – 26 May 2023

On a geographical basis, we continue to believe that private markets in the US are well-positioned to provide strong returns in the years ahead, and that the potential for further penetration of private capital in Europe continues to grow. Meanwhile, concerns over China should not dampen optimism around wider growth opportunities in Asia overall. From an investment stage perspective, Buyouts remain our largest allocation as we believe that high-quality managers in this space will continue to innovate and adapt in the years ahead, maintaining the potential for premium returns. The Venture and Growth Equity segment, while less fashionable than it was 12 months ago, nevertheless continues to nurture high-quality, profitable businesses, some of which could become the S&P 500 titans of tomorrow. Mezzanine, Infrastructure and Real Assets – a segment providing a yield while benefiting from floating rates and other inflation-hedging properties – remains a key component of our portfolio, comprising 9% currently against a target of 10%. As well as its relative stability and low correlation to other parts of the portfolio, the segment is supported by long-term, secular tailwinds such as the energy transition and digitisation. This may help explain why infrastructure and natural resources set a new fundraising record in 20224, firmly against the trend of other sectors facing broader macroeconomic headwinds over the past year.

. . . . . . . . . . .

Richard Gray, chairman, CT Private Equity Trust – 11 May 2023

Conditions within the private equity market have changed during 2022. An initially surprisingly benign reaction to the Russian invasion of Ukraine and its concomitant effects dissipated towards the end of the year as the challenges of inflation, higher interest rates and supply chain problems made their presence felt. That said the large element of the portfolio involved in tech enabled and healthcare related companies continued to make fundamental progress and to attract buyers at attractive prices keeping the realisations not far below historically high levels. The positive momentum exceeded the drag factors in 2022 delivering another good overall return. We expect that it will be harder to achieve exits this year and it also looks as though fund raising for private equity funds is becoming considerably more arduous. There are also other supportive factors. In particular there is a well-financed tier of larger private equity funds in the size bracket above us with the capital and the will to invest and many of our investee companies will prove attractive to them. Lastly there remains a steady increase in investors’ appetite for private equity globally. This all adds up to the prospect of a healthy two-way market with continuing opportunity and strong demand for high quality and resilient investments.

. . . . . . . . . . .

Renewable Energy

(compare renewable energy funds here)

Managers, Aquila Energy Efficiency – 2 May 2023

Global energy supply security remains uncertain for a mix of macroeconomic and geopolitical factors but has worked to act as a headwind for the energy efficiency sector. The stress on the demand-supply balance in natural gas, Europe’s critical primary energy resource, could also be accentuated as the region’s winter demand is unlikely to be as unseasonably mild as in 2022. The urgency for energy efficiency thus continues. IEA’s study indicates a €95 billion funding requirement to bridge the projected gas demand-supply deficit in 2023 through incentivizing faster improvements in energy efficiency, renewable energy integration, electrification of heat sources, and behavioural changes in energy consumption.

The investment requirement for energy efficiency for 2023 and beyond is far less than the resources expended to counter the energy crisis. EU region’s countries are estimated to have allocated about €681 billion so far (since September 2021) in energy crisis spending. The UK and Norway added to this with another €103 billion and €8 billion, respectively. It is unsustainable for public finances and largely mistargeted as fossil fuel consumption was subsidised. A realignment in budgets is overdue. In the UK, for instance, about a third of the allocated funding for energy-efficient buildings in 2020-2025 was unspent as of February 2023.

With timely investments, the region’s built environment could be vital in transforming the landscape. The existing buildings’ stock significantly contributes to decarbonisation (35% of energy-related emissions) and rationalisation of primary energy consumption (32% of natural gas consumption). Despite the challenges involved, some major areas of interventions with maximum impact include rooftop solar, replacement of gas boilers with heat pumps, insulation, smart thermostats, and district heating.

