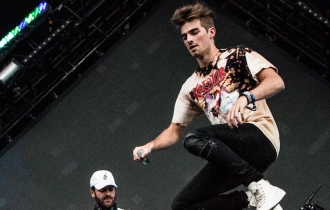

Hipgnosis Songs acquires catalogue from The Chainsmokers – Hipgnosis Songs (SONG) has announced that it has has acquired a music catalogue from The Chainsmokers, the 14th most streamed artist globally on Spotify with 41m monthly listeners. The Chainsmokers, an artist and producer duo made up of Alex Pall and Andrew Taggart, which SONG describe as having been the […]

In QuotedData’s other news 19 August 2019 – Acorn Income Fund has reported interim results showing its portfolio lagging the Numis Small Cap Index and the All Share. Acorn’s geared structure made up for some of the shortfall (the NAV return was 9.7% against 10.5% and 13.0% for the indices, respectively) and a narrower discount […]

Woodford watch – P2P Honeycomb merger off? – Sky News has a story which you can read here – that merger talks between P2P Global and Honeycomb Investment Trust have collapsed following objections from “several” shareholders in P2P including Aberdeen Standard Investments and Premier Fund Managers. The tie up makes logical sense in that both […]

Valuation developments drive NAV growth for Princess Private Equity over H1 – Princess Private Equity (PEY) has released high-level highlights from its first-half period to 30 June 2019. Key items include: PEY reported a NAV total return of 9.6%, closing the period at EUR11.64 per share; Valuation developments (+11.6% YTD) were the key driver of NAV […]

In QuotedData’s other news 16 August 2019: Worldwide Healthcare Trust (WWH) has announced the appointment of Dr Bandhana (Bina) Rawal as an independent non-executive director, with effect from 1 November 2019. Dr Rawal, a physician with 25 years’ experience in life sciences research and development, has held senior executive roles in drug development and scientific evaluation in […]

CATCo Reinsurance Opportunities updates on future in half-year results – Last month we published a story discussing CATCo Reinsurance Opportunities’ (CAT) proposals to return cash to its shareholders, following extreme hurricane claims (click here to read more on this). CAT’s shares are down by over 70% over the past year. 2017 and 2018 were the […]

Merian Chrysalis invests in delivery software as a service company Sorted – Merian Chrysalis (MERI), the UK-focused unquoteds investor, has gotten off to a strong start since launching in 2018 – the premium its shares trade at has increased from about 4.5% at the start of the year to over 20%. MERI has this morning […]

Murray International boosted by Fed pivot and sterling weakness – The £1.5bn market cap, global growth trust, Murray International (MYI), has reported half-year results to 30 June 2019. These are summarised below: Six months ended – 30 June 2019 Year ended – 31 December 2018 Share price +4.3% -6.8% NAV per share +10.6% -7.5% Benchmark […]

Energy-focused Riverstone Credit Opportunities Income reports early results – Riverstone Credit Opportunities Income (RCOI) is one of the newest companies in the listed investment sector (click here to read more about the company); the company has this morning reported half-year results to end-June 2019, though the actual period covered is from 28 May 2019 onwards Of the $100m […]

Oakley Capital to buy German consumer tech company – The UK and Europe focused private equity investment company, Oakley Capital Investments (OCI), has announced that Oakley Capital is acquiring a majority stake in Seven Miles GmbH (Seven Miles), partnering with its founders, Tom Schröder and Valentin Schütt. OCI will make an indirect contribution of around […]

LMS Capital completes Entuity sale – Contracts were exchanged in late July 2019 for the sale of LMS Capital’s investment in Entuity, with completion due on or before 30 September 2019. The company has confirmed that completion of the sale took place on 13 August 2019. After allowing for estimated transaction costs and payments due […]

It has been a busy morning of half-year results announcements. In QuotedData’s other news 14 August 2019: Apax Global Alpha (APAX) reported interim results to 30 June 2019; total NAV retur was +13.4% (+12.9% in constant currency terms). Last 12 months total NAV return was +14.4% (+12.2% constant currency) reflecting primarily strong performance of the private equity portfolio. Aberdeen Asian Income […]

CLS Holdings posts half-year NAV and profit growth – The company has reported a 5% rise in net asset value for the first half of 2019 as well as a 28.2% jump in profits. CLS, which has a £2.1bn portfolio in the UK, Germany and France, posted a EPRA NAV per share of 325.3p, compared to […]

Riverstone Energy’s discount widens in tough period for the sector – The commodities and natural resources company, Riverstone Energy (RSE), has reported half-year results to 30 June 2019. It has been a difficult year for the sector; we note that the company’s discount widened from around 20% this time last year to 35% over the […]

