Economic and Political Roundup

Investment companies | Monthly | March 2024

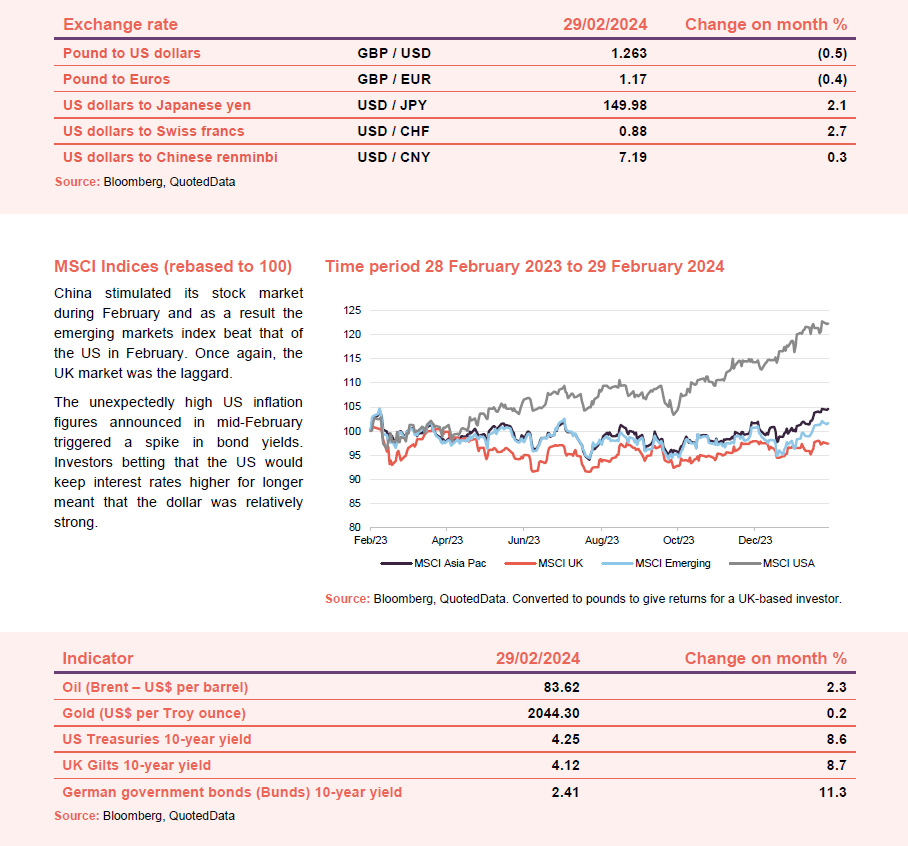

Despite further geopolitical uncertainty, US growth appeared undeterred, and the inflation rate continued on its downward trend, strengthening the likelihood of a soft landing. However, the inflation rate was higher than had been expected and the US central bank (the Federal Reserve or Fed) may delay interest rate cuts as a result; that unnerved markets. American unemployment remained at 3.7%, reinforced by continued wage growth. Yet, despite labour market resilience, the US consumer confidence index fell to 106.7, from January’s 110.9. Dana Peterson, chief economist at the Conference Board, partly attributed this to the uncertainty of the ‘political environment’.

‘I expect inflation to continue its return journey to 2 percent, although there will likely be bumps along the way – John Williams, The Federal Reserve

Whilst the Eurozone continued to lag behind the US, indicators of economic strength such as the HCOB PMI have improved, boosting hopes of a recovery. Moreover, the European benchmark STOXX600 index reached a record high on February 26th, building on a 3.4% gain since the beginning of the year. February’s selling price expectations for services also fell slightly, offering momentary solace from inflationary fears. However, even though inflation has been slowly declining, the European Central Bank (ECB)’s Martin Kazaks cautioned that cutting interest rates any time soon would be ‘risky’.

After falling into a recession in the final quarter of last year, the UK’s retail sales figures added to its woes with a decline of 2.5% in February.

Another concern for the UK is that it is still undergoing its longest run of falling living standards since 1955. The Spring Budget’s give with one hand and take with the other approach seems unlikely to do much to change that.

At a glance

Global

(compare global investment funds here, here, here and here)

Katie Potts, managing director, Herald, 21 February 2024

Maintaining wealth, let alone creating wealth, will be a challenge in a world with so much government debt and in which fiscal deficits will have to be both funded and reduced. Money will be sucked into bond markets and consumers and businesses will be squeezed by higher tax. It seems obvious that good returns may only be achieved through growing markets, and that technology continues to evolve, and that innovation creates new markets offering more potential than other sectors. Entrepreneurial management can exploit these opportunities but need access to capital to do this. Equally growth will occur where people work for $2/hour and there is evident migration of labour-intensive manufacturing to countries like Indonesia and Vietnam. The outlook for Europe including the UK seems challenging because labour is too expensive for low-cost manufacturing and there is limited availability of capital.

