Real Estate Roundup

Performance data

Performance data

November’s biggest movers in price terms are shown in the chart below.

November saw a host of companies report interim and full year results with varying outcomes. CLS Holdings, which owns a diverse portfolio split between the UK, Germany and France, gave a positive trading update that outlined its capital recycling programme and asset management initiatives. Its share price rose 14.4% in the month and in the year-to-date has grown 37.4%.

Topping the list of share price movers in November was estate agency group Countrywide following news that it had agreed a deal to sell commercial property consultancy Lambert Smith Hampton. Also high on the list was self-storage specialist Lok’n Store, which tops the list for year-to-date share price return with a 60% rise, and housebuilder Countryside. Student accommodation giant Unite Group completed its £1.4bn acquisition of rival Liberty Living, which saw its share price rise 11.2% in the month. U and I Group’s share price continued its seesaw performance having been in the top 10 gainers in September, the bottom 10 in October and back among the biggest risers this month. Town Centre Securities, which has outlined plans to further reduce its exposure to retail, was in the top 10 for the second month running.

Not for the first time Intu Properties suffered the biggest decrease in share price over a one-month period. In fact, the shopping centre landlord has, by far and away, seen its share price fall the most in the year-to-date of all property companies. Its share price sunk to 35p at the end of November from 110p at the beginning of the year. During November the group announced a trading update, where it predicted like-for-like rental income for 2019 to be down 9%.

British Land, which owns shopping centres as well as London office campuses, saw its share price drop 7.3% in the month after reporting a 5.4% fall in net asset value (NAV) in half-year results. The fall was largely due to a 10.7% drop in the value of its retail portfolio. Central London focused retail companies, Shaftesbury and Capital & Counties, both saw their share price fall during the month. Shaftesbury announced a fall in its NAV during full year results – mainly due to a big drop off in the value of its Longmartin joint venture in Covent Garden. Capital & Counties agreed a deal to sell its Earls Court estate for £425m, significantly short of the June 2019 valuation of £508m. Both PRS REIT and parent company Sigma Capital Group also saw their share price fall in November.

