Economic and Political Roundup

Investment companies | Monthly | January 2024

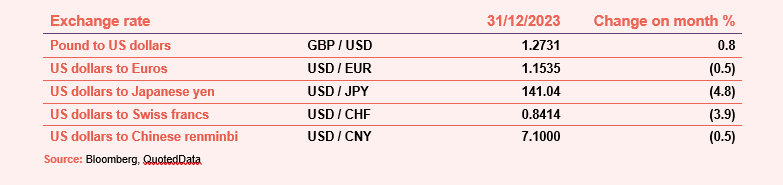

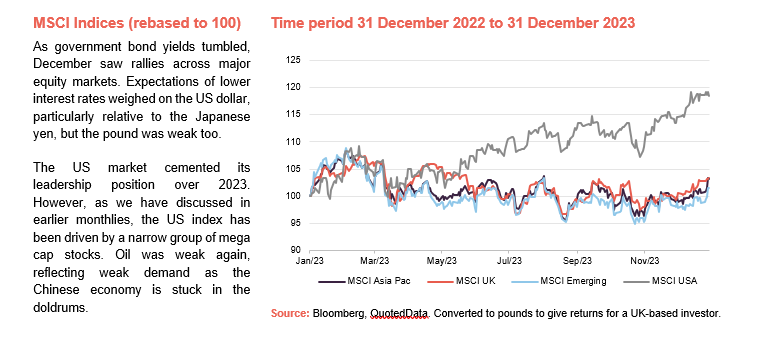

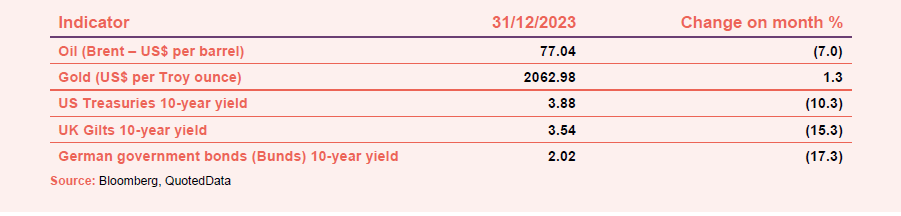

Political turbulence persisted in December, ushering in a new wave of global uncertainty in the build up to the 2024 election cycle. In spite of this, confidence in the US remained high as falling yields precipitated a global rally in risk assets. Market pricing now foresees six US interest rate cuts over 2024, with inflation as measured by the Fed’s favoured personal consumption index, falling below its 2% target rate, when measured on a six-month basis.

While softening, economic growth continues to run well above trend, coming in at 4.9%, and labour market strength was again on show, beating expectations to add 216,000 jobs.

“Inflation has eased from its highs, and this has come without a significant increase in unemployment. That’s very good news.” — Jay Powell, Federal Reserve chair

The positive mood extended to the UK as falling yields and an improving inflation outlook boosted returns, particularly in more economically sensitive areas of the economy which make up a large chunk of the market. Growth remains a concern however, with GDP dropping in the third quarter, and while inflationary data has improved dramatically, the threat of stagflation lingers.

Across the channel, the Eurozone finished the year strongly as inflation fell to 2.4% in November, down from 2.9% the month prior. The data stands in stark contrast to last year’s figures where the annual rate of inflation was 10.1%.

Still, it was not all good news, with European Central Bank forecasting a relatively grim growth outlook. Vice President Luis de Guindos spoke of incoming uncertainty, with prospects ‘tilted to the downside’.

At a glance

Global

(compare global investment funds here, here, here and here)

Nick Greenwood, manager, MIGO Opportunities Trust, 19 December 2023

The period under review was one of the toughest in recent years for the investment trust sector. It faced a perfect storm. This reflected a combination of four factors: rising UK interest rate expectations, kneejerk selling in the face of weak share prices, the rapid consolidation of the wealth management industry and, most importantly, the methodology used to disclose costs which makes closed end funds appear expensive when compared to their open ended peers.

Expectations as to where UK interest rates would peak steadily rose. At one point, forecasts approached 6.5%. During the summer it was possible to buy a two-year gilt on a redemption yield of 5.4%. Bearing in mind the vast majority of this return is effectively tax free for many investors, the ability to get a decent income from conventional sources undermined demand for many trusts. These were created to find a solution to the lack of income at a time when deposit rates were close to zero. In the new environment they needed to yield a premium to gilts which meant that share prices needed to fall. The sharp declines reflected a lack of demand rather than concerns about the quality of these trusts’ underlying investments. This provided an arbitrage opportunity given that in many cases demand for what the trusts owned remained steady. It was simply the structure in which they were held which was out of favour. It is in the alternatives sector where the bulk of our research efforts are currently focused seeking portfolios which have the scope to grow both net asset value and dividends.

In recent decades the wealth management industry has been a significant owner of trusts. Investec’s recent merger with Rathbones highlights the extent of the last decade’s consolidation from hundreds of small independent private client stockbrokers into a small number of major national chains. Given the newly combined organisation will have assets under management of £100 billion, it is difficult to see how these organisations will be able use closed ended funds in the longer term. In order to move the needle investors would want potential investments to represent at least 1% of their portfolio. In the case of a £100 billion pound pot this means buying a billion pounds’ worth of shares. Even in the case of the very largest trusts, this would be challenging. In the shorter term any unwinding of exposure is likely to be felt in trusts with market capitalisations between £500 million and £1 billion in size which until recently were big enough for the mega chains to include within portfolios.

The most serious threat comes from the unintended consequences of regulation which threatens the sector’s very existence. The methodology behind the calculation of underlying costs continues to drive capital from the sector. Investment trusts now appear very expensive especially in alternative asset classes such as shipping, private equity and second-hand life polices, where these calculations throw up some very strange results and, as a result, many trusts are uninvestable for some types of investors whose products are marketed on grounds of low cost. Whilst there has been some encouragement lately with HM Treasury acknowledging the problem and the issue being debated in the Houses of Parliament, we may have to wait some time for reform. Furthermore, it is clear that advisers have reacted to weak trust share prices associated with widening discounts by selling.

These challenges have supressed demand and left the market oversupplied. Given that trusts trade wherever the balance of supply and demand lies, it is not surprising that discounts across the sector stand close to widest ever levels. Previous occasions when share prices fell this far below the value of underlying portfolios were times of extreme stress in markets such as the global financial crisis.

We have heard the death knell sounded for investment trusts many times before. The sector has always evolved and progressed. There are self help measures which can be adopted. Oversupply can be dealt with via buy backs. The law of natural selection is alive and well in the world of closed end funds and we expect to see the recent trend of mergers and wind downs to continue. There are new audiences to focus on, such as self-directed investors and newer wealth management businesses often staffed by individuals who have departed the vast chains. Despite experimental capital structures being mooted, the closed end fund is the best structure for accessing illiquid asset classes. The travails of open ended property funds sum up the challenges and explain why investment trusts will continue to exist.

. . . . . . . . . . .

David Higgins, Majedie Investments, 15 December 2023

Markets have largely completed a transition to a new regime that will be characterised by higher interest rates, variable liquidity, and more geopolitical and cyclical volatility. Many of the tailwinds upon which the fortunes of conventional investment strategies rode have turned into headwinds. Against a backdrop that is likely to be more challenging, an investor’s ability to identify – and capitalise upon – idiosyncratic, bottom-up situations will be critical to success.

The global economic outlook is uncertain and is likely to remain so. When framing our decisions, we do not dismiss the possibility of a recession over the next 12-24 months. We can identify numerous possible threats to the equilibrium of markets, which include a sharper-than-expected economic slowdown, geopolitical instability, a possible resurgence of inflation (which would most likely be caused by rising commodity prices), or some other extraneous variable. The ‘equity risk premium’ is low by historic standards, i.e. the projected earnings yield on equities is very close to the yield on long-dated government bonds, which suggests that stocks are expensive at an aggregate level.

