Real Estate Roundup

Kindly sponsored by abrdn

Performance data

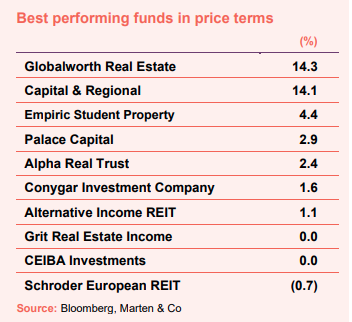

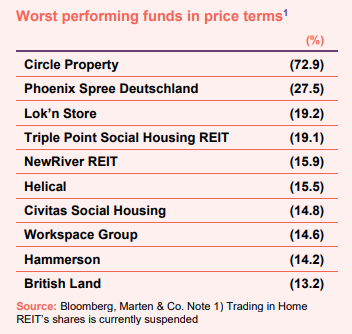

March’s biggest movers in price terms are shown in the charts below.

Property stocks tumbled further in March as stubborn inflation and a further interest rate hike was announced by the Bank of England. The median average share price fall across the sector was 7.9%. Perhaps reflecting the uncertainty in the market, many of the best performing companies have flipped to the worst performing, and vice versa, month-on-month. There were just seven positive share price movers in March, led by central and eastern European property investor Globalworth Real Estate, which last month was the biggest faller in price terms. Secondary shopping centre owner Capital & Regional also saw a double-digit uplift in its share price in March after reporting solid 2022 results. Empiric Student Property’s share price rose 4.4% in the month after it displayed the student accommodation sector’s resilience in full year results (see page 2). Conygar Investment Company and Alternative Income REIT were two of those companies among the worst performing in February – the former boosted by the announcement that Anglesey, where it owns 203 acres of land, had secured freeport status.

Topping the list of fallers over the month was Circle Property, which started the process of de-listing its shares from AIM with the first return of capital to shareholders from the sale of its assets (see page 3 of last month’s roundup for details). The share price of Berlin residential landlord Phoenix Spree Deutschland tumbled in March after it suspended its dividend, due to the slowdown in the investment market impacted condominium sales. The two social housing specialists Civitas Social Housing and Triple Point Social Housing REIT also saw a double-digit fall in their share prices in March, having both been in the list of best performing in February. This is despite Triple Point demonstrating the resilience of the sector and the benefits of its inflation-linked income in reporting a valuation uplift in 2022. The debacle at Home REIT may be (unfairly) impacting sentiment towards the social housing players. The recent share price recoveries of retail specialists NewRiver REIT and Hammerson came to a halt, with both experiencing double-digit falls in March (having topped the charts in February.

Valuation moves

Corporate activity

The board of Ediston Property Investment Company launched a strategic review into the future of the company having been severely impacted in its ability to grow by a persistent wide discount to NAV. The board said its preferred outcome was a merger with one or more REITs, but the strategic review could also result in the sale of the company.

Regional REIT’s manager, London and Scottish Property Investment Management, is in late-stage discussions to be acquired by “a large multi-national asset manager”. The board says that there will be no disruption to the services provided to Regional REIT and adds that it believes the transaction will enhance the overall strength and capabilities of the asset manager.

Dolphin Capital Investors terminated the investment management agreement with Dolphin Capital Partners (DCP) after discovering it had “entered into an undisclosed option agreement with the purchaser of the Amanzoe resort in Greece at the same time that the company sold its interest in the resort” (in August 2018). The undisclosed option agreement entitled DCP to acquire an additional 15% of the special purpose vehicle (SPV) holding the Amanzoe resort, further to a separate agreement for DCP to acquire 15% of the SPV that had been disclosed. The company said that it was seeking to recover the value arising from the undisclosed option agreement, which could be material. Miltos Kambourides, the co-founder and managing partner of DCP, was also removed from the board. The directors intend to self-manage its assets.

Land Securities launched a £400m Green Bond with a maturity of 9.5 years, paying a coupon of 4.875%. The transaction would help the company to deliver its pipeline of central London development opportunities.

