Real Estate Roundup

Kindly sponsored by abrdn

Performance data

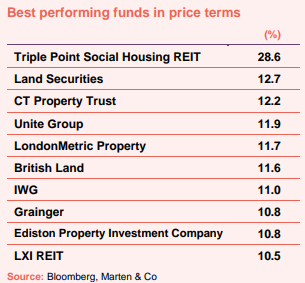

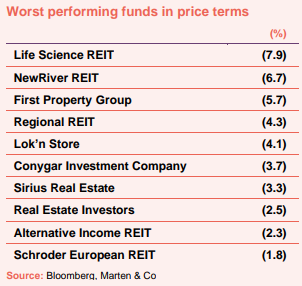

July’s biggest movers in price terms are shown in the charts below.

Better than expected inflation figures in the UK raised hope that interest rates had peaked, and that commercial property values may have bottomed out. Improving investor sentiment towards the sector was reflected in an increase in the median share price of 3.5% over the month. Top of the list was Triple Point Social Housing REIT, which is benefitting from the takeover of its peer Civitas Social Housing at a large premium to its share price. The company is still down 32.4% over the last 12 months, however, and trades on a discount to NAV of over 50%. The improved macro-economic outlook saw the two traditional property titans Land Securities and British Land record double digit share price gains in July. CT Property Trust’s share price has bounced around following a takeover offer by LondonMetric in May. Student accommodation giant Unite Group rallied after reporting strong trading and valuations numbers. Its share price was up 11.9%, despite raising £300m towards the end of the month in a discounted placing (more details on page 3). Build-to-rent specialist Grainger, which is set to benefit from higher mortgage costs pushing more people into rented accommodation, also bounced.

Topping the worst-performing list was Life Science REIT, whose share price continues to struggle less than two years after it launched. The company is down 31.7% over the last 12 months and has a job to do winning over investors on the huge growth potential for life science real estate. Retail park owner NewRiver REIT’s share price recovery lost momentum in July, but the group is still up 6.4% in the year to date – one of just a handful of property companies to be so. Regional REIT continues to suffer from negative investor sentiment towards the office sector and has now lost 24.2% of value so far in 2023. Self-storage specialist Lok’n Store was down 4.1% for the month, reflecting its discounted equity raise (see page 3). The company quickly set the money to use, acquiring a development site in Sussex as it looks to take advantage of favourable supply-demand dynamics in that sector. German and UK business park owner Sirius Real Estate had the wind knocked out of its sails having performed strongly so far this year in the face of high interest rates. It is still up 11.6% in 2023. Schroder European REIT’s share price took a hit after it posted a fall in values in half-year results at the end of June.

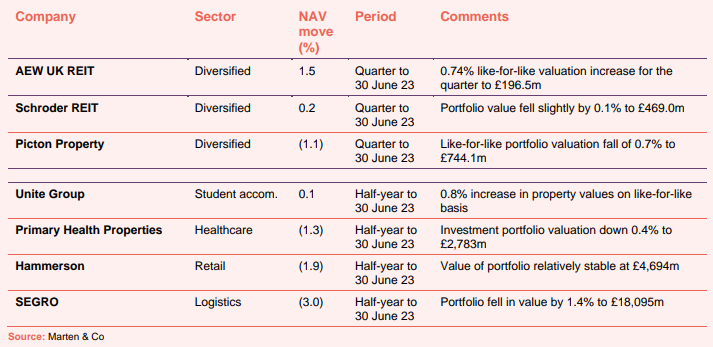

Valuation moves

Corporate activity in July

Unite Group raised £300m in a placing, with 32,693,930 new ordinary shares placed with institutional investors and retail investors subscribing for a total of 441,989 new ordinary shares. The issue price of 905p represents a discount of 4.2% to the prevailing share price of 945p. The proceeds will be used to develop two new purpose-built student accommodation schemes and accelerate asset management initiatives.

Lok’n Store raised £20.5m through the issue of 2,679,739 new ordinary shares at a price of 765p – a 12.1% discount to its prevailing share price. Proceeds will be used to fund its development pipeline.