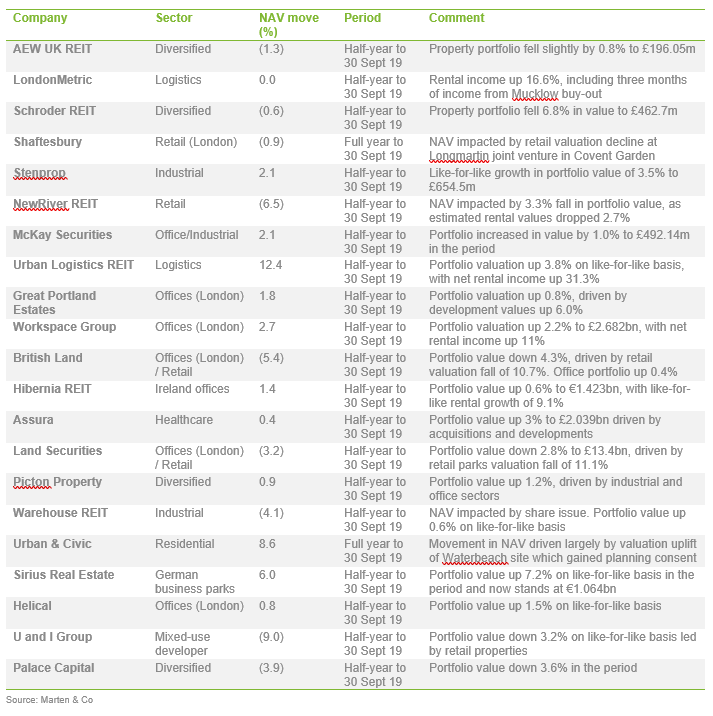

Valuation moves

Valuation moves

Managers’ views

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Diversified

The portfolio, now increasingly mature, is offering us numerous opportunities to undertake asset management initiatives which provide various potential routes to add value. Despite the backdrop of ongoing political uncertainty, the company remains confident in its ability to deliver on its objectives. The value of our assets has remained robust, particularly in the office and industrial sectors, where assets have either been acquired at conservative levels or provide exciting value-add opportunities. There has been some loss of value in retail assets, in line with the structural changes that we are seeing across the retail sector. However, this has been mitigated by the portfolio’s light exposure to the sector and also by valuation gains in other parts of the portfolio. Despite our positive outlook for the portfolio, we are conscious of the opportunity to limit downside risk in an uncertain macro environment and, with this in mind, we have recently taken a number of steps to reduce risk associated with the company’s debt facility.

The outlook for UK real estate markets in 2020 may be negatively impacted by political risks as well as macroeconomic factors. A risk of the UK leaving the EU without a deal could lead to a recessionary environment as companies delay investment decisions. An orderly Brexit transition should lead to continued growth with real assets benefiting from a low interest rate environment. This more uncertain outlook has driven a disciplined approach to selling low-yielding assets on completion of asset management initiatives.

In general, office markets appear to be relatively well placed to withstand a period of economic weakness. Take-up was steady through 2019 with tech, media and serviced office providers offsetting reduced demand from financial services. In strong regional centres vacancy rates are close to their low point before the financial crisis and new building is limited. Cities such as Manchester, Leeds and Bristol are capturing higher levels of growth and diversified economies with constrained supply are performing well.

The protracted uncertainty over Brexit across our markets has held back occupier demand and resulted in lower levels of office occupier take up. Despite this, the highly restricted supply of modern business space, especially across our South East office markets, has helped maintain rental values and is set to support future rental growth, especially with a recovery in business confidence.

There is still considerable pent up demand from a wide range of domestic and overseas buyers seeking to invest in our markets. However, the volume of transactions has been lower over the period with the investment market characterised by a shortage of supply due to political uncertainty. This has supported capital values which have also held steady.

The letting of our development and refurbishment schemes, the recycling of capital and the investment of firepower from our increased loan facilities provide us with the opportunity to build on the substantial growth we have delivered from the strategic investment in our portfolio over recent years. We hope that by the end of the year, political clarity will provide the basis for a more positive economic outlook. In the meantime, our focus on the strongest regions and sectors of the UK and their prospects to enhance our portfolio growth once confidence improves, provides us with an encouraging platform for the future.

There is much political and economic uncertainty at present and a perception that we are in an environment where interest rates are likely to remain low for the foreseeable future, alongside a period of lower returns generally. Against this backdrop we believe that investing in real assets remains attractive, in particular where there is a strong income stream with further potential for growth through active management. Investing in the right assets where there is good occupational demand will continue to deliver positive results for shareholders.

We have an encouraging pipeline of both leasing and active management activity, which underpins the reversionary potential of the portfolio. Recognising our portfolio composition and balance sheet strength, we believe Picton is well positioned to continue its track record of outperformance.

Logistics

Logistics

We continue to live and work in an uncertain world where many established principles and practices are being disrupted amid ongoing political and economic uncertainty and the accelerating impact of new technology.

The pace of change continues to weigh heavily on the real estate sector as polarisation of performances accelerate and varying levels of optimism and pessimism are reflected in valuations. The fact is, for many in the sector, technology is changing quicker than many beliefs. Whilst change and disruption is scary, being left behind is scarier. Our decision many years ago to pivot from retail into logistics and convenience was in response to the increasing disruption from the shift in consumer spend to online and top up shopping. We believe this trend will continue for many years as online penetration rises and consumer expectations increase.

Our more recent focus on urban logistics is very much in response to these changes as well as our efforts to further improve our portfolio’s resilience. The strong demand/supply dynamics in logistics provide terrific certainty and stability in an uncertain world and helps to ensure that the intrinsic value of warehousing, particularly urban, is growing every day. This has been our strong conviction call and one that prompted our strategic acquisition of A&J Mucklow Group in the period.