The UK does have an innovative, creative entrepreneurial spirit and had already lost energy intensive industries prior to the Russia/Ukraine disruption of the energy markets, so does not have the headwind faced in other economies. The headwind of rising corporation tax and ESG costs in the UK will now be reflected in profit expectations, and other countries will probably follow with higher taxes. The trouble is that the UK stock market also seems broken, and unlikely to provide capital to emerging businesses, and therefore unlikely to provide the investment opportunities that it has in the past. Nevertheless, having capital in a capital constrained world will present opportunities. There is still world leadership in the media sector and the creative industries, but the semiconductor sector, which was so important in the development of the smartphone, has diminished. Key UK-developed technologies included the processor (Arm), the graphics processor (Imagination), audio (Wolfson) and Bluetooth (CSR). Arm has now gone public again on NASDAQ and Imagination seems to be considering a US IPO in 2024, but the US/China semiconductor politics complicates both the valuations and the prospects. New companies will emerge using artificial intelligence. Necessity may lead to Government policy that is more sympathetic to the wealth generating element of the economy. It seems to have been hostile or at least careless for this century to date.

China has driven growth through infrastructure investment and property. There are now too many empty dwellings and too much debt for this to provide growth in future. Wages are now too high for low-cost manufacturing, which is another headwind. The bright spot is that China is emerging as the leading electric vehicle manufacturer. This will be particularly challenging for the German automotive industry, which is not just losing an important export market, but facing a new competitor. The important German chemical industry is endangered by higher energy costs, and East German labour costs are no longer cheap. It seems possible that Germany will face the deindustrialisation that the UK experienced in the 1970s and 1980s.

North America has been the engine of growth in 2023, but this has been driven by extraordinary fiscal and trade deficits, and anomalously low fixed rate domestic mortgages. The technology sector has brilliantly scaled businesses and has had cheap capital to do this. The trouble is that salaries are too high for smaller emerging companies, and in the quoted world the reporting of adjusted earnings per share which excludes share based payments is quite deceitful, and unsustainable in valuation terms. San Francisco is troubled economically and socially, and the elevated pay there seems anomalous in a world of remote working. However, the US is leading the way in artificial intelligence, albeit with an Asian supply chain.

Developed Asia including Taiwan, South Korea and Japan has the most vibrant stock markets, and an enviable work ethic. It has to be the area of greater focus for this Company. The overhanging cloud is President Xi’s ambitions towards Taiwan.

At the time of writing, the markets have taken the negative effect of conflicts in the Ukraine and Israel lightly. There could be an upside surprise from peace in these regions, but continued and even increased tensions seem more likely. This will drive increased defence spending, and investment in technology led defence solutions, not least in cybersecurity.

UK investors are acutely aware of the challenges faced by the UK economy following the explosion of Government spending and the high debt levels. It seems they are less aware that these challenges are faced in almost all developed counties. I fear they may move money to North America where valuations are high and the widespread use of adjusted earnings per share excluding share-based payments which is effectively understating both the costs of running a company and the price/earnings ratio. In the technology sector in particular share-based payments can be material. We are privileged to meet management teams around the world on a daily basis, and aware of the widespread challenges. The greatest concern is that the bond markets will force fiscal discipline, particularly in the United States, which will make global growth challenging. The key is to find strong management teams addressing growth markets to offset these headwinds.

. . . . . . . . . . .

Peter Burrows, chair, UIL Limited, 21 February 2024

Market volatility has been driven by significant uncertainties in both the economy and social and geopolitical considerations.

The key economic driver of markets has been the outlook for inflation in the developed world and the central banks’ focus on reducing it through higher central bank interest rates. While inflation is now on a lower trend, the remarkable outcome in many economies is that unemployment has remained well below trends and many economies have beaten expectations on GDP. However, in the last quarter the market firmly shifted its views on central bank interest rate reductions from if it will happen to when, especially in the USA. Many central banks take their lead from the US Federal Reserve. The upshot has been strong gains for most markets. Going forward we think most central banks have the opportunity to reduce rates.

The war in Ukraine has gone on longer than expected and today there continues to be no clear way forward. The outlook is grim as both sides are unable to gain ground.

The brutal conflict that has erupted in the Middle East is more concerning. These are deep seated politically ideological differences between many parties in the Middle East established over many years. The concern must be that this escalates into a much wider conflict.

The ongoing friction between the USA and China continues to deepen, and given these are the two largest economies globally this must pose significant risks at some point in the future, especially for technology businesses on each side of the Pacific Ocean.

Overlayed on all this is the USA election. The direction the USA takes matters and its position and influence in the above mentioned conflicts is itself very uncertain.

An ever increasing factor for investors is climate change. It has clearly had devastating impacts on a number of communities from wildfires in Hawaii to floods in Germany. We are seeing whole ecosystems being impacted from prolonged droughts to record temperatures. As investors we need to prepare for these outcomes to continue across the holdings in our portfolio.

There is a very perceptible shift to embrace Artificial Intelligence (“AI”) by most businesses and as with most technological developments, those without legacy businesses benefit the most, but eventually all businesses will need to adapt or risk failure. This has been our experience in the Fintech sector. UIL has a number of investments with significant exposure to AI, Blockchain and Quantum Computing.

