Grit Real Estate Income Group

Real estate | Update | 27 September 2023

Grit 2.0

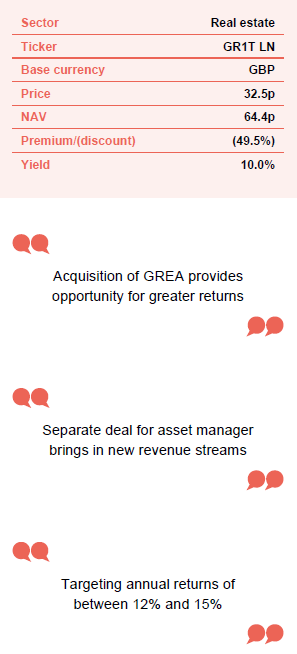

Having concluded its acquisition of a leading property developer and asset manager, pan-African property company Grit Real Estate Income Group (Grit) has been reborn. Grit 2.0 has a greater and more achievable return target (of between 12% and 15% per annum) thanks to the controlling stake it now owns in Gateway Real Estate Africa (GREA) and its attractive pipeline of net asset value (NAV) accretive, risk-mitigated development projects – most notably diplomatic residences across the continent that are let to the US government.

Ongoing asset recycling – away from the retail and hospitality sectors – has shored up its balance sheet, while creative means of raising additional capital should secure the substantial development pipeline and plot a way to ongoing, sustainable returns and growing, resilient income. A new line of revenue through the fee income earned from the property asset management business adds further robustness to its earnings and supports its dividend.

Pan-African real estate

Grit is a pan-African real estate company that invests in and actively manages a diversified portfolio of assets in selected African countries (excluding South Africa). It aims to deliver strong and sustainable income for shareholders, with the potential for income and capital growth, and targets a total shareholder return of between 12% and 15% a year.

At a glance

Rebuilding returns

Concluded acquisition of pan-African developer.

Grit has reached a key milestone in its turnaround strategy with the completion of the final part in a series of acquisitions of shares in pan-African property developer Gateway Real Estate Africa (GREA) in July, giving it a controlling stake in the company. This key achievement was the centrepiece of its plan for growth –announced in 2021 as part of its capital raise – and is focused on achieving greater returns from development projects and securing fee income from asset and property management services.

Having now secured controlling stakes in GREA (it now owns 51.5% in the company, with the balance owned by Public Investment Corporation – PIC), as well as development manager Africa Property Development Managers (APDM – where it owns 78.95% with the balanced also owned by PIC), it now has a clear route to NAV and earnings growth, and increased dividends.

Over the next few years, the group’s portfolio will be transformed, with new developments (pre-let to multinational corporates) making up 20% of the wider portfolio. Assets in non-core sectors (mainly in hospitality and retail) are being sold to fund these developments. This, coupled with new revenue streams from fee income through APDM, should help the company deliver greater returns and more resilient income going forward, as it looks to return to its position as one of the highest dividend payers in the real estate sector (in the three years prior to the COVID pandemic, the group’s dividend yield stood at more than 8.5%).

The addition of development returns – with a target of 16% IRR (internal rate of returm) on developments of US$150m at any one time, the fee income from these developments, and separate property management fees (more detail on APDM is on page 7), as well as the contracted lease uplifts within the current portfolio, give Grit’s management team confidence that it can achieve an NAV total return of between 12% and 15% per year on average.

The company is targeting a dividend of 4.5 to 5.5 US cents per share for the financial year to June 2023, which at today’s share price of 32.5p equates to a dividend yield of 10.0%.

GREA

GREA’s pipeline includes several diplomatic embassy housing projects let to the US government.

GREA has a pipeline of development projects across the continent – most notably developing diplomatic embassy housing for the United States Bureau of Overseas Buildings Operations. It has so far completed the development of two diplomatic residences for the US Embassy (in Kenya and Ethiopia), is close to completing a third in Mali and has seven more in its pipeline. GREA also has projects at various stages of development in sectors including offices, industrial, data centres and hospitals.

The returns on offer through development are potentially far greater than buying existing properties. The attraction of the GREA business and development pipeline is that the letting risk usually associated with development is absent. The group partners with multinational companies looking for real estate solutions in Africa, and secures land in conjunction with them before putting a spade in the ground. These risk-mitigated, pre-let developments are rare in the commercial real estate sector and very appealing.

