Africa, substantially de-risked

Africa, substantially de-risked

Grit Real Estate Income Group (Grit) is flying the flag for African real estate investment. The significant growth potential of the continent’s emerging economies has always gone hand-in-hand with some degree of risk. Grit’s investment strategy, however, retains exposure to that growth potential, while substantially de-risking it through US dollar and euro denominated leases to blue-chip multinational corporations, including government embassies.

Grit has built a reputation for being a trusted real estate partner for multinational companies operating across Africa and owns everything from offices to corporate accommodation. Strong tenant relationships have seen it expand its investment criteria to include development, which it hopes will turbo-boost returns. The group’s share price is yet to recover to pre-covid levels, putting it at an unmerited discount to NAV. With plans to de-list from the Johannesburg Stock Exchange in July – making London its primary listing, Grit’s shares will grab the attention of a wider pool of investors. Some form of a capital raise is also on the cards, with a pipeline of accretive acquisitions already lined up

Pan-African real estate

Pan-African real estate

Grit is a pan-African real estate company that invests in and actively manages a diversified portfolio of assets in selected African countries (excluding South Africa). It aims to deliver strong and sustainable income for shareholders, with the potential for income and capital growth and is targeting a net total shareholder return inclusive of NAV growth of 12.0% per annum.

Fund profile

Fund profile

Grit Real Estate, which is listed on the London Stock Exchange (LSE) main market, the Johannesburg Stock Exchange (JSE) main board and the Stock Exchange of Mauritius (SEM), is a pan-African real estate company that invests in and actively manages a diversified portfolio of assets in selected African countries (excluding South Africa).

It offers access to the growth potential of Africa that is de-risked from a currency perspective. The company’s assets are underpinned by predominantly US$ and euro denominated long-term leases to a range of blue-chip multinational tenant covenants.

The company, which employs 92 people in six countries, aims to deliver strong and sustainable income for shareholders, with the potential for income and capital growth and is targeting a net total shareholder return inclusive of NAV growth of 12.0% per annum.

Grit was originally incorporated in 2012 in Bermuda as a UK focused property company (known as Osiris Property International). In 2014, management bought the Bermudan vehicle and moved operations to Mauritius with a switch in investment focus to panAfrican real estate (excluding South Africa). The company, then known as Delta International Property Holdings, first listed on the JSE in 2014 and then the SEM and, in late 2015, rebranded to Mara Delta Property Holdings following the merger with Pivotal Fund Ltd. Following rapid expansion, the group rebranded to its present name in July 2017. It listed on the LSE on 31 July 2018 after raising US$132.2m of fresh equity.

JSE delisting

JSE delisting

Grit is proposing to delist from the JSE. It will retain its listing on the official market of the SEM and the main market of the LSE, with the LSE becoming its primary listing and SEM its secondary listing.

Shareholders on the JSE register can transfer their existing shares to either the SEM share register or the LSE share register before the delisting. Alternatively, they can sell their shares to a R14.90 per share conditional offer that is being made by Botswana Development Corporation (a strategic long-term shareholder in Grit) and ZEP-Re (a regional African reinsurance company established by an agreement of the heads of state and governments of the Common Market for Eastern and Southern Africa (COMESA)).

Grit says the cost and administrative burden placed on the company from being listed on three exchanges is excessive (including management time spent on regulatory compliance across the three exchanges and the cost of hiring three sets of advisors) and will be reduced as a result of the delisting.

Trading in shares on the JSE is illiquid and has been for an extended period of time and Grit believes it does not offer commensurate benefits and erodes shareholder value.

Delisting from the JSE will pave the way for the group to move trading in its shares up to the Premium Listing Segment of the Main Market of the LSE, which is expected to facilitate the group’s eligibility for inclusion in the main FTSE UK Index series. This will improve liquidity in the company’s shares and further diversify its shareholder base. Grit received shareholder approval for the delisting at a general meeting on 10 July 2020.

Investment strategy

Investment strategy

Grit’s investment strategy centres around being the long-term real estate partner for multinational corporate companies operating in Africa. Multinational corporate companies, such as Total and Vodacom (Vodafone in the UK), have tended to own their own real estate in Africa because of a lack of trusted real estate partners. However, due to its corporate governance structure and balance sheet, Grit has become the real estate partner of choice for many multinational companies. These companies often trade in hard currencies, which support US$ or euro leases.