. . . . . . . . . . .

Managers, Scottish American, 14 February 2024

During the past few years it seems that some parts of the media have become, for want of a better word, hysterical. Even the financial press, which used to be renowned for walking a line between dry and tedious, has often joined the fray of shouty headlines and breathless articles. This is understandable. Technology has disrupted the business models of traditional media channels. In a digital world, whoever conjures the most shocking headlines will gather the most clicks. And whoever accumulates the most clicks might be able to keep their jobs.

The headlines blaring at investors at the start of 2023 were alarming. Inflation was proving “untameable”, central banks were hiking “too aggressively”, and an economic “hard landing” was certain. Investor confidence declined, and stock markets fell. By March, the mood had changed. Inflation seemed to be peaking. Many of the grim predictions at the start of the year, like crashing house prices and tumbling profits, were swiftly forgotten. In their place appeared two words promising great riches: “Artificial Intelligence”. The stock market began a triumphant rise, which would continue until the summer.

Gloom then returned. Economic data looked “hot”, and inflation seemed persistent. Stocks fell. By November, behold! The data looked more friendly. Fears of war between the US and China, which had generated dire forecasts only months earlier, now receded. The stock market began another charge upwards, buoyed by a new hope: interest rate reductions. Stock indices reached new heights at the dawn of 2024. “Time to buy!” was the headline.

For the long-term investor, who is earnestly attempting to grow their capital and income over a period of many years, this hysteria is unhelpful. It is rather like trying to hold a conversation at a dinner-party while being repeatedly interrupted by a drunken guest, who veers endlessly between loud euphoria and wallowing self-pity. An unfortunate distraction.

Over the multi-year periods that matter to serious savers and investors, stock prices and dividends tend largely to follow company earnings. The key task for portfolio managers, therefore, is to identify companies with strong prospects of growing their earnings over many years. These prospects are unlikely to be affected by the monthly mood swings of the media. It is a job best done when sober.

. . . . . . . . . . .

Carolan Dobson, chair, Brunner, 13 February 2024

2024 will likely be another significant year in terms of ‘headline’ events with 64 countries plus the European Union holding elections. Associated ‘news’ is likely to be rampant. Along with two major conflicts, the geopolitical landscape remains dangerous.

Markets have been acutely concerned with inflation and second-guessing central bank’s rate rhetoric. Inflation appears to be more under control but events in the Middle East have the potential to disrupt that.

Not all economies are built equally, and we have already seen divergence in economic performance. As you will read in the Investment Manager’s Review on pages 24 to 39 of the annual report, the portfolio managers are largely agnostic to where a stock happens to be listed. A large proportion of world class businesses derive their revenues from a diverse range of locations around the globe, often unconnected with where their stock is listed. The managers also argue in their report that the ‘macro’ factors, which undoubtedly move markets (possibly dramatically) in the short term, ultimately have limited impact on the long-term outcomes for individual businesses and thus for stock market returns over the long term.

As ever this scenario provides a good hunting ground for stock pickers who can look past the immediate noise and focus on the long-term opportunities available from individual businesses, crafting a balanced portfolio of such opportunities.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

Dan Nickols and Matt Cable, fund managers, Rights and Issues, 20 February 2024

The Russian invasion of Ukraine in early 2022 sparked a surge in inflation around the world that has dominated markets ever since. As the direct effects of energy prices fed through into goods, services and wages, central banks reacted by sharply tightening monetary policy. This resulted in interest rates that have not been seen since before the financial crisis a decade and a half ago.

At the macro level this led to the market questioning whether monetary policy could tame inflation without causing a painful recession. For individual companies it was a test of both pricing power (the ability to pass on inflation to customers) and balance sheet strength (through the cost of debt finance). Meanwhile the implied market ‘discount rate’, or cost of equity, caused valuations to decline, especially in the case of higher-growth companies whose cash- flows are assumed to be higher further into the future. The combination of these factors has resulted in both weak returns and heightened volatility in markets around the world.

The UK has been no exception, with the FTSE All-Share index experiencing a series of dramatic swings throughout the year as market sentiment shifted from relative optimism to doom and gloom and back again. While it is clearly too early to definitively say that this phase is over, it is reassuring to note that global inflationary indicators were starting to look more benign towards the end of the year. As a result, the outlook for interest rates has started to come down while economic activity seems to be holding up. This combination suggests an increasing chance that inflation can be bought under control without the need for a damaging recession.

Under these circumstances it is no surprise that equity markets performed well into the end of the year, with the FTSE All-share index ultimately posting a positive return for 2023 as a whole.

. . . . . . . . . . .

Sir Laurie Magnus CBE, chair, City of London, 16 February 2024

The tightening of monetary policy in 2022 and 2023 by the world’s leading central banks is expected to lead to a further reduction in the rate of inflation. A significant slowdown in economic activity, however, appears unlikely as consumers continue to draw down excess savings from the Covid lockdowns and employment statistics remain relatively buoyant. Although it is generally accepted that interest rates have now peaked, market expectations for cuts may be exaggerated given continuing wage increases and “quantitative tightening” by central banks. There are also considerable risks resulting from the current war in the Middle East, with a widening conflict, such as the recent hostilities in the Red Sea area, raising the prospect of further political and economic turbulence including the disruption of supply chains and destabilisation of energy markets, as observed already in the Ukraine conflict.