Its work for CCI Global, at Tatu City in Kenya, is a good example of GREA’s standing as the leading developer in Africa. CCI Global won a contract to run the call centres for large US corporate companies, which were moving operations from the Philippines due to COVID restrictions. CCI had a mandate to move hundreds of thousands of jobs to Africa and signed a pre-let with GREA for a 24,000 sqm office at Tatu City – Kenya’s first special economic zone to the north of Nairobi.

GREA targets a 16% IRR on development. Historically it has had a development yield (return on development cost) of around 10.5%, and as the asset has become established, the property has tended to be revalued at yields between 8.5% and 9% (as yields harden – go down – as the capital value increases). It is these potential capital value gains (and therefore NAV growth) that Grit expects to capture going forward.

GREA’s low loan to value (LTV) of 20% will beneficially impact on Grit’s group LTV, lowering it by 2.9 percentage points to 42.6% (based on 31 December 2022 values).

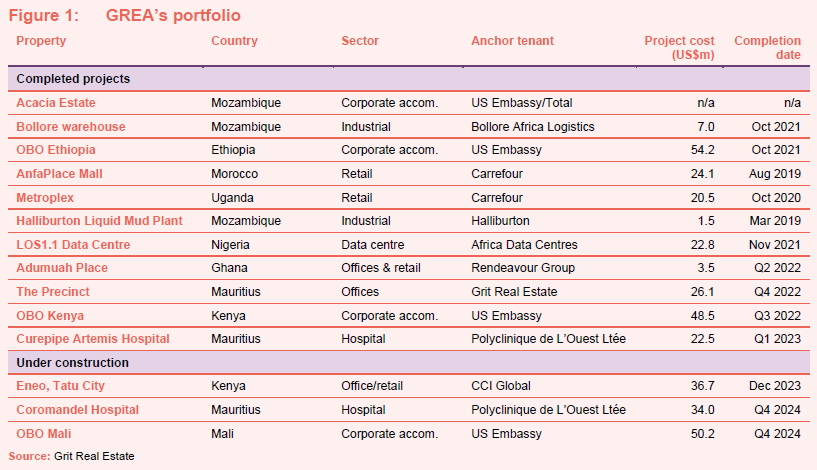

GREA portfolio and pipeline

GREA’s development focus is mainly on four sectors – corporate accommodation (including diplomatic residences for the US Embassy), industrial, data centres and healthcare. Figure 1 details GREA’s completed and current development projects, which have a range of completion dates over the next year.

GREA has a near-term pipeline of development projects that are ready to go with a development cost of around US$320m and an extended pipeline, where memoranda of understandings (MOUs) with landowners/tenants are in place, worth another US$660m. GREA’s activities are focused on the following four sectors:

- Corporate accommodation

GREA’s pipeline of diplomatic residences let to the US Embassy is the cornerstone of Grit’s investment case and growth strategy. GREA has a long relationship and strong track record working with the US Department of State, where it has so far delivered two projects – in Ethiopia and Kenya – and is currently on site in Mali. There is the potential for the development of a further seven projects in partnership with the US Embassy across Africa over several years with a total cost of around US$300m.

Grit says that the developer has been contacted by other embassies expressing their interest in replicating the work it has done across the continent for the US embassy.

New industrial platform formed to attract fresh capital.

- Industrial platform

Grit plans to scale up its industrial holdings in a separate platform, called Bora Africa, in which it will seek co-investors. It intends to bind up its current industrial assets (worth around US$78m) and GREA’s future industrial development assets into a single platform and look to sell stakes to investors such as African pension funds, with discussion at an advanced stage with the International Finance Corporation (IFC) to provide funding by way of a preference equity note to the platform.

GREA has an industrial development pipeline worth around US$200m and is seeking further land acquisitions across the continent for further development of industrial property. Grit says that there is a structural undersupply of industrial property across Africa and the continent benefits from favourable demographics (the population of Africa is expected to double by 2050, accounting for up to 40% of the world’s under-25s, and rapid urbanisation is set to follow) and growing demand-side pulls (with the digital transformation and internet penetration rates resulting in e-commerce footprints accelerating rapidly).

