Transition underway

African property company Grit Real Estate Income Group (Grit) believes that it has cleared a path for increased dividend distributions and NAV growth following a potentially decisive piece of corporate action in the form of a heavily NAV dilutive capital raise. It has used the proceeds to bring down its loan to value (LTV) under control and to expand its core business with the acquisition of a developer and asset manager.

Grit’s manager says that the developer – Gateway Real Estate Africa (GREA) – has an attractive pipeline of NAV accretive development projects, most notably diplomatic residences across the continent let to the US government and data centres (see page 4 for an in-depth look at the development pipeline). Meanwhile, within its current portfolio, its hospitality assets are rebounding with the return of international travel, and retail valuations seem to have bottomed out – suggesting valuation growth in these sectors. Grit also has plans to ramp up exposure to the industrial sector, which the manager says is chronically undersupplied across Africa.

Pan-African real estate

Grit is a pan-African real estate company that invests in, develops and actively manages a diversified portfolio in selected African countries. These assets are underpinned by mostly US$ and euro denominated long-term leases with a range of blue-chip multinational tenant covenants. The company aims to deliver strong and sustainable income for shareholders, with the potential for income and capital growth, and currently targets a shareholder return of 12% a year.

On path to increased income and enhanced returns

Having seen substantial valuation falls across large parts of its portfolio during the pandemic (especially in the retail and hospitality sectors, which together make up 46.3% of its portfolio), Grit took potentially decisive course-correcting action in the form of a capital raise at the end of 2021 to halt the slide and put it on a path of NAV growth and increased, sustainable dividend distributions (we detailed the rationale of the capital raise in our last note on Grit – click here to read it). A total of US$76.1m was raised in the open offer and placing, short of its target of US$135m. As per the strategy, the proceeds were used to reduce debt and acquire stakes in a developer – Gateway Real Estate Africa (GREA) – and development manager – Africa Property Development Managers (APDM).

Having fallen short of its fund raise target, Grit had to reconsider its plans. It had hoped to issue US$80.6m of new shares to the selling stakeholder of GREA and APDM – Gateway Partners – to gain controlling stakes in both. However, due to the reduced fund raise, Gateway Partners would have become a 22.5% shareholder in Grit – something that was not acceptable to either party.

Grit will instead build up its holding in GREA in phases throughout the rest of 2022. With the proceeds from the raise, the company acquired a controlling interest in APDM of 77.95% through the cash payment of US$7.59m to Gateway Partners for a 30.58% interest and the issuance of new shares to acquire a further 47.37% in the company. The company says that through its controlling interest in APDM, it has effective operational control of GREA while it builds up its shareholding.

Its direct stake in GREA was increased by 6.31% in April (it already owned 19.98%) through a US$13.86m cash payment to Gateway Partners and a vendor placement of 423,616 new shares. At the end of July, it intends to grow its interest in GREA to 35% for a cash consideration of US$19.44m. In December, Grit has the option to acquire Gateway Partners’ remaining 13.61% interest in GREA (and an additional 1% in APDM), which would bring its direct shareholding to 48.6%. The exercise of the option would prompt the issue of a free 10% incentive carry to APDM through a performance incentive that becomes effective on a defined exit event. This would bring Grit’s direct and indirect stake in GREA to 51.66%.

The capital raise had a dilutive impact on Grit’s EPRA net reinstatement value (NRV – Grit’s favoured net asset reporting metric, which measures NAV adjusted to reflect the value required to rebuild the portfolio). The shares were issued at a price of US$0.52 per share (compared to a last reported EPRA NRV of US$1.024). This was the principal driver in Grit’s EPRA NRV reduction of 15.3% at the end of December 2021 to US$0.867. The raise allowed Grit to reduce its loan to value (LTV) from 53.1% at June 2021 to 41.4% at the end of the year.

