Real Estate Roundup

Kindly sponsored by abrdn

Performance data

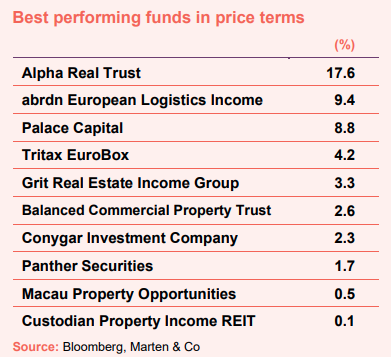

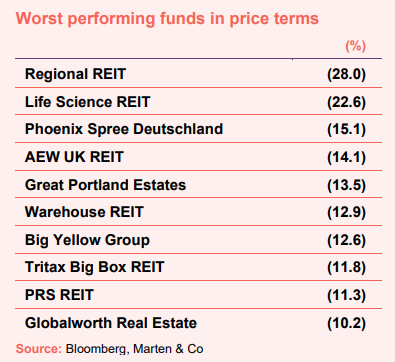

February’s biggest movers in price terms are shown in the charts below.

It was another month of disappointing share price performance for the real estate sector, as the timing of the fabled interest rate cuts that could kick start a recovery in the sector remains unclear with inflation proving sticky. As a result of the malaise, the median average share price fell another 5.0% across the listed sector in February. There were a handful of positive movers, led by real estate debt lender Alpha Real Trust. The thinly traded stock, which has a market cap of around £83m, rose 17.6% following a large trade. abrdn European Logistics Income was up almost 10% after revealing that it had received a number of proposals since launching its strategic review last year. Perhaps anticipating a possible merger with fellow European logistics operator Tritax EuroBox saw shares in the company lift 4.2% in the month. Merger talks between another abrdn fund (UK Commercial Property REIT) and the other Tritax fund (Big Box REIT – see page 3 for details) may have stoked the fire further (abrdn owns 60% of Tritax’s manager). Balanced Commercial Property Trust continued its portfolio rejig with the sale of its largest office holding (see page 4).

Not for the first time in recent years, UK regional office landlord Regional REIT suffered large monthly losses – this time by a bruising 28%. The company now trades on a seemingly unsustainably wide discount to net asset value (NAV) of over 70%. In a trading update, the company revealed the value of its portfolio took another hit resulting in its loan-to-value creeping up above 55%. Life Science REIT also saw a 20%-plus drop in its share price in February. This was despite the fact the company completed a significant letting at its Oxford Technology Park scheme (see page 4). It appears a large seller in the market is putting significant stress on its share price. Berlin residential landlord Phoenix Spree Deutschland suffered more share price losses after revealing further valuation declines in a trading update. AEW UK REIT was hit by two retail tenant failures, putting considerable pressure on earnings and its long-term uncovered dividend. Tritax Big Box REIT shareholders were seemingly unimpressed by the aforementioned proposed merger announcement, with the company’s share price down 11.8% in the month.