Warehouse REIT completed a debt refinancing for a new £320m facility, extending the tenure to June 2028. It comprises a £220m term loan and a £100m revolving credit facility (RCF) with a club of four lenders – HSBC, Bank of Ireland, NatWest and Santander. The debt covenants have been improved, with the minimum interest cover now 1.5 times compared to 2.0 times and the maximum LTV extended to 60% from 55%. Both the term loan and the RCF attract a margin of 2.2% plus SONIA for an LTV below 40% or 2.5% if above. The company has £230m of interest rate caps in place of which £200m fixes SONIA at 1.5% and the remaining £30m fixes SONIA at 1.75%.

Scandal-hit Home REIT is proposing changes to its investment policy as it looks to stabilise its business following the appointment of AEW as investment manager. This includes extending the permitted use of properties to include any form of residential during a two-year stabilisation period, in an effort to increase rent collection. Following the stabilisation period, it proposes to invest in “social use” residential accommodation, including for homelessness. The changes will be put to shareholders at a general meeting on 21 August.

Urban Logistics REIT put in place £57m of new debt on fixed rate terms, refinancing existing floating rate debt. The facility, with Aviva Investors, means the company has £367m of drawn debt and a further £51m undrawn, at an all-in rate of 4.2% and an average maturity of 6.0 years.

PRS REIT completed the refinancing of its £150m RCF with RBS and Lloyds Banking Group. A new £102m facility of fixed-rate debt for 15 years has been secured with Legal & General Investment Management, together with a further £75m of floating-rate debt agreed for two years with RBS. An interest rate cap will be put in place on the floating rate debt. The company did not disclose the interest rates agreed on the new facilities.

July’s major news stories – from our website

- Grit Real Estate completes acquisition of developer

Grit Real Estate Income Group has concluded the final phase in the acquisition of controlling interests in developer Gateway Real Estate Africa (GREA) and asset manager APDM. Grit now owns a direct interest of 51.48% in GREA and a 78.95% shareholding in APDM. The acquisitions are expected to have a positive impact on group LTV and future growth.

- Lar España sells retail parks for €129.1m

Lar España sold two retail park assets – Rivas Futura and Vistahermosa – for a combined €129.1m, at an exit yield of 6.3%. These were non-core assets where the company had completed its asset management plans and the sales price was 24% above the price they paid for them in 2018 and 2016 respectively.

- Helical to partner with TfL for tube office developments

Helical signed contracts with the Transport for London (TfL)’s wholly owned commercial property company for a joint venture to develop offices above or close to London tube stations at Bank, Paddington and Southwark, totalling 600,000 sq ft. All three sites have full planning permission.

- Great Portland Estates completes letting programme at The Hickman

Great Portland Estates completed the leasing of The Hickman office building on Whitechapel Road, E1, after letting the last remaining office space to digital transformation company TPXimpact. The company will occupy 6,757 sq ft on the second floor on a fitted basis with a five-year lease.

- LondonMetric disposes of assets to pay down floating rate debt

LondonMetric Property sold five assets for £42.8m, reflecting a net initial yield of 4.5% and in line with the 31 March 2023 book value. Three of the assets are long income with a WAULT of 12 years and have been sold individually for £25.3m in total. The other two assets are urban warehousing estates that have been sold as a portfolio for £17.5m. The sales proceeds will be used to reduce the company’s floating rate debt to £35m (representing just 4% of total drawn debt).

- Urban Logistics REIT sells assets ahead of book value

Urban Logistics REIT sold two non-core assets for £15m, at a 3.4% premium to the March 2023 valuation. It also secured four new lettings in the quarter to 30 June, generating £0.85m of annual rent, and two rent reviews at an average uplift of 20%.

- Warehouse REIT sells £30m of assets

Warehouse REIT completed £29.9m of sales, predominantly made up of the £27m disposal of Dales Manor Business Park in Cambridge at a 4.5% net initial yield. Following receipt of the sales proceeds, the group’s net debt is now £275m.