Hence, at an asset class level, we are not especially bullish. However, we also believe it is a mistake to generalise, especially at a time of widening dispersion at an individual-security level.

There is no shortage of attractive bottom-up situations that meet our selection criteria, especially when one hunts for them in areas that are off the beaten track. Selectivity, and an ability to identify differentiated fundamental return sources, will be the key to unlocking good investment outcomes over the years ahead.

. . . . . . . . . . .

Peter Ewins, lead manager, The Global Smaller Companies Trust, 14 December 2023

Throughout the period under review, economic data was closely monitored particularly in relation to inflation and what signals this was sending concerning the outlook for interest rates. While headline inflation rates have moderated considerably over the period in the US, Europe, the UK and elsewhere over the last six months, they mostly remain above targeted levels, which prompted further interest rate increases. Labour markets remained generally tight reflecting demographics and the impact of the pandemic in many developed countries. This has driven elevated wage inflation impacting upon the corporate profit margin outlook.

Tighter monetary policy has been unhelpful for equity market sentiment and valuations. There is more competition for investors’ capital with higher investment yields now available on government and corporate bonds and more satisfactory returns also available from deposit accounts. Higher interest rates have acted as planned by central banks to slow their local economies. With fiscal policy providing more support plus the benefit of better momentum heading into 2023, the US economy remained more resilient than those in Europe and the UK, where the impact of higher energy and food prices has been more significant on the cost of living. Within Asia, the Chinese economy failed to pick up as much as had been expected following the easing of pandemic restrictions early in 2023 with the property market still suffering from over supply. Japan has remained something of an outlier, with no move up in interest rates driving further weakness in the yen and helping to deliver a relatively steady stock market performance.

As we move into the second half of the financial year, we are seeing some individual companies exposed to more discretionary areas of consumer and corporate spending reporting weaker trading as the impact of previous monetary policy tightening feeds through more broadly. However, since the end of October equity markets and smaller company shares in particular have rallied, helped by more encouraging inflation data. Performance looking forward is likely to remain highly sensitive to perceptions around the path of interest rates.

. . . . . . . . . . .

James Harries, fund manager, STS Global Income & Growth Trust, 13 December 2023

While equity markets have lacked direction, government bond markets have been on the move. Over this period the US 10-year yield has risen from 3.47% to 4.57%. This updraft may be a result of several factors, including the influence of other major bond markets, notably Japan, concerns over large-scale upcoming issuance and, most likely, a belief that growth is proving impervious to higher interest rates. Whatever the cause, it represents a significant change in the relative price of government bonds to equities. 4.57%, when compared to an historic earnings yield for the S&P 500 of 4.80%, implies a further compression of the equity risk premium.

Perhaps more striking has been the move in inflation-linked bonds. Again, over the same period, the yield on US 30-year US Treasury Inflation Protected Securities has risen from 1.40% to 2.30%. At the same time, the 30-year break-even inflation rate has remained remarkably stable at close to the Federal Reserve’s inflation target of 2% (2.40% as at 30 September 2023). At least according to markets, this is not about increasing inflation expectations. It is a function of an expansion in real yields driven by the rise in the nominal interest rate.

At the same time, not only have equities continued to trade towards the upper end of historical valuation measures (the US CAPE remains at 29.3x) but credit spreads have been tightening.

It would seem to us that although a higher cost of capital has been reflected in government bond markets, it has yet to be for risk assets. Time will tell how this apparent contradiction resolves itself – as the effect of the change in interest rates gradually works its way through the economy.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

John Dodd, Kartik Kumar, fund managers, Artemis Alpha Trust – 20 December 2023

UK investors are driving in the rain

Daniel Kahneman established the concept of “loss aversion”, which is a cognitive bias impacting decision-making under uncertainty. The simple notion is that basic survival instincts impact human nature meaning that the pain of loss is felt more highly than the pleasure of an equivalent gain.

Kahneman’s demonstrated loss aversion with New York taxi drivers in the rain. A taxi driver earns more per hour when it is raining than when it is sunny and there is less demand. The price of a driver’s leisure is therefore lower when it is sunny. Counterintuitively, Kahneman found that taxi drivers work harder when it is sunny and less when it is rainy. This is because low income on a sunny day feels like lost income.

The same concept explains why golfers statistically make fewer successful putts for birdie than for par. A bogey feels like a loss, whereas a par does not.

The concept of loss aversion is widely applicable to financial markets where volatility in prices creates loss aversion. Customers in a supermarket will buy more goods when they are on sale, but investors in a stock market do the opposite. Investment trusts discounts widen after markets fall and fund outflows are highest after markets decline, not before.

Our view is that loss aversion is impacting behaviour in UK equity markets following poor and weak absolute and relative performance. One clear indicator is the fact that there have been over £76bn in outflows from UK funds since 2016. Another is the near halt in the market for initial public offerings after a boom in 2021.

Our approach to investing is aimed at helping to combat these natural instincts and take advantage of the opportunity it creates. In forecasting the prospective returns of a stock by estimating earnings and exit multiples, we are forced to see that, all else being equal, prospective returns rise when prices fall.

This approach can be seen in the current positioning in several respects. First, we have held on to poorly performing holdings where we retain conviction in future returns. Secondly, we have utilised gearing to increase our net exposure. Thirdly, we have made switches into holdings where we perceive risk-adjusted returns to be higher. This approach created significant value between March-September 2020 when prices were depressed, and sector dispersion was high.

Misperceptions over nominal yields and duration

The UK’s National Savings and Investment (NS&I) scheme raised over £10bn between April and September with one product offering a 1-year interest rate of 6.2%. UK investment platforms have seen weak flows as a result. There is a widespread view that equities are no longer attractive because of the yield now available on cash.

There are multiple issues with this comparison.

Firstly, company earnings and dividends tend to grow with economic and corporate prosperity. This means that mathematically, a business earning high returns on capital (e.g. 20%) that grows earnings by 3% per annum, will return more than 6% per annum even if it is purchased on a PE ratio of 25x. Both the earnings yield and dividend yield of this stock would be materially lower than 6%, but theoretically the return should be in excess of 6% owing to the growth generated.

Secondly, the duration of equities must be considered. Equities offer a perpetual claim on the earnings of a business. They are among the most long-term of all financial instruments. You should not be in equities if you do not have a long-term horizon.

A short-duration instrument, such as a 1-year savings product carries reinvestment risk, which is the risk that you cannot reinvest cash flow in the future at the current rate on offer. If your objective is to maximise your wealth over 5 or 10 years and you invest in a 1-year product, your long-term returns will be less certain.

The other important consideration with duration is that the longer the duration, the more sensitive the security’s value will be to changes in interest rates. This explains why investors in long-dated bonds have suffered significant losses in 2021 and 2022 as interest rates rose. Equities are long- duration instruments, but their values offered more resilience than bonds as their earnings grew with the inflation that prompted the interest rate increases.

Interest rates are likely above neutral and inflationary pressures appear to be abating. Equity values will be geared to a decline in interest rates as illustrated by the following quotation from Warren Buffett, writing in 2000:

“The best time to buy stocks… has been when interest rates were sky high, and it looked like a very safe thing to do to put your money into Treasury Bills… As attractive as that appeared, it was exactly the wrong thing to be doing. It was better to be buying equities at that time, because when interest rates changed, their values changed even much more.”

In a scenario where interest rates fall, a short-dated instrument will see reinvestment risk realised and will not capture the upside in values from gearing to duration.

. . . . . . . . . . .

