December 2023

Monthly | Investment companies

Kindly sponsored by abrdn

Winners and losers in November 2023

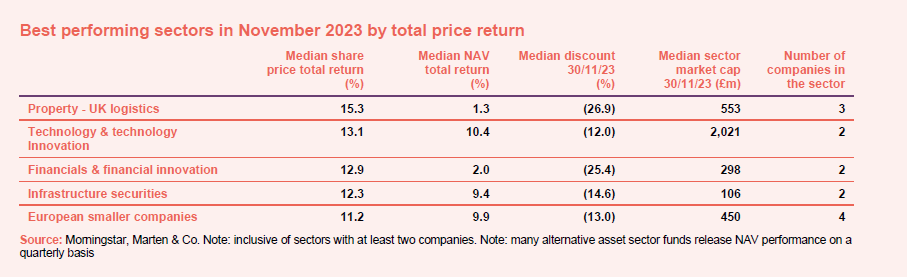

November marked one of the best months of performance in recent memory, with gains felt across multiple asset classes. The catalyst for this was the market’s expectation that we have hit peak interest rates and that we may be able to look forward to rate cuts. This led to one of the best months for bond returns in decades, with the US 10-year yield falling from 4.9% to 4.3%. There was also a powerful showing by global equities, with the MSCI All Countries World Index up 9% over the month. This bullishness was also felt in the investment trust sector, as November broke the previous streak of consecutive monthly falls for investment companies, with only 7 sectors failing to generate a positive share price return.

Some of the recently unloved sectors rebounded, with some of the largest share price gains seen in the property – UK Logistics sector. UK logistics with its low starting yields and economic sensitivity had been aggressively sold off in prior months. The market’s ‘risk-on’ attitude was also felt by the Technology & Technology Innovation sector. In the financial and financial innovation sector, the charge was led by Augmentum Fintech but hopes of a softer landing for economies have benefited bank shares too.

Likewise, the interest rate sensitive infrastructure securities sector rallied. So too did the European Smaller Companies sector which has high exposure to quality growth strategies, led by best-performer Montanaro European Smaller Companies.

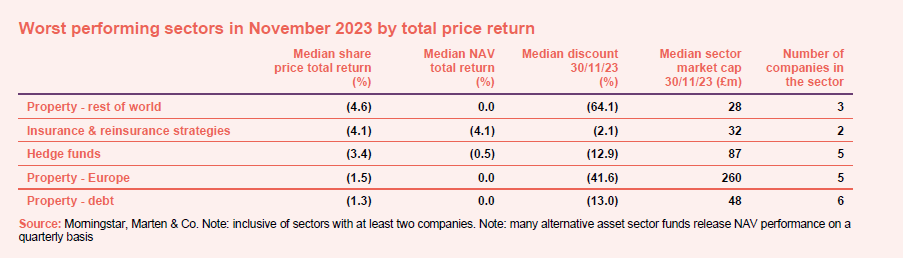

There were few negative performing sectors to choose from this month. The Property – Rest of World sector has some eclectic constituents. The two insurance/reinsurance funds and the constituents of the hedge fund sector have high US dollar exposure and the move in the exchange rate accounts for the shift in their NAV (as is the case for a number of individual NAV moves in that table.

The median share price return for the property – Europe hides some very large upwards moves in the share prices of abrdn European Logistics and Tritax EuroBox, which we discuss later.

There was nothing much of note going on in the property – debt sector.

