Real Estate Roundup

Performance data

Performance data

September’s biggest movers in price terms are shown in the chart below.

The month of September was a bumper month for many property companies’ share price, dominated by retail focused companies, who in general have taken a hammering over the past 18 months or so. Top of the list was Capital & Regional. Shares in the shopping centre landlord bounced after it announced it was in talks with South African REIT Growthpoint Properties to sell a majority stake in the company. In the year to date, Capital & Regional’s share price has fallen 27.4%.

Also high on the list was Hammerson, which owns shopping centres, retail parks and outlet centres in the UK, Ireland and France. Its share price grew following news that it had exceeded its £500m disposal target for the year. Another retail landlord, NewRiver REIT, was third on the list having made progress with its contrarian investment strategy into retail parks. Capital & Counties Properties also featured in the top five as plans to split its Earls Court estate and Covent Garden portfolio advanced. Housebuilders Inland Homes and Countryside Properties also made impressive gains in the month, while regeneration specialist U and I Group squeaked into the top 10 with a 11.1% increase.

On the flip side, the UK’s biggest estate agent group, Countrywide, which also owns a commercial real estate consultancy, was the worst performing in September. It is the second month in a row that it has been in the bottom 10 and in the year to date it is beaten only by Intu Properties as the worst performing listed property company, losing 53.5%.

Town Centre Securities, which owns a diverse property portfolio across the UK, was second on the list having reported a fall in NAV off the back of a drop in the value of its retail portfolio. Another regional property player, Harworth Group, was high on the list of fallers despite posting decent half-year results during the month. The group recorded growth in NAV, profits, earnings per share and dividend for the six months to 30 June 2019. Pan-African property company GRIT Real Estate Income Group reported good full-year results but saw its share price fall 3.7%. Specialist healthcare REIT Primary Health Properties’ share price fell slightly, by 2.9%, after raising £100m in a share placing. Self-storage specialist Big Yellow Group also saw its share price fall 2.9% for the month having been in the top 10 in August.

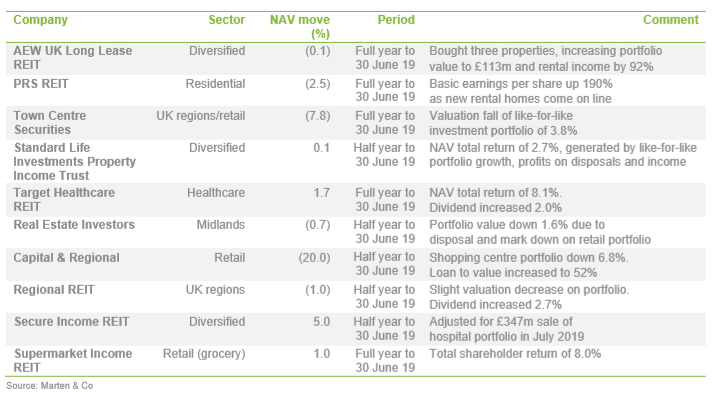

Valuation moves

Valuation moves

Corporate activity in September

Corporate activity in September

There were two major fundraisings in September. Primary Health Properties raised £100m and said it would use the capital to fund the development and acquisition of properties. It said the placing would also strengthen its balance sheet and reduce gearing in the near term.

Target Healthcare REIT raised £80m in an oversubscribed placing. The company will use the proceeds to grow the size and scale of the business having identified a pipeline of acquisitions.

Supermarket Income REIT announced intentions to raise £50m through a share placing to fund new acquisitions. It set the issue price at 102 pence per new ordinary share. The capital will be used to acquire three Sainsbury’s-let assets.

GRIT Real Estate Income Group, which invests in pan-African property, announced plans to carry out a placing of up to 280 million shares at a price no less than NAV. It plans to use the proceeds to reduce debt and grow its portfolio.

GCP Student Living was promoted to the FTSE 250 Index, taking the place of Millennium & Copthorne Hotels.