McKinsey’s projections indicate that to adhere to the ‘Fit for 55′ and RePowerEU targets, the buildings’ renovation rates need to be 15 times the current level of 0.2% per year. The corresponding investment requirements are enormous, translating to an attractive market opportunity if followed through with an actionable plan.

The projected energy efficiency investment and the resulting market size are simply quantified reiterations of the low-hanging untapped opportunity. The ambitious objectives of climate neutrality require a cohesive approach, incorporating multiple lines of action. The measures related to energy efficiency offer the most optimum and cost-effective solutions to address immediate and long-run targets for carbon reduction in businesses and society at large.

. . . . . . . . . . .

Healthcare

(compare renewable energy funds here)

James Douglas and Gareth Powell, co-managers, Polar Capital Global Healthcare – 11 May 2023

Macroeconomic, geopolitical and operational factors continue to drive a high degree of market uncertainty. On the one hand, there is a reasonable argument for caution based on tightening financial conditions, slowing economic activity and, ultimately, slowing earnings growth for the broader market. In such a scenario, the defensive qualities of the healthcare sector, offering a reasonable level of earnings visibility, is highly appealing. By contrast, a more optimistic stance might be based on the idea that stubbornly low levels of unemployment, elevated levels of personal income and excess savings could keep nominal consumer spending buoyant. In that scenario, the more consumer-sensitive areas of the market, including pockets of healthcare, might hold greater appeal for a longer period than expected versus the consensus bearish view that a recession (in the US) is imminent.

Importantly, the healthcare industry is composed of a broad and diversified universe of businesses that range from pharmaceuticals and biotechnology to medical equipment and supplies, medical insurance, healthcare facilities, and life sciences tools and services. This diversity, with many different end-markets and operating models across the market-capitalisation spectrum, is one of the reasons the sector can offer investors exciting investment opportunities in any given economic, political and regulatory environment.

Putting the opaque nature of the macroeconomic environment to one side, it is worth reflecting on the near and medium-term structural drivers in the healthcare industry that could yield revenue and earnings upside. In the near term, a pick-up in utilisation is a critical theme as more and more consumers engage with healthcare systems now that we are learning to live with, or even move beyond, COVID-19. Looking through a longer-term lens, the disruption of the delivery of healthcare will continue to be a central theme as healthcare systems globally look to satisfy an ever-growing demand for their products and services. Last but not least, consolidation will likely continue to be something that captures investors’ attention.

Conviction in the macroeconomic environment may well be hard to come by in 2023 given the ongoing tug-of-war between the fear of tightening financial conditions leading to a slowdown in economic activity versus the optimism of an economy being driven by low levels of unemployment and an upbeat consumer. That uncertainty simply goes to underpin our view that the healthcare sector, with its defensive characteristics, attractive valuations and dynamic growth profile, should be a very attractive place to invest. Further, with a number of key industry themes accelerating, potentially leading to upwards revenue and earnings revisions, there is building enthusiasm for the investment opportunities that lie ahead.

. . . . . . . . . . .

Kate Cornish-Bowden, chair, International Biotechnology Trust – 2 May 2023

Since the half year end in February, the risk of contagion following the demise of Silicon Valley Bank and Signature Bank in the US, and Credit Suisse in Europe, has sent shivers through the market. Nevertheless, the Board believes that the biotechnology sector offers a very compelling long term investment opportunity.

The aging global population will continue to ensure strong demand for therapeutics to treat disease and enhance quality of life. We are living through a period of great innovation in medical science, including exciting advances in cell based and gene therapies, which have the potential to change outcomes for patients suffering from diseases such as cancer and dementia. The renewed focus on drug development following the global pandemic has highlighted the potential for faster, more personalised clinical trials which should reduce the risks of late stage failure.

Cash rich, large pharmaceutical companies needing to replenish their pipelines are increasingly looking to smaller revenue generating innovative companies. We share our Investment Managers’ enthusiasm that the current more realistic valuations and the prospects for increased corporate activity in the biotech sector represent an excellent opportunity.