RM Secured Direct Lending delivering for yield seeking investors – Some of the highlights from the direct lending sector company, RM Secured Direct Lending’s (RMDL), first-half period to 30 June 2019 include: Loan investments totalled £122m with an increased average yield of 8.61%; Diversified portfolio with 35 debt investments (H1 2018: 30 investments) across 13 sectors […]

Green REIT board recommends €1.34bn sale to Henderson Park – Green REIT has reached agreement on the terms of a cash offer by Henderson Park to acquire it. The independent Green REIT board has unanimously recommended the deal, which will see Henderson Park subsidiary HPREF Dublin Office Bidco acquire the company for around €1.34bn. Under the terms […]

Regional REIT provides lettings update – Regional REIT (RGL), the regional real estate investment specialist focused on building a diverse portfolio of income producing regional UK core and core plus office and industrial property assets, this morning announced successful lettings amounting to around £1.27m per annum; RGL notes that the lettings provide a major uplift […]

JPMorgan American reports first results since new managers and strategy change – JPMorgan American has reported half-year results this morning; in the six months to 30th June 2019, the total NAV return in sterling terms was 15.3%. The discount narrowed slightly over the period as the shares slightly outperformed NAV. The total share price return was […]

In QuotedData’s other news 13 August 2019 The global smaller companies fund, Smithson (SSON), has reported interim results covering the period from its incorporation in August 2018 to 30 June 2019. From the date of the company’s launch on 19 October 2018 to 30 June 2019, NAV per share total return was 20.3% compared with the MSCI […]

NB Global Floating Rate Income reports results, does not expect much Brexit impact – NB Global Floating Rate Income (NB Global) trades under sterling (NBLS) and dollar lines (NBLU) in London. The company invests in below investment grade debt, with B rated paper accounting for 56% of the portfolio by market value in 2018.We note […]

Witan underperforms benchmark by 1.4% over first-half – The £1.87bn market cap closed-end fund, Witan (WTAN), uses a multi-manager strategy to provide investors with exposure to global equities. The company has this morning reported half-year results covering the period to 30 June 2019, over which it delivered a NAV total return of 13.5%, which was […]

Impact Healthcare REIT completes two Ipswich deals – Impact Healthcare REIT (IHR) offers investors exposure to a diversified portfolio of UK healthcare real estate assets, in particular care homes. The company has this morning announced that it has exchanged contracts to acquire two care homes and added a high-quality new tenant for a net outlay of […]

NextEnergy issues more preference shares – NextEnergy Solar Fund has entered into an agreement with an investment vehicle owned by Universities Superannuation Scheme, whereby 100,000,000 preference shares will be issued, raising gross proceeds of GBP100m. The net proceeds will be used to repay the existing GBP90m short-term debt facilities and invest in NextEnergy’s pipeline of opportunities. The rights […]

In QuotedData’s other news 12 August 2019 Unite Group, one of the UK’s leading owners, managers and developers of student accommodation, announces that it has exchanged contracts to acquire a new 620-bed development site in Nottingham.The direct let development, which is subject to planning consent, will open in time for the 2022/23 academic year. Total development costs […]

Autolus investment the main drag in an otherwise solid quarter from Syncona – Syncona, which predominantly invests in life sciences companies, has released a quarterly update this morning (covering the period to 30 June 2019). We have covered many of the events referenced by the company, in earlier news stories, which we link to in […]

In QuotedData’s other news 9 August 2019 BMO Global Smaller Companies has announced the issue of £35m of fixed-rate 20-year unsecured private placement notes at a coupon of 2.26%. This refinances the company’s 3.5% Convertible Unsecured Loan Stock (“CULS”) which matured on 31 July 2019. RDL Realisation has announced a special dividend of 255p per share. The special […]

JPMorgan Brazil asks for more time – JPMorgan Brazil has just released its results for the year ended 30 April 2019 and, while at least the NAV move was positive, once again the trust lagged its benchmark. A continuation vote is planned for this year’s AGM. The board is asking shareholders for more time to […]

Tritax Big Box on road to serious growth – Tritax Big Box REIT posted an uptick in profits in the first half of the year on the back of strong rental growth. Operating profit before changes in fair value of investment properties increased by 5.7% to £60.7m, while rental income grew 3.5% to £166.8m. The […]

AEW Long Lease rethinks its future – AEW UK Long Lease REIT has rejected several takeover approaches and plans to go it alone. The company received several proposals, but the board concluded none of the proposals reflect the true value of the group. The company said the proposals, in some instances, undervalued certain of the group’s assets or […]

Phoenix Spree discusses Berlin rent controls – Phoenix Spree Deutschland, the UK listed investment company specialising in Berlin residential real estate, has updated on proposed rent controls in the German capital. The proposed new Berlin State rent controls continue to create significant uncertainty which has negatively impacted the company share price, resulting in a valuation discount […]