Showing some grit

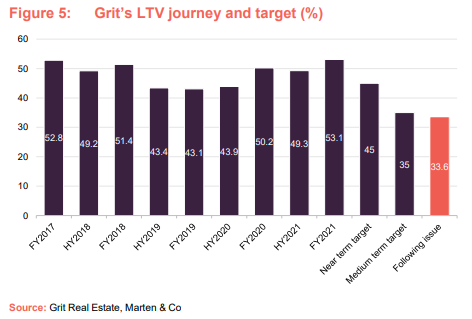

Grit Real Estate Income Group (Grit) has taken decisive action to secure its future with the announcement of a proposed capital raise of up to US$215.6m. The group’s portfolio has suffered heavy valuation declines during the COVID-19 pandemic, especially in the retail sector, which has seen its loan to value ratio (LTV – borrowings plus cash as a percentage of portfolio valuation) soar to 53.1%. The proceeds of the equity raise will be used in two parts: firstly to pay down debt and secondly to acquire a controlling stake in a real estate developer, which has an attractive pipeline of projects including diplomatic residences let to the US government (see page 7 for an in-depth look at the proposed capital raise and acquisition).

If fully subscribed, the issue will not only result in the LTV dropping to 33.6% but will allow Grit to address its short-dated debt and be a catalyst for a re-rating of the discount to net asset value (NAV). The active development pipeline and a resumption of dividend payments has led the group to raise its annual NAV total return target to between 13% and 15%, should the proposed fund raise be successful.

Pan-African real estate

Grit is a pan-African real estate company that invests in and actively manages a diversified portfolio of assets in selected African countries (excluding South Africa). It aims to deliver strong and sustainable income for shareholders, with the potential for income and capital growth, and currently targets a net total shareholder return including NAV growth of 12% a year.

At a glance

Share price and discount

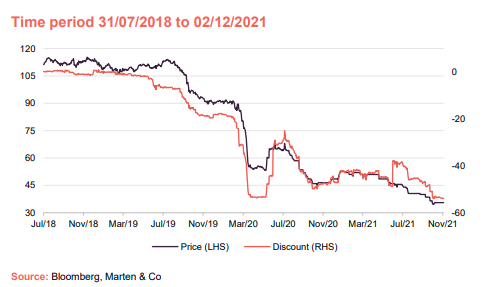

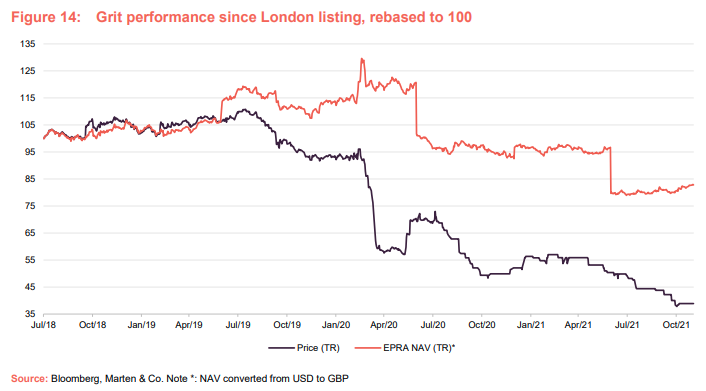

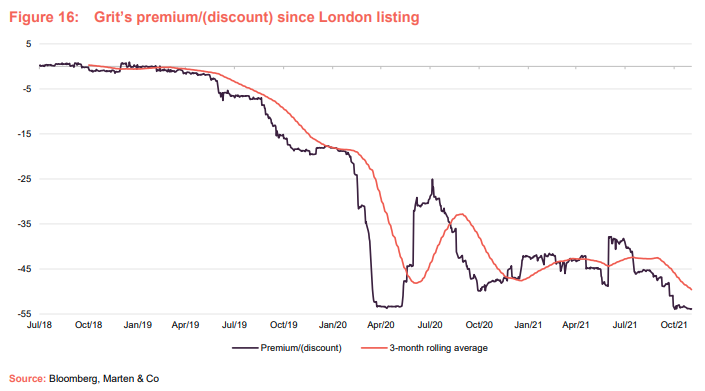

Grit’s share price traded at or around NAV for much of its first full year on the London Stock Exchange (LSE) before its discount widened during the course of the second half of 2019. The discount widened further on the outbreak of COVID-19 and continued to grow as the impact of COVID-19 on its retail portfolio weighed heavily. At 2 December 2021 the discount stood at 53.9%.

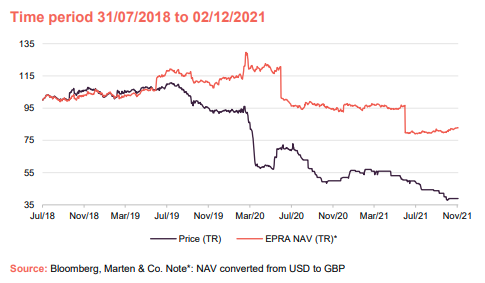

Performance since launch

Grit’s EPRA NAV had been consistent since it launched on the LSE in July 2018, but dived in June 2020 after reporting a 19.4% fall in EPRA NAV off the back of portfolio valuation write downs. A further decline in portfolio values was reported for the period to June 2021.

Fund profile

Grit has a primary listing on the Premium segment of the London Stock Exchange’s main market and a secondary listing on the Stock Exchange of Mauritius (SEM). Its focus is on investment in pan-African real estate and it actively manages a diversified portfolio of assets in selected African countries (excluding South Africa).

It offers access to the growth potential of Africa that is de-risked from a currency perspective. The company’s assets are underpinned by predominantly US dollar- and euro-denominated long-term leases to a range of blue-chip multinational tenants.