The urban logistics sub sector continues to show resilience in a context of wider economic and political uncertainty. The UK continues to be one of the fastest growing adopters of online retail sales and there is a requirement for tenants to develop their e-fulfilment capability accordingly. As such, key geographic regions across the UK are seeing buoyant leasing activity.

We also see a strong market for local delivery driven by 10% expected population growth across major UK conurbations by 2038 (source: Savills). Furthermore, supply in the 20,000-200,000 sq ft logistics space, where Urban Logistics is focused, has fallen by 36.0% since 2012 with land being lost to higher value uses. Growth of online retail could account for up to 25% of all retail sales by 2021, creating yet more demand for distribution warehousing, particularly in our size range of unit.

Our focus will be to continue acquiring assets and implementing asset management initiatives with a focus on rental growth in light of the current market dynamic of diminishing supply and increasing occupier demand. We will also focus on maintaining and building existing tenant relationships with a view to extending the group’s reputation as the leader in the smaller lot size urban logistics market. We will continue to build a pipeline of property acquisitions in the expectation that we will be able to raise new equity capital in the not too distant future.

Retail (London)

Retail (London)

The mood of uncertainty, which has grown since the 2016 EU referendum, may yet take some time to improve, and current forecasts for the national economy do not show any sign of return to confidence and optimism amongst businesses and consumers. The structural changes facing national retail are unlikely to abate, tempering retailer demand for space other than in the busiest locations.

By their nature, qualities and international appeal, London and the West End are much less affected by current national concerns, and their prospects for long-term growth and investment remain strongly positive. Our villages, in the popular heart of the West End, provide a character and variety which traditional high streets and shopping centres are unable to match, attracting exceptional footfall and seven-days-a week trading. Our skill in curating distinctive, prosperous destinations, which combine authentic experiences and innovative choices, is complemented by our long experience in continually adapting our buildings to meet trends in demand, occupier requirements and stringent environmental standards.

Our proven strategy, an impossible-to-replicate resilient portfolio, stable long-term financing and, most importantly, an experienced, enthusiastic and entrepreneurial team, guided by a responsible culture and embedded values, together provide the ingredients for the continued long-term success of this business.

Industrial

Industrial

Our conviction regarding the growth prospects of the UK multi-let industrial (MLI) asset class grows stronger as we gain more exposure to the sector. The increasing occupational demand, coupled with the restricted supply, continues to produce significant rental growth each time we renew or re-let any MLI units. This is generally the case across the whole MLI portfolio. We see no signs of this slowing in the near future as new types of occupiers, which have never previously occupied MLI units, enabled by technology and communication advancements, compete with traditional occupiers for MLI space. Supply continues to be constrained as it is still uneconomic to build new MLI estates at current rental levels. This is borne out by the growth in values shown by the MLI portfolio driven by growth in rents rather than changes in yields.

We have also committed to building out a market leading, technology-enabled management platform for the MLI asset class. We believe this sector is ripe for a platform approach in the same way as student accommodation, self-storage, hotels and serviced offices have evolved technology-enabled operating and marketing platforms to generate margin efficiencies and the ability to offer a wider range of services and products to their tenant base.

Occupational demand is strong, with employment in the UK at record levels, and we are not so far seeing any negative Brexit-related impact on demand for warehouse space in our target markets. Low vacancy rates coupled with the disconnect between investment values and replacement costs mean that the sector is positioned for further rental growth and we will continue to capture this at lease renewal and through new lettings. Our activities in the first half of the year have substantially increased the portfolio estimated rental value to £34.5m, against a contracted rent roll of £30.3m, showing the reversionary potential in the portfolio. We will continue to focus on actively managing the portfolio to drive returns, including disposing of a small number of identified assets where we can reinvest in attractive opportunities.

