Real Estate Roundup

Kindly sponsored by abrdn

Performance data

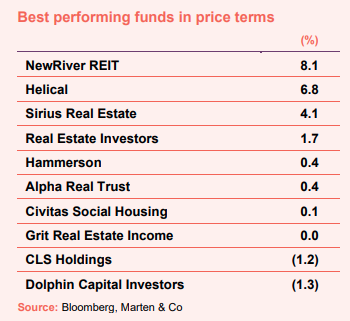

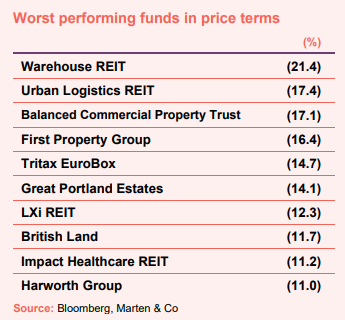

June’s biggest movers in price terms are shown in the charts below.

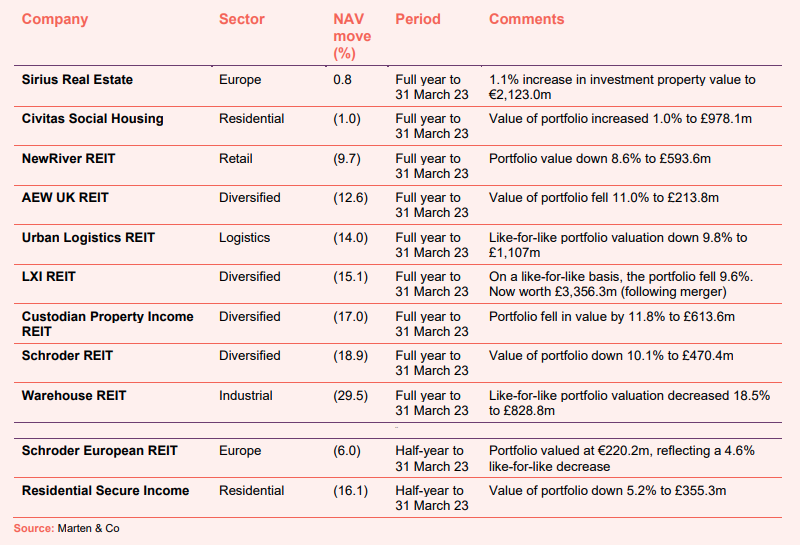

Sticky inflation in the UK and the Bank of England’s 0.5% hike in interest rates, which now sit at 5.0%, their highest level in 15 years, saw uncertainty return to the property market. The median share price fell across the sector once again, this time by a whopping 6.5%. There were just a handful of companies to record positive share price moves in June, with retail park owner NewRiver REIT topping the list. The company published annual results that showed its strategy to focus on resilient retail was paying off with strong operational performance. Meanwhile, it also sold a couple of assets, with the proceeds used to lower its debt level to 30% LTV (see page 4). Office developer Helical also saw its share price rise during the month, having dropped considerably in May on news of a double-digit fall in the value of its portfolio. So far this year its share price is down 22.0%. German and UK business park owner Sirius Real Estate reported an uplift in NAV in annual results (see page 2) – one of only a small handful of property companies to have done so in this high interest rate environment. Pan-African property owner Grit Real Estate Income’s share price was flat in June as it continues to work on its portfolio and lower its debt.

Topping the worst-performing list was Warehouse REIT, which reported an almost 30% drop in NAV in the year to the end of March (see page 2). The industrial and logistics sector has been hardest hit in terms of valuation declines. These follow the rapid rise in interest rates over the past nine months and reflect the extremely low property yields that they were trading on. That could also be behind Urban Logistics REIT’s share price performance, after it also posted a fall in NAV in annual results. The share prices of both are down 46.1% and 30.7% respectively over 12 months, suggesting investors are pricing in more valuation pain to come. Another logistics-focused trust, Tritax EuroBox, also featured in the list of worst performers and has seen its share price fall 40.4% over 12 months. This is despite reporting strong rental growth and having long-term, low-rate, fixed debt (we will be publishing a research note on the company shortly that details the strength of the portfolio and ongoing market fundamentals). Central London office developer Great Portland Estates and property titan British Land both featured in the list of biggest fallers for the second month in a row, as high interest rates continue to play havoc with the office sector.