- Data centres

GREA completed the development of a data centre in Lagos, Nigeria in 2022 and has a pipeline of four further developments including one in Morocco, which has a total development cost in excess of US$140m. Grit says that there is high demand for the data centres across Africa as internet penetration grows and the implementation of technology, and therefore the use of data, increases.

- Healthcare

GREA is currently developing two hospitals in Mauritius – Curepipe Artemis Hospital (formerly known as St Helene Clinic) and Coromandel Hospital – which are being delivered in partnership with Artemis Hospitals. Grit says the hospital/healthcare facilities are ground breaking for the country, providing a new healthcare system on the island. GREA has two further hospital developments in its near-term pipeline in two further African countries, which have a total cost of around US$250m.

Funding the development pipeline

To fund the next round of development, a capital call to investors in GREA, which Grit would have to contribute 51.5% of, is likely to come in the next year. Grit’s dilemma now is how to fund this capital call. The group’s current share price discount to NAV means that an equity raise is out of the question. Taking on more debt is also out of the picture at the moment due to high interest rates. Therefore, Grit’s management team has had to turn to creative solutions in raising money. It is a significant way through a US$160m asset recycling programme (more detail on page 8), with some of the sales proceeds being earmarked for funding developments (with proceeds also being used to reduce debt).

Further funding routes that Grit is actively pursuing include:

- the sale of stakes in individual assets (which it did with its Orbit Africa industrial asset in Kenya when it sold a 30% stake for US$7.2m in July 2022);

- the introduction of alternative sources of capital through development and mezzanine funding with DFI’s (development finance institutions). Dozens of DFI’s exist across Africa to provide capital for economic projects, such as the International Finance Corporation (IFC);

- the issuance of a corporate bond within the next two to three years. The legal structure was put in place to raise a corporate bond at the time of Grit’s debt refinancing with a syndicate of banks in 2022 (details of which can be found in our most recent annual overview note a link to which is on page 2 and 14); and

- the setting up of sub-structures within Grit and GREA’s portfolios to introduce fresh capital. Grit has progressed this with the formation of Bora Africa, as mentioned above, which incorporates all of Grit’s industrial assets and developments.

APDM – boost in earnings through fee income

Targeting fee income of 2% of NAV.

APDM, renamed as Grit Real Estate Solutions (GRES), offers Grit a new line of revenue based on management fees. It provides asset management and leasing services, property management and facilities management services on all assets developed by GREA as well as assets owned by third-party companies. Typically, it charges 0.75% of the market valuation for its asset management services, 2.5% to 5% of rent collections for its leasing services, and between 15% and 20% of operational costs for facilities management. It plans to expand its operations to more third-party companies and real estate owners such as pension funds in Africa.

GRES has 101 staff members managing US$1.2bn of assets across 12 countries and 639,000 sqm of space, with 497 tenants. Grit is targeting a fee income of 2% on NAV and between 10% and 15% of net operating income.