The company, which employs 92 people in six countries, aims to deliver strong and sustainable income for shareholders, with the potential for income and capital growth and is currently targeting a net total shareholder return inclusive of NAV growth of 12.0% per annum.

Grit has taken a number of steps to enhance its corporate structure with the ultimate aim of facilitating its inclusion in the UK FTSE Index series and improving liquidity in its shares. In 2020, it moved its corporate domicile from Mauritius to Guernsey, stepped up to the Premium listing segment of the London Stock Exchange and converted to a sterling quotation. The group also de-listed from the Johannesburg Stock Exchange last year, making the London Stock Exchange its primary listing.

Market outlook – suffering the effects of COVID

Despite Africa being far less affected by domestic COVID-19 cases and death rates than Europe, Asia and North America, it has suffered the same economic impacts felt worldwide and remains vulnerable to broader global economic developments associated with the pandemic. Government measures brought in at different points since March 2020 have included border closures to stop the spread of the disease, which has hit tourist numbers, and restrictions on large gatherings including the closure of non-essential retail and leisure. This has, in many cases, led to long-term financial implications for retailers. Other changing real estate trends that have emerged or accelerated during the pandemic and witnessed in other parts of the world, are less prominent in Africa. Working from home has become a new normal in the developed markets, but not so much in Africa, where limited access to quality internet connections, as well as the security of corporate data and company assets, mean it has neither been viable nor practical in many African countries.

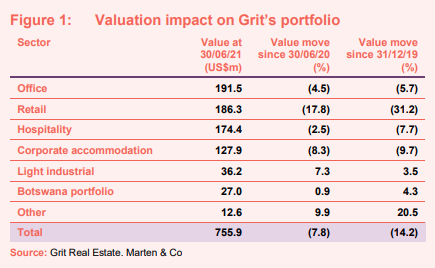

The impact of the pandemic on Grit has been considerable. The value of its portfolio, mainly in the retail sector, has suffered heavy losses over the past 20 months. Grit’s portfolio valuation has fallen by 14.2% (or US$114.9m) on a like-for-like basis since 31 December 2019, as shown in Figure 1.

This has resulted in the group’s loan to value (LTV) ratio growing from 43.9% to 53.1% in the same period. It is now close to breaching the lowest applied LTV debt covenant (restrictions that lenders put on lending agreements to limit the actions of the borrower) of 55%. In a bid to halt the decline, the company has moved to take defining action that it hopes will both reduce the LTV to below 35% and secure long-term net asset value growth potential. It has announced a capital raise of up to US$215.6m that will be used to reduce borrowings and acquire a development company (in-depth details of the plans are set out from page 7).

Grit’s EPRA net reinstatement value (NRV – Grit’s favoured net asset reporting metric, which measures NAV adjusted to reflect the value required to rebuild the portfolio) was down 12.6% in the six months to 30 June 2021 to US$1.024, due in part to a 7.8% like-for-like property valuation decline – mainly from its retail assets.

Rental collections across the group have been strong throughout the pandemic. Collection rates in the six months to 30 June 2021 averaged 93.7% of contracted rental income (compared to 91.4% in the six months to 31 December 2020). Grit provided limited concessions to tenants, representing 5.6% of contracted annual rent for the 12 months to 30 June 2021.

COVID recovery underway

According to Worldometer, total cases across Africa were just under 8.7m (as of 24 November 2021), with 222,610 deaths. Active cases stood at 396,822, with 1,888 critical cases. Outside of South Africa, where Grit does not invest, total cases were 5.7m and 132,953 deaths. In comparison, North America has had 58.6m cases and 1.2m deaths and Europe 71.7m cases and 1.4m deaths. On a per capita basis, Africa had less than one case per 100,000 people on 24 November 2021, compared to 26 in North America and 47 in Europe.

The vaccination rate across Africa has been disappointing, however. According to the World Health Organization, by the end of July 2021 just 79m COVID-19 vaccine doses had arrived in Africa and 21m people, or just 1.6% of Africa’s population, were fully vaccinated. High-income countries have given 61 times more doses per person than low-income countries. It is clear that it will take time for countries in Africa to demonstrate the level of vaccination that has been experienced in developed countries. Despite this, economies are opening up in Africa.

In Mauritius, where Grit owns four hotels, the borders opened fully from 1 October 2021 and Grit expects the island’s hospitality sector to return to normal operations during the current tourist season. Both of Grit’s Mauritian hospitality tenants have received strong government support, including cash flow support during the pandemic (details on Grit’s portfolio and tenants is on page 15). Regular flights to and from Senegal will resume from early December 2021, allowing the Grit-owned Club Med Cap Skirring resort, to resume operations.

Improving vaccination rates in both Europe and on the African continent should facilitate a return to more normal levels of trading and travel across the continent, which will assist in the recovery of domestic economies. Grit says it expects this to result in a normalisation of risk premia and discount rates applied on its assets by valuers.

Grit says that footfall across its retail assets has shown steady improvement, most notably in AnfaPlace in Morocco where current footfall statistics are 20% above pre-2019 redevelopment levels. Vacant retail space has been let, although on inferior rental terms to pre-COVID, which has resulted in Grit’s vacancy rate reducing to 5.3% at 30 June 2021 (from 8.0% at 31 December 2020).

Despite some encouraging signs of retail recovery, the pandemic has accelerated structural challenges in the retail sector and Grit is now looking to reduce its exposure to retail, primarily through the sale of assets (more detail on page 8).