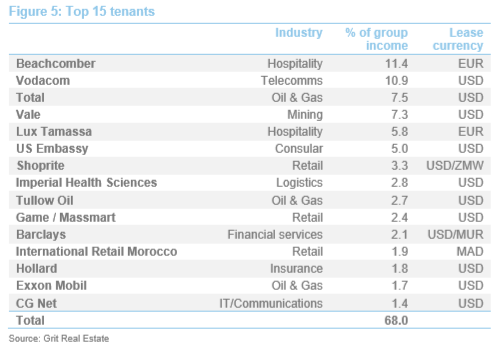

Grit is agnostic as to property asset classes and instead is driven by the real estate needs of its multinational company tenants. It owns offices, corporate accommodation, retail, warehousing and hospitality resorts. Grit ensures its lease covenants are signed by the parent company, or backed by a parental guarantee or counterparty, which heavily reduces the risk of default.

Grit will only operate in jurisdictions it regards as safe, where it has the ability to move money into the country and repatriate money to Mauritius and where there is no risk of expropriation of funds. Consequently, countries such as Algeria and Angola should not feature in the portfolio. Countries that have challenges around land ownership, such as Angola, Nigeria and Tanzania, are also avoided. The company favours countries where it has boots on the ground and where debt can be secured at relatively inexpensive rates (compared to others across the continent).

Characteristics of target countries include:

• stable governance/political maturity;

• strong US$ and foreign direct investment inflows;

• US$-based economies;

• high growth rates;

• acceptable sovereign ratings and outlook by ratings agencies;

• solid economic fundamentals; and

• a clear tax regime.

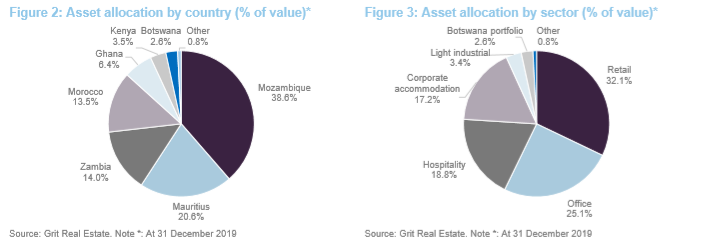

It aims to have half the portfolio invested in investment grade African countries, such as Morocco, Botswana and Mauritius (36% at present), and no more than 25% exposure to one country (although it is currently overweight in Mozambique, which makes up 38.6% of the portfolio by value).

When looking at investment opportunities, the company puts a high degree of importance on return on equity (ROE) over the property yield. This means tax leakage and other administrative costs when returning money back to Mauritius is a significant factor in acquisition appraisals. Its target ROE on acquisitions is 8.5% and above, which improves to double-digit returns when debt is applied.

Grit’s investment criteria have opened up to include development assets, which it says can return 12%–13% on construction costs.

Outlook

Outlook

Covid-19

Covid-19

The outbreak of covid-19 at the back end of 2019 was initially slow to spread to Africa, with the first case on the continent not reported until 14 February, in Egypt. For now, the continent still only accounts for a small fraction of cases worldwide, but the World Health Organisation (WHO) has warned that the pace of the spread is quickening.

The WHO said that many African countries had been quick to make difficult decisions and put in place lockdowns and key public health measures, such as promoting social distancing, good hand hygiene, and testing and tracing of contacts of people with covid19, with isolation of cases.

The swift and early action by African countries helped to keep numbers low, with countries like Morocco and Mauritius being particularly effective in quelling the spread. A large proportion of the 13,246 deaths (as at 13 July 2020) from the illness in Africa have come from just five countries: Algeria, Egypt, Nigeria, South Africa, and Sudan (none of which appear in Grit’s portfolio).

National governments have started to scale up health workforce and laboratory capacities and to set up points of entry screening at airports and border crossings, which WHO said had been effective in slowing the spread of the virus.

The shutdowns had come at considerable social and economic cost to countries, however.

Why Africa?

Why Africa?

The onset of covid-19 and its ongoing and growing presence in Africa has made any economic outlook redundant. The continent is an emerging market for many industries, including technology, transportation, and e-commerce. Mobile phone penetration is soaring and boosting economic growth rates, while banking systems are rapidly expanding services.

The emerging middle class in Africa – which has grown to 350m people, according to African Development Bank, and is expected to account for 43% of Africans by 2030 – will see a boom in consumer spending, which is set to rise from US$860bn in 2008 to US$1.4trn in 2020, according to the McKinsey Global Institute, and reach US$2.5trn by 2030.