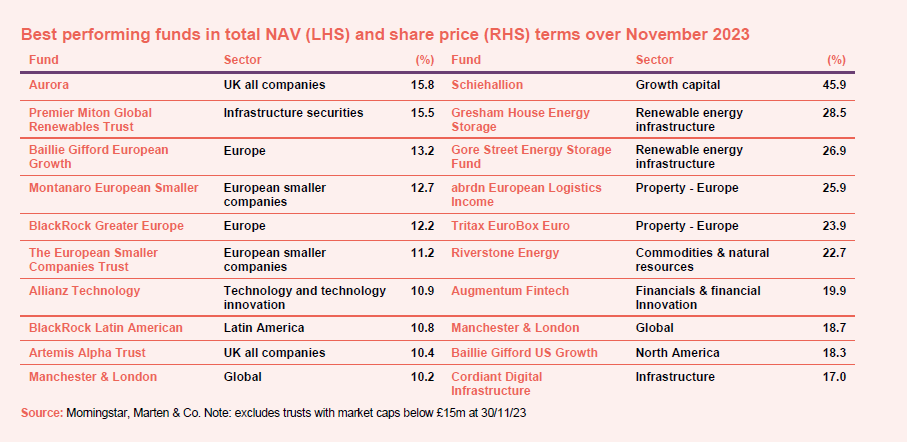

The majority of the top NAV performers were those who were best able to capture the rebound in global markets that we saw over November, with the fall in interest rate expectations being the common factor in our best performing trusts. However, the top performing trust, Aurora, is not what one would characterise as a high-growth strategy, rather its performance came on the back of the buyout of Hotel Chocolate (sold for a 170% premium). Aurora was also able to capitalise on the wider rebound in risk assets, reporting gains in excess of 20% for some of its top holdings. The rebound in UK equites can also be seen in Artemis Alpha Trust, where, for example, its holding in Ryanair was up 32% on the month.

Premier Miton Global Renewables delivered strong NAV returns, helped by the gearing provided by its zero dividend preference shares as well as a better month for those sectors.

European growth dominates our top performers though, with all of the four European equity trusts present here having some form of growth or quality-growth exposure. The rally in growth-focused strategies also benefited Allianz Technology and Manchester & London. Positions in Microsoft and Nvidia make up over 50% of the latter trust. These stocks were up 12% and 15% respectively over November. However, the standout example of the growth recovery was the leap in Schiehallion’s share price.

The other story of November was the recovery in some of the share prices of oversold renewable energy and infrastructure funds. Rising interest rates have been putting downward pressure on their NAVs and lessened the attraction of their dividend yields relative to cash deposits and yields on bond funds. Nevertheless, we think that this recovery should have some way to run yet.

abrdn European Logistics Income announced a strategic review towards the end of November and this was one trigger for the leap in its share price. However, it is notable that Tritax EuroBox’s shares recovered fairly steadily through the month, underpinned towards the end of November by news of lettings and a disposal. The Tritax fund is the obvious merger partner for the abrdn fund, should it opt to go down that route.

Riverstone Energy completed the sale of its investment in Hammerhead Energy, freeing up $260m and adding $51m to the fund’s NAV.

Worst Performing

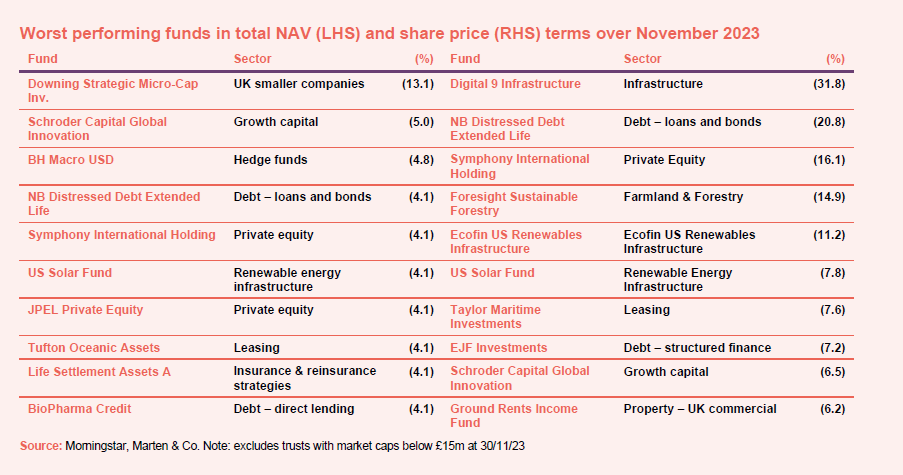

In NAV terms, the most common factor was exposure to US dollar denominated assets as the dollar weakened relative to sterling. However, Downing Strategic Micro Cap’s fall in NAV came as its largest position – Real Good Food – launched a strategic review in the face of difficult trading conditions.