Impact on hospitality minimalised

COVID-19 has severely impacted the economy of Mauritius after the borders were closed and tourist arrivals halted in March 2020, bringing the country’s vital hospitality sector to a complete standstill. The impact on Grit has been minimised by government-backed financial support afforded to hotel operators. This includes:

- COVID Bill. The Bill provided tenants with the ability to defer all rental payments to landlords from April 2020 to August 2020, encouraging tenants not to cancel leases due to inability to pay rent. However, such tenants were also bound by law to repay any rental deferments by no later than 31 December 2021;

- Cashflow support through the Mauritius Investment Corporation (MIC). In May 2020, the government announced a US$1.5bn support program run under the control of the central bank in a new vehicle called the Mauritius Investment Corporation. The cashflow support is provided to qualifying companies by means of a bond over a period of up to nine years at preferential interest rates. The bonds are convertible to equity at the end of the term should they not be redeemed. Key terms of the MIC program include the requirement to make, amongst other things, rental payments and not to alter the terms of material contracts, thus providing significant comfort to landlords;

- Wage subsidy scheme. The Mauritian government instituted a wage subsidy to assist operators in paying their work force. All salaries up to MUR25,000 per month in the tourism sector were paid for by government until the end of December 2020. The full amount is to be repaid to government only to the extent that the operators have taxable income in the next financial year; and

- Waiver of land leases. As all hotels are on leasehold properties, the government has waived all the land lease charges for 12 to 24 months.

Offices, corporate accommodation, light industrial

Offices, corporate accommodation and light industrial, which combined accounts for just over half of Grit’s overall portfolio value, have performed strongly during the pandemic. As mentioned earlier, the working from home trend has been less of an issue in Africa due to a lack of supporting infrastructure, such as inadequate internet connection, intermittent power supply and a lack of office infrastructure.

Grit’s corporate accommodation and light industrial portfolios have shown robust performance over the pandemic period. The valuation of the corporate accommodation assets, which make up 14% of the wider portfolio by value, was down 9.7% since the end of 2019 to June 2021, mainly due to one asset where the tenant has indicated it is leaving (more details on page 18). The light industrial portfolio, which accounts for 5.3% of the portfolio, has seen a 3.5% rise in value in the same period and a 7.3% uplift in the year to 30 June 2021.

Potential fund raise

Grit announced on 22 November a proposed open offer and placing of up to 414,647,283 new ordinary shares in the company at US$0.52 per share to raise up to US$215.6m. The open offer is being made on the basis of 1.3011 new ordinary shares for every one existing share. The issue price represents a premium of around 4% to Grit’s average closing price across the LSE and SEM on 19 November (LSE: £0.3468; SEM: US$0.53).

It should be noted that while this issue could be potentially NAV dilutive if existing shareholders do not elect to participate in the fund raising, the offer has been constructed in such a way as to try and protect existing shareholders’ rights as much as is practically possible. Furthermore, if all existing shareholders elect to take up their rights there will be no dilution (we discuss this further on page 12). Grit’s EPRA NRV is estimated to fall to around US$0.715 per share on a pro-forma basis if the issue is fully subscribed. Grit says that it expects the EPRA NRV to recover to around its 30 June 2021 level of US$1.024 in two years.

Deployment plans

As mentioned earlier, the difficult operating environment brought about by COVID-19 has directly impacted on Grit’s retail and hospitality assets (the value of its office, light industrial and corporate accommodation assets have held up well during the pandemic), which has resulted in significant asset valuation falls and in turn a direct impact on the group’s LTV metrics. At 30 June 2021, the LTV was 53.1%, well above its target of 35% to 40% and close to breaching its lowest applied LTV debt covenant of 55%.

Whilst the group has focused on LTV-enhancing factors within its control – including cost management (with a significant reduction in operating and administrative costs), stabilising revenues, managing collections and vacancies and extending debt maturities – it said the proceeds from the raise would be used to reduce overall borrowings and provide capital for the acquisition of a controlling stake in development company Gateway Real Estate Africa (GREA) and its external management company Africa Property Development Managers (APDM).

Reducing debt and asset recycling

Grit’s portfolio valuation has fallen by 14.2% (or US$114m) on a like-for-like basis since 31 December 2019, pushing up the LTV to 53.1%. Part of the capital raise would be used to reduce borrowings. The group proposes to use a portion of the proceeds on repaying debt, depending on how much is raised (a detailed look at Grit’s debt profile is on page 20).

The group will look to further reduce its debt through an asset recycling programme. It will look to sell 20% of its portfolio (worth US$755.9m at 30 June 2021) by the end of 2023 at, or as close as possible to, the most recent valuations and use the proceeds to pay down debt. It is in an exclusivity period with a buyer for the sale of its largest retail asset, AnfaPlace Mall, for around US$80m and it says further disposal announcements are expected in due course. The sale of AnfaPlace Mall would reduce the LTV by around 2%, the group estimates.

Although it is not counting on it, the group believes that the depressed valuations of its retail and hospitality assets will recover in time, further aiding the LTV recovery. Over the medium term, the group states that valuation (and NAV) growth prospects will be improved with the proposed acquisition of GREA and further future pipeline investment opportunities.

Acquisition of GREA and APDM

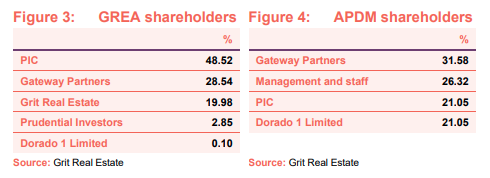

Grit currently owns a 19.98% stake in GREA and proposes to increase this to a controlling majority interest of 51.66%. It will also use the proceeds of the raise to acquire a direct majority stake of 78.95% in APDM.