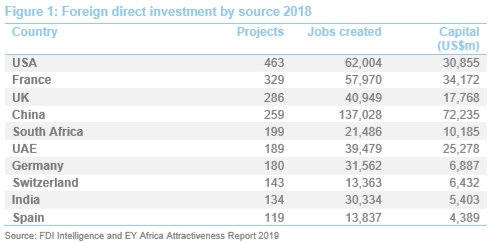

Foreign investment and loans to the region have risen almost fivefold since 2015 to over US$120bn, and the growth in African economies has seen the IMF upgrade many countries in the region – Botswana, Ghana, Kenya, Mozambique, Nigeria, Tanzania, Uganda and Zambia – to the rank of emerging markets.

In recent years, Africa has opened new trading lines around the world, mainly with other emerging markets. Since 2006, the region’s exports to the US have declined by 66%, while exports to countries such as Russia and Turkey have doubled and tripled respectively.

Investors from emerging markets such as China, India and the UAE now finance more than a third of foreign direct investment projects, as well as more than half of all jobs created and capital invested in the region.

China’s Belt and Road Initiative, launched in 2014, encompasses a wide range of infrastructure projects including ports, roads and rail links. Between 2014 and 2018, the UAE injected more than US$25.3bn worth of capital into the continent and the volume of non-oil trade between Dubai and Africa rose to US$37.2bn in 2018. India’s trade with Africa has increased from US$1bn in 1995 to nearly $60bn today, while in 2017, Russia’s trade with Africa was valued at US$17bn. However, in 2019 Russia signed dozens of contracts across Africa worth US$16.4bn with a focus on transport and logistics, oil and gas, minerals and banking.

Africa has embarked on a new era buoyed by the promise of the African Continental Free Trade Area (AfCFTA), the landmark free trade agreement that will become operational in 2020, as well as increased visa openness and harmonisation of monetary policy through West Africa’s new Eco currency.

Despite increased economic activity and political stability across the continent, Africa is still considered a risky investment proposition by many. As noted earlier, Grit has derisked African investment by signing leases with multinational corporate companies, with parental company guarantees.

Multinational corporations are focusing their investments into Africa in support of the development of emerging industries, such as technology and banking, as well as traditional industries like oil and gas.

Managers’ view

Managers’ view

Through its investment in real estate backed by multinational corporations, Grit hopes to capture Africa’s growth potential, while mitigating the inherent risks of investing in the continent. Each country that it looks at has their own economic drivers and therefore different property sectors it is targeting. As with most real estate companies, demand for and supply of real estate is a big consideration. However, for Grit it is also tenantled. Where the multinational corporate wants to go, it will follow, so long as the country falls within its investment boundaries.

It says its model has been proven in Mozambique, where over the last four years the currency has devalued by half and interest rates doubled. Grit’s portfolio in the country, which includes offices and corporate accommodation, has performed throughout the period. Even during the covid-19 pandemic, Grit’s hospitality portfolio in Mauritius – where you would expect severe stress due to lockdown – received no rental concession requests only rent deferral requests, reflecting the strength of the covenant.