Supermarket Income REIT refinanced £86.9m of debt held with Bayerische Landesbank with a new three-year term loan for the same amount. The new secured, interest-only, loan replaces three existing tranches and matures in March 2026. It is priced at a margin of 1.65% above SONIA.

LXI REIT secured a new £150m 16-year, interest-only term loan signed with a leading insurance company. The new facility carries a margin of 1.75% per annum plus the prevailing UK Treasury 2039 Gilt rate and is secured against a ring-fenced pool of assets. The company has also agreed a short-term extension of its existing £60m loan with HSBC, which now matures in December 2024, with a further six-month extension option. The facility now carries a margin of 2.05% per annum above SONIA.

Major news stories

- Tritax Big Box REIT disposes of trio of assets for £125m

Tritax Big Box REIT exchanged contracts for the sale of three investment assets for a total of £125m, in line with the 31 December 2022 valuations and reflecting a blended net initial yield of 4.6%.

- Landsec acquires full ownership of St David’s mall

Land Securities secured 100% ownership of St David’s shopping centre, Cardiff, with the purchase of the debt secured against the 50% share of the asset previously owned by intu plc. Comprising separate transactions with two debt holders, the overall purchase price represented a “meaningful discount” to the £113m September 2022 book value of Landsec’s existing 50% share of the centre, and a net initial yield of 9.7%.

- Supermarket Income REIT completes £430.9m Sainsbury’s store sale

Supermarket Income REIT completed the sale of its interest in a portfolio of Sainsbury’s let supermarkets for £430.9m. Sainsbury’s acquired 21 of the 26 stores in the Sainsbury’s Reversion Portfolio (SRP) and entered into new 15-year leases on four of the five remaining stores (which SUPR has an option to acquire for £28.3m). The one remaining store is expected to be sold at vacant possession value.

- LondonMetric swells coffers for opportunistic acquisition spree

Across the month, LondonMetric Property sold eight logistics assets for a total of £80.8m, as well as seven long income assets for £33.9m (LMP share: £29.6m), as it gears up to “take advantage of new opportunities that it expects to see across the urban and regional warehouse markets”.

- Workspace sells residential development in Wandsworth

Workspace Group sold the residential component of the Riverside mixed-use redevelopment in Wandsworth, London, for £53.95m, in line with its September 2022 valuation. Workspace will construct a new 153,000 sq ft business centre.

- abrdn Property Income Trust checks out £18m Morrison’s supermarket

abrdn Property Income Trust completed the purchase of a Morrison’s supermarket in Welwyn Garden City for £18.29m, in a sale and leaseback deal with Morrison’s entering into a new 25-year lease with rent reviews linked to CPI.

- Target Healthcare REIT exits Northern Ireland with £22m sale

Target Healthcare REIT exited Northern Ireland with the sale of four care homes for £22m. The disposal price was ahead of the book value at 31 December 2022, and results in an annualised IRR in excess of 10% over the period of ownership.

- Warehouse REIT makes series of disposals

Warehouse REIT concluded the sale of two distribution estates totalling 269,000 per sq ft, for £29.5m, generating an ungeared IRR of 9%.

- AEW UK REIT bags Matalan retail park

AEW UK REIT purchased a Matalan-let retail warehousing unit in Bamber Bridge, Preston for £6.45m, reflecting a net initial yield of 9.5%. The lease on the 58,696 sq ft unit has another 9.2 years to run and benefits from a 2027 rent review to the higher of open market value, or 2.5% per annum compounded, resulting in a minimum reversionary yield of 10.7%.