Grit’s manager says that by gaining control of GREA and the development manager APDM it has an identifiable route to attractive and sustainable shareholder returns through enhanced capital growth and increased dividends. It says that the potential benefits of acquiring GREA and APDM include:

- a material acceleration in the group’s ability to access development returns from risk-mitigated development projects;

- the delivery of strong NAV growth over the next 24 to 36 months as projects are completed, including access to an extensive pipeline of US diplomatic housing and data centre development opportunities that the manager says offer exposure to highly-rated tenants that underpin future income levels;

- the resumption of dividend payments (with a target to pay 5 to 6 US cents per share for the financial year to June 2022 and a similar target for the year to June 2023); and

- an expected increase in Grit’s total targeted shareholder return from 12% to between 13% and 15% per annum over time.

GREA and APDM

GREA was co-founded by Grit in 2018. It provides development and construction services in selected African countries for multinational companies. The group seeks to negate any letting risk by partnering with multinational companies looking for real estate solutions in Africa and secures land in conjunction with them.

GREA was established together with APDM, its external management company. GREA outsources the implementation and management of its investment mandate to APDM in return for development and asset management fees. APDM’s management fee is 1.5% of GREA’s gross asset value. APDM also generates additional fee income from a range of third-party clients and is entitled to a free 10% incentive carry in GREA through a performance incentive that becomes effective on a defined exit event.

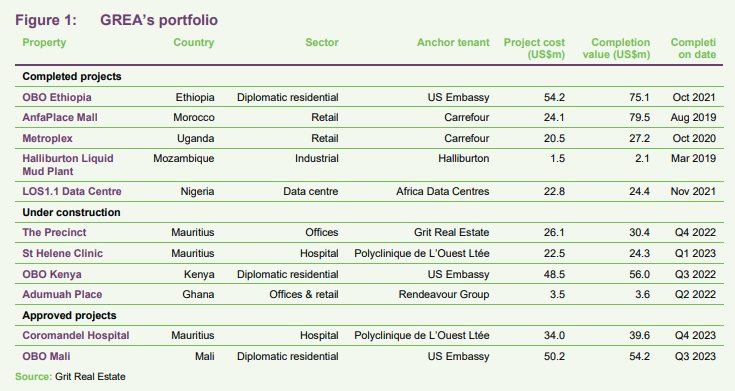

GREA has a substantial pipeline of development opportunities, most notably providing the United States Bureau of Overseas Buildings Operations (OBO) with embassy housing across Africa, and developing data centres for leading IT services and solutions providers. GREA has a portfolio of 11 projects across nine countries in various stages of development (details of which are set out in Figure 1). In addition, GREA holds a 46.55% interest in Acacia Estate, a 76-unit housing complex in Maputo, Mozambique let to the US Embassy and the oil and gas company Total.

As at 30 June 2021, GREA had unaudited net assets of US$193m. Grit obtained independent completion valuations from Knight Frank on all GREA projects, which it says gives it strong visibility on the NAV increasing to US$280m by the end of 2023.

Grit states that the main attraction of GREA’s development pipeline is its tie-up with the US embassy through OBO. It currently has three OBO-let assets in various stages of development and has a further pipeline worth around US$100m across other African countries. The OBO Ethiopia corporate accommodation tower is a co-development and equity partnership between US-based Verdant Ventures and GREA. It comprises 112 units and is located in Ethiopia’s capital city, Addis Ababa, which hosts over 130 diplomatic missions and is the third largest diplomatic community in the world behind Washington DC and Brussels.

The OBO Kenya diplomatic housing project in Nairobi comprises 90 diplomatic apartments and townhouses. It marks GREA’s first development in Kenya and a second development in conjunction with US-based developer, Verdant Ventures. With over 80 foreign diplomatic missions coupled with a growing international investor base, Grit says that there is a strong demand for diplomatic level, high security residential communities in Nairobi.

The OBO Mali diplomatic housing project, located in Bamako, is less than a kilometre from the US government embassy. The project consists of the development of a 45-unit diplomatic residential complex consisting of a multi-block mid-rise complex with high security requirements. The US government will occupy 100% of the premises. GREA will take part in the development in partnership with OCCEL Engineering, a contracting and development company in Nigeria.