GREA, which was co-founded by Grit in 2018, secured US$175m of equity commitments from its four principal shareholders – Grit, Public Investment Corporation of South Africa (PIC), Gateway Partners and Prudential Investors. It provides development and construction services in selected African countries for multinational companies. Rather than having the traditional developer mantra of buying land, obtaining planning permission then securing a tenant, the group partners with multinational companies looking for real estate solutions in Africa and secures land in conjunction with them – thereby negating any letting risk.

GREA was established together with APDM, its external management company, to which it outsources the implementation and management of its investment mandate in return for development and asset management fees. Its management fee is 1.5% of gross asset value. APDM also generates significant additional fee income through the provision of development and asset management services to a range of third-party clients.

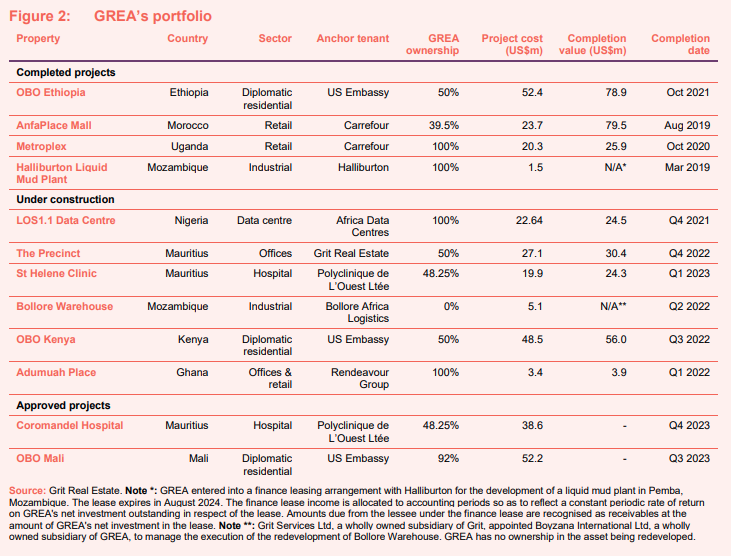

GREA, through the APDM team, has secured an accretive pipeline of development opportunities, most notably providing the United States Bureau of Overseas Buildings Operations (OBO) with embassy housing across Africa and developing data centres for leading IT services and solutions providers. GREA has a portfolio of 12 projects across nine countries in various stages of development (details of which are set out in Figure 2). In addition, GREA holds a 46.55% interest in Acacia Estate, a 76-unit housing complex in Maputo, Mozambique let to the US Embassy and the oil and gas company Total.

As at 30 June 2021, GREA had unaudited net assets of US$193m. Since that date, GREA has completed the OBO US Embassy compound in Ethiopia and Grit calculates GREA’s unaudited net asset value will be around US$197.2m by 31 December 2021 (the agreed date of the proposed acquisition). Grit estimates that the net asset value of GREA’s portfolio on completion of all the developments by the end of 2023 will be US$280m.

The main attraction of GREA’s development pipeline is its tie-up with the US embassy through OBO. It currently has three OBO-let assets in various stages of development and has a further pipeline worth around US$100m across other African countries. The OBO Ethiopia corporate accommodation tower is a co-development and equity partnership between US-based Verdant Ventures and GREA. It comprises 112 units and is located in Ethiopia’s capital city, Addis Ababa, which hosts over 130 diplomatic missions and is the third largest diplomatic community in the world behind Washington DC and Brussels.

The OBO Kenya diplomatic housing project in Nairobi comprises 90 diplomatic apartments and townhouses. It marks GREA’s first development in Kenya and a second development in conjunction with US based developer, Verdant Ventures. With over 80 foreign diplomatic missions coupled with a growing international investor base, Grit says that there is a strong demand for diplomatic level, high security residential communities in Nairobi.

The OBO Mali diplomatic housing project, located in Bamako, is less than a kilometre from the US government embassy. GREA is to take part in the development of turnkey units in partnership with OCCEL Engineering, a contracting and development company in Nigeria. The project consists of the development of a 45-unit diplomatic residential complex consisting of a multi block mid-rise complex with high security requirements. The US Government will occupy 100% of the premises.

As well as the further pipeline of diplomatic accommodation projects lined up with OBO across the continent, GREA has a handful of data centre assets and industrial developments in its development pipeline.

Acquisition details

GREA has recently called for the final payment from its shareholders under the original US$175m equity commitment (Grit’s contribution being US$17.9m). It is also putting in place funding for the next stage in its development. Should Grit not meet its capital commitment it will be diluted under the terms of the shareholders’ agreement and could be forced to sell its remaining interest in GREA.

As well as making its capital contribution, Grit believes that taking a controlling stake in GREA (and its manager APDM) would see it benefit from the fully funded pipeline of opportunities over the next three years, which would be significantly NAV-enhancing in nature. Grit has agreed to purchase all of the shares held by:

- Gateway Partners in GREA (28.54%) and APDM (31.58%);

- Dorado 1 Limited (which is 50% owned by Grit chief executive Bronwyn Knight and 50% owned by GREA chief executive Greg Pearson) in GREA (0.1%) and APDM (21.05%); and

- the GREA executive team in APDM (26.32%).

Grit will pay Gateway Partners US$71.5m for its combined shareholdings in GREA and APDM. It will pay Dorado 1 Limited just under US$5.4m and the GREA management team US$3.7m. All being payable in ordinary shares in Grit. The total payable by Grit for the acquisition of GREA and APDM is US$80.6m.