- Schroder European REIT buys Dutch warehouse

Schroder European REIT acquired a 9,115 sqm industrial warehouse in Alkmaar, the Netherlands, for €11m, reflecting a net initial yield of 5.6%. The deal was a sale and leaseback with occupier W.A. Schuurman Beheer B.V., an electrical engineering and renewable energy specialist, which signed a 20-year, triple net lease, with a break at 15 years, with annual inflation-linked indexation.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Logistics

Aubrey Adams, chairman:

The second half of the year saw investment market conditions deteriorate due to macroeconomic and geopolitical issues. A significant adjustment in underlying interest rates, in an attempt to curb high levels of inflation in the UK economy, caused a sharp increase in overall cost of capital and subsequently drove property yields higher. The relatively low volumes of investment transactions that completed in the latter part of the year were likely to have been priced around the time of the UK’s “mini-Budget” in September and October, when uncertainty was at its height. The valuers have been quick to reflect this in year-end valuations, which has led to a decline in our portfolio valuation and net asset value. We expect higher quality assets, of the type we own, to stabilise quicker and be more resilient in the face of a potentially weaker UK economy. Although we see the potential for some further but limited outward yield movements in the first half of the year, since the year end we have seen encouraging signs of the investment market stabilising and we believe there remains significant capital waiting to be deployed into the logistics sector, given its favourable long-term fundamentals.

We have seen exceptionally high occupational demand for new logistics space in recent times although it is likely that a more challenging economic backdrop may moderate occupational demand to levels which historically would have still been considered strong. The structural demand drivers, combined with very low levels of new logistics buildings supply, are expected to continue to support attractive rental growth in the future.

Looking further ahead, the outlook for the sector remains positive. The structural tailwinds in the occupational market continue as occupiers seek to reduce their own cost pressures by generating greater internal operating efficiencies, led by optimisation of supply chains. As the current spike in inflation recedes, we see good prospects for rental growth to exceed inflation over the medium term which will help us to deliver attractive returns to our shareholders.

Retail

Nick Hewson, chairman:

2022 demonstrated the continuing strength of the grocery sector set against a rapidly changing economic backdrop. The strong performance of the UK grocery market highlights how non-discretionary grocery expenditure is highly resilient to the volatile peaks and troughs of the economic cycle, especially in the current inflationary environment.

The most recent data from Kantar shows that the UK grocery market has grown 8.8% on the prior year, with annualised sales now exceeding the levels seen at the height of the pandemic lockdowns in 2021. This growth is further enhancing the strength of our primary tenants, Sainsbury’s and Tesco, which account for a combined 75% of our income. In January, Sainsbury’s predicted a 20% increase in full-year free cash flow to £600m and Tesco increased its free cash flow target by 29% to £1.8bn. At the store level, this results in revenue growing significantly ahead of rental increases, which are typically capped at 4% annually. The resulting increase in affordability provides a strong tailwind for future ERV growth across our supermarket portfolio.

The robust performance of the grocery sector is in stark contrast to the decline in values seen in the property investment market caused by the challenging macroeconomic and geopolitical backdrop. The significant increase in interest rates since September has caused a rapid decline in property values, with the MSCI Capital Values Index declining by over 19%. Supermarket property has been less volatile, but not immune, with a 13% like-for-like decline in our portfolio value resulting in a net initial yield of 5.5% as at 31 December 2022 (30 June 2022: 4.6%).

While the sharp adjustment in interest rates has impacted our property values, we took the prudent decision during the period, to protect earnings through hedging 100% of our drawn debt at a weighted average cost of 2.8%. As a result, we remain on track to deliver our 6 pence per share dividend target for the year.

David Hunter, chairman:

After the very obvious challenges of 2020 and 2021, the retail environment facing the Company in 2022 was more nuanced. On the positive side, we saw an end to the pandemic restrictions with all traders open for business and footfall trending back upwards towards 2019 levels. Retail failures were significantly down and rent collection levels much improved. Counteracting the good news, the UK economy faced increasing difficulties from low growth, high inflation and a sharp end to over a decade of very low interest rates accompanying a dramatic fall in consumer confidence.