Valuation moves

Corporate activity in June

CK Assets received enough support from shareholders to declare its 80p bid for Civitas Social Housing unconditional. Just over 64% of Civitas shareholders (including CK Assets’ 17% holding) accepted the bid, which was made on 9 May at a 27% discount to net asset value (NAV) but at a hefty premium to its share price.

Life Science REIT refinanced its existing £150m term loan and revolving credit facility (RCF) with HSBC and Bank of Ireland. The facilities include a £100m fully drawn term loan, increased from £75m, and a £50m RCF facility, both of which have had their terms extended to March 2026, with two further one-year extensions available. Additionally, the company has a £35m accordion facility available on the RCF, if required. Both facilities now carry a cost of SONIA plus a 2.5% margin. The SONIA reference rate on both facilities has been capped at 2.00% per annum until March 2025. The facility also includes a ratchet clause that reduces the margin rate to 2.35% if the gross loan to value ratio decreases to 30%. Following this refinancing £48.7m remains available in the RCF to be utilised in funding the ongoing development at Oxford Technology Park.

Impact Healthcare REIT increased the size and extended the maturity of its revolving credit facility (RCF) with NatWest and extended its RCF with HSBC by a year. The NatWest RCF has been increased by £24m, making the total facility £50m. It has also been extended by four years, to June 2028, with a further two one-year extension options. The margin will be 200 bps above SONIA (up from 190 bps) and the interest cover covenant has been reduced from 250% to 175% in the first two years, increasing to 200% for the remainder of the term. The group has also agreed a one-year extension option to its HSBC RCF to April 2026. The interest cover covenant is being reduced from 250% to 200%, with the margin remaining at 200 bps above SONIA.

Triple Point Social Housing REIT completed its initial share buyback programme of £5m. In aggregate, between 20 April 2023 and 12 June 2023, the company repurchased 9,322,512 ordinary shares at an average purchase price of 52.61 pence per share. The share buyback programme may be extended following receipt of proceeds from a proposed portfolio property sale.

Major news stories

- SEGRO acquires £120m Radlett Aerodrome site for rail freight terminal

SEGRO completed the acquisition of 419 hectares of land at the former Radlett Aerodrome in Hertfordshire for £120m, where it plans to develop a rail freight terminal with 3.6m sq ft of logistics warehousing.

- CLS lets German office on 30-year lease

CLS Holdings secured a 30-year lease with the City of Essen at its office scheme The Brix, in Essen. The City of Essen will take 17,400 sqm (187,292 sq ft) of space, with the lease benefiting from indexation.

- CLS also makes trio of sales for £49m

CLS Holdings sold three properties for a total of £49.0m, at an average of 7.5% above 31 December 2022 valuations. It has exchanged contracts to sell Westminster Tower, Albert Embankment to Australian developer Third.i, and also completed the sale of a small office in Maidenhead and land in Helsingborg, Sweden.

- LXi REIT checks out of £31m St Albans retail park

LXi REIT sold a retail park in St Albans to a UK institution for £31m, equating to a net initial yield of 4.7%. The property is let to B&Q (62% of rent), Aldi (28% of rent) and Costa (10% of rent) and has a weighted average unexpired lease term of 18 years. The proceeds are anticipated to be used to reduce leverage and be invested into higher yielding investments.

