On the path to recovery

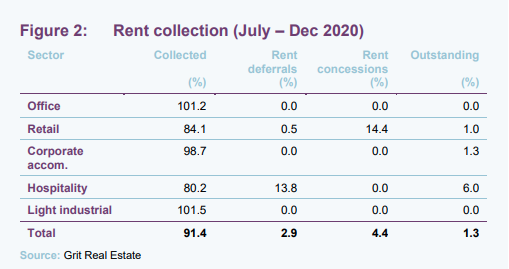

Despite significant headwinds caused by the COVID-19 pandemic, Grit Real Estate Income Group (Grit)’s diverse portfolio has proved resilient, with rent collection rates of 91.4% and a slight recovery in property valuations. Buoyed by the performance of its offices (the group’s largest sector exposure), corporate accommodation and industrial portfolios, plus its consistently strong rent receipts, the group has reinstated its dividend, albeit at a lower level than pre-pandemic.

Strong tenant covenants and positive state intervention have mitigated the impact on its hospitality holdings, while asset recycling has significantly brought its retail exposure down.

A consolidation of its corporate structure, which has seen it move corporate domicile from Mauritius to Guernsey, a step up to the Premium listing segment of the London Stock Exchange and conversion to a sterling quotation should facilitate Grit’s inclusion in the FTSE indices and improve liquidity in its shares.

Pan-African real estate

Grit is a pan-African real estate company that invests in and actively manages a diversified portfolio of assets in selected African countries (excluding South Africa). It aims to deliver strong and sustainable income for shareholders, with the potential for income and capital growth, and is targeting a net total shareholder return inclusive of NAV growth of 12.0% per annum.

Results for six months to December 2020

Grit reported a 6.3% increase in EPRA net reinstatement value (NRV – one of the new EPRA reporting metrics for property companies replacing EPRA net asset value (NAV)) over the six months to the end of December 2020. This increase (from US$1.171 to US$1.244) was primarily down to currency movements positively impacting property valuations.

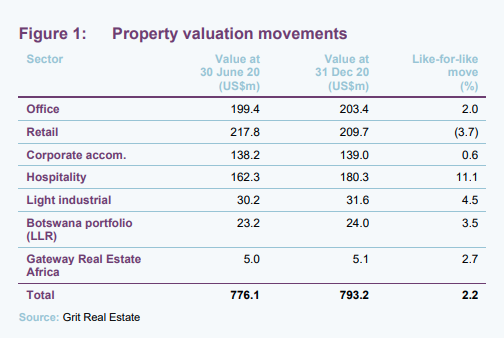

Total income producing assets were valued at US$849.2m (June 2020: US$823.5m), with like-for-like property values rising by 2.2%. The group’s retail properties fell in value by 3.7% as that sector continues to experience headwinds. All other sectors (office, hospitality, corporate accommodation and light industrial) saw valuation gains in the period. The like-for-like increase in the value of Grit’s hospitality assets was largely down to the euro’s performance against the dollar.

Gross rental income was flat, at US$31.6m for the period, while adjusted EPRA earnings per share was down 44.2% to US$3.16 cents per share. Rent collection for the period was 91.4%, with office and light industrial achieving above 100% collection rates (predominantly as a result of timing of recoveries from tenants), as shown in Figure 2.

The relatively strong rent collection figures have enabled Grit to reinstate its dividend and declare an interim dividend of US$1.5 cents per share for the period. The board also said it aims to pay a one-off quarterly dividend in 2021, dependant on sustained strong cash collections and continued progress on reducing the group’s loan to value (LTV) ratio.

Group LTV reduced to 49.3% from 50.2%, as a result of part asset disposals and reductions in debt balances. The LTV is expected to fall further over the coming months towards the group’s near-term target of 45%.

Pathway to recovery

The first thing to note is the relatively low prevalence of COVID-19 in Africa. Perhaps due to the continent’s battle-hardened experience of and approach to diseases, the COVID-19 pandemic has been less harshly felt in Africa compared to most of the rest of the world. According to Worldometer, total cases across the continent were just under 3.8m (as of 16 February 2021), with 99,545 deaths. Active cases stood at 364,574, with 2,417 critical cases. Outside of South Africa, where Grit does not invest, total cases were 2.3m and 51,232 deaths. In comparison, the US has had 28.4m cases and 499,991 deaths and Europe 32.5m cases and 774,196 deaths.