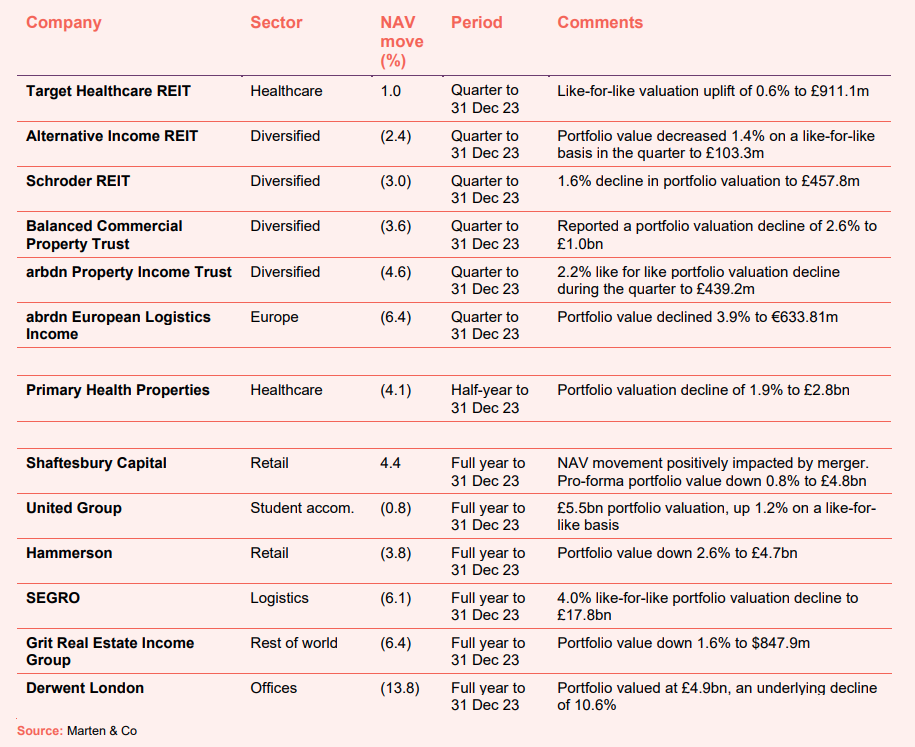

Valuation moves

Corporate activity

SEGRO raised £907m in a placing of shares. The company increased the size of the raise from around £800m to £900m due to demand. It also raised £7m from retail investors. In total, 110,585,366 new ordinary shares were issued at a placing price of 820p. The price represents a discount of 3.4% to the prevailing closing price on 27 February 2024. The company said the new equity will allow it to pursue additional growth opportunities, including new and existing development projects and to take advantage of potential acquisition opportunities.

Tritax Big Box REIT and UK Commercial Property REIT (UKCM) are in discussions over a possible £3.9bn merger of the two company – although UKCM’s chairman has yet to support the deal. Both boards, excluding UKCM chairman Peter Pereira Gray, had reached agreement on the key terms of a possible all-share offer at an exchange ratio of 0.444 new ordinary Tritax Big Box shares per UKCM share. The possible offer implied a value of 71.1p per UKCM share and around £924m for the company (at the time of the announcement). This represented a premium of 10.8% to UKCM’s share price, but a discount of 9.7% to its NAV at 31 December 2023. The deal has the support of UKCM’s two largest shareholders – Phoenix Life and Investec – who combined own 56.5% of the company.

Urban Logistics REIT approached the board of abrdn Property Income Trust (API) regarding an indicative share-for-share offer for the company. The indicative offer exchange ratio was 0.469 shares for each API share, valuing API’s shares at 59.2p. This follows a bid from Custodian Property Income REIT for API in January. Under the terms of that deal, which was approved by both boards, each API share would receive 0.78 new Custodian shares, which valued API shares at 62.1p at the time (but a subsequent fall in Custodian’s share price meant Urban Logistics’ bid was on more favourable terms). However, the downward movement in both Urban Logistics and Custodian’s share prices has seen the value of their bids drop substantially. Urban Logistics has until 13 March to make a formal offer.

Tritax EuroBox announced that Fitch Ratings has revised the company’s outlook to Stable from Negative. Fitch has also affirmed the company’s long-term issuer default rating at ‘BBB-‘, and affirmed its senior unsecured debt rating at ‘BBB’.

Supermarket Income REIT announced that Fitch Ratings had reaffirmed its existing investment grade, long-term issuer default rating of ‘BBB+’ with a stable outlook.

Major news stories

- FCA launches investigation into Home REIT

The Financial Conduct Authority (FCA) launched an investigation into Home REIT, after allegations of serious wrongdoing by its former manager Alvarium – the most serious of which centres on paying vastly inflated prices for assets to boost its NAV, surfaced in a short seller report in November 2022.

- Hammerson completes £500m asset disposal programme with Aberdeen mall sale

Hammerson agreed the sale of Union Square, a 52,000 sqm shopping centre in Aberdeen, for £111m. The price represents an 8% discount to the 31 December 2023 book value of £121m and a net initial yield of 11%. The sale concludes Hammerson’s £500m non-core disposal programme, which started in 2022.

- Unite to develop £250m student scheme in Newcastle

Unite Students entered into a joint venture framework agreement with Newcastle University for the development of a new student accommodation scheme that would deliver 2,000 new student beds. The estimated total development cost is £250m, with delivery expected by 2028.

- Balance Commercial Property Trust sells largest office holding

Balanced Commercial Property Trust sold its largest office holding as it continues to reduce its exposure to the challenged UK offices sector. Contracts were exchanged for the sale of the Leonardo Building in Crawley, a 110,000 sq ft out-of-town business park office, for a price of £26.1m, representing a 6.1% discount to the December 2023 valuation.