Graeme Proudfoot, chair, BlackRock Income and Growth Investment Trust – 20 December 2023

In my statement in the Half-Yearly Financial Report, I noted that the picture had been dominated by powerful geopolitical and macroeconomic drivers, with markets focused on the path of inflation and interest rates. This pattern continued through the rest of our financial year to 31 October 2023. Developed market central banks continued to implement tight monetary policy in a bid to bring inflation under control. However, this action was not without consequences and the first signs of stress in the financial system were seen in March 2023, with several regional bank failures in the US and a subsequent Swiss government brokered take-over of Credit Suisse by UBS. The Bank of England (BOE) acted swiftly to ensure there was no contagion to the UK financial system, albeit credit conditions have tightened steadily throughout the year.

The rate of UK inflation, as measured by the Consumer Price Index (CPI), peaked at 11.1% in October 2022, since when it has steadily reduced during this financial year. By 31 October 2023, UK inflation had fallen to 4.60%, bringing some much-needed relief to UK consumers and corporates alike. Inflation had previously been driven by high energy and food prices and although they fell during the year, they remain far higher than in recent years. Robust demand and wage growth have been key factors in the path of inflation this year, and ongoing structural issues also in the UK labour market acted to keep wage settlements high. The BOE continued to implement its policy of monetary tightening throughout most of the year, although in September 2023 the Monetary Policy Committee voted to hold the base rate steady at 5.25%, still the highest level since February 2008. This ended a run of fourteen consecutive rate increases since December 2021, which news was well received by the UK equity market. In December, the US Federal Open Markets Committee voted to hold the base rate of interest steady at 5.25%. It also signalled that interest rate cuts were likely in 2024 which saw markets rise in response. However, the BOE was more hawkish, noting that UK wage demands remained elevated and that the MPC would continue to consider the economic data before a rate cut could be contemplated.

While the market continues to express a somewhat pessimistic view of the outlook for company valuations, our portfolio managers note that trading and, importantly, earnings remain strong for many of the companies within our portfolio. Despite the negative sentiment around the outlook, the UK economy has displayed notable resilience, with household balance sheets and corporate earnings in better shape than many anticipated. In fact, the UK managed to avoid a much feared recession in 2023 and although the economic data indicates our economy shrank in October 2023, it is forecast to return to modest growth in 2024. As a result, the likelihood of a ‘soft landing’ – a slowdown in economic growth that avoids a recession – may well have increased, although this remains to be seen. In any case, the current cycle of monetary policy tightening appears to have peaked, and markets are now focused on if and when interest rates will be cut; an event that may be the catalyst for a broader change in market sentiment towards UK equities.

Another feature of the challenging economic environment this year has been the compounding effect on corporate profit margins of higher input costs and rising wage demands. Our portfolio managers note that this rise in operating costs has, in many cases, been passed on to the consumer. However, they believe companies may soon find this passthrough more difficult to achieve. Therefore, pricing power will be a key differentiator in 2024.

Notwithstanding the headwinds described, like all good active managers, our portfolio managers view equity market volatility as an opportunity and have been buying into high-quality domestic and mid-cap names at very attractive valuations following share price weakness. They believe there is a marked disconnect between the valuations ascribed to many UK companies and the underlying fundamentals of sales, revenue and future growth prospects. They have also been selectively adding to existing holdings which they believe are well placed to prosper as the economic landscape in the UK evolves.

. . . . . . . . . . .

Ashe Windham, chair, Miton UK Microcap Trust, 13 December 2023

For several reasons, UK equities have been deeply out of favour with both domestic and international buyers, and especially since the Brexit vote in June 2016. The valuations prevailing in the US market have persuaded companies either to move there or to relist there. The UK currently represents only a 3.5% weighting in world indices compared to 10% in 2000. This is a precipitous decline, mirrored by the collapse in the number of UK listed equities overall. There were some 3,000 listed companies in 1997 as against just 1,213 today, a number that is being steadily eroded by an accelerating trend of takeovers, barely offset by a feeble number of Initial Public Offerings. In this calendar year to date, over 30 companies have already been acquired, mostly by foreign companies, or are in the final stages of being so. Unless swift government action is taken, the risk to London’s position as the premier global financial centre is very real.

Domestic institutions, predominately pension funds and insurance companies, have been dramatically cutting their weightings in UK equities. They owned more than half the market in the 1990s. Now they own just 4%, as they have conformed to world index weightings. Contrarians should find valuations attractive, with UK equities trading on around 11 times 2023 earnings per share, versus Continental Europe on 14 times and the US on 20 times. You might reasonably wonder how relevant this is to the performance of the Company. In short, the macro trends affecting UK equities have been felt most acutely at the lowest market capitalisation end of the market. The SmallCap index has lost around 5% of its constituents this year thus far, suffering a 20% reduction in its market capitalisation as a result.

Thanks to the inexorable retreat from UK small cap equities, hastened by attractive 5%+ yields on short-dated gilts, the market has been ‘offer’ only, except in a rare few companies. Nowadays, market makers hold very little inventory and even sales of small quantities of stock are sufficient to trigger double digit percentage falls in prices. The flip side is that when the mood music changes, the gains in the better companies will be explosive. The foundations for big gains in the next small cap bull market are being laid now, for those brave enough to invest in quality stocks with solid balance sheets in the AIM sector. The Numis Alternative Markets index peaked on 6 September 2021 and, by the end of October this year had fallen 46.8% – that is some bear market!

Robert Talbut, chair, Shires Income, 13 December 2023

The main macro-economic trend in the six-month period was the continued rise in interest rates as central banks attempted to tackle inflation. The US Federal Reserve increased rates from 4.75% in March to 5.5% at the end of September and the Bank of England increased interest rates from 4.0% to 5.25%. In both cases rising short rates together with the corresponding rises in longer-term bond yields, have seen a rapid tightening of financial conditions since the end of 2021. Markets have accepted the likelihood that interest rates will remain higher for longer, and that the previous period of ultra-low interest rates will not be returned to. It is, however, increasingly likely that we are close to the peak in interest rates. Inflation has started to decline as key input costs such as energy and agricultural commodities fall, and although more persistent inputs such as wage inflation remain high, recent data suggests that economic growth is slowing, giving central banks some room to consider interest rate cuts as we move into 2024.

Over the last twelve months the UK economy has defied the pessimists with economic growth being far more resilient than feared and more recent data has also indicated that the recovery post Covid has been at least as strong as elsewhere in the world. In the US, the economy has performed reasonably well, driven by robust consumer and business balance sheets and, alongside moderating inflation, this has increased the probability of a soft landing. By contrast, the Chinese and European economies are facing some headwinds. The Chinese property market is heavily indebted and in considerable excess supply, with developer and homebuyer confidence very low. However, policy is now easing, which should prevent further downside outcomes and deflation becoming embedded in the economy, and this could even surprise markets on the upside. But in the Eurozone and the UK, the pass-through of earlier monetary policy tightening reflected in both short and longer-term interest rates, is still likely to mean that economic growth remains subdued in 2024 given the effects on mortgage rates and corporate borrowing costs.

. . . . . . . . . . .

Investment managers, Worsley Investors – 13 December 2023

After the first two months of 2023 had been buoyant, U.K. stock market prices, whilst variable, as a result of a strong dichotomy between investor hopes for lowered interest rates and central banks’ determination to drive inflation down to target levels, now stand at just above their opening level.

This is in line with the view expressed in the Annual Report that economic uncertainty appeared set to continue for at least the remainder of 2023. Given the inherent delays in the impact of tighter U.K. monetary policy, and in particular higher borrowing costs, the prospects for U.K. company earnings in the first half of 2024 remain subdued.