Asset allocation

Asset allocation

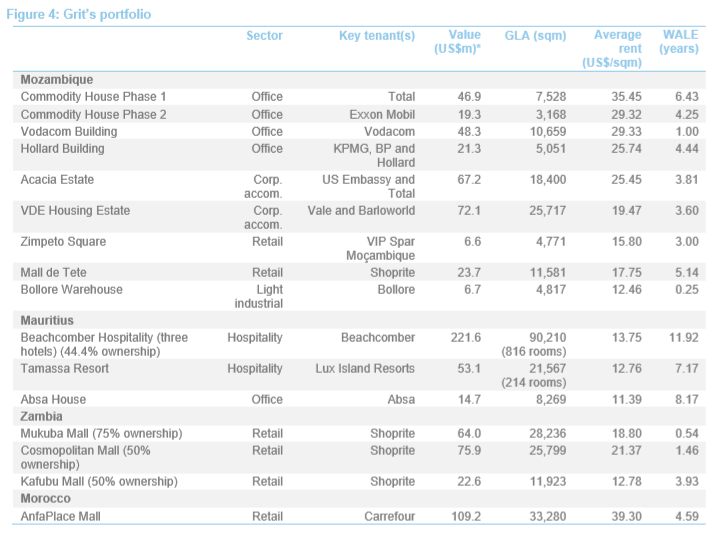

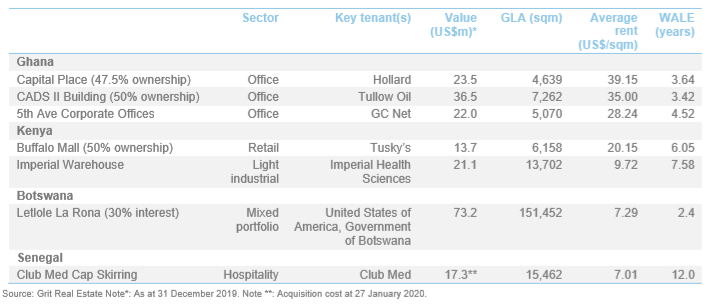

Grit has a portfolio of 47 assets located across eight countries and five asset classes. The group’s assets have a weighted average lease expiry (WALE) of 5.1 years, a weighted average contracted lease escalation of 2.7% per annum and are underpinned by a wide range of blue-chip multinational tenants across a variety of sectors. Rents are predominantly collected monthly, of which 94.1% are collected in US$, euro or pegged currencies.

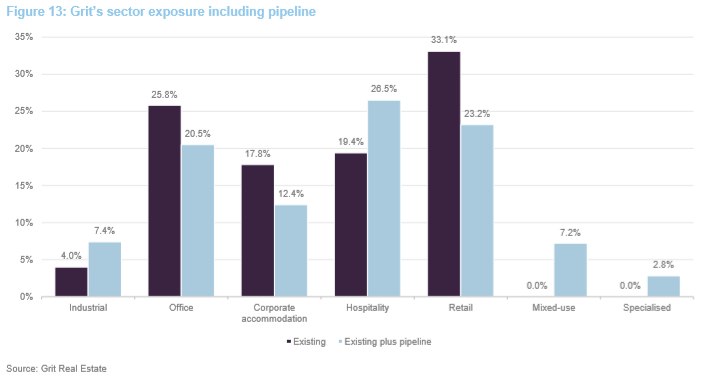

Top 15 tenants

Top 15 tenants

Beachcomber / Lux Tamassa

Beachcomber / Lux Tamassa

Two of Grit’s top five tenants, Beachcomber and Lux Tamassa, which combined account for 17.2% of income, operate in the hospitality sector and are owned by large Mauritian conglomerates – ENL Group and IBL respectively. While the hospitality sector has been shut down on the island of Mauritius due to covid-19, the impact on Grit is likely to be less severe compared to other hospitality owners around the world. Mauritius’s economy is highly dependent on hospitality and tourism and, recognising this, the government has gone to great lengths to protect the sector and the hundreds of thousands of jobs it provides. Beachcomber and Lux are the largest employers on the island, accounting for around 200,000 of the 550,000 workers in the hospitality sector in Mauritius.

On top of the rent deferral scheme, which stipulates that tenants can defer rental payments up to August 2020, but must pay it back in instalments to December 2021, the government and local banks have provided huge support to businesses and the economy. The government brought in a wage assistance scheme, whereby it would supplement the wages of all full and part-time employees in Mauritius. The government also owns the land and beaches of many of the resorts on the island and has given 12-month lease concessions on their land. A special relief programme has been set up by the Bank of Mauritius for businesses to help meet cash flow requirements at an interest rate of 1.5%, with a two-year loan repayment period.

Managers’ view: Although Grit expects challenges around cash flow timing from the two companies it has not received requests for rent concession and says that they are very secure.

Vodacom

Vodacom

Vodacom is Grit’s second largest tenant, accounting for 10.9% of income, and occupies a 10,659 sqm office in Mozambique. It is one of the biggest telecommunications operators in Africa. Outside its domestic market of South Africa, it added 4 million new customers in the year to March 2020 and posted a 12.5% increase in service revenue across international operations (which comprises Mozambique, the Democratic Republic of the Congo, Tanzania and Lesotho) to US$1.2bn.

It has performed strongly through the covid-19 pandemic, with the telecommunications sector benefitting from the adoption of new ways of working during the crisis and the dependence on technology increasing. A new stream of revenue for the business is mobile banking and its mobile banking platform, M-Pesa, now processes more than US$14.7bn a month in transactions in its African markets (outside South Africa).