Despite the relatively low prevalence of COVID in the jurisdictions where it owns property, Grit has been heavily impacted by the pandemic, with two of its largest asset class exposures (retail and hospitality) taking the brunt of state-imposed restrictions to limit the spread of the virus. Through intensive asset and portfolio management and corporate structure improvements, the company has set out a clear pathway to recovery.

Hospitality

Grit’s hospitality exposure is through the ownership of five hotels: four on the island of Mauritius and one in Senegal. The four Mauritian hotels (three let to Beachcomber and one to Lux) are let on triple net leases, which means that the tenant bears all costs associated with the assets and absolves Grit of any of the hospitality risk. The values of the hotels are therefore strongly related to the underlying credit quality of the tenant.

Beachcomber and Lux are both owned by large Mauritian conglomerates – ENL Group and IBL respectively – that own broad, diversified portfolios. Both groups have been beneficiaries of significant government legislative and stimulus programmes. All hospitality operators have received wage subsidies (around 35%-40% of their operating costs) and afforded the postponement of land rents (4%-8% of operating costs). The Mauritian government owns the land and beaches of many of the resorts on the island and gave 12-month lease concessions on their land. Legislation was also brought in that enforced rent concessions to Mauritian hospitality operators. Beachcomber resumed partial rent payments from August 2020, while Lux was fully paid up to the end of 2020.

In addition, both New Mauritius Hotel (NMH), owner of Beachcomber, and Lux Island Hotel Group have been key recipients of a government-backed financial stimulus package. A private limited company fully owned by the Bank of Mauritius, The Mauritius Investment Corporation (MIC), was formed to assist systemically large, important and viable corporations that were financially distressed as a result of the pandemic. The MIC invests in companies through a number of investment tools including equity and quasi-equity instruments.

NMH has received an indicative MIC funding package worth 2.5bn Mauritian rupees (around £45.7m), while Lux has received 1bn Mauritian rupees (around £18.3m). It is a pre-requisite that the funding is used to pay Mauritian creditors, which Grit is. The manager says this has provided it with sufficient comfort that despite impaired trading conditions, and even on the assumption that borders do not meaningfully open before 2022, these groups have sufficient liquidity and working capital to continue servicing their rental obligations to Grit and it will be able to collect deferred rent over the next year or two.

Despite the island’s being shut to international visitors for almost a year, Grit’s Mauritius hotels valuation in the six months to the end of 2020 was broadly flat, with an increase of 11.1% mainly due to the euro’s performance against the dollar. The hotels have remained operational throughout the period, with three of them used as quarantine facilities at the start of the pandemic (for which the government covered the cost). Two of the hotels are still being used as quarantine facilities, while the other two are open and operating for domestic use, with weekend occupancy rates particularly strong at around 90%.

Once international travel returns, the manager is confident that tourists will return to the island in great numbers. The island is considered to be relatively COVID-free, with a combination of an early and hard lockdown at the onset of the pandemic and high compliance rates resulting in very few cases among the 1.2m population. The country started its vaccination programme in late January 2021, with health workers and hospitality workers prioritised.

Borders have reopened but visitors are subject to a mandatory quarantine period in specified hotels (which include two of Grit’s hotels). The government is set to make an announcement in March 2021 on whether or not to lift the mandatory quarantine.

Grit’s Senegal asset, Club Med, has been closed during the pandemic and with the monsoon season resuming in April 2021 for five months, re-opening is currently targeted for the fourth quarter of 2021. All rent due up until December 2020 has been fully paid and a minimum of 50% of contracted rent will be paid until the resort reopens.

Retail

AnfaPlace Mall, in Morocco, has been the most affected asset in Grit’s property portfolio by some distance. The timing of the pandemic could not have been worse for the company, with the mall having recently undergone a refurbishment and Grit in the process of letting up the new vacant space. Lockdown resulted in delays to the start date of previously-agreed tenancies and negotiations with prospective tenants ending. The vacancy rate at the shopping centre has increased to 27.3%, as at 31 December 2020.

The company has forecast letting of the vacant space will take 18 months. As part of Grit’s existing strategy to reduce retail exposure, it sold a 39.5% stake in AnfaPlace, which reduced its exposure to the retail sector to below 25%.

Grit’s wider retail portfolio comprises two main categories – enclosed malls (which AnfaPlace falls under) and convenience open-air ‘strip malls’. Grit’s strip malls, located in Mozambique, Zambia and Kenya, are anchored by supermarkets and other service retailers, such as banks, that have been able to trade throughout the pandemic and have fared well.

