July 2023

Monthly roundup | Investment companies

Kindly sponsored by abrdn

Winners and losers in June 2023

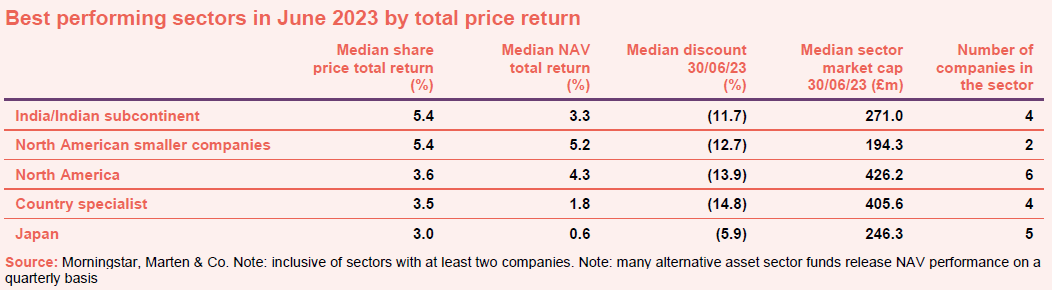

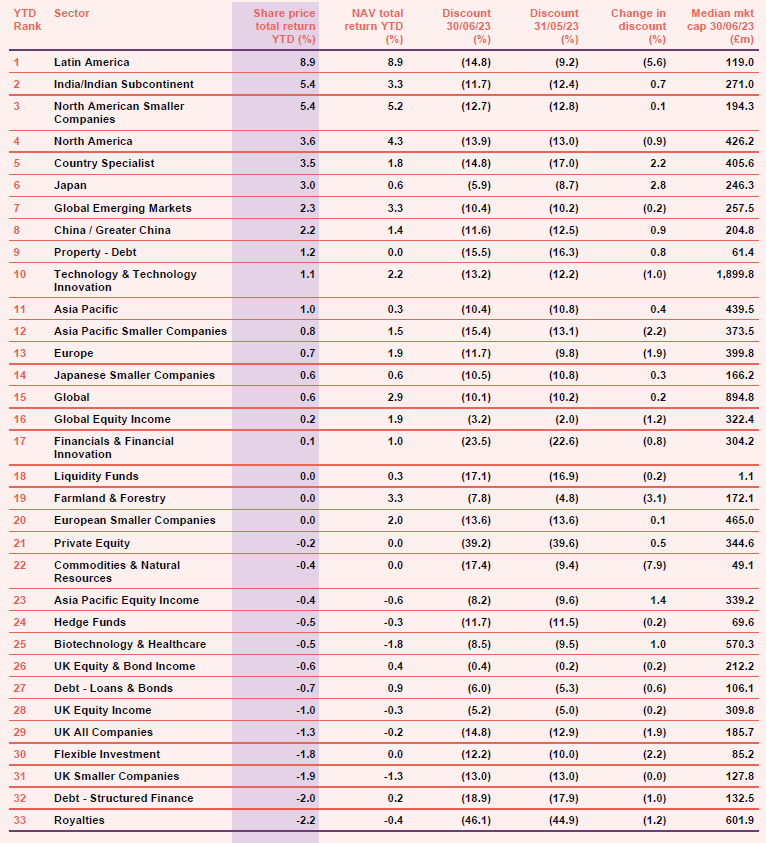

With much of the recent focus on the resilience of developed markets, particularly the US, a number of emerging economies have outperformed, leaning on macro stability and supportive fiscal spending made possible by moderating inflation. India leads the way, with the median share price for the sector up over 5.4% for the month. Over the past year, its benchmark NIFTY500 index is up 21%. With a pro-growth budget and an increasing focus on industrial policy and domestic consumption, the economy appears to be on a steady footing, with the country’s risk assets tracking its world leading growth rates.

Latin American is another emerging economy that has rebounded strongly – up 8.9% – although the sector has been left off the best performers list by virtue of the Blackrock Latin America Trust being the last fund standing following the wind up of the abrdn Latin America trust earlier this year – our sector results are screened with a requirement of having a minimum of at least two funds. Within the Country specialist sector, the Vietnam Enterprise and Vietnam Holding funds were also up strongly, boosted by relatively low inflation in the region, improved consumer spending, and increasing tourist activity.

The outperformance of the North American funds reflects improving risk sentiment in the region thanks to the continued resilience of the US economy. The growth over the last six months has been well documented, particularly regarding the concentration in US markets with the top seven companies on the tech dominated NASDAQ adding one entire Germany’s worth of market cap over the first six months of the year. Along with the AI binge, large cap tech has benefited from the relative safety provided by established, secular cashflows and unparalleled balance sheet strength which appears to have insulated the sector from continually rising discount rates. The two best performing trusts in the North American sector, North American Income trust and Baillie Gifford US growth, both hold large positions in outperformers such as NVDIA and Amazon.

