On the crest of a wave

On the crest of a wave

Aberdeen Standard European Logistics Income (ASLI) has assembled a property portfolio that is primed to cash in on the fundamental shift in consumer spending to online retail. The European logistics market is set to follow in the footsteps of the UK market, which has witnessed a surge in demand from occupiers wrestling for more efficient supply chains as online sales grow.

Supply of logistics property is already at historic lows across Europe and, coupled with strong demand, significant rental growth is expected to come through. ASLI has focused its attention on established logistics locations and quality real estate assets to ensure durability of income.

After a capital raising in July 2019, ASLI is seeking to further expand its portfolio, both in the countries it currently operates in and others that share similar supply/demand dynamics. It is also looking at the ‘last mile’ urban logistics sub-sector, strategically located parcel delivery hubs on the outskirts of major towns and cities, which is predicted to boom. Subject to the satisfactory deployment of the raised proceeds, the company is also considering further fundraising to support the expansion.

Big box and last mile urban warehouses in Europe

Big box and last mile urban warehouses in Europe

ASLI invests in a diversified portfolio of ‘big box’ logistics and ‘last mile’ urban warehouses in Europe with the aim of providing its shareholders with a regular and attractive level of income return. It is targeting a 5% yield in 2019 together with the potential for long-term income and capital growth (target total return of 7.5% a year in euros).

Portfolio update

Portfolio update

ASLI invests in European logistics property and is benefitting from strong growth in the sector. The fundamentals supporting growth in the logistics market throughout Europe were explained in QuotedData’s ASLI initiation note, published in March 2019. To recap, the major factor behind the rise of logistics is the shift in consumer spending to online. Ecommerce is having a material effect on the logistics market globally, and ecommerce businesses (predominantly online retailers) have provided significant ongoing demand for space in an undersupplied market.

The UK is ahead of most western countries in terms of online sales as a percentage of total sales, where it is now pushing 20% and has been predicted to grow even further. Sustained rental and capital growth over the past five years has seen the UK market become mature, where yields are at historic low levels of circa 4%. It is a territory, therefore, that is unlikely to feature in ASLI’s portfolio. Although behind the UK, the European market is on a similar growth trajectory to that witnessed in the UK over the past five years.

In most European countries, penetration of online sales has yet to fully kick in and ASLI expects to benefit from significant rental and capital growth going forward as Europe plays catch-up. Getting in now, while prices are comparatively better value than the UK – with average yields at around 5% across Europe – and demand high, could be a shrewd move. Vacancy rates, the amount of space that is not let to a tenant, across Europe’s main markets are at historic lows, and in 2018 dropped to just 5.5%. These supply/demand dynamics should create significant rental growth, especially in more land constrained urban locations.

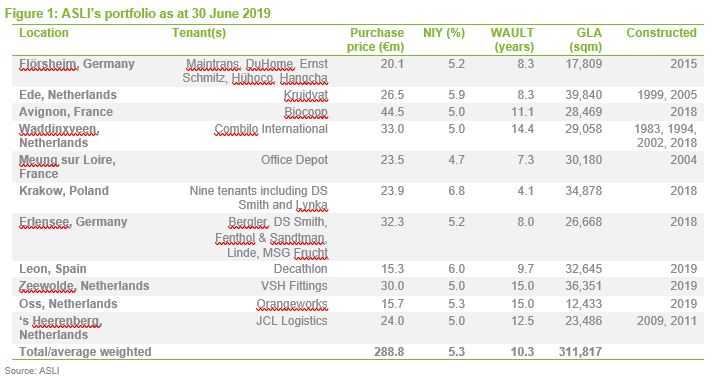

Since our initiation note in March 2019, ASLI has added one asset to its portfolio – a facility of about 23,000 sq m logistics facility in ‘s-Heerenberg in the Netherlands – which brought its investments up to €289m across 11 assets in five countries.

It hasn’t all been plain sailing for ASLI, though. It raised £46.4m in July 2019 in a fundraise that was targeting €100m. The result could be put down to the general malaise in the capital raising market as we head towards an uncertain Brexit outcome. As a result, ASLI is tweaking its approach to raising capital to fund portfolio growth (more detail on below).