In share price terms, Digital 9 plunged as both the headline price and deal terms for its disposal of Verne Global disappointed. With no portfolio news to trigger NB Distressed Debt’s share price fall, it seems that an unusually large seller weighed on its shares (the reported volume in the stock was well above recent norms). Symphony International gave back some of the gains it made in September/October on news of its planned managed wind down. Ground Rents Income fell as Michael Gove launched a consultation on capping ground rents.

In share price terms, Digital 9 plunged as both the headline price and deal terms for its disposal of Verne Global disappointed. With no portfolio news to trigger NB Distressed Debt’s share price fall, it seems that an unusually large seller weighed on its shares (the reported volume in the stock was well above recent norms). Symphony International gave back some of the gains it made in September/October on news of its planned managed wind down. Ground Rents Income fell as Michael Gove launched a consultation on capping ground rents.

There was little news on some of the other share price fallers. Foresight Sustainable Forestry argued against its widening discount in November, but results published earlier this month showed a fall in its NAV. The fall in Ecofin US Renewables may have been investor fatigue on the lack of news on its strategic review. However, it did reveal early in December that its problematic wind and solar assets will soon be operational again.

Moves in discounts and premiums

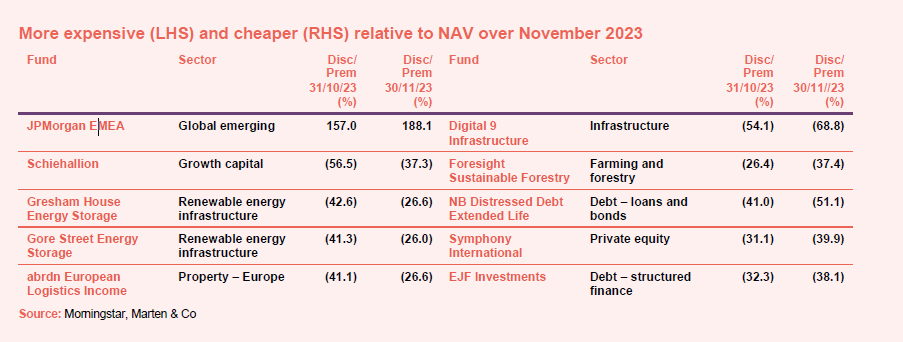

The violent shifts in JPMorgan Emerging Europe, Middle East and Africa’s share price continue. We discussed it in passing on the show on Friday 8 December. Schiehallion we have already mentioned, it was one of a number of funds that had become oversold that rallied on hopes of peak interest rates. We would also include the two battery storage funds in that group.

Barring EJF, we have discussed the other funds in the table already. EJF Investments published a positive monthly update during November, so its share price weakness seems strange.

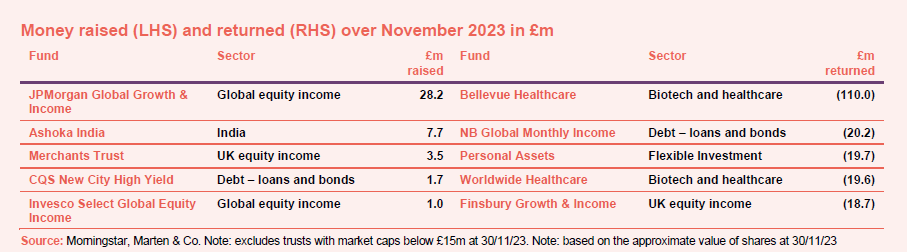

Money raised and returned

As the table shows, there was very little issuance again in November. Once again, JPMorgan Global Growth and Income led the pack. On the other side of the equation, we have the results of a redemption opportunity provided by Bellevue Healthcare. November was also the month that we said goodbye to minnow Chelverton Growth Trust and the more substantial Round Hill Music Royalty, as its bid completed. abrdn New dawn’s merger with Asia Dragon was also completed during the month.