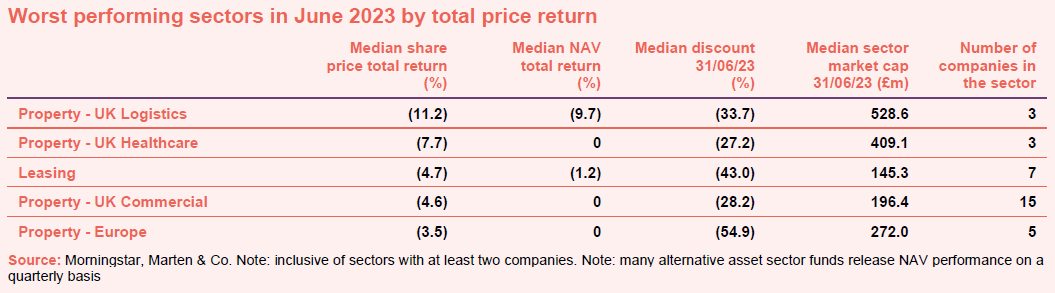

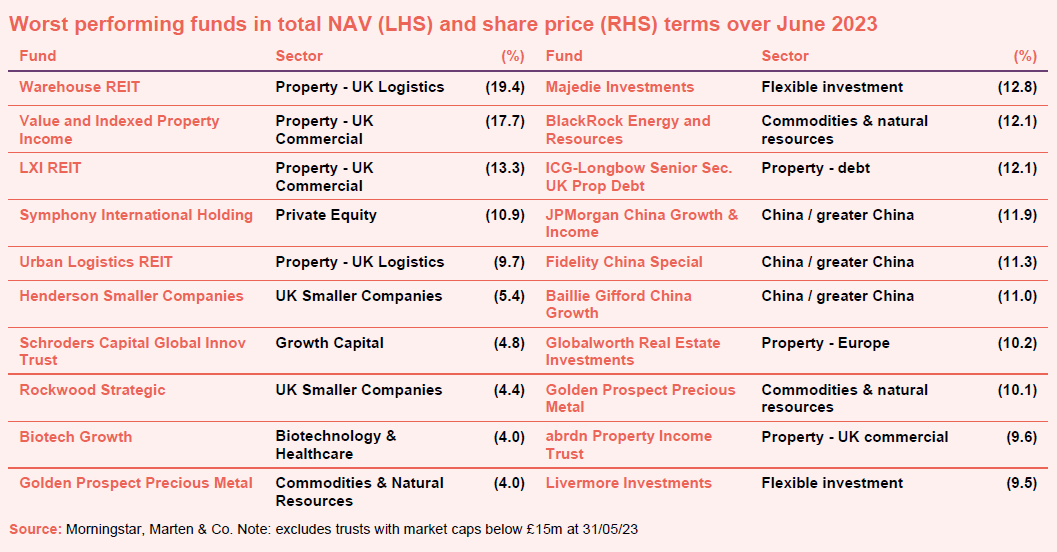

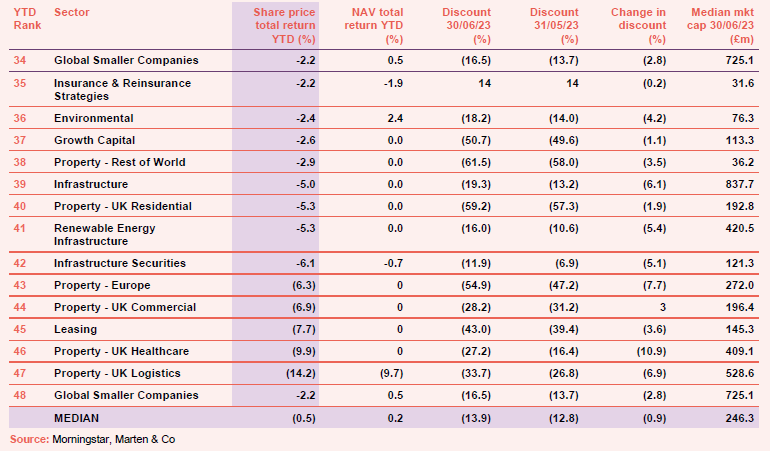

Outside of the leasing sector, the worst performers list in June was made up entirely of property sector exposure as inflation continues to run amok in the UK with money markets now fully pricing a 6.5% interest rate by February 2024, and a one-in-three chance of a 6.75% terminal rate which would be the highest since 1998. Logistics led the way, dragged down by a number of underperforming funds including Warehouse REIT, which reported a 29.5% drop in NTA during its latest annual results. The two care home REITS which make up the UK healthcare sector have bounced around considerably over the last few months. Generally insulated from the trials of the broader property sector, the funds appear to have been impacted by the income now on offer from low-risk government debt. The fortunes of the leasing sector, including funds such as Tufton Oceanic Assets and Taylor Maritime Investments remain closely tied to the outlook for global growth which has steadily trended downward over the last few months.