As well as the pipeline of diplomatic accommodation projects lined up with OBO across the continent, GREA has a handful of data centre assets and industrial developments at various stages of completion.

Improving market outlook

Grit’s manager says that its portfolio has performed strongly following the challenges inflicted by the COVID-19 pandemic. The retail and hospitality sectors, which were heavily impacted, are showing signs of positive recovery, while assets in the office, corporate accommodation and industrial sectors held up strong during the crisis and continue to perform well, it adds. This was reflected in strong and improving rent collection of 94.9% at the end of December 2021.

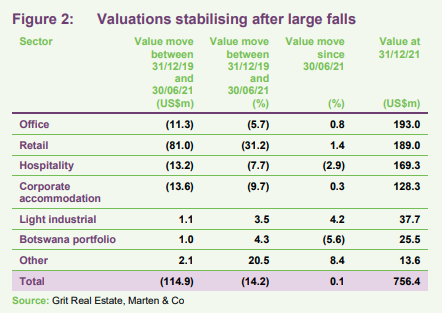

The value of Grit’s portfolio stabilised in the six months from June 2021 to December 2021, as shown in Figure 2, having fallen 14.2% in 18 months from December 2019 and June 2021.

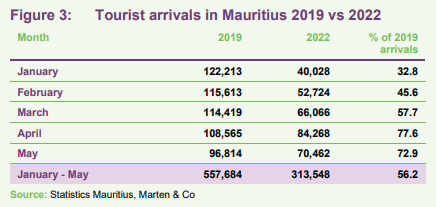

Hospitality

Grit’s hospitality portfolio is made up of five hotels – four in Mauritius and one recently refurbished scheme in Senegal. Mauritius’ borders opened fully from 1 October 2021, and the latest tourist figures look promising as international travel begins to return to pre-COVID levels. As shown in Figure 3, tourist arrivals to the island in the last two months – April and May – are at more than 70% of the level recorded in the same months in 2019. This is up from a level of just over 30% in January. The improving tourist rates should result in a normalisation of discount rates applied on its assets by valuers, the manager says.

Both of Grit’s Mauritian hospitality tenants – Beachcomber and Lux Tamassa –received strong government support during the pandemic, including liquidity support, minimising the impact on Grit. This included a COVID Bill, which provided tenants with the ability to defer all rental payments to landlords from April 2020 to August 2020 but bound them by law to repay any rental deferments by no later than 31 December 2021. Lux Tamassa is fully caught up on rent arrears, but Grit has afforded Beachcomber a 48-month period to repay US$5.3m cash concessions granted in 2021.

Regular flights to and from Senegal resumed from early December 2021, allowing the Grit-owned Club Med Cap Skirring resort to resume operations. Grit says that occupancy of the hotel is running at 85% and forward bookings are looking healthy. Grit acquired the 47-year-old hotel in a sale-and-leaseback deal with Club Med in January 2020 before upgrading and refreshing the asset. A planned expansion of the hotel has been postponed to 2024 as both parties assess forward looking demand.

Retail

Grit has brought the vacancy rate across its retail portfolio down from a peak of 22.8% at the end of 2020 to 12.5% at the end of 2021, thanks in no small part the manager says to the resilience of the group’s strip malls – smaller regional centres that are focused on grocery and general goods retail. Grit’s largest retail asset, AnfaPlace Mall in Morocco, struggled during the pandemic. It was redeveloped in 2019, leaving large parts of the centre vacant just as the pandemic struck. The company has managed to bring the vacancy rate down from 27.3% at the end of 2020 to 16.5% at the end of 2021, but at lower rents. The company is in the process of selling the asset (more details on page 11).

Offices, corporate accommodation and industrial

Grit’s office and corporate accommodation assets performed strongly during the pandemic, the manager says, with little change in occupation levels and continued strong demand. Grit says that the working from home trend has had less of an impact in Africa due to a lack of supporting infrastructure, such as inadequate internet connection, intermittent power supply and a lack of office infrastructure. It adds that it has noted an increase in demand for call centres in Ghana and Kenya.