The Dorado and GREA management team share purchase agreements constitute smaller related party transactions (as defined in the Listing Rules) due to the direct and indirect interests in GREA and APDM held by Bronwyn Knight (a director of Grit and a director of Dorado 1 Limited) and Greg Pearson (chief executive of GREA, in which Grit owns a 19.98% interest, and a director of Dorado 1 Limited). The consideration payable (directly and indirectly) to Bronwyn Knight is US$2.69m and Greg Pearson US$4.8m. As noted above, these transactions will also be settled in Grit ordinary shares.

Under the terms of the proposed acquisition, Grit will become the holding company of the enlarged group, incorporating GREA and APDM. The PIC will maintain its investment in GREA, APDM and the enlarged group (it already has an existing shareholding in Grit of 25.5%).

If the issue is fully subscribed and following the completion of the proposed acquisition, Grit says that its LTV ratio will fall from 53.1% to a pro forma level of 33.6%, due to the larger portfolio (estimated pro-forma value of US$869.2m) and the pay down of debt. The asset recycling strategy, mentioned earlier, is expected to further reduce the LTV ratio by around 3% by June 2023.

Grit believes the benefits of acquiring GREA and APDM include:

- a material acceleration in the group’s ability to access development returns from risk-mitigated development projects;

- the delivery of strong NAV growth over the next 24 to 36 months as projects are completed;

- access to an extensive further pipeline of OBO (US diplomatic housing) and data centre development opportunities that are accretive to NAV and offer exposure to highly-rated tenants that underpin future income levels;

- cements a key strategic relationship with Africa’s largest pension fund, PIC, as co-investor into GREA;

- the potential for new revenue and fee income streams from its clients and other third parties through APDM;

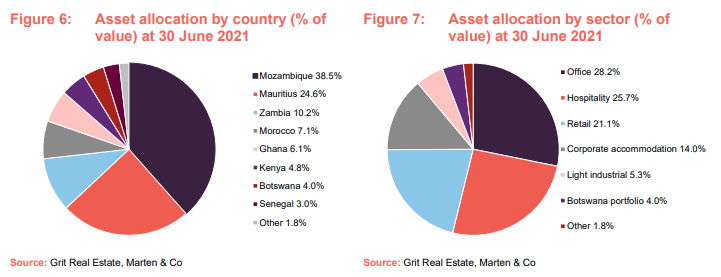

- diversifying the group’s geographic exposure (in particular reducing the company’s current overexposure to Mozambique, which at 30 June 2021 stood at 38.5%);

- a material reduction in consolidated LTV due to GREA’s current low leverage, leading to the potential for a debt restructure including the possible issuance of a corporate bond in the near future, extending the maturity profile and reducing the cost of debt;

- an expected increase in Grit’s total targeted shareholder return over time from 12% to between 13% and 15% per annum;

- the resumption of dividend payments (with a target to pay 5 to 6 US cents per share for the financial year to June 2022);

- cost savings through the elimination of dual cost structures.

Details of the open offer and placing

The open offer is being made to all existing shareholders on a proportionate basis to their current shareholdings and the issue of new ordinary shares in the placing will only be in respect of those not taken up by shareholders in the open offer. If 100% of qualifying shareholders elect to take up their open offer entitlement, then no new ordinary shares will be placed.

Grit says that it has received commitments from existing shareholders and new investors for more than US$65m and it expects to raise a minimum of around US$145.6m (assuming those indicative commitments are met and the full consideration for the proposed acquisition of US$80.6m is satisfied by the issue of new ordinary shares), representing 67.5% of the total issue.

The deadline for final applications for the open offer for existing shareholder is 15 December 2021, whilst the placing will close on 17 December 2021.

Dilution

Qualifying shareholders that take up their full open offer entitlement will not suffer any dilution to their ownership and voting interests in the company. Qualifying shareholders that do not take up any of their open offer entitlement and shareholders that are not eligible to participate in the open offer will suffer a dilution of between around 27.4% (if US$65m was raised) and around 55.6% (if US$215.6m was raised) to their ownership and voting interests in the company.

Grit’s largest shareholder, the PIC, is understood to be comfortable for around half of their 25.5% shareholding in Grit to be diluted and distributed to new shareholders, recognising that its shareholding is too large.

Costs and expenses

The total costs, charges and expenses payable by Grit in connection with the proposed acquisition, the issue and admission are expected to be around US$10.4m.

Investment process

Grit’s investment strategy centres around being the long-term real estate partner for multinational corporate companies operating in Africa. Multinational corporate companies, such as Total and Vodacom (Vodafone in the UK), have tended to own their own real estate in Africa because of a lack of trusted real estate partners. However, due to its corporate governance structure and balance sheet, Grit has become the real estate partner of choice for many multinational companies. These companies often trade in hard currencies, which support US$ or euro leases.

Grit is agnostic as to property asset classes and instead is driven by the real estate needs of its multinational company tenants. It owns offices, corporate accommodation, retail, warehousing and hospitality resorts. Grit ensures its lease covenants are signed by the parent company, or backed by a parental guarantee or counterparty, which heavily reduces the risk of default.

Grit will only operate in jurisdictions it regards as safe, where it has the ability to move money into the country and repatriate money to Mauritius and where there is no risk of expropriation of funds. Consequently, countries such as Algeria and Angola should not feature in the portfolio. Countries that have challenges around land ownership are also avoided. The company favours countries where it has boots on the ground and where debt can be secured at relatively inexpensive rates (compared to others across the continent).

Characteristics of target countries include:

- stable governance/political maturity;

- strong inflow of foreign direct investment;

- hard currency-based economies;

- sustainable high economic growth rates, with acceptable GDP/spending power per capita;

- natural synergies with the European tourism and local retail market;

- strong urbanised and youthful middle class;

- acceptable sovereign ratings and outlook by ratings agencies;

- solid economic fundamentals;

- favourable policy reform; and

- a clear tax regime.