Before the capital raising, ASLI had two deals in exclusivity worth €58m. It has decided to drop one of them, in Poznan, Poland, after discovering during due diligence that one of the larger tenants was likely to enforce a break option in its lease. It has since found an alternative asset in the Netherlands for a total investment of just under €50m. It has signed the purchase agreement of the other deal, in Warsaw, Poland, for €27.5m, with an expected closing in October 2019. This multi-let asset is predominantly leased out to DHL for another 10 years and becomes the first ‘last mile’ logistics asset in ASLI’s portfolio.

The new deal in the Netherlands, replacing the one in Poznan, has a strong urban angle as well and ASLI is undertaking advanced due diligence. It is a brand-new warehouse located in the most densely populated area in the Netherlands between the cities of The Hague and Rotterdam. The building is let to a third-party logistics operator (3PL) – a company that provides logistics services to retailers – on a 10-year lease, which benefits from inflation uplifts. It is located alongside the A4 motorway and would provide ASLI with another high-quality income stream.

The ‘last mile’ sub-sector is a fast-growing part of the logistics sector and, as the name suggests, consists of strategically located parcel delivery hubs on the outskirts of major towns and cities that predominantly service ecommerce deliveries to people’s homes and offices. With the growth of ecommerce, they have become more and more popular with retail companies and 3PLs, which service retailer contracts, as they try to streamline their supply chains. The high level of demand from tenants, coupled with a severe lack of supply given land constraints around most major cities in Europe, has pushed rents up and seen capital values increase.

It is a part of the market that ASLI is actively looking to buy into. However, the manager is not willing to pay the high prices that are being paid by some investors across Europe, and so has remained very selective. But, as well as the Warsaw asset, which has been agreed at a yield of 5.6%, and the Netherlands asset, it is also in negotiations to buy another in Madrid, Spain.

ASLI is also looking at opportunities in other countries in Northern and Western Europe that are experiencing rapid ecommerce growth. Countries such as Ireland, the Nordics – Norway, Sweden, Finland, Denmark – Italy and Portugal are all on the manager’s watchlist. It has indicated, however, that it is not looking further east than Poland.

Durability of income

Durability of income

For the fund manager, the magic phrase for ASLI is “durability of income”. Fund manager, Evert Castelein believes this can be achieved through a number of factors. Chiefly, the fund has bought – and will continue to target – assets in established logistics locations that are easily accessible by road and ideally also by train, water or air. It also focuses on buildings with a superior, modern specification: high floor load capacity, high eaves, multiple loading doors, and a large amount of yard space around the building. It stands to reason that a portfolio of well-located, quality buildings will generate stable income streams. Occupier demand for these buildings is such that if one tenant fails, another should be there to fill the void quickly.

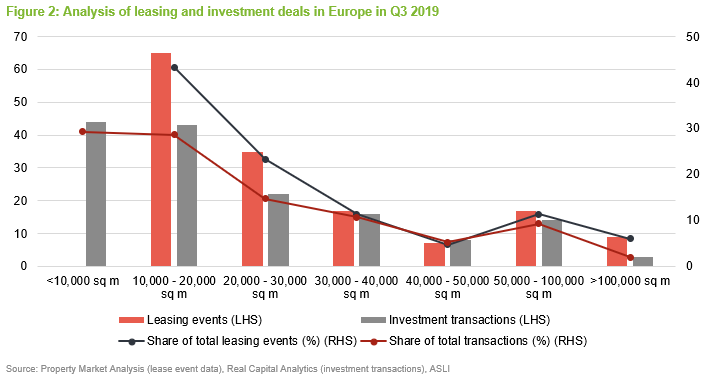

ASLI’s portfolio has an average lot size of under €30m and an average building size of about 30,000 sq m. This is believed by the investment manager to be the most liquid part of the market from both an occupier and investment perspective. If ASLI wanted to sell one of its assets, the pool of investors in that lot size bracket is very deep. A mammoth 150,000 sq m facility, on the other hand, is less liquid on an occupier and investment front. There are not many occupiers that can take such a big unit, which is often very bespoke and equipped with multi-level mezzanine floors. There is also a limited pool of investors for a €150m warehouse making it more difficult to dispose of such an asset.