The interim profit figures for British companies released in the period came in broadly in line with previously diminished expectations. Against that, once again a multitude of stocks with capitalisations below £150 million have seen their prices drop abruptly.

In the preponderance of instances these falls are the consequence of a substantial worsening in the outlook for the relevant sector, natural resources being a familiar example. Nevertheless, a proportion of the prices of well-founded companies also tend to fall prey to such sentiments and, inevitably, some come to be gravely mispriced and as such prospective investees.

. . . . . . . . . . .

Investment managers, Schroder UK Mid Cap Fund, 12 December 2023

UK equities rose over the period as the country emerged from a market crisis precipitated by the Truss/Kwarteng “mini-budget” in September 2022. The announcement of significant fiscal stimulus, without the usual checks and balances, prompted a spike in UK government bond yields, together with a sharp rise in market interest rates and mortgage rates. This put pressure on the UK pensions and fixed income market (LDI), prompting an intervention by the Bank of England. The market recovered as many of the policies announced were reversed, and the new chancellor Jeremy Hunt used his Autumn Statement to promise that the country would tighten its belt in the future.

While last year’s market turmoil in the UK was, to some extent, self-inflicted, other countries have since seen their government bond yields rise sharply and experienced their own crises. This has occurred against the backdrop of persistent global inflationary pressures, expectations of higher for longer policy interest rates and concerns around the sustainability of government budgets. Rising bond yields, for instance, have exposed management issues at US regional banks and forced the rescue of the investment bank Credit Suisse by rival UBS, in a deal facilitated by the Swiss authorities. It would seem as though change is afoot, in terms of the economic regime we have now entered, compared with the “lowflation” years following the 2007/08 GFC and, indeed, the three decade period of moderating inflation and rates starting in the 1990s.

Against this backdrop, equity markets and domestically focused sectors, in particular, have been sentiment driven and consequently very volatile. Valuations have fluctuated depending on whether macro-economic data indicated whether policy rates might be close to a peak for this cycle, or not. In this regard, the recovery in UK small and mid-caps over the period lost some momentum following the initial rebound from the lows of September 2022. More positively, towards the period end, market interest rates were relatively stable as the sell-off in UK government bonds moderated (while it accelerated in other territories, and in particular the US amid political disagreement over levels of government borrowing) and mortgage rates fell. This reflected hopes that near-term inflation pressures may be moderating, and UK base interest rates may have peaked for now, with the Bank of England’s chief economist Huw Pill, guiding the market to a “Table Mountain” rather than, previously, a “Matterhorn” shape for interest rates.

. . . . . . . . . . .

James Henderson and Laura Foll, fund managers, Lowland Investment Company, 4 December 2023

When we were writing last year’s annual report the expectation was that 2023 would be a recession year. This has not proven to be the case. While 0.4% real GDP growth in ‘23 (expected at the time of writing) cannot be classed as stellar it needs to be viewed in the context of interest rates rising to a decade high level and inflation coming down from over 10%. When we look ahead to 2024, we continue to see pessimism reflected in both company valuations and economic growth forecasts. The best remedy for this pessimism is to meet company management teams, who serve as a reminder of the dynamism and innovation that exist in the UK.

The consumer is enjoying real wage growth, with unemployment remaining low. Corporate balance sheets are, on the whole, conservative. Yet company valuations continue to reflect a deep scepticism about the sustainability of earnings. We disagree. The challenging backdrop of recent years (COVID, the Ukraine war) has forced companies to look hard at their cost base and run leanly. On any pickup in sales, it is therefore our expectation that the boost to earnings will be meaningful. The best returns can be made at times when earnings have the potential to grow and valuations are starting from a low base. It is hard to argue that we are not in those times currently.

. . . . . . . . . . .

Neil England, chair, Schroder British Opportunities, 1 December 2023

The world is an uncertain place as I write, and equity markets may well remain out of favour for the next few months. High interest rates and uncertainty over future rates have continued to be a major negative factor affecting investment companies that focus on growth. The assumption is that these companies will need cash to fund that growth and that will be expensive and/or difficult to get. Unfortunately, the market is not differentiating between those companies with genuine issues in this regard and those that have no such needs, as is the case with the vast bulk of our investments.

One result of this is that the price at which our shares are trading continues to significantly undervalue the Company as it does not reflect the strong fundamentals of our portfolio.

History suggests that within listed UK equities, small and medium sized growth companies are often the first to suffer in a bear market but also first to rerate on signs of recovery and a change in market sentiment. A reduction in interest rates may well be the trigger for this. UK inflation appears to have peaked, and some commentators are predicting a base rate reduction as early as Q2 2024. At the time of writing, we are experiencing some improvement in the share prices of our public investments. This has generated a post period end NAV increase of 4.7%.

. . . . . . . . . . .

Asia

(compare Asian market funds here, here, and here)SA

Sir Richard Stagg, chairman, JPMorgan Asia Growth and Income, 13 December 2023

Developed economies are likely to face further challenges over the coming year. Interest rates may now be at or near their peak in most countries and inflation pressures are subsiding. However, the monetary tightening already in place is yet to have its full effect on businesses and households. Recession may be avoided in most countries, but growth is likely to remain below trend in 2024.

The prospects for Asian economies seem brighter, both in the near and longer term. While Chinese economic growth is expected to slow from its rapid, pre-pandemic levels, GDP is still forecast to expand at a relatively strong pace over coming years. It is encouraging to see indications that Chinese government policy may be becoming more focused on growth at home and more open to collaboration with the west. Other Asian countries can look forward to years, if not decades, of strong growth and productivity increases thanks to the structural and social changes (including digitalisation, urbanisation and the expansion of the middle class) currently unfolding across the region.

The Board is conscious of the uncertain geopolitical environment in which Asian economies (like others) have to operate. We share, however, the Portfolio Managers’ enthusiasm for the many opportunities which this rapidly expanding region is generating. With valuations across most of the region at long-term lows relative to both historic levels and to the US and Europe, now seems a particularly auspicious moment to be investing in Asia.

. . . . . . . . . . .

Ayaz Ebrahim and Robert Lloyd, portfolio managers, JPMorgan Asia Growth & Income, 13 December 2023

Western economies have so far been surprisingly resilient to the high interest rates imposed by central banks trying to quash persistent inflation. However, financial conditions have changed around the world. Real incomes have been eroded by inflation and higher rates have raised the cost of borrowing for businesses and households. The full force of tighter monetary policy is expected to increasingly register with consumers and homeowners. Growth in the developed world is forecast to slow to around 1.5% and remain lacklustre in 2024.

Asia is set to fare better. The Chinese economy is expected to continue slowing, realising growth of around 4% next year, but this is still an enviable pace compared to western economies. And the Chinese government’s more pro-growth stance may see further efforts to reinvigorate the property market and support household incomes. India looks set to maintain its current pace of growth above 6% pa, consistent with the government’s long-term target, and the region as a whole, which accounts for 40% of the world’s GDP, is projected to grow at around 5% both this year and next.

The region’s longer-term outlook is also very positive. Asian nations are undergoing major structural and social changes such as rising incomes, urbanisation, infrastructure investment and digitalisation, which will ensure the region continues to grow rapidly, with domestic demand supported by the increasing prosperity of Asia’s burgeoning middle class. Furthermore, Asia is home to many innovative and dynamic companies that are leading the world in a wide range of industries, including semiconductor manufacturing, healthcare, renewable energy, next generation automotive production and financials. This provides us with many attractive long-term investment opportunities.

