Economic and Political Roundup

Investment companies | Monthly | February 2024

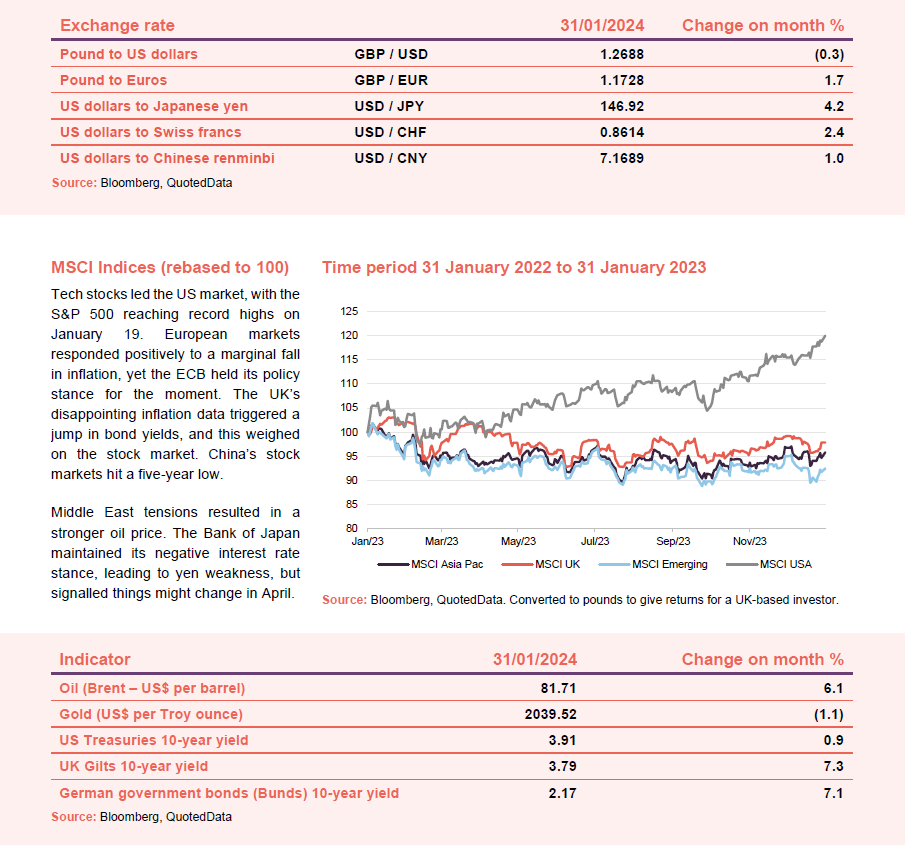

Amid the heightened geopolitical friction that has continued from December, global returns in January were relatively solid. In the US, GDP grew at an annualised 3.3% in the fourth quarter of 2023, while a blockbuster jobs report at the beginning of February reignited inflation concerns, maybe pushing out the date of the first interest rate cut.

‘It is already very important for European citizens to know that we are confident the next move will be a cut’ – Pablo Hernandez de Cos, ECB

Inflation fell to 2.8% in Europe, following an unexpected rise the month prior, however the ECB moved to dispel expectations of an immediate interest rate cut with the Central Bank’s reiteration of its data driven policy. Despite broadly positive data, market sentiment remained poor, with the Eurozone’s consumer confidence indicator making a 0.9 drop from December. Moreover, the crisis in the Red Sea has sparked fresh inflationary concerns through its effect on import prices.

Much like in Europe, hopes of interest rate cuts in the UK were pushed further away as December’s inflation data came in ahead of expectations; the Bank of England maintained its 5.25% rate. Cold water was also poured on discussions around further tax cuts in the upcoming spring budget., with David Bharier of the British Chambers of Commerce noting that pre-election giveaways will not fully relieve market woes, saying that ‘persistent inflation and high interest rates are likely to remain a barrier to business growth for some time to come’.