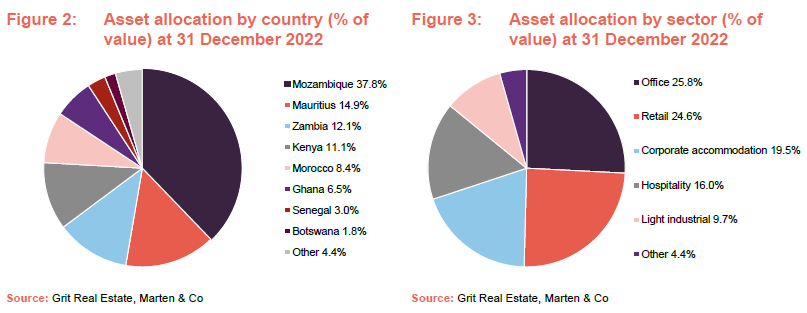

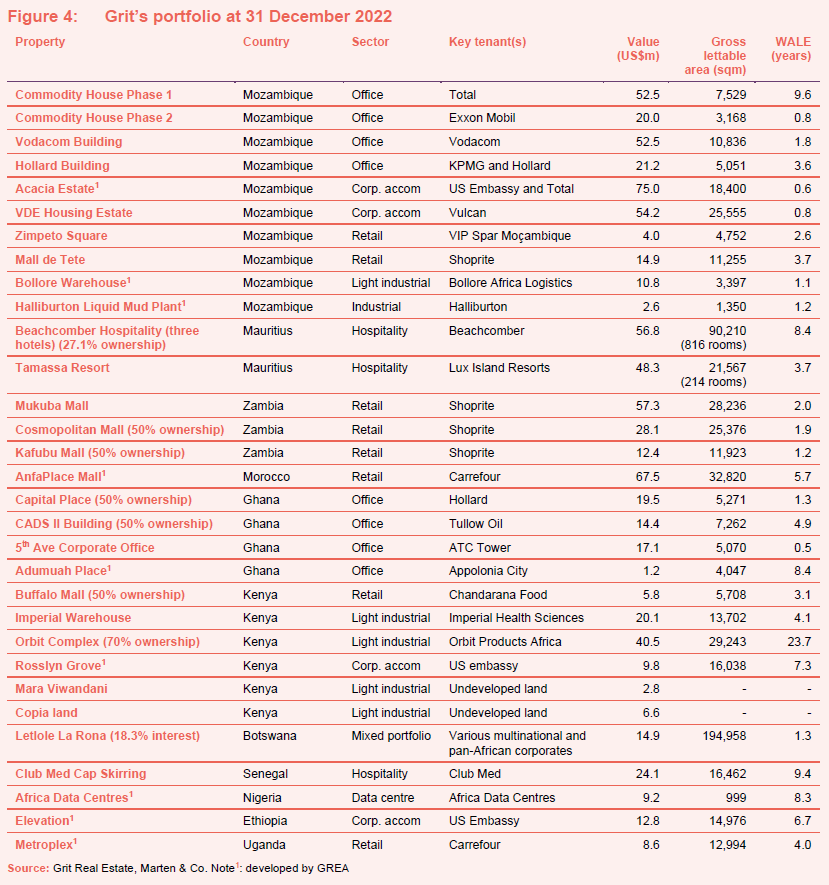

Portfolio

At 31 December 2022, Grit’s portfolio consisted of 60 assets located across 12 countries and eight asset classes, valued at US$832.9m, reflecting a net initial yield of 7.6% and a topped-up net initial yield of 7.9%. The group’s portfolio vacancy rate was 4.3% and weighted average lease expiry (WALE) was 4.6 years. The vast majority (85.9%) of income is underpinned by a wide range of blue-chip multinational tenants across a variety of sectors and has a weighted average contracted lease escalation of 4.1% per annum. Rents are predominantly collected monthly, of which 92.4% are collected in US$, euro or pegged currencies.

The composition of the portfolio has changed since the end of 2022 and that is shown in Figure 4. As part of its asset recycling programme, Grit completed the sale of its 47% interest in Beachcomber Hospitality (which owns three four-star hotels in Mauritius) in two tranches for a combined €40.4m.

The company also sold the final tranche of the shares it owns in Letlole La Rona (LLR – which is listed on the Botswana Stock Exchange) in June 2023. Completing the four-part exit from LLR (which once amounted to a 30% stake in the company), Grit has raised US$20.3m at a weighted average premium of 1.3% to the last published LLR NAV at 31 December 2022. It paid a total of US$17.6m for the stake between 2017 and 2019.

Grit has now disposed of US$135m worth of non-core assets, against a target of US$160m by the end of 2023. Further sales from its retail portfolio are expected over the remainder of the year.

Grit’s portfolio will continue to evolve with the completion of GREA developments. It expects that the US Embassy will become its top tenant within the next two years with the completion of further diplomatic residences, and corporate accommodation growing to around 20% to 25% of assets. Two hospitals will be added to the portfolio when development is completed by GREA, while industrial assets will likely grow to 20%. Retail and hospitality will both halve as a proportion of the portfolio through a combination of sales and the other sectors growing.