Current low valuations represent a great chance for us to invest in such companies at compelling prices. The MSCI AC Asia ex Japan Index is trading at a price to book ratio of 1.5x, below its long term average. Looking more deeply into the Index’s geographical constituents, valuations in China, Hong Kong and South Korea are also either close to or below their historical lows in price to book terms. India remains the sole market trading above its ten-year historical average valuation levels. Valuations at such compelling levels have already allowed us to add some new names to the portfolio at good prices, and to top up some existing holdings, as discussed above, but there are many other exciting opportunities still available to invest in companies well-placed to benefit from Asia’s exciting long term growth story.

For us, this is a most encouraging environment.

. . . . . . . . . . .

Schroder Investment Management, Schroder AsiaPacific Fund, 5 December 2023

The euphoria seen in markets at the beginning of 2023 over China’s move away from its “zero COVID” policy feels like a distant memory, as China’s long awaited post-COVID recovery has proved weaker than expected. Economic data out of China, and a lack of forceful policy response, has been disappointing, reigniting concerns over local government debts and the wider residential property sector. This has overshadowed more positive global developments stemming from more favourable US inflation data, its knock-on to the US interest rate cycle, and potential for a soft landing in the US. There have also been some signs that the inventory cycle has started to bottom, potentially pointing to a more favourable demand outlook. This in turn could support demand for Asian manufactured product, which historically has been supportive of Asian markets. However, as already highlighted, geopolitics remains an overhang to the region with areas of tension including US-China relations, Taiwan and Ukraine, notwithstanding the recent developments in the Middle East. The electoral cycle is a likely point of focus with both the US and Taiwan having elections next year.

Overall earnings have continued to be revised down following a reset to China and global growth expectations, leaving aggregate valuations broadly in line with their longer-term averages. However, this masks a large variation across individual markets where Singapore and Hong Kong, amongst others, look relatively cheap versus history, and India more expensive.

Although we did not have an optimistic view on the growth outlook for China, it has still managed to disappoint. This has brought renewed focus back on to the residential property sector, where private sector developers have seen a liquidity squeeze, as sales have continued to disappoint, impacting cashflow for the whole sector. The recent negative headlines around Chinese property developers such as Country Garden could cause further deterioration in homebuyers’ sentiment and financing capabilities for other private-sector developers, indirectly raising the risk of more defaults in the industry going forward. Therefore we expect policy easing, both on the demand and supply side, in the property sector to intensify to avoid more defaults and any wider impact on the financial sector. Our long-term concerns around the structural headwinds for the residential sector remain – property is likely to be less of a driver for the economy than in the past, given the already high levels of residential investment combined with an ageing demographic. It should be said we do not own any of the Chinese private sector developers in the portfolio.

Near term, we believe it is a lack of consumer confidence that is the problem rather than an inability to spend due to high borrowings. In fact, household balance sheets have only strengthened over the last two years, due to high levels of precautionary savings. It is measures to address this, such as progress on reforms, rather than a massive fiscal stimulus which is needed to give the consumer greater confidence to spend more. Nevertheless, in our view it is likely we will see further government stimulus, on top of the piecemeal measures we have seen so far, to boost growth given the fragility of the property sector. More positively, the regulatory backdrop does not appear to be getting worse and there are even tentative signs of reengagement between the US and China. Despite this, we remain very underweight combined Hong Kong and China, albeit we have been tentatively looking to add to holdings in both markets where valuations have come back. We are more positive on Hong Kong, where valuations are lower, and the SAR should see a recovery now that the border with the mainland has re-opened. Although visitor numbers to Hong Kong and Macau have picked-up materially, one needs to remain cognisant of the potential for tighter capital controls by the Chinese government should external balances become too wide.

India continues to be a market that offers highly attractive long-term opportunities but is currently being priced for that in many cases, which leaves the market looking relatively fully-valued and relatively expensive versus both its history and other regional markets. Despite this, it has benefitted from the uncertainty around the outlook for the Chinese market, together with the local demand driver of strong domestic inflows which have pushed the small and mid cap names up dramatically. We continue to favour the IT services names together with the banks but also have exposure to the fast-growing healthcare sector.

In the smaller ASEAN markets, we favour Singapore which is benefitting from its increasing status as a regional wealth management hub, as well as the growth of its ASEAN neighbours. We also have exposure to Vietnam, Indonesia and have recently added to our holdings in the Philippines.

Sector-wise, IT stocks, where we have been overweight, have been the bright spot. The potential for additional demand being generated by increased AI has seen many companies, however loosely affiliated with the theme, perform well. Whilst this has seen several companies, in our view, move into more speculative territory, we believe that a number of our companies are set to benefit from this additional demand driver over the medium to long term. We therefore remain overweight – albeit the recent rally has seen us selectively pare back holdings that we believe have got ahead of themselves. The IT names remain sensitive to the global economy and the Korean names are still trading at relatively attractive levels from a valuation perspective, in our view. While the visibility of demand remains low, the supply side adjustment is starting to take place as announcements on production and capex cuts have started to be seen and inventories appear to be peaking. Otherwise, we remain overweight to financials – a diverse sector spanning not only banks, but also insurers and exchange companies. Although we saw concern over banks earlier in the year following the Silicon Valley Bank and Credit Suisse collapses, the banks we own are generally well-capitalised with strong deposit franchises and fall into two camps; those that are benefitting from increased credit penetration, such as in India and Indonesia, and the more domestically-focussed retail names in more mature markets, such as Singapore, that in general trade at attractive valuations and decent dividend yields.

Underweights remain in those areas of the market generally perceived as more defensive, including consumer staples, health care and utilities, where valuations, in our view, still remain relatively full. More recently, however, the market’s correction in Chinese healthcare stocks has seen us add to a name there as described above.

Near term, it is likely that we will see further downward revisions to earnings as global growth slows, and an ongoing period of inventory adjustment amongst companies to reflect this slower growth, which will hopefully put them in a position to start to grow earnings once more when demand recovers. Positively, we are starting to see early indicators of a potential bottoming in the global goods cycle with PMIs showing tentative signs of improvement in inventories and new orders which historically, with a lag, have been a good lead indicator of exports. The distortion in the goods cycle from COVID was significant, with goods demand collapsing, post its surge in 2020, as services recovered, meaning that the goods cycle is much progressed when compared to that of services. Given overall aggregate valuations for the region are now trading at or below long-term averages, this does set up a more constructive backdrop for Asian markets in the coming year, barring a global hard landing or a more extreme geopolitical risk event.

To conclude, it is worth remembering that as investors we buy companies, not countries. We are mindful of the impact political and macroeconomic factors can have on equities and returns, but we are bottom-up stock-pickers first and foremost, focusing on the company’s return prospects and valuation. We do not try to pick companies which will do well based purely on a particular macro environment which we have forecast; rather we try to pick well-managed companies at attractive valuations, which have structural and sustainable competitive advantages. Therefore, a focus on attractive bottom-up ideas, in our view, remains essential.

. . . . . . . . . . .

Europe

(compare European funds here and here)

Marc van Gelder, chair, JPMorgan European Discovery, 13 December 2023

Higher interest rates are beginning to bite and economic activity seems to be slowing, which is likely to put earnings and share prices under pressure as we head into 2024. However, there are reasons to be optimistic; rates are at, or near, their peaks in the major developed economies and may begin to fall next year.

History shows that while European markets have been through challenging periods, performance has subsequently rebounded strongly as these challenges abate. European small cap companies tend to outperform as the broader market rallies. Looking ahead, any signs that central banks are considering lower interest rates should provide a significant boost to investor confidence and equity markets. If history is any guide, European small caps should do even better.

. . . . . . . . . . .

Francesco Conte and Edward Greaves, managers, JPMorgan European Discovery, 13 December 2023

The long-anticipated global slowdown appears to have finally arrived, and with it the likelihood that central bank rates have peaked. This makes the near-term outlook for equities very hard to anticipate. On the one hand, company earnings are slowing, on the other, the headwinds created by higher rates are starting to show signs of abating. We suspect that earnings will dominate in the near term, keeping equities under pressure, while expectations of lower interest rates may play an increasingly supportive role next year.