Major news stories and QuotedData views over November 2023

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

| · Marwyn Value Investors AGM – 14/12/23

· Gore Street Energy Storage manager presentation – 14/12/23 · Schroder BSC Social Impact AGM – 15/12/23 · CQS Natural Resources Growth & Income AGM – 15/12/23 · Asia Energy Impact EGM – 19/12/23 · AVI Global Trust AGM – 20/12/23 · RM Infrastructure Income EGM – 20/12/23 · European Opportunities EGM – 21/12/23 · Vietnam Holding AGM/EGM – 21/12/23 · Gulf Investments AGM – 22/12/23 |

· BioPharma Credit AGM – 28/12/23

· JPMorgan Japanese AGM – 11/01/24 · Finsbury Income & Growth AGM – 23/01/24 · Henderson Far East Income AGM – 24/01/24 · abrdn Equity Income manager presentation – 26/01/24 · BlackRock Frontier Markets AGM – 06/02/24 · abrdn Equity Income AGM – 20/02/24 · CT UK Capital & Income AGM – 07/03/24 · Master Investor Show – 09/03/24 |

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 1 September | HEIT, SOHO | Ed Simpson | GCP Infrastructure |

| 8 September | RNEW, RHM, RMII | Prashant Khemka | Ashoka WhiteOak |

| 15 September | EPIC, SONG, SUPR, TLEI | Dean Orrico | Middlefield Canadian Income |

| 22 September | AIG, GABI, GCP, HICL | Andrew Jones | LondonMetric Property |

| 29 September | DGI9, GIF, HICL, SONG | Carlos Hardenberg | Mobius Investment Trust |

| 6 October | ORIT, PSH, RGL | Alan Gauld | abrdn Private Equity |

| 13 October | EOT, GSF, CHRY | James de Uphaugh | Edinburgh Investment Trust |

| 20 October | SONG, SYNC | Tom Williams | Downing Renewables |

| 27 October | UKW, SONG, ADIG | Richard Sem | Pantheon Infrastructure |

| 3 November | ARIX, RWT | Minesh Shah | Renewables Infrastructure Group |

| 10 November | PCTN, DSM | Craig Martin | Vietnam Holding |

| 17 November | JMF, JMI | Joe Bauernfreund | AVI Global Trust |

| 24 November | NESF, SRE, UKCM, PCTN | Ben Green | Supermarket Income REIT |

| 1 December | ACIC, FCSS, TIGT, STS, VNH, DGI9 | Charles Luke | Murray Income |

| 8 December | CHRY, BEMO, RNEW | Joe Bauernfreund | AVI Japan Opportunity |

| Coming up | |||

| 5 January | James Carthew & Andrew McHattie discuss 2023 | ||

| 12 January | Tim Levene | Augmentum Fintech | |

| 19 January | TBD | SDCL Energy Efficiency | |

| 26 January | Richard Hulf | HydrogenOne Capital Growth | |

Research

As inflation eases and its looks increasingly like interest rates have peaked for now, the only major potential negative overhanging the financials sector is the thought that central banks may have overdone their tightening, which will precipitate a recession that leads to a sharp rise in defaults on the loans that banks have been making. The managers of Polar Capital Global Financials Trust (PCFT) believe both that the sector is more than pricing in a worst-case scenario and that we are more likely to experience a shallow recession.

Despite the significant headwinds that have faced both Asia and growth strategies during the last 12 months, Pacific Horizon’s (PHI’s) net asset value (NAV) has held up so that its long-term track record of outperformance versus peers remains intact.

Its portfolio appears to continue to offer strong growth prospects, but it still appears to be cheap when compared to its history.

Geiger Counter (GCL), which invests in companies involved in the exploration, development and production of uranium, is set to benefit from nuclear power’s colossal role in decarbonising the global electricity supply. Governments around the world are making nuclear energy (the only source of zero carbon baseload power – the minimum amount of electric power needed to be supplied to the electrical grid at any given time) a cornerstone of the green agenda.