It aims to have half the portfolio invested in investment grade African countries, such as Morocco, Botswana and Mauritius, and no more than 30% of gross assets exposed to one country (although it is currently overweight in Mozambique, which makes up 38.5% of the portfolio by value).

When looking at investment opportunities, the company puts a high degree of importance on return on equity (ROE) over the property yield. This means tax leakage and other administrative costs when returning money back to Mauritius is a significant factor in acquisition appraisals. Its target ROE on acquisitions is 8.5% and above, which improves to double-digit returns when borrowings are applied.

Risk mitigation

Grit mitigates operational and other risks associated with African real estate investments through the following measures:

- Country risk. Pre-determined/approved selection of target jurisdictions, which satisfy key investment criteria;

- Repatriation risk. Comprehensive understanding of regulations surrounding repatriation of funds and robust relations with local central banks;

- Currency risk. Prioritisation of assets with US$ or combined US$/euro denominated leases and tenants with hard currency revenues;

- Tenancy risk. Prioritisation of long-term leases with blue-chip multinational tenants, supported and strengthened by parent company guarantees;

- Operational risk. Detailed pre-investment assessment of the ease and cost necessary to ensure the functional operation of the asset, and the selection of reputable, experienced in-country partners and property managers;

- Over-exposure risk. A defined diversification strategy, with strategic limits in place related to any or a combination of the following factors:

- size and value of any single investment; and/or

- country level; and/or

- sectoral level; and/or

- exposure to any single tenant; and

- Political risk: Political risk insurance (PRI) – covering all of the group’s overseas operating jurisdictions – taken out to cover US$ liquidity and expropriation of funds, providing additional layers of protection against repatriation risk.

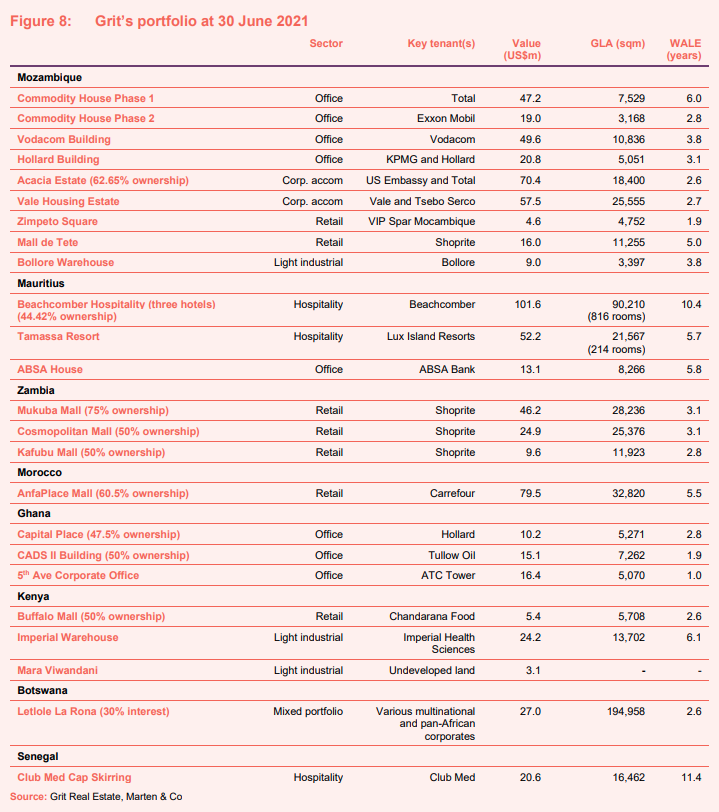

Current portfolio

Grit’s current portfolio consists of 54 assets located across eight countries and five asset classes, valued at US$755.9m, reflecting a net initial yield of 7.3%. The group’s portfolio has a 5.3% vacancy rate and a weighted average lease expiry (WALE) of 4.8 years. The vast majority (90.9%) of income is underpinned by a wide range of blue-chip multinational tenants across a variety of sectors and has a weighted average contracted lease escalation of 3.8% per annum. Rents are predominantly collected monthly, of which 92.7% are collected in US$, euro or pegged currencies.

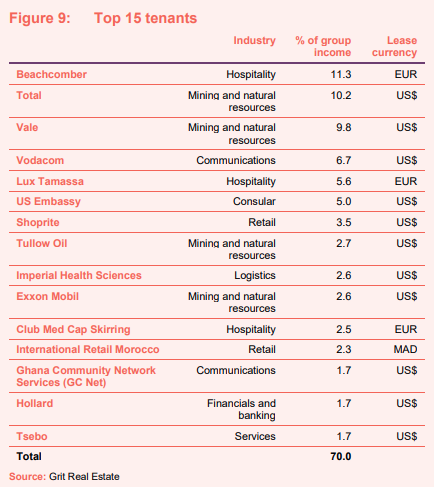

Top 15 tenants

Beachcomber / Lux

The two Mauritian hospitality groups in Grit’s portfolio, Beachcomber and Lux, account for 16.9% of total group income combined. Grit does not take any risk associated with the hotel operation through triple net leases, whereby the tenant bears all costs associated with the assets. The creditworthiness of the lease covenants are strong, with both companies’ parents being large conglomerates. As detailed earlier, both companies have received significant support from the Mauritian government to see them through the pandemic. In terms of rent receipts during the crisis, both operators have resumed rental payments to Grit. Lux is up-to-date on all lease commitments, including the collection of deferred rent from 2020. Beachcomber was provided with cashflow deferrals of 50% of the monthly rental value between January 2021 and October 2021 – amounting to around US$10m, which Grit expects to collect over the next 48 months to December 2025.