Meanwhile, China is struggling with deflation. The Central Bank cut its reserve requirement ratio – freeing up funds for additional bank lending. Construction giant Evergrande faces a court-imposed liquidation (but the court was in Hong Kong, so it is not clear whether mainland Chinese bodies will comply with it). In addition, China’s manufacturing activity looks to have contracted in January.

At a glance

Global

(compare global investment funds here, here, here and here)

Andrew Haining, chair, Chrysalis Investments, 29 January 2024

The market backdrop changed materially in late-2021 and into 2022, as investors were faced with a fundamental shift in the interest rate environment, which began its first major tightening cycle in over 30 years. This was in response to rising inflation, likely due in part to supply chain constraints stemming from COVID-19 related shutdowns, but further exacerbated by the war in Ukraine.

In the Investment Adviser’s view, the medium-term outlook for interest rates is likely to remain at levels higher than experienced since the global financial crisis (“GFC”). Higher discount rates typically have a greater impact on growth company valuations, where more of their value is based on future cash flows, compared with more mature companies. While a “higher-for-longer” thesis may not appear conducive to risk asset performance, often it is uncertainty over the direction of rates that investors most fear. This implies, as volatility of expectations around the exact course of interest rates abates, growth assets will be in a better position to deliver valuation performance from here.

. . . . . . . . . . .

Henry CT Strutt, chair, Edinburgh Worldwide, 17 January 2024

Stock markets rise and fall but the benefits of innovation accrue all around us. The opportunity for innovation and tech-led progress is stronger than ever. On many frontiers, entrepreneurs and innovative companies are creating products and services that will transform societal expectations. These frontiers stretch from healthcare to communications to computing and automation.

Much of this change is unaffected by the negative influence of equity markets and the tighter funding environment. It’s driven instead by structural shifts and new combinations of technologies already underway. We expect many of these advances to appear within 5-10 years, but we’re equally excited about possibilities beyond this timeframe.

Many of the companies with the greatest potential to deliver change are ones the market is shunning. They’re seen as reckless pre-profitable companies, early in their lifecycle with the temerity to believe that things can be different from how they’ve always been. With the market reflexively punishing such companies and aggressively discounting their potential, those of us who believe in progress, long-term relevance and human ingenuity have become the contrarians.

Nevertheless, observing markets over many decades suggests that such myopia risks missing out on where the long-term returns will ultimately come from.

Be assured that the steady progress of human ingenuity is very much alive and well. Stock markets might not reflect this, but there are good reasons to be bullish about how underlying change will coalesce with future equity returns.

. . . . . . . . . . .

Alex Crooke, fund manager, Bankers Investment Trust, 17 January 2024

Leading indicators for the global economy continue to point to fading growth, and in particular a contraction in Europe where money supply is negative and the highest interest rates starting to bite. The more positive news is that the valuation of most stocks appears to be now factoring in a mild recession. Forecasts for profit growth are modest with the exception of the companies associated with the Artificial Intelligence boom, where the bubble continues to inflate. The declining inflation numbers are also good news, but it is hard to judge when central banks will start cutting rates as inflation approaches or subsides below their 2% targets. We feel that inflation could surprise on the downside as China is now in outright deflation and, barring an energy crisis, most goods and services are in surplus.

As we look forward, employment is key to the direction of both the economy and, importantly, sentiment. So far into this interest rate cycle employment has held up very well, as many companies remember recent times when labour was hard to find so are consequently reluctant to shed labour as the economy slows. The market consensus view has swung towards a soft landing scenario led by the US, in which interest rates are cut in the early summer of 2024 and provide the stimulus to offset fading demand. We are a little more cautious as this type of soft landing has rarely been engineered successfully by central banks and we expect some overshoot to the downside.

US companies increasingly see share buybacks as their preferred method to return cash to investors and less companies in the US now pay dividends. We have undoubtedly missed some opportunities in the US market through our preference for dividend paying companies. We intend to widen our focus in the coming year although we will maintain our preference for cash generative companies with well defended market positions. Our stock selection seeks to avoid the overvalued and under invested companies, prioritising higher quality and lower geared companies, offering earnings resilience. Now that the cost of capital and debt is no longer close to zero, companies need to generate proper returns to justify their valuations, and our investment process aims to seek out these opportunities.