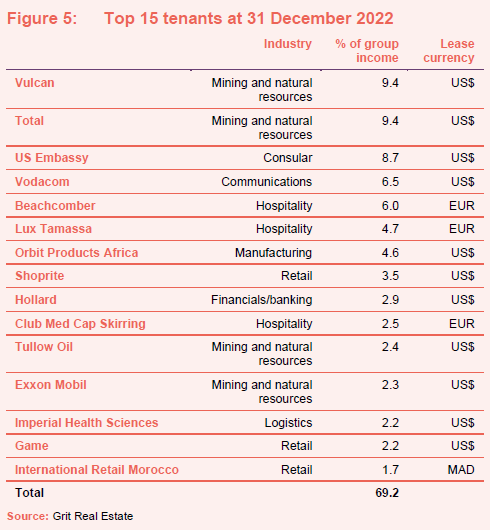

Top 15 tenants

Vulcan

Vulcan, part of the $18bn Indian conglomerate Jindal Group, is Grit’s largest tenant accounting for 9.4% of rental income through the leasing of the VDE Housing Estate corporate accommodation asset in Mozambique. Vulcan signed a short-term lease to occupy the estate after acquiring the nearby Moatize coalmine from Brazilian mining giant Vale, which had vacated the corporate accommodation following the sale of the mine to Vulcan. The VDE Housing Estate had been heavily marked down by valuers in recent periods due to the uncertainty over the tenancy (from US$57.5m in June 2021 to US$54.2m in December 2022) but negotiations for the renewal of the lease are at an advanced stage. A renewal of the lease is expected to result in a recovery in the value of the asset.

Total

Oil and gas giant Total is Grit’s second-largest tenant, making up 9.4% of income. The company occupies office space and corporate accommodation in Mozambique. Following a negotiation, Grit recently extended Total’s lease at the office building, Commodity House, for a further 11 years. In exchange, Grit did not pass on an 11% increase in rent due under its PPI (producer price index) inflation-linked lease. Instead, the rent will increase 5% this year and 4% for the next two years, followed by 3%, before reverting back to annual PPI uplifts. Grit says that the lease extension has been positive for the valuation of the building. Total’s Mozambique operations were significantly boosted by a US$15bn financing agreement to fund the construction of its liquefied natural gas (LNG) project. The site was the biggest natural gas finds in the southern hemisphere in the last 50 years and is expected to take two and a half years to get to the production phase.

US Embassy

The US Embassy now accounts for 8.7% of Grit’s income with the integration of new corporate accommodation assets in Kenya and Ethiopia from the GREA portfolio, adding to existing residences in Mozambique. As already mentioned, GREA has a strong relationship with the United States Bureau of Overseas Buildings Operations (OBO) to develop embassy housing for it across Africa. GREA is developing an additional diplomatic residence let to the US Embassy in Mali, with a further handful in the pipeline. Grit says that the US Embassy should become its top tenant by income within two years.

The Ethiopian corporate accommodation tower is a co-development and equity partnership between US-based Verdant Ventures and GREA. It comprises 112 units and is located in Ethiopia’s capital city, Addis Ababa, which hosts over 130 diplomatic missions and is the third-largest diplomatic community in the world behind Washington DC and Brussels.

Significant pipeline of opportunities to develop diplomatic residences for the US government.

The Kenyan diplomatic housing project in Nairobi is composed of 90 diplomatic apartments and townhouses. It marked GREA’s first development in Kenya and a second development in conjunction with US-based developer, Verdant Ventures.

The Mali diplomatic housing project, located in Bamako, is less than a kilometre from the US government embassy. The project consists of the development of a 45-unit diplomatic residential complex consisting of a multi-block mid-rise complex with high security requirements. The US government will occupy 100% of the premises. GREA will take part in the development in partnership with OCCEL Engineering, a contracting and development company in Nigeria.

Vodacom

Vodacom occupies a 10,659 sqm office in Mozambique and accounts for 6.5% of Grit’s income. Vodacom is one of the biggest telecommunications operators in Africa. Outside of its domestic market of South Africa, its customer base grew 20.4% to 50.2m in the year to 31 March 2023 and the group posted revenue growth of 18.8% across international operations (which comprise Mozambique, the Democratic Republic of the Congo, Tanzania and Lesotho). The group’s mobile banking platform, M-Pesa, processed US$364.8bn of transactions over the year to 31 March 2023, up 13.0%.