Capital & Regional announced it was in discussions to sell a majority stake in the company to South African REIT Growthpoint Properties. The deal would be through a combination of a partial offer in cash for Capital & Regional shares and an injection of capital to support the company’s strategy through a subscription for new Capital & Regional shares.

Custodian REIT extended a borrowing facility that was coming to the end of its life by three years. Lloyds Bank also agreed to increase the total funds available under the revolving credit facility from £35m to £50m.

WeWork pulled its multi-billion IPO after failing to attract enough support from investors. The move followed calls from its largest investor Softbank to shelve the listing.

Managers’ views

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

European industrial and logistics

European industrial and logistics

Aberdeen Standard European Logistics Income

The logistics market is sizeable and continues to grow as the sector benefits from the rapid take-up of logistics facilities, largely helped by the growth in e-commerce, and the long inflation-linked leases that quality tenants are prepared to sign up to in many parts of Europe. This strategy which is focused on investments on the Continent with attractive pricing, indexation of leases as standard and lower financing costs underpins our investment policy. As supply chain management gains importance due to growing e-commerce and ongoing urbanisation, prime logistics space may become scarce. The market has started to reflect this with increased pricing and lower yields which underpins valuations. However, with vacancy rates at historic low levels, rising construction costs and strong demand for modern warehouses, it is anticipated that rental growth will become an important driver for future capital growth in supply constrained areas.

Student accommodation

Student accommodation

GCP Student Living

The UK continues to attract substantial numbers of international students, with acceptances to full-time courses for the 2018/19 academic year up 4.4% year-on-year. The total number of EU and non-EU international students accepted to courses in the UK is at the highest level ever seen. Non-EU student numbers have increased by 4.9% year-on-year, with acceptances of EU students increasing 3.8% and to levels above those seen prior to the EU referendum in 2016. Initial data published by UCAS indicates that applications by EU students and non-EU students for the 2019/20 year have increased by 1.0% and 7.9% respectively on the previous year.

The number of acceptances for UK students showed a modest year-on-year decline of 0.8% for the 2018/19 academic year. This decrease has been widely attributed to the decline in the population of 18 year-olds in the UK, which is forecast to reverse after 2020. Whilst total acceptances to full-time higher education in the UK for the 2018/19 academic year remained broadly consistent with prior years, a combination of the cost of tuition and the removal of student number controls continues to benefit the top ranked universities most, suggesting a flight to quality as students increasingly view their choice of university in terms of expected future earnings.

Retail (grocery)

Retail (grocery)

Supermarket Income REIT

UK consumer spending on grocery has grown year-on-year since 1999. According to forecasts, total spending will continue to increase by a further 12.5% in the next five years from £194bn in 2019 to £218bn by 2024. Although dominated by a few players, the grocery market is dynamic and highly competitive and has fragmented over the last 15 years, with lower-price operators, led by Aldi and Lidl, experiencing strong sales growth. The discounters continue to expand their presence by adding new stores and competing on price. This has resulted in them successfully gaining market share, though principally from the existing discounter channel rather than the Big Four (Tesco, Asda, Sainsbury’s and Morrisons).

After a period of material expansion in store numbers since 2000, the Big Four have substantially completed their store growth plans and are now in a consolidation phase. The effect of this shift in strategic focus has been an end to sale-and-leaseback transactions involving the Big Four and, therefore, there has been a decline in the number of assets being offered to the investment market. Indeed, in a reversal of recent trends, Tesco has now become a net buyer of stores, spending around £1.2bn on store buybacks since 2015.

Operator buybacks will continue to be a key theme in the investment market, as changes to accounting rules through IFRS 16 mean that reducing existing lease commitments will be an increasingly attractive way for the operators to strengthen their underlying balance sheet. IFRS 16 effectively requires all rental obligations to be capitalised on a balance sheet as a financing liability and then expensed as a finance cost rather than rental expense in the income statement. The reduced supply of new stock from operators combined with a growing demand for supermarket assets will generate favourable supply and demand dynamics and therefore trigger a long-term compression in yields closer to those for the UK commercial property, with a corresponding increase in supermarket property asset values.