. . . . . . . . . . .

Nalaka De Silva, Simon Fox and Nic Baddeley, abrdn Diversified Income and Growth, 9 January 2024

Headline inflation appears to have peaked in developed markets; core inflation has also come down, but remains somewhat stickier. The challenge for central bankers from here is to thread the needle of holding rates high enough to keep inflationary pressures at bay and bring inflation back to target while at the same time, not tipping economies into recession. The US appears to be treading this path well, while data in the UK and Europe is suggestive of a more imminent downturn.

Geopolitics has also remained an issue in 2023, with the situation in Ukraine showing no signs of meaningful change, while just after year end, the Israeli-Palestinian conflict saw the deadliest events in over 50 years. Worries are that the situation could escalate into a wider regional confrontation.

Optimism around AI was a large driver of markets, with an explosion of Large Language Models (LLMs) and generative AI tools such as ChatGPT gaining headlines, but also ushering in new ways of working. These tools have the potential to increase productivity, with new models with abilities and functions being released regularly. Industries supporting this high growth area and related indices performed strongly as a result, with the NASDAQ up over 30% in local currency terms, outperforming the S&P 500 in the US by nearly 15%.

With investors concerned that entrenched inflation and sustained rate rises could result in tougher financial conditions the impact across private markets was varied. Deal activity across US and European private equity was down in H1 2023. However, levels of activity did vary across sectors with some proving to be more resilient than others. Financial services proved to be resilient as the rise in interest rates has resulted in consolidation across the sector and the expectation is that this will continue. It is likely that investors are waiting to see the extent of valuation corrections before activity across all sectors picks back up.

Within private credit as borrowing costs have gone up private equity firms continue to turn to private credit to finance transactions, shifting away from syndicated loan markets offered by the traditional banks. Default rates are increasing, up to 4.5% in Q1 2023 , as coverage ratios have dropped. In this climate, it is important to be rewarded for the level of risk.

Across real assets, infrastructure deal volumes were also down, the lowest since H1 2020, 1,336 deals totalling $394.83bn in H1 2023 but energy transition sectors continued to grow. This is not surprising as energy-security continues to be a priority and demand remains robust for assets that are driving the energy transition. Real estate liquidity is generally very low, and investors are waiting to see where values have shifted meaning transactions volumes have fallen; down roughly 55% vs 2022 in Europe. In Europe, there is a stronger preference for logistics and residential as long-term drivers such as e-commerce and supply chain modernisation for the former and demographic/ supply trends for the latter remain in place. In Asia-Pacific we see that fundraising has skewed towards opportunistic strategies. Overall, the delay in recovery is likely to come from tighter lending conditions and recession, although relative value is building back up. In summary, risks remain elevated, so a cautious approach must be taken at this time.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

James Henderson, Laura Foll, fund managers, Henderson Opportunities Trust, 31 January 2024

The key debates in the UK market over the last twelve months have been how fast inflation will come down and the resilience of the economy in the face of rising interest rates. Inflation is now successfully being brought down, finishing the financial year at 4.6%. More importantly from a consumer perspective, real wages are now back in modest growth. The consumer, and indeed the wider UK economy, has been more resilient than was feared at the start of the year. When thinking about why this is, we need to consider both sides of the household balance sheet, in other words the boost to interest income on household savings as well as higher interest costs on consumer borrowings. It is possible that this time last year the effect of the former was being underestimated versus the latter. While the two effects will be distributed unevenly across the UK population, there are undoubtedly some households that have seen a net benefit from the current interest rate backdrop. This can help to explain why, for example, retail sales have proved more resilient than some anticipated.

This more resilient economic backdrop is yet to be reflected in UK valuations, which remain at a historic low relative to other global equity markets. Therefore, we would summarise the domestic economic backdrop as “ok” (if not stellar), but with the equity market valued as though the actual outcome will be much worse. This strikes us as anomalous.