- NewRiver REIT makes double sale

NewRiver REIT sold the final two assets in its joint venture with Pimco, selling the Kittybrewster Retail Park in Aberdeen and Glendoe and Telford Retail Parks in Inverness for £62.6m (NewRiver share £31.3m), slightly below book value. The proceeds will be used to reduce net debt to £169.5m and LTV to 30.3%.

- AEW UK REIT sells industrial assets at premium to book value

AEW UK REIT sold two industrial assets – Euroway Trading Estate, Bradford and Lockwood Court, Leeds – for a combined £16.1m, reflecting a blended net initial yield of 6.2% and a premium to their most recent valuation of 17.3% and 9.7% respectively. The proceeds will be invested into higher yielding assets.

- Grit Real Estate completes Botswana sale

Grit Real Estate Income Group has sold its remaining 6.75% interest in Letlole la Rona (LLR), an associate owning predominantly industrial assets in Botswana. Grit sold the stake for $3.6m, concluding a four-part exit from the investment for an aggregate cash amount of $20.3m (vs $17.6m acquisition price). Proceeds are expected to be applied towards debt reduction and redeployment into acquisitions and future group projects over the medium term.

- Urban Logistics REIT finds quick resolution to tenant going bust

The leases on 12 sites owned by Urban Logistics REIT, accounting for 3.3% of group income, will be transferred to London-listed logistics company DX Group Plc after previous tenant, Tuffnells, fell into administration in June.

- Impact Healthcare REIT transfers leases of struggling tenant

Impact Healthcare REIT (IHR) transferred the leases of care homes let to Silverline Group, which accounted for 3.4% of rent but had not paid its rent due for the first two quarters of this year, to an affiliate of an existing tenant of the company. The leases have been transferred to Melrose Holdings Limited, a new company wholly-owned by Mahesh Patel, a managing partner of Impact Health Partners (IHR’s investment manager).

- Regional REIT’s tenant survey offers hope for offices

Regional REIT published the results of a tenant survey that showed that employees among its regional office tenant base (accounting for 24,000 people) are in the office on average 4.2 days a week.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Industrial and logistics

Richard Moffitt, chief executive:

The macroeconomic and geo-political picture for 2023 and beyond continues to evolve. Given the re-pricing of real estate assets and land values in 2022, we believe that the equilibrium level where buyers and vendors will trade has been found more quickly than witnessed in previous cycles. Investors are already returning to the market, attracted by re-based higher yields, rental value growth and the long-term drivers of the logistics sector.

As the take-up statistics for the last twelve months have borne out, an emphasis on resilient supply chains continue to be a key focus of our occupier base, coupled with the fact that e-commerce remains a fundamental and growing part of the economy. This provides a sound footing to our business model of last-touch, mid-sized logistics assets, let to financially resilient tenants.

The market continues to be characterised by low vacancy rates in the occupational space, providing confidence to investors looking to deploy capital. Whilst we are conscious of the weakening consumer environment (exacerbated by the cost of living crisis) and the rising occupational costs of labour and business rates, the fundamentals of the logistics sector continue to be attractive.

Neil Kirton, chairman:

There are clear signs that the investment market is stabilising and investors are returning, reflecting the very favourable supply-demand dynamics in our markets. However, as an industry, we are highly sensitive to the future path of interest rates and the outlook remains uncertain.

In this context, the ability to drive growth organically is key to delivering returns. Occupier demand for space remains robust and our sector continues to benefit from strong tailwinds, including the growth of online retail and heightened focus on supply chain resilience. In addition, our strong bias towards multi-let space in economically relevant locations means we are well placed to capture demand and drive rents. Selected development opportunities provide further upside and we will commit to these as and when the time is right.

Diversified

Simon Lee, chief executive:

The government and Bank of England believe they have more certainty over inflation over the near term, with inflation expected to return to more normal levels by the end of the year.

The impact of inflation for the group’s rental income is positive, given the portfolio’s rent review linkage to UK inflation (26% RPI, 38% CPI). We are, however, cognisant of the potential impact that current levels of inflation could have on the wider economy. This may also be an impact on the prospects of our tenant operators but they can be managed by the rent review caps to the mutual benefit of the company and its tenants.