Figure 2 provides a breakdown of the last 150 recorded leasing deals and 150 recorded investment transactions in European logistics assets, excluding the UK, as of the end of August, by building size. It shows that logistics buildings in the 10,000 sq m to 30,000 sq m size bands, make up 66.6% of all leasing deals and 43.4% of all investment transactions. (Note: leasing activity in the smaller size band (less than 10,000 sq m) is not tracked due to the difficulty in capturing a representative sample. ASLI assumes there is a lot of leasing activity in this size band, but the properties may be industrial rather than logistics.)

ASLI’s contracted leases also benefit from annual indexation, which is commonplace for European real estate, unlike in the UK. The majority of its leases, which provide a rental income of €16.8m, are subject to annual Consumer Prices Index (CPI) or ILAT (the French equivalent) indexation.

As mentioned earlier, logistics properties in Europe come with a more palatable yield than in the UK. Furthermore, they also benefit from significantly better financing costs. Financing costs are around 100 basis points lower on the continent, compared with the UK. ASLI has five long-term fixed rate loans totalling €108.9m. These are secured against assets, or a small portfolio of assets, in the same country, at combined all-in costs of 1.4%. When one factors in the difference in prime yields, the yield spread is very favourable for European assets and demonstrably better than the UK.

Asset management opportunities

Asset management opportunities

ASLI is looking at asset management initiatives within its current portfolio to drive rental income and capital values. A number of buildings in its portfolio have low site coverage, presenting ASLI with the opportunity to extend the size of the buildings or build new facilities on the plots of land. At its asset in Leon, Spain, the tenant – sports goods retailer Decathlon – has a five-year option to expand the building by an additional 10,000 sq m, which the manager believes is a key attraction for Decathlon. ASLI estimates that this would cost €2m and increase the value of the property by €3m.

In the Netherlands, at both its ‘s-Heerenberg and Waddinxveen assets, the potential to expand also exists. At ‘s-Heerenberg, the tenant – JCL Logistics – has an option to expand the building by up to 5,000 sq m, and at Waddinxveen, ASLI has the potential to expand the building by around 6,000 sq m. These projects are still at a very early stage, although the manager has said both tenants have expressed the potential need to expand in the future, especially in ‘s-Heerenberg where the tenant is using the building’s full capacity to store goods.

ASLI is also pursuing expansion opportunities at its asset in Meung Sur Loire, France. The building, which is let to Office Depot, has a site coverage of just 29%, providing ASLI with ample space for future development. The asset is located in the heart of France and serves Paris and central and southern France. ASLI expects demand for new facilities at the site to be high due to its proximity to the French capital, which has a chronic shortage of supply of logistics facilities.

Recent survey work undertaken by the manager identifies a significant interest in ESG (environmental, social and governance) issues amongst logistics tenants. To this end, another asset management initiative that ASLI is actively exploring is the roll-out of solar panel installation on its assets. It already leases out the roof of its Avignon building for around €160,000 a year, and is analysing the potential in the rest of its portfolio. ASLI is in advanced negotiations with two operators investing in solar panels to sign roof leases for the warehouses in Ede and ‘s-Heerenberg where subsidies had already been granted by the Dutch government. ASLI is hoping to generate green energy from these assets as from the fourth quarter of 2019. It has filed the application to get subsidies on the assets in Oss and Zeewolde as well, which it hopes will result in more green energy during the course of 2020. For the warehouses outside the Netherlands, ASLI is taking advice from an external consultant to find opportunities on the warehouses in France, Germany, Poland and Spain.

Future capital raises

Future capital raises

The investment manager continues to see interesting opportunities across Europe in the growing logistics sector despite increasing pricing pressure from new investors looking at the space. ASLI is seeking to grow its portfolio, which should further diversify its asset type and tenant.

The sector is highly competitive and to increase the chance of sellers accepting bids the investment manager is investigating the possibility of a larger and more flexible revolving bank facility. Debt will be held at the company level and will be for shorter term use. While gearing may increase in the short term, with ASLI using such a facility, portfolio level gearing is expected to remain at or around 35% of gross assets.