The overall impact of rent concessions and vacancies on income saw the value of its retail portfolio fall by 3.7% in the six months to 31 December 2020.

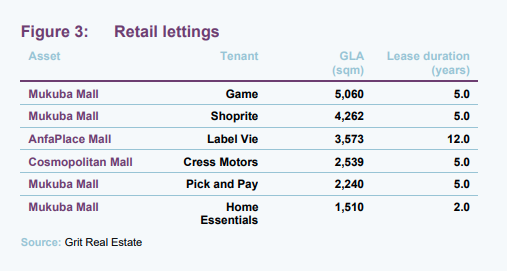

Despite the headwinds in the retail sector, Grit did complete a number of new lettings across its retail portfolio in the last six months totalling 19,184 sqm of space, as shown in Figure 3.

Solid performance in office, industrial and corporate accommodation portfolios

The rest of Grit’s property portfolio – which, combined, accounts for 52.4% of the overall portfolio value – has performed strongly during the pandemic.

The office sector in developed economies is going through a state of flux, with enforced working from home during lockdown expected to result in more flexible working practices and less space requirements. That is not likely to be an issue in Africa due to a lack of supporting infrastructure, such as inadequate internet connection, intermittent power supply and a lack of office infrastructure. In fact, across Grit’s offices, which accounts for 27.7% of the portfolio by value, employees have returned to the office en masse, with strict COVID-19 protocols in place. The office portfolio increased in value by 2% in the second half of last year, off the back of strong rent collection figures of over 100% for the final six months of 2020 (some office tenants have paid yearly rent upfront).

Grit’s corporate accommodation and light industrial portfolios also showed robust performance. The valuation of the corporate accommodation assets, which make up just over 15% of the wider portfolio by value, was stable at 0.6% growth, with rent collection figures of 98.7%. The light industrial portfolio, which accounts for 4.1% of the portfolio, saw a 4.5% rise in value and had a rent collection rate of over 100% (again, due to pre-payments).

It is likely that Grit will look to dilute its exposure to retail further in favour of the industrial and corporate accommodation sectors given the contrasting performances of the portfolios.

Strengthened balance sheet

Grit has declared that it wants to maintain an LTV ratio below 45% going forward, and has a medium-term target of 35%–40%. The group LTV is currently 49.3%, which Grit expects to reduce to towards 45% by the end of its financial year in June 2021. To achieve this, values will need to continue to stabilise and the manager will need to work through some progressive asset recycling to support NAV growth, as well as debt repayments. The group disposed of minority stakes in AnfaPlace (as mentioned earlier) and a corporate accommodation asset and is in negotiations to sell other non-core assets. It has also stated that it is selectively pursuing NAV accretive acquisitions and developments through various funding models.

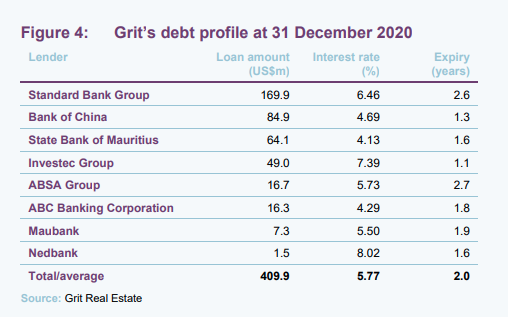

As a precaution, the group increased the headroom within its debt covenants for a period of 18 months last year, with the group’s lowest enforced LTV covenants increasing from 53% to 55%. Grit has total debt of US$409.9m, as at 31 December 2020, across eight different lenders, with an average cost of debt of 5.77% and an average maturity of 2.0 years. Figure 4 shows Grit’s debt profile.

On top of cost-saving measures, which will permanently eliminate US$1.5m of annual costs, the group also withheld its final dividend payment last year to preserve liquidity, which saved around US$13m. Following strong rent collection figures, the board has resumed dividend payments and declared an interim dividend of US$1.5 cents per share. The board said that it is aiming to pay a further one-off quarterly dividend in 2021, dependent on continued progress on its LTV target and strong rent collection. Going forward, the group said that it is contemplating adjusting its dividend pay-out ratio to 70%–80% of earnings.

Enhanced listing structure

Grit has taken a number of steps to enhance its corporate structure with the ultimate aim of facilitating its inclusion in the UK FTSE Index series and improving liquidity in its shares. In the past few months, it has moved its corporate domicile from Mauritius to Guernsey, stepped up to the Premium listing segment of the London Stock Exchange and converted to a sterling quotation. The group also de-listed from the Johannesburg Stock Exchange last year, making the London Stock Exchange its primary listing.