- Life Science REIT fully lets Oxford tech park building

Life Science REIT fully let Building 5 at Oxford Technology Park, covering 57,000 sq ft, to WAE Technologies Limited, part of Fortescue, a listed Australian company, on a 10-year lease worth £1,146,000 per year.

- Sirius Real Estate puts proceeds from capital raise to work

Sirius Real Estate acquired a business park in Klipphausen, near Dresden, Germany together with an adjacent land parcel for €13.75m (£11.73m). The acquisition was made using the proceeds of November 2023’s €165m (£147m) capital raise.

- Warehouse REIT disposes of two assets ahead of book value

Warehouse REIT sold two assets in separate transactions for a total of £13.4m, with the combined price 3.7% ahead of book value and an average net initial yield of 5.3%. The sales comprise Warrington South Industrial Estate, sold for £11.6m, and Pellon Lane, in Halifax for £1.8m. Total sales since April 2023 is now £53.0m, with proceeds being used to pay down debt.

- Custodian Property Income REIT makes further sales

Custodian Property Income REIT agreed the sale of two industrial assets in Warrington and Weybridge, and now has four assets under offer for sale, including a vacant former car dealership in Redhill and a vacant office in Castle Donington, for an aggregate £19.5m, representing a premium of 29% to their 31 December 2023 aggregate valuation.

- Ground Rents Income Fund sells South West assets

Ground Rents Income Fund sold freehold ground rent interests at assets in Bristol and Exeter, for a combined price of £3.45m. The assets currently generate annual rent of £113,991 and are operated by Vita Student as purpose-built student accommodation. The price represents a 4% premium to book value and reflects a net initial yield of 3.1%.

- Palace Capital continues portfolio sell off

Palace Capital sold three properties for a total of £15.2m – comprising Bridge Park, East Grinstead for £7.2m; High Street, Sutton for £3.6m; and Lendal & Museum Street, York for £4.4m. Further assets were under offer and if completed could precipitate a tender offer.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Retail

Ian Hawksworth, chief executive:

London and particularly our West End portfolio continues to display its enduring appeal and resilience as a leading global destination with strong leasing demand across all uses. It has been an excellent start as Shaftesbury Capital, with good progress on integration and positive metrics delivered across the business. The occupational market increasingly demonstrates strong polarisation of demand and a flight to quality. Our West End portfolio continues to attract target brands and concepts. There is strong demand for good quality, sustainable space with high amenity value. The West End, and particularly our portfolio, is a destination of choice for both market entry and expansion. It is a strong retail leasing market with units often attracting interest from multiple occupiers. Availability of restaurant and leisure space is very limited given the strong trading prospects together with constrained planning and licensing policies.

We are confident in the growth prospects of the West End which continues to demonstrate its enduring appeal and our portfolio is well-positioned to outperform. We are already seeing the benefits of the merger with excellent levels of activity and a strong leasing pipeline. Footfall within our portfolio is high, customer sales are tracking well ahead of 2022 levels and there is limited vacancy across the portfolio.

Rita-Rose Gagné, chief executive:

The recovery in footfall that we saw across our assets in FY 22 continued through FY 23 with consumers also increasingly returning to city centres, both for leisure and work. Footfall was +3% year-on- year (UK+1%, France +7% and Ireland +4%), closing the gap on 2019 levels, which we are now on average less than 10% below. Average dwell time was up 5% to 88 minutes. Overall, total sales and sales densities have risen by mid-teens percentages since 2019, with substantial evidence that repurposed space and new concepts materially outperform that which it is replacing.

Consumer spending continues to be resilient, with an improving outlook for 2024. Despite the ‘cost of living’ crisis, savings built during the Covid-19 pandemic, high levels of employment and strong wage growth, which outpaced inflation in the second half of 2023, have helped underpin continued consumer spend, along with evolving lifestyle trends. Like-for-like sales were up 1% in the UK and 3% for France.

The consumer and occupier landscape continues to evolve at pace. Occupiers are continuing to shift to using physical space for a broad mix of uses, including: point of sale; last mile fulfilment; returns; servicing; experiential; marketing; brand development; education; workspace; and leisure – ‘living spaces’. At the same time, visitors demand top quality environments and experiences. We continue to invest in our assets to partner with best-in-class occupiers to cater to the communities and catchments in which we operate, whether this be repurposing of obsolete department store space into leisure and modern retail, or redevelopment to residential, workspace, healthcare and lifestyle uses.