. . . . . . . . . . .

Managers, International Biotechnology Trust – 2 May 2023

The fundamentals underpinning the biotech industry are ever more compelling. On the demand side, the global population continues to be more heavily weighted towards the over 60s which is driving demand for medicines. Further, a growing middle class in developing markets is demanding better access to healthcare which is increasing the global take up of new drugs. The biotech industry is keeping up with this demand through an accelerating pace of innovation and an evolving regulatory backdrop that is enabling drugs to reach the market in a more efficient manner.

The 2023 to 2028 period will see an increase in the number of treatments reaching their patent expiry dates. While the prevalence of less easy to replicate biologics will mean that copycat therapies are generally slower to take hold, there is pressure on the big pharmaceutical companies to plug the impending revenue gaps in their product pipelines with new treatments.

The Investment Managers believe that big pharmaceutical companies, especially those with sound balance sheets stemming from COVID-19 vaccine and treatments sales, will be looking to deploy their cash and build their drug pipelines. Rather than focussing on early-stage biotech, the Investment Managers expect them to target de-risked companies with a shorter time horizon to profitability such as the ‘revenue growth’ names that already were the subject of acquisitions in the six months to February 2023.

With macro-economic uncertainty continuing and questions over access to affordable, reliable financing, the Investment Managers expect to continue to tilt the portfolio in favour of revenue growth and large cap biotech companies with carefully selected, well financed smaller cap names addressing the highest unmet needs making up the remainder of the portfolio.

Catalysts for 2023 are likely to include positive clinical readouts, good product launches, a steady flow of M&A deals and a reignition of biotech sector IPOs. Together, these could underpin investor interest in the sector and boost returns into the future.

. . . . . . . . . . .

Infrastructure

(compare infrastructure funds here)

Mike Bane, chair, HICL Infrastructure – 23 May 2023

HICL continues to operate in an unpredictable macroeconomic and geopolitical environment. Financial markets remain volatile, and the level and timing of peak inflation and interest rates remains uncertain. Against this short-term outlook, the Company’s own valuation assumes a significant decrease in inflation over the coming year, with HICL’s UK RPI forecast returning to 2.75% from April 2024.

InfraRed continues to see strong demand and robust pricing for high-quality core infrastructure assets, proven by HICL’s recent disposal, activity across other InfraRed-managed funds, and observed market data points. Notwithstanding this, the shift in macroeconomic conditions has negatively impacted listed market valuations across real assets.

Looking further ahead, the outlook for the core infrastructure asset class remains buoyant, underpinned by the growth drivers of decarbonisation and digitalisation combined with the growing need to enhance ageing infrastructure.

. . . . . . . . . . .

Managers, Ecofin Global Utilities and Infrastructure Trust – 18 May 2023

We are now seeing a welcome stabilisation in interest rates with bond yields discounting significant reductions in inflation and rates in the next few years. Gas and power prices are back to pre-crisis levels, providing an attractive pricing environment for utilities and the potential for good returns for renewables developers. For the next two years, most generators are broadly hedged so sensitivity to power prices will be limited. Lower natural gas prices will translate into lower customer bills, lessening the risk of clawback from power producers by governments seeking to reduce customer bills.

We believe that earnings guidance for utilities is conservative, being based on normalised power price assumptions but higher interest and capital expenditure related costs. Earnings per share growth targets are generally in the region of 6-8% per annum. Transportation infrastructure businesses are growing and investing to accomplish necessary renewal. This segment of EGL’s essential assets investment universe may be less recession-resistant but companies have the benefit of inflation-linkage in their contracts and regulated returns. We expect that the valuations in the listed segment will continue to be attractive to private equity. In EGL’s sectors we can find an appealing combination of growth and defensiveness, often in the same company.

We remain optimistic that the favourable policy support for decarbonisation and electrification, the relative competitiveness of renewables, and the ever-rising demand for energy price stability will continue to provide strong tailwinds for this strategy. Our focus on essential assets and asset-backed services should continue to do well in most market environments while undemanding share valuations lend downside protection.

