A story in today’s Financial Times seems to have triggered a slide in the share prices of a number of renewable energy companies. Rishi Sunak is said to be exploring the possibility of a windfall tax on all energy generating companies, including those in the renewable energy sector, as well as oil and gas companies. […]

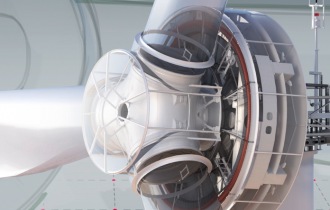

Greencoat Renewables is buying a 65MW portfolio of operating wind farms in France from Axpo, Switzerland’s largest producer of renewable energy. The acquisition comprises four wind farms, each of which benefits from long-term contracts with the French government. The 16MW Arcy-Précy windfarm is located in the Burgundy region of France and consists of eight Vestas […]

London office developer Helical has posted a 7.3% uplift in NAV for the year to 31 March 2022. The highlights of the results were: EPRA net tangible asset value per share up 7.3% to 572p (31 March 2021: 533p) EPRA net disposal value per share up 13.6% to 551p (31 March 2021: 485p) Net asset […]

Warehouse REIT delivered a NAV total return for the year to 31 March 2022 of 33.2%, as it gears up for a move from AIM to the main market. EPRA net tangible assets (NTA) per share was up 28.6% to 173.8p (31 March 2021: 135.1 pence), thanks to a large increase in the value of […]

In QuotedData’s morning briefing 24 May 2022: Alina Holdings says that due to “the recent collapse in Global Equity Markets, and the board’s relatively bleak economic outlook with the potential for ‘Stagflation’, leading to further stock market declines” it intends to undertake an accelerated strategic review, including the potential sale of the company or liquidation […]

JZ Capital Partners to benefit from portfolio holding sale in JZHL Secondary Fund – JZ Capital Partners (JZCP), has provided a further update in relation to its interest in the secondary fund, JZHL Secondary Fund, which was the fund it had earlier sold its interests in certain US microcap portfolio companies to. Since JZCP’s last […]

Bluefield Solar Income buys battery storage projects in Derbyshire and Worcestershire – Bluefield Solar Income (BSIF) has acquired two standalone 40 MW battery storage projects from Green Hedge Energy UK Limited for approximately £4.5m. The acquisition represents the development rights, grid connection costs and the leasehold of land for the two projects, which are based […]

Schroder Oriental Income cuts performance fee – Schroder Oriental Income (SOI) has posted its interim results for the six months to 29 February 2022. During this period, the trust delivered an NAV return of 0.9% and a share price return of -0.7%. The share price discount to NAV ended the six month period at 5.2%, […]

In QuotedData’s morning briefing 23 May 2022: Pantheon Infrastructure (PINT) has invested approximately $46.1m (£37m) in Cartier Energy, a district energy platform in the US. The business is made up of eight district energy systems located across the Northeast, Mid-Atlantic and Midwest and provides diversified energy services such as heat (steam, hot water), cooling (chilled […]

Scottish Mortgage Investment Trust’s Claire Shaw explains why investing in the next generation of green technologies requires time and patience. “What is the greater challenge to decarbonisation? The speed at which we need to find breakthrough innovations to reform carbon-intensive sectors at scale or the patience investors require to fund the companies set to do […]

Thank you to everyone that listened in today, whether you watched the Zoom live, on Facebook or on YouTube. In this week’s show, James Carthew covered the week’s top stories: • Scottish Mortgage • HydrogenOne This week’s interview was with James Thom of Aberdeen New Dawn – watch it again here.

The recent sell-off in growth and technology stocks has seen investment trust superstar Scottish Mortgage’s (SMT) share price plummet by around 50% over the past six months, which led it to announce negative returns in its 2021/2022 annual report for the first time in years. This downturn deviates from the consistent growth usually delivered by […]

JPMorgan Japanese (JFJ) has published its interim results for the six-months ended 31 March 2022. The period is one that has seen investors rotate away from the kind of high quality and high growth companies that JFJ focuses on (its manager runs a high conviction, unconstrained approach focused on finding the best investment ideas in […]

ICG-Longbow Senior Secured UK Property Debt (LBOW) has announced its annual results for the year ended 31 January 2022. LBOPW’s chairman, Jack Perry, says that at a domestic level, the UK property market has largely shaken off the effects of the Covid-19 pandemic with occupational, investment and finance market transactions returning to something like normal […]

Securities Trust of Scotland (STS) has announced its annual results for the year ended 31 March 2022. During the period, STS provided NAV and share price total returns of 16.8% and 17.4% respectively, which compared to a total return of 10.8% in the Lipper Global – Equity Global Income Index. These compare to a net […]