Top-down macroeconomic uncertainty has been dominating the performance of stock markets for some time. As a result we have transitioned towards a more diversified portfolio comprising companies that are benefitting from the current high interest rate environment, while adding attractively valued companies that should do well as interest rates begin to fall. While this is a difficult balancing act, the Trust’s performance has improved over recent months as portfolio adjustments are beginning to pay off. Looking to next year, the combination of extremely low valuations for European small caps, and possible central bank easing around the world, should be very positive for markets in general and even more so for our asset class.

. . . . . . . . . . .

Tom O’Hara and John Bennett, fund managers, Henderson European Focus, 13 December 2023

There is a lot to constantly distract an investor from more meaningful developments. When we as a team debate the outlook for inflation and the corresponding cost of capital, we try to take a longer-term view of changes across society and their potential impact on economic activity. In this respect, political discourse – and increasingly policy action – suggests something different and powerful is going on underneath the near-term focused chatter. Yes, central banks are raising rates and reversing that great “innovation” of the financial crisis – quantitative easing (“QE”) – in order to rein in inflation by cooling economic activity. But many governments, not least that of the United States, are making their job much harder. Economic hardship does not go down well with voters. De-globalisation and pro-labour populism are strong mandates for those who command the national coffers. The US is running an historically high budget deficit of 7%, as various stimulus packages – collectively known as ‘Bidenomics’ – splurge over $1trillion on highways, rail and other infrastructure, while providing generous incentives for corporates to deploy their capital into the ‘onshoring’ of critical supply chains in everything from semiconductors to electric vehicles and energy security. This is more than the US government mobilised in response to the Global Financial Crisis. Not even the profligate Europeans are engaging in such fiscal largesse; France and Italy are ‘only’ running budget deficits of around 5%. The OECD is averaging over 4%. We have never seen the likes of this government activity during peacetime (although it may be optimistic to describe the current geopolitical backdrop as such).

These trends don’t appear to be fads, just as zero interest rate policy (“ZIRP”) and QE were not short-lived phenomena. There are currently 35,000 trade protectionist measures in place globally, up from only 9,000 a decade ago, according to Global Trade Alert. Supply chains must adjust to new constraints, often through capital redeployment. Many of our investee companies are either seeing evidence of this in their order books and/or utilising their own strong balance sheets to invest. Construction spend on manufacturing facilities in the US has already reached almost 0.6% of GDP, a level not seen since before the World Trade Organisation was established in the early 1990s. Furthermore, a record 67% of Americans have a favourable view of trade unions, suggesting that ‘America First’ is a policy objective likely to be pursued, regardless of who secures the White House in 2024. In turn, other major economic blocs such as Europe feel obliged to follow with their own measures. One of the strands of our investment ‘DNA’ (for which we have introduced a dedicated section this year) is ‘Believe in Cycles’. We believe that we are at an inflection point in the long-cycle politics of globalisation, with corresponding long-duration implications for capital expenditure, wages, inflation and interest rates. Capital investment cycles tend to be long term in nature, for the simple reason that building stuff takes time. This affords many of our exposed investee companies a good degree of visibility under all but the most extreme scenarios for near-term economic momentum. Hard-landing or not, there will probably be ‘shovels going into the ground’.

Aside from industrial policy objectives, it is worth considering the strength of private sector capital deployment, as it highlights a key segment of the opportunities we are pursuing in European equities. It is well known that Europe does not possess the ‘Big Tech’ superstars. But, importantly, it does possess many of the enablers, or ‘picks and shovels’, that will be necessary as this exclusive club embarks on an unprecedented period of capital intensity. In 2019 the combined capital expenditure of Microsoft, Google, Meta (formerly Facebook), Amazon and Apple was around $70bn. In 2024 it will reach around $190bn, up by $35bn on 2023. The magnitude of this should not be understated; it equates to almost 20% of the “Bidenomics” bazooka: a sizeable spend even when set against an historic stimulus package in the largest economy on Earth. Moreover, it will be repeated each year for the foreseeable future, so that cumulatively it is likely to eclipse the fiscal programme.

To repeat: this is the capex outlook for only five companies. Dominant though they are, there is also a long tail of large, cash generative, well-financed companies across the globe which are investing into a critical juncture in both geopolitics and technological progress. This will create change.

. . . . . . . . . . .

Japan

(compare Japanese funds here and here)

Nicholas Weindling, Miyako Urabe, investment managers, JP Morgan Japanese, 5 December 2023

The reforms underway in Japan’s corporate sector are not the only positive recent development in the Japanese market. The economy has been on an improving trend since the government lifted its strict border controls in October 2022 and removed the last pandemic related restrictions earlier this year. Since then, tourist numbers have risen very sharply. This activity is benefiting a broad array of tourism and hospitality businesses.

There are also signs of a very welcome shift in Japan’s labour market. The country has labour shortages in many fields due to its aging population. Yet historically, companies have been resistant to raising wages to attract and retain workers, and Japanese wages barely increased for 30 years.

However, this is beginning to change. Recent wage increases have been significant and broad-based. For example, NTT, a telecoms company, has raised starting salaries by 14%, and JGC, which designs, constructs and maintains industrial facilities, has increased its base salary by 10%.

Although Japanese inflation remains relatively low in absolute terms and relative to other countries, it is noteworthy that inflation is the highest for decades at around 3%. The Bank of Japan (BoJ) response has been muted so far and it continues to pursue a negative interest rate policy although there have been some recent tweaks to yield curve control. It is possible that we see further shifts in policy and this may, in turn, have implications for the Japanese yen which has been weak against major currencies over the last year.

After a long period during which Japanese equities have been unloved and under-owned by global investors, Japan’s improving fundamentals have begun to attract attention. The stock market has reached multi-decade highs and outperformed global markets over the year ended 30th September 2023. One of the most welcome aspects of this market rebound is that it has been driven in part by foreign investors.

. . . . . . . . . . .

Miyako Urabe, Xuming Tao, Naohiro Ozawa, JP Morgan Japan Small Cap Growth & Income, 1 December 2023

The external environment remains uncertain, with persistent concerns over inflation and the ramifications of tight monetary policy, including the ongoing risk of a global recession. Japan is also seeing signs of inflation, as the rise in commodity prices, combined with a weaker yen, has imported inflationary pressures, although inflation is still low compared to other major markets. Some large corporates have announced notable wage hikes after decades of stagnant wages growth, which is very encouraging for the Japan economy, and the key question related to Japan’s inflation outlook is whether these pay increases will spread to mid- and small-sized enterprises. The Bank of Japan made small adjustments to its ultra-easy monetary policy in December 2022 and July 2023, intended to allow rates to drift higher, and the policy direction under the new governor will remain a focus for investors.

Another near-term support for the Japan economy, in addition to rising wages, is the country’s belated COVID reopening. Japan reopened its borders in October 2022, and inbound tourism and hospitality services have only resumed in recent months. The reopening of the Chinese economy is providing additional impetus to this rebound, not only via tourism, but also for many other consumer and industrial companies.

Over the medium to long term, the key structural support for Japan’s equity market remains the improvement in corporate governance. Improvements over the past few years are clear, in large part thanks to the Corporate Governance Code introduced in 2015. In addition to steps such as the rising proportion of independent board directors, we have seen notable increases in dividend payments and share buybacks by some companies. These measures have already improved shareholder returns, and with many Japanese companies still awash with cash, we expect further significant efforts to return cash to shareholders, and increase investment returns accordingly. As a team, we conduct over 4000 company meetings a year, on the ground in Tokyo, and we have sensed an acceleration in corporate reform efforts this year, particularly after the Tokyo Stock Exchange’s (TSE) initiatives announced earlier this year. These initiatives include a requirement for companies whose share price consistently trades below 1x price to book to disclose a strategy to improve this. We anticipate a broad-based improvement on the corporate governance front, not only companies trading below book value, considering balance sheet inefficiency is an issue seen across the market in Japan, and even high quality companies with strong competitive positions have room for improvement.