Geiger Counter was the best performing fund in June, bouncing back following a period of weakness in Q1. In general, the market for uranium has been trending up over the last couple of years as the renewable energy transition gathers steam and investors come around to the potential upside of nuclear power. As noted on page 1, investors have been piling into funds in Latin America attracted by high real yields and an unexpectedly resilient economy, with the region now supporting five of the world’s top eight performing currencies.

US funds represented a lower proportion of the June list of best performers than the month prior, although returns are only modest in relation to the size of their outperformance in May. NVDIA was still up 7% for the month while Microsoft was up 3%. Collectively the two stocks make up almost 40% of Manchester & London Investment Trust.

Several commodity funds managed to gain traction for the month as prices for industrial metals including copper and steal bounced off recent lows, although shares remained depressed on growth concerns. The returns of CC Japan Income & Growth reflect the continued momentum in the Japanese stock market which is now up almost 30% year to date, boosted by resilient corporate earnings and less restrictive monetary policy thanks to comparatively modest inflation.

As for share price moves, Hansa Investment Company rallied on news that its largest holding, Ocean Wilson had initiated a strategic review for the sale of its major subsidiary company. Crystal Amber’s returns were driven by the sale of British oil producer Hurricane Energy as it continues its wind-up process. It’s not immediately clear what drove the returns of the two private equity funds, Apax, and Petershill Partners (while categorised as growth capital, private markets represent the majority of Petershill’s assets), however both are recovering after a challenging 12 months. The rest of the list is made up of emerging market funds which have benefited from the outperformance of their respective regions.

Worst-performing

As noted on page 2, the UK property sector faces continued pressure from rising rates and untamed inflation. Outside of property, the worst performers for the month reflect the rotation away from riskier sectors of the market, including small caps, growth capital, and biotech. These companies are perceived as having large capital requirements and relatively weak balance sheets which are reliant on external funding for growth.

China is also well represented as things have gone from bad to worse in in the region. Optimism around the reopening has now given way to a raft of geopolitical and economic concerns. The economy continues to battle tepid domestic demand, credit growth, and a global slowdown in trade while efforts to stimulate it risk exacerbating a deeply complex and already overleveraged property sector. The outlook remains just as uncertain with the yuan in constant decline, and the ever-present threat of escalating trade restrictions weighing further on confidence.

Outside of China, Schroder Capital Global Innovation’s struggles continued with the fund’s persistent discount refusing to budge from around 50%. A continuation vote is planned for 2025. Elsewhere, Baker Steel Resources has suffered from the general malaise in commodity prices which have been trending down as global growth expectations fall. Gold also struggled as economic resilience in the US led to a ‘hawkish pause from the Federal Reserve and a selloff in bonds, negatively impacting Golden Prospect.

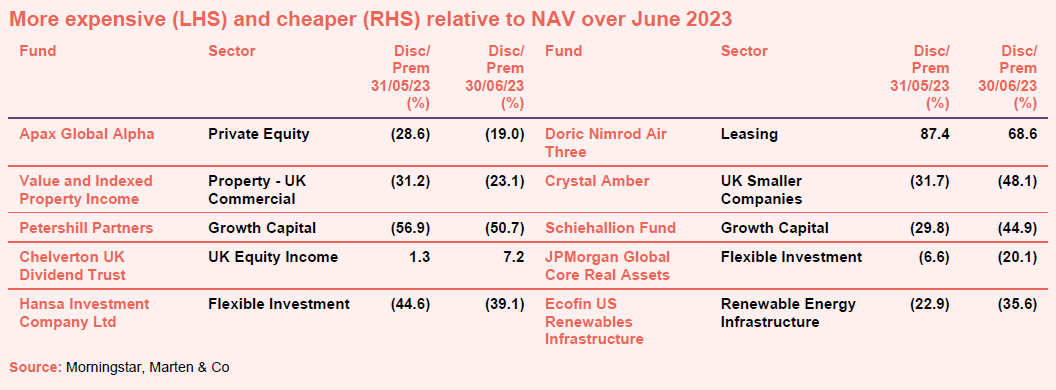

Moves in discounts and premiums

Of the funds not already referenced, the discounts for Value and Indexed Property and Chelverton UK Dividend Trust tightened as a result of the NAV falling faster than the corresponding drop in share prices. In terms of funds getting cheaper, JPMorgan Global Core Real Assets was impacted by a large overweight to US real estate, which makes up more than 50% of the fund, with a weak USD compounding the losses.