The interest rate rises used to combat inflation have meant that property values in the UK have been impacted as was shown in the group’s valuation yield shifting to 5.4%. There are signs that the bottom of this value cycle has been met with the CBRE monthly index shows a rise (0.6%) in capital values for first time since the repricing last year.

We see a number of opportunities such as assets coming out of open-ended funds due to redemptions, a number of corporate bonds are coming to maturity meaning they will need to find alternative sources of funding such as sale and leasebacks. The most significant opportunity we see is further M&A activity in the REIT market. There are a large number of mid-market generalist REITs which do not have the same access to capital, liquidity and low cost base which LXI does. We believe we have shown the material tangible benefits of which a merger can achieve with the SIR plc.

Alastair Hughes, chairman:

The principal cause of this correction is more persistent core inflation, driven by high energy and food prices, leading to increasing interest rates. Tighter fiscal and monetary conditions, combined with a withdrawal of pandemic related business support programmes, have led to a rise in business insolvencies and a slowdown in consumer spending. In real estate markets, higher interest rates have impeded debt-backed buyers and increased refinance risk for many borrowers, with a related fall in equity and bond prices leaving some institutions over-allocated to real estate. This environment has led to weaker sentiment and a sharp fall in transaction volumes.

The resultant decline in values has increased average real estate net initial yields from 3.8% in June 2022 to 4.7% today, the highest level since June 2020, with our portfolio now yielding 5.8%. As expected, lower yielding, higher growth real estate sectors such as South East and London industrial have been most adversely impacted by this rerating, resulting in a reversal in the unprecedented polarisation of returns over recent years. Higher yielding sectors – such as retail warehousing, and offices in stronger regional centres – have been less adversely impacted, leading to a convergence in returns across the main sectors. Against this backdrop, our well diversified portfolio has outperformed the Benchmark due to the active management of the higher yielding, regional industrial estates, as well as higher-yielding retail warehousing and offices in stronger regional centres.

Occupational markets have, so far, remained more resilient, with average nominal rental value growth for UK real estate of 2.5% per annum since June 2022. Although below current inflation levels, there remains a strong positive long-term correlation between rental growth rates and inflation, with sectors benefiting from structural demand drivers and lower vacancy rates delivering rental growth well above the long-term average of approximately 0.9%. For example, in contrast with the sharp decline in capital values, average industrial rental values have increased by 5.9% since June 2022.

There are initial signs that the investment market is now stabilising, with a capital value decline from our underlying portfolio of -0.5% over the quarter to March 2023 (Benchmark: -1.3%), contrasting with -11.9% over the quarter to December (Benchmark: -13.2%). The extent of any subsequent recovery will depend on falling inflation, with the Bank of England currently forecasting a return to its target rate in 2024. In this seemingly benign scenario, interest rates should fall, but probably to a higher equilibrium rate of around 3%, above the ultra-low levels of the recent past. A gap of approximately 2% between property yields and 10-year gilts is approaching the long-term average for fair value, which, combined with a more a stable political backdrop and currency, should attract domestic and international capital flows back to the sector.

Looking forward, long term structural trends such as urbanisation, technological change, demographics and sustainability should continue to drive returns, with multi-let industrial estates, retail warehousing, certain London office sub-markets and some alternative sectors expected to outperform. These sectors should also benefit from limited new development. This contrasts with secondary office and weaker retail assets, where obsolescence, higher vacancy and lower levels of occupational demand will negatively impact returns.

Custodian Property Income REIT

Richard Shepherd-Cross, manager:

Despite investment market volatility during 2022, in many ways the real estate market is in a much better place than it has been for the last 18 months. Rent collection levels are very strong, COVID-19 restrictions appear to be behind us and the impact of COVID-19 on tenants’ businesses is largely resolved. The economy has, thus far, narrowly avoided recession but even in a slowdown we are not faced with an over-supply of real estate and rising vacancy rates which are so often associated with the property market in recession.