Retail

Retail

Town Centre Securities

The retail sector has had a turbulent 12 months. Major high street brands have experienced trading difficulties attributable largely to structural change in consumer trends, oversized portfolios and the impact of wider economic uncertainties such as the devalued pound and increased costs.

Pressure has been felt by landlords as tenants have gone into administration and entered into CVAs or opened up a dialogue on rent affordability in the current trading climate. Where rents have been rebased through CVAs for some tenants, others who have stronger balance sheets and have typically managed their real estate growth more effectively are beginning to seek some level of equilibrium in rents with their CVA competitors. This will stall rental growth/recovery over the short to medium term for all but the super prime retail stock.

Due to stresses in the trading environment the valuation of the retail elements of our portfolio deteriorated by 2.7% during the second half of the year and 5.6% overall year on year. This relatively robust performance is largely down to the active asset management and targeted investment across the estate and the mixed-use nature of much of our portfolio where our strategy has been to invest in and develop assets which have diversity of uses. That said within our overall portfolio we have also seen some significant shifts in value on an asset by asset basis.

UK regional markets

UK regional markets

Regional REIT

At £20bn, investment volumes in the first half of 2019 were 29% below the same period in 2018 and 26% below average. This was attributed to the continued uncertainty caused by the six-month extension to the Brexit deadline, which has now been extended until the end of October 2019. However, there is evidence that the UK regions performed better than London in Q2 2019. Despite investment volumes for single assets in the UK regions falling 25% below the five-year quarterly average at £3.7 bn in Q2 2019, London volumes dropped to the lowest level since Q4 2011 at £4.0 bn – 37% below the five-year average.

Research from CBRE indicates that regional offices have outperformed in comparison to central London offices, delivering superior returns of 10.8% in the 12 months ending July 2019 in comparison to central London office returns of 4.9% – a trend that has been witnessed over the last three years.

Harworth Group

Local political risk is undoubtedly higher. However, this does not detract from the continued strong Central Government support for both residential and commercial development. Incentives to support home ownership, such as Help-to-Buy, have been extended (albeit in more limited form) to 2023, whilst the Government’s continued commitment to regional devolution in the form of new powers and monies to regional mayors has been actively supported by the new Prime Minister. Once further monies have been devolved, this should help unlock major new residential and commercial development through new infrastructure investment, without having to resort to Central Government assistance.

Healthcare

Healthcare

Target Healthcare REIT

July 2019 marked the 50th anniversary of the successful Apollo 11 mission to put man on the moon. Society has changed markedly since then; life expectancy has surged, pension age has equalised for men and women, and the ‘Baby Boomer’ post war children have become the wealthiest generation in recent history. That same cohort are now casting aside historic ”aged” stereotyping and living life to the full for much longer.

One wonders what could be accomplished if the forward planning required for a moon landing could be applied to planning for the cost and resources required by a rapidly ageing society. By 2035, there will be double the number of people aged over 65 living with four or more comorbidities; the Alzheimer’s Society predict those living alone with dementia will double over the next two decades, and Age UK already describes what it calls care ‘deserts’ where 30% of local authority areas have ‘no access’ to residential care beds and 60% have ‘no access’ to nursing home beds. One small step, it seems, is all that is needed to start the process.

Diversified

Diversified

UK Commercial Property REIT

Given the macroeconomic environment, the UK commercial property market is holding up well with positive total returns still forecast. While investment volumes are considerably down compared to previous years, occupancy is generally high, apart from the much-publicised problems in the retail sector. Conversely, the industrial sector benefits from this trend as retailers move more of their business online, increasing the need for storage and distribution space. The property market continues to be underpinned by strong fundamentals: relatively high yields compared to other asset classes, limited development, high occupancy rates and, in most cases, controlled leverage.