Grit says that its corporate accommodation portfolio showed robust performance over the pandemic period. The valuation of the corporate accommodation assets, which make up 14% of the wider portfolio by value, was down 9.7% since the end of 2019 to June 2021, mainly due to one asset where valuers have apportioned a higher discount rate to the property due to re-letting uncertainty (more details on page 11). However, Grit is hopeful that a new tenant will be found, which should support a recovery in valuation for that asset.

Grit’s industrial portfolio currently accounts for 5.6% of the wider portfolio, but the company has plans to ramp up its exposure to the sector (more details on page 12). Grit says that the continent is massively undersupplied in good-quality industrial property yet demand for space is high. This supply/demand imbalance should result in rental and capital value growth, it adds.

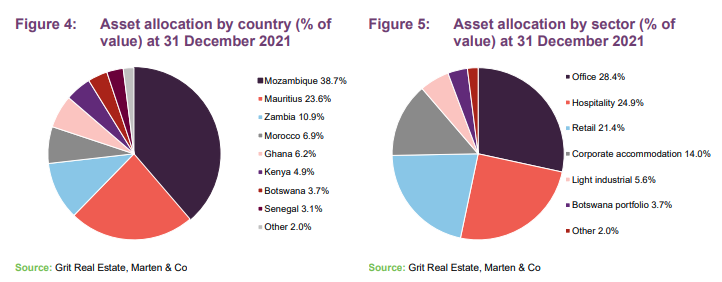

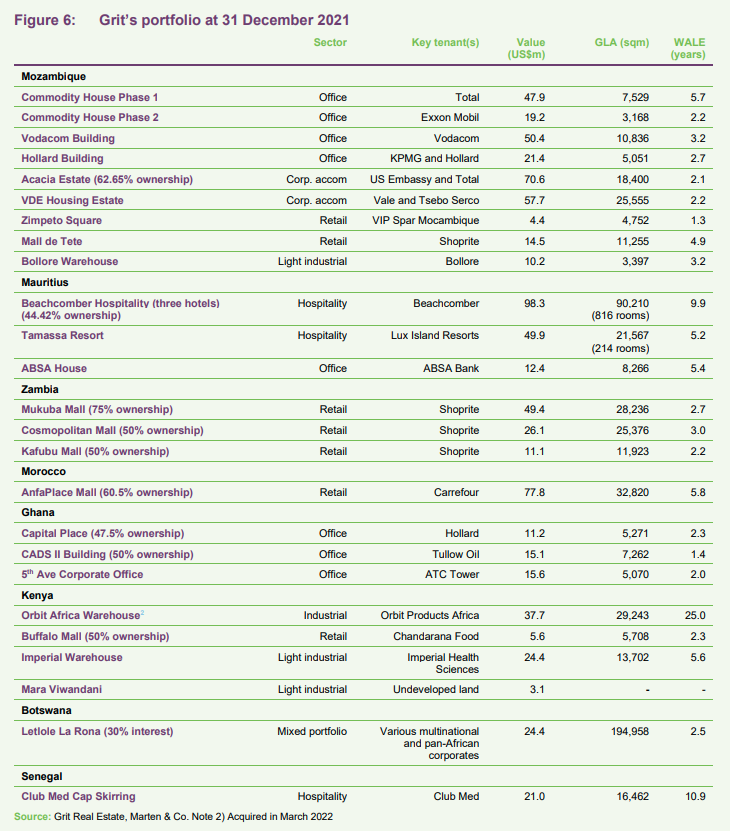

Portfolio

Grit’s current portfolio consists of 54 assets located across eight countries and five asset classes, valued at US$756.4m. The group’s portfolio has a 5.7% vacancy rate and a weighted average lease expiry (WALE) of 4.4 years. The vast majority (90.0%) of income is underpinned by a wide range of blue-chip multinational tenants across a variety of sectors and has a weighted average contracted lease escalation of 4.7% per annum. Rents are predominantly collected monthly, of which 91.6% are collected in US$, euro or pegged currencies. The group’s LTV was 41.4% at December 2021. It is currently negotiating the refinancing of a large portion of its debt to a syndication of banks, cross-collateralised across multiple countries and assets. This will include a Bank of China loan for US$76.4m, which matured in April 2022 but has been extended to the end of the year to allow for the long-term refinancing into this syndication.