. . . . . . . . . . .

Emerging markets

(compare emerging markets funds here)

Chetan Seghal, lead portfolio manager, Templeton Emerging Markets, 7 December 2023

Emerging markets have been volatile due to fears of higher interest rates lasting for longer. Long-term yields have now started to come off, which should be positive for the emerging markets asset class. A few emerging markets economics, such as Brazil, have already started to cut their interest rates. The onset of an easing cycle in selected countries tilts the balancing act of tackling inflation yet pursuing economic growth. The impact of a rate cut is positive for overall consumption as well as for financing costs for companies which should also spur investments.

Besides rate cuts, other long-term opportunities abound in emerging markets. The increasingly popular China+1 strategy, where global manufacturers establish an additional overseas production base in China plus one other country, stands to benefit India, Mexico and several other Association of Southeast Asian Nations (“ASEAN”) economies.

Another longstanding theme is the transition to a greener future. Asia is home to well-run companies in the electric vehicle and solar equipment segment. The structural theme of electrical vehicles has seen a short-term slowdown impacted by slower growth and concerns of oversupply. We believe that the long-term structural growth opportunities for these sectors remain intact supported by national commitments underpinning energy transition to a cleaner environment.

The recovery of demand in China has been tepid and low birth rates and difficulties in the property sector pose further long-term challenges to its growth trajectory. Whilst government policy has become more supportive, we are cognisant that more substantive policies and a rebound in consumer activity is a prerequisite for a recovery in Chinese equities. We remain watchful for such developments. China’s internet sector, which forms a large part of the index, has already adjusted to the new policy and demand environment. We expect future returns for the sector to be driven more by steady cash flow generation and corporate actions.

The semiconductor cycle has remained weak due to slower demand. With the emerging popularity of AI, there has been a demand uplift that primarily benefits companies within the value chain. In the portfolio, our holdings in TSMC and Samsung Electronics are direct beneficiaries of AI-driven demand. In India, information technology services have been impacted by a slowdown in discretionary spending. Nevertheless, cost takeout deals-deals aimed at saving costs-have been strong.

Amidst an uncertain macroeconomic environment, we continue to retain a bottom-up focus on research. We believe that the long-term fundamentals for emerging markets remain attractive despite near term headwinds, and that equities offer good potential for investors. We believe that breadth of opportunities, growth, innovation and stronger institutional resilience together create an attractive future for emerging markets.

. . . . . . . . . . .

Investment manager, Barings Emerging EMEA Opportunities, 7 December 2023

In the short term, global equity markets are likely to remain volatile as investors weigh up a potential peak in monetary tightening later this year by the Federal Reserve against a back-drop of deteriorating corporate earnings.

The outlook for emerging markets, however, is more constructive as the policy cycle has also already peaked in many countries and in some is already easing again. China’s re-opening and policy stimulus should help lift economic activity globally, which should support a recovery in corporate earnings in 2024 and beyond.

Markets in the Middle East are likely to be volatile over the coming months as sentiment has been negatively impacted by the recent Israel-Hamas conflict. This has renewed concerns of supply disruption in the energy market, which, along with supply cuts, have kept the oil price higher than it might otherwise have been. Looking further ahead, we continue to believe there is a great potential for long term structural growth as the region further diversifies its economies.

The South African economy remains challenged as issues with the country’s electricity supply have significantly impacted how businesses have been able to function. This remains a major issue for the country, and therefore we continue to be highly selective with our exposure. We do, however, believe there are some green shoots of recovery emerging with the potential for domestic consumption to pick up as inflation falls.

A subdued European growth outlook makes us wary of the economic slowdown that may be experienced by the small, open economies of central Europe. However, this will allow for the cooling of tight labour markets, paving the way for lower inflation readings. Importantly, larger economies such as Poland are set to benefit from the continued rise in services exports, making it an export powerhouse within Europe, and in turn, raising the wealth of citizens, improving disposable incomes and consumption patterns.

In Turkey, recent moves towards more orthodox monetary policy have rightly been rewarded by the market but, with inflation still running above 50% and the Lira at record lows, many hurdles remain. If policymakers continue on this path then economic progress will likely follow, with job creation supported by a large and young population and business leaders that have honed their skill set in a rapidly expanding domestic economy.

We expect Greece to continue to successfully attract investment in its service sector-based economy whilst the recent upgrade of its sovereign risk to investment grade status should prompt a period of high activity on the Athens exchange. This is likely to involve prominent IPOs and the placement of stakes in the Greek banking sector, currently held by the Hellenic Financial Stability Fund.

. . . . . . . . . . .

China

(compare emerging market funds here)

The year under review was marked by a series of unexpected challenges. The most prominent was China’s abrupt exit from its stringent zero COVID policy last December. Following a wave of COVID infections, life returned to normal by Q2 2023. After an initial round of enthusiasm about reopening, China’s sluggish economic recovery undershot many people’s expectations, with the exception of travel-related consumption. There are several reasons for this disappointing turn of events. Primarily, as we have discussed in previous reports, China faces the structural challenge of transitioning away from its heavy reliance on fixed asset investment, in particular property development. This process will take years, and meanwhile the property sector, which comprises 6% of the Chinese economy and 13% including related activities, remains challenged. Concerns about developers’ balance sheet strength and declining property sales and prices are adversely impacting consumption and domestic growth more generally. What has disappointed us is that it is taking longer than expected for domestic consumer confidence to recover. This is reflected in lukewarm non-travel discretionary consumption, and a reluctance to invest.

A decline in Chinese exports has also been a drag on growth. Total exports declined 5.6% in USD terms in the first eight months of 2023, due in part to the depreciation of the renminbi. Higher overseas interest rates have dampened demand for Chinese exports, and there was a degree of front-loading of consumption during COVID, while some multinational companies have adopted a ‘China+1’ sourcing strategy, to strengthen their supply chains by reducing reliance on Chinese imports.

China’s policy response to the economic slowdown became more active in 2023. In the property market, the regulatory focus has shifted from preventing an asset bubble to stimulating demand. Local governments were given the green light to remove various purchase restrictions, which should help unleash pent-up housing demand, while the legacy mortgage rate, which was set artificially high to prevent property speculation, was lowered to reduce the debt servicing burden on households. The loan prime rate (LPR) was also cut to reduce borrowing costs, and bank deposit rates were lowered simultaneously to protect bank margins. To stimulate demand for properties, the central government has advocated the redevelopment of shantytowns in large cities. All these policies are in addition to supply-side stimuli such as renewed access to onshore bond and equity markets for developers, intended to help strengthen their balance sheets. Arrangements are now in place to restructure the debt of troubled local government financing vehicles (LGFV, i.e. the issuers of quasi-municipal bonds). At the end of October, China’s legislature approved a plan to issue RMB 1trn additional sovereign debt and to raise the fiscal deficit ratio for 2023 to 3.8% above the long-term ceiling of 3%. The magnitude and frequency of this stimulus policy surprised the market.

In terms of domestic politics, it was no surprise that President Xi secured his third term as leader in March, and assembled a new cabinet. Since then, industrial policies have generally been pro-business and pro-growth, acknowledging the challenges faced by the economy. To name a few of these policies, the government established a bureau, headed by the country’s top economic planner, to oversee the development of the private economy. Cyber-security reviews of internet platforms were completed. After the last round of online platform regulations, online platform companies now operate under clearer regulations and guidelines. The way regulation is conducted has also changed from punishment and fines post events to consultation and setting guidelines before events. A good example of this is that regulators quickly proposed regulations on generative AI and large language models in order to safeguard the development of this new industry.