Standard Life Investments Income Trust

The second quarter saw a fall in transaction activity to levels last seen in 2012. Overseas investors have been net sellers of the UK office market with Chinese capital controls now appearing to have a significant effect on global real estate markets. Although New York has perhaps borne the brunt of Chinese disinvestment, London is not immune, and there are indications that other global investors are displaying more caution towards London too, which see London office pricing could soften in the second half of the year. The retail sector has a very shallow pool of buyers tending to be opportunistic in nature with a large amount of stock being quietly marketed. The lack of demand in the occupier market and uncertainty about where rental values will settle mean investors are, in many retail sub-sectors, demanding discounts to valuation. The share price discount to net asset value for listed stocks with a high retail weighting also provides an indication of sentiment towards this sector.

Secure Income REIT

Political uncertainty is reaching a crescendo in the UK as the probability of a no-deal Brexit has risen significantly. Regrettably, uncertainty is also likely to continue into 2020 and quite possibly beyond. Any of the following: a disorderly Brexit, the prospects of an imminent general election or a far-left Labour government is likely to sustain demand for lowerrisk inflation-protected investments. Continued Sterling weakness should also contribute to attracting overseas capital into these assets, especially if global economic concerns continue to suppress government bond yields across the world. The £347m sale of our non-core hospitals at a 16% premium to valuation to a US healthcare REIT is an illustration of this trend. The fact that these assets delivered an unlevered total return of over 100% during the five years of our ownership as a quoted REIT demonstrates how ostensibly “boring” assets that churn out highly predictable income streams can deliver exciting returns.

BMO Real Estate Investments

The outlook continues to be dominated by the stresses in the retail sector and the Brexit process, with its political and economic ramifications. A slowdown in global growth offers additional challenges, with a period of muted rental growth now likely to be the outcome and meaningful differences in the prospect for the underlying property sectors. However, with fiscal policy potentially easing and the market expecting interest rates to remain at low levels by past standards, property market performance may receive some support once there is greater clarity on political sentiment.

AEW UK Long Lease REIT

The long income property sector continues to benefit from strong competition amongst investors looking to buy into long-let inflation-linked income and assets that are akin to social infrastructure. Returns from long income property outperformed traditional commercial real estate in the first half of 2019 and show a total return of 8.2% in the 12 months to June 2019 vs 3.9% from all property. We have seen this first-hand when acquiring properties as well as in our own portfolio which, excluding assets let to Meridian Steel, delivered a capital return of 3.4% over this period in addition to the income derived from the Group’s properties.

Residential

Residential

PRS REIT

The build-to-rent market is growing steadily and investment in the private rented sector (PRS) in 2018 increased by 11% on the previous year to £2.6bn. By the end of the first quarter of 2019, there were approximately 30,000 completed PRS homes in the UK. About half of this output was concentrated in London and almost all of the development comprised apartments. A similar number of PRS homes is currently under construction and a further 70,000 or so homes are in planning. The vast majority of this delivery remains apartment schemes in urban centres. To place the scale of this PRS activity in context, it accounts for under 1% of the total value of the rental stock in the UK. By comparison, in more mature PRS markets, such as the United States, institutionally-owned properties represent nearly 50% of the total rental market. According to Savills, at full maturity, the UK PRS market could be worth around £550bn and encompass more than 1.7 million households. This indicates the scale of opportunity available to market participants, including the PRS REIT.

Ireland commercial

Ireland commercial

Yew Grove REIT

The short-term outlook is likely to see significant volatility as Brexit and its various contortions continues to roil the markets. It is likely that this may have a dampening effect on investors, and for a time prices and values. The medium-term outlook is still good, although perhaps a little less optimistic than at this time 12 months ago. Even with the political and potential macroeconomic headwinds, the company has continued to invest well, manage its portfolio profitably and grow by raising further debt and equity capital. Our pipeline of potential acquisitions in our key geographical markets over the next twelve months stands at over €125m of well tenanted industrial and office properties.

New research

New research

We have published an annual overview note on Civitas Social Housing. Read it by clicking on the link or by visiting www.quoteddata.com.

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.