Beachcomber / Lux

The two Mauritian hospitality groups in Grit’s portfolio, Beachcomber and Lux, accounted for 10.7% of total group income combined at the end of December 2022. As mentioned earlier, Grit has since sold its 47% stake in Beachcomber. It does, however, still own the Tamassa Resort, operated by Lux (which accounts for 4.7% of income). Grit does not take any risk associated with the hotel operation through triple net leases, whereby the tenant bears all costs associated with the assets. The creditworthiness of the lease covenant is strong, with Lux’s parent company being large Mauritian conglomerate IBL Group. The company received significant support from the Mauritian government during the pandemic. In terms of rent receipts, it has fully caught up with rent arrears that were afforded to it during 2021.

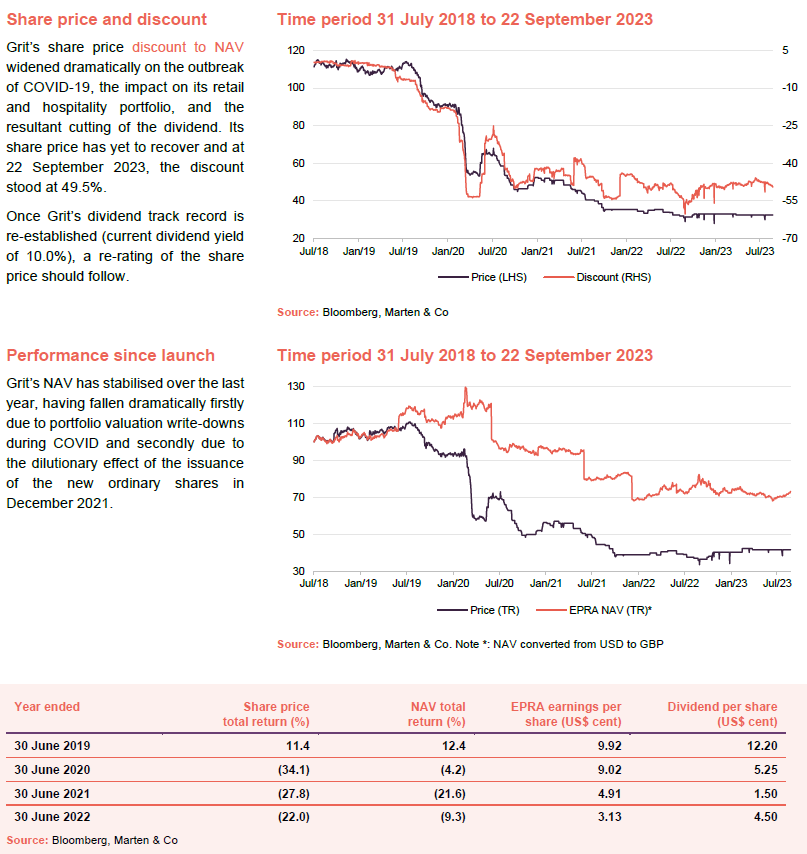

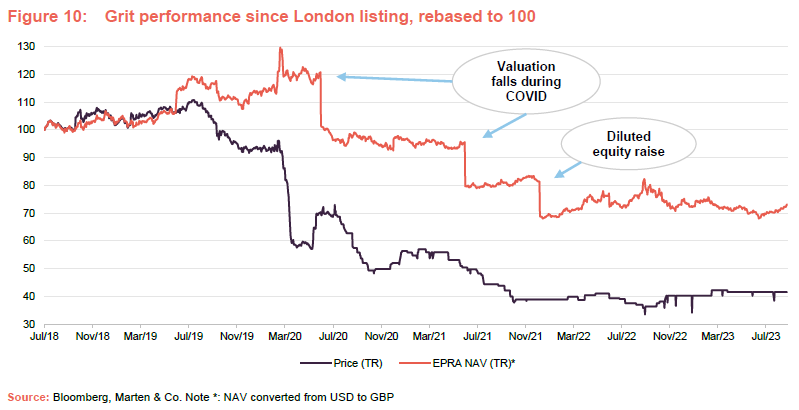

Performance

Following Grit’s conversion to a sterling quotation on the London Stock Exchange (LSE) in August 2020, we have converted its historic NAV and share price from US$ to sterling in Figure 10. Grit’s NAV has stabilised over the last year, having fallen dramatically firstly due to portfolio valuation write-downs during COVID and secondly due to the dilutionary effect of the issuance of the new ordinary shares in December 2021. Grit’s NAV had been moving in the right direction following its launch on the LSE in July 2018 and prior to the pandemic.