Total

Oil and gas giant Total is Grit’s second largest tenant, making up 10.2% of income. The company occupies office space and corporate accommodation in Mozambique on leases to 2028 and 2024 respectively. Total’s Mozambique operations were significantly boosted by a US$15bn financing agreement to fund the construction of its liquefied natural gas (LNG) project. The site was the biggest natural gas find in the southern hemisphere in the last 50 years and is expected to take two and a half years to get to the production phase.

Vale

Brazilian mining giant Vale currently accounts for 9.8% of Grit’s income, through the leasing of Grit’s VDE Housing Estate corporate accommodation asset in Mozambique for a further two years. Vale announced in late January 2021 that it was consolidating its ownership of the Moatize mine and the Nacala Corridor infrastructure project, both in Mozambique, and divesting its coal assets ahead of a possible exit from Mozambique. The VDE Housing Estate has been heavily marked down by valuers and at 30 June 2021 was valued at US$57.5m (down 18.5% from US$70.6m in June 2020). Grit says that the quality of the asset and location to the mine gives it confidence in re-letting the asset on similar terms to another mining company, which would see the value recover.

Vodacom

Vodacom occupies a 10,659 sqm office in Mozambique and accounts for 6.7% of Grit’s income. Vodacom is one of the biggest telecommunications operators in Africa and has performed strongly through the COVID-19 pandemic, with the telecommunications sector benefiting from increased dependence on technology. Outside of its domestic market of South Africa, its customer base grew 10.1% to 42.5m in the six months to 30 September 2021 and the group posted a 9% increase in service revenue across international operations (which comprises Mozambique, the Democratic Republic of the Congo, Tanzania and Lesotho) to R10.7bn. A new stream of revenue for the business is mobile banking and its mobile banking platform, M-Pesa, now processes more than 15.2bn transactions a year in its African markets (outside of South Africa).

New acquisition

Grit has entered into a development contract with fast-moving consumer goods manufacturer Orbit Africa, which is the leading manufacturer of personal care and home care products for the East Africa region, that will see it refurbish the existing manufacturing plant in Kenya and develop a new 14,741 sqm extension facility.

The acquisition, on a sale and leaseback basis, of the existing 29,243 sqm warehouse and manufacturing facility is at a net acquisition yield of 9.60%. The facility will be leased back to Orbit Africa on a new 25-year US$-denominated triple net lease, with an option to extend the lease term for a further 10 years, and includes a contracted average escalation of 2% per annum. The transaction is targeted to complete in December 2021.

A further redevelopment and expansion of the existing facility will be undertaken from the second quarter of 2022, with expected completion in the fourth quarter of 2023, when it will be let on a new 20-year triple net lease at a contractual development yield of 16.0%.

The total expected investment in the combined acquisition and redevelopment is expected to be US$53.6m and will be funded through a US$25m senior debt facility from the International Finance Corporation (IFC), with the balance provided through a Grit issued perpetual preference note of up to US$31.5m. Grit says that it will invest the additional proceeds of the perpetual note into near-term growth opportunities such as the St Helene Clinic in Mauritius.

Performance

Following Grit’s conversion to a sterling quotation on the LSE in August 2020, we have converted its historic NAV and share price from US$ to sterling in Figure 14. Grit’s EPRA NAV had been consistent since it launched on the LSE in July 2018, but dived in June 2020 after reporting a 19.4% fall in EPRA NAV off the back of portfolio valuation write downs. Grit’s share price rose initially, but started to fall in the second half of 2019 and plummeted following the outbreak of COVID-19 in early 2020. Its share price has tailed off further as the pandemic continues to have a significant impact on its portfolio.

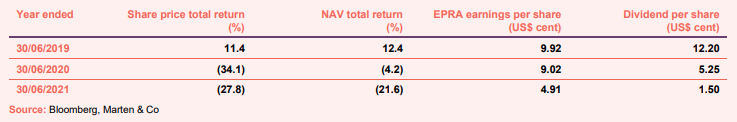

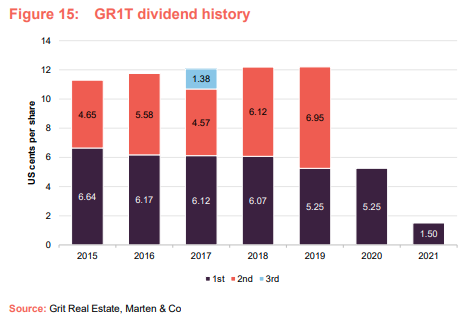

Dividend

Grit has historically had one of the largest dividend yields of property companies listed on the LSE, and in 2019 paid 12.20 US cents per share – a 10.3% dividend yield on its 31 December 2019 share price. The company declared and paid a dividend for the first half of its 2020 financial year (1 July 2019 to 31 December 2019) in line with the previous year, but due to slower rent collections as a result of COVID-19, the board decided to suspend its dividend in the second half of the year. The group declared an interim dividend of 1.50 US cents per share for the first half of its 2021 financial year, but again decided against recommending a final dividend for the financial year ended 30 June 2021, reflecting the board’s caution against a backdrop of the global COVID-19 pandemic. However, the board expects that dividends will be back to normal levels (at least 80% of distributable earnings) in time following the issue and proposed acquisition and is targeting paying a dividend in the current financial year of between 5 to 6 US cents per share.