Asset allocation

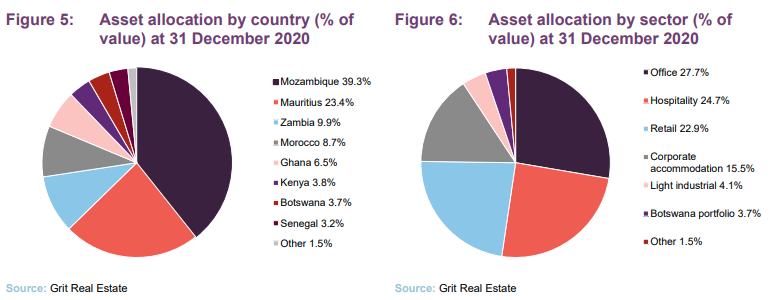

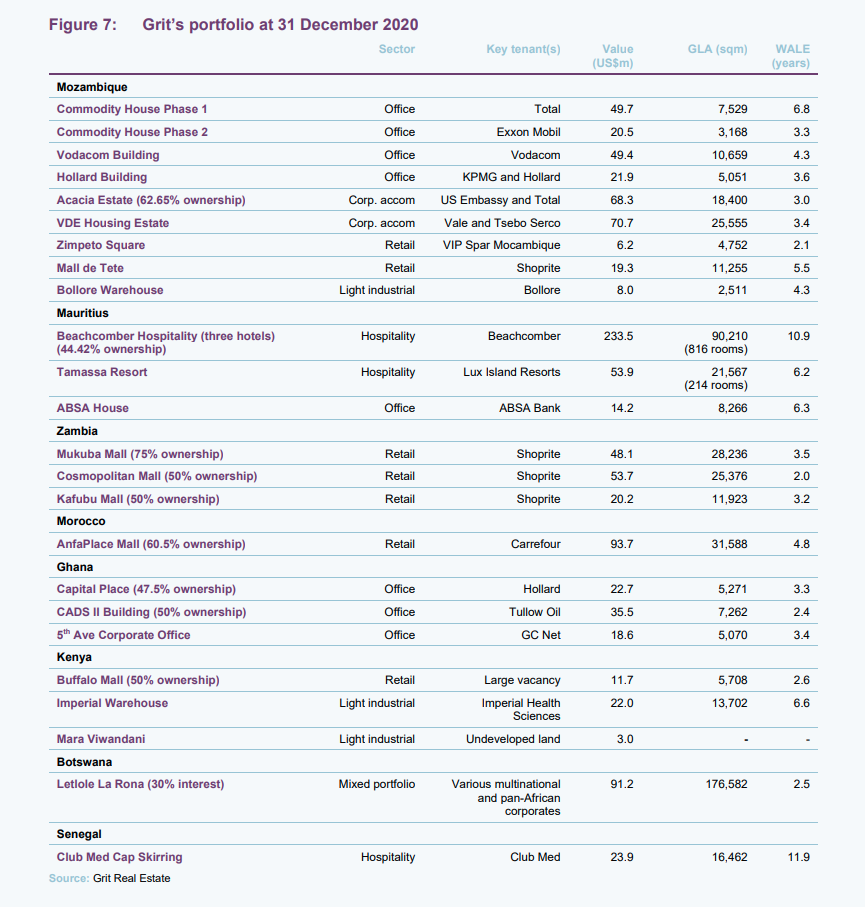

Grit has a portfolio of 54 assets located across eight countries and five asset classes, valued at US$801.9m. The group’s assets have a weighted average lease expiry (WALE) of 5.2 years, a weighted average contracted lease escalation of 2.9% per annum and are underpinned by a wide range of blue-chip multinational tenants across a variety of sectors. Rents are predominantly collected monthly, of which 93.0% are collected in US$, euro or pegged currencies.