In the 12 months to 31 March 2023 the UK commercial property market saw valuations decline by 17% with the bulk of the rerating in the quarter to December 2023. These valuation decreases were primarily due to changes in the macro-economic environment including heightened uncertainty from rising inflation, slowing economic growth, the energy crisis, increasing interest rates, stresses in supply chains, constraints in the labour market and low consumer spending against the backdrop of seeking to mitigate the impact of climate change. With valuations appearing to have stabilised it is possible to see the rapid correction due to the new interest rate environment as strongly positive for the market, maintaining liquidity and providing future acquisition opportunities.

Laura Elkin, manager:

Despite some major political and economic volatility, the UK economy has performed better than expected since September 2022. UK recession has been avoided to date with GDP recording modest growth of 0.2% during April following 0.1% growth in the first quarter. The prospect of lower household energy bills from July and the impact of the fiscal loosening announced in March’s Budget mean that recovery is expected to gain traction in H2 2023. Inflation is expected to resume its downward trajectory, albeit slowly.

The UK’s labour market has remained resilient but, with a slowdown in job creation seen since the fourth quarter of 2022, the unemployment rate is projected to increase before the end of 2023, adding to the cost of living pressure already being acutely felt by many consumers.

As financial markets take stock of recent uncertainties, including the instability and failure of various US based financial institutions, we expect the lending environment to remain cautious.

Following the swift repricing of UK commercial property in the second half of 2022 and an improving macro-economic outlook, UK property is expected to offer healthy return prospects over coming periods. Consensus forecasts show an expected return to positive rental growth across all major market sectors by 2025 and all UK property total returns to average 5.6% per annum over the next five years (2023-2027).

Residential

Rob Whiteman, chairman:

The UK’s structural housing shortfall continues and most of the population lives in areas where home purchase is unaffordable for average earners, with an estimated need for £34bn of annual investment over the next decade to begin addressing the shortfall. Persistent inflation, rising mortgage rates and the consistent demand for a permanent home have increased demand for shared ownership as the most affordable homeownership option (particularly in light of the Help to Buy programme’s end in March 2023). The UK population demographic is rapidly aging and social isolation can have a material impact on the health of the elderly, driving demand for independent retirement accommodation.

Housing associations, who have historically been the primary investors in affordable housing, are now dealing with rent caps on their social and affordable rent portfolios in addition to allocating c.£10bn for fire safety and c.£25bn to upgrade the energy efficiency of their social rented stock by 2030. These financial pressures impact their ability to continue to fund their 43,000 homes per year development programmes, with many now looking to bring in partners to acquire some of their existing 200,000 shared ownership homes. This is continuing to drive demand and opportunity for further long-term investment into the sector – both to fund new homes and acquire existing shared ownership portfolios providing capital to housing associations to invest back into their social rented stock.

Europe

Sir Julian Berney, chairman:

Confidence surrounding the European economy is improving with recessionary fears diminishing. Expectations are for economic growth to be modest for some time, as governments continue to tighten economic policies to reduce inflation and preserve financial stability. As a result, the pricing of real estate will continue to be challenging and exacerbated by rising debt costs, sustainability concerns and corporates post-COVID optimum occupational intentions. Banks are becoming much more discerning on who they lend to and the type of real estate they wish to lend on. Their clear preference to focus on better quality assets that meet sustainability benchmarks will continue. As a result, we anticipate further valuation falls as investors face refinancing dilemmas, sustainability risks and equity investors re-price their cost of capital.

Real estate research notes

Tritax EuroBox – Optimism returns

abrdn European Logistics Income – Riding out the storm

Urban Logistics REIT – Fundamentals strong as market stabilises

Lar España Real Estate – Dominant assets make a resilient business

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.