UK equities remain attractively valued relative to overseas equivalents. This has encouraged further takeovers of UK companies by private equity firms and foreign businesses, including the acquisition of Round Hill Music Royalties Fund from the Company’s portfolio. There has subsequently been a bid in January 2024 for Wincanton, another of City of London’s investee companies, from a large French private company. More takeovers can be expected while the discounted value of UK equities relative to global peers persists. Although the prospect of political change in the UK may weigh on equity valuations until after the general election, the compelling dividend yields from many companies effectively “pay investors to hold on” and should help to mitigate the downside risks of current uncertainties.

. . . . . . . . . . .

Andrew Bell, chair, Diverse Income, 13 February 2024

There is a well-known pictorial illusion which, depending upon the viewer’s perspective, can look like a duck or a rabbit (Google “duck or rabbit” to see). For much of the second half of 2023 this was what faced investors. Inflation rates were falling sharply, and interest rates had reached a plateau, but was the reason that higher rates were leading economies towards a recession (the hard landing fear) or that inflation had been more transitory than was diagnosed in 2022 so that its elimination did not require a recession and economies could rebound as it fell?

Either way, expectations have grown that interest rates have peaked in most major economies and will begin to decline in 2024. At the time of writing, it remains unclear whether this will occur to revive depressed economies or to reward declines in inflation in economies experiencing modest or weak growth. One scenario would argue for defensively hunkering down, the other in favour of looking forward to better times. Our strategy is adaptable to either. Diverse Income’s manager aims to invest in well-managed, soundly financed companies which prosper in normal times but are able to use their cash flows and access to capital markets to gain strength in tougher conditions.

Partly as a consequence of the long-term structural factors that have contributed to the derating of the UK market, one particular feature of the past year has been the opposite directions taken by the large-capitalisation companies and the rest of the market, continuing the trend seen in 2022. In late October 2023 the large caps were little changed, while the mid and smaller capitalization stocks were down 5-10% and AIM stocks down almost 20%. When a market sustains a prolonged period of disengagement by investors, almost inevitably the less liquid parts suffer the most, a particular headwind for our manager’s investment approach, which by design invests across the size spectrum. The consequence of recent shifts within the market is that the valuation gap in favour of smaller companies is as significant as it has been for many years.

More encouragingly, since late October, when there were tangible signs of the UK’s inflation performance improving (alleviating fears of a further series of interest rate rises), the ensuing market recovery has been led by smaller and mid-sized companies. If this trend continues, the Company’s exposure to smaller companies can be expected to become a tailwind and see better rewards in the coming year, on the back of improved earnings performance (as the cost and demand hurdles abate) and a greater willingness of investors to give credit for the fundamental performance of smaller companies.

. . . . . . . . . . .

Asia

(compare Asian market funds here, here, and here)

Nicholas Yeo and Elizabeth Kwik, abrdn China, 16 February 2024

The Financial Year was marked by considerable market volatility, with a sharp contrast between strong performance in the first six months, followed by an extended period of weakness in the second half. At the beginning of the Financial Year, the central government’s strict Covid policies hampered economic progress. As the authorities pivoted to reliance on herd immunity, policies were removed more quickly than expected. This effectively brought to an end to the nationwide zero-Covid policy. Share prices briefly surged on hopes of a big increase in activity, fuelled by the knowledge that considerable demand had built up during the Covid lockdowns. However, the strength of the recovery proved rather underwhelming and short-lived and company reports began to indicate that the market had run ahead of corporate fundamentals.

Other factors also began to influence sentiment. Among them was the difficult global macroeconomic backdrop, as many central banks tightened monetary policy as they attempted to stem inflationary pressures. Added to this was a flare-up in geopolitical tensions between the US and China. At home, there were growing concerns about the financial health of China’s domestic real estate sector. Liquidity problems made life very difficult for some of the heavily indebted property giants, epitomised by Country Garden, one of the country’s top three developers, which subsequently defaulted on an international bond. The high level of debt held by local government was also a concern, given the cost of servicing the debt and the fact that it is not permitted to sell land.

As China’s economic recovery faltered, calls mounted for central government measures to support demand. Gradually some measures were implemented, but it became clear government was hesitant to provide the level of support investors expected, preferring to drip-feed a range of small, targeted measures, as opposed to an immediate and powerful boost.

The mood was lifted by a Politburo meeting in July when the government indicated a significantly increased level of economic support, aimed at improving the operating environment for private enterprises and the platform economy, boosting capital markets, and increasing investor confidence. Other measures included support aimed at the struggling property sector, including 1 trillion yuan in planned government bond issuance for infrastructure investment. Towards the end of the Financial Year there were signs the medicine was beginning to work, with third-quarter Gross Domestic Product (“GDP”) better than expected.