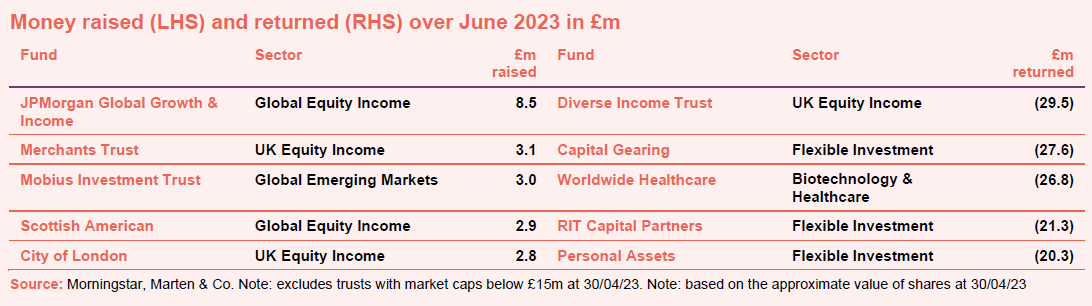

Money raised and returned

June proved to be a quiet month for fund raising outside of a steady issue of shares from several larger trusts. For those companies returning cash, Diverse Income paid out on its annual redemption request in June, representing 10.5% of the fund’s issued share capital. The other funds on the list all operate active buyback policies as they attempt to manage their respective discounts.

Major news stories and QuotedData views over June 2023

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London.

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

|

Research

After years of squeezed margins thanks to ultra-low interest rates, banks’ profitability is increasing (in part, as the spread between the interest rates that they pay on deposits and the rates that they charge borrowers widens). However, higher rates have brought increased recession risk and have exposed inept risk management within some US regional banks, with some high-profile bank failures. The managers of Polar Capital Global Financials Trust (PCFT) were quick to cut exposure to more exposed areas of the sector, while increasing PCFT’s weighting towards areas such as insurance and reinsurance, where the picture looks brighter.

An inflection point in artificial intelligence (AI) – which combines computer science and datasets to enable problem-solving – is close to being reached. Major improvements in output and rapid adoption make the likelihood that it will become a general purpose technology – technologies that can affect an entire economy, like the computer and internet before it – and impact on all parts of everyday life an inevitability.

Aquila European Renewables (AERI) is about four years old. Since launch, it has built up a 464MW portfolio of operational solar, wind and hydropower projects, spread across six European power markets. It has also generated returns in line with the target that it set at launch, returning an average of 7.2% per year against a target of 6.0–7.5%. For 2023, AERI is targeting a dividend of 5.51 cents per share (that is euro cents – given that it invests in Europe, it presents its figures in euros), 5% ahead of the target it had for 2022. Importantly, the board reckons that this will be covered 1.8x.

Vietnam Holding (VNH) has put in a compelling performance in net asset value (NAV) total return terms versus competing funds investing in emerging Asia (see page 25), but this is not being reflected in its share price. Presently, its share price is at a 13.5% discount to its NAV. This is despite Vietnam’s long-term structural growth drivers remaining intact (see page 7) and a strong outlook for GDP growth over the next five years (the forecast is for an average of 6.7% a year through to 2028).

abrdn European Logistics Income (ASLI) is riding out the storm of market valuation declines, with a focus on managing its portfolio and securing income. It has recently completed a number of letting renewals across its portfolio (see page 9) and uncapped, annual inflation-linked rental uplifts on two-thirds of its leases offer further promise. Evidence that valuations in the European logistics real estate sector are stabilising is growing, not least through thesale of an assetfrom ASLI’s portfolio at a small premium to bookvalue, which should serve to support its net asset value (NAV).

After a tough year for investment strategies focused on quality and growth of all kinds, Montanaro UK Smaller Companies (MTU) may finally be seeing the light at the end of the tunnel, thanks to the possible plateauing of interest rates. Manager Charles Montanaro remains focused on picking high-quality stocks with long-term growth potential, sticking with the approach despite the headwinds of early 2022. In fact, the sell off in UK small caps has meant that MTU has become even more attractive on a fundamental basis, with many of its holdings trading on attractive valuation multiples, despite demonstrating the same growth potential.

We are quickly approaching year three of Temple Bar’s rehabilitation under the new management of Redwheel, who took over the fund in November 2020. While sticking to its value-seeking roots, managers Ian Lance and Nick Purves favour a more balanced approach than the deep value model employed by the fund’s previous manager, which had been a drag on performance through the growth dominated decade that followed the global financial crisis (GFC). So far, the change has paid off handsomely, with the shares up 76% since the handover, compared 35 percentage points ahead of the benchmark UK index. Although it might be disingenuous to attribute the recent outperformance purely to the change in management, considering the dramatic swings we have seen in equity markets since the pandemic, the team certainly appears to have established a foundation for ongoing success.

Appendix 1 – median performance by sector, ranked by 2023 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.