Grit’s share price rose initially after launch, but started to fall in the second half of 2019 and plummeted following the outbreak of COVID-19 in early 2020. Its share price tailed off further as the pandemic continued to have a significant impact on its portfolio and has yet to recover.

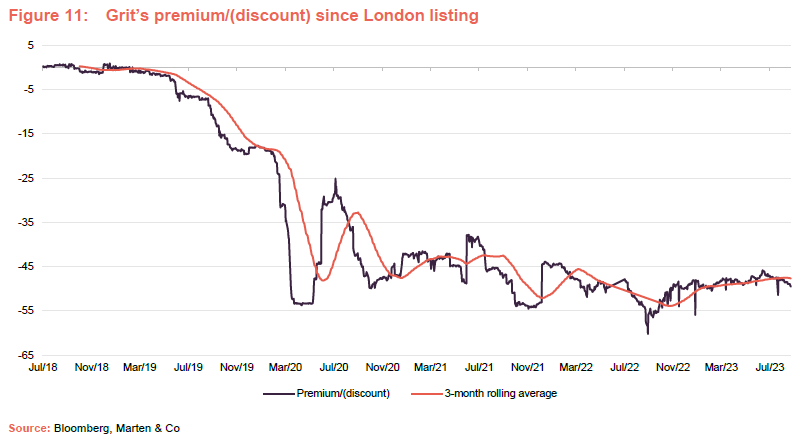

Premium/(discount)

Grit’s share price had fluctuated between trading at a slight premium and a slight discount to NAV for much of its first full year on the LSE before its discount widened during the course of the second half of 2019. The discount widened dramatically on the outbreak of COVID-19 at the start of 2020 and the resultant cutting of the dividend. It narrowed as a clean-up of its corporate structure took place, but widened again as the impact of COVID-19 on its retail and hospitality portfolio continued to weigh heavily. At 22 September 2023, the discount stood at 49.5%.

Once Grit’s dividend track record is re-established (current dividend yield of 10.0% and board guidance of a dividend of between 4.5 cents and 5.5 cents per share for the year to 30 June 2023), a re-rating of the share price should follow.

Fund profile

The company’s website is www.grit.group.

Grit has a primary listing on the premium segment of the London Stock Exchange’s main market and a secondary listing on the Stock Exchange of Mauritius (SEM). Its focus is on investment in pan-African real estate and it actively manages a diversified portfolio of assets in selected African countries (excluding South Africa).

Assets underpinned by hard currency leases – predominantly US dollar and euro.

It offers access to the growth potential of Africa that is de-risked from a currency perspective. The company’s assets are underpinned by predominantly US dollar- and euro-denominated long-term leases to a range of blue-chip multinational tenant covenants.

The company, which employs 160 people in six countries, aims to deliver strong and sustainable income for shareholders, with the potential for income and capital growth and is currently targeting a net total shareholder return inclusive of NAV growth of between 12% and 15% per annum.

Grit has taken a number of steps to enhance its corporate structure with the ultimate aim of facilitating its inclusion in the UK FTSE Index series and improving liquidity in its shares. In 2020, it moved its corporate domicile from Mauritius to Guernsey, stepped up to the premium listing segment of the London Stock Exchange, and converted to a sterling quotation. The group also de-listed from the Johannesburg Stock Exchange in 2021, making the London Stock Exchange its primary listing.

Previous publications

QuotedData has published five previous notes on Grit. You can read them by clicking the links or visiting our website.

Figure 12: QuotedData’s previously published notes on Grit

| Title | Note type | Date |

| Africa, substantially de-risked | Initiation | 15 July 2020 |

| On the path to recovery | Update | 17 February 2021 |

| Showing some grit | Annual overview | 7 December 2021 |

| Transition underway | Update | 4 July 2022 |

| Going for growth | Annual overview | 20 December 2022 |

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Grit Real Estate Income Group.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.