If the global macroeconomic picture remains soft, more support may well be necessary, especially in the real estate sector. For investors, history suggests a patient, long-term approach leads to the best returns and that is likely to be the case once again in China.

. . . . . . . . . . .

Global emerging markets

(compare global emerging markets fund here)

Aidan Lisser, chair, JPMorgan Emerging Markets, 23 February 2024

The past three years have certainly been challenging. As highlighted in my 2023 annual statement, rising interest rates have put the Company’s quality growth strategy under pressure, by undermining the valuations of some portfolio companies. At the same time, the Company has had to navigate through a global pandemic, the Russia-Ukraine war and an insipid Chinese recovery.

However, looking ahead in 2024, there are reasons to be more optimistic: emerging market economies are in general doing well, with stronger growth, less inflation and lower debt than their western counterparts; meanwhile falling global inflation should provide emerging market central banks with scope to cut interest rates in due course; lower rates should, in turn, bring relief to household and corporate balance sheets; the US dollar is down considerably, which eases the interest burden on emerging market debt; and China’s economy is growing, albeit more slowly than previously expected, but still faster than most developed economies. Furthermore, valuations have fallen, and earnings are forecast to grow strongly in 2024/25. That said, in political terms 2024 will be a busy and complex year, with the recent Taiwanese and Indonesian presidential elections to be followed by elections in India, Mexico and South Africa, as well as in the US and Britain.

In addition, the long-term case for investment in emerging markets remains strong, thanks to their superior economic growth prospects, and favourable demographics, which will continue to drive incomes and consumption. And there are many high-quality, innovative, disruptive businesses in these markets capable of capitalising on the various investment opportunities such economic vibrancy generates.

. . . . . . . . . . .

Managers, Gulf Investment Fund, 21 February 2024

Saudi Arabia

The Saudi government plans to continue with its expansionary policy with expenditures dedicated to education, healthcare and social development initiatives along with the country’s major infrastructure projects.

Saudi Arabia won its bid to host the Expo 2030 which is expected to attract more than 40 million visitors and is expected to be implemented with a planned outlay of SAR 29.3 billion (US$7.8 billion). The country was the lone bidder to host the FIFA World Cup in 2034. This should lead to more event-driven infrastructure spending.

Saudi Arabia is offering a 30-year tax break to global companies moving regional headquarters to the country, as part of its Vision 2030 agenda to diversify its economy away from oil. The package includes a zero per cent rate for corporate income tax and withholding tax related to approved regional headquarters activities.

Qatar

Qatar’s 2024 decrease in revenues is largely on the back of a lower average oil price assumption of $60 per barrel for 2024 ($65 in 2023). Qatar is set to invest over USD 19 billion in 395 projects spanning water and electricity networks, public services, and road infrastructure.

UAE

The UAE has approved a budget for 2024-2026 with a total estimated expenditure of US$52.3 billion. The 2024 budget, recently endorsed, expects revenues of US$17.9 billion and expenses of US$17.5 billion, resulting in a projected surplus of US$0.5 billion.

The UAE economy should continue to see strong non-oil GDP growth into 2024. The tourism sector achieved a 19.9 per cent year-on-year increase in visitors to Dubai, totalling 15.4 million during the period of January to November 2023.

The UAE industrial sector’s contribution to gross domestic product reached about AED 197 bn (US$53.6 bn) in 2023 achieving 30 percent of Operation 300 bn’s target since it’s 2021 launch.

Kuwait

Has approved US$5.6 bn in capital spending to enhance crude output capacity and develop gas resources. The initiative aims to increase oil production to 3.5 million barrels per day by 2030 and meet domestic gas demand.

It has unveiled a four-year program encompassing 107 major projects, spanning economic, social, entertainment, and human resources sectors. The ambitious initiative aims to address demographic challenges by revising residence laws for foreigners and reducing the expatriate population, which currently constitutes nearly 70 per cent of Kuwait’s 4.5 million residents. Notable projects include participation in the Gulf Railway, the construction of Kuwait Airport Terminal 2, and an increase in flight numbers from 240,000 to 650,000. The program also targets an increase in free natural gas output from 521 million cubic feet to 930 million cubic feet daily at the end of the program.

Oman

Has set a budget for 2024 with total projected revenue of US$28.6 bn, based on an oil price of US$60/barrel, expenditure of US$30.3 bn, resulting in a deficit of US$1.7 bn or 1.5 per cent of GDP in 2024. Oil revenues in the 2024 budget constitute 54 per cent of total revenues, while the gas sector’s contribution amounts to 14 per cent and non-oil revenues represent 32 per cent of total public revenues. The 2024 state budget is geared towards enhancing the business environment and increasing private sector involvement in economic development.

Non-hydrocarbon growth accelerated from 1.2 per cent in 2022 to 2.7 per cent in the January-June period of 2023. This acceleration was attributed to the recovery of Oman’s agricultural and construction activities, along with a resilient services sector.

Oman is strategically investing over US$30 bn in the hydrogen economy, aiming to become one of the world’s leading hydrogen producers by 2030.

. . . . . . . . . . .