In terms of the external environment, persistently high inflation in US and Europe shaped the expectation that interest rates will be ‘higher for longer’. Higher debt servicing costs squeezed household budgets and in turn cast a shadow over the demand for Chinese exports, putting further downward pressure on the renminbi. But there were also some positive developments. We were happy to see the resumption of high-level engagement between the China and US governments, which should help to reduce the risks of future misunderstandings and miscalculations.

. . . . . . . . . . .

India

(Compare India funds here)

Amit Mehta, Sandip Patodia and Ayaz Ebrahim, portfolio managers, JPMorgan Indian, 12 December 2023

Perhaps the most compelling aspect of India’s transformation is the rapid growth in capital spending, which will also help balance the mix of GDP, which is currently skewed to services, more into manufacturing. As we noted in our last report, India has under-invested in capital formation over the last decade, but both the government and the private sector have now realised that capex is essential if the country is to achieve its target of 6% GDP growth over the next decade. The government has prioritised capex spending accordingly – almost doubling capital expenditure as a percentage of budget from 12% in the last decade, to 22% currently – and progress has been remarkable. Highway construction has grown by nearly 60% in the last nine years, from an already high base. Additionally, rail investments have increased more than fourfold in the last six years, port capacity has climbed by more than 80%, reducing turnaround times, and the country boasts 73 new airports. Metro rail has risen three and a half times, with more cities now benefiting from metro services.

The government has also implemented economic reforms to put the private sector on a solid footing. It has formalised the industrial sector by introducing a nationwide goods and services tax, reduced the corporate tax rate, lowered real lending rates, and introduced subsidies to incentivise domestic manufacturing. These measures, combined with buoyant demand, have improved the financial health of private companies, which are now at peak profitability and have sufficient firepower to fund investment without depending too much on external financing.

The government’s encouragement of domestic manufacturing is paying off. Companies are improving their cost competitiveness by upgrading existing facilities, stepping up automation and electrification, and switching to renewable energy. These efforts have reduced the cyclicality in earnings inherent in the manufacturing sector, and India is now winning new business, replacing China in parts of the global supply chain, as multinational companies seek to diversify and secure supply in the wake of recent geopolitical events.

. . . . . . . . . . .

Biotech and healthcare

(compare biotech and healthcare funds here)

James Douglas and Gareth Powell, fund managers, Polar Capital Global Healthcare, 12 December 2023

With sentiment weak, and exchange-traded fund (ETF) outflows pointing to diminished appetite for the healthcare sector, the classic contrarian indicators are pointing to a more constructive stance. More importantly, healthcare’s fundamentals remain strong, as illustrated by the delivery of ground-breaking medical breakthroughs, a material pickup in utilisation and patient volumes plus much-needed progress in shifting the site of care out of inpatient hospital settings and in to lower-cost, more efficient outpatient settings such as surgery day centres and ASCs.

As we look forward to the next financial year, there is much to engage and excite. The introduction of highly effective weight-loss medications has created huge amounts of interest, and is driving significant dispersions in returns for the so-called GLP-1 winners (the drug developers, device manufacturers and distributors) versus the GLP-1 losers (medical device companies with exposure to areas such as sleep apnoea, diabetes and orthopaedics). However, once the market has all the relevant clinical data and the euphoria dies down, there will likely be a wide range of interesting investment opportunities driven by the recent dislocation.

The adoption of AI platforms machine and ML software could revolutionise select diagnostic procedures, improving clinician workflow and driving superior outcomes for patients. In a highly complex and data-intensive industry, AI and ML are also being used to drive efficiencies for healthcare systems in areas such as revenue collection, patient scheduling and insurance claims. Emerging markets, especially China, are another area of interest which could see a renaissance in the coming months and years as the healthcare system finds the right balance between cost control, compliance and attracting innovative, best-in-class therapies, devices and capital equipment.

In conclusion, the healthcare sector is heavily out of favour but attractively valued, is delivering high levels of innovation and has consistently shown the ability to deliver strong revenue and earnings growth, regardless of the economic, political and regulatory environment. It is these characteristics that fuel our optimism for the year ahead.

. . . . . . . . . . .

Environmental

(compare environmental funds here)

Michael Naylor, chair, Jupiter Green Investment Trust – 18 December 2023

Technological advances and innovation are key to combating the world’s climate and environmental crisis. These solutions are now helping to set the pace for policy and regulation – a welcome reversal to the previous relationship where solutions were constrained by policy. The scale of change required to reverse global warming is creating significant opportunities for investors to support environmental solutions companies, which provide products and services critical to achieving sustainability targets. It is becoming ever more evident that these solutions will spread widely and to as-yet unpenetrated sectors of the global economy.

Governments are likely to continue to play a major role, in terms to encouraging development of environmental solutions as part of the path to net zero, and through the regulating of all companies to improve transparency around climate and biodiversity impact.

As attitudes toward addressing climate solutions shift, there is a broadening of the value chain beyond the conventional lens. The opportunities throughout the market that this creates will be plentiful and we firmly believe the Jupiter Green Investment Trust remains well-positioned to identify them.

. . . . . . . . . . .

Infrastructure securities

(compare infrastructure securities funds here)

Investment manager, Ecofin Global Utilities and Infrastructure – 18 December 2023

Over the 12 months, pan-European diversified utilities performed well. For these large integrated utilities, power prices were declining from 2022’s crisis levels but power retail and trading businesses were thriving. European transportation and environmental services, which offer sound pricing models with contractual inflation hedges, performed relatively well too.

North American utilities, on the other hand, especially renewables developers, saw their valuations grind lower. Issues around cost inflation, supply chains and permit delays for renewables were rarely out of the headlines. Wildfires were a constant reminder of climate risks but the main adverse factor for renewables, utilities and infrastructure was rising interest rates. These sectors are big users of capital and the higher cost of capital weighs on the present value of future cash flows while also raising concerns about future returns. This is especially so in the US where there can be insufficient cost hedging or inflation indexation in contracts. The impact on share prices was more dramatic than its financial impact, leaving valuations for many fast-growing renewables developers at very depressed levels.

Compounding these issues were summertime profit warnings from Siemens Energy and Orsted (not held in the portfolio) who cited cost pressures and technological difficulties for US offshore wind, and also by NextEra Energy Partners. It halved its aggressive renewables growth targets in September due to funding costs – the benchmark 10-year US government bond yield had increased from 3.8% to 4.8% since 30 June. These profit warnings came at a time when confidence that policy and operating environments were supportive of ambitious global renewables targets was already shaky. By 30 September, the underperformance of US utilities versus the S&P 500 index year-to-date was close to 30%, a divergence unprecedented over the prior 3 decades.

This underperformance of utilities contrasted with the earnings progress of most portfolio companies, their outlook, dividend paying abilities and capital investment plans in what are often highly regulated businesses. Earnings per share expectations have generally been increasing, particularly for European integrated utilities but also, though to a lesser extent, for US peers. Companies are benefitting from power prices which, although lower than 2022, remain well above pre-Ukraine crisis levels. Meanwhile, Power Purchase Agreement (PPA) data shows that renewables operators overall are able to pass through the effects of cost inflation to customers while contracted power prices for new projects are adjusting upward to reflect the higher cost of capital and overall equipment costs to maintain project returns.

. . . . . . . . . . .

Technology and technology innovation

(compare technology funds here)

Ben Rogoff and Ali Unwin, fund managers, Polar Capital Technology, 11 December 2023