- AEW UK REIT buys York car park for £10m

AEW UK REIT acquired a mixed-use asset in York city centre for £10.02m, reflecting a net initial yield of 9.3%. The 99,769 sq ft asset is multi-let to five tenants, with 75% of the income from National Car Parks (NCP), which has occupied the 297-space car park since 2005 and has a further nine years remaining on its lease.

- Lok’n Store deploys equity proceeds on site acquisition

Lok’n Store made the first deployment following its equity raise, buying a site in Eastbourne, Sussex, for the development of a 60,000 sq.ft store. The initial land cost was £5.53m and total net project costs are expected to be £12.0m.

- Sirius Real Estate buys two industrial assets

Sirius Real Estate acquired two mixed-use industrial assets, in Liverpool and Barnsley, for £9.5m. With a combined area of 71,957 sq ft of predominantly workshop accommodation, the purchase price represents a net initial yield of 9.6%.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Retail

Rita-Rose Gagné, chief executive:

The consumer and occupier landscape continues to evolve at pace. Occupiers are continuing to shift to using physical space for a broad mix of uses, including point of sale; last mile fulfilment; returns; servicing; experiential; education; workspace, and leisure -living spaces. At the same time, consumers demand top quality environments and experiences.

Consumer spending continues to be resilient, with sales positive vs HY 22, reflecting an inflationary environment, although we have seen some change in spend patterns with consumers trading down in certain categories (e.g. fashion accessories outperforming jewellery). In-store footfall and sales have also been supported by a more cautious consumer, focusing on value (price vs. quality) which is easier to do in-person. In addition, the increasing number of occupiers charging for online deliveries and returns continues to drive store visits.

Logistics

David Sleath, chief executive:

Occupier demand for industrial and logistics space is proving resilient due to the long-term, structural drivers at play in our sector. At the same time, modern sustainable space is in short supply across our chosen sub-markets in Europe and a lack of available land limits the potential supply response. We expect that this supply-demand tension will drive further rental growth across our portfolio, normalising over time towards our long-held expectations of 2% to 6% per annum.

Valuations have been much more stable in the first half of 2023 and investment has activity picked up across the market, including our own disposal of a UK big box portfolio since the period end (which was sold ahead of June 2023 book value). This demonstrates that investors are seeing value at current levels of pricing, and we believe that demand will further increase as clarity emerges around future interest rates, with investors attracted by the positive fundamentals and long-term structural growth potential in logistics and industrial warehousing.

Healthcare

Harry Hyman, chief executive:

The primary care market continues to face challenges in meeting the growing demand for healthcare services. The capacity of existing facilities remains a significant obstacle to implementing government policies aimed at expanding service delivery within general practice, including social prescribing, clinical pharmacists, physiotherapists, mental health, minor operations and other activities. The need for additional space is driven by a population that is growing, aging and suffering from increased chronic illnesses, which are placing a greater burden on healthcare systems in both the UK and Ireland. The extent of the NHS England backlog remains a significant concern, with hospitals struggling to meet objectives for cancer care and routine treatments. The number of patients waiting for treatment has reached record highs, exacerbating the need for improved and increased primary healthcare infrastructure.

There is a growing expectation that many services in the medium-term will progressively move from hospitals to primary care settings, necessitating substantial investment in facilities to accommodate these changes and alleviate the pressure on secondary care. in the years to come. The UK government’s new vision for primary care premises, advocating the establishment of hubs or “super hubs” is a step in this direction. The UK government’s vision is that these hubs is to promote collaboration among various primary care staff and provide a wider range of services in a single location. Larger GP practices with more staff and patients are shown to produce better outcomes. This is in line with larger purpose-built medical centres typical of PHP’s portfolio.

Declining rents in real terms have made investing in the transformation of GP facilities less appealing. Construction costs have risen significantly over the past decade, surpassing the growth in primary care rents, driven by material and labour costs and increasing sustainability requirements, all of which has been compounded by Brexit and the COVID-19 pandemic. Future developments will now need a significant shift of between 20% to 30% in rental values to make them economically viable and we continue to actively engage with both the NHS, Integrated Care Boards and District Valuer for higher rent settlements.