North America

(compare North America funds here and here)

Stephen White, chair, Brown Advisory US Smaller Companies,

12 February 2024

For much of the half year under review, US equity markets moved within a narrow trading range, with low volatility, reduced trading volumes and restrained corporate activity.

Geopolitical risks remained elevated with the ongoing war between Russia and Ukraine and then, in October, the Hamas terrorist assaults on Israel and the latter’s significant response, but these only impacted to a limited extent on financial markets.

US domestic news, be it political, economic or corporate, continued to be mixed, pulling markets in both directions, unsure as to whether the economy would hit a ‘hard’ or a ‘soft’ landing in 2024.

However, the main driver of markets in this period, was the perceived direction of US monetary policy and interest rates as well as an assessment of when a pivot was likely to take place.

Having paused in June, the Fed at their July meeting raised the benchmark interest rate by 25 basis points to a 5.25%-5.50% target range, a 22-year high. The Chairman, Jerome Powell, reiterated that the Fed was focused on bringing down inflation to its 2% target, suggesting that they had ‘a long way to go’, even though tighter conditions would weigh on economic activity. At subsequent meetings and important speeches, such as Jackson Hole, the Fed and its members stuck to their mantra that inflation risks remained on the upside and that rates would have to stay higher for longer.

Against this background, coupled with data showing the economy and the jobs market to be resilient, bond yields climbed steadily higher, with the 10-year Treasury bond yield briefly touching 5 percent in October. The US equity markets reflecting the bond markets lost value, falling for three consecutive months. Small cap stocks were again the laggards, as investors continued to favour the mega-caps, particularly those now known as the ‘Magnificent Seven’, and other technology stocks with any perceived connection to artificial intelligence.

November saw the start of a rebound in markets as the Fed began to change its tune. While it held the federal funds rate steady, its Chairman noted that financial conditions had tightened ‘significantly’. Reinforced by softening employment and inflation data, this encouraged hopes that the Fed’s tightening cycle was over and that a ‘soft economic landing’ was likely. 10-year yields dropped quickly and as much as they had done at the time of the global financial crisis.

The Fed’s meeting in December boosted optimism again as the inflation numbers continued to improve and members of the committee suggested that cuts in interest rates would come during 2024. Share prices responded positively to the further fall in bond yields as investors reallocated monies to the equity market in anticipation of a year-end rally.

Although the mega caps continued to perform well, a general broadening of buying interest fuelled a renewed demand for smaller companies. The sudden large inflow of funds into the sector boosted share prices with especially large gains seen in the more speculative stocks or those that had been heavily shorted as operators rushed to buy back their positions.

As a result, the Russell 2000 had its best December rally ever. However, this did not really benefit the Company, given its limited exposure to lower quality, heavily indebted and speculative stocks. This was the main cause of our underperformance relative to the benchmark. Over the six-month period, in sterling terms the Russell 2000 achieved a total return of 7.8%, comparable to that from the S&P 500 of 7.7%, and only slightly below that of the Nasdaq of 11.0%.

. . . . . . . . . . .

Financials and Financial Innovation

(compare financials and financial innovation funds here)

Simon Cordery, chair, Polar Capital Global Financials Trust, 15 February 2024

2023 proved to be a most frustrating year for investors in the global financials sector. While we saw broad stock market improvements over the period, predominantly led by technology, the financials sector underperformed, following a few years of relative out-performance. Sentiment has not been favourable towards the sector despite a backdrop of historically low valuations and improving profitability at banks in particular. It seems that rising interest rates, high inflation and the fear of a slowdown in economic growth weighed more heavily on investors’ minds.

Several US bank failures and the controversial events surrounding the distressed Credit Suisse sale to UBS also played their part in denting confidence in the sector. Although high interest rates are generally favourable to the performance of banks, investors are focusing instead on the potential for loan losses which these might cause. However, as interest rate hikes moderate and succeed in reducing inflation to target levels, central banks may start the process of lowering rates once more and this should act as a catalyst to investment in the financials sector.

The highest interest rates in more than a decade have offered investors an almost risk free safe haven in the form of government bonds and even cash, with an appealing headline return (before the effects of inflation). This has provided a credible alternative to equities and corporate bonds; investors currently seem happy to wait for a better time to invest their cash.

Geopolitical risk remains high. The ongoing war in Ukraine and the consequences of COVID continue to impact economic activity. Energy prices remain volatile and supply chain issues persist. The opening up of China, post the ending of zero- COVID polices, has not provided the fillip to the investment markets expected this time last year. The troubles of the Chinese property market and their impact on the local banking sector seem yet to be fully realised. These factors have dampened investment and broader economic activity. The more recent conflict within the Gaza Strip has stoked geopolitical risk issues and raised tensions across the Middle East. None of this is helpful in moving investor sentiment to increase risk. A speedy resolution in the Middle East and any sign of improvement with regards to Ukraine would be positives for investors but it is difficult to see either development currently.

. . . . . . . . . . .