Managers’ view: Strong tenant in a covid-resilient sector. Company has paid 12 months’ rent upfront to Grit.

Total

Total

Oil and gas giant Total is Grit’s third largest tenant, making up 7.5% of income. The company occupies office space and corporate accommodation in Mozambique on longterm leases to 2028 and 2024 respectively. Although the coronavirus pandemic has curbed energy demand around the world, Total’s Mozambique operations have been significantly boosted by a US$15bn financing agreement to fund the construction of its liquified natural gas (LNG) project. The site was the biggest natural gas find in the southern hemisphere in the last 50 years and is expected to take two and a half years to get to the production phase.

Managers’ view: The financing agreement is great news for Grit, with demand for its office and corporate accommodation from Total secured for the long term. Total has paid a third of the rent for the next three years on the corporate accommodation upfront.

Vale

Vale

Brazilian mining giant Vale accounts for 7.3% of Grit’s income, through the leasing of corporate accommodation in Mozambique. The company’s Mozambique subsidiary Vale-Mozambique owns coal processing plants in Tete and reported a 4.6% increase in coal production in the first quarter of this year. However, due to covid-19, it has withdrawn its guidance for coal production in 2020 and postponed maintenance plans for the site.

The maintenance plan was expected to increase the plant’s productivity and yield. Vale recently signed for an additional 40 housing units at Grit’s VDE Housing Estate, which followed the delivery of 60 units last year.

Managers’ view: When the maintenance plans are back on track, Vale will start housing more ex-pats in that region. Grit is well-placed to fill their needs.

US Embassy

US Embassy

Grit provides the US Embassy in Mozambique with corporate accommodation. The US Embassy has six years left on its lease and pays the rent annually in advance. The site was specifically chosen by the US Embassy and the buildings’ specification includes specialist features such as safe rooms.

Managers’ view: This is the premier corporate residential estate in the region, with other multinational corporate companies looking to replicate its design for their staff housing needs.

Shoprite

Shoprite

Food retailer Shoprite is the preeminent African retailer to come out of South Africa. Grit has exposure to Shoprite in Mozambique and Zambia, the latter of which was Shoprite’s third best operating store in the whole of Africa in 2019.

Managers’ view: Shoprite has continued to operate during the covid-19 pandemic and has seen sales growth during the period as people stockpile goods.

Acquisition pipeline and developments

Acquisition pipeline and developments

Grit has a vast pipeline of accretive acquisitions that it is actively pursuing, and is considering funding them through a hybrid capital instrument or a potential capital raise – when its discount narrows sufficiently. It is considering issuing hybrid preference shares, with the proceeds funding accretive acquisitions. Grit says existing shareholders will benefit alongside new preference note shareholders as the company grows and achieves economies of scale.

The pipeline consists of a mix of asset acquisitions and developments, which Grit expects to deliver higher capital growth prospects in the medium term.

It has conditionally agreed the acquisition of seven assets in four countries totalling US$103.5m. This includes the funding of 60 new corporate accommodation units at its VDE Housing Estate in Mozambique, let to Vale on a five-year lease (as mentioned above). Grit also has agreements in place to: fund the development of two hospitals in Mauritius – St Helene and Coromandel Hospitals; acquire a 50% shareholding in two offices in Accra, Ghana, let to PwC and Huawei; and acquire two industrial assets in Nairobi, Kenya.

While currently making up 33.1% of the portfolio, the retail sector does not feature in Grit’s investment pipeline, and the managers are looking to sell some non-core retail assets. As Figure 5 shows, Grit’s portfolio will be greatly diversified if it secured its identified acquisition pipeline, with exposure to the retail sector falling to 23.2%.

In February 2020, the company announced that it had entered into an agreement to acquire a stake in a Moroccan real estate investment trust (REIT). The REIT (or Organisme de Placement Collectif Immobilier (OPCI), as it is known in Morocco) will be made up of one asset – the mixed-use property Massira Corner, located in Casablanca, which is owned by Residence Massirat Al Houda (a subsidiary of Société Soprima).

Grit has agreed to buy a share in the OPCI / REIT from Residence Massirat Al Houda and intends to inject further equity into the vehicle from its key cornerstone investors. Grit will then look to grow the asset base of the OPCI / REIT with a number of identified acquisitions in a bid to diversify the vehicle’s sector and tenant exposures.