Whilst our eyes are open to the current macro-economic environment, our occupiers are thriving and our visitor numbers are on the rise in our realigned portfolio. City centres remain the dominant locations for commerce and lifestyle. Our destinations are in high demand by occupiers and visitors. The importance of a physical presence in a digitally integrated strategy for best-in-class operators is undeniable.

Offices

Paul Williams, chief executive:

London is maintaining its long-term reputation as a world-leading city with broad appeal to a diverse range of businesses and investors despite the ongoing macroeconomic challenges. Following its peak at 11.1% in October 2022, CPI inflation declined significantly through the course of 2023, ending the year at 4.0%. The hike in UK interest rates appears to have concluded, with base rate on hold at 5.25% since August. On the assumption that inflation slows further towards the 2% target, the consensus expectation is for a series of base rate cuts in 2024 and beyond.

Market interest rates have responded positively to slowing inflation but remain volatile. The yield on the 10-year UK gilt, which started 2023 at 3.7%, ended the year at 3.6%, having peaked at 4.7% in August. However, since the start of 2024, it has increased again to 4.1%. This reflects both a small rise in inflation in December and more cautious ‘higher for longer’ commentary from central banks.

Combined with the higher cost and restricted availability of debt, sentiment in the investment market was subdued in 2023. Meanwhile, the occupational market has remained strong for the right product in the right location. Businesses are focused on their longer-term real estate strategies and the flight to quality is continuing. With constrained availability and a thin forward development pipeline, rents for the best space are rising.

The vacancy rate across central London rose 1.7% in 2023 to 9.1%. However, averages do not show the full picture. West End vacancy is 4.4%, compared to the City at 11.9% and Docklands at 16.7%, while availability of new space rose more slowly than secondary space. We believe that the supply of new buildings has rarely been more constrained, particularly in the West End, which helps to explain why rents here are rising.

According to CBRE, the amount of space currently under construction across London is relatively low with 12.9m sq ft due to complete by 2027, of which 7.9m sq ft (62%) is currently available. Compared to long-term take-up, this equates to eight months’ supply (and 11 months’ supply in the West End) of new space being delivered over the coming four years.

London has broad appeal to a diverse range of businesses, both by sector and by size. We are encouraged by the substantial 74% increase in overall active demand to 9.9m sq ft at the end of 2023, which indicates a rapid rise in interest from a range of sectors.

Economic prospects are an important demand driver for offices. Growth in jobs, population and the economy, alongside inflation prospects all have an impact. According to CBRE, following a boom in office job creation over the last three years (+415k new jobs), a further c.165k (net) positions are expected to be created over the next five years and there is a continuing increase in the number of companies requiring staff to come back to the office. The demand outlook for London offices remains positive. London real GDP growth of 1-2% per annum is forecast to continue outperforming the UK and there is an ongoing increase in the population of c.0.9m to 10.6m by 2035.

We have previously anticipated an acceleration in rental growth for the best buildings. Occupier demand continues to focus on well-located space with best-in-class amenity and service, while existing supply and the development pipeline are restricted. We expect these conditions to become increasingly favourable through 2024 and as such increase our portfolio rental guidance for the year to a range of 2% to 5%, with our better buildings to outperform.

Over the last few years, we have reduced our exposure to buildings which can no longer meet evolving occupier requirements and have invested significant capital upgrading our remaining portfolio. With inflation continuing to reduce and the cost and availability of finance improving, property yields are expected to respond, following a period of substantial increases. We believe we are now approaching the end of this yield cycle, with transaction volumes expected to increase and for opportunities to emerge.

Student accommodation

Joe Lister, chief executive:

Structural factors continue to drive a growing supply/demand imbalance for student accommodation. Demographic growth will see the population of UK 18-year-olds increase by 124,000 (16%) by 2030, supporting growing demand for UK Higher Education. Demand from international students also remains high, as reflected in the 23% growth in overseas students since 2019/20 (source: HESA).