The commercial property market continues to be impacted by economic turbulence but primary care asset values have continued to perform well relative to mainstream commercial property recognising the security of their government backed income, crucial role in providing sustainable healthcare infrastructure and more importantly a much stronger rental growth outlook enabling attractive reversion over the course of long leases.

The lack of recent transactions in the first half of the year has resulted in valuers, to an extent, placing reliance on sentiment to arrive at fair values. We continue to see that for both the primary care and indeed the wider commercial property markets, the high level of financial market volatility and economic uncertainty has resulted in a ‘wait-and-see’ attitude amongst investors until the outlook settles down.

Rising interest rates will undoubtedly continue to impact the market. However, notwithstanding the significant increases and volatility in interest rates seen in the first half of 2023 we continue to believe further significant reductions in primary care values are likely to be muted with a stronger rental growth outlook offsetting the impact of any further yield expansion.

Additionally, the market for primary care assets is relatively small with most assets tightly held by the main specialists in the sector and consequently we anticipate most investors will likely hold their existing assets in the current market primarily because of:

- Limited supplies of stock;

- Very secure, rising income streams with an improving rental growth outlook;

- The main specialists in the sector all having strong balance sheets so there are unlikely to be any “forced sales”; and

- A desire from investors to seek a “Safe Haven” with some shifting from other property sectors.

Student accommodation

Richard Smith, chief executive:

Structural factors continue to drive a growing supply / demand imbalance for student accommodation. Demographic growth will see the population of UK 18-year-olds increase by 140,000 (19%) by 2030. Application rates to university have also grown steadily over recent years, reflecting the value young adults place on a higher level of education and the life experience and opportunities it offers. Demand from international students also continues to grow, as reflected in the 2% increase in undergraduate applications for the 2023/24 academic year.

The supply of student accommodation cannot keep pace with student demand, and many university cities are already facing housing shortages. There has been a 20-40% reduction in the availability of homes to rent in most UK regions when compared to prior to the pandemic (source: Zoopla). Private landlords are choosing to leave the sector in response to rising costs from higher mortgage rates and increasing regulation, such as EPC certification and the anticipated Renters Reform Act. Annual mortgage repayment costs for buy-to-let landlords are expected to rise on average by £3,300 by the end of 2025. We expect these additional costs to either be passed on to students or result in a further reduction in the supply of HMOs (housing in multiple occupancy). The recent reduction in private housing supply has significantly increased demand for our product in many cities and we expect this trend to continue for a number of years.

New supply of purpose-built student accommodation (PBSA) is also down 60% on pre-pandemic levels, reflecting viability challenges created by higher build and funding costs. In many markets, property valuations are now below replacement costs, further constraining new supply. Once allowance is made for first generation university-owned beds leaving the market each year through obsolescence, we expect to see almost no net growth in PBSA supply in the near term.

Market conditions are the strongest we have seen for many years. There is growing unmet need for high-quality, affordable student housing at a time when HMO landlords are leaving the sector and new supply of PBSA is limited. There is growing appeal for students in our all-inclusive, fixed-price offer, which compares favourably in price to HMOs. This supports sustainable growth in rent and earnings in 2024 and beyond.

Real estate research notes

An annual overview note on Tritax EuroBox (EBOX). After rapid value declines due to higher interest rates, optimism has grown that prices are stabilising. The company’s is in a good place to increase annual rent through its quality portfolio.

An update note on abrdn European Logistics Income (ASLI). The company is riding out the storm of market valuation declines, with a focus on managing its portfolio and securing income.

An update note on Urban Logistics REIT (SHED). The company’s wide share price discount to NAV, following a re-rating as values in the sector suffered as interest rates rose, is attractive especially given the operational strength of the company.

Urban Logistics REIT – Fundamentals strong as market stabilises

An initiation note on Lar España Real Estate (LRE). The dominant nature of the company’s assets have proved their resilience in hard times. Now the company has returned dividends back to pre-pandemic levels.

Lar España Real Estate – Dominant assets make a resilient business

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.