The combination of our dividend stream and its growth is the key valuation driver of the company. That said, I take comfort from the fact that in the current very low interest rate environment, the portfolio is conservatively valued on a net initial yield of 6.5%, particularly given the enhancements we continue to make both to the duration and quality of the income stream.

Retail

Retail

Despite a relatively resilient consumer backdrop, which has seen modest wage growth and employment at a 40-year high, the retail sector continues to face significant challenges, and there remains a clear divergence in retailer performance as a result. Retailers focused on providing convenience, value or services – which represent the majority of our occupiers – have shown resilience due to their focus on essential spending and the barriers to replicating their business models online. In contrast, retailer underperformance in these market conditions has generally been a result of operating in structurally challenged sub-sectors, mismanagement, or a combination of both factors. Some of these underperforming retailers have entered into Company Voluntary Arrangements (‘CVAs’) to reduce rent costs, and in extreme cases, have exited the market completely, impacting rental income for retail property owners. Even for those retailers performing well, the market conditions have increased their focus on occupational costs, resulting in more challenging negotiations around new lettings and renewals. However, we feel relatively better positioned in responding to this pressure, due to our affordable rents, our active approach to asset management, and our conveniently located assets.

It remains our belief that the UK has too much retail space. While we have aligned ourselves to the right types of assets, which meet the everyday needs of consumers and the changing needs of successful retailers, this excess of space has led to increased vacancy in town centres, a lack of investment by landlords and lower business rates income for councils, with significant implications for the vitality of town centres. Local Authorities remain the ultimate custodians of these spaces, and they have taken an increasingly interventionist approach in recent years, acquiring retail assets with the aim of delivering much-needed regeneration projects for their communities. With our market-leading asset management platform, we are well positioned to support Local Authorities as they take these steps, bringing our scale, relationships and expertise to help them generate sustainable income from these assets while they realise their ambitions for their town centres.

Offices (London)

Offices (London)

London’s commercial real estate markets have again trended broadly flat over the period, lacking clear direction as political and economic uncertainty persisted due to continued negotiations regarding the UK’s future relationship with the EU and the UK general election. Despite the uncertain environment, activity in London’s occupational markets remained resilient, with rental growth in a number of subsectors, although transaction levels in investment markets slowed as vendors have been less willing to bring assets to the market.

Given the cyclical nature of our markets, we actively monitor numerous lead indicators to help identify key trends in our marketplace. Over the last six months, our property capital value indicators are largely unchanged and continue to provide limited market visibility. Investment activity in the central London commercial property market remains healthy and the real yield spread over gilt yields continues to be supportive. Prime yields are currently trending flat, although it is possible that there is some yield contraction in the event of greater political clarity. We do not expect significant rental value movements in the very near-term and, given the rental performance of the portfolio in the first half of the year, our rental value growth range for the financial year to 31 March 2020 is unchanged at minus 2.0% to +1.5%.

We operate in a climate of political uncertainty and we hope that the forthcoming general election will provide clarity in a manner which is positive for the UK economy. We remain a company focused on the creation of capital profits through the development and letting of the high-quality office space that today’s occupiers are seeking. Our current portfolio will continue to generate such profits as it reaches its fully let and stabilised potential. Further growth is dependent on the group unearthing new opportunities and management’s efforts are focused on achieving this. With our experience and track record, we are confident in our ability to add to our pipeline and to continue the growth of Helical.

Our ambition is to have a balanced portfolio that generates sufficient net rental income to firstly, exceed all of our recurring costs and second, provide a surplus significantly greater than our annual dividend to Shareholders. We have a see-through estimated rental value on the portfolio of £59.6m and expect to generate this surplus once all of our current development and asset management activities are complete. We are also seeking a pipeline of opportunities to grow the balance sheet through the creation of development profits and capital surpluses.