. . . . . . . . . . .

Managers, Aberforth Smaller Companies, 31 January 2024

Geopolitical risk was already elevated at the start of 2023 as the war in Ukraine continued. It rose further towards the end of the year with Hamas’s attack on Israel. However, financial markets were dominated by one issue – inflation and its implications for monetary policy, especially US monetary policy. Persistent inflation had driven the Federal Reserve to raise interest rates by a cumulative 525 basis points in the sixteen months to July 2023. This brought to an end the era of very low borrowing costs that followed the global financial crisis of 2007 and 2008. Understandably, markets have struggled with this new reality and have been eager for indications that inflationary pressure might be relenting.

The ebb and flow of sentiment through the year can be gauged from the US ten year government bond yield. This started 2023 at 3.8% and surged to 5.0% in August, which was its highest level since 2007. As inflation data improved and markets started to anticipate lower interest rates, the yield dropped to 3.9% by the year end, a move that was echoed by the strong performance of equity indices over the last two months of the year.

The UK and much of Europe are also facing higher borrowing costs. These contributed to lacklustre economic growth in 2023, compounding the effects of high energy costs and waning momentum from the pandemic recovery. Recession threatens several European economies, including the UK’s, while China’s reopening has so far proved rather tepid. The brighter spots in terms of economic activity are the US, which is benefiting from government spending through the Inflation Reduction Act and other programmes, and some emerging economies, which are proving more resilient than in past phases of US monetary tightening.

An overall weaker economic backdrop has complicated trading for companies. Results for 2023 will be reported in the first half of 2024 and are likely to show that profits declined in the UK and in Europe. Even the US stock market is expected to experience next to no profit growth, notwithstanding its “magnificent seven” technology leviathans. There are several reasons for this. First, higher interest rates and the other macro-economic uncertainties have put pressure on revenues. Second, it is proving more difficult to raise selling prices as the rate of inflation reduces, but labour costs are continuing to rise. These are harder to pass through to customers, which squeezes profit margins. Third, the cost of borrowing is rising as debt terms are renegotiated in today’s environment of higher interest rates.

Turning specifically to small UK quoted companies, the Managers expect a double digit percentage decline in profits for 2023, with falls for nearly half of the profitable companies that they track closely. Unsurprisingly, those companies operating close to the housing market have been most affected, but it has been notable that overseas facing companies also experienced more challenging trading conditions in the second half of 2023. The effect of this slowdown on profits might be close to half of the impact typically experienced in a full economic recession. Strong balance sheets and battle-hardened boards of directors offer mitigation, but what is important is how much of this is already embedded in the stock market’s valuations of the companies.

. . . . . . . . . . .

Neil Hermon, fund manager, Henderson Smaller Companies, 31 January 2024

Whilst inflation has fallen significantly over the last year, it remains elevated against official targets. Central banks led by the US Federal Reserve have, therefore, retained their hawkish stance. However, it is clear we are at the end of the monetary policy tightening cycle and even the Chair of the Federal Reserve conceded that rate cuts were being debated by the committee. What is not clear is the timing of when rates start to fall and the speed of their decrease. In the meantime, the delayed transmission mechanism of rising interest rates and their impact means that economic conditions are likely to remain difficult in the short term. Notwithstanding this, the prospect of a monetary easing cycle is likely to support global equity markets and allow valuation multiples to expand.

Geopolitics remain challenging, with the ongoing conflicts in Ukraine and Gaza and continued tensions between China and the US. The longer-term economic implications of this are material. There is an urgent need to reduce European dependence on Russian oil and gas supplies and a requirement to decrease China’s influence on the global supply chain through investment in nearshoring capability. In addition, domestic politics are likely to be an area of volatility with up to half of the global population going to the polls in the coming 12 months in key elections in UK, USA, India, Mexico, South Korea and the EU.

In the corporate sector we are encouraged by the fact that conditions are intrinsically stronger than they were during the Global Financial Crisis of 2008-2009. In particular, balance sheets are more robust. Dividends have recovered strongly and we are seeing an increasing number of companies buying back their own stock.