Many university cities are facing housing shortages and our investment activity is focused on those markets with the most acute need. Since 2021, there has been an 8% reduction in the number of HMOs in England (source: Department for Levelling Up), equivalent to 100,000-150,000 fewer beds available for students to rent. Private landlords are choosing to leave the sector in response to rising mortgage costs and increasing regulation. New supply of PBSA is also down 60% on pre-pandemic levels, reflecting planning backlogs and viability challenges created by higher costs of construction and funding. Obsolescence of older university accommodation is also expected to increase due to building age and the need to operate buildings more sustainably. In many cities, property valuations are below replacement costs, further constraining new supply.

The combination of these factors has significantly increased demand for our accommodation in many cities and we expect this supply challenge to continue for a number of years.

Healthcare

Steven Owen, chairman:

The primary care market continues to face challenges in meeting the growing demand for healthcare services. The capacity of existing facilities remains a significant obstacle to implementing government policies aimed at expanding service delivery within general practice, including social prescribing, clinical pharmacists, physiotherapists, mental health, minor operations and other activities. The need for additional space is driven by a population that is growing, ageing and suffering from increased chronic illnesses, which is placing a greater burden on healthcare systems in both the UK and Ireland. The extent of the NHS England backlog remains a significant concern, with hospitals struggling to meet objectives for cancer care and routine treatments. The number of patients waiting for treatment has reached record highs, exacerbating the need for improved and increased primary healthcare infrastructure with approximately one-third of the UK’s current primary care estate in need of replacement.

There is a growing expectation that many services in the medium term will progressively move from hospitals to primary care settings, necessitating substantial investment in facilities to accommodate these changes and alleviate the pressure on secondary care in the years to come. The UK government’s vision for primary care premises, advocating the establishment of hubs or “super hubs”, is a step in this direction. The UK government’s vision is that these hubs promote collaboration among primary care staff and provide a wider range of services in a single location. Larger GP practices with more staff and facilities are shown to produce better patient outcomes. This is in line with larger purpose-built medical centres typical of PHP’s portfolio and our own ongoing engagement with occupiers where many surgeries require more space.

Declining rents in real terms have made investing in the transformation of GP facilities less appealing. Construction costs have risen significantly over the past decade, surpassing the growth in primary care rents, driven by material and labour costs and increasing sustainability requirements, all of which has been compounded by Brexit, the COVID-19 pandemic and the fiscal policy outlook.

Future developments will now need a significant shift of between 20% to 30% in rental values to make them economically viable and we continue to actively engage with both the NHS, Integrated Care Boards (ICB) and District Valuer (DV) for higher rent settlements. However, despite these negotiations typically becoming protracted, we are starting to see positive movement in some locations where the NHS need for investments in new buildings is strongest. We are aware of instances where the ICB have stepped in and overruled the DV’s proposals when those have prevented much needed schemes from progressing. This along with the use of “top-up” rents and capital contributions is starting to allow certain schemes to progress viably and we anticipate this will accelerate.

The commercial property market continues to be impacted by economic turbulence but primary care asset values have continued to perform well relative to mainstream commercial property due to recognition of the security of their government backed income, crucial role in providing sustainable healthcare infrastructure and more importantly a stronger rental growth outlook enabling attractive reversion over the course of long leases.

We continue to see that for both the primary care and indeed the wider commercial property markets, the high level of financial market volatility and economic uncertainty has resulted in a ‘wait-and-see’ attitude amongst investors, which is expected to continue until the UK interest rate outlook moderates and becomes more certain. However, notwithstanding the significant increases and volatility in interest rates seen in 2023, we continue to believe further significant reductions in primary care values are likely to be limited with a stronger rental growth outlook offsetting the impact of any further yield expansion.

Real estate research notes

An update note on Tritax EuroBox (EBOX). is sailing in calmer waters as demonstrated by a portfolio valuation that has changed little and a 30% uplift in earnings that now fully covers its 8.6%-yielding dividend.

An annual overview note on Urban Logistics REIT (SHED). The company appears to be a re-rating candidate as values stabilise and management extracts the rental reversion in the portfolio.

An update note on Lar España Real Estate (LRE SM). The company continues to defy the doom and gloom surrounding the retail sector, posting strong financial and operational numbers.

An update note on Grit Real Estate Income Group (GR1T). The company has been reborn, with the acquisitions of a developer and asset manager making annual return targets of 12-15% more achievable.

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.