Premium/(discount)

Grit had fluctuated between trading at a slight premium and a slight discount for much of its first full year on the LSE before its discount widened during the course of the second half of 2019. The discount widened further on the outbreak of COVID-19 at the start of 2020. It narrowed as the clean-up of its corporate structure took place but widened again as the impact of COVID-19 on its retail portfolio continued to weigh heavily. At 2 December 2021 the discount stood at 53.9%.

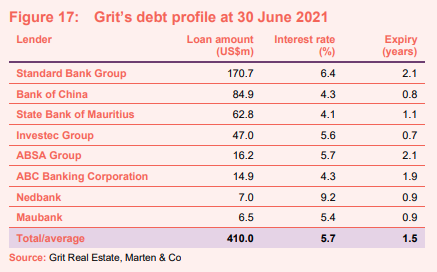

Borrowings

Grit currently has total borrowings of US$410.0m, as at 30 June 2021, across eight different lenders, with an average cost of debt of 5.7% and an average maturity of 1.48 years. Grit recently secured maturity extensions for the bulk of its debt to beyond April 2023, extending its average maturity to 1.83 years. If the capital raise is successful, Grit plans to secure and lock-in longer-term, more cost-effective debt funding through a consolidated debt strategy (including a potential bond issue). Figure 17 shows Grit’s debt profile at 30 June 2021.

The group will take on more debt on the completion of its acquisition of the Kenya asset, as detailed on page 18. The US$25m loan provided by the IFC carries a tenure of eight years; of which the first three years are provided under a capital repayment moratorium. The facility has an interest rate of 5.75% per annum above six-month LIBOR.

A perpetual preference note is expected to be issued in early December 2021 to further finance the Kenya acquisition. The principal amount of the note is up to US$31.5m, with US$27.5m to be issued initially. The note will be treated as equity for IFRS accounting purposes and has a cash coupon of 9% per annum and a 4% per annum redemption premium. The yield of the note up to the fifth anniversary will be floored at 13% per annum and capped at 16% per annum. Although it has no fixed maturity date, the note carries a material coupon step-up provision after the fifth anniversary, which is expected to result in Grit redeeming the note on or before the fifth anniversary. The note has a further potential maximum 3% per annum return which is linked to the performance of Grit’s share price over the duration of the note.

The management team

Following completion of the proposed acquisition, the APDM management team will join Grit. GREA’s chief executive (and co-founder of Grit) Greg Pearson will join Grit as chief investment officer and remain as chief executive of GREA. GREA’s chief financial officer Krishnen Kistnen will remain in that role at GREA in the enlarged group. The following are key members of Grit’s senior management team.

Bronwyn Knight

Bronwyn is the chief executive officer of Grit. She played an instrumental role in the JSE listing of Delta Property Fund Limited in 2012, where she held the positions of chief financial officer and chief operating officer prior to taking up the leadership role at Mara Delta Property Holdings. During her tenure at Delta Property Fund Limited, Bronwyn spearheaded the diversification of the REIT’s funding sources in the debt capital markets, leading to the establishment of a ZAR 2 billion Domestic Medium Term Note Programme (DMTN Programme). In addition, Bronwyn co-headed the team responsible for growing assets under management from ZAR 2.2 billion at listing to ZAR 11.8 billion in May 2016. She is a founder member and served as non-executive director on the board of Mara Delta Property Holdings Limited (now Grit) where she played a significant role in the listing and conversion of the fund to its current pan-African focus, underpinned by dollar based leases. She assumed the role of chief executive officer in the lead-up to the fund’s merger with Pivotal to form Mara Delta. She has grown the portfolio from $220m at inception to around $800m currently. In November 2019, Bronwyn was awarded the 2019 EY World Entrepreneur Award – Southern Africa.

Leon van de Moortele

Leon is the chief financial officer of Grit. He has served in the global risk management services team within PwC, where he became the senior manager in charge of data management. He is a chartered accountant and also holds an Honours Degree in Accounting Science. In 2004, Leon moved to Solenta Aviation, where he became group finance director during which time the group expanded from 12 aircraft to 48 aircraft, operating in eight African countries. Leon joined Grit in April 2015 as chief financial officer, where he has continued to utilise his tax structuring knowledge and experience in operating in Africa to expand the asset base of the group.

Moira Van Der Westhuizen

Moira is the chief operating officer at Grit. She joined the company in May 2016, originally as the chief integration officer and has over 20 years of experience in finance, business and auditing, which includes running her own business. In 2005 she was appointed audit partner in an audit and accounting practice, and in 2008 moved to Mauritius to work for Investec Bank and later the CCI Group as the group financial controller

Greg Pearson

Greg co-founded Grit with Bronwyn. He was previously head of Africa for AECOM, the US listed infrastructure firm, where he established many of his client relationships with multinational companies operating across the African continent. Greg was instrumental in sustaining Grit’s rapid growth from its inception in 2014 through to 2018, when he left to focus his attention on GREA. He has since successfully completed a series of developments across the office, retail, leisure, education and healthcare sectors.

Darren Veenhuis

Darren is chief strategy officer at Grit. He joined Grit in October 2018 and heads the group’s strategy and capital markets function. A former director and head of CEMEA equity sales at Deutsche Bank (London), he successfully led the distribution of numerous initial public offerings, block trades and secondary market trading activities across local emerging market and London Stock Exchanges. Prior to joining Deutsche Bank in 2006, Darren worked in structured syndicate at JP Morgan (London) and Ernst & Young in both London and South Africa. Darren is a qualified Chartered accountant and a CFA Institute Charter Holder.

Previous publications

QuotedData has published two previous notes on Grit – Africa, substantially de-risked and On the path to recovery. You can read them by clicking the links.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Grit Real Estate Income Group.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.