Offices (London) / Retail

Offices (London) / Retail

Our campus strategy is really resonating with businesses and their employees alike and with occupancy of 97% across our London campuses and 96% in retail, our portfolio remains effectively full. In London, we signed 671,000 sq ft of lettings and renewals. Our developments are now 87% pre-let or under offer, securing £55m pa of future rental income. We are also successfully repurposing existing space to appeal to a broader range of occupier, with lettings to tech companies Monzo and Skyscanner at Broadgate and Regent’s Place respectively (post period end) and a renewal to Visa, our biggest occupier at Paddington. Overall, offices values were up 0.4%.

We are committed to ensuring our offer meets the needs of a broad range of occupiers. In London, office customers can choose from a range of product, varied in terms of fit out, flexibility and price. Importantly, customers can tailor their requirements across these products depending on their specific need, as well as change their requirements over time as their businesses evolve. Storey Club, which provides high quality ad hoc meeting and events space is now fully operational at Paddington and we will soon launch our second standalone Storey building in Haggerston. The breadth of this customer offer, underpinned by our campuses, is key to our leasing success.

The retail market remained tough, and we saw this reflected in valuations which were down 10.7%. However, our portfolio delivered positive like for like retailer sales with footfall flat, compared to a market where both metrics were negative. Long term deals were on average 15% ahead of previous passing rent, but we have been pragmatic in our approach, to keep occupancy high and support operational performance. Shorter-term deals are often an effective way to secure a new occupier for space which has become vacant unexpectedly through a CVA or administration. More generally, this trend towards more flexible leasing is reflective of the broader market as occupiers seek seasonal or pop-up sites in different locations on a shorter term basis. We continue to be proactive in our response to CVAs: Over two thirds of store closures since April 2017 are either re-let, under offer or in negotiations. Overall, leasing was 1% ahead of previous passing rent excluding rates mitigation deals and assets being readied for development.

We expect the retail market to remain challenging as it continues to be impacted by structural change, CVAs and administrations. Outlets will continue to be among the best performers in this sector and dominant retail destinations will attract a greater share of retailer demand. We’ll continue to develop plans for repurposing assets where we see opportunity to create value.

Real estate fundamentals in London are sound. The office market remains in good health and our activities in the capital as a percentage of our portfolio will increase in the coming years – up from 67% today. We have a substantial development pipeline in the capital and will continue to look at further opportunities.

With a general election and the UK’s proposed exit from the EU further delayed, there will be continued uncertainty in the near term. However, we go into the second half of the year with confidence. We have a clear strategic direction and, with modest gearing, we’re well positioned to seize value-creating opportunities as we see them.

Healthcare

Healthcare

Assura remains well-positioned to become the NHS’s partner of choice in primary care property in a highly fragmented market characterised by significant under-investment in infrastructure. Our portfolio of 560 medical centres compares with a total UK market of approximately 9,000, highlighting Assura’s strong prospects for further growth. The strength of our balance sheet has seen us receive continued support from our existing lenders, raising £107m in the period. We retain headroom for further investment with an LTV of 36%, average weighted interest rate of 3.16% and available facilities of £310m.

We also have a strong pipeline of £65m of targeted acquisitions and £72m of development opportunities currently in legal hands. The open market rent review mechanism in our sector provides income growth whilst recent land and construction cost inflation provides the potential for future rental growth. We have seen trends in cost inflation flowing through to open market rent reviews. Looking ahead, Assura will continue its work to provide outstanding spaces for health services in our communities whilst also providing stable long-term returns, reflected in the proposed increase in quarterly dividend from January 2020.

Residential

Residential

The Urban & Civic Master Developer model continues to return sustainable growth in generally static market conditions. Whilst the published indices are that political uncertainty is weighing on land values, the company maintains upward performance by creating new prime environments where housebuilders want to build, and homeowners want to live. Given the now maturing nature of Urban & Civic projects and the extent of existing pipeline, the reasonable assumption is for further medium-term acceleration.