Existing nuclear reactors’ lives are being extended, while Asia drives a global fleet expansion as demand for uranium surges. Meanwhile, a 10-year bear market has restricted investment in any new supply and created a highly supportive backdrop for uranium, with the spot price jumping considerably in recent months.

America is still showing signs of the ‘exceptionalism’ it covets, by being in better economic health than its developed peers, as is evidenced by its stronger gross domestic product (GDP) growth and better controlled inflation. Yet it is not all plain sailing for US equity investors, as Fran Radano, the manager of North American Income Trust (NAIT), points out. He believes that cracks are starting to show in the US’s economic outlook, but the market is yet to reflect this. Given that this is coupled with what Fran believes are exuberantly-high equity valuations in segments of the US market, he has rotated NAIT into more defensive stocks. In addition, he thinks that NAIT’s value-bias is better suited to the central bank’s (the Federal Reserve or ‘Fed’) ‘higher for longer’ attitude towards interest rates.

JLEN Environmental Assets (JLEN) and the wider renewable energy sector have seen discounts to net asset value (NAV) widen to unprecedented levels as investor sentiment wavers in the face of higher interest rates. JLEN’s 20.2% discount to NAV is hard to fathom given the fundamental strength of its investment case and future growth opportunities.

Undeterred, JLEN’s managers are focusing their efforts on laying the foundations for future NAV growth, with investments in green hydrogen, for example (there are many colours of hydrogen but green is the most sustainable and environmentally friendly as it produced by splitting water through electrolysis using electricity generated from renewable sources). This is a sector that is predicted to grow 500 times by 2050, requiring $5trn of infrastructure investment.

BlackRock Throgmorton Trust (THRG) continues to demonstrate its commitment to UK quality-growth small-and-mid-caps that has long characterised the trust, even in the face of apparent headwinds, such as rising interest rates and lower UK economic growth. While the UK small-and-mid-cap sector has been somewhat out of favour recently, the stock-specific strengths of THRG’s holdings have allowed it to pull away from the wider UK small-and-mid-cap market once again, outperforming over both the near and long term (12 months and five years respectively).

As we show on page 14 of this note, AVI Global Trust (AGT) has been performing well recently.

Where it can, AGT’s manager seeks to engage with investee companies behind the scenes, working with them to unlock the value that it sees in them for the benefit of all shareholders. Lately, AGT has also been involved in some more high-profile situations, which we discuss in this note.

While the net asset value (NAV) seems to be moving in the right direction, the double discount – AGT’s own share price discount to NAV plus the gap between the share prices of investee companies and their underlying intrinsic value – is almost at its widest level since the manager started to calculate it in 2006.

Thanks in no small part to Alliance Trust’s (ATST) diversified blend of actively managed strategies, the trust’s performance has been ahead of global equity markets over multiple time frames. ATST has been able to capture benefits of the major sentiment shifts behind the differing segments of global equities over the last five years. This sets it apart from its wider peer group, where the presence of strategies with strong stylistic biases (such as expensive growth stocks) meant that the median return of this group has not kept pace in recent years.

Downing Renewables and Infrastructure (DORE) set out to build an attractive portfolio of renewable energy assets diversified by geography and asset type, and has succeeded in that. In doing so, it identified an opportunity to build a portfolio of hydropower assets in Sweden. As we describe in this note, the management team has identified a number of ways in which it feels that it can significantly enhance the returns of these assets.

Herald Investment Trust (HRI) demonstrates why patience can be key when it comes to investing. The managers highlight the drought of funding available to small cap technology stocks. The team has ensured that HRI has sufficient liquidity to take advantage of opportunities as these arise. HRI is operating in a buyers’ market, and this often gives it the power to dictate terms.

With its strong focus on growth, European Opportunities Trust (EOT) has faced significant headwinds during the last couple of years as, in the face of higher inflation and interest rates, investors have favoured more value and defensive exposures over growth stocks. Inflation now seems to be coming under control, but with growing signs of a recession in Europe, sentiment in financial markets is poor. Consequently, valuations of European equities are cheap relative to their history and global markets.