Whilst the market had anticipated that falls in 2020 and 2021 would mark the low point in valuations, steeply falling values in other sectors in the second half of 2022 coupled with an absence of available bank debt continued to impact retail valuations, albeit to a far lesser degree than other real estate sectors. This also reflected very limited investment comparable transactions and general continuation of negative sentiment. Our view is that following the repricing there is now a very selective buying opportunity in the sector.

Rita-Rose Gagné, chief executive:

Best-in-class occupiers recognise the importance of city centre locations and the symbiotic nature of their physical and online channels, and we are working in partnership to deliver our proposition to this new reality. This integrated experience is the Hammerson offering and will continue to attract the very best occupiers during the ongoing flight to quality. We are well placed to benefit from these trends. Rents and rates have been largely re-based, vacancy is tight, and we have long term certainty in our lease expiry, and attractive yields in our managed portfolio, that offer the potential to deliver attractive total returns.

Our unique development opportunities provide a distinctive opportunity to create further value by bringing a broader mix of uses to the existing estate through integral and complementary repurposing and development which will enhance the proposition of the whole estate. Meanwhile, we will also create option value on stand-alone projects. We have a strong platform and over the medium term we see multiple opportunities to continue to unlock deep value.

Residential

Triple Point Social Housing REIT

Chris Phillips, chairman:

2022 has proven to be another year of unforeseen challenges. Inflation and resultant rising interest rates were to be expected, but their pace of increase was accelerated by geopolitical events, most notably the tragic war in Ukraine, as well as the fallout from heightened domestic political volatility in the UK in the latter half of the year. The Bank of England base rate increased by 375 basis points in 12 months, and inflation reached levels not seen in over 40 years. Higher interest rates have provided investors seeking income with a range of options, many of which have not been viable over the last 15 years, and inflation and its root causes have created operational challenges for business throughout the UK and indeed the world. Questions remain about the impact these challenges will have on property valuations as investors and valuers grapple with understanding the real impact on the performance of property assets, and their relative attractiveness when compared to alternative sources of income.

Specialised Supported Housing valuations showed resilience throughout the COVID pandemic and are relatively well-insulated from the impact of an economic downturn, however they are not impervious to the pressures of rising interest rates. Whilst we feel well positioned relative to most other real estate sectors, the risk of further outward movement in social housing yields remains, principally driven by the tighter spread versus the risk-free rate. We expect any movement to be limited relative to some other commercial property sectors due to the excess demand for Specialised Supported Housing coupled with a continued lack of supply.

Steve Smith, chairman:

The national supply of new homes continues to remain below required levels. Elevated house prices and increased borrowing costs remain obstacles to home purchases. This is illustrated in a survey published by Rightmove in August 2022, which reported that across Great Britain the average price of a first-time buyer home was 7.2 times the average salary. Affordability constraints are also being stretched by the increase in the cost-of-living. We expect these factors to continue to drive demand for rental property and the potential for further rental growth in 2023.

Against this backdrop, the company is offering high-quality, modern, energy-efficient, supported by high customer service standards provided by the award-winning rental brand, ‘Simple Life’. The homes we provide are for the long-term and so remove the uncertainty many residents feel when renting in the private sector. We aim to foster a sense of community across our developments with regular events and an app that also acts as a hub, bringing together all of our stakeholders.

Critically, our homes are priced at an affordable level for average families. As previously stated, the portfolio’s average rent as a proportion of household income is c.25%, well within Home England’s stated affordability target of 35%.

Offices

Fredrik Widlund, chief executive:

We expect 2023 to be in many ways the reverse of 2022 with the first six months being challenging whilst inflation and interest rates are forecast to peak before the economy and property market improve in the second half. Our strategy and our focus on the three largest countries in Europe remains unchanged but as usual with slightly different priorities as we expect to be a net seller in 2023 and thus will place even greater emphasis on operational improvements. Ultimately, we are confident that CLS will remain successful by responding to tenant and market needs by having the best properties in our locations.

It is easy to confuse flexibility with working from home which are two very different things. Flexibility, alongside empowering employees, promotes a good work-life balance and helps employees achieve both personal and professional goals. As has become increasingly clear, working from home, more than a day or two, has been shown to simply not work very well for many roles and teams.