After an active 2021, the initial public offering (“IPO”) market has become considerably quieter as equity market confidence has diminished. There are no signs this is likely to change in the short-term. Merger and acquisition (“M&A”) activity has remained robust as acquirors, particularly private equity, look to exploit opportunities thrown up by the recent equity market falls. We expect this to continue in the coming months as UK equity market valuations remain markedly depressed versus other developed markets.

In terms of valuations, the equity market is trading below long-term averages. In addition, smaller companies are trading at a historically high discount to their larger counterparts. A sharp rebound in corporate earnings following the pandemic-induced shock in 2020 has now faded. Weak economic activity has led to subdued corporate earnings growth in 2023 compounded by rising interest costs and a higher corporate tax burden. These dynamics are unlikely to change in 2024. However, the view that the UK economy is entering a moderate recession is now consensual and the debate is now focused on whether the trough will be deeper than expected.

Although uncertainty remains around short-term economic conditions, we think that the portfolio is well positioned to withstand an economic downturn and exploit any opportunities this would present. The movements in equity markets have thrown up some fantastic buying opportunities. However, it is important to be selective as the strength of franchise, market positioning and balance sheets will likely determine the winners from the losers.

. . . . . . . . . . .

Managers, Troy Income & Growth Trust, 23 January 2024

The investment backdrop during the past 12 months can be well summarised as ‘unsettled’. Inflation, interest rates, geopolitics, and the aftershocks of COVID-related disruption have dominated the narrative, driving volatility and uncertainty. Global and US markets have risen strongly for much of the past year, with the MSCI World and S&P 500 indices up +22% (total return USD) and +23% (total return USD) respectively in the year ending 30 September 2023. However, the positive drivers have been extremely narrow with the majority of gains stemming from the so-called ‘Magnificent Seven’ technology giants (Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia and Tesla) which have risen on a wave of enthusiasm surrounding ‘AI’.

The year as a whole was positive for UK equities with the FTSE All-Share Index rising +13.8% (total return GBP). It was also positive for the Company, albeit with a rise that lagged the market – NAV and share price total returns were +6.6% and +6.3% respectively. We discuss performance in more detail later in this report.

The favourable return from the UK market came primarily in the initial months of the period. The swift resolution to the Truss/Kwarteng mini-budget episode set the FTSE All-Share Index on a sharp rise through the first quarter of the Company’s year. This enthusiasm was extended by the post-COVID ‘China reopening’ as we entered calendar year 2023 which supported the UK commodity and consumer companies exposed to the geography. It seemed that some stability and even renewed growth would provide support for earnings and markets. However, February marked the high point for the UK index. The US banking stress in March caused a sharp sell-off in financial stocks globally and served as a sharp reminder that higher interest rates are likely to have acute and unpredictable impacts.

. . . . . . . . . . .

Asia

(compare Asian market funds here, here, and here)

Neil Rogan, chair, Invesco Asia Trust, 24 January 2024

Headwinds remain: China’s recovery is being hampered most notably by property oversupply and bad debts. Persistent inflation in the United States has led to American interest rates being higher for longer, which puts pressure on Asian currencies. Monetary tightening in the US and Europe will depress economic activity at some point soon, even if recession is avoided. This will further negatively reduce demand for Asian exports, which have already been affected by the protectionist parts of President Biden’s Inflation Reduction Act. The 2024 US Presidential election will provide lots of noise and perhaps further reason to avoid risk assets. At best, you could only argue that the headwinds are not becoming stronger.

The surprising thing is that favourable tailwinds have not yet appeared. There is the possibility of a rapprochement between the US and China: China’s economic needs plus the US stance against Russia would suggest a more favourable relationship would help the US and China. Dollar interest rates and US bond yields are close to peaking, even if they do not fall as much as some are expecting. Asian corporate governance is much stronger these days, so many companies can prosper even through harsh times. Asian economies are more resilient than in previous cycles with larger domestic consumption meaning they are less dependent on exports.

. . . . . . . . . . .