Performance

Performance

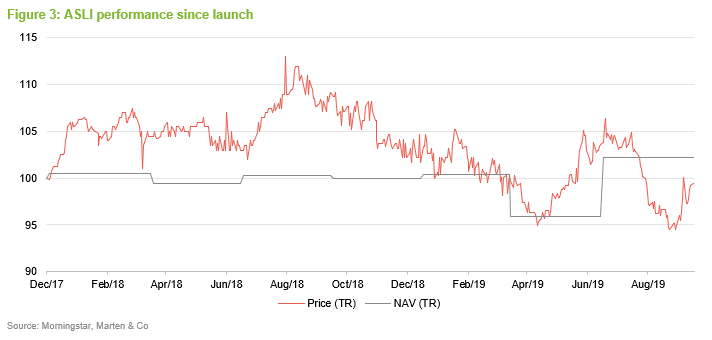

ASLI’s net asset value (NAV) initially made modest progress after launch, with rising property values offset by expenses incurred in the establishment of the portfolio and the initial dividends not quite being covered by earnings. At the end of June 2019, ASLI’s NAV increased 0.9% in euro terms in the quarter – largely attributable to a portfolio capital value increase of 1.7%. In sterling terms, the NAV rose 5.2% in the period.

Peer group

Peer group

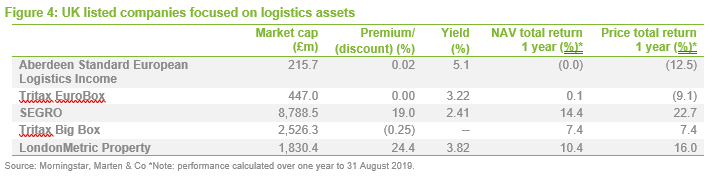

Most companies investing in European logistics are unlisted funds or subsidiaries of larger groups. Of the listed companies, Tritax EuroBox is ASLI’s closest competitor. SEGRO owns a mixture of ‘big box’, urban and industrial space, predominantly in the UK with around a third located in Europe. Tritax Big Box and LondonMetric Property are UK-focused and provide a comparison to ASLI’s UK peers.

ASLI is the smallest among this peer group. but has a favourable yield (the highest in the peer group).

Premium/discount

Premium/discount

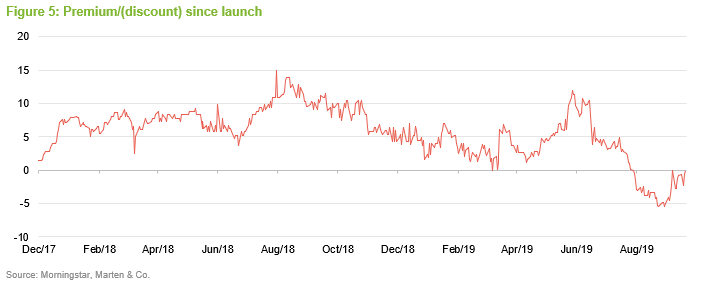

ASLI has almost exclusively traded at a premium since launch, peaking at just under 15% in August 2018. Its premium narrowed over the next seven months before spiking again in early July 2019. Following its capital raise on 26 July 2019, it lost its premium rating but has since recovered and now trades at a slight premium of 0.02%.

Fund profile

Fund profile

ASLI invests in a portfolio of European logistics assets, diversified by both geography and tenant, with a focus on well-located assets at established distribution hubs and within population centres. ASLI’s aim is to provide its shareholders with a regular and attractive level of income return together with the potential for long-term income and capital growth (it is targeting a total return of 7.5% a year in euros). ASLI benefits from inflation-linked leases across its portfolio.

ASLI is targeting a dividend of 5% of the IPO price for the year ended 31 December 2019 and paid 3p per share for the period from launch to 31 December 2018. Dividends will be paid in sterling, but the assets and the income derived from them will predominantly be in euros. The manager may use currency hedging to help reduce the volatility of the income, but there is no current intention to hedge the capital value of the portfolio.

Portfolio management services are undertaken by Aberdeen Standard Investments Ireland Limited, part of the Aberdeen Standard Investments group of companies. Aberdeen Standard Investments Real Estate has an extensive regional presence, with 25 offices in 14 countries across Europe.

Previous publications

Previous publications

QuotedData published its initiation note on ASLI, Poised to expand? in March 2019. You can read this note by clicking on the link.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Aberdeen Standard European Logistics Income.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.