To maintain revenues when facing continued political uncertainty, housebuilders may regard Urban & Civic sites as a preferable low risk route to return on capital employed. Build cost pressures are abating. We are seeing those signs in the interest for new parcels from existing and new customers alike: current licences and forward realisations number 28 with a further 11, including some smaller sales, in legal documentation.

Group projects amount to 32,000 consented or allocated plots, with a further 19,000 moving through the planning process. That represents a tripling of holdings in five years. We offer a rapid and pre consented route to sales in affordable and well-connected locations with strong underlying demographics in the South East. NPPF guidance envisages circumstances in which councils might need to plan for more housing than the standard method calculation. A recent report from, planning consultants, Lichfields reviewed the plan making progress of all local authorities in England, excluding London, and found that plans in the South East either matched or were providing for less than the 273,000-home target, predominantly citing constraints on supply. That is our area and those are the authorities with which Urban & Civic, as the leading Master Developer, can command most leverage.

Mixed-use development

Mixed-use development

The public sector owns about 15% of all land in our cities (over 20% in London and up to 40% in some boroughs) but lacks the planning and development expertise and the financial resources to address the growing need for more affordable, convenient and inspiring mixed-used places. As a specialist in this field, U+I is ideally placed to deliver both socio-economic value for communities and superior shareholder returns.

U+I focuses on the three high growth geographies of the London City Region (within one hour’s commute from Central London), Manchester and Dublin. These regions are concentrated with highly talented people, attract large numbers of tourists, have excellent transport links and show tolerance for diversity. The London City Region is a global commerce, technology and culture hub with a population that is forecast to grow by 10% in the next seven years. Manchester is the most economically important city outside London with 14% population growth forecast in the next five years. Dublin is the capital of the fastest growing economy in the EU.

While these structural growth drivers are clear, optimum progress is hindered by current political and economic uncertainties which are leading to delayed decisions in both the public sector and in the deployment of capital into major regeneration projects. In the short term, with the general election now set, inactivity in the real estate environment is likely to continue, causing further delays in planning, development and investment decisions.

We continue to focus on delivering milestone events within our existing valuable public private partnerships (PPP) pipeline. As part of this we are actively progressing discussions with potential funding partners for three key PPP projects at Mayfield, Manchester; 8 Albert Embankment and Landmark Court in London, totalling some £2bn gross development value (GDV) of projects. There is positive interest in our projects – particularly from Asian, North American and domestic investors – which is particularly encouraging given the levels of caution from inward capital to the UK. The most important milestone to advance these discussions remains securing a resolution to grant planning and we expect a decision on all three projects in H2.

German business parks

German business parks

During the first half of the current financial year Sirius achieved a significant milestone in being included in the FTSE 250 index for the first time. While inclusion in the FTSE 250 provides multiple benefits to shareholders the management team is focused on identifying ways in which the company can take advantage of its new standing and remain committed to growing the business organically and through acquisitions.

Sirius’ value-add business model continues to flourish due to the diversity that comes from intensive asset management and the company’s wide range of products. Occupier demand for both conventional and flexible space remains strong while investor appetite for exposure to the German light industrial market continues to drive yields down. Part of this is fuelled by the low rates of financing available which Sirius is strongly positioned to take advantage of.

With significant vacancy in our value-add portfolio and a defensive portfolio gross yield of 7.4%, there remains considerable potential to increase rent roll and capital values. Following the completion of the acquisitions that were notarised in the period, the company has in the region of €80m of funding available for future acquisitions on its own balance sheet. As such, the company is well positioned for a busy and progressive second half of the financial year and is trading in line with the board’s expectations.

New research

New research

We have published an update note on Aberdeen Standard European Logistics Income. We have also published the first in a series of research notes on the different real estate sectors, starting with the retail market. Read it by clicking on the link or by visiting www.quoteddata.com.

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.