Japan

(compare Japanese funds here and here)

Harry Wells, chair, CC Japan Income and Growth Trust, 24 January 2024

Despite decent returns over the last decade, the Japanese equity market remains undervalued. The earnings yield dwarfs the negative return from cash. The Government and The Tokyo Stock Exchange are committed to cleaning up capital inefficiencies and boosting returns on equity. Companies are being forced to change their behaviour. TOPIX listed companies are still sitting on considerable amounts of cash estimated at the yen equivalent of over US $1 trillion. This should steadily be reduced through increasing shareholder distributions, share buy backs, management buyouts (“MBOs”) and private equity deals. The recent rationalisation of cross holdings and subsidiaries by the influential Toyota group and the gathering pace of MBOs executed at significant premiums to existing share prices are examples. The drive for efficiency is complemented by PM Kishida’s efforts to mobilise a shift in the mountain of household savings and domestic institutional funds into income generating assets including equities. The recent doubling of NISA allowances, Japan’s equivalent of the UK ISA, is one such initiative to encourage savings into the stock market. It remains to be seen whether the inevitable but gradual steps towards normalisation of monetary policy as a corollary of inflation serve to stimulate equity investment flows. For now, BOJ monetary policy remains uniquely accommodating compared to other major Central Banks.

Deflation in Japan has at last given way to some inflation. Wage growth should help the consumer. Tourism is picking up. Reshoring manufacturing capacity has seen a recovery in capital expenditure. The weakness of the yen is an export opportunity. Forecasts for corporate earnings growth are healthy with an estimated growth of at least 7.5% for both 2024 and 2025. These virtuous developments will benefit further from any recovery of the world economy and improvement in global political tensions. The risks of widening conflict in the Middle East quite apart from tensions over Taiwan and Korea are apparent. The recent earthquake also reminds us that Japan is susceptible to natural disasters. That aside, most commentators believe that the USA is heading for a soft landing rather than a deep recession. World equity markets tend to take a lead from the policy actions of the US Federal Reserve, but Japanese equities now stand out on their own merits. Our mandate is well placed to continue to provide solid total returns and the Board has every confidence in Richard Aston and the team at Chikara to keep producing them.

. . . . . . . . . . .

Global Emerging Markets

(compare global emerging markets fund here)

During the review period, EMEA markets were, as usual, driven in part by developments beyond the Company’s investable universe. Disappointment in the performance of the Chinese economy since its reopening in late 2022 weighed on investor sentiment not only in Asia, but also in other emerging markets, and across the developed world, as Chinese export demand has been weaker than expected. Investors are also concerned about ongoing issues in the Chinese property sector. The rapid increase in global interest rates over the past two years has been slow to register on economic activity, but the spectre of recession in the US and other western economies cast a pall over these markets for much of the past year. However, higher rates have been supportive for most financial names in these markets, boosting margins and dividends.

Within EMEA markets, the oil price remained the key determinant of market direction, and it has been volatile over the past year. News in May 2023 that the OPEC+ group of oil producers had agreed to cut production, removing about 1.5 million bbl per day from supply, supported the oil price during the 3rd quarter of 2023 (‘3Q23’), but concerns about economic growth and stability of demand set downward pressure. This ‘tug of war’ tends to occur on the derivative market when ‘real oil’ markets are far more stable and mostly focused on volumes rather than price volatility. Thus, we saw the price end the period close to where it began. The reduction in oil production and oil price volatility ensured most major Middle Eastern oil producers struggled to make gains over the period. The notable exception was ARAMCO, the world’s largest oil producer, and one of our largest positions, which benefitted from better than expected income reported for 3Q23 and consequent announcement of additional dividend pay out above the previously declared range.