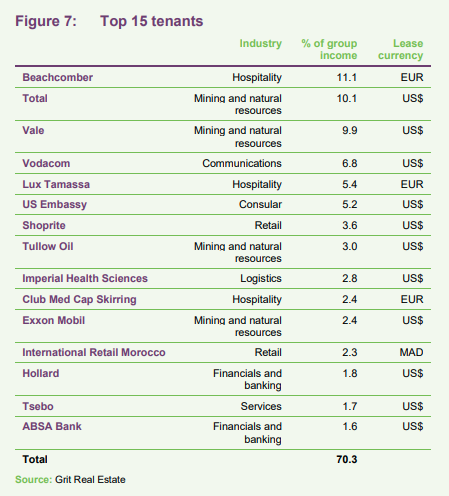

Top 15 tenants

Beachcomber / Lux

Combined, the two Mauritian hospitality groups in Grit’s portfolio, Beachcomber and Lux, account for 16.5% of total group income. By using triple net leases, whereby the tenant bears all costs associated with the assets, Grit does not take any risk associated with the hotel operation. Grit says that the creditworthiness of the lease covenants is strong, with both companies’ parents being large conglomerates. As detailed earlier, both companies received significant support from the Mauritian government to see them through the pandemic. In terms of rent receipts, Grit says that both operators have resumed full rental payments. Lux is fully caught up with rent arrears, while Beachcomber has been given a bit more breathing space, with 48-months to make up the US$5.3m it owes.

Total

Oil and gas giant Total is Grit’s second-largest tenant, making up 10.1% of income. The company occupies office space and corporate accommodation in Mozambique on leases that run until 2028 and 2024, respectively. Total’s Mozambique operations were significantly boosted by a US$15bn financing agreement to fund the construction of its liquefied natural gas (LNG) project. The site was reported to be the biggest natural gas find in the southern hemisphere in the last 50 years and is expected to take two and a half years to get to the production phase.

Vale

Brazilian mining giant Vale currently accounts for 9.9% of Grit’s income, through the leasing of Grit’s VDE Housing Estate corporate accommodation asset in Mozambique. The lease runs for a further year and a half. Vale announced in late January 2021 that it was consolidating its ownership of the Moatize mine and the Nacala Corridor infrastructure project, both in Mozambique, and divesting its coal assets ahead of a possible exit from Mozambique. The VDE Housing Estate had been heavily marked down by valuers, but has now stabilised and at 31 December 2021 was valued at US$57.7m (US$57.5m at 30 June 2021, but down 18.3% from US$70.6m in June 2020). Vale sold the Moatize coalmine to Indian conglomerate Jindal Group at the end of 2021. Grit says that it has opened negotiations with Jindal over leasing the corporate accommodation. The quality of the asset and proximity to the mine gives it confidence in re-letting the asset on similar terms, which should see the value recover, it says.

Vodacom

Vodacom occupies a 10,659 sqm office in Mozambique and accounts for 6.8% of Grit’s income. Vodacom is one of the biggest telecommunications operators in Africa. Outside of its domestic market of South Africa, its customer base grew 4.9% to 41.7m in the year to 31 March 2022 and the group saw revenue growth of 5.6% across international operations (which comprises Mozambique, the Democratic Republic of the Congo, Tanzania and Lesotho). The group’s mobile banking platform, M-Pesa, now serves 47.1m customers and processes more than 52m transactions a day worth US$324.6bn over the year to 31 March 2022.