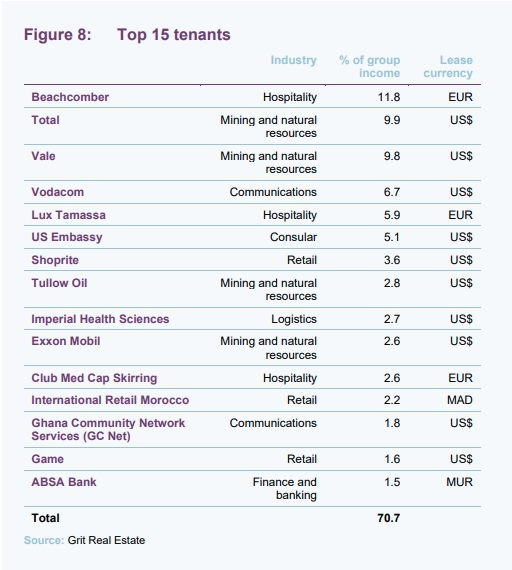

Top 15 tenants

Beachcomber / Lux

The two Mauritian hospitality groups in Grit’s portfolio, Beachcomber and Lux, account for 17.7% of total group income combined. As mentioned earlier, Grit does not take any risk associated with the hotel operation through the triple net leases. The creditworthiness of the lease covenants are strong, with both companies’ parents being large conglomerates. As detailed earlier, both companies have received significant support from the Mauritian government to see them through the pandemic. In terms of rent receipts during the crisis, both operators have resumed rental payments to Grit, and although collection rates have not yet fully stabilised, the company expects these to normalise in the coming months and to collect 100% of the rents outstanding over the lease term.

Vale

Brazilian mining giant Vale accounts for 9.8% of Grit’s income, through the leasing of Grit’s VDE Housing Estate corporate accommodation asset in Mozambique for a further three and a half years. Vale announced in late January 2021 that it was consolidating its ownership of the Moatize mine and the Nacala Corridor infrastructure project, both in Mozambique, and divesting its coal assets in Mozambique. It has committed US$2.5bn in capex over the next two years on projects in Mozambique, which Grit says mitigates the near-term risk of Vale’s exit from Mozambique. The group added that the quality of the asset meant it was confident in the long-term letting prospects for the asset.

Total

Oil and gas giant Total is Grit’s second largest tenant, making up 9.9% of income. The company occupies office space and corporate accommodation in Mozambique on long-term leases to 2028 and 2024 respectively. Total’s Mozambique operations were significantly boosted by a US$15bn financing agreement to fund the construction of its liquefied natural gas (LNG) project. The site was the biggest natural gas find in the southern hemisphere in the last 50 years and is expected to take two and a half years to get to the production phase. Total has paid a third of the rent for the next three years on the corporate accommodation upfront.

Vodacom

Vodacom occupies a 10,659 sqm office in Mozambique and accounts for 6.7% of income. Grit has agreed terms on a five-year lease renewal with Vodacom at the office, which is subject to final contracts. Vodacom is one of the biggest telecommunications operators in Africa and has performed strongly through the COVID-19 pandemic, with the telecommunications sector benefitting from the adoption of new ways of working during the crisis and the dependence on technology increasing.

Outside its domestic market of South Africa, it added 4 million new customers in the year to March 2020 and posted a 12.5% increase in service revenue across international operations (which comprises Mozambique, the Democratic Republic of the Congo, Tanzania and Lesotho) to US$1.2bn. A new stream of revenue for the business is mobile banking and its mobile banking platform, M-Pesa, now processes more than US$14.7bn a month in transactions in its African markets (outside of South Africa).

Potential NAV accretive acquisitions

Grit has committed to funding the development of two hospitals in Mauritius for a cost of around US$19.5m. The hospitals, St Helene and Coromandel, will be let to PDL (Artemis) on 15-year euro-linked leases and produce a 10.5% yield on cost. The company is in advanced stages of securing equity funding from a development finance institution (DFI) for the development of the healthcare facilities.

Grit has also entered into a development contract with fast-moving consumer goods manufacturer Orbit Africa that will see Grit refurbish its existing manufacturing plant in Kenya and develop a new 14,741 sqm extension facility. A 25-year lease has been signed with Orbit Africa on the existing, refurbished unit and a 23-year lease agreement has been signed on the extension. Grit says it expects the developments to cost just over US$45m and return a yield of 10.1% and 9.9% respectively. Funding of the developments will be made through a combination of debt funding secured from a DFI and equity from the issuance of a perpetual preference note. Further detail will be announced once negotiations have concluded (expected in the next two months).

These deals are expected to have a positive 0.5% to 2% effect on Grit’s NAV.