Political developments were another significant driver for EMEA regional markets. In Poland, market euphoria in response to the victory for progressive opposition parties in national elections seems to us to be overdone, as we do not expect the change of government to result in any major changes to the country’s economic outlook. In Turkey, the confirmation of President Erdogan for another five-year term came as no surprise, but investors, especially those from abroad, welcomed the appointment of market-friendly heads to both the central bank and the Ministry of Economy. The President has given them clear mandates to fight inflation and rationalise economic policy, but this will be a long and difficult task. As we outlined in the Company’s Half Year Report, Turkey faces several significant macroeconomic challenges, and we are sceptical that the market’s recent gains can be sustained. However, recent events at least hold out hope for some improvement in the Turkish economy, and we may be tempted to invest in this market if these early positive signs are followed by concrete evidence that the investment environment has stabilised. Elsewhere, the sudden, violent developments in Israel and Gaza shocked the world, but are unlikely, in our view, to escalate into broader conflict across the Middle East. However, their longer-term implications for the regional and global political situation, while still unclear, are likely to be profound.

Events in Poland and Turkey saw these markets outperform relative to other countries in the reference index over the review period on the market assessment that their country risk premia had diminished. Greece also did well, thanks to upward revisions to the earnings outlook., Greece is going through the process of upward adjustment of the investment grade of its debt. This upward revision led to a reduction in the costs of equity and increase market acceptance of investment multiples. Cuts to oil production saw Saudi Arabia and UAE underperform. South Africa also lagged due to long running concerns about stability of electricity supply and negative earnings momentum related to lower consumption rates of the population and profit margin squeezes for business.

Another notable feature of the past year was the poor relative performance of large stocks such as those within the financial and petrochemical industries, while mid-caps outperformed. Newly listed names also outperformed. Disappointingly, large caps in the Middle East region, mostly consisting of banks, had a mediocre year. Investors were concerned that liquidity would not support market growth and faster repricing of deposits rather than loans will create challenges for earnings momentum. In addition, the Petrochemical sector is suffering global competition from Asia, mostly Chinese players. When new names were listed with realistic prices and clear dividend policies, this created anchor valuations and helped the new issues experience strong gains in early trading.

. . . . . . . . . . .

Commodities and Natural Resources

(compare commodities and natural resources funds here)

Tom Holland, Mark Hume, BlackRock Energy and Resources Income Trust, 31 January 2024

After a very strong performance in 2022, the last twelve months to 30 November 2023 have been tougher in the extractive mining and traditional energy industries and even harder for many of the companies in the energy transition sector. Commodity prices pulled back from their prior year highs, especially in the energy commodities such as natural gas and thermal coal. Whilst some of this reflected market conditions normalising following the dislocations as a result of the Russia – Ukraine conflict, as we progressed through the year greater concerns emerged about the demand outlook both in major Western economies and in China.

The impact of inflation and higher interest rates was most acutely felt in some of the industries related to the energy transition sector. The offshore wind industry saw several high-profile project cancellations or deferrals as spiralling costs rendered projects uneconomic in the face of higher funding costs. The explosive growth in electric vehicle sales also slowed, albeit from exceptional rates of growth to “just” a high rate but consumers in the key market of the United States of America (US) appear yet to be convinced with several US manufacturers recently reducing near-term sales targets.

Despite some of these challenges, it was encouraging to see that policy support and regulation focused on the energy transition did not take backward steps during the year. Although the methods of implementation are yet to be announced by individual countries, the agreement at the COP28 meeting in December 2023 to triple renewable energy capacity globally by 2030 reaffirms the strong tailwind for growth that companies in this sector would experience over the coming years.

Whilst it would appear on the surface that broader equity markets did substantially better over the year than the Company’s areas of focus, it should be noted that equity market performance has been narrow relative to historic averages. That is to say that the positive performance was concentrated in a small number of shares, mainly the “Magnificent 7” in the technology sector.

. . . . . . . . . . .

Private Equity

(compare private equity funds here)

In terms of the broader private activity market, we are not planning for an immediate uplift in deal activity as we move into 2024, despite some encouraging noises in the industry about the potential for a pick-up in levels. The uncertain financial market backdrop caused by the sharp increases in both inflation and interest rates has impacted both buyers and sellers’ willingness to transact in the short term. Furthermore, availability and pricing of debt to finance new transactions will continue to be a challenge. 2023 was a tough year for private equity deal activity and whilst we can definitely see a scenario where deal volumes materially pick up in 2024, we continue to plan with caution.