Portfolio recycling

Grit has set out a strategy to dispose around 20% of its portfolio by the end of 2023 and to use the proceeds to pay down debt and further reduce its LTV. The properties targeted for sale are non-core and mature assets. One such sale was that of the ABSA House office building in Mauritius. The sale price of US$12.2m was in line with valuation and the net sales proceeds to Grit are expected to be US$4.1m.

By now, the company had hoped to have sold AnfaPlace Mall, its only true shopping centre (the rest of its retail assets are strip malls – smaller regional centres that are focused around grocery and general goods retail), but an exclusivity period with a buyer at a price just under the end of year valuation of US$77.8m expired at the end of March. The group said it was now in negotiations with two parties for the sale of the asset.

In May, Grit announced the potential sale of a 30% stake in its newly-acquired Orbit industrial asset and development scheme in Nairobi, Kenya, to Letlole La Rona (LLR) for US$7.23m (being the pro-rata share of equity contributions to date). Last year, Grit entered into a development contract with fast-moving consumer goods manufacturer Orbit Africa, which is the leading manufacturer of personal care and home care products for the East Africa region, to refurbish the existing manufacturing plant in Kenya and develop a new 14,741 sqm extension facility.

The acquisition, on a sale and leaseback basis, of the existing 29,243 sqm warehouse and manufacturing facility was at a net acquisition yield of 9.6%. The facility will be leased back to Orbit Africa on a new 25-year US$-denominated triple net lease, with an option to extend the lease term for a further 10 years, and includes a contracted average escalation of 2% per annum.

A further redevelopment and expansion of the existing facility is expected to complete in the fourth quarter of 2023, when it will be let on a new 20-year triple net lease at a contractual development yield of 16.0%.

The total expected investment in the combined acquisition and redevelopment is expected to be US$53.6m. The asset, originally acquired after Grit raised US$31.5m in perpetual notes and US$25m in debt from the International Finance Corporation (the investment arm of the World Bank), forms part of a broader industrial sector focused investment strategy being pursued by the company.

Grit says that it sees a structural undersupply of industrial property across Africa and expects to make further investments in the sector over the short and medium term with partners, including LLR and African-focused development finance institutions.

Performance

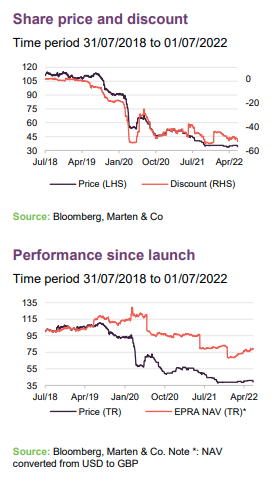

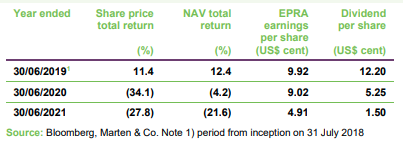

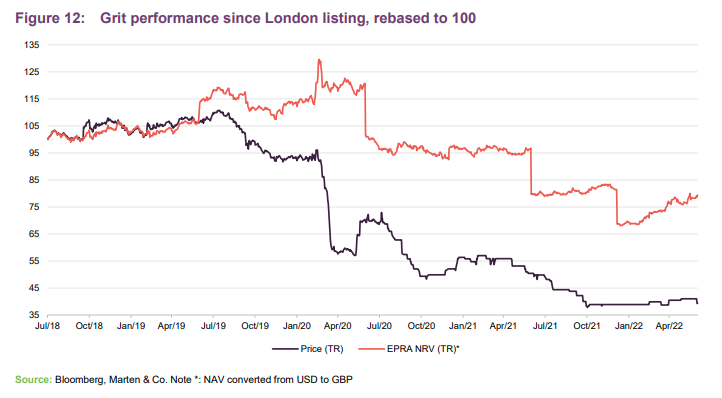

Following Grit’s conversion to a sterling quotation on the London Stock Exchange (LSE) in August 2020, we have converted its historic NAV and share price from US$ to sterling in Figure 12. Grit’s NAV had been fairly stable since it launched on the LSE in July 2018, but it dived in June 2020 and again in June 2021 after reporting substantial falls in EPRA NRV off the back of portfolio valuation write-downs impacted by COVID uncertainty. EPRA NRV at December 2021 fell 15.3%, principally due to the dilutionary effect of the issuance of the new ordinary shares.