The group has identified two properties that are likely to be acquired by the OPCI / REIT. The first is a 350-room Club Med resort in Essaouira, Morocco, which is currently being developed and will be leased to Club Med on a 15-year fixed euro lease. It has an estimated development value of €87m. The second is Grit’s AnfaPlace Mall.

Grit has extended the target execution dates on the acquisition pipeline and is evaluating each due to the current and future impact of the covid-19 pandemic.

Development rationale – risk mitigation

Development rationale – risk mitigation

The expansion of the VDE Housing Estate marked the first development prefunded by Grit. The development of the 60 units was completed within the budgeted US$13.7m and were valued by Knight Frank in December 2019 at US$17.35m, representing a valuation uplift of US$3.65m or 26.6%.

Grit says the VDE development acts as a blueprint for further development opportunities that are risk-mitigated through pre-lets to multinational blue-chip companies.

To facilitate its growth in development projects, and to get a piece of the development profits, Grit founded Gateway Real Estate Africa and owns just under 20% of the company. It offers Grit a secure pipeline of future acquisitions and it maintains 20% of its development profits. Due to the nature of the assets that Grit invests in, there is often a phase two development requirement, which it can now keep in-house. More importantly, it provides Grit with an end-to-end solution for its multinational tenants and is a key differentiator to its competitors.

Gateway Real Estate Africa, whose managing director Greg Pearson co-founded Grit, is capitalised to the tune of $175m and has four active projects – two US Embassy housing compounds, a retail asset in Uganda and a facility in Mozambique for US energy multinational Halliburton.

Performance

Performance

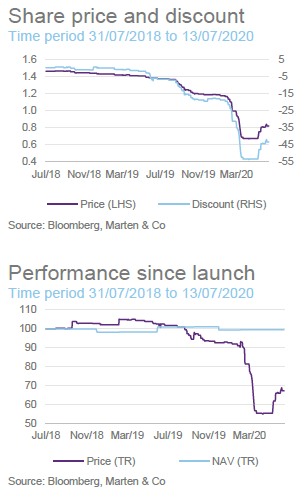

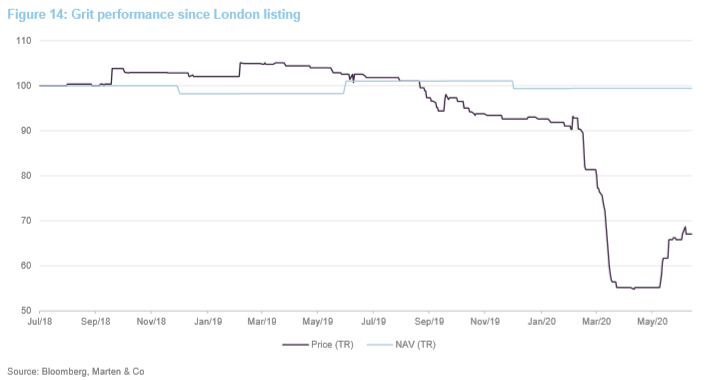

Grit’s EPRA NAV has been consistent since it launched on the London Stock Exchange in July 2018. Grit’s share price rose initially but started to fall in the second half of 2019 and plummeted following the outbreak of covid-19. Its share price has started to pick up in recent weeks on news that it was going to pay a dividend for the period January 2020 to June 2020 and its intention to de-list from the JSE.

On the JSE, Grit’s share price has not seen the same level of volatility as on the LSE. The impact of covid-19 has been less severe on Grit’s share price on the JSE, and after an initially drop it has recovered much of the loss. Grit’s NAV was erratic in its early days as it pieced together the portfolio.

Covid-19 impact

Covid-19 impact

As with all real estate companies around the world, Grit has seen the level of rent collection drop over the past few months as lockdown measures have been implemented across Africa to differing severity.

On 3 June 2020, Grit announced rent collection figures for April and May of 80% and 76% respectively. In June, the group billed around 74% of contracted rent, due to local government laws on rent concessions during the pandemic, but collected almost 100% of that (72.9% of contracted rent). It has collected an additional US$4.6m in prepaid rents for the 2020 calendar year in the period March to June 2020. The collection figures are at the upper end of the scale when compared to UK-listed property companies and reflects the diverse nature of the portfolio, both in terms of geography and asset class.