That said, market uncertainty and volatility does provide a silver lining around the attractiveness of new investment opportunities. These periods tend to present differentiated opportunities such as corporate carve outs and public to private transactions, and family owners of attractive businesses can often be more willing to sell long-held assets for liquidity or portfolio reasons. Furthermore, entry multiples tend to be lower during these periods, compared to long-term averages. The aftermath of the dot com bubble and the global financial crisis are good examples of private equity’s ability to take advantage of these periods of uncertainty and generate strong investment performance.

More broadly, companies continue to stay private for longer and the governance model of private equity, through majority control and active ownership, provides the opportunity for hands-on value creation and for decisions to be taken more efficiently and effectively in response to changing market circumstances.

. . . . . . . . . . .

Property

(compare UK property funds here, here, here, here, here, here and here)

Frederic Vecchioli, chief executive, Safestore

There are numerous drivers of self-storage growth. Most private and business customers need storage either temporarily or permanently for different reasons at any point in the economic cycle, resulting in a market depth that is, in our view, the reason for its exceptional resilience. The growth of the market is driven both by the fluctuation of economic conditions, which has an impact on the mix of demand, and by growing awareness of the product.

Safestore’s domestic customers’ need for storage is often driven by life events such as births, marriages, bereavements, divorces or by the housing market including house moves and developments and moves between rental properties. Safestore has estimated that UK owner-occupied housing transactions drive around 8-13% of the Group’s new lets.

The Group’s business customer base includes a range of businesses from start-up online retailers through to multi-national corporates utilising our national coverage to store in multiple locations while maintaining flexibility in their cost base.

The self-storage market has been growing consistently for over 20 years across many European countries but few regions offer the unique characteristics of London and Paris, both of which consist of large, wealthy and densely populated markets. In the London region, the population is 13 million inhabitants with a density of 5,200 inhabitants per square mile, 11,000 per square mile in Central London and up to 32,000 per square mile in the densest boroughs.

The population of the Paris urban area is 10.7 million inhabitants with a density of 9,300 inhabitants per square mile in the urban area but 54,000 per square mile in the City of Paris and first belt, where 69% of our French stores are located and which has one of the highest population densities in the western world. 85% of the Paris region population live in central parts of the city versus the rest of the urban area, which compares with 60% in the London region. There are currently c. 245 storage centres within the M25 as compared to only c. 122 in the Paris urban area.

In addition, barriers to entry in these two important city markets are high, due to land values and limited availability of sites as well as planning regulation. This is the case for Paris and its first belt in particular, which inhibits new development possibilities.

. . . . . . . . . . .

Renewable Energy Infrastructure

(Compare renewable energy funds here)

Duncan Neale, director, Atrato Onsite Energy, 10 January 2024

During the financial year, UK wholesale electricity prices saw a normalisation following the peak that occurred in the second half of 2022, when the average daily price on the N2EX day ahead auction was £128/MWh. The fall in wholesale energy prices was driven by the decline in natural gas prices, albeit they are still trading above the long-term average. For the month of September 2023, there was a 69% decrease in the average auction price to £83/MWh, when compared with £271/MWh for the same month in the prior year.

With energy prices rising at a significant pace in August 2022, the Government announced a £211/MWh price cap for businesses (the Energy Bill Relief Scheme) from 1st October 2022 for their price of electricity. The price cap was introduced by the Government for the six months to March 2023, to support businesses struggling with their energy bills. This intervention restored some stability in the energy price market, giving households and businesses more certainty around their energy bills. Following the end of the price cap, the Government introduced a more targeted scheme in April 2023 to continue to support businesses with their energy costs which will run until March 2024. The Energy Bills Discount Scheme targets its support of businesses that are more vulnerable to rising energy prices, due to their energy intensive operations, and does so through a discount on the wholesale element of business energy bills, when it reaches a certain threshold (over £302/MWh).

. . . . . . . . . . .

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.