Property

(compare UK property funds here, here, here, here, here, here and here)

Ian Hawksworth, chief executive of Shaftesbury

London and particularly our West End portfolio continues to display its enduring appeal and resilience as a leading global destination with strong leasing demand across all uses. It has been an excellent start as Shaftesbury Capital, with good progress on integration and positive metrics delivered across the business. The occupational market increasingly demonstrates strong polarisation of demand and a flight to quality. Our West End portfolio continues to attract target brands and concepts. There is strong demand for good quality, sustainable space with high amenity value. The West End, and particularly our portfolio, is a destination of choice for both market entry and expansion. It is a strong retail leasing market with units often attracting interest from multiple occupiers. Availability of restaurant and leisure space is very limited given the strong trading prospects together with constrained planning and licensing policies.

We are confident in the growth prospects of the West End which continues to demonstrate its enduring appeal and our portfolio is well-positioned to outperform. We are already seeing the benefits of the merger with excellent levels of activity and a strong leasing pipeline. Footfall within our portfolio is high, customer sales are tracking well ahead of 2022 levels and there is limited vacancy across the portfolio.

. . . . . . . . . . .

Rita-Rose Gagné, chief executive of Hammerson

The recovery in footfall that we saw across our assets in FY 22 continued through FY 23 with consumers also increasingly returning to city centres, both for leisure and work. Footfall was +3% year-on- year (UK+1%, France +7% and Ireland +4%), closing the gap on 2019 levels, which we are now on average less than 10% below. Average dwell time was up 5% to 88 minutes. Overall, total sales and sales densities have risen by mid-teens percentages since 2019, with substantial evidence that repurposed space and new concepts materially outperform that which it is replacing.

Consumer spending continues to be resilient, with an improving outlook for 2024. Despite the ‘cost of living’ crisis, savings built during the Covid-19 pandemic, high levels of employment and strong wage growth, which outpaced inflation in the second half of 2023, have helped underpin continued consumer spend, along with evolving lifestyle trends. Like-for-like sales were up 1% in the UK and 3% for France.

The consumer and occupier landscape continues to evolve at pace. Occupiers are continuing to shift to using physical space for a broad mix of uses, including: point of sale; last mile fulfilment; returns; servicing; experiential; marketing; brand development; education; workspace; and leisure – ‘living spaces’. At the same time, visitors demand top quality environments and experiences. We continue to invest in our assets to partner with best-in-class occupiers to cater to the communities and catchments in which we operate, whether this be repurposing of obsolete department store space into leisure and modern retail, or redevelopment to residential, workspace, healthcare and lifestyle uses.

Whilst our eyes are open to the current macro-economic environment, our occupiers are thriving and our visitor numbers are on the rise in our realigned portfolio. City centres remain the dominant locations for commerce and lifestyle. Our destinations are in high demand by occupiers and visitors. The importance of a physical presence in a digitally integrated strategy for best-in-class operators is undeniable.

. . . . . . . . . . .

Paul Williams, chief executive of Derwent London

London is maintaining its long-term reputation as a world-leading city with broad appeal to a diverse range of businesses and investors despite the ongoing macroeconomic challenges. Following its peak at 11.1% in October 2022, CPI inflation declined significantly through the course of 2023, ending the year at 4.0%. The hike in UK interest rates appears to have concluded, with base rate on hold at 5.25% since August. On the assumption that inflation slows further towards the 2% target, the consensus expectation is for a series of base rate cuts in 2024 and beyond.

Market interest rates have responded positively to slowing inflation but remain volatile. The yield on the 10-year UK gilt, which started 2023 at 3.7%, ended the year at 3.6%, having peaked at 4.7% in August. However, since the start of 2024, it has increased again to 4.1%. This reflects both a small rise in inflation in December and more cautious ‘higher for longer’ commentary from central banks.

Combined with the higher cost and restricted availability of debt, sentiment in the investment market was subdued in 2023. Meanwhile, the occupational market has remained strong for the right product in the right location. Businesses are focused on their longer-term real estate strategies and the flight to quality is continuing. With constrained availability and a thin forward development pipeline, rents for the best space are rising.

The vacancy rate across central London rose 1.7% in 2023 to 9.1%. However, averages do not show the full picture. West End vacancy is 4.4%, compared to the City at 11.9% and Docklands at 16.7%, while availability of new space rose more slowly than secondary space. We believe that the supply of new buildings has rarely been more constrained, particularly in the West End, which helps to explain why rents here are rising.

According to CBRE, the amount of space currently under construction across London is relatively low with 12.9m sq ft due to complete by 2027, of which 7.9m sq ft (62%) is currently available. Compared to long-term take-up, this equates to eight months’ supply (and 11 months’ supply in the West End) of new space being delivered over the coming four years.

London has broad appeal to a diverse range of businesses, both by sector and by size. We are encouraged by the substantial 74% increase in overall active demand to 9.9m sq ft at the end of 2023, which indicates a rapid rise in interest from a range of sectors.

Economic prospects are an important demand driver for offices. Growth in jobs, population and the economy, alongside inflation prospects all have an impact. According to CBRE, following a boom in office job creation over the last three years (+415k new jobs), a further c.165k (net) positions are expected to be created over the next five years and there is a continuing increase in the number of companies requiring staff to come back to the office. The demand outlook for London offices remains positive. London real GDP growth of 1-2% per annum is forecast to continue outperforming the UK and there is an ongoing increase in the population of c.0.9m to 10.6m by 2035.