The company’s corporate accommodation, office and industrial assets (48% of net asset value at 31 December 2019) have performed well during the period, with concessions worth less than 0.05% of monthly rent agreed across these assets. Unsurprisingly, it has experienced difficulties in the retail sector and, to a lesser extent, in the hospitality sector.

In the retail sector, which accounted for 32.1% of total net asset value on 31 December 2019, the group is supporting tenants whose operations have been materially impacted by covid-19, through short-term concessions. These concessions represented around 9% of total rent due in April and 12% in May.

Grit’s largest retail asset, the AnfaPlace Mall in Morocco, has been hardest hit. The country went into lockdown on 15 March, with trade resuming on 25 June. While lockdown measures have started to ease, many of the AnfaPlace Mall tenants have been heavily impacted. The mall had recently been refurbished, with Grit in the process of letting up vacant units. It says a lot of tenants that had signed up prior to covid-19 have delayed move-in dates to 1 September 2020, while ongoing negotiations to let a large amount of space have broken down.

Grit has also been hit by the collapse of South Africa’s second-largest clothing retailer, Edgars, which had let stores within four of the group’s retail malls, representing 1.2% of income. The company is in the process of re-letting the space on short-term deals at lower rents.

The company says the rest of its retail portfolio, which is largely made up of open air “strip malls”, has not been as badly affected due to the convenience and grocery nature of the retail tenants and their low rental tone.

In return for the concessions, Grit has agreed or is in negotiations on a number of compensatory measures with tenants including extension of leases and the insertion of a clause on retail leases that the retailer provides turnover figures (important information for landlords in assessing the strength of a retailer’s performance that are traditionally difficult to obtain).

In the hospitality sector, which accounted for 18.8% of total net asset value on 31 December 2019, short term payment deferrals have been agreed or are being finalised on up to 16% of rent due for April and May, and will now be due in the company’s next financial year.

In Senegal, the company is expecting to provide up to nine months of rent deferral support to Club Med at the Cap Skirring resort. In return for this, the company says the rent will slightly increase following the deferral period. The contracted capital expenditure programme for a phase two redevelopment and expansion of the scheme has been delayed, improving Grit’s free cashflow position.

In Mauritius, where Grit owns a stake in three Beachcomber resorts and a Lux Tamassa resort, the government has passed a Covid-19 Bill that provides protection to both tenant and landlord whereby rent can be deferred up to August 2020 but it has to be re-paid by 31 December 2021. It provides Grit with security of income, albeit delayed.

The impact of covid-19 on the valuation of Grit’s properties will be varied. The company’s properties were valued on 30 June 2020 by external valuers but has yet to be reported. Management believes that reasonable assumptions on its retail portfolio are for a 10% to 15% drop in valuations.

It says it expects the value of its hospitality portfolio to come off slightly, but due to the strength of the counterparties behind the operators, it is not expecting a hospitality bloodbath like some other companies will see.

For the rest of the portfolio, which has performed well during covid-19, it expects to see normal growth movement and potentially a small premium.

In analysing a number of different valuation scenarios, Grit says its loan to value (LTV) could increase to the high-40% mark, from 43.9% at December 2019. In a worst-case scenario modelling, the LTV would be at 52.5%. The group’s most restrictive debt covenant stipulates a group LTV of 53%. Grit says it has agreed, or is in advanced discussions, with its lenders to extend LTV and interest cover covenants and introduce ‘covid relief’ for an 18-month period, as a precautionary measure.

Dividend

Dividend

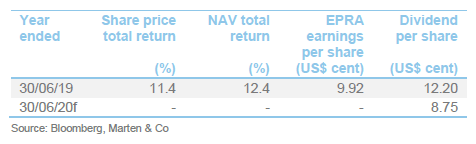

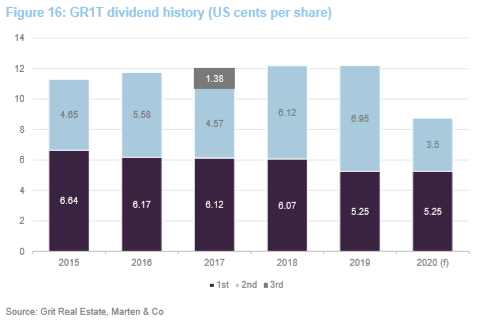

Grit has one of the largest dividend yields of property companies listed on the LSE, and last year paid 12.20 US cents per share – a 10.3% dividend yield on its 31 December 2019 share price. The company declared and paid a dividend for the first half of its financial year (1 July 2019 to 31 December 2019) in line with the previous year, but due to slower rent collections as a result of covid-19, the board decided to revise its dividend guidance for the year. It is now targeting a full-year dividend of at least 8.75 US cents per share, with the potential to increase it in line with rent collection.