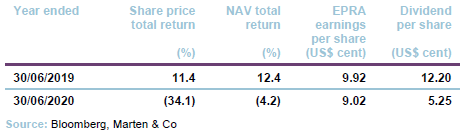

Performance

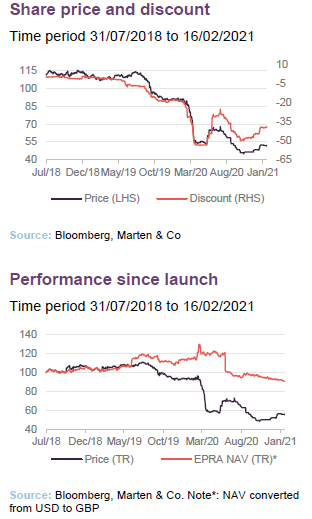

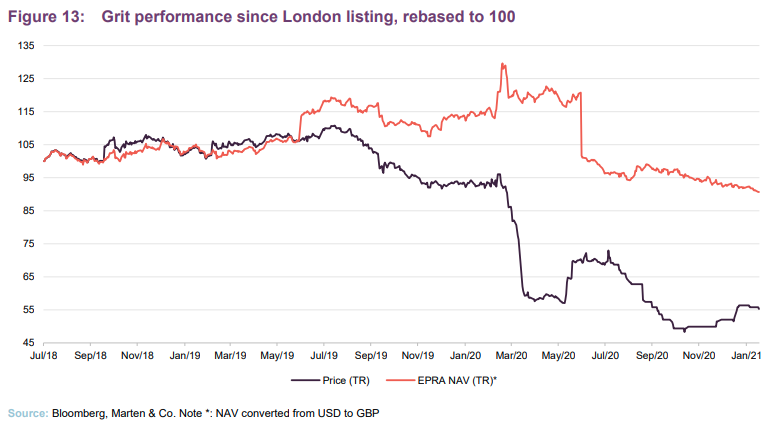

Following Grit’s conversion to a sterling quotation on the LSE in August 2020, we have converted its historic NAV and share price from US$ to sterling in Figure 13. Grit’s EPRA NAV had been consistent since it launched on the London Stock Exchange in July 2018, but dived in June 2020 after reporting a 19.4% fall in EPRA NAV off the back of portfolio valuation write downs. Grit’s share price rose initially, but started to fall in the second half of 2019 and plummeted following the outbreak of COVID-19 in early 2020. Its share price had started to pick up, but tailed off again with the suspension of its dividend.

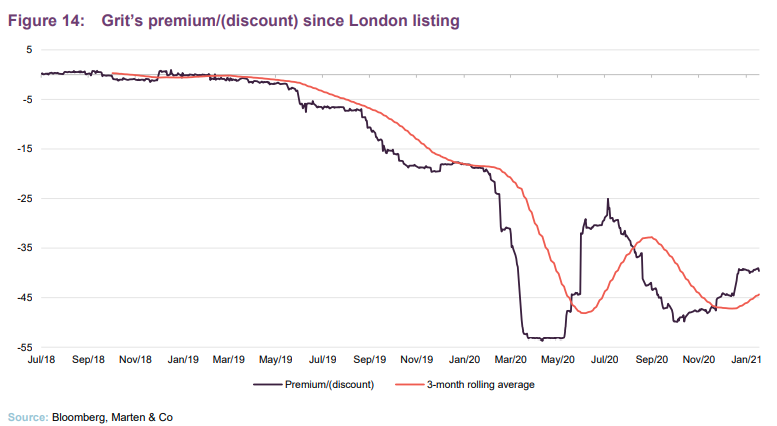

Premium/(discount)

Grit had fluctuated between trading at a slight premium and a slight discount for much of its first full year on the LSE before its discount widened during the course of the second half of 2019. The discount widened further on the outbreak of COVID-19 at the start of 2020, but has since narrowed as the clean-up of its corporate structure has taken place. At 16 February 2021 the discount stood at 39.6%.

Fund profile

Grit Real Estate has a primary listing on the Premium segment of the LSE main market and a secondary listing on the Stock Exchange of Mauritius (SEM). Its focus is on investment in pan-African real estate and it actively manages a diversified portfolio of assets in selected African countries (excluding South Africa).

It offers access to the growth potential of Africa that is de-risked from a currency perspective. The company’s assets are underpinned by predominantly US$- and euro-denominated long-term leases to a range of blue-chip multinational tenant covenants.

The company, which employs 92 people in six countries, aims to deliver strong and sustainable income for shareholders, with the potential for income and capital growth and is targeting a net total shareholder return inclusive of NAV growth of 12.0% per annum.

Previous publications

QuotedData published an initiation note on Grit in July 2020, entitled Africa, substantially de-risked.

The legal bit

This marketing communication has been prepared for Grit Real Estate Income Group by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.