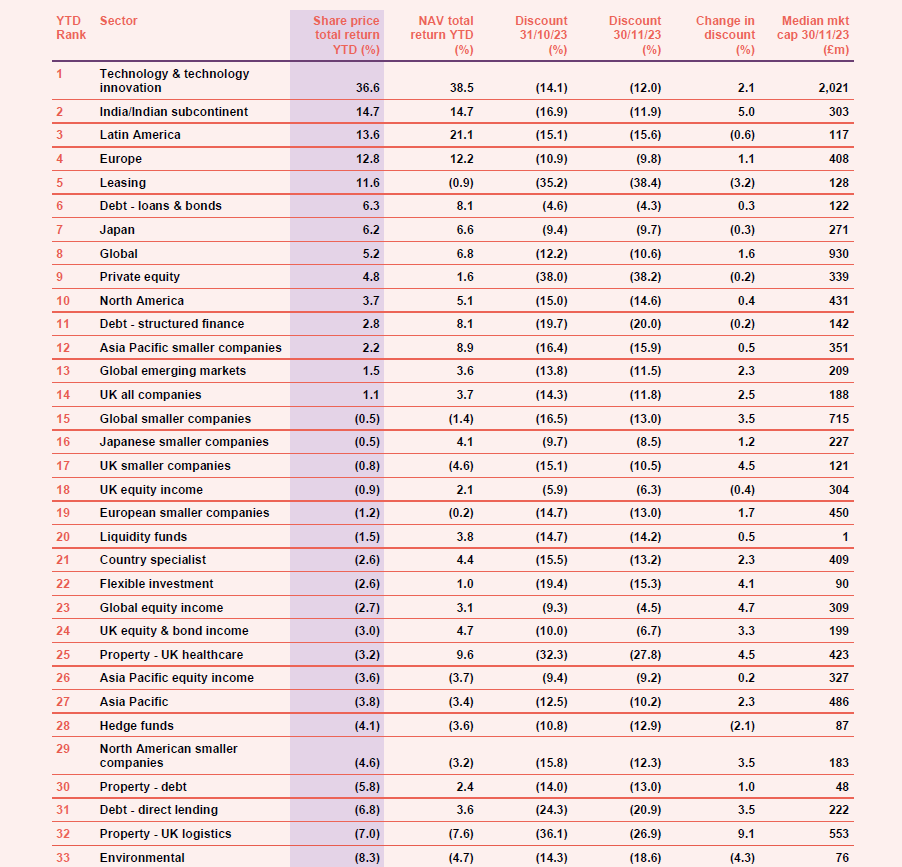

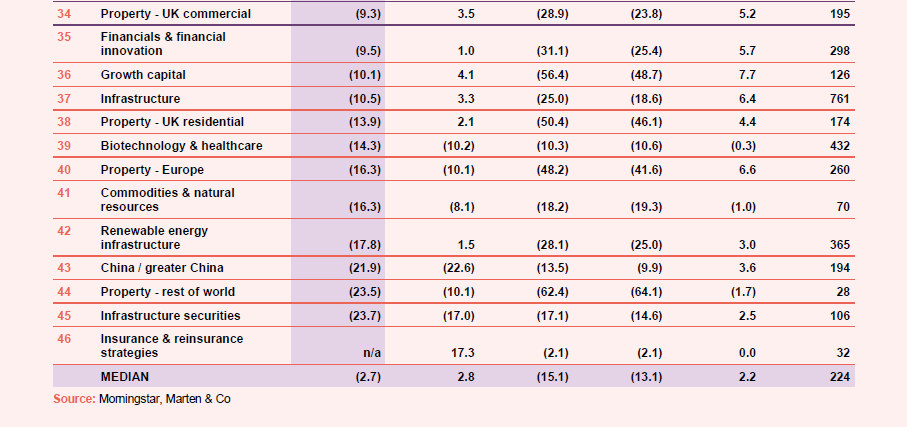

Appendix 1 – median performance by sector, ranked by 2023 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice toretail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.