Premium/(discount)

Premium/(discount)

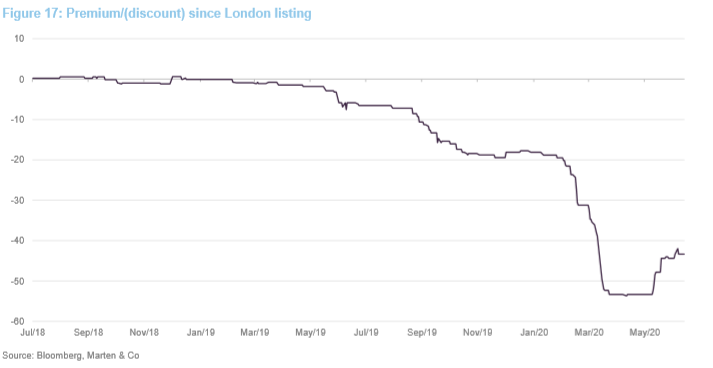

Grit had fluctuated between trading at a slight premium and a slight discount for much of its first full year on the LSE before its discount widened during the course of the second half of 2019. The discount widened further on the outbreak of covid-19 at the start of 2020, exacerbated by Grit’s announcement of a four-week delay in paying its interim dividend due to longer central bank processing times and delays in movements of cash balances to Mauritius. The discount has narrowed slightly and at 13 July 2020 the discount stood at 43.3%.

Investment team

Investment team

Bronwyn Corbett is the chief executive officer of Grit. She played an instrumental role in the JSE listing of Delta Property Fund Limited in 2012, where she held the positions of chief financial officer and chief operating officer prior to taking up the leadership role at Mara Delta Property Holdings.

During her tenure at Delta Property Fund Limited, Bronwyn spearheaded the diversification of the REIT’s funding sources in the debt capital markets, leading to the establishment of a ZAR 2 billion Domestic Medium Term Note Programme (DMTN Programme).

In addition, Bronwyn co-headed the team responsible for growing assets under management from ZAR 2.2 billion at listing to ZAR 11.8 billion in May 2016. She is a founder member and served as non-executive director on the board of Mara Delta Property Holdings Limited (now Grit) where she played a significant role in the listing and conversion of the fund to its current pan-African focus, underpinned by dollar based leases.

She assumed the role of chief executive officer in the lead-up to the fund’s merger with Pivotal to form Mara Delta. She has grown the portfolio from $220m at inception to around $860m currently.

In November 2019, Bronwyn was awarded the 2019 EY World Entrepreneur Award – Southern Africa.

Leon van de Moortele is the chief financial officer of Grit. He has served in the global risk management services team within PwC, where he became the senior manager in charge of data management. He is a Charted Accountant and also holds an Honours Degree in Accounting Science.

In 2004, Leon moved to Solenta Aviation, where he became group finance director during which time the group expanded from 12 aircraft to 48 aircraft, operating in eight African countries.

Leon joined Grit in April 2015 as chief financial officer, where he has continued to utilise his tax structuring knowledge and experience in operating in Africa to expand the asset base of the group.

Moira Van Der Westhuizen is the chief operating officer at Grit. She joined the company in May 2016, originally as the chief integration officer and has over 20 years of experience in finance, business and auditing, which includes running her own business. In 2005 she was appointed audit partner in an audit and accounting practice, and in 2008 moved to Mauritius to work for Investec Bank and later the CCI Group as the group financial controller.

Adam Nisbet is head of investments and joined Grit in 2019 from Collins Property Projects (a division of JSE-listed Tradehold Limited) where he held the position of development director responsible for all of the group’s development and refurbishment projects in Africa. He holds a BSc Honours in Quantity Surveying.

Greg Pearson co-founded Grit with Bronwyn Corbett. He was previously head of Africa for AECOM, the US listed infrastructure firm, where he established many of his client relationships with multinational companies operating across the African continent. Greg has subsequently taken up the managing director position at Gateway Real Estate Africa, Grit’s 20% owned development associate.

The legal bit

The legal bit

This marketing communication has been prepared for Grit Real Estate Income Group by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.