Fundamentally human beings are social creatures and the work benefits of this sociability such as collaboration, spontaneity, creativity, learning and mentoring are only effective when people meet. To encourage and help employees meet their objectives, the offices of the future must be flexible, inclusive and attractive. They must also provide both individual workspace as well as meeting rooms, video conferencing, chill-out areas, cafés and canteens amongst other amenities whilst being well-located to transport and urban facilities.

Ultimately, this might seem to be an unsurprising message from an owner of offices but we believe that deep down most people and organisations know this to be true. This belief is fundamental to our conviction of remaining a long-term office investor. To that end, we were a net acquirer in 2022, making two acquisitions for £76.9 million and six disposals for £57.9 million, resulting in net additions of £19.0 million. Given greater uncertainty in the market and focus, we expect to be a net disposer in 2023 although we do expect that there will be attractive acquisition opportunities emerging towards the end of the year.

Student accommodation

Duncan Garrood, chief executive:

Student applications continued to grow into the 2022/23 academic year, and UCAS and HESA data illustrates that demand for UK higher education remains robust with both undergraduate and post-graduate applications forecast to continue growing. For academic year 2022/23, undergraduate applications from UK domestic students grew 1.3%, while applications from non-EU students grew 13.5%. UCAS predict overall undergraduate applications will increase by nearly 30% over the next five years. The number of post-graduates has climbed to 820,000 for academic year 2022/23, an increase of 10.4% from 2021/22, the highest annual increase experienced in the past five years.

The agency StuRents predicts the UK could have a shortfall of 450,000 student beds by 2025, exacerbated by a potential contraction in the HMO market which would drive more students towards the PBSA sector. Customer demand for purpose-built student accommodation has never been so strong. Having already secured 65% revenue occupancy for the 2023/24 academic year, a level reached some ten weeks earlier than in the prior year, we are confident of achieving another successful year from an occupancy perspective. In October 2022 we issued guidance that we anticipated achieving like-for-like rental growth in excess of 5% for academic year 2023/24, however our direct-let model and dynamic pricing capability provides management with confidence that like-for-like growth of at least 6% can now be achieved.

Healthcare

Rupert Barclay, chairman:

Economic uncertainty peaked at the end of the third quarter, at the time of the mini-budget, and led to a sharp rise in interest rates. This contributed to falls in asset values in many real estate sectors in the second half of 2022. While healthcare was not immune, the essential nature of our tenants’ services – which translated into zero voids, 100% rent collection for 2022 and further rental growth – helped our asset values to hold up much better than most other real estate sub-sectors. At the same time, the returns available to us on acquisitions remain above our cost of capital and rising rents over the life of our leases, all of which are long duration with inflation-linked rent reviews, should support capital growth.

We’re a long-term responsible business and our resilient and defensive portfolio provides essential homes for the care of vulnerable older people across the UK. Our business model remains robust and we’ll continue to be disciplined in investing capital, while managing the business efficiently. The acquisitions we’ve made and the indexation in our leases should support further earnings growth in 2023 and a rising dividend.

Europe

Robert Hingley, chairman:

European real estate markets continue to adjust to more challenging economic conditions, particularly higher inflation and interest rates, with consequential impacts on transaction volumes and real asset pricing.

Whilst it is still too early to predict when the current real estate cycle will bottom out, PSD remains well positioned, with a strong balance sheet and conservative debt financing. Moreover, our core rental business continues to thrive, with rental values well supported by the positive demographic trends that continue to exist within the Berlin residential property market. This, combined with the ongoing programme of investment into our buildings, underpins the future reversionary potential that exists within the portfolio.

Real estate research notes

Lar España Real Estate – Dominant assets make a resilient business

Civitas Social Housing – Time to buy?

abrdn European Logistics Income – Negotiating choppy waters

Grit Real Estate Income Group – Going for growth

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.