We have previously anticipated an acceleration in rental growth for the best buildings. Occupier demand continues to focus on well-located space with best-in-class amenity and service, while existing supply and the development pipeline are restricted. We expect these conditions to become increasingly favourable through 2024 and as such increase our portfolio rental guidance for the year to a range of 2% to 5%, with our better buildings to outperform.

Over the last few years, we have reduced our exposure to buildings which can no longer meet evolving occupier requirements and have invested significant capital upgrading our remaining portfolio. With inflation continuing to reduce and the cost and availability of finance improving, property yields are expected to respond, following a period of substantial increases. We believe we are now approaching the end of this yield cycle, with transaction volumes expected to increase and for opportunities to emerge.

. . . . . . . . . . .

Joe Lister, chief executive of Unite Group

Structural factors continue to drive a growing supply/demand imbalance for student accommodation. Demographic growth will see the population of UK 18-year-olds increase by 124,000 (16%) by 2030, supporting growing demand for UK Higher Education. Demand from international students also remains high, as reflected in the 23% growth in overseas students since 2019/20 (source: HESA).

Many university cities are facing housing shortages and our investment activity is focused on those markets with the most acute need. Since 2021, there has been an 8% reduction in the number of HMOs in England (source: Department for Levelling Up), equivalent to 100,000-150,000 fewer beds available for students to rent. Private landlords are choosing to leave the sector in response to rising mortgage costs and increasing regulation. New supply of PBSA is also down 60% on pre-pandemic levels, reflecting planning backlogs and viability challenges created by higher costs of construction and funding. Obsolescence of older university accommodation is also expected to increase due to building age and the need to operate buildings more sustainably. In many cities, property valuations are below replacement costs, further constraining new supply.

The combination of these factors has significantly increased demand for our accommodation in many cities and we expect this supply challenge to continue for a number of years.

. . . . . . . . . . .

Steven Owen, chairman of Primary Health Properties

The primary care market continues to face challenges in meeting the growing demand for healthcare services. The capacity of existing facilities remains a significant obstacle to implementing government policies aimed at expanding service delivery within general practice, including social prescribing, clinical pharmacists, physiotherapists, mental health, minor operations and other activities. The need for additional space is driven by a population that is growing, ageing and suffering from increased chronic illnesses, which is placing a greater burden on healthcare systems in both the UK and Ireland. The extent of the NHS England backlog remains a significant concern, with hospitals struggling to meet objectives for cancer care and routine treatments. The number of patients waiting for treatment has reached record highs, exacerbating the need for improved and increased primary healthcare infrastructure with approximately one-third of the UK’s current primary care estate in need of replacement.

There is a growing expectation that many services in the medium term will progressively move from hospitals to primary care settings, necessitating substantial investment in facilities to accommodate these changes and alleviate the pressure on secondary care in the years to come. The UK government’s vision for primary care premises, advocating the establishment of hubs or “super hubs”, is a step in this direction. The UK government’s vision is that these hubs promote collaboration among primary care staff and provide a wider range of services in a single location. Larger GP practices with more staff and facilities are shown to produce better patient outcomes. This is in line with larger purpose-built medical centres typical of PHP’s portfolio and our own ongoing engagement with occupiers where many surgeries require more space.

Declining rents in real terms have made investing in the transformation of GP facilities less appealing. Construction costs have risen significantly over the past decade, surpassing the growth in primary care rents, driven by material and labour costs and increasing sustainability requirements, all of which has been compounded by Brexit, the COVID-19 pandemic and the fiscal policy outlook.

Future developments will now need a significant shift of between 20% to 30% in rental values to make them economically viable and we continue to actively engage with both the NHS, Integrated Care Boards (ICB) and District Valuer (DV) for higher rent settlements. However, despite these negotiations typically becoming protracted, we are starting to see positive movement in some locations where the NHS need for investments in new buildings is strongest. We are aware of instances where the ICB have stepped in and overruled the DV’s proposals when those have prevented much needed schemes from progressing. This along with the use of “top-up” rents and capital contributions is starting to allow certain schemes to progress viably and we anticipate this will accelerate.

The commercial property market continues to be impacted by economic turbulence but primary care asset values have continued to perform well relative to mainstream commercial property due to recognition of the security of their government backed income, crucial role in providing sustainable healthcare infrastructure and more importantly a stronger rental growth outlook enabling attractive reversion over the course of long leases.

We continue to see that for both the primary care and indeed the wider commercial property markets, the high level of financial market volatility and economic uncertainty has resulted in a ‘wait-and-see’ attitude amongst investors, which is expected to continue until the UK interest rate outlook moderates and becomes more certain. However, notwithstanding the significant increases and volatility in interest rates seen in 2023, we continue to believe further significant reductions in primary care values are likely to be limited with a stronger rental growth outlook offsetting the impact of any further yield expansion.

. . . . . . . . . . .

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.