In QuotedData’s morning briefing 20 May 2022: Ecofin Renewables Infrastructure (RNEW) has announced that its fundraising, which was undertaken as both a placing and REX retail offer, has raised gross proceeds of US$13.1m. US$10.8m was raised through the placing and £1.8m (equivalent to approximately US$2.3m) was raised through the REX Retail Offer. RNEW will issue […]

London office landlord and developer Great Portland Estates says it expects positive rental growth over the next year as the supply of new offices are choked off by weaker sentiment and cost inflation. This coupled with a continued “flight to quality” offices by occupiers gives cause for a positive outlook, with the company giving a […]

Over the twelve months to 31 March 2022, Scottish Mortgage returned -13.1% in NAV terms and -9.5% in share price terms as compared to a 12.8% increase in the All-World Index. The chair says “these last couple of years have been extraordinary and do not offer a suitable timeframe over which to judge investment returns” […]

Asset Value Investors (AVI), manager of AVI Japan Opportunities, has submitted shareholder proposals to SK Kaken addressing six issues which it feels contribute to that company’s poor share price performance, low valuation, and potential delisting from the Tokyo Stock Exchange (TSE). AVI says that, despite a high-quality business model and a dominant share of the […]

HICL Infrastructure has invested in fibre broadband for the first time, buying a 55% shareholding in ADTIM SAS in France from DIF Capital Partners. Following completion, ADTIM will represent approximately 2% of HICL’s portfolio, by value. ADTIM is an independent wholesale fibre network providing low density rural areas in the South of France with 18,300km of […]

In QuotedData’s morning briefing 19 May 2022: Interim results released today for Ecofin Global Utilities and Infrastructure (EGL) show that the trust is off to a great start in this financial year. For the six months ended 31 March 2022, it returned 14.1% in share price terms and 13.7% in NAV terms, both well-ahead of […]

Regional REIT has acquired three offices in Derby, Milton Keynes and Crawley for a total of £48.2m, reflecting a blended net initial yield of 8.7%. The assets It has acquired Orbis 1-3, Derby (totalling 122,153 sq ft) for £19.8m, and a 8.6% yield. It is located on a 7.54-acre site on the Pride Park business park. […]

British Land delivered a NAV total return for the year to March 2022 of 15.6% as the value of its portfolio continues to recover from the pandemic lows. The company’s EPRA Net Tangible Assets (NTA) was up 12.2% to 727p, while it paid dividends during the year totalling 21.92p. Its portfolio valuation rebounded 6.8% on […]

Schroder British Opportunities buys global insurance business as it boosts private equity exposure – Schroder British Opportunities (SBO) has bought CFC, a leading technology-driven global insurance business. The investment has been made via VIP SIV I LP, a fund managed by Vitruvian Partners. Founded in 1999, CFC was one of the pioneers in the cyber […]

In QuotedData’s morning briefing 18 May 2022: Riverstone Energy (RSE) has led a investment round in Infinitum Electric, creator of the breakthrough air-core motor. Infinitum Electric will use the investment to vertically integrate and automate production of its motors for the commercial and industrial market segments, and complete development and commercialisation of a traction motor […]

Asset Value Investors (AVI) has launched a public campaign on the submission of its shareholder proposals to NS Solutions, a subsidiary of Nippon Steel Corporation. NS Solutions is held by both AVI Global Trust and AVI Japan Opportunity Trust. Between them, they own 1.2% of voting rights of NS Solutions. Having first invested in March […]

JPMorgan Multi Asset Growth and Income has announced results for the 12 months ended 28 February 2022. Over that period, the company achieved a positive total return of 8.1% on its net asset value, an outperformance of 2.1% for the year, against the reference index (a total return of 6.0% per annum measured over a […]

JLEN Environmental Assets says that its NAV at the end of March 2022 was 115.3p, up 14.6% from the value at end December 2021. Higher power prices added 13.4p to the NAV and inflation added 2.6p. NAV at 31 December 100.7p Less dividends paid in the quarter (1.7p) Power prices (excluding assets previously held at […]

Schroder British Opportunities Trust has made an investment into Mintec, the leading provider of food-related commodity pricing, via Schroders’ long standing investment partner Synova. Synova first invested in Mintec in December 2017 and has supported the company through a period of rapid growth, technological development, and international expansion. Synova’s investment helped Mintec launch their proprietary […]

In QuotedData’s morning briefing 17 May 2022: Sequoia Economic Infrastructure has received £10m from the administrators of Simple Energy (the parent of Bulb Energy). £2.5m of this covers the interest on the loan that has accrued since Simple went into administration. The other £7.5m reduces the fund’s exposure to Simple/Bulb to about 1.5% of its […]