. . . . . . . . . . .

Property

(compare UK property funds here, here, here, here, here, here and here)

Toby Courtauld, chief executive of Great Portland Estates:

It is clear from our recent leasing experience that high quality offices remain in high demand. With hybrid working here to stay, and customers having more choices about where they work, our spaces need to provide compelling reasons to come into the office. With average office rents only c.5% – 10% of a typical London business’ salary cost, and the office environment a key tool in attracting and retaining talent, we anticipate that competition for the very best spaces will remain healthy.

So, with office demand robust, we expect that the uncertain economic outlook in the near term will exacerbate the shortage of new deliveries in central London, further restricting supply. As a result, we anticipate supportive rental conditions for the best spaces with rents for prime office space likely to rise over the next 12 months by 3.0% to 6.0%.

. . . . . . . . . . .

Gerald Kaye, chief executive of Helical:

While previous valuation falls have been caused by recessions following periods of economic exuberance leading to an oversupply of new office space, the current decline in values reflects a number of differing cyclical and structural factors.

The economy has been affected by multiple geopolitical and economic events which have generated high levels of inflation and a steep rise in interest rates. We have had ultra-low interest rates since 2009 and with the base rate rising from 0.10% in December 2021 to the current 4.50%, the financing of real estate has become significantly more expensive. The rise in interest rates has also led to a repricing of government bonds across the market. Consequently, valuation yields have risen.

In addition, structural changes are impacting the office market, with the latest sustainability criteria challenging the suitability of older office buildings.

Around 75% of buildings in the central London office market do not meet the MEES (Minimum Energy Efficiency Standards) rating of EPC A or B rating required by 2030 and these buildings will need significant capex to bring them up to the necessary standard when leases end and tenants vacate. Previously, these less sustainable buildings could have remained in the market with a low cost refurbishment and a reletting at a significantly lower rent than for the better buildings. For buildings below an EPC rating of B this will no longer be an option. The additional costs of bringing these older buildings up to the required standard is exacerbated by the significant build cost inflation we have seen in the last year.

The impact of all these factors has accelerated the bifurcation in the market. With best-in-class property valuations adjusting to reflect the movement in bond yields, it is the older, poorer quality buildings that are facing what is likely to be a deeper correction, with downward price discovery potentially not reaching an endpoint until a lease ends and the rent stops, or from refinancing events.

Tenant demand for the best, newly developed or refurbished buildings at the forefront of sustainability with top quality amenities is strong, and seeing rising rental values.

. . . . . . . . . . .

Andrew Jones, chief executive of LondonMetric Property:

Interest rates remain the yardstick by which all investments are assessed, and so the material shift in monetary policy has had a profound impact on real estate valuations. Whilst the full impact is continuing to play out, we expect some of the short term reactions to be superseded by longer term trajectories.

Lower yielding and high growth sectors certainly took the brunt of the initial repricing in the latter part of 2022, whilst higher yielding ex-growth sectors remained largely unscathed. This seems largely irrational and we would expect some of these initial movements to unwind, with other movements accelerating as market data becomes more evident and reliable.

For a while now, the logistics sector has been the only property asset class transacting, which helps to explain why valuations in March 2023 are stronger than the market had been expecting at the end of 2022. Whilst liquidity is much improved from the days of the mini budget, it is still likely to remain far from optimum until five year swap rates fall back below 300bps. We still have some way to go as, whilst it is down materially from its highs of 540bps immediately following the mini budget last Autumn, it remains elevated at around 400bps, reflecting stubbornly high inflation.

For those sectors that have not seen material re-pricing, when more liquidity returns, they will surely print at yields materially softer than those currently suggested by valuers’ yield sheets. We expect the greatest fallout to be in those troubled sectors facing structural headwinds and a perfect storm of falling rental values, weaker valuations and higher borrowing costs.