Grit’s share price rose initially, but started to fall in the second half of 2019 and plummeted following the outbreak of COVID-19 in early 2020. Its share price tailed off further as the pandemic continued to have a significant impact on its portfolio.

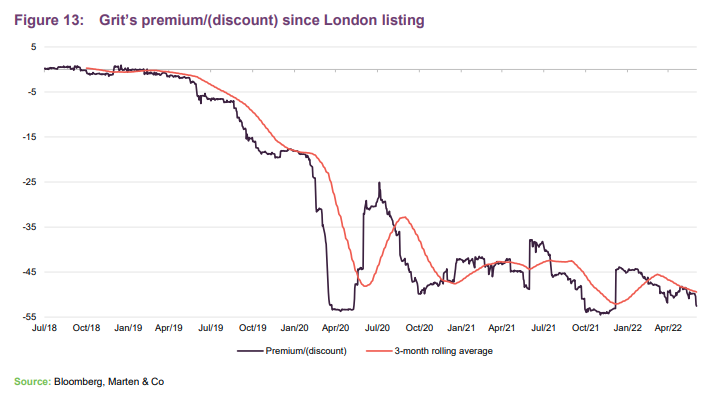

Premium/(discount)

Grit’s share price had fluctuated between trading at a slight premium and a slight discount for much of its first full year on the LSE before its discount widened during the course of the second half of 2019. The discount widened further on the outbreak of COVID-19 at the start of 2020 and the resultant cutting of the dividend. It narrowed as a clean-up of its corporate structure took place, but widened again as the impact of COVID-19 on its retail and hospitality portfolio continued to weigh heavily. At 1 July 2022, the discount stood at 52.6%.

Board guidance on the dividend is that it would pay between 5 cents and 6 cents per share for the year to 30 June 2022 (it declared an interim dividend of 2.5 cents in February) and that guidance level has been maintained for the next financial year to June 2023. A full year dividend of 5 cents per share would equate to a dividend yield of 12.2% (using Bloomberg’s GBP/USD exchange rate on 1 July 2022 of 1.2095) at the current share price of 34.0p.

Fund profile

Grit has a primary listing on the Premium segment of the London Stock Exchange’s main market and a secondary listing on the Stock Exchange of Mauritius (SEM). Its focus is on investment in pan-African real estate and it actively manages a diversified portfolio of assets in selected African countries (excluding South Africa).

It offers access to the growth potential of Africa that is de-risked from a currency perspective. The company’s assets are underpinned by predominantly US dollar- and euro-denominated long-term leases to a range of blue-chip multinational tenant covenants.

The company, which employs 92 people in six countries, aims to deliver strong and sustainable income for shareholders, with the potential for income and capital growth and is currently targeting a net total shareholder return inclusive of NAV growth of 12.0% per annum.

Grit has taken a number of steps to enhance its corporate structure with the ultimate aim of facilitating its inclusion in the UK FTSE Index series and improving liquidity in its shares. In 2020, it moved its corporate domicile from Mauritius to Guernsey, stepped up to the Premium listing segment of the London Stock Exchange and converted to a sterling quotation. The group also de-listed from the Johannesburg Stock Exchange last year, making the London Stock Exchange its primary listing.

Previous publications

QuotedData has published three previous notes on Grit – Africa, substantially de-risked, published on 15 July 2020, On the path to recovery, published 17 February 2021 and Showing some grit, published 7 December 2021. You can read them by clicking the links or visiting our website.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Grit Real Estate Income Group.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.